QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

FIRST VIRTUAL COMMUNICATIONS, INC.

|

| (Name of Registrant as Specified In Its Charter) |

KILLKO A. CABALLERO

|

(Name of Person(s) Filing Proxy Statement)

|

Payment of Filing Fee (Check the appropriate box):

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

FIRST VIRTUAL COMMUNICATIONS, INC.

3393 Octavius Drive

Santa Clara, California 95054

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 14, 2002

TO THE STOCKHOLDERS OF FIRST VIRTUAL COMMUNICATIONS, INC.:

Notice Is Hereby Given that an annual meeting of stockholders ofFirst Virtual Communications, Inc., a Delaware corporation (the "Company"), will be held on Friday, June 14, 2002 at 9:00 a.m. local time at the Company's offices at 3393 Octavius Drive, Santa Clara, California 95054 (together with all adjournments and postponements thereof, the "Annual Meeting"), for the following purposes, as more fully described in the attached Proxy Statement:

- 1.

- To elect two directors to hold office until the 2005 Annual Meeting of Stockholders.

- 2.

- To approve the Company's Non-Employee Directors' Stock Option Plan, as amended, to provide for (i) an increase in the aggregate number of shares of Common Stock authorized under such plan by 800,000 shares, to an aggregate of 1,500,000 shares, (ii) an increase in the initial and annual automatic grants under such plan to non-employee directors for service on the Board of Directors, (iii) an increase in the initial and annual automatic grants under such plan to non-employee directors for service on the Audit, Compensation and Nominating Committees of the Board of Directors, (iv) a change in the vesting schedule for all grants made pursuant to such plan, and (v) an extension of the option exercise period after a director ceases to be a member of the Board of Directors, an employee or consultant to the Company.

- 3.

- To ratify the selection of PricewaterhouseCoopers LLP as independent accountants of the Company for its fiscal year ending December 31, 2002.

- 4.

- To consider and act upon such other business and matters or proposals as may come before the Annual Meeting.

The Board of Directors has fixed the close of business on April 25, 2002 as the record date for the determination of stockholders entitled to notice of, and to vote at, this Annual Meeting and at any adjournment or postponement thereof.

| | | By Order of the Board of Directors, |

|

|

JULIE M. ROBINSON

Secretary |

Santa Clara, California

May 3, 2002 | | |

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, WE HOPE YOU WILL VOTE AS SOON AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING OR YOU MAY VOTE YOUR SHARES ON THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON YOUR PROXY. IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE, YOU MAY BE ABLE TO VOTE ON THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS PROVIDED WITH YOUR VOTING FORM. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

1

FIRST VIRTUAL COMMUNICATIONS, INC.

3393 Octavius Drive

Santa Clara, California 95054

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 14, 2002

INFORMATION CONCERNING SOLICITATION AND VOTING

GENERAL

The enclosed proxy is solicited on behalf of the Board of Directors (the "Board") of First Virtual Communications, Inc., a Delaware corporation (the "Company"), for use at an annual meeting of stockholders to be held on Friday, June 14, 2002 at 9:00 a.m. local time (together with all adjournments and postponements thereof, the "Annual Meeting"), for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at the Company's offices, 3393 Octavius Drive, Santa Clara, California 95054. The Company intends to mail this proxy statement and accompanying proxy card on or about May 3, 2002 to all stockholders entitled to vote at the Annual Meeting.

SOLICITATION

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to the beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other employees of the Company. No additional compensation will be paid to directors, officers or other employees for these services.

VOTING RIGHTS AND OUTSTANDING SHARES

Only holders of record of Common Stock and the Company's Series A Preferred Stock at the close of business on April 25, 2002 will be entitled to notice of, and to vote at, the Annual Meeting. At the close of business on April 25, 2002 the Company had outstanding and entitled to vote 40,116,179 shares of Common Stock and 27,437 shares of Series A Preferred Stock convertible into 4,247,214 shares of Common Stock.

Each holder of record of Common Stock on April 25, 2002 will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting. Each holder of record of Series A Preferred Stock on April 25, 2002 will be entitled to one vote for each share of Common Stock into which such holder's shares of Series A Preferred Stock is convertible on such date.

All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions will be counted towards the tabulation of votes cast on the proposals presented to the stockholders and will have the same effect as a negative vote. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether a matter has been approved.

2

VOTING VIA THE INTERNET OR BY TELEPHONE

Stockholders may grant a proxy to vote their shares by means of the telephone or on the Internet. The law of Delaware, under which the Company is incorporated, specifically permits electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspector of election can determine that such proxy was authorized by the stockholder.

The telephone and Internet voting procedures below are designed to authenticate stockholders' identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders' instructions have been recorded properly. Stockholders granting a proxy to vote via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies that must be borne by stockholder.

For Shares Registered in Your Name

Stockholders of record may go to http://www.computershare.com/us/proxy to grant a proxy to vote their shares by means of the Internet. They will be required to provide the control number and pin number located at the bottom of their proxy cards. The voter will then be asked to complete an electronic proxy card. The votes represented by such proxy will be generated on the computer screen and the voter will be prompted to submit or revise them as desired. Any stockholder using a touch-tone telephone may also grant a proxy to vote shares by calling 1-800-816-8908 and following the recorded instructions.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose stock is held in street name receive instruction for granting proxies from their banks, brokers or other agents, rather than the Company's proxy card.

A number of brokers and banks are participating in a program provided through ADP Investor Communication Services that offers the means to grant proxies to vote shares by means of the telephone and Internet. If your shares are held in an account with a broker or bank participating in the ADP Investor Communications Services program, you may grant a proxy to vote those shares telephonically by calling the telephone number shown on the instruction form received from your broker or bank, or via the Internet at ADP Investor Communication Services' web site at http://www.proxyvote.com.

General Information for All Shares Voted Via the Internet or By Telephone

Votes submitted via the Internet or by telephone must be received by 9:00 a.m., Pacific Daylight Time on June 13, 2002. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

REVOCABILITY OF PROXIES

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of the Company at the Company's principal executive office, 3393 Octavius Drive, Santa Clara, California 95054, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

STOCKHOLDER PROPOSALS

Proposals of stockholders that are intended to be presented at the Company's 2003 Annual Meeting of Stockholders pursuant to Rule 14a-8 of the Securities and Exchange Commission (the "SEC") must be received by the Company no later than December 30, 2002 in order to be included in the proxy statement relating to that Annual Meeting. The deadline for submitting a stockholder proposal or a nomination for director that is not to be included in that proxy statement and proxy is not later than the close of business on February 27, 2003 nor earlier than the close of business on January 28, 2003. Stockholders are also advised to review the Company's Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

3

PROPOSAL 1

ELECTION OF DIRECTORS

The Company's Amended and Restated Certificate of Incorporation and Bylaws provide that the Board shall be divided into three classes, each class consisting, as nearly as possible, of one-third of the total number of directors, with each class having a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy, including a vacancy created by an increase in the size of the Board shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director's successor is elected and qualified.

The Board is presently composed of seven members. There are two directors in the class whose term of office expires in 2002. Each of the nominees for election to this class is currently a director of the Company. If elected at the Annual Meeting, each of the nominees would serve until the 2005 annual meeting and until his successor is elected and has qualified, or until the director's earlier death, resignation or removal.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the two nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, the shares will be voted for the election of a substitute nominee as management may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that either nominee will be unable to serve.

Set forth below is biographical information for each person nominated and each person whose term of office as a director will continue after the Annual Meeting.

NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2005 ANNUAL MEETING

ADAM STETTNER

Mr. Stettner, age 38, has served as a director of the Company since the Company's merger with CUseeMe Networks, Inc. ("CUseeMe Networks") on June 19, 2001. Prior to the merger, Mr. Stettner served as a director of CUseeMe Networks from March 1999. Mr. Stettner has been the managing director of the Special Situations Technology Fund, an investment fund, since April 1997. He is also the President of Stettner Consultants, Inc., a computer consulting company, that he formed in 1989. Mr. Stettner received a B.S. in Physics with a minor in Computer Science from Cornell University and an M.S. also from Cornell University.

ROBERT W. WILMOT

Mr. Wilmot, age 57, has served as a director of the Company since October 1998. Since May 1995, he has been Chairman of Wilmot Consulting, Inc., a private investment advisory firm. Mr. Wilmot is a founder of a number of companies, including ES2 SA, the OASIS Group Plc, CMI Ltd., MOVID Technology Inc., Poqet Computer Inc., VXtreme, Inc., iBEAM INC., Biztro Inc. and Integrity Arts, Inc. He is a director of Com21, Inc. and @POS.com, Inc., as well as several private internet companies. Mr. Wilmot received a B.S. in electrical engineering from Nottingham University.

4

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2003 ANNUAL MEETING

EDWARD HARRIS

Mr. Harris, age 45, has served as a director of the Company since September 2000. Since December 1998, he has been a Senior Investment Analyst for Vulcan Inc., a venture capital firm wholly-owned by Paul G. Allen. From 1992 to 1998, Mr. Harris was a financial executive in the high technology industry, and served as Chief Financial Officer for three early stage companies: Mirror Software, Inc., a provider of medical imaging software, from September 1997 to September 1998; Starwave Incorporated, a leading Internet company, which was founded by Mr. Allen, from August 1996 to September 1997; and Claircom Communications Group, L.P., an affiliate of McCaw Cellular Incorporated and provider of specialized air-to-ground wireless communications services, December 1992 to December 1995. From 1990 to 1992, Mr. Harris was an investment banker for Sumishin Capital and for Salomon Brothers, Inc. from 1985 to 1990. Mr. Harris currently serves as a director of RCN Corporation and Click21earn.com, Inc., as well as several private companies. Mr. Harris received an M.B.A. from the Columbia University Graduate School of Business and a B.A. in Economics from Rutgers University.

JONATHAN G. MORGAN

Mr. Morgan, age 48, has served as a director of the Company since the merger with CUseeMe Networks on June 19, 2001. Prior to the merger, Mr. Morgan served as a director of CUseeMe Networks from May 1996. In 1991, Mr. Morgan founded and currently is a Managing Partner of Rostrevor Partners, LLC, a strategic consulting services company which provides services to early stage emerging growth companies. From 1993 until 2001, Mr. Morgan was a Managing Director at Prudential Securities as well as a Managing Director at Prudential Volpe Technology Group, a division of Prudential Securities, which provides investment banking services to technology companies. Mr. Morgan received an M.B.A. from the University of Western Ontario, London (located in Ontario, Canada).

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2004 ANNUAL MEETING

RALPH UNGERMANN

Mr. Ungermann, age 60, has served as a director of the Company and as its Chairman of the Board since co-founding the Company in 1993. Mr. Ungermann served as the Company's Chief Executive Officer and President from 1993 until January 1999 and from July 2000 until the Company's merger with CUseeMe Networks on June 19, 2001. From July 1979 to July 1993, Mr. Ungermann was Chief Executive Officer and co-founder of Ungermann-Bass, Inc., a computer networking company, now a subsidiary of Newbridge Networks Corporation. Prior to his work at Ungermann-Bass, Mr. Ungermann was the co-founder and Chief Operating Officer of Zilog, Inc., an early leader in the microprocessor industry, where he introduced the Z80 product line. He also serves as a director of Vertel Corporation. Mr. Ungermann received a B.S.E.E. from the University of California at Berkeley and an M.S.E.E. from the University of California at Irvine.

KILLKO A. CABALLERO

Mr. Caballero, age 42, has served as a director and the Chief Executive Officer and President of the Company since the merger with CUseeMe Networks on June 19, 2001. Prior to the merger, Mr. Caballero served as a director of CUseeMe Networks since 1995 and was appointed chairman of the Board of Directors in January 2000. Mr. Caballero also served as CUseeMe Networks' Chief Executive Officer from December 1998 until its merger with the Company and as President from

5

August 1997 until the merger. He served as CUseeMe Networks' interim President during June and July 1997, and as Senior Vice President of Research and Development and Chief Technology Officer from November 1995 until June 1997. Mr. Caballero was a co-founder of White Pine Software, Europe and served as President, Chief Executive Officer and Chairman of the Board of Directors of White Pine Software, Europe from July 1991 until November 1995. Mr. Caballero holds a license in commercial and industrial sciences, major in computer sciences from the University of Geneva.

NORMAN GAUT, PH.D.

Dr. Gaut, age 64, has served as a director of the Company since October 2001. Dr. Gaut served as Chief Executive Officer and President of PictureTel Corporation, a videoconferencing solutions company, from January 1986 through September 2001, and served on PictureTel's Board of Directors since its inception in 1984 until October 2001. He became Chairman of PictureTel's Board of Directors in April 1987. Dr. Gaut holds a doctorate in planetary physics and a master's degree in meteorology from the Massachusetts Institute of Technology. He holds a bachelor's degree in physics from the University of California, Los Angeles.

BOARD COMMITTEES AND MEETINGS

During the fiscal year ended December 31, 2001, the Board held ten meetings and twice acted by unanimous written consent. The Board has an Audit Committee, a Compensation Committee and a Nominating Committee.

The Audit Committee meets with the Company's independent accountants at least annually to review the results of the annual audit and discuss the financial statements; recommends to the Board the independent accountants to be retained; and receives and considers the accountants' comments as to controls, adequacy of staff and management performance and procedures in connection with audit and financial controls. The members of the Audit Committee in 2001 were David Norman, a former director of the Company who resigned from the Board in October 2001, Mr. Harris, and Mr. Morgan, who was appointed to the Audit Committee in June 2001. In October 2001, Dr. Gaut was appointed to the Audit Committee to replace Mr. Norman. The Audit Committee is currently composed of three non-employee directors: Dr. Gaut and Messrs. Harris and Morgan. The Audit Committee met five times during fiscal year 2001. All members of the Company's Audit Committee are independent, as independence is defined in Rule 4200(a)(15) of the NASD listing standards. The Audit Committee has adopted a written Audit Committee Charter.

The Compensation Committee makes recommendations concerning salaries and incentive compensation, awards stock options to employees and consultants under the Company's stock option plans and otherwise determines compensation levels and performs such other functions regarding compensation as the Board may delegate. The Compensation Committee in 2001 consisted of Messrs. Harris and Wilmot. It is currently composed of Dr. Gaut and Messrs. Harris and Wilmot. The Compensation Committee met one time during the fiscal year 2001.

The Nominating Committee's function is to evaluate, nominate and recommend individuals for membership on the Board. The Nominating Committee was formed in March 2001 and was initially composed of Allwyn Sequeira, a former director of the Company who resigned from the Board in June 2001, and Mr. Wilmot. In June 2001, Mr. Stettner was appointed to the Nominating Committee to replace Mr. Sequeira. The Nominating Committee did not meet nor take any actions during the fiscal year 2001.

During the fiscal year ended December 31, 2001, all directors attended at least 75% of the aggregate of the meetings of the Board and of the committees on which they served, held during the period for which they were a director or committee member, respectively.

6

PROPOSAL 2

APPROVAL OF THE 1997 NON-EMPLOYEE DIRECTORS' STOCK OPTION PLAN, AS AMENDED

In September 1997, the Board adopted, and the stockholders subsequently approved, the Company's 1997 Non-Employee Directors' Stock Option Plan (the "Directors' Plan"). As a result of an amendment in 2001, there are currently 700,000 shares of Common Stock authorized for issuance under the Directors' Plan.

In April 2002, the Board amended the Directors' Plan, subject to stockholder approval, to provide for an increase in the aggregate number of shares of Common Stock authorized for issuance under the Directors' Plan from 700,000 shares to 1,500,000 shares, an increase of 800,000 shares, in order to ensure that the Company is able to continue to attract and retain qualified members to its Board.

In July 2001, the Board amended the Directors' Plan, subject to stockholder approval, to (a) provide for an increase in the automatic (i) initial grant of an option to purchase shares of Common Stock of the Company from 30,000 shares to 40,000 shares for each non-employee director upon the director's initial election as a member of the Board, and (ii) renewal grant for continued service on the Board of an additional option to purchase shares of Common Stock of the Company from 10,000 shares to 40,000 shares to each non-employee director upon the anniversary of a non-employee's election to the Board, provided that the non-employee director continues to remain on the Board as a non-employee director; (b) provide for an increase in the automatic (i) initial grant of an option to purchase shares of Common Stock of the Company from (x) 10,000 shares to 15,000 shares for each non-employee director upon the director's initial election as a member of the Compensation Committee or Nominating Committee, and (y) 10,000 shares to 25,000 shares for each non-employee director upon the director's initial election as a member of the Audit Committee, and (ii) renewal grant for continued service on the Compensation Nominating and Audit Committees of the Board of an additional option to purchase shares of Common Stock of the Company from (x) 10,000 shares to 15,000 shares for each non-employee director serving on the Compensation Committee or Nominating Committee, and (y) 10,000 shares to 25,000 shares to each non-employee director serving on the Audit Committee, upon the anniversary following the date of the initial grant for service on any such committee, provided that the non-employee director continues to remain on the respective committee as a non-employee director; (c) provide that all stock option grants made pursuant to the Directors' Plan shall become exercisable on a daily ratable basis over a one (1) year period from the date of grant; and (d) provide that all future stock option grants made pursuant to the Directors' Plan shall terminate on the earlier of ten (10) years from the date of grant or the date 24 months following the date of the termination of the director's service as a director of or employee of or consultant to the Company.

As of April 15, 2002, options to purchase an aggregate of 360,000 shares of the Company's Common Stock had been granted and were outstanding under the Directors' Plan (net of canceled or expired options), and 340,000 shares, plus any shares that might in the future be returned to the Directors' Plan as a result of cancellations or expirations of options, remained available for future grant under the Directors' Plan.

Stockholders are requested in this Proposal 2 to approve the Directors' Plan, as amended. The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the meeting will be required to approve the Directors' Plan, as amended.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

The essential features of the Directors' Plan are outlined below.

7

GENERAL

The Directors' Plan provides for the automatic grant of nonstatutory stock options to directors of the Company who are not otherwise at the time of grant employees of or consultants to the Company or of any affiliate of the Company. Options granted under the Directors' Plan are not intended to qualify as "incentive stock options" within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"). See "Federal Income Tax Information" with respect to the Directors' Plan for a discussion of the tax treatment of nonstatutory stock options.

PURPOSE

The Board adopted the Directors' Plan to provide a means by which non-employee directors of the Company may be given an opportunity to purchase stock in the Company, to assist in retaining the services of such persons, to secure and retain the services of persons capable of filling such positions and to provide incentives for such persons to exert maximum efforts for the success of the Company. Five of the current directors of the Company are eligible to participate in the Directors' Plan.

ADMINISTRATION

The Board administers the Directors' Plan. The Board has the power to construe and interpret the Directors' Plan but not to determine the persons to whom or the dates on which options will be granted, the number of shares to be subject to each option, the time or times during the term of each option within which all or a portion of such option may be exercised, the exercise price, the type of consideration or the other terms of the option.

The Board has the power to delegate administration of the Directors' Plan to a committee composed of not fewer than two members of the Board. As used herein with respect to the Directors' Plan, the "Board" refers to any committee the Board appoints as well as to the Board itself.

ELIGIBILITY

The Directors' Plan provides that options may be granted only to non-employee directors of the Company. A "non-employee director" is defined in the Directors' Plan as a director of the Company who is not otherwise an employee of or consultant to the Company or any affiliate of the Company.

STOCK SUBJECT TO THE DIRECTORS' PLAN

An aggregate of 700,000 shares of Common Stock is authorized for issuance under the Directors' Plan. In April 2002, the Board approved, subject to stockholder approval, an amendment to the Directors' Plan to increase the aggregate number of shares reserved for issuance thereunder from 700,000 shares to 1,500,000 shares, an increase of 800,000 shares. If options granted under the Directors' Plan expire or otherwise terminate without being exercised, the shares of Common Stock not acquired pursuant to such options again becomes available for issuance under the Directors' Plan. If the Company reacquires unvested stock issued under the Directors' Plan, the reacquired stock will again become available for reissuance under the Directors' Plan.

TERMS OF OPTIONS

The following is a description of the terms of options under the Directors' Plan.

Automatic Grants. Under the Directors' Plan, each non-employee director who was a director at the time of the adoption of the Directors' Plan was automatically granted an option to purchase 10,000 shares of Common Stock. Each non-employee director who was first elected to the Board after the adoption of the plan was automatically granted an option to purchase 30,000 shares of Common Stock. In July 2001, the Board amended the Directors' Plan, subject to stockholder approval of this Proposal,

8

to provide for an increase in the automatic initial grant of an option to purchase shares of Common Stock from 30,000 shares to 40,000 shares to each non-employee director upon the directors' initial election as a member of the Board. Currently, each non-employee director additionally is granted an option to purchase 10,000 shares of Common Stock on each anniversary of each such director's original grant under the Directors' Plan. In July 2001, the Board amended the Directors' Plan, subject to stockholder approval of this Proposal, to provide for an increase in the automatic renewal grant of an option to purchase shares of Common Stock from 10,000 shares to 40,000 shares for each non-employee director on each anniversary of each such director's original grant under the Directors' Plan.

In March 2001, the Board amended the Directors' Plan and the stockholders of the Company subsequently approved the amended Directors' Plan, to provide for the automatic grant of (i) an option to purchase 10,000 shares of Common Stock to each non-employee director upon the director's appointment to each of the Audit, Compensation or Nominating Committees, and (ii) a renewal option to purchase 10,000 shares of Common Stock on each anniversary of the initial grant for service on the committee, so long as the director is not then an employee of the Company, has continuously served on the committee during such time and is a member of the committee at the time of grant. In July 2001, the Board amended the Directors' Plan, subject to stockholder approval of this Proposal, to provide for an increase in the automatic grants to members of the Audit, Compensation and Nominating Committees of the Board as follows: (i) each non-employee director will be automatically granted an option to purchase 15,000 shares of Common Stock upon the director's initial appointment to each of the Compensation and Nominating Committees of the Board; (ii) each non-employee director serving on each of the Compensation or Nominating Committees of the Board additionally will be granted an option to purchase 15,000 shares of Common Stock on each anniversary of such director's appointment to such committee or, if later, the anniversary of such non-employee director's prior stock option grant for service on such committee, so long as the director continues to be a non-employee director and has continuously served on such committee for the entire preceding twelve month period; (iii) each non-employee director will be automatically granted an option to purchase 25,000 shares of Common Stock upon the director's initial appointment as a member of the Audit Committee of the Board; and (iv) each non-employee director serving on the Audit Committee of the Board additionally will be granted an option to purchase 25,000 shares of Common Stock on each anniversary of such director's appointment to such committee or, if later, the anniversary of such non-employee director's prior stock option grant for service on such committee, so long as the director continues to be a non-employee director and has continuously served on such committee for the entire preceding twelve month period.

Exercise Price; Payment. The exercise price of options granted under the Directors' Plan is equal to 100% of the fair market value of the stock subject to the option on the date of the grant. On April 15, 2002, the closing price of the Company's Common Stock as reported on The Nasdaq National Market System was $0.67 per share.

The exercise price of options granted under the Directors' Plan must be paid in (i) cash at the time the option is exercised, (ii) by delivery of other Common Stock of the Company, or (iii) in a combination of the methods of payment described in (i) or (ii).

Option Exercise. In July 2001, the Board amended the Directors' Plan, subject to stockholder approval of this Proposal, to provide that options granted under the Directors' Plan become exercisable on a daily ratable basis over a one year period from the date of grant, so long as the optionee has continuously provided services to the Company or an affiliate of the Company from the date of grant until the applicable vesting date. Currently, options granted under the Directors' Plan become exercisable over a period of five years from the date of grant, with ten percent of the shares becoming exercisable on the date six months following the date of grant and the remaining ninety percent of the shares becoming exercisable on a daily ratable basis thereafter for the remaining four and one-half

9

years, so long as the optionee has continuously provided services to the Company or an affiliate of the Company from the date of grant until the applicable vesting date.

Term. The term of options under the Directors' Plan expire ten years from date of grant. In July 2001, the Board amended the Directors' Plan, subject to stockholder approval of this proposal, to provide that options under the Directors' Plan terminate 24 months after termination of the optionholder's service unless the optionholder dies before the optionholder's service has terminated, in which case the option may be exercised (to the extent the option was exercisable at the time of the optionholder's death) within 18 months of the optionholder's death by the person or persons to whom the rights to such option pass by will or by the laws of descent and distribution. Currently, options under the Directors' Plan terminate 12 months after termination of the optionholder's service unless the optionholder dies before the optionholder's service has terminated, in which case the option may be exercised as set forth in the preceding sentence. An optionholder may designate a beneficiary who may exercise the option following the optionholder's death.

RESTRICTIONS ON TRANSFER

The Directors' Plan provides that options shall be transferable by the optionee only upon such terms and conditions as are set forth in the option agreement as the Board shall determine in its discretion, provided, that, if the option agreement does not specifically provide for the transferability of an option, then the option shall not be transferable except by will or by the laws of descent and distribution, and may be exercised during the lifetime of the person to whom the option is granted only by such person.

EFFECT OF CERTAIN CORPORATE EVENTS

If any change is made in the stock subject to the Directors' Plan or subject to any option granted under the Directors' Plan (through merger, consolidation, reorganization, recapitalization, stock dividend, dividend in property other than cash, stock split, liquidating dividend, combination of shares, exchange of shares, change in corporate structure or other transaction not involving the receipt of consideration of the Company), the Directors' Plan and options outstanding thereunder will be appropriately adjusted as to the type(s) and the maximum number of securities subject to the Plan, the maximum number of securities which may be granted to any person in a particular calendar year and the type(s), number of securities and price per share of stock subject to such outstanding options.

In the event of a dissolution, liquidation, sale of substantially all of the assets of the Company, specified type of merger of the Company, or acquisition by certain "persons" (within the meaning of Section 13(d) or Section 14(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act")) of at least 50% of the combined voting power entitled to vote in the election of directors, then any options outstanding under the Directors' Plan shall be terminated if not exercised prior to such event.

DURATION, AMENDMENT AND TERMINATION

The Board may suspend or terminate the Directors' Plan at any time. Unless sooner terminated, the Directors' Plan will terminate on September 24, 2007.

The Board may also amend the Directors' Plan at any time or from time to time. However, no amendment will be effective unless approved by the stockholders of the Company to the extent stockholder approval is necessary for the Directors' Plan to satisfy the requirements of Rule 16b-3 or any Nasdaq or securities exchange listing requirements.

10

FEDERAL INCOME TAX INFORMATION

Nonstatutory Stock Options. Nonstatutory stock options granted under the Directors' Plan generally have the following federal income tax consequences:

There are no tax consequences to the optionholder or the Company by reason of the grant of a nonstatutory stock option. Upon exercise of a nonstatutory stock option, the optionholder normally will recognize taxable ordinary income equal to the excess of the stock's fair market value on the date of exercise over the option exercise price. However, to the extent the stock is subject to certain types of vesting restrictions, the taxable event will be delayed until the vesting restrictions lapse unless the participant elects to be taxed on receipt of the stock. If the optionholder becomes an employee, the Company is required to withhold from regular wages or supplemental wage payments an amount based on the ordinary income recognized. Subject to the requirement of reasonableness and the satisfaction of a tax reporting obligation, the Company will generally be entitled to a business expense deduction equal to the taxable ordinary income realized by the optionholder.

Upon disposition of the stock, the optionholder will recognize a capital gain or loss equal to the difference between the selling price and the sum of the amount paid for such stock plus any amount recognized as ordinary income upon exercise of the option (or vesting of the stock). Such gain or loss will be long-term or short-term depending on whether the stock was held for more than one year. Slightly different rules may apply to optionholders who acquire stock subject to certain repurchase options or who are subject to Section 16(b) of the Exchange Act. Long-term capital gains currently are generally subject to lower tax rates than ordinary income or short-term capital gains. The maximum long-term capital gains rate for federal income tax purposes is currently 20% while the maximum ordinary income rate and short-term capital gains rate is effectively 38.6%.

NEW PLAN BENEFITS

The following table presents certain information with respect to automatic option grants expected to be made in 2002, subject to the stockholders' approval this Proposal, for non-employee directors under the Director's Plan. This table assumes that each non-employee director continues as one of our directors throughout the year and that the Company does not elect any additional non-employee directors or appoint any additional directors to the Audit, Compensation or Nominating Committees of the Board.

NEW PLAN BENEFITS

1997 NON-EMPLOYEE DIRECTORS' STOCK OPTION PLAN

| | Number of Shares

Underlying Options Granted

|

|---|

Name and Position

|

|---|

| | Board

| | Committees

|

|---|

| Norman Gaut | | 40,000 | | 40,000 |

Edward Harris |

|

40,000 |

|

40,000 |

Jonathan G. Morgan |

|

40,000 |

|

25,000 |

Adam Stettner |

|

40,000 |

|

15,000 |

Robert W. Wilmot |

|

40,000 |

|

30,000 |

11

PROPOSAL 3

RATIFICATION OF SELECTION OF INDEPENDENT ACCOUNTANTS

The Board has selected PricewaterhouseCoopers LLP as the Company's independent accountants for the fiscal year ending December 31, 2002 and has further directed that management submit the selection of independent accountants for ratification by the stockholders at the Annual Meeting. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company's independent accountants is not required by the Company's Bylaws or otherwise. However, the Board is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. If stockholders fail to ratify the selection, the Audit Committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee and the Board in their discretion may direct the appointment of different independent accountants at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of PricewaterhouseCoopers LLP.

AUDIT FEES. During the fiscal year ended December 31, 2001, the aggregate fees billed by Pricewaterhouse Coopers LLP for the audit of the Company's financial statements for such fiscal year and for the reviews of the Company's interim financial statements was $233,000.

FINANCIAL INFORMATION SYSTEMS DESIGN AND IMPLEMENTATION FEES. During the fiscal year ended December 31, 2001, the Company did not incur any information technology consulting fees from services provided by Pricewaterhouse Coopers LLP.

ALL OTHER FEES. During the fiscal year ended December 31, 2001, the aggregate fees billed by Pricewaterhouse Coopers LLP for professional services other than audit and information technology consulting fees was $320,230, which were primarily for services provided in connection with the Company's merger with CuseeMe Networks.

The Audit Committee has determined that the rendering of the non-audit services by Pricewaterhouse Coopers LLP is compatible with maintaining the accountant's independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 3

12

EXECUTIVE OFFICERS

The executive officers of the Company and their ages as of April 29, 2002 are as follows:

NAME

| | AGE

| | POSITION

|

|---|

| Ralph Ungermann | | 60 | | Executive Chairman |

| Killko A. Caballero | | 42 | | Chief Executive Officer and President |

| Timothy A. Rogers | | 47 | | Senior Vice President and Chief Financial Officer |

| Robert Romano | | 46 | | Executive Vice President, Worldwide Sales and Strategic Alliances |

Biographical information about Messrs. Ungermann and Caballero is set forth under Proposal 1 above.

Mr. Rogers commenced his employment as Senior Vice President and Chief Financial Officer of the Company in January 2002. Prior to his employment with the Company, Mr. Rogers served as Senior Vice President and Chief Financial Officer of Integrated Telecom Express, Inc. from May 1998 until October 2001. From February 1992 until February 1998, Mr. Rogers was Vice President in the Investment Banking Department of J.P. Morgan & Co., Ltd. Mr. Rogers received an M.B.A. from Stanford University Graduate School of Business and an A.B. in Asian Studies, Russian Language and Literature from Dartmouth College.

Mr. Romano commenced his employment as Executive Vice President, Strategic Alliances with the Company in October 2001. In January 2002, he became Executive Vice President, Worldwide Sales and Strategic Alliances of the Company. Prior to his employment with the Company, Mr. Romano served as President of VCON, Inc., a U.S. subsidiary of an Israeli-based video conferencing company, from August 1998 until July 2001. Prior to that, he served as Vice President and General Manager of VTEL Corporation, a video-conferencing technology company, from January 1995 until August 1998. Mr. Ramano received a B.A. in Business Admintstration/Accounting from the University of Washington.

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company's Common Stock as of April 15, 2002 by (i) all those known by the Company to be the beneficial owner of more than 5% of the Company's Common Stock, (ii) each director, (iii) each of the executive officers named in the Summary Compensation Table, and (iv) all directors and executive officers as a group.

| | BENEFICIAL OWNERSHIP(2)

| |

|---|

BENEFICIAL OWNER(1)

| | NUMBER OF SHARES

| | PERCENT OF TOTAL

| |

|---|

| Entities Affiliated with Special Situations Fund(3) | | 6,260,664 | | 15.6 | % |

| | 153 E. 53rd Street

55th Floor

New York, NY 10022 | | | | | |

| Edward Harris(4) | | 5,436,062 | | 12.0 | % |

| | c/o Vulcan Inc.

505 Fifth Avenue South

Seattle, WA 98104 | | | | | |

| Vulcan Inc.(5) | | 5,335,305 | | 11.8 | % |

| | 505 Fifth Avenue South

Seattle, WA 98104 | | | | | |

Ralph Ungermann(6) |

|

2,329,889 |

|

5.8 |

% |

Adam Stettner(7) |

|

1,260,115 |

|

3.1 |

% |

Killko Caballero(8) |

|

592,296 |

|

1.5 |

% |

Robert W. Wilmot(9) |

|

360,148 |

|

* |

|

Norman Gaut(10) |

|

213,472 |

|

* |

|

James Griffin(11) |

|

209,249 |

|

* |

|

Jonathan Morgan(12) |

|

174,464 |

|

* |

|

Robert Scott(13) |

|

78,375 |

|

* |

|

Randy Acres |

|

5,164 |

|

* |

|

Ruth Cox |

|

700 |

|

* |

|

Raymond Cavanagh |

|

0 |

|

* |

|

All directors and executive officers as a group (14 persons)(13) |

|

10,689,100 |

|

23.0 |

% |

- *

- Less than one percent.

- (1)

- Unless otherwise noted in the table, the address for the Company's executive officers and directors is: c/o First Virtual Communications, Inc., 3393 Octavius Drive, Santa Clara, CA 95054.

- (2)

- This table is based upon information supplied by officers, directors, principal stockholders and Schedules 13D and 13G filed with the SEC. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Beneficial ownership also includes shares of stock subject to options exercisable within 60 days of April 15, 2000. Percentage of beneficial ownership is based on 40,116,179 shares of Common Stock outstanding as of April 15, 2002.

14

Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned.

- (3)

- Includes 3,960,964 shares of Common Stock held by Special Situations Fund III, L.P. ("SSF III"), 1,310,528 shares held by Special Situations Cayman Fund, L.P. ("SSCF") and 989,172 shares held by Special Situations Technology Fund, L.P. ("SSTF"), a fund for which Adam Stettner, a member of the Company's Board, serves as the managing director. Austin W. Marxe and David Greenhouse, who serve as officers, directors and members or principal shareholders of the investment advisors to the funds, claim sole voting and dispositive powers for all 6,260,664 shares.

- (4)

- Includes 5,335,305 shares of Common Stock held by Vulcan Inc., which includes 4,247,214 shares of Common Stock issuable upon conversion of shares of Series A Preferred Stock held by Vulcan Inc.; 892,591 shares of Common Stock issuable upon exercise of a warrant held by Vulcan Inc. and 195,500 shares of Common Stock held by Vulcan Inc. Also, includes 99,757 shares of Common Stock that Mr. Harris has the right to acquire pursuant to outstanding options exercisable within 60 days of April 15, 2002. Mr. Harris disclaims beneficial ownership of all shares held by Vulcan Inc.

- (5)

- Includes 4,247,214 shares of Common Stock issuable upon conversion of shares of Series A Preferred Stock held by Vulcan Inc. and 892,591 shares of Common Stock issuable upon exercise of a warrant held by Vulcan Inc.

- (6)

- Includes 2,174,577 shares of Common Stock held in the name of Ralph Ungermann, Trustee or Successor Trustee of the Ralph K. Ungermann Living Trust U/A/D May 18, 1988, as amended, and 155,312 shares Mr. Ungermann has the right to acquire pursuant to outstanding options exercisable within 60 days of April 15, 2002.

- (7)

- Includes 989,172 shares held by SSTF and 115,071 shares of Common Stock that Mr. Stettner has the right to acquire pursuant to outstanding options exercisable within 60 days of April 15, 2002. The shares deemed to be beneficially owned by Mr. Stettner exclude the shares described in note three above for SSF III and SSCF, except to the extent of his pecuniary interest therein, if any.

- (8)

- Includes 150,481 shares of Common Stock that Mr. Caballero has the right to acquire pursuant to outstanding options exercisable within 60 days of April 15, 2002.

- (9)

- Includes 178,750 shares of Common Stock held in the name of Robert W. Wilmot and Mary J. Wilmot, trustees of the Wilmot Living Trust u/d/t dated April 18, 1995, and 181,398 shares Mr. Wilmot has the right to acquire pursuant to outstanding options exercisable within 60 days of April 15, 2002.

- (10)

- Includes 5,138 shares of Common Stock that Dr. Gaut has the right to acquire pursuant to outstanding options exercisable within 60 days of April 15, 2002.

- (11)

- Includes 209,249 shares of Common Stock that Mr. Griffin has the right to acquire pursuant to outstanding options exercisable within 60 days of April 15, 2002.

- (12)

- Includes 174,464 shares Common Stock that Mr. Morgan has the right to acquire pursuant to outstanding options exercisable within 60 days of April 15, 2002.

- (13)

- Includes 78,375 shares of Common Stock that Mr. Scott has the right to acquire pursuant to outstanding options exercisable within 60 days of April 15, 2002.

- (14)

- Includes shares described in the notes above, as applicable, including an aggregate of 1,169,245 shares which certain named executive officers and directors of the Company have the right to acquire within 60 days after April 15, 2002 and 29,166 shares which an officer of the Company not required to be named in this table has the right to acquire within 60 days after April 15, 2002. In addition, includes 4,247,214 shares of Common Stick issuable upon conversion of Series A Preferred Stock and 892,591 shares of Common Stock issuable upon exercise of a warrant.

15

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company's directors and executive officers and persons who own more than ten percent of a registered class of the Company's equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2001, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with; except that one report, covering an aggregate of eleven transactions, was filed late by Mr. Ungermann and one report, covering an aggregate of one transaction, was filed by Pier Carlo Falotti, a former director of the Company.

EXECUTIVE COMPENSATION

COMPENSATION OF DIRECTORS

The Company does not currently provide cash compensation to directors for services in their capacity as a director, but directors may be reimbursed for certain expenses in connection with attendance at Board and committee meetings. The Company may compensate non-employee directors in the future.

All of the Company's non-employee directors are entitled to receive non-discretionary annual stock option grants under the Directors' Plan. Under the Directors' Plan, each non-employee director who is first elected to the Board after the adoption of the plan is automatically granted an option to purchase 30,000 shares of Common Stock and, subject to stockholder approval of Proposal 2, this initial grant will be increased from 30,000 shares to 40,000 shares. Each non-employee director is additionally granted an option to purchase 10,000 shares of Common Stock on each anniversary of the director's original grant under the Directors' Plan and, subject to stockholder approval of Proposal 2, this annual grant will be increased from 10,000 shares to 40,000 shares. In addition, each non-employee director serving on the Audit, Compensation or Nominating Committees of the Board, is granted an option under the Directors' Plan to purchase 10,000 shares of Common Stock upon the director's appointment to the committee and on each anniversary of such director's original grant upon joining such committee, so long as the director is not then an employee of the Company, has continuously served on the committee during such time and is a member of the committee at the time of grant. Subject to stockholder approval of Proposal 2, the initial option grants to nonemployee directors serving on the Audit, Compensation and Nominating Committees will be increased from 10,000 shares to 25,000 shares, 15,000 shares and 15,000 shares, respectively. Furthermore, subject to stockholder approval of Proposal 2, each non-employee director serving on the Audit, Compensation and Nominating Committees will be automatically granted an annual option to purchase 25,000 shares, 15,000 shares and 15,000 shares, respectively, on each anniversary of the director's initial grant for service on each such Committee, so long as the director continues to be a non-employee director and has continuously served on such Committee for the preceding twelve month period. Options granted under the Directors' Plan are granted at the fair market value of the Common Stock on the date of grant. Options granted to non-employee directors under the Directors' Plan currently have a ten-year term and vest over a period of five years, with ten percent of the shares vesting six months after the grant date and the remaining shares vesting ratably on a daily basis thereafter. Subject to stockholder approval of Proposal 2, options granted under the Directors' Plan will become exercisable on a daily ratable basis over a one year period from the date of grant.

During the year ended December 31, 2001, pursuant to the terms of the Directors' Plan, each of Messrs. Morgan and Stettner, upon their appointment to the Board in June 2001, were each granted

16

options to purchase 30,000 shares of Common Stock at an exercise price per share of $1.01. In addition for their services on the Audit and Nominating Committees of the Board, respectively, each of Messrs. Morgan and Stettner were granted options to purchase 10,000 shares of Common Stock under the Directors' Plan at an exercise price per share of $0.86. Pursuant to the terms of the Directors' Plan, Dr. Gaut, upon his appointment to the Board and Audit Committee in October 2001, was granted an option to purchase 30,000 shares of Common Stock for service on the Board and an option to purchase 10,000 shares of Common Stock for service on the Audit Committee, each at an exercise price per share of $0.91. Mr. Harris was granted an option to purchase 10,000 shares of Common Stock at an exercise price per share of $0.80 and Mr. Wilmot was granted an option to purchase 10,000 shares of Common Stock at an exercise price per share of $0.83 each pursuant to the terms of the Directors' Plan for services on committees of the Board. All option grants to these directors were made at the fair market value of the Common Stock on the respective dates of grant.

In January 2001, pursuant to the terms of the Company's 1997 Equity Incentive Plan (the "Incentive Plan"), each of Messrs. Harris and Wilmot were granted an option to purchase 20,000 shares of Common Stock. These options were granted at an exercise price of $1.219 per share, the fair market value of the Common Stock on the date of grant. In March 2001, pursuant to the terms of the Incentive Plan and for services on the Audit and Nominating Committees of the Board, Mr. Harris was granted two options, each to purchase 10,000 shares of Common Stock. In March 2001, pursuant to the terms of the Incentive Plan and for services on the Compensation Committee of the Board, Mr. Wilmot was granted an option to purchase 10,000 shares of Common Stock. These options granted to Messrs. Harris and Wilmot were granted at an exercise price of $1.313 per share, the fair market value on the date of grant. In July 2001, pursuant to the terms of the Incentive Plan and for services on the Compensation Committee of the Board, Mr. Wilmot was granted an option to purchase 10,000 shares of Common Stock at an exercise price of $0.80 per share, the fair market value on the date of grant. In addition, in July 2001, pursuant to the terms of the Incentive Plan and in order to align prior grants made to the non-employee directors of the Company with the amendments approved by the Board under the Directors' Plan for service on the Board and committees of the Board, Mr. Wilmot was granted three options to purchase 40,000, 15,000 and 15,000 shares of Common Stock, respectively; Mr. Harris was granted three options to purchase 40,000, 15,000 and 25,000 shares of Common Stock, respectively; Mr. Stettner was granted two options to purchase 40,000 and 15,000 shares of Common Stock, respectively; and Mr. Morgan was granted two options to purchase 40,000 and 25,000 shares of Common Stock, respectively. Each of these options were granted at an exercise price per share of $0.80, the fair market value on the date of grant.

17

COMPENSATION OF EXECUTIVE OFFICERS

The following table shows for the fiscal years ended December 31, 2001, 2000, and 1999, certain compensation awarded or paid to, or earned by, the Company's President and Chief Executive Officer, the Company's other four most highly compensated executive officers who earned more than $100,000 in salary and bonus at December 31, 2001, the Company's former President and Chief Executive Officer and one former executive officer who would have been among the most highly compensated executive officers earning more than $100,000 in salary and bonus at December 31, 2001 (collectively, the "Named Executive Officers"):

SUMMARY COMPENSATION TABLE

| |

| | Annual

Compensation

| | Annual

Compensation

| | Long-Term

Compensation

Awards

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus

($)

| | Securities

Underlying

Options(#)

| | All Other

Compensation

($)(1)

|

|---|

| Killko Caballero(2) | | 2001 | | 150,364 | | 22,922 | | 438,900 | | 4,338 |

| President and Chief | | 2000 | | — | | — | | — | | — |

| Executive Officer | | 1999 | | — | | — | | — | | — |

Ralph Ungermann(3) |

|

2001 |

|

20,596 |

|

— |

|

250,000 |

|

4,214 |

| Executive Chairman and | | 2000 | | 69,225 | | — | | — | | 4,068 |

| Former President and | | 1999 | | 47,975 | | — | | 50,000 | | 6,424 |

| Chief Executive Officer | | | | | | | | | | |

Robert Scott(4) |

|

2001 |

|

108,434 |

|

17,982 |

|

— |

|

4,332 |

| Chief Marketing | | 2000 | | — | | — | | — | | — |

| Officer | | 1999 | | — | | — | | — | | — |

James Griffin(5) |

|

2001 |

|

223,615 |

|

50,150 |

|

200,000 |

|

8,695 |

| Former Executive Vice | | 2000 | | 53,675 | | — | | 300,000 | | 520 |

| President, Product | | 1999 | | — | | — | | — | | — |

| Operations | | | | | | | | | | |

Randy Acres(6) |

|

2001 |

|

201,058 |

|

33,047 |

|

183,000 |

|

2,891 |

| Former Vice President | | 2000 | | 106,181 | | 12,005 | | 217,000 | | 833 |

| Finance and Chief | | 1999 | | — | | — | | — | | — |

| Financial Officer | | | | | | | | | | |

Ruth Cox(7) |

|

2001 |

|

131,995 |

|

121,059 |

|

200,000 |

|

7,339 |

| Former Chief | | 2000 | | 165,953 | | 27,951 | | 300,000 | | 1,000 |

| Marketing Officer | | 1999 | | — | | — | | — | | — |

Raymond Cavanagh(8) |

|

2001 |

|

75,377 |

|

46,053 |

|

— |

|

4,300 |

| Former Vice President | | 2000 | | — | | — | | — | | — |

| Worldwide Sales | | 1999 | | — | | — | | — | | — |

- (1)

- Represents insurance premiums paid by the Company with respect to group life and health insurance for the benefit of the Named Executive Officer.

- (2)

- Mr. Caballero commenced his employment with the Company upon its merger with CUseeMe Networks on June 19, 2001.

- (3)

- Mr. Ungermann served as President and Chief Executive Officer from July 2000 until the merger with CUseeMe Networks on June 19, 2001.

- (4)

- Mr. Scott commenced his employment with the Company upon its merger with CUseeMe Networks on June 19, 2001. Mr. Scott's services as an employee at the Company will end on April 30, 2002.

- (5)

- Mr. Griffin's services as an employee of the Company ended on March 12, 2002.

- (6)

- Mr. Acres' services as an employee of the Company ended on January 2, 2002.

- (7)

- Ms. Cox's services as an employee of the Company ended on July 15, 2001.

- (8)

- Mr. Cavanagh commenced his employment with the Company upon its merger with CUseeMe Networks on June 19, 2001. His services as an employee of the Company ended on January 2, 2002.

18

OPTION GRANTS IN LAST FISCAL YEAR

The Company grants options to its executive officers under the Incentive Plan. As of April 15, 2002, options to purchase a total of 2,995,864 shares were outstanding under the Incentive Plan and options to purchase 1,919,612 shares remained available for future grants. The following table sets forth each grant of stock options made during the fiscal year ended December 31, 2001 to each of the Named Executive Officers:

| |

| |

| |

| |

| | Potential Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(4)

|

|---|

| | Number of

Underlying

Options/SARs

Granted

(#)(1)

| | % of Total

Options/SARs

Granted to

Employees in

Fiscal Year(2)

| |

| |

|

|---|

Name

| | Exercise or

Base Price

($/Sh)(3)

| | Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Killko Caballero(5) | | — | | — | | — | | — | | — | | — |

Ralph Ungermann |

|

250,000 |

|

5.5 |

% |

1.25 |

|

01/09/11 |

|

196,875 |

|

496,875 |

Robert Scott(6) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

James Griffin(7) |

|

200,000 |

|

4.4 |

% |

1.25 |

|

09/04/02 |

|

151,500 |

|

397,500 |

Randy Acres(8) |

|

183,000 |

|

4.0 |

% |

1.25 |

|

03/31/02 |

|

144,113 |

|

363,713 |

Ruth Cox(9) |

|

200,000 |

|

4.4 |

% |

1.25 |

|

04/15/02 |

|

157,500 |

|

397,500 |

Raymond Cavanagh(10) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

- (1)

- Generally, 12.5% of the options become exercisable six months after the grant date and approximately 2.38% each month thereafter for 42 months. The term of each option granted is generally the earlier of (i) ten years or (ii) 30 days after termination of the employment of the holder.

- (2)

- Based on an aggregate of 4,577,180 options granted to employees, consultants and directors, including the Named Executive Officers, of the Company during the fiscal year ended December 31, 2001.

- (3)

- The exercise price per share of each option is equal to the fair market value of the Common Stock on the date of grant.

- (4)

- The potential realizable value is calculated based on the term of the option at its time of grant. It is calculated by assuming that the stock price on the date of grant appreciates at the indicated annual rate, compounded annually for the entire term of the option, and that the option is exercised and sold on the last day of its term for the appreciated stock price. All calculations are based on rounding the number of years remaining on the term of the option to the nearest whole number. No gain to the option holder is possible unless the stock price increases over the option term. The 5% and 10% assumed rates of appreciation are derived from the rules of the SEC and do not represent the Company's estimate or projection of its future Common Stock price.

- (5)

- Pursuant to its merger with CUseeMe Networks on June 19, 2001, the Company assumed the outstanding options to purchase common stock of CUseeMe Networks, including options to purchase 438,900 shares of Common Stock of the Company granted by CUseeMe Networks in the Company's fiscal year 2001 to Mr. Caballero at an exercise price of $.922 per share. 12.5% of the options become exercisable every six months commencing on the first six months after the date of grant until the options are fully vested four years from the date of grant.

- (6)

- Pursuant to its merger with CUseeMe Networks on June 19, 2001, the Company assumed the outstanding options to purchase common stock of CuseeMe Networks, including options to purchase 250,800 shares of Common Stock of the Company granted by CUseeMe in the Company's fiscal year 2001 to Mr. Scott at an exercise price of $.922 per share. 12.5% of the options become exercisable every six months commencing on the first six months after the date of grant until the options are fully vested four years from the date of grant. Mr. Scott's services as an employee of the Company will end on April 30, 2002.

- (7)

- Following Mr. Griffin's termination of employment services in March 2002, the Board approved the extension of the period whereby Mr. Griffin may exercise then vested options until September 4, 2002.

- (8)

- Following Mr. Acres' termination of employment services in January 2002, the Board approved the extension of the period whereby Mr. Acres could have exercised the then vested options until March 31, 2002. All unexercised options held by Mr. Acres were cancelled on March 31, 2002.

- (9)

- Following Ms. Cox's termination of employment services in July 2001, the Company and Ms. Cox entered into an agreement pursuant to which, among other things, Ms. Cox had until April 15, 2002 to exercise any stock options held by her which were vested as of such date. All unexercised options held by Ms. Cox were cancelled on April 15, 2002.

- (10)

- Pursuant to its merger with CuseeMe Networks on June 19, 2001, the Company assumed the outstanding options to purchase Common Stock of CuseeMe Networks, including options to purchase 94,050 and 87,780 shares of Common Stock of the Company granted by CuseeMe Networks to Mr. Cavanagh in 2001, at an exercise price of $1.146 and $.922 per share, respectively. The options become exercisable at the rate of 12.5% every six months commencing on the first six months after the date of grant until fully vested four years from the date of grant. Following Mr. Cavanagh's termination of employment services in January 2002, the Board approved the extension of the period whereby Mr. Cavanagh could have exercised the outstanding vested options held by him until March 31, 2002. All unexercised options held by Mr. Cavanagh were cancelled on March 31, 2002.

19

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END OPTION VALUES

The following table discloses the aggregate dollar value realized upon exercise of stock options in the last fiscal year by the Named Executive Officers. For each Named Executive Officer, the table also includes the total number of unexercised options and the aggregate dollar value of in-the-money unexercised options held at the end of the last completed fiscal year, separately identifying the exercisable and unexercisable options.

| |

| |

| | Number of Securities

Underlying Unexercised

Options as of

December 31, 2001

| |

| |

|

|---|

| |

| |

| | Value of In-The-Money

Options as of

December 31, 2001

|

|---|

| | Shares

Acquired

on

Exercise

(#)

| |

|

|---|

Name

| | Value

realized

($)

| | Exercisable

(#)

| | Unexercisable

(#)

| | Exercisable

($)

| | Unexercisable

($)

|

|---|

| Killko Caballero | | — | | — | | 54,863 | | 384,037 | | — | | — |

Ralph Ungermann |

|

— |

|

— |

|

70,587 |

|

179,413 |

|

— |

|

— |

Robert Scott |

|

— |

|

— |

|

31,350 |

|

219,450 |

|

— |

|

— |

James Griffin |

|

— |

|

— |

|

56,470 |

|

143,530 |

|

— |

|

— |

Randy Acres |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

Ruth Cox |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

Raymond Cavanagh |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

EMPLOYMENT AND CONSULTING AGREEMENTS AND CHANGE-IN-CONTROL AGREEMENTS

EMPLOYMENT AND CONSULTING AGREEMENTS

Following the merger with CUseeMe Networks on June 19, 2001, Mr. Caballero commenced his employment as President and Chief Executive Officer of the Company pursuant to an employment and non-competition agreement executed on March 22, 2001. The term of the employment and non-competition agreement is two years unless terminated earlier in accordance with such agreement. The Company agreed to pay Mr. Caballero a base salary of $300,000 per year and a target bonus to be determined by the Compensation Committee (but in any event, not less than one-third of his base salary for the year). Mr. Caballero is eligible to receive the target bonus provided that he meets or exceeds certain personal and corporate performance targets and provided further, that in the first year of employment, Mr. Caballero is guaranteed payment of 50% of the target bonus. In the event that Mr. Caballero's employment is terminated by the Company without "cause" or by Mr. Caballero for "good reason" (each as defined in the agreement), he is entitled to severance payments equal to one year of his then current base salary, 50% of the target bonus in effect on the date of termination, acceleration of any unvested stock options by a period of one year and continued health care coverage for up to one year after the date of termination. In addition, if Mr. Caballero's employment is terminated by death or complete disability, then all unvested stock options shall have their vesting accelerated by a period of one year.

Following the merger with CuseeMe Networks on June 19, 2001, Mr. Scott commenced his employment as Chief Marketing Officer of the Company pursuant to an employment agreement dated April 11, 2001. Pursuant to the employment agreement, the Company agreed to pay Mr. Scott a base salary of $230,000 per year and a target bonus for his first year of employment of $85,000. On March 20, 2002, the Company entered into an agreement with Mr. Scott pursuant to which Mr. Scott's services as Chief Marketing Officer of the Company will terminate on April 30, 2002. Mr. Scott has agreed to be available at the Company's reasonable request to provide consulting services after April 30, 2002 through May 16, 2002. The Company has agreed to make severance payments to

20

Mr. Scott in the form of a continuation of his base salary in effect as of April 30, 2000, for a period of twelve weeks following April 30, 2002, provided Mr. Scott remains an employee of the Company through April 30, 2002.

On March 12, 2002, the Company entered into an agreement with Mr. Griffin pursuant to which Mr. Griffin's services as Executive Vice President, Product Operations terminated as of the same date. The Company agreed to provide severance payments to Mr. Griffin equal to his base salary for a period of six months and continued health care coverage for up to six months following his date of termination. The Company further agreed to pay Mr. Griffin $21,250 over a six month period as bonus compensation.

On January 2, 2002, the Company entered into an agreement with Randy Acres pursuant to which Mr. Acres' services as Vice President, Finance and Chief Financial Officer terminated as of the same date. Pursuant to the agreement, the Company made severance payments to Mr. Acres equal to his current base salary for a period of twelve weeks following his date of determination. In addition, the Company extended the re-payment date on all sums due by Mr. Acres on two outstanding loans made by the Company to Mr. Acres until June 30, 2002.

In April 2001, the Company entered into an agreement with Ms. Cox pursuant to which Ms. Cox's services as Chief Marketing Officer of the Company terminated on July 15, 2001. After July 15, 2001, Ms. Cox agreed to provide consulting assistance to the Company in areas of her expertise until January 15, 2002. During this consultation period, the Company agreed to pay Ms. Cox a monthly fee of $17,500 per month. In addition, the Company paid Ms. Cox a bonus of $15,750 in fiscal year 2001 and agreed to pay an additional bonus of $15,750 in fiscal year 2002, based on the Company's quarterly performance results during the consultation period. Pursuant to the agreement, Ms. Cox had 90 days after the last day of the consultation period to exercise any stock options held by her which were vested as of that date.

On January 2, 2002, the Company entered into an agreement with Mr. Cavanagh pursuant to which Mr. Cavanagh's services as Vice President, Worldwide Sales of the Company terminated as of the same date. The Company made severance payments to Mr. Cavanagh equal to his current base salary for a period of six weeks following his date of determination.

NON-EMPLOYEE DIRECTORS' CHANGE OF CONTROL PLAN

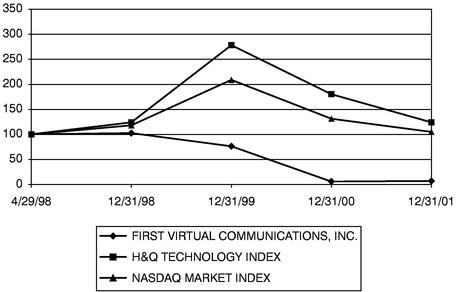

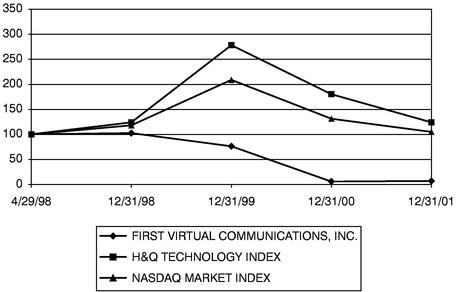

In February 1999, the Board adopted the Non-Employee Directors' Change of Control Plan to provide non-employee directors of the Company with the protection of certain benefits in case of a termination of his or her status as a director of the Company in connection with a change of control of the Company. The Non-Employee Directors' Change of Control Plan provides, as of the date of a change of control of the Company, as defined in the plan, that, subject to certain tax circumstances, each of the Company's then non-employee director's outstanding stock options, restricted stock awards and restricted stock purchases will vest and be exercisable in full.