Exhibit 99.1

Improving health care in America through Innovative Solutions

Nasdaq:PSSI

David Smith President and Chief Executive Officer

PSS World Medical, Inc.

Culture Enhanced by Discipline

Entrepreneurial

Market Share Growth Focus

High Burn Rate

Espirit de Corps

GROWTH

Profit

Customer Satisfaction

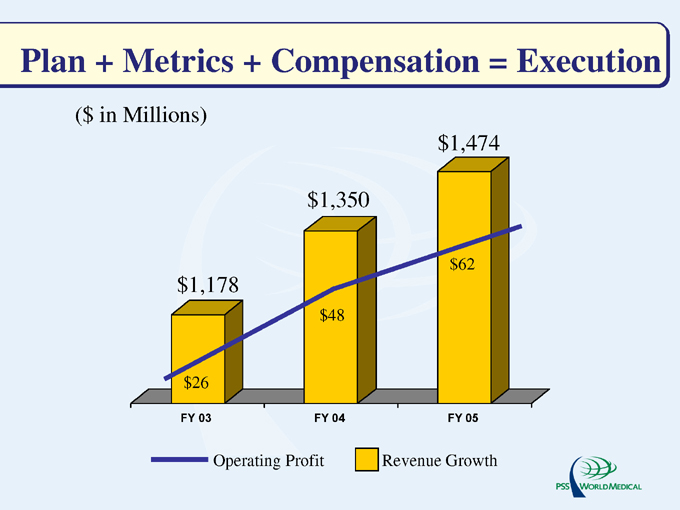

Plan + Metrics + Compensation = Execution

($ in Millions) $1,178 $1,350 $1,474 $26 $48 $62

FY 03 FY 04 FY 05

Operating Profit Revenue Growth

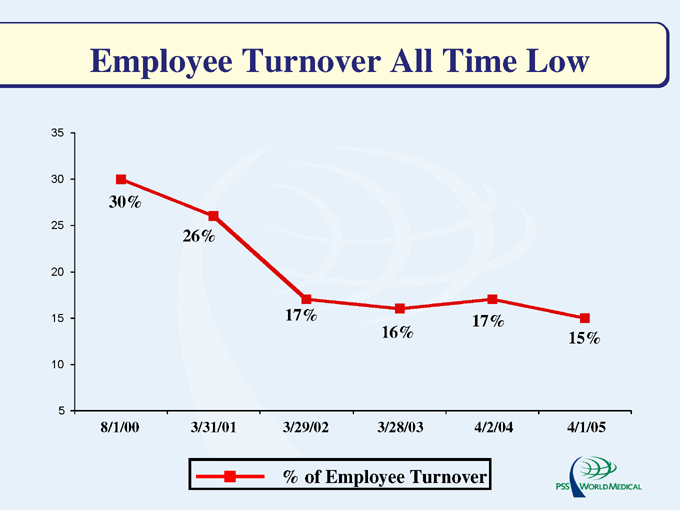

Employee Turnover All Time Low

35 30 25 20 15 10 5

30%

26%

17% 17%

16% 15%

8/1/00 3/31/01 3/29/02 3/28/03 4/2/04 4/1/05

% of Employee Turnover

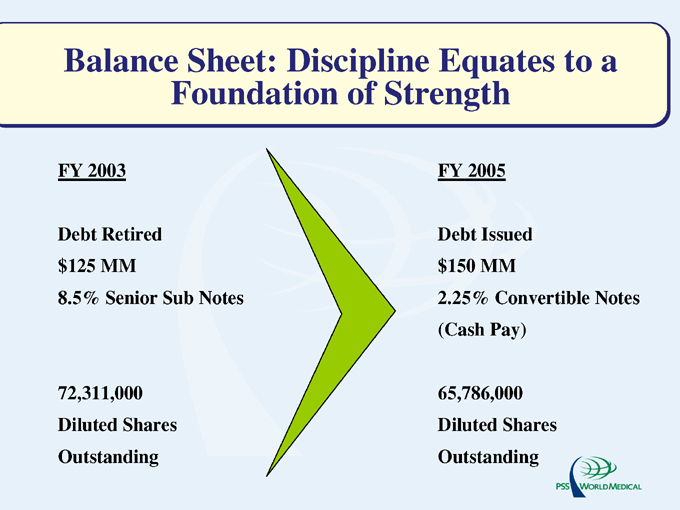

Balance Sheet: Discipline Equates to a Foundation of Strength

FY 2003 FY 2005

Debt Retired Debt Issued

$125 MM $150 MM

8.5% Senior Sub Notes 2.25% Convertible Notes (Cash Pay)

72,311,000 65,786,000

Diluted Shares Diluted Shares

Outstanding Outstanding

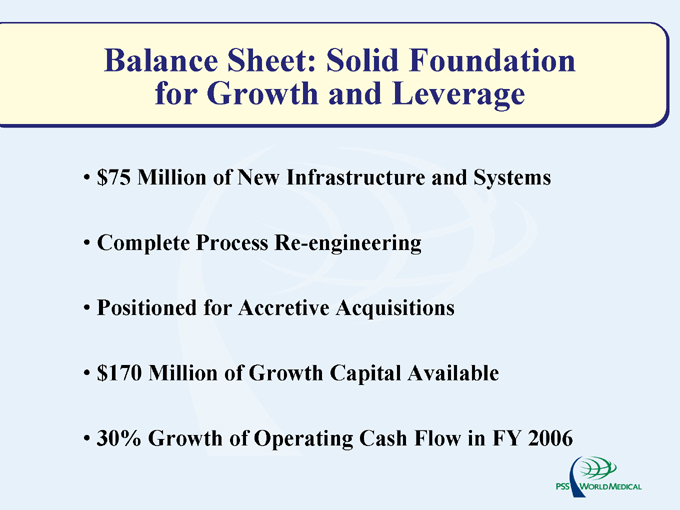

Balance Sheet: Solid Foundation for Growth and Leverage $75 Million of New Infrastructure and Systems Complete Process Re-engineering Positioned for Accretive Acquisitions $170 Million of Growth Capital Available 30% Growth of Operating Cash Flow in FY 2006

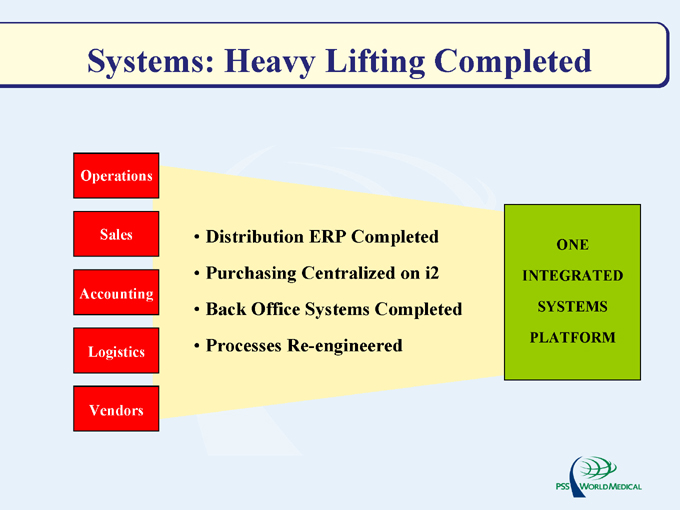

Systems: Heavy Lifting Completed

Operations Sales Accounting Logistics Vendors

Distribution ERP Completed Purchasing Centralized on i2 Back Office Systems Completed Processes Re-engineered

ONE

INTEGRATED

SYSTEMS

PLATFORM

Systems: The Next Step in Development

Customer Service Systems Development Customer Intelligence Gathering Advanced Ordering Systems Sales Force Productivity Advanced Warehouse—PSS

Leverage Investments for Efficiency Gains

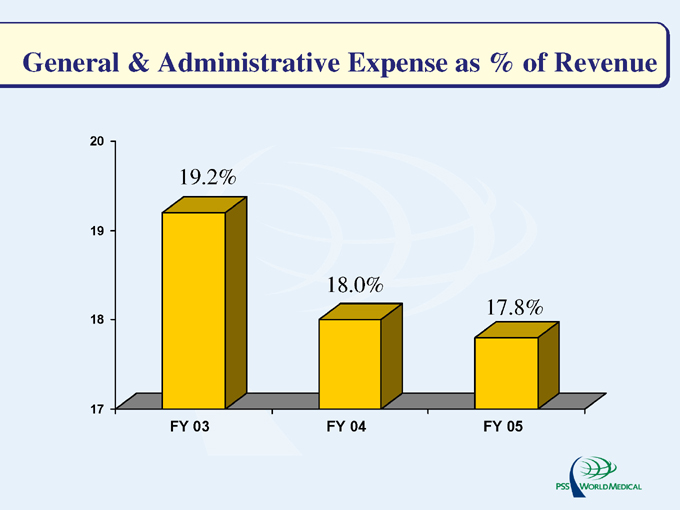

General & Administrative Expense as % of Revenue

20 19 18 17

19.2%

18.0%

17.8%

FY 03 FY 04 FY 05

20 19 18 17

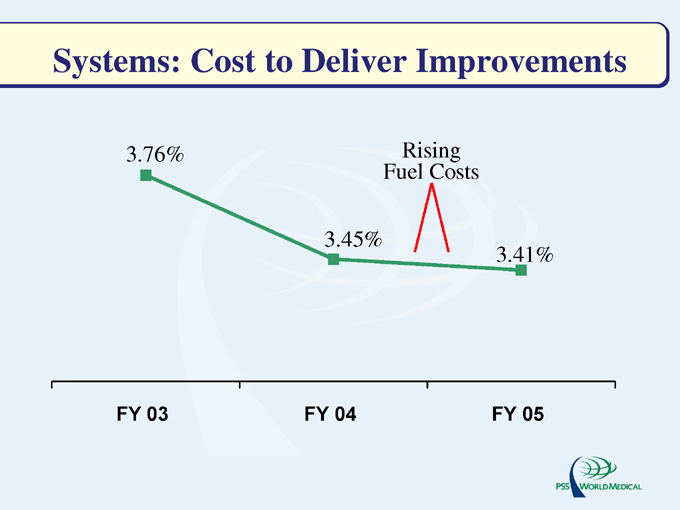

Systems: Cost to Deliver Improvements

3.76% Rising Fuel Costs

3.45%

3.41%

FY 03 FY 04 FY 05

Good Offense Starts with Defense

Developed Rx Distribution Capability

Acquired Billing Services Company

Developed Equipment & Housekeeping Product Lines Develop Customer Solution Programs Built 30% Plus Capacity Created Sourcing Platform

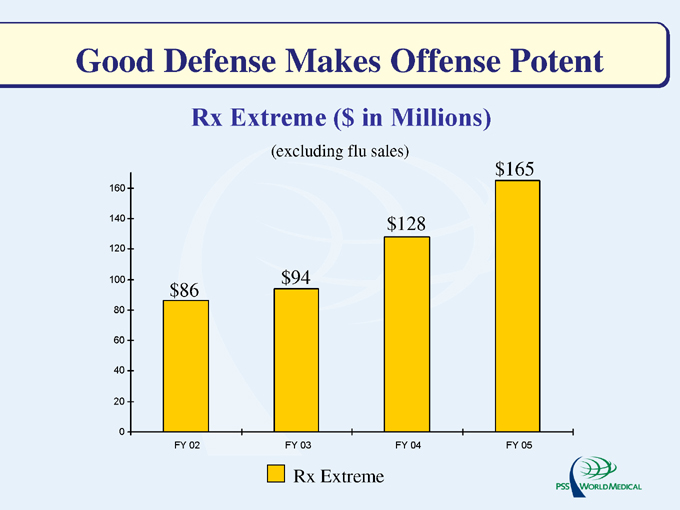

Good Defense Makes Offense Potent

Rx Extreme ($ in Millions)

(excluding flu sales)

160 140 120 100 80 60 40 20 0 $86 $94 $128 $165

FY 02 FY 03 FY 04 FY 05

Rx Extreme

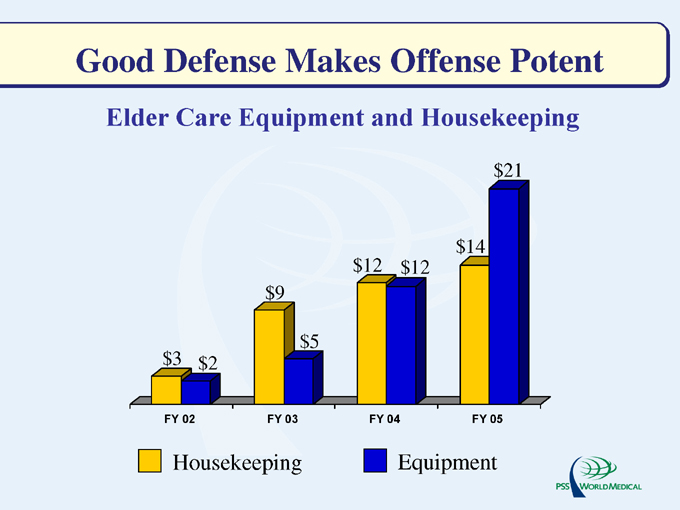

Good Defense Makes Offense Potent

Elder Care Equipment and Housekeeping

$3

$2

$9

$5

$12

$12

$14

$21

FY 02 FY 03 FY 04 FY 05

Housekeeping Equipment

FY 2005—FY 2008—Potent Offense

Offense

Global Sourcing Leverage

Continued Employee/Resource Development Product Offering Expansion Continued Customer Service Enhancements Strategic Acquisitions

FINANCIAL

COMPETITION

TECHNOLOGY & INNOVATION

HEALTH CARE

SPENDING

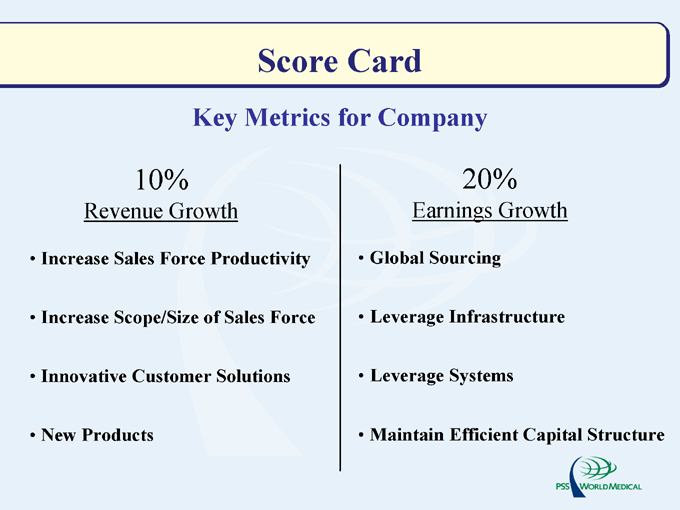

Score Card

Key Metrics for Company

10%

Revenue Growth

Increase Sales Force Productivity Increase Scope/Size of Sales Force Innovative Customer Solutions New Products

20%

Earnings Growth

Global Sourcing Leverage Infrastructure Leverage Systems

Maintain Efficient Capital Structure

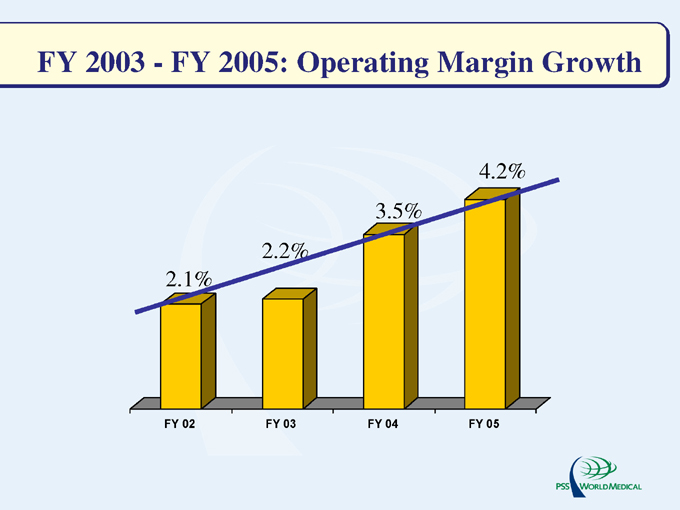

FY 2003—FY 2005: Operating Margin Growth

4.2% 3.5% 2.2% 2.1%

FY 02 FY 03 FY 04 FY 05

David Bronson Executive Vice President and Chief Financial Officer

PSS World Medical, Inc.

Fiscal Year 2005: A Year of Successes & Challenges

Successes

Revenue and Profitability Growth EPS Goals and Guidance Met JDE Implementation Acquisition Integration Sarbanes-Oxley 404 Compliance

Challenges

Elder Care Business Profitability Home Care Revenue Growth SOX 404 Costs Uncontrollables

Flu Vaccine Shortage Fuel Cost Increases Weather Related Impacts

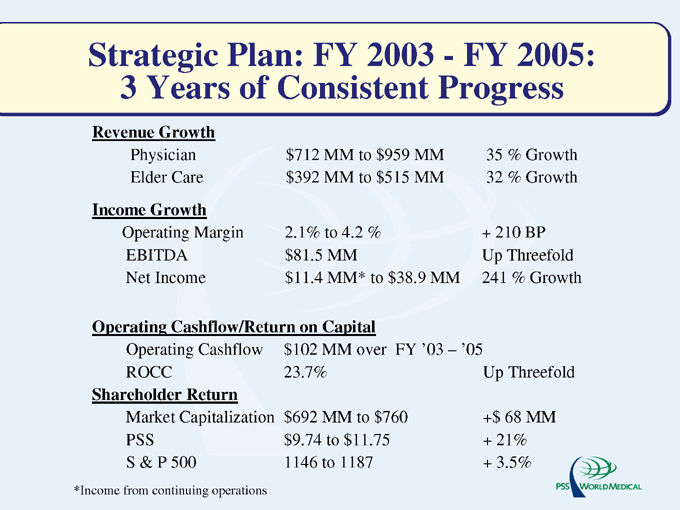

Strategic Plan: FY 2003—FY 2005: 3 Years of Consistent Progress

Revenue Growth

Physician $712 MM to $959 MM 35% Growth

Elder Care $392 MM to $515 MM 32% Growth

Income Growth

Operating Margin 2.1% to 4.2% + 210 BP

EBITDA $81.5 MM Up Threefold

Net Income $11.4 MM* to $38.9 MM 241% Growth

Operating Cashflow/Return on Capital

Operating Cashflow $102 MM over FY ’03 – ’05

ROCC 23.7% Up Threefold

Shareholder Return

Market Capitalizatio $692 MM to $760 +$68 MM

PSS $9.74 to $11.75 + 21%

S & P 500 1146 to 1187 + 3.5%

*Income from continuing operations

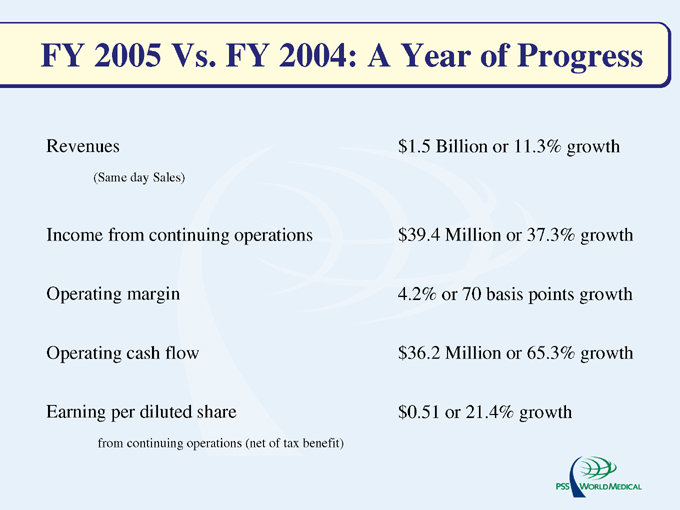

FY 2005 Vs. FY 2004: A Year of Progress

Revenues

(Same day Sales)

Income from continuing operations Operating margin Operating cash flow

Earning per diluted share from continuing operations (net of tax benefit) $1.5 Billion or 11.3% growth

$39.4 Million or 37.3% growth 4.2% or 70 basis points growth $36.2 Million or 65.3% growth $0.51 or 21.4% growth

Sarbanes-Oxley 404 Compliance

18 month process of evaluating, documenting and testing internal controls Executive-led steering committee 34 business processes 515 business and financial controls documented and tested Improvements in:

ERP system access and security Inventory processes Segregation of duties at branch locations

Shared Services Progress Development

Information Technology

Shared Financial Services

Training

Global Sourcing

Business Development

Compliance & Tax

Marketing

Human Resources

Operations

“The Customer” PSS Division Gulf South Division Shared Services SMT Joint Service Agreements

Shared Services Progress & Development

Outcomes

Costs have been reduced as % of sales by 140 bps Functions are professionally staffed and managed Controls have been enhanced Industry best practices create competitive advantage

Strategic Plan FY 2006—FY 2008: Launching a New 3 Year Plan

Expected 20% Per Annum Growth of Earnings Per Share Fiscal Years 2006—2008

Profit Growth Drivers:

Revenue Growth Capacity Utilization Global Product Sourcing Shared Services Leverage

Significant Increases in Operating Cash Flow

Goals Do Not Include Acquisitions

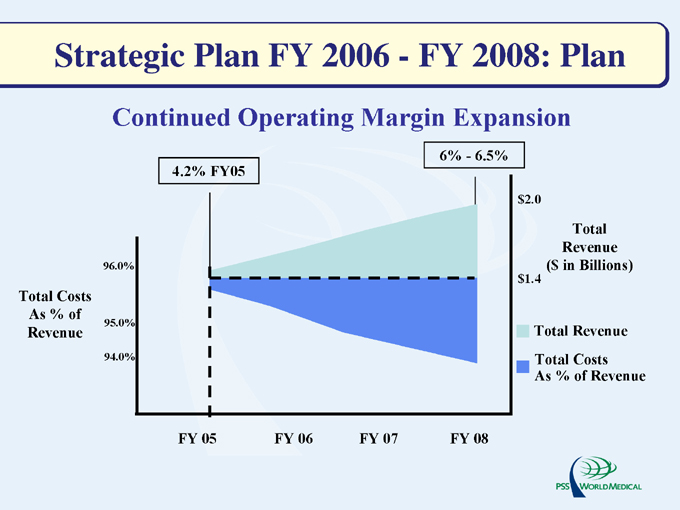

Strategic Plan FY 2006—FY 2008: Plan

Continued Operating Margin Expansion

4.2% FY05

Total Costs As % of Revenue

96.0%

95.0%

94.0%

6%—6.5% $2.0

$1.4

Total Revenue ($ in Billions)

Total Revenue Total Costs As % of Revenue

FY 05 FY 06 FY 07 FY 08

FY 2006—FY 2008: Renewed Focus on Working Capital Management

Inventory Turns

Receivables Management Systems Technology Uses of Cash Measures of Effectiveness

Cash EPS

OCF Ratio to Revenues

FY 2006—FY 2008: Efficient Capital Structure

Bank Credit Facility Convertible Bonds Share Repurchases Capital Needs

CAPEX

Working Capital Growth Acquisition Strategy

FY 2006—FY 2008: Acquisition Strategy

Target assets complementary to core business strategy

Fold-ins Strategic

Size range $10mm - $40mm of revenues Accretive within 12 months Funded with cash flows & bank debt 1-2 each year, both business New VP business development

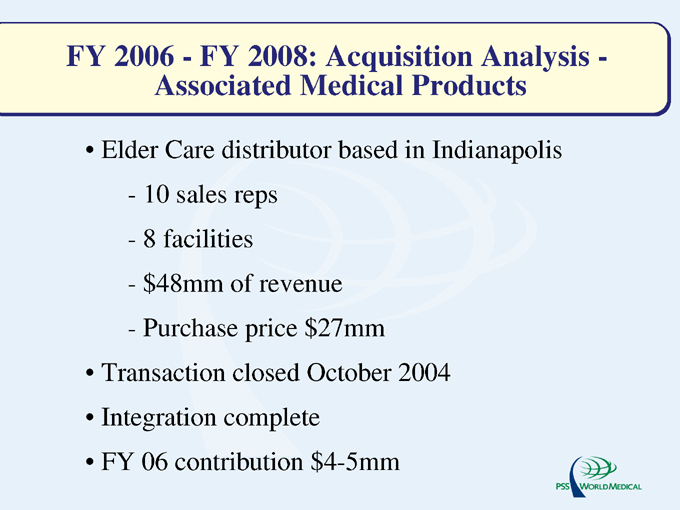

FY 2006—FY 2008: Acquisition Analysis -Associated Medical Products

Elder Care distributor based in Indianapolis

10 sales reps 8 facilities $48mm of revenue Purchase price $27mm

Transaction closed October 2004 Integration complete FY 06 contribution $4-5mm

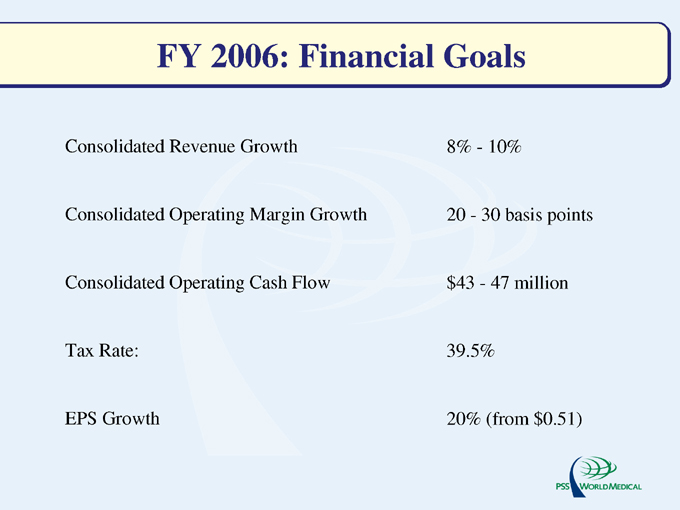

FY 2006: Financial Goals

Consolidated Revenue Growth 8%—10%

Consolidated Operating Margin Growth 20 - 30 basis points

Consolidated Operating Cash Flow $43 - 47 million

Tax Rate: 39.5%

EPS Growth 20% (from $0.51)

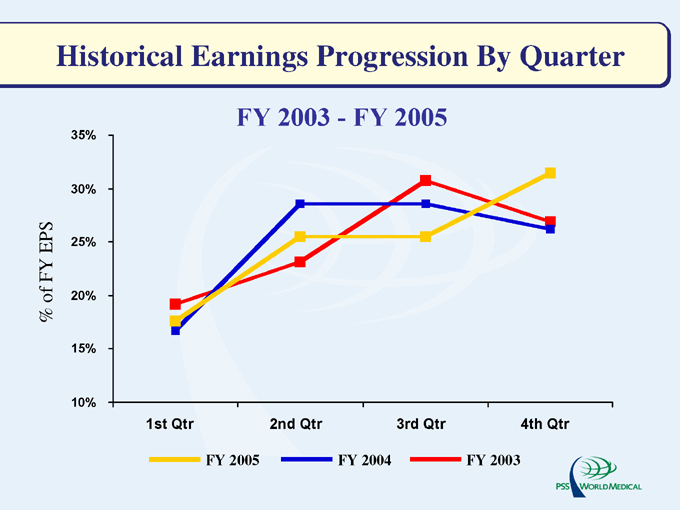

Historical Earnings Progression By Quarter

FY 2003—FY 2005

% of FY EPS

35% 30% 25% 20% 15% 10%

1st Qtr 2nd Qtr 3rd Qtr 4th Qtr

FY 2005 FY 2004 FY 2003

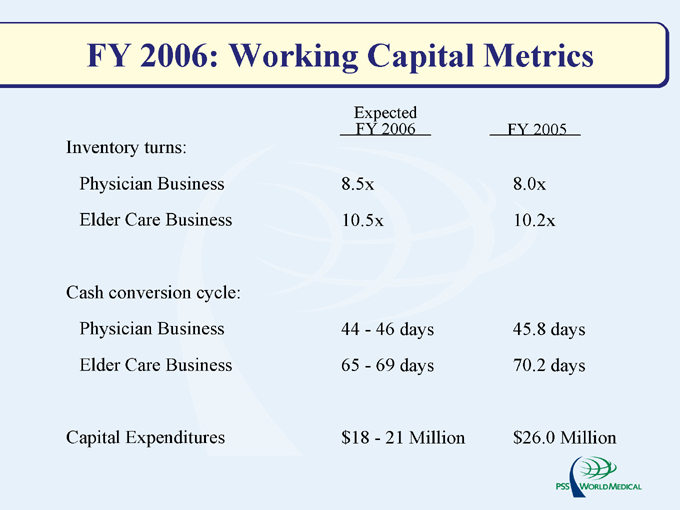

FY 2006: Working Capital Metrics

Expected FY 2006 FY 2005

Inventory turns:

Physician Business 8.5x 8.0x

Elder Care Business 10.5x 10.2x

Cash conversion cycle:

Physician Business 44—46 days 45.8 days

Elder Care Business 65—69 days 70.2 days

Capital Expenditures $18—21 Million $26.0 Million

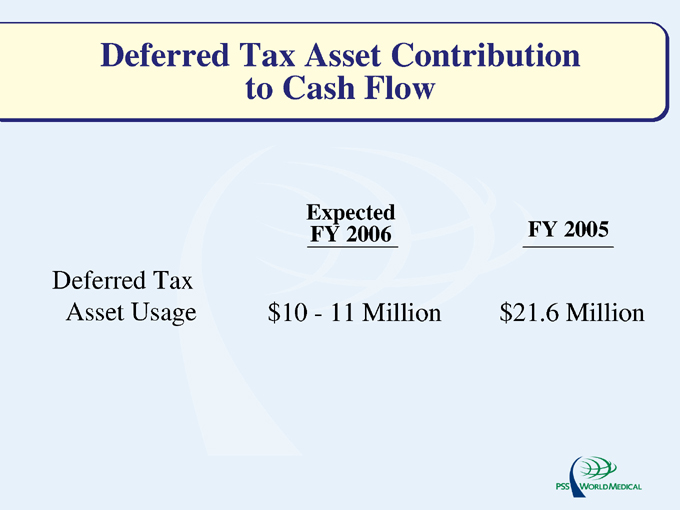

Deferred Tax Asset Contribution to Cash Flow

Expected FY 2006 FY 2005

Deferred Tax Asset Usage $10—11 Million $21.6 Million

Delivering Shareholder Value

Revenue and earnings growth momentum Expanding market share leadership Strong corporate governance Continued operating margin expansion Significant increase in operating cash flows

Low-cost capital structure with capacity for strategic investments

20% per annum EPS growth projected for FY 2006—FY 2008

John Sasen Chief Marketing Officer

PSS World Medical, Inc.

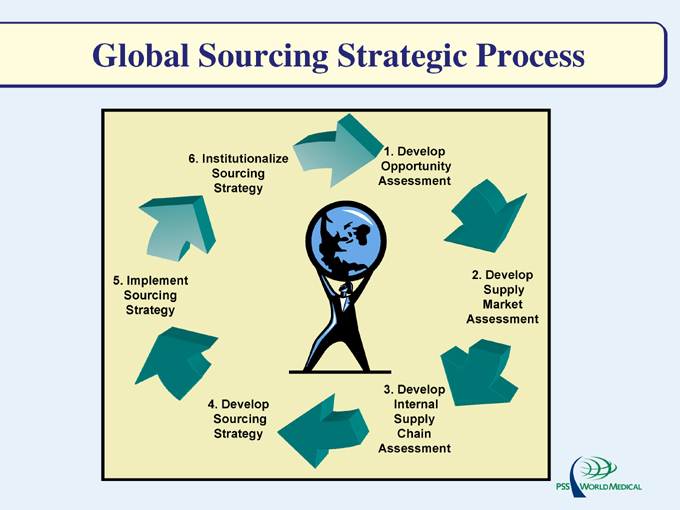

Global Sourcing Strategic Process

1. Develop Opportunity Assessment

2. Develop Supply Market Assessment

3. Develop Internal Supply Chain Assessment

4. Develop Sourcing Strategy

5. Implement Sourcing Strategy

6. Institutionalize Sourcing Strategy

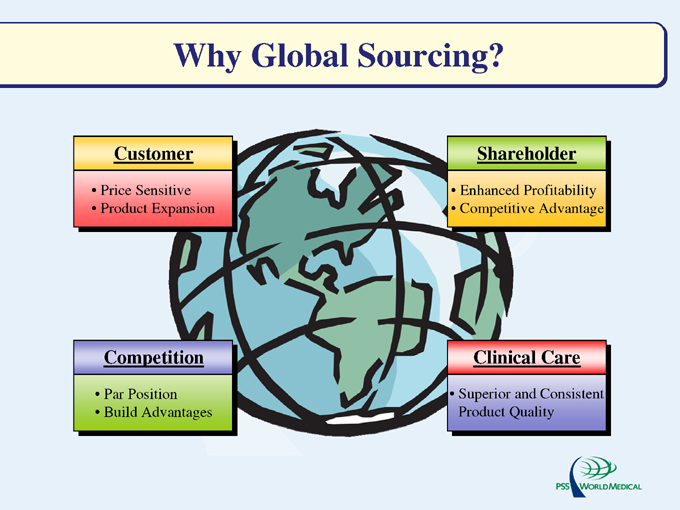

Why Global Sourcing?

Customer

Price Sensitive Product Expansion

Shareholder

Enhanced Profitability Competitive Advantage

Competition

Par Position Build Advantages

Clinical Care

Superior and Consistent Product Quality

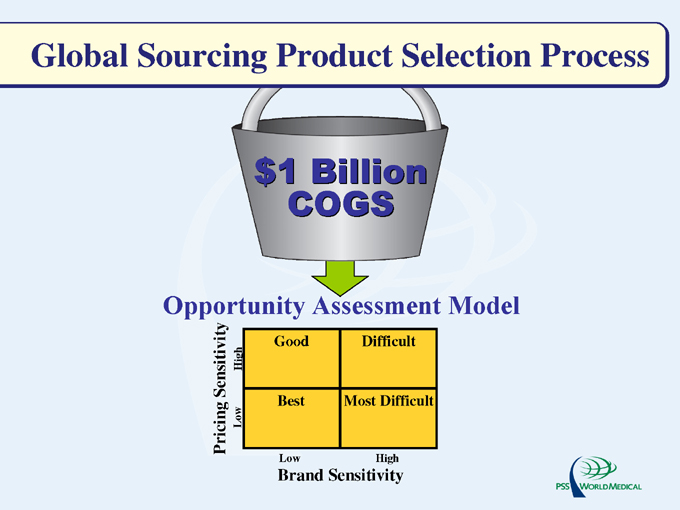

Global Sourcing Product Selection Process $1 Billion COGS

Opportunity Assessment Model

Pricing Sensitivity

Low High

Good Difficult

Best Most Difficult

Low High

Brand Sensitivity

Significant Product Conversion Opportunity $300 Million

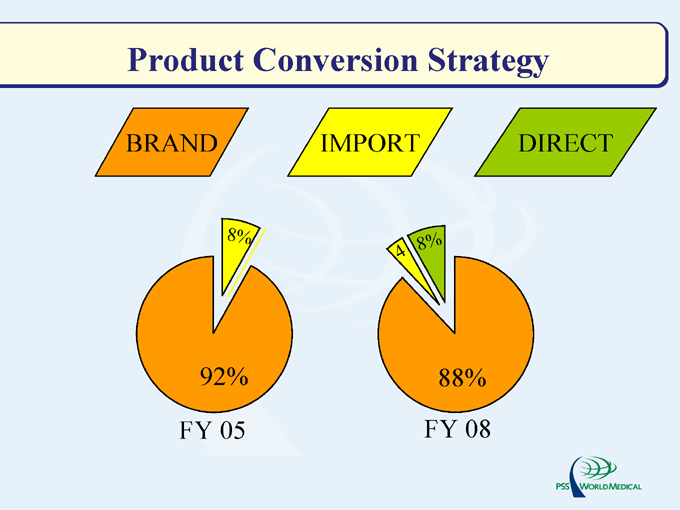

Product Conversion Strategy

BRAND IMPORT DIRECT

8%

92%

FY 05

4

8%

88%

FY 08

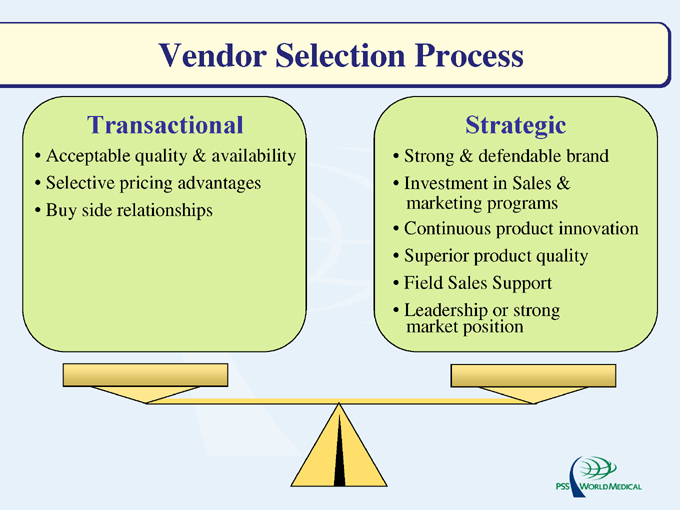

Vendor Selection Process

Transactional

Acceptable quality & availability Selective pricing advantages Buy side relationships

Strategic

Strong & defendable brand Investment in Sales & marketing programs Continuous product innovation Superior product quality Field Sales Support

Leadership or strong market position

Strengthening Our Brand

Today a $135+ Million Product Line

Building on Customer Trust Through Enhanced Quality and Product Expansion

Global Sourcing

Go to Market

Branding Process

Share Objectives

Value Proposition

Alignment of Goals, Resources & Incentives

Sales Training Marketing Support

LAUNCH

Kevin English Senior Vice President Shared Financial Services

PSS World Medical, Inc.

Global Sourcing Strategic Process

1. Develop Opportunity Assessment

2. Develop Supply Market Assessment

3. Develop Internal Supply Chain Assessment

4. Develop Sourcing Strategy

5. Implement Sourcing Strategy

6. Institutionalize Sourcing Strategy

Imperatives

Quality Control Cost Availability

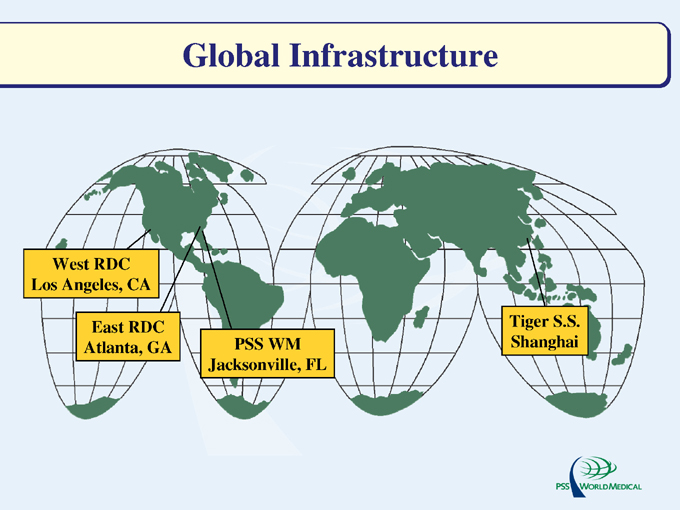

Global Infrastructure

West RDC Los Angeles, CA

East RDC Atlanta, GA

PSS WM Jacksonville, FL

Tiger S.S. Shanghai

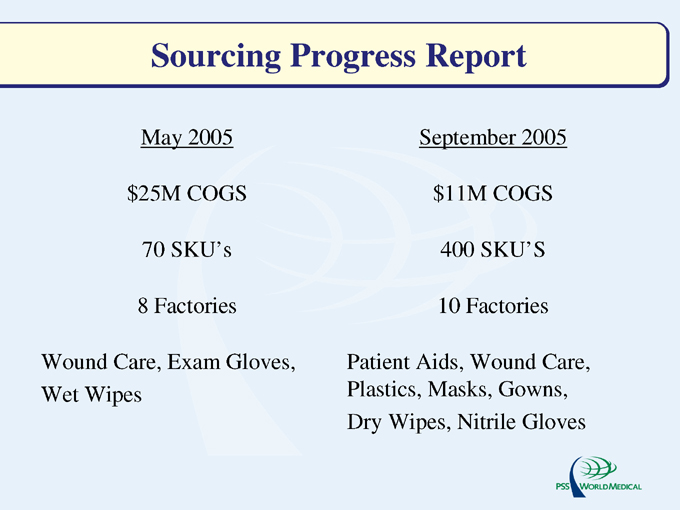

Sourcing Progress Report

May 2005 September 2005

$25M COGS $11M COGS

70 SKU’s 400 SKU’S

8 Factories 10 Factories

Wound Care, Exam Gloves, Wet Wipes

Patient Aids, Wound Care, Plastics, Masks, Gowns, Dry Wipes, Nitrile Gloves

Proof of Delivery

Significant Financial Opportunity $300 Million

$45 Million

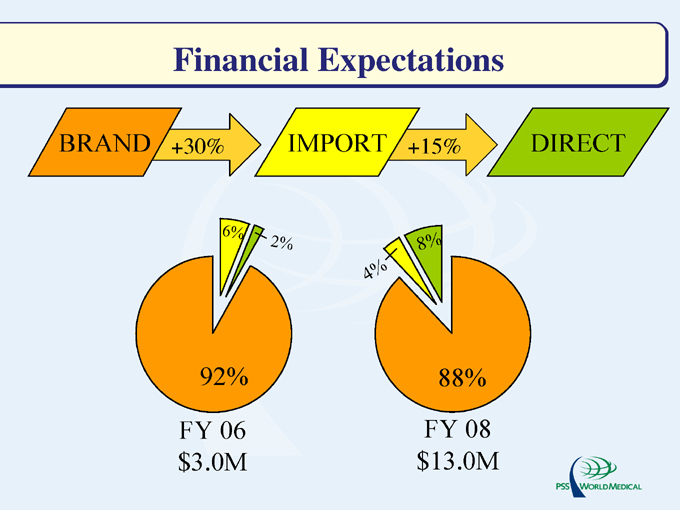

Financial Expectations

BRAND

+30%

IMPORT

+15%

DIRECT

6%

2%

92%

FY 06 $3.0M

4%

8%

88%

FY 08 $13.0M

Gary Nutter President

Gulf South Medical Supply, Inc.

Eldercare Business

GULF SOUTH

MEDICAL SUPPLY

Investor Day

Current Trends

FY05 – Year of Growth & Investment Strategic Customer Segment Growth Key Product Category Growth

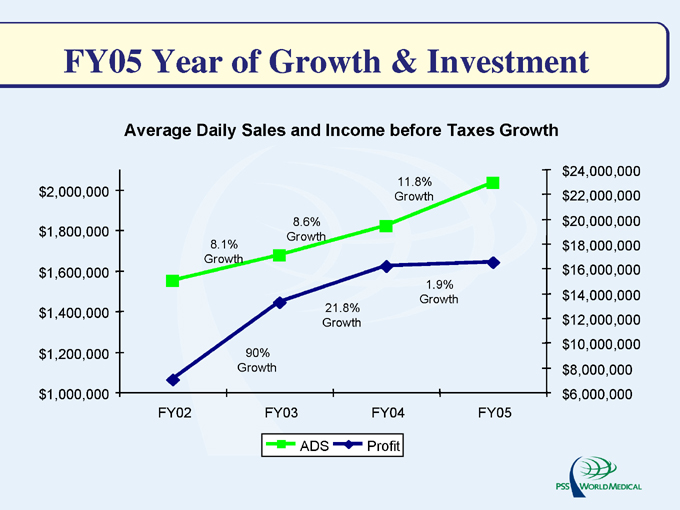

FY05 Year of Growth & Investment

Average Daily Sales and Income before Taxes Growth $2,000,000 $1,800,000 $1,600,000 $1,400,000 $1,200,000 $1,000,000

FY02

FY03

FY04

FY05 $24,000,000 $22,000,000 $20,000,000 $18,000,000 $16,000,000 $14,000,000 $12,000,000 $10,000,000 $8,000,000 $6,000,000

8.1% Growth

8.6% Growth

11.8% Growth

90% Growth

21.8% Growth

1.9% Growth

ADS

Profit

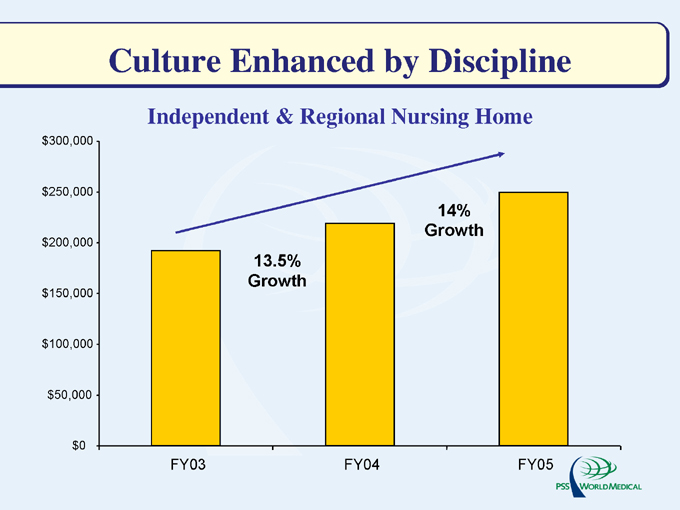

Culture Enhanced by Discipline

Independent & Regional Nursing Home $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0

FY03 FY04 FY05

13.5% Growth

14% Growth

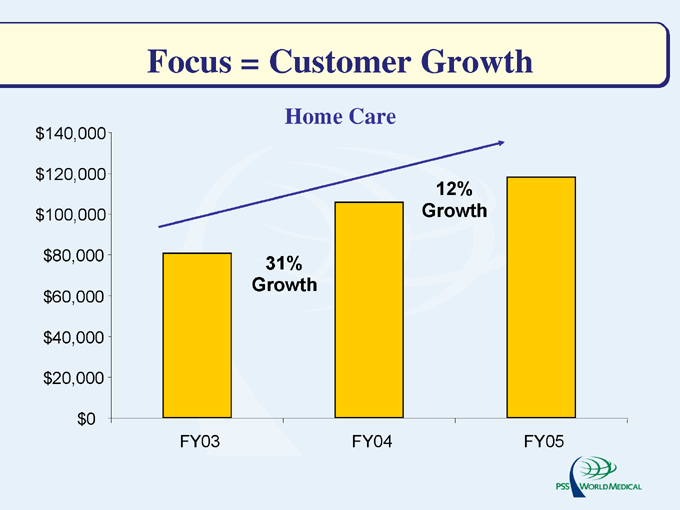

Focus = Customer Growth

Home Care $140,000 $120,000 $100,000 $80,000 $60,000 $40,000 $20,000 $0

FY03 FY04 FY05

31% Growth

12% Growth

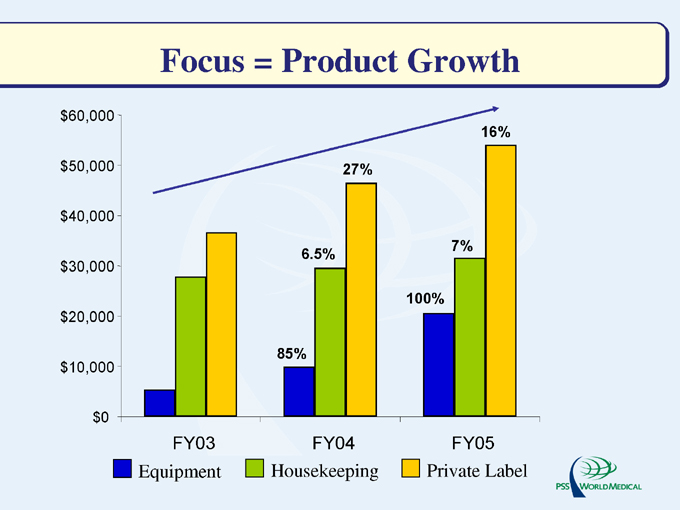

Focus = Product Growth $60,000 $50,000 $40,000 $30,000 $20,000 $10,000 $0

FY03 FY04 FY05

85%

6.5%

27%

100%

7%

16%

Equipment

Housekeeping

Private Label

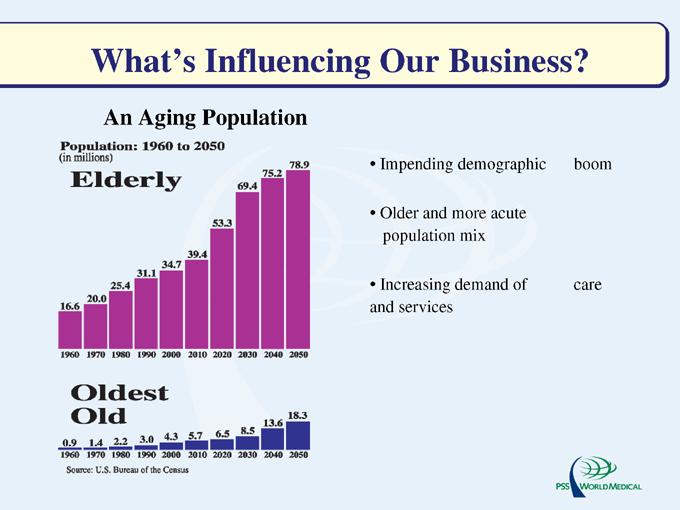

What’s Influencing Our Business?

An Aging Population

Population: 1960 to 2050 (in millions)

Elderly

16.6 20.0 25.4 31.1 34.7 39.4 53.3 69.4 75.2 78.9

1960 1970 1980 1990 2000 2010 2020 2030 2040 2050

Oldest old

0.9 1.4 2.2 3.0 4.3 5.7 6.5 8.5 13.6 18.3

1960 1970 1980 1990 2000 2010 2020 2030 2040 2050

Source: U.S. Bureau of the Census

Impending demographic boom

Older and more acute population mix

Increasing demand of care and services

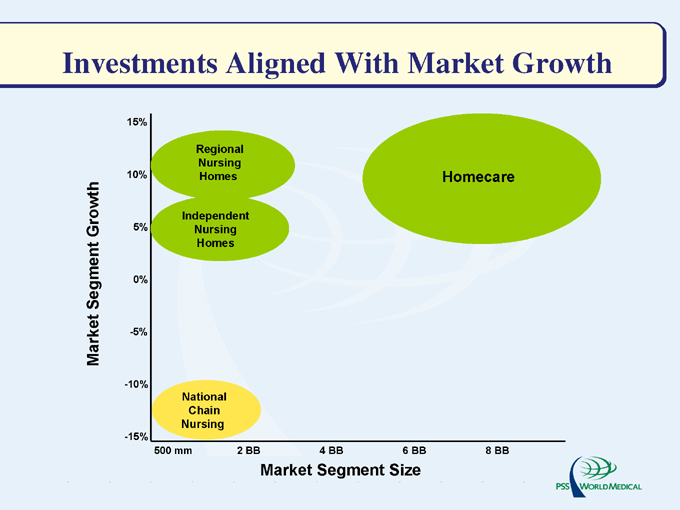

Investments Aligned With Market Growth

Market Segment Growth

-15% -10% 5% 0% -5% 10% 15%

Regional Nursing Homes

Independent Nursing Homes

Homecare

National Chain Nursing

500 mm 2 BB 4 BB 6 BB 8 BB

Market Segment Size

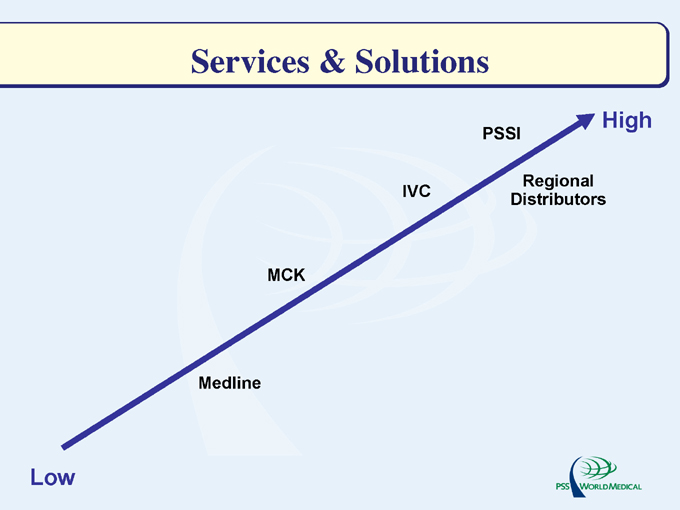

Solving Our Customers Challenges

Reimbursement

Staffing

Tort

Services & Solutions

MCK

IVC

PSSI

High

Regional Distributors

Medline

Low

FY06 Sales Growth Initiatives

Focused targeting approach

Leverage professional billing services Realign corporate account team Field quotas Product line extensions SFS training Innovative Business Solutions

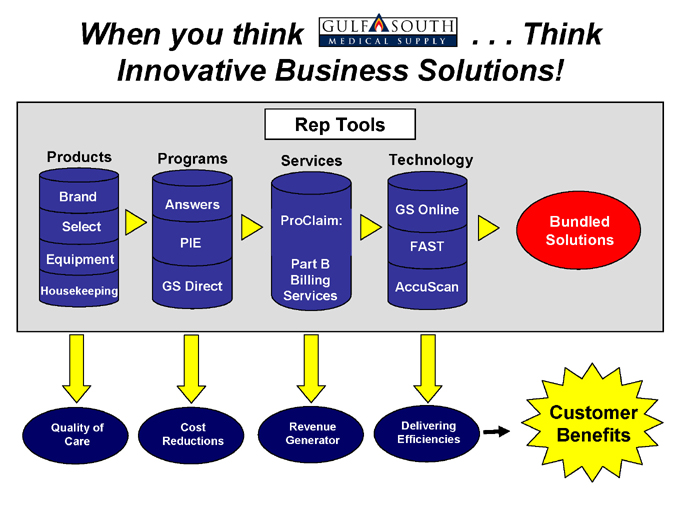

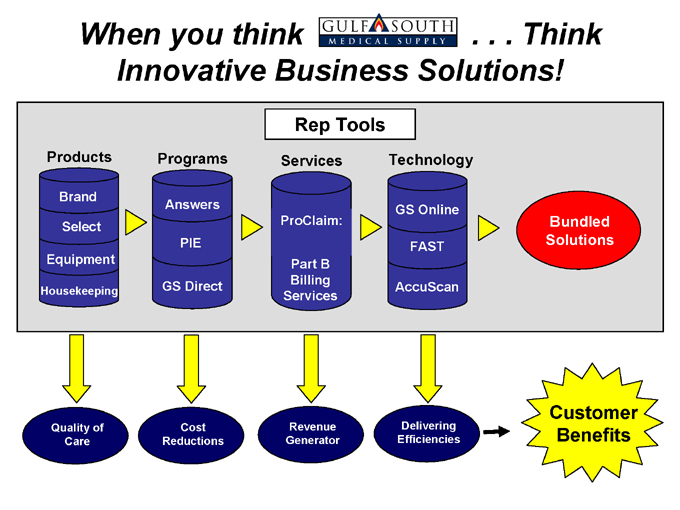

When you think

. . . Think

Innovative Business Solutions!

Rep Tools

Products

Brand

Select

Equipment

Housekeeping

Programs

Answers PIE GS Direct

Services

ProClaim:

Part B Billing Services

Technology

GS Online FAST AccuScan

Bundled Solutions

Quality of Care Cost Reductions Revenue Generator Delivering Efficiencies

Customer Benefits

answer plus

When you think

. . . Think

Innovative Business Solutions!

Rep Tools

Products

Brand

Select

Equipment

Housekeeping

Programs

Answers PIE GS Direct

Services

ProClaim:

Part B Billing Services

Technology

GS Online FAST AccuScan

Bundled Solutions

Quality of Care Cost Reductions Revenue Generator Delivering Efficiencies

Customer Benefits

Investments To Improve Customer Satisfaction

Increase truck fleet by 25%

Realign compensation to drive customer satisfaction metrics

Complete ERP implementation

Distribution system complete

Customer service & Ordering system

Training & Development

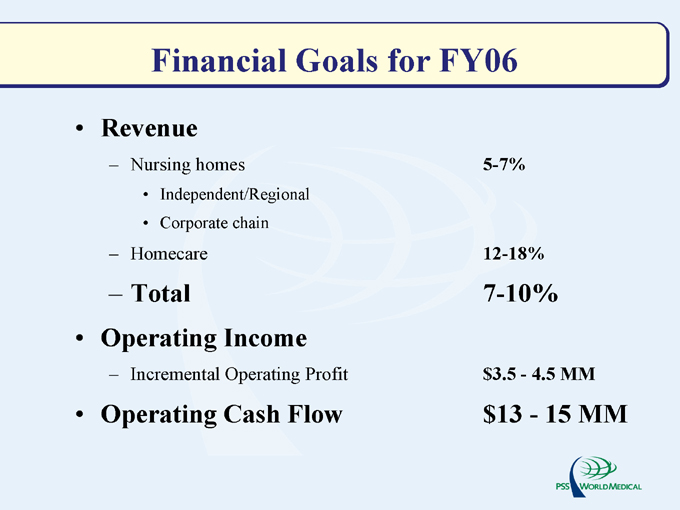

Financial Goals for FY06

Revenue

Nursing homes 5-7%

Independent/Regional Corporate chain

Homecare 12-18%

Total 7-10%

Operating Income

Incremental Operating Profit $3.5—4.5 MM

Operating Cash Flow $13—15 MM

Gary Corless President

Physician Sales & Service, Inc.

Physician Business

Investor Day

Today

Important Trends Market Factors Business Plan The Score Card

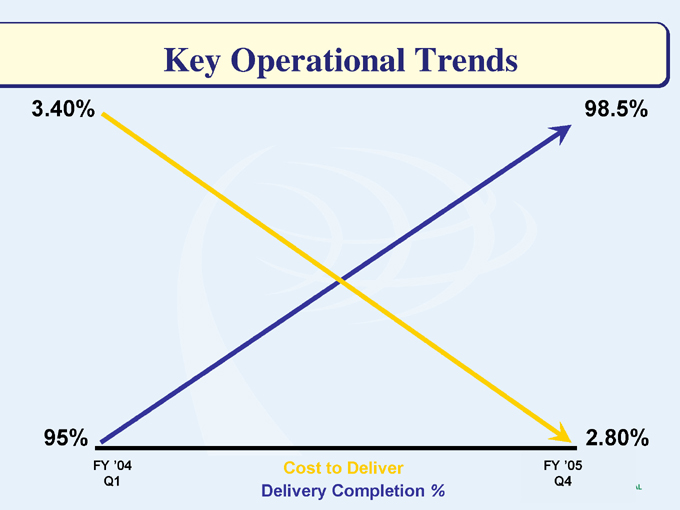

Key Operational Trends

3.40%

98.5%

95%

FY ‘04 Q1

2.80%

FY ‘05 Q4

Cost to Deliver Delivery Completion %

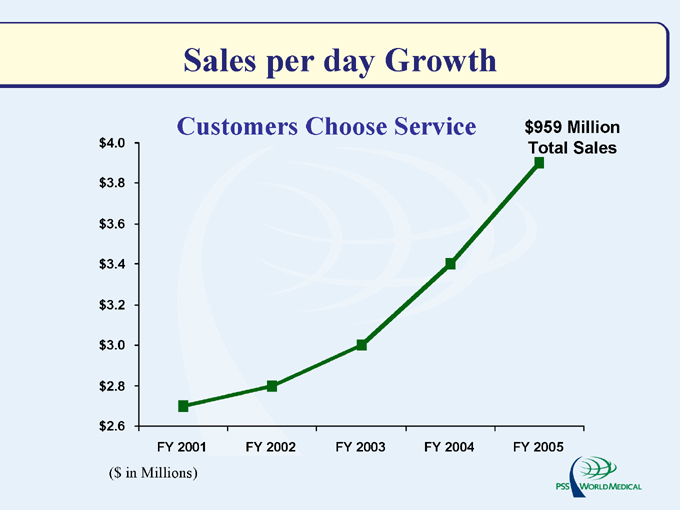

Sales per day Growth

Customers Choose Service $959 Million Total Sales $4.0 $3.8 $3.6 $3.4 $3.2 $3.0 $2.8 $2.6

FY 2001 FY 2002 FY 2003 FY 2004 FY 2005

($ in Millions)

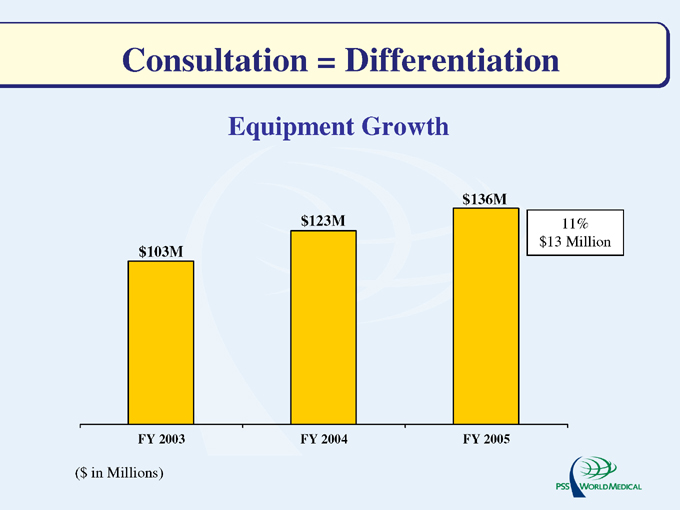

Consultation = Differentiation

Equipment Growth $103M $123M $136M

11% $13 Million

FY 2003 FY 2004 FY 2005

($ in Millions)

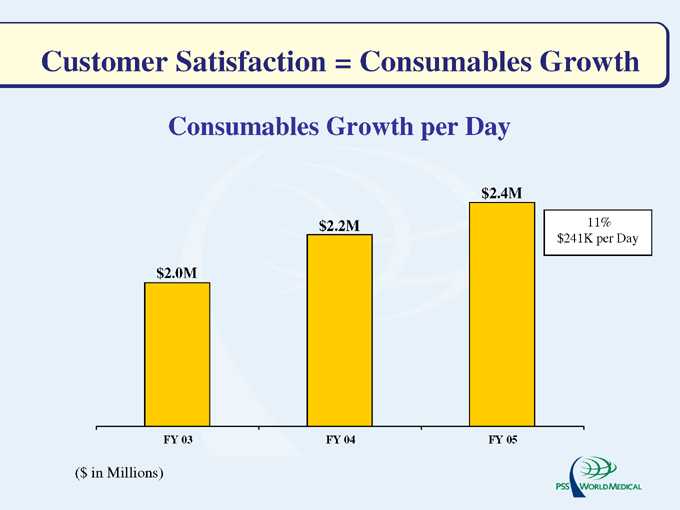

Customer Satisfaction = Consumables Growth

Consumables Growth per Day $2.0M $2.2M $2.4M

11% $241K per Day

FY 03

FY 04

FY 05

($ in Millions)

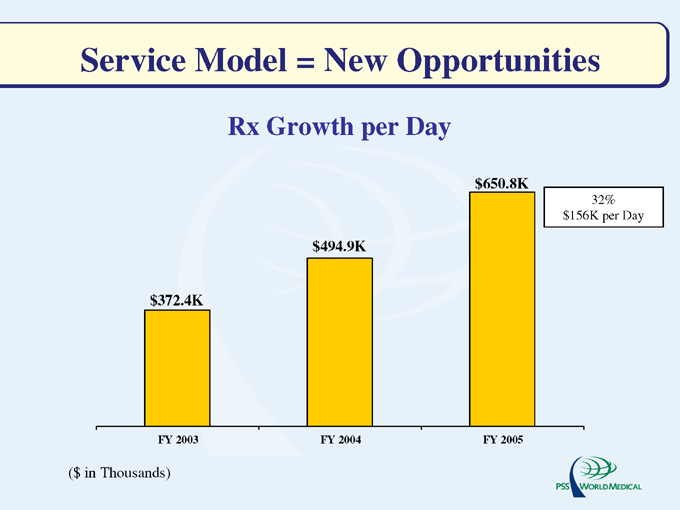

Service Model = New Opportunities

Rx Growth per Day $372.4K $494.9K $650.8K

32% $156K per Day

FY 2003

FY 2004

FY 2005

($ in Thousands)

Customer Satisfaction & Profitability

Operating Income $17M

2.51% $18M

2.49% $23M

3.03% $46M

5.17% $62M

6.46%

FY 2001 FY 2002 FY 2003 FY 2004 FY 2005

($ in Millions)

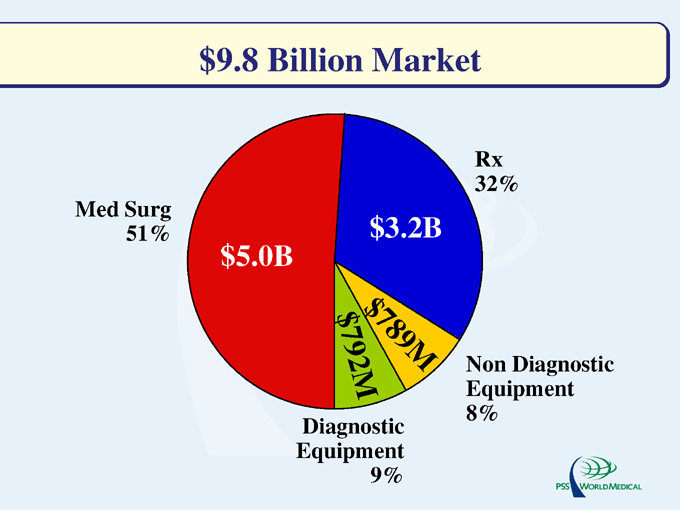

$9.8 Billion Market

Med Surg 51% $5.0B $3.2B

M

8 9

$72M

$79

Rx 32%

Diagnostic Equipment 9%

Non Diagnostic Equipment 8%

Environment is Robust

Insurance

Demographics

Technology

Reimbursement

Strength of Position

Sales Capability & Service Offering

LOW

CAH

HSIC MCK

PSS

HIGH

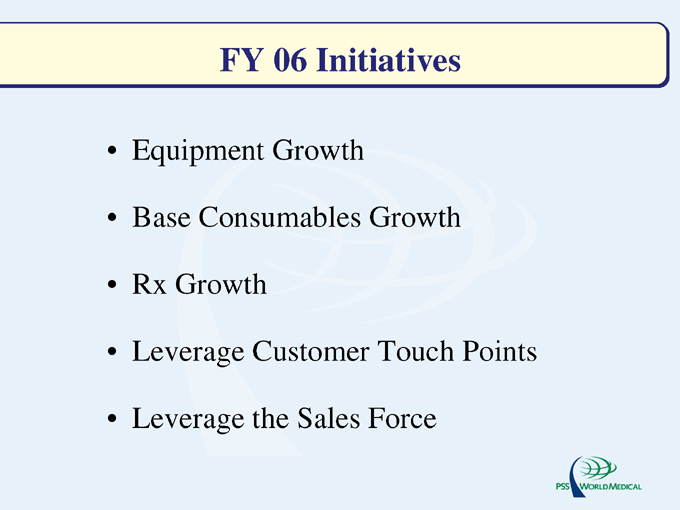

FY 06 Initiatives

Equipment Growth Base Consumables Growth Rx Growth Leverage Customer Touch Points Leverage the Sales Force

Risk Factors

Sales Rep Bandwidth

Procurement Technology

From Current Risk to Future Opportunity

Leverage the Sales Force

- Expand Competitive Advantage by Increasing Time & Expertise

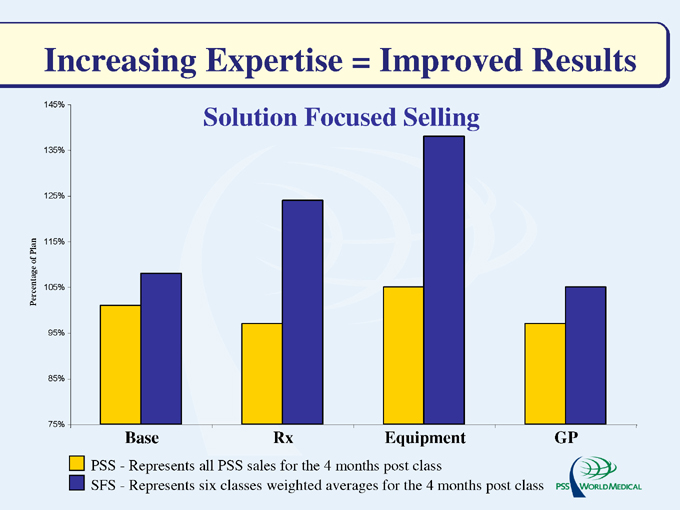

Increasing Expertise = Improved Results

Solution Focused Selling

145%

135%

125%

115%

105%

95%

85%

75%

Percentage of Plan

PSS—Represents all PSS sales for the 4 months post class

SFS—Represents six classes weighted averages for the 4 months post class

Base

Rx

Equipment

GP

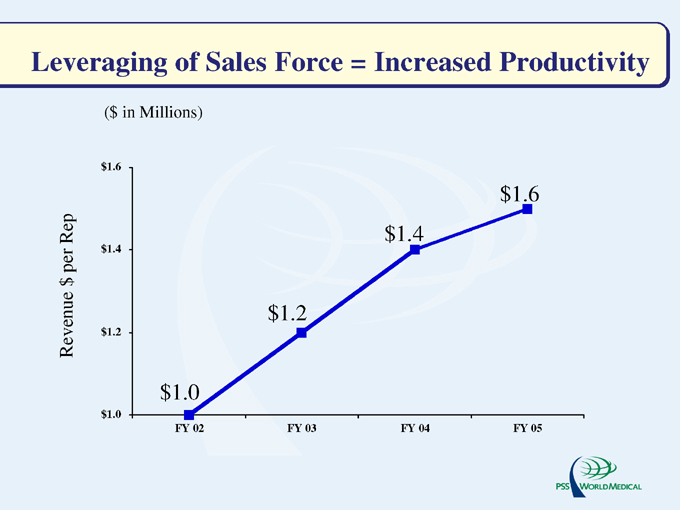

Leveraging of Sales Force = Increased Productivity

($ in Millions) $1.6 $1.4 $1.2 $1.0

Revenue $ per Rep $1.0 $1.2 $1.4 $1.6

FY 02 FY 03 FY 04 FY 05

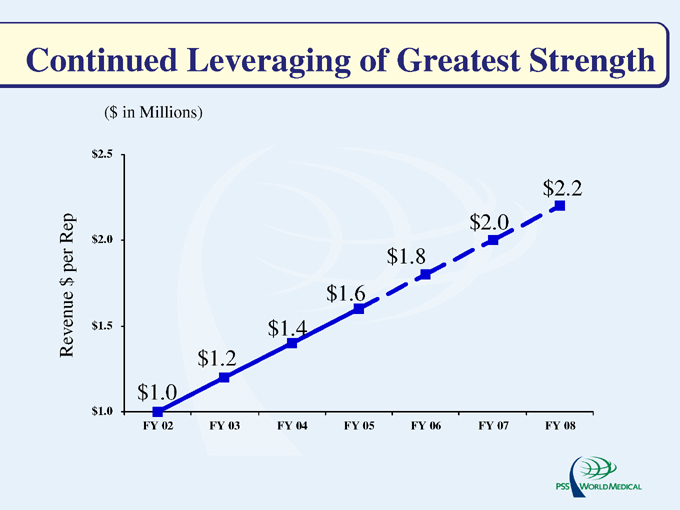

Continued Leveraging of Greatest Strength

($ in Millions)

Revenue $ per Rep $2.5 $2.0 $1.5 $1.0 $1.0 $1.2 $1.4 $1.6 $1.8 $2.0 $2.2

FY 02

FY 03

FY 04

FY 05

FY 06

FY 07

FY 08

Increase Selling Time

Technology Solutions Benefit Customers & Reps

Sales Support Model

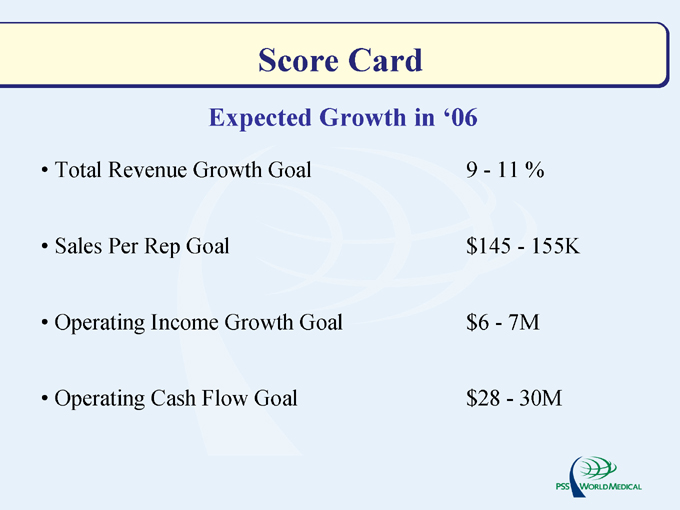

Score Card

Expected Growth in ‘06

Total Revenue Growth Goal 9—11 %

Sales Per Rep Goal $145—155K

Operating Income Growth Goal $6—7M

Operating Cash Flow Goal $28—30M

Improving health care in America through Innovative Solutions

Nasdaq:PSSI