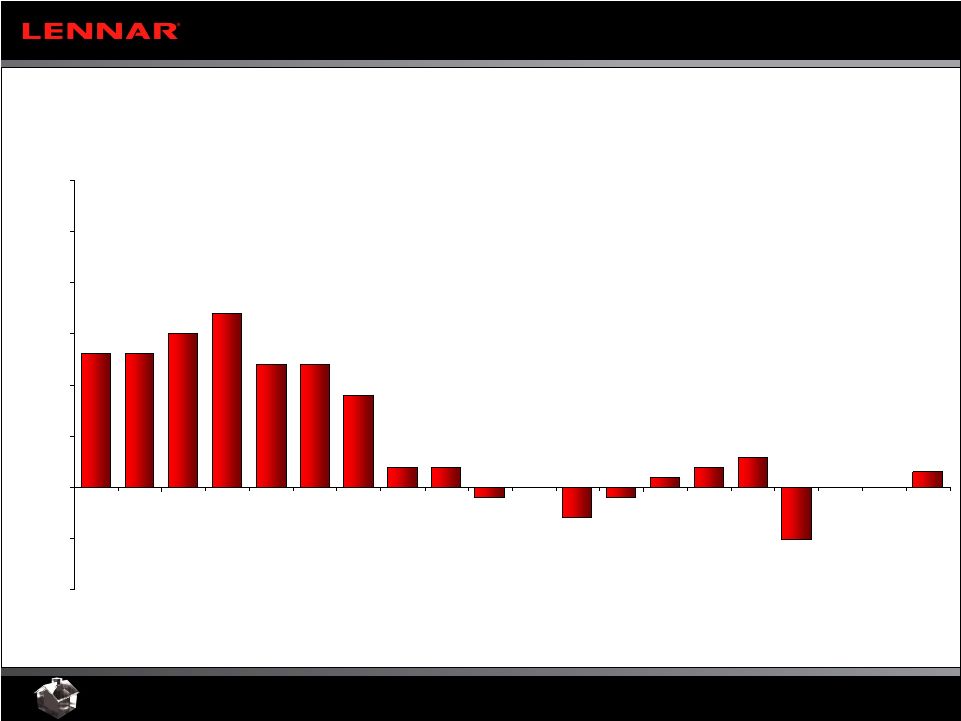

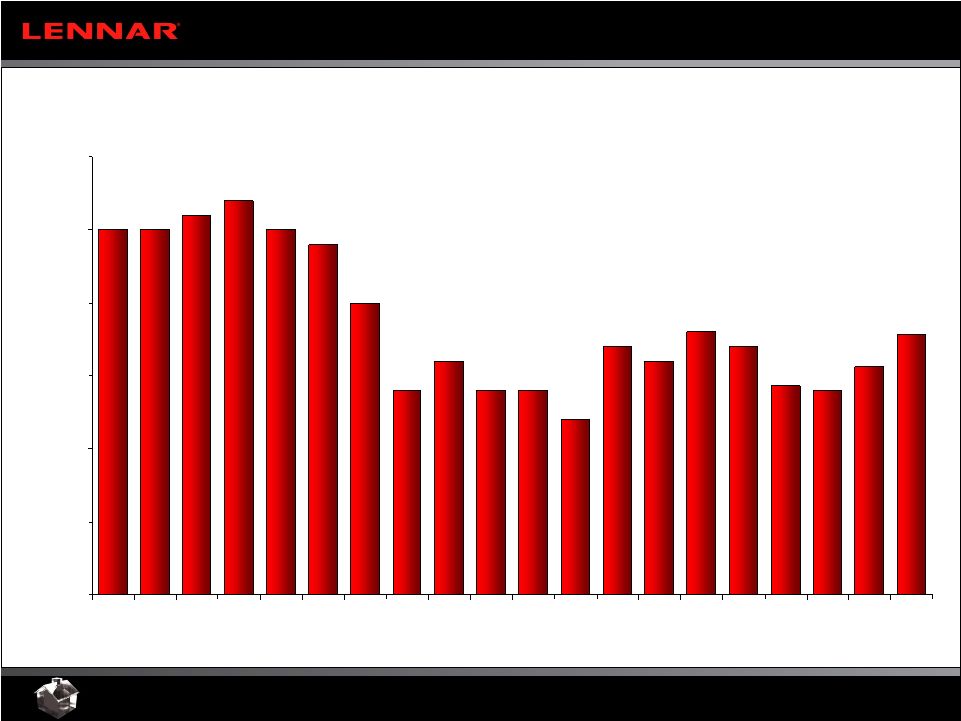

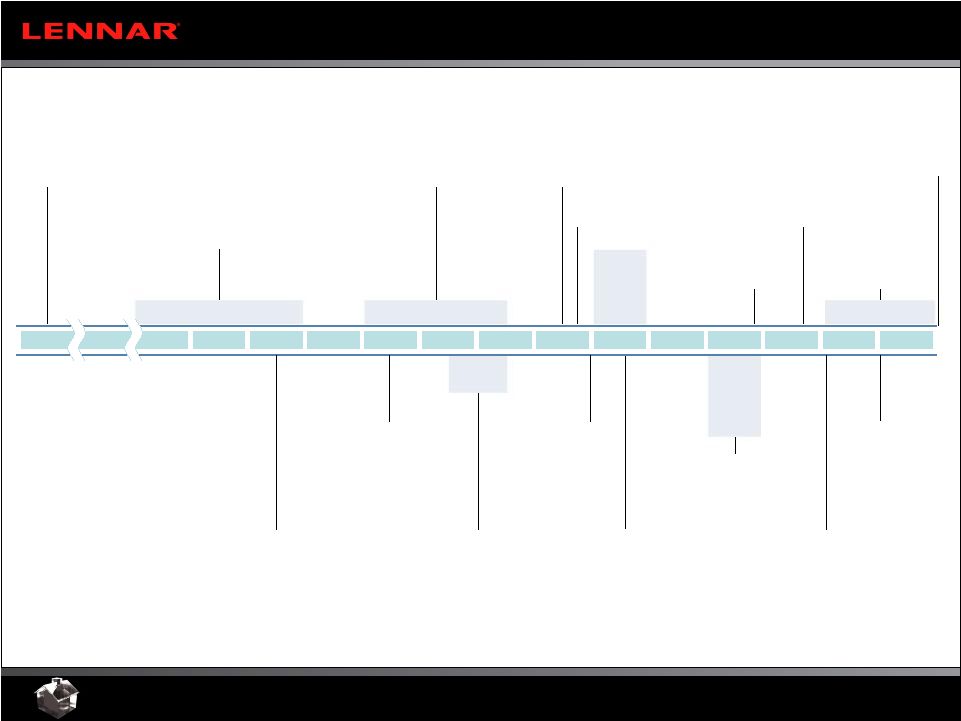

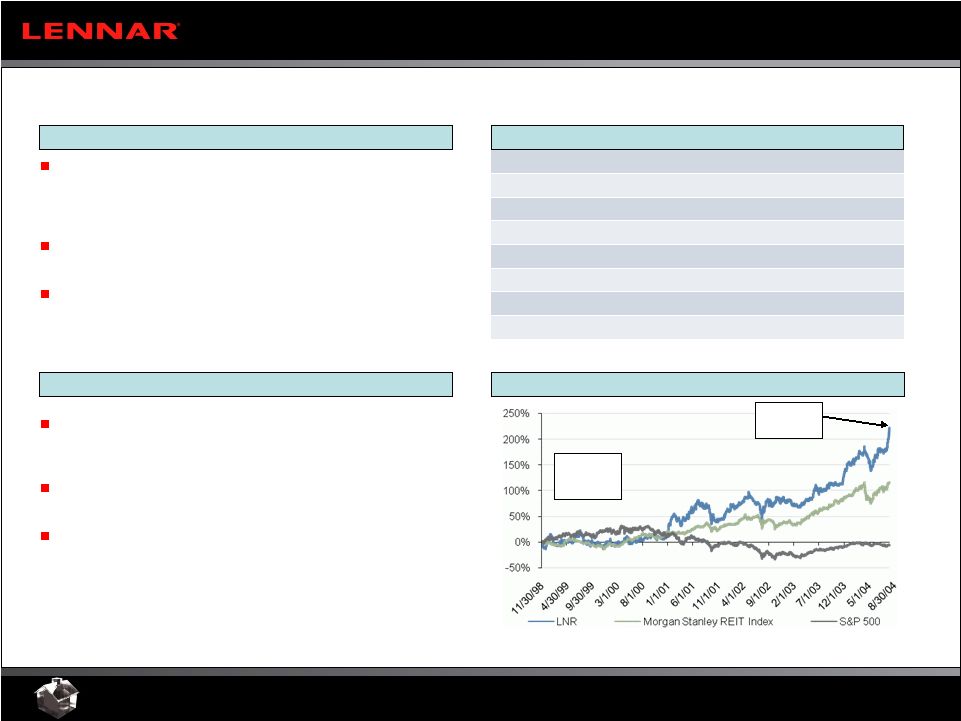

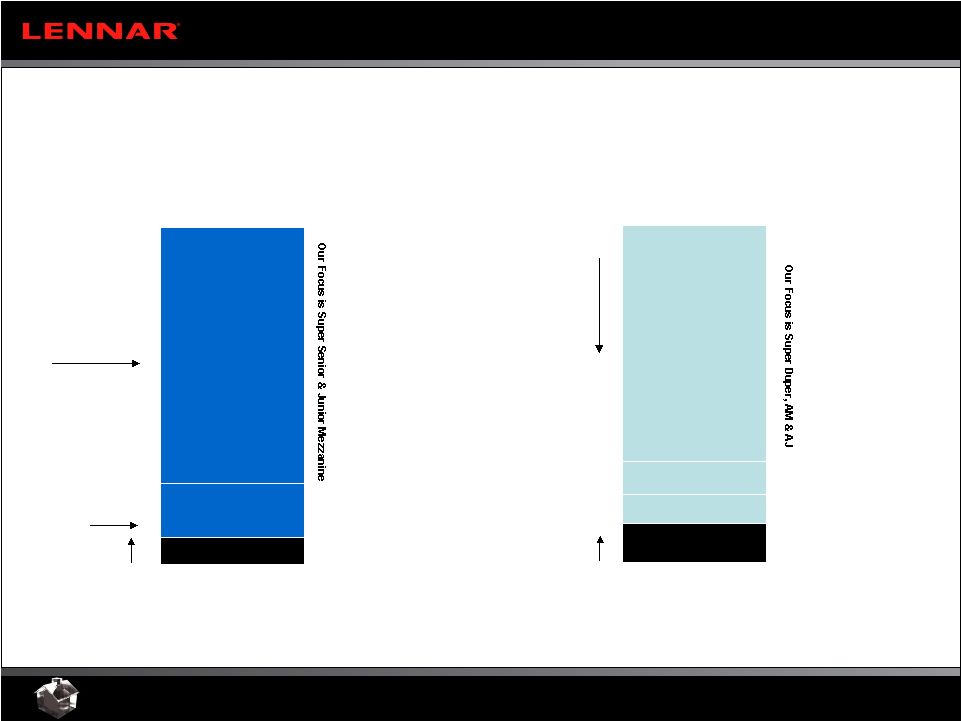

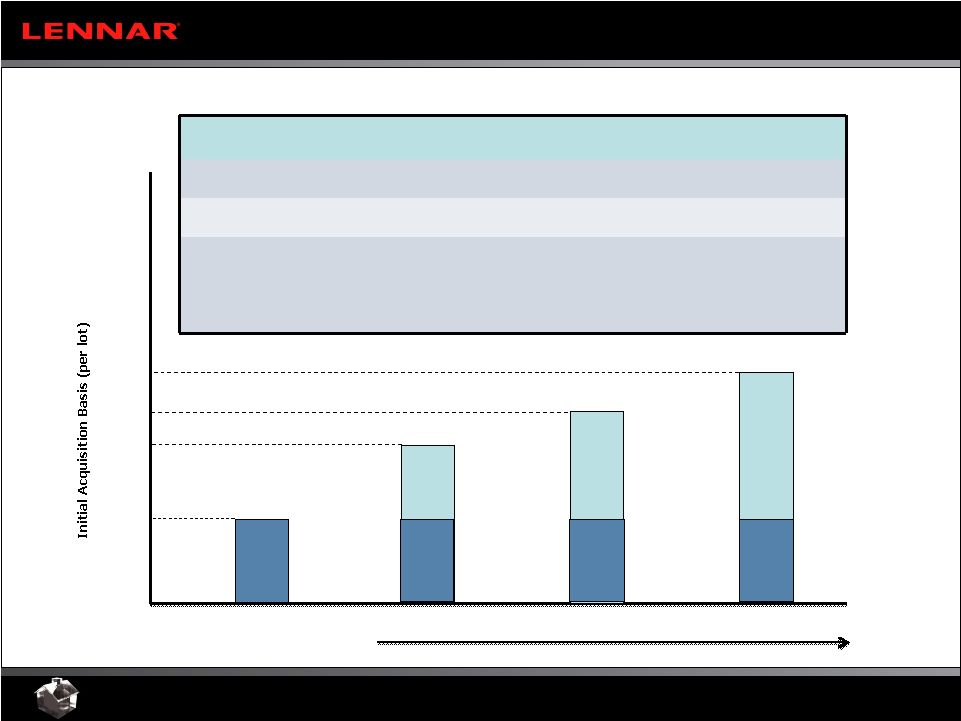

Rialto and Lennar have a long history of identifying opportunities, particularly in troubled markets, and responding with innovative strategies that have yielded strong results Rialto Capital Strategic Opportunity Rialto and Lennar 24 Rialto Team and Lennar – Long History of Innovation and Strong Results 1986 1984 1982 1970s 1954 1990 1988 1994 1992 1998 1996 2002 2000 2006 2004 2008 Early 1980s Recession Bank / S&L Failures S&L / Real Estate Led Recession Evolution of CMBS Market Asian Financial Crisis, Russian Debt Default & LTCM Bailout Evolution of European Real Estate CMBS / Structured Finance Market U.S. Residential Dislocation and Financial Crisis Lennar, founded in 1954, has taken advantage of many real estate cycles since its formation as a homebuilder and land acquirer / developer Mr. Krasnoff’s relationship with Lennar (as outside advisor) begins 1977 Lennar was one of the first to issue builder bonds to fill home mortgage void left by failing savings & loans Mr. Krasnoff and Mr. Miller co-found LNR Property Corporation Lennar’s Asset Management Division (led by Mr. Krasnoff and the predecessor organization to LNR) honed skills working with banks and savings & loans to turn around troubled assets Early pioneer in the development of the CMBS market and first buyers of non-investment grade mortgages coupled with special servicing Producing over half of Lennar earnings, LNR spun off as a separate NYSE-listed company Formation of Lennar Land Partners Became industry leading buyer and special servicer of non-investment grade CMBS (thru 2007). Worked out billions of dollars of non-performing loans Entered the European market to take advantage of significant transition from public to private ownership of real estate assets Raised $1.125 billion LNR Commercial Property Investment and $700 million LNR European Investors Funds to take advantage of skills in commercial property development in US and securities and structured debt in Europe Mr. Krasnoff founded Rialto to take advantage of turmoil in today’s residential market Lennar and Rialto Closed innovative Morgan Stanley / Lennar / Rialto $525 million land venture One of the first to invest in and workout large portfolios of distressed real estate assets (>$5 billion of non- performing loans) One of the first to enter Japan to workout large portfolios of distressed real estate assets (>$8 billion of non-performing loans) Early pioneer of commercial CDOs and B-notes LNR / Lennar acquired one of the largest public land companies (Newhall Land and Farming) that led to the creation of LandSource LNR’s $4.2 billion “go-private” transaction Lennar acquired interest in Clayton Holdings, a loan servicer Legacy Securities PPIP Fund with Rialto as sub-advisor closed after being selected by US Treasury – Potential capacity subject to final closing of $4.4 billion dedicated to CMBS and RMBS |