California Apartment Markets Conference

November 16, 2004

Keith R. Guericke – President and Chief Executive Officer

Essex Property Trust, Inc.

Overview

Dedicated West Coast multifamily REIT

Formed in 1971

Initial Public Offering in June 1994 – $19.50/share

Consistent operating philosophy through numerous

market cycles

Research-based strategy

Experienced, committed management with strong track

record

Among the highest in total return to shareholders

Top four executives have worked together 18 years

Management/Founders currently own approximately

9% of Essex

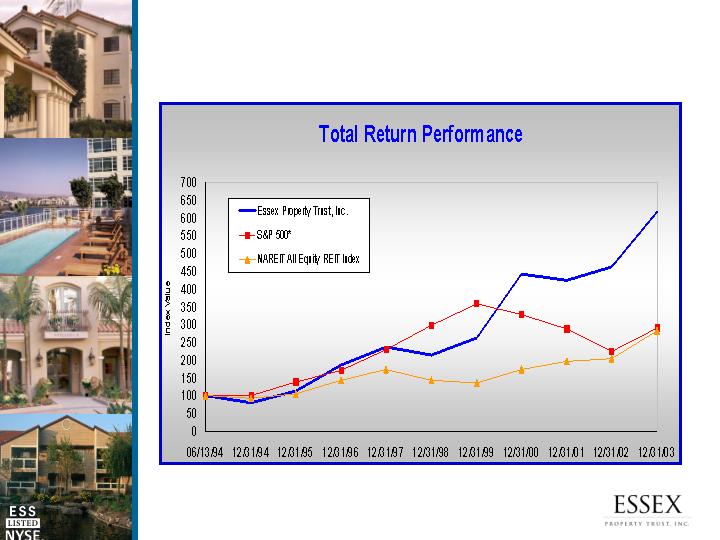

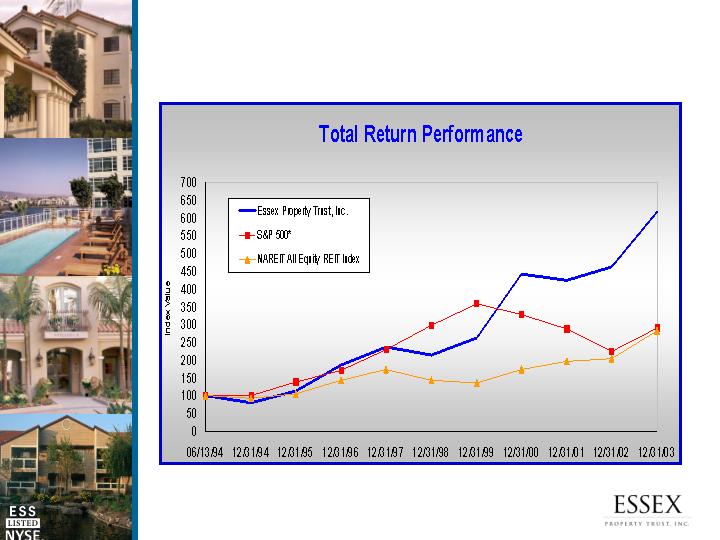

A Decade of Total Return Performance

Source: SNL Financial LC

Strategically Positioned Among Peers

& nbsp; 5-Year* Total

& nbsp; Annual Return

Essex Property Trust 21.91%

Archstone Communities 17.47%

Avalon Bay 18.77%

BRE Properties 17.19%

Equity Residential 14.96%

*Source: NAREIT ReitWatch, September 30, 2004

Keys to Success

Prudent Operating Principals

Proprietary Research Model

Capital Resources

Entrepreneurial Approach

Operating Principals

Requirements for Long-Term Success

Stable and high occupancy

Predictable low risk from new construction

Expanding and diverse economy

Limited housing supply

Dedicated West Coast Presence

Permanent constraints to new supply

Job growth expectation

High cost of home ownership

Large and dynamic technology component

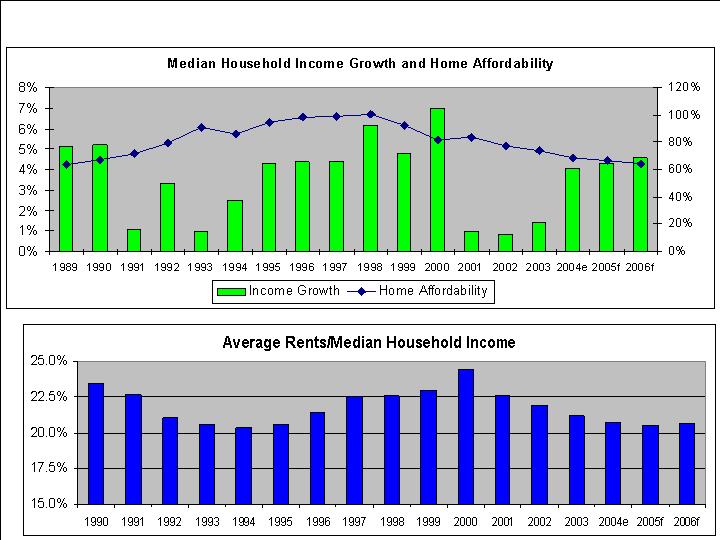

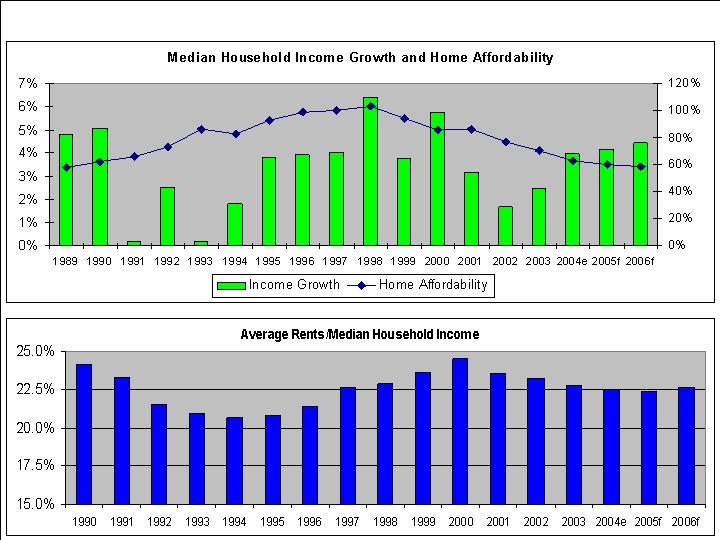

Proprietary Research Model

Change in

Occupancy

SUPPLY FUNDAMENTALS

New Construction

of Multifamily and

Single-Family Housing

Apartment Vacancy Rates

Current

Market

Conditions

Basic Data Input

DEMAND FUNDAMENTALS

Cost to Own

Single-Family Housing

Diverse Economic Base

Household Growth

Household Income Growth

Job Growth

High Quality of Life

Future

Rents /

Occupancy

Ranking of

24

Submarkets

Analysis

Essex

Model

Excess

Supply

and

Demand

Apply

Changes to

Current

Conditions

Submarket

Projection

Essex Portfolio

Essex – Southern California

Essex – Northern California and Seattle

Essex Portfolio

Essex – Southern California

Essex – Northern California and Seattle

Proven Market Timing

Pacific

Northwest

20%

Southern

California

10%

Q4-1994

San Francisco

Bay Area

70%

Southern

California

58%

Portland

Metro Area

4%

San Francisco

Bay Area

18%

Seattle

Metro Area

18%

Other

2%

Q3-2004

Capital Resources

Attractive financing and well-managed leverage

Access to a variety of capital resources

Common stock offerings

Preferred stock issuances

Discretionary Fund Capital

Essex Apartment Value Fund, L.P.

July 2001

September 2003

August 2004

August 2004

September 2004

October 2004

Fund I Update

Formed Fund I with nine Institutional Investors including

Essex’s 21.4% general and limited partner

Fully invested – $640 million (including leverage)

Entered into purchase and sale agreement with United

Dominion Realty Trust, Inc. (UDR)

Contract price of $756 million

16 apartment communities; 4,646 units

Sold Palermo, 230 units in San Diego, to a condo converter

for $58.2 million

First closing on Fund I sales transaction

Contract price of $264 million

7 properties – 1,777 units

Second closing on Fund 1 sales transaction

Contract price of $322 million

7 properties – 1,904 units, including Essex’s 49.9%

interest in Coronado at Newport North

Remaining assets are expected to close in 2005

Total return to investors in excess of 25 IRR

Essex Apartment Value Fund, L.P.

Final Close:

Total Equity Committed:

Essex Ownership:

Approximate

Investment Capacity:

Investment Strategy:

Fund II Update

Eight investors

Includes seven of the nine Fund I investors

$266 million

$75 million (28.21%)

Approximately $750 (with 65% leverage)

Seattle and Northern California

Primarily through acquisitions

Development limited to 25%

Value-added renovation

Entrepreneurial Approach

Condominium Conversion Opportunities

Development Joint Ventures

Value-Added Real Estate Opportunities

Palermo

San Diego, California

Units: 230

Constructions Cost: $44.9 million

Sold August 2004: $58.2 million

Hidden Valley Apartment Homes

5065 Hidden Park Court – Simi Valley, California

Units: 324

Estimated Cost: $48.3 million

Initial Occupancy: December 2003

Stabilization: November 2004

The Essex on Lake Merritt

One Lakeside Drive – Oakland, California

Units: 270

Constructions Cost: $72.7 million

Stabilized Operations: First Quarter 2003

Sold August 2004: $88 million

Invested $5 million with condo converter (buyer) to participate

in one-third of the condo sales profits.

Pillars of the Industry 2003

Gold Nugget Merit Award 2002

Best Residential Plan

San Francisco Business Journal 2001

Best Land Purchase

San Francisco Business Journal 2001

Recent Northern California Acquisitions

Vista Belvedere – Tiburon

76-Units located in Marin County

UPREIT transaction

Contract price of $17.4 million

$229,605 per door

Economic cap rate of 5.74%

Recent Northern California Acquisitions

The Esplanade Apartments – San Jose

278 Units

Contract price of approximately $60.1 million

$216,157 per door

Economic cap rate of 5.0%

Recent Northern California Acquisitions

Harbor Cove – Foster City

400 Units

Contract price of approximately $67.0 million

$167,735 per door

Economic cap rate of 5.11%

Recent Northern California Acquisitions

Carlmont Woods - Belmont

195 Units

Contract price of approximately $23.2 million

$118,718 per door

Economic cap rate of 5.10%

Forward-looking Statement

SAFE HARBOR STATEMENT

UNDER THE PRIVATE SECURITIES LITITIGATION REFORM ACT OF 1995

This presentation includes statements that qualify as forward-looking

statements under the Private Securities Litigation Reform Act of 1995,

including statements about projected growth in Funds from Operations

and dividends, the Company's 2002 business plan, its projections

regarding internal growth, external growth and redevelopment, its strategy

and projections regarding the growth in its various markets, and its

projections regarding the Essex Apartment Value Fund. The Company's

actual results may differ materially from those projected in such forward-

looking statements due to various factors, including, but not limited to,

changes in economic conditions and market demand for rental units, the

impact of competition and competitive pricing, unexpected delays in the

development and leasing of development and redevelopment projects, and

the other risks detailed in the Company's Securities and Exchange

Commission filings.

THANK YOU!

Keith R. Guericke – President and Chief Executive Officer

Essex Property Trust, Inc.