UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07153

| T. Rowe Price Fixed Income Series, Inc. |

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2020

|

| Government Money Portfolio | June 30, 2020 |

| T. ROWE PRICE GOVERNMENT MONEY PORTFOLIO |

HIGHLIGHTS

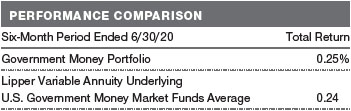

| ■ | The Government Money Portfolio returned 0.25% in the six-month period ended June 30, 2020, versus 0.24% for the Lipper Variable Annuity Underlying U.S. Government Money Market Funds Average. |

| ■ | The Federal Reserve (Fed) decreased short-term interest rates twice in March: by 50 basis points on March 3 and by an additional 100 basis points on March 15. |

| ■ | At the end of June, the portfolio’s weighted average maturity (WAM) was longer than that of the average competitor. Because of the Fed’s deep rate cuts in March, we extended the WAM toward the end of the reporting period to lock in higher rates before they declined. |

| ■ | We expect the Fed to be on hold for the foreseeable future, as the impact of the coronavirus on the economic outlook is a strong headwind. |

Log in to your account at troweprice.com for more information.

*Certain mutual fund accounts that are assessed an annual account service fee can also save money by switching to e-delivery.

CIO Market Commentary

Dear Investor

Financial markets recorded widely mixed results during the first half of 2020 as the spread of the coronavirus disrupted global economies. Although stocks and bonds experienced extraordinary volatility, historic levels of fiscal and monetary stimulus helped mitigate the losses.

Market sentiment was positive as we entered the year, and the S&P 500 Index advanced to a record high on February 19. However, stocks began falling as the coronavirus spread in Italy and other countries outside China. The major indexes continued their slide as cases mounted in the U.S. and New York City became the epicenter of the pandemic. Governments throughout the world issued stay-at-home orders to contain the virus, and some sectors, such as travel, restaurants, and shopping malls, nearly came to a halt.

According to the National Bureau of Economic Research, a recession officially began in February, ending the longest expansion in U.S. history. Over 22 million Americans lost their jobs in March and April, and many measures of economic activity, including retail sales and industrial production, experienced record-setting declines. By March 23, the S&P 500 Index had fallen by about a third from the start of the year.

In response to the rapid economic contraction, global central banks took bold accommodative steps, and many governments around the world passed emergency spending packages. The Federal Reserve cut its short-term lending rate to near zero and began massive purchases of government and corporate bonds to stimulate the economy and supply liquidity in the fixed income market.

The federal government also provided trillions of dollars in fiscal help in the form of direct payments to many Americans, expanded unemployment insurance, and subsidies to sectors such as transportation and health care that had been directly impacted by the pandemic. As lockdowns eased late in the period, there were signs of economic recovery, especially in stronger-than-expected payroll data, but surges in new virus cases in some states remained a concern.

Boosted by the stimulus and indications that the economy was mending faster than many expected, nearly all sectors recouped some of their losses by the end of June, and some segments were back in positive territory. For the six-month period, the tech-heavy Nasdaq Composite Index reached record highs and easily outperformed other benchmarks as the pandemic appeared to accelerate trends in retail, social media, and content streaming that benefited the large technology platforms. Large- and mid-cap growth stocks also produced positive returns and outperformed small-caps and value shares, which lost ground.

The S&P 500 Index finished the period with modest losses overall. Within the benchmark, tech and consumer discretionary stocks rallied, but energy shares were down more than 35% (including dividends) amid tumbling oil prices, and the financials sector struggled in a low-yield environment. Non-U.S. equity markets were generally negative and lagged the U.S. benchmarks.

In the fixed income universe, Treasuries were the top performers as yields dropped to record lows during the period, and other U.S. investment-grade bonds were also generally positive. High yield and emerging markets bonds were particularly hard hit during the market sell-off in March, but the sectors staged a strong recovery as investors sought out higher-yielding securities. Emerging markets debt denominated in U.S. dollars outperformed local currency issues, as weakness in certain currencies weighed on local bond performance in U.S. dollar terms.

As we enter the second half of the year, we expect markets to remain volatile. The scale of the stimulus and the potential for medical breakthroughs create the potential for stocks to move higher, but much depends on the course of the virus. Rising tensions between the U.S. and China, social unrest, and the U.S. elections in November could also drive market performance.

Our investment teams will be carefully monitoring these developments, and I believe that our disciplined fundamental research and strategic investing approach will continue to serve our shareholders well in this uncertain environment.

Thank you for your continued confidence in T. Rowe Price.

Sincerely,

Robert Sharps

Group Chief Investment Officer

Management’s Discussion of Fund Performance

INVESTMENT OBJECTIVE

The fund’s goals are preservation of capital, liquidity, and, consistent with these, the highest possible current income.

FUND COMMENTARY

How did the portfolio perform in the past six months?

The Government Money Portfolio returned 0.25% in the six-month period ended June 30, 2020, versus 0.24% for the Lipper Variable Annuity Underlying U.S. Government Money Market Funds Average. (Past performance cannot guarantee future results.)

What factors influenced the portfolio’s performance?

In the early part of the reporting period, the market was debating whether the Fed needed to cut rates further—following three rate cuts in the second half of 2019—to continue the economic expansion. As COVID-19, the disease caused by the coronavirus, emerged as a global risk, institutional investors moved assets from prime money market funds into government money funds. Assets of government money funds increased, leading to higher prices in the government debt market. Institutional prime money funds, on the other hand, saw heavy outflows that put pressure on their government-regulated liquidity buckets.

With the economy decelerating rapidly due to the pandemic and related lockdowns, the Fed moved decisively to do its part in aiding a recovery. Policymakers cut rates by 50 basis points on March 3 and then by another 100 basis points at an unusual Sunday meeting on March 15. These rate cuts brought the fed funds target rate back to the 0.00% to 0.25% range, where it had been from late 2008 until late 2015.

Facing distress in the money market, the Fed also put into place several programs to allay liquidity concerns and placate the market. Specifically, they are the Commercial Paper Funding Facility for issuers to obtain direct funding from the central bank; the Primary Dealer Credit Facility for dealers to finance their inventory through the Fed; and the Money Market Mutual Fund Liquidity Facility (MMLF), which provided a vehicle for prime money funds to sell securities to the Fed. The MMLF was the most appropriate and beneficial program to resolve the impasse caused by money funds hoarding cash to maintain liquidity. It gave the market a buyer when the broker-dealers were unwilling to buy securities.

The yield on the 90-day Treasury bill plunged from 1.55% to 0.16% during the past six months, while the six-month Treasury bill yield dropped from 1.60% to 0.18%. Other short-term interest rates, such as the three-month London interbank offered rate (LIBOR), initially declined to a lesser extent, due in part to some lingering stresses in certain funding markets. However, money market yields eventually fell to very low levels as Fed actions increased liquidity and promoted the normal functioning of financial markets.

While government money funds’ assets increased, the supply of Treasury bills also increased due to the Treasury Department’s needs to finance various new support programs. Therefore, money market rates moved lower based on the Fed’s rate cuts and not on a supply/demand imbalance.

How is the portfolio positioned?

At the end of June, the portfolio’s weighted average maturity (WAM) was longer than that of its average competitor. Because of the Fed’s deep rate cuts in March, we extended the WAM toward the end of the reporting period to lock in higher rates before they declined.

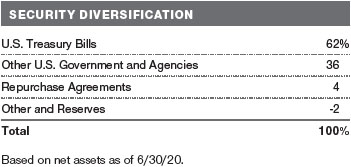

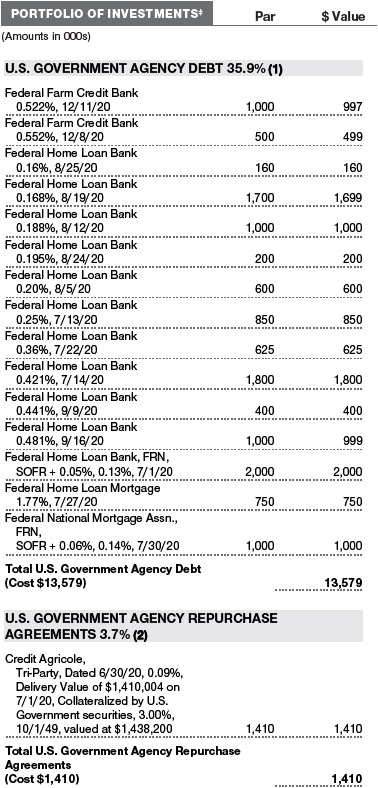

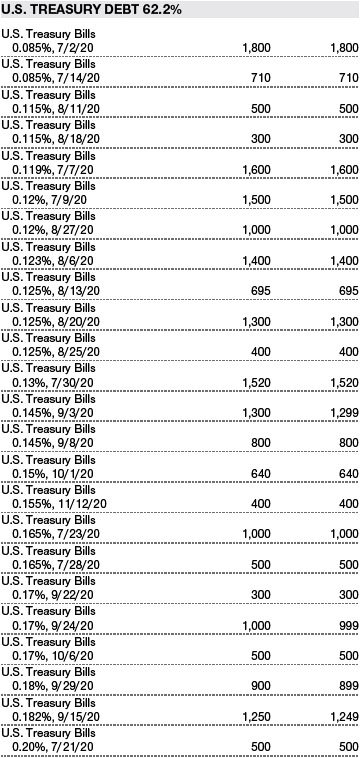

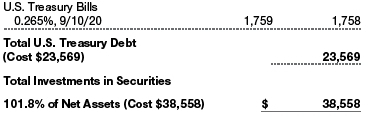

As a government money fund, the portfolio is required to invest almost exclusively in Treasury bills and other U.S. government securities, as well as repurchase agreements fully collateralized by government securities. Of course, the fund is not subject to the liquidity fees and redemption restrictions (also known as gates) that may be applied to nongovernment money funds during times of severe redemption activity. At the end of June, more than 60% of the portfolio’s assets were invested in Treasury bills, while other U.S. government and agency securities accounted for slightly more than one-third of the portfolio. Repurchase agreements represented the rest.

What is portfolio management’s outlook?

The Federal Reserve’s projections, and most market participants’ expectations, including ours, are for the central bank to be on hold for the foreseeable future. The true impacts of the coronavirus on employment and growth have yet to be seen, and forecasts are dire. To balance the longer average maturities, the fund maintains a high degree of liquidity. As always, our focus remains on principal stability and on investments with the highest credit quality.

The views expressed reflect the opinions of T. Rowe Price as of the date of this report and are subject to change based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

RISKS OF INVESTING IN THE GOVERNMENT MONEY PORTFOLIO

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

The potential for realizing a loss of principal could derive from:

Credit risks. An issuer of a debt instrument could suffer an adverse change in financial condition that results in a payment default, rating downgrade, or inability to meet a financial obligation. The credit quality of the securities held by the portfolio may change rapidly in certain market environments, which could result in significant net asset value deterioration and the inability to maintain a $1.00 share price.

Interest rate risks. A decline in interest rates may lower the portfolio’s yield, or a rise in the overall level of interest rates may cause a decline in the prices of fixed income securities held by the portfolio. The portfolio’s yield will vary; it is not fixed for a specific period like the yield on a bank certificate of deposit. This is a disadvantage when interest rates are falling because the portfolio would have to reinvest at lower interest rates. Increases in demand for government securities may cause the yield on those securities to fall or even drop to a negative rate.

Repurchase agreement risks. A counterparty to a repurchase agreement may become insolvent or fail to repurchase securities from the portfolio as required, which could increase its costs or prevent it from immediately accessing its collateral.

BENCHMARK INFORMATION

Note: Lipper, a Thomson Reuters Company, is the source for all Lipper content reflected in these materials. Copyright 2020 © Refinitiv. All rights reserved. Any copying, republication or redistribution of Lipper content is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

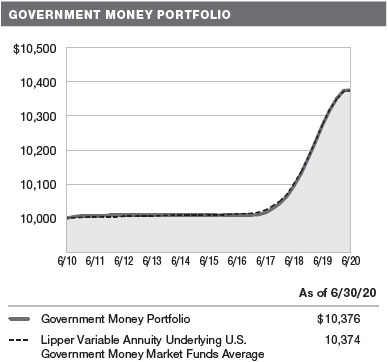

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the portfolio over the past 10 fiscal year periods or since inception (for portfolios lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from portfolio returns as well as mutual fund averages and indexes.

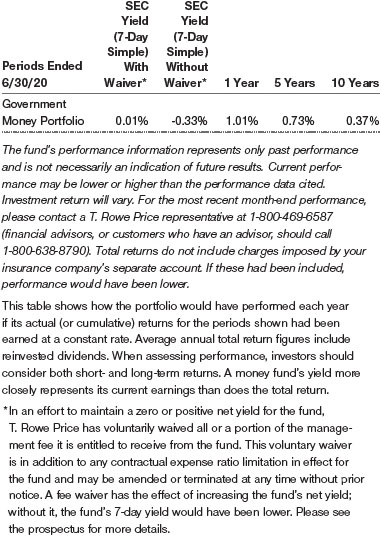

AVERAGE ANNUAL COMPOUND TOTAL RETURN

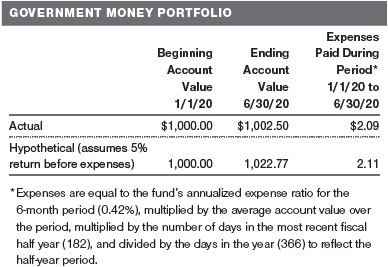

FUND EXPENSE EXAMPLE

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and actual expenses. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

Unaudited

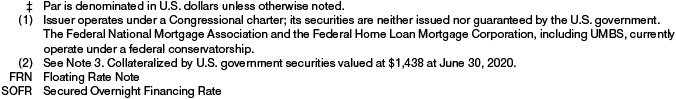

The accompanying notes are an integral part of these financial statements.

June 30, 2020 (Unaudited)

The accompanying notes are an integral part of these financial statements.

June 30, 2020 (Unaudited)

The accompanying notes are an integral part of these financial statements.

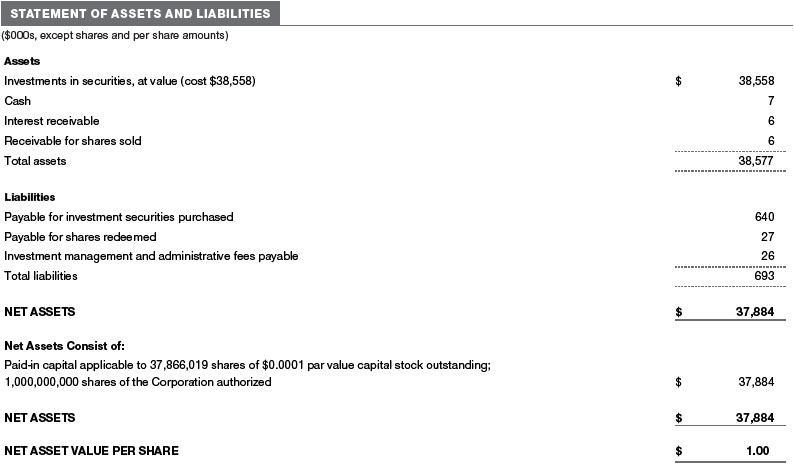

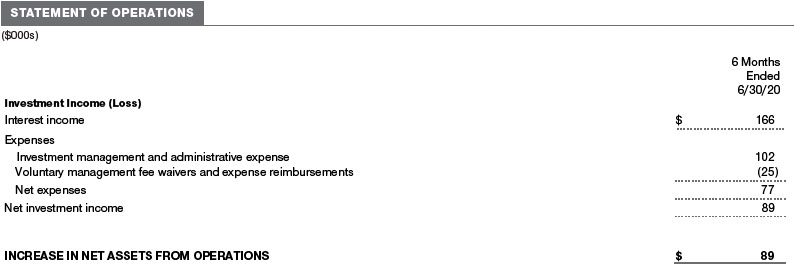

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

T. Rowe Price Fixed Income Series, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act). The Government Money Portfolio (the fund) is a diversified, open-end management investment company established by the corporation. The fund seeks preservation of capital, liquidity, and, consistent with these, the highest possible current income. Shares of the fund are currently offered only to insurance company separate accounts established for the purpose of funding variable annuity contracts and variable life insurance policies. The fund intends to operate as a government money market fund and has no intention to voluntarily impose liquidity fees on redemptions or temporarily suspend redemptions.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Investment transactions are accounted for on the trade date basis. Income and expenses are recorded on the accrual basis. Realized gains and losses are reported on the identified cost basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Income tax-related interest and penalties, if incurred, are recorded as income tax expense. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared daily and paid monthly. A capital gain distribution may also be declared and paid by the fund annually.

New Accounting Guidance In March 2020, the FASB issued Accounting Standards Update (ASU), ASU 2020-04, Reference Rate Reform (Topic 848) – Facilitation of the Effects of Reference Rate Reform on Financial Reporting, which provides optional, temporary relief with respect to the financial reporting of contracts subject to certain types of modifications due to the planned discontinuation of the London Interbank Offered Rate (LIBOR) and other interbank-offered based reference rates as of the end of 2021. The guidance is effective for certain reference rate-related contract modifications that occur during the period March 12, 2020 through December 31, 2022. Management is currently evaluating the impact, if any, of the ASU on the fund’s financial statements.

Indemnification In the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’s maximum exposure under these arrangements is unknown; however, the risk of material loss is currently considered to be remote.

NOTE 2 - VALUATION

The fund’s financial instruments are valued and its net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC. The fund’s financial instruments are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value. The T. Rowe Price Valuation Committee (the Valuation Committee) is an internal committee that has been delegated certain responsibilities by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures, including the comparison of amortized cost to market-based value, and approves all fair value determinations.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values. For example, securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

In accordance with Rule 2a-7 under the 1940 Act, the fund values its securities at amortized cost, which approximates fair value. Securities for which amortized cost is deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. On June 30, 2020, all of the fund’s financial instruments were classified as Level 2 in the fair value hierarchy.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Repurchase Agreements The fund engages in repurchase agreements, pursuant to which it pays cash to and receives securities from a counterparty that agrees to “repurchase” the securities at a specified time, typically within seven business days, for a specified price. The fund enters into such agreements with well-established securities dealers or banks that are members of the Federal Reserve System and are on Price Associates’ approved list. All repurchase agreements are fully collateralized by U.S. government or related agency securities, which are held by the custodian designated by the agreement. Collateral is evaluated daily to ensure that its market value exceeds the delivery value of the repurchase agreements at maturity. Although risk is mitigated by the collateral, the fund could experience a delay in recovering its value and a possible loss of income or value if the counterparty fails to perform in accordance with the terms of the agreement.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

At June 30, 2020, the cost of investments for federal income tax purposes was $38,558,000.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management and administrative agreement between the fund and Price Associates provides for an all-inclusive annual fee equal to 0.55% of the fund’s average daily net assets. The fee is computed daily and paid monthly. The all-inclusive fee covers investment management services and ordinary, recurring operating expenses but does not cover interest expense; expenses related to borrowing, taxes, and brokerage; or nonrecurring extraordinary expenses.

Price Associates may voluntarily waive all or a portion of its management fee and reimburse operating expenses to the extent necessary for the fund to maintain a zero or positive net yield (voluntary waiver). Any amounts waived/paid by Price Associates under this voluntary agreement are not subject to repayment by the fund. Price Associates may amend or terminate this voluntary arrangement at any time without prior notice. For the six months ended June 30, 2020, expenses waived/paid totaled $25,000.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. During the six months ended June 30, 2020, the fund had no purchases or sales cross trades with other funds or accounts advised by Price Associates.

NOTE 6 - OTHER MATTERS

Unpredictable events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases, and similar public health threats may significantly affect the economy and the markets and issuers in which a fund invests. Certain events may cause instability across global markets, including reduced liquidity and disruptions in trading markets, while some events may affect certain geographic regions, countries, sectors, and industries more significantly than others, and exacerbate other pre-existing political, social, and economic risks.

These types of events may also cause widespread fear and uncertainty, and result in, among other things: quarantines and travel restrictions, including border closings; disruptions to business operations and supply chains; exchange trading suspensions and closures, and overall reduced liquidity of securities, derivatives, and commodities trading markets; reductions in consumer demand and economic output; and significant challenges in healthcare service preparation and delivery. The funds could be negatively impacted if the value of a portfolio holding were harmed by such political or economic conditions or events. In addition, the operations of the funds, their investment advisers, and the funds’ service providers may be significantly impacted, or even temporarily halted, as a result of extensive employee illnesses or unavailability, government quarantine measures, and restrictions on travel or meetings and other factors related to public emergencies. Recently, a novel strain of coronavirus (COVID-19) has resulted in disruptions to global business activity and caused significant volatility and declines in global financial markets.

Governmental and quasi-governmental authorities and regulators have in the past responded to major economic disruptions with a variety of significant fiscal and monetary policy changes, including but not limited to, direct capital infusions into companies, new monetary programs, and dramatically lower interest rates. An unexpected or quick reversal of these policies, or the ineffectiveness of these policies, could negatively impact overall investor sentiment and further increase volatility in securities markets.

INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www.troweprice.com/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

Effective for reporting periods on or after March 1, 2019, a fund, except a money market fund, files a complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. Prior to March 1, 2019, a fund, including a money market fund, filed a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A money market fund files detailed month-end portfolio holdings information on Form N-MFP with the SEC each month and posts a complete schedule of portfolio holdings on its website (troweprice.com) as of each month-end for the previous six months. A fund’s Forms N-PORT, N-MFP, and N-Q are available electronically on the SEC’s website (sec.gov).

APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT

Each year, the fund’s Board of Directors (Board) considers the continuation of the investment management agreement (Advisory Contract) between the fund and its investment advisor, T. Rowe Price Associates, Inc. (Advisor), on behalf of the fund. In that regard, at a meeting held on March 9–10, 2020 (Meeting), the Board, including all of the fund’s independent directors, approved the continuation of the fund’s Advisory Contract. At the Meeting, the Board considered the factors and reached the conclusions described below relating to the selection of the Advisor and the approval of the Advisory Contract. The independent directors were assisted in their evaluation of the Advisory Contract by independent legal counsel from whom they received separate legal advice and with whom they met separately.

In providing information to the Board, the Advisor was guided by a detailed set of requests for information submitted by independent legal counsel on behalf of the independent directors. In considering and approving the Advisory Contract, the Board considered the information it believed was relevant, including, but not limited to, the information discussed below. The Board considered not only the specific information presented in connection with the Meeting but also the knowledge gained over time through interaction with the Advisor about various topics. The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and considers factors that are relevant to its annual consideration of the renewal of the T. Rowe Price funds’ advisory contracts, including performance and the services and support provided to the funds and their shareholders.

Services Provided by the Advisor

The Board considered the nature, quality, and extent of the services provided to the fund by the Advisor. These services included, but were not limited to, directing the fund’s investments in accordance with its investment program and the overall management of the fund’s portfolio, as well as a variety of related activities such as financial, investment operations, and administrative services; compliance; maintaining the fund’s records and registrations; and shareholder communications. The Board also reviewed the background and experience of the Advisor’s senior management team and investment personnel involved in the management of the fund, as well as the Advisor’s compliance record. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Advisor.

Investment Performance of the Fund

The Board took into account discussions with the Advisor and reports that it receives throughout the year relating to fund performance. In connection with the Meeting, the Board reviewed the fund’s net annualized total returns for the 1-, 2-, 3-, 4-, 5-, and 10-year periods as of September 30, 2019, and compared these returns with the performance of a peer group of funds with similar investment programs and a wide variety of other previously agreed-upon comparable performance measures and market data, including those supplied by Broadridge, which is an independent provider of mutual fund data.

On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the relative market conditions during certain of the performance periods, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Advisor under the Advisory Contract and other benefits that the Advisor (and its affiliates) may have realized from its relationship with the fund, including any research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers. The Board considered that the Advisor may have received some benefit from soft-dollar arrangements pursuant to which research is received from broker-dealers that execute the fund’s portfolio transactions. However, the Board also considered that, effective January 2020, the Advisor began bearing the cost of research services for all client accounts that it advises, including the T. Rowe Price funds. The Board received information on the estimated costs incurred and profits realized by the Advisor from managing the T. Rowe Price funds. While the Board did not review information regarding profits realized from managing the fund in particular because the fund had either not achieved sufficient portfolio asset size or not recognized sufficient revenues to produce meaningful profit margin percentages, the Board concluded that the Advisor’s profits were reasonable in light of the services provided to the T. Rowe Price funds.

The Board also considered whether the fund benefits under the fee levels set forth in the Advisory Contract from any economies of scale realized by the Advisor. Under the Advisory Contract, the fund pays the Advisor a single fee, or all-inclusive management fee, which is based on the fund’s average daily net assets. The all-inclusive management fee includes investment management services and provides for the Advisor to pay all of the fund’s ordinary, recurring operating expenses except for interest, taxes, portfolio transaction fees, and any nonrecurring extraordinary expenses that may arise. The Advisor has generally implemented an all-inclusive management fee structure in situations where a fixed total expense ratio is useful for purposes of providing certainty of fees and expenses for the investors in these funds, and has historically sought to set the initial all-inclusive fee rate at levels below the expense ratios of comparable funds to take into account the potential future economies of scale. Because the fund serves as an underlying option to variable annuity products, the all-inclusive fee structure is utilized to create certainty for the annuity providers’ overall pricing decisions and disclosures. Assets of the fund are included in the calculation of the group fee rate, which serves as a component of the management fee for many T. Rowe Price funds and declines at certain asset levels based on the combined average net assets of most of the T. Rowe Price funds (including the fund). Although the fund does not have a group fee component to its management fee, its assets are included in the calculation because the primary investment resources utilized to manage the fund are shared with other actively managed funds. The Board concluded that, based on the profitability data it reviewed and consistent with this all-inclusive management fee structure, the advisory fee structure for the fund continued to be appropriate.

Fees and Expenses

The Board was provided with information regarding industry trends in management fees and expenses. Among other things, the Board reviewed data for peer groups that were compiled by Broadridge, which compared: (i) contractual management fees, total expenses, actual management fees, and nonmanagement expenses of the fund with a group of competitor funds selected by Broadridge (Expense Group) and (ii) total expenses, actual management fees, and nonmanagement expenses of the fund with a broader set of funds within the Lipper investment classification (Expense Universe). The Board considered the fund’s contractual management fee rate, actual management fee rate, and total expenses (all of which generally reflect the all-inclusive management fee rate and do not deduct the operating expenses paid by the Advisor as part of the overall management fee) in comparison with the information for the Broadridge peer groups. Broadridge generally constructed the peer groups by seeking the most comparable funds based on similar investment classifications and objectives, expense structure, asset size, and operating components and attributes and ranked funds into quintiles, with the first quintile representing the funds with the lowest relative expenses and the fifth quintile representing the funds with the highest relative expenses. The information provided to the Board indicated that the fund’s contractual management fee ranked in the fifth quintile (Expense Group), the fund’s actual management fee rate ranked in the fifth quintile (Expense Group and Expense Universe), and the fund’s total expenses ranked in the fourth quintile (Expense Group) and fifth quintile (Expense Universe).

The Board requested additional information from management with respect to the fund’s relative management fees and total expenses ranking in the fourth and fifth quintiles and reviewed and considered the information provided relating to the fund, other funds in the peer groups, and other factors that the Board determined to be relevant.

The Board also reviewed the fee schedules for other investment portfolios with similar mandates that are advised or subadvised by the Advisor and its affiliates, including separately managed accounts for institutional and individual investors; subadvised funds; and other sponsored investment portfolios, including collective investment trusts and pooled vehicles organized and offered to investors outside the United States. Management provided the Board with information about the Advisor’s responsibilities and services provided to subadvisory and other institutional account clients, including information about how the requirements and economics of the institutional business are fundamentally different from those of the mutual fund business. The Board considered information showing that the Advisor’s mutual fund business is generally more complex from a business and compliance perspective than its institutional account business and considered various relevant factors, such as the broader scope of operations and oversight, more extensive shareholder communication infrastructure, greater asset flows, heightened business risks, and differences in applicable laws and regulations associated with the Advisor’s proprietary mutual fund business. In assessing the reasonableness of the fund’s management fee rate, the Board considered the differences in the nature of the services required for the Advisor to manage its mutual fund business versus managing a discrete pool of assets as a subadvisor to another institution’s mutual fund or for an institutional account and that the Advisor generally performs significant additional services and assumes greater risk in managing the fund and other T. Rowe Price funds than it does for institutional account clients.

On the basis of the information provided and the factors considered, the Board concluded that the fees paid by the fund under the Advisory Contract are reasonable.

Approval of the Advisory Contract

As noted, the Board approved the continuation of the Advisory Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund and its shareholders for the Board to approve the continuation of the Advisory Contract (including the fees to be charged for services thereunder).

LIQUIDITY RISK MANAGEMENT PROGRAM

In accordance with Rule 22e-4 (Liquidity Rule) under the Investment Company Act of 1940, as amended, the fund has established a liquidity risk management program (Liquidity Program) reasonably designed to assess and manage the fund’s liquidity risk, which generally represents the risk that the fund would not be able to meet redemption requests without significant dilution of remaining investors’ interests in the fund. The fund’s Board of Directors (Board) has appointed the fund’s investment advisor, T. Rowe Price Associates, Inc. (Price Associates), as the administrator of the Liquidity Program. As administrator, Price Associates is responsible for overseeing the day-to-day operations of the Liquidity Program and, among other things, is responsible for assessing, managing, and reviewing with the Board at least annually the liquidity risk of each T. Rowe Price fund. Price Associates has delegated oversight of the Liquidity Program to a Liquidity Risk Committee (LRC), which is a cross-functional committee composed of personnel from multiple departments within Price Associates.

The Liquidity Program’s principal objectives include supporting the T. Rowe Price funds’ compliance with limits on investments in illiquid assets and mitigating the risk that the fund will be unable to timely meet its redemption obligations. The Liquidity Program also includes a number of elements that support the management and assessment of liquidity risk, including an annual assessment of factors that influence the fund’s liquidity and the periodic classification and reclassification of a fund’s investments into categories that reflect the LRC’s assessment of their relative liquidity under current market conditions. Under the Liquidity Program, every investment held by the fund is classified at least monthly into one of four liquidity categories based on estimations of the investment’s ability to be sold during designated time frames in current market conditions without significantly changing the investment’s market value.

As required by the Liquidity Rule, at a meeting held on May 4, 2020, the Board was presented with an annual assessment prepared by the LRC, on behalf of Price Associates, that addressed the operation of the Liquidity Program and assessed its adequacy and effectiveness of implementation, including any material changes to the Liquidity Program and the determination of each fund’s Highly Liquid Investment Minimum (HLIM). The annual assessment included consideration of the following factors, as applicable: the fund’s investment strategy and liquidity of portfolio investments during normal and reasonably foreseeable stressed conditions, including whether the investment strategy is appropriate for an open-end fund, the extent to which the strategy involves a relatively concentrated portfolio or large positions in particular issuers, and the use of borrowings for investment purposes and derivatives; short-term and long-term cash flow projections covering both normal and reasonably foreseeable stressed conditions; and holdings of cash and cash equivalents, as well as available borrowing arrangements.

For the fund and other T. Rowe Price funds, the annual assessment incorporated a report related to a fund’s holdings, shareholder and portfolio concentration, any borrowings during the period, cash flow projections, and other relevant data for the period of June 1, 2019, through March 31, 2020. The report described the methodology for classifying a fund’s investments (including derivative transactions) into one of four liquidity categories, as well as the percentage of a fund’s investments assigned to each category. It also explained the methodology for establishing a fund’s HLIM and noted that the LRC reviews the HLIM assigned to each fund no less frequently than annually.

Certain provisions of the Liquidity Program initially became effective on December 1, 2018, and the full Liquidity Program was formally approved by the Board in April 2019. During the period covered by the annual assessment, the LRC has concluded, and reported to the Board, that the Liquidity Program since its implementation has operated adequately and effectively and is reasonably designed to assess and manage the fund’s liquidity risk.

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

There has been no change to the procedures by which shareholders may recommend nominees to the registrant’s board of directors.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Fixed Income Series, Inc.

| By | /s/ David Oestreicher | |||||

| David Oestreicher | ||||||

| Principal Executive Officer | ||||||

| Date | August 18, 2020 | |||||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ David Oestreicher | |||||

| David Oestreicher | ||||||

| Principal Executive Officer | ||||||

| Date | August 18, 2020 | |||||

| By | /s/ Alan S. Dupski | |||||

| Alan S. Dupski | ||||||

| Principal Financial Officer | ||||||

| Date | August 18, 2020 | |||||