| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM N-CSR |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

| Investment Company Act File Number: 811-07153 |

| T. Rowe Price Fixed Income Series, Inc. |

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: (410) 345-2000 |

| Date of fiscal year end: December 31 |

| Date of reporting period: June 30, 2010 |

Item 1: Report to Shareholders

|

| Limited-Term Bond Portfolio | June 30, 2010 |

| Highlights |

• Short-term bonds ended in positive territory during the past six months as interest rates in the two- to five-year range fluctuated widely.

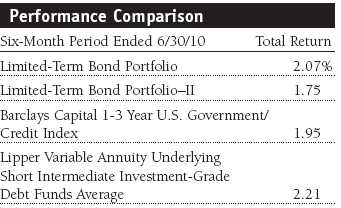

• The fund outpaced the Barclays benchmark index but trailed its Lipper peer group average.

• Our allocation to investment-grade corporate securities and an underweight in Treasuries bolstered the portfolio’s relative performance, while our high cash reserves restrained results.

• Global austerity measures and high debt burdens are likely to weigh on investor sentiment, but we remain committed to our risk-conscious investment approach that has guided us through volatile market conditions in the past.

The views and opinions in this report were current as of June 30, 2010. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

Manager’s Letter

T. Rowe Price Limited-Term Bond Portfolio

Dear Investor

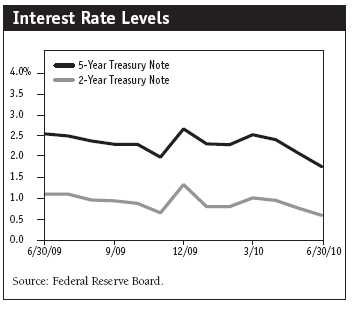

Short-term bonds ended the first half of the year in positive territory. Interest rates in the two- to five-year range followed a roller coaster pattern that ended with yields below their levels at the beginning of the year. Long-term Treasuries were particularly strong as nervous investors sought out U.S. government bonds, while riskier assets trailed toward the end of the period.

Market Environment

Investors shed higher-risk assets late in the period amid uncertainty about U.S. financial reform. Mounting concerns about Greece and the potential contagion to other European countries, and possibly even the U.S., added to the turmoil. The attention of global investors was riveted on the euro zone throughout the past six months as the major powers attempted to deal with the spreading crisis. In the face of mounting budget deficits and unwieldy debt burdens, governments were forced to impose fiscal austerity measures that carried the risk of slowing economic growth just as global economies are gaining traction. China’s actions to restrict bank lending and cool its overheated real estate market also weighed on sentiment.

In the U.S., inventories held by wholesalers rose during the period while retail sales fell in May for the first time in more than a year, suggesting that the economy is still struggling to gain some traction. Weak sales could discourage businesses from increasing their orders and result in a slowdown in production. Nevertheless, we do not believe the economy is heading back into a recession. Sharp increases in productivity as a result of cost-cutting appear to be coming to an end, setting the stage for an eventual improvement in job gains and household spending.

Through it all, the U.S. Federal Reserve adopted a cautious stance, stating that “economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.” With inflation below the Fed’s comfort zone of 1% to 2% a year, the central bank is unlikely to start raising short-term rates until clear signs emerge that the battle is over and core inflation is accelerating from its current level.

Performance

The portfolio generated a gain of 2.07% during the six months ended June 30, 2010, leading the Barclays Capital 1-3 Year U.S. Government/Credit Index but trailing the average for its Lipper peer group, which measures the performance of similar funds. (Performance for the Portfolio–II was lower, reflecting its different expense ratio.) The portfolio’s relative performance was hindered primarily by our higher cash reserves as a result of strong cash flows into the fund. As we like to point out, the objective of the portfolio is to provide greater income than is available from a money market fund but with a higher degree of principal risk. The portfolio’s net asset value rose from $5.04 at the end of December to $5.07 at the end of the period, while dividends contributed $0.07 per share over the same period.

Our sector allocation drove results relative to the Barclays benchmark. We were overweight in investment-grade corporate securities and underweight in U.S. Treasuries, which benefited our relative return—although conditions changed toward the end of the period. Earlier in the year, the yields on investment-grade corporates tightened versus Treasury yields as active new issuance was met with strong demand. As the yield differential contracted, the corporate sector outperformed U.S. Treasuries until May, when sovereign debt concerns drove investors to the safety of U.S. government bonds.

We also maintained exposure to mortgage-backed securities (MBS), which aided the fund’s relative return since these securities are not held in our benchmark. MBS did well as a result of a program initiated by the Federal Reserve to support the market, which led to a tightening in yield spreads versus Treasuries as demand picked up. Declining new issuance of these securities after March also bolstered the sector as supply dwindled.

Our slightly higher-than-normal cash level weighed on relative results. We have been opportunistically putting to work heavy cash flows from investors. In addition, many of our Lipper competitors have higher risk profiles, which aided their results as lower-quality debt led the rally early in the period.

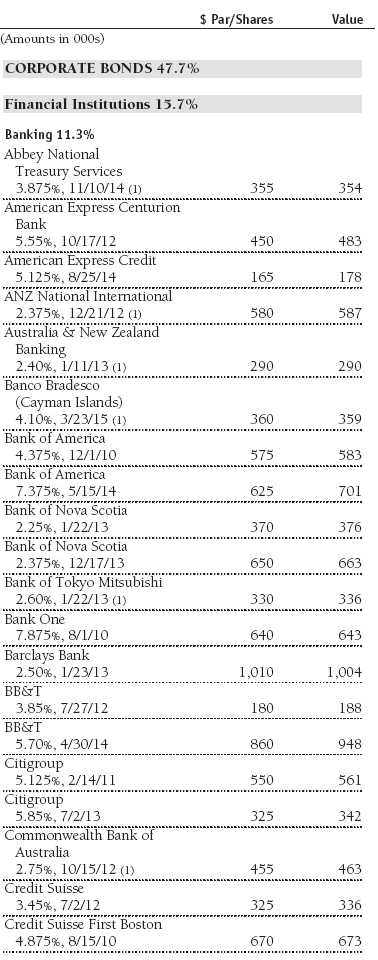

Investment-grade corporate bonds remain the largest overweight position in the portfolio relative to the Barclays benchmark. Corporate debt and other credit-sensitive bonds rallied as investors diverted assets from money market investments into securities with greater return potential. Thanks to low interest rates and cost-cutting measures, corporate profitability remained strong. Our largest allocation was in industrial companies that have held up well during the economic uncertainty and recent market volatility.

The portfolio remains underweight in U.S. Treasury and agency securities because of better valuations in corporates. We reduced our MBS exposure on strength during the period, since their valuations have reached historically high levels, and we increased our allocation to asset-backed securities (ABS). ABS offer attractive yields within a strong technical market due to limited issuance.

At the end of June, 50% of the portfolio was allocated to corporate bonds and notes, 23% to MBS, 10% to ABS, and the remainder to U.S. government obligations, other securities, and cash reserves. Only 22% of the portfolio was invested in BBB securities (the lowest end of the investment-grade range), while 70% was rated A or higher. The balance was in cash reserves and BB and lower-rated bonds.

Outlook

High debt burdens and severe fiscal austerity measures in developed countries are likely to dim the outlook for global growth, and we expect these issues to weigh on investor sentiment at least over the near term. In the U.S., the potential for financial reform to affect banks’ credit ratings may also fuel volatility—although we believe such legislation ultimately will improve the stability of the banking system. At the same time, corporate fundamentals remain strong, and domestic economic data are somewhat encouraging, notwithstanding some recent mixed signals.

We accumulated somewhat higher cash positions in April and May, which put us in a good position to add riskier assets as we worked down our reserves. It is worth repeating that the short-term securities we purchase for your fund are less vulnerable to market volatility than long-term bonds. Consequently, we do not expect your fund to feel the impact of rising interest rates at some point down the road to the same extent as funds with longer maturities. Our analysts continue to work with our global economics and equity teams to uncover the most appealing investment opportunities available. We remain committed to our risk-conscious investment approach rooted in fundamentals, with a long-term perspective that has guided us through volatile market conditions in the past.

Thank you for investing with T. Rowe Price.

Respectfully submitted,

Edward A. Wiese

President and chairman of the portfolio’s Investment

Advisory Committee

July 16, 2010

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

| Risks of Fixed-Income Investing |

Bonds are subject to interest rate risk (the decline in bond prices that usually accompanies a rise in interest rates) and credit risk (the chance that any fund holding could have its credit rating downgraded or that a bond issuer will default by failing to make timely payments of interest or principal), potentially reducing the fund’s income level and share price. Mortgage-backed securities are subject to prepayment risk, particularly if falling rates lead to heavy refinancing activity, and extension risk, which is an increase in interest rates that causes a fund’s average maturity to lengthen unexpectedly due to a drop in mortgage prepayments. This could increase the fund’s sensitivity to rising interest rates and its potential for price declines.

| Glossary |

Barclays Capital 1-3 Year U.S. Government/Credit Index: A broad index that incorporates corporate, Treasury, and agency bonds with maturities of one to three years.

Duration: A measure of a bond fund’s sensitivity to changes in interest rates. For example, a fund with a duration of two years would fall about 2% in price in response to a one-percentage-point rise in interest rates, and vice versa.

Fed funds rate: The interest rate charged on overnight loans of reserves by one financial institution to another in the United States. The Federal Reserve sets a target federal funds rate to affect the direction of interest rates.

Lipper averages: The averages of available mutual fund performance returns for specified time periods in defined categories as tracked by Lipper Inc.

30-day SEC yield: A method of calculating a fund��s yield that assumes all portfolio securities are held until maturity. The Securities and Exchange Commission (SEC) requires all bond funds to calculate this yield. Yield will vary and is not guaranteed.

Yield curve: A graphic depiction of the differences in yields among fixed income securities with varying maturities.

Performance and Expenses

T. Rowe Price Limited-Term Bond Portfolio

| Growth of $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the portfolio over the past 10 fiscal year periods or since inception (for portfolios lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from portfolio returns as well as mutual fund averages and indexes.

Fund Expense Example

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Shares of the fund are currently offered only through certain insurance companies as an investment medium for both variable annuity contracts and variable life insurance policies. Please note that the fund has two classes of shares: the original share class and II Class. II Class shares are sold through financial intermediaries, which are compensated for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and actual expenses. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

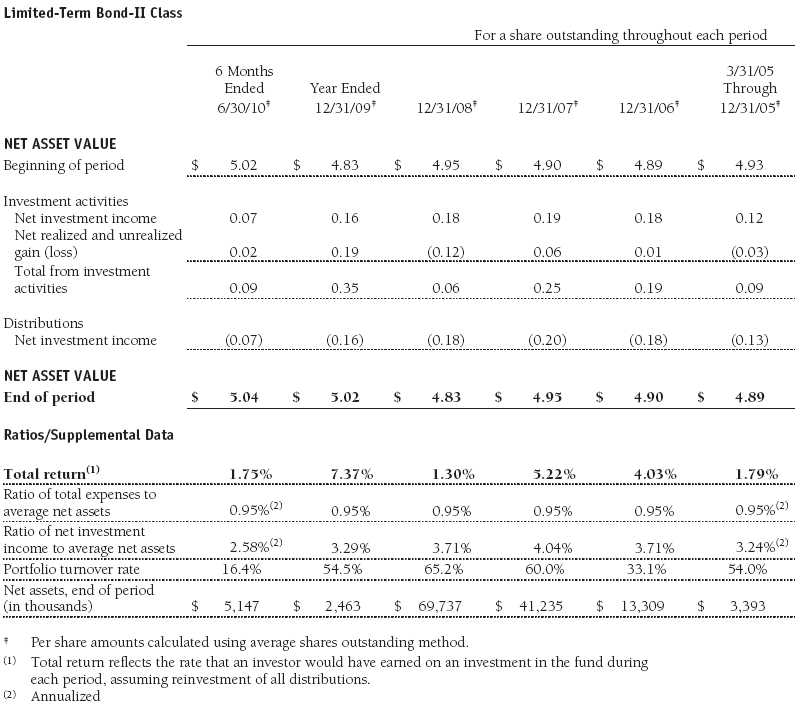

Financial Highlights

T. Rowe Price Limited-Term Bond Portfolio

(Unaudited)

The accompanying notes are an integral part of these financial statements.

Financial Highlights

T. Rowe Price Limited-Term Bond Portfolio

(Unaudited)

The accompanying notes are an integral part of these financial statements.

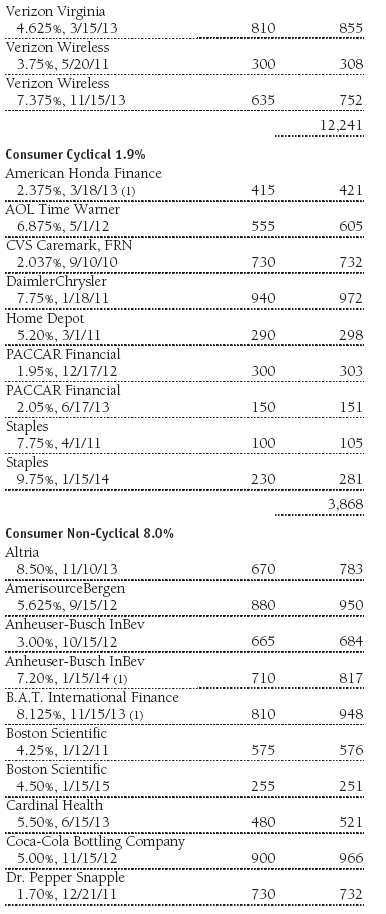

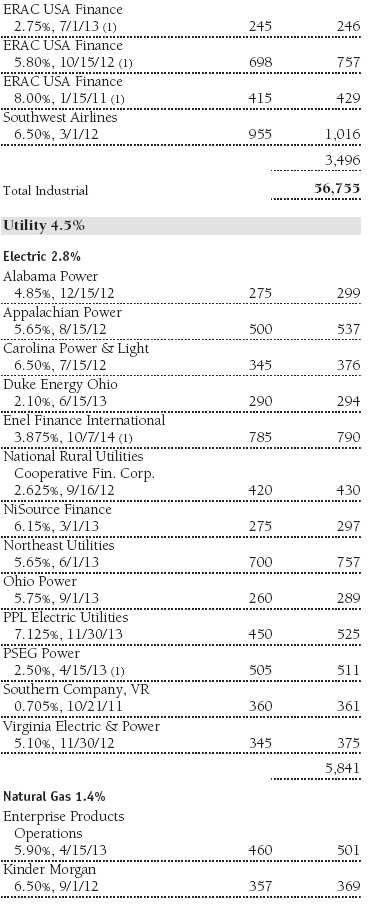

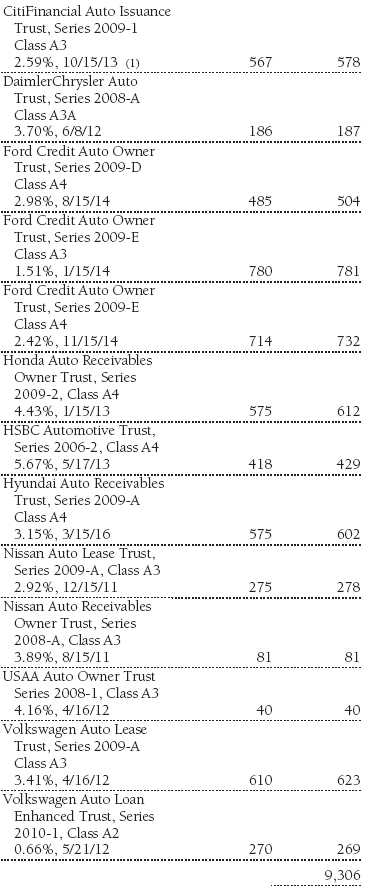

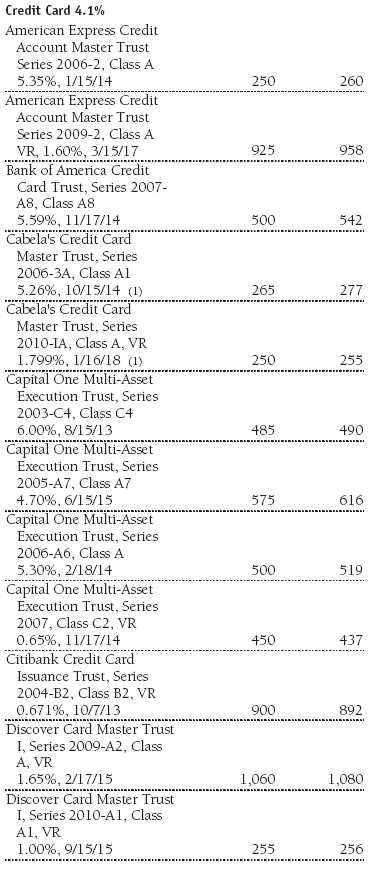

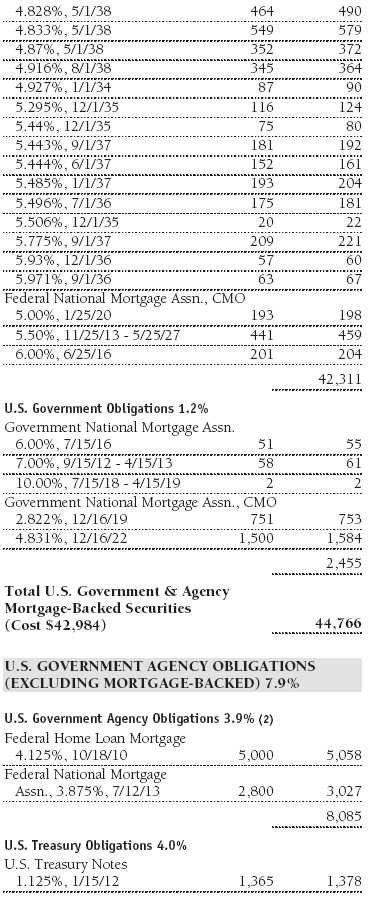

Portfolio of Investments‡

T. Rowe Price Limited-Term Bond Portfolio

June 30, 2010 (Unaudited)

The accompanying notes are an integral part of these financial statements.

Statement of Assets and Liabilities

T. Rowe Price Limited-Term Bond Portfolio

June 30, 2010 (Unaudited)

($000s, except shares and per share amounts)

The accompanying notes are an integral part of these financial statements.

Statement of Operations

T. Rowe Price Limited-Term Bond Portfolio

(Unaudited)

($000s)

The accompanying notes are an integral part of these financial statements.

Statement of Changes in Net Assets

T. Rowe Price Limited-Term Bond Portfolio

(Unaudited)

($000s)

The accompanying notes are an integral part of these financial statements.

Notes to Financial Statements

T. Rowe Price Limited-Term Bond Portfolio

June 30, 2010 (Unaudited)

T. Rowe Price Fixed Income Series, Inc. (the corporation), is registered under the Investment Company Act of 1940 (the 1940 Act). The Limited-Term Bond Portfolio (the fund) is a diversified, open-end management investment company and is one portfolio established by the corporation. The fund seeks a high level of income consistent with moderate fluctuations in principal value. Shares of the fund currently are offered only through certain insurance companies as an investment medium for both variable annuity contracts and variable life insurance policies. The fund has two classes of shares: the Limited-Term Bond Portfolio original share class (Limited-Term Bond Class), offered since May 13, 1994, and the Limited-Term Bond Portfolio–II (Limited-Term Bond-II Class), offered since March 31, 2005. Limited-Term Bond–II Class shares are sold through financial intermediaries, which it compensates for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to both classes; and, in all other respects, the same rights and obligations as the other class.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by fund management. Fund management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale of securities.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Paydown gains and losses are recorded as an adjustment to interest income. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Earnings on investments recognized as partnerships for federal income tax purposes reflect the tax character of such earnings. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid by each class annually. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Class Accounting Limited-Term Bond–II pays distribution, shareholder servicing, and/or certain administrative expenses in the form of Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets. Investment income and investment management and administrative expense are allocated to the classes based upon the relative daily net assets of each class’s settled shares; realized and unrealized gains and losses are allocated based upon the relative daily net assets of each class’s outstanding shares.

New Accounting Pronouncement On January 1, 2010, the fund adopted new accounting guidance that requires enhanced disclosures about fair value measurements in the financial statements. Adoption of this guidance had no impact on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s investments are reported at fair value as defined by GAAP. The fund determines the values of its assets and liabilities and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Debt securities are generally traded in the over-the-counter (OTC) market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation. Investments in private investment companies are valued at the entity’s net asset value (or equivalent) as of the valuation date. Forward currency exchange contracts are valued using the prevailing forward exchange rate.

Other investments, including restricted securities, and those financial instruments for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

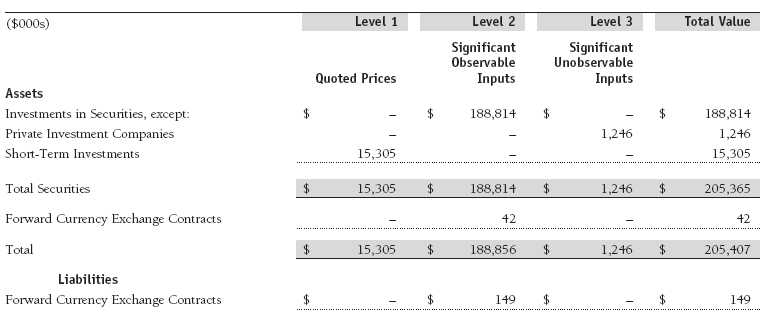

Valuation Inputs Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical financial instruments

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar financial instruments, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. The following table summarizes the fund’s financial instruments, based on the inputs used to determine their values on June 30, 2010:

Following is a reconciliation of the fund’s Level 3 holdings for the six months ended June 30, 2010. Gain (loss) reflects both realized and change in unrealized gain (loss) on Level 3 holdings during the period, if any, and is included on the accompanying Statement of Operations. The change in unrealized gain/loss on Level 3 instruments held at June 30, 2010, totaled $156,000 for the six months ended June 30, 2010.

NOTE 3 - DERIVATIVE INSTRUMENTS

During the six months ended June 30, 2010, the fund invested in derivative instruments. As defined by GAAP, a derivative is a financial instrument whose value is derived from an underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable; it requires little or no initial investment and permits or requires net settlement. The fund invests in derivatives only if the expected risks and rewards are consistent with its investment objectives, policies, and overall risk profile, as described in its prospectus and Statement of Additional Information. The fund may use derivatives for a variety of purposes, such as seeking to hedge against declines in principal value, increase yield, invest in an asset with greater efficiency and at a lower cost than is possible through direct investment, or to adjust portfolio duration and credit exposure. The risks associated with the use of derivatives are different from, and potentially much greater than, the risks associated with investing directly in the instruments on which the derivatives are based. Investments in derivatives can magnify returns positively or negatively; however, the fund at all times maintains sufficient cash reserves, liquid assets, or other SEC-permitted asset types to cover the settlement obligations under its open derivative contracts.

The fund values its derivatives at fair value, as described below and in Note 2, and recognizes changes in fair value currently in its results of operations. Accordingly, the fund does not follow hedge accounting, even for derivatives employed as economic hedges. The fund does not offset the fair value of derivative instruments and the right to reclaim or obligation to return collateral executed with the same counterparty under a master netting arrangement.

As of June 30, 2010, the fund held foreign exchange derivatives with a fair value of $42,000, included in unrealized gain on forward currency exchange contracts, and $149,000, included in unrealized loss on forward currency exchange contracts, on the accompanying Statement of Assets and Liabilities.

Additionally, during the six months ended June 30, 2010, the fund recognized $44,000 of realized gain on Foreign Currency Transactions and a $35,000 change in unrealized loss on Foreign Currency Transactions related to its investments in foreign exchange derivatives; such amounts are included on the accompanying Statement of Operations.

Forward Currency Exchange Contracts The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. It uses forward currency exchange contracts (forwards) primarily to protect its non-U.S. dollar-denominated securities from adverse currency movements relative to the U.S. dollar. A forward involves an obligation to purchase or sell a fixed amount of a specific currency on a future date at a price set at the time of the contract. Although certain forwards may be settled by exchanging only the net gain or loss on the contract, most forwards are settled with the exchange of the underlying currencies in accordance with the specified terms. Forwards are valued at the unrealized gain or loss on the contract, which reflects the net amount the fund either is entitled to receive or obligated to deliver, as measured by the difference between the forward exchange rates at the date of entry into the contract and the forward rates at the reporting date. Appreciated forwards are reflected as assets, and depreciated forwards are reflected as liabilities on the accompanying Statement of Assets and Liabilities. Risks related to the use of forwards include the possible failure of counterparties to meet the terms of the agreements; that anticipated currency movements will not occur, thereby reducing the fund’s total return; and the potential for losses in excess of the fund’s initial investment. During the six months ended June 30, 2010, the fund’s exposure to forwards, based on underlying notional amounts, was generally between 0% and 2% of net assets.

Counterparty Risk and Collateral The fund has entered into collateral agreements with certain counterparties to mitigate counterparty risk associated with over-the-counter (OTC) derivatives, including swaps and forward currency exchange contracts. Subject to certain minimum exposure requirements (which range from $100,000 to $500,000), collateral generally is determined based on the net aggregate unrealized gain or loss on all OTC derivative contracts with a particular counterparty. Collateral, both pledged by and for the benefit of the fund, is held in a segregated account by a third-party agent and can be in the form of cash or debt securities issued by the U.S. government or related agencies. Securities posted as collateral by the fund are so noted in the accompanying Portfolio of Investments and remain in the fund’s net assets. As of June 30, 2010, no collateral was pledged by either the fund or counterparties.

At any point in time, the fund’s risk of loss from counterparty credit risk on OTC derivatives is the aggregate unrealized gain on appreciated contracts in excess of any collateral pledged by the counterparty for the benefit of the fund. In accordance with standard derivatives agreements, counterparties to OTC derivatives may be able to terminate derivative contracts prior to maturity in the event the fund fails to maintain sufficient asset coverage; its net assets decline by stated percentages; or it otherwise fails to meet the terms of its agreements, which would cause the fund to accelerate payment of any net liability owed to the counterparty under the contract.

NOTE 4 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

T. Rowe Price Term Asset-Backed Opportunity Fund, L.L.C. During the six months ended June 30, 2010, the fund invested in the T. Rowe Price Term Asset-Backed Opportunity Fund, L.L.C. (private fund), a private investment company managed by Price Associates that participates in the Term Asset-Backed Securities Loan Facility (TALF) program created and administered by the Federal Reserve Bank of New York (FRBNY). The TALF program provides eligible borrowers with term loans secured by eligible asset-backed securities and/or commercial mortgage-backed securities, which are either owned by the borrower or purchased by the borrower and subsequently pledged as collateral for a TALF loan. TALF loans generally are nonrecourse in nature. The private fund is treated as a partnership for federal income tax purposes. It has a limited life extending five years from final termination of the TALF program, currently scheduled for June 30, 2010, with two possible one-year extensions. Invested capital generally will be returned to investors as underlying securities are liquidated and the TALF loans mature, with the balance paid at maturity of the private fund. Ownership interests in the private fund may not be redeemed, sold, or assigned. As of June 30, 2010, the fund had outstanding capital commitments in the amount of $741,000, which may be called at the discretion of the private fund’s manager.

Other Purchases and sales of portfolio securities other than short-term and U.S. government securities aggregated $37,309,000 and $20,030,000, respectively, for the six months ended June 30, 2010. Purchases and sales of U.S. government securities aggregated $6,143,000 and $9,642,000, respectively, for the six months ended June 30, 2010.

NOTE 5 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

In accordance with federal tax regulations, the fund recognized capital losses in the current period for tax purposes that had been recognized in the prior fiscal year for financial reporting purposes. Such deferrals relate to net capital losses realized between November 1, 2009 and June 30, 2010, and totaled $153,000. The fund intends to retain realized gains to the extent of available capital loss carryforwards. As of December 31, 2009, the fund had $286,000 of unused capital loss carryforwards, all expire in fiscal 2016.

At June 30, 2010, the cost of investments for federal income tax purposes was $199,168,000. Net unrealized gain aggregated $6,090,000 at period-end, of which $6,605,000 related to appreciated investments and $515,000 related to depreciated investments.

NOTE 6 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management and administrative agreement between the fund and the manager provides for an all-inclusive annual fee equal to 0.70% of the fund’s average daily net assets. The fee is computed daily and paid monthly. The agreement provides that investment management, shareholder servicing, transfer agency, accounting, custody services, and directors’ fees and expenses are provided to the fund, and interest, taxes, brokerage commissions, and extraordinary expenses are paid directly by the fund.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| Approval of Investment Management Agreement |

On March 9, 2010, the fund’s Board of Directors (Board) unanimously approved the continuation of the investment advisory contract (Contract) between the fund and its investment manager, T. Rowe Price Associates, Inc. (Adviser). The Board considered a variety of factors in connection with its review of the Contract, also taking into account information provided by the Adviser during the course of the year, as discussed below:

Services Provided by the Manager

The Board considered the nature, quality, and extent of the services provided to the fund by the Adviser. These services included, but were not limited to, management of the fund’s portfolio and a variety of related activities, as well as financial and administrative services, reporting, and communications. The Board also reviewed the background and experience of the Adviser’s senior management team and investment personnel involved in the management of the fund. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Adviser.

Investment Performance of the Fund

The Board reviewed the fund’s average annual total returns over the 1-, 3-, 5-, and 10-year periods, as well as the fund’s year-by-year returns, and compared these returns with a wide variety of previously agreed upon comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data. On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the severity of the market turmoil during 2008 and 2009, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Adviser under the Contract and other benefits that the Adviser (and its affiliates) may have realized from its relationship with the fund, including research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers. The Board considered that the Adviser may receive some benefit from its soft-dollar arrangements pursuant to which it receives research from broker-dealers that execute the applicable fund’s portfolio transactions. The Board also received information on the estimated costs incurred and profits realized by the Adviser and its affiliates from advising T. Rowe Price mutual funds, as well as estimates of the gross profits realized from managing the fund in particular. The Board concluded that the Adviser’s profits were reasonable in light of the services provided to the fund. The Board also considered whether the fund or other funds benefit under the fee levels set forth in the Contract from any economies of scale realized by the Adviser. The Board noted that, under the Contract, the fund pays the Adviser a single fee based on the fund’s assets and that the Adviser, in turn, pays all expenses of the fund, with certain exceptions. The Board concluded that, based on the profitability data it reviewed and consistent with this single fee structure, the Contract provided for a reasonable sharing of any benefits from economies of scale with the fund.

Fees

The Board reviewed the fund’s single-fee structure (for the Investor Class and II Class) and compared it with fees and expenses of other comparable funds based on information and data supplied by Lipper. The information provided to the Board indicated that the fund’s management fee rate and total expense ratio (for both classes) were above the median for comparable funds. (For these purposes, the Board assumed the fund’s management fee rate was equal to the single fee less the fund’s operating expenses.) The Board also reviewed the fee schedules for institutional accounts of the Adviser and its affiliates with smaller mandates. Management informed the Board that the Adviser’s responsibilities for institutional accounts are more limited than its responsibilities for the fund and other T. Rowe Price mutual funds that it or its affiliates advise and that the Adviser performs significant additional services and assumes greater risk for the fund and other T. Rowe Price mutual funds that it advises than it does for institutional accounts. On the basis of the information provided, the Board concluded that the fees paid by the fund under the Contract were reasonable.

Approval of the Contract

As noted, the Board approved the continuation of the Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board was assisted by the advice of independent legal counsel and concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund to approve the continuation of the Contract, including the fees to be charged for services thereunder.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES | |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment | |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the | |

| undersigned, thereunto duly authorized. | |

| T. Rowe Price Fixed Income Series, Inc. | |

| By | /s/ Edward C. Bernard |

| Edward C. Bernard | |

| Principal Executive Officer | |

| Date | August 17, 2010 |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment | |

| Company Act of 1940, this report has been signed below by the following persons on behalf of | |

| the registrant and in the capacities and on the dates indicated. | |

| By | /s/ Edward C. Bernard |

| Edward C. Bernard | |

| Principal Executive Officer | |

| Date | August 17, 2010 |

| By | /s/ Gregory K. Hinkle |

| Gregory K. Hinkle | |

| Principal Financial Officer | |

| Date | August 17, 2010 |