Karen Colonias CEO Brian Magstadt CFO The Power to Strengthen January 2019

Safe Harbor This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements relating to events or results that may occur in the future are forward-looking statements, including but not limited to, statements or estimates regarding our plans, sales, sales trends, sales growth rates, revenues, profits, costs, working capital, balance sheet, inventories, products (including truss and concrete products as well as software offerings), relationships with contractors and partners (including our collaboration with The Home Depot, Inc.), market strategies, market share, expenses (including operating expenses and research, development and engineering investments), inventory turn rates, cost savings or reduction measures, repatriation of funds, results of operations, tax liabilities, losses, capital spending, housing starts, price changes (including product and raw material prices, such as steel prices), profitability, profit margins, operating income, operating income margin (referring to consolidated income from operations as a percentage of net sales), operating expenses as a percentage of net sales, effective tax rates, depreciation or amortization expenses, amortization periods, capital return (also called return on invested capital), stock repurchases, dividends, compensation arrangements, prospective adoption of new accounting standards, effects of changes in accounting standards, effects and expenses of (including eventual gains or losses related to) mergers and acquisitions and related integrations, effects and expenses of equity investments, effects of changes in foreign exchange rates or interest rates, effects and costs of SAP and other software program implementations (including related expenses, such as capital expenditures, and savings), effects and costs of credit facilities and capital lease obligations, headcount, engagement of consultants, the Company’s 2020 Plan and other operating initiatives (discussed under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below), the Company’s efforts and costs to implement the 2020 Plan and initiatives, the targets and assumptions under the 2020 Plan and such other initiatives (including targets associated with organic compound annual growth rate in consolidated net sales, operating income, operating income margin, operating expenses as a percentage of net sales, cost structure rationalization, improved working capital management, return on invested capital, stock repurchases, and overall balance sheet discipline) and the projected effects and impact of any of the foregoing on our business, financial condition and results of operations. Forward-looking statements generally can be identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “target,” “continue,” “predict,” “project,” “change,” “result,” “future,” “will,” “could,” “can,” “may,” “likely,” “potentially,” or similar expressions. Forward-looking statements are necessarily speculative in nature, are based on numerous assumptions, and involve known and unknown risks, uncertainties and other factors (some of which are beyond our control) that could significantly affect our operations and may cause our actual actions, results, financial condition, performance or achievements to be substantially different from any future actions, results, financial condition, performance or achievements expressed or implied by any such forward-looking statements. Those factors include, but are not limited to: (i) the impact, execution and effectiveness of the Company’s current strategic plan, the 2020 Plan, and initiatives the realization of the assumptions made under the plan and the efforts and costs to implement the plan and initiatives; (ii) general economic cycles and construction business conditions including changes in U.S. housing starts; (iii) customer acceptance of our products; (iv) product liability claims, contractual liability, engineering and design liability and similar liabilities or claims, (v) relationships with partners, suppliers and customers and their financial condition; (vi) materials and manufacturing costs; (vii) technological developments, including system updates and conversions; (viii) increased competition; (ix) changes in laws or industry practices; (x) litigation risks and actions by activist shareholders; (xi) changes in market conditions; (xii) governmental and business conditions in countries where our products are manufactured and sold; (xiii) natural disasters and other factors that are beyond the Company’s reasonable control; (xiv) changes in trade regulations, treaties or agreements or in U.S. and international taxes, tariffs and duties including those imposed on the Company’s income, imports, exports and repatriation of funds; (xv) effects of merger or acquisition activities; (xvi) actual or potential takeover or other change-of- control threats; (xvii) changes in our plans, strategies, objectives, expectations or intentions; and (xviii) other risks and uncertainties indicated from time to time in our filings with the U.S. Securities and Exchange Commission, including the Company’s most recent Annual Report on Form 10-K under the heading “Item 1A - Risk Factors.” Each forward-looking statement contained in the Company’s Quarterly Reports on Form 10-Q is specifically qualified in its entirety by the aforementioned factors. In light of the foregoing, investors are advised to carefully read the Company’s Quarterly Reports on Form 10-Q in connection with the important disclaimers set forth above and are urged not to rely on any forward-looking statements in reaching any conclusions or making any investment decisions about us or our securities. All forward-looking statements hereunder are made as of the date of the Company’s most recent Quarterly Report on Form 10-Q and are subject to change. Except as required by law, we do not intend and undertake no obligation to update, revise or publicly release any updates or revisions to any forward-looking statements hereunder, whether as a result of the receipt of new information, the occurrence of future events, the change of circumstances or otherwise. We further do not accept any responsibility for any projections or reports published by analysts, investors or other third parties. Each of the terms the “Company,” “we,” “our,” “us” and similar terms used herein refer collectively to Simpson Manufacturing Co., Inc., a Delaware corporation and its wholly-owned subsidiaries, including Simpson Strong- Tie Company Inc., unless otherwise stated. This presentation does not provide information with respect to the final fiscal quarter of 2018. To the extent that estimates have been made concerning the full 2018 fiscal year or any subsequent years, these reflect statements that have previously been made in the Company’s securities filings. 2

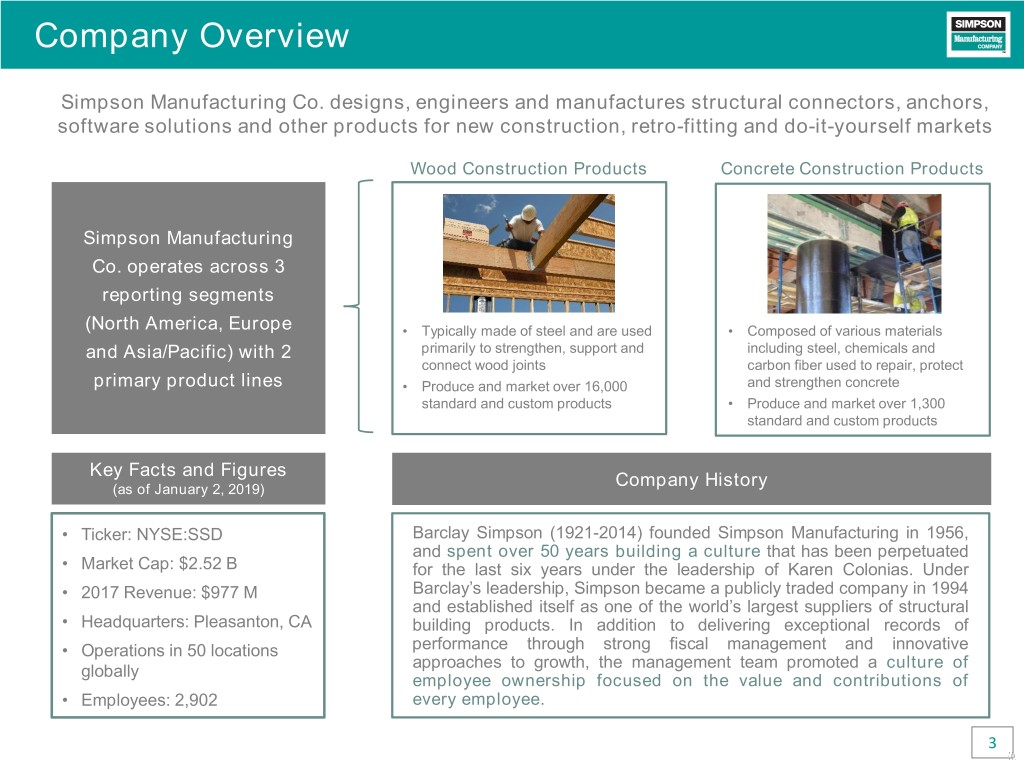

Company Overview Simpson Manufacturing Co. designs, engineers and manufactures structural connectors, anchors, software solutions and other products for new construction, retro-fitting and do-it-yourself markets Wood Construction Products Concrete Construction Products Simpson Manufacturing Co. operates across 3 reporting segments (North America, Europe • Typically made of steel and are used • Composed of various materials and Asia/Pacific) with 2 primarily to strengthen, support and including steel, chemicals and connect wood joints carbon fiber used to repair, protect primary product lines • Produce and market over 16,000 and strengthen concrete standard and custom products • Produce and market over 1,300 standard and custom products Key Facts and Figures Company History (as of January 2, 2019) • Ticker: NYSE:SSD Barclay Simpson (1921-2014) founded Simpson Manufacturing in 1956, and spent over 50 years building a culture that has been perpetuated • Market Cap: $2.52 B for the last six years under the leadership of Karen Colonias. Under • 2017 Revenue: $977 M Barclay’s leadership, Simpson became a publicly traded company in 1994 and established itself as one of the world’s largest suppliers of structural • Headquarters: Pleasanton, CA building products. In addition to delivering exceptional records of • Operations in 50 locations performance through strong fiscal management and innovative approaches to growth, the management team promoted a culture of globally employee ownership focused on the value and contributions of • Employees: 2,902 every employee. 3

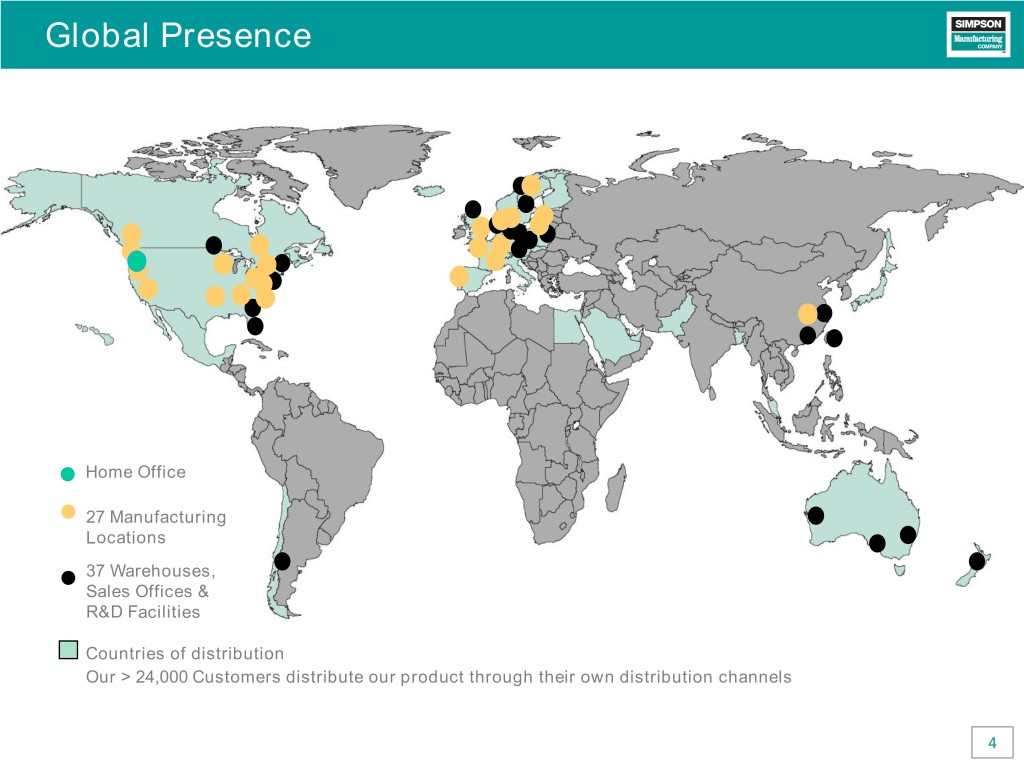

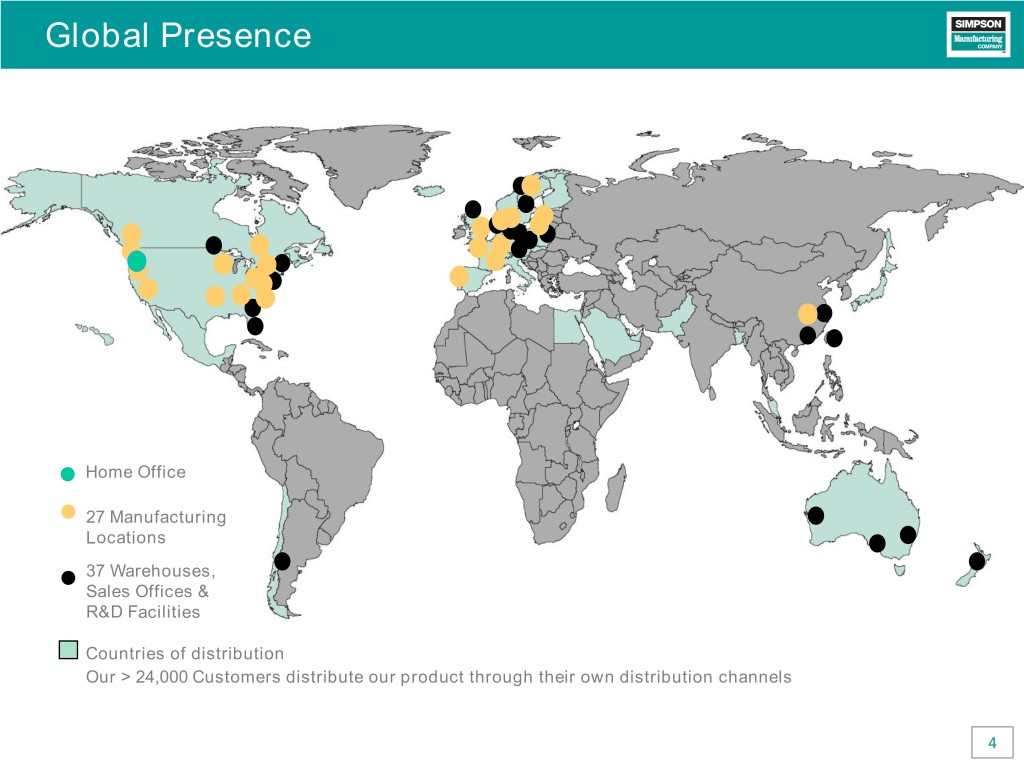

Global Presence Home Office 27 Manufacturing Locations 37 Warehouses, Sales Offices & R&D Facilities Countries of distribution Our > 24,000 Customers distribute our product through their own distribution channels 4

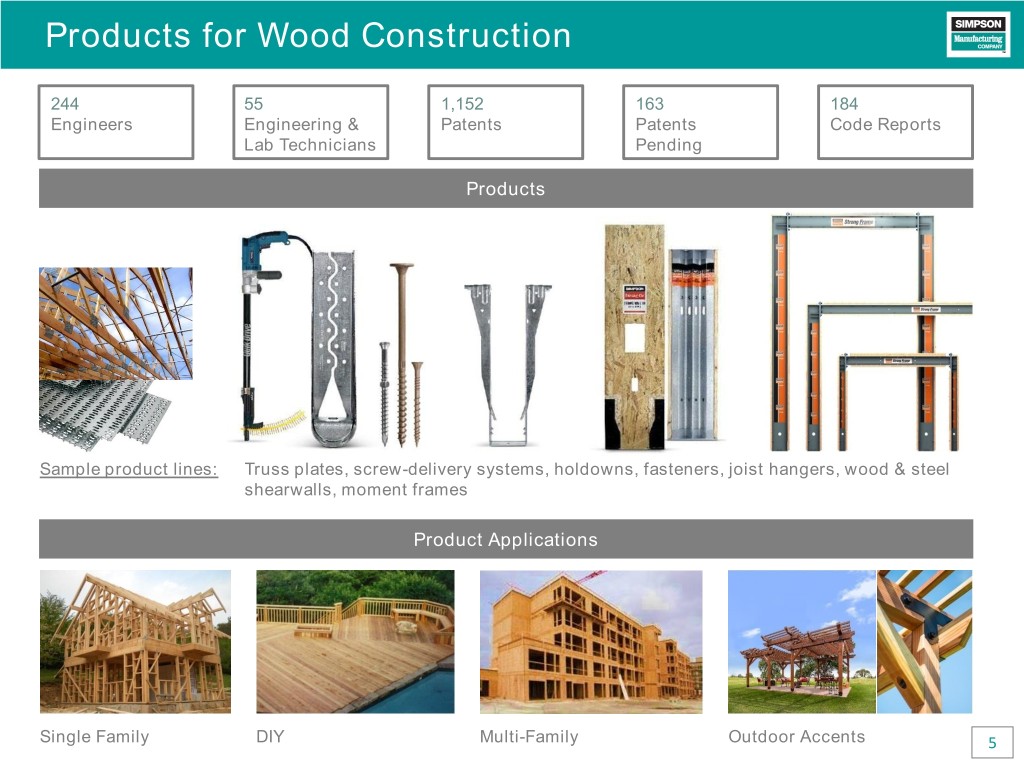

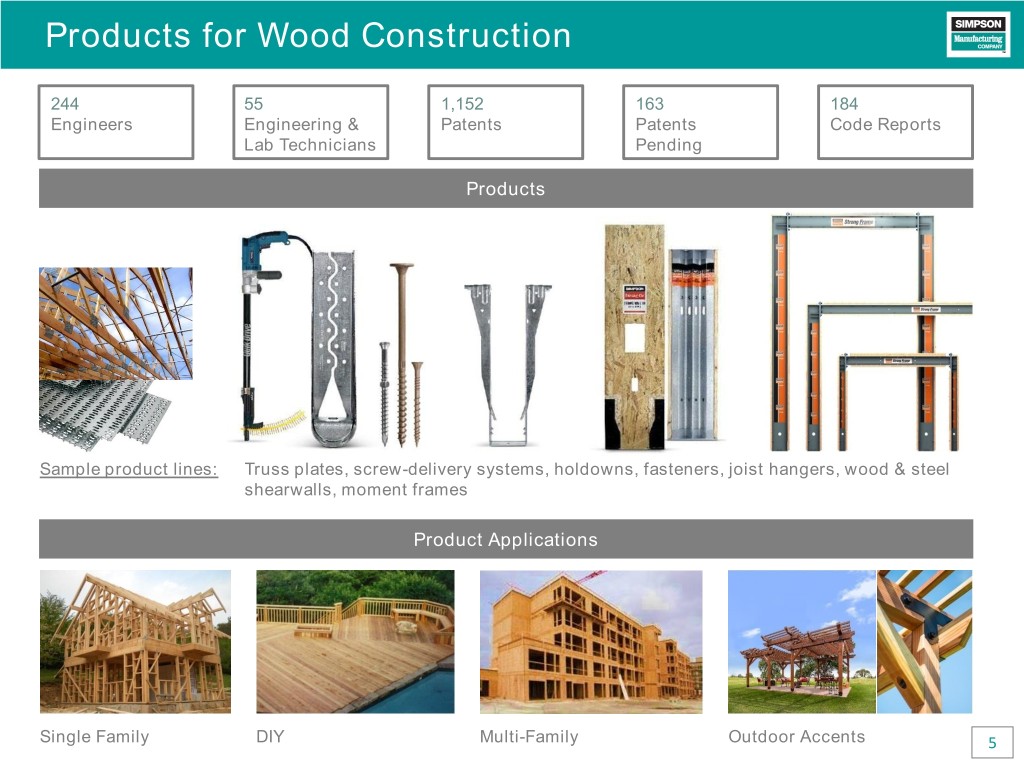

Products for Wood Construction 244 55 1,152 163 184 Engineers Engineering & Patents Patents Code Reports Lab Technicians Pending Products Sample product lines: Truss plates, screw-delivery systems, holdowns, fasteners, joist hangers, wood & steel shearwalls, moment frames Product Applications Single Family DIY Multi-Family Outdoor Accents 5

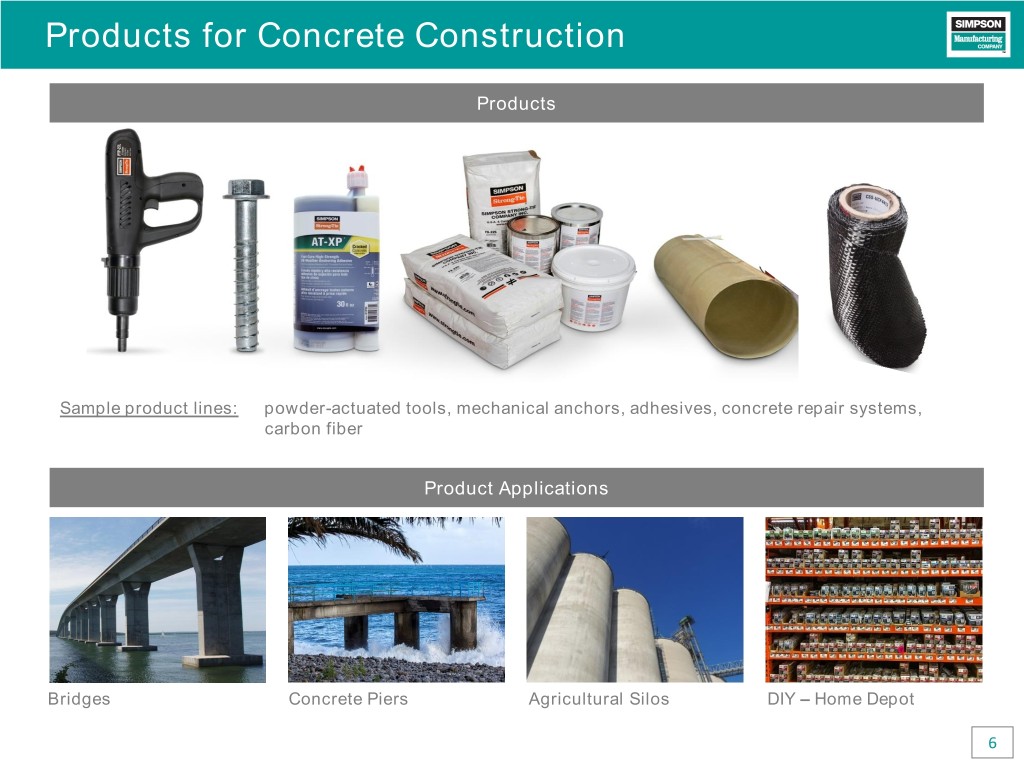

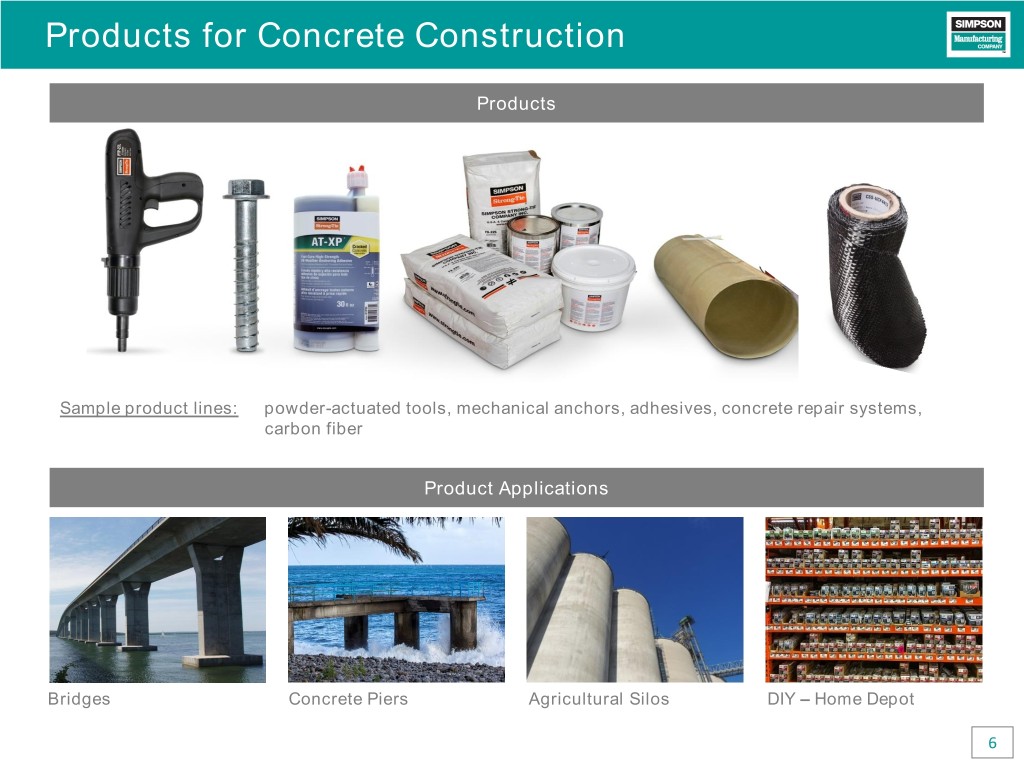

Products for Concrete Construction Products Sample product lines: powder-actuated tools, mechanical anchors, adhesives, concrete repair systems, carbon fiber Product Applications Bridges Concrete Piers Agricultural Silos DIY – Home Depot 6

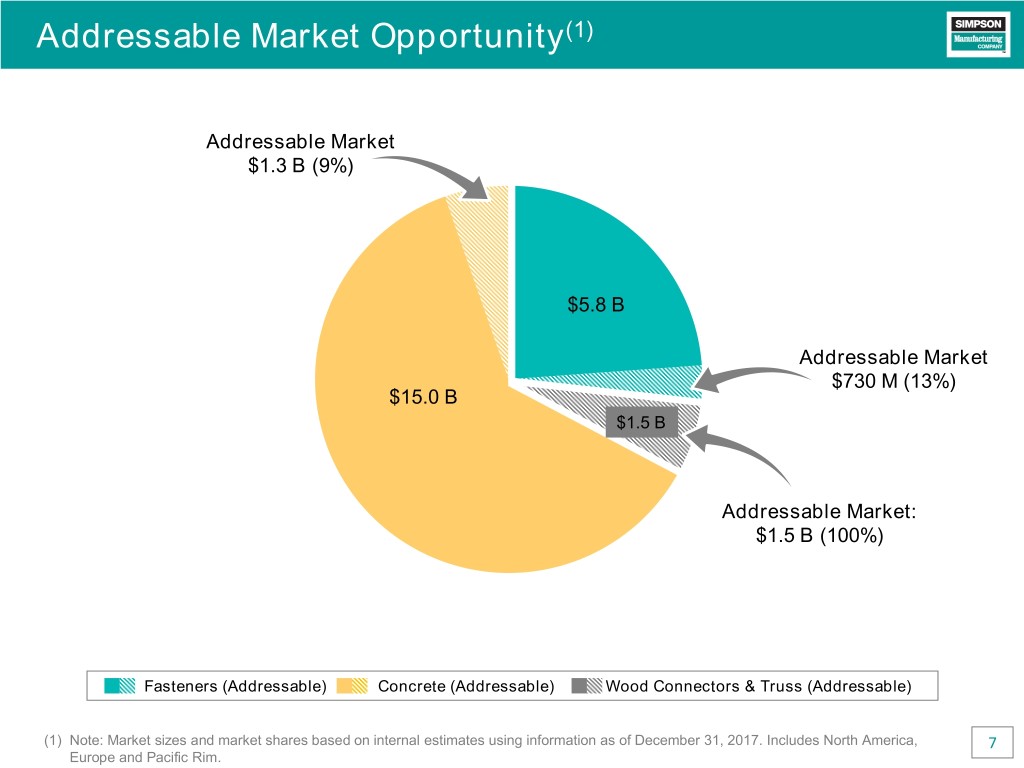

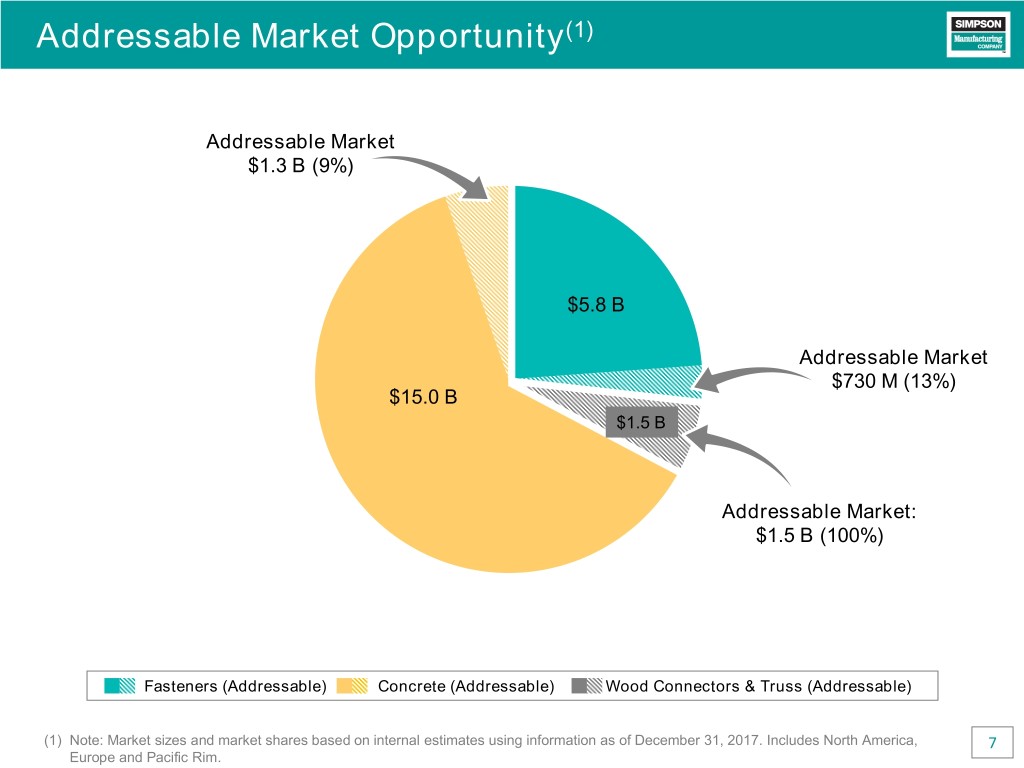

Addressable Market Opportunity(1) Addressable Market $1.3 B (9%) $5.8 B Addressable Market $730 M (13%) $15.0 B $1.5 B Addressable Market: $1.5 B (100%) Fasteners (Addressable) Concrete (Addressable) Wood Connectors & Truss (Addressable) (1) Note: Market sizes and market shares based on internal estimates using information as of December 31, 2017. Includes North America, 7 Europe and Pacific Rim.

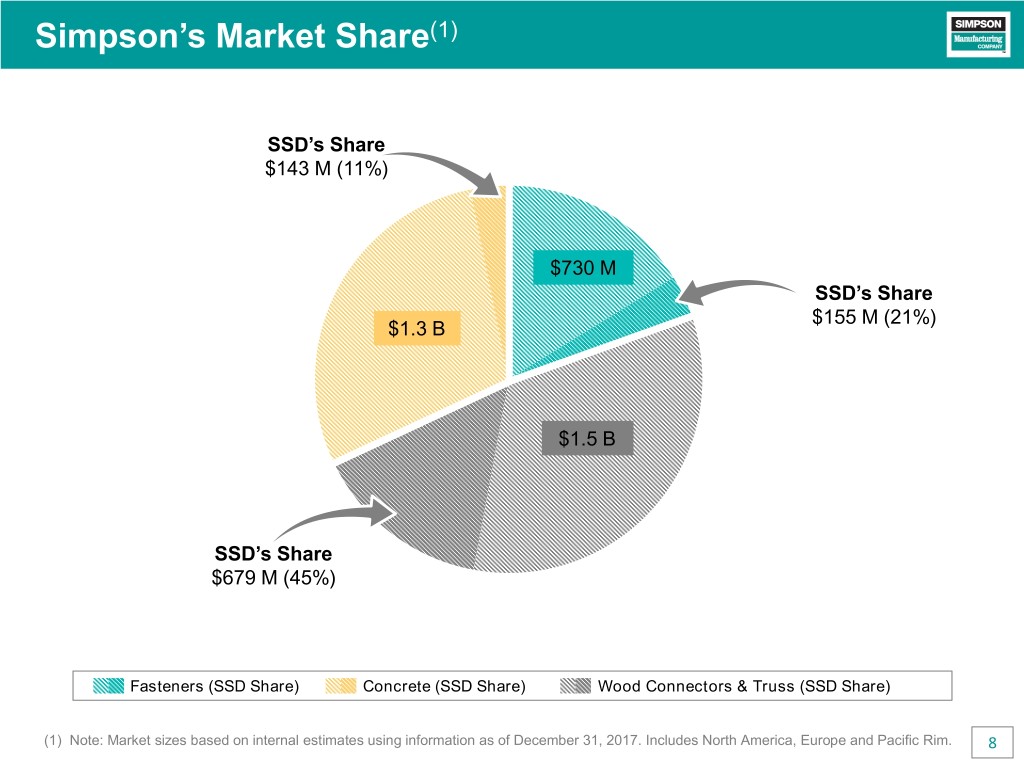

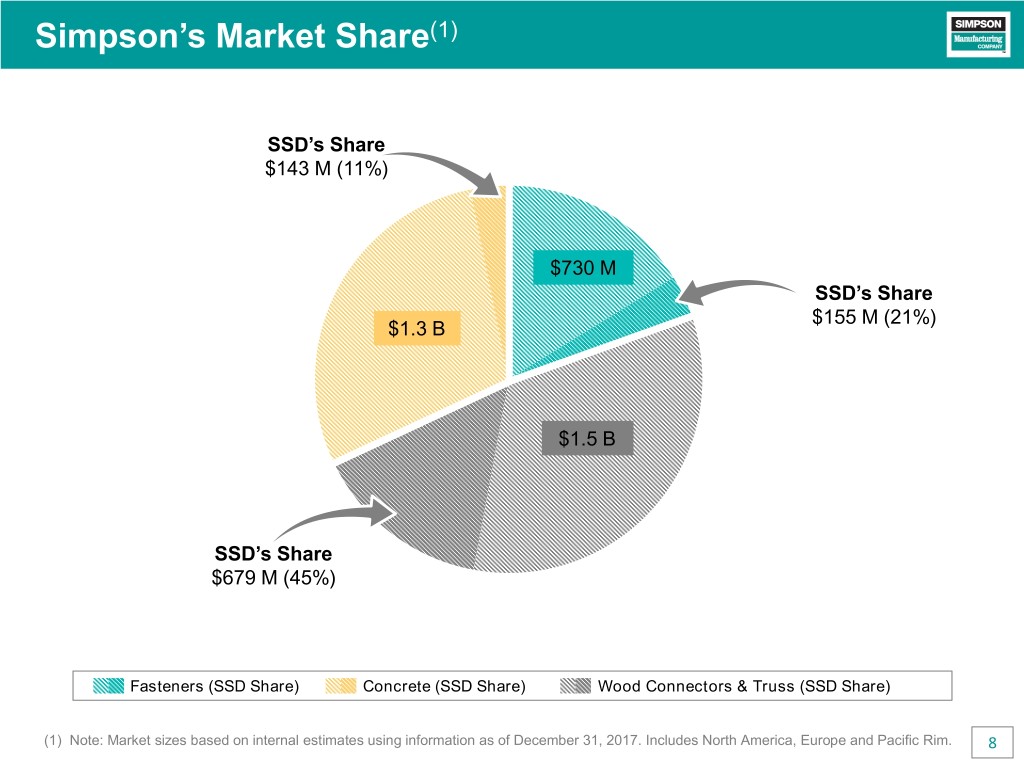

Simpson’s Market Share(1) SSD’s Share $143 M (11%) $730 M SSD’s Share $155 M (21%) $1.3 B $1.5 B SSD’s Share $679 M (45%) Fasteners (SSD Share) Concrete (SSD Share) Wood Connectors & Truss (SSD Share) (1) Note: Market sizes based on internal estimates using information as of December 31, 2017. Includes North America, Europe and Pacific Rim. 8

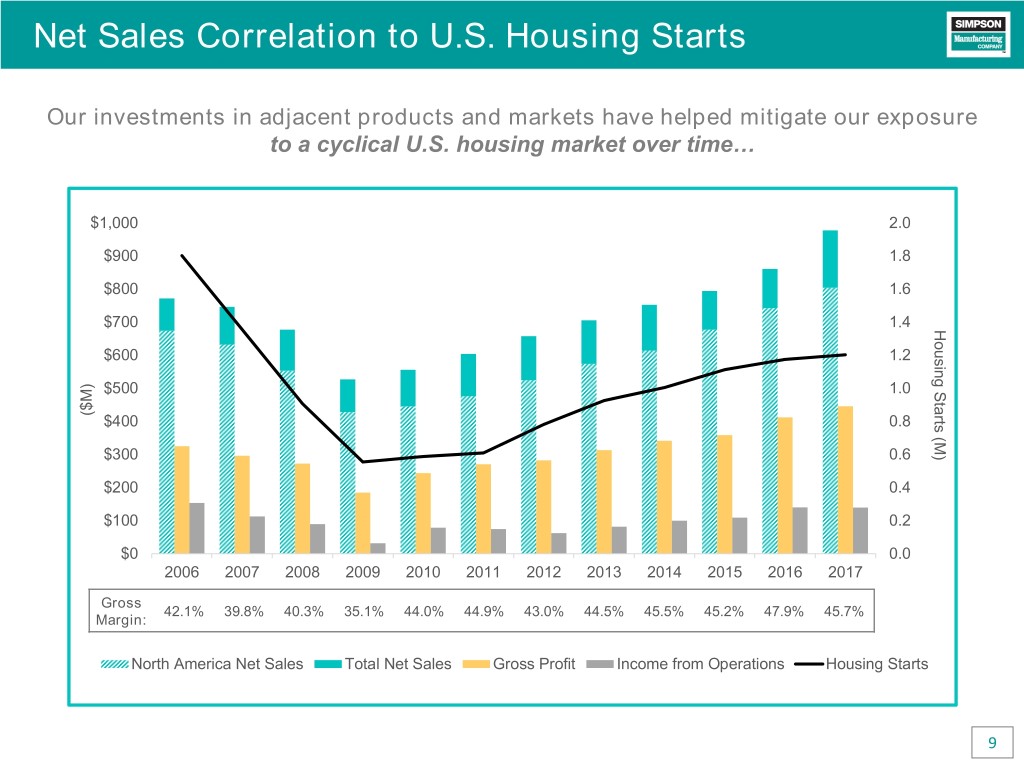

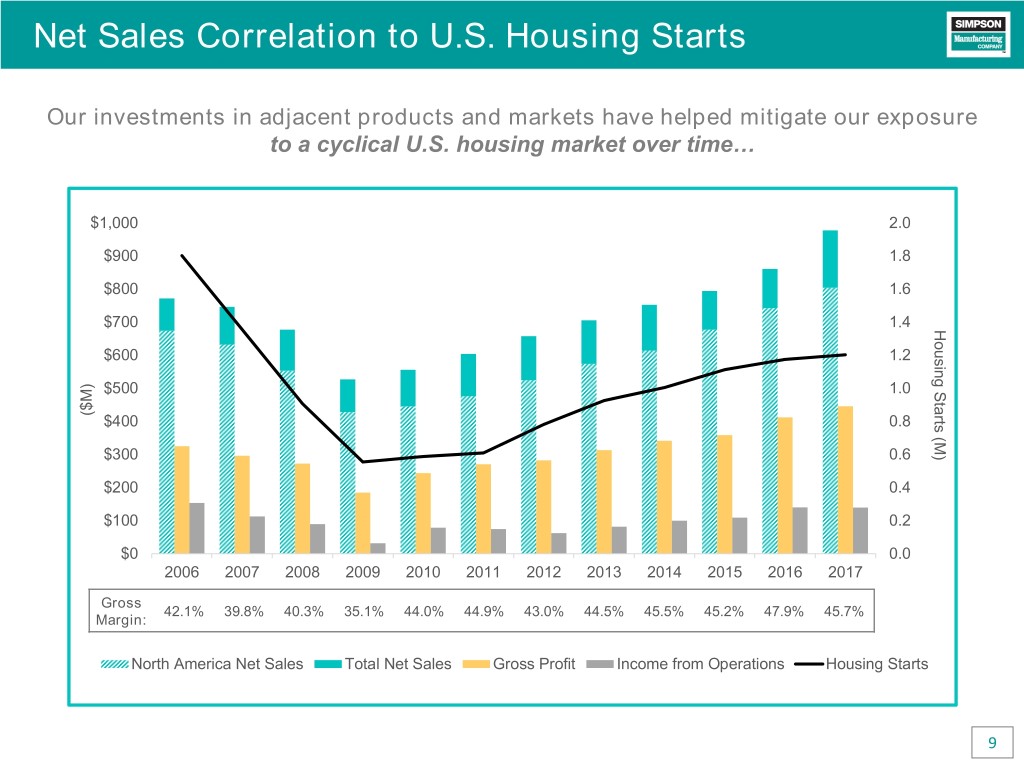

Net Sales Correlation to U.S. Housing Starts Our investments in adjacent products and markets have helped mitigate our exposure to a cyclical U.S. housing market over time… $1,000 2.0 $900 1.8 $800 1.6 $700 1.4 Housing Starts (M) $600 1.2 $500 1.0 ($M) $400 0.8 $300 0.6 $200 0.4 $100 0.2 $0 0.0 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Gross 42.1% 39.8% 40.3% 35.1% 44.0% 44.9% 43.0% 44.5% 45.5% 45.2% 47.9% 45.7% Margin: North America Net Sales Total Net Sales Gross Profit Income from Operations Housing Starts 9

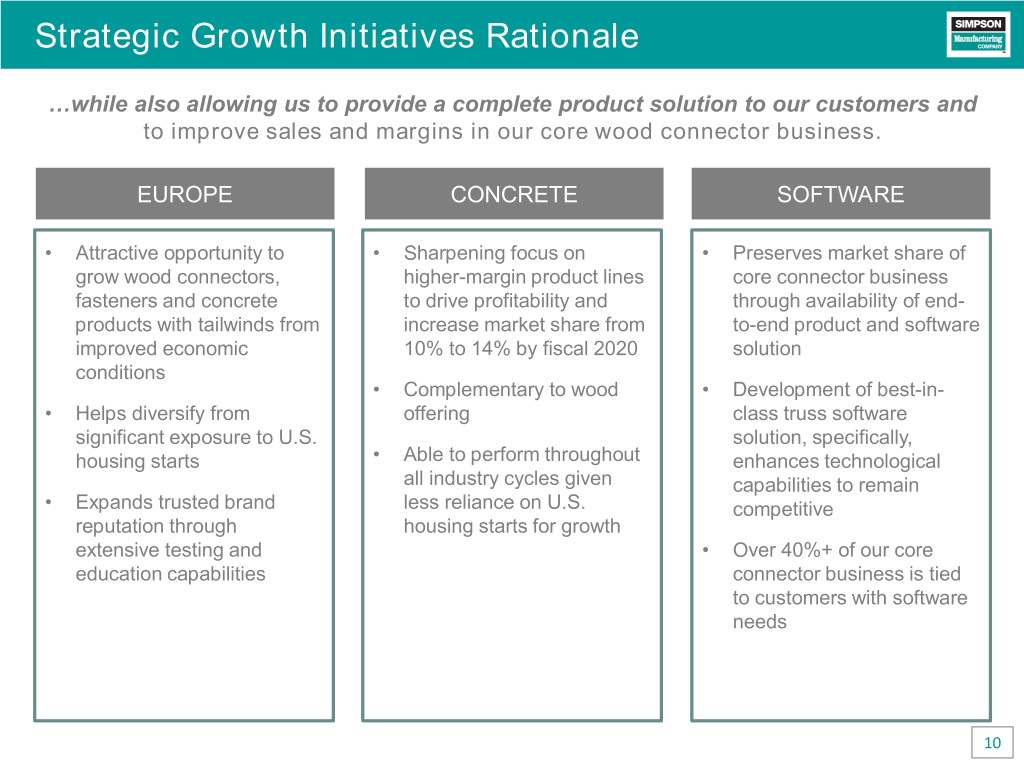

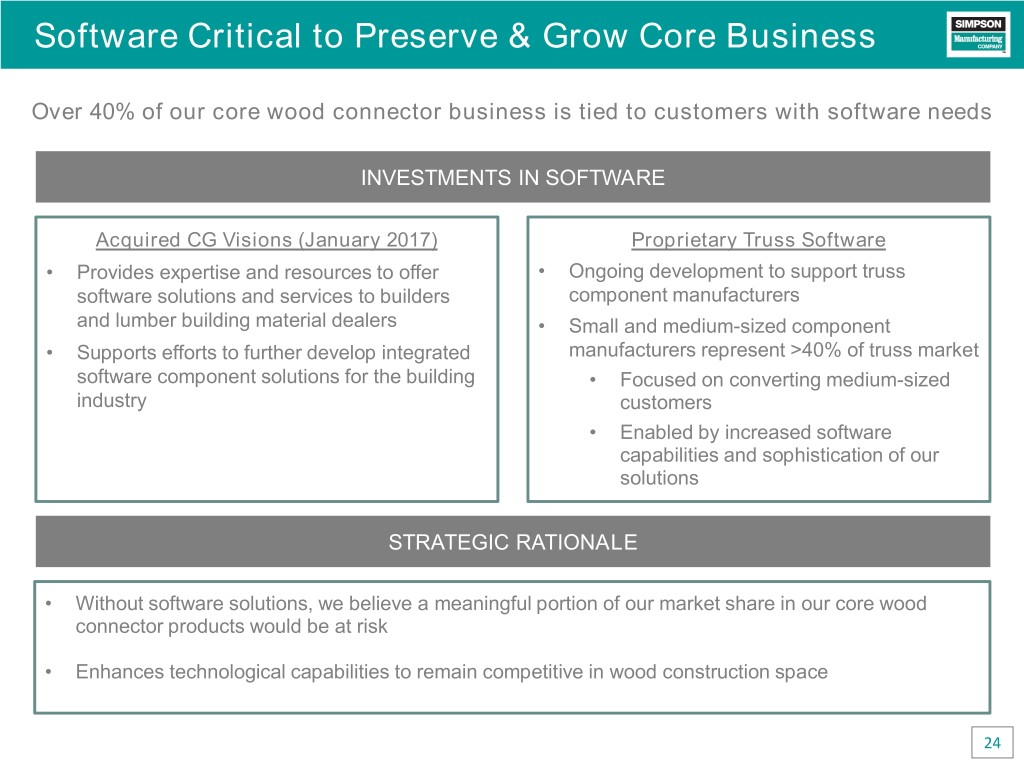

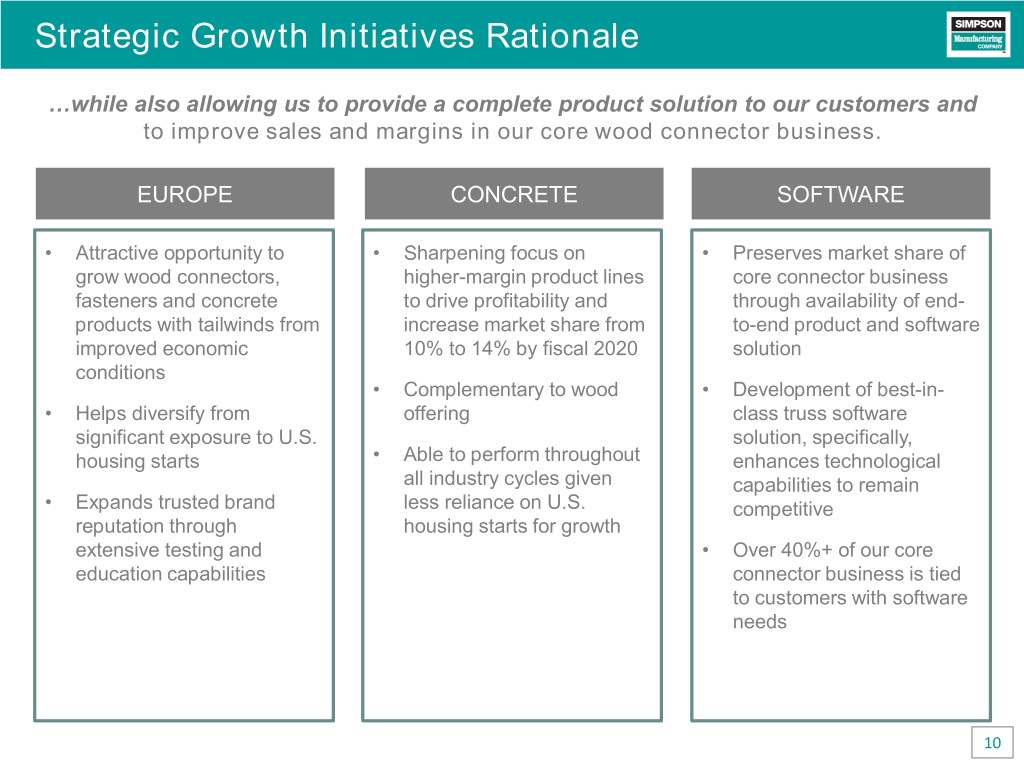

Strategic Growth Initiatives Rationale …while also allowing us to provide a complete product solution to our customers and to improve sales and margins in our core wood connector business. EUROPE CONCRETE SOFTWARE • Attractive opportunity to • Sharpening focus on • Preserves market share of grow wood connectors, higher-margin product lines core connector business fasteners and concrete to drive profitability and through availability of end- products with tailwinds from increase market share from to-end product and software improved economic 10% to 14% by fiscal 2020 solution conditions • Complementary to wood • Development of best-in- • Helps diversify from offering class truss software significant exposure to U.S. solution, specifically, housing starts • Able to perform throughout enhances technological all industry cycles given capabilities to remain • Expands trusted brand less reliance on U.S. competitive reputation through housing starts for growth extensive testing and • Over 40%+ of our core education capabilities connector business is tied to customers with software needs 10

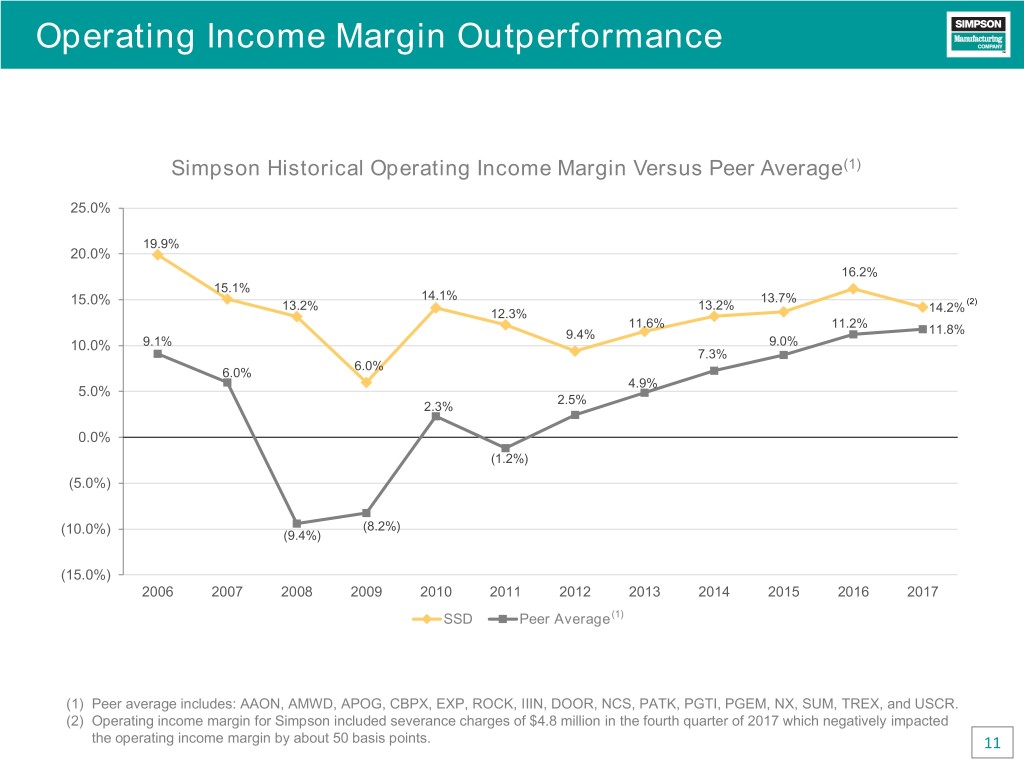

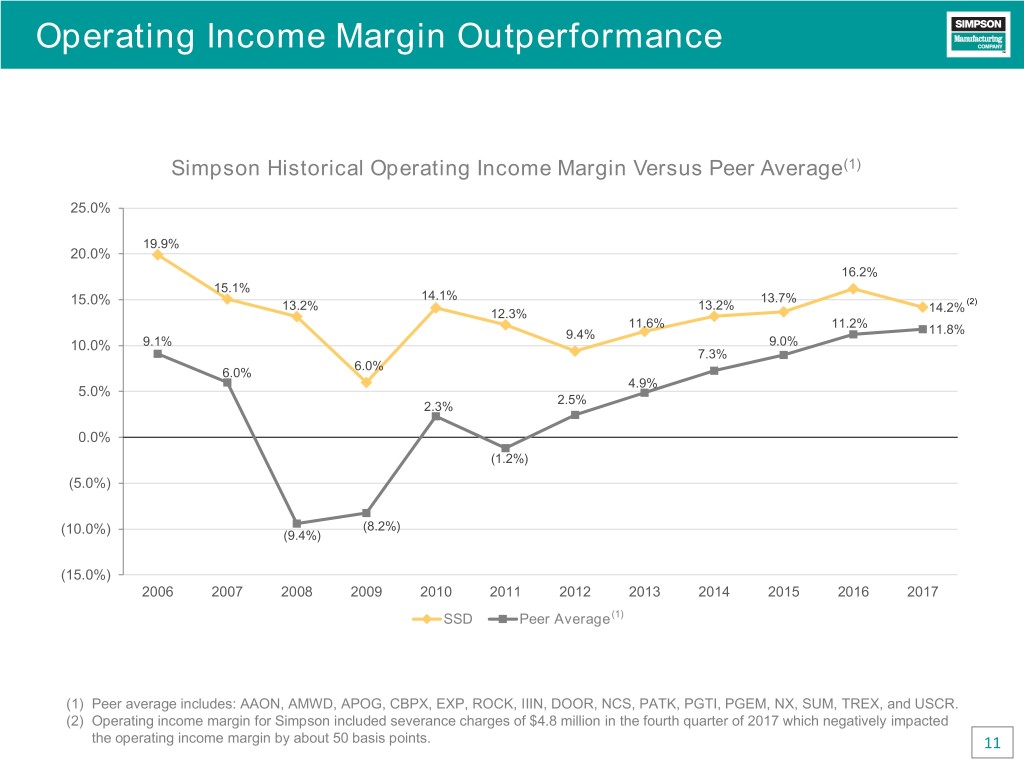

Operating Income Margin Outperformance Simpson Historical Operating Income Margin Versus Peer Average(1) 25.0% 19.9% 20.0% 16.2% 15.1% 14.1% 13.7% 15.0% 13.2% 13.2% (2) 12.3% 14.2% 11.6% 11.2% 9.4% 11.8% 10.0% 9.1% 9.0% 7.3% 6.0% 6.0% 4.9% 5.0% 2.5% 2.3% 0.0% (1.2%) (5.0%) (8.2%) (10.0%) (9.4%) (15.0%) 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 SSD Peer Average (1) (1) Peer average includes: AAON, AMWD, APOG, CBPX, EXP, ROCK, IIIN, DOOR, NCS, PATK, PGTI, PGEM, NX, SUM, TREX, and USCR. (2) Operating income margin for Simpson included severance charges of $4.8 million in the fourth quarter of 2017 which negatively impacted the operating income margin by about 50 basis points. 11

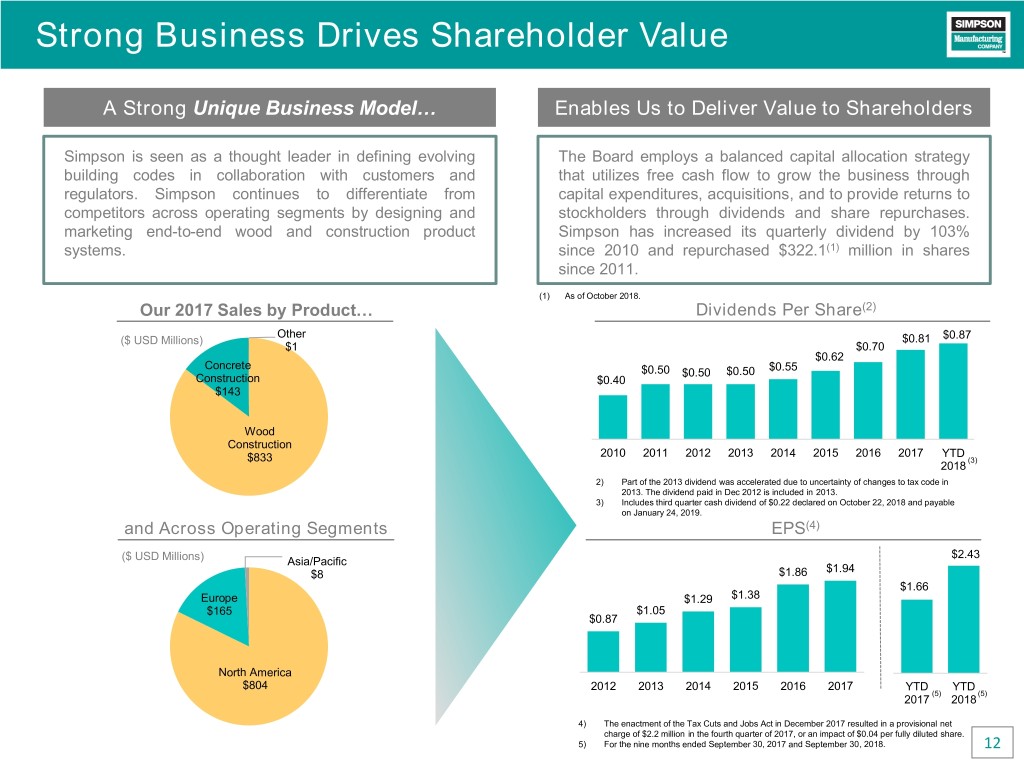

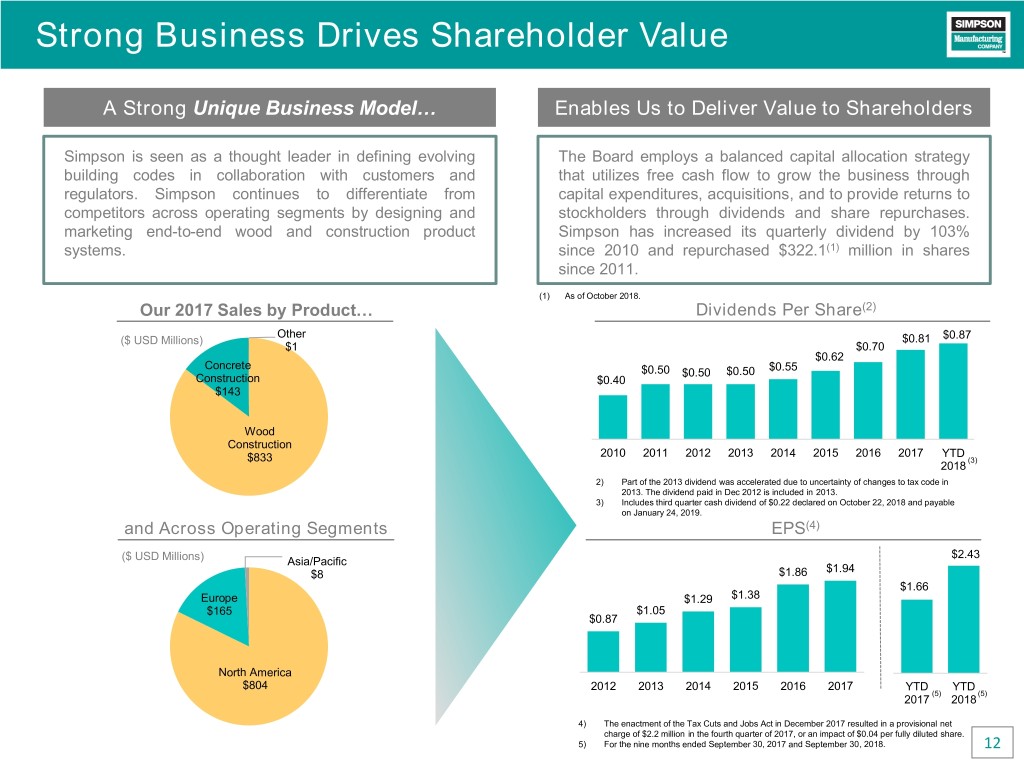

Strong Business Drives Shareholder Value A Strong Unique Business Model… Enables Us to Deliver Value to Shareholders Simpson is seen as a thought leader in defining evolving The Board employs a balanced capital allocation strategy building codes in collaboration with customers and that utilizes free cash flow to grow the business through regulators. Simpson continues to differentiate from capital expenditures, acquisitions, and to provide returns to competitors across operating segments by designing and stockholders through dividends and share repurchases. marketing end-to-end wood and construction product Simpson has increased its quarterly dividend by 103% systems. since 2010 and repurchased $322.1(1) million in shares since 2011. (1) As of October 2018. Our 2017 Sales by Product… Dividends Per Share(2) Other ($ USD Millions) $0.81 $0.87 $1 $0.70 $0.62 Concrete $0.55 $0.50 $0.50 $0.50 Construction $0.40 $143 Wood Construction 2010 2011 2012 2013 2014 2015 2016 2017 YTD $833 (3) 2018 2) Part of the 2013 dividend was accelerated due to uncertainty of changes to tax code in 2013. The dividend paid in Dec 2012 is included in 2013. 3) Includes third quarter cash dividend of $0.22 declared on October 22, 2018 and payable on January 24, 2019. and Across Operating Segments EPS(4) $2.43 ($ USD Millions) Asia/Pacific $1.94 $8 $1.86 $1.66 Europe $1.29 $1.38 $165 $1.05 $0.87 North America $804 2012 2013 2014 2015 2016 2017 YTD YTD (5) (5) 2017 2018 4) The enactment of the Tax Cuts and Jobs Act in December 2017 resulted in a provisional net charge of $2.2 million in the fourth quarter of 2017, or an impact of $0.04 per fully diluted share. 5) For the nine months ended September 30, 2017 and September 30, 2018. 12

Thoughtful Deployment of Capital We seek profitable growth opportunities in the building products range to create long-term value while consistently returning capital to our shareholders. Based on shareholder feedback, the initial results of an extensive review of our capital allocation strategy and the high degree of confidence we have in our business, the Company has established a current target capital return to shareholders of a minimum of 50% of cash flows from operations through both dividends and repurchases of the Company’s shares of common stock. STOCK REPURCHASES: • $300 M credit facility • $65.4 M available under • $167 M of cash & cash equivalents(2) (1) $275.0 M authorization • No debt – insignificant amount of capital • Repurchased $85.5 M(1) lease obligations • Use strong cash position to pay dividends and conduct Dividend and Share strategic share repurchases Repurchase Program • Generate cash exploiting real estate and/or tax opportunities • Grow the business organically Organic Growth Investments through strategic capital investments in the business • Utilize free cash flow to grow Creating Value for Shareholders the business and maximize long-term shareholder value (1) Year-to-date as of October 29, 2018. 13 (2) As of September 30, 2018.

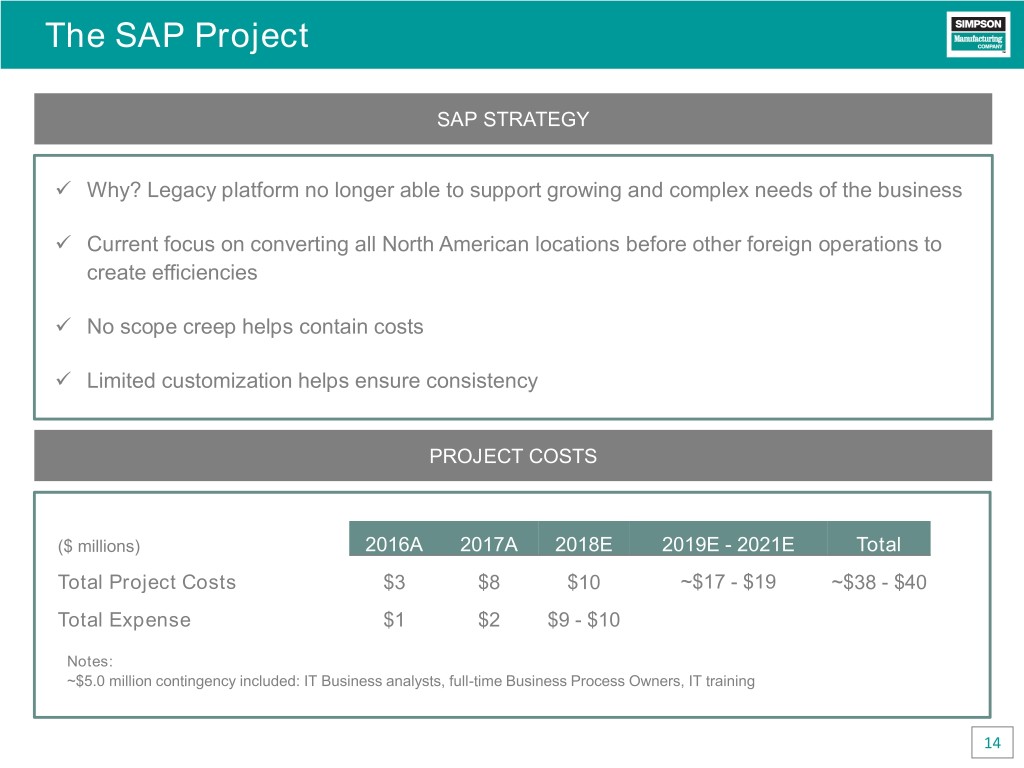

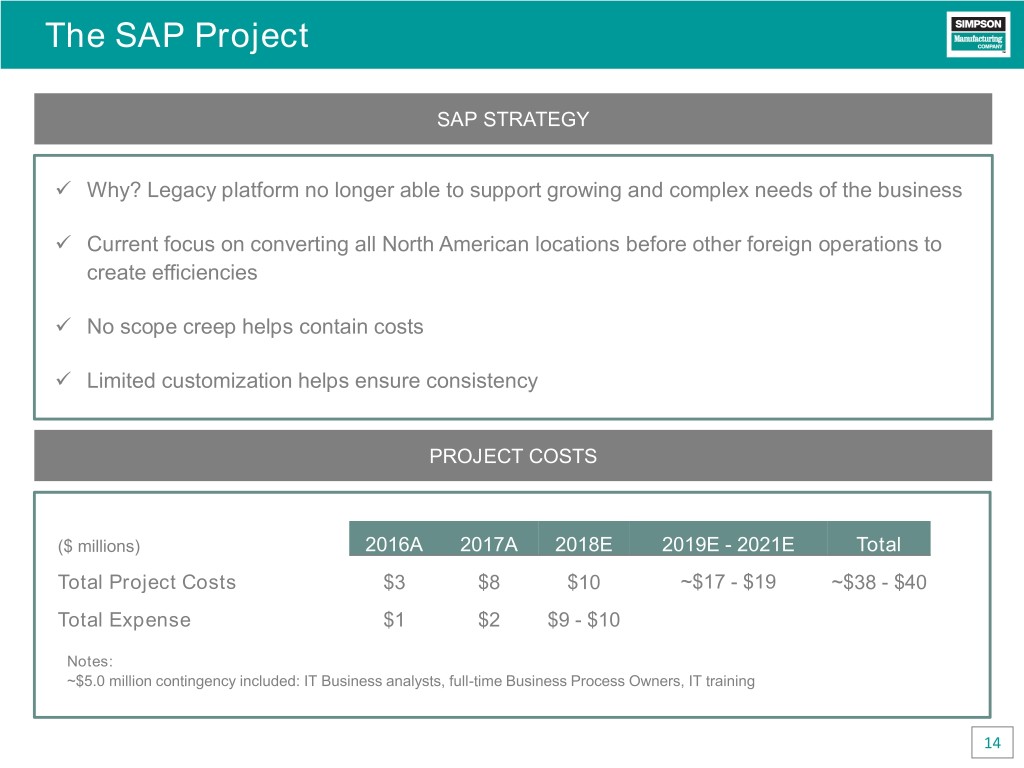

The SAP Project SAP STRATEGY Why? Legacy platform no longer able to support growing and complex needs of the business Current focus on converting all North American locations before other foreign operations to create efficiencies No scope creep helps contain costs Limited customization helps ensure consistency PROJECT COSTS ($ millions) 2016A 2017A 2018E 2019E - 2021E Total Total Project Costs $3 $8 $10 ~$17 - $19 ~$38 - $40 Total Expense $1 $2 $9 - $10 Notes: ~$5.0 million contingency included: IT Business analysts, full-time Business Process Owners, IT training 14

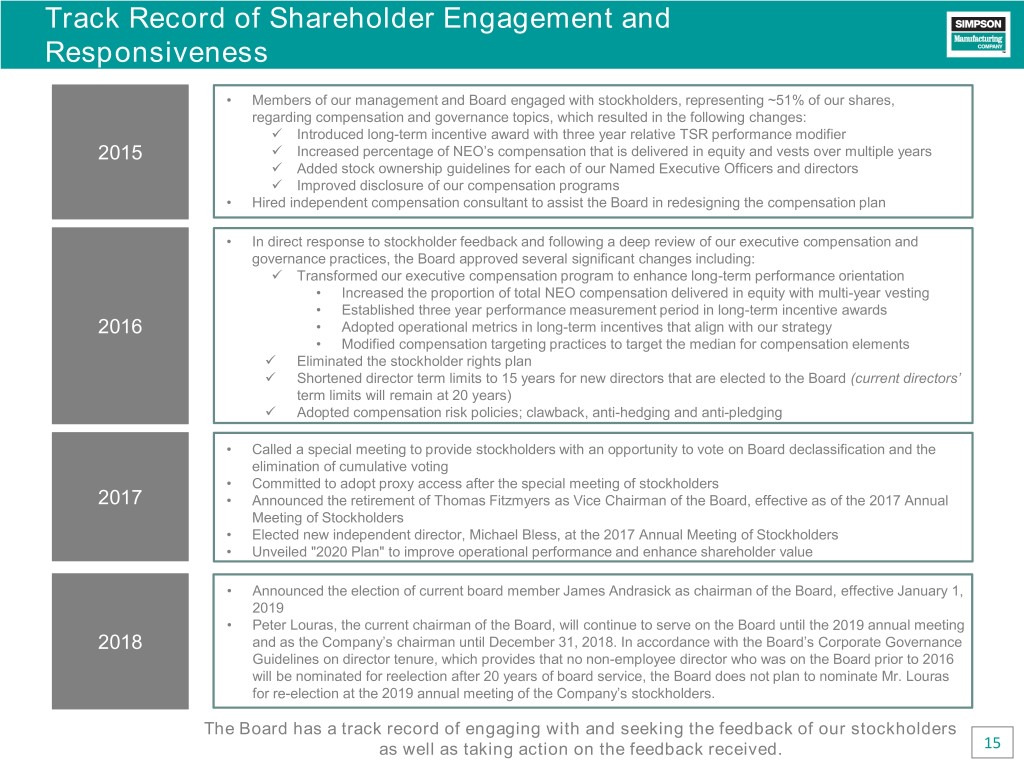

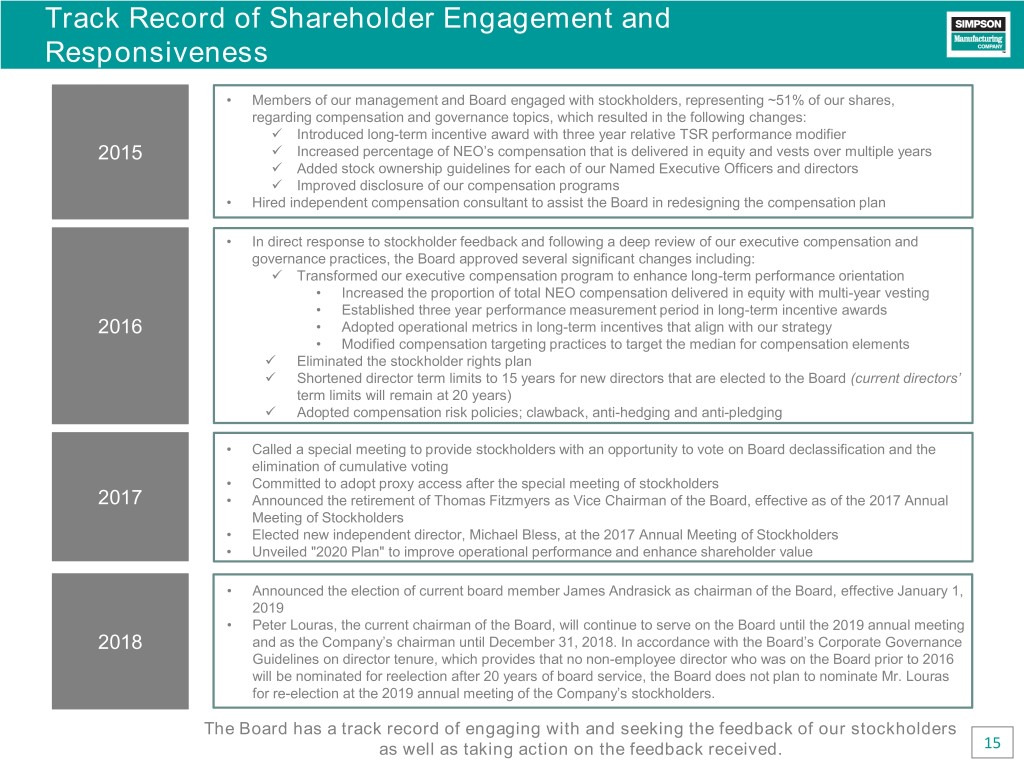

Track Record of Shareholder Engagement and Responsiveness • Members of our management and Board engaged with stockholders, representing ~51% of our shares, regarding compensation and governance topics, which resulted in the following changes: Introduced long-term incentive award with three year relative TSR performance modifier 2015 Increased percentage of NEO’s compensation that is delivered in equity and vests over multiple years Added stock ownership guidelines for each of our Named Executive Officers and directors Improved disclosure of our compensation programs • Hired independent compensation consultant to assist the Board in redesigning the compensation plan • In direct response to stockholder feedback and following a deep review of our executive compensation and governance practices, the Board approved several significant changes including: Transformed our executive compensation program to enhance long-term performance orientation • Increased the proportion of total NEO compensation delivered in equity with multi-year vesting • Established three year performance measurement period in long-term incentive awards 2016 • Adopted operational metrics in long-term incentives that align with our strategy • Modified compensation targeting practices to target the median for compensation elements Eliminated the stockholder rights plan Shortened director term limits to 15 years for new directors that are elected to the Board (current directors’ term limits will remain at 20 years) Adopted compensation risk policies; clawback, anti-hedging and anti-pledging • Called a special meeting to provide stockholders with an opportunity to vote on Board declassification and the elimination of cumulative voting • Committed to adopt proxy access after the special meeting of stockholders 2017 • Announced the retirement of Thomas Fitzmyers as Vice Chairman of the Board, effective as of the 2017 Annual Meeting of Stockholders • Elected new independent director, Michael Bless, at the 2017 Annual Meeting of Stockholders • Unveiled "2020 Plan" to improve operational performance and enhance shareholder value • Announced the election of current board member James Andrasick as chairman of the Board, effective January 1, 2019 • Peter Louras, the current chairman of the Board, will continue to serve on the Board until the 2019 annual meeting 2018 and as the Company’s chairman until December 31, 2018. In accordance with the Board’s Corporate Governance Guidelines on director tenure, which provides that no non-employee director who was on the Board prior to 2016 will be nominated for reelection after 20 years of board service, the Board does not plan to nominate Mr. Louras for re-election at the 2019 annual meeting of the Company’s stockholders. The Board has a track record of engaging with and seeking the feedback of our stockholders as well as taking action on the feedback received. 15

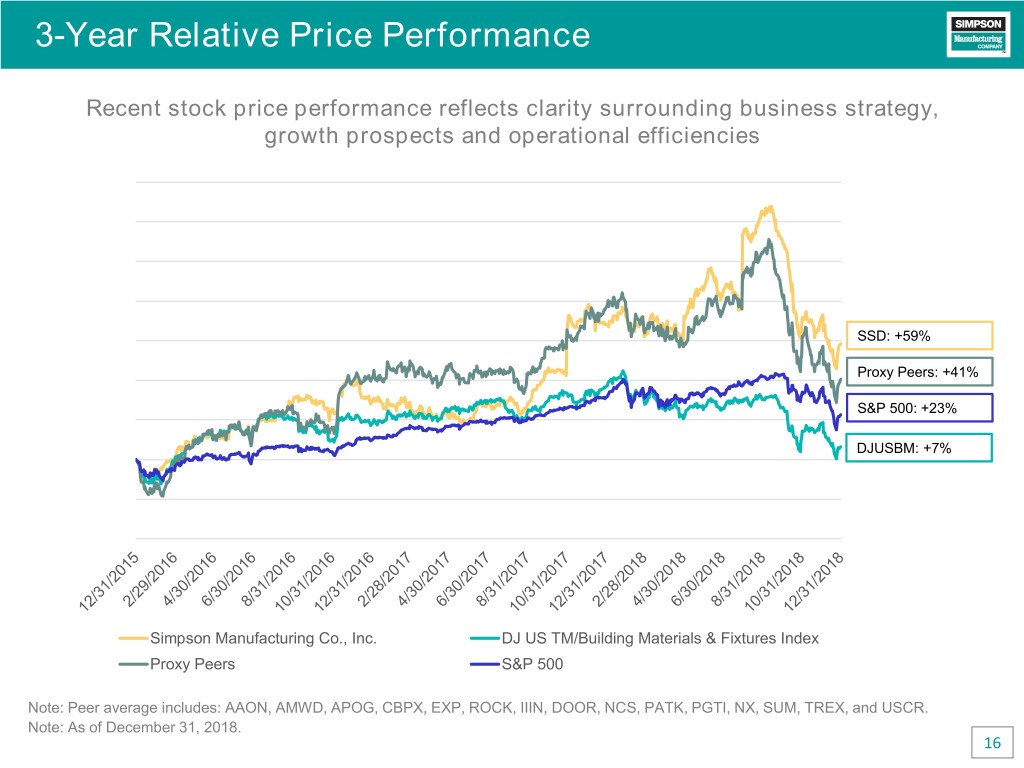

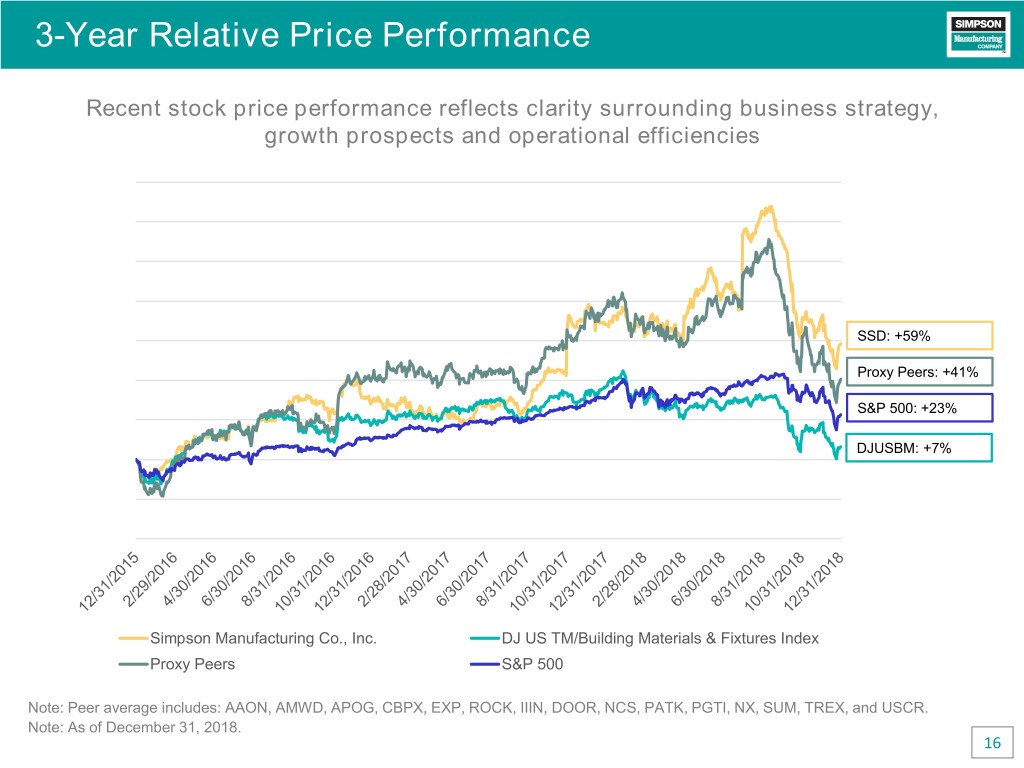

3-Year Relative Price Performance Recent stock price performance reflects clarity surrounding business strategy, growth prospects and operational efficiencies 140% 120% 100% 80% 60% SSD: +59% Proxy Peers: +41% 40% S&P 500: +23% 20% DJUSBM: +7% 0% -20% -40% Simpson Manufacturing Co., Inc. DJ US TM/Building Materials & Fixtures Index Proxy Peers S&P 500 Note: Peer average includes: AAON, AMWD, APOG, CBPX, EXP, ROCK, IIIN, DOOR, NCS, PATK, PGTI, NX, SUM, TREX, and USCR. Note: As of December 31, 2018. 16

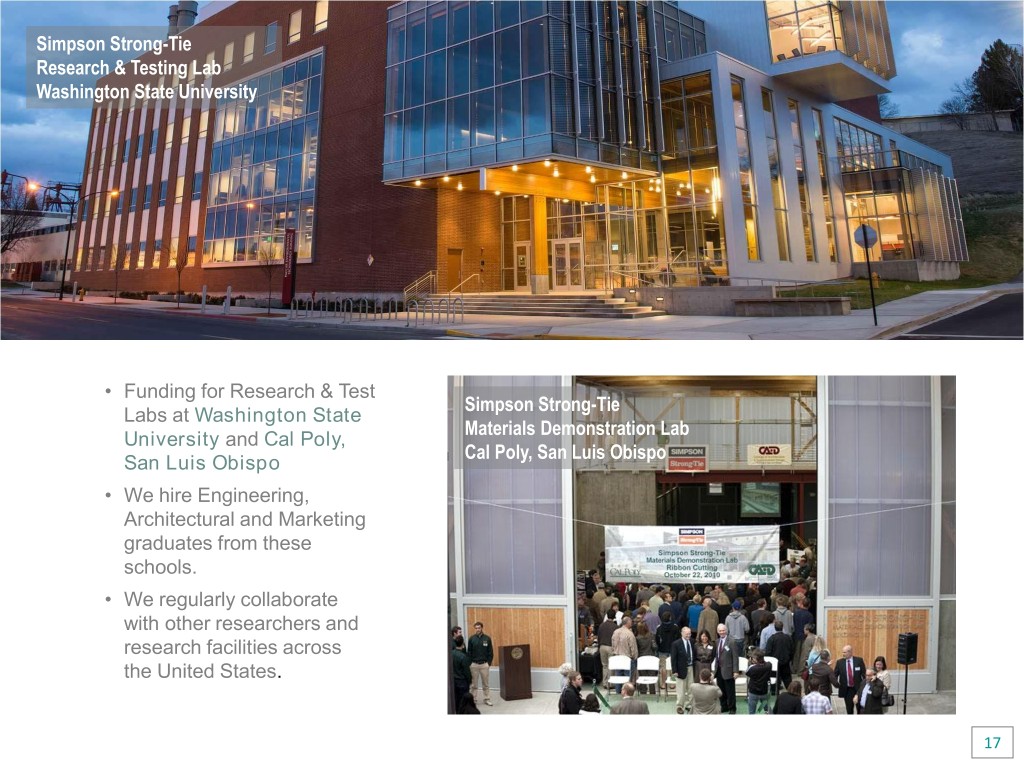

Simpson Strong-Tie Research & Testing Lab Washington State University • Funding for Research & Test Simpson Strong-Tie Labs at Washington State Materials Demonstration Lab University and Cal Poly, Cal Poly, San Luis Obispo San Luis Obispo • We hire Engineering, Architectural and Marketing graduates from these schools. • We regularly collaborate with other researchers and research facilities across the United States. 17

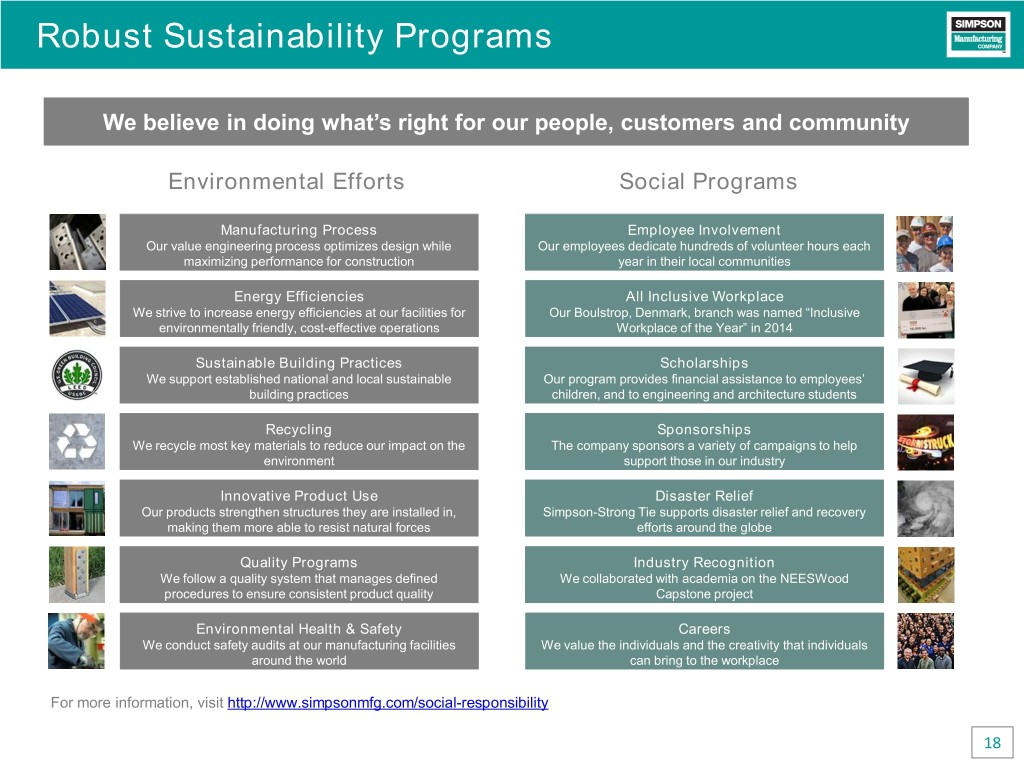

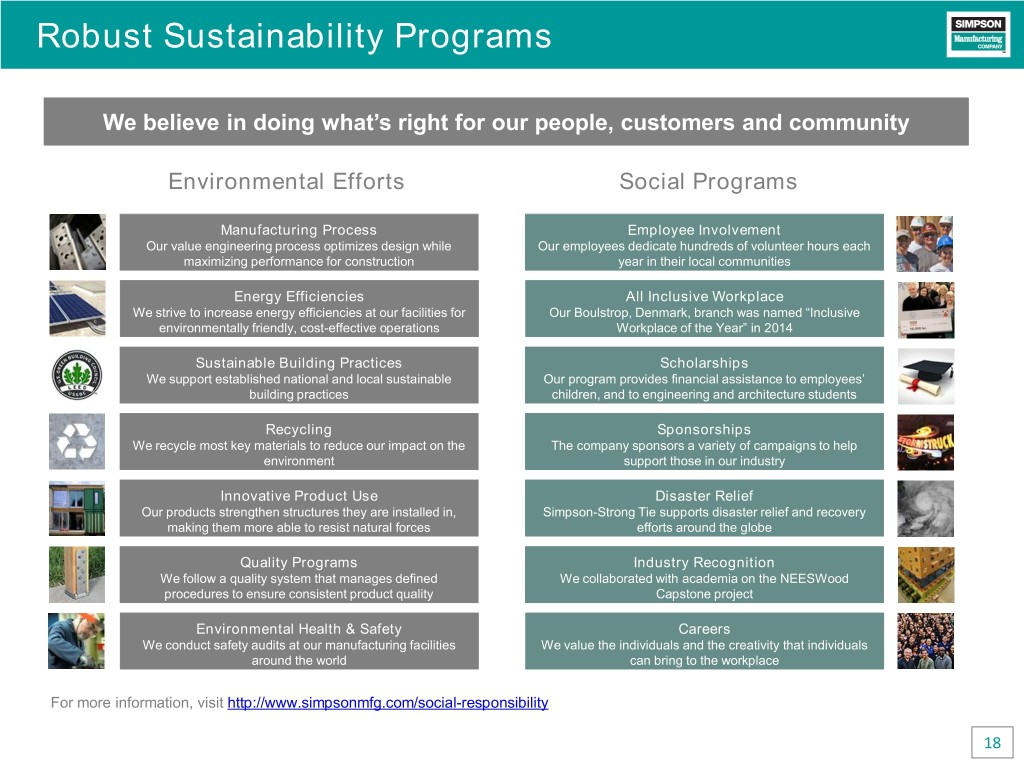

Robust Sustainability Programs We believe in doing what’s right for our people, customers and community Environmental Efforts Social Programs Manufacturing Process Employee Involvement Our value engineering process optimizes design while Our employees dedicate hundreds of volunteer hours each maximizing performance for construction year in their local communities Energy Efficiencies All Inclusive Workplace We strive to increase energy efficiencies at our facilities for Our Boulstrop, Denmark, branch was named “Inclusive environmentally friendly, cost-effective operations Workplace of the Year” in 2014 Sustainable Building Practices Scholarships We support established national and local sustainable Our program provides financial assistance to employees’ building practices children, and to engineering and architecture students Recycling Sponsorships We recycle most key materials to reduce our impact on the The company sponsors a variety of campaigns to help environment support those in our industry Innovative Product Use Disaster Relief Our products strengthen structures they are installed in, Simpson-Strong Tie supports disaster relief and recovery making them more able to resist natural forces efforts around the globe Quality Programs Industry Recognition We follow a quality system that manages defined We collaborated with academia on the NEESWood procedures to ensure consistent product quality Capstone project Environmental Health & Safety Careers We conduct safety audits at our manufacturing facilities We value the individuals and the creativity that individuals around the world can bring to the workplace For more information, visit http://www.simpsonmfg.com/social-responsibility 18

2020 PLAN

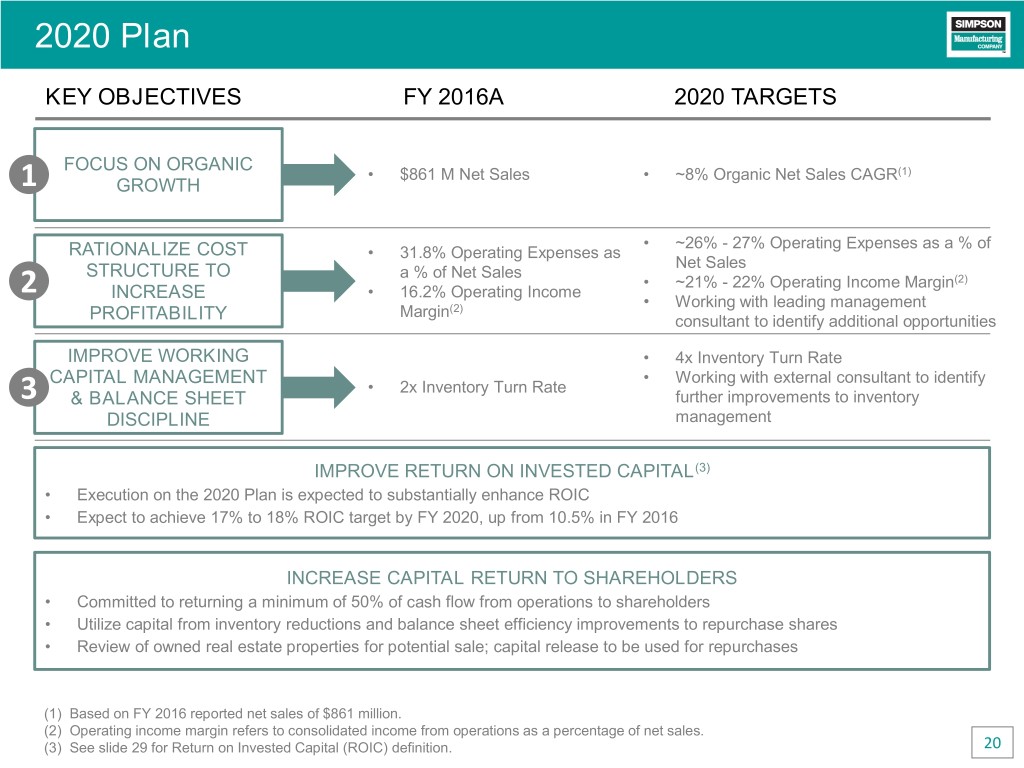

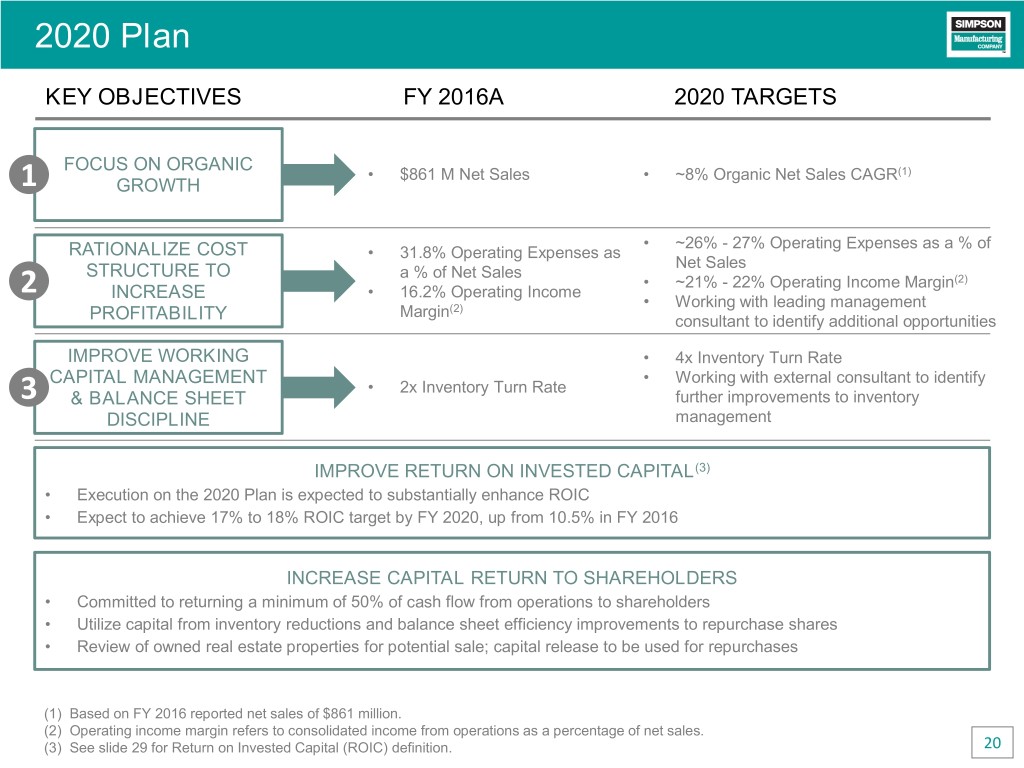

2020 Plan KEY OBJECTIVES FY 2016A 2020 TARGETS FOCUS ON ORGANIC • $861 M Net Sales • ~8% Organic Net Sales CAGR(1) 1 GROWTH • ~26% - 27% Operating Expenses as a % of RATIONALIZE COST • 31.8% Operating Expenses as Net Sales STRUCTURE TO a % of Net Sales • ~21% - 22% Operating Income Margin(2) 2 INCREASE • 16.2% Operating Income • Working with leading management Margin(2) PROFITABILITY consultant to identify additional opportunities IMPROVE WORKING • 4x Inventory Turn Rate CAPITAL MANAGEMENT • Working with external consultant to identify • 2x Inventory Turn Rate 3 & BALANCE SHEET further improvements to inventory DISCIPLINE management IMPROVE RETURN ON INVESTED CAPITAL(3) • Execution on the 2020 Plan is expected to substantially enhance ROIC • Expect to achieve 17% to 18% ROIC target by FY 2020, up from 10.5% in FY 2016 INCREASE CAPITAL RETURN TO SHAREHOLDERS • Committed to returning a minimum of 50% of cash flow from operations to shareholders • Utilize capital from inventory reductions and balance sheet efficiency improvements to repurchase shares • Review of owned real estate properties for potential sale; capital release to be used for repurchases (1) Based on FY 2016 reported net sales of $861 million. (2) Operating income margin refers to consolidated income from operations as a percentage of net sales. (3) See slide 29 for Return on Invested Capital (ROIC) definition. 20

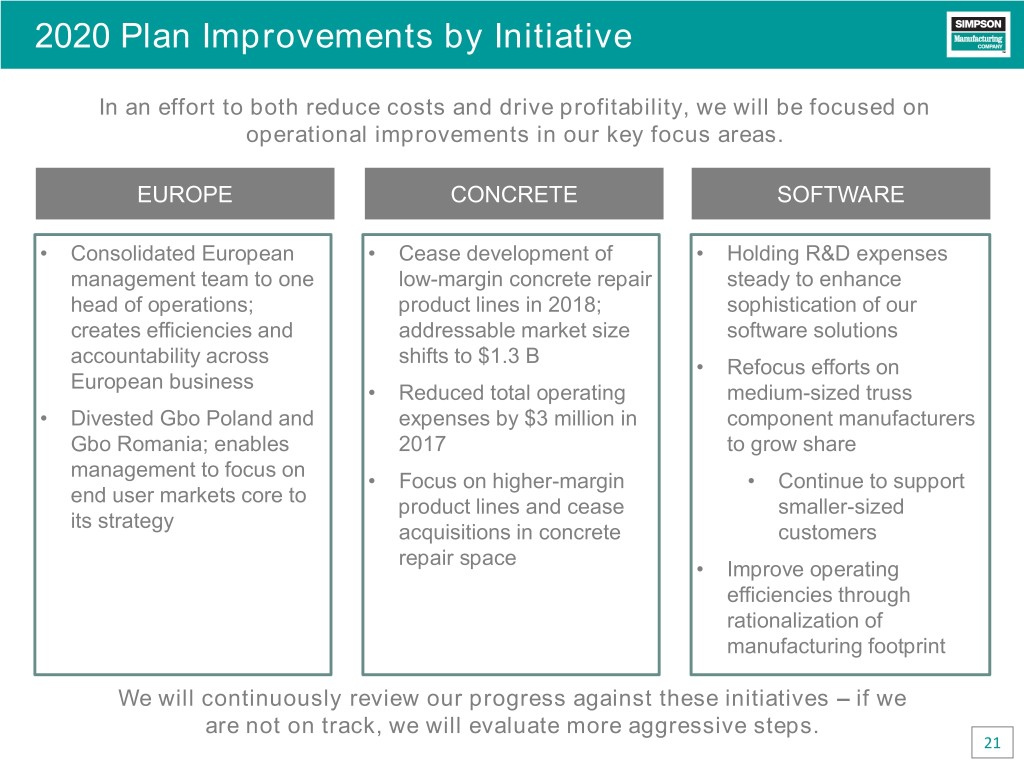

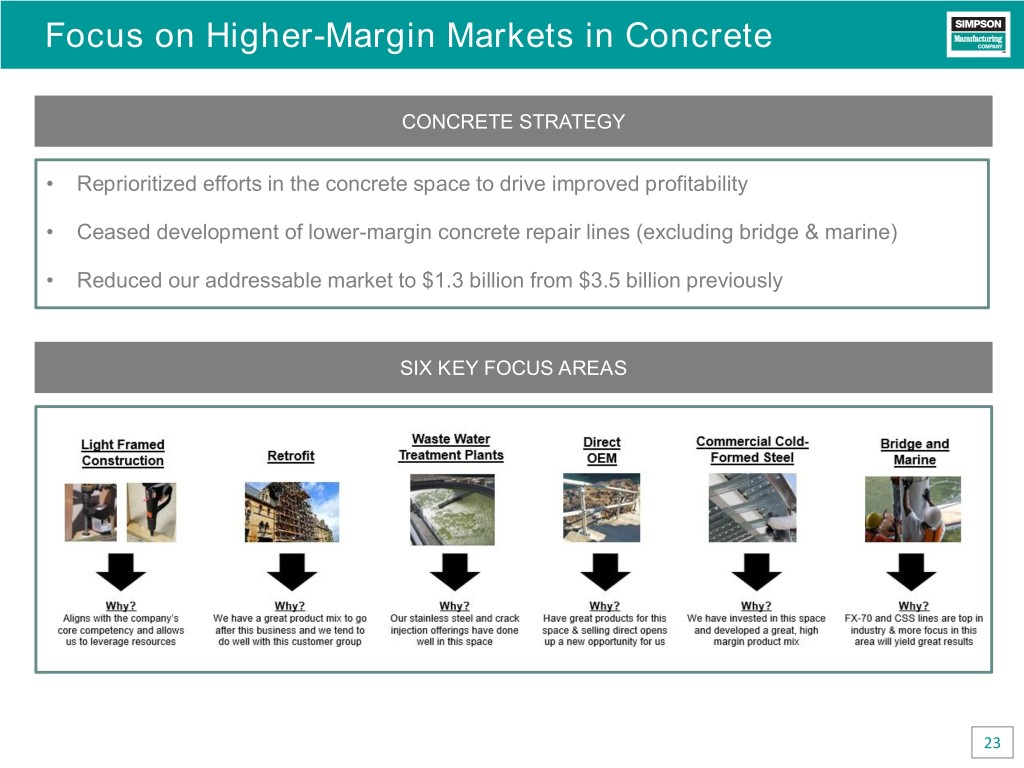

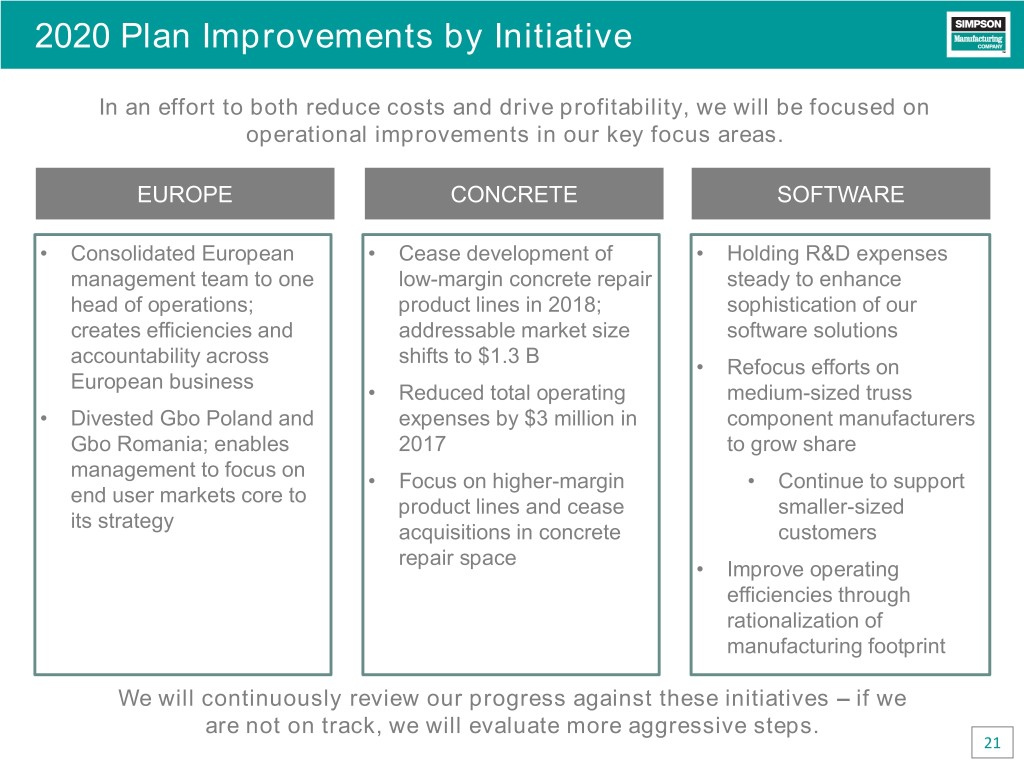

2020 Plan Improvements by Initiative In an effort to both reduce costs and drive profitability, we will be focused on operational improvements in our key focus areas. EUROPE CONCRETE SOFTWARE • Consolidated European • Cease development of • Holding R&D expenses management team to one low-margin concrete repair steady to enhance head of operations; product lines in 2018; sophistication of our creates efficiencies and addressable market size software solutions accountability across shifts to $1.3 B • Refocus efforts on European business • Reduced total operating medium-sized truss • Divested Gbo Poland and expenses by $3 million in component manufacturers Gbo Romania; enables 2017 to grow share management to focus on • Focus on higher-margin • Continue to support end user markets core to product lines and cease smaller-sized its strategy acquisitions in concrete customers repair space • Improve operating efficiencies through rationalization of manufacturing footprint We will continuously review our progress against these initiatives – if we are not on track, we will evaluate more aggressive steps. 21

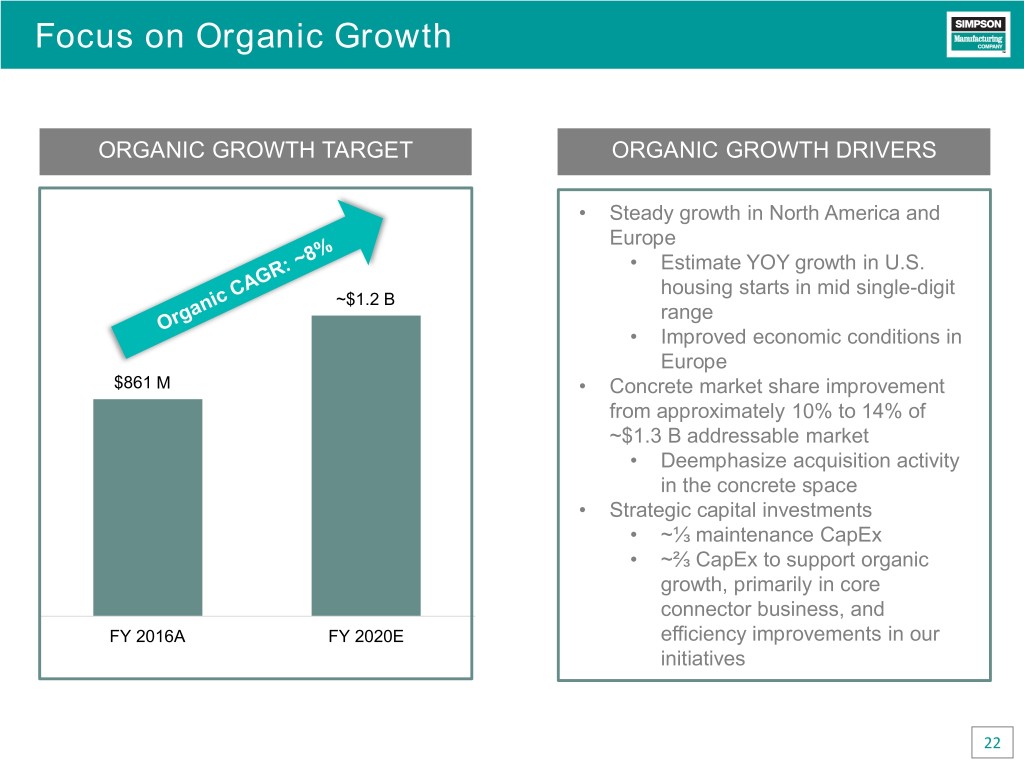

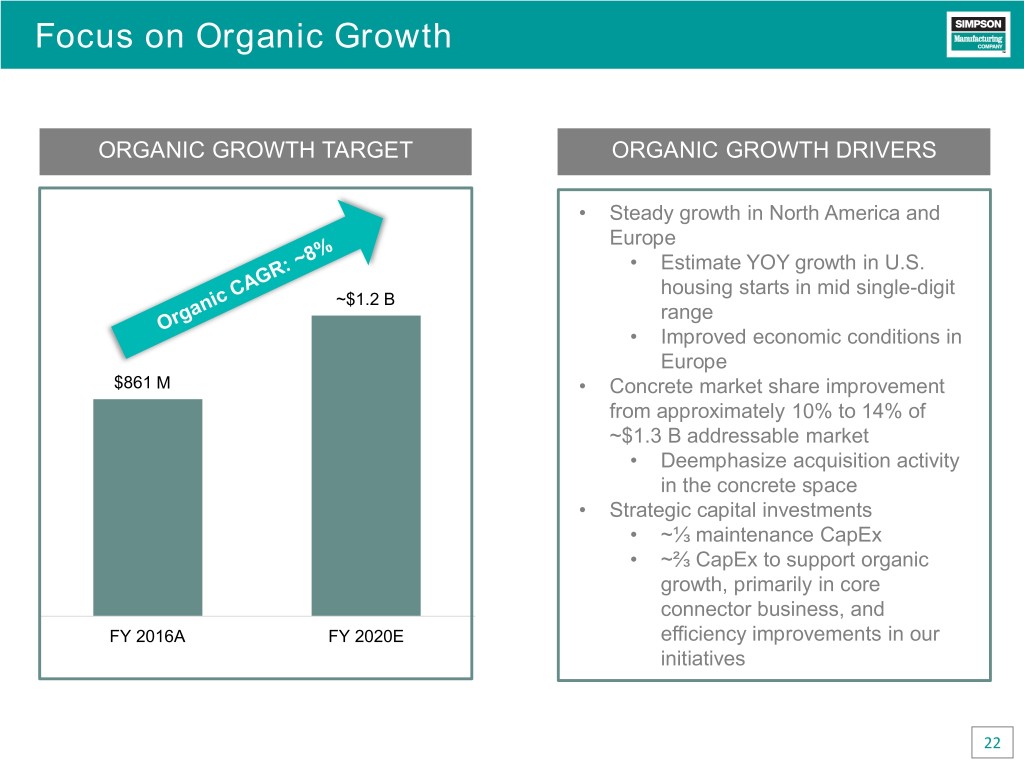

Focus on Organic Growth ORGANIC GROWTH TARGET ORGANIC GROWTH DRIVERS • Steady growth in North America and Europe • Estimate YOY growth in U.S. housing starts in mid single-digit ~$1.2 B range • Improved economic conditions in Europe $861 M • Concrete market share improvement from approximately 10% to 14% of ~$1.3 B addressable market • Deemphasize acquisition activity in the concrete space • Strategic capital investments • ~⅓ maintenance CapEx • ~⅔ CapEx to support organic growth, primarily in core connector business, and FY 2016A FY 2020E efficiency improvements in our initiatives 22

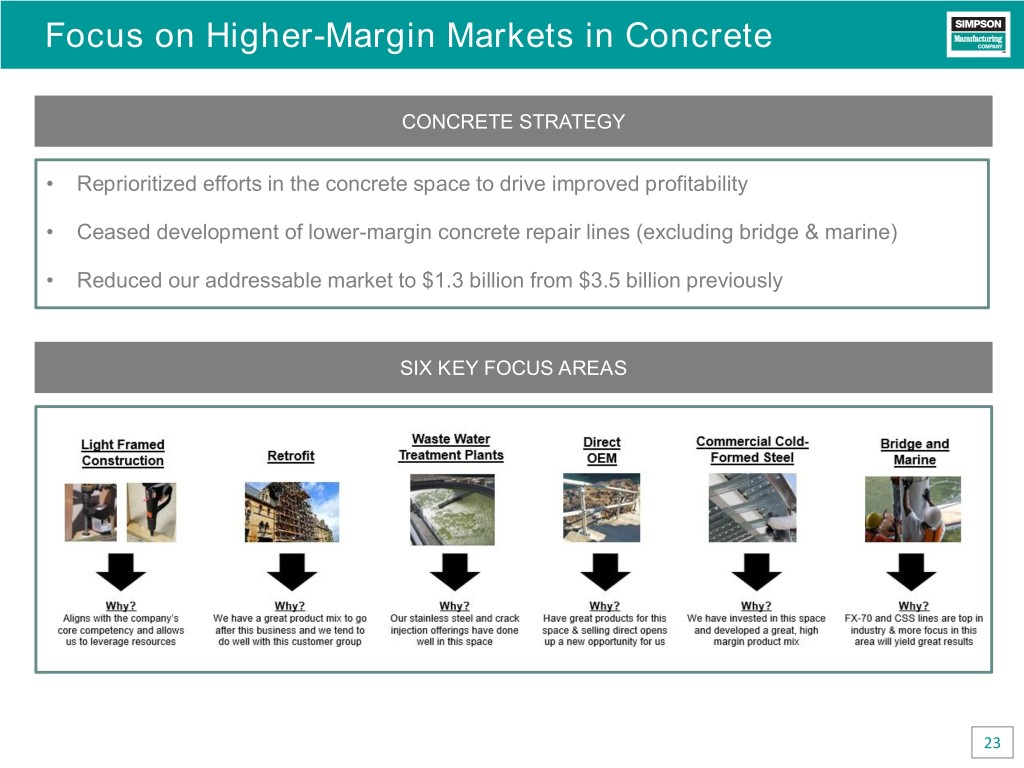

Focus on Higher-Margin Markets in Concrete CONCRETE STRATEGY • Reprioritized efforts in the concrete space to drive improved profitability • Ceased development of lower-margin concrete repair lines (excluding bridge & marine) • Reduced our addressable market to $1.3 billion from $3.5 billion previously SIX KEY FOCUS AREAS 23

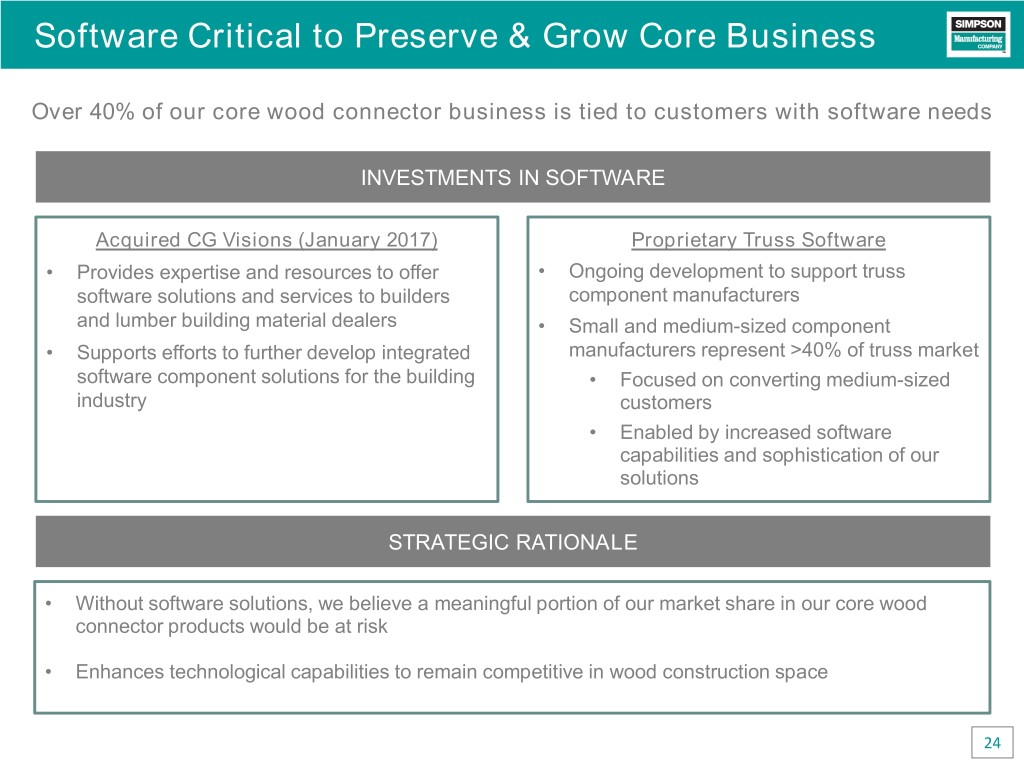

Software Critical to Preserve & Grow Core Business Over 40% of our core wood connector business is tied to customers with software needs INVESTMENTS IN SOFTWARE Acquired CG Visions (January 2017) Proprietary Truss Software • Provides expertise and resources to offer • Ongoing development to support truss software solutions and services to builders component manufacturers and lumber building material dealers • Small and medium-sized component ~$500 M • Supports efforts to further develop integrated manufacturers represent >40% of truss market software component solutions for the building • Focused on converting medium-sized industry customers • Enabled by increased software capabilities and sophistication of our solutions STRATEGIC RATIONALE • Without software solutions, we believe a meaningful portion of our market share in our core wood connector products would be at risk • Enhances technological capabilities to remain competitive in wood construction space 24

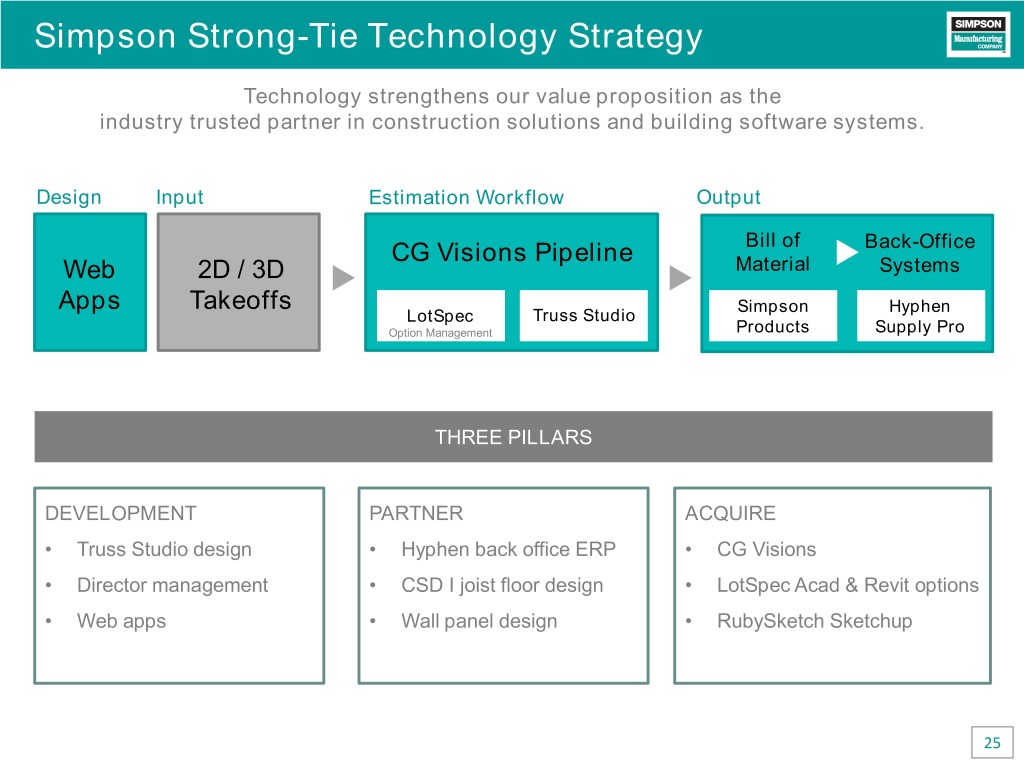

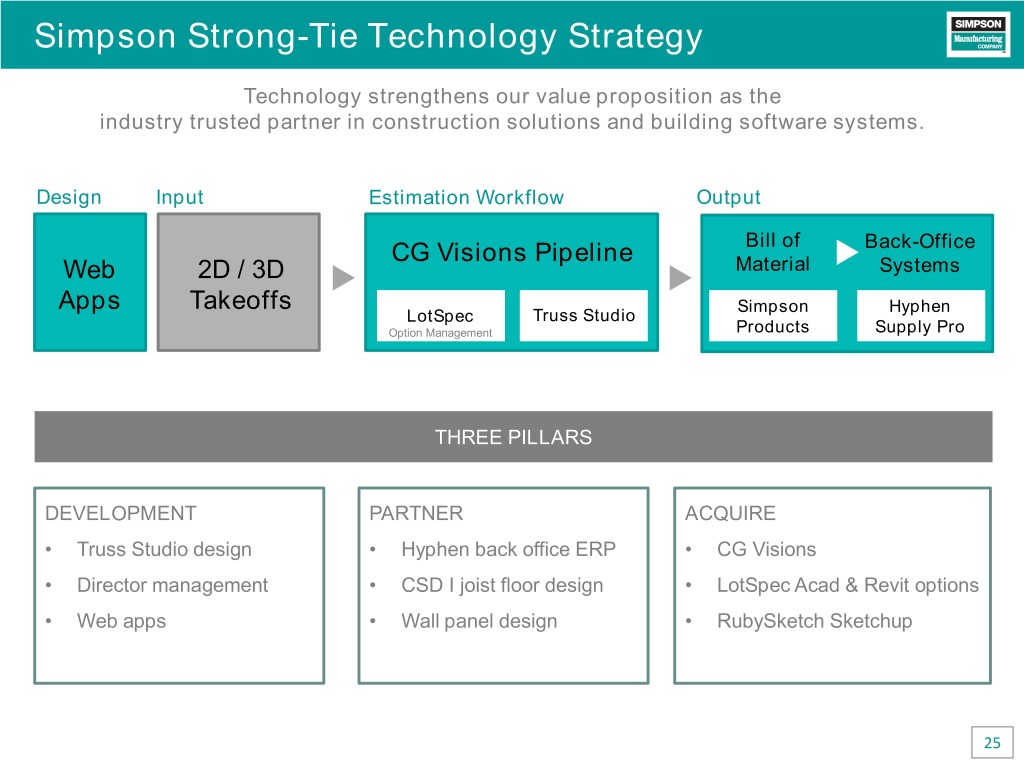

Simpson Strong-Tie Technology Strategy Technology strengthens our value proposition as the industry trusted partner in construction solutions and building software systems. Design Input Estimation Workflow Output CG Visions Pipeline Bill of Back-Office Web 2D / 3D Material Systems Apps Takeoffs Simpson Hyphen LotSpec Truss Studio Option Management Products Supply Pro THREE PILLARS DEVELOPMENT PARTNER ACQUIRE • Truss Studio design • Hyphen back office ERP • CG Visions • Director management • CSD I joist floor design • LotSpec Acad & Revit options • Web apps • Wall panel design • RubySketch Sketchup 25

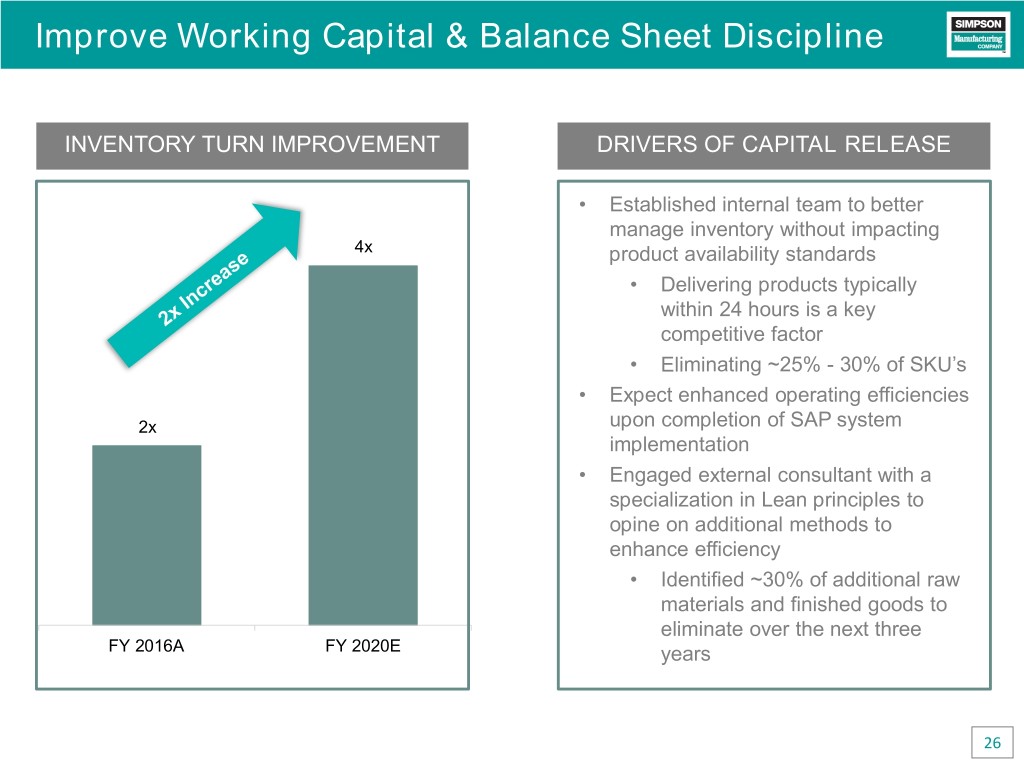

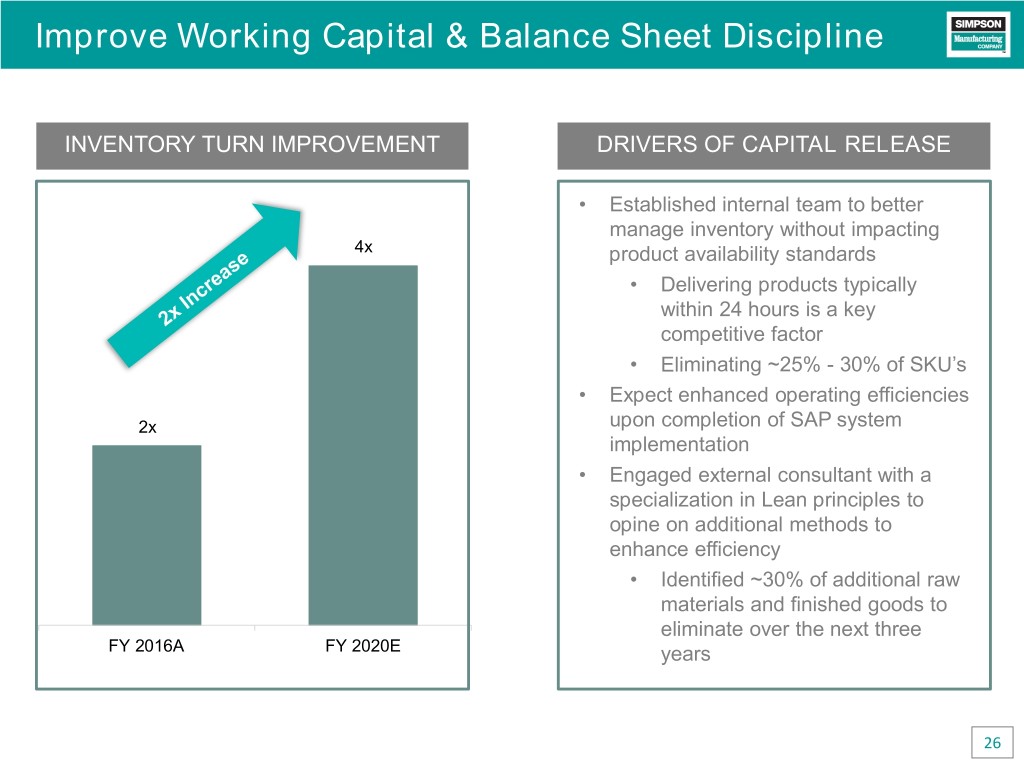

Improve Working Capital & Balance Sheet Discipline INVENTORY TURN IMPROVEMENT DRIVERS OF CAPITAL RELEASE • Established internal team to better manage inventory without impacting 4x product availability standards • Delivering products typically within 24 hours is a key competitive factor • Eliminating ~25% - 30% of SKU’s • Expect enhanced operating efficiencies 2x upon completion of SAP system implementation • Engaged external consultant with a specialization in Lean principles to opine on additional methods to enhance efficiency • Identified ~30% of additional raw materials and finished goods to eliminate over the next three FY 2016A FY 2020E years 26

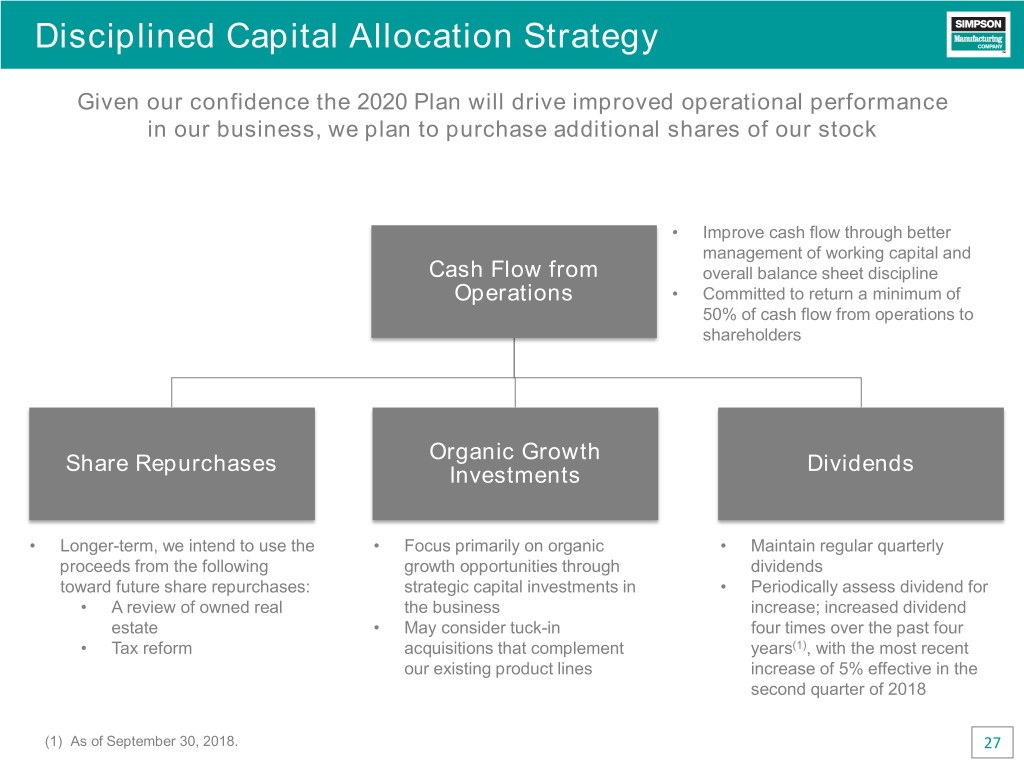

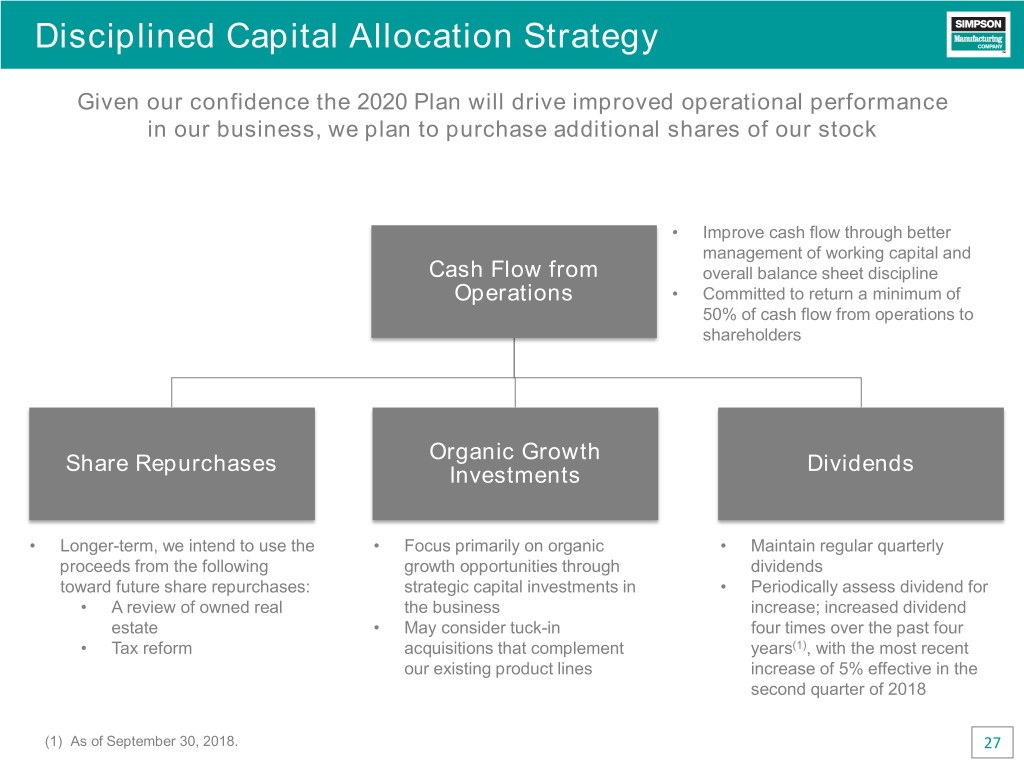

Disciplined Capital Allocation Strategy Given our confidence the 2020 Plan will drive improved operational performance in our business, we plan to purchase additional shares of our stock • Improve cash flow through better management of working capital and Cash Flow from overall balance sheet discipline Operations • Committed to return a minimum of 50% of cash flow from operations to shareholders Organic Growth Share Repurchases Dividends Investments • Longer-term, we intend to use the • Focus primarily on organic • Maintain regular quarterly proceeds from the following growth opportunities through dividends toward future share repurchases: strategic capital investments in • Periodically assess dividend for • A review of owned real the business increase; increased dividend estate • May consider tuck-in four times over the past four • Tax reform acquisitions that complement years(1), with the most recent our existing product lines increase of 5% effective in the second quarter of 2018 (1) As of September 30, 2018. 27

Summary We believe our execution on the 2020 Plan will create substantial value for all shareholders of Simpson Manufacturing Company 2017 → 2020: Focusing on organic growth Rationalizing our cost structure to improve Company-wide profitability Improving working capital management and balance sheet discipline Increasing capital return to shareholders Working with external management and Lean consultants to perform independent, in- depth analyses of our operations to identify incremental opportunities for improvement beyond the 2020 Plan We expect these objectives will result in an improved ROIC(1) target to approximately 17% to 18% by FY 2020 (1) See slide 29 for Return on Invested Capital (ROIC) definition. 28

Return on Invested Capital (“ROIC”) Definition When referred to in this presentation, the Company’s return on invested capital (“ROIC”) for a fiscal year is calculated based on (i) the net income of that year as presented in the Company’s consolidated statements of operations prepared pursuant to generally accepted accounting principles in the U.S. (“GAAP”), as divided by (ii) the average of the sum of the total stockholders’ equity and the total long-term liabilities at the beginning of and at the end of such year, as presented in the Company’s consolidated balance sheets prepared pursuant to GAAP for that applicable year. As such, the Company’s ROIC, a ratio or statistical measure, is calculated using exclusively financial measures presented in accordance with GAAP. 29

www.simpsonmfg.com/financials Simpson’s People Make the Difference 30