J.P. MORGAN HEALTHCARE CONFERENCE JANUARY 13, 2015 | SAN FRANCISCO, CA

1 FORWARD LOOKING STATEMENT Cautionary Statement Regarding Forward Looking Statements This presentation contains “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, known as the PSLRA. These statements, as they relate to Laboratory Corporation of America Holdings (“LabCorp”) or Covance Inc. (“Covance”), the management of either such company or the proposed transaction between LabCorp and Covance, involve risks and uncertainties that may cause results to differ materially from those set forth in the statements. These statements are based on current plans, estimates and projections, and therefore, you are cautioned not to place undue reliance on them. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. LabCorp and Covance undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by law. Forward-looking statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and future financial results of the pharmaceutical industry, and other legal, regulatory and economic developments. We use words such as “anticipates,” “believes,” “plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,” “should,” “could,” “estimates,” “predicts,” “potential,” “continue,” “guidance,” and similar expressions to identify these forward-looking statements that are intended to be covered by the safe harbor provisions of the PSLRA. Actual results could differ materially from the results contemplated by these forward-looking statements due to a number of factors, including, but not limited to, those described in the documents LabCorp and Covance have filed with the U.S. Securities and Exchange Commission (the “SEC”) as well as the possibility that (1) LabCorp and Covance may be unable to obtain stockholder or regulatory approvals required for the proposed transaction or may be required to accept conditions that could reduce the anticipated benefits of the merger as a condition to obtaining regulatory approvals; (2) the length of time necessary to consummate the proposed transaction may be longer than anticipated; (3) problems may arise in successfully integrating the businesses of LabCorp and Covance or such integration may be more difficult, time-consuming or costly than expected; (4) the proposed transaction may involve unexpected costs; (5) the businesses may suffer as a result of uncertainty surrounding the proposed transaction, including difficulties in maintaining relationships with customers or retaining key employees; (6) the parties may be unable to meet expectations regarding the timing, completion and accounting and tax treatments of the transaction; or (7) the industry may be subject to future risks that are described in the “Risk Factors” section of the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed from time to time with the SEC by LabCorp and Covance. Neither LabCorp nor Covance gives any assurance that either LabCorp or Covance will achieve its expectations. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of LabCorp and Covance described in the “Risk Factors” section of their respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the SEC. All forward-looking statements included in this presentation are based upon information available to LabCorp and Covance on the date hereof, and neither LabCorp nor Covance assumes any obligation to update or revise any such forward-looking statements.

2 FORWARD LOOKING STATEMENT Additional Information and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this press release in any jurisdiction in contravention of applicable law. This presentation relates to a proposed transaction between Covance and LabCorp, and may be deemed to be solicitation material in respect of the proposed transaction. In connection with the proposed transaction, LabCorp has filed a registration statement on Form S-4 with the SEC, which includes a preliminary proxy statement/prospectus. Covance will deliver a definitive proxy statement/prospectus to Covance stockholders. This presentation is not a substitute for the registration statement, proxy statement/prospectus or any other documents that Covance or LabCorp may file with the SEC or send to stockholders in connection with the proposed transaction. Before making any voting decision, investors and security holders of Covance are urged to read carefully and in their entirety the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed by LabCorp or Covance with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction and related matters. Investors and security holders will be able to obtain free copies of the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed by Covance or LabCorp with the SEC through the website maintained by the SEC at www.sec.gov. In addition, investors and security holders may obtain free copies of the proxy statement/prospectus and other relevant documents filed by Covance with the SEC by accessing Covance’s website at www.covance.com or upon written request to Covance Inc., Office of the Secretary, 210 Carnegie Center, Princeton, New Jersey 08540. Free copies of the registration statement, proxy statement/prospectus and other relevant documents filed by LabCorp with the SEC are available on LabCorp’s website at www.labcorp.com or upon written request to Laboratory Corporation of America Holdings, Office of the Secretary, 358 South Main Street, Burlington, North Carolina 27215. Participants in Solicitation LabCorp, Covance and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Covance’s stockholders in connection with the proposed transaction. Information regarding Covance’s directors and executive officers is contained in the proxy statement for Covance’s 2014 Annual Meeting of Shareholders, which was filed with the SEC on March 24, 2014. You can obtain a free copy of this document at the SEC’s website at www.sec.gov or by accessing Covance’s website at www.covance.com. Information regarding LabCorp’s executive officers and directors is contained in the proxy statement for LabCorp’s 2014 Annual Meeting of Shareholders filed with the SEC on April 4, 2014. You can obtain a free copy of this document at the SEC’s website at www.sec.gov or by accessing LabCorp’s website at www.labcorp.com. Additional information regarding those persons and other persons who may be deemed participants in the proxy solicitation, including their respective direct and indirect interests in the proposed transaction, by security holdings or otherwise, is contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC. You may obtain free copies of these documents as described in the preceding paragraph.

3 INTRODUCTION TO LABCORP • ~$6B in revenue last year • $60B US Clinical Laboratory market • 34,000+ employees worldwide • National network of 37 primary laboratories and 1,750 patient service centers • Offers broad range of 4,500+ clinical, anatomic pathology, genetic and genomic tests • Processes ~500,000 patient specimens daily • Serves >220,000 physicians, government agencies, managed care organizations, hospitals, clinical labs and pharmaceutical companies • Comprehensive logistics and IT connectivity capabilities Leading National Clinical Laboratory

4 CORE BUSINESS STRENGTH Enhance IT capabilities to improve physician and patient experience Development of knowledge services Scientific innovation at appropriate pricing IT innovation Continue to improve efficiency to offer the most compelling value in laboratory services Business process re-engineering BeaconLBS Enlighten Health Attractive opportunities for capital deployment 174 new tests launched in 2014 Our Five Pillar strategy and ongoing initiatives continue without interruption: Deploy capital to investments that enhance our business and return capital to shareholders

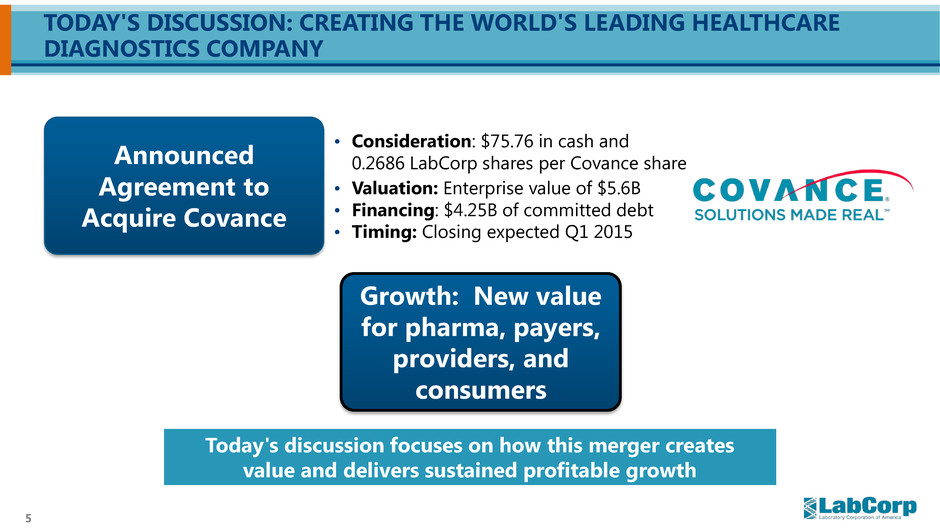

5 TODAY'S DISCUSSION: CREATING THE WORLD'S LEADING HEALTHCARE DIAGNOSTICS COMPANY Growth: New value for pharma, payers, providers, and consumers Announced Agreement to Acquire Covance Today's discussion focuses on how this merger creates value and delivers sustained profitable growth • Consideration: $75.76 in cash and 0.2686 LabCorp shares per Covance share • Valuation: Enterprise value of $5.6B • Financing: $4.25B of committed debt • Timing: Closing expected Q1 2015

6 • ~$2.5B in revenue last year • Serves $140 billion global pharmaceutical R&D market • Only provider of full spectrum of drug development services • Involved in the development of all of the top 50 drugs on the market • #1 in central laboratory / preclinical services • ~$900M revenue in Phase I-IV clinical trial management services • Generates more safety and efficacy data than any other CRO • Market leader in nutritional chemistry and food safety testing • 12,500+ employees worldwide • Global network of operations in 30+ countries with trial activity in over 100 countries Leading CRO & Drug Development Services Provider INTRODUCTION TO COVANCE

7 TRANSFORMATIVE COMBINATION: CREATING THE WORLD'S LEADING HEALTHCARE DIAGNOSTICS COMPANY Powerful combination of personnel, assets, and capabilities Strong management teams Commercial infrastructure and global footprint Physician and consumer access and connectivity Scientific, bioinformatics and analytics expertise Continued innovation and targeted investment Industry growth Complementary datasets Breadth of relationships (physicians, pharma, consumers, payers, hospitals, etc.) Trends favor high quality, efficient providers that deliver better outcomes at lower cost

8 COMBINATION CREATES THE BEST END-TO-END PARTNER FOR PHARMACEUTICAL AND BIOTECH DEVELOPMENT New/small position Leading position Strong position Diagnostic development Biomarker discovery & validation Pre- clinical Phase IV On-market care delivery • Post-mkt drug surveillance • Lab services • Monitoring outcomes Central laboratory Phase I Phase II Phase III Approval & Launch

9 LABCORP WILL BE THE PARTNER OF CHOICE FOR BIOPHARMA AND IMPROVE THE LIVES OF PATIENTS • Faster, higher quality clinical trials at lower cost • Increased sales during patent lifetime • Expedited commercialization of companion diagnostics • Data analytics reduce safety recalls • More personalized medicines • Extended life and improved quality of life • Greater access to and transparency regarding clinical trials • Improved patient outcomes at lower cost • Fewer failures of therapy • Data & analytics to inform prescribing decisions • Reduced hospitalization costs • Greater access to clinical trials for patients • Data & analytics drive increased confidence in prescriptions for: – ...the right drug... – ...the right patient... – ...the right time • Improve people's health • Drive profitable growth • Create shareholder value LabCorp

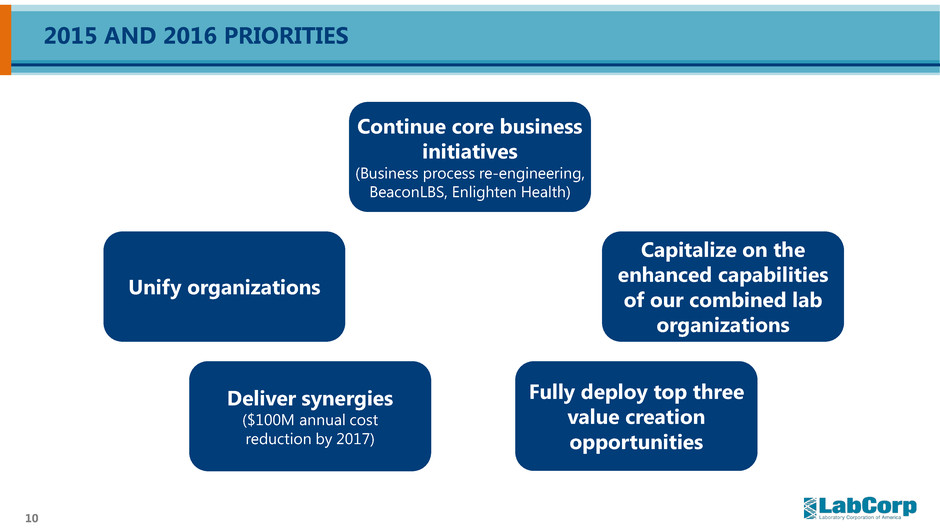

10 2015 AND 2016 PRIORITIES Deliver synergies ($100M annual cost reduction by 2017) Fully deploy top three value creation opportunities Continue core business initiatives (Business process re-engineering, BeaconLBS, Enlighten Health) Capitalize on the enhanced capabilities of our combined lab organizations Unify organizations

11 COMBINATION PROVIDES SIGNIFICANT NEW GROWTH AVENUES Prioritized top 3 opportunities based on materiality, feasibility, and strategic fit Deliver faster clinical trial enrollment 1 Partner of choice to develop and commercialize companion diagnostics 2 Enhance Phase IV trial experience and post-market surveillance 3 International expansion Predictive analytics for stakeholders Food safety & nutritional chemistry Wave One Wave Two

12 DETAIL ON THE TOP THREE OPPORTUNITIES Enhance Phase IV trial experience and post-market surveillance 3 Deliver faster clinical trial enrollment 1 Partner of choice to develop and commercialize companion diagnostics 2 >$150M >$100M >$50M Incremental 2018 Revenue

13 TOP THREE VALUE CREATORS TO BRING TO MARKET IN 2016 Enhance Phase IV trial experience and post-market surveillance 3 Deliver faster clinical trial enrollment 1 Partner of choice to develop and commercialize companion diagnostics 2

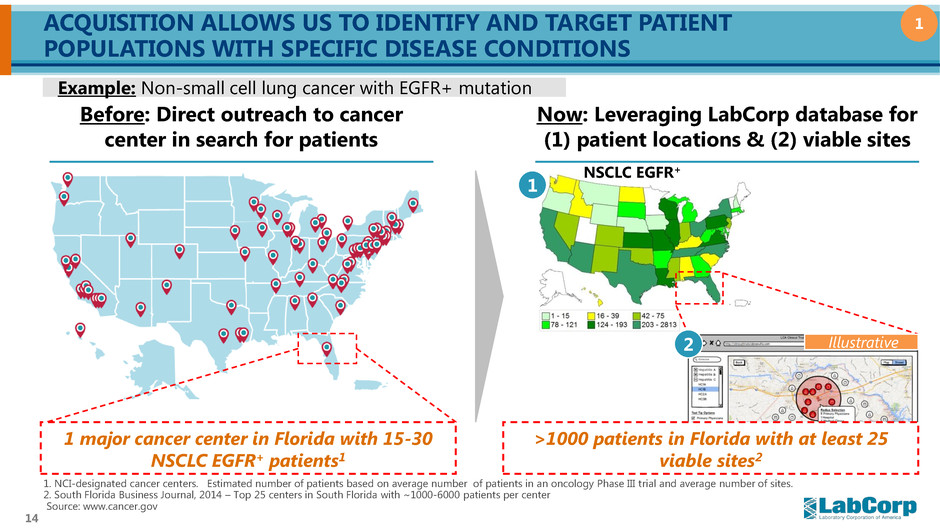

14 ACQUISITION ALLOWS US TO IDENTIFY AND TARGET PATIENT POPULATIONS WITH SPECIFIC DISEASE CONDITIONS Before: Direct outreach to cancer center in search for patients Now: Leveraging LabCorp database for (1) patient locations & (2) viable sites Example: Non-small cell lung cancer with EGFR+ mutation 1 >1000 patients in Florida with at least 25 viable sites2 1. NCI-designated cancer centers. Estimated number of patients based on average number of patients in an oncology Phase III trial and average number of sites. 2. South Florida Business Journal, 2014 – Top 25 centers in South Florida with ~1000-6000 patients per center Source: www.cancer.gov Illustrative NSCLC EGFR+ 1 major cancer center in Florida with 15-30 NSCLC EGFR+ patients1 1 2

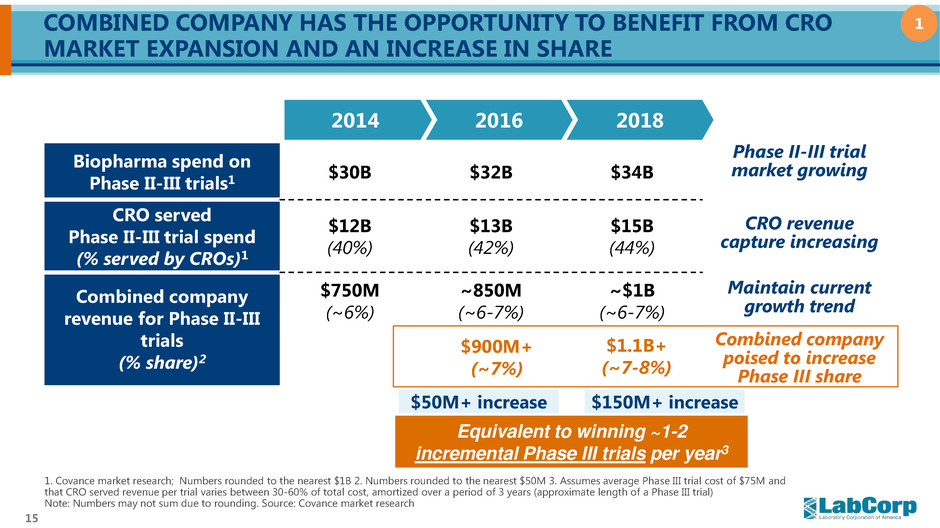

15 COMBINED COMPANY HAS THE OPPORTUNITY TO BENEFIT FROM CRO MARKET EXPANSION AND AN INCREASE IN SHARE 2014 2016 2018 Biopharma spend on Phase II-III trials1 $30B $32B $34B CRO served Phase II-III trial spend (% served by CROs)1 $12B (40%) $13B (42%) $15B (44%) Combined company revenue for Phase II-III trials (% share)2 $750M (~6%) ~850M (~6-7%) ~$1B (~6-7%) 1. Covance market research; Numbers rounded to the nearest $1B 2. Numbers rounded to the nearest $50M 3. Assumes average Phase III trial cost of $75M and that CRO served revenue per trial varies between 30-60% of total cost, amortized over a period of 3 years (approximate length of a Phase III trial) Note: Numbers may not sum due to rounding. Source: Covance market research Phase II-III trial market growing CRO revenue capture increasing Equivalent to winning ~1-2 incremental Phase III trials per year3 $1.1B+ (~7-8%) $900M+ (~7%) Maintain current growth trend Combined company poised to increase Phase III share $150M+ increase $50M+ increase 1

16 TOP THREE VALUE CREATORS TO BRING TO MARKET IN 2016 Enhance Phase IV trial experience and post-market surveillance 3 Deliver faster clinical trial enrollment 1 Partner of choice to develop and commercialize companion diagnostics 2

17 COMBINED COMPANY WILL DRIVE CRO SHARE GAIN FOR DRUG TRIALS REQUIRING CDX PROGRAMS 2 Capabilities Capabilities CDx development enabled by biomarker discovery and validation Market-leading biomarker and early stage trial support Execution on lab-based CDx for clinical validation in trials Late stage trial support linked seamlessly with CDx validation CDx approval and commercialization Peri-approval and market access support Experience with utilization of lab network to offer CDx at wide scale and/or enable kit development Phase IV and post-marketing surveillance support Drug-CDx approval and commercialization Preclinical and early stage trials Drug-CDx approval and launch Drug-CDx market delivery Late stage trials Early stage services strength followed by seamless execution of CDx will boost share of clinical trials

18 COMPANION DIAGNOSTICS CAPABILITIES ADD >$100M REVENUE BY 2018 1. Based on estimated biomarker testing revenue of $200K per compound and total historical downstream testing revenue equal to 8.6x biomarker testing revenue 2. Covance estimates for currently obtainable projects with CDx development partner onboard 3. Assumptions based on market conditions expected by Covance 4. 2018 range corresponds to 1% additional market share on estimated 6% baseline for Covance in Phase II currently 5. Based on Credit Suisse 2013 analyst report figures for total trial cost by phase and CRO-addressable trial costs Note: "Opportunity" column shows potential yearly incremental revenue reasonably achievable as a result of CDx development and commercialization offerings Source: Credit Suisse 2013, Jefferies 2014, KeyBanc 2014, Covance 2 Sources of new value for combined company 2018 added opportunity Revenue generator Key figures for estimate Biomarker & central lab testing $60M+ 50-200 added biomarker development and testing contracts per year $1.8M total downstream testing revenue per biomarker contract1 CDx development services $40M+ ~30 new CDx partner opportunities now; ~$240M potential annual revenue2 15-40% of potential revenue captured; 10% CAGR to 20183 Early-Phase clinical trials share $30M+ 1-2 incremental Phase II trials won per year by 20184 $30M revenue per Phase II trial5

19 TOP THREE VALUE CREATORS TO BRING TO MARKET IN 2016 Enhance Phase IV trial experience and post-market surveillance 3 Deliver faster clinical trial enrollment 1 Partner of choice to develop and commercialize companion diagnostics 2

20 UNMET NEEDS ADDRESSED BY COMBINED COMPANY'S ENHANCED PHASE IV PATIENT EXPERIENCE AND POST-MARKET SURVEILLANCE LabCorp patient web portal eliminates scheduling hassle 1,750 LabCorp patient service centers and ~5,000 phlebotomists in physician offices make testing more convenient Combined company positioned to deliver superior Phase IV trial experience 9627304306793165311494017647376938735140 9336183321644828584837011709672125353387 5862158231013310387766827211572694951817 9589754693992642197915523385766231676275 4757036876987687698769876q8ew6rq98ew76r9 9439196283887054367774322427685465465413 2132132168798746546543213213213579873541 3213587987954132132132132198739876846514 32132132132132789/70918798798743251321321 0..3549877674351321357/9432132132216587987 987451327/7698732132121332365449485366768 0000010652624854730558615989991401707698 3854831887501429389089950685453076511680 3337322265175662207526951791442252808165 1716677667230430679316531149401764737693 8735140933618332165458725435465465337322 9627304306793165311494017647376938735140 9336183321644828584837011709672125353387 5862158231013310387766827211572694951817 Real World Safety: prevent drugs from being recalled 12 Trillion test results and 70M+ unique patients enable Post-market surveillance Real World Efficacy: expand commercial indications Identify safety signals early Avoid recall Modify prescription guidelines Combined co. real world evidence Identify new indications 3

21 COMBINED COMPANY HAS OPPORTUNITY TO GROW SHARE IN PHASE IV TRIALS AND POST-MARKET SURVEILLANCE Biopharma Phase IV and post-market spend1 $12B $13B $14B CRO served Phase IV / post-market spend (% served by CROs) 1 $5B (38%) $5B (39%) $6B (40%) Combined company revenue for Phase IV / post-market (% share)2 ~$150M (~3%) ~$180 (~4%) ~$220 (~4%) Phase IV trial market growing CRO revenue capture increasing Equivalent to winning ~2-4 incremental Phase IV / post-market trials per year3 $270M+ (~4-5%) $200M+ (~4%) Maintain current growth trend Combination poised to increase Phase IV/post-mkt share $50M+ increase $20M+ increase 1. Covance market research; Numbers rounded to the nearest $1B 2. Numbers rounded to the nearest $10M 3. Assumes average Phase IV trial cost of $10M and length of <1 year, and average post-market surveillance cost of $30-40M and length of ~5 years; assumes CRO served revenue per trial varies between 30-60% of total cost (Covance market research, Parexel Biopharmaceutical Statistical Sourcebook 2014) Note: Numbers may not sum due to rounding. 2014 2016 2018 3

22 COMBINED COMPANY RETAINS FINANCIAL STRENGTH Financial review and closing comments

23 COMBINED COMPANY RETAINS FINANCIAL STRENGTH: NO FUNDAMENTAL SHIFT IN LONG-TERM CAPITAL ALLOCATION STRATEGY (1) LabCorp EBITDA adjusted to exclude restructuring and other special charges of $29.6 million (2) Covance EBITDA adjusted to exclude restructuring and asset impairment charges of $71.2 million LTM Ended Sept. 30, 2014 ($ in Millions) LabCorp Covance Pro Forma Combined Revenue $5,936 $2,510 $8,446 Adjusted EBITDA1, 2 $1,191 $424 $1,615 EBITDA Margin 20.1% 16.9% 19.1% Operating Cash Flow $774 $325 1,099 Capital Expenditures $217 $164 $381 Free Cash Flow $557 $161 $718 • Accretive to Adjusted EPS before synergies in Year 1; Earns cost of capital by Year 4 • Commitment to investment grade balance sheet • Near-Term Free Cash Flow used to pay down debt and invest in fold-in acquisitions • Share buyback program resumes as we approach 2.5x target leverage ratio

24 COMBINATION CREATES THE WORLD'S LEADING HEALTHCARE DIAGNOSTICS COMPANY LabCorp • Improve people's health • Drive profitable growth • Create shareholder value • Faster, higher quality clinical trials at lower cost • Increased sales during patent lifetime • Expedited commercialization of companion diagnostics • Data analytics reduce safety recalls • More personalized medicines • Extended life and improved quality of life • Greater access to and transparency regarding clinical trials • Improved patient outcomes at lower cost • Fewer failures of therapy • Data & analytics to inform prescribing decisions • Reduced hospitalization costs • Greater access to clinical trials for patients • Data & analytics drive increased confidence in prescriptions for: – ...the right drug... – ...the right patient... – ...the right time