Exhibit 99.1

MARLIN CAPITAL INVESTMENTS, LLC

555 S. Federal Highway, #450

Boca Raton, FL 33432

January 29, 2015

The Board of Directors

Broadvision Inc.

1700 Seaport Blvd.

Suite 210

Redwood City, CA 94063

Gentlemen:

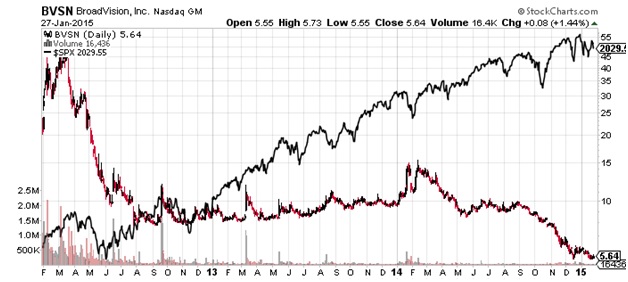

We are the beneficial owners of a combined 343,144 shares of common stock of Broadvision Inc. (the “Company”), equating to 7.1% of the Company. We originally submitted a letter to your board on October 4, 2011 with an all cash offer to acquire the Company for $10.50 per share. The Company notified us that you had unanimously declined this offer on October 20, 2011. The stock is subsequently down 48% from our offer price to its current price of $5.54 per share, while the S&P 500 has risen 82% over this same period.

Since you declined our offer to acquire the Company at $10.50 per share over three years ago, the Company has burned through an additional $20 million in cash and nothing has changed with your business except declining revenues. Still no glimpse of transparency for shareholders or a future for any of Broadvision’s business lines, as was noted in our previous letter prior to a further 48% destruction in shareholder value. This cannot continue.

Like a bad case of déjà vu, the Company still burns through $2-3 million every quarter with no prospects to the underlying businesses. Hence, the Company trades at a discount to its cash on hand and seems poised to continue to trade at this discount until the Company burns through all of its cash and the stock is at $0. Something must change here to protect the economic interests of all common shareholders in the Company. Your shareholders have clearly been an afterthought to your stagnant and unresponsive management team and board of directors. It is unacceptable for a Nasdaq listed public company to show such disregard for its shareholders.

In addition, we demand further clarity regarding a certain related party transaction (as noted in the most recent 10-Q) involving a private entity controlled by the Company’s CEO, Pehong Chen, and in which CFO Peter Chu is a shareholder. As a result of an agreement with this related party, Broadvision has invested approximately $8.6 million in a private entity and continues making payments of $400,000 per quarter for “certain labor outsourcing services”. On top of this $1,600,000 per year in ongoing payments to their private entity, Chen’s and Chu’s salaries are an additional $550,000 per year in aggregate.

This seems to make clear that management is using the Company as their personal piggy bank and will continue to bleed dry the only value in the Company: its cash. Management continues to enjoy lofty salaries and generous consulting payments to their private entity while generating no value for shareholders or buying any stock in the market themselves. The lack of insider buying while the stock trades below cash value amplifies our perception that the underlying businesses have no real value.

The snapshot of the balance sheet and cap structure as of September 30, 2014 shows the following:

| Cash & Equivalents | | $ | 39,617,000 | |

| Receivables | | $ | 2,177,000 | |

| Payables | | $ | (490,000 | ) |

| Accrued Expenses | | $ | (2,349,000 | ) |

| Shares Outstanding | | | 4,822,000 | |

Based on historical burn, the Company will be left with approximately $37 million in cash when it announces fourth quarter results on February 5, 2015. This equates to ~$7.67 per share in cash based on the current 4,822,000 shares outstanding.

We propose two options that are the only equitable resolutions for the Company’s shareholders to prevent further shareholder value being destroyed:

| 1) | Dividend out the cash on hand to the shareholders. Leave a minimal amount of cash on the balance sheet to maintain the public company expenses while putting the businesses up for auction. This allows shareholders to recoup the only current asset, its cash, while gauging if there is any market value for the businesses in an auction. These businesses are currently garnering a negative valuation in the public market. The Company could dividend out $7 per share in cash and still retain ~$3,250,000 on hand to cover overhead while going through the auction process. The Company could evaluate new business opportunities that could generate additional shareholder value while going through this process as well. |

| 2) | We are prepared to invest in the company and lead it in a new direction to begin generating shareholder value. Alongside the investment, we would plan on identifying new business opportunities while vending out old assets. We would give shareholders a shot at generating a return and would actually keep them abreast of their investment, which is a primary responsibility of operating a Nasdaq listed company. |

None of Broadvision’s business lines are showing any traction or promise going forward. Clearvale is a dying legacy business still responsible for the majority of the Company’s declining revenues. Vmoso has no perceived value at this point and is competing in a crowded and competitive market, with Facebook having also recently announced a competing product. Broadvision does not have the salesforce or the resources to compete even if its product was superior, which lack of adoption and sales point to the opposite.

We are ready to meet with the Board of Directors and its representatives as soon as possible in order to proceed with any of the aforementioned options. Please contact us at 561-961-4635 to discuss any questions the Board might have and next steps from here to finally start creating value for shareholders.

Very truly yours,

/s/ Barry Honig

Barry Honig, Manager

/s/Michael Brauser

Michael Brauser, Manager