Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 0 Fourth Quarter 2012 Financial Teleconference

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 1 Statements contained in this presentation about future performance, including, without limitation, operating results, asset and rate base growth, capital expenditures, San Onofre Nuclear Generating Station (SONGS), EME bankruptcy and restructuring activities, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors,” and “Management’s Discussion and Analysis” in Edison International’s 2012 Form 10-K and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. Forward-Looking Statements

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 2 Changes in Financial Reporting Financial Reporting • On December 17, 2012, Edison Mission Energy (EME) filed for relief under Chapter 11 of the U.S. Bankruptcy Code resulting in the following changes: For 2012, Edison International (EIX) reports results of EME as Discontinued Operations under “Parent Company and Other” Beginning Q1 2013, EME’s financial results will no longer be consolidated with EIX • Edison Mission Group (EMG) included in EIX Parent & Other Continuing Operations Includes remaining immaterial investments of EMG other than EME and other new business activity Presentation • All segment operating and financial information for EME removed from this presentation Further EME Information • EME’s restructuring: www.edisonmissionrestructuring.com • EME’s business: www.edisonmissionenergy.com

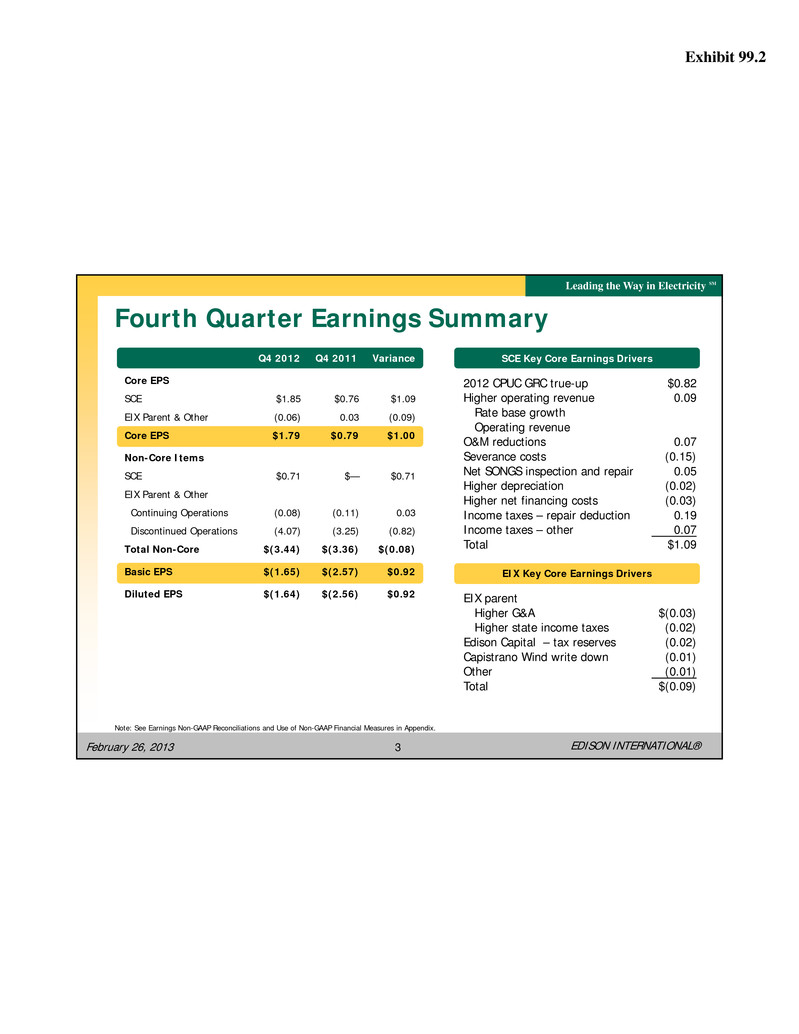

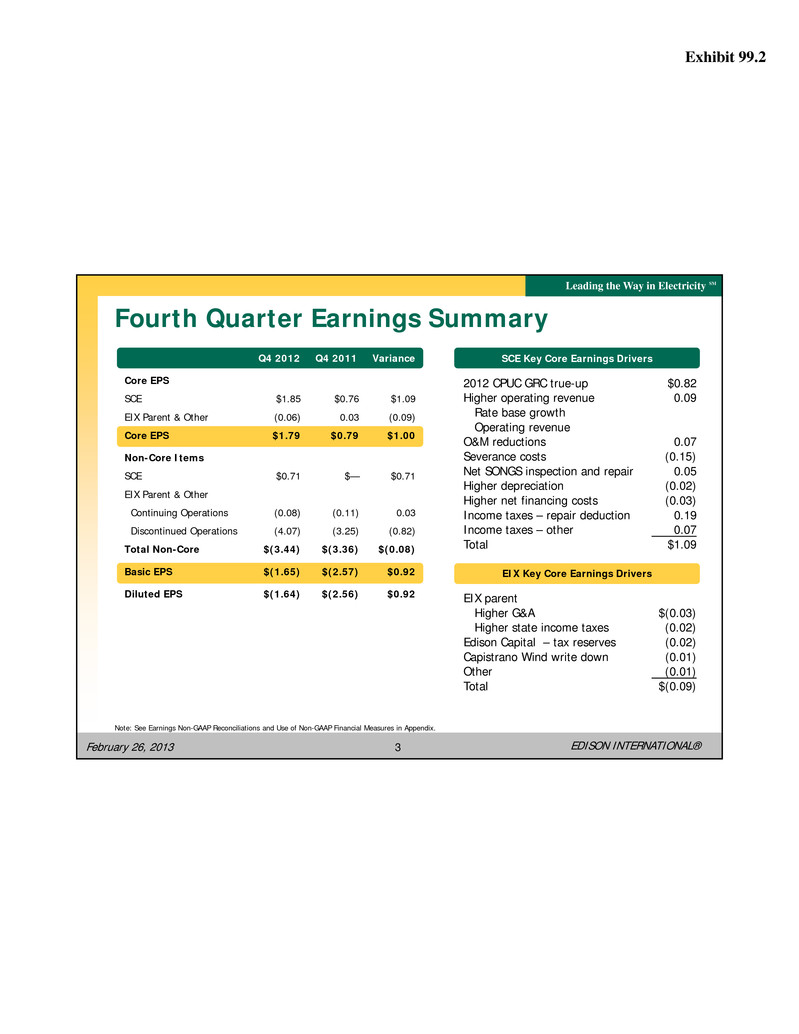

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 3 Fourth Quarter Earnings Summary Note: See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix. SCE Key Core Earnings Drivers 2012 CPUC GRC true-up $0.82 Higher operating revenue 0.09 Rate base growth Operating revenue O&M reductions 0.07 Severance costs (0.15) Net SONGS inspection and repair 0.05 Higher depreciation (0.02) Higher net financing costs (0.03) Income taxes – repair deduction 0.19 Income taxes – other 0.07 Total $1.09 Q4 2012 Q4 2011 Variance Core EPS SCE $1.85 $0.76 $1.09 EIX Parent & Other (0.06) 0.03 (0.09) Core EPS $1.79 $0.79 $1.00 Non-Core Items SCE $0.71 $— $0.71 EIX Parent & Other Continuing Operations (0.08) (0.11) 0.03 Discontinued Operations (4.07) (3.25) (0.82) Total Non-Core $(3.44) $(3.36) $(0.08) Basic EPS $(1.65) $(2.57) $0.92 Diluted EPS $(1.64) $(2.56) $0.92 EIX Key Core Earnings Drivers EIX parent Higher G&A $(0.03) Higher state income taxes (0.02) Edison Capital – tax reserves (0.02) Capistrano Wind write down (0.01) Other (0.01) Total $(0.09)

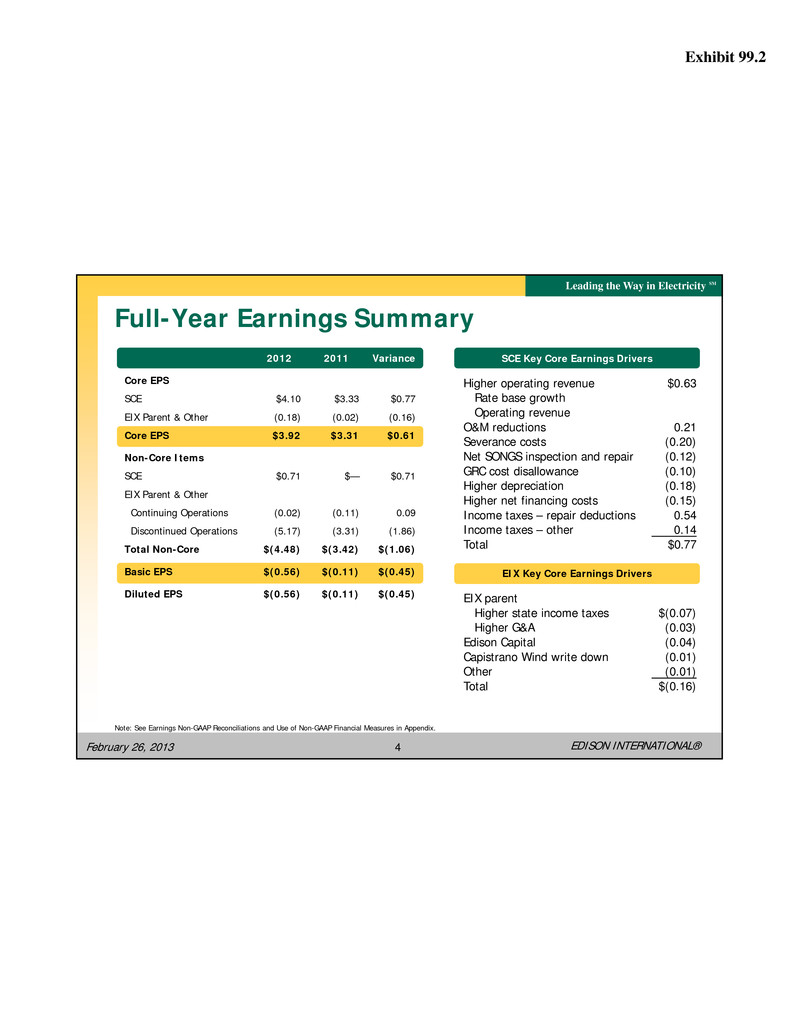

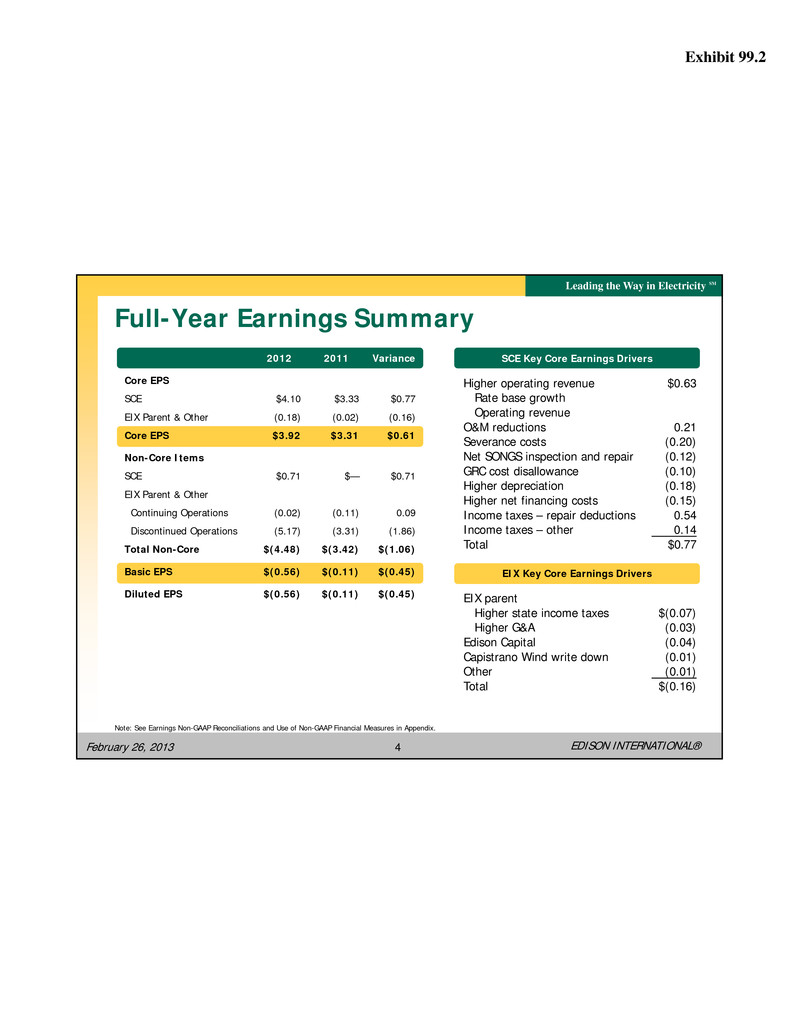

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 4 Full-Year Earnings Summary Note: See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix. 2012 2011 Variance Core EPS SCE $4.10 $3.33 $0.77 EIX Parent & Other (0.18) (0.02) (0.16) Core EPS $3.92 $3.31 $0.61 Non-Core Items SCE $0.71 $— $0.71 EIX Parent & Other Continuing Operations (0.02) (0.11) 0.09 Discontinued Operations (5.17) (3.31) (1.86) Total Non-Core $(4.48) $(3.42) $(1.06) Basic EPS $(0.56) $(0.11) $(0.45) Diluted EPS $(0.56) $(0.11) $(0.45) SCE Key Core Earnings Drivers Higher operating revenue $0.63 Rate base growth Operating revenue O&M reductions 0.21 Severance costs (0.20) Net SONGS inspection and repair (0.12) GRC cost disallowance (0.10) Higher depreciation (0.18) Higher net financing costs (0.15) Income taxes – repair deductions 0.54 Income taxes – other 0.14 Total $0.77 EIX Key Core Earnings Drivers EIX parent Higher state income taxes $(0.07) Higher G&A (0.03) Edison Capital (0.04) Capistrano Wind write down (0.01) Other (0.01) Total $(0.16)

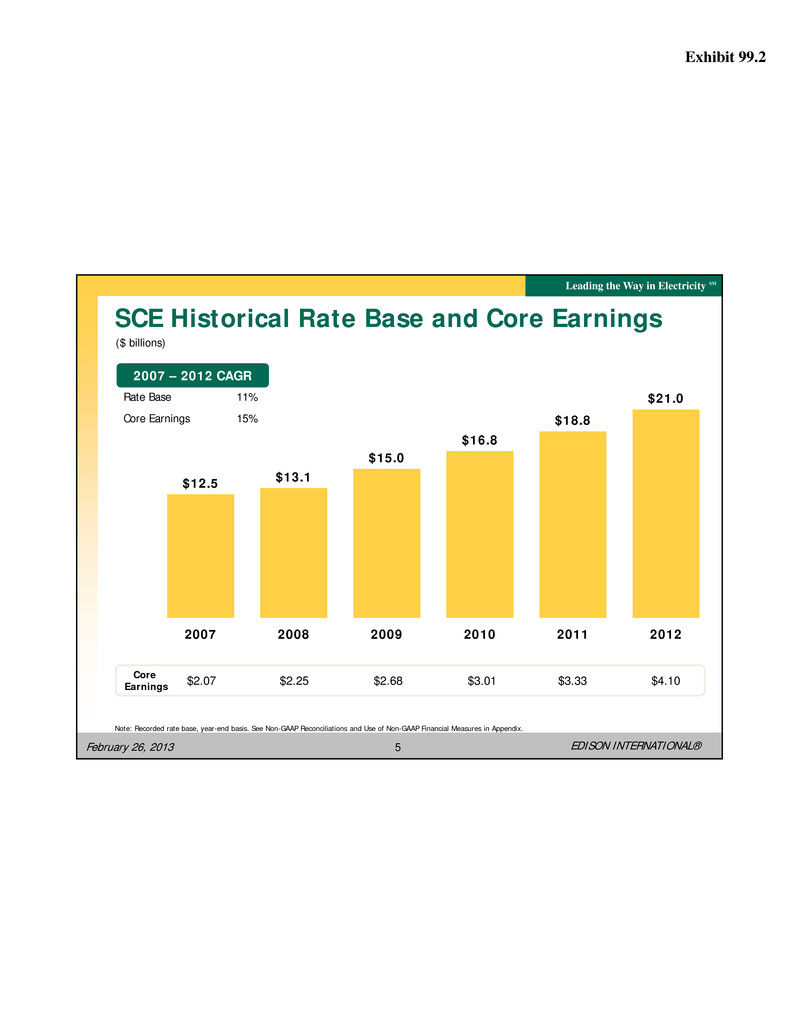

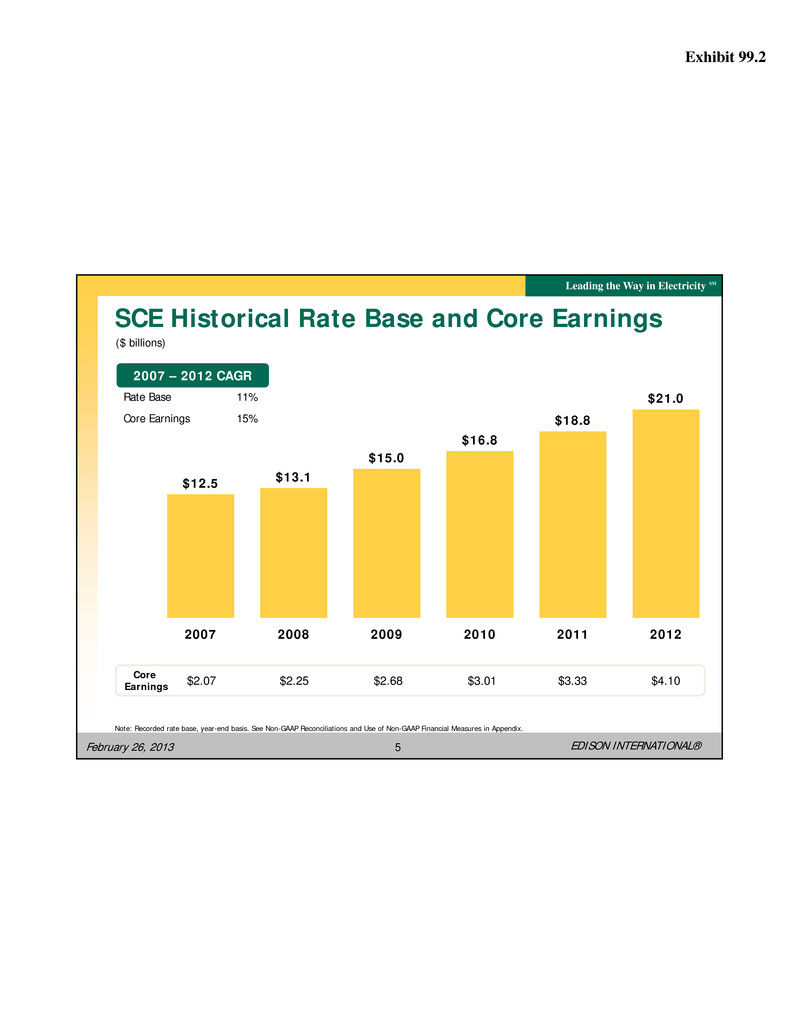

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 5 $12.5 $13.1 $15.0 $16.8 $18.8 $21.0 2007 2008 2009 2010 2011 2012 Rate Base Core Earnings 11% 15% 2007 – 2012 CAGR Note: Recorded rate base, year-end basis. See Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix. Core Earnings $2.07 $2.25 $2.68 $3.01 $3.33 SCE Historical Rate Base and Core Earnings ($ billions) $4.10

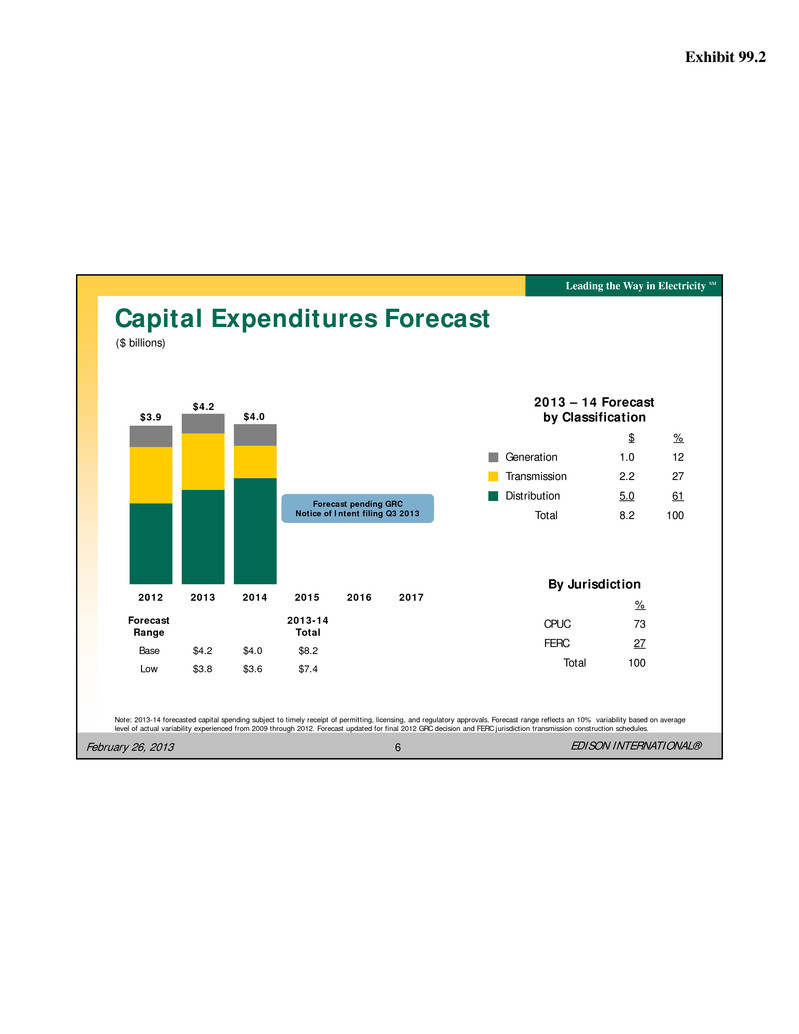

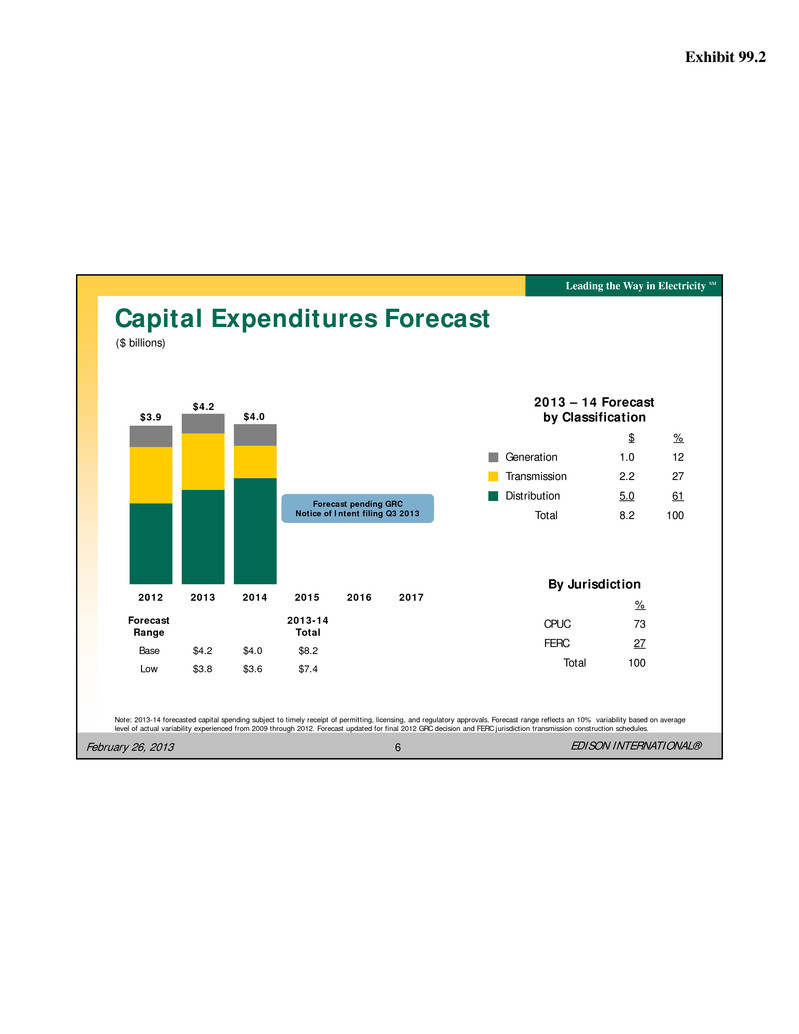

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 6 $3.9 $4.2 $4.0 2012 2013 2014 2015 2016 2017 Forecast pending GRC Notice of Intent filing Q3 2013 Note: 2013-14 forecasted capital spending subject to timely receipt of permitting, licensing, and regulatory approvals. Forecast range reflects an 10% variability based on average level of actual variability experienced from 2009 through 2012. Forecast updated for final 2012 GRC decision and FERC jurisdiction transmission construction schedules. Capital Expenditures Forecast ($ billions) Forecast Range 2013-14 Total Base $4.2 $4.0 $8.2 Low $3.8 $3.6 $7.4 By Jurisdiction % CPUC 73 FERC 27 Total 100 2013 – 14 Forecast by Classification $ % Generation 1.0 12 Transmission 2.2 27 Distribution 5.0 61 Total 8.2 100

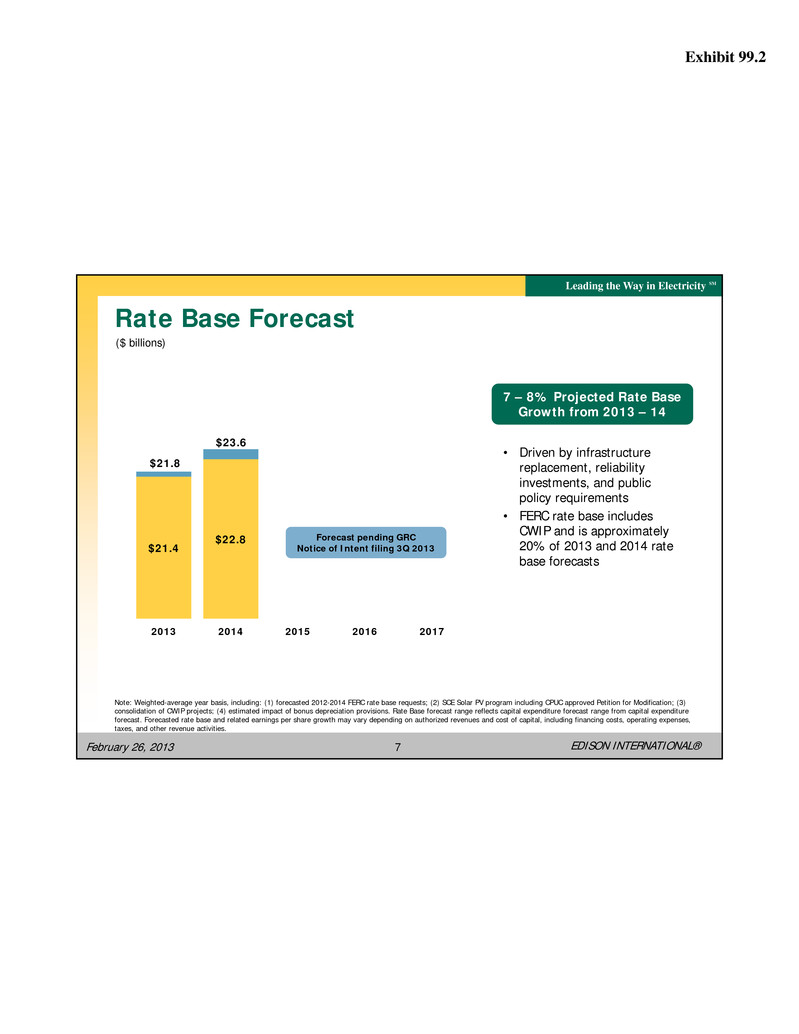

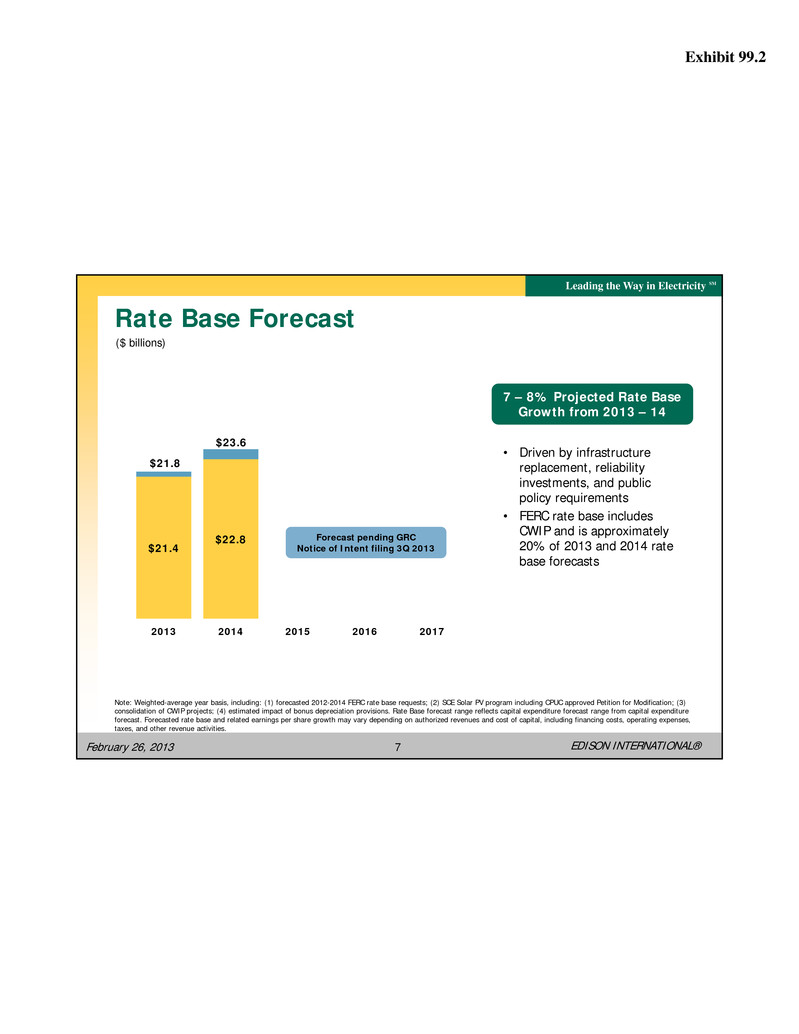

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 7 ($ billions) Rate Base Forecast $21.4 $22.8 $21.8 $23.6 2013 2014 2015 2016 2017 Note: Weighted-average year basis, including: (1) forecasted 2012-2014 FERC rate base requests; (2) SCE Solar PV program including CPUC approved Petition for Modification; (3) consolidation of CWIP projects; (4) estimated impact of bonus depreciation provisions. Rate Base forecast range reflects capital expenditure forecast range from capital expenditure forecast. Forecasted rate base and related earnings per share growth may vary depending on authorized revenues and cost of capital, including financing costs, operating expenses, taxes, and other revenue activities. Smart Grid Forecast pending GRC Notice of Intent filing 3Q 2013 • Driven by infrastructure replacement, reliability investments, and public policy requirements • FERC rate base includes CWIP and is approximately 20% of 2013 and 2014 rate base forecasts 7 – 8% Projected Rate Base Growth from 2013 – 14

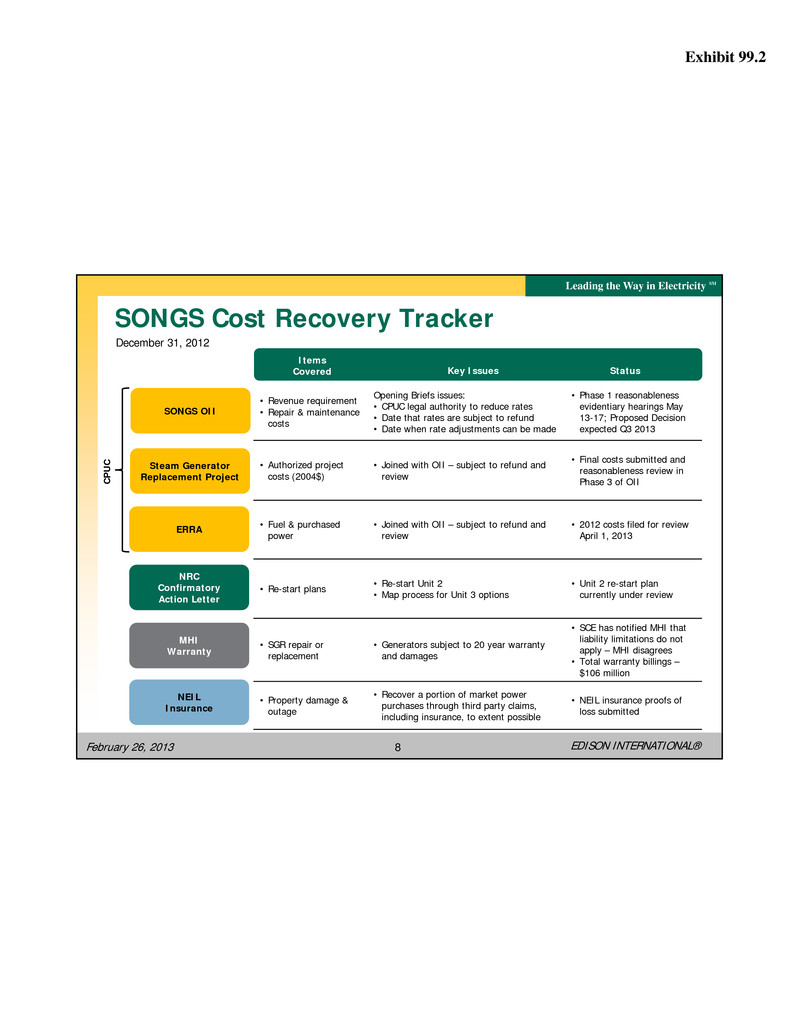

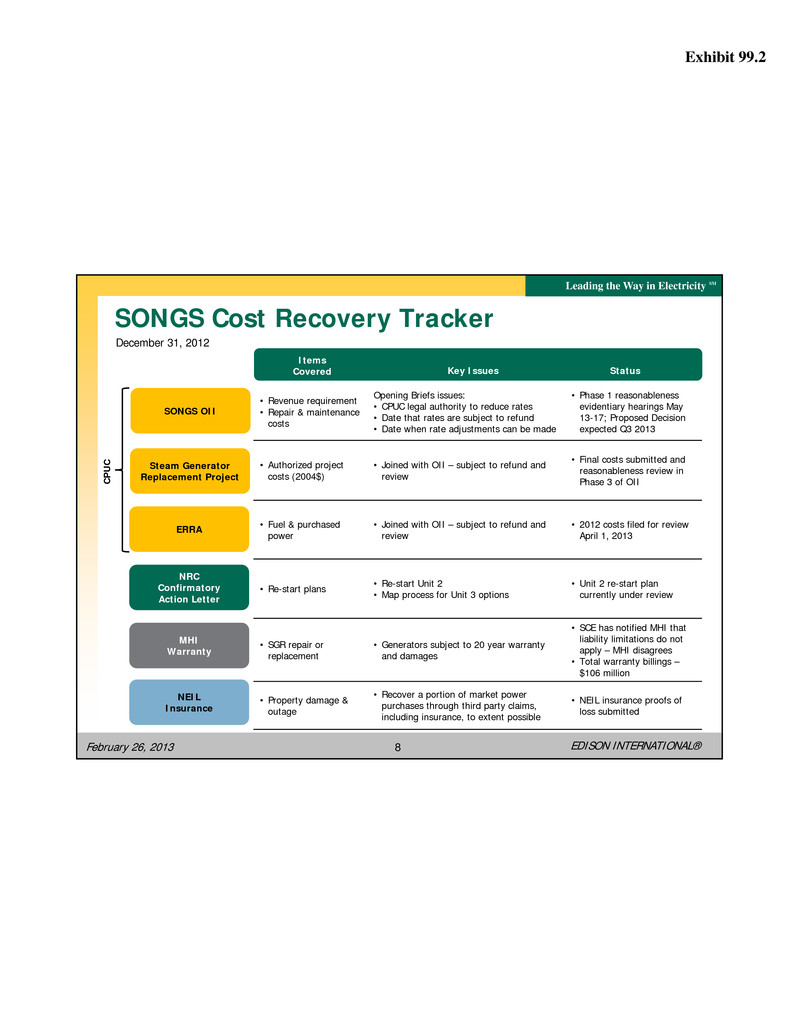

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 8 SONGS Cost Recovery Tracker ERRA Steam Generator Replacement Project NRC Confirmatory Action Letter MHI Warranty Items Covered Key Issues Status SONGS OII • Revenue requirement • Repair & maintenance costs Opening Briefs issues: • CPUC legal authority to reduce rates • Date that rates are subject to refund • Date when rate adjustments can be made • Phase 1 reasonableness evidentiary hearings May 13-17; Proposed Decision expected Q3 2013 • Authorized project costs (2004$) • Joined with OII – subject to refund and review • Final costs submitted and reasonableness review in Phase 3 of OII • Fuel & purchased power • Joined with OII – subject to refund and review • 2012 costs filed for review April 1, 2013 • Re-start plans • Re-start Unit 2• Map process for Unit 3 options • Unit 2 re-start plan currently under review • SGR repair or replacement • Generators subject to 20 year warranty and damages • SCE has notified MHI that liability limitations do not apply – MHI disagrees • Total warranty billings – $106 million • Property damage & outage • Recover a portion of market power purchases through third party claims, including insurance, to extent possible • NEIL insurance proofs of loss submitted NEIL Insurance CP UC December 31, 2012

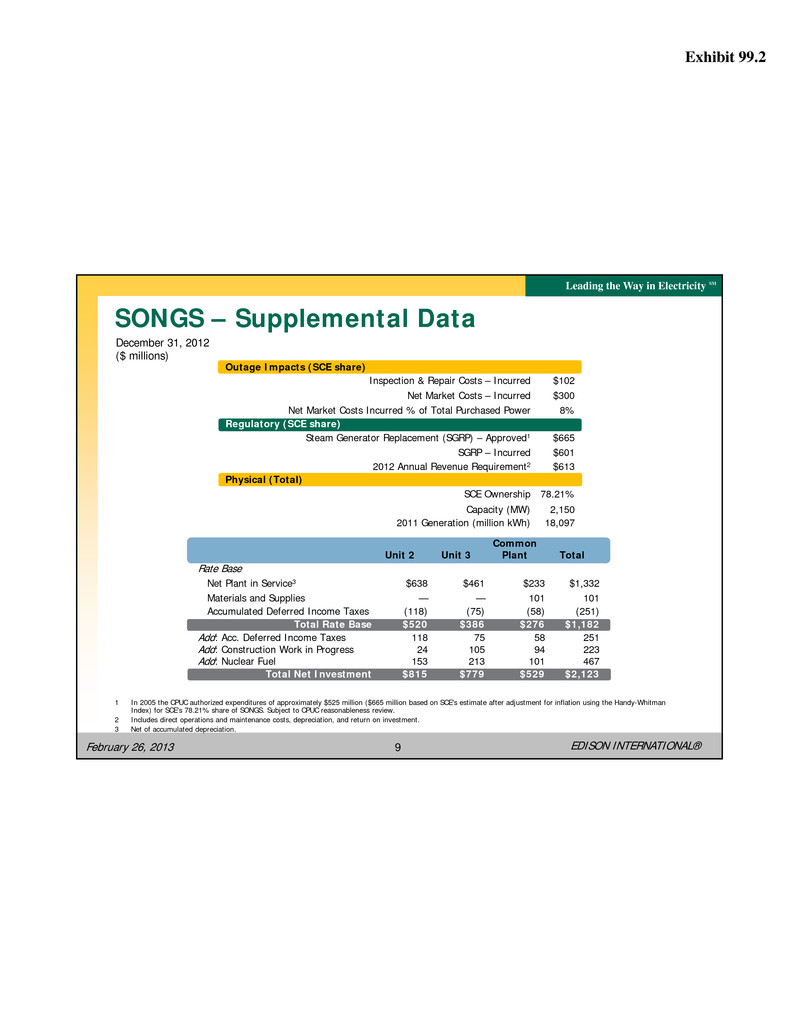

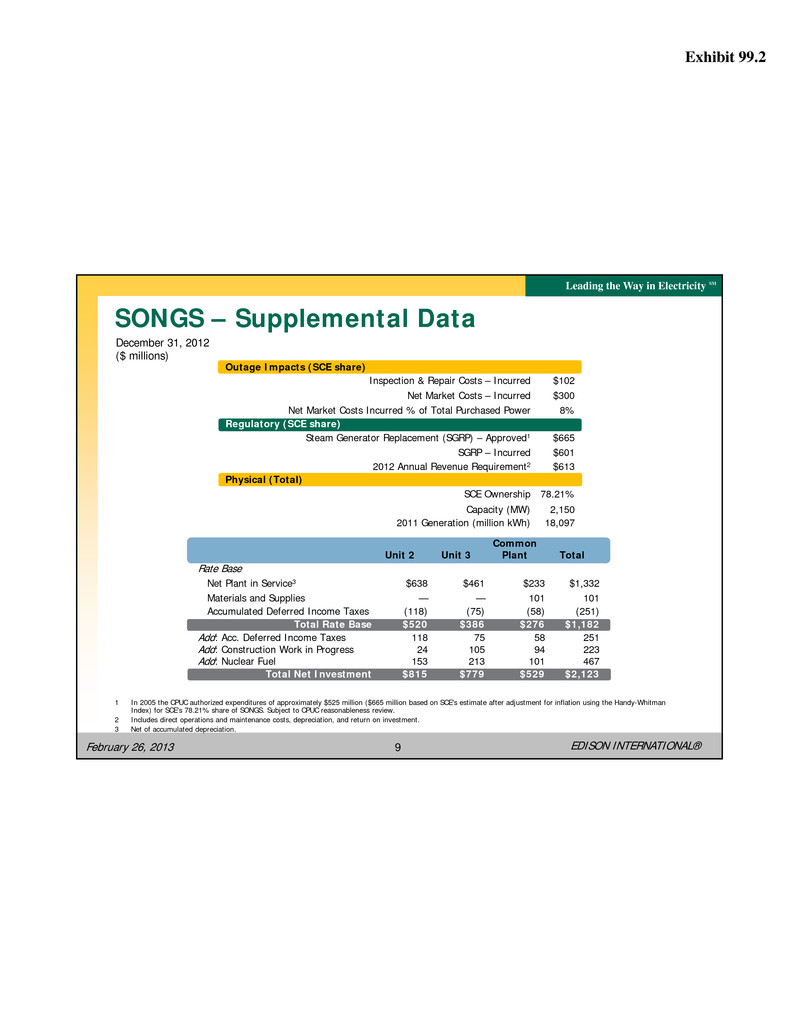

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 9 SONGS – Supplemental Data 1 In 2005 the CPUC authorized expenditures of approximately $525 million ($665 million based on SCE's estimate after adjustment for inflation using the Handy-Whitman Index) for SCE's 78.21% share of SONGS. Subject to CPUC reasonableness review. 2 Includes direct operations and maintenance costs, depreciation, and return on investment. 3 Net of accumulated depreciation. December 31, 2012 ($ millions) Outage Impacts (SCE share) Inspection & Repair Costs – Incurred $102 Net Market Costs – Incurred $300 Net Market Costs Incurred % of Total Purchased Power 8% Regulatory (SCE share) Steam Generator Replacement (SGRP) – Approved1 $665 SGRP – Incurred $601 2012 Annual Revenue Requirement2 $613 Physical (Total) SCE Ownership 78.21% Capacity (MW) 2,150 2011 Generation (million kWh) 18,097 Unit 2 Unit 3 Common Plant Total Rate Base Net Plant in Service3 $638 $461 $233 $1,332 Materials and Supplies — — 101 101 Accumulated Deferred Income Taxes (118) (75) (58) (251) Total Rate Base $520 $386 $276 $1,182 Add: Acc. Deferred Income Taxes 118 75 58 251 Add: Construction Work in Progress 24 105 94 223 Add: Nuclear Fuel 153 213 101 467 Total Net Investment $815 $779 $529 $2,123

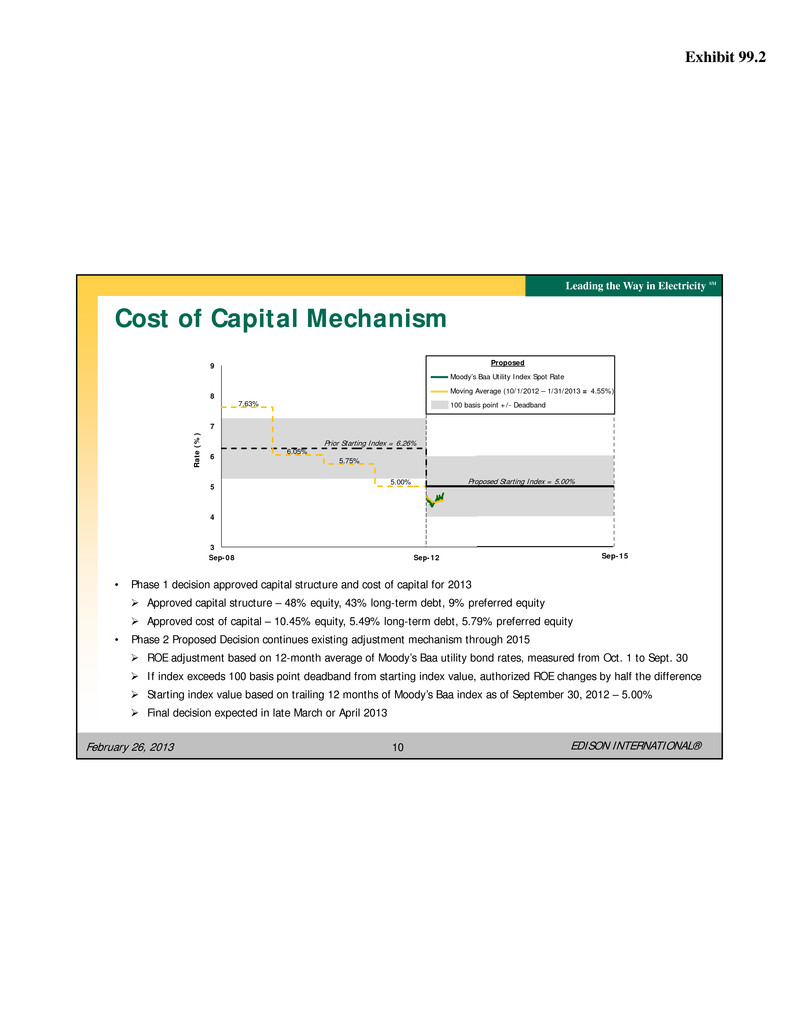

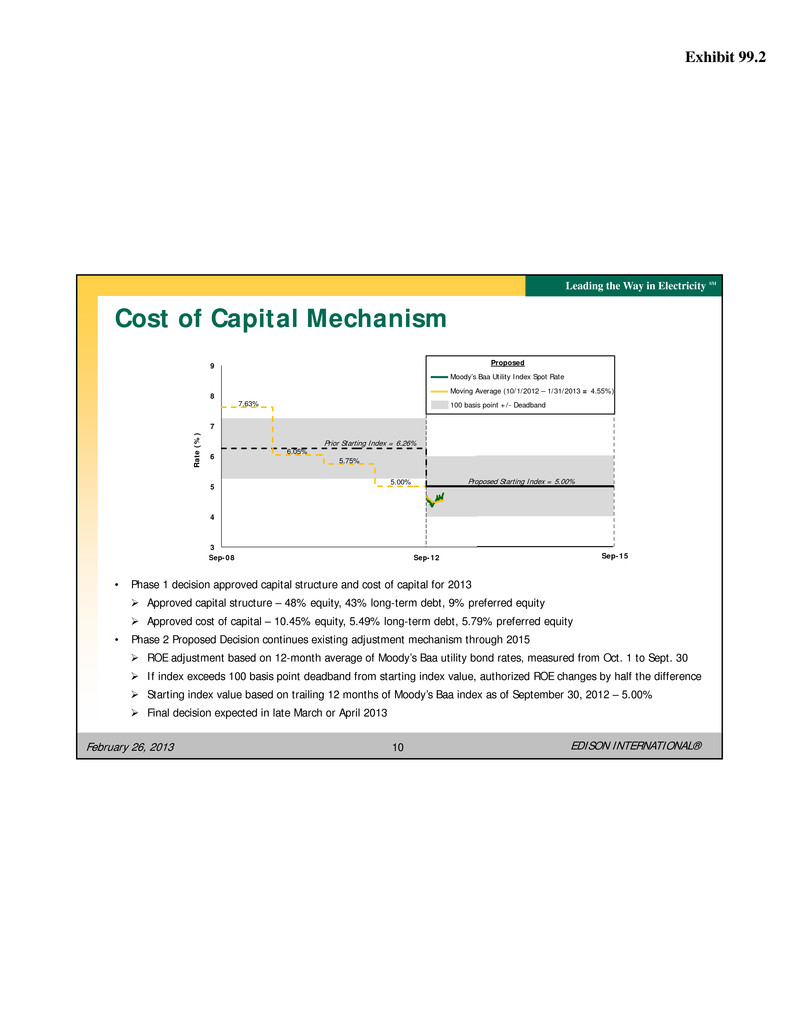

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 10 3 4 5 6 7 8 9 Sep-08 Sep-12 Ra te (% ) Cost of Capital Mechanism • Phase 1 decision approved capital structure and cost of capital for 2013 Approved capital structure – 48% equity, 43% long-term debt, 9% preferred equity Approved cost of capital – 10.45% equity, 5.49% long-term debt, 5.79% preferred equity • Phase 2 Proposed Decision continues existing adjustment mechanism through 2015 ROE adjustment based on 12-month average of Moody’s Baa utility bond rates, measured from Oct. 1 to Sept. 30 If index exceeds 100 basis point deadband from starting index value, authorized ROE changes by half the difference Starting index value based on trailing 12 months of Moody’s Baa index as of September 30, 2012 – 5.00% Final decision expected in late March or April 2013 7.63% 6.05% 5.75% 5.00% Prior Starting Index = 6.26% Sep-15 Proposed Moody’s Baa Utility Index Spot Rate Moving Average (10/1/2012 – 1/31/2013 = 4.55%) 100 basis point +/- Deadband Proposed Starting Index = 5.00%

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 11 FERC Return on Equity FERC Formula Rates • August 2011 – FERC accepted SCE’s formula rates effective January 1, 2012 • Rates remain subject to refund and settlement • Next settlement conference February 27-28, 2013 • September 2012 – Formula Rate update filed for 2013; $178 million increase in transmission rates implemented on October 1, 2012, subject to pending FERC order FERC ROE • 2013 proposed 11.1% ROE: Proposed 9.93% base ROE – using median of SCE proxy group +50 bps CAISO participation +65 bps weighted average for project incentives 2008 CWIP ROE Appeal • FERC policy on median vs. midpoint of proxy group: Median – utilities filing individually Midpoint – ISO members filing as a group • December 2011 – SCE appealed 2008 ROE in CWIP proceeding based on median vs. midpoint issue to D.C. Circuit of the U.S. Court of Appeals • Oral arguments scheduled for March 25, 2013, with court decision expected by Q4 2013

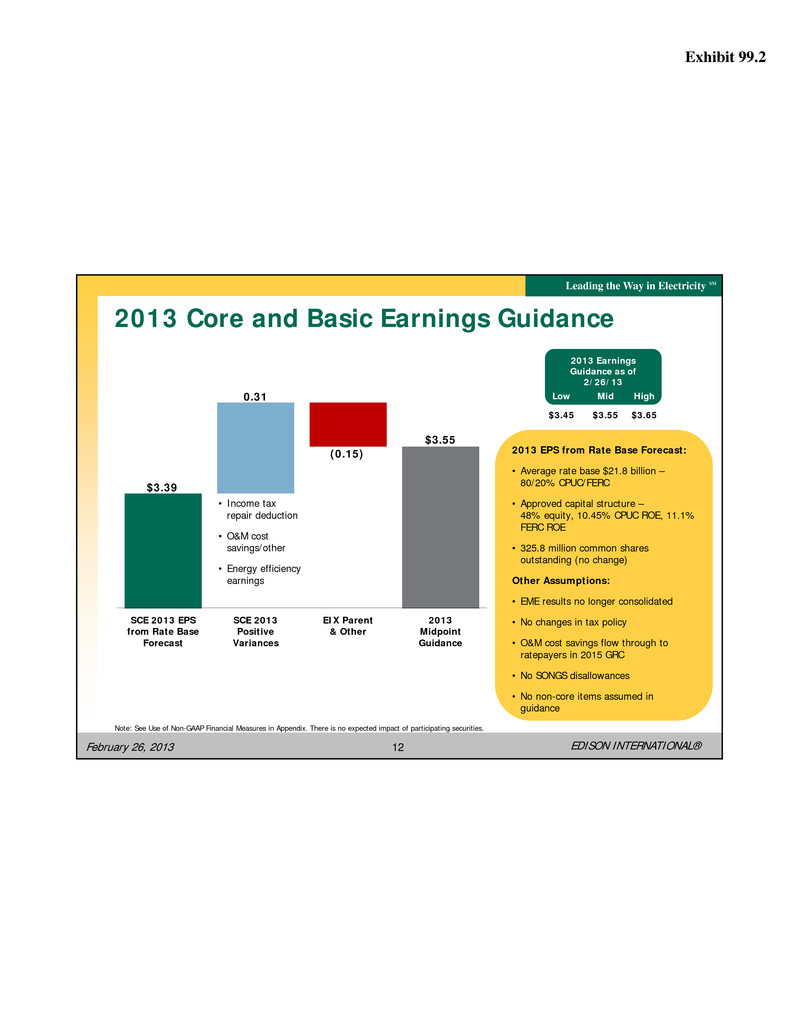

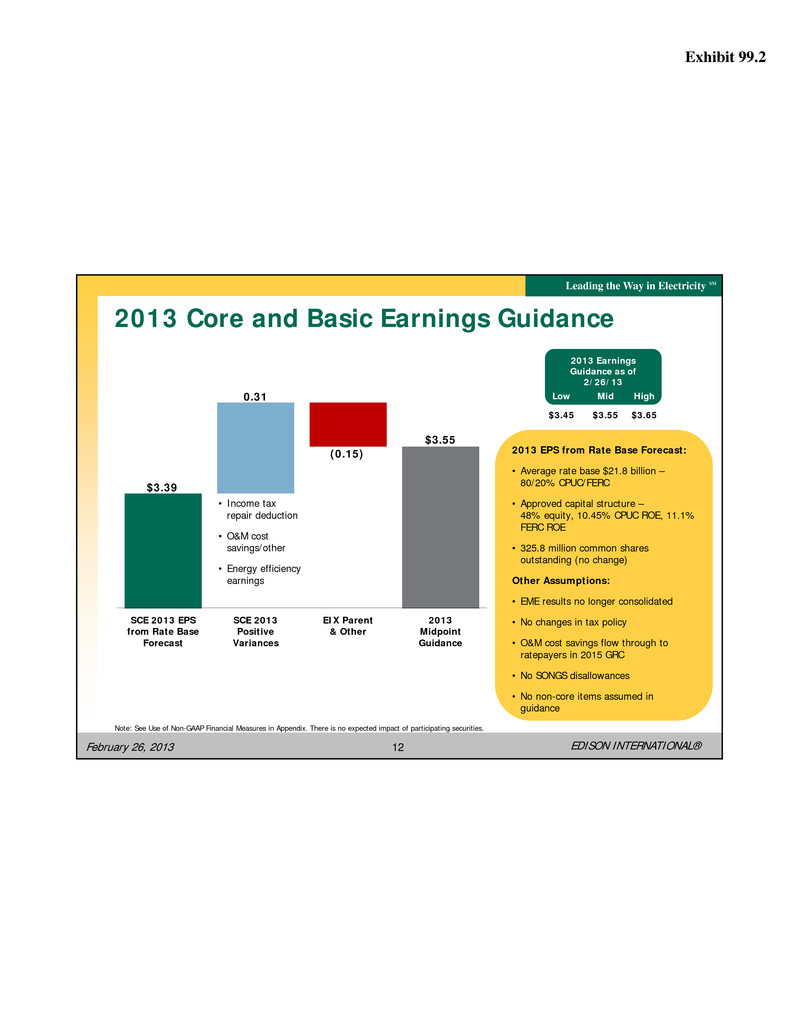

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 12 $3.39 0.31 (0.15) $3.55 SCE 2013 EPS from Rate Base Forecast SCE 2013 Positive Variances EIX Parent & Other 2013 Midpoint Guidance 2013 Core and Basic Earnings Guidance Note: See Use of Non-GAAP Financial Measures in Appendix. There is no expected impact of participating securities. 2013 EPS from Rate Base Forecast: • Average rate base $21.8 billion – 80/20% CPUC/FERC • Approved capital structure – 48% equity, 10.45% CPUC ROE, 11.1% FERC ROE • 325.8 million common shares outstanding (no change) Other Assumptions: • EME results no longer consolidated • No changes in tax policy • O&M cost savings flow through to ratepayers in 2015 GRC • No SONGS disallowances • No non-core items assumed in guidance 2013 Earnings Guidance as of 2/26/13 Low $3.45 Mid $3.55 High $3.65 • Income tax repair deduction • O&M cost savings/other • Energy efficiency earnings

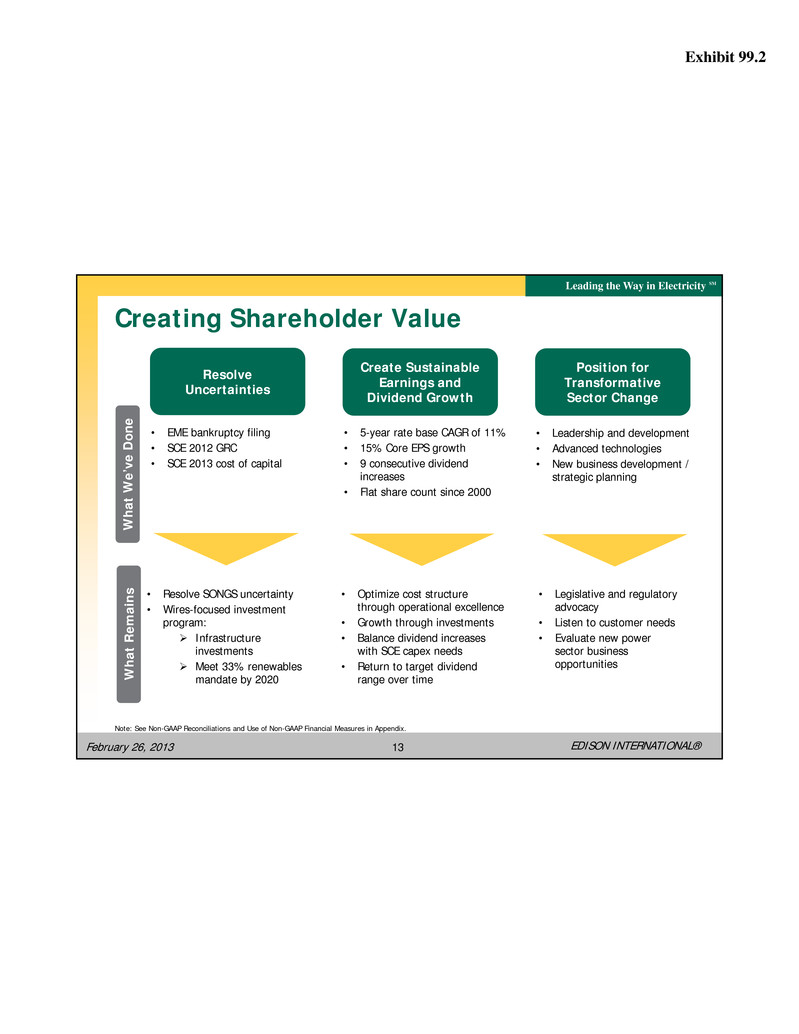

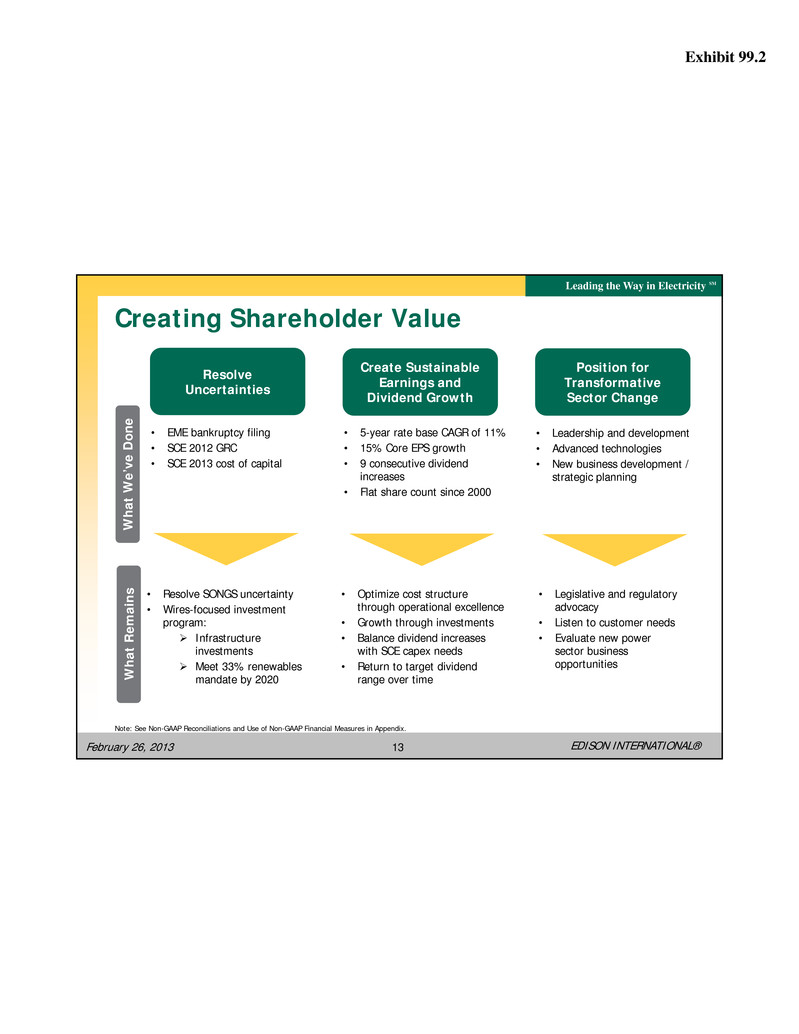

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 13 Creating Shareholder Value Resolve Uncertainties Create Sustainable Earnings and Dividend Growth Position for Transformative Sector Change • EME bankruptcy filing • SCE 2012 GRC • SCE 2013 cost of capital • 5-year rate base CAGR of 11% • 15% Core EPS growth • 9 consecutive dividend increases • Flat share count since 2000 • Leadership and development • Advanced technologies • New business development / strategic planning • Resolve SONGS uncertainty • Wires-focused investment program: Infrastructure investments Meet 33% renewables mandate by 2020 • Optimize cost structure through operational excellence • Growth through investments • Balance dividend increases with SCE capex needs • Return to target dividend range over time • Legislative and regulatory advocacy • Listen to customer needs • Evaluate new power sector business opportunities Note: See Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix. W ha t W e’v e D on e W ha t R em ain s

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 14 Appendix

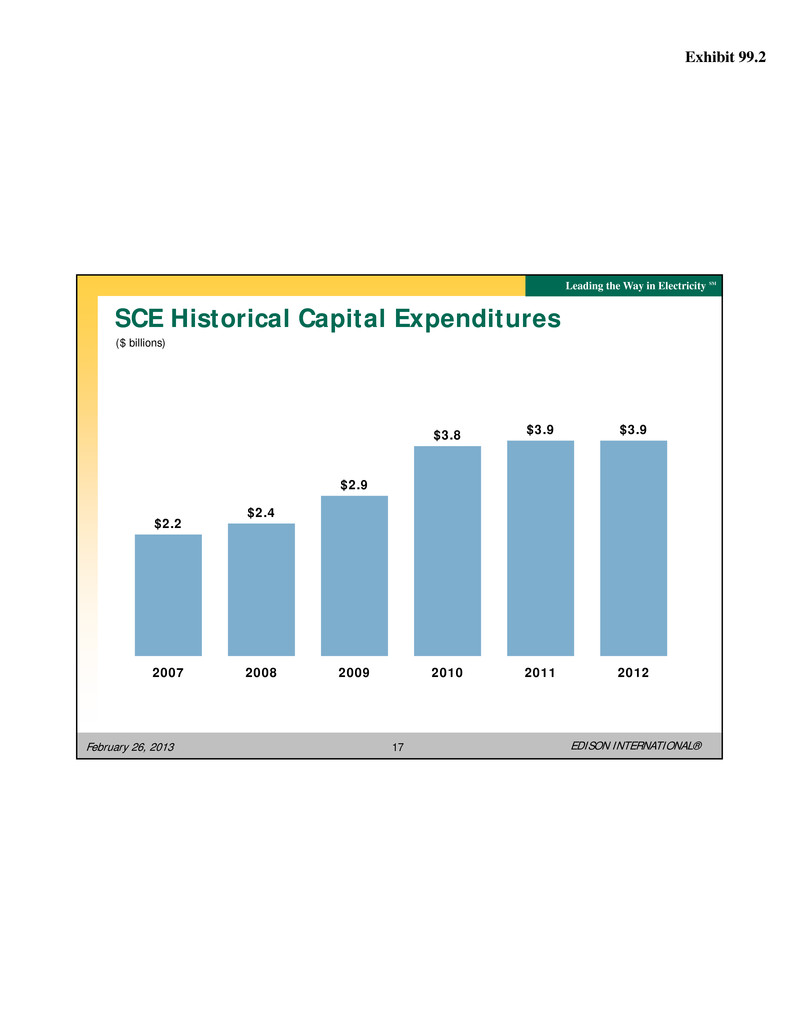

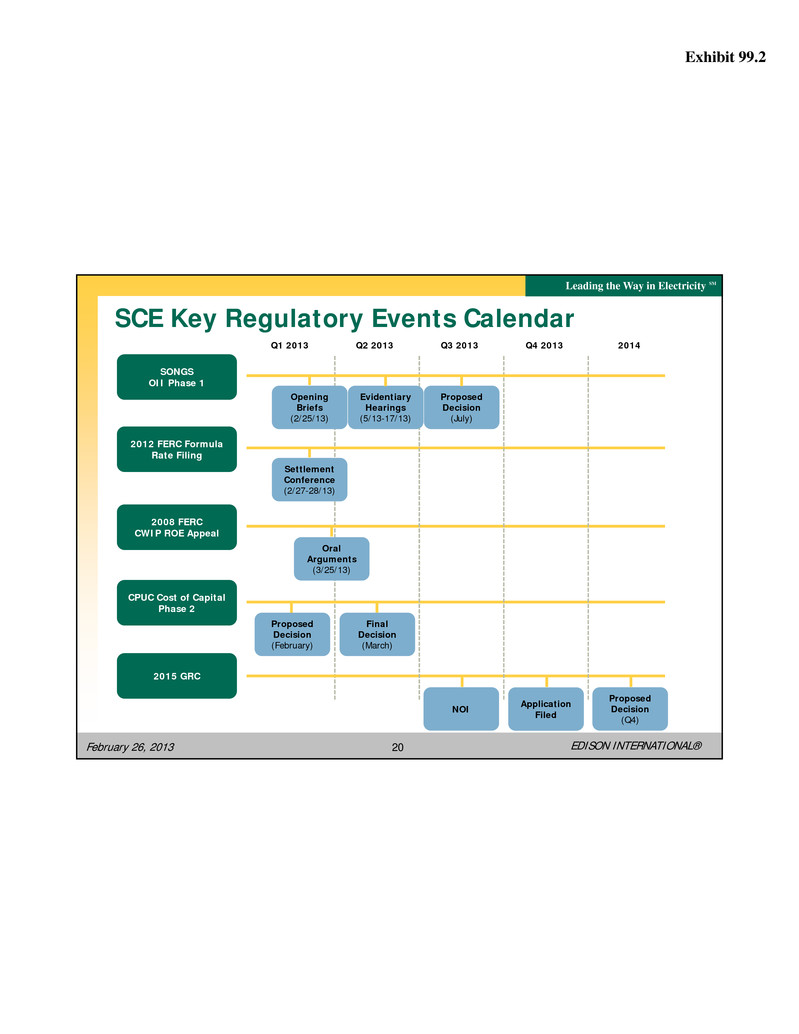

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 15 What’s New Since Our Last Presentation • SONGS Cost Recovery Tracker (p. 8) • FERC Return on Equity (p. 11) • 2013 Core and Basic Earnings Guidance (p. 12) • Creating Shareholder Value (p. 13) • SCE Historical Capital Expenditures (p. 17) • SCE Key Regulatory Events Calendar (p. 20) • SCE Decoupled Regulatory Model (p. 21) • SCE Energy Efficiency Programs (p. 27) • SCE Operational Excellence Framework (p. 32) • EIX Transaction Support Agreement (p. 33)

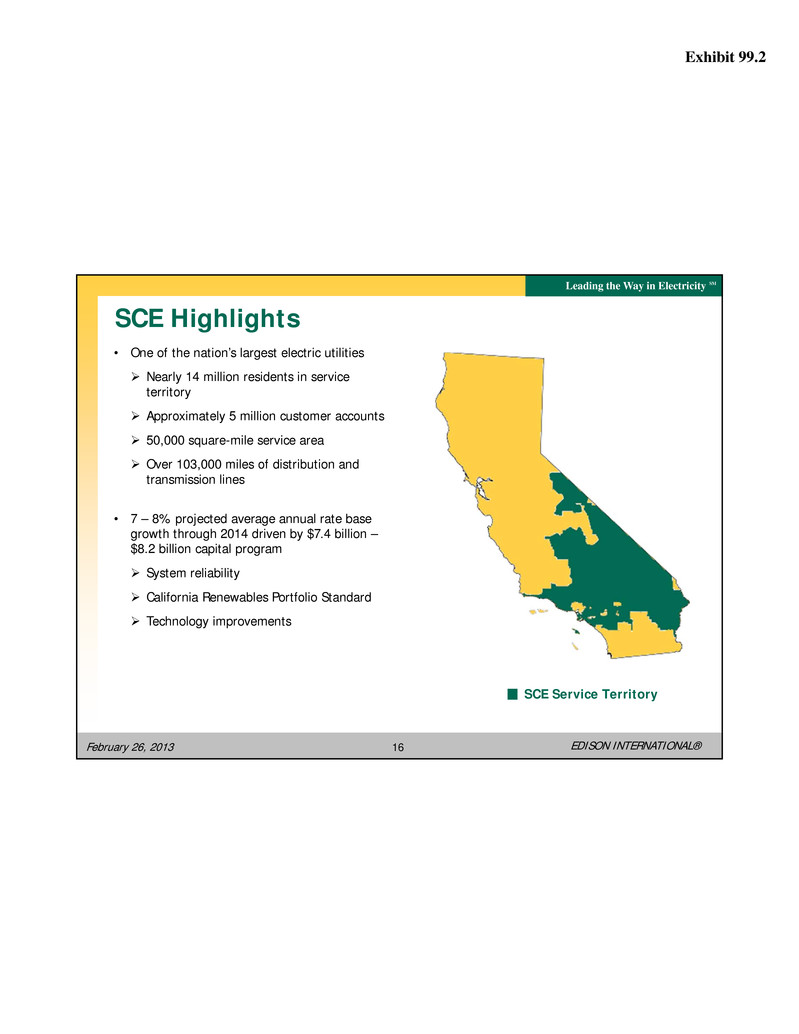

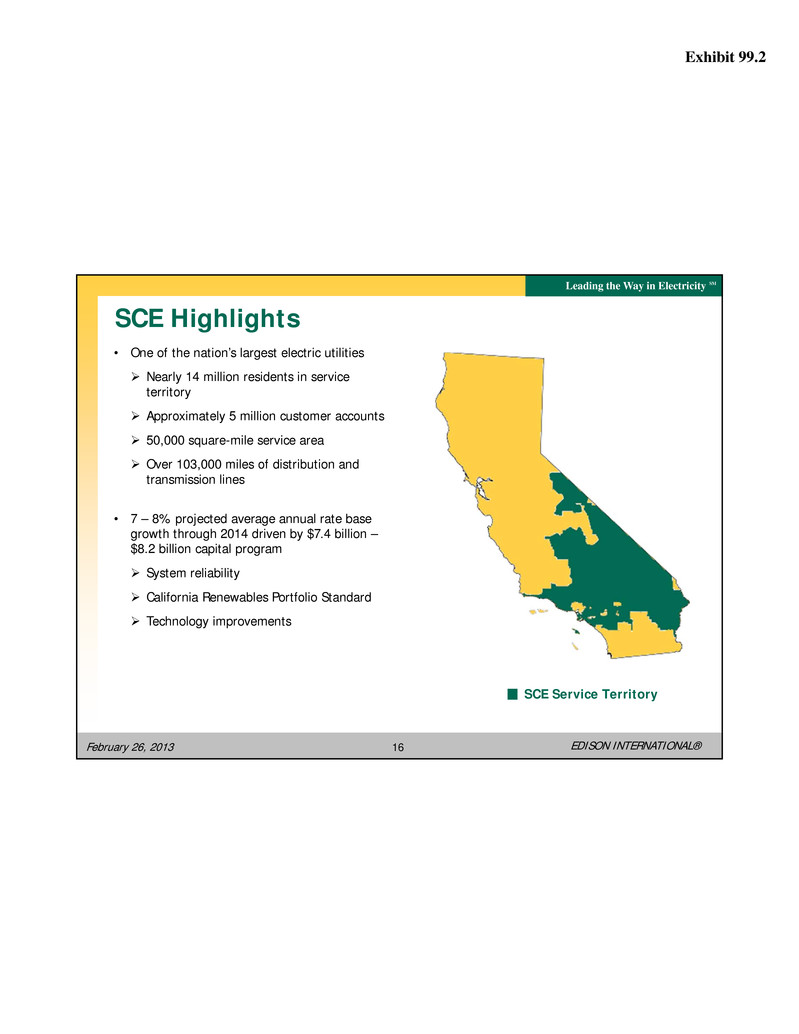

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 16 • One of the nation’s largest electric utilities Nearly 14 million residents in service territory Approximately 5 million customer accounts 50,000 square-mile service area Over 103,000 miles of distribution and transmission lines • 7 – 8% projected average annual rate base growth through 2014 driven by $7.4 billion – $8.2 billion capital program System reliability California Renewables Portfolio Standard Technology improvements SCE Highlights SCE Service Territory

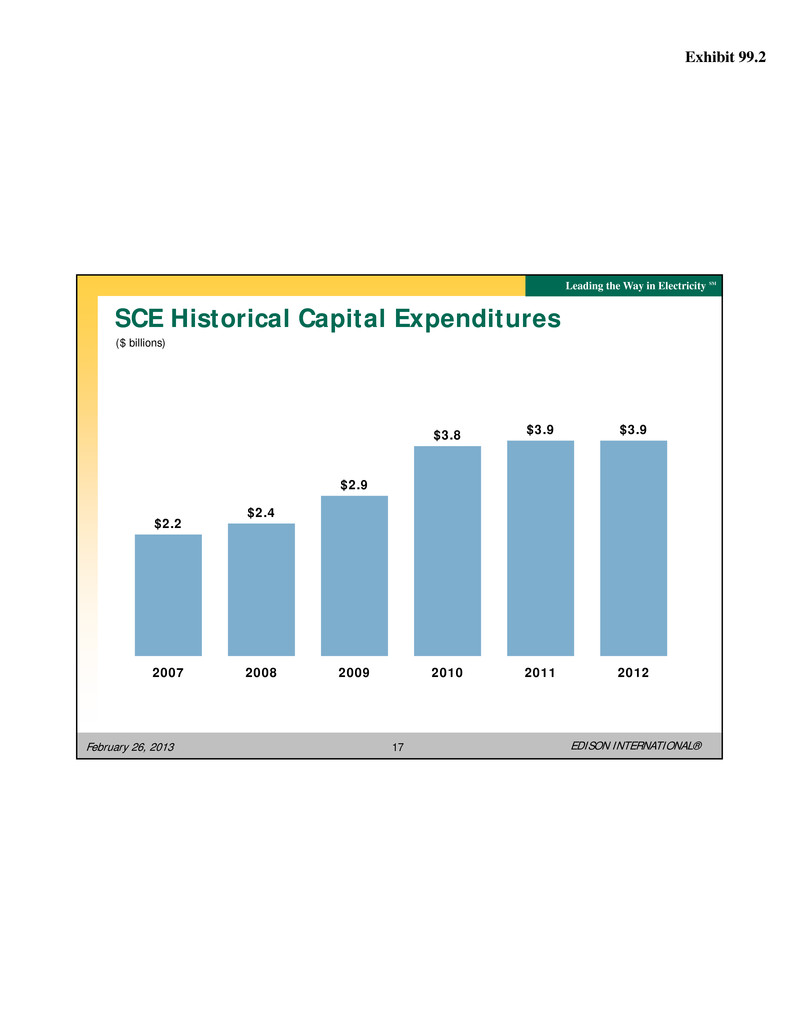

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 17 $2.2 $2.4 $2.9 $3.8 $3.9 $3.9 2007 2008 2009 2010 2011 2012 SCE Historical Capital Expenditures ($ billions)

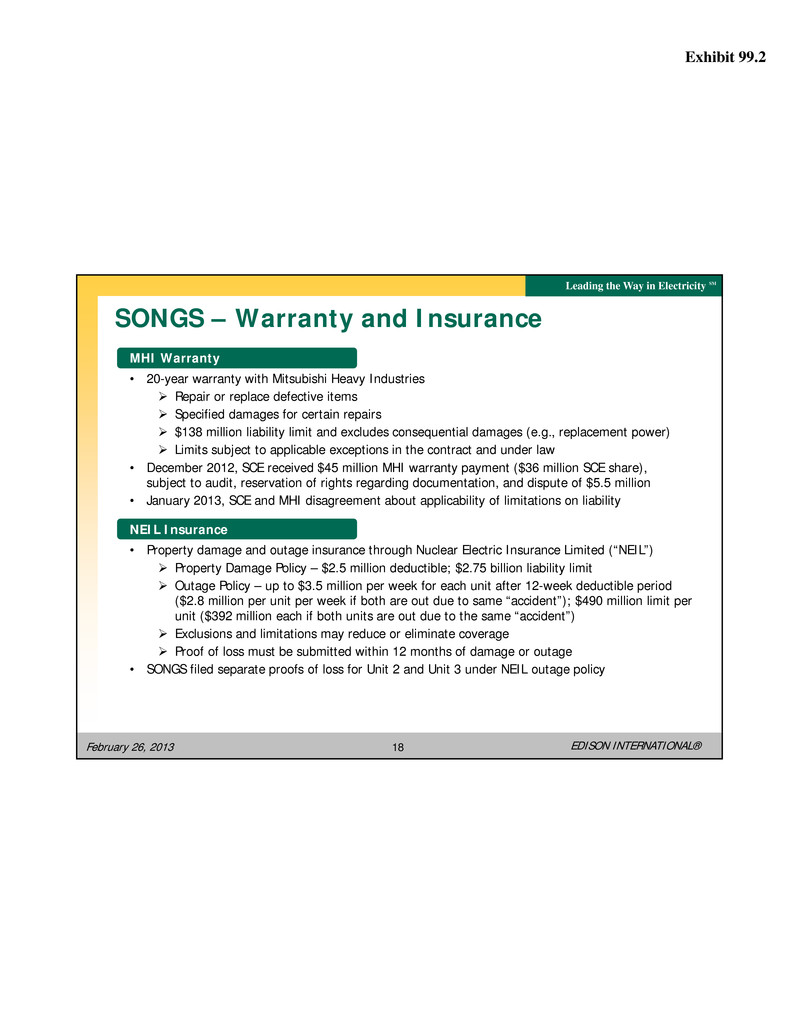

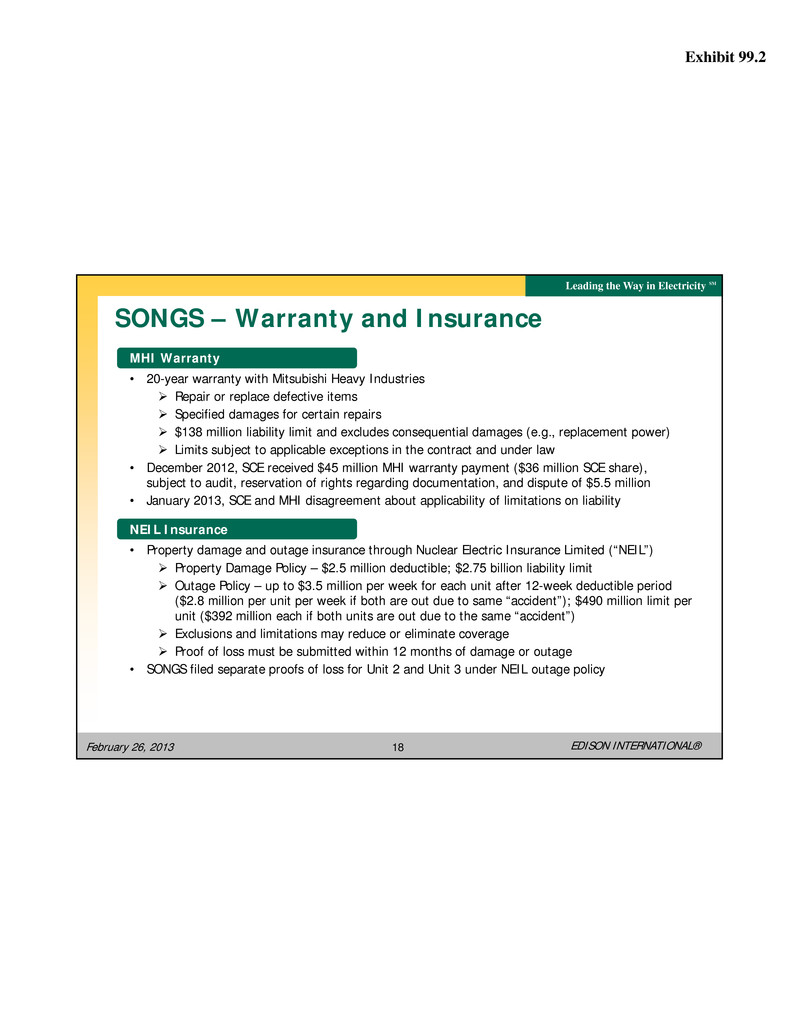

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 18 SONGS – Warranty and Insurance MHI Warranty • 20-year warranty with Mitsubishi Heavy Industries Repair or replace defective items Specified damages for certain repairs $138 million liability limit and excludes consequential damages (e.g., replacement power) Limits subject to applicable exceptions in the contract and under law • December 2012, SCE received $45 million MHI warranty payment ($36 million SCE share), subject to audit, reservation of rights regarding documentation, and dispute of $5.5 million • January 2013, SCE and MHI disagreement about applicability of limitations on liability NEIL Insurance • Property damage and outage insurance through Nuclear Electric Insurance Limited (“NEIL”) Property Damage Policy – $2.5 million deductible; $2.75 billion liability limit Outage Policy – up to $3.5 million per week for each unit after 12-week deductible period ($2.8 million per unit per week if both are out due to same “accident”); $490 million limit per unit ($392 million each if both units are out due to the same “accident”) Exclusions and limitations may reduce or eliminate coverage Proof of loss must be submitted within 12 months of damage or outage • SONGS filed separate proofs of loss for Unit 2 and Unit 3 under NEIL outage policy

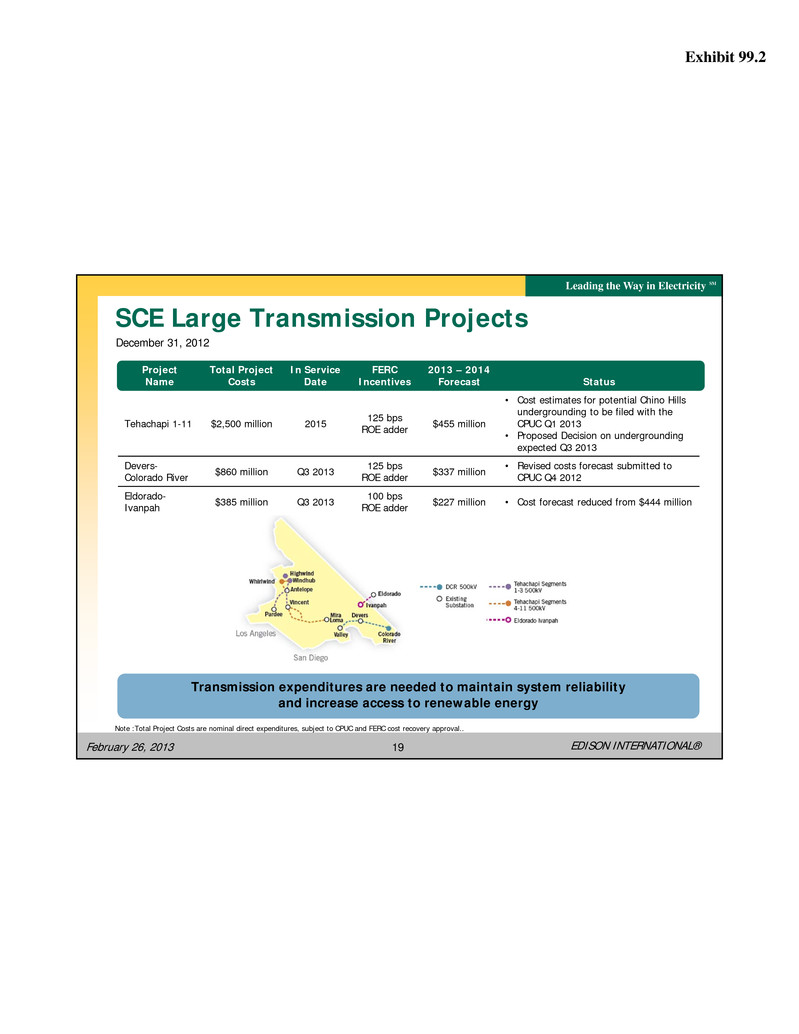

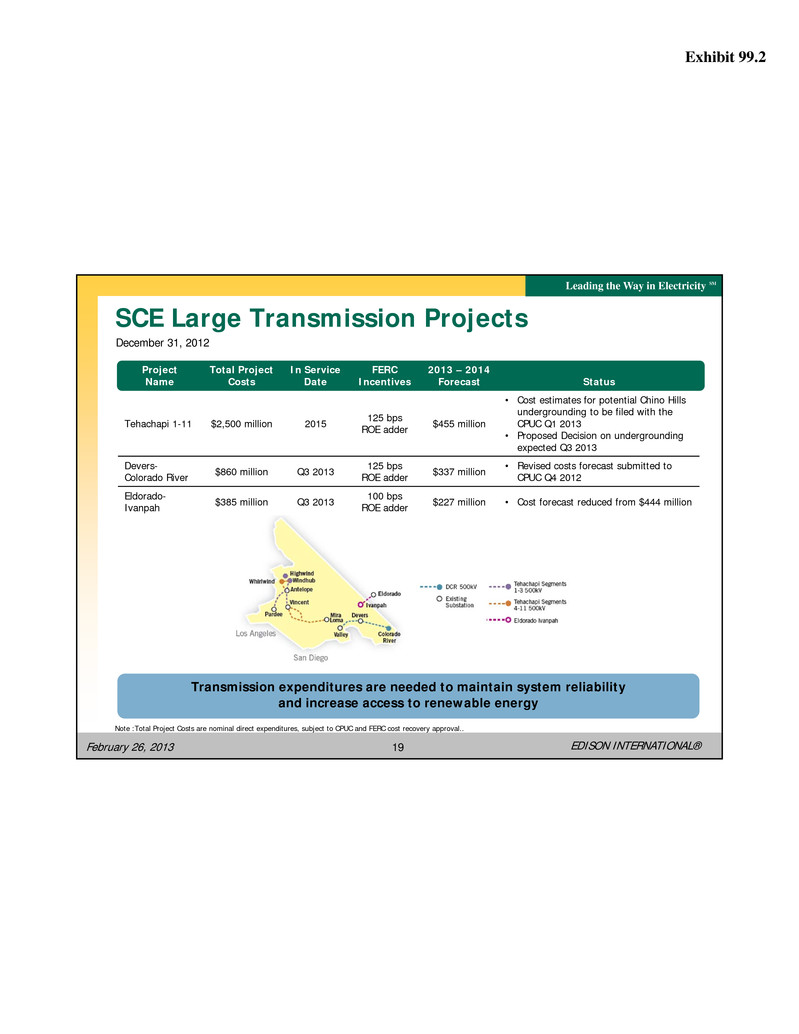

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 19 SCE Large Transmission Projects December 31, 2012 Project Name Total Project Costs In Service Date FERC Incentives 2013 – 2014 Forecast Status Tehachapi 1-11 $2,500 million 2015 125 bpsROE adder $455 million • Cost estimates for potential Chino Hills undergrounding to be filed with the CPUC Q1 2013 • Proposed Decision on undergrounding expected Q3 2013 Devers- Colorado River $860 million Q3 2013 125 bps ROE adder $337 million • Revised costs forecast submitted to CPUC Q4 2012 Eldorado- Ivanpah $385 million Q3 2013 100 bps ROE adder $227 million • Cost forecast reduced from $444 million Transmission expenditures are needed to maintain system reliability and increase access to renewable energy Note :Total Project Costs are nominal direct expenditures, subject to CPUC and FERC cost recovery approval..

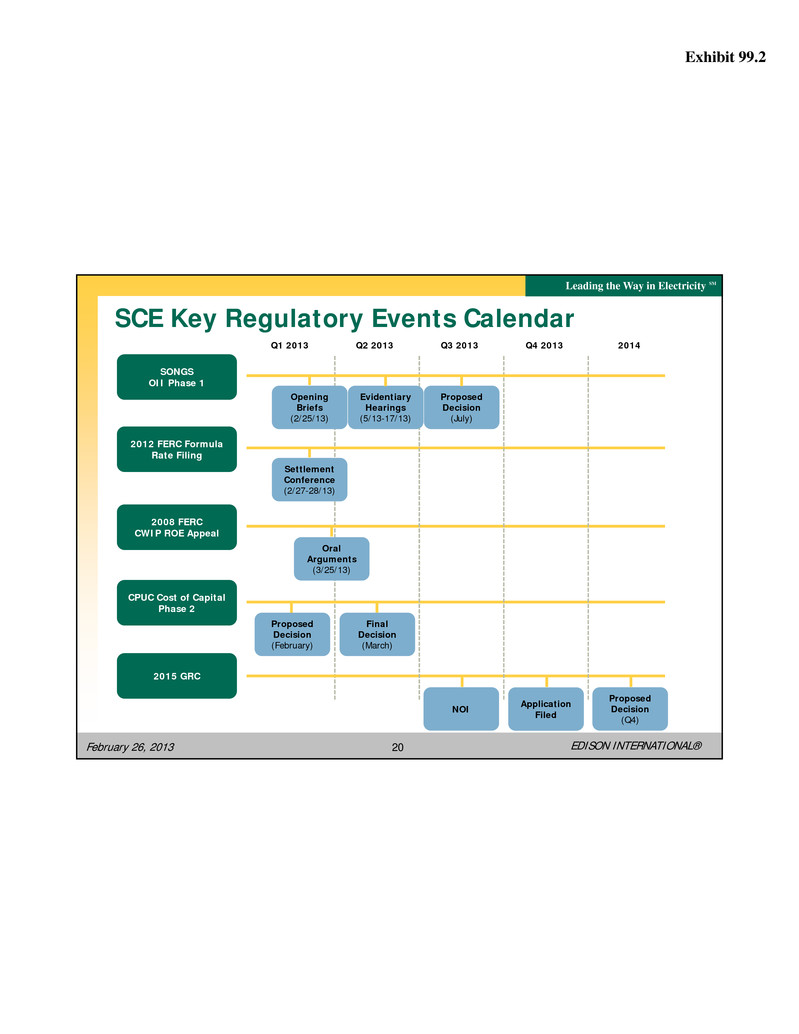

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 20 SCE Key Regulatory Events Calendar 2008 FERC CWIP ROE Appeal 2012 FERC Formula Rate Filing CPUC Cost of Capital Phase 2 2015 GRC Q1 2013 Q2 2013 Q3 2013 Q4 2013 2014 Settlement Conference (2/27-28/13) Proposed Decision (February) Final Decision (March) NOI Application Filed Proposed Decision (Q4) Oral Arguments (3/25/13) SONGS OII Phase 1 Opening Briefs (2/25/13) Proposed Decision (July) Evidentiary Hearings (5/13-17/13)

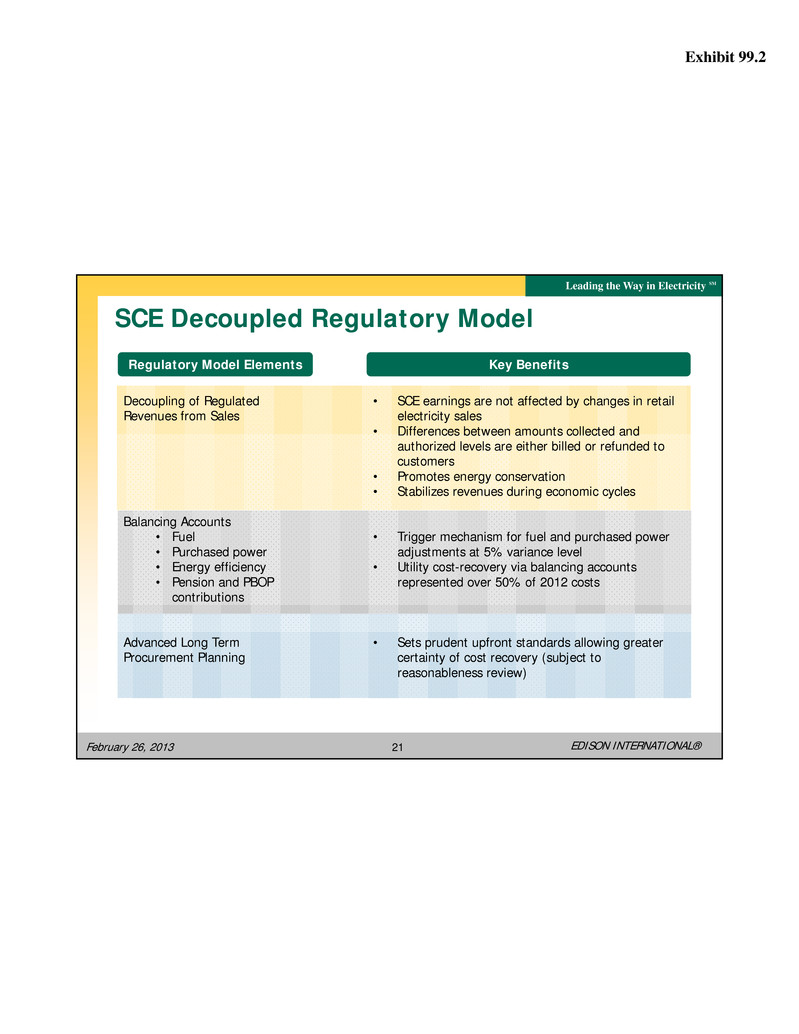

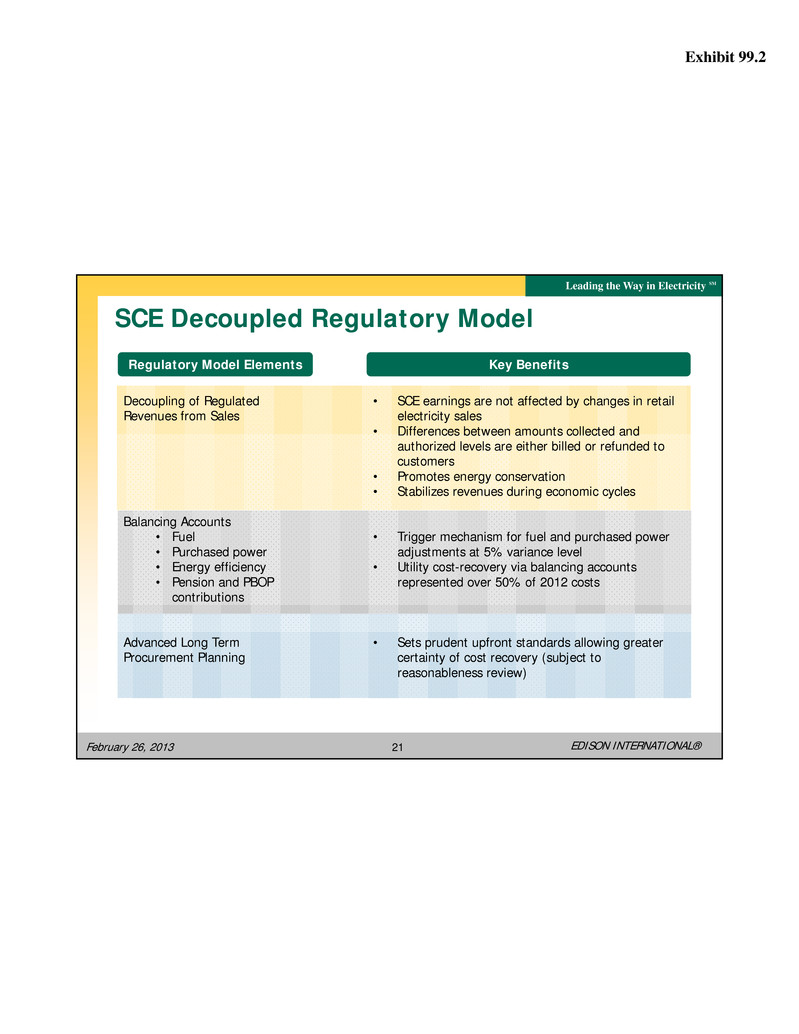

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 21 SCE Decoupled Regulatory Model Decoupling of Regulated Revenues from Sales Balancing Accounts • Fuel • Purchased power • Energy efficiency • Pension and PBOP contributions Advanced Long Term Procurement Planning • SCE earnings are not affected by changes in retail electricity sales • Differences between amounts collected and authorized levels are either billed or refunded to customers • Promotes energy conservation • Stabilizes revenues during economic cycles • Trigger mechanism for fuel and purchased power adjustments at 5% variance level • Utility cost-recovery via balancing accounts represented over 50% of 2012 costs • Sets prudent upfront standards allowing greater certainty of cost recovery (subject to reasonableness review) Regulatory Model Elements Key Benefits

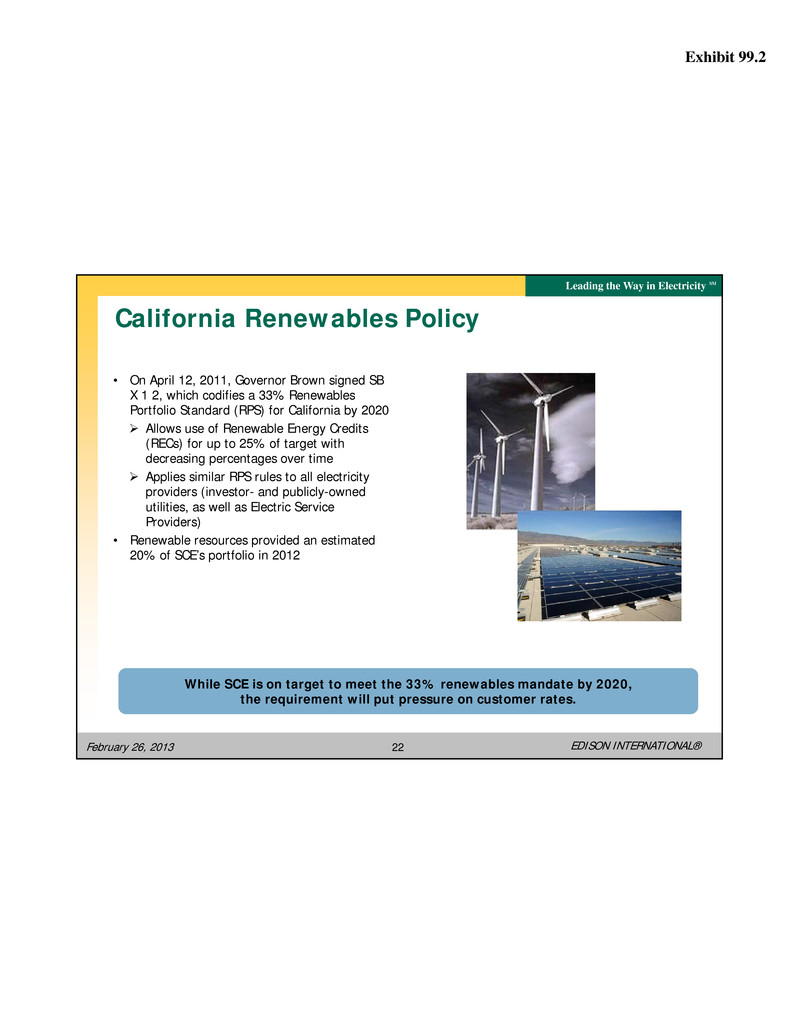

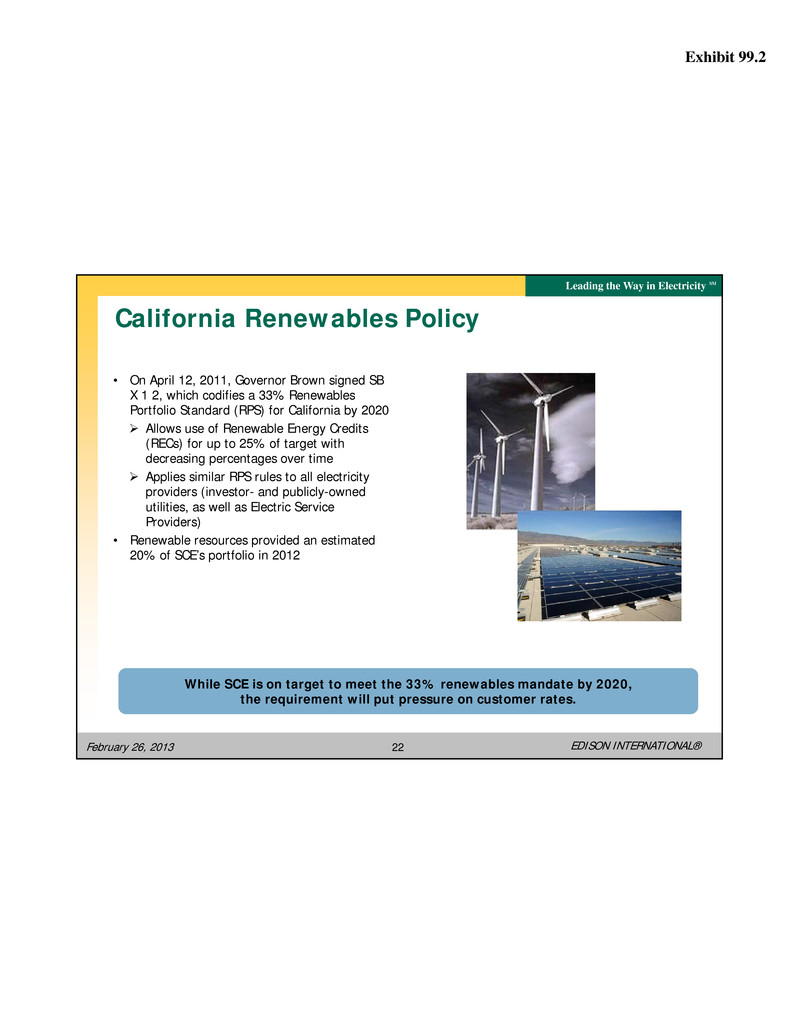

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 22 California Renewables Policy • On April 12, 2011, Governor Brown signed SB X 1 2, which codifies a 33% Renewables Portfolio Standard (RPS) for California by 2020 Allows use of Renewable Energy Credits (RECs) for up to 25% of target with decreasing percentages over time Applies similar RPS rules to all electricity providers (investor- and publicly-owned utilities, as well as Electric Service Providers) • Renewable resources provided an estimated 20% of SCE’s portfolio in 2012 While SCE is on target to meet the 33% renewables mandate by 2020, the requirement will put pressure on customer rates.

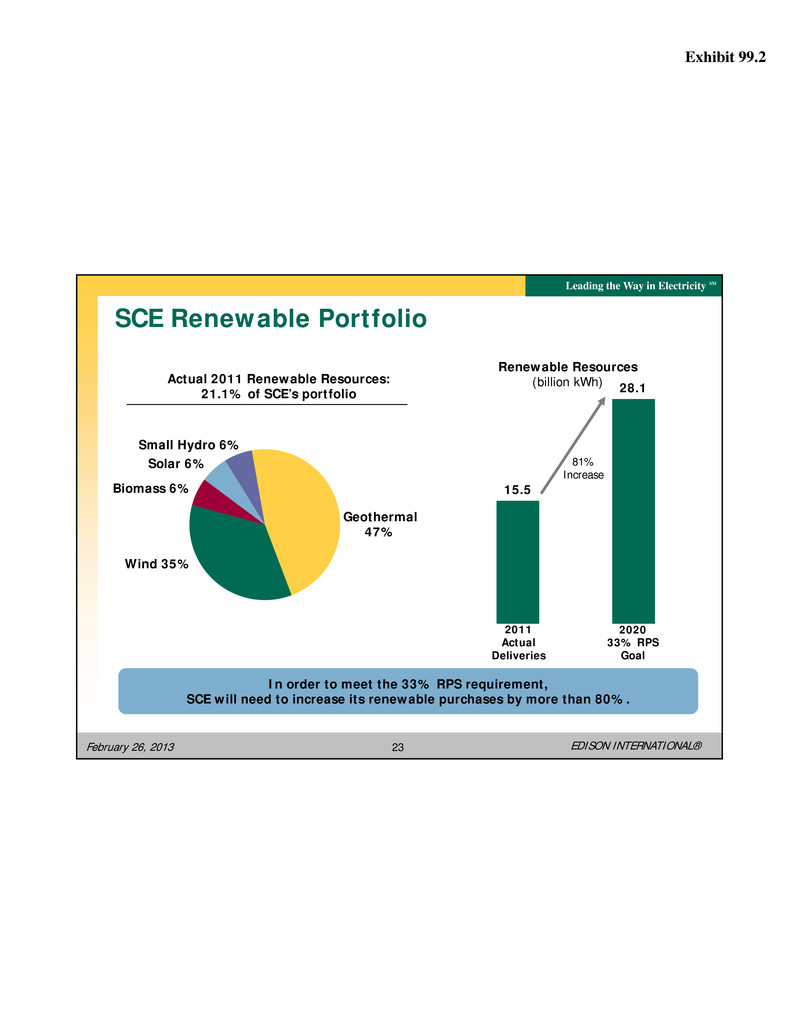

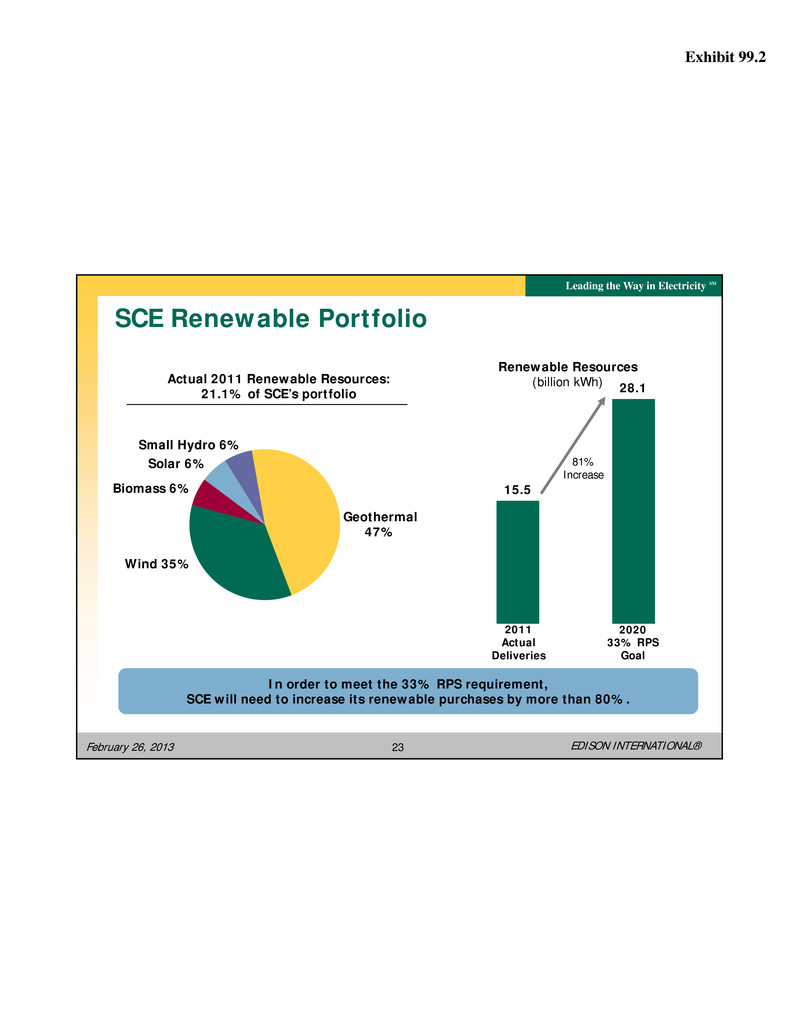

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 23 SCE Renewable Portfolio Solar 6% Small Hydro 6% Geothermal 47% Biomass 6% Wind 35% Renewable Resources (billion kWh) 15.5 28.1 2011 Actual Deliveries 2020 33% RPS Goal 81% Increase Actual 2011 Renewable Resources: 21.1% of SCE’s portfolio In order to meet the 33% RPS requirement, SCE will need to increase its renewable purchases by more than 80%.

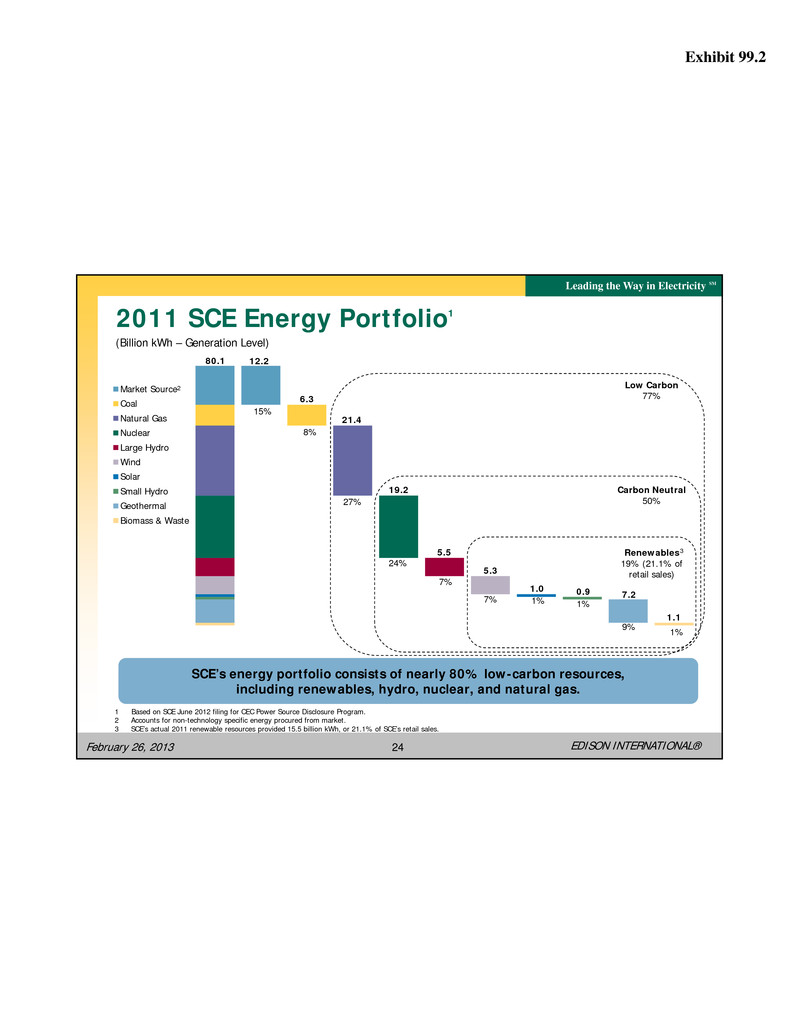

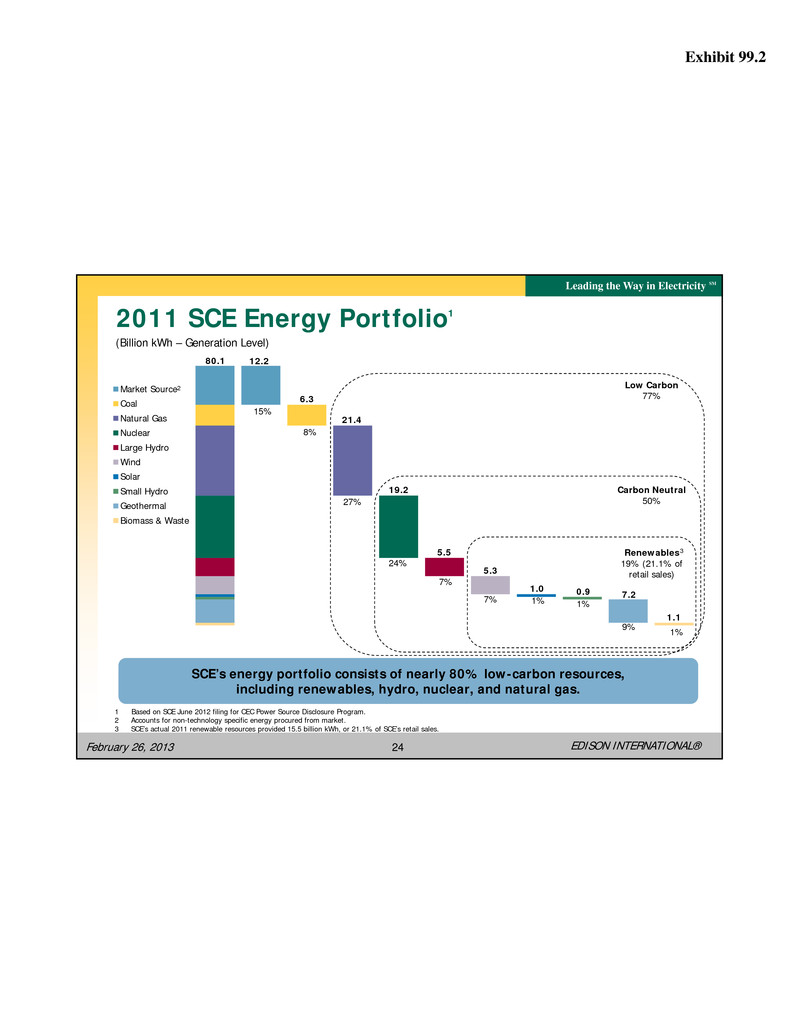

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 24 Market Source Coal Natural Gas Nuclear Large Hydro Wind Solar Small Hydro Geothermal Biomass & Waste 2011 SCE Energy Portfolio1 12.2 6.3 21.4 19.2 5.5 5.3 1.0 0.9 7.2 1.1 27% 1% 1% 9% 1% Renewables 19% (21.1% of retail sales) Carbon Neutral 50% 7% 7% 24% 2 Low Carbon77% 3 15% 8% 80.1 (Billion kWh – Generation Level) 1 Based on SCE June 2012 filing for CEC Power Source Disclosure Program. 2 Accounts for non-technology specific energy procured from market. 3 SCE’s actual 2011 renewable resources provided 15.5 billion kWh, or 21.1% of SCE’s retail sales. SCE’s energy portfolio consists of nearly 80% low-carbon resources, including renewables, hydro, nuclear, and natural gas.

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 25 California Climate Change Policy • Assembly Bill 32 (2006) – reduces State GHG emissions to 1990 levels by 2020 (~16% reduction) • Cap and trade program basics: State-wide cap in 2013 – decreases over time Compliance met through allowances, offsets, or emissions reductions Excess allowances sold, or “banked” for future use • 32.3 million 2013 allowances vs. 10.4 million metric tons 2012 GHG emissions reported to the State Allowances sold into auction and bought back for compliance Auction every 3 months First auction Nov. 14, 2012 – $10.09/ton clearing price SB 1018 (2012) – auction revenues used for rate relief for residential (~93%), small business, and large industrial customers • GHG costs will increase rates in the long term Revenue allocation to residential customers will put downward pressure on those customers' rates in the near term Other 30% Cap & Trade 20%Fuel Efficiency 18% RPS 12% Energy Efficiency 11% Low Carbon Fuel 9% AB32 Emissions Reduction Programs

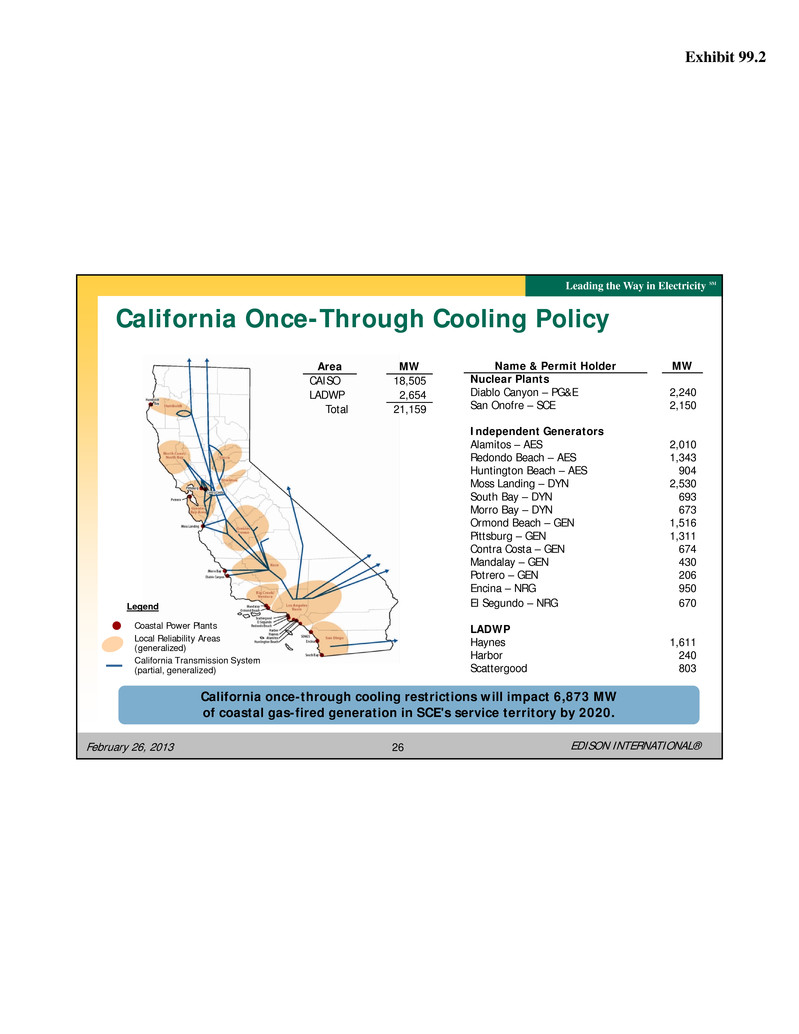

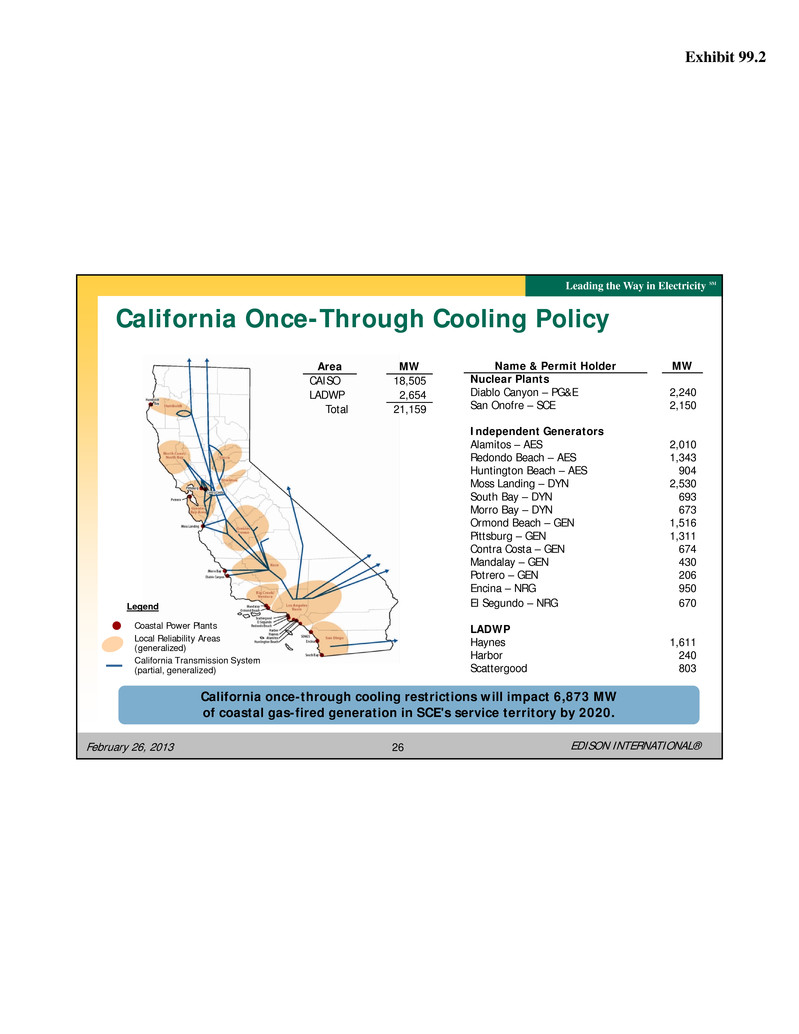

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 26 Coastal Power Plants Local Reliability Areas (generalized) California Transmission System (partial, generalized) Legend Name & Permit Holder MW Nuclear Plants Diablo Canyon – PG&E 2,240 San Onofre – SCE 2,150 Independent Generators Alamitos – AES 2,010 Redondo Beach – AES 1,343 Huntington Beach – AES 904 Moss Landing – DYN 2,530 South Bay – DYN 693 Morro Bay – DYN 673 Ormond Beach – GEN 1,516 Pittsburg – GEN 1,311 Contra Costa – GEN 674 Mandalay – GEN 430 Potrero – GEN 206 Encina – NRG 950 El Segundo – NRG 670 LADWP Haynes 1,611 Harbor 240 Scattergood 803 Area MW CAISO 18,505 LADWP 2,654 Total 21,159 California Once-Through Cooling Policy California once-through cooling restrictions will impact 6,873 MW of coastal gas-fired generation in SCE's service territory by 2020.

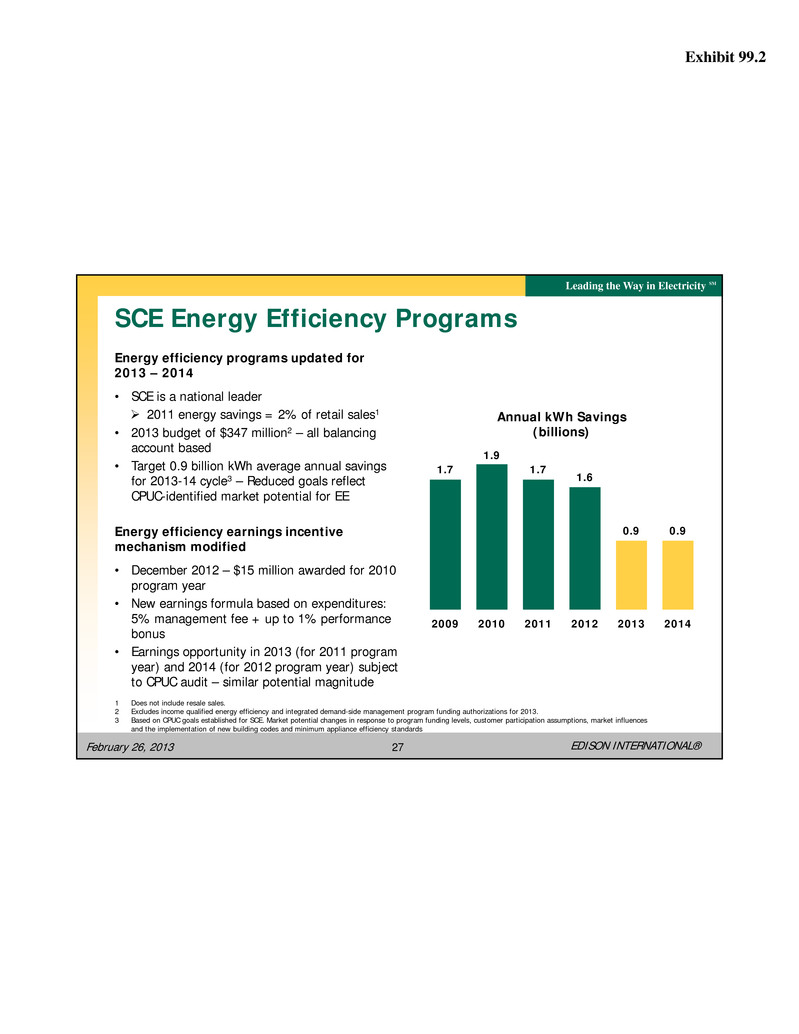

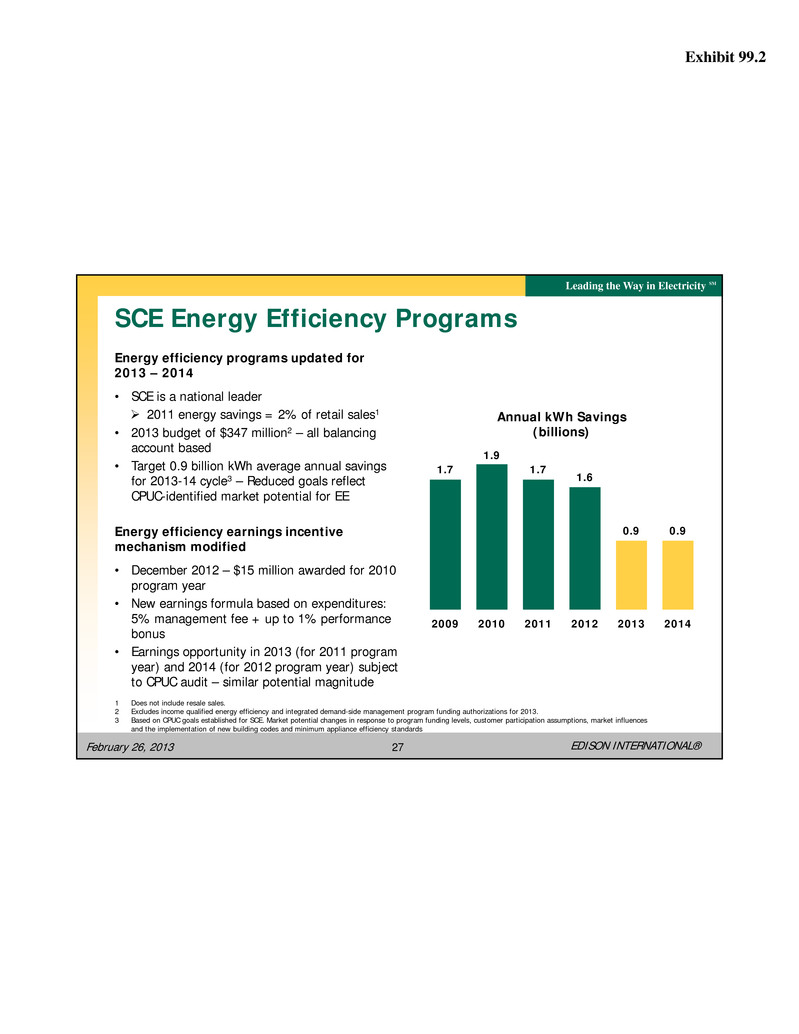

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 27 SCE Energy Efficiency Programs 1.7 1.9 1.7 1.6 0.9 0.9 2009 2010 2011 2012 2013 2014 Energy efficiency programs updated for 2013 – 2014 • SCE is a national leader 2011 energy savings = 2% of retail sales1 • 2013 budget of $347 million2 – all balancing account based • Target 0.9 billion kWh average annual savings for 2013-14 cycle3 – Reduced goals reflect CPUC-identified market potential for EE Energy efficiency earnings incentive mechanism modified • December 2012 – $15 million awarded for 2010 program year • New earnings formula based on expenditures: 5% management fee + up to 1% performance bonus • Earnings opportunity in 2013 (for 2011 program year) and 2014 (for 2012 program year) subject to CPUC audit – similar potential magnitude 1 Does not include resale sales. 2 Excludes income qualified energy efficiency and integrated demand-side management program funding authorizations for 2013. 3 Based on CPUC goals established for SCE. Market potential changes in response to program funding levels, customer participation assumptions, market influences and the implementation of new building codes and minimum appliance efficiency standards Annual kWh Savings (billions)

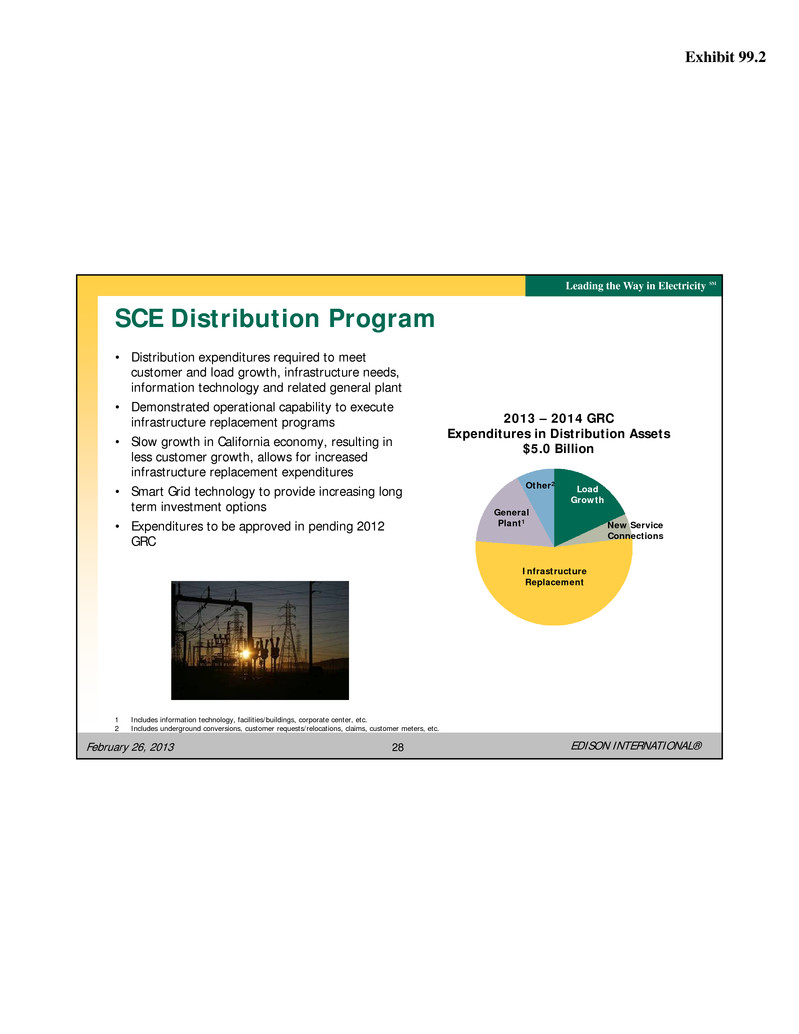

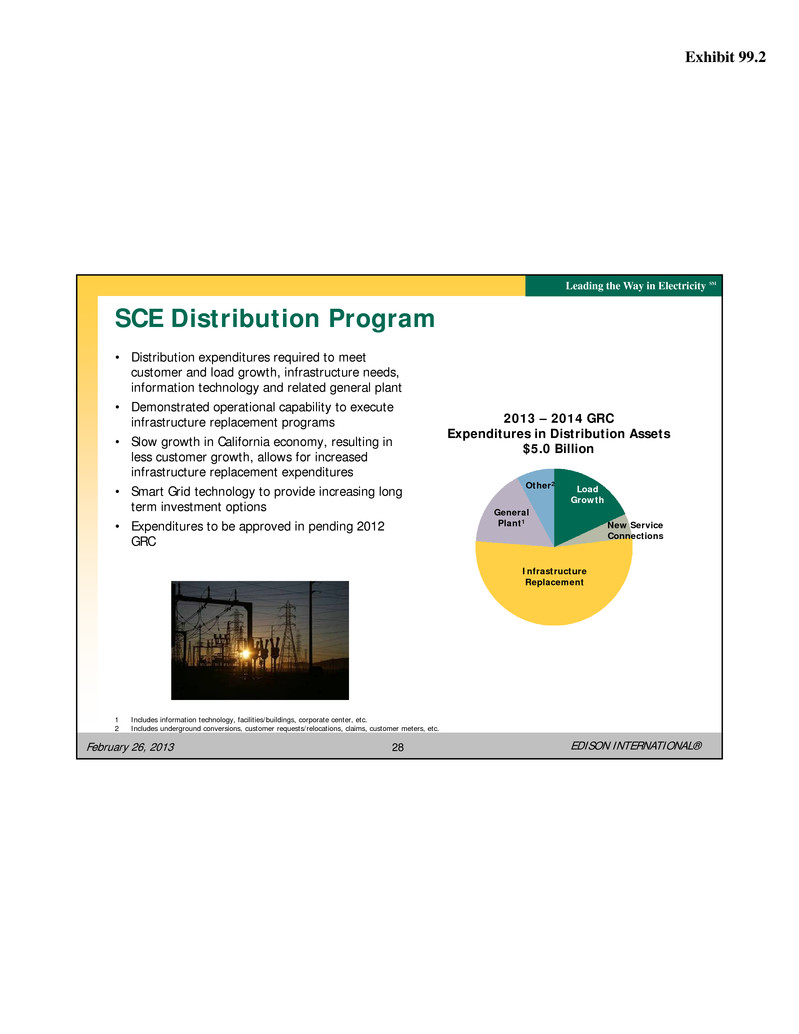

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 28 SCE Distribution Program • Distribution expenditures required to meet customer and load growth, infrastructure needs, information technology and related general plant • Demonstrated operational capability to execute infrastructure replacement programs • Slow growth in California economy, resulting in less customer growth, allows for increased infrastructure replacement expenditures • Smart Grid technology to provide increasing long term investment options • Expenditures to be approved in pending 2012 GRC 2013 – 2014 GRC Expenditures in Distribution Assets $5.0 Billion 1 Includes information technology, facilities/buildings, corporate center, etc. 2 Includes underground conversions, customer requests/relocations, claims, customer meters, etc. Load Growth New Service Connections Infrastructure Replacement General Plant1 Other2

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 29 12.3 15.9 US Average SCE 29% Higher $120 $94 US Average SCE 21% Lower SCE Rates and Bills Comparison • SCE’s residential rates are above national average due, in part, to a cleaner fuel mix – cost for renewables are higher than high carbon sources • Average monthly residential bills are lower than national average – higher rate levels offset by lower usage 39% lower SCE residential customer usage than national average, from mild climate and higher energy efficiency building standards • Public policy mandates (33% RPS, AB32 GHG, Once-through Cooling) and electric system requirements will drive rates and bills higher Source: EIA's Form 826 Data Monthly Electric Utility Sales and Revenue Data (December 2011 – November 2012). 2012 Average Residential Rates (¢/kWh) 2012 Average Residential Bills ($ per Month) Key Factors ¢ ¢ SCE’s average residential rates are above national average, but residential bills are below national average due to lower energy usage.

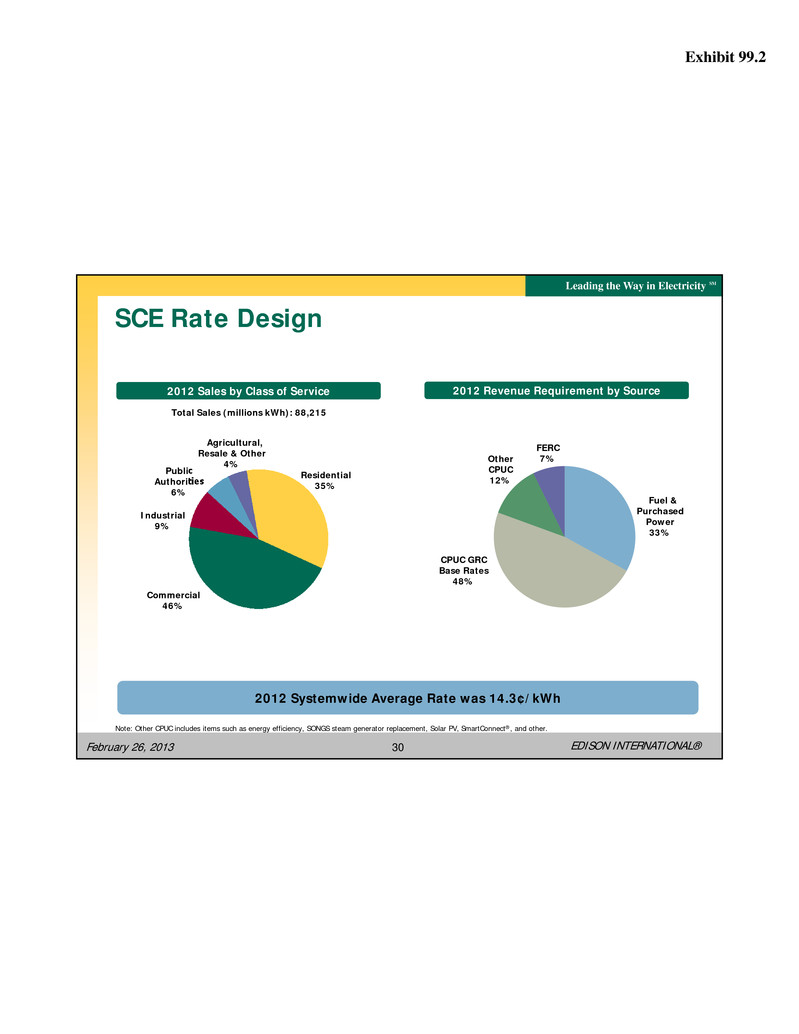

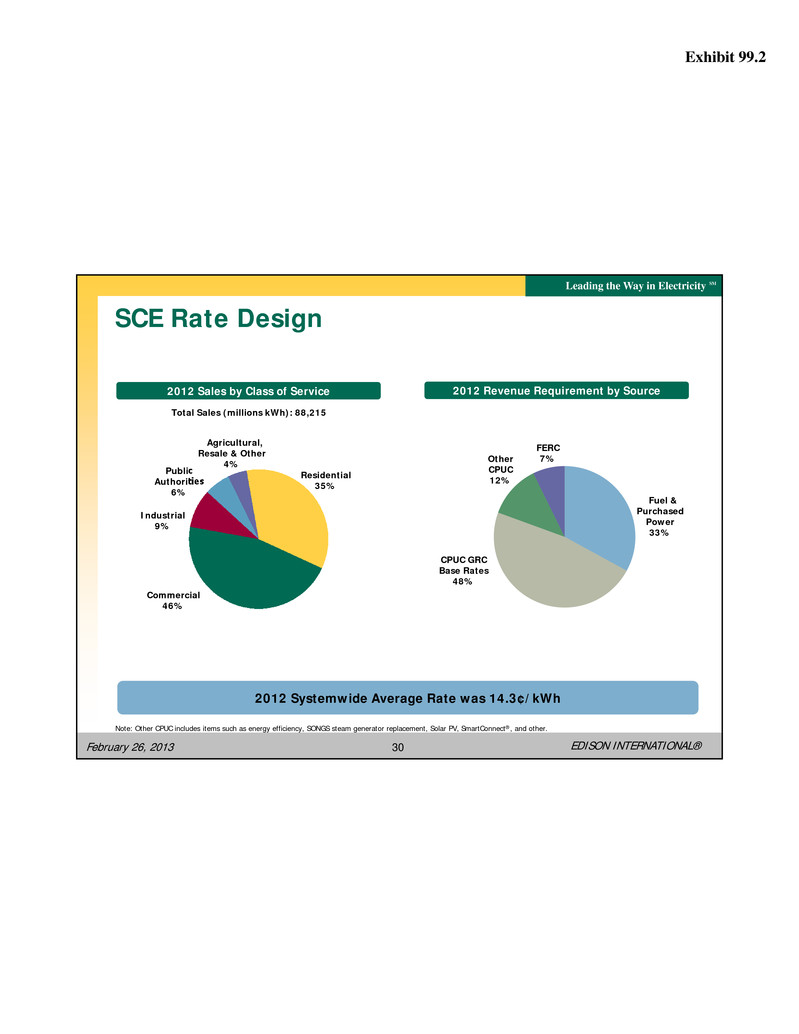

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 30 SCE Rate Design 2012 Sales by Class of Service 2012 Revenue Requirement by Source Note: Other CPUC includes items such as energy efficiency, SONGS steam generator replacement, Solar PV, SmartConnect®, and other. 2012 Systemwide Average Rate was 14.3¢/kWh Public Authorities 6% Agricultural, Resale & Other 4% Residential 35% Industrial 9% Commercial 46% Total Sales (millions kWh): 88,215 FERC 7% Fuel & Purchased Power 33% CPUC GRC Base Rates 48% Other CPUC 12%

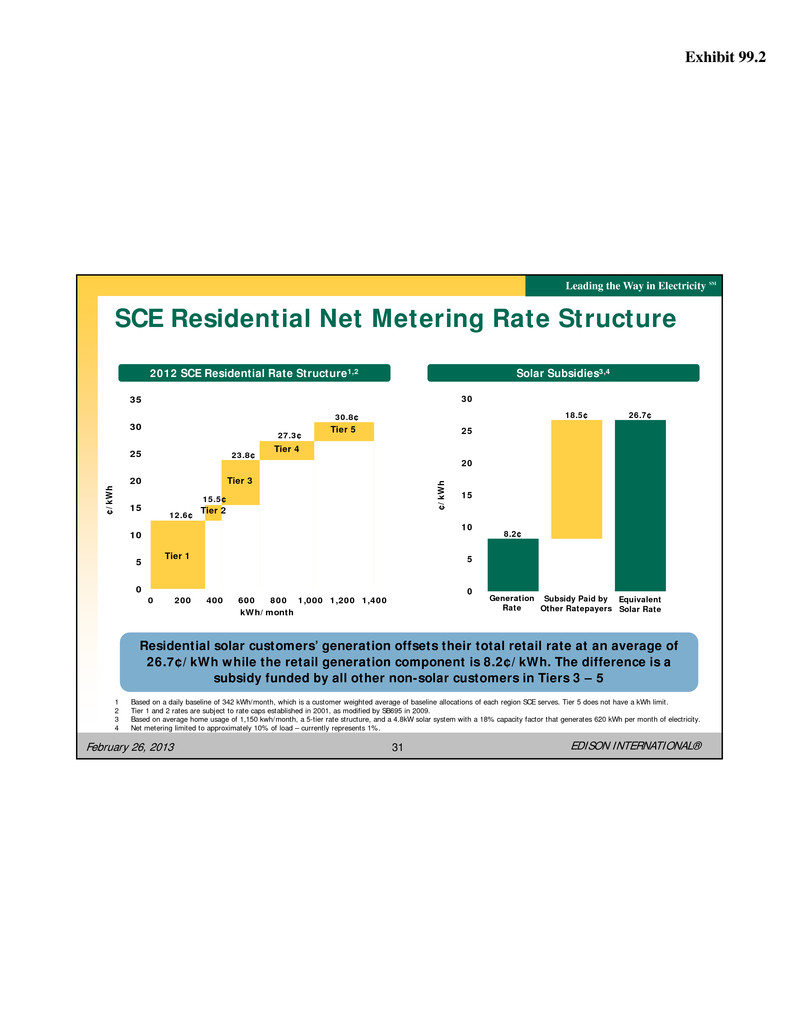

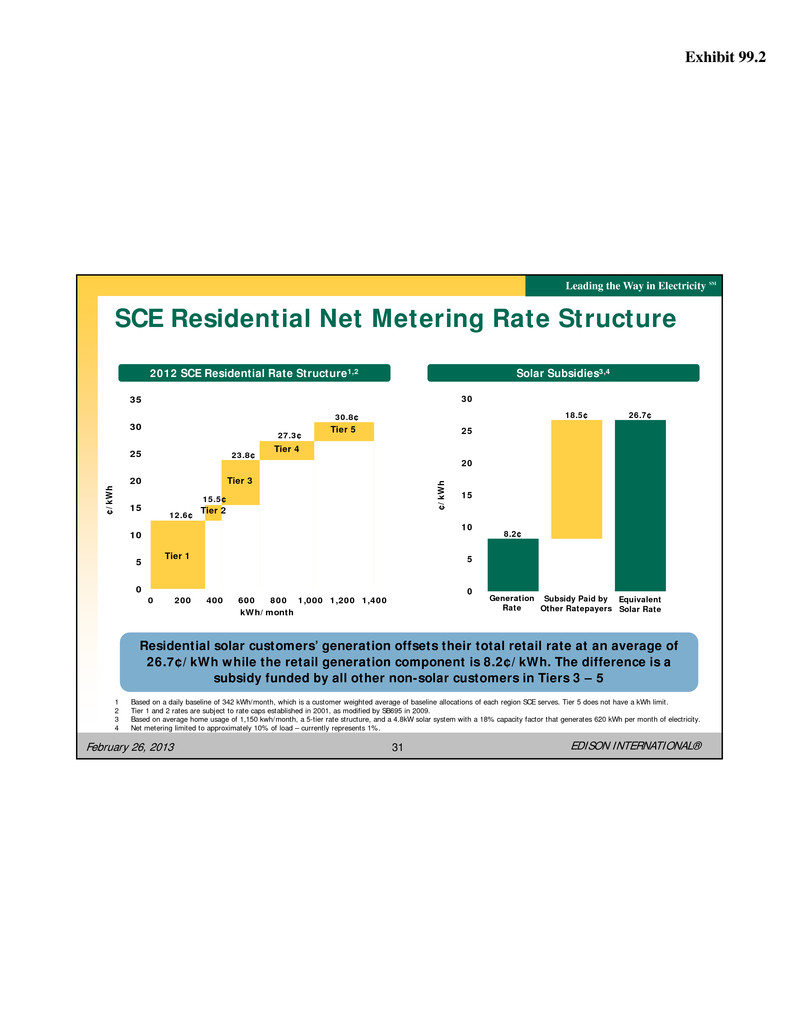

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 31 SCE Residential Net Metering Rate Structure 12.6¢ 15.5¢ 23.8¢ 27.3¢ 30.8¢ 0 5 10 15 20 25 30 35 0 200 400 600 800 1,000 1,200 1,400 ¢/ kW h kWh/month Tier 1 Tier 2 Tier 3 Tier 4 Tier 5 2012 SCE Residential Rate Structure1,2 8.2¢ 26.7¢18.5¢ 0 5 10 15 20 25 30 ¢/ kW h Solar Subsidies3,4 Generation Rate Subsidy Paid by Other Ratepayers Equivalent Solar Rate 1 Based on a daily baseline of 342 kWh/month, which is a customer weighted average of baseline allocations of each region SCE serves. Tier 5 does not have a kWh limit. 2 Tier 1 and 2 rates are subject to rate caps established in 2001, as modified by SB695 in 2009. 3 Based on average home usage of 1,150 kwh/month, a 5-tier rate structure, and a 4.8kW solar system with a 18% capacity factor that generates 620 kWh per month of electricity. 4 Net metering limited to approximately 10% of load – currently represents 1%. Residential solar customers’ generation offsets their total retail rate at an average of 26.7¢/kWh while the retail generation component is 8.2¢/kWh. The difference is a subsidy funded by all other non-solar customers in Tiers 3 – 5

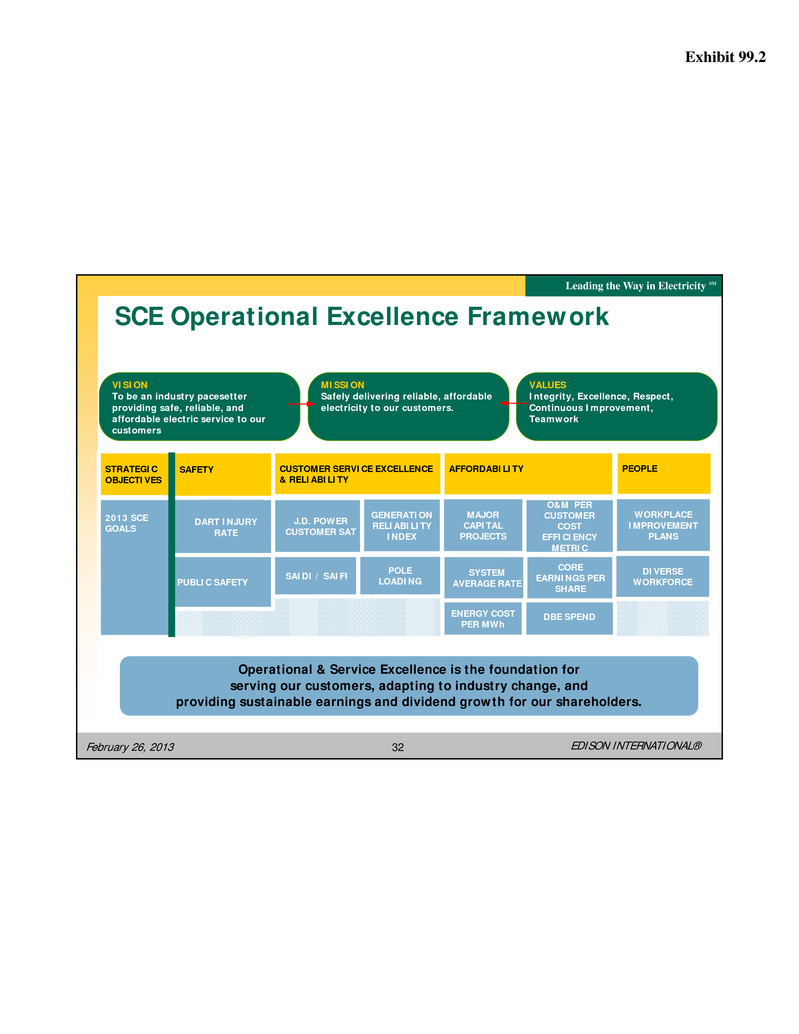

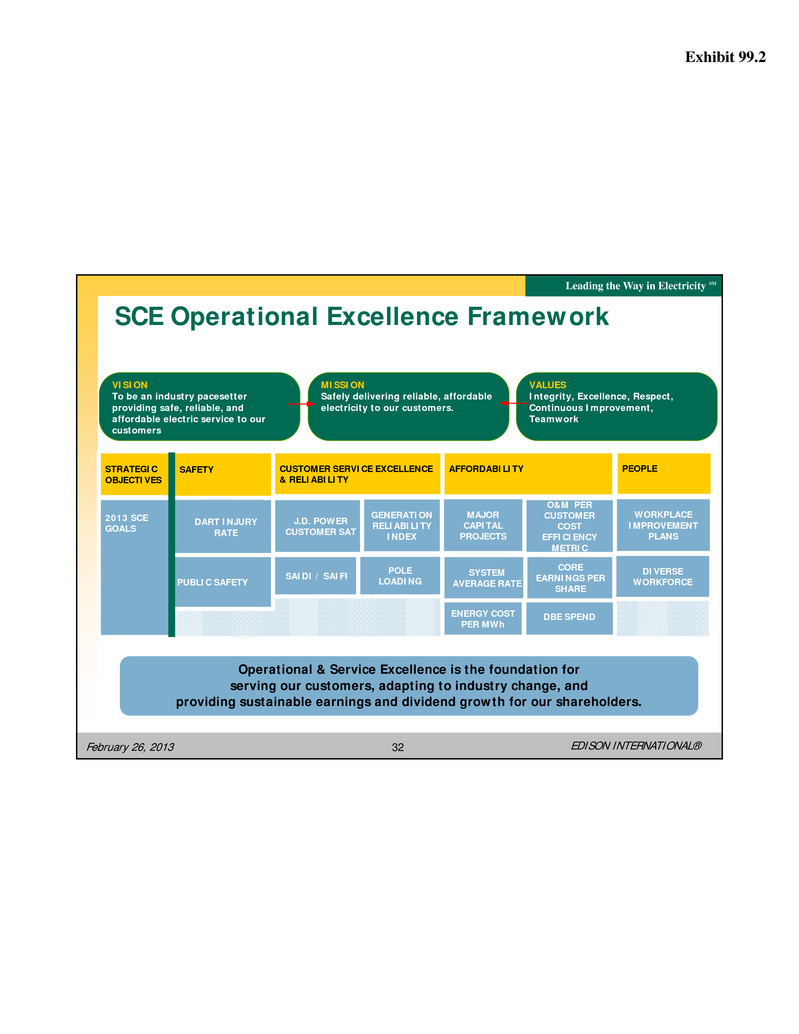

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 32 SCE Operational Excellence Framework 2013 SCE GOALS STRATEGIC OBJECTIVES DART INJURY RATE GENERATION RELIABILITY INDEX J.D. POWER CUSTOMER SAT* SAFETY CUSTOMER SERVICE EXCELLENCE & RELIABILITY AFFORDABILITY VISION To be an industry pacesetter providing safe, reliable, and affordable electric service to our customers MISSION Safely delivering reliable, affordable electricity to our customers. VALUES Integrity, Excellence, Respect, Continuous Improvement, Teamwork DART INJURY RATE DBE SPEND GENERATIO N RELIABILITY INDEX SAIDI / SAIFIPUBLIC SAFETY WORKPLACE IMPROVEMENT PLANS CORE EARNINGS PER SHARE SYSTEM AVERAGE RATE MAJOR CAPITAL PROJECTS O&M PER CUSTOMER COST EFFICIENCY METRIC ENERGY COST PER MWh DIVERSE WORKFORCE POLE LOADING PEOPLE G NERATION RELIABILITY INDEX J.D. POWER CUSTOMER SAT WORKPLACE IMPROVEMENT PLANS MAJOR CAPITAL PROJECTS O&M PER CUSTOMER COST EFF CIENCY METRIC Operational & Service Excellence is the foundation for serving our customers, adapting to industry change, and providing sustainable earnings and dividend growth for our shareholders.

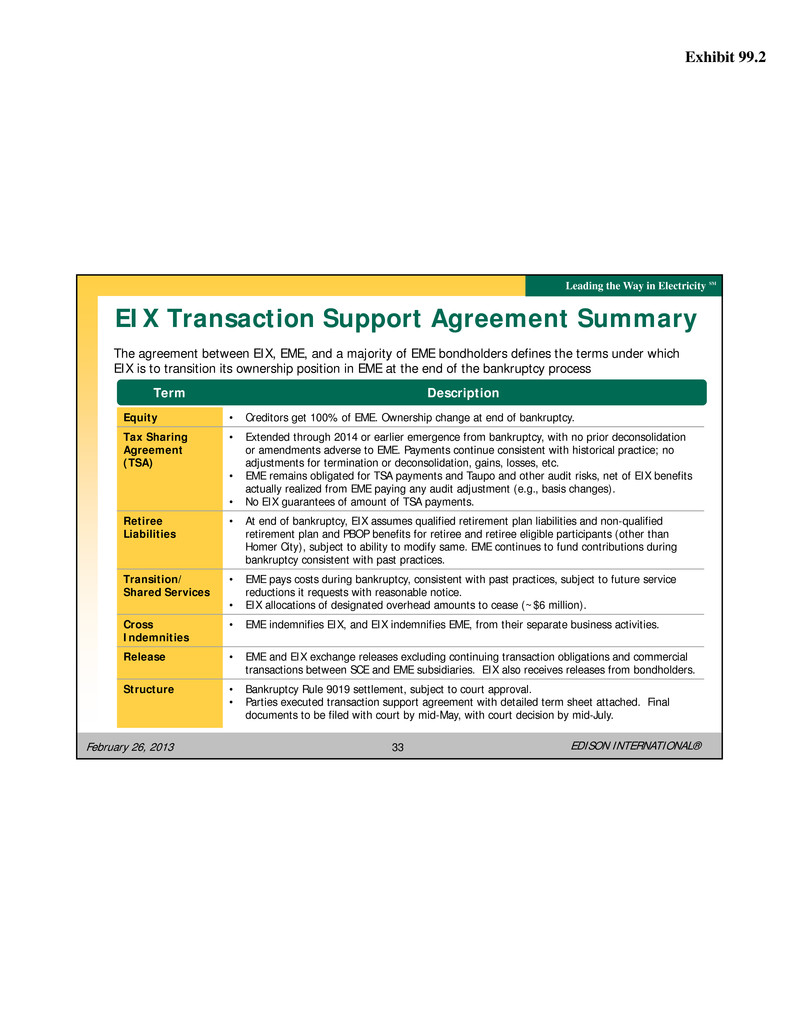

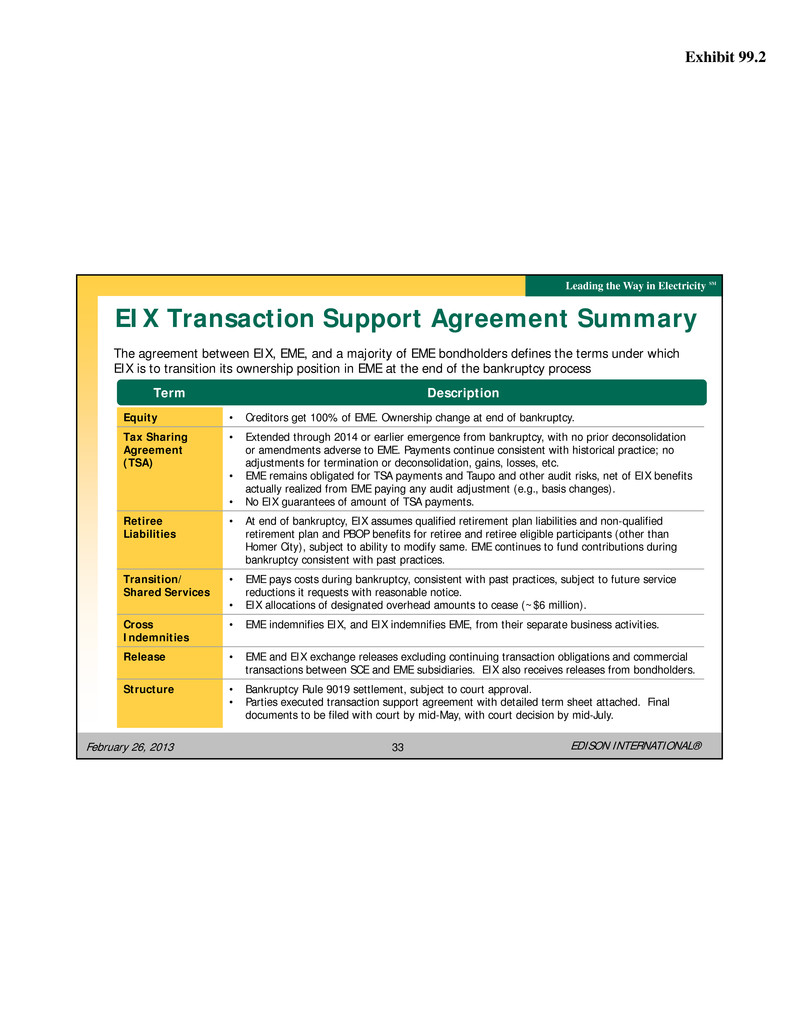

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 33 EIX Transaction Support Agreement Summary Term Description Equity • Creditors get 100% of EME. Ownership change at end of bankruptcy. Tax Sharing Agreement (TSA) • Extended through 2014 or earlier emergence from bankruptcy, with no prior deconsolidation or amendments adverse to EME. Payments continue consistent with historical practice; no adjustments for termination or deconsolidation, gains, losses, etc. • EME remains obligated for TSA payments and Taupo and other audit risks, net of EIX benefits actually realized from EME paying any audit adjustment (e.g., basis changes). • No EIX guarantees of amount of TSA payments. Retiree Liabilities • At end of bankruptcy, EIX assumes qualified retirement plan liabilities and non-qualified retirement plan and PBOP benefits for retiree and retiree eligible participants (other than Homer City), subject to ability to modify same. EME continues to fund contributions during bankruptcy consistent with past practices. Transition/ Shared Services • EME pays costs during bankruptcy, consistent with past practices, subject to future service reductions it requests with reasonable notice. • EIX allocations of designated overhead amounts to cease (~$6 million). Cross Indemnities • EME indemnifies EIX, and EIX indemnifies EME, from their separate business activities. Release • EME and EIX exchange releases excluding continuing transaction obligations and commercial transactions between SCE and EME subsidiaries. EIX also receives releases from bondholders. Structure • Bankruptcy Rule 9019 settlement, subject to court approval. • Parties executed transaction support agreement with detailed term sheet attached. Final documents to be filed with court by mid-May, with court decision by mid-July. The agreement between EIX, EME, and a majority of EME bondholders defines the terms under which EIX is to transition its ownership position in EME at the end of the bankruptcy process

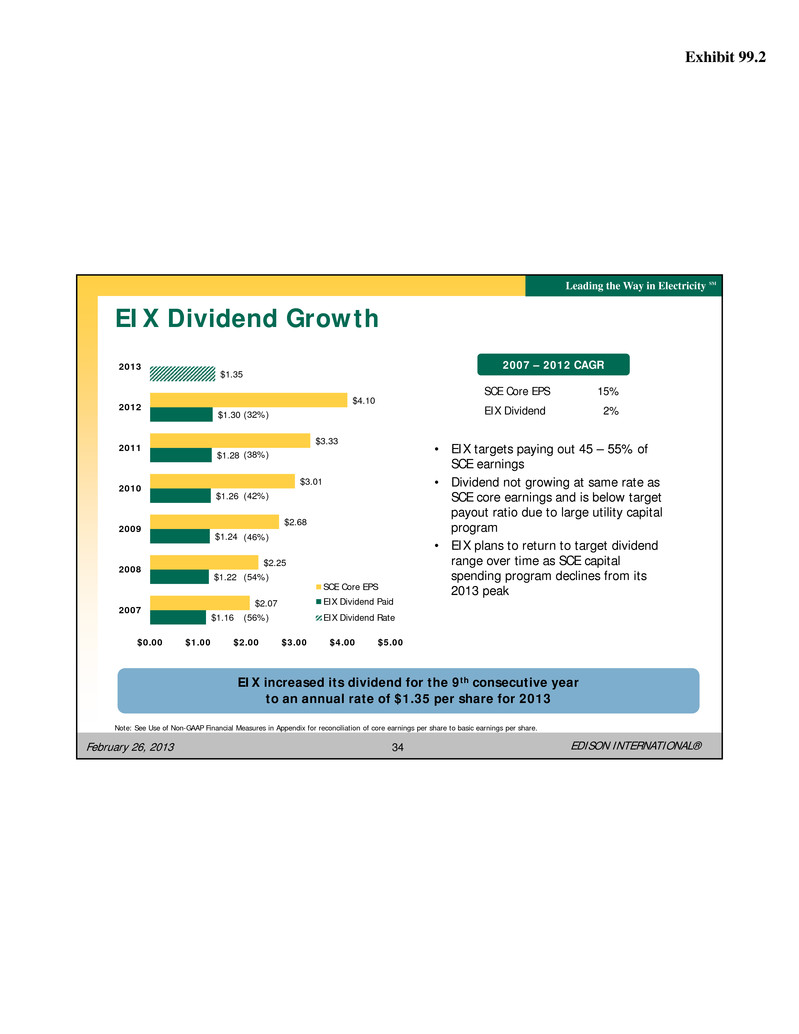

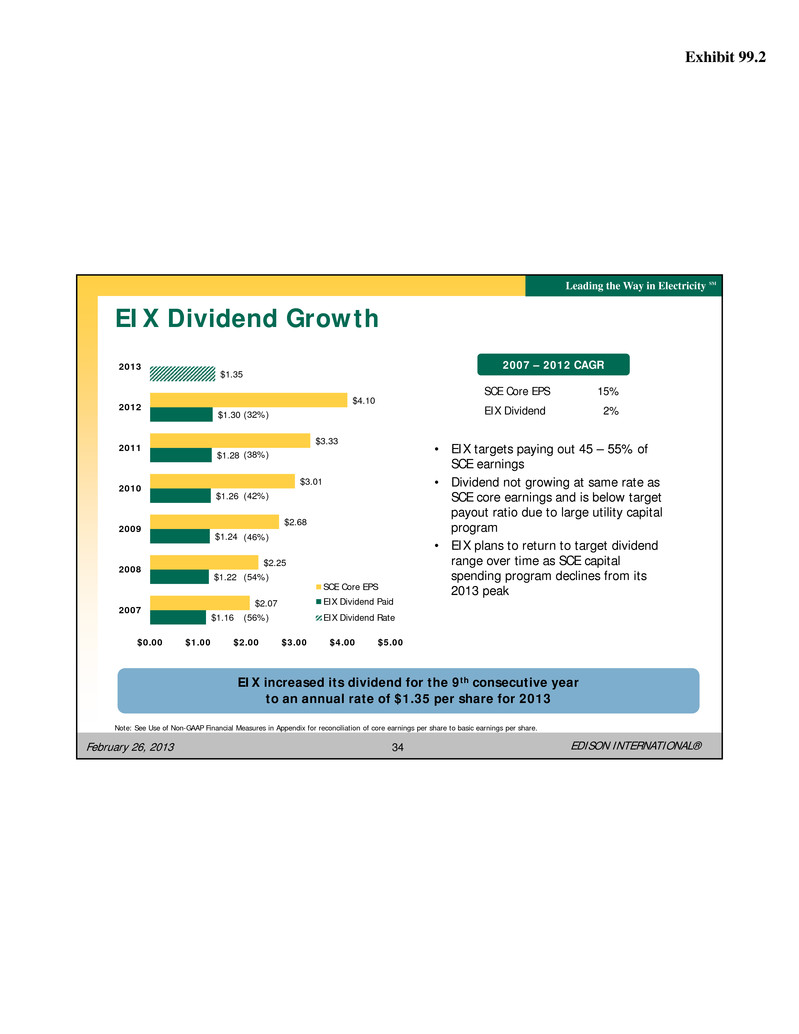

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 34 $1.16 $1.22 $1.24 $1.26 $1.28 $1.30 $1.35 $2.07 $2.25 $2.68 $3.01 $3.33 $4.10 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 2007 2008 2009 2010 2011 2012 2013 SCE Core EPS EIX Dividend Paid EIX Dividend Rate EIX Dividend Growth EIX increased its dividend for the 9th consecutive year to an annual rate of $1.35 per share for 2013 • EIX targets paying out 45 – 55% of SCE earnings • Dividend not growing at same rate as SCE core earnings and is below target payout ratio due to large utility capital program • EIX plans to return to target dividend range over time as SCE capital spending program declines from its 2013 peak SCE Core EPS EIX Dividend 15% 2% 2007 – 2012 CAGR (38%) (42%) (46%) (54%) (56%) Note: See Use of Non-GAAP Financial Measures in Appendix for reconciliation of core earnings per share to basic earnings per share. (32%)

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 35 Non-GAAP Reconciliations ($ millions) Note: See Use of Non-GAAP Financial Measures. EME’s financial results are reported as non-core for all periods. Q4 2011 $247 9 $256 $– (19) – (16) (1,060) (1,095) $(839) Q4 2012 $602 (20) $582 $231 (26) – – (1,326) (1,121) $(539) Reconciliation of EIX Core Earnings to EIX GAAP Earnings 2011 $1,085 (9) $1,076 $– (19) – (16) (1,078) (1,113) $(37) 2012 $1,338 (60) $1,278 $231 (37) 31 – (1,686) (1,461) $(183) Earnings Attributable to Edison International Core Earnings SCE EIX Parent and Other Core Earnings Non-Core Items SCE – 2012 GRC Repair deductions (2009 – 2011) EIX Parent & Other– Consolidated State deferred tax impacts related to EME EIX Parent & Other – Gain on sale of Beaver Valley lease interest EIX Parent & Other – Write-down of net investment in aircraft leases EIX Parent & Other– Discontinued operations Total Non-Core Basic Earnings

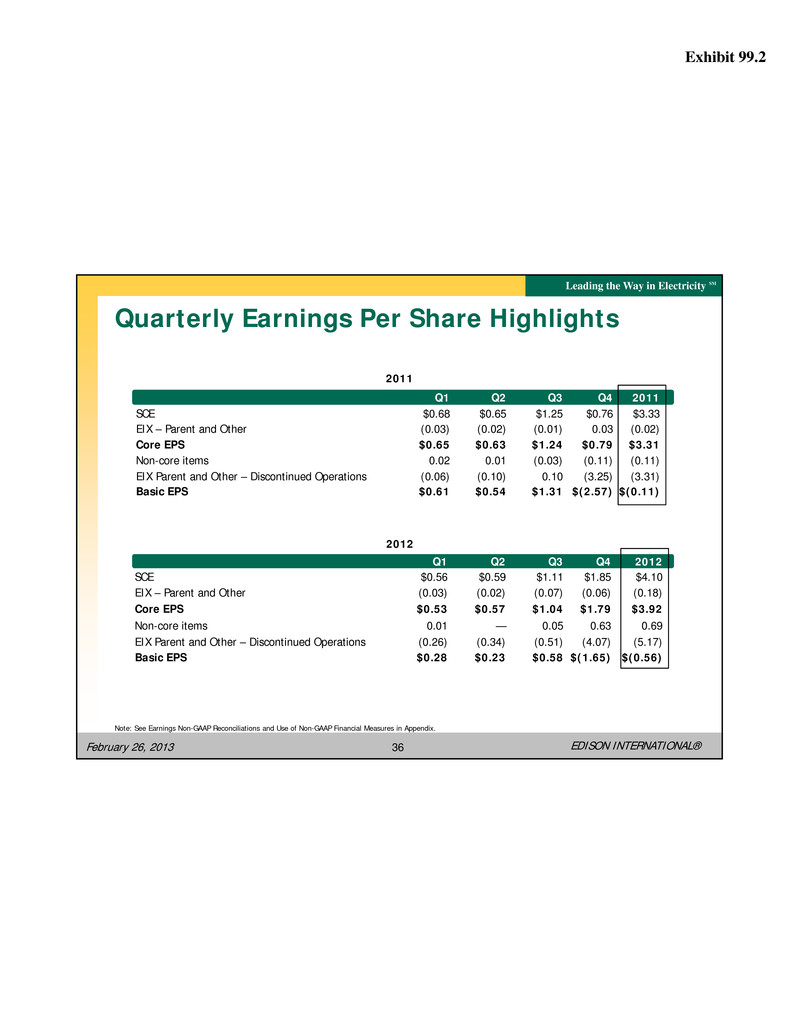

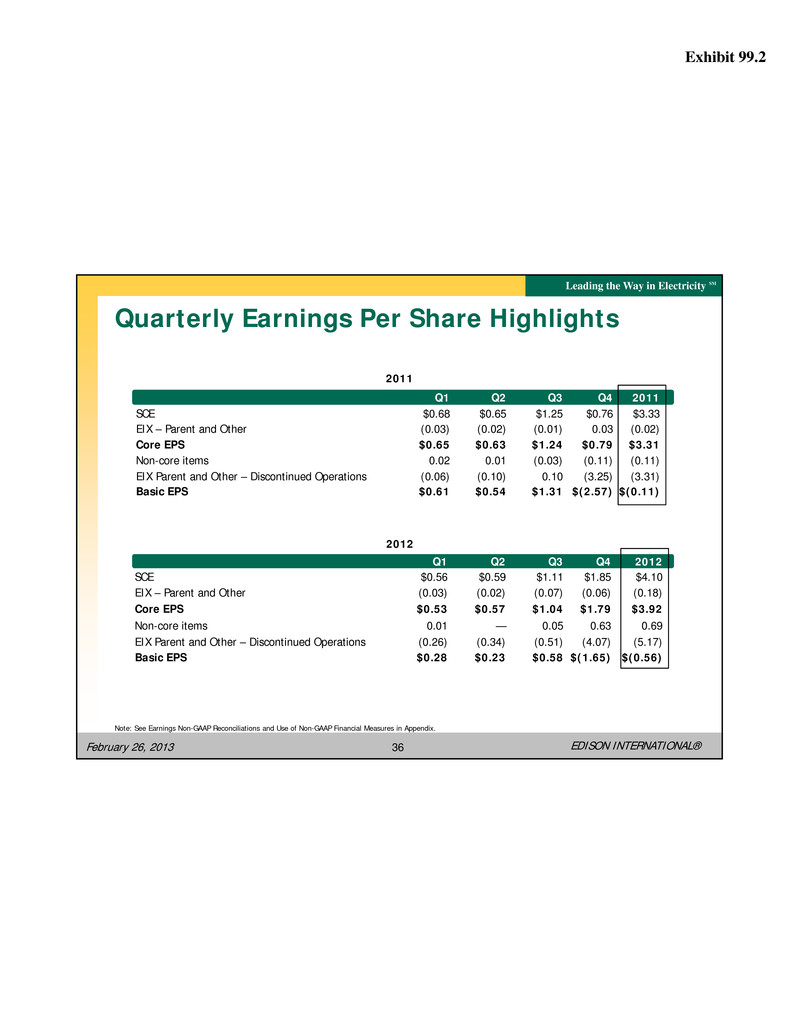

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 36 Quarterly Earnings Per Share Highlights Q1 Q2 Q3 Q4 2011 SCE $0.68 $0.65 $1.25 $0.76 $3.33 EIX – Parent and Other (0.03) (0.02) (0.01) 0.03 (0.02) Core EPS $0.65 $0.63 $1.24 $0.79 $3.31 Non-core items 0.02 0.01 (0.03) (0.11) (0.11) EIX Parent and Other – Discontinued Operations (0.06) (0.10) 0.10 (3.25) (3.31) Basic EPS $0.61 $0.54 $1.31 $(2.57) $(0.11) Note: See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix. Q1 Q2 Q3 Q4 2012 SCE $0.56 $0.59 $1.11 $1.85 $4.10 EIX – Parent and Other (0.03) (0.02) (0.07) (0.06) (0.18) Core EPS $0.53 $0.57 $1.04 $1.79 $3.92 Non-core items 0.01 — 0.05 0.63 0.69 EIX Parent and Other – Discontinued Operations (0.26) (0.34) (0.51) (4.07) (5.17) Basic EPS $0.28 $0.23 $0.58 $(1.65) $(0.56) 2011 2012

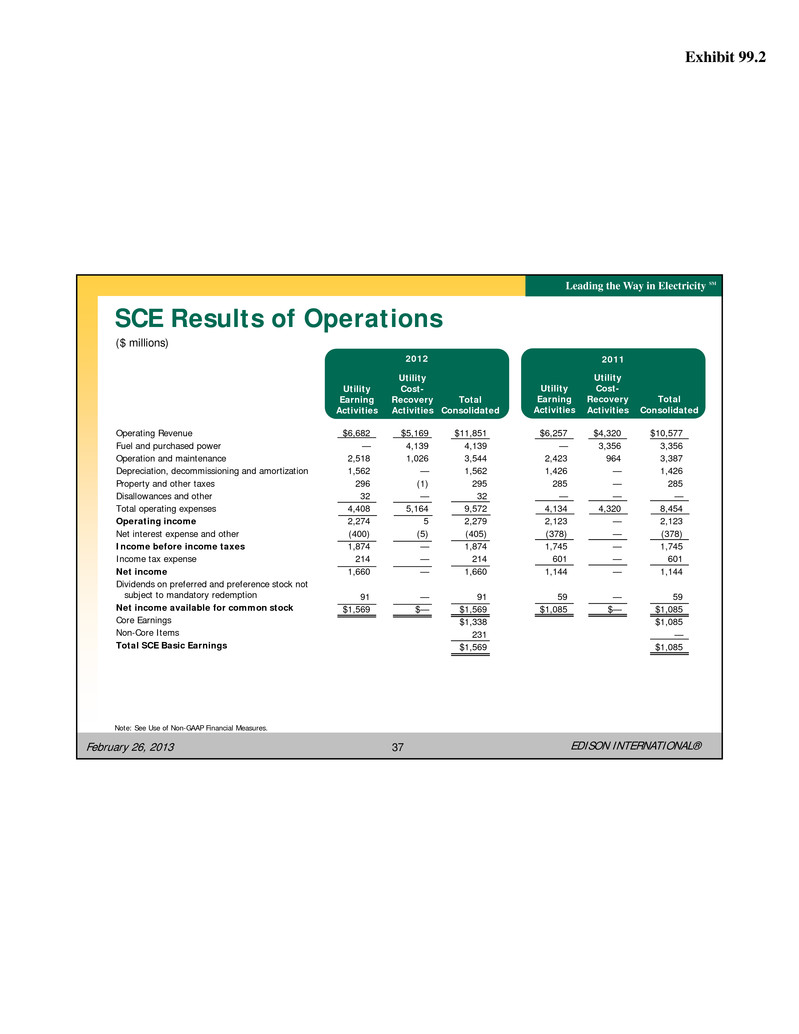

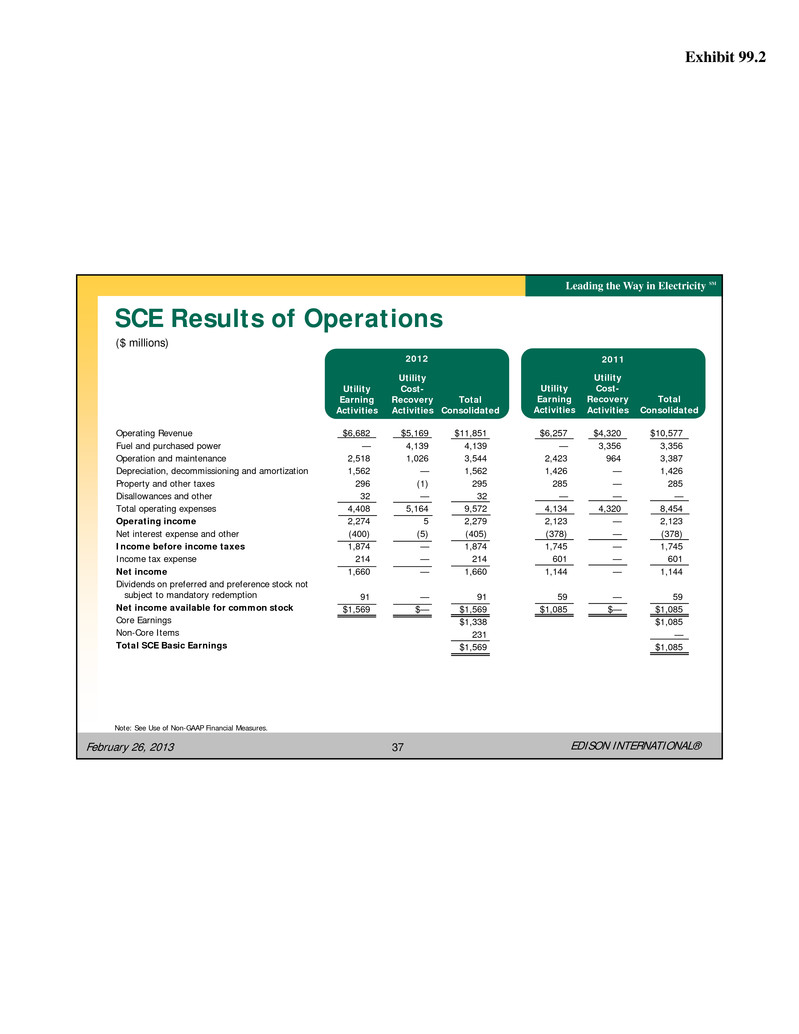

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 37 $6,682 — 2,518 1,562 296 32 4,408 2,274 (400) 1,874 214 1,660 91 $1,569 $5,169 4,139 1,026 — (1) — 5,164 5 (5) — — — — $— $6,257 — 2,423 1,426 285 — 4,134 2,123 (378) 1,745 601 1,144 59 $1,085 $4,320 3,356 964 — — — 4,320 — — — — — — $— $10,577 3,356 3,387 1,426 285 — 8,454 2,123 (378) 1,745 601 1,144 59 $1,085 $1,085 — $1,085 SCE Results of Operations ($ millions) Note: See Use of Non-GAAP Financial Measures. Utility Earning Activities Utility Cost- Recovery Activities Total Consolidated 2011 Utility Earning Activities Utility Cost- Recovery Activities Total Consolidated 2012 Operating Revenue Fuel and purchased power Operation and maintenance Depreciation, decommissioning and amortization Property and other taxes Disallowances and other Total operating expenses Operating income Net interest expense and other Income before income taxes Income tax expense Net income Dividends on preferred and preference stock not subject to mandatory redemption Net income available for common stock Core Earnings Non-Core Items Total SCE Basic Earnings $11,851 4,139 3,544 1,562 295 32 9,572 2,279 (405) 1,874 214 1,660 91 $1,569 $1,338 231 $1,569

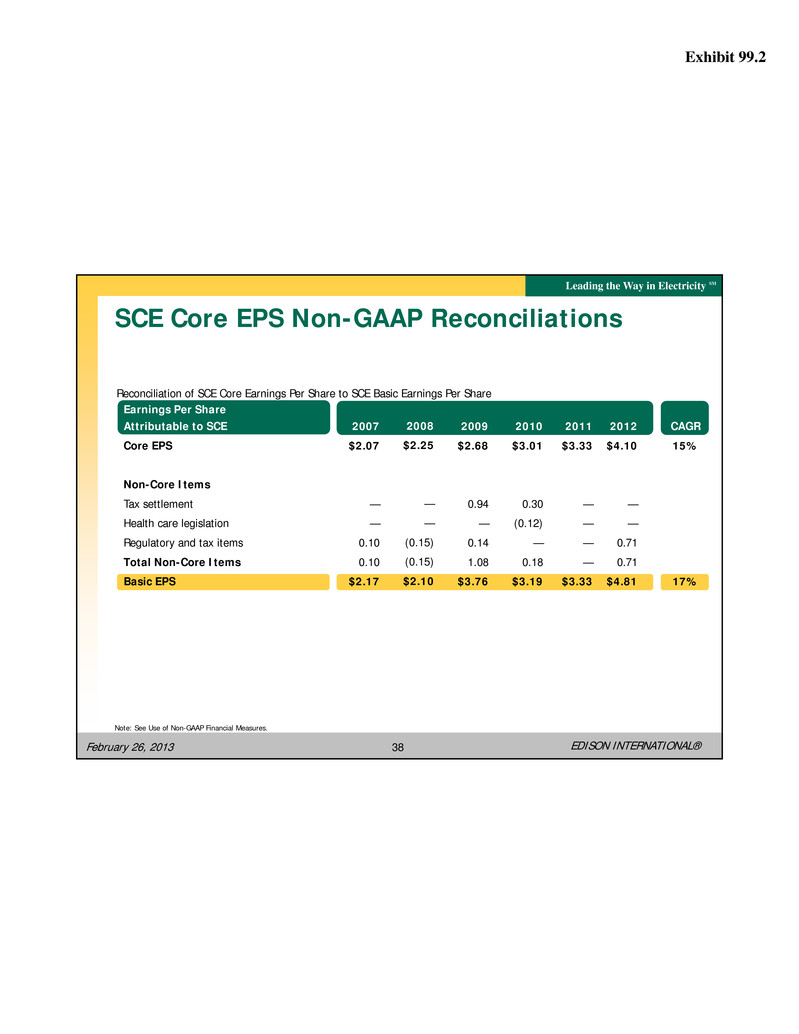

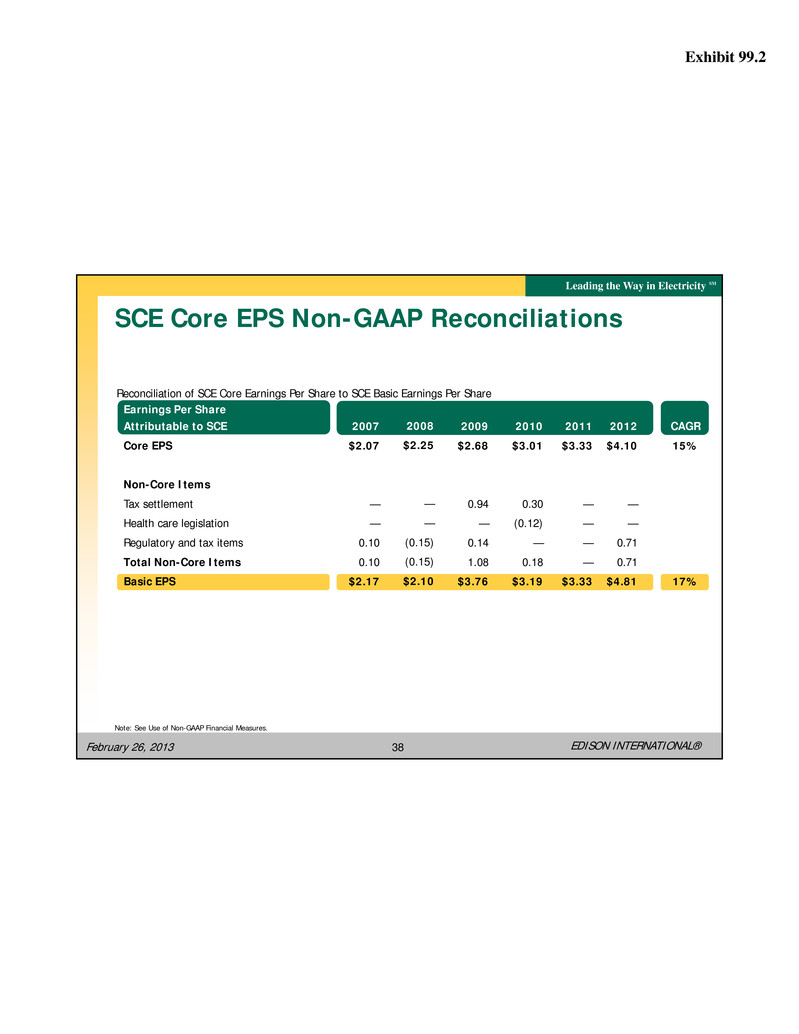

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 38 Earnings Per Share Attributable to SCE Core EPS Non-Core Items Tax settlement Health care legislation Regulatory and tax items Total Non-Core Items Basic EPS SCE Core EPS Non-GAAP Reconciliations Note: See Use of Non-GAAP Financial Measures. Reconciliation of SCE Core Earnings Per Share to SCE Basic Earnings Per Share 2007 $2.07 — — 0.10 0.10 $2.17 2008 $2.25 — — (0.15) (0.15) $2.10 2009 $2.68 0.94 — 0.14 1.08 $3.76 2010 $3.01 0.30 (0.12) — 0.18 $3.19 CAGR 15% 17% 2011 $3.33 — — — — $3.33 2012 $4.10 — — 0.71 0.71 $4.81

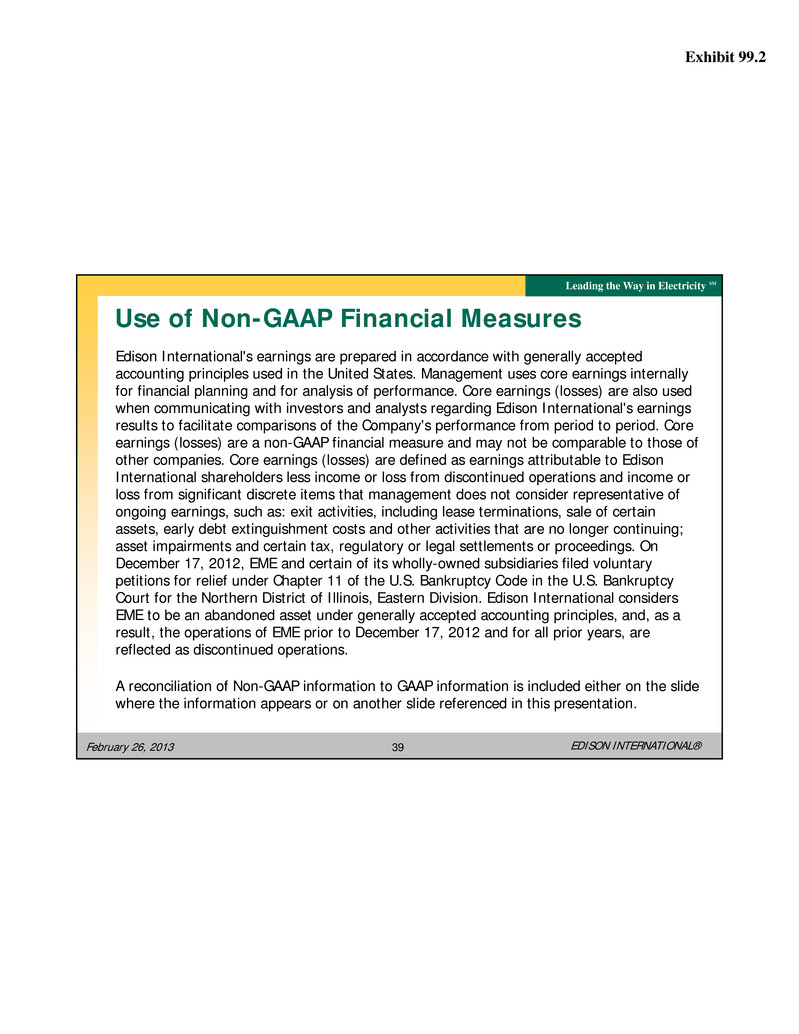

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 39 Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings (losses) are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings (losses) are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (losses) are defined as earnings attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including lease terminations, sale of certain assets, early debt extinguishment costs and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. On December 17, 2012, EME and certain of its wholly-owned subsidiaries filed voluntary petitions for relief under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the Northern District of Illinois, Eastern Division. Edison International considers EME to be an abandoned asset under generally accepted accounting principles, and, as a result, the operations of EME prior to December 17, 2012 and for all prior years, are reflected as discontinued operations. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. Use of Non-GAAP Financial Measures

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM February 26, 2013 40 Investor Relations Contacts Scott Cunningham, Vice President (626) 302-2540 scott.cunningham@edisonintl.com Felicia Williams, Senior Manager (626) 302-5493 felicia.williams@edisonintl.com