- LEN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Lennar (LEN) DEF 14ADefinitive proxy

Filed: 1 Mar 23, 6:31am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

Lennar Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

Building a Sustainable Lennar

At Lennar, sustainability is about configuring our business to remain financially strong, while employing new technologies to modernize our business practices, and adopting evermore social and environmental practices to fulfill the highest aspirations of our stakeholders. With a foundation of solid governance principles, including our continuing commitment to our core values of quality, value and integrity, we have created an environmentally conscious homebuilding strategy that focuses on inclusion and diversity, and engages and supports the communities where we do business.

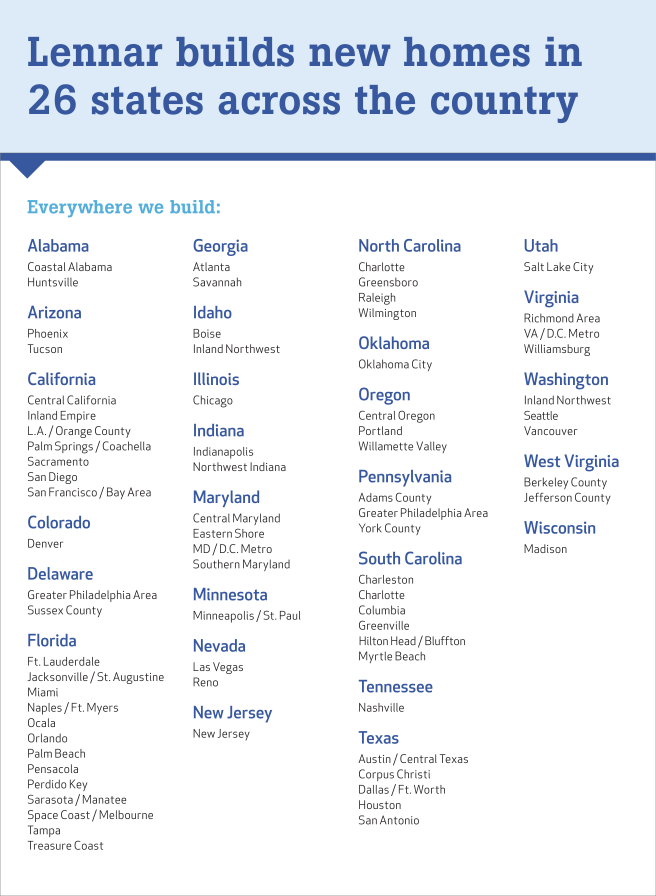

We are the second largest homebuilder in the United States by deliveries, revenues and net earnings, and we build homes to last, meeting the lifestyle preferences of our customers. We include as standard in our new homes sustainable and energy efficient features, making them healthier and easier to live in than prior generations of homes. We are constantly focused on improving the future of home ownership and rental, whether through our commitment to solar energy, our strides to improve water and air quality, or our strategic investments in companies that develop energy and resource saving products. We incorporate these innovative products in new homes and help our partners bring them to market faster. By focusing broadly, we can create healthy homes and family experiences, alongside a strong bottom line, while appealing to both customers and investors who expect and demand a broader social responsibility. We are truly driving the greatest shareholder value and building a “sustainable” Lennar.

|

Stockholders

We are focused on creating long-term value for our stockholders through a commitment to corporate ethics, risk management, careful execution of our strategies, and investments in initiatives that are redefining the future of both Lennar and our industry.

While we are intensely focused on our core homebuilding business, we believe our technology investments represent a significant opportunity to create efficiencies in our internal operations and to reduce our costs.

Homebuyers

We are bringing the dream of homeownership to our homebuyers.

We use our size to maximize our purchasing power so we can provide our homeowners with luxury features as standard items through our Everything’s Included® approach. We also provide connected homes that are wifi guaranteed with no dead spots, and green building features that reduce energy consumption and costs.

Our investments in technology provide our homeowners with enhanced experiences, including our digitized financing process that allows homeowners to finance their homes with less paper, in less time, and with more transparency. |

Environment

Our purchasing power enables us to include green features in our homes. Each new home we build is healthier and more energy efficient, and has less impact on the environment, than prior generations of homes as a result of features like:

• Solar power that generates clean energy;

– almost 13,000 solar power Lennar home deliveries in fiscal 2022

– over 61,000 solar power Lennar home deliveries since 2013

• Low-VOC paint that reduces pollution

• WaterSense® faucets that reduce water flow without sacrificing performance

• Low-E windows that reduce infrared and ultraviolet light coming into the home

• Energy Star® appliances that reduce energy consumption

In addition, our home design and engineering work optimizes building materials and reduces construction waste. We are embracing green practices as we move toward a more environmentally and economically sustainable future. |

Community

Giving back to the communities in which we operate, with both our time and financial support, is one of our core values.

THE LENNAR FOUNDATION The Lennar Foundation, which was created over 30 years ago, is focused on helping people through medical research, education, jobs training, and support for vulnerable groups. Lennar contributed $1,000 per home delivered in 2022, or $66.4 million, to the Lennar Foundation.

Below are recent examples of The Lennar Foundation’s giving and support:

• Helped build state-of-the-art outpatient hospital, “The Lennar Foundation Medical Center,” at the University of Miami

• Supported cancer research at the Sylvester Comprehensive Cancer Center in Miami

• Established the Lennar Foundation Cancer Center at City of Hope Orange County in Irvine, California

• Established a college scholarship program for underserved students where each student’s full college costs, including dorm, books and meals, are paid for

• Created a residential construction job skills training program in Miami, and expanded the program to multiple additional locations

FOCUSED ACTS OF CARING Annually, each of Lennar’s divisions chooses a charitable organization to help by donating time and financial support.

DOLPHINS CHALLENGE CANCER Lennar associates from across the country participate in a bike, run, and walk event. Funds raised from these efforts support the Sylvester Comprehensive Cancer Center in Miami.

|

Associates

We believe that everyone can succeed, no matter where you start or the path you have taken. Our associates are our most valuable asset, and we are committed to building an inclusive and diverse workforce that supports each associate’s unique journey.

TALENT Our success starts and ends with having the best talent. We are focused on attracting, developing, engaging and retaining our associates. For example, our university talent program brings diverse college graduates and summer interns into Lennar to grow our talent pipeline.

WELL-BEING We understand the importance of life balance and offer associates a competitive and comprehensive benefits package, including paid parental leave and resources for whole-self well-being (physical, social, and financial).

CULTURE We believe having an inclusive work environment, where everyone has a sense of belonging, not only drives engagement but fosters innovation, which is critical to driving growth. Our “Everyone’s Included” mantra anchors our unique culture.

SAFETY Safe work environments, through worker safety and regulatory compliance, are a priority for us. Measurements of our worker safety metrics are reviewed by our Audit Committee and Board of Directors so we can ensure that we are successfully managing and improving our safety program. |

Trade Partners

We are focused on being the builder of choice for our trade partners. Our size and scale, combined with our even-flow production and Everything’s Included® platform, allow us to provide predictable, consistent work for our trade partners.

Corporate Governance

Our Board is built on a foundation of strong governance practices that promote integrity and accountability, and this guides our conduct and commitment to doing the right thing for the right reason.

Our governance practices include:

• Majority independent directors

• Strong independent Lead Director

• Annual election of all directors

• Stock ownership guidelines

• Active stockholder engagement

• Board oversight of risk management and cybersecurity protection

• Executive compensation that is aligned with stockholder interests

• Strong corporate controls |

|

ANNUAL MEETING OF STOCKHOLDERS | |||||||||||||

YOUR VOTE IS IMPORTANT Even if you plan to attend the Annual Meeting, we encourage you to vote your shares in advance to ensure they are counted. |

When: Wednesday, April 12, 2023

11:00 AM Eastern Time |

Where: Virtual Meeting Site:

www.virtualshareholdermeeting.com/LEN2023 | ||||||||||||

HOW YOU CAN VOTE

|

Dear Stockholder:

You are invited to attend the 2023 Annual Meeting of Stockholders of Lennar Corporation. The Annual Meeting will be held in a virtual format. To attend, vote, and submit questions during the Annual Meeting, visit www.virtualshareholdermeeting.com/LEN2023 and enter the control number included in your Notice Regarding the Availability of Proxy Materials, voting instruction form, or proxy card. Online access to the webcast will open approximately 15 minutes prior to the start of the Annual Meeting.

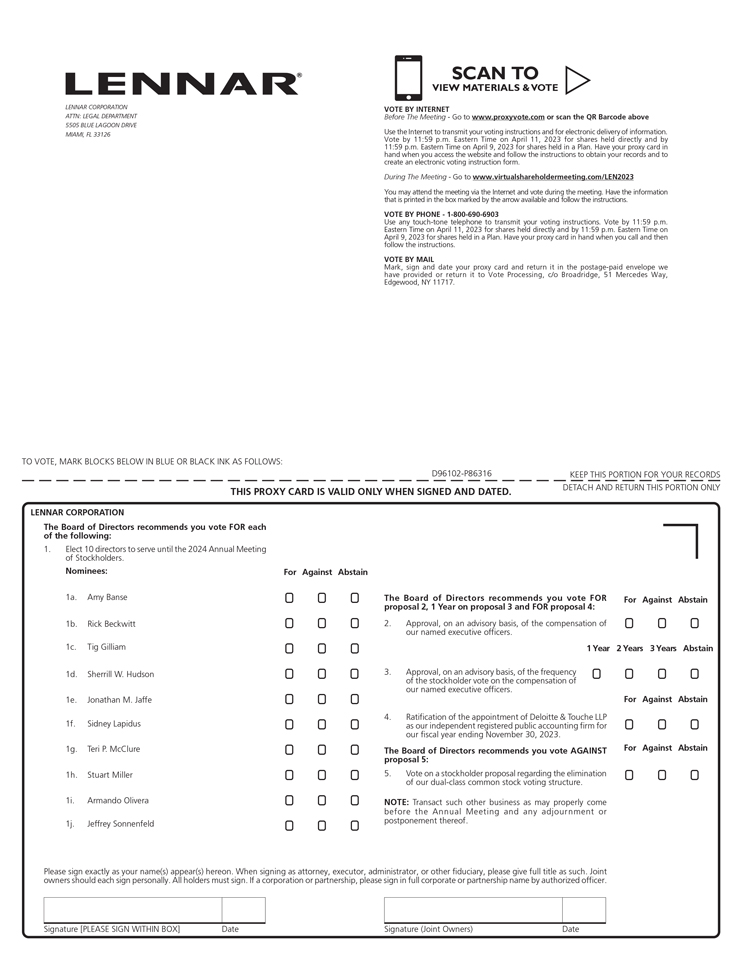

At the Annual Meeting, you will be asked to consider the following proposals:

Proposal 1: Elect ten directors to serve until the 2024 Annual Meeting of Stockholders.

Proposal 2: Approve, on an advisory basis, the compensation of our named executive officers.

Proposal 3: Approve, on an advisory basis, the frequency of the stockholder vote on the compensation of our named executive officers.

Proposal 4: Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending November 30, 2023.

Proposal 5: Vote on a stockholder proposal regarding our dual-class common stock voting structure, which we refer to as Equal Voting Rights for Each Share.

We will also transact any other business that may properly come before the Annual Meeting and any adjournment or postponement of the Annual Meeting.

Only stockholders of record as of the close of business on February 15, 2023, may vote at the Annual Meeting.

It is important that your shares be represented at the Annual Meeting, regardless of the number you hold. Even if you plan to attend the virtual Annual Meeting, please vote in advance. You can still vote your shares during the Annual Meeting if you participate electronically.

Sincerely,

Mark Sustana Vice President, General Counsel and Secretary March 1, 2023 | |||||||||||||

|

Online Before the Meeting* www.proxyvote.com

| |||||||||||||

|

Phone 1-800-690-6903

| |||||||||||||

|

Complete, sign and date your proxy/voting instruction card and mail it in the postage-paid return envelope.

| |||||||||||||

|

Online at the Meeting* Attend the Annual Meeting virtually and follow the instructions on the website.

| |||||||||||||

* Detailed instructions for Internet voting are set forth on the Notice Regarding the Availability of Proxy Materials, which also contains instructions on how to access our proxy statement and annual report online.

| ||||||||||||||

We mailed a Notice Regarding the Availability of Proxy Materials containing instructions on how to access our proxy statement and annual report on or about March 1, 2023.

Lennar’s proxy statement and annual report are available online at www.proxyvote.com.

| ||||||||||||||

This summary does not contain all the information stockholders should consider, and we encourage stockholders to read the entire proxy statement carefully.

| Annual Meeting of Stockholders | ||

| When: Wednesday, April 12, 2023 11:00 AM Eastern Time

Where: Virtual Meeting Site: www.virtualshareholdermeeting.com/LEN2023

The Annual Meeting will be held in a virtual format. To attend, vote, and submit questions during the Annual Meeting visit www.virtualshareholdermeeting.com/LEN2023 and enter the control number included in your Notice Regarding the Availability of Proxy Materials, voting instruction form, or proxy card. Online access to the webcast will open approximately 15 minutes prior to the start of the Annual Meeting.

| |

Voting Matters

| For more information | Board’s recommendation | |||||

| Proposal 1 | To elect ten directors to serve until the 2024 Annual Meeting of Stockholders. | Page 8 | FOR all nominees | |||

| Proposal 2 | To approve, on an advisory basis, the compensation of our named executive officers, which we refer to as “say on pay.” | Page 24 | FOR | |||

| Proposal 3 | To approve, on an advisory basis, the frequency of the stockholder vote on the compensation of our named executive officers, which we refer to as “say on frequency”. | Page 49 | FOR every one year | |||

| Proposal 4 | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending November 30, 2023. | Page 50 | FOR | |||

| Proposal 5 | To vote on a stockholder proposal regarding our dual-class common stock voting structure, which we refer to as Equal Voting Rights for Each Share. | Page 53 | AGAINST | |||

We will also transact any other business that may properly come before the Annual Meeting and any adjournment or postponement of the Annual Meeting.

2 | LENNAR CORPORATION 2023 PROXY STATEMENT

Proxy Summary

Directors

The following table introduces our Board of Directors (“Board”) .

Current Committee Memberships

| ||||||||||||||

| Director Nominee |

Independent |

Director Since |

Audit |

Compensation | Nominating & Corporate Governance |

Executive | Independent Directors Transactions | |||||||

Amy Banse

| ⬛ | 2021 | ⬛ | ⬛ | ||||||||||

Rick Beckwitt

| 2018 | |||||||||||||

Theron (Tig) Gilliam

| ⬛ | 2010 | ⬛* | ⬛ | ⬛ | |||||||||

Sherrill W. Hudson

| ⬛ | 2008 | ⬛* | ⬛ | ||||||||||

Jonathan M. Jaffe

| 2018 (1) | |||||||||||||

Sidney Lapidus (2)

| ⬛ | 1997 | ⬛ | ⬛ | ||||||||||

Teri P. McClure

| ⬛ | 2013 | ⬛ | ⬛ | ||||||||||

Stuart Miller (3)

| 1990 | ⬛ | ||||||||||||

Armando Olivera

| ⬛ | 2015 | ⬛* | ⬛ | ||||||||||

Jeffrey Sonnenfeld

| ⬛ | 2005 | ⬛ | ⬛ | ||||||||||

| Meetings in fiscal 2022 | 11 | 5 | 4 | 0 | 0 | |||||||||

⬛ Chair |

| * | Audit committee financial expert |

| (1) | Mr. Jaffe also was a director from 1997-2004 |

| (2) | Lead Director since 2005 |

| (3) | Executive Chair since 2018 |

LENNAR CORPORATION 2023 PROXY STATEMENT | 3

Proxy Summary

4 | LENNAR CORPORATION 2023 PROXY STATEMENT

Proxy Summary

Corporate Governance Practices

Independence

| • | All non-management directors are independent |

| • | Independent directors meet regularly in executive session |

| • | All members of the Audit, Compensation, and Nominating and Corporate Governance Committees are independent |

Accountability

| • | Annual election of all directors and majority voting in uncontested elections |

| • | Annual stockholder advisory vote to approve named executive officer (“NEO”) compensation |

| • | Compensation clawback policy |

| • | Annual board and committee evaluations |

Board Practices

| • | Corporate Governance Guidelines that are publicly available and reviewed annually |

| • | Balanced and diverse Board composition |

| • | Regular review of cybersecurity, safety and other significant risks |

Ethical Practices

| • | Code of Business Ethics and Conduct that is applicable to all our directors, officers, and associates |

| • | Ethics hotline available to all associates as well as third parties |

| • | Audit Committee responsible for reviewing complaints regarding financial, accounting, auditing, code of conduct, or related matters |

Alignment with Stockholder Interests

| • | Pay-for-performance executive compensation program |

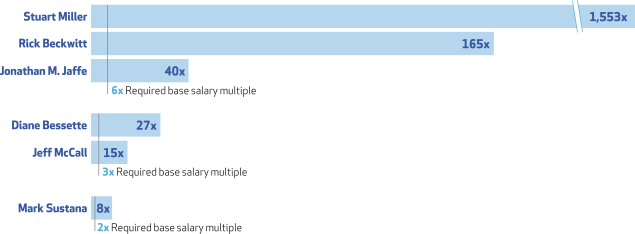

| • | Robust stock ownership guidelines for directors and executive officers |

| • | Prohibition against director and executive officer hedging of Lennar stock |

| • | Prohibition against director and executive officer pledging of Lennar stock used to satisfy stock ownership guidelines |

Stockholder Engagement

We regularly engage with our stockholders about our business and operations. During fiscal 2022, we spoke with stockholders representing approximately 72% of our non-affiliated outstanding shares about issues of importance to them, including our executive compensation practices and our corporate governance policies.

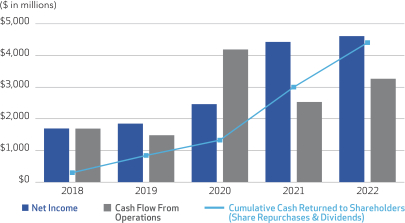

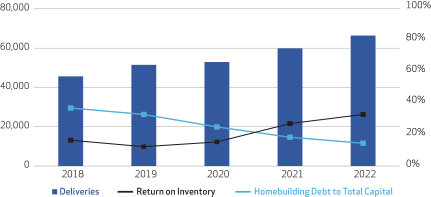

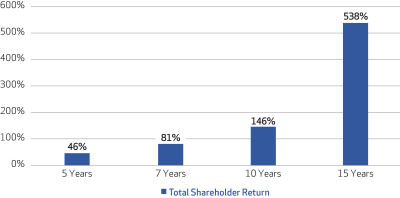

Performance Highlights

During fiscal 2022, Lennar achieved strong financial and operational performance, including:

| REVENUE | PRETAX INCOME | HOME DELIVERIES | NEW HOME ORDERS | |||||||||

$33.7B p 24%

|

$6.0B p 3%

|

66,399 p 11%

|

61,105 q 5%

|

LENNAR CORPORATION 2023 PROXY STATEMENT | 5

Proxy Summary

Compensation Practices

We employ a number of practices that reflect our pay-for-performance compensation philosophy and related approach to executive compensation.

| What we do

|  | What we don’t do

| |||||||||

• Directly link pay of senior management to performance

• Maintain a compensation clawback policy

• Maintain robust stock ownership guidelines for executive officers and our directors

• Require a “double-trigger” for change in control severance benefits

• Retain an independent compensation consultant

| • No hedging by executive officers

• No excise tax “gross-up” payments, except with respect to required HSR Act filings in connection with our equity grants and related expenses

• No supplemental company-paid retirement benefits

• No employment contracts with our NEOs

• No excessive severance or change in control benefits | |||||||||||

Compensation Highlights

Informed by feedback received during extensive outreach to stockholders, the results of the Company’s 2022 Advisory Vote on Executive Compensation, and consultations with its independent compensation advisor, the Compensation Committee approved significant changes to the fiscal 2022 executive compensation programs for each of Stuart Miller, the Company’s Executive Chairman, Rick Beckwitt, the Company’s Co-Chief Executive Officer and Co-President, and Jonathan Jaffe, the Company’s Co-Chief Executive Officer and Co-President. The table below shows the feedback received from stockholders, and the resulting changes that were made to the compensation program.

What Stockholders Said: | Action We Took: | |

Evaluate total executive compensation relative to peers. | Total compensation for Messrs. Miller, Beckwitt and Jaffe for fiscal 2022 was reduced approximately 11%, 12% and 12%, respectively, from total compensation for fiscal 2021. | |

Short-term cash incentive bonuses should be subject to a maximum annual payout cap set as a dollar amount, as opposed to the previously uncapped annual cash bonuses for fiscal 2021. The cash bonus is based on a percentage of Pretax Income, subject to a capital charge. | We added a cap to the annual cash bonus for Messrs. Miller, Beckwitt and Jaffe of $7.0 million, $6.0 million and $6.0 million, respectively. | |

Short-term cash incentives should be a lower percentage of total compensation, and long-term equity incentives should be a higher percentage of total compensation, as opposed to a 50/50 split, which was the split applied for fiscal 2021 for Messrs. Miller, Beckwitt and Jaffe. Stockholder suggested incentive pay mix: 30% cash / 70% equity. | With respect to Messrs. Miller, Beckwitt and Jaffe, during fiscal 2022, in connection with the decision to add a cap to, and therefore reduce, the 2022 annual cash bonus, and as part of the shift of the overall compensation mix towards equity, the incentive pay mix was adjusted mid-cycle to target approximately 20% cash and 80% equity. The increased equity percentage provides even greater alignment with stockholders. | |

Long-term equity incentives should be more heavily weighted towards performance shares versus time-based shares, as opposed to a 50/50 split when granted at target, which was the split applied for fiscal 2021 for Messrs. Miller, Beckwitt and Jaffe. Stockholder suggested weighting: 40% time-based shares / 60% performance shares. | With respect to Messrs. Miller, Beckwitt and Jaffe, during fiscal 2022, the equity pay mix was adjusted mid-cycle to place more weighting on performance-based equity to achieve an approximately 65% performance-based and 35% time-based share mix. The increase in the performance share allocation provides even greater alignment with stockholders. | |

Performance shares target award payouts should only be provided in connection with outperformance versus peers, which provides a stronger link between executive pay and Company performance. Target should be greater than the 50th percentile relative to our peer group. The target for the fiscal 2021 grant for Messrs. Miller, Beckwitt and Jaffe was 50% relative to our peer group. Stockholder suggested target: 55th percentile. | The performance shares target award payouts for Messrs. Miller, Beckwitt and Jaffe were increased to the 60th percentile, which is a higher performance shares target than suggested by our stockholders. The increase in the performance target goals to the 60th percentile relative to those in our peer group further strengthened the alignment between executive pay and Company performance. | |

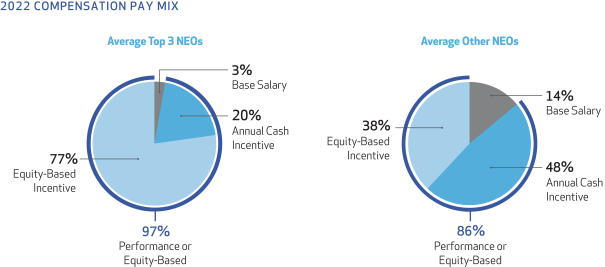

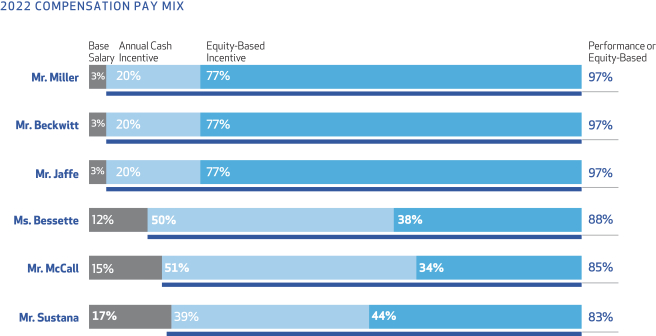

Our executive compensation programs are designed to reward both short-term and long-term growth in the revenues and profitability of our business, as well as total stockholder return. As shown below, the vast majority of fiscal 2022 compensation for our named executive officers was performance-based or equity-based.

6 | LENNAR CORPORATION 2023 PROXY STATEMENT

Proxy Summary

Consistent with our compensation objectives, our named executive officers received the following total direct compensation (base salary, annual cash incentive awards, and equity awards) for fiscal 2022:

2022 NEO COMPENSATION SUMMARY

| Name | Salary ($) | Stock Awards ($) | Annual Cash Incentive Awards ($) | Total ($) | ||||||||||||

| Stuart Miller | 1,000,000 | 26,499,994 | 7,000,000 | 34,499,994 | ||||||||||||

| Executive Chairman |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Rick Beckwitt | 800,000 | 23,199,948 | 6,000,000 | 29,999,948 | ||||||||||||

Co-Chief Executive Officer and Co-President |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Jonathan M. Jaffe | 800,000 | 23,199,948 | 6,000,000 | 29,999,948 | ||||||||||||

Co-Chief Executive Officer and Co-President |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Diane Bessette | 750,000 | 2,250,595 | 3,000,000 | 6,000,595 | ||||||||||||

Vice President, Chief Financial Officer and Treasurer |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Jeff McCall | 750,000 | 1,750,862 | 2,625,000 | 5,125,862 | ||||||||||||

| Executive Vice President |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Mark Sustana | 500,000 | 1,350,447 | 1,200,000 | 3,050,447 | ||||||||||||

Vice President, General Counsel and Secretary |

|

|

|

|

|

|

|

|

|

|

|

| ||||

LENNAR CORPORATION 2023 PROXY STATEMENT | 7

Directors are elected at each annual meeting of stockholders for a term expiring at the next annual meeting. Upon the recommendation of the Nominating and Corporate Governance Committee (the “NCG Committee”), our Board has nominated Amy Banse, Rick Beckwitt, Theron I. (“Tig”) Gilliam, Sherrill W. Hudson, Jonathan M. Jaffe, Sidney Lapidus, Teri P. McClure, Stuart Miller, Armando Olivera and Jeffrey Sonnenfeld for re-election, each for a term that will expire at the next annual meeting of stockholders. Each nominee has consented to serve if elected.

Our Board is responsible for overseeing the management of our business. We believe that each of our director nominees possesses the necessary experience, skills, and qualities to fully perform the duties of a director and to contribute to Lennar’s success. In addition, we believe each of our director nominees possesses outstanding personal integrity and interpersonal and communication skills, is highly accomplished professionally, has an understanding of the interests and issues that are important to our stockholders, and is able to dedicate sufficient time to fulfilling the obligations of a director. Each director nominee’s principal occupation and other pertinent information about each director nominee’s experience, qualifications, attributes, and skills that led the Board to conclude that these individuals should serve as directors follows below.

We keep our non-management directors informed of our business at meetings and through reports and analyses presented to the Board or to committees of the Board. Regular communications between the directors and management also occur apart from meetings of the Board of Directors and committees of the Board. Among other things, from time to time, the Board schedules calls with senior management to discuss the Company’s business strategies.

8 | LENNAR CORPORATION 2023 PROXY STATEMENT

Proposal 1: Election of Directors Nominees for Election

Nominees for Election

| ||||

Amy Banse

Age: 63

Director Since: 2021

Independent

| Committees

• Compensation • Nominating and Corporate Governance | |||

Professional Experience

Ms. Banse is a Venture Partner with Mastry, an early stage venture capital fund. Ms. Banse previously served as executive vice president, Comcast Corporation, a global media and technology company, and as managing director and head of funds at Comcast Ventures LLC from August 2011 to September 2020. Under her leadership, Comcast Ventures grew the size and diversity of its portfolio, making it one of the country’s most active corporate venture arms, investing in early-and later-stage companies across a wide spectrum of industries, including commerce, digital media, cybersecurity, SaaS, enterprise, and autonomous vehicles. From 2005 to 2011, Ms. Banse was senior vice president, Comcast Corporation and president, Comcast Interactive Media, a division of Comcast responsible for developing online strategy and operating the company’s digital properties. In this role, she drove the acquisition of a number of digital properties, including Fandango, and, together with her team, oversaw the development of Xfinity TV. During her tenure at Comcast beginning in 1991, Ms. Banse held various positions at the company, including content development, programming investments and overseeing the development and acquisition of Comcast’s cable network portfolio. Earlier in her career, Ms. Banse was an associate at Drinker, Biddle & Reath LLP.

Qualifications

The Board nominated Ms. Banse to serve as a director because of her experience with digital media and technology, her strategic and financial expertise, and her executive leadership experience.

|

Other Boards

• Adobe, Inc.

• On Holding AG

• The Clorox Company

| |||

| ||||

Rick Beckwitt

Age: 63

Director Since: 2018

| Committees

• None | |||

Professional Experience

Mr. Beckwitt has served as our Co-Chief Executive Officer and Co-President since November 2020, and, prior to that, our Chief Executive Officer from April 2018 to November 2020. Before that time, Mr. Beckwitt served as our President from April 2011 to April 2018, and our Executive Vice President from 2006 to 2011.

Qualifications

The Board nominated Mr. Beckwitt to serve as a director because he has extensive knowledge of the homebuilding industry and our Company’s operations and strategic plans.

|

Other Boards

• Eagle Materials Inc.

• previously, Five Point Holdings, LLC | |||

LENNAR CORPORATION 2023 PROXY STATEMENT | 9

Proposal 1: Election of Directors Nominees for Election

| ||||

Tig Gilliam

Age: 58

Director Since: 2010

Independent

| Committees

• Audit (financial expert)

• Compensation

• Independent Directors Transactions | |||

Professional Experience

Mr. Gilliam has served as Chief Executive Officer of NES Fircroft (formerly known as NES Global Talent), a global talent solutions company, since November 2014. Mr. Gilliam was previously a Managing Director and Operating Partner of AEA Investors LP, a private equity firm, from November 2013 to November 2014, and the Regional Head of North America and member of the Executive Committee at Addeco Group SA, a human resources, temporary staffing, and recruiting firm, from March 2007 until July 2012. From 2002 until he joined Addeco, Mr. Gilliam was with International Business Machines (“IBM”), serving, among other things, as the Global Supply Chain Management Leader for IBM Global Business Services. Mr. Gilliam was a partner with PricewaterhouseCoopers Consulting until it was acquired by IBM in October 2002.

Qualifications

The Board nominated Mr. Gilliam to serve as a director because of his expertise in matters related to supply chain management and human resources.

|

Other Boards

• GMS, Inc. | |||

| ||||

Sherrill W. Hudson

Age: 80

Director Since: 2008

Independent

| Committees

• Audit (chair, financial expert)

• Compensation | |||

Professional Experience

Mr. Hudson served on the Board of TECO Energy, Inc., an energy-related holding company, from January 2003 until July 2016. Previously, Mr. Hudson was Executive Chairman of TECO Energy from August 2010 to December 2012, and Chairman and Chief Executive Officer of TECO Energy from 2004 until August 2010. Prior to joining TECO Energy in July 2004, Mr. Hudson spent 37 years with Deloitte & Touche LLP until he retired in 2002. Mr. Hudson is a member of the Florida Institute of Certified Public Accountants.

Qualifications

The Board nominated Mr. Hudson to serve as a director because of his extensive knowledge of accounting and his management experience.

|

Other Boards

• CBIZ, Inc.

• United Insurance Holdings Corp. | |||

10 | LENNAR CORPORATION 2023 PROXY STATEMENT

Proposal 1: Election of Directors Nominees for Election

| ||||

Jonathan M. Jaffe

Age: 63

Director Since: 2018

| Committees

• None | |||

Professional Experience

Mr. Jaffe has served as our Co-Chief Executive Officer and Co-President since November 2020, and, prior to that, served as our President from April 2018 to November 2020. Mr. Jaffe served as our Chief Operating Officer from December 2004 to January 2019, and he continues to have responsibility for the Company’s operations nationally. Previously, Mr. Jaffe served as Vice President of Lennar from 1994 to April 2018, and prior to then, he served as a Regional President in our Homebuilding operations.

Qualifications

The Board nominated Mr. Jaffe to serve as a director because he has extensive knowledge of the homebuilding industry and our Company’s operations and strategic plans.

|

Other Boards

• Opendoor Technologies Inc.

• previously, Five Point Holdings, LLC | |||

| ||||

Sidney Lapidus

Age: 85

Director Since: 1997

Lead Director Since: 2005

Independent

| Committees

• Independent Directors Transactions (chair) • Executive | |||

Professional Experience

Mr. Lapidus is a retired partner of Warburg Pincus LLC, a private equity investment firm, where he was employed from 1967 until his retirement in 2007.

Qualifications

The Board nominated Mr. Lapidus to serve as a director because of the extensive knowledge of business enterprises (including homebuilding companies) and corporate governance he gained as a partner in a private equity investment firm and as a director of a number of publicly- and privately-owned companies.

|

Other Boards

• Mr. Lapidus serves on the boards of a number of non-profit organizations

• previously, Knoll, Inc. | |||

LENNAR CORPORATION 2023 PROXY STATEMENT | 11

Proposal 1: Election of Directors Nominees for Election

| ||||

Teri P. McClure

Age: 59

Director Since: 2013

Independent

| Committees

• Compensation (chair)

• Nominating and Corporate Governance | |||

Professional Experience

From 1995 until her retirement in 2019, Ms. McClure worked at United Parcel Service (“UPS”), serving most recently as Chief Human Resources Officer and Senior Vice President, Labor. Ms. McClure has served in various positions at UPS, including Chief Legal, Communications and Compliance Officer, and, prior to that, Senior Vice President of Legal, Compliance and Public Affairs, General Counsel and Corporate Secretary. Before joining UPS, Ms. McClure practiced with the Troutman Sanders law firm in Atlanta.

Qualifications

The Board nominated Ms. McClure to serve as a director because of her long tenure as a senior executive of a Fortune 100 company, strong operational capabilities and broad business experience.

|

Other Boards

• Fluor Corporation

• GMS Inc.

• JetBlue Airways Corporation | |||

| ||||

Stuart Miller

Age: 65

Director Since: 1990

Executive Chairman Since: 2018

| Committees

• Executive | |||

Professional Experience

Mr. Miller has served as our Executive Chairman since April 2018. Before that time, Mr. Miller served as our Chief Executive Officer from 1997 to April 2018 and our President from 1997 to April 2011. Before 1997, Mr. Miller held various executive positions with us.

Qualifications

The Board nominated Mr. Miller to serve as a director because he has extensive knowledge of the homebuilding industry, he has been in executive leadership positions at the Company for decades and he is able to define the Company’s strategy and future priorities.

|

Other Boards

• Doma Holdings, Inc. • Five Point Holdings, LLC | |||

12 | LENNAR CORPORATION 2023 PROXY STATEMENT

Proposal 1: Election of Directors Nominees for Election

| ||||

Armando Olivera

Age: 73

Director Since: 2015

Independent

| Committees

• Audit (financial expert)

• Nominating and Corporate Governance | |||

Professional Experience

Mr. Olivera was President of Florida Power & Light Company (“FPL”), a subsidiary of NextEra Energy, Inc. and one of the largest investor-owned electric utilities in the United States, from June 2003, and Chief Executive Officer from July 2008, until his retirement in May 2012. Mr. Olivera joined FPL in 1972. Prior to his 2003 appointment as President, Mr. Olivera served in a variety of management positions with FPL, including Vice President of Planning and Budgets, Vice President of Construction Services, System Operations and Distribution and Senior Vice President of System Operations. From 2012 to 2015, Mr. Olivera served as a Senior Advisor to Britton Hill Partners, a private equity firm. Mr. Olivera has been a Senior Advisor to Ridge-Lane Limited Partners, a strategic advisory firm, since 2017 and a Venture Partner in the Ridge-Lane Sustainability Practice from 2018 to 2021.

Qualifications

The Board nominated Mr. Olivera to serve as a director because of his experience and understanding of operations and finance as well as his strong business leadership skills.

|

Other Boards

• Consolidated Edison, Inc.

• Fluor Corporation | |||

LENNAR CORPORATION 2023 PROXY STATEMENT | 13

Proposal 1: Election of Directors Nominees for Election

| ||||

Jeffrey Sonnenfeld

Age: 68

Director Since: 2005

Independent

| Committees

• Audit • Nominating and Corporate Governance | |||

Professional Experience

Mr. Sonnenfeld has served as the Senior Associate Dean for Executive Programs and the Lester Crown Professor-in-the-Practice of Management at the Yale School of Management since 2001. In 1989, Mr. Sonnenfeld founded the Chief Executive Leadership Institute of Yale University, the world’s first “CEO College,” and he has served as its President since that time. Previously, Mr. Sonnenfeld spent ten years as a professor at the Harvard Business School. Recently, Mr. Sonnenfeld was named by Business Week as one of the world’s “ten most influential business school professors.” He has chaired several blue ribbon commissions for the National Association of Corporate Directors, and the NACD’s Directorship magazine recently named him one of the “100 most influential figures in governance.” He was awarded the Ellis Island Medal in 2018 by the US Ellis Island Foundation, and awarded many scholarly honors for the impact of his many research articles on leadership and governance matters. In addition to his post as a regular commentator for CNBC, he is a columnist for Fortune, a regular commentator on PBS’s “Nightly Business Report,” and a frequently cited management expert in the global media. Mr. Sonnenfeld’s columns also regularly appear in The Wall Street Journal, Forbes, The Washington Post, Politico, and the New York Times.

Qualifications

The Board nominated Mr. Sonnenfeld to serve as a director because of his business acumen and experience, as well as his exceptional work in the areas of corporate governance and leadership development as President of the Chief Executive Leadership Institute of Yale University.

|

Other Boards

• IEX Group Investors Exchange

• Atlas Merchant Capital | |||

14 | LENNAR CORPORATION 2023 PROXY STATEMENT

Each year, the Board undertakes a review of director independence, which includes a review of each director’s responses to questionnaires asking about any relationships with us.

The Board reviewed director independence in January 2023 and determined that each of Ms. Banse, Mr. Gilliam, Mr. Hudson, Mr. Lapidus, Ms. McClure, Mr. Olivera and Mr. Sonnenfeld is “independent” under the NYSE corporate governance listing standards and the director independence standards set forth in our Corporate Governance Guidelines, which are consistent with the NYSE standards. After considering any relevant transactions or relationships between each director or any of his or her family members on one side, and the Company, our senior management or our independent registered public accounting firm on the other side, the Board of Directors has affirmatively determined that none of the independent directors has a material relationship with us (either directly, or as a partner, significant stockholder, officer or affiliate of an organization that has a material relationship with us), other than as a member of our Board. In determining whether Mr. Gilliam is independent, the Board viewed Mr. Gilliam’s position as a director of a company that supplies drywall to Lennar as not impairing his independence. The Board also considered that NES Fircroft, where Mr. Gilliam is Chief Executive Officer, and Generation Brands, from which Lennar purchases lighting products, are both subsidiaries of AEA Investors LP, of which Mr. Gilliam was a Managing Director and Operating Partner from November 2013 to November 2014, but did not view these relationships as impairing Mr. Gilliam’s independence. In determining whether Ms. McClure is independent, the Board viewed Ms. McClure’s position as a director of a company that supplies drywall to Lennar as not impairing her independence. In determining whether Ms. Banse is independent, the Board viewed Ms. Banse’s position as an outside advisor to, and limited partner in, a third-party fund in which a Lennar subsidiary has an investment as not impairing her independence.

Mr. Lapidus serves as our Lead Director. In this capacity, Mr. Lapidus presides over Board meetings and presides at all meetings of our independent directors. The Lead Director’s additional duties, which are listed in our By-Laws, include:

| • | at the request of the Board of Directors, presiding over meetings of stockholders; |

| • | conveying recommendations of the independent directors to the full Board; and |

| • | serving as a liaison between the Board and management. |

Our Board believes that having an Executive Chairman and an independent Lead Director, each with distinct responsibilities, works well for us because all but three of our directors (our Executive Chairman and each of our Co-CEOs) are independent, and our Lead Director can cause the independent directors to meet at any time. Therefore, the Lead Director can at any time bring to the attention of a majority of the directors any matters he thinks should be addressed by the Board.

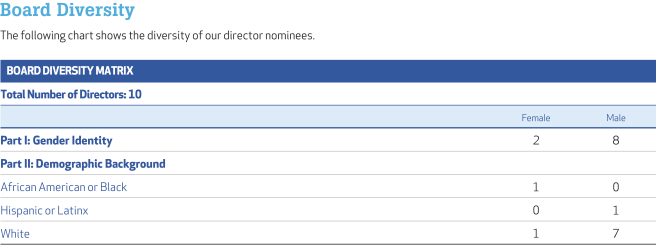

The NCG Committee endeavors to create a Board with a diversity of backgrounds and a variety of life experiences, made up of individuals with a history of conducting their personal and professional affairs with the utmost integrity and consistent with the highest ethical standards. Beyond those threshold requirements, the NCG Committee and the Board of Directors have determined that a Lennar director should have the following characteristics, as set forth in our Corporate Governance Guidelines:

| • | Ability to comprehend Lennar’s strategic goals and to help guide management to accomplish those goals; |

| • | Time available to participate in person in Board and committee meetings and to be present at annual meetings of stockholders; |

| • | Willingness to demand that officers and associates conduct themselves, and require all individuals they supervise to conduct themselves, at all times in an honest and ethical manner in all their dealings on behalf of the Company; and |

| • | Knowledge of, and experience with regard to, at least some of the following: (i) real estate properties and real estate-related loans and securities, including any lending and financing activities; (ii) public company regulations imposed by the SEC and the NYSE, among others; (iii) portfolio and risk management; (iv) the major geographic locations within which the Company operates; (v) sound business practices; and (vi) accounting and financial reporting. |

LENNAR CORPORATION 2023 PROXY STATEMENT | 15

Corporate Governance Board Committees

The NCG Committee will consider possible candidates for nomination as directors suggested by management, by directors, and by stockholders. If a stockholder wishes to recommend a potential nominee for director, the stockholder should submit a recommendation in writing to the NCG Committee at the address set forth under “Corporate Governance — Communication with the Board of Directors” containing: the recommending stockholder’s name and contact information; the candidate’s name and contact information; a description of the candidate’s background and qualifications; the reasons why the recommending stockholder believes the candidate would be well suited for the Board; a written statement by the candidate that the candidate is willing and able to serve on the Board; a written statement by the recommending stockholder that the candidate meets the criteria established by the Board; any information relevant to a determination of whether the candidate can be considered an independent director; any business or personal relationship of the candidate with the recommending stockholder; any arrangements between the candidate and anyone other than the Company to compensate the candidate for seeking election to the Board or serving on the Board; and a brief description of the recommending stockholder’s ownership of our common stock and the period during which such shares have been held.

The NCG Committee will evaluate the suitability of potential candidates recommended by stockholders in the same manner as it evaluates all other candidates. When deciding whether to recommend that the Board of Directors nominate a candidate who has been presented by a stockholder, the NCG Committee will consider, among other things, the candidate’s background and qualifications and whether it is appropriate to add another director to the Board. The NCG Committee may conduct an independent investigation of the background and qualifications of a candidate recommended by a stockholder, and may request an interview with the candidate.

The Board has five standing committees: the Audit, Compensation, NCG, Executive, and Independent Directors Transactions Committees. The charters of each of the Audit Committee, the Compensation Committee, and the NCG Committee setting forth the committees’ respective responsibilities can be found in the Investor Relations—Governance section of our website at www.lennar.com. Those charters also are available in print to any stockholder who requests them through our Investor Relations department. We periodically review and revise the committee charters. The Audit Committee and the Compensation Committee charters were most recently revised on June 26, 2019, and the NCG Committee charter was most recently revised on June 22, 2022. Only independent directors may serve on any of our committees, except the Executive Committee.

Chair: Sherrill Hudson

Members: Tig Gilliam Armando Olivera Jeffrey Sonnenfeld | Audit Committee

| |||

THE AUDIT COMMITTEE IS RESPONSIBLE FOR:

• selecting and overseeing the engagement of our independent auditors; • pre-approving all audit and non-audit services provided by our independent auditors; • reviewing reports regarding our internal control environment, systems, and performance; • overseeing the integrity of our financial statements and our compliance with legal and regulatory requirements; • discussing and reviewing our policies with respect to risk assessment and risk management, including guidelines and policies governing our risk assessment and risk management processes; and • overseeing cybersecurity matters, including response planning, disaster recovery and business continuity considerations.

The Board of Directors has determined that each member of the Audit Committee meets the independence requirements under the NYSE’s corporate governance listing standards and the independence standards for audit committee members required by the SEC, and that each member is financially literate, knowledgeable, and qualified to review financial statements. In addition, the Board of Directors has determined that each of Mr. Gilliam, Mr. Hudson, and Mr. Olivera meets the requirements of an audit committee financial expert under SEC rules.

| ||||

16 | LENNAR CORPORATION 2023 PROXY STATEMENT

Corporate Governance Board Committees

Chair: Teri P. McClure

Members: Amy Banse Tig Gilliam Sherrill Hudson | Compensation Committee

| |||

THE COMPENSATION COMMITTEE IS RESPONSIBLE FOR:

• designing our executive compensation philosophy, policies, and plans; • establishing executive salaries, targets, and performance goals for annual incentive awards and certifying that the goals have been attained; • establishing terms of equity awards and other forms of compensation for our senior executives and our directors; • administering our 2016 Equity Incentive Plan, as amended and restated (the “2016 Equity Plan”); • reviewing the results of the annual advisory stockholder vote on executive compensation and considering whether to recommend adjustments to Lennar’s executive compensation policies and plans as a result of such votes; and • overseeing the Company’s human capital management.

The Compensation Committee has the authority to engage the services of outside legal or other experts and advisors as it deems necessary and appropriate to assist the committee in fulfilling its duties and responsibilities. For more information on outside advisors, see the Compensation Discussion and Analysis section of this proxy statement, which begins on page 25.

The Board of Directors has determined that each member of the Compensation Committee meets the independence requirements under the NYSE’s corporate governance listing standards and meets the independence standards for compensation committee members required by the SEC.

| ||||

Compensation Committee Interlocks and Insider Participation

None of the directors who served on the Compensation Committee during fiscal 2022 was, or ever has been, an officer or employee of the Company. There were no transactions between Lennar and any of the directors who served as members of the Compensation Committee for any part of fiscal year 2022 that would require disclosure by Lennar under the SEC’s rules requiring disclosure of certain relationships and related-party transactions.

Chair: Jeffrey Sonnenfeld

Members: Amy Banse Teri P. McClure Armando Olivera | Nominating and Corporate Governance Committee

| |||

THE NCG COMMITTEE IS RESPONSIBLE FOR:

• soliciting, considering, recommending, and nominating candidates to serve on the Board under criteria adopted by it from time to time; • advising the Board with respect to Board and Committee composition; • reviewing and recommending changes to our Corporate Governance Guidelines; • overseeing periodic evaluations of the Board and the committees; • overseeing the Company’s environmental, social and governance efforts and progress; and • reviewing and reporting to the Board on a periodic basis with regard to matters of corporate governance.

The Board of Directors has determined that each member of the NCG Committee meets the independence requirements under the NYSE’s corporate governance standards.

| ||||

LENNAR CORPORATION 2023 PROXY STATEMENT | 17

Corporate Governance Risk Management

Chair: Sidney Lapidus

Member: Tig Gilliam

| Independent Directors Transactions Committee

| |||

As permitted by our By-Laws, our Board of Directors has established this committee with the authority to approve certain transactions between Lennar and Five Point Holdings, LLC (in which we own a substantial minority interest), and to review and make recommendations to the Board with respect to other matters referred to it by the Board.

| ||||

Members: Sidney Lapidus Stuart Miller

| Executive Committee

| |||

As permitted by our By-Laws, our Board has established this committee with the authority to act on behalf of the Board, except as that power is limited by the corporate laws of the State of Delaware or by our Board.

| ||||

Board Role in Management of Risk

Our Board is actively involved in the oversight and management of risks that could affect Lennar. Management, in consultation with the Board, identifies areas of risk that particularly affect us. Senior members of our management team report to the Board on each of those areas of risk on a rotating basis at the regularly-scheduled quarterly Board meetings. The areas of risk reported to the Board change from time to time based on business conditions, the advice of outside advisors, and a review of risks identified by our competitors in their public filings. Currently, the risk areas reported on to our Board on a regular basis relate to housing inventory and land supply, construction costs and homebuilding overhead, construction quality and warranty, our multifamily business, our financial services business, associate retention and human resources, legal (including regulatory and compliance issues), natural disasters and information technology (including cybersecurity), taxation and strategic investments.

Our Board of Directors also asks for and receives reports on other risks that affect the Company after review of business presentations made during regular Board meetings. In addition, one of the responsibilities of our Audit Committee is to discuss and review policies with respect to risk assessment and risk management, including guidelines and policies governing our risk assessment and risk management processes.

Compensation-Related Risks

In 2022, as part of our risk management process, we conducted a comprehensive review and evaluation of our compensation programs and policies. The assessment covered each material component of executive and non-executive compensation. In evaluating our compensation components, we identified risk-limiting characteristics including the following:

| • | We conduct an annual comprehensive analysis of peer group compensation and refer to broader market-based benchmarking studies to evaluate how our compensation program compares. |

| • | A high percentage of our overall pay mix to senior management and key associates is equity-based, which creates an incentive to generate long-term appreciation of stockholder value. |

| • | The Compensation Committee may use negative discretion to adjust annual incentive compensation downward when warranted. |

| • | Service-based equity awards granted to our executive officers vest over a three-year period, and performance-based equity awards granted to our executive officers vest after a three-year performance period, which mitigates the risk of excessive focus on short-term returns. |

18 | LENNAR CORPORATION 2023 PROXY STATEMENT

Corporate Governance Corporate Governance Documents

| • | We have a compensation clawback policy that may be triggered in the event of a restatement of financial results. |

| • | Our stock ownership guidelines require executive officers to hold a meaningful amount of Lennar stock, which mitigates the risk of excessive focus on short-term returns and aligns the interests of those executives with the interests of stockholders. |

Cybersecurity Risks

Cybersecurity is an integral part of risk management at our Company. Our Audit Committee is responsible for the oversight of cybersecurity risks, and receives a cybersecurity report from management at least quarterly, and more often as needed. The report includes information regarding the nature of threats, defense and detection capabilities, incident response plans and associate training activities. In the last three years, we have not had a significant cybersecurity breach or attack that had a material impact on our business or results of operations.

The Company’s cybersecurity program is periodically assessed by an independent third party. We utilize information technology security experts to assist us in our evaluations of the effectiveness of the security of our information technology systems, and we regularly enhance our security measures to protect our systems and data. We use various encryption, tokenization and authentication technologies to mitigate cybersecurity risks and have increased our monitoring capabilities to enhance early detection and rapid response to potential cyber threats. We provide cybersecurity awareness training of threats to associates at least annually and routinely deploy simulated phishing tests to increase security awareness.

Corporate Governance Documents

Our Corporate Governance Guidelines describe our practices and policies and provide a framework for our Board governance. The topics addressed in our Corporate Governance Guidelines include director qualifications, director responsibilities, management succession, director compensation, and independence standards.

Our Code of Business Ethics and Conduct, which is applicable to all our directors, officers, and associates, promotes our commitment to high standards for ethical business practices. The Code addresses a number of issues, including conflicts of interest, corporate opportunities, fair dealing, confidential information, and insider trading, and confirms our intention to conduct our business with the highest level of integrity. It states that our reputation for integrity is one of our most valuable assets, and that each director, officer, and associate is expected to contribute to the care and preservation of that asset.

Our Corporate Governance Guidelines and our Code of Business Ethics and Conduct are both available on our website, www.lennar.com, in the Investor Relations—Governance section.

Our Board normally meets quarterly, but holds additional meetings as required. In connection with regularly-scheduled Board meetings, our independent directors periodically meet in executive session without our non-independent directors and management.

Our Corporate Governance Guidelines require every director to attend substantially all meetings of the Board and of the committees on which they serve. During fiscal 2022, the Board met four times. Each director attended at least 75% of the total number of Board meetings and applicable committee meetings held while that director was serving on our Board. We encourage directors and nominees for election as directors to attend the annual meeting of stockholders. All members of our Board who were serving at the time of the 2022 annual meeting of stockholders attended the virtual meeting.

Communication with the Board of Directors

Stockholders and other interested parties may communicate with our Board, a committee of the Board, the independent directors as a group, or any individual director by sending an e-mail to feedback@lennar.com. These communications will automatically be submitted to our Lead Director, who will distribute them as appropriate.

In addition, anyone who wishes to communicate with our Board, a committee of the Board, the independent directors as a group, or any individual director, may send correspondence to the Office of the General Counsel at Lennar Corporation, 5505 Blue Lagoon Drive, Miami, Florida 33126. The General Counsel will compile and submit on a periodic basis all stockholder correspondence as addressed. Items that are unrelated to the duties and responsibilities of the Board, such as business solicitation or advertisements, junk mail or mass mailings, resumes or other job-related inquiries, and spam, will not be forwarded.

LENNAR CORPORATION 2023 PROXY STATEMENT | 19

Corporate Governance Certain Relationships and Related Transactions

Certain Relationships and Related Transactions

All “related person transactions” (as defined by SEC rules) must be approved by our Audit Committee. Directors must recuse themselves from any discussion or decision affecting their personal, business, or professional interests.

Current SEC rules require disclosure of any transaction, arrangement, or relationship in which (i) Lennar or one of its subsidiaries is a participant, (ii) the amount involved exceeds $120,000, and (iii) any executive officer, director, director nominee, beneficial owner of more than 5% of Lennar’s common stock, or any immediate family member of any such person, has or will have a direct or indirect material interest. Except as described below, since December 1, 2021, we have not had any such transactions, arrangements, or relationships.

In February 2015, Mr. Miller, our Executive Chairman, entered into a Time-Sharing Agreement with one of our subsidiaries that provides that Mr. Miller can sub-lease aircraft leased by that subsidiary for non-business or personal business purposes. Under the Time-Sharing Agreement, Mr. Miller pays the subsidiary, out of a prepayment fund established under the terms of the agreement, the aggregate incremental cost of each flight based on a list of expenses authorized by federal regulations. The subsidiary retains sole discretion to determine what flights Mr. Miller may schedule, and the Time-Sharing Agreement specifically provides that Lennar’s prior planned use of the aircraft takes precedence over Mr. Miller’s use. Mr. Miller paid our subsidiary $474,000 (calculated in accordance with Federal Aviation Administration regulations) for his personal use of the aircraft during fiscal 2022.

Mr. Beckwitt and Mr. Jaffe, our Co-CEOs, also entered into Time-Sharing Agreements with our subsidiary that have essentially the same terms as Mr. Miller’s agreement, including (for each executive) the establishment of a prepayment fund for the cost of each flight. Mr. Beckwitt paid our subsidiary $456,000 under his February 2015 agreement for his personal use of the aircraft during fiscal 2022. Mr. Jaffe paid our subsidiary $410,000 under his October 2017 agreement for his personal use of the aircraft during fiscal 2022.

Occasionally, a spouse or other guest may accompany Mr. Miller, Mr. Beckwitt, or Mr. Jaffe when they are using corporate aircraft for business travel and additional seating is available. As there is no incremental cost to Lennar for an additional passenger accompanying an executive on a flight, no amount has been included in the Summary Compensation Table to reflect that usage. However, due to special tax rules regarding personal use of business aircraft, Mr. Miller, Mr. Beckwitt, or Mr. Jaffe may be treated as receiving taxable income when a spouse or guest accompanies one of them on a business trip.

In April 2019, Jeffrey Miller, Stuart Miller’s brother, entered into an agreement with one of our subsidiaries that provides that Jeffrey Miller can sub-lease an aircraft leased by that subsidiary for personal purposes. The arrangement helps to offset the cost of the aircraft when it is not being used by Lennar. Lennar retains sole discretion to determine what flights may be scheduled. Jeffrey Miller pays for use of the aircraft based on a fee structure similar to that used by third-party charter companies. Jeffrey Miller did not use the aircraft in fiscal 2022, and therefore did not make any payments for his use of the aircraft during fiscal 2022.

Jack Beckwitt, Mr. Beckwitt’s son, is employed by Lennar as a Senior Land Acquisition Manager. For fiscal 2022, Jack Beckwitt received a salary of $117,000, a cash bonus of $81,200, and other benefits totaling approximately $6,000 (including matching contributions to his 401(k) plan).

Brad Miller, Mr. Miller’s son, is employed by Lennar as a Director of Land Acquisitions. For fiscal 2022, Brad Miller received a salary of $173,000, a cash bonus of $130,000, a grant of restricted Class A common stock with a value of $55,000, and other benefits totaling approximately $14,000 (including matching contributions to his 401(k) plan and a car allowance).

20 | LENNAR CORPORATION 2023 PROXY STATEMENT

Corporate Governance Director Compensation

We maintain a compensation program for the non-management directors of the Board. Directors who are associates do not receive any additional compensation for their services as directors of the Company. In fiscal 2022, our compensation program for the non-management directors consisted of the following types and levels of compensation:

| Type of pay | Amount ($) | Form | ||

| Annual Equity Grant (1) | $135,000 | Shares of Class A common stock | ||

| Annual Retainer | $140,000 | 50% in cash, and 50% in shares of Class A common stock | ||

| Audit Committee Members | $25,000 | Cash | ||

| Audit Committee Chair | $30,000 | Cash | ||

| Compensation Committee Members | $15,000 | Cash | ||

| Compensation Committee Chair | $20,000 | Cash | ||

| NCG Committee Members | $10,000 | Cash | ||

| NCG Committee Chair | $20,000 | Cash | ||

| Lead Director | $75,000 | Cash | ||

| (1) | Share value of $135,000 is based on the closing price of the stock on the date of grant, April 12, 2022 ($76.51). |

Annual Equity Grant

At the time of each annual meeting, each non-management director receives a grant of shares of our Class A common stock. Directors are permitted to sell 50% of that stock at any time, but must hold the remaining stock until the second anniversary of the grant date.

Retainer and Committee Fees Paid in Cash

Fifty percent of the annual retainer, and the committee fees and lead director fee, are paid in quarterly cash installments. Non-management directors are also reimbursed for incidental expenses arising from their attendance at Board meetings and committee meetings.

Compensation Deferral

A director may elect to defer payment of both the cash and stock portion of the annual retainer and committee and lead director fees until the year the director ceases to serve on our Board or the director’s death. If a director makes this election, a number of phantom shares of Class A common stock with a value equal to the amount of the deferred retainer and fees is credited to the director’s deferred compensation account each quarter. These phantom shares accrue dividend-equivalents, which are credited to the director’s account and treated as though they were used to purchase additional shares of Class A common stock.

When a director’s deferred compensation account terminates, the director will receive cash equal to the value of the number of phantom shares of Class A common stock and, if applicable, any, phantom shares of Class B common stock credited to the director’s account. That value is determined by multiplying the number of phantom shares by the closing price of the applicable common stock on either the date of the director’s death or a specified date during the year of the director’s separation from service.

Steve Gerard, a member of the Board since 2000, participated in the deferred compensation program until his death in April 2022. On April 12, 2022, the date of Mr. Gerard’s death, he had 49,755 phantom shares of Class A common stock and 388 phantom shares of Class B common stock in his deferred compensation account. On that date, the closing price of the Company’s Class A common stock and Class B common stock was $76.51 and $65.41, respectively. As a result, the Company paid $3,832,157 to settle Mr. Gerard’s deferred compensation account.

For fiscal 2022, each of Messrs. Hudson, Lapidus, Olivera and Sonnenfeld elected to defer payment of both the cash and stock portions of their fees. During September 2021, Mr. Gilliam elected to terminate his participation in the deferred compensation program with respect to the cash portion of his Board and Committee fees, which termination was effective during the second quarter of fiscal 2022. Ms. McClure participated in the deferred compensation program until her termination in the program became effective in the second quarter of fiscal 2021.The table below sets forth the aggregate number of phantom shares of Class A common stock held by such directors in their respective deferred compensation accounts at November 30, 2022.

LENNAR CORPORATION 2023 PROXY STATEMENT | 21

Corporate Governance Director Compensation

| Name | Aggregate Number of Class A Shares of Phantom Stock Held in Deferred Compensation Account at November 30, 2022 | |

| Tig Gilliam | 39,147 | |

| Sherrill W. Hudson | 62,156 | |

| Sidney Lapidus | 60,426 | |

| Teri P. McClure (1) | 21,273 | |

| Armando Olivera | 21,850 | |

| Jeffrey Sonnenfeld | 53,526 | |

| (1) | The shares of phantom stock are shares that Ms. McClure received prior to terminating the deferral election. |

The following table sets forth information regarding the compensation of our non-management directors for fiscal 2022. Messrs. Miller, Beckwitt and Jaffe are omitted from the table as they do not receive any additional compensation for their service as directors. Compensation for these three executives is described in the Compensation Discussion and Analysis section of this proxy statement, which begins on page 25.

| Name | Fees Earned ($)(1) | Stock Awards ($)(1)(2) | All Other ($)(3) | Total ($) | ||||||||||||

Amy Banse |

| 95,000 |

|

| 204,759 |

|

| 164 |

|

| 299,923 |

| ||||

Steven L. Gerard (4) |

| 57,500 |

|

| 34,931 |

|

| 17,254 |

|

| 109,685 |

| ||||

Tig Gilliam |

| 110,000 |

|

| 204,964 |

|

| 54,966 |

|

| 369,930 |

| ||||

Sherrill W. Hudson |

| 115,000 |

|

| 204,964 |

|

| 85,332 |

|

| 405,296 |

| ||||

Sidney Lapidus |

| 145,000 |

|

| 204,964 |

|

| 83,177 |

|

| 433,141 |

| ||||

Teri P. McClure |

| 98,750 |

|

| 204,759 |

|

| 30,681 |

|

| 334,190 |

| ||||

Armando Olivera |

| 105,000 |

|

| 204,964 |

|

| 29,578 |

|

| 339,542 |

| ||||

Jeffrey Sonnenfeld |

| 108,750 |

|

| 204,964 |

|

| 72,818 |

|

| 386,532 |

| ||||

| (1) | Each of Messrs. Hudson, Lapidus, Olivera and Sonnenfeld decided to defer 100% of both the cash and stock portions of their annual retainer and committee fees. These amounts were credited in the form of phantom shares of Class A common stock to the directors’ respective deferred compensation accounts. Mr. Gilliam elected to terminate his participation in the deferred compensation program with respect to the cash portion of his Board and Committee fees, which termination became effective during the second quarter of fiscal 2022. |

| Name | Deferred Cash ($) | Deferred Stock ($) | Phantom Shares Credited to Account | |||||||||

Tig Gilliam |

| 27,500 |

|

| 70,000 |

|

| 1,144 |

| |||

Sherrill W. Hudson |

| 115,000 |

|

| 70,000 |

|

| 2,215 |

| |||

Sidney Lapidus |

| 145,000 |

|

| 70,000 |

|

| 2,574 |

| |||

Armando Olivera |

| 105,000 |

|

| 70,000 |

|

| 2,096 |

| |||

Jeffrey Sonnenfeld |

| 108,750 |

|

| 70,000 |

|

| 2,146 |

| |||

| (2) | Amount reflects (i) 50% of the annual retainer fee, payable in shares of Class A common stock, and (ii) the fair market value of the 1,764 shares of Class A common stock that constitute the annual equity grant. The annual equity grant award was made on April 12, 2022, to each of Ms. Banse, Mr. Gilliam, Mr. Hudson, Mr. Lapidus, Ms. McClure, Mr. Olivera, and Mr. Sonnenfeld and had a grant date fair value of $76.51 per share. These shares were fully vested upon issuance, but 50% of the shares are subject to a two-year minimum holding period. |

| (3) | With respect to Ms. Banse, the amount reflects cash in lieu of fractional shares relating to the quarterly annual retainer fees paid in stock. With respect to Mr. Gerard and Ms. McClure, the amount includes both cash in lieu of fractional shares relating to the quarterly annual retainer fee paid in stock, and dividend equivalents payable on phantom shares held in each of Mr. Gerard’s and Ms. McClure’s deferred compensation account that were received prior to termination of the deferral election. With respect to Messrs. Gilliam, Hudson, Lapidus, Olivera and Sonnenfeld, the amounts include dividend-equivalents payable on phantom shares held in the directors’ respective deferred compensation accounts. Deferred dividend equivalents are credited to the applicable director’s deferred compensation account in the form of additional phantom shares, calculated at the fair market value of a share of our Class A common stock on the dividend record dates. The table below sets forth the phantom shares credited to each participating director’s account from deferred dividend equivalents for fiscal 2022. |

22 | LENNAR CORPORATION 2023 PROXY STATEMENT

Corporate Governance Director Compensation

| Name | Dividends Deferred ($) | Phantom Shares Credited to Account for Deferred Dividends | ||||||

Steven L. Gerard |

| 17,185 |

|

| 188 |

| ||

Tig Gilliam |

| 54,966 |

|

| 686 |

| ||

Sherrill W. Hudson |

| 85,332 |

|

| 1,065 |

| ||

Sidney Lapidus |

| 83,177 |

|

| 1,038 |

| ||

Teri McClure |

| 30,516 |

|

| 381 |

| ||

Armando Olivera |

| 29,578 |

|

| 370 |

| ||

Jeffrey Sonnenfeld |

| 72,818 |

|

| 909 |

| ||

| (4) | Mr. Gerard received a prorated amount of deferred compensation for his period of service as a director during the year. |

Stock Ownership Requirements

Our Board has adopted stock ownership guidelines establishing minimum equity ownership requirements for members of our Board. The purpose of the guidelines is to align the interests of directors with the interests of stockholders and to further promote our commitment to sound corporate governance. Under our stock ownership guidelines, a director is expected to own, by a date not later than five years after being elected as a director, shares of our common stock with a value equal to five times the annual director retainer. All of our directors are in compliance with these requirements.

LENNAR CORPORATION 2023 PROXY STATEMENT | 23

Every year, we give our stockholders the opportunity to vote, on a non-binding basis, on whether they approve the compensation of our named executive officers. This vote is often referred to as “say on pay.” At the 2023 Annual Meeting, we will ask our stockholders to vote, on an advisory basis, on the fiscal 2022 compensation of our named executive officers as disclosed in the Compensation Discussion and Analysis (“CD&A”) that follows this proposal.

We encourage you to review the CD&A, the compensation tables, and the related narrative disclosures. We believe Lennar’s success is attributable in substantial part to our talented and committed executives. Therefore, the compensation of our NEOs is designed to help us continue to retain, motivate, and recruit high-quality, experienced executives who can help us achieve our short-term and long-term corporate goals and strategies.

We believe our executive compensation program strikes an appropriate balance between utilizing responsible, measured pay practices and effectively incentivizing our executives to dedicate themselves fully to creating value for our stockholders. As explained in the CD&A, we seek this balance by using a mix of short-term and long-term compensation components—both fixed and variable—and basing a meaningful percentage of the compensation of our named executive officers on Lennar’s financial performance and stockholder return. Further, we maintain strong corporate governance practices regarding executive compensation, including robust stock ownership guidelines and a compensation clawback policy, to promote continued alignment of our executives’ interests with those of our stockholders and to discourage excessive risk- taking to achieve short-term gains.

We are requesting that our stockholders approve the following resolution:

RESOLVED, that the stockholders of Lennar Corporation approve, on a non-binding, advisory basis, the compensation of Lennar’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, which disclosure includes the Compensation Discussion and Analysis, the tabular disclosures regarding such compensation, and the accompanying narrative disclosures, set forth in Lennar’s 2023 Annual Meeting proxy statement.

Although this say on pay vote is non-binding, the Board and the Compensation Committee will review the results of the vote and consider those results when determining future executive compensation arrangements.

24 | LENNAR CORPORATION 2023 PROXY STATEMENT

This Compensation Discussion and Analysis describes our compensation philosophy, policies, and plans, as well as our compensation-setting process and the 2022 compensation of our named executive officers, or NEOs. In addition, we explain why we believe that our executive compensation program is in the best interests of Lennar and you, our stockholders.

For fiscal 2022, our named executive officers (“NEOs”) were:

Stuart Miller Executive Chairman | Rick Beckwitt Co-Chief Executive | Jonathan M. Jaffe Co-Chief Executive Officer and Co-President | Diane Bessette Vice President, Chief Financial Officer and Treasurer | Jeff McCall Executive Vice | Mark Sustana Vice President, General Counsel and Secretary |

Table of Contents | ||||||||||||||

| 25 | 2019 Performance Shares – Results | 38 | ||||||||||||

| 29 | Other Benefits | 39 | ||||||||||||

| 30 | Change in Control Effects | 39 | ||||||||||||

| 31 | Other Compensation Practices | 39 | ||||||||||||

| 32 | ||||||||||||||

Stockholder Engagement and the Say on Pay Vote

The Compensation Committee and full Board take the outcome of the Say on Pay vote seriously and are focused on gathering and responding to our stockholders’ feedback regarding the Company’s executive compensation programs. As part of its compensation- setting process, the Compensation Committee considers the results of the stockholder advisory vote on our executive compensation from the prior year. Approximately 63% of the votes cast at our 2022 Annual Meeting were voted in favor of our executive compensation, as compared to approximately 84% the prior year.

Our Say on Pay vote received a lower than expected vote at the 2022 Annual Meeting. In response, the Compensation Committee made significant changes to our executive compensation program and remains committed to understanding and being responsive to stockholder sentiment. The Compensation Committee and management reached out to investors, in some instances multiple times, prior to and following the 2022 Annual Meeting to ensure that any actionable feedback received could be better incorporated into Compensation Committee discussions and decisions for fiscal 2022 and beyond.