- SO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

The Southern Company (SO) DEF 14ADefinitive proxy

Filed: 5 Apr 19, 4:40pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

The Southern Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

| Our Strategy | ||

We are one of America’s premier energy companies, delivering clean, safe, reliable and affordable energy to our electric and natural gas customers through our state-regulated utilities. Our strategy is to maximize long-term value to stockholders through a customer-, community- and relationship-focused business model that is designed to produce sustainable levels of return on energy infrastructure. See the back coverof this Proxy Statement for our geographic footprint. | Our Customer Centric Business Model

| |

| Our Key Financial Objectives | ||

►Superior risk-adjusted total shareholder return ►A high degree of financial integrity and strong investment grade credit ratings ►Strong, sustainable returns on invested capital ►Regular, predictable and sustainable earnings per share (EPS) and dividend growth* *Future dividends are subject to the approval of the Board of Directors and dependent on earnings, financial condition and other factors |  | |

| Our Low-Carbon Future |

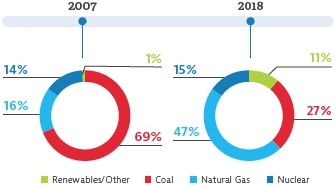

Southern Company is committed to providing clean, safe, reliable and affordable energy, while transitioning to low-to no-carbon operations by 2050.Since 2007, the percentage of energy generated from coal has decreased approximately 61%.

| Energy Mix* | GHG Emission Reduction Goals | |

|  |

| * | Includes non-affiliate power purchase agreements |

Cover:Southern Power Company’s Garland Solar Facility in Kern County, California

Thomas A. Fanning  The foundation of our business remains strong. Our customer-focused business model, with an emphasis on outstanding reliability, best-in-class customer service and rates well below the national average, continues to be the cornerstone for delivering value to customers and stockholders alike. | Dear Fellow Stockholders: You are invited to attend the 2019 Annual Meeting of Stockholders at 10:00 a.m., ET, on Wednesday, May 22, 2019, at The Lodge Conference Center at Callaway Gardens, Pine Mountain, Georgia, where we will discuss, among other things, Southern Company’s 2018 performance. Overview of 2018 Performance Southern Company made many significant accomplishments in 2018. On an adjusted basis, we exceeded our guidance for the year. We successfully completed more than $11 billion in strategic, value-accretive transactions, including closing on the sale of Gulf Power on January 1, 2019. These actions served to strengthen our balance sheet, substantially reduce our projected equity needs and remove significant risk from our financing plans. We believe these transactions also position us for future growth. Tax reform was also a significant factor in 2018. We reached timely, innovative and constructive outcomes with regulators in multiple jurisdictions that have paved the way to deliver approximately $1.8 billion in benefits to customers while simultaneously preserving our credit quality and improving earnings per share. At Georgia Power’s Plant Vogtle, the first new nuclear reactors to be built in the U.S. in three decades are under construction. In 2018, we saw significant progress in the construction of Vogtle units 3 and 4 and we achieved our principal year-end construction targets. Taking into consideration engineering, procurement and the initial test plan, the new Plant Vogtle units are approximately 75% complete. This past summer, we announced that Southern Nuclear revised the estimated cost to complete the project and recalibrated site production expectations with a site-wide project reset. Since then, we have seen marked improvement in construction productivity at the site. Much hard work remains in order to sustain this momentum, but we are pleased with the project’s progress and remain confident that it will meet the in-service dates approved by regulators. Valuing and Developing Our People Diversity and inclusion continued to be key focus areas for us in 2018. Each of our operating companies is focused on cultivating a culture of inclusion that acknowledges and values the uniqueness of its employees. Their multi-pronged approach includes the formation of diversity and inclusion councils, employee resource groups, training and development, education and awareness, inclusive benefits and policies and diverse community partnerships. This great work has been validated by external observers as Southern Company was once again recognized as one of the “Top 50 Companies for Diversity” in 2018 by bothDiversityIncandBlack Enterprise. We hope you can join us at the annual meeting. A webcast of the Annual Meeting will be available atinvestor.southerncompany.com, starting at 10:00 a.m., ET, on Wednesday, May 22, 2019. A replay will be available following the meeting. Your vote is important. We urge you to vote promptly, even if you plan to attend the annual meeting. Thank you for your continued support of Southern Company.  Thomas A. Fanning |

investor.southerncompany.com 3

Letter from the Independent Directors

Dear Fellow Stockholders:

As members of the Board of Directors, we want to thank you for your continued investment in Southern Company. As independent Directors, we strive to govern Southern Company in a prudent and transparent manner that helps the Company achieve long-term value for you, its stockholders. We proactively oversee business strategy, corporate governance and executive compensation, among other matters. We are pleased to share with you our progress on specific actions undertaken over the past year.

Oversight of Business Strategy

One of our Board’s key responsibilities is overseeing Southern Company’s strategy of maximizing long-term value to stockholders through a customer-, community- and relationship-focused business model anchored by our premier, state-regulated utilities in order to deliver strong and sustainable risk-adjusted returns over time. By focusing on our long-term outlook, we are best able to support our common goal of creating enduring value for customers, employees and stockholders alike.

At each Board meeting and during our strategy planning sessions, we contribute to management’s strategic plan by engaging senior leadership in robust discussions about overall strategy, business priorities and long-term risk and growth opportunities. In particular, in 2018, we focused considerable time on discussions about the construction of Plant Vogtle Units 3 and 4, strategic transactions, tax reform and the risks and opportunities of a low carbon future. Our Board has been and will continue to be committed to the oversight of long-term strategy for the enterprise.

Corporate Governance

In 2018, we continued our focus on Board governance, Board refreshment and Board succession planning. We have a nationally-recognized search firm engaged to assist our evergreen search for Board candidates with qualifications, attributes, skills and experiences aligned with our strategic imperatives that drive long-term value.

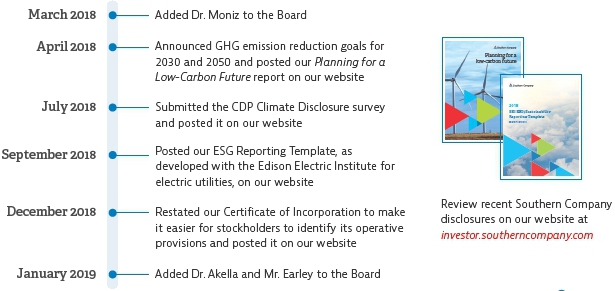

In December 2018, we elected two new independent Directors to our Board, Dr. Janaki Akella and Anthony F. Earley, Jr., effective January 2, 2019. We also had two directors retire in 2018. We remain committed to regular refreshment of our Board over the coming years.

Executive Compensation

Southern Company had an outstanding year in 2018, led by Thomas A. Fanning, the Chairman, President and Chief Executive Officer (CEO). In overseeing executive compensation, it is our responsibility to ensure that the CEO’s 2018 pay is aligned with financial performance and stockholder interests. Also in 2018, we worked to develop a new metric for the CEO’s compensation that is aligned with our greenhouse gas (GHG) emission reduction goals for 2030 and 2050. You can read about these decisions in the Compensation Discussion and Analysis that begins onpage 40.

Thank you for the trust you place in us. We value your support, and we encourage you to share your opinions, suggestions and concerns with us. You can do so by writing to us at Southern Company, 30 Ivan Allen Jr. Boulevard NW, Atlanta, Georgia 30308, Attention: Corporate Secretary. You can also send an email tocorpgov@southerncompany.com. The email address can also be accessed from the Corporate Governance webpage atinvestor.southerncompany.comunder the link entitled Governance Inquiries.

We are grateful for the opportunity to serve Southern Company on your behalf.

Sincerely,

|  |  |  |  | ||||

| Dr. Janaki Akella | Juanita Powell Baranco | Jon A. Boscia | Henry A. Clark III | Anthony F. Earley, Jr. | ||||

|  |  |  |  | ||||

| David J. Grain | Veronica M. Hagen | Donald M. James | John D. Johns | Dr. Dale E. Klein | ||||

|  |  |  |  | ||||

Dr. Ernest J. Moniz | William G. Smith, Jr. | Dr. Steven R. Specker | Larry D. Thompson | E. Jenner Wood III |

4 Southern Company2019 Proxy Statement

For more than a century, Southern Company has been building the future of energy. We deliver the energy resources and solutions our customers and communities need to drive growth and prosperity.

How we do our work is just as important as what we do. Our uncompromising values are key to our sustained success. They guide our behavior and ensure we put the needs of those we serve at the center of all we do.

At Southern Company, Our Values will guide us to make every decision, every day, in the right way.

| Safety First |  |

We believe the safety of our employees and customers is paramount. We aim to perform and maintain every job, every day, safely.

| ► | We demonstrate safety first by meeting and exceeding the requirements of applicable laws and regulations and continually improve by investing in research and cutting-edge safety technologies and processes. |

| ► | Our target is excellence, and to achieve this we pursue and sustain high standards, establish stretch goals, embrace benchmarking and aggressively identify and close gaps in performance. |

| Superior Performance |  |

We are dedicated to superior performance throughout our business.

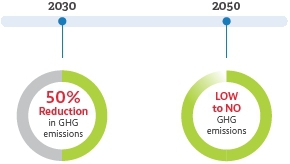

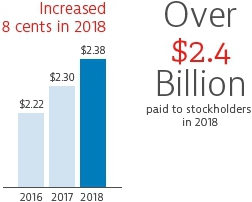

Financial Performance in 2018

| ► | Our adjusted EPS exceeded our guidance range for the year |

| ► | We increased our dividend for the 17th consecutive year, with dividend yield as of year-end 2018 at 5.4% |

| ► | Since 1948, quarterly dividends paid to stockholders have equaled or exceeded the previous quarter |

| * | For a reconciliation of adjusted EPS to EPS under generally accepted accounting principles (GAAP), seepage 93. |

investor.southerncompany.com 5

Our Values

Operational Performance in 2018

| ► | We ranked in the top quartile on the Customer Value Benchmark Survey and were recognized among the most highly rated utilities for customer satisfaction by J.D. Power. |

| ► | We produced top quartile generation availability performance. |

| ► | We continued our commitment to employee safety by concentrating efforts on safety processes, safety culture and risk reduction to prevent injuries. |

| ► | Our employees demonstrated their commitment to serving our communities during and after the multiple severe weather events experienced in 2018. |

| Unquestionable Trust |  |

Honesty, respect, fairness and integrity drive our behavior. We keep our promises, and ethical behavior is our standard.

|

| Our Code of Ethics can be reviewed at https://www.southerncompany.com/corporate-responsibility/committed-governance/values-and-ethics.html |

| ► | A Code of Ethics guides the behavior of all employees and Board members, and covers subjects including relationships, environmental compliance, financial integrity, competitive practices and other subjects which apply to all employees, officers and Board members of Southern Company |

| ► | A Concerns Program is a resource available to all Southern Company system employees and contractors to report any illegal or unethical behaviors by telephone or email |

| Total Commitment |  |

We are committed to the success of our employees, our customers, our stockholders and our communities. We fully embrace, respect, and value our differences and diversity.

| ► | We believe thatall our people should feel respected, valued, engaged and included. It's part of why we have been widely recognized as a best place to work, and why we have received several national awards for diversity. |

| ► | We support our ongoing success by engaging a workforce that reflects our service territory's changing population and sustaining a culture of excellence in which every employee is valued, respected, productive and engaged. |

| ► | We believe having an inclusive workplace that leverages the diversity of our people helps us achieve success in an ever-evolving energy landscape. |

6 Southern Company2019 Proxy Statement

Notice of Annual Meeting of Stockholders of Southern Company

|

Date and Time |

|

|

Place |

|

|

Record Date On or about April 5, 2019, these proxy materials and our annual report are being mailed or made available to stockholders. |

Items of Business Stockholders are being asked to vote on the four agenda items described below and to consider any other business properly brought before the 2019 annual meeting and any adjournment or postponement of the meeting. | |||

| 1 | Elect 15 Directors | ||

| 2 | Conduct an advisory vote to approve executive compensation, often referred to as a Say on Pay | ||

| 3 | Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2019 | ||

| 4 | Approve an amendment to the Certificate of Incorporation to reduce the supermajority vote requirement to a majority vote | ||

Every Vote is Important to Southern Company We have created an annual meeting website to make it easy to access our 2019 annual meeting materials. | |||

At the annual meeting website you can find an overview of the items to be voted, the proxy statement and the annual report to read online or to download, as well as a link to vote your shares. Even if you plan to attend the annual meeting in person, please vote as soon as possible by internet or by telephone or, if you received a paper copy of the proxy form by mail, by signing and returning the proxy form. |

|  |

|  |  | |||

| Internet 24/7 |

| Telephone 24/7 |

| Vote by Mail |

Vote by Internet or Telephone Voting by internet or by telephone is fast and convenient, and your vote is immediately confirmed and tabulated. By Order of the Board of Directors. April 5, 2019 | |||||

| Important Notice Regarding the Availability of Proxy Materials for the 2019 Annual Meeting of Stockholders to be held on May 22, 2019:The proxy statement and the annual report are available at investor.southerncompany.com. |

investor.southerncompany.com 7

Item 1 |  The Board recommends a vote FOReach nominee for Director | ||||

Election of 15 Directors | |||||

| ► | The Board, acting upon the recommendation of the Nominating, Governance and Corporate Responsibility Committee, has nominated 15 of the Directors currently serving for re-election to the Southern Company Board of Directors. | ||||

►Janaki Akella | ►Thomas A. Fanning | ►Ernest J. Moniz | |||

►Juanita Powell Baranco | ►David J. Grain | ►William G. Smith, Jr. | |||

►Jon A. Boscia | ►Donald M. James | ►Steven R. Specker | |||

►Henry A. Clark Ill | ►John D. Johns | ►Larry D. Thompson | |||

►Anthony F. Earley, Jr. | ►Dale E. Klein | ►E. Jenner Wood Ill | |||

| ► | Each nominee holds or has held senior executive positions, maintains the highest degree of integrity and ethical standards and complements the needs of the Company and the Board. | ||||

| ► | Through their positions, responsibilities, skills and perspectives, which span various industries and organizations, these nominees represent a Board of Directors that is diverse and possesses appropriate collective qualifications, skills, knowledge and experience. | ||||

Item 2 |  The Board recommends a vote FORthis proposal | ||

Advisory Vote to Approve Executive Compensation (Say on Pay) | |||

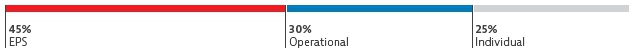

| ► | We believe our compensation program provides the appropriate mix of fixed and at-risk compensation. Our short- and long-term performance-based compensation program ties pay to Company performance, rewards achievement of financial and operational goals and relative total shareholder return (TSR), encourages individual performance that is in line with our long-term strategy, is aligned with stockholder interests and remains competitive with our industry peers. | ||

Item 3 |

|  The Board recommends a vote FORthis proposal | |

Ratify the Independent Registered Public Accounting Firm for 2019 | |||

| ► | The Audit Committee has appointed Deloitte & Touche as our independent registered public accounting firm for 2019. | ||

| ► | This appointment is being submitted to stockholders for ratification. | ||

Item 4 |

|  | |

Approve an Amendment to the Certificate of Incorporation to Reduce the Supermajority Vote Requirement to a Majority Vote | |||

| ► | A supermajority vote requirement like the one contained in Article Eleventh of the Restated Certificate of Incorporation (Certificate of Incorporation or Certificate) historically has been intended to facilitate corporate governance stability and provide protection against self-interested action by large stockholders by requiring broad stockholder consensus to make certain fundamental changes. | ||

| ► | As corporate governance standards have evolved, many stockholders and commentators now view a supermajority requirement as limiting the Board’s accountability to stockholders and the ability of stockholders to effectively participate in corporate governance. | ||

8 Southern Company2019 Proxy Statement

New and Noteworthy in our 2019 Proxy Statement | |

| ► | Read about our two new Directors onpages 13 and15 |

| ► | Read about how our governance practices are aligned with the Investor Stewardship Group Corporate Governance Principles onpage 35 |

| ► | Read about our recent stockholder engagement efforts starting onpage 36 |

| ► | Read about the new compensation metric for our CEO that is aligned with our GHG emission reduction goals for 2030 and 2050 onpage 48 |

investor.southerncompany.com 9

10 Southern Company2019 Proxy Statement

investor.southerncompany.com 11

Southern Company Board of Directors

Board of Directors Qualifications, Attributes, Skills and Experience

We believe effective oversight comes from a Board that represents a diverse range of experience and perspectives that provides the collective qualifications, attributes, skills and experience necessary for sound governance.The Nominating, Governance and Corporate Responsibility Committee establishes and regularly reviews with the Board the qualifications, attributes, skills and experience that it believes are desirable to be represented on the Board to ensure that they align with the Company’s long-term strategy.

We believe our Directors possess a range and depth of expertise and experience to effectively oversee the Company’s operations, risks and long-term strategy.The most important of these are described below.

Audit, Finance and Transactional Effective allocation of capital, including our major capital projects, is a key part of our long-term strategic success. We believe Directors with experience in finance, accounting, banking and risk management are critical to overseeing these matters. Directors with public company merger, acquisition and disposition experience are particularly important to the creation of stockholder value through the continued integration of the businesses we have acquired, the disposition of our former businesses and the consideration of potential future strategic opportunities. |  | |

CEO and Senior Executive Leadership |  | |

Corporate Governance and Service on Public Company Boards |  | |

Governmental Affairs, Regulation and Policy Directors with a deep understanding of, or experience with, the oversight of environmental policy, regulation, risk and business operation matters permit us successfully to navigate these areas and to provide safe, reliable and responsible operations. In addition, Directors with an in-depth understanding of the risks and opportunities for our Company in a low-carbon future provide valuable insights to our Board. |  | |

Relevant Industry Operations We continue to work to advance our country’s capability to generate nuclear power. To do this, we need Directors on our Board with deep knowledge and experience in the development, generation and regulation of nuclear energy. We acquired Southern Company Gas in 2016, and we continue to evaluate opportunities within the midstream through downstream business in the natural gas industry. We believe it is important to include Directors with natural gas industry and operations experience. |  | |

Major Projects |  | |

Security and Resiliency of Operations |  | |

Technology and New Economy |  |

12 Southern Company2019 Proxy Statement

Southern Company Board of Directors

Biographical Information about our Board of Directors

Age:58 Director since:2019 Board committees:Operations, Environmental and Safety; Business Security Subcommittee Other public company directorships:None | Janaki AkellaIndependent Digital Transformation Leader, Google LLC, multinational technology company specializing in internet-related products Director highlights Dr. Akella’s qualifications include electrical engineering, global business technology and data analytics analysis expertise. Her experience with technology market disruptions is particularly valuable to the Board as the Southern Company system continues to develop innovative business strategies. ►On December 11, 2018, we announced that the Board elected Dr. Akella as an independent Director, effective January 2, 2019. ►Dr. Akella serves as the Digital Transformation Leader of Google LLC, a position she has held since 2017. At Google, Dr. Akella addresses challenges and complex technical issues arising from new technologies and new business models. ►Prior to joining Google, Dr. Akella held a number of leadership positions during a 17-year career at McKinsey & Company where she most recently served as principal. She led and contributed to over 100 consulting engagements in North America, Europe, Asia and Latin America with multiple project teams and client executives. She began her career with Hewlett-Packard as a member of the system technology technical staff, engineer scientist and technical contributor. ►She previously served on the Board of the Guindy College of Engineering North American Alumni and is active in the Churchill Club. |

Age:70 Director since: 2006 Board committee:Audit Other public company directorships:None (formerly a Director of Cox Radio, Inc., John H. Harland Company and Georgia Power) | Juanita Powell BarancoIndependent Executive Vice President and Chief Operating Officer of Baranco Automotive Group, large retailer of new and used high-end automobiles Director highlights Ms. Baranco’s qualifications include senior leadership experience, governmental affairs knowledge and experience and risk management experience, as well as her operations experience as a successful business owner and operator. Her legal experience as a former assistant attorney general for the State of Georgia and her knowledge of our business from almost a decade of service on the Board of Directors of Georgia Power Company (Georgia Power or GPC) are also valuable to the Board. ►Ms. Baranco had a successful legal career, which included serving as Assistant Attorney General for the State of Georgia, before she cofounded the first Baranco automobile dealership in Atlanta in 1978. ►She served as a Director of Georgia Power, the largest subsidiary of the Company, from 1997 to 2006. During her tenure on the Georgia Power Board, she was a member of the Controls and Compliance, Diversity, Executive and Nuclear Operations Overview Committees. ►She served on the Federal Reserve Bank of Atlanta Board for a number of years and also on the Boards of Directors of John H. Harland Company and Cox Radio, Inc. ►An active leader in the Atlanta community, she serves on the Board of the Commerce Club, the Woodruff Arts Center and the Buckhead Coalition. She is past Chair of the Board of Regents for the University System of Georgia and past Board Chair for the Sickle Cell Foundation of Georgia, and she previously served on the Board of Trustees for Clark Atlanta University and on the Advisory Council for the Catholic Foundation of North Georgia. |

investor.southerncompany.com 13

Southern Company Board of Directors

Age:66 Director since:2007 Board committees:Nominating, Governance and Corporate Responsibility; Operations, Environmental and Safety Other public company directorships:None (formerly a Director of PHH Corporation, Sun Life Financial Inc., Armstrong World Industries, Lincoln Financial Group, Georgia Pacific Corporation and The Hershey Company) | Jon A. BosciaIndependent Founder and President, Boardroom Advisors, LLC (retired), board governance consulting firm Director highlights Mr. Boscia’s qualifications include senior leadership experience, financial expertise, corporate governance expertise, capital allocation knowledge and experience and risk management experience. As a former president and chief executive officer of large companies, he contributes important operations management and strategic planning perspectives. ►Mr. Boscia founded Boardroom Advisors, LLC in 2008. He served as President from 2008 until his retirement in February 2018. ►From September 2008 until March 2011, Mr. Boscia served as President of Sun Life Financial Inc. In this capacity, Mr. Boscia managed a portfolio of the company’s operations with ultimate responsibility for the United States, United Kingdom and Asia business groups and directed the global marketing and investment management functions. ►Previously, Mr. Boscia served as Chairman of the Board and Chief Executive Officer of Lincoln Financial Group, a diversified financial services organization, until his retirement in 2007. Mr. Boscia became the Chief Executive Officer of Lincoln Financial Group in 1998. During his time at Lincoln Financial Group, the company earned a reputation for its stellar performance in making major acquisitions. ►Mr. Boscia is a past member of the Board of PHH Corporation, where he was Chair of the Audit Committee and a member of the Regulatory Oversight Committee, past member of the Board of Sun Life Financial Inc., where he was a member of the Investment Oversight Committee and the Risk Review Committee, and past member of the Board of The Hershey Company, where he chaired the Corporate Governance Committee and served on the Executive Committee. ►In addition, Mr. Boscia has served in leadership positions on other public company Boards as well as not-for-profit and industry Boards. |

Age:69 Director since:2009 Board committee:Audit Other public company directorships:None | Henry A. “Hal” Clark IIIIndependent Senior Advisor of Evercore Inc. (retired), global independent investment advisory firm Director highlights Mr. Clark’s qualifications include finance and capital allocation knowledge and experience, risk management experience, mergers and acquisitions experience and investment advisory experience specific to the power and utilities industries, which are all valuable to the Board. The skills Mr. Clark developed with his extensive experience in capital markets transactions are particularly valuable to the Board as the Southern Company system continues to finance major capital projects. ►Mr. Clark was a Senior Advisor with Evercore Inc. (formerly Evercore Partners Inc.) from July 2009 until his retirement in December 2016. As a Senior Advisor, Mr. Clark was primarily focused on expanding advisory activities in North America with a particular focus on the power and utilities sectors. ►With more than 30 years of experience in the global financial and the utility industries, Mr. Clark brings a wealth of experience in finance and risk management to his role as a Director. ►Prior to joining Evercore, Mr. Clark was Group Chairman of Global Power and Utilities at Citigroup, Inc. from 2001 to 2009. ►His work experience includes numerous capital markets transactions of debt, equity, bank loans, convertible securities and securitization, as well as advice in connection with mergers and acquisitions. He also has served as policy advisor to numerous clients on capital structure, cost of capital, dividend strategies and various financing strategies. ►He has served as Chair of the Wall Street Advisory Group of the Edison Electric Institute. |

14 Southern Company2019 Proxy Statement

Southern Company Board of Directors

Age:69 Director since:2019 Board committees:Compensation and Management Succession; Operations, Environmental and Safety Other public company directorships:Ford Motor Company | Anthony F. “Tony” Earley, Jr.Independent Chairman, President and Chief Executive Officer, PG&E Corporation (retired), public utility holding company providing natural gas and electric services Director highlights Mr. Earley’s qualifications include senior leadership experience, energy industry expertise including regulation, nuclear generation, technology, environmental matters and major capital projects. His experience as the president and chief executive officer of energy companies and his involvement in electric industry-wide research and development programs are valuable to the Board. ►On December 11, 2018, we announced that the Board elected Mr. Earley as an independent Director, effective January 2, 2019. ►Mr. Earley served as Chairman, President and Chief Executive Officer of PG&E Corporation from 2011 until February 2017, when he became Executive Chairman. He served as Executive Chairman until his retirement from PG&E in December 2017. On January 29, 2019, PG&E Corporation and its subsidiary Pacific Gas and Electric Company filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code. ►Before joining PG&E Corporation, he served in several executive leadership roles during 17 years at DTE Energy, including Executive Chairman, President, Chief Executive Officer and Chief Operating Officer. He served in various executive roles at Long Island Lighting Company, including President and Chief Operating Officer. He was also a partner at the Hunton & Williams LLP law firm (now Hunton Andrews Kurth LLP) as a member of the energy and environmental team, where he participated in the licensing of both nuclear and non-nuclear generating plants and represented nuclear utilities in rulemaking actions before the U.S. Nuclear Regulatory Commission. ►Prior to beginning his lengthy career in the utility industry, Mr. Earley earned a degree in physics and served in the U.S. Navy as the chief engineer officer of the nuclear submarine,USS Hawkbill. ►Mr. Earley is a member of the Board of Directors of Ford Motor Company and serves on the Compensation (chairman), the Nominating and Governance and the Sustainability and Innovation Committees. ►He previously served on the executive committees of the Edison Electric Institute and the Nuclear Energy Institute and served on the Board of the Electric Power Research Institute. |

Age:62 Director since:2010 Board committee:None Other public company directorships:Vulcan Materials Company (formerly a Director of The St. Joe Company) | Thomas A. Fanning Chairman of the Board, President and Chief Executive Officer of the Company Director highlights Mr. Fanning’s qualifications include senior leadership experience, electric and natural gas industry knowledge and experience, nuclear and new technology experience, governmental affairs experience and financial expertise. His deep knowledge of the Company based on more than 30 years of service, as well as his civic participation on a local and national level, are valuable to the Board. ►Mr. Fanning has held numerous leadership positions across the Southern Company system during his more than 30 years with the Company. He served as Executive Vice President and Chief Operating Officer of the Company from 2008 to 2010, leading the Company’s generation and transmission, engineering and construction services, research and environmental affairs, system planning and competitive generation business units. He served as the Company’s Executive Vice President and Chief Financial Officer from 2003 to 2008, where he was responsible for the Company’s accounting, finance, tax, investor relations, treasury and risk management functions. In those roles, he also served as the chief risk officer and had responsibility for corporate strategy. ►He serves as the co-chair of the Electricity Subsector Coordinating Council, which serves as the principal liaison between the federal government and the electric power sector to protect the integrity of the national electric grid. ►Mr. Fanning is a Director of Vulcan Materials Company, serving as a member of the Audit Committee and the Compensation Committee. He served on the Board of Directors of the Federal Reserve Bank of Atlanta from 2012 to 2018 and is a past chairman. ►He also served on the Board of Directors for the St. Joe Company, a real estate developer and asset manager, from 2005 to 2011. |

investor.southerncompany.com 15

Southern Company Board of Directors

Age:56 Director since:2012 Board committees:Compensation and Management Succession; Finance (Chair) Other public company directorships:New Fortress Energy LLC | David J. GrainIndependent Chief Executive Officer and Managing Director, Grain Management, LLC (Grain Management), private equity firm specializing in the communications industry Director highlights Mr. Grain’s qualifications include capital allocation expertise, financial expertise, major capital projects knowledge and experience, technology innovations knowledge and experience and risk management experience. Mr. Grain’s extensive experience managing large and small businesses and raising and managing investor capital, particularly in a regulated industry, is also valuable to the Board. ►Mr. Grain is the founding member and managing director of Grain Management, a private equity firm focused on investments in the media and communications sectors, which he founded in 2006. With offices in Sarasota, Florida and Washington, D.C., the firm manages funds for a number of the country’s leading academic institutions, endowments and public pension funds. Grain Management also builds, owns and operates wireless infrastructure assets across North America. ►Mr. Grain also founded and was Chief Executive Officer of Grain Communications Group, Inc. ►Prior to founding Grain Management, he served as President of Global Signal, Inc., Senior Vice President of AT&T Broadband’s New England Region and Executive Director in the High Yield Finance Department at Morgan Stanley. ►Mr. Grain was appointed by President Obama in 2011 to the National Infrastructure Advisory Council. ►He previously served as Chairman of the Florida State Board of Administration Investment Advisory Council as an appointee of former Governor Charlie Crist, where he provided independent oversight of the state board's funds and major investment responsibilities, including investments for the Florida Retirement System programs. ►Mr. Grain is a Director of New Fortress Energy LLC, serving as a member of the Audit Committee. ►He is currently a member of the Advisory Board of the Amos Tuck School of Business Administration at Dartmouth College and serves on the Investment Committee of the United States Tennis Association. |

16 Southern Company2019 Proxy Statement

Southern Company Board of Directors

| Veronica M. HagenIndependent Chief Executive Officer, Polymer Group, Inc., now known as AVANTIV, Inc. (retired), global manufacturer of specialty materials Director highlights Ms. Hagen’s qualifications include senior leadership experience, corporate governance knowledge and experience, environmental matters experience and risk management experience. Ms. Hagen’s experience as the chief executive officer of two global companies allows her to contribute key valuable insights to the Board regarding operations management, customer service and strategic planning. ►From 2007 until her retirement in 2013, Ms. Hagen served as Chief Executive Officer of Polymer Group, Inc. and served from 2007 to 2015 as a Director. Ms. Hagen also served as President of Polymer Group, Inc. from January 2011 until her retirement in 2013. Polymer Group, Inc. is a leading producer and marketer of engineered materials. ►Prior to joining Polymer Group, Inc., Ms. Hagen was the President and Chief Executive Officer of Sappi Fine Paper, a division of Sappi Limited, the South African-based global leader in the pulp and paper industry, from November 2004 until 2007. ►She also served as Vice President and Chief Customer Officer at Alcoa Inc. and owned and operated Metal Sales Associates, a privately-held metal business. ►She serves on the Audit Committee, Compensation Committee and the Nominating/ Corporate Governance Committee of the Board of Directors of American Water Works Company, Inc. Ms. Hagen also serves as the Chair of the Leadership Development and Compensation Committee and a member of the Nominating and Governance Committee of the Board of Directors of Newmont Mining Corporation. She also serves on the Audit Committee of the Board of Directors of Stericycle, Inc. | |

Age:73 Director since:2008 Board committees: Compensation and Management Succession; Finance Other public company directorships:American Water Works Company, Inc., Newmont Mining Corporation and Stericycle, Inc. |

| Donald M. JamesIndependent Chairman of the Board and Chief Executive Officer of Vulcan Materials Company (retired), producer of aggregate and aggregate-based construction materials Director highlights Mr. James’ qualifications include senior leadership experience, corporate governance experience, financial expertise, legal experience, risk management experience and environmental matters experience. Mr. James brings important perspectives on management, operations and strategy from his experience as the former chief executive officer of a public company. ►Mr. James joined Vulcan Materials Company in 1992 as Senior Vice President and General Counsel and then became President of the Southern Division, then Senior Vice President of the Construction Materials Group and then President and Chief Executive Officer. Mr. James retired from his position as Chief Executive Officer of Vulcan Materials Company in July 2014 and Executive Chairman in January 2015. He retired in December 2015 as Chairman of the Board of Directors of Vulcan Materials Company. ►Prior to joining Vulcan Materials Company, Mr. James was a partner at the law firm of Bradley, Arant, Rose & White for 10 years. ►Mr. James serves on the Finance, the Governance and Nominating (Chair) and the Human Resources Committees of Wells Fargo & Company’s Board of Directors. ►Mr. James is a Trustee of Children’s of Alabama, where he serves on the Executive Committee and the Compensation Committee. | |

Age:70 Director since:1999 Board committees: Compensation and Management Succession; Finance Other public company directorships:Wells Fargo & Company (formerly a Director of Vulcan Materials Company and Protective Life Corporation) |

investor.southerncompany.com 17

Southern Company Board of Directors

| John D. JohnsIndependent Executive Chairman of Protective Life Corporation (Protective Life), provider of financial services through insurance and investment products Director highlights Mr. Johns’ qualifications include senior leadership experience, financial expertise, capital allocation experience and risk management experience. His legal experience as the former general counsel of a large energy public holding company that included natural gas operations and his prior service for over a decade on the Board of Directors of Alabama Power Company (Alabama Power or APC) are also of significant value to the Board. ► Mr. Johns served as Chairman and Chief Executive Officer of Protective Life from 2002 to 2017 and President from 2002 to January 2016. He joined Protective Life in 1993 as Executive Vice President and Chief Financial Officer. ► Before his tenure at Protective Life, Mr. Johns served as general counsel of Sonat, Inc., a diversified energy company. ► Prior to joining Sonat, Inc., Mr. Johns was a founding partner of the law firm Maynard, Cooper & Gale, P.C. ► He previously served on the Board of Directors of Alabama Power from 2004 to 2015. During his tenure on the Alabama Power Board, he was a member of the Nominating and Executive Committees. ► He is a member of the Board of Directors of Regions Financial Corporation, where he chairs the Risk Committee, and Genuine Parts Company, where he serves as Lead Independent Director and chairs the Compensation, Nominating and Governance Committee and the Executive Committee. ► Mr. Johns has served on the Executive Committee of the Financial Services Roundtable in Washington, D.C. and is a past chairman of the American Council of Life Insurers. ► Mr. Johns has served as the Chairman of the Business Council of Alabama, the Birmingham Business Alliance, the Greater Alabama Council, Boy Scouts of America and Innovation Depot, Alabama’s leading business and technology incubator. | |

Age: 67 Director since:2015 Board committees: Compensation and Management Succession (Chair); Finance Other public company directorships: Genuine Parts Company, Protective Life and Regions Financial Corporation (formerly a Director of Alabama Power) |

| Dale E. KleinIndependent Associate Vice Chancellor of Research of the University of Texas System and former Commissioner and Chairman, U.S. Nuclear Regulatory Commission, federal agency responsible for regulation of nuclear reactor materials and safety Director highlights Dr. Klein’s qualifications include nuclear energy research, regulation, technology and safety knowledge and experience, as well as experience in environmental matters and governmental affairs. His senior leadership experience demonstrated as the Chairman of the U.S. Nuclear Regulatory Commission is also important to the Board. ► Dr. Klein was Commissioner from 2009 to 2010 and Chairman from 2006 through 2009 of the U.S. Nuclear Regulatory Commission. He also served as Assistant to the Secretary of Defense for Nuclear, Chemical and Biological Defense Programs from 2001 through 2006. ► Dr. Klein has more than 40 years of experience in the nuclear energy industry. ► Dr. Klein began his career at the University of Texas in 1977 as a professor of mechanical engineering which included a focus on the university’s nuclear program. He spent 33 years in various teaching and leadership positions including Director of the nuclear engineering teaching laboratory, Associate Dean for research and administration in the College of Engineering and Vice Chancellor for special engineering programs. ► He serves on the Audit and Nuclear and Operating Committees of Pinnacle West Capital Corporation, an Arizona energy company, and is a member of the Board of Pinnacle West Capital Corporation’s principal subsidiary, Arizona Public Service Company. | |

Age: 71 Director since: 2010 Board committees: Compensation and Management Succession; Operations, Environmental and Safety; Business Security Subcommittee Other public company directorships: Pinnacle West Capital Corporation, Arizona Public Service Company |

18 Southern Company2019 Proxy Statement

Southern Company Board of Directors

Age:74 Director since:2018 Board committees:Nominating, Governance and Corporate Responsibility; Operations, Environmental and Safety; Business Security Subcommittee (Chair) Other public company directorships:None | Ernest J. MonizIndependent Cecil and Ida Green Professor of Physics and Engineering Systems Emeritus, Special Advisor to the President of Massachusetts Institute of Technology (MIT) and former U.S. Secretary of Energy Director highlights Dr. Moniz’s qualifications include senior leadership experience, energy industry experience, nuclear expertise and environmental matters knowledge. Having served as U.S. Secretary of Energy, Dr. Moniz brings key insights about energy regulation and policy and environmental matters. His current roles in academia and as the leader of non-profit energy industry organizations allow him to contribute up-to-date perspectives on clean energy, climate change and environmental matters. ►Dr. Moniz is an American nuclear physicist and former U.S. Secretary of Energy who served from May 2013 until January 2017. Dr. Moniz engaged regularly with issues related to energy regulation and policy, environmental regulation and policy and GHG emissions. ►He also serves as the President and Chief Executive Officer of The Energy Futures Initiative, Inc. (EFI) and Co-Chairman and Chief Executive Officer of the Nuclear Threat Initiative, positions he has held since June 2017. EFI is a non-profit organization providing analytically-based, unbiased policy options to advance a cleaner, safer, more affordable and more secure energy future. The Nuclear Threat Initiative is a non-profit, non-partisan organization working to protect lives, livelihoods and the environment from nuclear, biological, radiological, chemical and cyber dangers. ►Dr. Moniz’s involvement in national energy policy began in 1995, when he served as Associate Director for Science in the Office of Science and Technology Policy in the Executive Office of the President. ►He later oversaw the U.S. Department of Energy’s science, energy and security programs as Under Secretary from 1997 to 2001. ►He was a member of the President’s Council of Advisors on Science and Technology from 2009 to 2013 and received the Department of Defense Distinguished Public Service Award in 2016. ►Prior to his appointment as Secretary of Energy, he had a career spanning four decades at MIT, during which he was head of the MIT Department of Physics from 1991 to 1995 and in 1997, and was the Founding Director of the MIT Energy Initiative and Director of the Laboratory for Energy and the Environment. Since January 2017, Dr. Moniz has served as the Cecil and Ida Green Professor of Physics and Engineering Systems Emeritus and Special Advisor to the President of MIT. ►Dr. Moniz is also a non-resident Senior Fellow at the Harvard Belfer Center and the inaugural Distinguished Fellow of the Emerson Collective. ►Dr. Moniz served on the U.S. Department of Defense Threat Reduction Advisory Committee and the Blue Ribbon Commission on America’s Nuclear Future. He also is Chair of the Strategic Advisory Board of the Clean Energy Venture Fund, a member of the Council on Foreign Relations and a fellow of the American Association for the Advancement of Science, the American Academy of Arts and Sciences, the Humboldt Foundation and the American Physical Society. |

investor.southerncompany.com 19

Southern Company Board of Directors

Age:65 Director since:2006 Board committee:Audit (Chair) Other public company directorships:Capital City Bank Group, Inc. | William G. Smith, Jr.Independent Chairman of the Board, President and Chief Executive Officer of Capital City Bank Group, Inc., publicly-traded financial holding company providing a full range of banking services Director highlights Mr. Smith’s qualifications include senior leadership experience, finance and capital allocation expertise, risk management expertise and audit and financial reporting experience. Mr. Smith contributes valuable perspectives on management, operations and regulatory compliance from his experience as the chief executive officer of a public company in a highly-regulated industry. ►Mr. Smith began his career at Capital City Bank in 1978, where he worked in a number of positions of increasing responsibility before being elected President and Chief Executive Officer of Capital City Bank Group, Inc. in January 1989. He was elected Chairman of the Board of the Capital City Bank Group, Inc. in 2003. He is also the Chairman and Chief Executive Officer of Capital City Bank. ►He previously served on the Board of Directors of the Federal Reserve Bank of Atlanta. ►Mr. Smith is the former Federal Advisory Council Representative for the Sixth District of the Federal Reserve System and past Chair of Tallahassee Memorial HealthCare and the Tallahassee Area Chamber of Commerce. |

Age:73 Director since:2010 Board committees:Compensation and Management Succession; Operations, Environmental and Safety (Chair) Other public company directorships:None | Steven R. SpeckerLead Independent Director Chief Executive Officer, TAE Technologies, Inc. (retired), research and development company focused on creating new sources of clean energy Director highlights Dr. Specker’s qualifications include senior leadership, nuclear generation, regulation, technology and development of nuclear energy, environmental matters and major capital projects. His experience as the president and chief executive officer of a clean energy company and an electric industry-wide research and development program that spanned every aspect of generation, environmental protection, power delivery, retail use and power markets is valuable to our Board. ►Dr. Specker served as Chief Executive Officer of TAE Technologies Inc. from October 2016 until his retirement in 2018. TAE Technologies Inc. is an international private company focusing on clean fusion energy technology. ►Dr. Specker served as President and Chief Executive Officer of the Electric Power Research Institute (EPRI) from 2004 until 2010. EPRI provides thought leadership, industry expertise and collaborative value to help the electricity sector identify issues, technology gaps and broader needs that can be addressed through effective research and development programs. ►Prior to joining EPRI, Dr. Specker founded Specker Consulting, LLC, a private consulting firm, which provided operational and strategic planning services to technology companies serving the global electric power industry. ►Dr. Specker also served in a number of leadership positions during his 30-year career at General Electric Company (GE), including serving as President of GE’s nuclear energy business, President of GE digital energy and Vice President of global marketing. ►He is also a former member of the Boards of Trilliant Incorporated, a leading provider of Smart Grid communication solutions, and TAE Technologies, Inc. |

20 Southern Company2019 Proxy Statement

Southern Company Board of Directors

Age:73 Director since:2014 (previously served from 2010 to 2012) Board committees:Finance; Nominating, Governance and Corporate Responsibility (Chair) Other public company directorships:Franklin Templeton Series Mutual Funds, Graham Holdings Company (formerly a Director of Cbeyond, Inc.) | Larry D. Thompson Counsel at Finch McCranie, LLP (law firm) and former Executive Vice President, Government Affairs, General Counsel and Corporate Secretary, PepsiCo Inc., global consumer products company in the food and beverage industry Director highlights Mr. Thompson’s qualifications include senior leadership experience, corporate governance knowledge and experience, risk management experience and governmental affairs and regulatory compliance knowledge and experience. His legal skills developed as the former general counsel of a global consumer products public company, as well as his knowledge and experience from his service as a former U.S. Attorney and as a former U.S. Deputy General Counsel, are valuable to the Board. ►Mr. Thompson joined Finch McCranie, LLP as Counsel in 2015. Mr. Thompson has been on the faculty of The University of Georgia School of Law as the John A. Sibley Chair of Corporate and Business Law since 2011. He is currently on a leave of absence until 2020 while he serves as the Independent Corporate Compliance Monitor and Auditor for Volkswagen AG, a position for which he was appointed by the U.S. Department of Justice in 2017. ►From 2012 until his retirement in 2014, Mr. Thompson served as Executive Vice President, Government Affairs, General Counsel and Corporate Secretary for PepsiCo Inc., one of the world’s largest packaged food and beverage companies. From 2004 to 2011, he served as Senior Vice President of Government Affairs, General Counsel and Corporate Secretary of PepsiCo Inc. At PepsiCo Inc., Mr. Thompson was responsible for its worldwide legal function, its government affairs organization and its charitable foundation, where he served on the Board. ►His government career includes serving as Deputy Attorney General in the U.S.Department of Justice and leading the National Security Coordination Council. In 2002, President George W. Bush named Mr. Thompson to head the Department of Justice’s Corporate Fraud Task Force. ►Mr. Thompson is an Independent Trustee of various investment companies in the Franklin Templeton group of mutual funds and a Director and a member of the Compensation Committee of Graham Holdings Company (formerly The Washington Post Company). ►He also serves as an Advisory Director of the Georgia Justice Project. ►Mr. Thompson previously served as a Director of Cbeyond, Inc., a provider of technology and services to small and mid-sized companies, from 2010 to 2012. ►Mr. Thompson served as a Director of Southern Company from 2010 to 2012 and was a member of the Audit Committee. |

investor.southerncompany.com 21

Southern Company Board of Directors

Age:67 Director since:2012 Board committee:Audit Other public company directorships:Genuine Parts Company, Oxford Industries, Inc. (formerly a Director of Crawford & Company and Georgia Power) | E. Jenner Wood IIIIndependent Corporate Executive Vice President – Wholesale Banking, SunTrust Banks, Inc. (retired), publicly-traded company providing a full range of financial services Director highlights Mr. Wood’s qualifications include senior leadership experience, finance and banking knowledge and experience and risk management experience. From the knowledge and experience he gained from 10 years of service as a former member of the Board of Directors of Georgia Power, he contributes key perspectives on our operations and strategic imperatives. ►Mr. Wood served as Corporate Executive Vice President – Wholesale Banking of SunTrust Banks, Inc. from October 2015 until his retirement in December 2016. Prior to that, he served as Chairman and Chief Executive Officer of the Atlanta Division of SunTrust Bank from 2001 to 2015. He began his career with SunTrust Banks, Inc. in 1975 and advanced through various management positions including Chairman of the Board, President and Chief Executive Officer of the Georgia/North Florida Division and Chairman, President and Chief Executive Officer of SunTrust’s Central Group with responsibility over Georgia and Tennessee. ►He served as a member of the Board of Georgia Power from 2002 until May 2012. During his tenure on the Georgia Power Board, he served as a member of the Compensation, Executive and Finance Committees. He also served as a Director of Crawford & Company, a large independent claims company, from 1997 to 2013. ►Mr. Wood is a Director of Oxford Industries, Inc., where he serves as a member of the Executive Committee, and a Director of Genuine Parts Company, where he serves on the Audit Committee and the Compensation, Nominating and Governance Committee. ►He is active in numerous civic and community organizations, serving as the Chairman of the Metro Atlanta Chamber of Commerce and as a Vice Chairman of the Robert W.Woodruff Foundation, the Joseph B. Whitehead Foundation and the Lettie Pate Evans Foundation. Mr. Wood also serves as a Trustee of the Sartain Lanier Family Foundation, Camp-Younts Foundation and the Jesse Parker Williams Foundation. |

22 Southern Company2019 Proxy Statement

Corporate Governance at

Southern Company

Key Corporate Governance Practices

We seek to establish corporate governance standards and practices that create long-term value for our stockholders and positive influences on the governance of the Company. Our key corporate governance practices include:

| 22 | Annual election of Directors |

| 24 | All Board committees are comprised of independent Directors |

| 27 | Annual review of Board leadership structure |

| 28 | Strong Lead Independent Director with clearly defined powers |

| 28 | Independent Directors meet in executive session at each regular Board meeting |

| 29 | Annual Board and committee self-evaluations |

| 29 | Majority voting for Directors, with a Director resignation policy |

| 31 | 15 of 16 Directors are independent, with an average tenure of independent Directors of 6.2 years |

| 31 | Over 30% of our Directors are gender and ethnically diverse |

| 31 | Regular Board refreshment |

| 34 | Annual long-term and emergency management succession planning review |

| 34 | Proxy access bylaw provision |

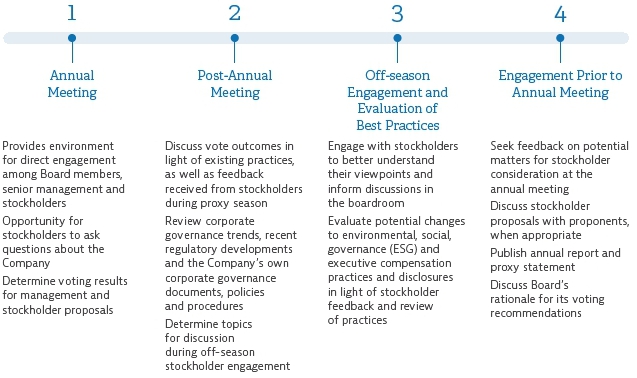

| 36 | Proactive year-round stockholder engagement |

| 59 | Clawback policy for incentive awards |

| 62 | Anti-hedging and anti-pledging provisions |

| 63 | Strong stock ownership guidelines |

| 10% threshold for stockholders to request a special meeting |

Recent Governance and Disclosure Highlights

We are committed to enhancing our governance practices each year. Recent governance and disclosure highlights include:

| ► | Continued our stockholder engagement efforts with significant focus on institutional investor and environmental stakeholder outreach |

| ► | Enhanced focus on evergreen Board refreshment and Board succession planning |

| ► | Since March 2018, have added three new Directors to the Board and, as of the annual meeting, will have had three Directors retire over the same period |

investor.southerncompany.com 23

Corporate Governance at Southern Company

Information relating to our corporate governance is available on our website atinvestor.southerncompany.comunder the link entitled Corporate Governance.

| ► | Board of Directors — Background and Experience |

| ► | Composition of Board Committees |

| ► | Board Committee Charters |

| ► | Corporate Governance Guidelines |

| ► | Link for on-line communication with Board of Directors |

| ► | Management Council — Background and Experience |

| ► | Executive Stock Ownership Requirements |

| ► | Code of Ethics |

| ► | Restated Certificate of Incorporation |

| ► | By-Laws |

| ► | Securities and Exchange Commission (SEC) Filings |

| ► | Policies and Practices for Political Spending and Lobbying-Related Activities |

| ► | Anti-Hedging and Anti-Pledging Provision |

These documents also may be obtained by requesting a copy from the Corporate Secretary, Southern Company, 30 Ivan Allen Jr. Boulevard NW, Atlanta, Georgia 30308.

Charters for each of the Board’s five standing committees can be found on our website atinvestor.southerncompany.comunder the link entitled Corporate Governance. All members of the Board’s standing committees are independent Directors.

Audit Committee

| Members | Meetings in 2018 | Attendance | Report |

William G. Smith, Jr.,Chair Juanita Powell Baranco Henry A. Clark III E. Jenner Wood III | 10 |  | |

The Audit Committee’s duties and responsibilities include the following: ►Oversee the Company’s financial reporting, audit process, internal controls and legal, regulatory and ethical compliance. ►Appoint the Company’s independent registered public accounting firm, approve its services and fees and establish and review the scope and timing of its audits. ►Review and discuss the Company’s financial statements with management, the internal auditors and the independent registered public accounting firm, including critical accounting policies and practices, material alternative financial treatments within GAAP, proposed adjustments, control recommendations, significant management judgments and accounting estimates, new accounting policies, changes in accounting principles, any disagreements with management and other material written communications between the internal auditors and/or the independent registered public accounting firm and management. ►Recommend the filing of the Company’s and its registrant subsidiaries’ annual financial statements with the SEC. The Board has determined that all members of the Audit Committee are independent as defined by the New York Stock Exchange (NYSE) corporate governance rules within its listing standards and rules of the SEC promulgated pursuant to the Sarbanes-Oxley Act of 2002. The Board has determined that all members of the Audit Committee are financially literate under NYSE corporate governance rules and that William G. Smith, Jr. qualifies as an audit committee financial expert as defined by the SEC. | |||

24 Southern Company2019 Proxy Statement

Corporate Governance at Southern Company

Compensation and Management Succession Committee

| Members | Meetings in 2018 | Attendance | Letter and Report |

John D. Johns, Chair Anthony F. Earley, Jr. David J. Grain Veronica M. Hagen Donald M. James Dale E. Klein Steven R. Specker | 10 |  | |

The Compensation and Management Succession Committee’s duties and responsibilities include the following: ►Evaluate the performance of the CEO at least annually, review the evaluation with the independent Directors of the Board and approve the compensation level of the CEO for ratification by the independent Directors of the Board based on this evaluation. ►Oversee the evaluation and review and approve the compensation level of the other executive officers. ►Review and approve compensation plans and programs, including performance-based compensation, equity-based compensation programs and perquisites. ►Review CEO and other management succession plans with the CEO and the full Board, including succession of the CEO in the event of an emergency. ►Review risks and associated risk management activities related to workforce issues. ►Review the assessment of risk associated with employee compensation policies and practices, particularly performance-based compensation, as they relate to risk management practices and/or risk-taking incentives. ►Review and discuss with management the Compensation Discussion and Analysis (CD&A). The Board has determined that all members of the Compensation and Management Succession Committee are independent as defined by the NYSE corporate governance rules within its listing standards. The Compensation and Management Succession Committee engaged Pay Governance LLC (Pay Governance) to provide an independent assessment of the current executive compensation program and any management-recommended changes to that program and to work with management to ensure that the executive compensation program is designed and administered consistent with the Compensation and Management Succession Committee’s requirements. Pay Governance also advises the Compensation and Management Succession Committee on executive compensation and related corporate governance trends. Pay Governance is engaged directly by the Compensation and Management Succession Committee and does not provide any services to management unless authorized to do so by the Compensation and Management Succession Committee. The Compensation and Management Succession Committee reviewed Pay Governance’s independence and determined that Pay Governance is independent and the engagement did not present any conflicts of interest. Pay Governance also determined that it was independent from management, which was confirmed in a written statement delivered to the Compensation and Management Succession Committee. | |||

investor.southerncompany.com 25

Corporate Governance at Southern Company

Finance Committee

| Members | Meetings in 2018 | Attendance | |

David J. Grain,Chair Veronica M. Hagen Donald M. James John D. Johns Larry D. Thompson | 7 |  | |

The Finance Committee’s duties and responsibilities include the following: ►Review the Company’s financial matters and recommend actions to the Board such as dividend philosophy and financial plan approval. ►Provide input regarding the Company’s financial plan and associated financial goals. ►Review the financial strategy of and the strategic deployment of capital by the Company. ►Provide input to the Compensation and Management Succession Committee on financial goals and metrics for the Company’s annual and long-term incentive compensation programs. The Board has determined that each member of the Finance Committee is independent. | |||

Nominating, Governance and Corporate Responsibility Committee

| Members | Meetings in 2018 | Attendance | |

Larry D. Thompson,Chair Jon A. Boscia Ernest J. Moniz | 7 |  | |

The Nominating, Governance and Corporate Responsibility Committee’s duties and responsibilities include the following: ►Recommend Board size and membership criteria and identify, evaluate and recommend Director candidates. ►Oversee and make recommendations regarding the composition of the Board and its committees. ►Review and make recommendations regarding total compensation for non-employee Directors. ►Periodically review and recommend updates to the Corporate Governance Guidelines and Board committee charters. ►Coordinate the performance evaluations of the Board and its committees. ►Oversee the Company’s practices and positions to advance its corporate citizenship, including environmental, sustainability and corporate social responsibility initiatives. ►Oversee the Company’s stockholder engagement program. The Board has determined that each member of the Nominating, Governance and Corporate Responsibility Committee is independent. | |||

26 Southern Company2019 Proxy Statement

Corporate Governance at Southern Company

Operations, Environmental and Safety Committee

| Members | Meetings in 2018 | Attendance | |

Steven R. Specker,Chair Janaki Akella Jon A. Boscia Anthony F. Earley, Jr. Dale E. Klein Ernest J. Moniz | 5 |  | |

The Operations, Environmental and Safety Committee’s duties and responsibilities include the following: ►Oversee information, activities and events relative to significant operations of the Southern Company system including nuclear and other power generation facilities, electric transmission and distribution, natural gas distribution and storage, fuel and information technology initiatives. ►Oversee significant environmental and safety regulation, policy and operational matters. ►Oversee the Southern Company system’s management of significant construction projects. ►Provide input to the Compensation and Management Succession Committee on the key operational goals and metrics for the annual short-term incentive compensation program. The Board has determined that each member of the Operations, Environmental and Safety Committee is independent. Business Security Subcommittee (Cyber and Physical Resiliency) In 2014, the Board established a Business Security Subcommittee of the Operations, Environmental and Safety Committee, currently comprised of Ernest J. Moniz, Chair, Janaki Akella and Dale E. Klein. The subcommittee held four meetings in 2018, and attendance was 100%. The Business Security Subcommittee’s responsibilities include the following: ►Oversee management’s efforts to establish and continuously improve enterprise-wide security policies, programs, standards and controls, including those related to cyber and physical security. ►Oversee management’s efforts to monitor significant security events and operational and compliance activities. | |||

Board and Governance Structure and Processes

Our Governance Guidelines allow the independent Directors flexibility to split or combine the Chairman and CEO responsibilities, and the independent Directors annually review our leadership structure to determine the structure that is in the best interest of Southern Company and its stockholders.

The Board continues to believe that its current leadership structure, which has a combined role of Chairman and CEO counterbalanced by a strong independent Board led by a Lead Independent Director and independent Directors chairing each of the Board committees, is most suitable for us at this time and is in the best interest of stockholders because it provides the optimal balance between independent oversight of management and unified leadership.

| ► | The combined role of Chairman and CEO is held by Tom Fanning, who is the Director most familiar with our business and industry, including the regulatory structure and other industry-specific matters, as well as being most capable of effectively identifying strategic priorities and leading discussion and execution of strategy. |

| ► | Independent Directors and management have different perspectives and roles in strategy development. The CEO brings Company-specific experience and expertise, while our independent Directors bring experience, oversight and expertise from outside the Company and its industry. |

| ► | The Board believes that the combined role of Chairman and CEO promotes the development and execution of our strategy and facilitates the flow of information between management and the Board, which is essential to effective corporate governance. |

investor.southerncompany.com 27

Corporate Governance at Southern Company

Role of the Lead Independent Director The Lead Independent Director is elected by the independent Directors of the Board. At the 2018 annual meeting, Dr. Specker was elected by the independent Directors to serve as Lead Independent Director effective May 23, 2018. The Lead Independent Director has the following key powers and responsibilities: ►Approving the agenda (with the ability to add agenda items) and schedule for Board meetings and information sent to the Board; ►Calling and chairing executive sessions of the non-management Directors; ►Chairing Board meetings in the absence of the Chairman; ►Meeting regularly with the Chairman; ►Acting as the principal liaison between the Chairman and the non-management Directors (although every Director has direct and complete access to the Chairman at any time); ►Serving as the primary contact Director for stockholders and other interested parties; and ►Communicating any sensitive issues to the Directors. |  Dr. Steven R. Specker  Our Board is committed to overseeing Southern Company’s long-term strategy on behalf of all stockholders.  |

Meetings of Non-Management Directors

Non-management Directors (our independent Directors) meet in executive session without any members of the Company’s management present at each regularly-scheduled Board meeting. These executive sessions promote an open discussion of matters in a manner that is independent of the Chairman and CEO. The Lead Independent Director chairs each of these executive sessions.

Meetings and Attendance

The Board met 14 times in 2018. Our Directors are engaged, as demonstrated by the average Director attendance at all applicable Board and committee meetings in 2018 of 94%.All of our Directors attended at least 75% of applicable meetings in 2018. All Director nominees are expected to attend the annual meeting of stockholders. All nominees for Director at the 2018 annual meeting attended the annual meeting in 2018. | Engaged Directors 2018 Board and Committee Meeting Attendance

|

Communicating with the Board

We encourage stockholders or interested parties to communicate directly with the Board, the independent Directors or the individual Directors, including the Lead Independent Director.

| ► | Communications may be sent to the Board as a whole, to the independent Directors or to specified Directors, including the Lead Independent Director, by regular mail or electronic mail. |

| ► | Regular mail should be sent to our principal executive offices, to the attention of the Corporate Secretary, Southern Company, 30 Ivan Allen Jr. Boulevard NW, Atlanta, Georgia 30308. |

| ► | Electronic mail should be directed tocorpgov@southerncompany.com. The electronic mail address also can be accessed from the Corporate Governance webpage located under Corporate Governance on our website atinvestor.southerncompany.com under the link entitled Governance Inquiries. |

With the exception of commercial solicitations, all communications directed to the Board or to specified Directors will be relayed to them.

28 Southern Company2019 Proxy Statement

Corporate Governance at Southern Company

Board and Committee Self-Evaluation Process

Our Board and each of its committees have a robust annual self-evaluation process. The Nominating, Governance and Corporate Responsibility Committee oversees the annual self-assessment process on behalf of the Board. To facilitate a robust self-evaluation process, the Board engaged the services of an independent third party to facilitate its annual self-assessment. The process involves an interview of each Director and a facilitated discussion with the full Board detailing the interviews and any follow up items. The objective is to allow the Directors to share their perspectives and consider necessary adjustments, if any, in response to the collective feedback.

| Board Governance Enhancements from Recent Self-Evaluation Process | |

| ► | Restructured meeting schedules to allow more time at many committee meetings throughout the year |

| ► | Evaluated Board materials to ensure an appropriate quantity of materials to facilitate a robust discussion |

| ► | Reviewed and updated agenda items to be considered at each meeting to use the Directors’ time more effectively |

Majority Voting for Directors and Director Resignation Policy

We have a majority vote standard for Director elections, which requires that a nominee for Director in an uncontested election receive a majority of the votes cast at a stockholder meeting in order to be elected to the Board. The Board believes that the majority vote standard in uncontested Director elections strengthens the Director nomination process and enhances Director accountability.

We also have a Director resignation policy, which requires any nominee for election as a Director to submit an irrevocable letter of resignation as a condition to being named as such nominee, which would be tendered in the event that nominee fails to receive the affirmative vote of a majority of the votes cast in an uncontested election at a meeting of stockholders. Such resignation would be considered by the Board, and the Board would be required to either accept or reject such resignation within 90 days from the certification of the election results.

investor.southerncompany.com 29

Corporate Governance at Southern Company

Director Independence Standards

No Director will be deemed to be independent unless the Board affirmatively determines that the Director has no material relationship with the Company directly or as an officer, stockholder or partner of an organization that has a relationship with the Company. The Board has adopted categorical guidelines which provide that a Director will not be deemed to be independent if within the preceding three years:

| ► | The Director was employed by the Company or the Director’s immediate family member was an executive officer of the Company. |

| ► | The Director has received, or the Director’s immediate family member has received, during any 12-month period, direct compensation from the Company of more than $120,000, other than Director and committee fees. (Compensation received by an immediate family member for service as a non-executive employee of the Company need not be considered.) |

| ► | The Director was affiliated with or employed by, or the Director’s immediate family member was affiliated with or employed in a professional capacity by, a present or former external auditor of the Company and personally worked on the Company’s audit. |

| ► | The Director was employed, or the Director’s immediate family member was employed, as an executive officer of a company where any of the Company’s present executive officers at the same time served on that company’s compensation committee. |