EDISON INTERNATIONAL® Leading the Way in Electricity SM June 7, 2013 0 SCE San Onofre Nuclear Generating Station Conference Call

EDISON INTERNATIONAL® Leading the Way in Electricity SM June 7, 2013 1 Statements contained in this presentation about future performance, including, without limitation, operating results, asset and rate base growth, capital expenditures, San Onofre Nuclear Generating Station (SONGS), regulatory outcomes, tax and accounting matters, and other statements that are not purely historical, are forward-looking statements. These forward- looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors,” and “Management’s Discussion and Analysis” in Edison International’s first quarter 2013 Form 10-Q, 2012 Form 10-K and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. Forward-Looking Statements

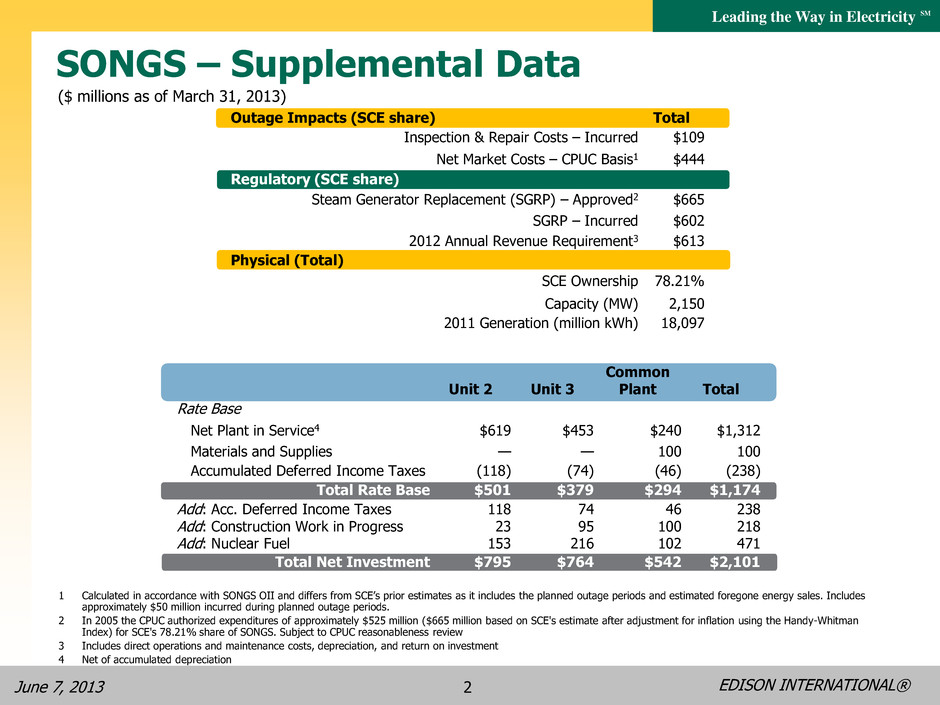

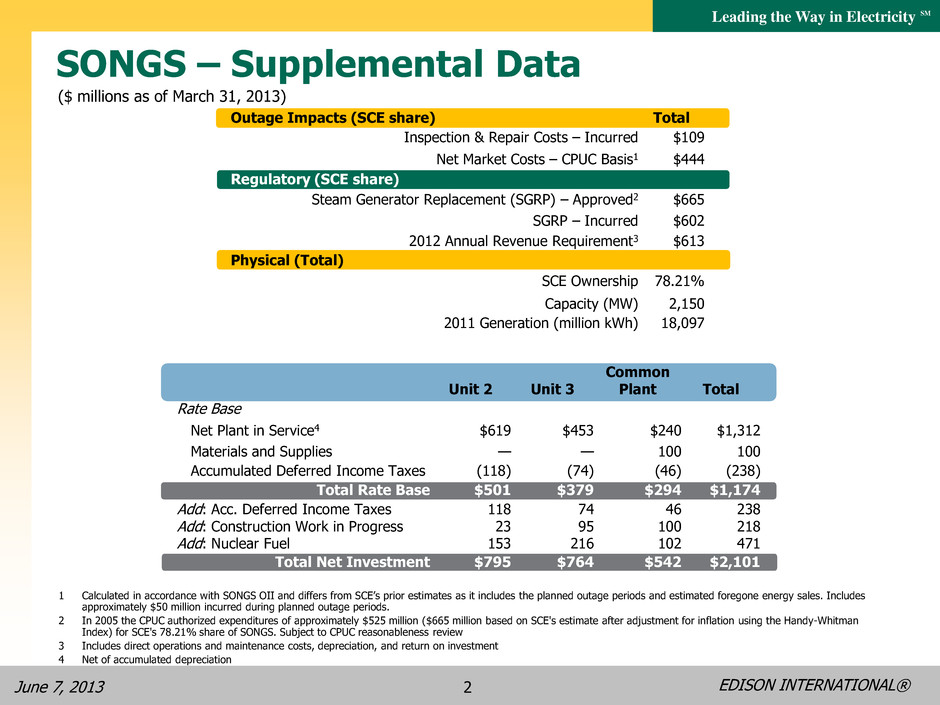

EDISON INTERNATIONAL® Leading the Way in Electricity SM June 7, 2013 2 SONGS – Supplemental Data 1 Calculated in accordance with SONGS OII and differs from SCE’s prior estimates as it includes the planned outage periods and estimated foregone energy sales. Includes approximately $50 million incurred during planned outage periods. 2 In 2005 the CPUC authorized expenditures of approximately $525 million ($665 million based on SCE's estimate after adjustment for inflation using the Handy-Whitman Index) for SCE's 78.21% share of SONGS. Subject to CPUC reasonableness review 3 Includes direct operations and maintenance costs, depreciation, and return on investment 4 Net of accumulated depreciation Outage Impacts (SCE share) Total Inspection & Repair Costs – Incurred $109 Net Market Costs – CPUC Basis1 $444 Regulatory (SCE share) Steam Generator Replacement (SGRP) – Approved2 $665 SGRP – Incurred $602 2012 Annual Revenue Requirement3 $613 Physical (Total) SCE Ownership 78.21% Capacity (MW) 2,150 2011 Generation (million kWh) 18,097 Unit 2 Unit 3 Common Plant Total Rate Base Net Plant in Service4 $619 $453 $240 $1,312 Materials and Supplies — — 100 100 Accumulated Deferred Income Taxes (118) (74) (46) (238) Total Rate Base $501 $379 $294 $1,174 Add: Acc. Deferred Income Taxes 118 74 46 238 Add: Construction Work in Progress 23 95 100 218 Add: Nuclear Fuel 153 216 102 471 Total Net Investment $795 $764 $542 $2,101 ($ millions as of March 31, 2013)

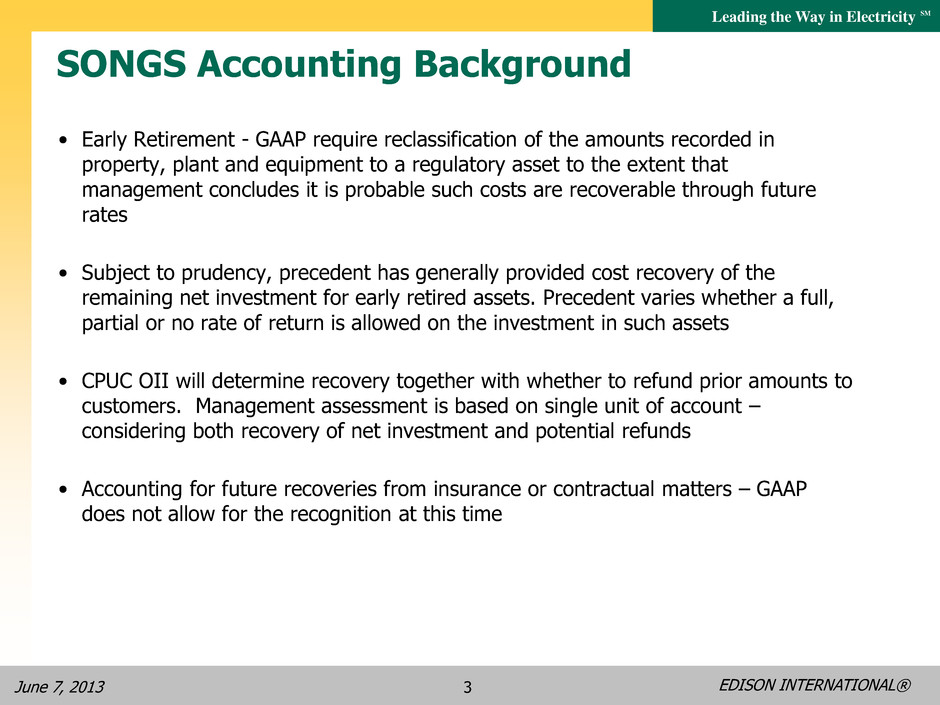

EDISON INTERNATIONAL® Leading the Way in Electricity SM June 7, 2013 3 SONGS Accounting Background • Early Retirement - GAAP require reclassification of the amounts recorded in property, plant and equipment to a regulatory asset to the extent that management concludes it is probable such costs are recoverable through future rates • Subject to prudency, precedent has generally provided cost recovery of the remaining net investment for early retired assets. Precedent varies whether a full, partial or no rate of return is allowed on the investment in such assets • CPUC OII will determine recovery together with whether to refund prior amounts to customers. Management assessment is based on single unit of account – considering both recovery of net investment and potential refunds • Accounting for future recoveries from insurance or contractual matters – GAAP does not allow for the recognition at this time

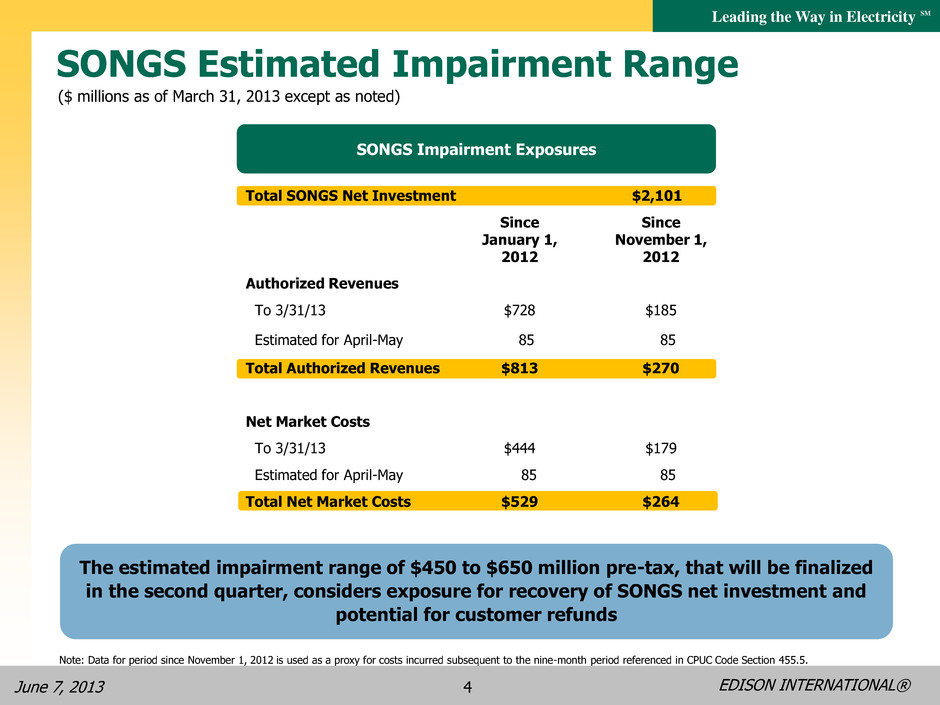

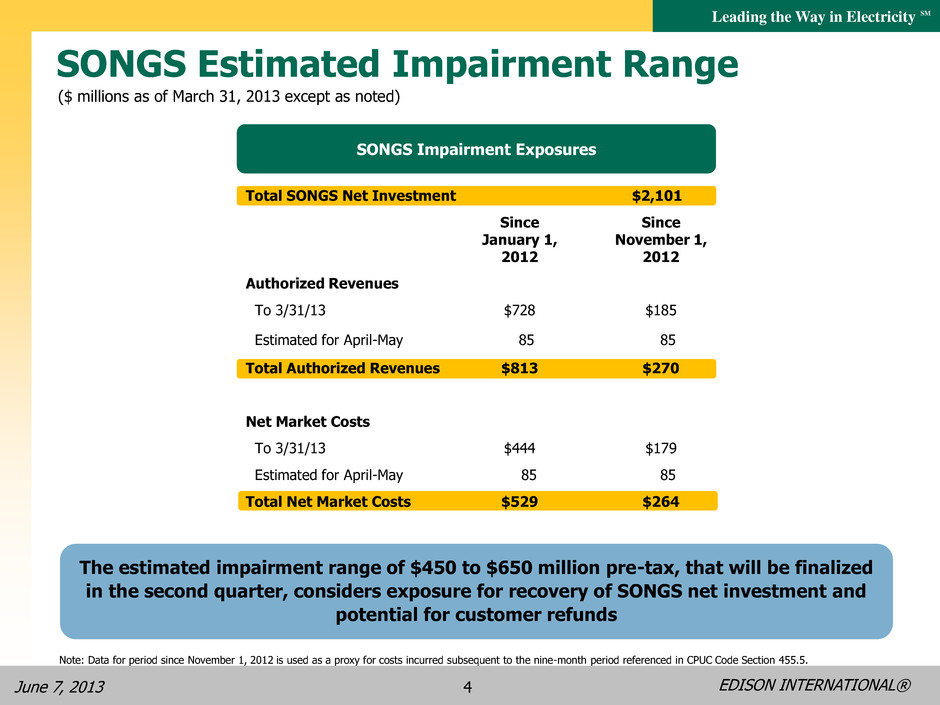

EDISON INTERNATIONAL® Leading the Way in Electricity SM June 7, 2013 4 SONGS Estimated Impairment Range ($ millions as of March 31, 2013 except as noted) The estimated impairment range of $450 to $650 million pre-tax, that will be finalized in the second quarter, considers exposure for recovery of SONGS net investment and potential for customer refunds Total SONGS Net Investment $2,101 Since January 1, 2012 Since November 1, 2012 Authorized Revenues To 3/31/13 $728 $185 Estimated for April-May 85 85 Total Authorized Revenues $813 $270 Net Market Costs To 3/31/13 $444 $179 Estimated for April-May 85 85 Total Net Market Costs $529 $264 SONGS Impairment Exposures Note: Data for period since November 1, 2012 is used as a proxy for costs incurred subsequent to the nine-month period referenced in CPUC Code Section 455.5.

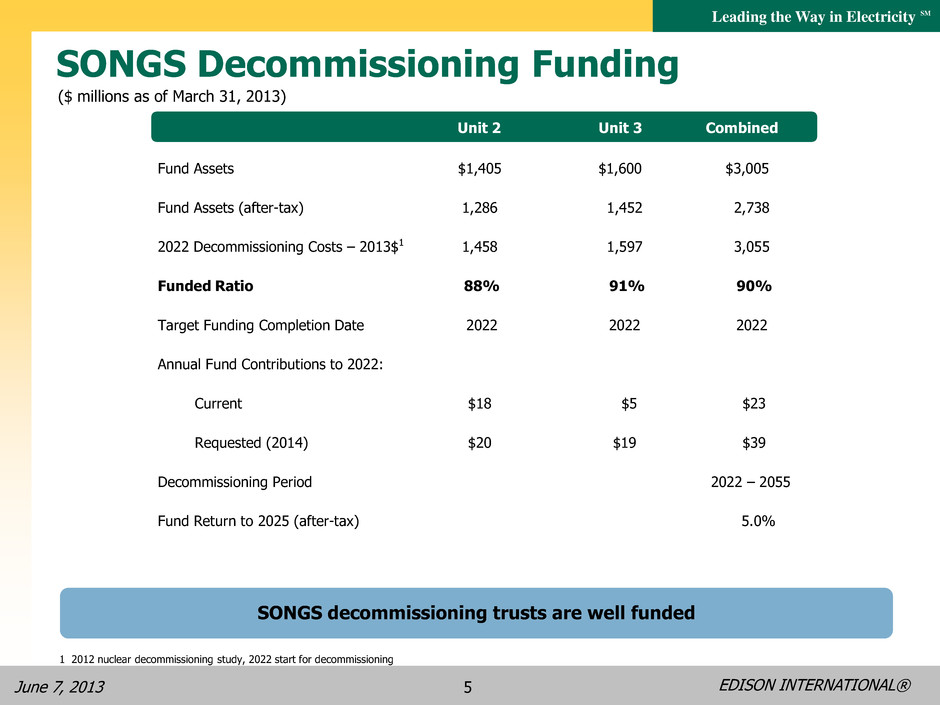

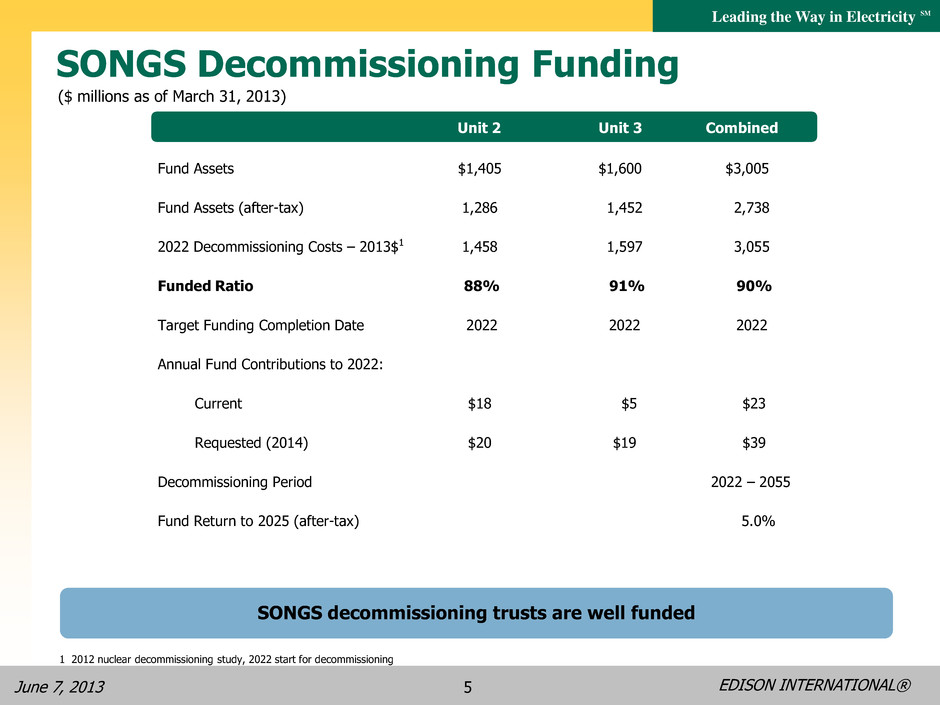

EDISON INTERNATIONAL® Leading the Way in Electricity SM June 7, 2013 5 SONGS Decommissioning Funding Fund Assets $1,405 $1,600 $3,005 Fund Assets (after-tax) 1,286 1,452 2,738 2022 Decommissioning Costs – 2013$1 1,458 1,597 3,055 Funded Ratio 88% 91% 90% Target Funding Completion Date 2022 2022 2022 Annual Fund Contributions to 2022: Current $18 $5 $23 Requested (2014) $20 $19 $39 Decommissioning Period 2022 – 2055 Fund Return to 2025 (after-tax) 5.0% SONGS decommissioning trusts are well funded ($ millions as of March 31, 2013) Unit 2 Unit 3 Combined 1 2012 nuclear decommissioning study, 2022 start for decommissioning

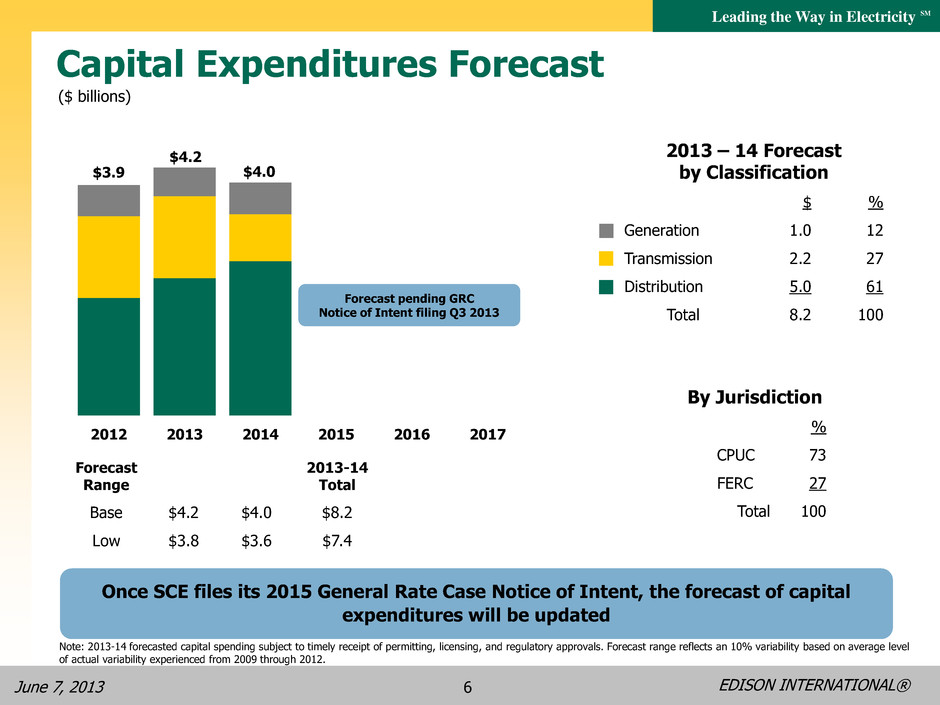

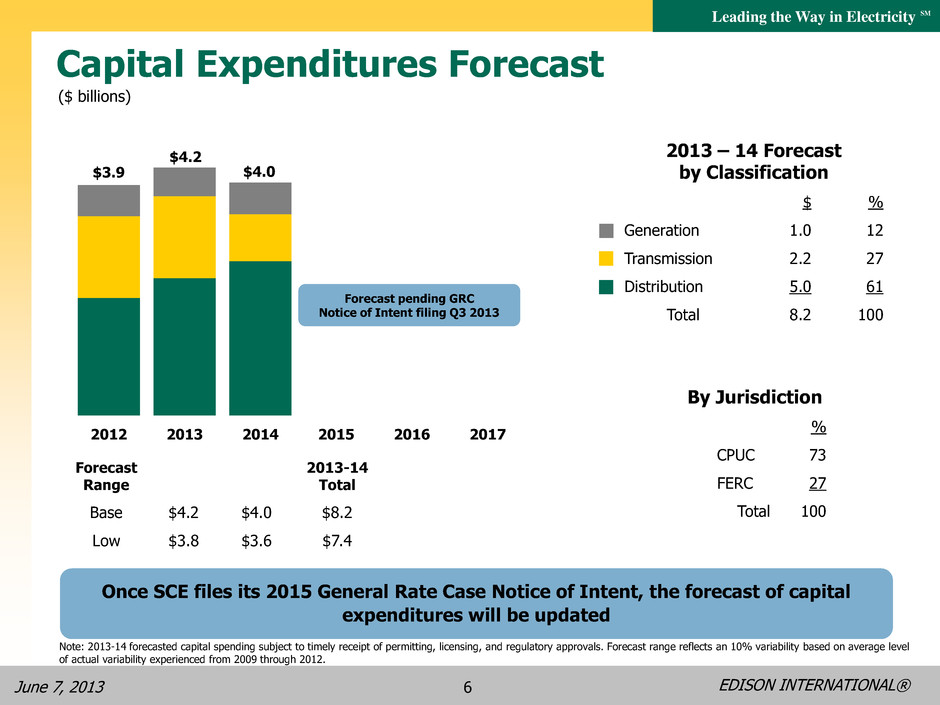

EDISON INTERNATIONAL® Leading the Way in Electricity SM June 7, 2013 6 $3.9 $4.2 $4.0 2012 2013 2014 2015 2016 2017 Forecast pending GRC Notice of Intent filing Q3 2013 Note: 2013-14 forecasted capital spending subject to timely receipt of permitting, licensing, and regulatory approvals. Forecast range reflects an 10% variability based on average level of actual variability experienced from 2009 through 2012. Capital Expenditures Forecast ($ billions) Forecast Range 2013-14 Total Base $4.2 $4.0 $8.2 Low $3.8 $3.6 $7.4 By Jurisdiction % CPUC 73 FERC 27 Total 100 2013 – 14 Forecast by Classification $ % Generation 1.0 12 Transmission 2.2 27 Distribution 5.0 61 Total 8.2 100 Once SCE files its 2015 General Rate Case Notice of Intent, the forecast of capital expenditures will be updated

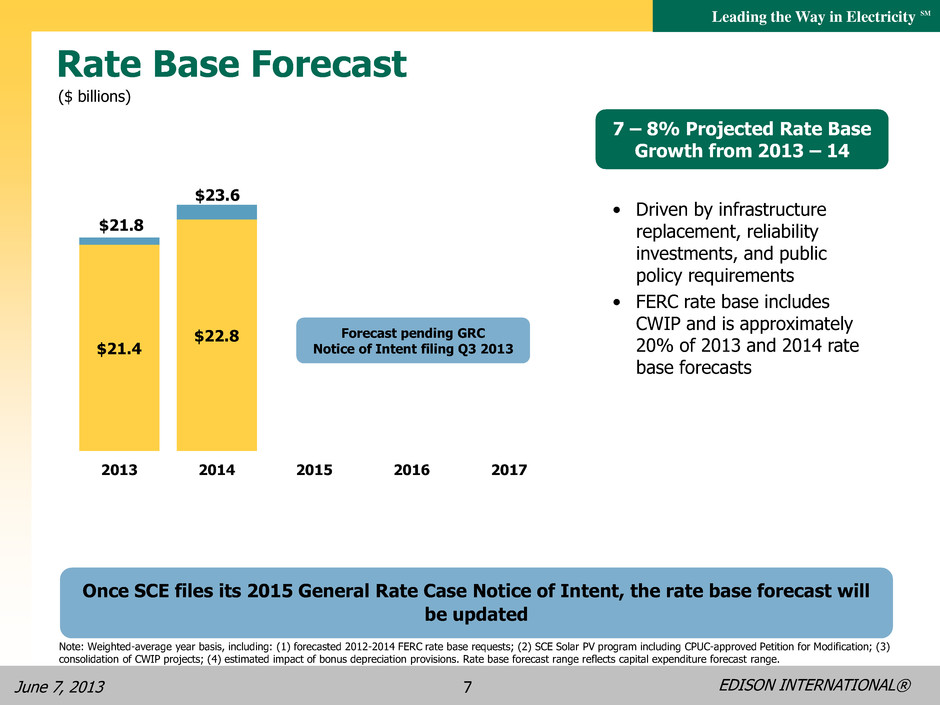

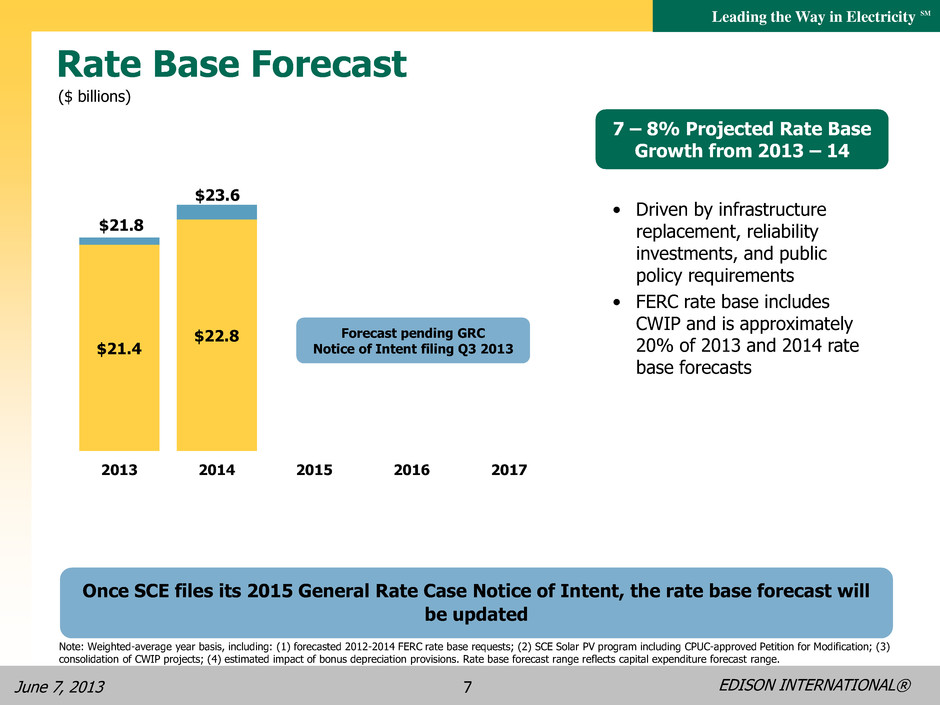

EDISON INTERNATIONAL® Leading the Way in Electricity SM June 7, 2013 7 Rate Base Forecast $21.4 $22.8 $21.8 $23.6 2013 2014 2015 2016 2017 Note: Weighted-average year basis, including: (1) forecasted 2012-2014 FERC rate base requests; (2) SCE Solar PV program including CPUC-approved Petition for Modification; (3) consolidation of CWIP projects; (4) estimated impact of bonus depreciation provisions. Rate base forecast range reflects capital expenditure forecast range. Smart Grid Forecast pending GRC Notice of Intent filing Q3 2013 • Driven by infrastructure replacement, reliability investments, and public policy requirements • FERC rate base includes CWIP and is approximately 20% of 2013 and 2014 rate base forecasts 7 – 8% Projected Rate Base Growth from 2013 – 14 ($ billions) Once SCE files its 2015 General Rate Case Notice of Intent, the rate base forecast will be updated

EDISON INTERNATIONAL® Leading the Way in Electricity SM June 7, 2013 8 2013 Core and Basic Earnings Guidance Note: See Use of Non-GAAP Financial Measures in Appendix SONGS Guidance Changes: • $(0.15) per share from removal of $1.2 billion rate base effective in June pending regulatory treatment of return on investment • $(0.03) per share from no AFUDC on CWIP effective in June pending regulatory treatment of return on investment • $(0.02) per share of other transition costs • $(0.92) to $(1.30) per share non-core charge range Continuing Guidance Assumptions: • Approved capital structure – 48% equity, 10.45% CPUC ROE, 11.1% FERC ROE • 325.8 million common shares outstanding • SCE positive variances from rate base forecast include: income tax repair deduction, O&M cost savings/other, energy efficiency earnings • EME results not consolidated • No changes in tax policy • O&M cost savings flow through to ratepayers in 2015 GRC • No SONGS insurance or warranty recoveries • No non-core items except $0.06/share reported in Q1 2013 Earnings Guidance as of 4/30/13 2013 Earnings Guidance as of 6/07/13 Low id High Low Mid High SCE $3.70 $3.50 EIX Parent & Other (0.15) (0.15) EIX Core EPS $3.45 $3.55 $3.65 $3.25 $3.35 $3.45 Non-core Items 0.06 (1.24) (0.86) EIX Basic EPS .51 $3.61 $3.71 $2.01 $2.59

EDISON INTERNATIONAL® Leading the Way in Electricity SM June 7, 2013 9 Appendix

EDISON INTERNATIONAL® Leading the Way in Electricity SM June 7, 2013 10 Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including sale of certain assets, and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. Use of Non-GAAP Financial Measures EIX Investor Relations Contacts Scott Cunningham, Vice President (626) 302-2540 scott.cunningham@edisonintl.com Felicia Williams, Senior Manager (626) 302-5493 felicia.williams@edisonintl.com