- LEN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Lennar (LEN) 8-KLennar Reports First Quarter Results

Filed: 31 Mar 09, 12:00am

Additional Unconsolidated Joint Venture Disclosures Exhibit 99.2 |

Disclaimer Statement This presentation includes "forward-looking statements," as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding our business, financial condition, results of operations, cash flows, strategies and prospects. You can identify forward-looking statements by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements. These factors include those described under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission. We do not undertake any obligation to update forward-looking statements, except as required by federal securities laws. |

1 Joint Ventures Joint Ventures Additional Disclosures Additional Disclosures Our unconsolidated JV disclosures are made in accordance with generally accepted accounting principles. Based upon investor / analyst requests, we are providing additional joint venture disclosures which we believe will be useful in evaluating our joint ventures. Highlighted below are the new disclosures included in each section: Detailed JV Information New – Ten Largest Joint Venture Investments New – Types of Joint Venture Partners Detailed JV Debt Disclosures New – JV Composition by Type of Debt New – Lennar Cash Payments for Recourse Reductions New – Future JV Debt Maturities Corporate Governance New – Summary of our JV Corporate Governance New – JV Interests are Prohibited From Being Pledged |

2 Detailed JV Information |

3 Detailed Joint Venture Information New - Ten Largest Joint Venture Investments 10 Largest Joint Ventures (based on LEN investment) as of February 28, 2009 (Dollars in Thousands) Remaining JV JV Debt Homes/ Partner JV Year LEN Total JV Gross Recourse Reimbursement Net Recourse Total Debt Without Total JV Total JV to Total Homesites Joint Venture Name Type Type Formed Location Investment Assets Debt to Lennar Agreements Debt to Lennar Recourse to Lennar Debt Equity Capital Ratio in JV Platinum Triangle Partners, LLC Strategic Land 2004 Orange County, CA 95,587 $ 270,782 $ 74,889 $ 37,445 $ 37,444 $ - $ 74,889 $ 188,689 $ 28% 3,477 Asante LH, LLC Financial / Developer Land 2007 Phoenix, AZ 85,122 187,461 - - - - - 170,734 - 4,067 Heritage Fields El Toro, LLC Financial Land 2005 Orange County, CA 83,043 1,429,677 - - - 544,242 544,242 664,503 45% 4,895 Runkle Canyon, LLC HB Land 2005 Los Angeles, CA 36,467 74,167 - - - - - 72,616 - 461 Bellevue Towers Investors, LLC Financial HB 2005 Seattle, WA 29,897 423,072 - - - 309,481 309,481 88,316 78% 536 Lennar Intergulf (Central Park), LLC Strategic HB 2005 Orange County, CA 25,100 184,232 50,456 25,228 25,228 75,685 126,141 49,556 72% 240 MS Rialto Residential Holdings, LLC Financial Land 2007 National 21,322 552,740 - - - 203,841 203,841 316,937 39% 10,106 Lennar Intergulf (Pacific), LLC Strategic HB 2004 San Diego, CA 20,659 94,707 15,000 - 15,000 34,678 49,678 40,372 55% 151 Ballpark Village, LLC Land Owner Land 2004 San Diego, CA 19,808 96,888 - - - 58,910 58,910 37,335 61% 1,455 USH/SVA Star Valley, LLC HB Land 2001 Tucson, AZ 18,642 45,318 4,052 - 4,052 4,051 8,103 37,213 18% 4,176 Total JVs 435,647 3,359,044 144,397 62,673 81,724 1,230,888 1,375,285 1,666,271 45% 29,564 LandSource Communities Development LLC Financial Land 2003 National - 1,737,132 - - - 1,351,165 1,351,165 (40,774) 103% 32,076 Others 341,165 2,470,298 320,638 59,740 260,898 832,910 1,153,548 1,003,073 53% 73,318 Total bank debt 776,812 $ 7,566,474 $ 465,035 $ 122,413 $ 342,622 $ 3,414,963 $ 3,879,998 $ 2,628,570 $ 60% 134,958 Land seller and CDD debt 8,920 - 8,920 89,501 98,421 Total debt 473,955 $ 122,413 $ 351,542 $ 3,504,464 $ 3,978,419 $ 10 Largest JVs 44% 31% 24% 36% 64% LandSource 23% - - 40% -2% Other 33% 69% 76% 24% 38% Total 100% 100% 100% 100% 100% |

4 Detailed Joint Venture Information New - Types of Joint Venture Partners As of February 28, 2009 (Dollars in Thousands) We have a diverse group of joint venture partners: JV with land owners / developers: provides access to homesites owned or controlled by land owner/developer JV with other homebuilders: joint bid on land parcels smarter way to purchase; Examples include Centex, Pulte, KB Home and Toll Brothers JV with financial partners: partner brings the majority of the capital while Lennar manages the venture; Examples include Morgan Stanley, MSD Capital and Stockbridge JV with strategic partners: partner brings specific expertise (e.g., commercial or infill experience); Examples include LNR Property Corp. and Intergulf Partner Type Gross Recourse Net Recourse Total Debt JV Debt Total JV Debt Reimbursement Debt Without Recourse Total JV Total JV to Total Remaining Homes/ Assets to Lennar Agreements to Lennar to Lennar Debt Equity Capital Ratio Homesites in JV LandSource 1,737,132 $ - $ - $ - $ 1,351,165 $ 1,351,165 $ (40,774) $ 103% 32,076 Land Owners / Developers 870,945 103,066 - 103,066 228,085 331,151 392,400 46% 35,915 Other Builders 887,787 127,709 8,862 118,847 270,219 397,928 404,710 50% 15,644 Financial 3,442,969 87,568 50,878 36,690 1,429,259 1,516,827 1,551,317 49% 37,596 Strategic 627,641 146,692 62,673 84,019 136,235 282,927 320,917 47% 13,727 Total bank debt 7,566,474 $ 465,035 $ 122,413 $ 342,622 $ 3,414,963 $ 3,879,998 $ 2,628,570 $ 60% 134,958 Land seller and CDD debt 8,920 - 8,920 89,501 98,421 Total debt 473,955 $ 122,413 $ 351,542 $ 3,504,464 $ 3,978,419 $ |

5 Detailed JV Debt Disclosures |

6 Detailed JV Debt Disclosures New – JV Composition by Type of Debt As of February 28, 2009 (Dollars in Thousands) Joint ventures with recourse debt have substantial assets and equity to support the debt as of February 28, 2009 as follows: Feb-09 Nov-08 Nov-07 Nov-06 JVs with recourse debt 36 41 75 94 JVs with non-recourse debt 23 27 36 44 JVs without debt 36 48 103 123 _________________________________________________________________ JV total There has been significant progress on reducing the number of joint ventures, with extra focus on joint ventures with recourse debt Total Assets 2,244,818 $ Total Liabilities 1,244,814 $ Total Equity 1,000,004 $ 95 116 214 261 |

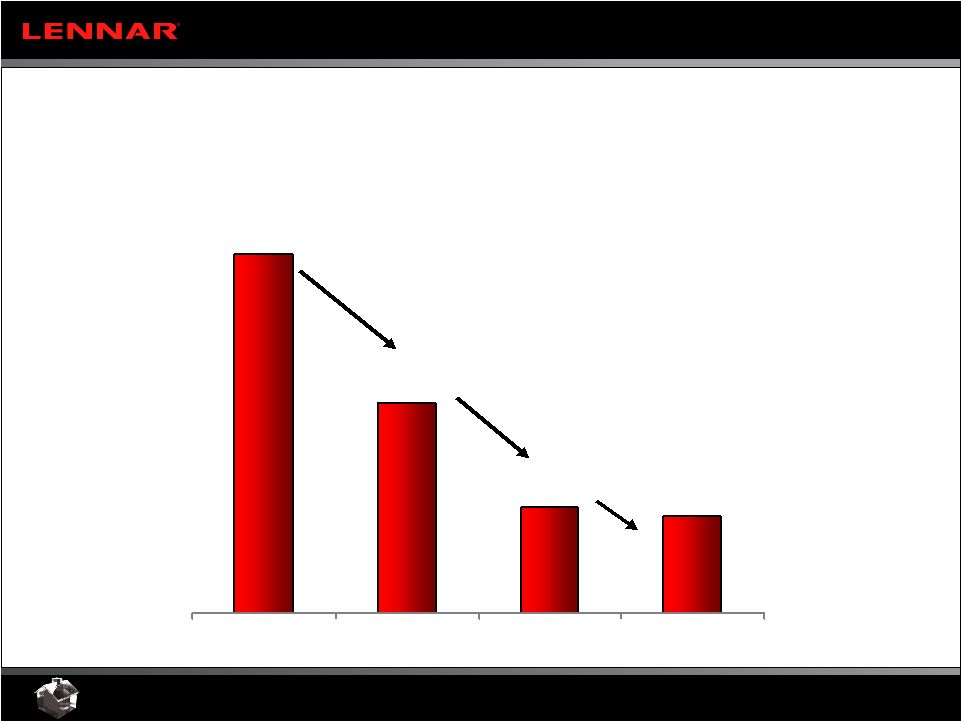

7 $1,764 $1,034 $520 $474 Nov-07 Nov-08 Feb-09 Detailed JV Debt Disclosures New - Lennar Cash Payments for Recourse Reductions Lennar cash payments to re-margin or pay-down loans as part of the recourse reductions $156 $199 (Dollars in Millions) $19 Nov-06 |

8 Detailed JV Debt Disclosures Detailed JV Debt Disclosures New - New - Future JV Debt Maturities Future JV Debt Maturities (Dollars in Thousands) The above amounts are maturities per current debt agreements and are not estimations of Lennar’s cash payments that will be made to reduce debt balances Debt maturities are typically three years, but are often restructured or refinanced at the end of that three-year period Recourse debt reductions occur from a variety of transactions: for example, contributions from all partners (i.e., joint and several debt), asset sales and finance restructurings Principal maturities of JVs' debt are as follows: Debt Without Gross Net Debt Without Recourse Recourse Debt Reimbursement Recourse Debt Recourse To Lennar To Lennar to Lennar Agreements to Lennar Excluding LandSource For LandSource Totals 2009 214,553 $ 8,862 $ 205,691 $ 528,157 $ 1,107,165 $ 1,849,875 $ 2010 100,895 25,228 75,667 698,416 - 799,311 2011 63,018 50,878 12,140 813,832 - 876,850 Thereafter 86,569 37,445 49,124 23,393 244,000 353,962 465,035 122,413 342,622 2,063,798 1,351,165 3,879,998 Land seller and CDD debt 8,920 - 8,920 76,087 13,414 98,421 Total JV debt 473,955 $ 122,413 $ 351,542 $ 2,139,885 $ 1,364,579 $ 3,978,419 $ |

9 Detailed JV Debt Disclosures Condensed Balance Sheets (Dollars in Thousands) February 28, 2009 2008 2007 2006 Assets: Cash and cash equivalents 103,950 $ 135,081 $ 301,468 $ 276,501 $ Inventories 7,053,539 7,115,360 7,941,835 8,955,567 Other assets 408,985 541,984 827,208 868,073 7,566,474 $ 7,792,425 $ 9,070,511 $ 10,100,141 $ Liabilities and equity: Accounts payable and other liabilities 959,485 $ 1,042,002 $ 1,214,374 $ 1,387,745 $ Debt 3,978,419 4,062,058 5,116,670 5,001,625 Equity of: Lennar 776,812 766,752 934,271 1,447,178 Others 1,851,758 1,921,613 1,805,196 2,263,593 Total equity 2,628,570 2,688,365 2,739,467 3,710,771 7,566,474 $ 7,792,425 $ 9,070,511 $ 10,100,141 $ Lennar's equity in JVs 30% 29% 34% 39% Partner's equity in JVs 70% 71% 66% 61% Debt to total capital ratio 60% 60% 65% 57% Debt to total capital ratio (excluding LandSource) 50% 50% 61% 59% November 30, |

10 Detailed JV Debt Disclosures Detail of Total Debt Balances (Dollars in Thousands) February 28, 2009 2008 2007 2006 Lennar's net recourse exposure 351,542 $ 392,450 $ 794,934 $ 1,102,920 $ Reimbursement agreements from partners 122,413 127,428 238,692 661,486 Lennar's maximum recourse exposure 473,955 $ 519,878 $ 1,033,626 $ 1,764,406 $ Partner several recourse 243,366 $ 285,519 $ 465,641 $ 930,177 $ Non-recourse land seller debt or other debt 84,660 90,519 202,048 259,191 Non-recourse bank debt with completion guarantees - excl. LandSource 784,779 820,435 1,432,880 699,588 Non-recourse bank debt with completion guarantees - LandSource - - - 248,850 Non-recourse bank debt without completion guarantees - excl. LandSource 1,040,494 994,580 748,412 1,099,413 Non-recourse bank debt without completion guarantees - LandSource 1,351,165 1,351,127 1,234,063 - Non-recourse debt to Lennar 3,504,464 $ 3,542,180 $ 4,083,044 $ 3,237,219 $ Total debt 3,978,419 $ 4,062,058 $ 5,116,670 $ 5,001,625 $ Lennar's maximum recourse exposure as a % of total JV debt 12% 13% 20% 35% November 30, |

11 Detailed JV Debt Disclosures Lennar’s Net Recourse Debt Exposure (Dollars in Thousands) February 28, 2009 2008 2007 2006 Sole recourse debt - $ - $ - $ 18,920 $ Several recourse debt - repayment 74,840 78,547 123,022 163,508 Several recourse debt - maintenance 144,439 167,941 355,513 560,823 Joint and several recourse debt - repayment 151,047 138,169 263,364 64,473 Joint and several recourse debt - maintenance 94,709 123,051 291,727 956,682 Land seller and CDD debt recourse exposure 8,920 12,170 - - Lennar's maximum recourse exposure 473,955 519,878 1,033,626 1,764,406 Less joint and several reimbursement agreements with Lennar's partners (122,413) (127,428) (238,692) (661,486) Lennar's net recourse exposure 351,542 $ 392,450 $ 794,934 $ 1,102,920 $ November 30, |

12 Corporate Governance |

13 Corporate Governance Corporate Governance New – New – Summary of our JV Corporate Governance Summary of our JV Corporate Governance Joint ventures have been a successful and consistent business strategy for Lennar since the mid- 1970s Each joint venture is governed by an executive committee consisting of members from each of the partners of that JV We are the managing JV member in approximately 70% of our joint ventures Each quarter we perform a comprehensive review of both our wholly-owned and joint venture assets Our internal audit department periodically tests our joint ventures to ensure that we are in compliance with the operating agreements and other fiduciary responsibilities In transactions with joint ventures in which we are a partner: When we purchase land from the JV – we defer our pro-rata share of the joint venture’s earnings until the home is delivered to a third party • We buy homesites in arms-length transactions • Purchases are approved by joint venture partner(s) When we sell land to the JV– we defer a portion of the profit equal to our ownership % until the land is sold to a third party In both transactions above, any loss that is generated is recognized at the time of the transaction and not deferred |

14 Corporate Governance Corporate Governance New – New – Summary of our JV Corporate Governance Summary of our JV Corporate Governance Lennar has never siphoned cash from one joint venture to another JV Lennar has never pledged its interest in any joint venture for the benefit of another JV Lennar does not use its investment in one joint venture as collateral for debt in another joint venture Lennar does not cross collateralize debt between different joint ventures Funds are never commingled among joint ventures Lennar currently has no specific performance agreements to purchase homesites from its joint ventures |

15 Corporate Governance Corporate Governance New - New - JV Interests Are Prohibited From Being Pledged JV Interests Are Prohibited From Being Pledged Example – sample language in a loan agreement that prohibits the pledging of our interest in one joint venture for the benefit of another: “Borrower will not suffer to occur or exist, whether occurring voluntarily or involuntarily, any change in, or Lien or Encumbrance with respect to, the legal or beneficial ownership of any interest in Borrower, provided, that Borrower may cause or permit transfers of membership interests in Borrower to Persons solely owned and controlled by Lennar or Partner.” |