21

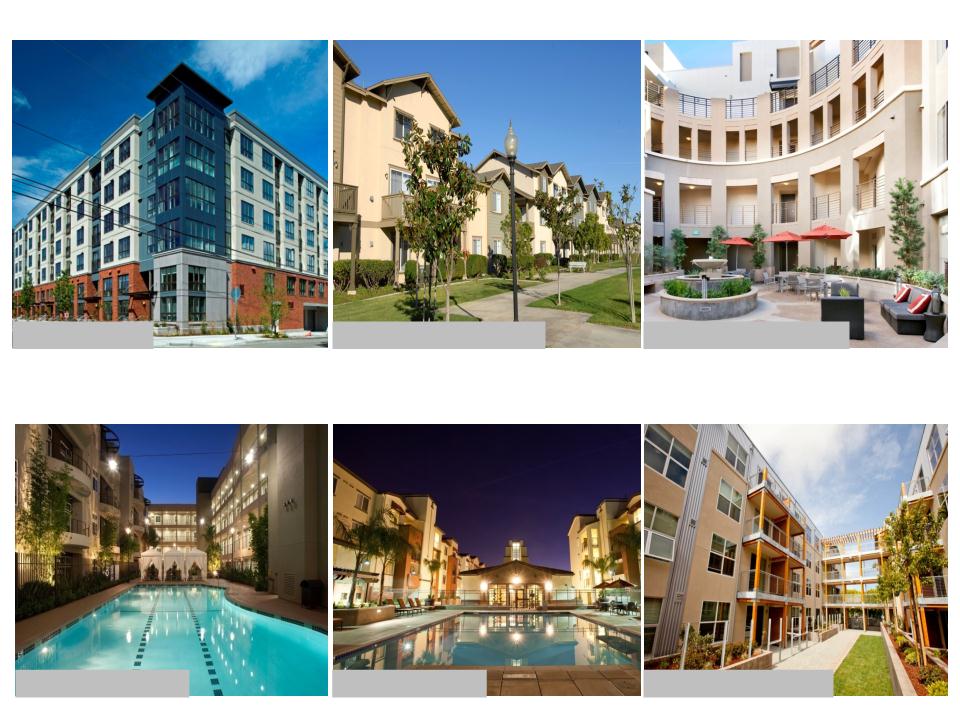

Investing Strategy

§ An innovative

management team

responsive to changing

market dynamics with the

ability to source and

structure unique

opportunities within the

multifamily space

§ Disciplined underwriting,

rigorous analysis, and total

return driven

First multifamily REIT to create a fund business (raises $250 million

of equity for Fund I).

Monetizes Fund I at a +40% IRR. Creates Fund II with $265 million of

equity.

Acquires $106 million of multifamily REIT unsecured bonds yielding

10.3% near the bottom of the market.

Acquires early in the recovery. First acquisition was a foreclosed

condo at 55% of cost. Acquires over $1 billion of properties over the

next 24 months.

Early entrant in preferred equity investment and achieves 13%

annual rate on a $12 million investment.

Establishes Wesco I joint venture partnership with $200 million of

equity. Fully invested by year-end 2011.

Establishes Wesco II for a $175 million Preferred Equity Investment

in Park Merced at a 10.1% annual return for 7-years.

2001

2004

2009

2010

2011

Acquires joint venture partner’s interest in the co-investment Essex

Skyline and receives $2.3 million promote income. Issued 320,000

fewer shares of ESS common stock by initially acquiring with a

partner.

2012

Core Competencies

Began developing early in the recovery. Delivers first project post

recession 6 months ahead of schedule and $5 million below budget.