- SSD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Simpson Manufacturing (SSD) DEF 14ADefinitive proxy

Filed: 12 Apr 02, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto | ||

| Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

SIMPSON MANUFACTURING CO., INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

SIMPSON MANUFACTURING CO., INC.

4120 Dublin Blvd., Suite 400

Dublin, California 94568

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

The annual meeting of stockholders of Simpson Manufacturing Co., Inc. (the "Company"), a Delaware corporation, will be held at 2:00 p.m., Pacific Daylight Time, on May 13, 2002, at the Company's home office located at 4120 Dublin Blvd., Suite 400, Dublin, California, for the following purposes:

Only stockholders of record as of March 21, 2002, are entitled to notice of and will be entitled to vote at this meeting or any adjournment thereof.

| BY ORDER OF THE BOARD OF DIRECTORS | |

Michael J. Herbert Secretary |

Dublin, California

April 12, 2002

TO ASSURE THAT YOUR SHARES ARE REPRESENTED AT THE MEETING, YOU ARE URGED TO COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE POSTAGE-PAID ENVELOPE PROVIDED, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. YOUR PROXY CAN BE REVOKED BY YOU AT ANY TIME BEFORE IT IS VOTED.

SIMPSON MANUFACTURING CO., INC.

4120 Dublin Blvd., Suite 400

Dublin, California 94568

April 12, 2002

PROXY STATEMENT

Solicitation and Voting of Proxies

The accompanying proxy is solicited on behalf of the Board of Directors of Simpson Manufacturing Co., Inc., a Delaware corporation (the "Company"), for use at the Annual Meeting of Stockholders of the Company to be held at the Company's home office located at 4120 Dublin Blvd., Suite 400, Dublin, California, on May 13, 2002, at 2:00 p.m., Pacific Daylight Time, or any adjournment (the "Meeting"). Only holders of record of the Company's Common Stock at the close of business on March 21, 2002, will be entitled to vote at the Meeting. At the close of business on that date, the Company had 12,188,218 shares of Common Stock outstanding and entitled to vote. A majority, or 6,094,110, of these shares, present in person or by proxy at the Meeting, will constitute a quorum for the transaction of business. This Proxy Statement and the Company's Annual Report to Stockholders for the year ended December 31, 2001, are being mailed to each stockholder on or about April 12, 2002.

Revocability of Proxy

A stockholder who has given a proxy may revoke it at any time before it is exercised at the Meeting, by (1) delivering to the Secretary of the Company (by any means, including facsimile) a written notice stating that the proxy is revoked, (2) signing and so delivering a proxy bearing a later date or (3) attending the Meeting and voting in person (although attendance at the Meeting will not, by itself, revoke a proxy). If, however, a stockholder's shares are held of record by a broker, bank or other nominee and that stockholder wishes to vote at the Meeting, the stockholder must bring to the Meeting a letter from the broker, bank or other nominee confirming the stockholder's beneficial ownership of the shares to be voted.

Expenses of Proxy Solicitation

The expenses of this solicitation of proxies will be paid by the Company. Following the original mailing of this Proxy Statement and other soliciting materials, the Company or its agents may also solicit proxies by mail, telephone or facsimile or in person.

Voting Rights

The holders of the Company's Common Stock are entitled to one vote per share on any matter submitted to a vote of the stockholders, except that, subject to certain conditions, stockholders may cumulate their votes in the election of directors, and each stockholder may give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of shares held by such stockholder or may distribute such stockholder's votes on the same principle among as many candidates as such stockholder thinks fit. No stockholder will be entitled, however, to cumulate votes (that is, cast for any nominee a number of votes greater than the number of votes that the stockholder normally is entitled to cast) unless the nominees' names have been placed in nomination prior to the voting and the stockholder gives notice at the Meeting prior to the voting of the stockholder's intention to cumulate the stockholder's votes. If any one stockholder gives such notice, all stockholders may cumulate their votes for nominees. In the election of directors, the nominees receiving the highest number of affirmative votes of the shares entitled to be voted for them up to the number of directors to be elected by such shares are elected. Votes against a nominee and votes withheld have no legal effect.

The Board of Directors expects all nominees named below to be available for election. In case any nominee is not available, the proxy holders may vote for a substitute. The Company knows of no

specific matter to be brought before the Meeting that is not identified in the notice of the Meeting or this Proxy Statement. If, however, proposals of stockholders that are not included in this Proxy Statement are presented at the Meeting, the proxies will be voted in the discretion of the proxy holders. Regulations of the Securities and Exchange Commission permit the proxies solicited by this Proxy Statement to confer discretionary authority with respect to matters of which the Company is not aware a reasonable time before the Meeting. Accordingly, the proxy holders may use their discretionary authority to vote with respect to any such matter pursuant to the proxies solicited hereby.

Directors will be elected at the Meeting by a plurality of the votes cast at the Meeting by the holders of shares represented in person or by proxy. Approval of Proposal No. 2 will require the affirmative vote of a majority of the votes cast at the Meeting by the holders of shares represented in person or by proxy. Abstentions and broker nonvotes are counted as shares present for determination of a quorum but are not counted as affirmative or negative votes on any item to be voted upon and are not counted in determining the number of shares voted on any item.

2

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of March 21, 2002, unless otherwise indicated, with respect to the beneficial ownership of the Company's Common Stock by (1) each stockholder known by the Company to be the beneficial owner of more than 5% of the Company's Common Stock, (2) each director and director nominee, (3) each person currently serving as an executive officer of the Company named in the Summary Compensation Table (see "Executive Compensation" below), and (4) all current executive officers and directors of the Company as a group.

| Name and, for Each 5% Beneficial Owner, Address | Amount and Nature of Beneficial Ownership(1) | Percent of Class | |||

|---|---|---|---|---|---|

Barclay Simpson(2) 4120 Dublin Blvd., Suite 400 Dublin, CA 94568 | 3,508,840 | 28.8 | % | ||

Neuberger Berman, LLC(3) 605 Third Avenue New York, NY 10158 | 1,059,516 | 8.7 | % | ||

Royce & Associates, Inc. and Royce Management Company(4) 1414 Avenue of the Americas New York, NY 10019 | 736,800 | 6.0 | % | ||

Thomas J Fitzmyers(5) | 241,468 | 2.0 | % | ||

Stephen B. Lamson(6) | 55,847 | * | |||

Donald M. Townsend(7) | 22,653 | * | |||

Earl F. Cheit(8) | 2,000 | * | |||

Peter N. Louras, Jr.(9) | 2,500 | * | |||

Sunne Wright McPeak(10) | 2,000 | * | |||

Barry Lawson Williams(11) | 500 | * | |||

Michael J. Herbert | — | * | |||

All current executive officers and directors as a group(12) | 3,835,808 | 31.4 | % |

3

receipt of dividends from or proceeds from the sale of such shares. Neuberger Berman Inc. owns 100% of Neuberger and Neuberger Berman Management, Inc. As of December 31, 2001, Neuberger had shared dispositive power with respect to 1,059,516 shares, sole voting power with respect to 268,116 shares and shared voting power with respect to 786,400 shares. With regard to the shared voting power, Neuberger Berman Management, Inc. and Neuberger Funds are deemed to be beneficial owners for purpose of section 13(d) of the Securities and Exchange Act of 1934, as amended, since they have shared power to make decisions whether to retain or dispose of the securities. Neuberger and Neuberger Berman Management, Inc. serve as sub-advisor and investment manager, respectively, of Neuberger Berman Genesis Fund Portfolio, which holds such shares in the ordinary course of its business and not with the purpose nor with the effect of changing or influencing the control of the issuer. The above-mentioned shares are also included with the shared power to dispose calculation.

4

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nominees

Thomas J Fitzmyers, Earl F. Cheit and Barry Lawson Williams, whose terms as directors expire in 2002, have been nominated for re-election at the Meeting. The names of the Company's directors, and certain information about them, are set forth below. It is intended that shares represented by proxies in the accompanying form will be voted for the election of Messrs. Fitzmyers, Cheit and Williams. Although the Board of Directors does not know whether any nominations will be made at the Meeting other than the nomination of Messrs. Fitzmyers, Cheit and Williams, if any nomination is made at the Meeting, or if votes are cast for any candidates other than those nominated by the Board of Directors, the persons authorized to vote shares represented by executed proxies in the enclosed form (if authority to vote for the election of directors or for any particular nominees is not withheld) will have full discretion and authority to vote cumulatively and allocate votes among any of the nominees of the Board of Directors in such order as they may determine.

| Name | Age | Director Since | Position | |||

|---|---|---|---|---|---|---|

Barclay Simpson(1)(4) | 80 | 1956 | Chairman of the Board and Director (term expiring in 2003) | |||

Thomas J Fitzmyers | 61 | 1978 | President and Chief Executive Officer and Director (term expiring in 2002) | |||

Stephen B. Lamson | 49 | 1990 | President and Chief Operating Officer, Simpson Strong-Tie Company Inc., and Director (term expiring in 2004) | |||

Earl F. Cheit(2)(4) | 75 | 1994 | Director (term expiring in 2002) | |||

Peter N. Louras, Jr.(1)(3)(4) | 52 | 1999 | Director (term expiring in 2004) | |||

Sunne Wright McPeak(2)(4) | 53 | 1994 | Director (term expiring in 2003) | |||

Barry Lawson Williams(1)(2)(3)(4) | 57 | 1994 | Director (term expiring in 2002) |

The Board of Directors has not established a nominating committee.

Executive Officers

Barclay Simpson, Thomas J Fitzmyers and Stephen B. Lamson are executive officers of the Company (in Stephen B. Lamson's case, by virtue of his policy-making functions for the Company as President and Chief Operating Officer of Simpson Strong-Tie Company Inc.) and are also directors and executive officers of subsidiaries of the Company. Michael J. Herbert, age 43, the Chief Financial Officer, Treasurer and Secretary of the Company and of subsidiaries of the Company, and Donald M. Townsend, age 55, a director and the Chief Executive Officer of the Company's subsidiary, Simpson Dura-Vent Company, Inc. ("Simpson Dura-Vent" or "SDV"), are also regarded as executive officers of

5

the Company, because, by virtue of their roles in management, they perform policy-making functions for the Company.

Biographical Information

Barclay Simpson has been the Chairman of the Board of Directors of the Company since 1994. He has been with the Company since its inception 1956. Mr. Simpson also is a member of the Boards of Directors of Calender Robinson Insurance, the University Art Museum of the University of California at Berkeley, and the California College of Arts and Crafts and is active in other charitable and educational institutions.

Thomas J Fitzmyers has served as President and a director of the Company since 1978, as the Chief Executive Officer and a director of Simpson Strong-Tie Company Inc. ("Simpson Strong-Tie" or "SST") since 1983 and as a director of Simpson Dura-Vent since 1982. He was appointed as the Company's Chief Executive Officer in 1994. Mr. Fitzmyers was employed by Union Bank from 1971 to 1978. He was a Regional Vice President when he left Union Bank to join the Company in 1978.

Stephen B. Lamson has served as the President and Chief Operating Officer of Simpson Strong-Tie since 2000 and served as its Secretary from 1992 to 2000. Prior to that, he served as the Company's, SST's and SDV's Chief Financial Officer and Treasurer from 1989 to 2000 and as the Company's and SDV's Secretary from 1989 to 2000. Mr. Lamson has served as a director of the Company since 1990, as a director of SST since 1992 and as a director of SDV since 1989. From 1980 to 1989, Mr. Lamson was with Coopers & Lybrand. He was an audit manager when he left that firm to join the Company in 1989.

Earl F. Cheit is Dean and Edgar F. Kaiser Professor Emeritus, Haas School of Business, University of California, Berkeley. He was, until 2001, Chairman of the Board of Shaklee Corporation and Senior Advisor, Asia Pacific Economic Affairs, The Asia Foundation. He is a Trustee of Mills College and is a member of the Board of Trustees and founding Chairman of Cal Performances, the performing arts presenter and commissioner at UC Berkeley.

Peter N. Louras, Jr. is a retired executive of The Clorox Company. He joined Clorox in 1980 and had been Group Vice President since May 1992. In this position, he served on Clorox's Executive Committee with overall responsibility for the company's international business activities and business development function, which handles all acquisitions and divestitures. Before joining Clorox, Mr. Louras, a certified public accountant, worked at Price Waterhouse in San Francisco. Mr. Louras is a member of the American Institute of CPAs and the Pennsylvania Institute of CPAs. He is currently a member of the Board of Regents of JFK University and sits on the boards of various not-for-profit organizations.

Sunne Wright McPeak has served since 1996 as the President and Chief Executive Officer of the Bay Area Council, a business-sponsored organization founded in 1945 that promotes economic prosperity and environmental quality in the San Francisco Bay Area. From 1993 to 1996, she was the President and Chief Executive Officer of the Bay Area Economic Forum, a partnership of government, business, academic and foundation sectors of the nine San Francisco Bay Area counties. From 1979 through 1994, she served on the Board of Supervisors of Contra Costa County, including several terms as Chair. Her most recent term as Chair concluded in 1992. In addition, Ms. McPeak served as President of the California State Association of Counties and has been a member of the advisory boards of the Urban Land Institute and California State University, Hayward. She is currently a director of the California Foundation for the Environment and the Economy and the Bridge Housing Corporation.

Barry Lawson Williams has been President of Williams Pacific Ventures Inc., a venture capital and real estate consulting firm, since 1987. He is a director of PG&E Corporation, CH2M HILL

6

Companies, Ltd., USA Education, Inc., Newhall Land and Farming Co. Inc., Northwestern Mutual Life Insurance Co., R.H. Donnelly & Co., Synavant and Kaiser Permanente. Mr. Williams is also a General Partner of WDG Ventures Inc., a California limited partnership. He recently was interim President and Chief Executive Officer of the American Management Association International during 2001.

Michael J. Herbert has served as the Company's and its subsidiaries Chief Financial Officer, Treasurer and Secretary since 2000. From 1988 to 2000 he held various financial management positions, most recently as Director of Finance, with Sun Microsystems, Inc.

Donald M. Townsend has been employed by the Company since 1981 and has served as a director of Simpson Dura-Vent since 1984 and as its President and Chief Operating Officer since 1991. He has served as SDV's Chief Executive Officer since 1994. From 1984 to 1991, he was the Vice President and General Manager of SDV.

Attendance at Meetings

The Board of Directors held five meetings and its committees held a total of six meetings in 2001 (including four meetings of the Audit Committee and one meeting of the Compensation Committee). Each director attended all of the meetings of the Board of Directors in 2001, except Peter Louras who missed one meeting, and all of the meetings of the committees on which he or she served in 2001, except Peter Louras and Sunne McPeak who each missed one committee meeting.

THE BOARD RECOMMENDS A VOTE "FOR" ELECTION OF THOMAS J FITZMYERS, EARL F. CHEIT AND BARRY LAWSON WILLIAMS, THE THREE NOMINEES FOR DIRECTOR AT THIS MEETING.

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Board of Directors has selected PricewaterhouseCoopers LLP as its principal independent auditors to audit the Company's financial statements for 2002, and the stockholders will be asked to ratify such selection. PricewaterhouseCoopers LLP has audited the Company's financial statements since prior to 1975. A representative from PricewaterhouseCoopers LLP will be present at the Meeting, will be given an opportunity to make a statement at the Meeting if he or she desires to do so, and will be available to respond to appropriate questions.

THE BOARD RECOMMENDS A VOTE "FOR" RATIFICATION OF SELECTION OF PRICEWATERHOUSECOOPERS LLP.

7

Summary Compensation Table

The table below provides information relating to compensation for the years ended December 31, 2001, 2000 and 1999, for the Chief Executive Officer and the other four most highly compensated executive officers of the Company, including the President and Chief Operating Officer of SST and the Chief Executive Officer of SDV (determined as of the end of 2001) (collectively, the "Named Executive Officers"). The amounts shown include compensation for services in all capacities that were provided to the Company and its subsidiaries.

| | | | | | Long-Term Compensation | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | Awards | | | |||||||||

| | | Annual Compensation | Payouts | | ||||||||||||

| | | | Securities Underlying Options/ SARs(#)(2) | | ||||||||||||

| Name and Principal Position | Year | Salary($) | Bonus($) | Other Annual Compensation($) | Restricted Stock Awards($) | LTIP Payouts($) | All Other Compensation($)(3) | |||||||||

| Thomas J Fitzmyers, President and Chief Executive Officer of the Company | 2001 2000 1999 | 281,424 273,230 265,272 | 1,102,348 1,404,860 1,318,761 | 109,149 — — | (1) | — — — | — — 4,500 | — — — | 25,500 25,500 24,000 | |||||||

| Barclay Simpson, Chairman of the Board of the Company | 2001 2000 1999 | 150,000 150,000 150,000 | 568,324 786,932 738,706 | — — — | — — — | — — 500 | — — — | 22,500 22,500 22,500 | ||||||||

| Stephen B. Lamson, President and Chief Operating Officer of SST(4) | 2001 2000 1999 | 185,400 180,000 116,940 | 662,307 861,247 781,396 | — — — | — — — | — — 2,500 | — — — | 25,500 25,500 17,541 | ||||||||

| Michael J. Herbert Chief Financial Officer and Secretary of the Company | 2001 2000 | 159,650 103,333 | 226,531 86,430 | — — | — — | — — | — — | 23,948 — | ||||||||

| Donald M. Townsend, President and Chief Executive Officer of SDV | 2001 2000 1999 | 188,085 182,607 177,288 | 302,679 410,091 489,724 | 13,815 13,412 13,021 | — — — | — — 2,500 | — — — | 25,500 25,500 24,000 | ||||||||

8

Employee Stock Options

No options to purchase shares of Common Stock were granted or to be granted to the Named Executive Officers for the year ended December 31, 2001.

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND

DECEMBER 31, 2001, OPTION/SAR VALUES

| Name | Shares Acquired on Exercise(#) | Value Realized($)(1) | Number of Securities Underlying Unexercised Options/SARs at December 31, 2001, (#) Exercisable/ Unexercisable | Value of Unexercised In-the-Money Options/SARs at December 31, 2001, ($) Exercisable/ Unexercisable | ||||

|---|---|---|---|---|---|---|---|---|

| Thomas J Fitzmyers | 4,500 | 182,025 | 11,250/11,250 | 295,242/271,758 | ||||

| Barclay Simpson | 500 | 13,750 | 750/750 | 12,923/10,052 | ||||

| Stephen B. Lamson | 23,048 | 895,451 | 6,250/3,750 | 164,023/65,227 | ||||

| Donald M. Townsend | — | — | 5,625/2,500 | 167,078/40,398 |

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Boards of Directors of the Company comprises Barclay Simpson, the Chairman of the Board of the Company, and Peter N. Louras, Jr. and Barry Lawson Williams, both independent directors of the Company. Mr. Louras and Mr. Williams have no relationships with the Company or any of its subsidiaries other than as members of the Company's Board of Directors and certain committees of the Company's Board of Directors. Certain transactions to which Mr. Simpson, his affiliates and members of his family have been parties are described below.

Real Estate Transactions

The Company, directly and through its subsidiaries, leases certain of its facilities from general partnerships (the "Partnerships") wholly or partly comprising current or former directors, officers, employees and stockholders of the Company and its subsidiaries. The Partnerships, their partners, the

9

percentage interests of such partners in the Partnerships and the properties that the Partnerships lease, or previously leased and sold, to the Company or a subsidiary, are as follows:

| Partnership | Partners (percentage interests) | Property Location | ||

|---|---|---|---|---|

| Simpson Investment Company ("SIC") | Barclay Simpson (77%), John B. Simpson (5%), Anne Simpson Gattis (5%), Jean D. Simpson (5%), Jeffrey P. Gainsborough (2%), Julie Marie Simpson (2%), Elizabeth Simpson Murray (2%) and Amy Simpson (2%) | San Leandro, California | ||

Doolittle Investors | Barclay and Sharon Simpson (25.51%), SIC (25.51%), Everett H. Johnston Family Trust (23.13%), Judy F. Oliphant, Successor Trustee of the Oliphant Family Revocable Trust Agreement Dated January 27, 1993 (Survivors Trust) "Oliphant Trust") (20.61%), and Thomas J Fitzmyers (5.24%), | San Leandro, California | ||

Columbus-Westbelt Investment Co. | Barclay and Sharon Simpson (13.31%), Jeffrey P. Gainsborough (11.01%), Julie Marie Simpson (11.01%), Elizabeth Simpson Murray (11.01%) and Amy Simpson (11.01%), Everett H. Johnston Family Trust (5.54%), Oliphant Trust (5.54%), Tyrell T. Gilb Trust (5.54%), Doyle E. Norman (5.54%), Robert J. Phelan (5.54%), Richard C. Perkins Trust (5.48%), Stephen P. Eberhard (5.05%), Stephen B. Lamson (3.32%) and Thomas J Fitzmyers (1.10%), | Columbus, Ohio | ||

Vacaville Investors | Everett H. Johnston Family Trust (49.90%), SIC (27.50%), Oliphant Trust (12.47%), Barclay and Sharon Simpson (4.57%), Richard C. Perkins Trust (4.43%) and Thomas J Fitzmyers (1.13%), | Vacaville, California | ||

Vicksburg Investors | Everett H. Johnston Family Trust (41.17%), Barclay and Sharon Simpson (33.92%), Oliphant Trust (12.61%), Richard C. Perkins Trust (6.28%) and Thomas J Fitzmyers (6.02%) | Vicksburg, Mississippi |

Barclay Simpson is the managing partner of SIC, a general partnership of Mr. Simpson and his seven children. Everett H. Johnston, formerly a director and executive officer of the Company (now retired), is the managing partner of each Partnership other than SIC. Richard C. Perkins, Stephen P. Eberhard and Robert J. Phelan are officers of SST and Doyle E. Norman (retired) and Tyrell T. Gilb (deceased) are former employees of the Company. Sharon Simpson is Barclay Simpson's wife.

10

Aggregate lease payments by the Company and its subsidiaries to the Partnerships in 2001, 2000 and 1999 were, and the terms of the leases will expire, as follows:

| | Lease Payments | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Partnership | Lease Expiration Date | ||||||||||

| 2001 | 2000 | 1999 | |||||||||

| SIC(1) | $ | 82,331 | $ | 197,594 | $ | 185,100 | (1) | ||||

| Doolittle Investors | 253,080 | 253,080 | 253,080 | 12/31/09 | |||||||

| Columbus Westbelt Investment Co. | 626,328 | 592,381 | 581,064 | 9/30/05 | |||||||

| Vacaville Investors | 438,898 | 437,640 | 437,640 | 11/30/07 | |||||||

| Vicksburg Investors | 368,543 | 367,013 | 354,868 | 11/30/03 | |||||||

The leases with the Partnerships are expected to continue until the expiration of the respective terms of the leases, and they may be renewed. The Company's future rent obligations under the continuing leases are expected to be consistent with the rents paid in 2001, subject to adjustments as provided in certain of the leases.

If and when any lease is proposed to be amended or renewed or any property subject to any lease is proposed to be purchased by the Company, the Company will enter into such transaction only with the approval of a majority of the directors of the Company who are not employees or officers of the Company and who are not partners of any of the Partnerships and only after such directors satisfy themselves that such transaction will be fair, just and reasonable as to the Company, beneficial to the Company and on terms reasonably consistent with the terms available from unrelated parties in similar transactions negotiated at arm's length.

The Company does not intend in the future to lease from any of the Partnerships or any other entities controlled by any of its directors, officers or employees any facilities that are not on or adjacent to the property subject to the existing leases.

Cash Profit Sharing Bonus Plan

The Company maintains a cash profit sharing bonus plan for the benefit of employees of the Company and its subsidiaries. The Company may change, amend or terminate its bonus plan at any time. Under the bonus plan as currently in effect, the Compensation Committee of the Board of Directors determines a "qualifying level" for the coming fiscal year for the Company, SDV and each branch of SST. The qualifying level is equal to the value of the net operating assets (as defined) of the Company, SDV or the respective branch of SST, multiplied by a rate of return on those assets. If profits exceed the qualifying level in any fiscal quarter, a portion of such excess profits is distributed to the eligible employees as cash bonuses. The percentage of excess profits distributed and the rates used to calculate the amounts to be distributed to the Named Executive Officers are determined by the Compensation Committee of the Board of Directors, while the percentage of excess profits distributed and the rates used to calculate the amounts to be distributed to all other participants are determined by the executive officers. The failure to earn a cash bonus in any given quarter does not affect the ability to earn a cash bonus in any other quarter. Amounts paid under these programs aggregated $16.4 million, $18.6 million and $17.8 million in 2001, 2000 and 1999, respectively, the amounts of which paid to Named Executive Officers in 2001, 2000 and 1999 are shown in the Summary Compensation Table above.

11

1994 Stock Option Plan

By affording selected employees and directors of and consultants to the Company and its subsidiaries the opportunity to buy shares of Common Stock of the Company, the Simpson Manufacturing Co., Inc. 1994 Stock Option Plan (the "Option Plan") is intended to enhance the ability of the Company and its subsidiaries to retain the services of persons who are now employees, directors or consultants, to secure and retain the services of new employees, directors and consultants, and to provide incentives for such persons to exert maximum efforts for the success of the Company and its subsidiaries. The Option Plan was adopted by the Company's Board of Directors and approved by the Company's stockholders prior to the Company's initial public offering in 1994. It was amended in 1997 and again in 2000 with shareholder approval. No more than 2,000,000 shares of Common Stock may be sold (including shares already sold) pursuant to all options granted under the Option Plan. Common Stock sold on exercise of options granted under the Option Plan may be previously unissued shares or reacquired shares, bought on the market or otherwise. Options to purchase 7,000 and 139,750 shares of Common Stock were granted pursuant to commitments made related to the preceding fiscal years under the Option Plan in 2000 and 1999, respectively, and options to purchase 9,500 shares of Common Stock, out of a possible 300,250 shares, were committed to be granted in 2001. No options were committed to be granted under the Option Plan to Named Executive Officers in 2001 and 2000. Options granted under the Option Plan to Named Executive Officers in 1999 are shown in the Summary Compensation Table above.

Profit Sharing Plans

The Company's subsidiaries maintain defined contribution profit sharing plans for their U.S. based salaried employees (the "Salaried Plan") and for U.S. based nonunion hourly employees (the "Hourly Plan"). An employee is eligible for participation in a given year if he or she is an employee on the first and last days of that calendar year and completes at least 1,000 hours of service during that calendar year for the Salaried Plan or 750 hours of service during that calendar year for the Hourly Plan. As of December 31, 2001, there were 461 participants in the Salaried Plan and 646 participants in the Hourly Plan. Under the Salaried Plan and the Hourly Plan, the Board of Directors may authorize contributions to the plan trusts in their exclusive discretion. Contributions to the plan trusts by the Company's subsidiaries are limited to the amount deductible for federal income tax purposes under section 404(a) of the Internal Revenue Code. Barclay Simpson and Michael J. Herbert, who are Named Executive Officers of the Company, are trustees of the plan trusts. Mr. Simpson and Mr. Herbert are also participants in the Salaried Plan. The amounts contributed by the Company for their accounts in 2001, 2000 and 1999 are shown in the Summary Compensation Table above. Certain of the Company's foreign subsidiaries maintain similar plans for their employees.

Compensation of Directors

The Company's directors who do not receive compensation as officers or employees of the Company are each paid an annual retainer of $10,000 and a fee of $1,000 for attending in person each meeting of the Board of Directors and for attending in person each meeting of any committee held on a day when the Board of Directors does not meet. Each outside director is also paid $500 for each committee meeting he or she attends in person on the same day as a Board of Directors meeting and for each Board of Directors meeting attended by telephone conference. Directors are also reimbursed for expenses incurred in connection with their attendance at Board of Directors and committee meetings.

12

1995 Independent Director Stock Option Plan

The Simpson Manufacturing Co., Inc. 1995 Independent Director Stock Option Plan (the "Independent Director Plan") was adopted by the Board of Directors and approved by the stockholders in 1995 and was amended by the Board of Directors in 1997. The purpose of the Independent Director Plan is to give independent directors of the Company an opportunity to buy shares of Common Stock of the Company, to encourage independent directors in their efforts on behalf of the Company and to secure their continued service to the Company. No options to purchase shares of Common Stock were committed to be granted under the Independent Director Plan in 2001 and 2000.

Report of the Audit Committee of the Board of Directors

The Audit Committee of the Board of Directors (the "Audit Committee") is responsible for financial and accounting management. Its policies and practices are described as follows:

Composition. The Audit Committee is composed of three independent directors, as defined by the New York Stock Exchange rules, and operates under a written charter adopted by the Board of Directors. The members of the Audit Committee are Barry Lawson Williams, Chairman, Earl F. Cheit and Sunne Wright McPeak.

Responsibilities. The responsibilities of the Audit Committee include recommending to the Board of Directors an accounting firm to be engaged as the Company's independent accountants. Management is responsible for the Company's internal controls and financial reporting process. The independent accountants are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report theron. The Audit Committee's responsibility is to oversee these processes.

Review with Management and Independent Accountants. The Audit Committee has met and held discussions with management and the independent accountants. Management represented to the Audit Committee that the Company's consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent accountants. The Audit Committee has discussed with the independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61, "Communication with Audit Committees."

The Company's independent accountants also provided the Audit Committee the written disclosures and the letter required by Independent Standards Board Standard No. 1, "Independence Discussions with Audit Committees," and the Audit Committee discussed with the independent accountants, PricewaterhouseCoopers LLP, that firm's independence. On that basis, the Audit Committee believes that PricewaterhouseCoopers LLP is independent.

Summary. Based upon the Audit Committee's discussions with management and the independent accountants and the Audit Committee's review of the representations of management, and the report of the independent accountants to the Audit Committee, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2001, as filed with the Securities and Exchange Commission. The Audit Committee believes that it has satisfied its responsibilities under its charter.

| Audit Committee |

Barry Lawson Williams, Chair Earl F. Cheit Sunne Wright McPeak |

13

Audit and Related Fees

Audit Fees. For professional services for the audit of Company's annual consolidated financial statements for 2001 and the review of the consolidated financial statements included in the Company's Forms 10-Q for 2001, PricewaterhouseCoopers LLP billed the Company an aggregate of approximately $282,000.

Financial Information Systems Design and Implementation Fees. PricewaterhouseCoopers LLP billed no fees to the Company for financial information systems design and implementation for 2001.

All Other Fees. For all other services rendered by PricewaterhouseCoopers LLP for 2001, including income tax preparation and consultation and for statutorily required reviews in certain locations outside the U.S. where the Company has operations, PricewaterhouseCoopers LLP billed the Company an aggregate of approximately $542,000.

The Audit Committee has determined that the fees for services rendered were compatible with maintaining PricewaterhouseCoopers LLP's independence.

Report of the Compensation Committee, 1994 Stock Option Plan Committee and Board of Directors on Executive Compensation

The Compensation Committee and the 1994 Stock Option Plan Committee of the Board of Directors are responsible for the development and review of the Company's compensation policy for all the salaried employees. The overall philosophy of the Company's compensation program is to provide a high degree of incentive to employees by creating programs that reward achievement of specific profit goals. The Company believes that these incentive programs based on profit targets are best suited to align the interests of employees and stockholders. The Company does not have any special plans for the Chief Executive Officer or other executive officers of the Company. The absence of special plans for the executive officers is intended to create a sense of unity and cooperation among the Company's employees. The four elements of the Company's compensation plan for most salaried employees and all officers are base salary, a profit sharing retirement plan, a cash profit sharing bonus plan and the Option Plan.

The Compensation Committee has not performed any recent salary surveys, but based on surveys in prior years and recent raises, it believes the base salaries for the Chief Executive Officer and other executive officers are competitive when compared to similar companies. Each of the Named Executive Officers received an increase in salary of 3% in 2001, except for Barclay Simpson, Chairman, who did not receive an increase in salary in 2001.

All U.S. based salaried employees, including the Chief Executive Officer and other executive officers, participate in the profit sharing plan in proportion to their salaries. For 2001, 15% of all U.S. based salaried employees' base pay will be contributed to the profit sharing plan subject to the limitations of applicable law. In 2001, Thomas J Fitzmyers, President and Chief Executive Officer, Stephen B. Lamson, President and Chief Operating Officer of SST and Donald M. Townsend, President and Chief Executive Officer of SDV, were subject to a contribution limit under applicable law; the Company's contribution to the profit sharing plan for their accounts was $25,500 each.

All salaried employees, except those on commission programs, participate in the Company's quarterly cash profit sharing bonus plan. Annually, the Compensation Committee establishes an acceptable range of participation in the profits in excess of the qualifying level to be distributed as cash bonuses for each profit center. The Compensation Committee also approves the specific percentages to be distributed to the Chief Executive Officer and other executive officers. The executive officers determine the specific percentages for distributions to all other participating employees. Historically, the percentage of profits in excess of the qualifying level distributed under these plans has not changed substantially from year to year. Employees with higher levels of responsibility typically receive higher

14

proportions of the cash profit sharing for their profit center. In 2001, the Chief Executive Officer received 392% of his base salary in cash profit sharing bonuses. Because the cash profit sharing bonus plan is based upon a return on net operating assets, and not subjectively determined, the Compensation Committee believes the plan provides substantial incentive to all participating employees, not only the Company's officers.

The 1994 Stock Option Plan Committee believes an option plan is most effective if options are granted to all participants on an objective rather than subjective basis. Therefore, under the Option Plan, participants are granted options if Company-wide and profit center operating goals are met. The Compensation Committee establishes these goals at the beginning of the year. The 1994 Stock Option Plan Committee also believes that option plans with broad based participation are most effective. The 1994 Stock Option Plan Committee determines each year the employees who are eligible to participate in the Option Plan, based on job responsibilities and contributions made to the Company. At present, approximately one quarter of the Company's salaried employees participate in the Option Plan. The 1994 Stock Option Plan Committee determines the number of options to be granted under the Option Plan. In determining the potential grants, the 1994 Stock Option Plan Committee considers previous stock and option awards, current options owned, job responsibilities and contributions to the Company. These same considerations apply to option grants to the Chief Executive Officer and other executive officers. Because of the responsibilities of the Chief Executive Officer and the other executive officers, their stock option grants are generally higher than those of other participants who also achieve their goals. Most of the operating goals were not met in 2001 and, accordingly, options to purchase only 9,500 shares of Common Stock, out of a possible 300,250 shares, were committed to be granted in 2001.

In 1995, the Company adopted the Independent Director Plan to give the outside members of the Board of Directors an opportunity to buy shares of Common Stock of the Company. The Independent Director Plan is administered by the Board of Directors (as its manager and not as its trustee) and determines which persons are eligible to be granted options. The Board of Directors believes this kind of option plan is most effective if options are granted to outside directors on an objective basis. Therefore, the Board of Directors determines the number of shares subject to options that they believe will be an appropriate incentive to be granted when an outside director becomes a member of the Board of Directors and if Company-wide operating goals, established by the Compensation Committee at the beginning of the year, are met. These operating goals were not met in 2001 and, accordingly, no stock options were committed to be granted to any of the outside directors.

| Compensation Committee | 1994 Stock Option Plan Committee | |

|---|---|---|

| Barclay Simpson, Chair | Barry Lawson Williams, Chair | |

| Peter N. Louras, Jr. | Peter N. Louras, Jr. | |

| Barry Lawson Williams |

15

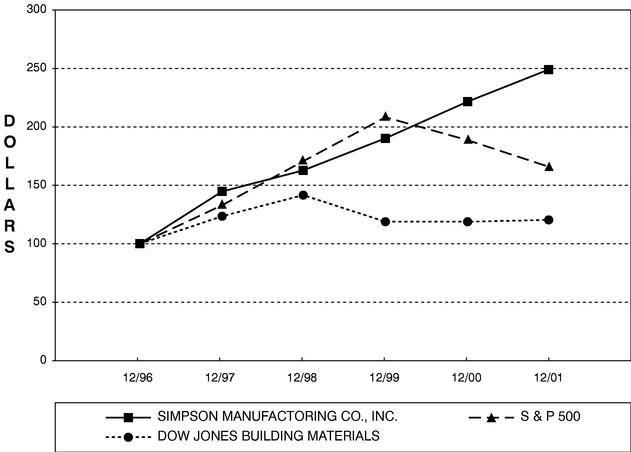

Company Stock Price Performance

The graph below compares the cumulative total stockholder return on the Company's Common Stock from December 31, 1996, through December 31, 2001, with the cumulative total return on the S & P 500 Index and the Dow Jones Building Materials Index over the same period (assuming the investment of $100 in the Company's Common Stock and in each of the indices on December 31, 1996, and reinvestment of all dividends).

SIMPSON MANUFACTURING CO., INC.

Comparison of Cumulative Total Return

December 31, 1996, to December 31, 2001

Historical returns are not necessarily indicative of future performance.

16

The Board of Directors does not presently intend to bring any other business before the Meeting and, so far as is known to the Board of Directors, no matters are to be brought before the Meeting except as specified in the notice of the Meeting. As to any business that may properly come before the Meeting, however, it is intended that proxies, in the form enclosed, will be voted in respect thereof in accordance with the judgment of the persons voting such proxies.

DISCLAIMER REGARDING INCORPORATION BY REFERENCE OF THE REPORT OF THE COMPENSATION COMMITTEE AND THE STOCK PRICE PERFORMANCE GRAPH

THE INFORMATION SHOWN IN THE SECTIONS ENTITLED "REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS," "REPORT OF THE COMPENSATION COMMITTEE, THE 1994 STOCK OPTION PLAN COMMITTEE AND BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION" AND "COMPANY STOCK PRICE PERFORMANCE" SHALL NOT BE DEEMED TO BE INCORPORATED BY REFERENCE BY ANY GENERAL STATEMENT INCORPORATING BY REFERENCE THIS PROXY STATEMENT INTO ANY FILING BY THE COMPANY WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, EXCEPT TO THE EXTENT THAT THE COMPANY INCORPORATES THIS INFORMATION BY SPECIFIC REFERENCE, AND SUCH INFORMATION SHALL NOT OTHERWISE BE DEEMED FILED UNDER SUCH ACTS.

STOCKHOLDER PROPOSALS

Stockholder proposals for inclusion in the proxy statement and form of proxy relating to the Company's 2003 Annual Meeting of Stockholders must be received by the Company a reasonable time before the Company's solicitation is made, and in any event not later than December 13, 2002.

BY ORDER OF THE BOARD

Michael J. Herbert

Secretary

TO ASSURE THAT YOUR SHARES ARE REPRESENTED AT THE MEETING, YOU ARE URGED TO COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE POSTAGE-PAID ENVELOPE PROVIDED, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. YOUR PROXY CAN BE REVOKED BY YOU AT ANY TIME BEFORE IT IS VOTED.

17

PROXY

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS OF

SIMPSON MANUFACTURING CO., INC.

The undersigned hereby appoints Barclay Simpson and Thomas J Fitzmyers, and each of them, attorneys and proxies of the undersigned, with full power of substitution and resubstitution, to vote on behalf of the undersigned all shares of the common stock of Simpson Manufacturing Co., Inc. that the undersigned is entitled to vote at the Annual Meeting of Shareholders to be held on May 13, 2002, at 4120 Dublin Blvd., Suite 400, Dublin, California, and at all adjournments thereof, hereby revoking any proxy heretofore given with respect to such common stock, and the undersigned authorizes and instructs said proxies to vote as indicated on the reverse side hereof. The shares represented by this proxy will be voted as directed, or if directions are not indicated, will be voted for the election as directors of some or all of the persons listed on this proxy, in the manner described in the proxy statement. This proxy confers on the proxyholders the power of cumulative voting and the power to vote cumulatively for fewer than all of the nominees as described in such proxy statement.

| SEE REVERSE SIDE | (CONTINUED AND TO BE SIGNED ON THE REVERSE SIDE) | SEE REVERSE SIDE | ||

| | | | | |||

|---|---|---|---|---|---|---|

Vote by Telephone | Vote by Internet | |||||

It's fast, convenient, and immediate! Call Toll-Free on a Touch-Tone Phone 1-877-PRX-VOTE (1-877-779-8683) | It's fast, convenient, and your vote is immediately confirmed and posted. | |||||

| Follow these four easy steps: | Follow these four easy steps: | |||||

| 1. | Read the accompanying Proxy Statement and Proxy Card. | 1. | Read the accompanying Proxy Statement and Proxy Card. | |||

2. | Call the toll-free number 1-877-PRX-VOTE (1-877-779-8683) | 2. | Go to the Website http://www.eproxyvote.com/ssd | |||

3. | Enter your 14-digit Voter Control Number located on you Proxy Card above your name. | 3. | Enter your 14-digit Voter Control Number located on you Proxy Card above your name. | |||

4. | Follow the recorded instructions. | 4. | Follow the instructions provided. | |||

Your vote is important! Call1-877-PRX-VOTEanytime! | Your vote is important! Go tohttp://www.eproxyvote.com/ssdanytime! | |||||

Do not return you Proxy Card if you are voting by Telephone or Internet

DETACH HERE

/x/ Please mark votes as in this example

Unless otherwise specified, this proxy will be voted for all of the nominees listed below as directors and for proposal 2,and will be voted in the discretion of the proxies on such other matters as may properly come before the meeting or any adjournment thereof.Such other matters are not related.

| | | | | | | | | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FOR | AGAINST | ABSTAIN | ||||||||||||

| 1. | Election of Directors to serve for three-year terms | 2. | Ratification of appointment of Pricewaterhouse Coopers LLP as independent auditors | / / | / / | / / | ||||||||

| Nominees: | (01) Thomas J Fitzmyers | |||||||||||||

| (02) Earl F. Cheit, and | ||||||||||||||

| (03) Barry Lawson Williams | ||||||||||||||

| | | | | | | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| FOR ALL NOMINEES | / / | / / | WITHHOLD FROM ALL NOMINEES | |||||||

/ / | ||||||||||

(INSTRUCTION: To withhold authority to vote for any individual nominee, write that nominee's name in the space provided above.) | ||||||||||

| MARK HERE FOR ADRESS CHANGE AND NOTE AT LEFT / / | ||||||||||

IF VOTING BY MAIL, PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE (Please sign exactly as name appears, at left, indicating title or representative capacity, where applicable) | ||||||||||

| | | | | | | | | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Signature: | Date: | Signature: | Date: | |||||||||||