1971 George Marcus forms Essex Property Corporation

1988 Essex delivers 8 development communities under the name Summerhill Development

1994 Prices IPO at $19.50 per share (6.3 million shares). Essex has ownership in 16 apartment

communities in the West Coast

1997 Increases portfolio by 60%, acquiring 27 communities. Reaches $1 billion market

capitalization

2001 Creates Essex Apartment Value Fund L.P. with approximately $700 million in investment

capability

2002 Acquires John M. Sachs, Inc. through a merger and adds 18 communities to portfolio

2004 Sells remaining Essex Fund I assets for $756 million, generating a 41% gross partnership IRR

and forms Essex Apartment Value Fund II with $750 million investment capacity

2010 Michael Schall appointed new CEO. Company acquires 12 communities for $584 million

and achieves 42% one-year total shareholder return

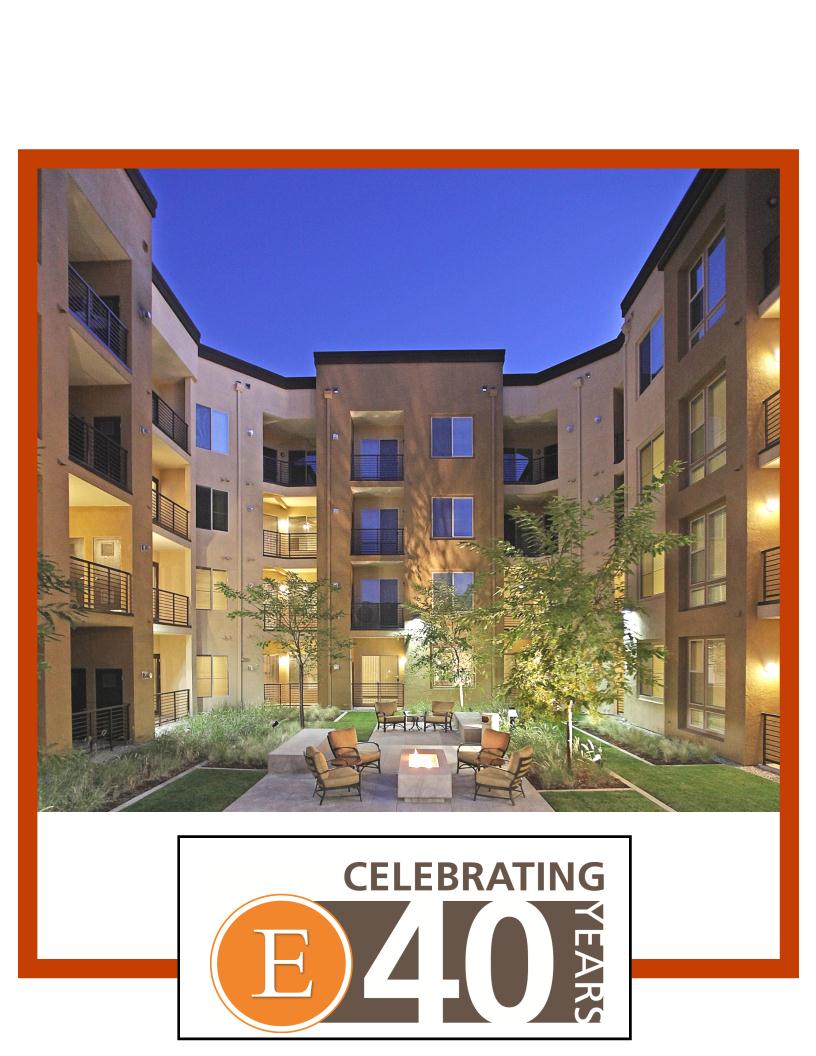

CELEBRATING 40 YEARS of EXCELLENCE

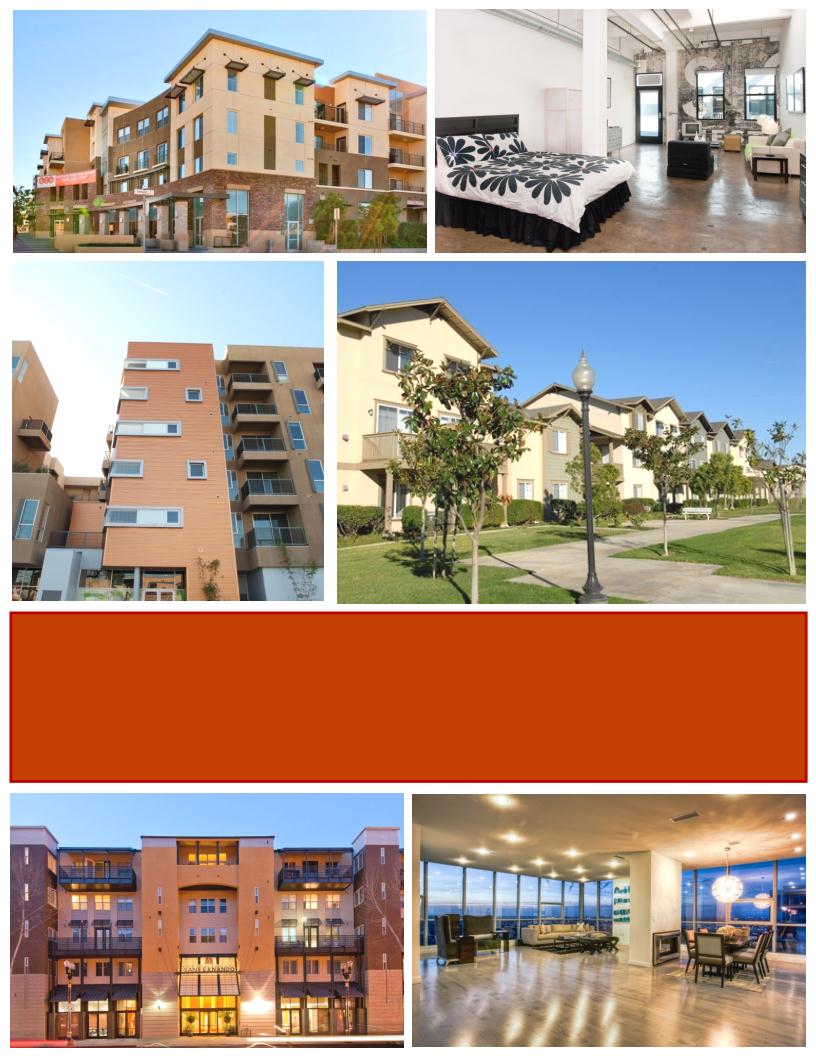

ACCOMPLISHMENTS

§ Highest total return of any REIT since IPO - 1,882% (Source: SNL Financial)

§ Cumulative Dividend paid in excess of $50 per share since IPO

§ At IPO, Essex owned 16 multifamily properties (4,410 units); currently, Essex has ownership in

150 apartment communities (30,716 units)

§ Total capitalization at IPO was $250 million; as of March 31, 2010, total capitalization was $6.7

billion

§ IPO stock price was $19.50 a share, today the stock trades around $135 per share

4