Exhibit 13

MANAGEMENT’S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with the consolidated financial statements and the notes relating thereto included herein. When necessary, reclassifications have been made to prior period’s data for purposes of comparability with current period presentation.

Critical Accounting Policies and Estimates

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” is based upon the Company’s consolidated financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of these financial statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses. Note 1 to the Company’s Audited Consolidated Financial Statements for the year ended December 31, 2007, contains a summary of the Company’s significant accounting policies. Management believes the Company’s policy with respect to the methodology for the determination of the allowance for loan losses involves a higher degree of complexity and requires management to make difficult and subjective judgments, which often require assumptions or estimates about highly uncertain matters. Changes in these judgments, assumptions or estimates could materially impact results of operations. This critical policy and its application is periodically reviewed with the Audit Committee and the Board of Directors.

The provision for loan losses is based upon management’s evaluation of the adequacy of the allowance, including an assessment of known and inherent risks in the portfolio, giving consideration to the size and composition of the loan portfolio, actual loan loss experience, level of delinquencies, detailed analysis of individual loans for which full collectibility may not be assured, the existence and estimated net realizable value of any underlying collateral and guarantees securing the loans, and current economic and market conditions. Although management uses the best information available, the level of the allowance for loan losses remains an estimate, which is subject to significant judgment and short-term change. Various regulatory agencies, as an integral part of their examination process, periodically review the Company’s allowance for loan losses. Such agencies may require the Company to make additional provisions for loan losses based upon information available to them at the time of their examination. Furthermore, the majority of the Company’s loans are secured by real estate. Accordingly, the ability to collect a substantial portion of the carrying value of the Company’s loan portfolio is susceptible to changes in local real estate market conditions and may be adversely affected should real estate values decline. Future adjustments to the allowance for loan losses may be necessary due to economic, operating, regulatory and other conditions beyond the Company’s control.

Overview

Unity Bancorp, Inc. (the “Parent Company”) is a bank holding company incorporated in New Jersey and registered under the Bank Holding Company Act of 1956, as amended. Its wholly-owned subsidiary, Unity Bank (the “Bank,” or when consolidated with the Parent Company, the “Company”) is chartered by the New Jersey Department of Banking and Insurance. The Bank provides a full range of commercial and retail banking services through the Internet and its seventeen branch offices located in Hunterdon, Middlesex, Somerset, Union and Warren counties in New Jersey and Northampton County in Pennsylvania. These services include the acceptance of demand, savings and time deposits and the extension of consumer, real estate, Small Business Administration (“SBA”) and other commercial credits.

Results of Operations

Fiscal year 2007 was a challenging year for financial institutions. During much of the year, a flat and at times inverted Treasury yield curve reduced Bank spreads and net interest margins. There was some relief, beginning in September, as the Federal Reserve Board began lowering rates with a 50 basis point decrease in the target federal funds rate. This was the first of three rate drops in 2007 that reduced the Fed Funds target rate 100 basis points to 4.25 percent by year end and the Prime lending rate to 7.25 percent. Throughout 2007, deposit gathering remained extremely competitive and highly priced throughout the New Jersey and Eastern Pennsylvania marketplaces. In addition, disruptions in the credit markets spurred by the subprime mortgage crisis contributed to a challenging operating environment for financial institutions.

1

Despite this challenging operating environment, our performance in 2007 included the following accomplishments:

· Adding full-service branches in Palmer Township, Pennsylvania and Middlesex, New Jersey,

· Expanding our SBA lending offices as far south as Florida and west to Illinois,

· Growing our loan portfolio 16.2 percent,

· Growing deposits by 6.1 percent,

· Reducing our level of nonperforming loans $3.4 million, and

· Introducing new products such as third party annuity and alternative investments and remote deposit capture.

Net income for the year ended December 31, 2007 was $4.7 million, a 19.2 percent decrease compared to $5.8 million for 2006.

| | 2007 | | 2006 | |

Earnings per basic share | | $ | 0.68 | | $ | 0.85 | |

Earnings per diluted share | | $ | 0.66 | | $ | 0.81 | |

Return on average assets | | 0.66 | % | 0.90 | % |

Return on average equity | | 10.11 | % | 13.56 | % |

Efficiency ratio | | 71.48 | % | 67.21 | % |

Drivers of reduced earnings include:

· A higher cost of funds and reduced net interest margin,

· A lower level of net gains on SBA loan sales as a result of the Company’s strategic decision during the third quarter 2007 to begin retaining a significant portion of its SBA 7(a) program loans in its portfolio, rather than selling them to the secondary market. In prior periods, the Company had sold the majority of its production to the secondary market and consequently realized significant gains on these sales as noninterest income. However, the current market spread on these transactions has narrowed and provided the opportunity for the Company to hold these loans in its portfolio and enhance interest income, rather than sell these loans.

· An impairment charge of $607 thousand on FHLMC preferred stock during the fourth quarter, and

· Higher operating expenses related to the expansion of our retail and lending networks.

2006 vs. 2005

Net income for the year ended December 31, 2006 was $5.8 million, a 5.9% decrease compared to net income of $6.2 million for 2005. Earnings per basic and diluted share for the year ended December 31, 2006 were $0.85 and $0.81, respectively compared to $0.92 and $0.87 for the prior year. These declines were the result of increased net interest income driven by a higher volume of earning assets and a lower provision for loan losses, offset by higher operating expenses and lower noninterest income.

Net Interest Income

The primary source of income for the Company is net interest income, the difference between the interest earned on earning assets such as investments and loans, and the interest paid on deposits and borrowings. Factors that impact the Company’s net interest income include the interest rate environment, the volume and mix of earning assets and interest-bearing liabilities, and the competitive nature of the Company’s marketplace.

For the majority of 2007, the Company faced a flat, and at times, inverted Treasury yield curve in which deposit and borrowing costs have risen faster than the yields on earning assets. In September 2007, the Federal Reserve Board began to lower rates. Rates were reduced three times by year-end for a total of 100 basis points resulting in a Prime lending rate of 7.25 percent and a Fed Funds target rate of 4.25 percent. However, despite these rate reductions, the costs of funding asset growth remained high and margins remained tight, due to the lack of liquidity in the marketplace.

During 2007, tax equivalent interest income increased $5.8 million or 13.4 percent to $49.1 million. Of the $5.8 million increase in interest income on a tax equivalent basis, $4.5 million can be attributed to the increase in average interest-earning assets while $1.3 million may be attributed to an increase in the yield on interest-earning assets. The average volume of interest-earning assets increased $62.8 million to $678.5 million in 2007 compared to $615.7 million in 2006. This was due to a $62.8 million increase in average loans and a $684 thousand increase in average federal funds sold and interest-bearing deposits with banks, partially offset by a $717 thousand decrease in average securities. The yield on interest-earning assets increased 21 basis points to 7.23 percent in 2007 due to the impact of a higher overall interest rate environment during the first nine months of 2007 compared to 2006. Interest income on variable rate instruments, such as SBA loans, commercial loans, and consumer home equity lines of credit, increased due to these higher market rates. In addition, the average interest rate

2

earned on residential mortgage loans increased 33 basis points to 5.84 percent in 2007, compared to 5.51 percent in 2006.

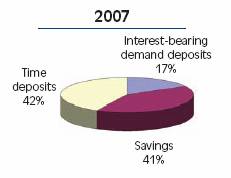

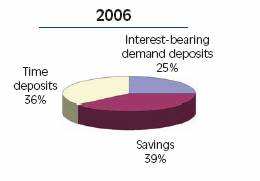

The higher interest rate environment and competitive New Jersey and Eastern Pennsylvania marketplaces in 2007 also increased interest expense and the cost of funds. Total interest expense was $24.5 million in 2007, an increase of $5.0 million or 25.9 percent compared to 2006. Of the $5.0 million increase in interest expense in 2007, $3.5 million was attributed to an increase in interest-bearing liabilities while $1.5 million was due to an increase in the rates paid on these liabilities. Interest-bearing liabilities averaged $588.3 million in 2007, an increase of $61.5 million, or 11.7 percent, compared to 2006. The increase in interest-bearing liabilities was a result of increases in the savings, time deposits, and borrowed funds and subordinated debentures categories, offset in part by a decline in interest-bearing demand deposits. Average interest-bearing deposits increased $32.3 million, as average savings deposits increased $20.4 million and average time deposits increased $43.8 million while average interest-bearing demand deposits declined $32.0 million. Average borrowed funds and subordinated debentures increased $29.2 million to $85.0 million in 2007 compared to $55.8 million in 2006 due to the addition of $30 million in FHLB borrowings. The average cost of interest-bearing liabilities increased 47 basis points to 4.16 percent, primarily due to the repricing of deposits and borrowings in a higher interest rate environment. The cost of interest-bearing deposits increased 47 basis points to 4.01 percent in 2007 and the cost of borrowed funds and subordinated debentures increased 12 basis points to 5.03 percent. The high cost of deposits in our marketplace combined with a shift in our deposit mix from interest-bearing demand deposits into higher cost savings and time deposits as illustrated below contributed to this higher cost of funding.

Tax-equivalent net interest income amounted to $24.6 million in 2007, an increase of $761 thousand, or 3.2 percent, compared to 2006. Net interest margin decreased 25 basis points to 3.62 percent for 2007, compared to 3.87 percent in 2006. The tighter net interest margin was primarily the result of the higher cost of deposits to fund asset growth. The net interest spread was 3.07 percent, a 26 basis point decrease from 3.33 percent in 2006.

For 2006, tax-equivalent net interest income totaled $23.8 million, an increase of $1.5 million or 6.9 percent from the $22.3 million earned in 2005. This increase was the result of a larger volume of interest-earning assets offset in part by a 41 basis point decrease in net interest spread, which averaged 3.33 percent in 2006. Net interest margin was 3.87 percent for 2006 compared to 4.17 percent in 2005.

The table on the following page reflects the components of net interest income, setting forth for the periods presented herein: (1) average assets, liabilities and shareholders’ equity, (2) interest income earned on interest-earning assets and interest expense paid on interest-bearing liabilities, (3) average yields earned on interest-earning assets and average rates paid on interest-bearing liabilities, (4) net interest spread (which is the average yield on interest-earning assets less the average rate on interest-bearing liabilities), and (5) net interest income/margin on average earning assets. Rates/Yields are computed on a fully tax-equivalent basis, assuming a federal income tax rate of 34 percent.

3

Consolidated Average Balance Sheets

(Dollar amounts in thousands – Interest amounts and interest rates/yields on a fully tax-equivalent basis.)

| | 2007 | | 2006 | |

| | Average | | | | Rate/ | | Average | | | | Rate/ | |

Years ended December 31, | | Balance | | Interest | | Yield | | Balance | | Interest | | Yield | |

ASSETS | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | |

Federal funds sold and interest-bearing deposits with banks | | $ | 22,290 | | $ | 1,068 | | 4.79 | % | $ | 21,606 | | $ | 1,042 | | 4.82 | % |

Securities: | | | | | | | | | | | | | |

Available for sale | | 69,189 | | 3,511 | | 5.07 | | 66,474 | | 3,103 | | 4.67 | |

Held to maturity | | 37,724 | | 1,986 | | 5.26 | | 41,156 | | 2,069 | | 5.03 | |

Total securities (A) | | 106,913 | | 5,497 | | 5.14 | | 107,630 | | 5,172 | | 4.81 | |

Loans, net of unearned discount: | | | | | | | | | | | | | |

SBA | | 84,185 | | 9,039 | | 10.74 | | 84,113 | | 8,615 | | 10.24 | |

Commercial | | 341,841 | | 25,738 | | 7.53 | | 294,773 | | 21,914 | | 7.43 | |

Residential mortgage | | 68,443 | | 3,995 | | 5.84 | | 59,933 | | 3,305 | | 5.51 | |

Consumer | | 54,789 | | 3,722 | | 6.79 | | 47,652 | | 3,208 | | 6.73 | |

Total loans (A), (B) | | 549,258 | | 42,494 | | 7.74 | | 486,471 | | 37,042 | | 7.61 | |

Total interest-earning assets | | $ | 678,461 | | $ | 49,059 | | 7.23 | % | $ | 615,707 | | $ | 43,256 | | 7.02 | % |

Noninterest-earning assets: | | | | | | | | | | | | | |

Cash and due from banks | | 13,467 | | | | | | 12,439 | | | | | |

Allowance for loan losses | | (8,184 | ) | | | | | (7,493 | ) | | | | |

Other assets | | 29,304 | | | | | | 29,302 | | | | | |

Total noninterest-earning assets | | 34,587 | | | | | | 34,248 | | | | | |

Total Assets | | $ | 713,048 | | | | | | $ | 649,955 | | | | | |

| | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | |

Interest-bearing demand deposits | | $ | 85,750 | | $ | 1,928 | | 2.25 | % | $ | 117,730 | | $ | 2,648 | | 2.25 | % |

Savings deposits | | 204,214 | | 8,064 | | 3.95 | | 183,815 | | 6,948 | | 3.78 | |

Time deposits | | 213,407 | | 10,206 | | 4.78 | | 169,572 | | 7,101 | | 4.19 | |

Total interest-bearing deposits | | 503,371 | | 20,198 | | 4.01 | | 471,117 | | 16,697 | | 3.54 | |

Borrowed funds and subordinated debentures | | 84,962 | | 4,276 | | 5.03 | | 55,756 | | 2,735 | | 4.91 | |

Total interest-bearing liabilities | | $ | 588,333 | | $ | 24,474 | | 4.16 | % | $ | 526,873 | | $ | 19,432 | | 3.69 | % |

Noninterest-bearing liabilities: | | | | | | | | | | | | | |

Demand deposits | | 75,581 | | | | | | 77,747 | | | | | |

Other liabilities | | 2,416 | | | | | | 2,218 | | | | | |

Total noninterest-bearing liabilities | | 77,997 | | | | | | 79,965 | | | | | |

Shareholders’ equity | | 46,718 | | | | | | 43,117 | | | | | |

Total Liabilities and Shareholders’ Equity | | $ | 713,048 | | | | | | $ | 649,955 | | | | | |

Net interest spread | | | | $ | 24,585 | | 3.07 | % | | | $ | 23,824 | | 3.33 | % |

Tax-equivalent basis adjustment | | | | (159 | ) | | | | | (79 | ) | | |

Net interest income | | | | $ | 24,426 | | | | | | $ | 23,745 | | | |

Net interest margin | | | | | | 3.62 | % | | | | | 3.87 | % |

|

(A) | Yields related to securities and loans exempt from federal and state income taxes are stated on a fully tax-equivalent basis. They are reduced by the nondeductible portion of interest expense, assuming a federal tax rate of 34 percent and applicable state tax rates. |

(B) | The loan averages are stated net of unearned income, and the averages include loans on which the accrual of interest has been discontinued. |

4

| | 2005 | | 2004 | | 2003 | |

Years ended December 31, | | Average

Balance | | Interest | | Rate/

Yield | | Average

Balance | | Interest | | Rate/

Yield | | Average

Balance | | Interest | | Rate/

Yield | |

ASSETS | | | | | | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | |

Federal funds sold and interest-bearing deposits with banks | | $ | 17,160 | | $ | 572 | | 3.33 | % | $ | 15,039 | | $ | 193 | | 1.28 | % | $ | 10,846 | | $ | 138 | | 1.27 | % |

Securities: | | | | | | | | | | | | | | | | | | | |

Available for sale | | 74,208 | | 3,152 | | 4.25 | | 83,291 | | 3,374 | | 4.05 | | 63,102 | | 2,403 | | 3.81 | |

Held to maturity | | 31,139 | | 1,477 | | 4.74 | | 17,395 | | 867 | | 4.98 | | 19,633 | | 998 | | 5.08 | |

Total securities (A) | | 105,347 | | 4,629 | | 4.39 | | 100,686 | | 4,241 | | 4.21 | | 82,735 | | 3,401 | | 4.11 | |

Loans, net of unearned discount: | | | | | | | | | | | | | | | | | | | |

SBA | | 74,369 | | 6,558 | | 8.82 | | 62,853 | | 4,296 | | 6.83 | | 65,555 | | 4,115 | | 6.28 | |

Commercial | | 230,039 | | 16,164 | | 7.03 | | 192,435 | | 12,934 | | 6.72 | | 175,685 | | 12,495 | | 7.11 | |

Residential mortgage | | 62,103 | | 3,318 | | 5.34 | | 50,242 | | 2,712 | | 5.40 | | 52,014 | | 3,126 | | 6.01 | |

Consumer | | 45,707 | | 2,648 | | 5.79 | | 38,979 | | 1,860 | | 4.77 | | 32,323 | | 1,676 | | 5.19 | |

Total loans (A), (B) | | 412,218 | | 28,688 | | 6.96 | | 344,509 | | 21,802 | | 6.33 | | 325,577 | | 21,412 | | 6.58 | |

Total interest-earning assets | | $ | 534,725 | | $ | 33,889 | | 6.34 | % | $ | 460,234 | | $ | 26,236 | | 5.70 | % | $ | 419,158 | | $ | 24,951 | | 5.96 | % |

Noninterest-earning assets: | | | | | | | | | | | | | | | | | | | |

Cash and due from banks | | 12,661 | | | | | | 13,304 | | | | | | 14,216 | | | | | |

Allowance for loan losses | | (6,398 | ) | | | | | (5,724 | ) | | | | | (4,783 | ) | | | | |

Other assets | | 24,399 | | | | | | 15,603 | | | | | | 13,764 | | | | | |

Total noninterest-earning assets | | 30,662 | | | | | | 23,183 | | | | | | 23,197 | | | | | |

Total Assets | | $ | 565,387 | | | | | | $ | 483,417 | | | | | | $ | 442,355 | | | | | |

| | | | | | | | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | |

Interest-bearing demand deposits | | $ | 150,420 | | $ | 2,605 | | 1.73 | % | $ | 188,840 | | $ | 2,656 | | 1.41 | % | $ | 184,220 | | $ | 2,703 | | 1.47 | % |

Savings deposits | | 130,911 | | 3,164 | | 2.42 | | 49,330 | | 620 | | 1.26 | | 36,976 | | 423 | | 1.14 | |

Time deposits | | 118,174 | | 3,820 | | 3.23 | | 96,686 | | 2,507 | | 2.59 | | 90,814 | | 2,733 | | 3.01 | |

Total interest-bearing deposits | | 399,505 | | 9,589 | | 2.40 | | 334,856 | | 5,783 | | 1.73 | | 312,010 | | 5,859 | | 1.88 | |

Borrowed funds and subordinated debentures | | 46,604 | | 2,014 | | 4.32 | | 29,169 | | 1,225 | | 4.20 | | 21,532 | | 1,169 | | 5.43 | |

Total interest-bearing liabilities | | $ | 446,109 | | $ | 11,603 | | 2.60 | % | $ | 364,025 | | $ | 7,008 | | 1.93 | % | $ | 333,542 | | $ | 7,028 | | 2.11 | % |

Noninterest-bearing liabilities: | | | | | | | | | | | | | | | | | | | |

Demand deposits | | 78,519 | | | | | | 85,283 | | | | | | 79,102 | | | | | |

Other liabilities | | 2,634 | | | | | | 1,445 | | | | | | 1,152 | | | | | |

Total noninterest-bearing liabilities | | 81,153 | | | | | | 86,728 | | | | | | 80,254 | | | | | |

Shareholders’ equity | | 38,125 | | | | | | 32,664 | | | | | | 28,559 | | | | | |

Total Liabilities and Shareholders’ Equity | | $ | 565,387 | | | | | | $ | 483,417 | | | | | | $ | 442,355 | | | | | |

Net interest spread | | | | $ | 22,286 | | 3.74 | % | | | $ | 19,228 | | 3.77 | % | | | $ | 17,923 | | 3.85 | % |

Tax-equivalent basis adjustment | | | | (52 | ) | | | | | (70 | ) | | | | | (56 | ) | | |

Net interest income | | | | $ | 22,234 | | | | | | $ | 19,158 | | | | | | $ | 17,867 | | | |

Net interest margin | | | | | | 4.17 | % | | | | | 4.18 | % | | | | | 4.28 | % |

5

The rate volume table below presents an analysis of the impact on interest income and expense resulting from changes in average volume and rates over the periods presented. Changes that are not due to volume or rate variances have been allocated proportionally to both, based on their relative absolute values. Amounts have been computed on a tax-equivalent basis, assuming a federal income tax rate of 34 percent.

| | 2007 versus 2006 | | 2006 versus 2005 | |

Year ended December 31,

(Dollar amounts in thousands | | Increase (Decrease)

Due to change in | | Increase (Decrease)

Due to change in | |

on a tax equivalent basis) | | Volume | | Rate | | Net | | Volume | | Rate | | Net | |

Interest Income: | | | | | | | | | | | | | |

Federal funds sold and interest-bearing deposits | | $ | 32 | | $ | (6 | ) | $ | 26 | | $ | 172 | | $ | 298 | | $ | 470 | |

Investment securities | | (44 | ) | 369 | | 325 | | 153 | | 390 | | 543 | |

Net loans | | 4,504 | | 948 | | 5,452 | | 5,705 | | 2,649 | | 8,354 | |

Total interest income | | $ | 4,492 | | $ | 1,311 | | $ | 5,803 | | $ | 6,030 | | $ | 3,337 | | $ | 9,367 | |

| | | | | | | | | | | | | |

Interest Expense: | | | | | | | | | | | | | |

Interest-bearing demand deposits | | $ | (720 | ) | $ | — | | $ | (720 | ) | $ | (639 | ) | $ | 682 | | $ | 43 | |

Savings deposits | | 794 | | 322 | | 1,116 | | 1,583 | | 2,201 | | 3,784 | |

Time deposits | | 2,011 | | 1,094 | | 3,105 | | 1,949 | | 1,332 | | 3,281 | |

Total deposits | | $ | 2,085 | | $ | 1,416 | | $ | 3,501 | | $ | 2,893 | | $ | 4,215 | | $ | 7,108 | |

Other debt | | 1,472 | | 69 | | 1,541 | | 425 | | 296 | | 721 | |

Total interest expense | | $ | 3,557 | | $ | 1,485 | | $ | 5,042 | | $ | 3,318 | | $ | 4,511 | | $ | 7,829 | |

Net interest income – fully tax-equivalent (FTE) | | $ | 935 | | $ | (174 | ) | $ | 761 | | $ | 2,712 | | $ | (1,174 | ) | $ | 1,538 | |

Increase in tax-equivalent adjustment | | | | | | 80 | | | | | | 27 | |

Net interest income | | | | | | $ | 681 | | | | | | $ | 1,511 | |

Provision for Loan Losses

The provision for loan losses totaled $1.6 million for 2007 and 2006. The provision for loan losses is comprised of the specific and general reserve factors used to determine reserve levels on certain types of loans. In 2006, the provision for loan losses decreased $300 thousand from $1.9 million in 2005 due to the change and composition of the loan portfolio, the results of the analysis of the estimated probable losses inherent in the loan portfolio, the credit worthiness of particular borrowers, and general economic conditions.

The provision for loan losses is determined based on management’s evaluation of the adequacy of the allowance for loan losses which is maintained at a level that is sufficient to absorb estimated probable losses in the loan portfolio as of the balance sheet date. (For additional information, see the section titled Allowance for Loan Losses). Management believes the current provision is appropriate based on its assessment of the adequacy of the allowance for loan losses.

Noninterest Income

Noninterest income was $5.9 million for 2007, a $1.7 million, or 22.2 percent decrease compared to $7.6 million for 2006. The decrease in noninterest income was due primarily to the net loss on securities, a decrease in gains on sales of SBA 7(a) loans, lower gains on the sale of mortgage loans and decreased service charges on deposits accounts.

The following table shows the components of noninterest income for 2007, 2006 and 2005:

(In thousands) | | 2007 | | 2006 | | 2005 | |

Service charges on deposit accounts | | $ | 1,383 | | $ | 1,602 | | $ | 1,766 | |

Service and loan fee income | | 1,607 | | 1,637 | | 2,111 | |

Gain on SBA loan sales, net | | 2,399 | | 2,972 | | 2,956 | |

Gain on mortgage loan sales | | 52 | | 363 | | 382 | |

Bank owned life insurance | | 198 | | 187 | | 185 | |

Gains on sales of other loans | | — | | 82 | | — | |

Net security (losses) gains | | (571 | ) | 69 | | 69 | |

Other income | | 872 | | 726 | | 721 | |

Total noninterest income | | $ | 5,940 | | $ | 7,638 | | $ | 8,190 | |

Service charges on deposits decreased $219 thousand or 13.7 percent to equal $1.4 million in 2007 compared to $1.6 million in 2006. These decreases were a result of lower levels of uncollected fees due to faster clearing times upon the implementation of the federal “Check 21” law and its increase in electronic check processing, in addition to

6

reduced holding times on checks from 5 days to 4 days. This was consistent with 2006 when service charges on deposit accounts decreased $164 thousand, or 9.3 percent, from 2005 as a result of the lower volume of uncollected and overdraft fees collected on deposit accounts.

Service and loan fee income remained relatively flat at $1.6 million for 2007 and 2006. Compared to 2005, service and loan fee income decreased as a result of a decline in SBA servicing income due to payoffs in the SBA serviced portfolio and lower prepayment penalties on commercial loans due to the higher interest rate environment.

Gains on SBA loan sales reflect the Company’s participation in the SBA’s guaranteed loan program. Under the SBA 7(a) program, the SBA guarantees up to 85 percent of the principal of a qualifying loan. The Company usually sells the guaranteed portion of the loan into the secondary market and retains the unguaranteed portion.

The Company expects to sell approximately half of its volume of newly generated SBA loans in 2008. Future sales will be determined on a loan by loan basis on whether it is more profitable to portfolio SBA loans and earn the interest income or to sell the loan and record the gain on sale and future servicing income.

Gains on the sale of SBA loans decreased $573 thousand or 19.3 percent to $2.4 million in 2007 compared to $3.0 million in 2006 on a comparable sales volume. Gains on the sale of SBA loans remained consistent at $3.0 million during 2006 and 2005 despite a higher volume of loan sales in 2006. The sales of guaranteed SBA loans totaled $41.6 million, $41.2 million, and $37.5 million for 2007, 2006 and 2005, respectively. The decrease in gains on these sales during both periods was the result of lower premiums.

Gains on the sale of mortgage loans decreased $311 thousand in 2007 to $52 thousand due to a lower volume. Gains on the sale of mortgage loans decreased $19 thousand in 2006 to $363 thousand due to a lower volume of mortgage loans being sold. Sales of mortgage loans totaled $3.0 million, $20.9 million, and $25.2 million for 2007, 2006 and 2005, respectively. Sales decreased significantly during 2007 as the Company chose to hold these loans in its portfolio in response to volatility within the market.

In December 2004, the Company purchased $5 million of bank-owned life insurance (“BOLI”) to offset the rising costs of employee benefits. In 2007, the cash surrender value of the BOLI increased $198 thousand compared to $187 thousand the prior year.

During 2007, the Company realized $571 thousand in net security losses compared to gains of $69 thousand in 2006 and 2005. This loss was due to a $607 thousand write-down on three Federal Home Loan Mortgage Corporation (“FHLMC”) investment grade, perpetual callable preferred securities, which the Company classified as impaired due to the recent decline in market value and the uncertainty that it will recover their $3.9 million book value within a reasonable period.

Other income equaled $872 thousand, $726 thousand, and $721 thousand in 2007, 2006 and 2005, respectively.

Noninterest Expense

Total noninterest expense was $22.1 million for 2007, an increase of $1.1 million or 5.1 percent over 2006. Branch expansion, growth of our SBA lending franchise, and technological investments during the year contributed to the increase in operational expense. During the year, the Company opened branches in Palmer Township, Pennsylvania and Middlesex, New Jersey.

The following table presents a breakdown of noninterest expense for the years 2007, 2006 and 2005:

(In thousands) | | 2007 | | 2006 | | 2005 | |

Compensation and benefits | | $ | 11,446 | | $ | 11,028 | | $ | 9,639 | |

Occupancy, net | | 2,777 | | 2,580 | | 2,256 | |

Processing & communications | | 2,433 | | 2,220 | | 2,010 | |

Furniture & equipment | | 1,675 | | 1,538 | | 1,350 | |

Loan servicing | | 604 | | 542 | | 482 | |

Professional services | | 598 | | 636 | | 547 | |

Advertising | | 457 | | 575 | | 697 | |

Deposit insurance | | 67 | | 67 | | 61 | |

Other expenses | | 2,056 | | 1,859 | | 1,634 | |

Total noninterest expense | | $ | 22,113 | | $ | 21,045 | | $ | 18,676 | |

Compensation and benefits expense, the largest component of noninterest expense, totaled $11.4 million in 2007, an increase of $418 thousand or 3.8 percent compared to 2006. This increase was due to increased head count as the Company added retail and lending staff, increased merit and incentive based payments and an increase in medical benefits premiums. Compensation and benefits expense was $11.0 million for 2006, an increase of $1.4 million or 14.4 percent, compared to 2005. The increase in compensation and benefits expense for the year was related to increased head count during the year, merit increases and increased health care costs. At December 31, 2007, 2006 and 2005 there were 201, 185 and 190 full-time equivalent employees, respectively.

Occupancy expense increased $197 thousand or 7.6 percent to $2.8 million in 2007. The increase was due to leasehold improvements and utilities expenses related to the expansion of our retail branch and SBA loan office locations, partially offset by lower maintenance related expenses at our existing locations. Occupancy expense was $2.6 million for 2006, a 14.4 percent increase over the prior year. The increase in occupancy expense was

7

related to the opening of a branch location in Forks Township, Pennsylvania in 2006 and higher branch maintenance costs, as well as annual lease increases and increased utility and property tax expenses.

Processing and communications expenses increased $213 thousand or 9.6 percent to $2.4 million in 2007 compared to the prior year. These increases were the result of higher phone and data line expenses. Processing and communications expense increased to $2.2 million in 2006, a $210 thousand or 10.4 percent increase compared to 2005. The increase was due to higher data processing costs due to increased loan and deposit transactional volume.

Furniture and equipment expense increased $137 thousand or 8.9 percent to $1.7 million in 2007 compared to the prior year. These increases were due primarily to higher software and network maintenance, equipment lease and depreciation expenses as we continue to invest in the technology necessary to efficiently service our customers. Furniture and equipment expense increased 13.9 percent to $1.5 million for 2006. The increases in 2006 were due to branch expansion and refurbishment related costs.

Loan servicing costs increased $62 thousand or 11.4 percent to $604 thousand in 2007 compared to 2006. Loan servicing expense amounted to $542 thousand for 2006, an increase of $60 thousand, or 12.4 percent compared to 2005. The increases during both periods were due to higher collection costs on delinquent loans.

Professional service fees decreased $38 thousand to $598 thousand in 2007 compared to 2006 due to lower legal, accounting and audit related fees, partially offset by increased consultant and loan review fees. Professional services fees totaled $636 thousand for 2006, an $89 thousand, or 16.3 percent increase, compared to 2005. This included increased legal, accounting and audit related fees.

Advertising expense decreased $118 thousand to $457 thousand in 2007. The decrease was due to the use of less expensive delivery channels during 2007. Advertising expense was $575 thousand for 2006, a decrease of $122 thousand or 17.5 percent, compared to 2005. The decrease was due to reduced advertising.

Deposit insurance expense was $67 thousand for 2007 and 2006, and $61 thousand for 2005.

Other expenses increased $197 thousand or 10.6 percent to $2.1 million compared to the prior year. This increase was due primarily to increased employee recruiting and director fees. Other expenses amounted to $1.9 million for 2006, an increase of $225 thousand or 13.8 percent from the prior year. This increase was related to the establishment of a reserve for loan commitments, higher director fees and increased office supply expenses.

Income Tax Expense

For 2007, the Company reported income tax expense of $2.0 million for a 29.5 percent effective tax rate compared to $2.9 million or a 33.5 percent effective tax rate in 2006. The decrease in the tax provision was the result of lower pre-tax earnings and a lower effective tax rate. The lower effective tax rate for 2007 is related to a higher proportion of revenue being generated at a subsidiary with a lower effective tax, in addition to a higher balance of tax-free securities. The Company anticipates a 33.5 percent effective income tax rate in 2008.

For 2006, the Company reported income tax expense of $2.9 million for a 33.5 percent effective tax rate compared to $3.7 million or a 37.3 percent effective tax rate in 2005. The decrease in the tax provision was the result of lower pre-tax earnings and a lower effective tax rate. The reduction in the effective tax rate in 2006 was related to a higher proportion of revenue being generated at a subsidiary with a lower effective tax rate.

Financial Condition

Total assets increased $58.1 million, or 8.4 percent, to $752.2 million at December 31, 2007, compared to $694.1 million at December 31, 2006. This increase was due to an $82.4 million increase in loans, offset by an $18.7 million decrease in federal funds sold and interest-bearing deposits and a $6.9 million decrease in total securities.

Average total assets for 2007 were $713.0 million, a $63.1 million increase from the prior year’s $650.0 million average balance. The increase in average assets was due primarily to growth in the loan portfolio funded by savings, time deposits and borrowed funds.

Investment Securities Portfolio

The Company’s securities portfolio consists of available for sale and held to maturity investments. The investment securities portfolio is maintained for asset-liability management purposes, as an additional source of liquidity, and as an additional source of earnings.

Securities available for sale are investments carried at fair value that may be sold in response to changing market and interest rate conditions or for other business purposes. Activity in this portfolio is undertaken primarily to manage liquidity and interest rate risk, to take advantage of market conditions that create economically attractive returns and as an additional source of earnings. Securities available for sale consist primarily of U.S. Government sponsored agencies, obligations of state and political subdivisions, mortgage-backed securities, corporate bonds and equity securities.

8

Securities available for sale were $64.9 million and $62.6 million at December 31, 2007 and 2006, respectively. During 2007, there were $18.6 million of purchases, $11.0 million of maturities and pay downs, $5.3 million in sales and $563 thousand in appreciation in the market value of the portfolio. Securities purchases and sales consisted primarily of agency bonds and mortgage-backed securities. At December 31, 2007, the portfolio had a net unrealized loss of $767 thousand compared to a net unrealized loss of $1.3 million at the end of the prior year. These unrealized gains and losses are reflected net of tax in shareholders’ equity as accumulated other comprehensive loss.

The average balance of securities available for sale amounted to $69.2 million in 2007 compared to $66.5 million in 2006. The average yield earned on the available for sale portfolio increased 40 basis points, to 5.07 percent in 2007 from 4.67 percent in 2006. The weighted average repricing of securities available for sale, adjusted for prepayments, amounted to 2.8 years at December 31, 2007, compared to 3.1 years in 2006.

Included in available for sale securities at December 31, 2007 were three Federal Home Loan Mortgage Corporation (“FHLMC”) investment grade, perpetual callable preferred securities which the Company classified as impaired due to the decline in market value and the uncertainty that they will recover their $3.9 million book value within a reasonable period. The FHLMC securities were investment grade at the time of purchase and remain investment grade with ratings of AA- from S&P and Aa3 from Moody’s. At December 31, 2007, the Company had recognized an impairment charge of $607 thousand related to these securities. The securities continue to perform according to their contractual terms and all dividend payments are current.

Securities held to maturity, which are carried at amortized cost, are investments for which there is the positive intent and ability to hold to maturity. The portfolio is comprised of mortgage-backed securities, obligations of U.S. Government and government sponsored agencies, obligations of state and local subdivisions, and corporate securities. Management determines the appropriate security classification of available for sale or held to maturity at the time of purchase.

Securities held to maturity were $33.7 million at December 31, 2007, a decrease of $9.1 million or 21.2 percent, from year-end 2006. As of December 31, 2007 and 2006, the market value of held to maturity securities was $33.6 million and $42.4 million, respectively. The average balance of securities held to maturity amounted to $37.7 million in 2007 compared to $41.2 million in 2006. The average yield earned on held to maturity securities increased 23 basis points, from 5.03 percent in 2006 to 5.26 percent in 2007. The weighted average repricing of held to maturity securities, adjusted for prepayments, amounted to 3.0 years at December 31, 2007 and December 31, 2006.

Approximately 83 percent of the total investment portfolio had a fixed rate of interest.

Securities with a carrying value of $54.9 million and $47.6 million at December 31, 2007 and 2006, respectively, were pledged to secure government deposits, secured other borrowings and for other purposes required or permitted by law.

Loan Portfolio

The loan portfolio, which represents the Company’s largest asset group, is a significant source of both interest and fee income. The portfolio consists of commercial, SBA, residential mortgage and consumer loans. Elements of the loan portfolio are subject to differing levels of credit and interest rate risk.

Total loans increased $82.4 million, or 16.2 percent to $590.1 million at December 31, 2007, from $507.7 million at year-end 2006. Growth in the loan portfolio was generated by increases of $53.6 million in commercial loans, $14.4 million in SBA loans, $10.2 million in residential mortgages, and $4.2 million in consumer loans.

Average loans increased $62.8 million or 12.9 percent from $486.5 million in 2006, to $549.3 million in 2007. The increase in average loans was due primarily to growth in the commercial, residential mortgage and consumer loan portfolios. The yield on the loan portfolio was 7.74 percent in 2007 compared to 7.61 percent in 2006. The increase in the yield on the loan portfolio was due to a higher interest rate environment in 2007.

The SBA provides guarantees of up to 85 percent of the principal amount of SBA 7(a) loans. SBA 7(a) loans available for sale are generally sold in the secondary market with the unguaranteed portion held in the portfolio. However during the third quarter of 2007 the Company announced a strategic decision to begin retaining a portion of its SBA 7(a) program loans in its portfolio, rather than selling them into the secondary market. Although the decision impacted earnings in the short-term, management believes it will benefit the Company over the long-term. SBA 7(a) loans held to maturity amounted to $68.9 million at December 31, 2007, an increase of $2.1 million from December 31, 2006. SBA 7(a) loans held for sale, carried at the lower of cost or market, amounted to $24.6 million at December 31, 2007, an increase of $12.4 million from December 31, 2006. SBA 7(a) loans are often originated outside of the Company’s marketplace.

Commercial loans are generally made in the Company’s marketplace for the purpose of providing working capital, financing the purchase of equipment, inventory or commercial real estate and for other business purposes. These loans amounted to $365.8 million at December 31, 2007,

9

an increase of $53.6 million from year-end 2006. The commercial portfolio is expected to continue to increase in 2008. Included in commercial loans at December 31, 2007 are $72.1 million of SBA 504 loans. The SBA 504 program consists of real estate backed commercial mortgages where generally the Company has the first mortgage and the SBA has the second mortgage on the property. The Company generally has a 50 percent loan to value ratio on SBA 504 program loans.

Residential mortgage loans consist of loans secured by 1-4 family residential properties. These loans amounted to $73.7 million at December 31, 2007, an increase of $10.2 million from December 31, 2006. During 2007, the Company held the majority of originated mortgages in its portfolio compared to prior years when it sold these loans into the secondary market.

Consumer loans consist of home equity loans and loans for the purpose of financing the purchase of consumer goods, home improvements, and other personal needs, and are generally secured by the personal property being purchased. These loans amounted to $57.1 million at December 31, 2007, an increase of $4.2 million or 7.9 percent from $52.9 million at December 31, 2006. The growth in consumer loans is related to the growth in home equity loans and lines.

The following table sets forth the classification of loans by major category, including unearned, deferred costs and excluding the allowance for loan losses for the past five years at December 31:

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| | | | % of | | | | % of | | | | % of | | | | % of | | | | % of | |

(In thousands) | | Amount | | Total | | Amount | | Total | | Amount | | Total | | Amount | | Total | | Amount | | Total | |

SBA held for sale | | $ | 24,640 | | 4.2 | % | $ | 12,273 | | 2.4 | % | $ | 14,001 | | 3.1 | % | $ | 7,574 | | 2.0 | % | $ | 14,014 | | 4.1 | % |

SBA held to maturity | | 68,875 | | 11.7 | % | 66,802 | | 13.2 | % | 64,660 | | 14.4 | % | 55,576 | | 14.9 | % | 49,983 | | 14.7 | % |

Commercial | | 365,786 | | 61.9 | % | 312,195 | | 61.5 | % | 260,581 | | 58.1 | % | 207,771 | | 55.6 | % | 188,197 | | 55.4 | % |

Residential mortgage | | 73,697 | | 12.5 | % | 63,493 | | 12.5 | % | 62,039 | | 13.8 | % | 60,240 | | 16.1 | % | 51,176 | | 15.1 | % |

Consumer | | 57,134 | | 9.7 | % | 52,927 | | 10.4 | % | 47,286 | | 10.6 | % | 42,419 | | 11.4 | % | 36,385 | | 10.7 | % |

Total Loans | | $ | 590,132 | | 100.0 | % | $ | 507,690 | | 100.0 | % | $ | 448,567 | | 100.0 | % | $ | 373,580 | | 100.0 | % | $ | 339,755 | | 100.0 | % |

The Company has a concentration to a group of borrowers in the Hotel/Motel industry of approximately 13 percent of the total loan portfolio. There are no other concentrations of loans to any borrowers or group of borrowers exceeding 10 percent of the total loan portfolio. There are no foreign loans in the portfolio. As a preferred SBA lender, a portion of the SBA portfolio is outside of the Company’s lending area.

The following table shows the maturity distribution or repricing of the loan portfolio and the allocation of floating and fixed interest rates at December 31, 2007.

| | Within | | 1-5 | | After | | | |

(In thousands) | | 1 Year | | Years | | 5 Years | | Total | |

SBA | | $ | 67,518 | | $ | 25,627 | | $ | 370 | | $ | 93,515 | |

Commercial | | 111,273 | | 215,337 | | 39,176 | | 365,786 | |

Residential mortgage | | 13,965 | | 31,756 | | 27,976 | | 73,697 | |

Consumer | | 22,336 | | 9,953 | | 24,845 | | 57,134 | |

Total | | $ | 215,092 | | $ | 282,673 | | $ | 92,367 | | $ | 590,132 | |

Amount of loans with maturities or repricing dates greater than one year: | | | |

Fixed interest rates | | $ | 159,624 | |

Floating or adjustable interest rates | | 215,416 | |

Total | | $ | 375,040 | |

Asset Quality

Inherent in the lending function is the possibility that a customer may not perform in accordance with the contractual terms of the loan. A borrower’s inability to pay its obligations according to the contractual terms can create the risk of past due loans and ultimately credit losses, especially on collateral deficient loans.

Nonperforming loans generally consist of loans that are not accruing interest (nonaccrual loans) as a result of principal or interest being in default for a period of 90 days or more or when the ability to collect principal and interest according to the contractual terms is in doubt. When a loan is classified as nonaccrual, interest accruals discontinue and all past due interest previously recognized as income is reversed and charged against current period income. Unless the ability to collect principal and interest is reasonably assured, any payments received from the borrower are applied to outstanding principal until such time as management determines that the financial condition of the borrower and other factors merit recognition of a portion of such payments as interest income.

Credit risk is minimized by loan diversification and adhering to credit administration policies and procedures. Due diligence on loans begins upon the application for a

10

loan by a prospective borrower. Documentation, including a borrower’s credit history, materials establishing the value of potential collateral, the source of funds for repayment of the loan and other factors are analyzed before a loan is submitted for approval. The loan portfolio is then subject to ongoing internal reviews for credit quality. In addition, an outside firm is used to conduct independent credit reviews.

The following table sets forth information concerning nonperforming loans and nonperforming assets at December 31 for the past five years:

(In thousands) | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

Nonperforming by category | | | | | | | | | | | |

Commercial | | $ | 1,630 | | $ | 3,172 | | $ | 1,250 | | $ | 1,534 | | $ | 1,568 | |

SBA(1) | | 2,110 | | 5,212 | | 1,391 | | 2,013 | | 3,175 | |

Residential mortgage | | 1,192 | | 322 | | 1,510 | | 288 | | 458 | |

Consumer | | 529 | | 203 | | 210 | | 256 | | 194 | |

Total nonperforming loans | | $ | 5,461 | | $ | 8,909 | | $ | 4,361 | | $ | 4,091 | | $ | 5,395 | |

OREO | | 106 | | 211 | | 178 | | 345 | | 327 | |

Total nonperforming assets | | $ | 5,567 | | $ | 9,120 | | $ | 4,539 | | $ | 4,436 | | $ | 5,722 | |

Past due 90 days or more and still accruing interest | | | | | | | | | | | |

Commercial | | $ | 41 | | $ | — | | $ | — | | $ | — | | $ | 1,842 | |

SBA | | 114 | | — | | — | | — | | 34 | |

Residential mortgage | | — | | 78 | | — | | — | | — | |

Consumer | | — | | — | | — | | — | | — | |

Total | | $ | 155 | | $ | 78 | | $ | — | | $ | — | | $ | 1,876 | |

Nonperforming loans to total loans | | 0.93 | % | 1.75 | % | 0.97 | % | 1.10 | % | 1.59 | % |

Nonperforming assets to total loans and OREO | | 0.94 | % | 1.80 | % | 1.01 | % | 1.19 | % | 1.68 | % |

Allowance for loan losses as a percentage of nonperforming loans | | 153.49 | % | 85.58 | % | 158.04 | % | 143.14 | % | 99.20 | % |

(1) SBA Loans Guaranteed | | $ | 714 | | $ | 2,953 | | $ | 758 | | $ | 1,240 | | $ | 1,904 | |

Nonperforming loans were $5.5 million at December 31, 2007, a $3.4 million decrease from $8.9 million at year-end 2006. During 2007, there was approximately $8.0 million in loans transferred into nonaccrual status, offset by $11.4 million in payoffs, charge-offs or principal pay downs. Included in nonperforming loans at December 31, 2007 are approximately $714 thousand of loans that are guaranteed by the SBA.

There were $155 thousand of loans past due 90 days or more and still accruing at December 31, 2007, compared to $78 thousand at December 31, 2006 and no such loans at December 31, 2005.

Other real estate owned (“OREO”) properties totaled $106 thousand at year-end 2007, a decrease of $105 thousand from $211 thousand at December 31, 2006.

Potential problem loans are those where information about possible credit problems of borrowers causes management to have doubts as to the ability of such borrowers to comply with loan repayment terms. These loans are not included in nonperforming loans as they continue to perform. Potential problem loans, which consist primarily of commercial and SBA products, were $2.6 million at December 31, 2007 and $4.3 million at December 31, 2006.

Allowance for Loan Losses and Unfunded Commitments

We maintain an allowance for loan losses at a level that the Company believes is sufficient to absorb probable and estimated credit losses in the loan portfolio as of the balance sheet date. While we make allocations to specific loans, the total reserve is available for all loan losses.

Management utilizes a standardized methodology to assess the adequacy of the allowance for loan losses. This process includes the allocation of specific and general reserves. Specific reserves are made to significant individual impaired loans and are determined in accordance with SFAS 114, Accounting by Creditors for Impairment of a Loan. We have defined impaired loans to include all nonaccrual loans. All other “non-impaired” loans are allocated a general reserve. This general reserve is set based upon the historical net charge-off rate adjusted for certain environmental factors such as: delinquency and impairment trends, charge-off and recovery trends, volume and loan term trends, risk and underwriting policy trends, staffing and experience changes, national

11

and local economic trends, industry conditions and credit concentration changes.

Additions to the allowance for loan losses are made by provisions charged to expense whereas the allowance is reduced by net charge-offs (i.e., loans judged to be not collectable are charged against the reserve, less any recoveries on such loans). Although management attempts to maintain the allowance at a level deemed adequate to provide for probable losses, future additions to the allowance may be necessary based upon certain factors including obtaining updated financial information about the borrower’s financial condition and changes in market conditions and underlying collateral values. In addition, various regulatory agencies periodically review the adequacy of the allowance for loan losses. These agencies have in the past and may in the future require the Company to make additional adjustments based on their judgments about information available to them at the time of their examination.

The allowance for loan losses amounted to $8.4 million at December 31, 2007, compared to $7.6 million at year-end 2006. The increase in the allowance for loan losses was due to the provision for loan losses of $1.6 million exceeding $791 thousand of net charge-offs. In addition, the increase in the allowance for loan losses was attributable to the specific and general reserve factors used to determine reserve levels on certain types of loans, the analysis of the estimated probable losses inherent in the loan portfolio based upon the review of particular loans, the credit worthiness of particular borrowers, and general economic conditions, offset by decreased levels of nonperforming loans.

The following is a summary of the allowance for loan losses for the past five years:

(In thousands) | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

Balance at beginning of year | | $ | 7,624 | | $ | 6,892 | | $ | 5,856 | | $ | 5,352 | | $ | 4,094 | |

Charge-offs: | | | | | | | | | | | |

Commercial | | 155 | | 298 | | 300 | | 601 | | 294 | |

SBA | | 770 | | 573 | | 301 | | 320 | | 486 | |

Residential mortgage | | — | | — | | 49 | | 18 | | — | |

Consumer | | 50 | | 62 | | 523 | | 29 | | 93 | |

Total charge-offs | | 975 | | 933 | | 1,173 | | 968 | | 873 | |

Recoveries: | | | | | | | | | | | |

Commercial | | 18 | | 75 | | 84 | | 181 | | 419 | |

SBA | | 147 | | 20 | | 204 | | 99 | | 78 | |

Residential mortgage | | — | | — | | — | | — | | — | |

Consumer | | 19 | | 20 | | 71 | | 17 | | 34 | |

Total recoveries | | 184 | | 115 | | 359 | | 297 | | 531 | |

Total net charge-offs | | $ | 791 | | $ | 818 | | $ | 814 | | $ | 671 | | $ | 342 | |

Provision charged to expense | | $ | 1,550 | | $ | 1,550 | | $ | 1,850 | | $ | 1,175 | | $ | 1,600 | |

Balance at end-of-year | | $ | 8,383 | | $ | 7,624 | | $ | 6,892 | | $ | 5,856 | | $ | 5,352 | |

Net charge-offs to average loans | | 0.14 | % | 0.17 | % | 0.20 | % | 0.19 | % | 0.11 | % |

Allowance to total loans | | 1.42 | % | 1.50 | % | 1.54 | % | 1.57 | % | 1.58 | % |

In addition to the allowance for loan losses, we maintain an allowance for unfunded loan commitments. This commitment reserve is reported on our balance sheet as an other liability. We determine this amount using estimates of future loan funding and losses related to those credit exposures. The commitment reserve totaled $102 thousand and $127 thousand at December 31, 2007 and 2006, respectively.

12

The following table sets forth, for each of the major lending categories, the amount of the allowance for loan losses allocated to each category and the percentage of total loans represented by such category, as of December 31st of each year. The allocated allowance is the total of identified specific and general reserves by loan category. The allocation is made for analytical purposes and is not necessarily indicative of the categories in which future losses may occur. The total allowance is available to absorb losses from any segment of the portfolio.

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| | | | % of | | | | % of | | | | % of | | | | % of | | | | % of | |

(In thousands) | | Amount | | Loans | | Amount | | Loans | | Amount | | Loans | | Amount | | Loans | | Amount | | Loans | |

Balance applicable to: | | | | | | | | | | | | | | | | | | | | | |

SBA | | $ | 2,188 | | 15.9 | % | $ | 2,066 | | 15.6 | % | $ | 1,712 | | 17.5 | % | $ | 1,724 | | 16.9 | % | $ | 1,296 | | 18.8 | % |

Commercial | | 5,115 | | 61.9 | % | 4,865 | | 61.5 | % | 4,417 | | 58.1 | % | 3,436 | | 55.6 | % | 3,526 | | 55.4 | % |

Residential mortgage | | 570 | | 12.5 | % | 305 | | 12.5 | % | 444 | | 13.8 | % | 375 | | 16.1 | % | 270 | | 15.1 | % |

Consumer | | 510 | | 9.7 | % | 388 | | 10.4 | % | 319 | | 10.6 | % | 321 | | 11.4 | % | 260 | | 10.7 | % |

Total | | $ | 8,383 | | 100.0 | % | $ | 7,624 | | 100.0 | % | $ | 6,892 | | 100.0 | % | $ | 5,856 | | 100.0 | % | $ | 5,352 | | 100.0 | % |

Deposits

Deposits, which include noninterest-bearing demand deposits and interest-bearing demand, savings and time deposits, are the primary source of the Company’s funds. The Company offers a variety of products designed to attract and retain customers, with primary focus on building and expanding relationships. For 2007, the Company realized continued growth in deposits. This growth was achieved through the emphasis on customer service, competitive rate structures and selective marketing through the Company’s branch network. The Company continues to focus on establishing a comprehensive relationship with business borrowers, seeking deposits as well as lending relationships.

The following are period-end deposit balances for each of the last three years.

At December 31, | | 2007 | | 2006 | | 2005 | |

(In thousands) | | Amount | | % | | Amount | | % | | Amount | | % | |

Interest-bearing demand deposits | | $ | 78,019 | | 13.0 | % | $ | 105,382 | | 18.6 | % | $ | 139,076 | | 26.7 | % |

Savings deposits | | 196,390 | | 32.7 | % | 205,919 | | 36.4 | % | 141,935 | | 27.2 | % |

Time deposits | | 256,259 | | 42.6 | % | 175,392 | | 30.9 | % | 161,302 | | 30.9 | % |

Noninterest-bearing demand deposits | | 70,600 | | 11.7 | % | 79,772 | | 14.1 | % | 79,547 | | 15.2 | % |

Total deposits | | $ | 601,268 | | 100.0 | % | $ | 566,465 | | 100.0 | % | $ | 521,860 | | 100.0 | % |

Total deposits increased $34.8 million to $601.3 million at December 31, 2007 from $566.5 million at December 31, 2006. The increase in deposits was the result of an $80.9 million increase in time deposits, partially offset by declines in interest-bearing demand deposits, demand deposits and savings deposits.

The mix of deposits shifted during 2007 as the concentration of demand deposits and interest-bearing demand deposits fell and the concentration of higher-cost savings and time deposits increased.

The average cost of interest-bearing deposits in 2007 was 4.01 percent compared to 3.54 percent for 2006. The increase in the cost of deposits can be attributed to the high cost of deposits in the New Jersey and Eastern Pennsylvania marketplaces, the lack of liquidity in these marketplaces, and the shift in the mix of deposits. The Company expects the trend of growth in the deposit base to continue in 2008.

13

The following are average deposits for each of the last three years.

| | 2007 | | 2006 | | 2005 | |

(In thousands) | | Amount | | % | | Amount | | % | | Amount | | % | |

Interest-bearing demand deposits | | $ | 85,750 | | 14.8 | % | $ | 117,730 | | 21.4 | % | $ | 150,420 | | 31.5 | % |

Savings deposits | | 204,214 | | 35.3 | % | 183,815 | | 33.5 | % | 130,911 | | 27.4 | % |

Time deposits | | 213,407 | | 36.8 | % | 169,572 | | 30.9 | % | 118,174 | | 24.7 | % |

Noninterest-bearing demand deposits | | 75,581 | | 13.1 | % | 77,747 | | 14.2 | % | 78,519 | | 16.4 | % |

Total deposits | | $ | 578,952 | | 100.0 | % | $ | 548,864 | | 100.0 | % | $ | 478,024 | | 100.0 | % |

Borrowed Funds and Subordinated Debentures

Borrowed funds consist primarily of fixed rate advances from the Federal Home Loan Bank (“FHLB”) of New York and repurchase agreements. These borrowings are used as a source of liquidity or to fund asset growth not supported by deposit generation. Residential mortgages and investment securities collateralize the borrowings from the FHLB, while investment securities are pledged against the repurchase agreements.

As of December 31, 2007, borrowed funds totaled $85.0 million, an increase of $30.0 million from the prior year-end, as available pricing presented a favorable alternative to the high cost of deposits in the New Jersey and Eastern Pennsylvania marketplaces. The change since December 31, 2006 was due to the addition of a $10.0 million FHLB advance in April 2007, a $10.0 million FHLB repo-advance in August 2007, and a $10.0 million FHLB repo-advance in December 2007.

Due to the current interest rate environment, the Company chose to redeem $9.0 million in subordinated debentures issued by Unity (NJ) Statutory Trust I on September 26, 2007, which were issued on September 26, 2002 at a floating rate of 3-month Libor plus 340 basis points.

As of December 31, 2007 and 2006, the Company was a party to the following transactions:

(In thousands) | | 2007 | | 2006 | |

FHLB Borrowings: | | | | | |

Overnight line of credit | | $ | 5,000 | | $ | 5,000 | |

Fixed rate advances | | 40,000 | | 30,000 | |

Repurchase agreements | | 30,000 | | 10,000 | |

Other repurchase agreements | | 10,000 | | 10,000 | |

Subordinated debentures | | 15,465 | | 24,744 | |

| | | | | | | |

At December 31, 2007, the Company had $11.3 million of additional availability at the FHLB. Pledging additional collateral in the form of 1-4 family residential mortgages or investment securities can increase the line with the FHLB. The maximum borrowing line available if additional collateral was pledged as of December 31, 2007 amounted to approximately $62.0 million.

For additional information see Note 10 to the Consolidated Financial Statements.

Market Risk

Based on the Company’s business, the two largest risks facing the Company are market risk and credit risk. Market risk, for the Company, is primarily limited to interest rate risk, which is the impact that changes in interest rates would have on future earnings. The Company’s Asset/Liability Committee (“ALCO”) manages this risk. The principal objectives of ALCO are to establish prudent risk management guidelines, evaluate and control the level of interest rate risk in balance sheet accounts, determine the level of appropriate risk given the business focus, operating environment, capital, and liquidity requirements, and actively manage risk within Board approved guidelines. ALCO reviews the maturities and repricing of loans, investments, deposits and borrowings, cash flow needs, current market conditions, and interest rate levels.

The Company uses various techniques to evaluate risk levels on both a short and long-term basis. One of the monitoring tools is the “gap” ratio. A gap ratio, as a percentage of assets, is calculated to determine the maturity and repricing mismatch between interest rate-sensitive assets and interest rate-sensitive liabilities. A gap is considered positive when the amount of interest rate-sensitive assets repricing exceeds the amount of interest rate-sensitive liabilities repricing in a designated time period. A positive gap should result in higher net interest income with rising interest rates, as the amount of the assets repricing exceed the amount of liabilities repricing. Conversely, a gap is considered negative when the amount of interest rate-sensitive liabilities exceeds interest rate-sensitive assets, and lower rates should result in higher net interest income.

Repricing of mortgage-related investments are shown by contractual amortization and estimated prepayments based on the most recent 3-month constant prepayment rate. Callable agency securities are shown based upon their option-adjusted spread modified duration date (“OAS”), rather than the next call date or maturity date. The OAS date considers the coupon on the security, the time to the next call date, the maturity date, market volatility and current rate levels. Fixed rate loans are allocated based on expected amortization.

14

The following table sets forth the gap ratio at December 31, 2007. Assumptions regarding the repricing characteristics of certain assets and liabilities are critical in determining the projected level of rate sensitivity. Certain savings and interest checking accounts are less sensitive to market interest rate changes than other interest-bearing sources of funds. Core deposits such as demand interest, savings and money market deposits are allocated based on their expected repricing in relation to changes in market interest rates.

(In thousands) | | Under six

months | | Six months

through

one year | | More than

one year

through

two years | | More than

two years

through

five years | | More than

five years

through

ten years | | More than

ten years

and not

repricing | | Total | |

Assets | | | | | | | | | | | | | | | |

Cash & due from banks | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 14,336 | | $ | 14,336 | |

Federal funds sold | | 21,976 | | — | | — | | — | | — | | — | | 21,976 | |

Investment securities | | 16,568 | | 12,249 | | 14,952 | | 25,851 | | 20,237 | | 8,734 | | 98,591 | |

Loans | | 180,505 | | 34,587 | | 70,053 | | 212,620 | | 62,468 | | 29,899 | | 590,132 | |

Other assets | | — | | — | | — | | — | | — | | 27,161 | | 27,161 | |

Total Assets | | $ | 219,049 | | $ | 46,836 | | $ | 85,005 | | $ | 238,471 | | $ | 82,705 | | $ | 80,130 | | $ | 752,196 | |

Liabilities and Shareholders’ Equity | | | | | | | | | | | | | | | |

Noninterest-bearing demand deposits | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 70,600 | | $ | 70,600 | |

Savings and interest–bearing demand deposits | | 177,944 | | 878 | | 6,769 | | 69,304 | | 19,514 | | — | | 274,409 | |

Time deposits | | 138,829 | | 60,466 | | 39,197 | | 17,416 | | 351 | | — | | 256,259 | |

Borrowed funds and subordinated debentures | | 20,465 | | — | | 10,000 | | 20,000 | | 50,000 | | — | | 100,465 | |

Other liabilities | | — | | — | | — | | — | | — | | 3,203 | | 3,203 | |

Shareholders’ equity | | — | | — | | — | | — | | — | | 47,260 | | 47,260 | |

Liabilities and Shareholders’ Equity | | $ | 337,238 | | $ | 61,344 | | $ | 55,966 | | $ | 106,720 | | $ | 69,865 | | $ | 121,063 | | $ | 752,196 | |

Interest Rate Swap | | $ | 10,000 | | — | | — | | $ | (10,000 | ) | — | | — | | — | |

Gap | | $ | (128,189 | ) | $ | (14,508 | ) | $ | 29,039 | | $ | 141,751 | | $ | 12,840 | | $ | (40,933 | ) | — | |

Cumulative Gap | | $ | (128,189 | ) | $ | (142,697 | ) | $ | (113,658 | ) | $ | 28,093 | | $ | 40,933 | | — | | — | |

Cumulative Gap to Total Assets | | (17.0 | )% | (19.0 | )% | (15.1 | )% | 3.7 | % | 5.4 | % | — | | — | |

At December 31, 2007, there was a six-month liability-sensitive gap of $118.2 million and a one-year liability-sensitive gap of $132.7 million, as compared to liability-sensitivity gaps of $124.4 million and $133.7 million at December 31, 2006. The six-month and one-year cumulative gap to total assets ratios were within the board-approved guidelines of +/- 20 percent.

Other models are also used in conjunction with the static gap table, which is not able to capture the risk of changing spread relationships over time, the effects of projected growth in the balance sheet or dynamic decisions such as the modification of investment maturities as a rate environment unfolds. For these reasons, a simulation model is used, where numerous interest rate scenarios and balance sheets are combined to produce a range of potential income results. Net interest income is managed within guideline ranges for interest rates rising or falling by 200 basis points. Results outside of guidelines require action by ALCO to correct the imbalance. Simulations are typically created over a 12-24 month time horizon. At December 31, 2007, these simulations show that with a 200 basis point immediate increase in interest rates, net interest income would decrease by approximately $1.1 million or 4.2 percent. An immediate decline of 200 basis points in interest rates would increase net interest income by approximately $1.2 million or 4.4 percent. These variances in net interest income are within the board-approved guidelines of +/- 7 percent.

Finally, to measure the impact of longer-term asset and liability mismatches beyond two years, the Company utilizes Modified Duration of Equity and Economic Value of Portfolio Equity (“EVPE”) models. The modified duration of equity measures the potential price risk of equity to changes in interest rates. A longer modified duration of equity indicates a greater degree of risk to rising interest rates. Because of balance sheet optionality, an EVPE analysis is also

15

used to dynamically model the present value of asset and liability cash flows, with rate shocks of 200 basis points. The economic value of equity is likely to be different as interest rates change. Like the simulation model, results falling outside prescribed ranges require action by ALCO. The Company’s variance in the economic value of equity with rate shocks of 200 basis points is a decline of 26.84 percent in a rising rate environment and an increase of 4.49 percent in a falling rate environment. The variance in the EVPE at December 31, 2007 is within board-approved guidelines of +/- 35 percent.

Financial Derivatives

In order to manage interest rate risk, the Company may enter into financial derivative contracts such as interest rate swaps. At December 31, 2007, the Company was a party to one interest rate swap transaction with the following characteristics:

· Pay fixed, receive variable – Libor,

· Notional/contract amount = $10 million,

· Fair value = ($23) thousand,

· Maturity date = 9/23/2011,

· Weighted average interest rate paid = 4.10%, and

· Weighted average interest rate received = 4.88%.

The Company was not a party to any financial derivative transactions at December 31, 2006.

For additional information see Note 12 to the Consolidated Financial Statements.

Operating, Investing and Financing

The Consolidated Statements of Cash Flows present the changes in cash from operating, investing and financing activities. At December 31, 2007, the balance of cash and cash equivalents was $36.3 million, a decrease of $19.1 million from December 31, 2006.

Net cash used in operating activities totaled $3.8 million at December 31, 2007, as compared to providing $7.6 million at December 31, 2006. The primary source of funds was net income from operations adjusted for: provision for loan losses, depreciation expenses, proceeds from SBA loans held for sale and mortgage loans held for sale, offset by originations of SBA and mortgage loans held for sale.

Net cash used in investing activities amounted to $66.9 million in 2007, increasing from a year ago. The cash used in investing activities was primarily a result of funding of the loan and securities portfolios, offset by sales, maturities and pay-downs in the investment portfolio.

Net cash provided by financing activities amounted to $51.6 million for 2007, compared to $74.1 million in 2006. The increase in cash provided by financing activities was due to growth in the Company’s deposit base and an increase in the Company’s borrowings.

Liquidity

The Company’s liquidity is a measure of its ability to fund loans, withdrawals or maturities of deposits and other cash outflows in a cost-effective manner.

Parent Company

Generally, the Parent Company’s cash is used for the payment of operating expenses and cash dividends. The principal sources of funds for the Parent Company are dividends paid by the Bank. The Parent Company only pays expenses that are specifically for the benefit of the Parent Company. Other than its investment in the Bank, Unity Statutory Trust II and Unity Statutory Trust III, the Parent Company does not actively engage in other transactions or business. The majority of expenses paid by the Parent Company are related to Unity Statutory Trust II and Unity Statutory Trust III.

At December 31, 2007, the Parent Company had $433 thousand in cash and $216 thousand in marketable securities, valued at fair market value compared to $6.9 million in cash and $270 thousand in marketable securities at December 31, 2006. The decrease in cash at the Parent Company was due primarily to the redemption of $9.0 million in subordinated debentures issued through its subsidiary Unity (NJ) Statutory Trust I, the repurchase of approximately 380 thousand shares of Unity Bancorp stock at a total cost of $3.9 million, and the quarterly payment of cash dividends.

Consolidated Bank

The principal sources of funds for the Bank are deposits, scheduled amortization and prepayments of loan and investment principal, sales and maturities of investment securities and funds provided by operations. While scheduled loan payments and maturing investments are relatively predictable sources of funds, deposit flows and loan prepayments are greatly influenced by general interest rates, economic conditions and competition.

Total FHLB borrowings amounted to $75.0 million and third party repurchase agreements totaled $10.0 million, as of December 31, 2007. At December 31, 2007, $11.3 million was available for additional borrowings from the FHLB. Pledging additional collateral in the form of 1-4 family residential mortgages or investment securities can increase the line with the FHLB. Additional sources of liquidity are the securities available for sale portfolio and SBA loans held for sale portfolio, which amounted to $64.9 million and $24.6 million respectively, at December 31, 2007.

16

As of December 31, 2007, deposits included $30.5 million of Government deposits, as compared to $40.1 million at year-end 2006. These deposits are generally short in duration and are very sensitive to price competition. The Company believes that the current level of these types of deposits is appropriate. Included in the portfolio were $23.3 million of deposits from three municipalities. The withdrawal of these deposits, in whole or in part, would not create a liquidity shortfall for the Company.

At December 31, 2007, the Bank had approximately $132.0 million of loan commitments, which will either expire or be funded, generally within one year. The Company believes it has the necessary liquidity to honor all commitments. Many of these commitments will expire and never be funded. In addition, approximately 25 percent of these commitments are for SBA Loans, which may be sold into the secondary market.

Off-Balance Sheet Arrangements and Contractual Obligations

The following table shows the amounts and expected maturities of off–balance sheet arrangements as of December 31, 2007. Further discussion of these commitments is included in Note 11 to the Consolidated Financial Statements.

(In thousands) | | One Year

or Less | | One to

Three

Years | | Three to

Five

Years | | Over Five

Years | | Total | |

Standby letters of credit | | $ | 994 | | $ | 2,951 | | $ | — | | $ | — | | $ | 3,945 | |

| | | | | | | | | | | | | | | | |

The following table shows the contractual obligations of the Company by expected payment period, as of December 31, 2007. Further discussion of these commitments is included in Notes 10-11 to the Consolidated Financial Statements.

(In thousands) | | One Year

or Less | | One to

Three

Years | | Three to

Five

Years | | Over Five

Years | | Total | |

Borrowed funds and subordinated debentures | | $ | 5,000 | | $ | 20,000 | | $ | — | | $ | 75,465 | | $ | 100,465 | |

Operating lease obligations | | 1,165 | | 577 | | 217 | | 160 | | 2,119 | |

Purchase obligations – Fiserv | | 1,397 | | 2,012 | | 1,051 | | — | | 4,460 | |

Total | | $ | 7,562 | | $ | 22,589 | | $ | 1,268 | | $ | 75,625 | | $ | 107,044 | |

Long-term debt obligations include fixed term borrowings from the Federal Home Loan Bank, repurchase agreements and subordinated debentures. The borrowings have defined terms and under certain circumstances are callable at the option of the lender.

Operating leases represent obligations entered into by the Company for the use of land, premise and equipment. The leases generally have escalation terms based upon certain defined indexes.

Purchase obligations represent legally binding and enforceable agreements to purchase goods and services from third parties and consist primarily of contractual obligations under data processing service agreements.

17

Capital

A significant measure of the strength of a financial institution is its capital base. Federal regulators have classified and defined capital into the following components: (1) tier 1 capital, which includes tangible shareholders’ equity for common stock, qualifying preferred stock and other qualifying hybrid instruments, and (2) tier 2 capital, which includes a portion of the allowance for loan losses, certain qualifying long-term debt and preferred stock which does not qualify for tier 1 capital. Minimum capital levels are regulated by risk-based capital adequacy guidelines, which require a bank to maintain certain capital as a percent of assets and certain off-balance sheet items adjusted for predefined credit risk factors (risk-adjusted assets). A bank is required to maintain, at a minimum, tier 1 capital as a percentage of risk-adjusted assets of 4.0 percent and combined tier 1 and tier 2 capital as a percentage of risk-adjusted assets of 8.0 percent.

The following table summarizes the Company’s and the Bank’s risk-based and leveraged capital ratios at December 31, 2007 and 2006, as well as the required minimum regulatory capital ratios.

Company | | Dec. 2007 | | Dec. 2006 | | Adequately

Capitalized

Requirements | | Well

Capitalized

Requirements | |

Leverage ratio | | 8.25 | % | 9.08 | % | 4.00 | % | N/A | |

Tier 1 risk-based capital ratio | | 9.81 | % | 10.80 | % | 4.00 | % | N/A | |

Total risk-based capital ratio | | 11.06 | % | 13.60 | % | 8.00 | % | N/A | |

Bank | | Dec. 2007 | | Dec. 2006 | | Adequately

Capitalized

Requirements | | Well

Capitalized

Requirements | |

Leverage ratio | | 7.06 | % | 7.20 | % | 4.00 | % | 5.00 | % |

Tier 1 risk-based capital ratio | | 8.39 | % | 8.55 | % | 4.00 | % | 6.00 | % |

Total risk-based capital ratio | | 11.00 | % | 12.38 | % | 8.00 | % | 10.00 | % |