QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

ALTERNATIVE RESOURCES CORPORATION

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

ALTERNATIVE RESOURCES CORPORATION

600 Hart Road

Suite 300

Barrington, Illinois 60010

(847) 381-6701

Notice of Annual Meeting of Stockholders

June 13, 2002

To the Stockholders of

ALTERNATIVE RESOURCES CORPORATION:

The Annual Meeting of Stockholders of Alternative Resources Corporation, a Delaware corporation (the "Company"), will be held at the Company's corporate headquarters at 600 Hart Road, Suite 300, Barrington, IL 60010 on Thursday, June 13, 2002, at 10:00 A.M., local time, for the following purposes:

- 1.

- To elect two Class I directors, three Class II directors and one Class III director.

- 2.

- To consider and transact such other business as may properly come before the Annual Meeting or any adjournments thereof.

The Board of Directors has fixed the close of business on April 18, 2002, as the record date for determining the stockholders entitled to notice of and to vote at the Annual Meeting.

|

|

By Order of the Board of Directors |

|

|

|

|

|

Steven Purcell

Senior Vice President, Chief Financial Officer,

Secretary and Treasurer |

May 13, 2002

All stockholders are urged to attend the meeting in person or by proxy. Whether or not you plan to attend the meeting, please complete, sign and date the enclosed proxy card and return it promptly in the enclosed envelope provided, which requires no postage for mailing in the United States. A prompt response is helpful, and your cooperation will be appreciated. Your proxy can be withdrawn at any time before it is voted.

ALTERNATIVE RESOURCES CORPORATION

600 Hart Road

Suite 300

Barrington, Illinois 60010

Proxy Statement

Annual Meeting of Stockholders to be Held June 13, 2002

This Proxy Statement is being mailed to stockholders on or about May 13, 2002 and is furnished in connection with the solicitation of Proxies by the Board of Directors (the "Board of Directors" or "Board") of Alternative Resources Corporation (the "Company") for the Annual Meeting of Stockholders to be held on June 13, 2002, for the purpose of considering and acting upon the matters specified in the Notice of Annual Meeting of Stockholders accompanying this Proxy Statement. If the form of Proxy that accompanies this Proxy Statement is executed and returned, the shares represented by the Proxy will be voted. A Proxy may be revoked at any time prior to its voting by (1) written notice to the Secretary of the Company, (2) delivery to the Secretary of a duly executed Proxy bearing a later date or (3) voting in person at the Annual Meeting (although attendance at the Annual Meeting by itself will not revoke a previously granted Proxy).

A majority of the outstanding shares of Common Stock of the Company ("Common Stock") entitled to vote at this meeting and represented in person or by proxy will constitute a quorum. The affirmative vote of the holders of a plurality of the shares of Common Stock entitled to vote and represented in person or by proxy at this meeting is required to elect directors.

Expenses incurred in the solicitation of proxies will be borne by the Company. Officers of the Company may make additional solicitations in person or by telephone. The Company does not anticipate that the costs and expenses incurred in connection with this proxy solicitation will exceed an amount normally expected for a proxy solicitation for an election of directors in absence of a contest.

The Company's Form 10-K Annual Report for the year ended December 31, 2001 accompanies this Proxy Statement.

As of March 22, 2002, the Company had outstanding 17,702,819 shares of Common Stock, and such shares are the only shares entitled to vote at the Annual Meeting. Each share is entitled to one vote on each matter to be voted upon at the Annual Meeting.

SECURITIES BENEFICIALLY OWNED BY

PRINCIPAL STOCKHOLDERS AND MANAGEMENT

Set forth in the following table are the beneficial holdings (and the percentages of outstanding shares represented by such beneficial holdings) as of March 22, 2002, except as otherwise noted, of (i) each person (including any "group" as defined in Section 13(d)(3) of the Securities Exchange Act of 1934 (the "Exchange Act")) known by the Company to own beneficially more than 5% of its outstanding Common Stock, (ii) directors and nominees for directorships, (iii) each Named Executive Officer (as defined under "Executive Compensation" below), and (iv) all directors and executive officers as a group. Except as otherwise indicated, the Company believes that the beneficial owners of the Common Stock listed below, based on information provided by such owners, have sole investment and voting power with respect to such shares, subject to community property laws where applicable. Under Rule 13d-3 of the Exchange Act, persons who have the power to vote or dispose of Common Stock of the Company, either alone or jointly with others, are deemed to be beneficial owners of such Common Stock.

Name

| | Number of Shares

Beneficially Owned

| | Percent of

Class

| |

|---|

Wynnchurch Capital Partners, L.P(1)

150 Field Drive, Suite 165

Lake Forest, Illinois 60045 | | 15,000,000 | | 45.87 | % |

John Hatherly(2)

150 Field Drive, Suite 165

Lake Forest, Illinois 60045 |

|

15,000,000 |

|

45.87 |

% |

Larry Kane

2654 Kingston Drive

Northbrook, IL 60062 |

|

1,577,280 |

|

8.91 |

% |

Denny L. Robinson and Terry and Kathleen Olson, as a group(3)

53565 Hunters Crossing

Shelby Township, MI 48315 |

|

1,412,500 |

|

7.98 |

% |

Raymond R. Hipp |

|

422,300 |

|

2.39 |

% |

Steven Purcell |

|

302,500 |

|

1.71 |

% |

Victor Fricas |

|

300,000 |

|

1.69 |

% |

David Nolan(4) |

|

164,850 |

|

* |

|

Miner Smith(6) |

|

17,850 |

|

* |

|

Sharon McKinney(6) |

|

52,975 |

|

* |

|

Syd N. Heaton(5)(6) |

|

148,455 |

|

* |

|

JoAnne Brandes(6) |

|

38.000 |

|

* |

|

Charles W. Sweet(6) |

|

7,380 |

|

* |

|

Frank Hayes |

|

— |

|

— |

% |

Richard J. Renaud |

|

— |

|

— |

% |

Michael J. Hering |

|

— |

|

— |

% |

All directors and executive officers as a group (10 persons)(6) |

|

16,289,460 |

|

49.69 |

% |

- *

- Less than 1%.

2

- (1)

- Based upon a Schedule 13G dated February 15, 2002, as filed with the Securities and Exchange Commission. According to that 13G, these shares are based on (i) Warrant to purchase 4,920,208 shares of common stock issued to Wynnchurch Capital Partners, L.P. and Warrant to purchase 5,079,792 shares of common stock issued to Wynnchurch Capital Partners Canada, L.P.; (ii) Note issued to Wynnchurch Capital Partners, L.P., convertible into a total of 1,968,083 shares of Common Stock and Note issued to Wynnchurch Capital Partners Canada, L.P. convertible into a total of 2,031,917 shares of Common Stock; and (iii) Contingent Warrant to purchase 492,021 shares of Common Stock issued to Wynnchurch Capital Partners, L.P. and Contingent Warrant to purchase 507,979 shares of Common Stock issued to Wynnchurch Capital Partners Canada, L.P. According to the 13G, power is exercised through Wynnchurch Management, Inc., the sole general partner of the sole general partner of Wynnchurch Capital Partners, L.P. and Wynnchurch GP Canada, Inc., the sole general partner of the sole general partner of Wynnchurch Capital Partners Canada, L.P. None of the shares are currently outstanding, but are deemed to be beneficially owned based upon the right to acquire the shares upon exercise of the Warrants and Contingent Warrants and upon conversion of the Notes.

- (2)

- Mr. Hatherly is the President, Treasurer and Director of Wynnchurch Management, Inc. and Wynnchurch GP Canada, Inc., and as such, may be deemed to beneficially own the securities held by Wynnchurch Capital Partners, L.P. See footnote (1) above.

- (3)

- Based upon a Schedule 13D dated February 8, 2002, as filed with the Securities and Exchange Commission. According to that 13D, Mr. Robinson has sole voting and dispositive power over 1,070,000 shares held by him as Trustee of the Denny L. Robinson Revocable Living Trust and Terry and Kathleen Olson have sole voting and dispositive power over 342,500 shares.

- (4)

- Based upon shares benefically owned by Mr. Nolan on July 13, 2001, the date of his resignation as an executive officer of the Company.

- (5)

- Includes 3,000 shares owned by Mr. Heaton's wife.

- (6)

- Includes 17,850 shares (Mr. Smith), 2,975 shares (Ms. McKinney), 20,000 shares (Mr. Heaton), 38,000 shares (Ms. Brandes), 2,380 shares (Mr. Sweet) and 81,205 shares (all directors and executive officers as a group) that are subject to presently exercisable options or options exercisable within 60 days of March 22, 2002.

3

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Amended and Restated Certificate of Incorporation of the Company provides that the Board of Directors of the Company shall be divided into three classes, as nearly equal in number as possible, with one class being elected each year for a three-year term. At the Annual Meeting of Stockholders, two Class I directors are to be elected to serve until 2004, three Class II directors are to be elected to serve until 2005 and one Class III director is to be elected to serve until 2003. Mr. Hatherly and Mr. Hayes were initially appointed to the Board in February 2002 pursuant to the terms of the Securities Purchase Agreement described below under "Certain Transactions." Mr. Renaud and Mr. Hering have also been nominated as Directors pursuant to the terms of the Securities Purchase Agreement. Three directors will continue to serve in accordance with their prior election or appointment. The directors will hold office until the end of their respective terms and until their successors are elected and qualified, unless they die, resign or are removed from office prior to that time.

It is intended that the proxies (except proxies marked to the contrary) will be voted for the nominees listed below. It is expected that the nominees will serve, but if any nominee declines or is unable to serve for any unforeseen cause, the proxies will be voted for such substitute nominee as the Board of Directors recommends or vote to allow the vacancy to remain open until filled by the Board of Directors, as the Board recommends.

The Board of Directors recommends a vote FOR the Class I, Class II and Class III nominees.

Nominee and Continuing Directors

The following table sets forth certain information with respect to the nominees and the continuing directors:

Name and Age

| | Director Since:

| | Principal Occupation and Other Information

|

|---|

|

|

|

|

|

| Class I Nominees for Election with Terms Expiring in 2004 |

Frank Hayes (40) |

|

February 2002 |

|

Mr. Hayes has been Managing Director of Wynnchurch Capital Ltd., a private equity company, since November 2001. He has over 15 years of private equity investing and corporate finance experience. Prior to joining Wynnchurch, Mr. Hayes was Managing Director of Catalyst Equity Partners, LLC, a private equity fund, from 2000 to 2001. Prior to joining Catalyst, he was a Managing Director for GKH Partners, L.P., a leveraged buyout fund, from 1991 to 1998. Mr. Hayes began his career at Price Waterhouse as a CPA. |

Richard J. Renaud (55) |

|

Nominee |

|

Mr. Renaud has been Chairman of Wynnchurch Capital, Ltd., a private equity company, since 1999. From 1997 to 1999, Mr. Renaud was Chairman, President and CEO of Peelbrooke Capital Inc. He has been an active private equity investor and CEO of various companies since the early 1970's. |

|

|

|

|

|

4

Class II Nominees for Election with Terms Expiring in 2005 |

Syd N. Heaton (62) |

|

March 1998 |

|

Mr. Heaton was Chairman and Chief Executive Officer of Advantis, a networking technology company formed by IBM Corporation and Sears, Roebuck and Co., from 1992 through his retirement in 1997. Previously he held a variety of management positions with IBM. |

Steven Purcell (51) |

|

May 1999 |

|

Mr. Purcell joined the Company in August 1998 as Senior Vice President, Chief Financial Officer, Secretary and Treasurer He was elected to the Board of Directors in May 1999. Prior to joining the Company, he was Chief Financial Officer for American Business Information, a provider of business and consumer data and data processing services. From 1991 to 1996 he served as Vice President—Finance, Chief Financial Officer and Treasurer, of Micro Warehouse, a direct marketer of hardware, software and accessories. |

John A. Hatherly (43) |

|

February 2002 |

|

Mr. Hatherly has been President and Managing Partner of Wynnchurch Capital Ltd., a private equity company, since 1999. He served as the Head of Merchant Banking for GE Capital from 1987 to 1999. Mr. Hatherly also serves on the Board of Directors of iaxis NV, Wormser Company, Connection Concepts, Inc. and Dundee Wealth Management. In addition, Mr. Hatherly has been an advisor for the past 10 years to the Board of Directors of Weider Health & Fitness. |

Class III Nominee for Election with Term Expiring in 2003. |

Michael J. Hering (33) |

|

Nominee |

|

Mr. Hering has been Chief Financial Officer of Wynnchurch Capital, Ltd., a private equity company, since October 2000. Prior to joining Wynnchurch Capital, Ltd., Mr. Hering was Manager of Analysis with the Chicago Tribune Company from 1996 to 2000. Mr. Hering was assistant controller for LaSalle Partners Ltd. from 1994 to 1996 and an auditor with Coopers & Lybrand LLP from 1991 to 1994. |

|

|

|

|

|

|

|

|

|

|

5

Class I Director with Term Expiring in 2004 |

JoAnne Brandes (48) |

|

August 1994 |

|

Ms. Brandes has been Senior Vice President, General Counsel and Secretary for S.C. Johnson Commercial Markets, Inc., a worldwide commercial products and solutions company, since October 1997. Ms. Brandes was Vice President, General Counsel—Worldwide Professional for S.C. Johnson & Son, Inc., from October 1996 to October 1997, and was Vice President—Corporate Communications Worldwide for S.C. Johnson & Son, Inc. from October 1994 to October 1996. From May 1992 through September 1994, she was Director—Corporate Communications Worldwide for S.C. Johnson & Son, Inc. Ms. Brandes currently serves on the Boards of Directors of Bright Horizons Family Solutions and Johnson Family Funds, Inc. and is a regent of the University of Wisconsin System. |

Class III Directors with Terms Expiring in 2003 |

Raymond R. Hipp (59) |

|

August 1994 |

|

Mr. Hipp has been Chairman of the Board, President and Chief Executive Officer of the Company since July 1998. Previously he was Chief Executive Officer of ITI Marketing Services, a provider of telemarketing services, from August 1996 until May 1998 when the company was sold. He was a self-employed management consultant from September 1994 to August 1996. Mr. Hipp was President of Comdisco Disaster Recovery Services, a provider of business continuity services for the information technology industry, from 1980 through August 1994. Mr. Hipp previously held executive and management positions with International Business Machines Corporation. He currently serves on the Board of Directors of Gardner Denver Inc. |

Charles W. Sweet (58) |

|

February 2001 |

|

Mr. Sweet has been president of C.W. Sweet, Inc., an executive search firm, since January 2002.Previously, he was Chairman of A.T. Kearney Executive Search. He has over 29 years of executive search experience. Prior to assuming the leadership role as Chairman, Mr. Sweet spent 14 years as President of the division, with management responsibility for A.T. Kearney Executive Search offices in North America, Europe, Asia and South America. He has completed more than 250 search assignments in a wide variety of industries, covering virtually every functional area with an emphasis on strategically critical general management assignments and boards of directors. Mr. Sweet serves on the board of directors of GreatBanc, and Calypaso Systems, Inc. He is an elected trustee and head of the finance committee of the Village of Barrington Hills, Illinois, is on the board of advisors for Ridge Capital Fund and is a trustee for the University of Richmond. |

6

BOARD OF DIRECTORS

The Board of Directors held four meetings during 2001. All directors attended at least 75 percent of the aggregate number of such meetings and of meetings of Board committees on which they served in 2001.

The Board of Directors has an Audit Committee, currently consisting of Syd N. Heaton, JoAnne Brandes and Charles Sweet, each of whom is independent as such term is defined in the National Association of Securities Dealers' listing standards. The Audit Committee held three meetings in 2001. The functions of the Audit Committee are described under "Report of the Audit Committee."

The Board of Directors has a Compensation Committee, currently consisting of Charles Sweet, Syd N. Heaton and John Hatherly. In addition, the full Board of Directors addressed various compensation-related matters during the year. The Compensation Committee met three times during 2001. The functions of the Compensation Committee include determining executive officers' salaries and bonuses and administering and determining awards under the Company's Incentive Stock Option Plan and certain other employee benefit plans.

Directors who are not employees or officers of the Company receive $2,000 for each Board meeting attended and $1,000 for each committee meeting attended (if the committee meeting does not fall on the same date as the board meeting) and also receive a non-qualified stock option to purchase 5,000 shares of Common Stock under the Company's Incentive Stock Option Plan on the date of each annual meeting (and on the date of initial election to the Board if other than at an annual meeting). In addition, all directors are reimbursed for certain expenses in connection with attendance at Board and committee meetings.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16 of the Securities Exchange Act of 1934, as amended (the "Act"), requires the Company's officers (as defined under Section 16) and directors and persons who own greater than 10% of a registered class of the Company's equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the "Commission"). Except as set forth below, based solely on a review of the forms it has received and on written representations from certain reporting persons that no such forms were required for them, the Company believes that, during 2001, all Section 16 filing requirements applicable to its officers, directors and greater than 10% beneficial owners were complied with by such persons. Mr. Smith inadvertently failed to timely file a Form 3 following commencement of his service as an executive officer of the Company in July 2001. Ms. McKinney inadvertently failed to timely file a Form 5 to report one transaction. Mr. Sweet inadvertently failed to timely file a Form 3 following his appointment to the Board in February 2001 and a Form 4 for a transaction that occurred in May 2001.

7

EXECUTIVE COMPENSATION

The following table sets forth information with respect to compensation paid or earned for services rendered to the Company by the Company's chief executive officer and each of the four other executive officers of the Company as of December 31, 2001 and one additional individual for whom disclosure would have been provided but for the fact that he was not serving as an executive officer as of December 31, 2001 (together, the "Named Executive Officers"), for the years indicated.

Summary Compensation Table

| |

| |

| |

| | Long Term Compensation Awards

| |

|

|---|

| | Annual Compensation

| | Restricted

Stock

Award(s)

($)(1)(2)

| | Securities

Underlying

Options

(#)(2)

| |

|

|---|

Name and Principal Position

| | All Other

Compensation

($)(3)

|

|---|

| | Year

| | Salary ($)

| | Bonus ($)

|

|---|

Raymond R. Hipp

Chairman of the Board

President and Chief

Executive Officer | | 2001

2000

1999 | | $

| 360,000

360,000

300,000 | | | —

—

— | |

$

| —

93,600

— | | —

—

75,000 | | $

| 1,748

8,545

115,058 |

Steven Purcell

Senior Vice President

Chief Financial Officer,

Secretary and Treasurer |

|

2001

2000

1999 |

|

$

|

300,000

300,000

250,000 |

|

$ |

—

—

35,000 |

|

$

|

—

62,400

— |

|

—

—

40,000 |

|

$

|

687

4,318

92,958 |

Miner Smith(4)

President and General Manager—

IT Staffing Business |

|

2001 |

|

$ |

110,577 |

|

$ |

125,000 |

|

|

— |

|

150,000 |

|

$ |

229 |

David Nolan(4)

Former President of Field

Operations |

|

2001

2000

1999 |

|

$

|

145,833

250,000

123,000 |

|

|

—

—

— |

|

$

|

—

62,400

— |

|

—

25,000

200,000 |

|

$

|

312

7,094

6,247 |

Victor J. Fricas(5)

President and General Manager—

IT Solution Business |

|

2001

2000 |

|

$

|

210,000

175,000 |

|

|

—

— |

|

$ |

—

46,800 |

|

—

5,000 |

|

$

|

674

4,057 |

Sharon A. McKinney(6)

Senior Vice President, Human

Resources |

|

2001

2000

1999 |

|

$

|

180,000

180,000

148,308 |

|

$

|

—

24,000

— |

|

$

|

—

15,600

— |

|

25,000

—

40,000 |

|

$

|

1,535

4,031

64,751 |

- (1)

- As of December 31, 2001, the number of shares and the value (based upon the closing price of the Company's Common Stock on December 31, 2001), of the restricted stock held by each of the Executive Officers was as follows: Mr. Hipp (300,000 shares / $156,000), Mr. Purcell (200,000 shares / $104,000), Mr. Fricas (150,000 shares / $78,000) and Ms. McKinney (50,000 shares / $26,000).

- (2)

- On November 1, 2000, all of the options then held by the Named Executive Officers (covering 965,000 shares of Common Stock in the aggregate), including the options granted in 2000, were cancelled. In exchange, each of the Named Executive Officers received the restricted stock awards specified for the year 2000 in the Summary Compensation Table above. These restricted stock awards vested as to 50% of the shares on July 1, 2001 and vest as to the remaining shares on July 1, 2002.

8

- (3)

- Amounts for 2001 represent term life insurance premiums paid by the Company for coverage in excess of standard coverage provided to all employees. In addition, Ms. McKinney also received $1,067 in Company matching contributions under the Company's 401(K) plan.

- (4)

- Mr. Smith joined the Company as an executive officer effective July 16, 2001. Mr. Nolan served as President of Field Operations until July 13, 2001.

- (5)

- Mr. Fricas became an executive officer effective November 1, 2000.

- (6)

- Ms. McKinney became an executive officer effective January 22, 1999.

Option Grants in Last Fiscal Year

The following table sets forth information regarding stock options granted to the Named Executive Officers during 2001. The Company has not awarded any stock appreciation rights to the Named Executive Officers.

| | Individual Grants

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term(4)

|

|---|

| | Number of

Securities

Underlying

Options Granted

(#)(1)

| |

| |

| |

|

|---|

| | % of Total

Options Granted

to Employees

in Fiscal Year(2)

| |

| |

|

|---|

Name

| | Exercise

or Base Price

($/SH)(3)

| | Expiration

Date

|

|---|

| | 5% ($)

| | 10% ($)

|

|---|

| Raymond R. Hipp | | — | | — | | | — | | | | | — | | | — |

Steven Purcell |

|

— |

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

Miner Smith |

|

150,000 |

|

58.1 |

% |

$ |

0.45 |

|

7/16/2011 |

|

$ |

42,450 |

|

$ |

107,578 |

David Nolan |

|

— |

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

Victor J. Fricas |

|

— |

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

Sharon A. McKinney |

|

25,000 |

|

9.7 |

% |

$ |

0.375 |

|

7/12/2011 |

|

$ |

5,896 |

|

$ |

14,941 |

- (1)

- The options are not exercisable during the first six months from the date the options were originally granted, which is ten years prior to the specified expiration date. Thereafter, the options become exercisable at the rate of 2.38 percent of the total share subject to the option on and after the first day of each month.

- (2)

- Based on 258,000 total options granted to employees, including the Named Executive Officers, in 2001.

- (3)

- The exercise price was equal to the fair market value of the Common Stock on the date of grant.

- (4)

- The potential realizable values are presented net of the option exercise prices but before any federal or state income taxes associated with exercises and were calculated based on the term of the option at its time of grant (ten years). They were calculated by assuming the stock price on the date of grant would appreciate at the indicated annual rates, which are prescribed by the SEC, compounded annually for the entire term of the option and that the option would be exercised and sold on the last day of its term for the appreciated stock price. Actual gains will be dependent on the future performance of the Company's Common Stock and the option holders' continued employment over the vesting periods. The potential realizable values do not reflect the Company's prediction of its stock price performance. The amounts reflected in the table may not be achieved.

9

Fiscal Year-End Option Values

The following table sets forth information regarding stock options held by the Named Executive Officers as of December 31, 2001. None of the Named Executive Officers exercised any options during 2001.

| | Number of Securities

Underlying Unexercised

Options At Fiscal Year-End

| | Value of Unexercised

In-the-Money Options at

Fiscal Year-End(1)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Raymond R. Hipp | | — | | — | | — | | | — |

| Steven Purcell | | — | | — | | — | | | — |

| Miner Smith | | — | | 150,000 | | — | | $ | 10,500 |

| David Nolan | | — | | — | | — | | | — |

| Victor J. Fricas | | — | | — | | — | | | — |

| Sharon A. McKinney | | — | | 25,000 | | — | | $ | 3,625 |

- (1)

- The value of the options is calculated by subtracting the exercise price per share from the closing price of the Company's Common Stock as of December 31, 2001, which was $0.52.

Employment Agreements

Mr. Hipp is employed as Chairman of the Board, President and Chief Executive Officer under an employment agreement dated July 23, 1998 which extended initially through December 31, 2001, subject to an automatic one-year extension as of such date and as of each December 31 thereafter, unless 90 days' notice of intent not to extend is given by Mr. Hipp or the Company. Under the agreement, Mr. Hipp received $250,000 upon execution of the agreement, and is entitled to a base salary of not less than $300,000 per year. The agreement also provides that Mr. Hipp is eligible for an incentive compensation award for each calendar year. The Board of Directors approved an incentive compensation award for 2001 of up to approximately $300,000 based upon attainment by the Company of certain revenue and earnings per share targets specified in the agreement. Because such targets were not met, no incentive compensation award was paid to Mr. Hipp for calendar year 2001. In addition, in the event the Company terminates Mr. Hipp without cause, Mr. Hipp will be entitled to an amount equal to two years' base salary plus a prorated portion of any applicable annual incentive award for the year in which termination occurs.

Mr. Purcell is employed as the Senior Vice President and Chief Financial Officer under an employment agreement dated August 1, 1998, which extended initially through December 31, 2001, subject to automatic one-year extensions as of such date and as of each December 31, thereafter, unless 90 days' notice of intent not to extend is given by Mr. Purcell or the Company. Under the agreement, Mr. Purcell received $150,000 upon execution of the agreement, and is entitled to a base salary of not less than $250,000 per year. The agreement also provides that Mr. Purcell is eligible for an incentive compensation award for each calendar year. The Board of Directors approved an incentive compensation award for 2001 of up to approximately $175,000 based upon attainment by the Company of certain revenue and earnings per share targets specified in the agreement. Because such targets were not met, no incentive compensation award with respect to such revenue and earnings targets was paid to Mr. Purcell for calendar year 2001. In addition, in the event the Company terminates Mr. Purcell without cause, Mr. Purcell will be entitled to an amount equal to two years' base salary plus a prorated portion of any applicable annual incentive award for the year in which the termination occurs.

Mr. Smith is employed as President and General Manager—IT Staffing Business under an employment agreement dated July 16, 2001 which extended initially through December 31, 2001, subject to an automatic one-year extension as of such date and as of each December 31 thereafter,

10

unless 90 days' notice of intent not to extend is given by Mr. Smith or the Company. Under the agreement, Mr. Smith is entitled to a base salary of not less than $250,000 per year and is entitled to receive a guaranteed minimum annual incentive compensation award of $125,000 for each of (i) the balance of 2001 and (ii) fiscal year 2002. Mr. Smith is also eligible to receive an additional incentive compensation award of $50,000-$75,000 for fiscal year 2002, based solely upon satisfaction of certain performance goals established by the Board following the effective date of this Agreement, and paid in semi-annual increments over the course of 2002. In addition, in the event the Company terminates Mr. Smith without cause, Mr. Smith will be entitled to an amount equal to one year's base salary plus a prorated portion of any applicable annual incentive award for the year in which the termination occurs.

Mr. Nolan was employed as the President of Field Operations under an employment agreement dated July 1, 1999, which extended initially through December 31, 1999, subject to automatic one-year extensions as of such date and as of each December 31, thereafter, unless 90 days' notice of intent not to extend was given by Mr. Nolan or the Company. Under the agreement, Mr. Nolan was entitled to a base salary of $250,000 per year. Mr. Nolan resigned from the Company effective July 13, 2001.

Mr. Fricas is employed as the President and General Manager—IT Solution Business under an employment agreement dated August 15, 2000, which extended initially through December 31, 2000, subject to automatic one year extensions as of such date and as of each December 31, thereafter, unless 90 days' notice of intent not to extend is given by Mr. Fricas or the Company. Under the agreement, Mr. Fricas is entitled to a minimum base salary of $175,000 per year. The agreement also provides that Mr. Fricas is eligible for an incentive compensation award for each calendar year. The Company did not pay an incentive bonus to Mr. Fricas during 2001 because the Company did not meet certain revenue and earnings per share targets specified in the agreement. In addition, in the event the Company terminates Mr. Fricas without cause, Mr. Fricas will be entitled to an amount equal to one year's base salary plus a prorated portion of any applicable annual incentive award for the year in which the termination occurs.

Ms. McKinney is employed as the Senior Vice President, Human Resources under an employment agreement dated August 15, 2000, which extended initially through December 31, 2000, subject to automatic one-year extensions as of such date and as of each December 31, thereafter, unless 90 days' notice of intent not to extend is given by Ms. McKinney or the Company. Under the agreement, Ms. McKinney is entitled to a base salary of $180,000 per year. The agreement also provides that Ms. McKinney is eligible for an incentive compensation award for each calendar year. The Company did not pay an incentive bonus to Ms. McKinney during 2001 because the Company did not meet certain revenue and earnings per share targets specified in the agreement. In addition, in the event the Company terminates Ms. McKinney without cause, Ms. McKinney will be entitled to an amount equal to one year's base salary plus a prorated portion of any applicable annual incentive award for the year in which the termination occurs.

11

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Overview of Executive Compensation Policies

The Compensation Committee of the Board of Directors determines the salaries and bonuses of executive officers and other key employees of the Company and administers the Company's Incentive Stock Option Plan. In setting the compensation levels of the Company's executive officers and in administering the Stock Option Plan, the Compensation Committee has established the following principles:

- 1)

- Provide competitive compensation levels and use equity ownership through the Incentive Stock Option Plan to attract and retain highly qualified individuals.

- 2)

- Set competitive base compensation levels and utilize significant performance-based incentive compensation to achieve total compensation targets.

- 3)

- Establish performance goals which are aggressive and are aligned with an objective of increasing stockholder value at a greater rate than the rate achieved by the upper quartile of the Russell 2000 Index.

- 4)

- Use discretionary cash awards as appropriate to recognize outstanding individual contributions or overall Company performance that far exceeds annual goals.

- 5)

- Allocate stock options and /or restricted stock grants broadly across the organization so that all executive officers and key employees have a stockholder perspective.

The overall compensation of the executive officers consists of the compensation components set forth below. The Compensation Committee believes that in 2001 the executive officers of the Company were compensated at levels comparable to other information services or staffing companies.

Total Compensation—2001

Base Salaries of the Named Executive Officers were paid as specified in the Summary Compensation Tables above. The Compensation Committee believes that the base salary levels of the executive officers are comparable to their peers within the information services and staffing industries.

Under the Company's 2001 Target Bonus Plan, the Compensation Committee established certain corporate revenue and profit goals, specific revenue and profit goals for certain business units, and executive specific goals. For 2001, no bonuses were paid to any of the executive officers under the Target Bonus Plan. However, one of the executive officers received an incentive compensation award pursuant to the terms of his employment agreement.

Executive officers and other key employees of the Company are eligible to participate in the Incentive Stock Option Plan. The purpose of the Stock Option Plan is to provide incentive to management and key employees to maximize stockholder value by providing them with opportunities to acquire shares of the Company's Common Stock. Options and/or shares of restricted stock are granted to executive officers and key employees who the Compensation Committee, in its sole discretion, determines to be responsible for the future growth and profitability of the Company. The Compensation Committee determines the employees to whom options and/or restricted stock will be granted and establishes the number of shares covered by each grant and the exercise price and vesting period for each grant.

12

Compensation of Chairman of the Board and Chief Executive Officer.

Mr. Hipp was elected Chairman of the Board, President and Chief Executive Officer effective August 1, 1998. During 2001, he was paid a salary at an annual rate of $360,000. Under the terms of his employment agreement, Mr. Hipp was eligible for an incentive compensation award in 2001. The Board of Directors approved an incentive compensation award for 2001 of up to $300,000 based upon the attainment by the Company of certain revenue and earnings targets. Because such targets were not met, no incentive compensation was paid for 2001.

Deductibility of Compensation in Excess of $1 Million Per Year.

Internal Revenue Code section 162(m), in general, precludes a public corporation from claiming a tax deduction for compensation in excess of $1 million in any taxable year for any executive officer named in the summary compensation table in such corporation's proxy statement. Certain performance-based compensation is exempt from this tax deduction limitation. The Compensation Committee's policy is to structure executive compensation in order to maximize the amount of the Company's tax deduction. However, the Compensation Committee reserves the right to deviate from that policy to the extent it is deemed necessary to serve the best interests of the Company.

Respectfully Submitted By:

The Compensation Committee

Charles Sweet

Syd N. Heaton

John A. Hatherly

13

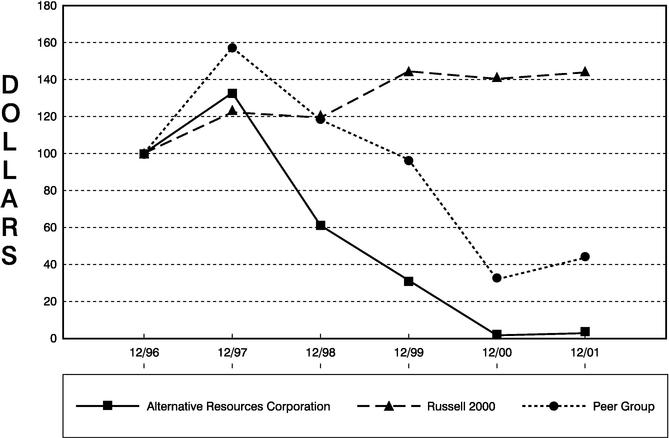

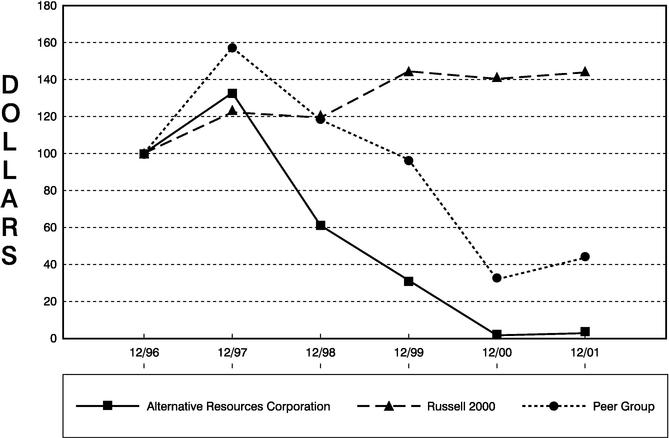

PERFORMANCE GRAPH

The following graph sets forth a comparison of the Company's cumulative total stockholder return on its Common Stock for the period beginning December 31, 1996, and ending December 31, 2001, against the cumulative total return of the Russell 2000 Index and a Company selected peer group for the same period. The peer group consists of publicly-traded companies in both the staffing and computer services industries and includes the following companies: Computer Horizon Corporation, Computer Task Group, Inc., MPS Group., Keane, Inc., Spherion Corporation, Personnel Group of America, Inc., RCM Technologies, Inc., Analysts International Corporation, CDI Corporation and Comforce Corporation. The total stockholder return for each company in the peer group has been weighted according to its stock market capitalization. This graph and table shown below assumes an investment of $100 on December 31, 1996 in each of the Company's Common Stock, the Russell 2000 Index and the peer group and assumes reinvestment of dividends, if any. The stock price performance shown below is not necessarily indicative of future stock price performance.

| | December 31, 2000

|

|---|

| | 1996

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

|

|---|

| Alternative Resources Corporation | | $ | 100.00 | | $ | 132.73 | | $ | 61.15 | | $ | 31.65 | | $ | 1.98 | | $ | 2.99 |

| Russell 2000 Index | | $ | 100.00 | | $ | 122.36 | | $ | 119.25 | | $ | 144.60 | | $ | 140.23 | | $ | 143.71 |

| Peer Group C | | $ | 100.00 | | $ | 157.44 | | $ | 118.28 | | $ | 96.55 | | $ | 32.14 | | $ | 43.65 |

14

CERTAIN TRANSACTIONS

Mr. Hatherly, a director of the Company, is the President, Treasurer and Director of Wynnchurch Management, Inc. and Wynnchurch GP Canada, Inc. (collectively "Wynnchurch"). On January 31, 2002, the Company entered into a Securities Purchase Agreement with Wynnchurch, pursuant to which the Company issued to Wynnchurch 15% Senior Subordinated Convertible Notes in the principal amount of $10 million, which are due on January 31, 2009. These Notes are convertible into the Company's Common Stock at a conversion price of $2.50 per share. In conjunction with the issuance of these Notes, the Company issued to Wynnchurch warrants to purchase 10 million shares of the Company's Common Stock at $0.55 per share and an additional warrant to purchase 1 million shares of Common Stock at $0.73 per share, the latter of which are generally not exercisable for one year and expire on the occurrence of certain events. The Securities Purchase Agreement is an exhibit to the Company's Form 10-K Annual Report for the year ended December 31, 2001, which accompanies this Proxy Statement.

AUDIT COMMITTEE REPORT

The responsibilities of the Audit Committee, which are set forth in the Audit Committee Charter adopted by the Board of Directors, include providing oversight to the Company's financial reporting process through periodic meetings with the Company's independent auditors and management to review accounting, auditing, internal controls and financial reporting matters. The management of the Company is responsible for the preparation and integrity of the financial reporting information and related systems of internal controls. The Audit Committee, in carrying out its role, relies on the Company's senior management, including senior financial management, and its independent auditors.

We have reviewed and discussed with senior management the Company's audited financial statements for the year ended December 31, 2001. Management has confirmed to us that such financial statements (1) have been prepared with integrity and objectivity and are the responsibility of management and, (2) have been prepared in conformity with accounting principles generally accepted in the United States of America.

We have discussed with KPMG LLP, our independent auditors, the matters required to be discussed by SAS 61 (Communications with Audit Committee), as amended by SAS 90. SAS 61 and SAS 90 require our independent auditors to provide us with additional information regarding the scope and results of their audit of the Company's financial statements, including with respect to (1) their responsibility under auditing standards generally accepted in the United States of America, (2) significant accounting policies, (3) quality of accounting principles, (4) management judgments and accounting estimates, (5) significant audit adjustments, (6) other information in documents containing audited financial statements, (7) any disagreements with management, (8) any consultations with other accountants, (9) any major issues discussed with management prior to retention, (10) any difficulties encountered in performing the audit and (11) any fees from management advisory services.

We have received from KPMG LLP a letter providing the disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) with respect to any relationships between KPMG LLP and the Company that in their professional judgment may reasonably be thought to bear on independence. KPMG LLP has discussed its independence with us, and has confirmed in such letter that, in its professional judgment, it is independent of the Company within the meaning of the federal securities laws. The Audit Committee has considered whether the non-audit services rendered by KPMG LLP are compatible with maintaining their independence.

Based on the review and discussions described above with respect to the Company's audited financial statements, we recommended to the Board of Directors that such financial statements be included in the Company's Form 10-K Annual Report for the year ended December 31, 2001.

15

As specified in the Audit Committee Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and in accordance with accounting principals generally accepted in the United States of America. That is the responsibility of management and the Company's independent auditors. In giving our recommendation to the Board of Directors, we have relied on (1) management's representation that such financial statements have been prepared with integrity and objectivity and in conformity with accounting principals generally accepted in the United States of America, and (2) the report of the Company's independent auditors with respect to such financial statements.

Respectfully Submitted By:

The Audit Committee

Syd N. Heaton

JoAnne Brandes

Charles Sweet

INDEPENDENT ACCOUNTANTS

The Company's Board of Directors, upon the recommendation of the Company's Audit Committee, has appointed the firm of KPMG LLP as independent accountants to audit the books, records and accounts of the Company for 2002.

It is expected that representatives of KPMG LLP will be present at the annual meeting with the opportunity to respond to appropriate questions and to make a statement if they desire to do so.

Audit Fees—The Company was billed a total of $209,500 by KPMG LLP, the Company's independent auditors, for professional services rendered for the audit of the Company's annual financial statements for the fiscal year ended December 31, 2001 and the reviews of interim financial statements included in the Company's Quarterly Reports on Form 10-Q filed during 2001.

Financial Information Systems Design and Implementation Fees—The Company did not engage KPMG LLP for financial information systems design and implementation services during the fiscal year ended December 31, 2001.

All Other Fees—The Company was billed a total of $181,000 for all other services rendered by KPMG LLP during the fiscal year ended December 31, 2001 that are not set forth above. Such services included employee benefit plan audit fees, income tax assistance and tax return preparation.

PROPOSALS OF SECURITY HOLDERS

A stockholder proposal to be presented at the 2003 Annual Meeting of Stockholders must be received at the Company's corporate headquarters, 600 Hart Road, Suite 300, Barrington, Illinois 60010 by no later than January 13, 2003 for evaluation as to inclusion in the Proxy Statement in connection with such Meeting.

In order for a stockholder to nominate a candidate for director, under the Company's Bylaws, timely notice of the nomination must be given in writing to the Secretary of the Company. To be timely, any such notice must be delivered or mailed by first class United States mail, postage prepaid, to the Secretary at the principal executive offices of the Company not less than sixty (60) days nor more than ninety (90) days prior to the date of the annual meeting of stockholders or, if the Company mails its notice and proxy to the stockholders less than sixty (60) days prior to the annual meeting, within ten (10) days after the notice and proxy is mailed. Such notice must describe various matters regarding the nominee and the stockholder giving the notice, including such information as name, address, occupation and shares held.

16

In order for a stockholder to bring other business before a stockholders meeting, timely notice must be given to the Secretary of the Company within the time limits described above. Such notice must include various matters regarding the stockholder giving the notice and a description of the proposed business. These requirements are separate from, and in addition to, the requirements a stockholder must meet to have a proposal included in the Company's proxy statement.

OTHER MATTERS TO COME BEFORE THE MEETING

The Board of Directors of the Company knows of no other business, which may come before the Annual Meeting. However, if any other matters are properly presented to the Meeting, the persons named in the proxies will vote upon them in accordance with their judgment.

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE SIGN THE PROXY AND RETURN IT IN THE ENCLOSED STAMPED ENVELOPE.

|

|

By Order of the Board of Directors |

|

|

|

|

|

Steven Purcell

Senior Vice President, Chief Financial

Officer, Secretary and Treasurer |

Barrington, Illinois

Date: May 13, 2002 |

|

|

17

Alternative Resources Corporation

Use ablack pen. Print in CAPITAL letters inside the grey areas as shown in this example. |

|

A

|

|

B

|

|

C

|

|

1

|

|

2

|

|

3

|

|

X

|

|

o |

|

MARK HERE FOR ADDRESS CHANGE AND NOTE ABOVE. |

Annual Meeting Proxy Card

|

(A) Proposal No. 1—Election of Directors

| 1. Election of two Class I Directors (terms to expire in 2004) | | Election of three Class II Directors (terms to expire in 2005) | | Election of one Class III Director (term to expire in 2003). |

| | | For | | Withhold | | | | | | For | | Withhold | | | | | | For | | Withhold | | |

01—Frank Hayes |

|

o |

|

o |

|

|

|

03—Syd N. Heaton |

|

o |

|

o |

|

|

|

06—Michael J. Hering |

|

o |

|

o |

|

|

| 02—Richard J. Renaud | | o | | o | | | | 04—Steven Purcell | | o | | o | | | | | | | | | | |

| | | | | | | | | 05—John A. Hatherly | | o | | o | | | | | | | | | | |

The Board of Directors recommends that you vote FOR all nominees listed in Proposal 1.

(B) Other Matters

2. Each of the persons named as proxies herein is authorized, in such person's direction, to vote upon such other matters as may properly come before the Annual Meeting.

(C) Authorized Signatures—Sign Here—This section must be completed for your instructions to be executed.

This Proxy must be signed exactly as your name appears hereon. When shares are held by joint tenants, both should sign. Attorney's, executors, administrators, trustees and guardians should indicate their capacities. If the signer is a corporation, please print full corporate name and indicate capacity of duly authorized officer executing on behalf of the corporation. If the signer is a partnership or limited liability company, name and indicate capacity of duly authorized person executing on behalf of the partnership or limited liability company.

| Signature 1 | | Signature 2 | | Date (dd/mm/yyyy) |

| |

| |

/ /

|

Proxy—Alternative Resources Corporation

|

600 Hart Road, Suite 300, Barrington, Illinois 60010

This proxy is solicited on behalf of the Board of Directors for the Annual Meeting of Stockholders to be held on June 13, 2002

The undersigned hereby appoints Raymond R. Hipp and Steven Purcell, or either of them, with full power of substitution, to represent and to vote the stock of the undersigned at the Annual Meeting of Stockholders of Alternative Resources Corporation, to be held at the Company's corporate headquarters at 600 Hart Road, Suite 300, Barrington, Illinois 60010, on Thursday, June 13, 2002 at 10 A.M., local time, or at any adjournment thereof, as follow:

THE PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED BY THE UNDERSIGNED STOCKHOLDER(S). IF NO DIRECTION IS MADE, THE PROXY WILL BE VOTED FOR ALL DIRECTORS SPECIFIED ON THE REVERSE HEREOF.

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

Please indicate any change in address. (Continued and to be signed on reverse side.)

QuickLinks

SECURITIES BENEFICIALLY OWNED BY PRINCIPAL STOCKHOLDERS AND MANAGEMENTPROPOSAL NO. 1 ELECTION OF DIRECTORSBOARD OF DIRECTORSSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEEXECUTIVE COMPENSATIONSummary Compensation TableOption Grants in Last Fiscal YearFiscal Year-End Option ValuesCOMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATIONPERFORMANCE GRAPHCERTAIN TRANSACTIONSAUDIT COMMITTEE REPORTINDEPENDENT ACCOUNTANTSPROPOSALS OF SECURITY HOLDERSOTHER MATTERS TO COME BEFORE THE MEETING