STRONG FOUNDATION. STRONGER FUTURE. Simpson Manufacturing Co., Inc. Investor Presentation February 2025 Exhibit 99.2

2 Safe Harbor Note: The financial results in this presentation as of and for the fiscal year ended December 31, 2024 are unaudited. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "outlook," "target," "continue," "predict," "project," "change," "result," "future," "will," "could," "can," "may," "likely," "potentially," or similar expressions. Forward-looking statements are all statements other than those of historical fact and include, but are not limited to, statements about future financial and operating results, our plans, objectives, business outlook, priorities, expectations and intentions, expectations for sales and market growth, comparable sales, earnings and performance, stockholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, our strategic initiatives, including the impact of these initiatives on our strategic and operational plans and financial results, and any statement of an assumption underlying any of the foregoing. Forward-looking statements are subject to inherent uncertainties, risks and other factors that are difficult to predict and could cause our actual results to vary in material respects from what we have expressed or implied by these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those expressed in or implied by our forward-looking statements include the effect of global pandemics such as the COVID-19 pandemic or other widespread public health crisis and their effects on the global economy, the effects of inflation and labor and supply shortages, on our operations, and the operations of our customers, suppliers and business partners, as well as those discussed in the "Risk Factors" and " Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and other reports we file with the SEC. We caution that you should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Readers are urged to carefully review and consider the various disclosures made in our reports filed with the SEC that advise of the risks and factors that may affect our business, results of operations and financial condition.

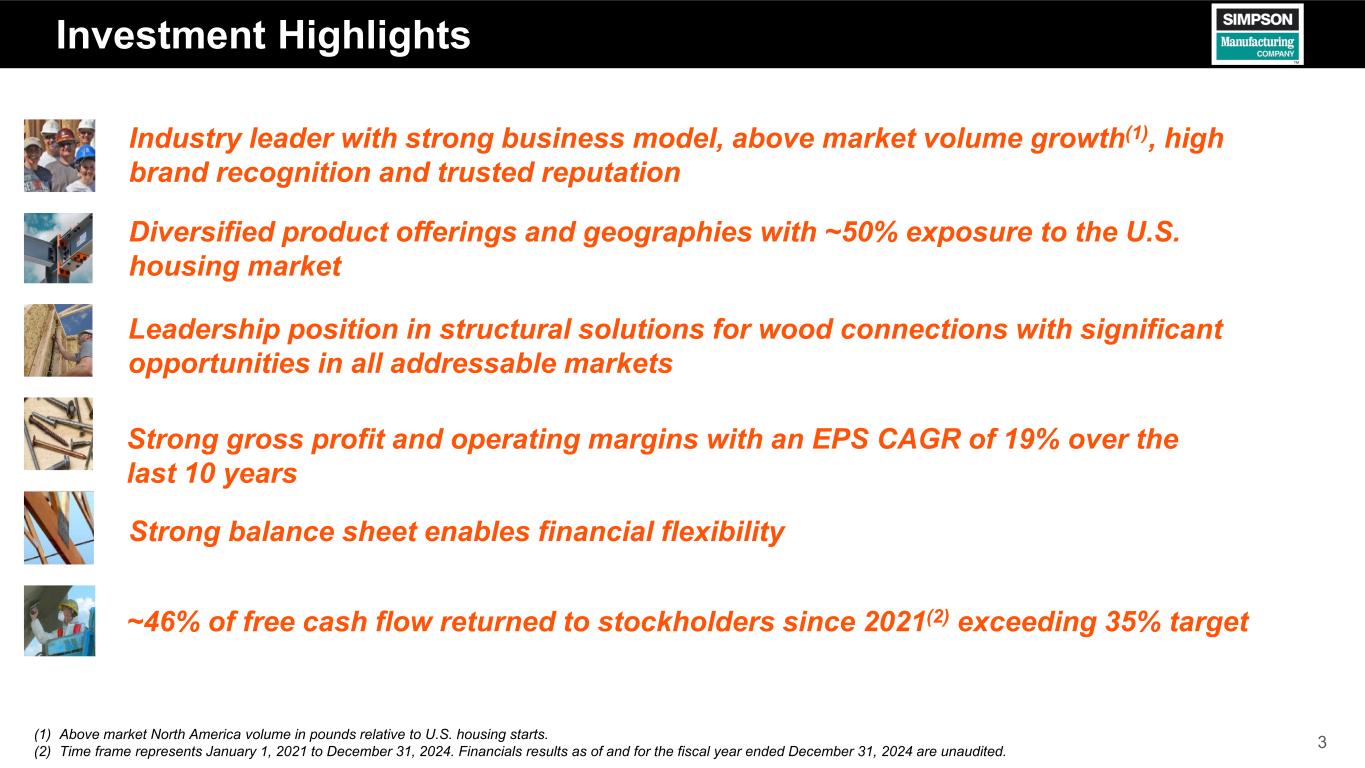

3 Investment Highlights Industry leader with strong business model, above market volume growth(1), high brand recognition and trusted reputation Diversified product offerings and geographies with ~50% exposure to the U.S. housing market Leadership position in structural solutions for wood connections with significant opportunities in all addressable markets Strong gross profit and operating margins with an EPS CAGR of 19% over the last 10 years Strong balance sheet enables financial flexibility ~46% of free cash flow returned to stockholders since 2021(2) exceeding 35% target (1) Above market North America volume in pounds relative to U.S. housing starts. (2) Time frame represents January 1, 2021 to December 31, 2024. Financials results as of and for the fiscal year ended December 31, 2024 are unaudited.

4 Celebrating 30 Years as a Public Company Performance Since IPO CEO, Mike Olosky, rings the NYSE Closing Bell on September 6, 2024 to commemorate the Company’s 30th anniversary as a publicly traded company. Note: The financial results as of and for the fiscal year ended December 31, 2024 are unaudited. (1) Since its debut at $11.50 per share ($2.875 split-adjusted) at its initial public offering (IPO) on May 25, 1994. Thirty years and two stock splits later, shares of Simpson closed at $167.59 on February 5, 2025, which, together with quarterly dividends, has resulted in a total compound annual growth rate of approximately 14%. Revenue Growth (1994 – 2024) $0.14 ~15x $2.2 B EPS Growth (1994 – 2024) $150 M ~54x $7.60 $167.59Compound annual growth rate of ~14%(1) since 1994 IPO $0.00 $30.00 $60.00 $90.00 $120.00 $150.00 $180.00 $210.00

5 Simpson’s Brand and Culture At Simpson, we describe the unique culture of our organization as our “Secret Sauce.” To deliver innovative solutions that help people design and build safer, stronger structures. OUR MISSION OUR COMPANY VALUES 1. Relentless Customer Focus 2. Long-Range View 3. High-Quality Products 4. Be The Leader 5. Everybody Matters 6. Enable Growth 7. Risk-Taking Innovation 8. Give Back 9. Be Humble, Have Fun

6 Our Strong Business Model Why Simpson? Our Customer-Centric Approach Broad portfolio of solutions Unparalleled availability & delivery Longstanding relationships Comprehensive service Innovation leader Impactful industry outreach • 26 of top 30 builders on a program • ~250 builders representing >50% of US housing starts • Millions of specifications • Thousands of dealers & retailers • ~98% product fill rate • 24-48 hour typical delivery • 48-hour turnaround on specials • Same-day shipping availability • ~700 field sales reps • Thousands of jobsite visits • Dedicated customer service and technical support • 26 training centers • 700+ training workshops per year • Partnering with organizations to support construction trades education • 15K standard & custom wood products • 3K standard & custom concrete products • 50+ software and web-app solutions • Pioneer of construction solutions • 8 accredited test labs • ~120 code evaluation reports • 500+ patents worldwide Our customer-centric approach and commitment to service differentiates us from other vendors and suppliers.

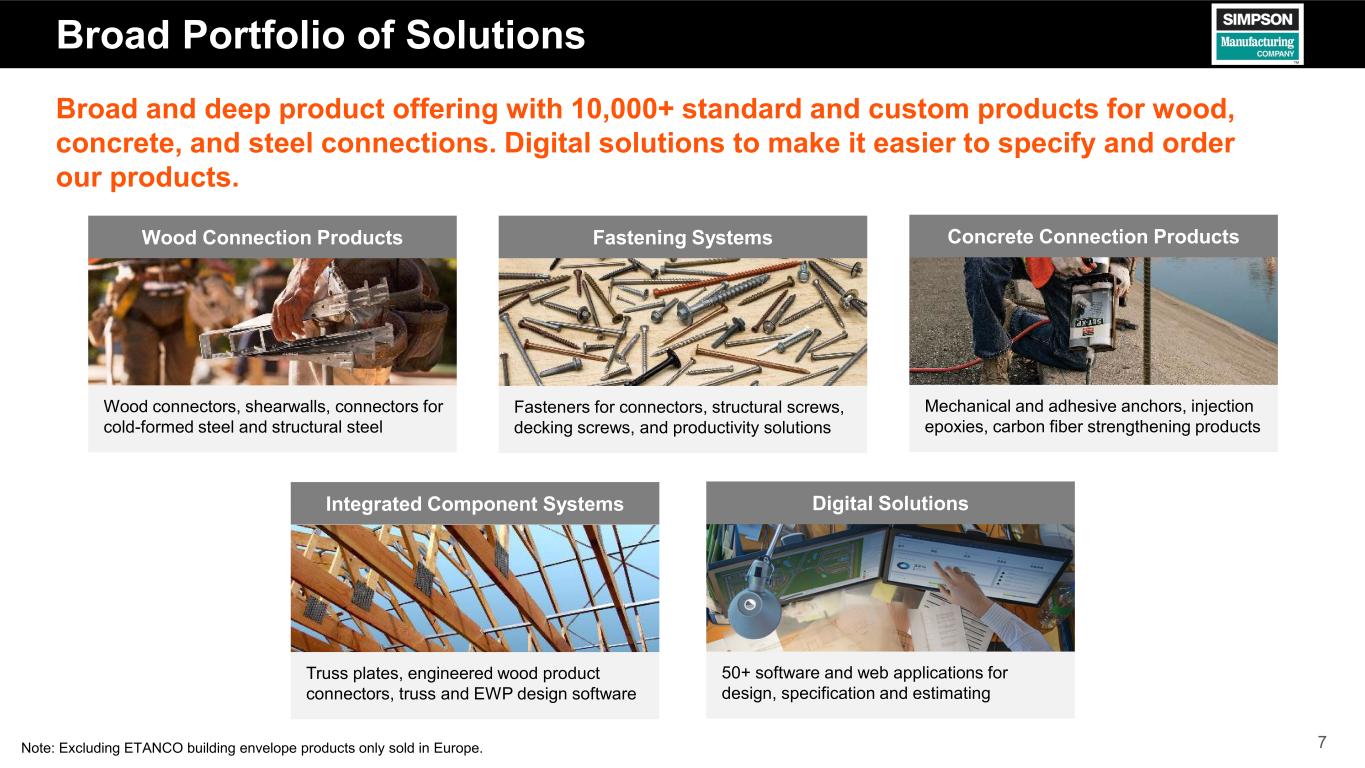

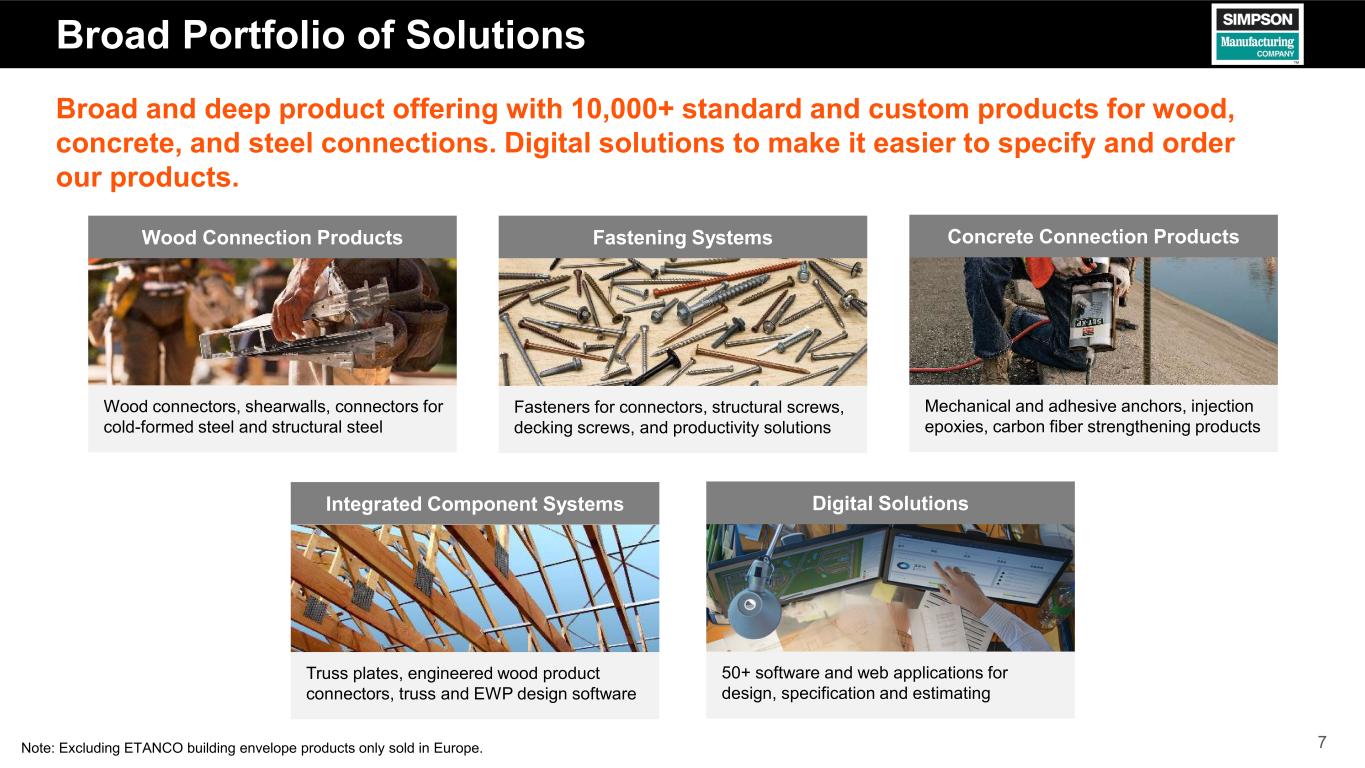

Broad Portfolio of Solutions Wood Connection Products Fastening Systems Concrete Connection Products Integrated Component Systems Wood connectors, shearwalls, connectors for cold-formed steel and structural steel Fasteners for connectors, structural screws, decking screws, and productivity solutions Truss plates, engineered wood product connectors, truss and EWP design software Mechanical and adhesive anchors, injection epoxies, carbon fiber strengthening products Broad and deep product offering with 10,000+ standard and custom products for wood, concrete, and steel connections. Digital solutions to make it easier to specify and order our products. Digital Solutions 50+ software and web applications for design, specification and estimating Note: Excluding ETANCO building envelope products only sold in Europe. 7

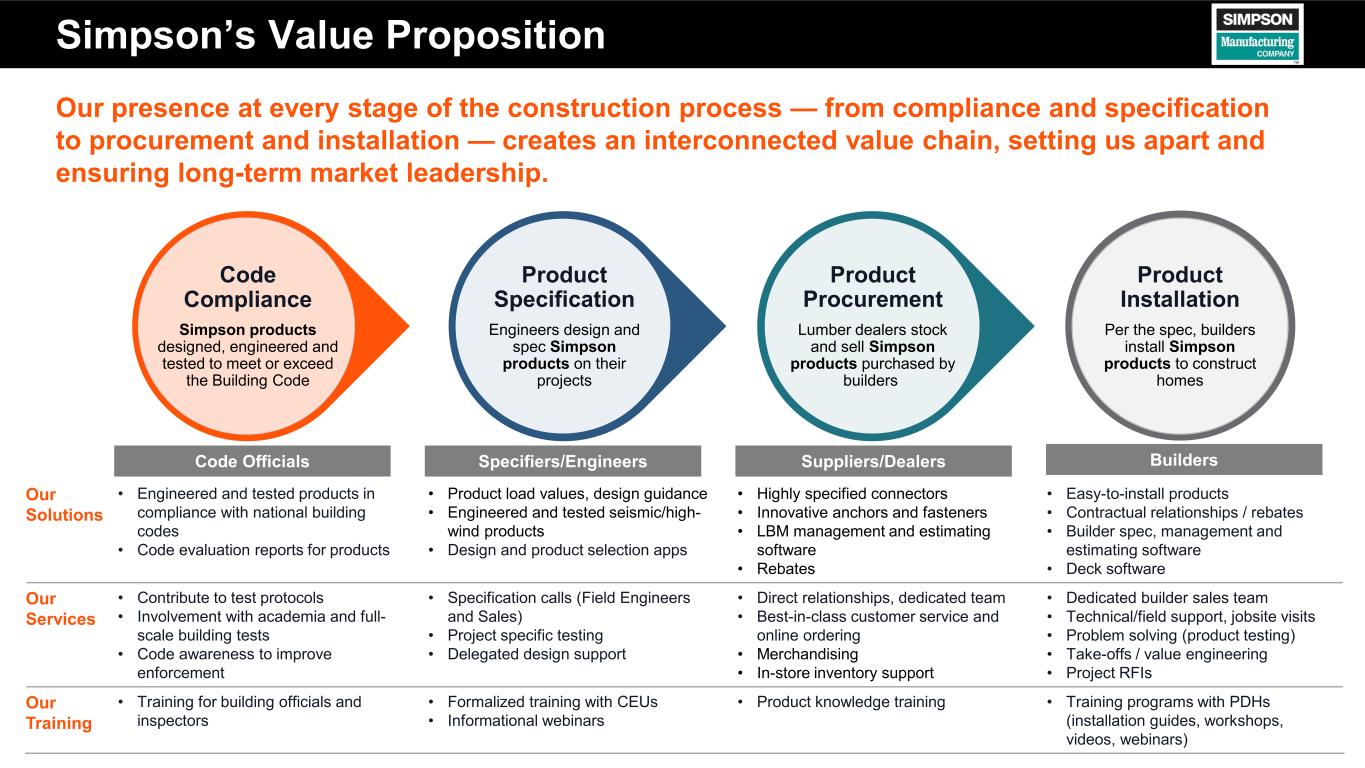

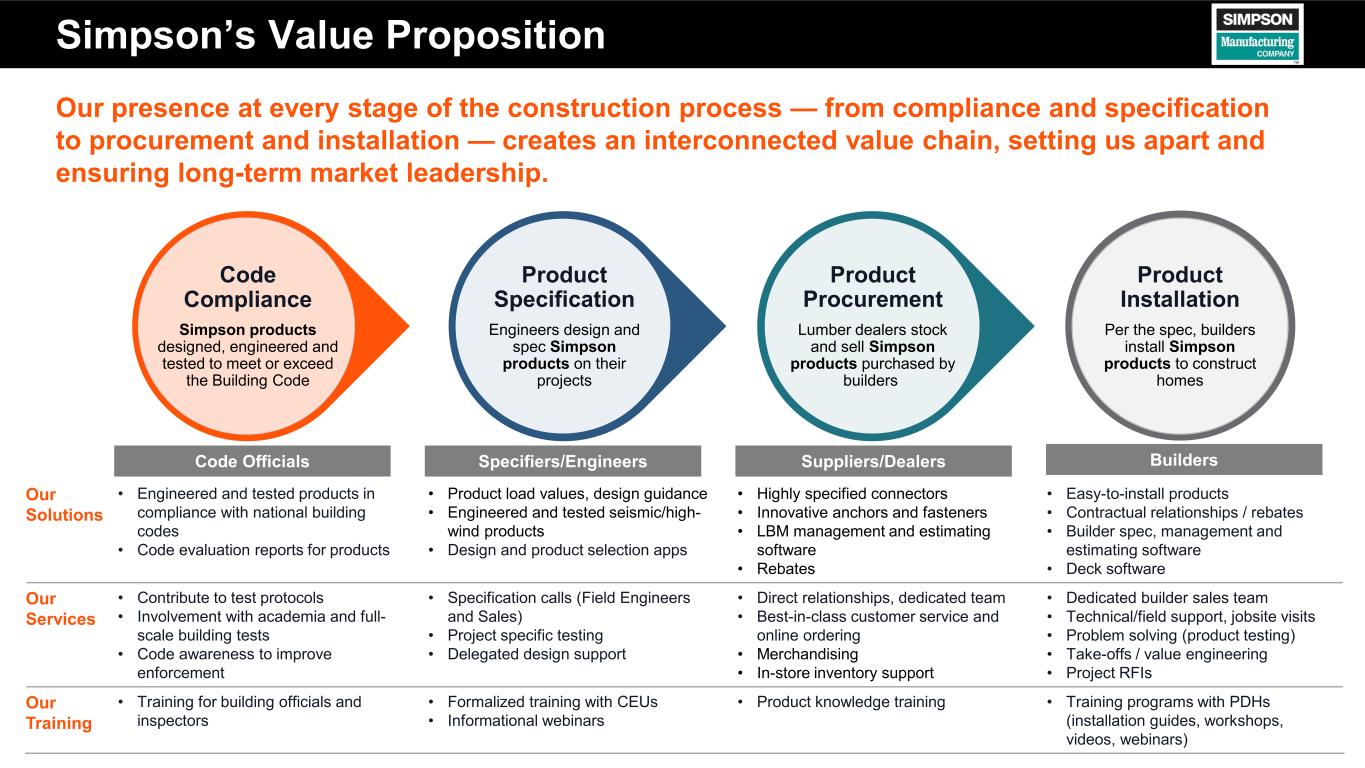

Simpson’s Value Proposition Product Installation Per the spec, builders install Simpson products to construct homes Product Procurement Lumber dealers stock and sell Simpson products purchased by builders Product Specification Engineers design and spec Simpson products on their projects Code Compliance Simpson products designed, engineered and tested to meet or exceed the Building Code Our Solutions • Engineered and tested products in compliance with national building codes • Code evaluation reports for products • Product load values, design guidance • Engineered and tested seismic/high- wind products • Design and product selection apps • Highly specified connectors • Innovative anchors and fasteners • LBM management and estimating software • Rebates • Easy-to-install products • Contractual relationships / rebates • Builder spec, management and estimating software • Deck software Our Services • Contribute to test protocols • Involvement with academia and full- scale building tests • Code awareness to improve enforcement • Specification calls (Field Engineers and Sales) • Project specific testing • Delegated design support • Direct relationships, dedicated team • Best-in-class customer service and online ordering • Merchandising • In-store inventory support • Dedicated builder sales team • Technical/field support, jobsite visits • Problem solving (product testing) • Take-offs / value engineering • Project RFIs Our Training • Training for building officials and inspectors • Formalized training with CEUs • Informational webinars • Product knowledge training • Training programs with PDHs (installation guides, workshops, videos, webinars) Our presence at every stage of the construction process — from compliance and specification to procurement and installation — creates an interconnected value chain, setting us apart and ensuring long-term market leadership. Code Officials Specifiers/Engineers Suppliers/Dealers Builders

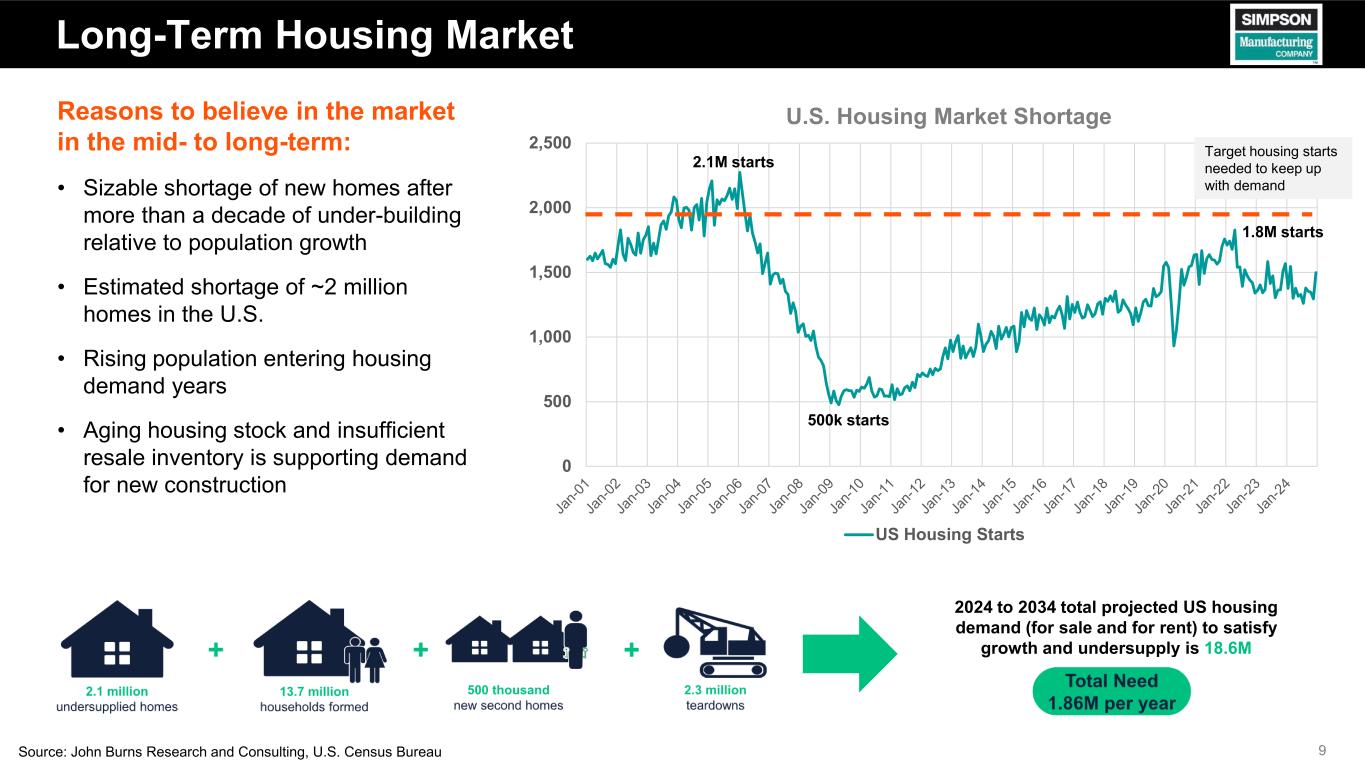

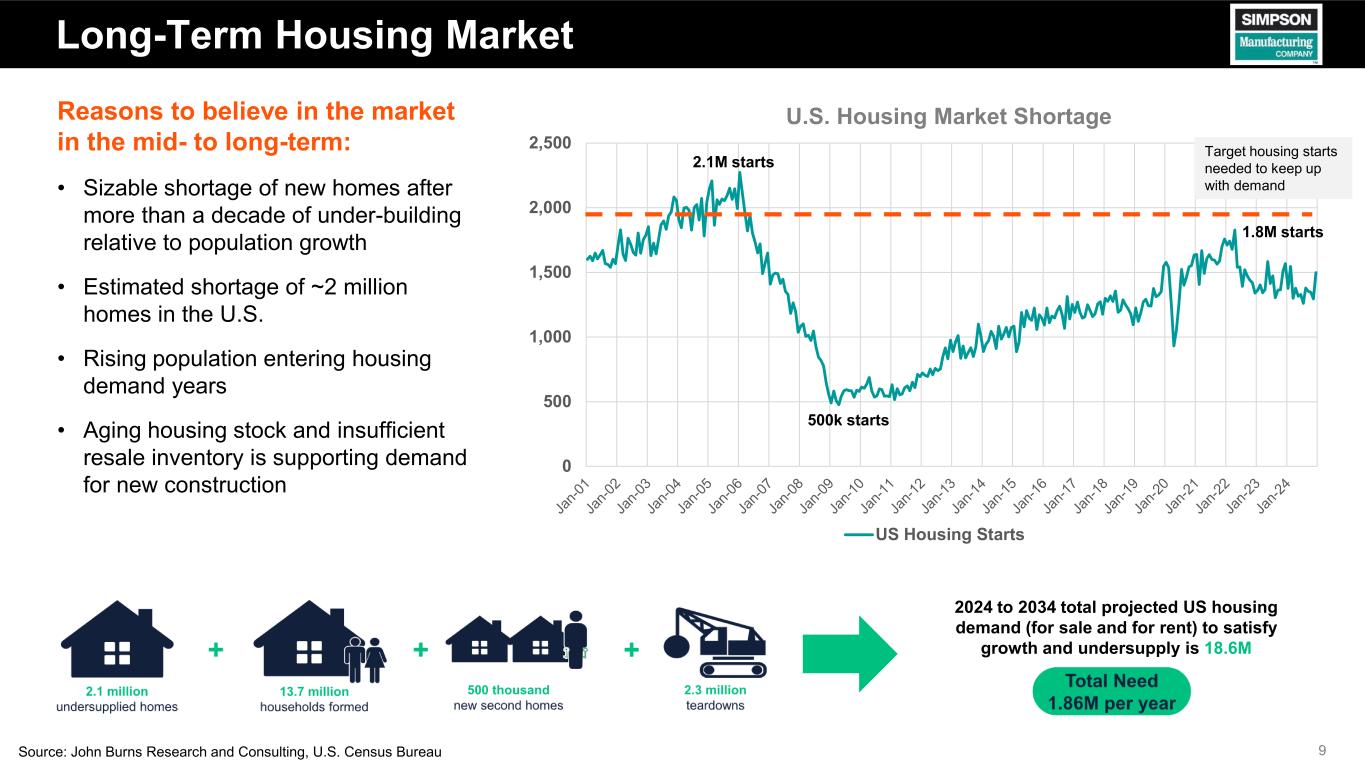

9 Long-Term Housing Market Reasons to believe in the market in the mid- to long-term: • Sizable shortage of new homes after more than a decade of under-building relative to population growth • Estimated shortage of ~2 million homes in the U.S. • Rising population entering housing demand years • Aging housing stock and insufficient resale inventory is supporting demand for new construction 0 500 1,000 1,500 2,000 2,500 US Housing Starts Target housing starts needed to keep up with demand 500k starts 1.8M starts U.S. Housing Market Shortage 2024 to 2034 total projected US housing demand (for sale and for rent) to satisfy growth and undersupply is 18.6M 2.1M starts Source: John Burns Research and Consulting, U.S. Census Bureau

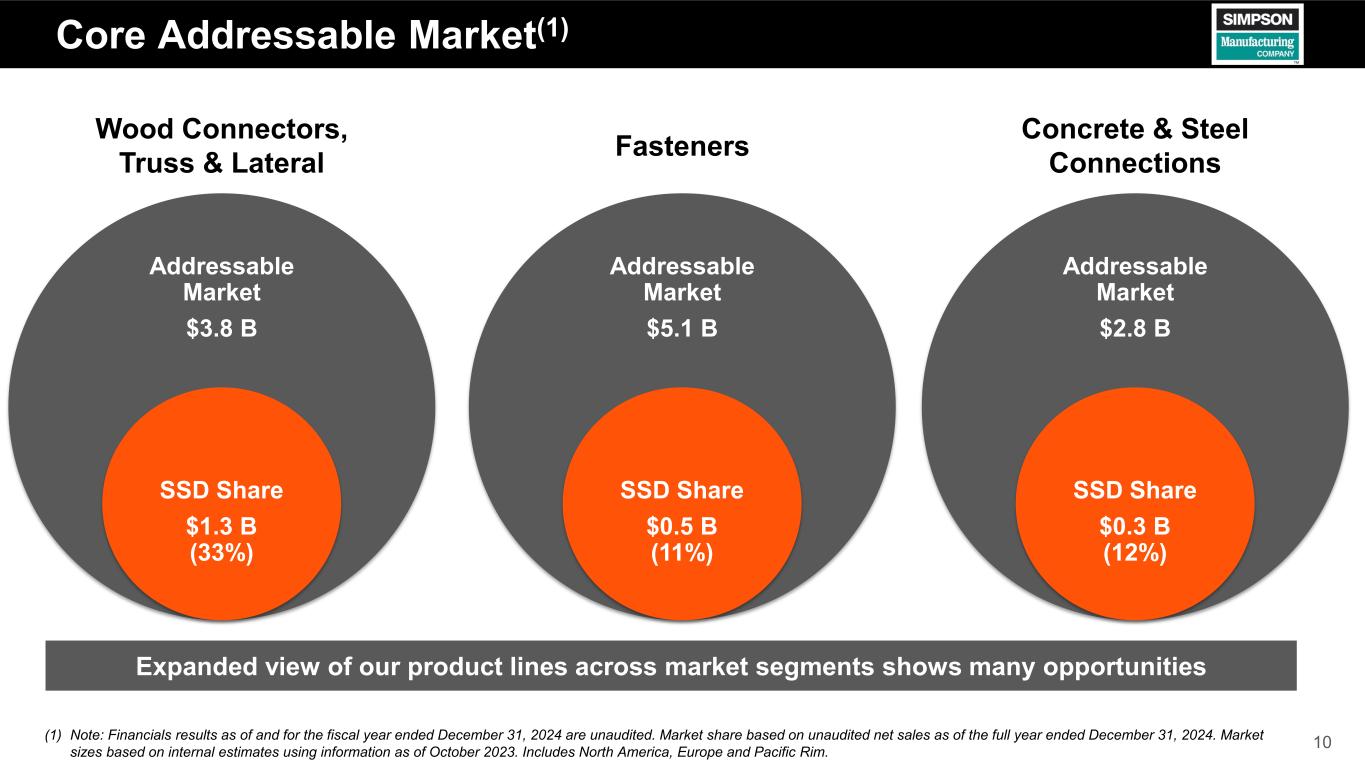

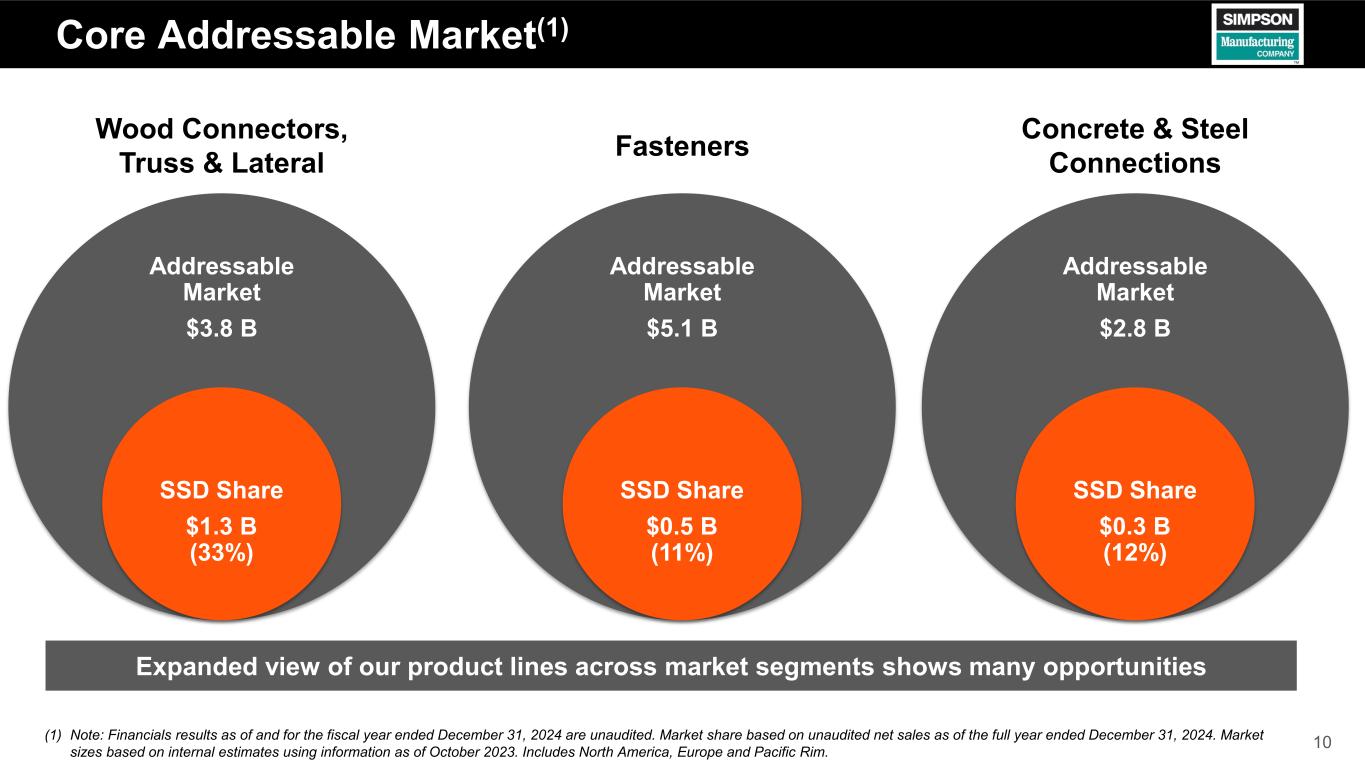

10 Core Addressable Market(1) Wood Connectors, Truss & Lateral Concrete & Steel Connections Addressable Market $3.8 B SSD Share $1.3 B (33%) Fasteners $1.7 B (17%) Expanded view of our product lines across market segments shows many opportunities Addressable Market $5.1 B SSD Share $0.5 B (11%) Addressable Market $2.8 B SSD Share $0.3 B (12%) (1) Note: Financials results as of and for the fiscal year ended December 31, 2024 are unaudited. Market share based on unaudited net sales as of the full year ended December 31, 2024. Market sizes based on internal estimates using information as of October 2023. Includes North America, Europe and Pacific Rim.

11 5 Key End Use Markets in North America Our market focused approach enables us to better serve current customers and identify opportunities to reach new customers and product opportunities. See Appendix for additional details.

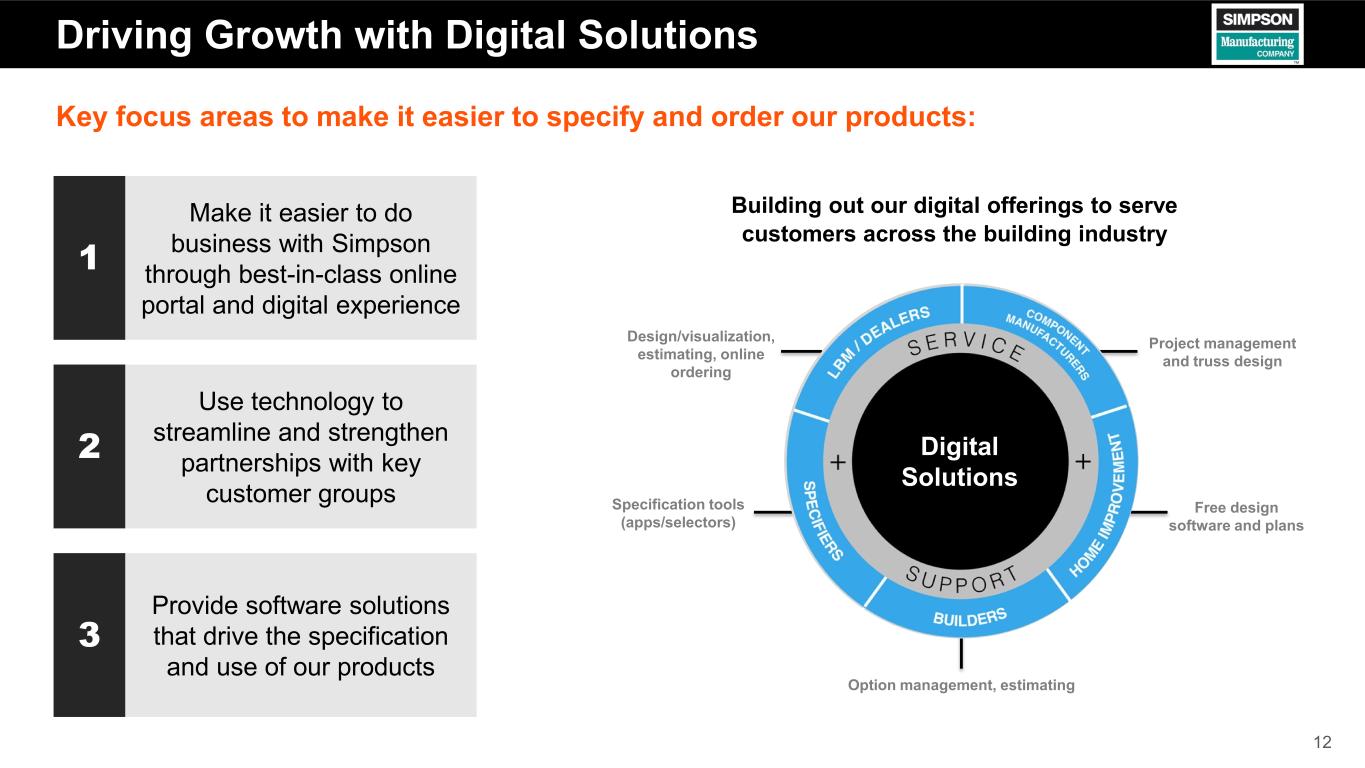

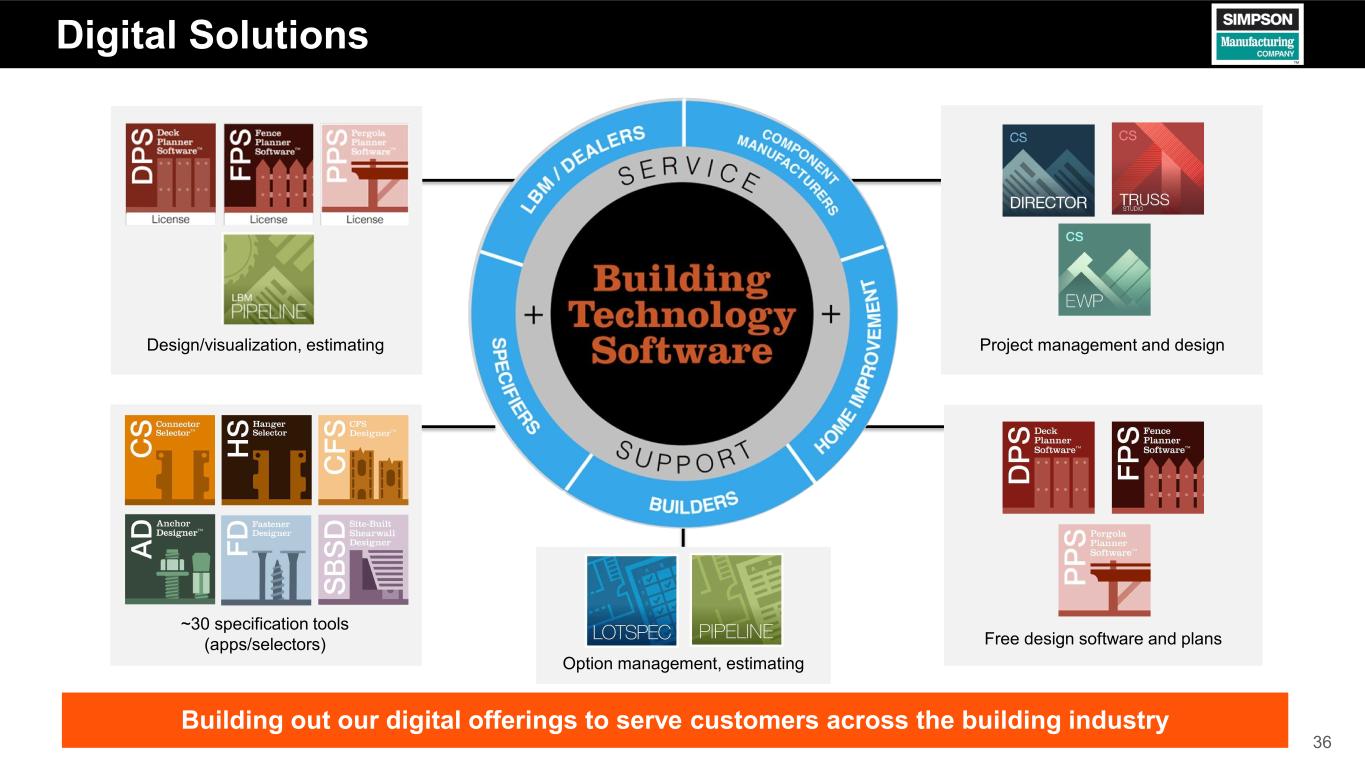

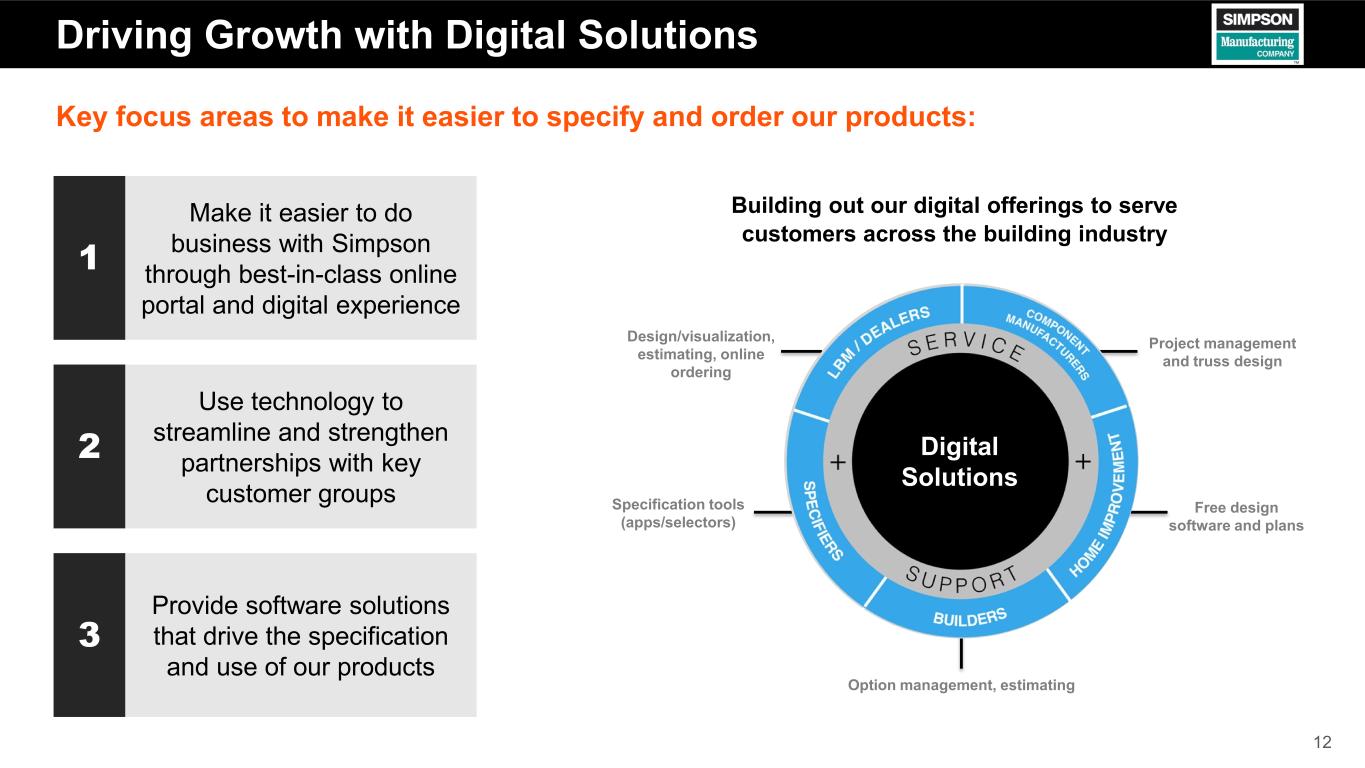

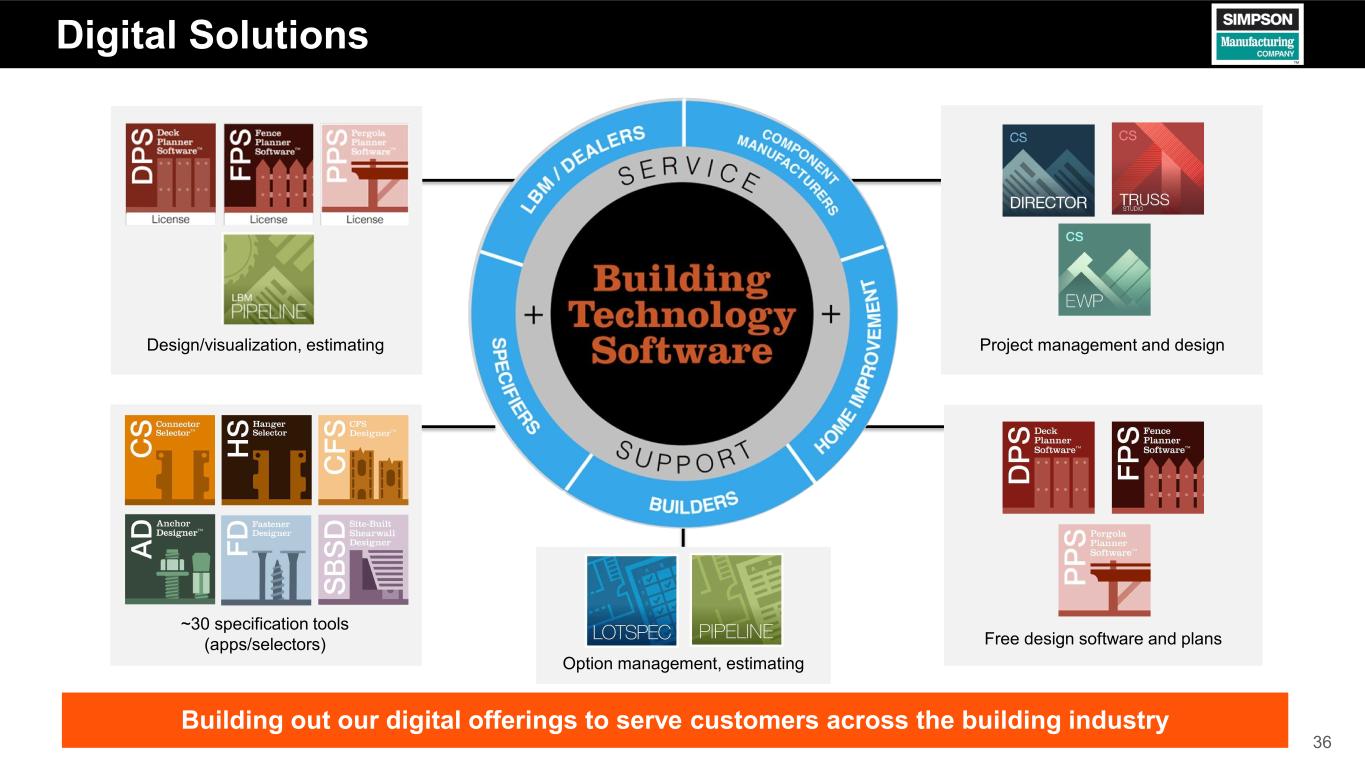

12 Driving Growth with Digital Solutions Key focus areas to make it easier to specify and order our products: Specification tools (apps/selectors) Design/visualization, estimating, online ordering Option management, estimating Project management and truss design Free design software and plans Digital Solutions Building out our digital offerings to serve customers across the building industry Make it easier to do business with Simpson through best-in-class online portal and digital experience Use technology to streamline and strengthen partnerships with key customer groups Provide software solutions that drive the specification and use of our products 1 2 3

13 Europe Strategy BUILDING STRONG BRANDS IN OUR CORE BUSINESS GROW WITH OUR STRONG SOLUTIONS IN OUR HIGHEST POTENTIAL MARKETS DOUBLE STRUCTURAL FASTENERS OFFER COMPLETE PRODUCT SOLUTIONS CONNECTORS FASTENERS ANCHORS STRONGER EFFORT IN COMMERCIAL NEW BUILDING AND RESIDENTIAL RENOVATION #1 IN WOOD CONNECTORS BUILD ON OUR STRONG POSITION IN FACADE TARGETED EXPANSION IN PAVEMENT REINFORCEMENT EXPLOIT THE MASS TIMBER TREND FOCUS ON THE COUNTRIES WHERE WE ALREADY OPERATE

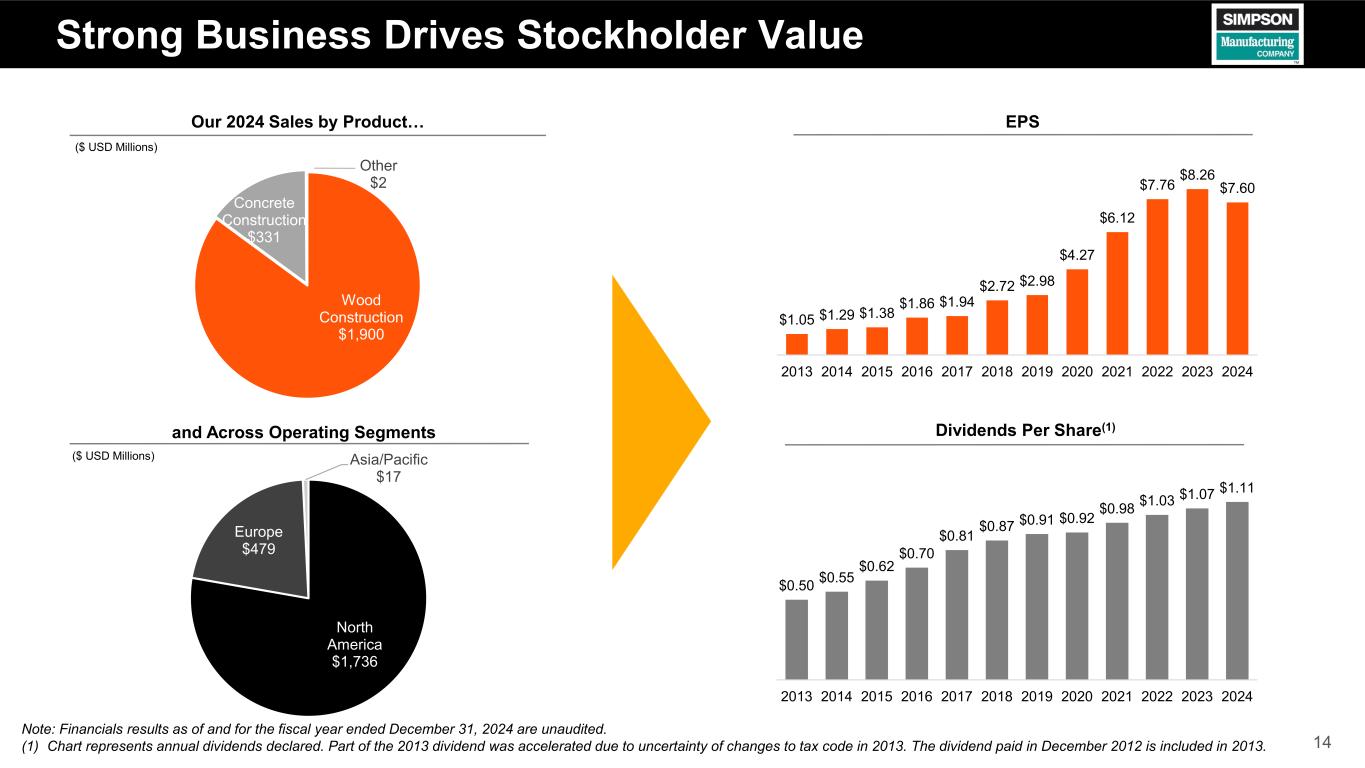

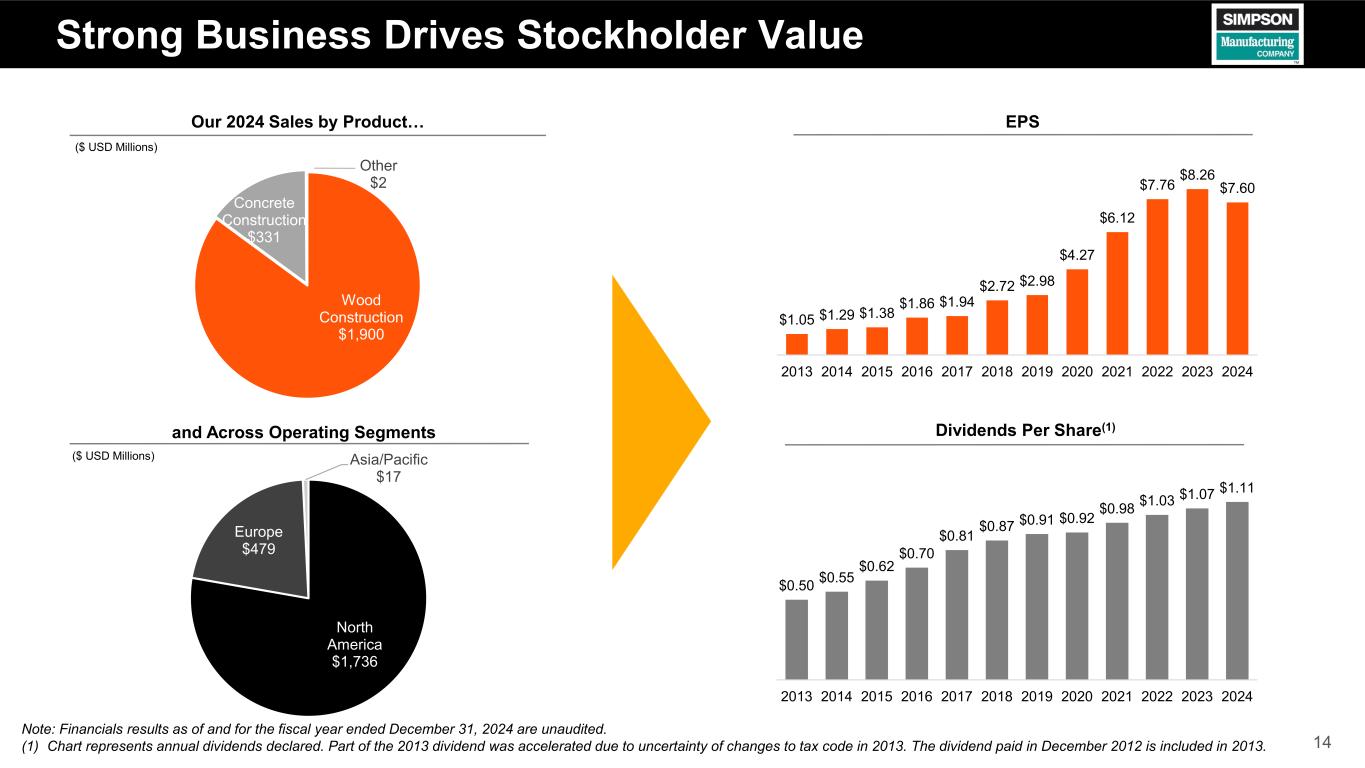

14 North America $1,736 Europe $479 Asia/Pacific $17 Strong Business Drives Stockholder Value Our 2024 Sales by Product… ($ USD Millions) and Across Operating Segments ($ USD Millions) EPS Dividends Per Share(1) Note: Financials results as of and for the fiscal year ended December 31, 2024 are unaudited. (1) Chart represents annual dividends declared. Part of the 2013 dividend was accelerated due to uncertainty of changes to tax code in 2013. The dividend paid in December 2012 is included in 2013. Wood Construction $1,900 Concrete Construction $331 Other $2 $1.05 $1.29 $1.38 $1.86 $1.94 $2.72 $2.98 $4.27 $6.12 $7.76 $8.26 $7.60 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 $0.50 $0.55 $0.62 $0.70 $0.81 $0.87 $0.91 $0.92 $0.98 $1.03 $1.07 $1.11 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

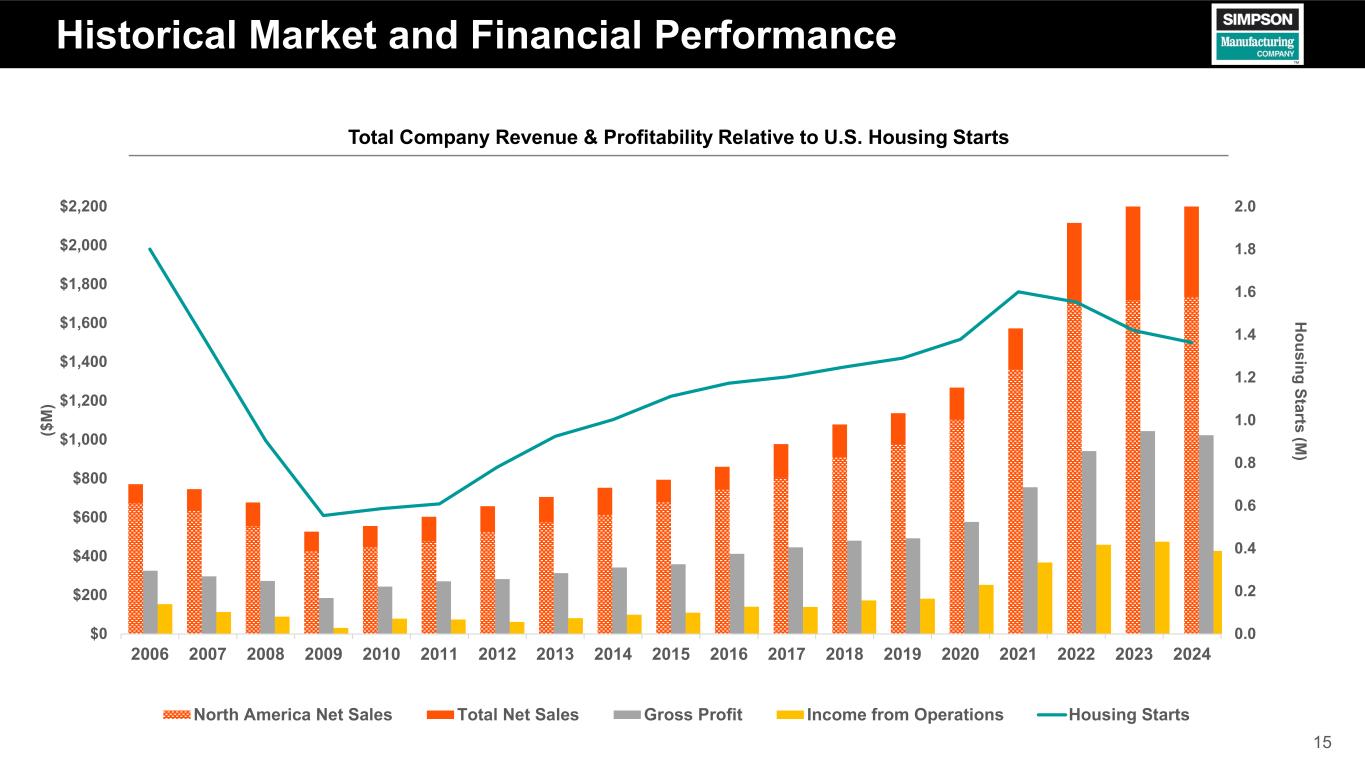

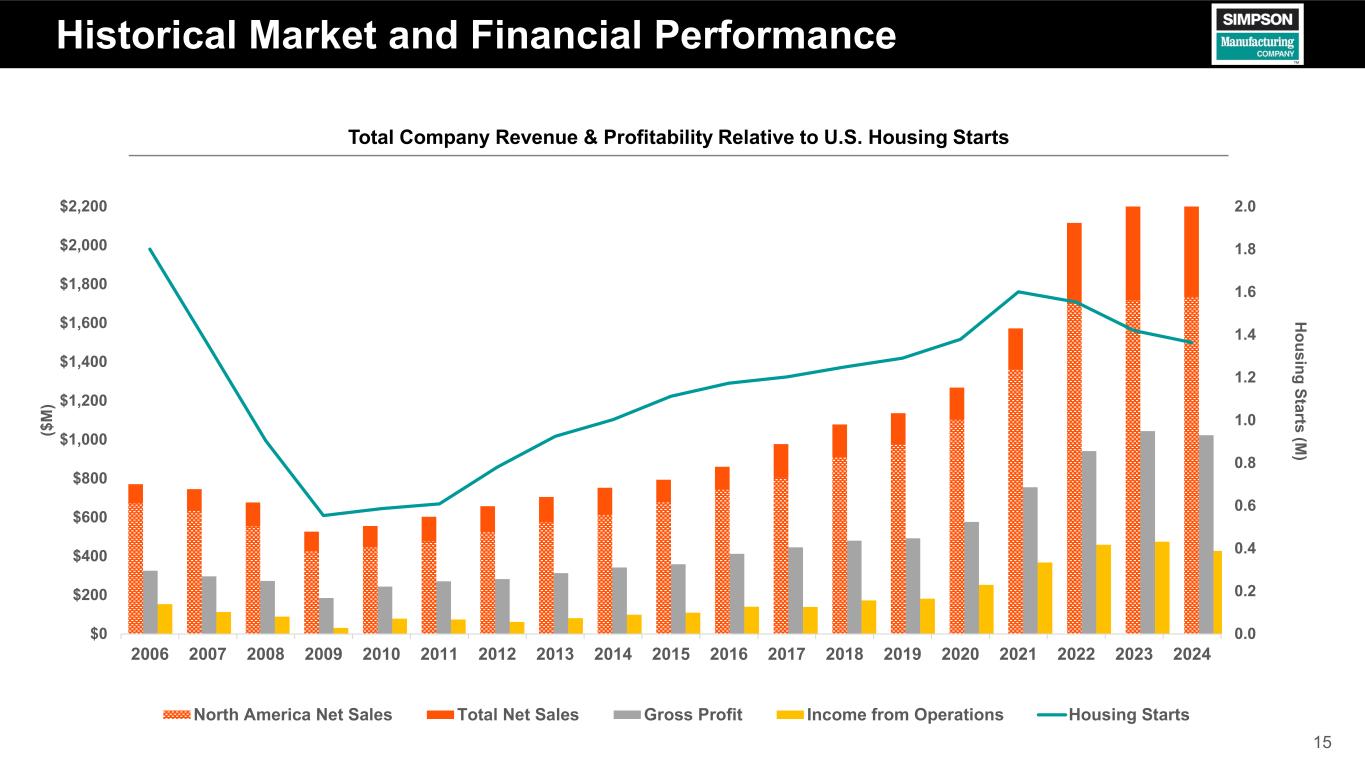

15 Historical Market and Financial Performance Total Company Revenue & Profitability Relative to U.S. Housing Starts 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 $2,200 H ousing Starts (M ) ($ M ) North America Net Sales Total Net Sales Gross Profit Income from Operations Housing Starts

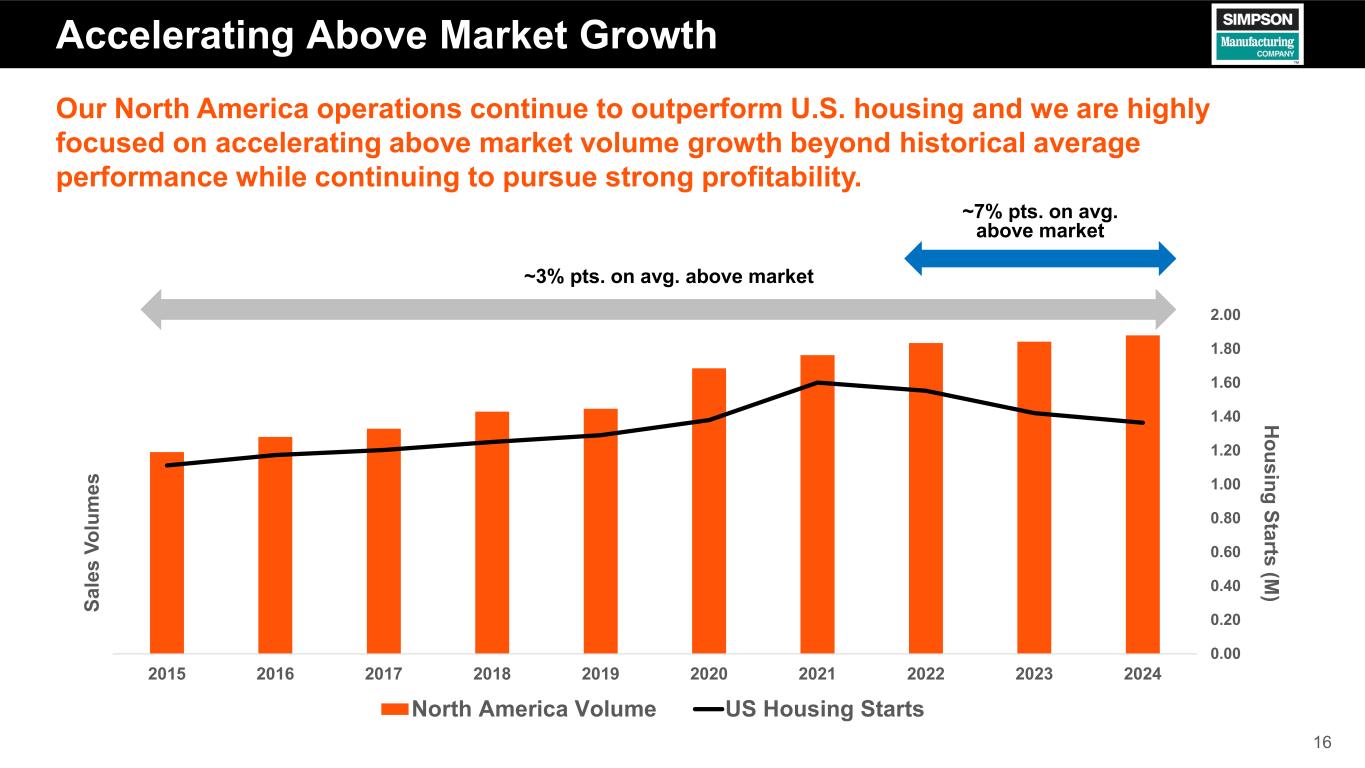

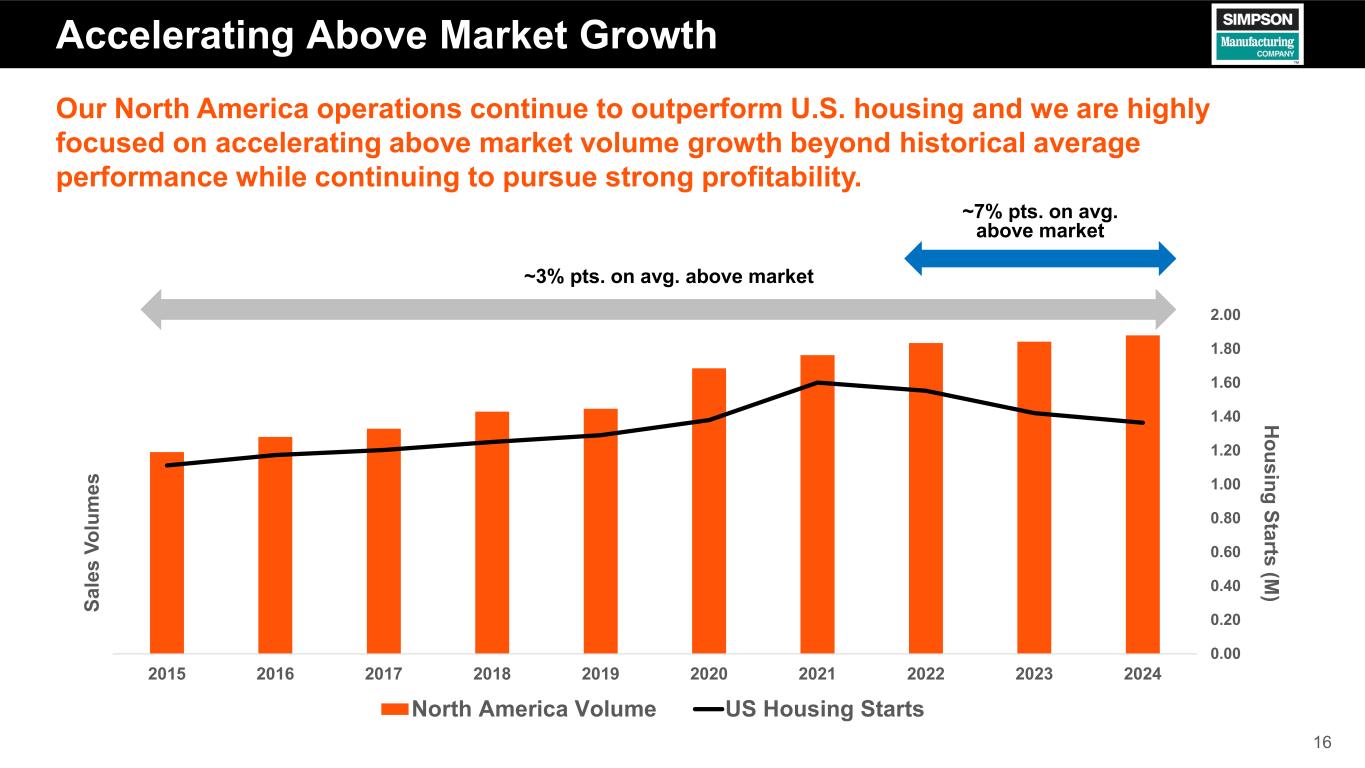

16 Accelerating Above Market Growth Our North America operations continue to outperform U.S. housing and we are highly focused on accelerating above market volume growth beyond historical average performance while continuing to pursue strong profitability. 0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60 1.80 2.00 - 50 100 150 200 250 300 350 400 450 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 H ousing Starts (M ) Sa le s Vo lu m es North America Volume US Housing Starts ~3% pts. on avg. above market ~7% pts. on avg. above market

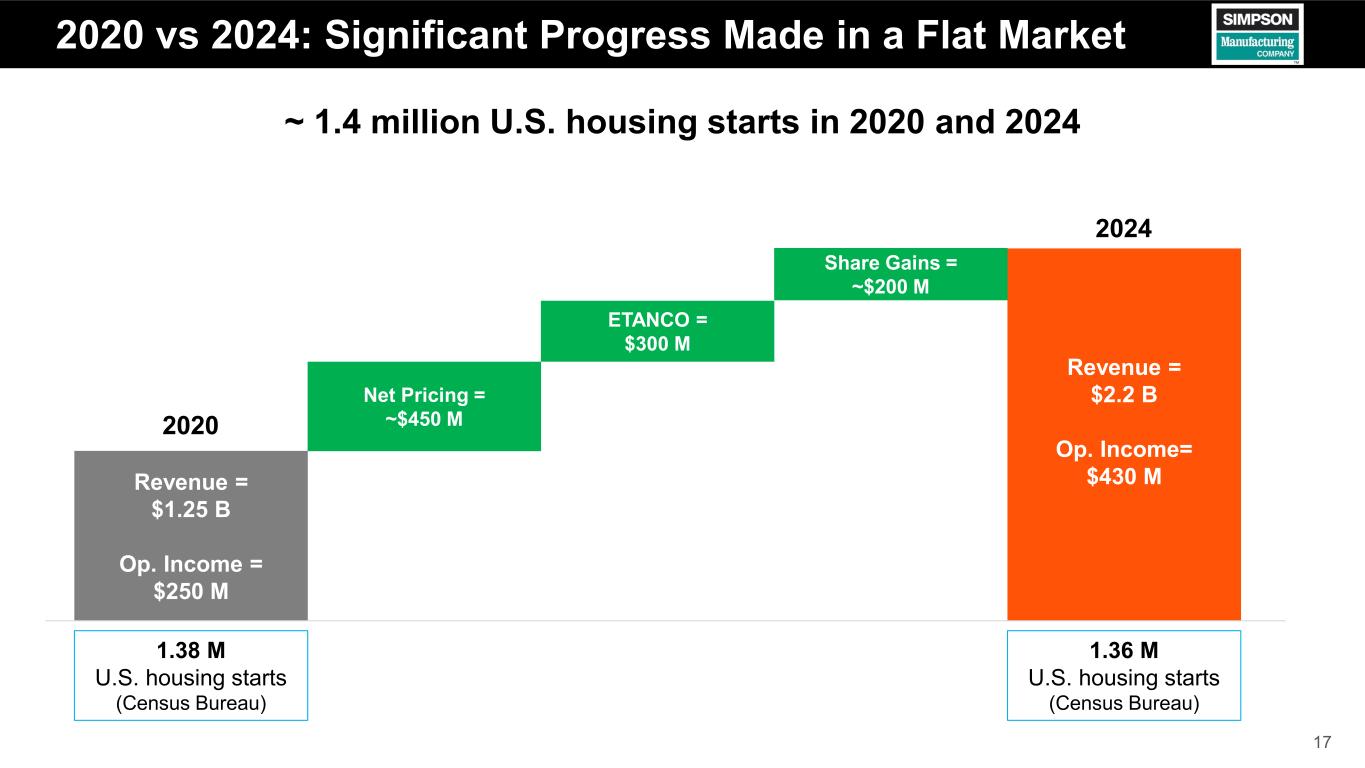

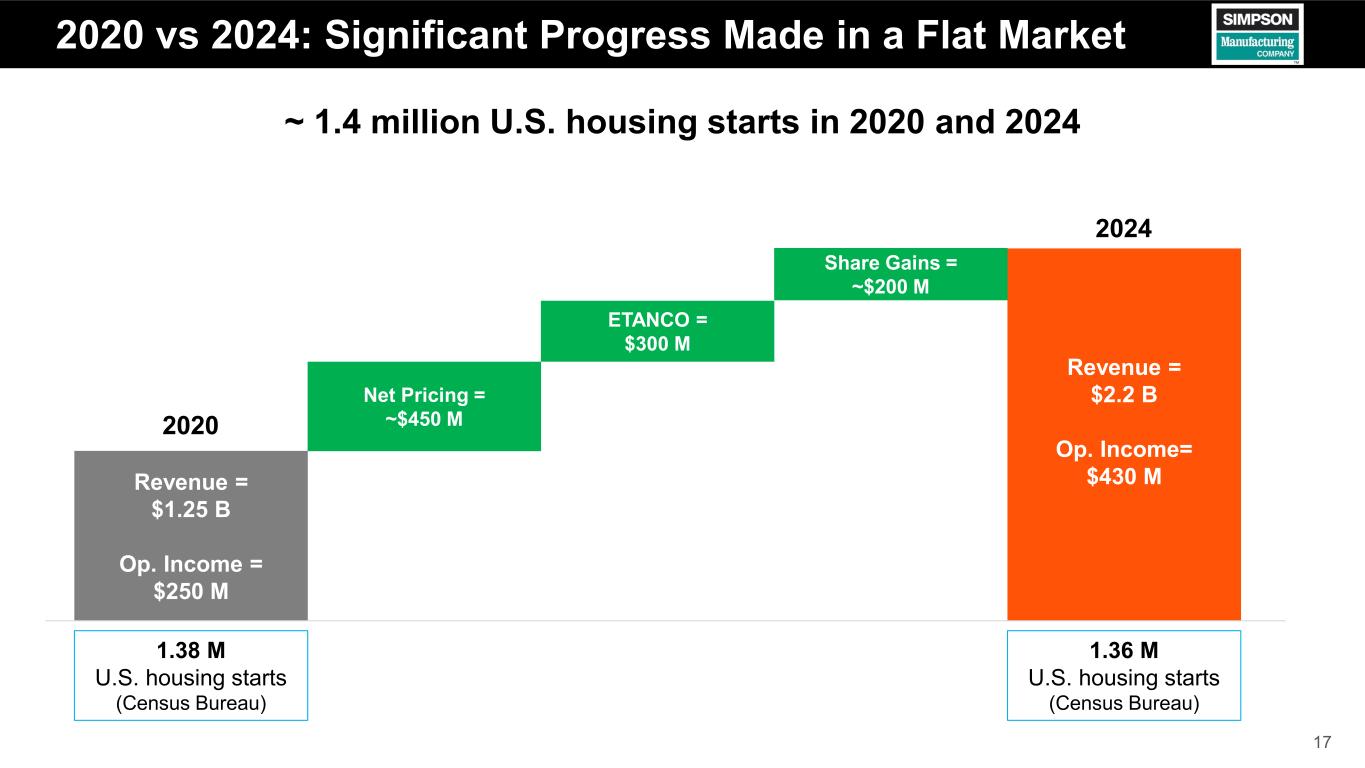

17 2020 vs 2024: Significant Progress Made in a Flat Market ~ 1.4 million U.S. housing starts in 2020 and 2024 Revenue = $1.25 B Op. Income = $250 M Net Pricing = ~$450 M Revenue = $2.2 B Op. Income= $430 M ETANCO = $300 M Share Gains = ~$200 M 2020 2024 1.38 M U.S. housing starts (Census Bureau) 1.36 M U.S. housing starts (Census Bureau)

Our Business in 2020 vs. 2024 ~$1B more revenue ~$200M more operating profit Clearer targets and strategies Stronger market leadership in connectors, improved share in fasteners and anchors Shifted to market-focused sales Promoted high-potential talent and external experts to senior leadership Despite market headwinds, entering 2025 from a position of strength Transitioned to direct sales, away from two-step distribution Streamlined processes and focused on high-impact products Improved M&A process for smoother integrations Grew European business and nearing right-sized footprint Investments in manufacturing, logistics, and software development

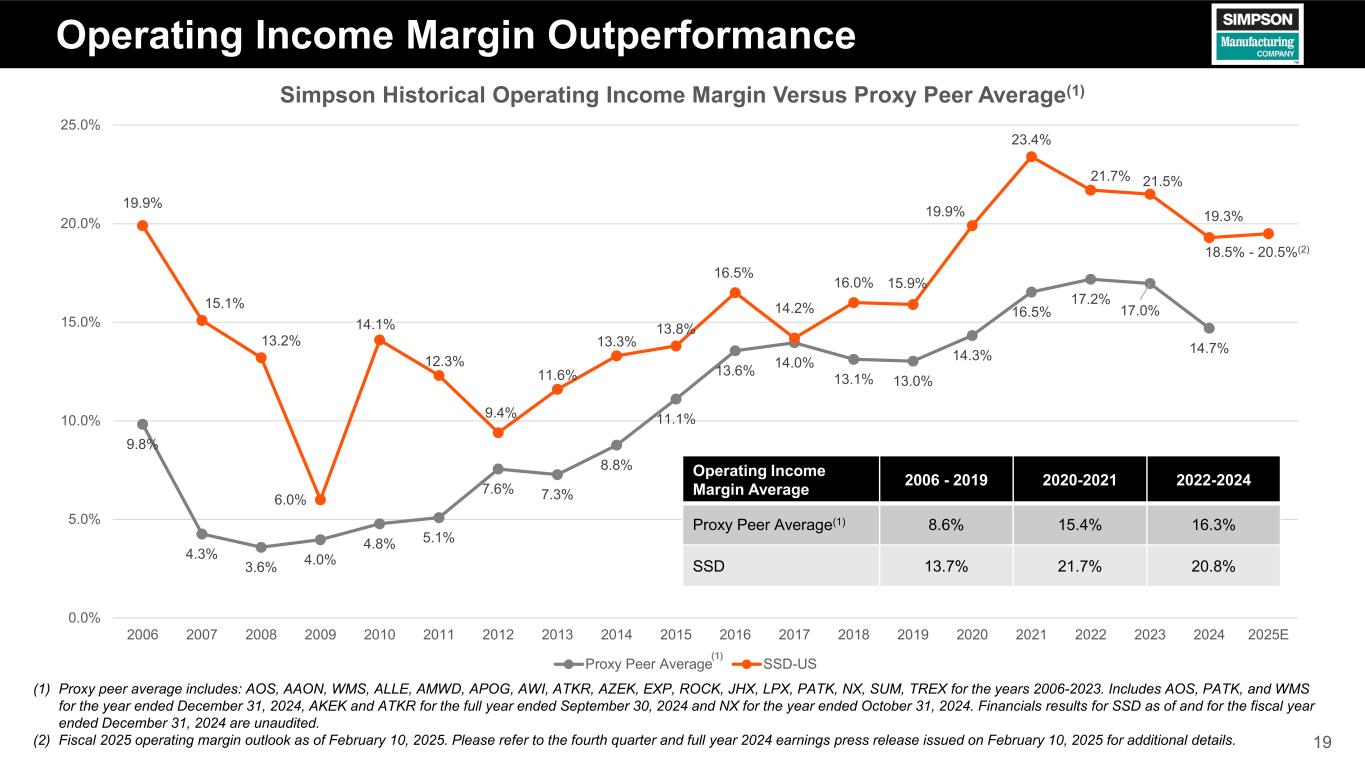

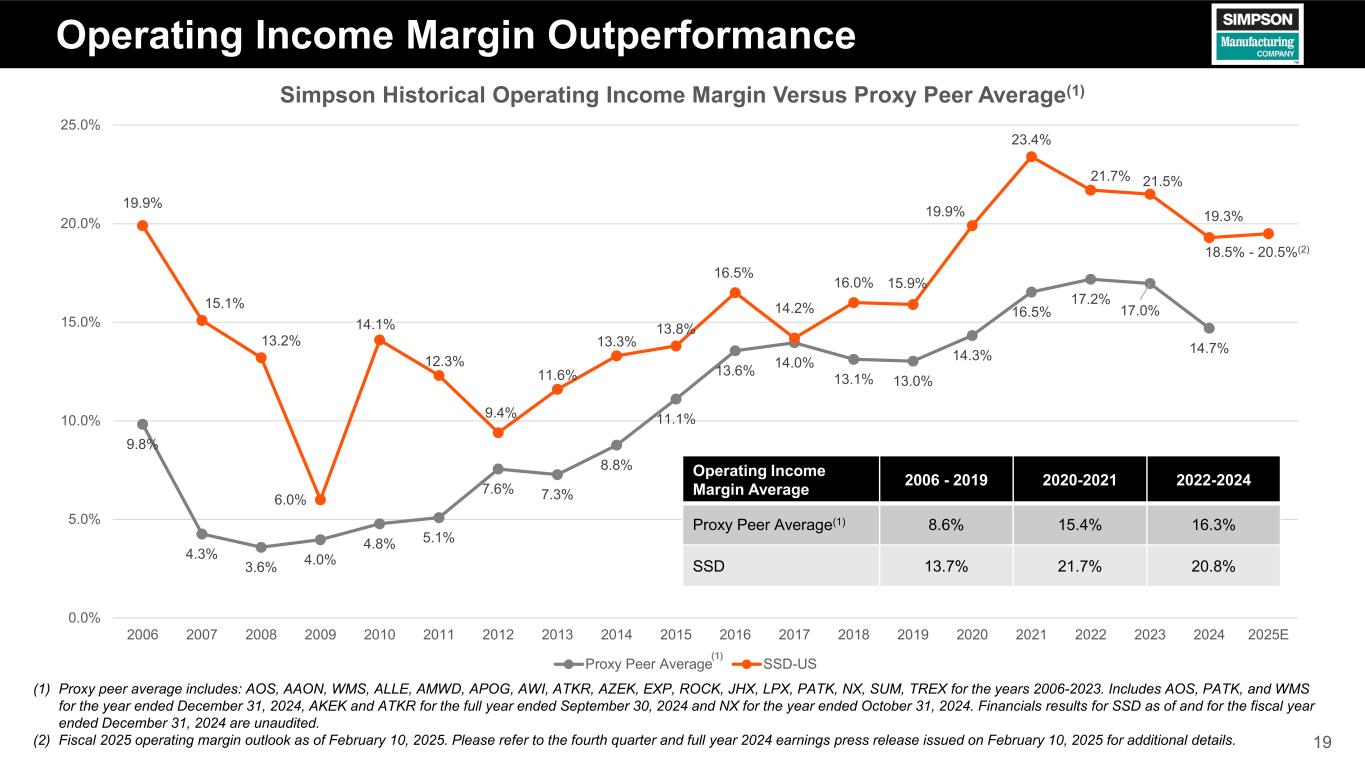

19 9.8% 4.3% 3.6% 4.0% 4.8% 5.1% 7.6% 7.3% 8.8% 11.1% 13.6% 14.0% 13.1% 13.0% 14.3% 16.5% 17.2% 17.0% 14.7% 19.9% 15.1% 13.2% 6.0% 14.1% 12.3% 9.4% 11.6% 13.3% 13.8% 16.5% 14.2% 16.0% 15.9% 19.9% 23.4% 21.7% 21.5% 19.3% 18.5% - 20.5%(2) 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025E Simpson Historical Operating Income Margin Versus Proxy Peer Average(1) Proxy Peer Average SSD-US(1) (1) Proxy peer average includes: AOS, AAON, WMS, ALLE, AMWD, APOG, AWI, ATKR, AZEK, EXP, ROCK, JHX, LPX, PATK, NX, SUM, TREX for the years 2006-2023. Includes AOS, PATK, and WMS for the year ended December 31, 2024, AKEK and ATKR for the full year ended September 30, 2024 and NX for the year ended October 31, 2024. Financials results for SSD as of and for the fiscal year ended December 31, 2024 are unaudited. (2) Fiscal 2025 operating margin outlook as of February 10, 2025. Please refer to the fourth quarter and full year 2024 earnings press release issued on February 10, 2025 for additional details. Operating Income Margin Outperformance Operating Income Margin Average 2006 - 2019 2020-2021 2022-2024 Proxy Peer Average(1) 8.6% 15.4% 16.3% SSD 13.7% 21.7% 20.8%

20 Well-Positioned to Drive Growth We are well-positioned to execute our growth strategy given our demonstrated commitment to disciplined capital allocation. $206 $208 $151 $400 $427 $340 $33 $33 $44 $62 $89 $183 $7 $8 $6 $811 $23 $79 $40 $40 $42 $44 $45 $47 $61 $76 $24 $79 $50 $100 $142 $158 $116 $995 $207 $408 2019 2020 2021 2022 2023 2024 Cash Generated by Operations Capital Expenditures Acquisitions & Purchases of Intangible Assets Dividends Share Repurchases Note: Financials results as of and for the fiscal year ended December 31, 2024 are unaudited.

21 Quarterly Cash Dividends Capital Return History $940.0 Million 2021 – 2024(1) Cumulative Free Cash Flow defined as: Cash flow from operations ($1,318.0 M) less Capital expenditures ($377.9 M) 26.9% 18.9% Repurchases of Common Stock(2) (1) Time frame represents January 1, 2021 to December 31, 2024. Financials results as of and for the fiscal year ended December 31, 2024 are unaudited.

22 Use of Cash Priorities Cash Flow From Operations Share Repurchases • Evaluating potential M&A in the markets we operate (support key growth initiatives) • Integrating ETANCO remains the priority • Maintain quarterly cash dividends(1) • Consistently and moderately raise dividends • Capital return target of 35% of free cash flow(2) • Selective and opportunistic share repurchases • Board approved $100 M share repurchase authorization through December 2025 • Capital return target of 35% of free cash flow(2) Organic Growth Dividends (1) On January 31, 2025, the Company's Board of Directors declared a quarterly dividend of $0.28 per share, payable on April 24, 2025 to stockholders of record on April 3, 2025. (2) The Company defines free cash flow as cash flow from operations less capital expenditures. • Focused on repaying debt incurred to finance the acquisition of ETANCODebt Repayment Acquisitions • Prioritizing facility expansions (capacity, service, efficiencies and safety) • Investing in growth initiatives (engineering, marketing, sales personnel, testing capabilities, etc.) Past and Potential Future Uses of Cash Flows

23 Investments to Meet Growing Demand Expansion of Columbus, OH Facility Greenfield Gallatin, TN Facility • Support fastener sales growth • Balance supply chain and reduce risk • Reduce lead times • Achieve company fill rate standards • Vertically integrate manufacturing • Future capacity to support growth • Maintain safety standards • Ensure excellent service levels • Allow needed headcount growth • Improve production costs Expansion of North American manufacturing operations to better serve our customers Expected H1 2025 Expected H2 2025

24 Acquisition Strategy • Focused on strengthening our business model by expanding our product lines to develop complete solutions for the markets in which we operate • Improve our manufacturing capabilities and supply chain efficiencies to reduce lead-times and bring production closer to the end customer • The majority of actionable opportunities are smaller / tuck-in type acquisitions Evaluate potential M&A opportunities to accelerate our strategic growth priorities

25 Company Ambitions(1) Strengthening our values-based culture Being the business partner of choice Striving to be an innovative leader in the markets we operate Continuing above market growth relative to U.S. housing starts Maintain operating income margin of >20% EPS growth ahead of net revenue growth 1 2 4 3 5 6 (1) Revised January 1, 2025.

Social Responsibility Diversity, Equity and Inclusion Leadership & Development Human Capital Management Health and Safety Striving to ensure everyone at our Company feels included and empowered, and equipping our employees with the tools and confidence to nurture themselves and their careers • GOAL: Foster diversity in our workforce and maintain representation of differing genders, ages, races, ethnicities, and abilities Partnered with DiversityJobs to promote our job postings, and recently established a promotion guide to ensure a fair and consistent approach • GOAL: Ensure all employees have access to opportunities to grow and thrive in their careers with the Company Launched employee skills assessment and began creating meaningful development programs to ensure continued employee growth • GOAL: Strengthen our values-based leadership and culture based on our Company value that Everybody Matters Formed a partnership with Gallup to conduct our biannual Global Employee Engagement Survey • GOAL: Provide the highest standard of safety and create a healthy working environment In 2024, improved the global Total Recordable Incident Rate to 0.98, below the gold standard of recognized international experts 26 We operate in an environmentally responsible manner to protect our employees, customers and communities while prioritizing an inclusive, equitable and diverse company Corporate Social Responsibility Environmental Manufacturing Facilities Energy Conservation Waste Reduction and Recycling Sustainable Building Practices Committed to continuously improving the efficiency of our resource use to lessen our impact, and designing and manufacturing products with environmental conservation in mind • GOAL: Minimize amount of total waste generated by manufacturing processes through companywide lean practices In 2024, continued the work at each of our facilities to advance toward appropriate environmental stewardship practices • GOAL: Improve energy efficiencies at facilities globally to ensure eco- friendly, cost-effective operations In 2024, continued various energy conservation initiatives across our operations • GOAL: Support the Circular Economy by minimizing our largest recognized waste stream and sending unused steel back upstream Continuously work to improve the design of our products to minimize scrap steel during the stamping process, reducing both costs and energy • GOAL: Support sustainable business practices through use of green building technology and non-toxic materials Completed testing on a 10-story mass-timber structure, paving the way for increased adoption of regenerative construction materials

APPENDIX

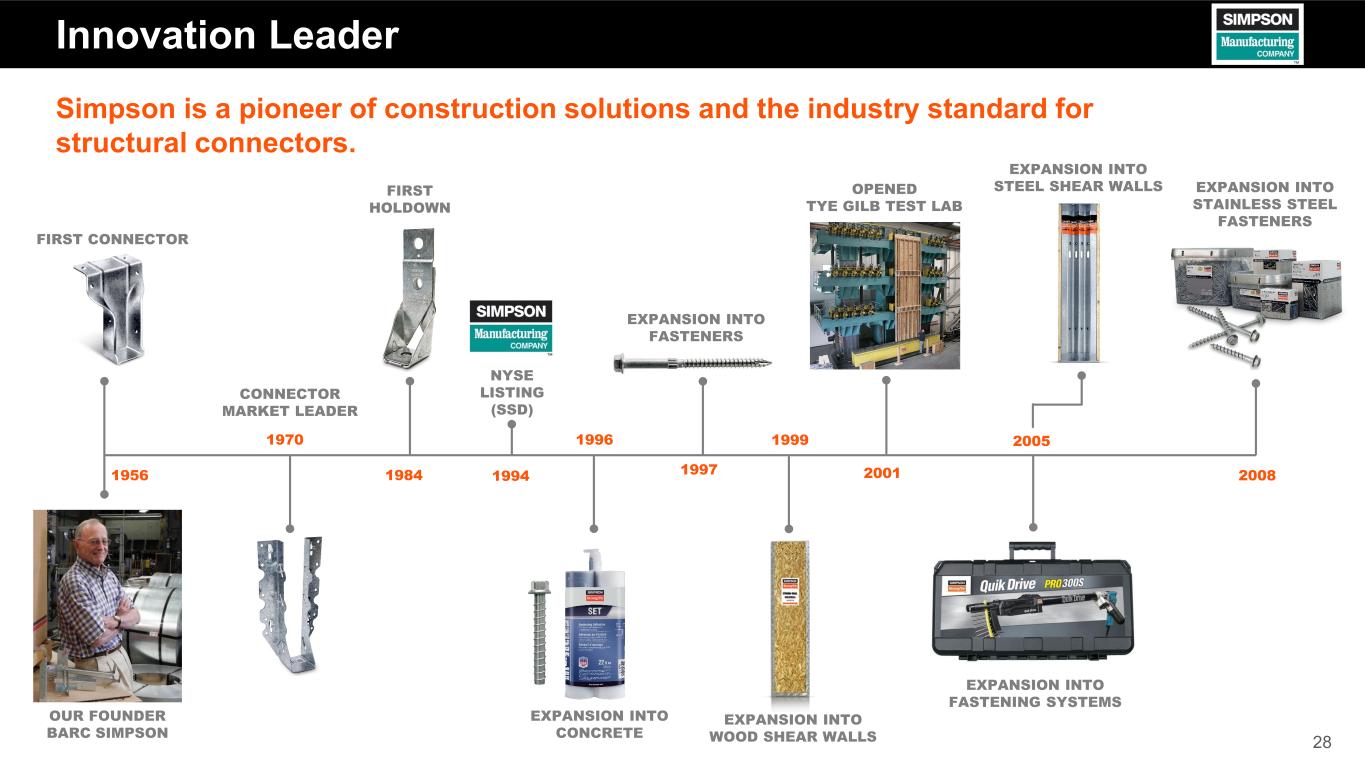

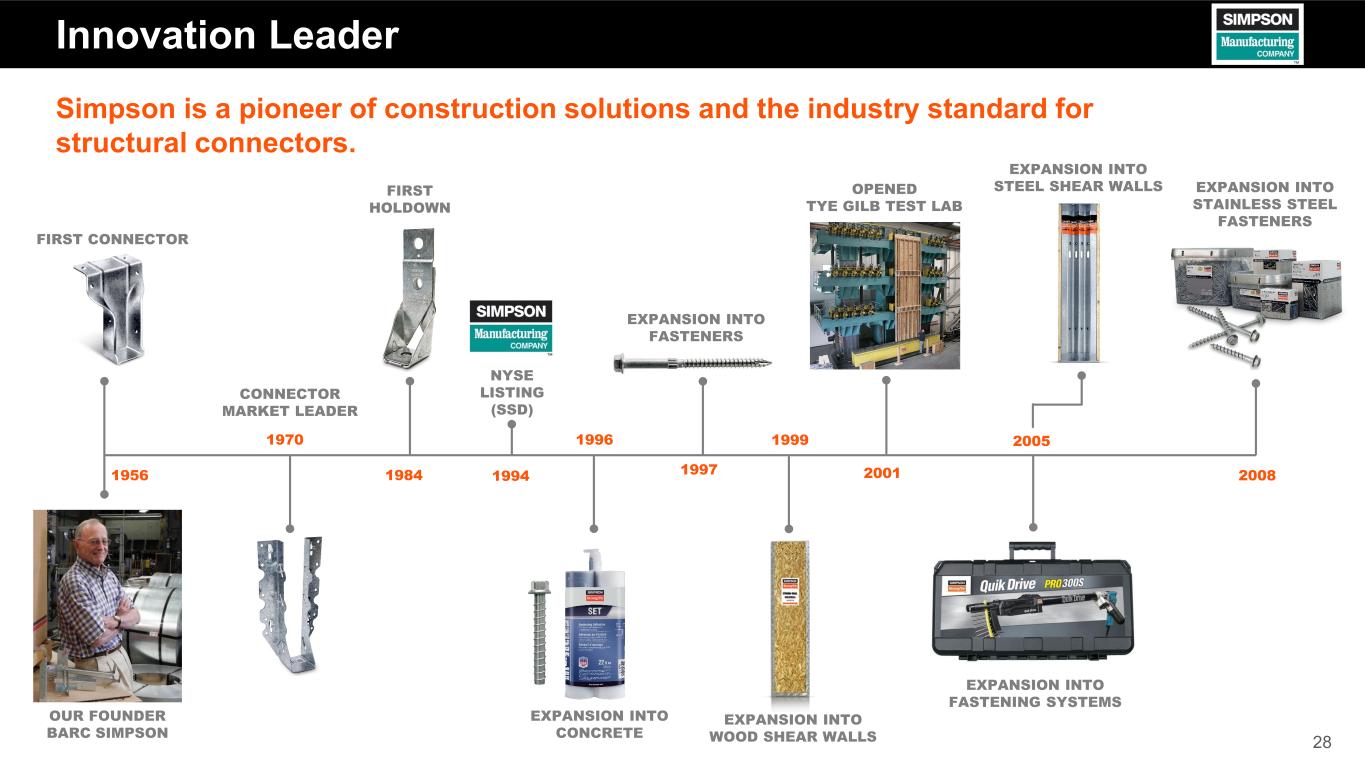

28 Innovation Leader 1956 1970 1984 1996 1997 1999 2005 Simpson is a pioneer of construction solutions and the industry standard for structural connectors. 1994 NYSE LISTING (SSD) OUR FOUNDER BARC SIMPSON EXPANSION INTO CONCRETE EXPANSION INTO FASTENERS FIRST CONNECTOR CONNECTOR MARKET LEADER EXPANSION INTO WOOD SHEAR WALLS EXPANSION INTO FASTENING SYSTEMS 2001 OPENED TYE GILB TEST LAB EXPANSION INTO STEEL SHEAR WALLSFIRST HOLDOWN 2008 EXPANSION INTO STAINLESS STEEL FASTENERS

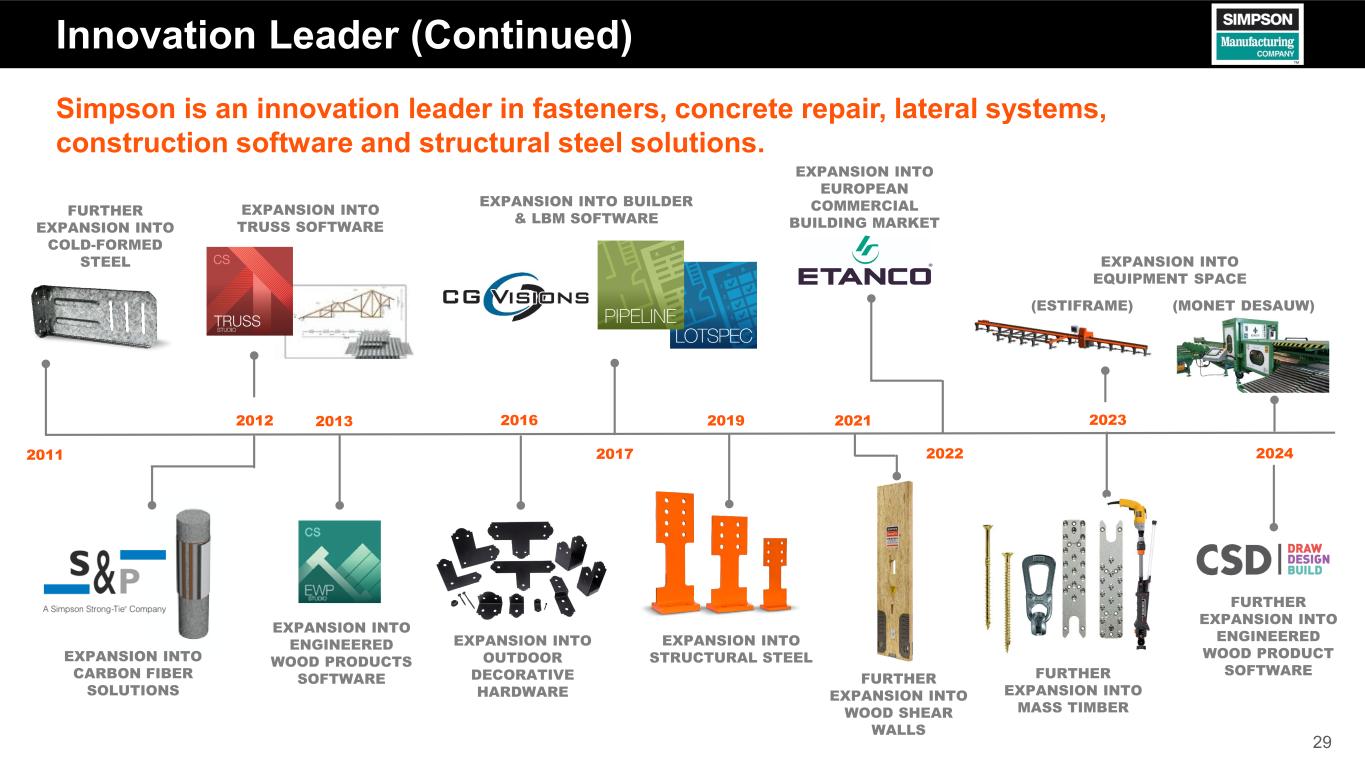

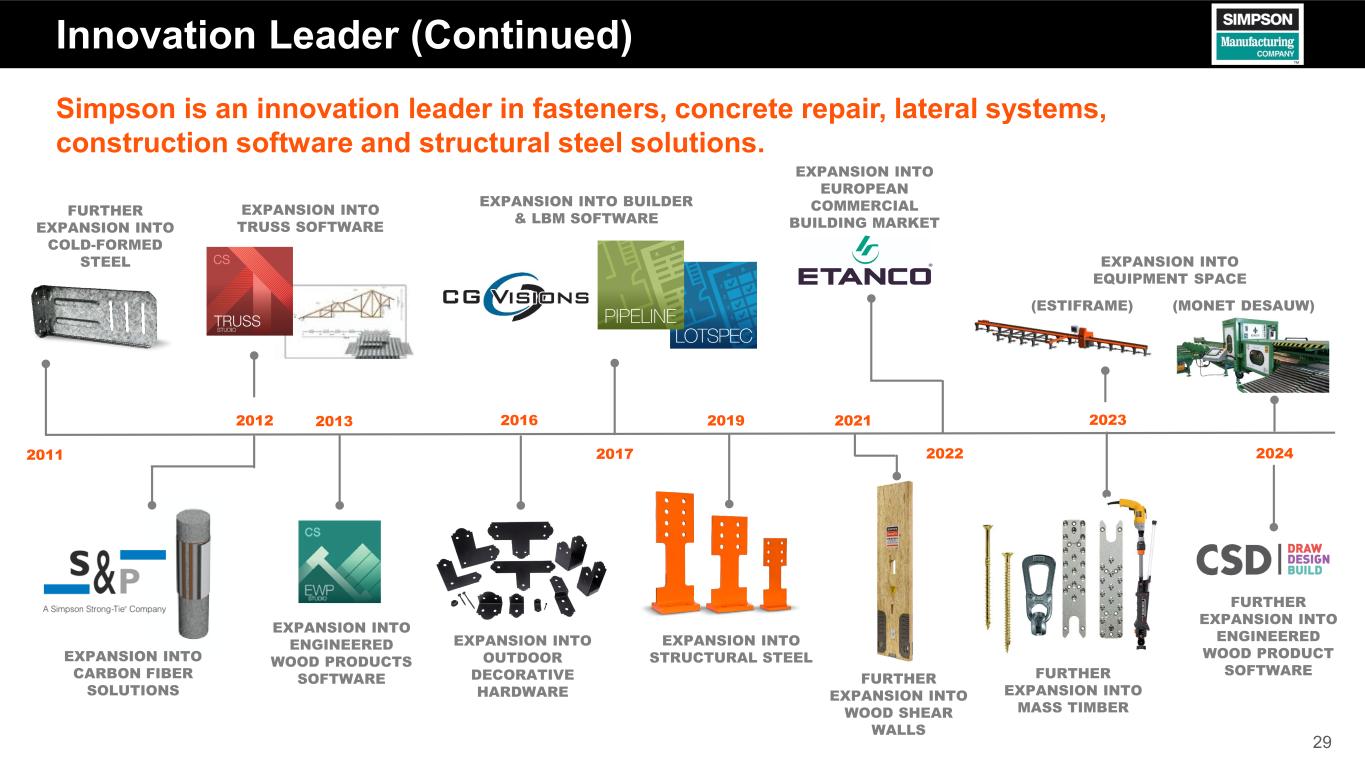

29 Innovation Leader (Continued) Simpson is an innovation leader in fasteners, concrete repair, lateral systems, construction software and structural steel solutions. 2011 2016 20192012 2017 FURTHER EXPANSION INTO COLD-FORMED STEEL EXPANSION INTO CARBON FIBER SOLUTIONS EXPANSION INTO BUILDER & LBM SOFTWARE EXPANSION INTO STRUCTURAL STEEL EXPANSION INTO OUTDOOR DECORATIVE HARDWARE 2021 FURTHER EXPANSION INTO WOOD SHEAR WALLS 2022 EXPANSION INTO EUROPEAN COMMERCIAL BUILDING MARKET 2023 FURTHER EXPANSION INTO MASS TIMBER EXPANSION INTO TRUSS SOFTWARE 2013 EXPANSION INTO ENGINEERED WOOD PRODUCTS SOFTWARE EXPANSION INTO EQUIPMENT SPACE (ESTIFRAME) 2024 (MONET DESAUW) FURTHER EXPANSION INTO ENGINEERED WOOD PRODUCT SOFTWARE

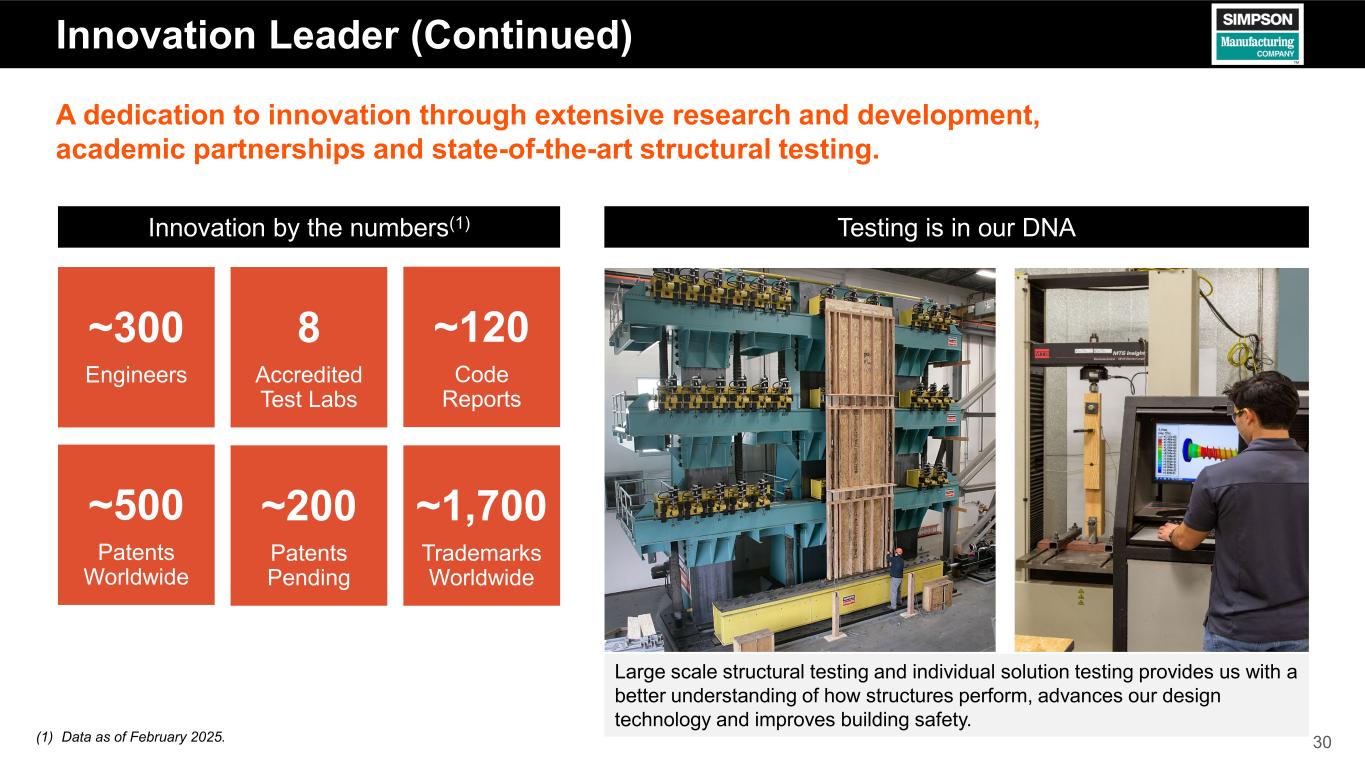

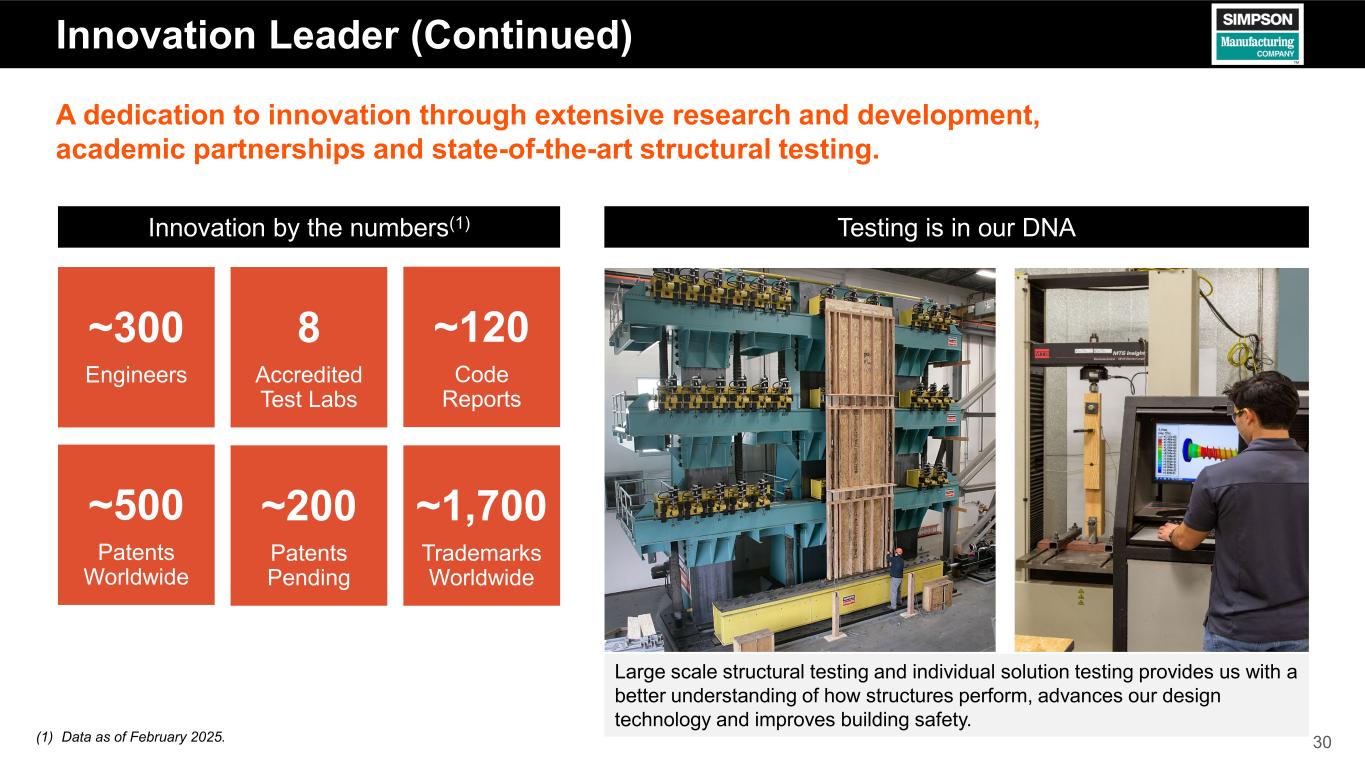

30 Innovation Leader (Continued) ~300 Engineers ~1,700 Trademarks Worldwide 8 Accredited Test Labs ~500 Patents Worldwide ~200 Patents Pending ~120 Code Reports A dedication to innovation through extensive research and development, academic partnerships and state-of-the-art structural testing. Testing is in our DNAInnovation by the numbers(1) Large scale structural testing and individual solution testing provides us with a better understanding of how structures perform, advances our design technology and improves building safety. (1) Data as of February 2025.

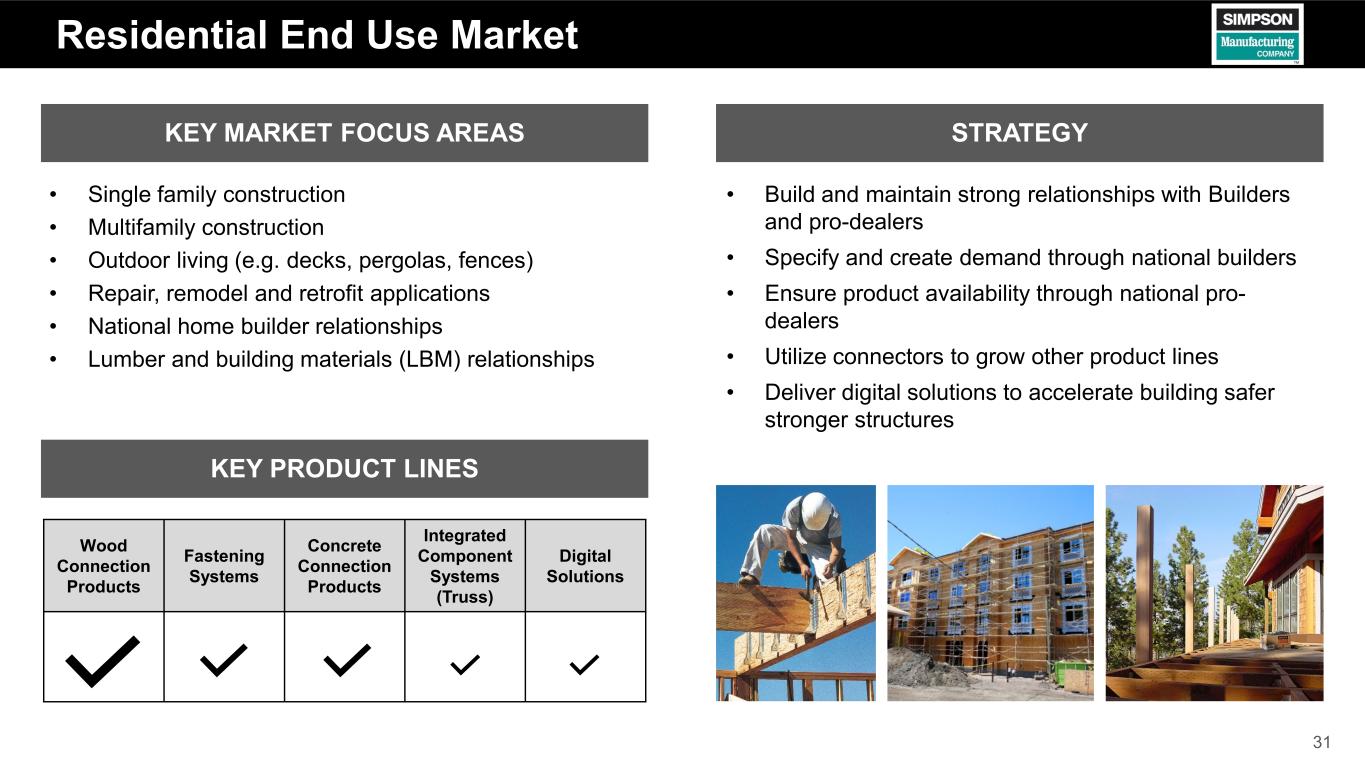

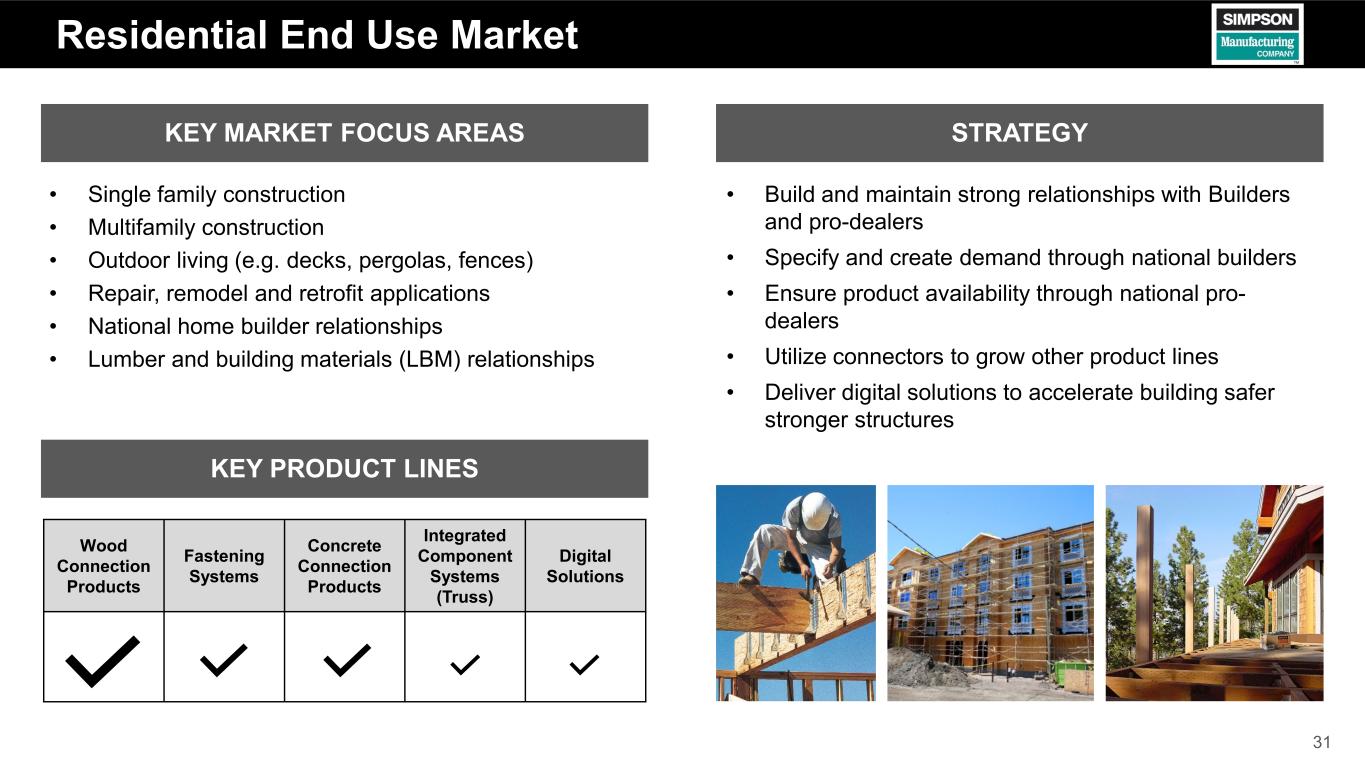

31 Residential End Use Market KEY PRODUCT LINES KEY MARKET FOCUS AREAS STRATEGY • Single family construction • Multifamily construction • Outdoor living (e.g. decks, pergolas, fences) • Repair, remodel and retrofit applications • National home builder relationships • Lumber and building materials (LBM) relationships • Build and maintain strong relationships with Builders and pro-dealers • Specify and create demand through national builders • Ensure product availability through national pro- dealers • Utilize connectors to grow other product lines • Deliver digital solutions to accelerate building safer stronger structures Wood Connection Products Fastening Systems Concrete Connection Products Integrated Component Systems (Truss) Digital Solutions

32 Commercial End Use Market KEY MARKET FOCUS AREAS STRATEGY • Retail and office buildings • Institutional (education, healthcare) • Public and utilities (water supply, pipelines, ports) • Transportation (bridges, tunnels, airports) • Manufacturing (factories, warehouses, data centers) • Structural steel buildings • Call on and educate engineers and designers to drive specifications • Provide training and support to contractors and distributors • Deliver digital solutions that make it easy for engineers to specify and contractors to use our products • Continue to build out solutions portfolio to increase breadth of line in structural steel, anchors, fasteners, strengthening and products for cold-formed steel • Strategic partnership with Structural Technologies – largest installer of carbon fiber products KEY PRODUCT LINES Wood Connection Products Fastening Systems Concrete Connection Products Integrated Component Systems Digital Solutions ---

33 OEM End Use Market KEY MARKET FOCUS AREAS STRATEGY • Aligned with our business model; identify opportunity for existing connectors, fasteners, anchors and truss plates products into this market • Engineer and launch value-added OEM-specific structural solutions • Leverage our engineering testing capabilities • Develop direct and distribution sales channels • Utilize external innovation opportunities • Offer custom connector fabrication for the Mass Timber industry • Off-site construction (manufactured housing, modular construction, post-frame construction, prefab sheds) • Mass timber construction • Wood and steel fastening (crates, trailers, RV manufacturers, etc.) • Concrete anchoring and kitting (material handling and precast concrete mfrs, private label & kitting) KEY PRODUCT LINES Wood Connection Products Fastening Systems Concrete Connection Products Integrated Component Systems Digital Solutions

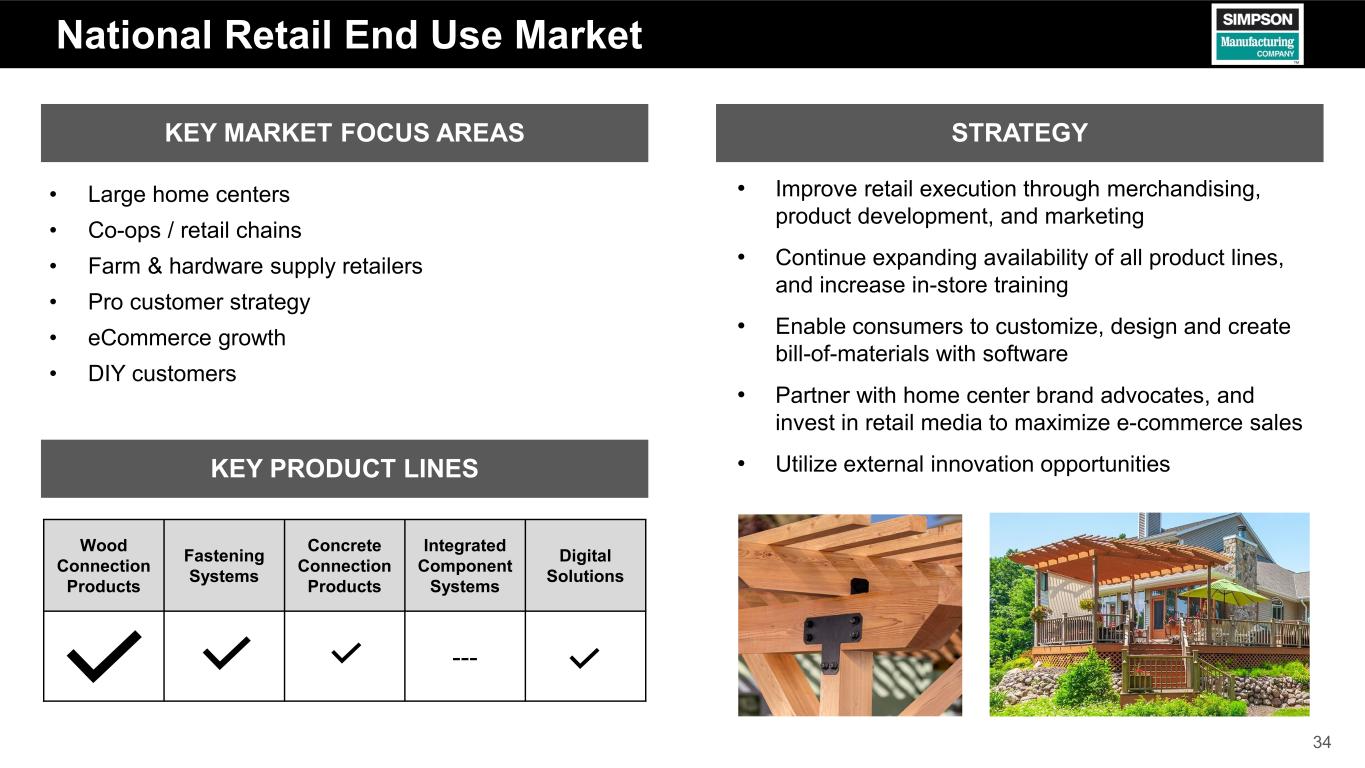

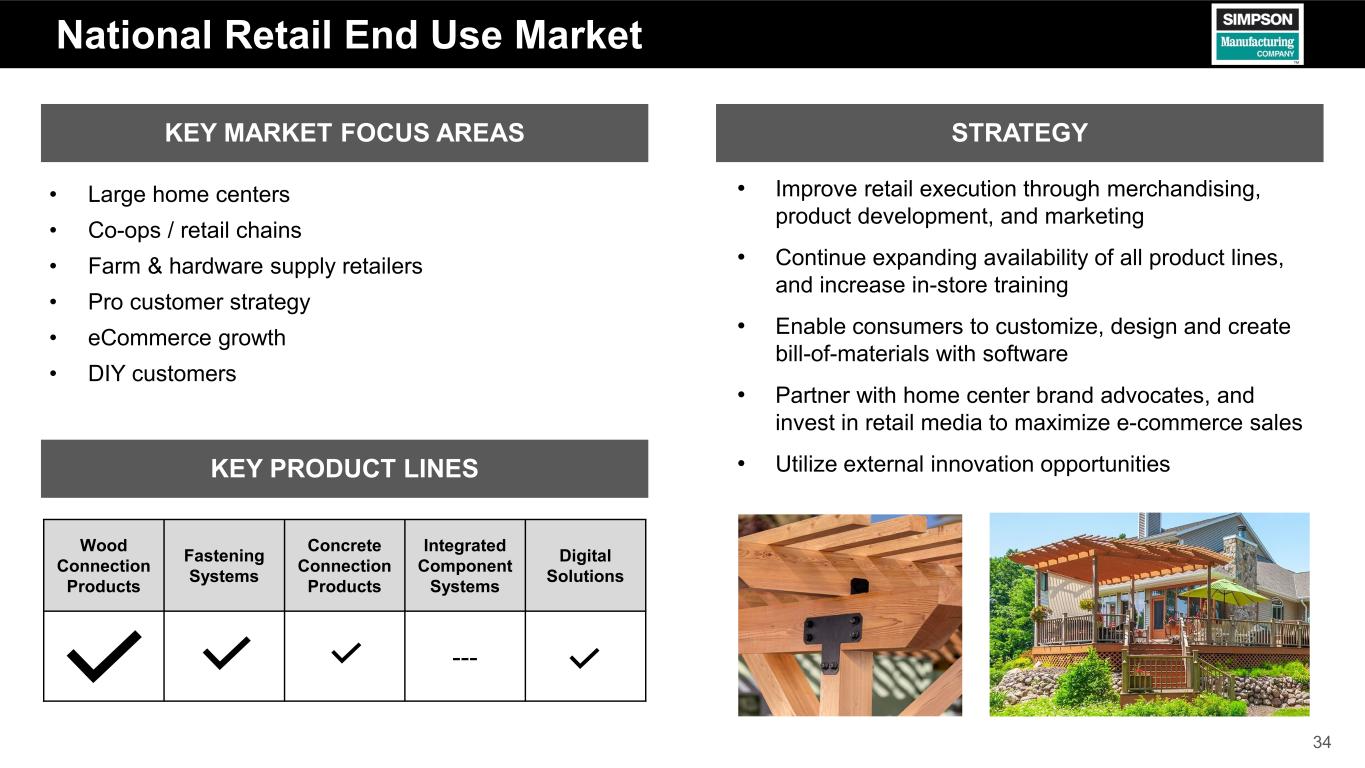

34 National Retail End Use Market KEY MARKET FOCUS AREAS STRATEGY • Improve retail execution through merchandising, product development, and marketing • Continue expanding availability of all product lines, and increase in-store training • Enable consumers to customize, design and create bill-of-materials with software • Partner with home center brand advocates, and invest in retail media to maximize e-commerce sales • Utilize external innovation opportunities • Large home centers • Co-ops / retail chains • Farm & hardware supply retailers • Pro customer strategy • eCommerce growth • DIY customers KEY PRODUCT LINES Wood Connection Products Fastening Systems Concrete Connection Products Integrated Component Systems Digital Solutions ---

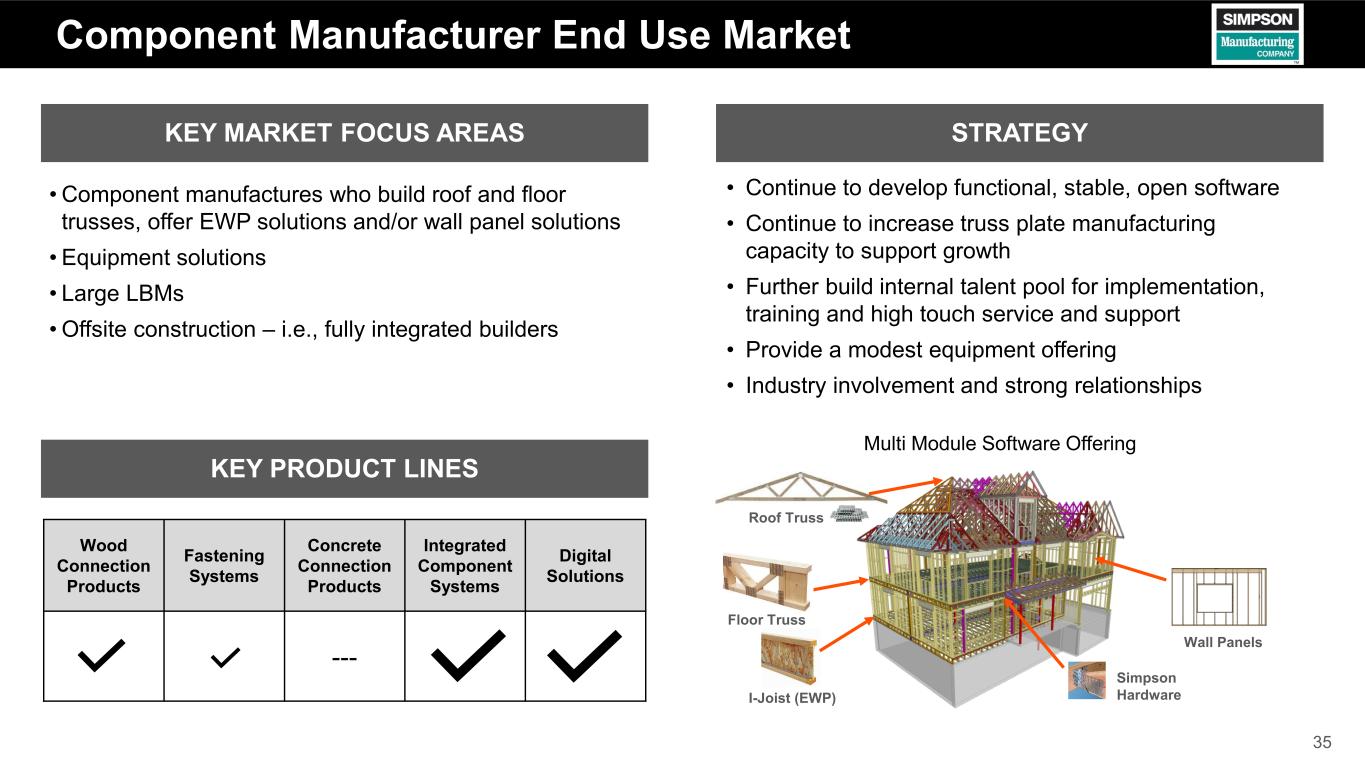

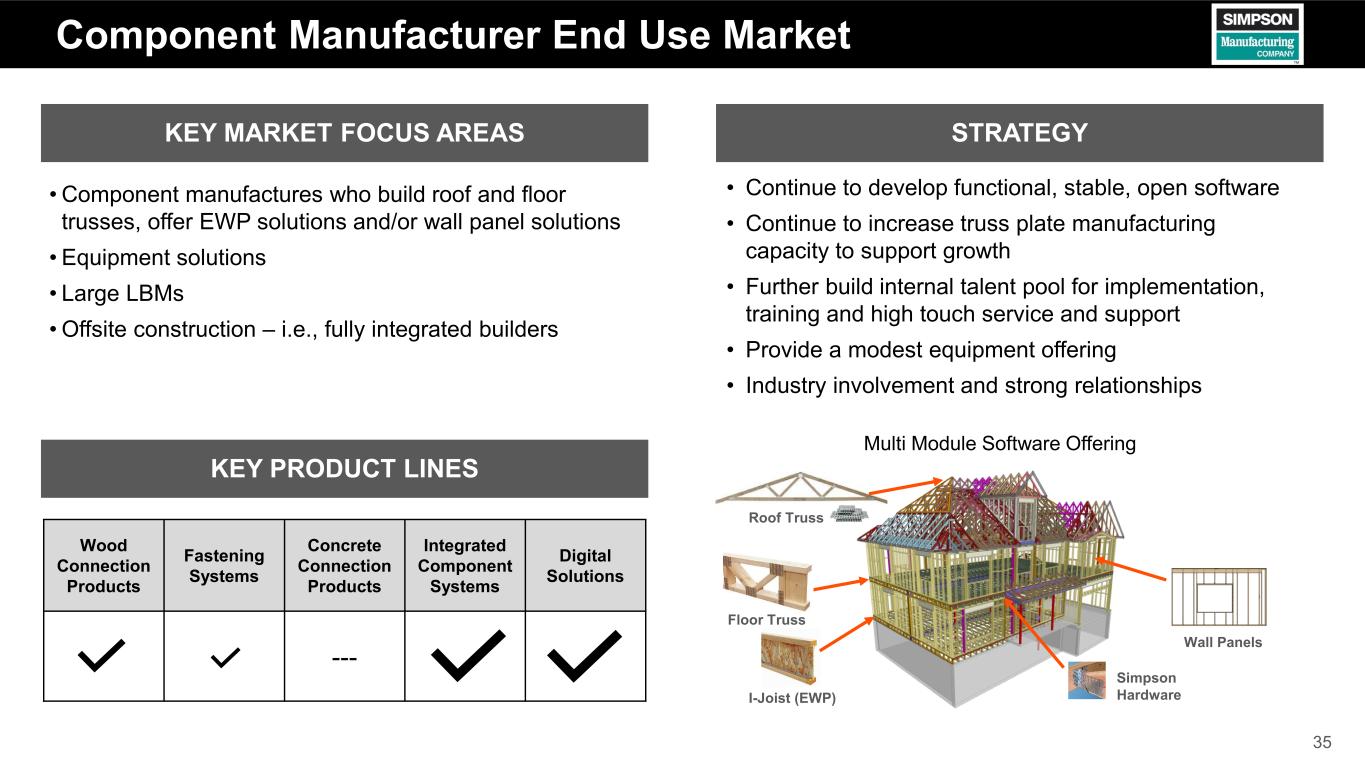

35 Component Manufacturer End Use Market KEY MARKET FOCUS AREAS STRATEGY • Component manufactures who build roof and floor trusses, offer EWP solutions and/or wall panel solutions • Equipment solutions • Large LBMs • Offsite construction – i.e., fully integrated builders Wall Panels 35 Roof Truss Floor Truss I-Joist (EWP) Simpson Hardware Multi Module Software Offering • Continue to develop functional, stable, open software • Continue to increase truss plate manufacturing capacity to support growth • Further build internal talent pool for implementation, training and high touch service and support • Provide a modest equipment offering • Industry involvement and strong relationships KEY PRODUCT LINES Wood Connection Products Fastening Systems Concrete Connection Products Integrated Component Systems Digital Solutions ---

36 Digital Solutions Building out our digital offerings to serve customers across the building industry ~30 specification tools (apps/selectors) Design/visualization, estimating Option management, estimating Project management and design Free design software and plans

STRONG FOUNDATION. STRONGER FUTURE.