- SO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

The Southern Company (SO) DEF 14ADefinitive proxy

Filed: 15 Apr 22, 4:16pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

The Southern Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

| 2022 Notice of Annual Meeting of Stockholders & | Proxy Statement |

Southern Company is a holding company that conducts its business through its subsidiaries; accordingly, unless the context otherwise requires, references in this proxy statement to Southern Company’s operations, such as generating activities, GHG emissions and employment practices, refer to those operations conducted through its subsidiaries.

See Appendix A - Definitions of Key Terms on page 111 for many key terms and acronyms used in this proxy statement.

Our Mission

Building the future of energy

For more than a century, we’ve been providing clean, safe, reliable and affordable energy to the customers and communities we’re privileged to serve. Through industry-leading innovation and a commitment to a net-zero future, we’re delivering sustainable and resilient energy solutions that help to drive growth and prosperity.

Our Values

How we do our work is just as important as what we do. Our uncompromising values are key to our sustained success. They guide our behavior and ensure we put the needs of those we serve at the center of all we do.

At Southern Company, Our Values will guide us to make every decision, every day, in the right way.

| Safety First | We believe the safety of our employees and customers is paramount. We will perform and maintain every job, every day, safely. |

| Unquestionable Trust | Honesty, respect, fairness and integrity drive our behavior. We keep our promises, and ethical behavior is our standard. |

| Superior Performance | We are dedicated to superior performance throughout our business. We will continue our strong focus on innovative solutions, improving how we run our business and our commitment to environmental stewardship. |

| Total Commitment | We are committed to the success of our employees, our customers, our stockholders and our communities. We fully embrace, respect and value our differences and diversity. |

Our Code of Ethics

Our Code of Ethics defines our culture. It guides behavior and makes Our Values come to life every day. These ethical guidelines apply to all of us and remind us that how we do our jobs is just as important as what we do.

| ► | Learn more at www.southerncompany.com/about/governance/values-and-ethics.html |

New or notable in this proxy statement

| ► | Environmental and social highlights that are of interest to our investors and other stakeholders |

| ► | Extensive stakeholder engagement efforts that include independent Director participation and how we have responded to feedback |

| ► | Enhanced Board skills and Board diversity disclosures |

| ► | Board oversight of ESG |

| ► | Board oversight of cybersecurity |

| ► | Operational goals for annual incentive awards promote our sustainable business model and align with key ESG matters |

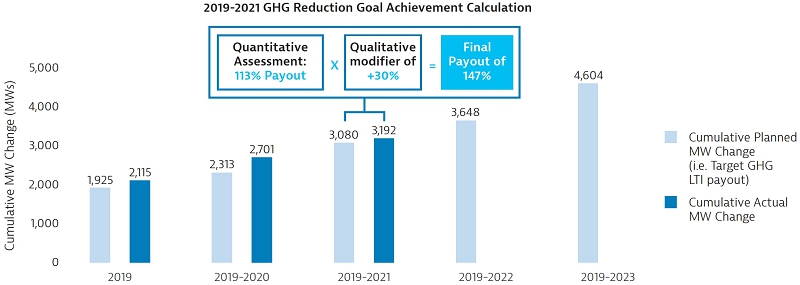

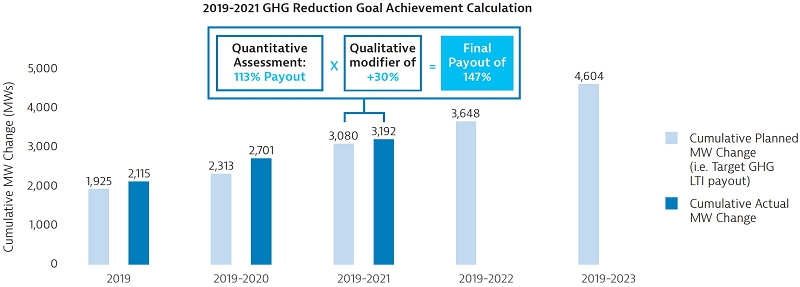

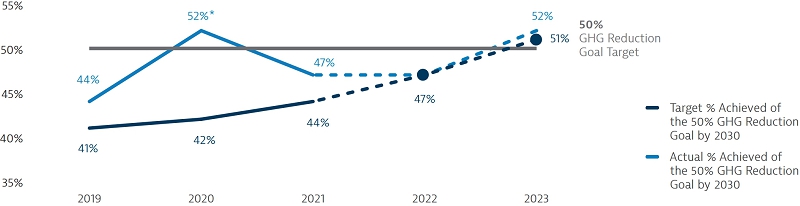

| ► | GHG reduction goal that is a component of the CEO’s long-term equity incentive compensation program |

1

Letter from our Chairman and Chief Executive Officer

Dear Fellow Stockholders:

You are invited to attend the Southern Company 2022 Annual Meeting of Stockholders at 10:00 a.m., ET, on Wednesday, May 25, 2022 at The Lodge Conference Center, Callaway Gardens, Pine Mountain, Georgia. We are pleased to welcome our stockholders back to an in-person annual meeting and look forward to discussing Southern Company’s 2021 performance. We will also webcast the meeting for those that are not able to attend in person.

2021 was an outstanding year for Southern Company. We benefited from strong customer growth, improving retail trends and continued investment in our state rate-regulated utilities.

Our businesses were not immune to lingering pandemic-related complications, inflationary pressures and a tight labor market. However, through innovation, strategic planning and effective execution, we were able to manage through the challenges.

With a solid financial outlook and premier, state-regulated electric and gas utility franchises that are industry leaders for operational performance and customer satisfaction, we believe we are well-positioned to continue that momentum.

Focus on Our Sustainable Business Strategy

Knowing that tomorrow’s needs are on today’s doorstep, Southern Company is aggressively working to bolster the sustainability of our business for the long term. We continue to make solid progress toward our net zero emissions goal by transforming our generation fleet, researching next-generation energy technologies and constructing the first new nuclear units to be built in the U.S. in more than three decades. As we make these transitions, we remain focused on maintaining a reliable and resilient system and striving for an equitable future for our employees, customers and communities we serve.

We continued to make meaningful progress at Plant Vogtle Units 3 and 4, and we are entering the final stages of testing for Unit 3. The project has continued to face challenges which have added to our project timelines and costs. Our priority is bringing these units online safely, after which they are expected to serve as reliable carbon-free energy resources for customers for the next 60 to 80 years.

Value and Develop Our People

Southern Company’s mission is to provide clean, safe, reliable and affordable energy to customers and communities. Our more than 27,000 employees work hard every day to deliver smart solutions anchored in remarkable service, resilience and safety.

In early 2022, we were recognized by Fortune magazine as one of the World’s Most Admired Companies. This recognition is a testament to the people across our enterprise who are making thousands of good decisions every day in alignment with our core values of Safety First, Unquestionable Trust, Superior Performance and Total Commitment.

In addition, Southern Company has been named the number two Best Large Employer in America by Forbes magazine. Of the 500 large employers included in the ranking, Southern Company was first among energy industry peers, first among Georgia-based companies and first in the entire Southeast. This recognition is especially significant because it was based directly on employee feedback.

These accolades are a tangible result of our commitment to value and develop our people, and our efforts to create a workplace where all groups are well-represented, included and treated fairly, and where everyone feels welcomed, valued and respected.

Excel at the Fundamentals

The foundation of our business remains strong. With performance characterized by outstanding fundamentals, high customer satisfaction, operational excellence and constructive regulatory relationships, our success is the direct result of an unwavering emphasis on the core values that have shaped our Company’s identity since its inception.

| 2 | Southern Company 2022 Proxy Statement |

Letter from our Chairman and Chief Executive Officer

At Southern Company, our vision is rooted in knowing energy provides an opportunity for people to live more comfortable and connected lives, fuels businesses that are shaping industries and creates possibilities for future generations. We put our vision in motion by placing our customers and communities at the center of everything we do. Understanding their needs and going out of our way to prepare them for what is ahead, our mission remains the same–provide clean, safe, reliable and affordable energy.

Our customer-focused business model continues to be the cornerstone for delivering value to customers and stockholders alike, and our management team is experienced and motivated, with a long track record of successfully executing on this time-tested model. We believe our Company is poised for continued success, both today and in the years ahead.

We hope you can join us at the annual meeting. A webcast of the annual meeting will be available at investor.southerncompany.com starting at 10:00 a.m., ET, on Wednesday, May 25, 2022. A replay will be available following the meeting.

Your vote is important. We urge you to vote as soon as possible by internet or by telephone or, if you received a paper copy of the proxy form by mail, by signing and returning the proxy form.

We are grateful for your continued support of Southern Company. It is a privilege to serve you.

|

Thomas A. Fanning Chairman, President and |

3

Letter from our Independent Directors

Dear Fellow Stockholders:

As independent Directors, we strive to govern Southern Company in a prudent and transparent manner with a commitment to sound governance principles. We thank you for the trust you place in us.

Oversight of Strategy

The energy industry is changing, driven by the advent of new technologies as well as the focus on decarbonization by customers, investors and other stakeholders. Southern Company’s objective is to develop business strategies that help customers and communities shift to a new energy economy.

One of our Board’s primary responsibilities is overseeing Southern Company’s strategy of maximizing long-term value to stockholders through a customer-focused business model that prioritizes the provision of clean, safe, reliable and affordable energy. At each Board meeting and during our regular strategy sessions, we contribute to management’s strategic plan by engaging senior leadership in robust discussions about overall strategy, business priorities, long-term risks and growth opportunities.

In 2021, the Company made significant progress toward its net zero by 2050 goal by announcing plans to retire or repower with natural gas a significant portion of the system’s coal generating facilities, pending regulatory approval. The Board continues to work closely with management on this meaningful shift, with focus given to capital allocation for replacement capacity and grid enhancements, community and employee impacts and advocacy for policies to help mitigate the transition burden on customers.

A key element of Southern Company’s decarbonization strategy is the construction of Plant Vogtle Units 3 and 4. Once complete, these units are expected to serve customers with carbon-free electricity for the next 60 to 80 years. While the

Company made significant progress on the units in 2021, it also faced challenges leading to additional delays and cost increases. We are focused on our oversight of the project.

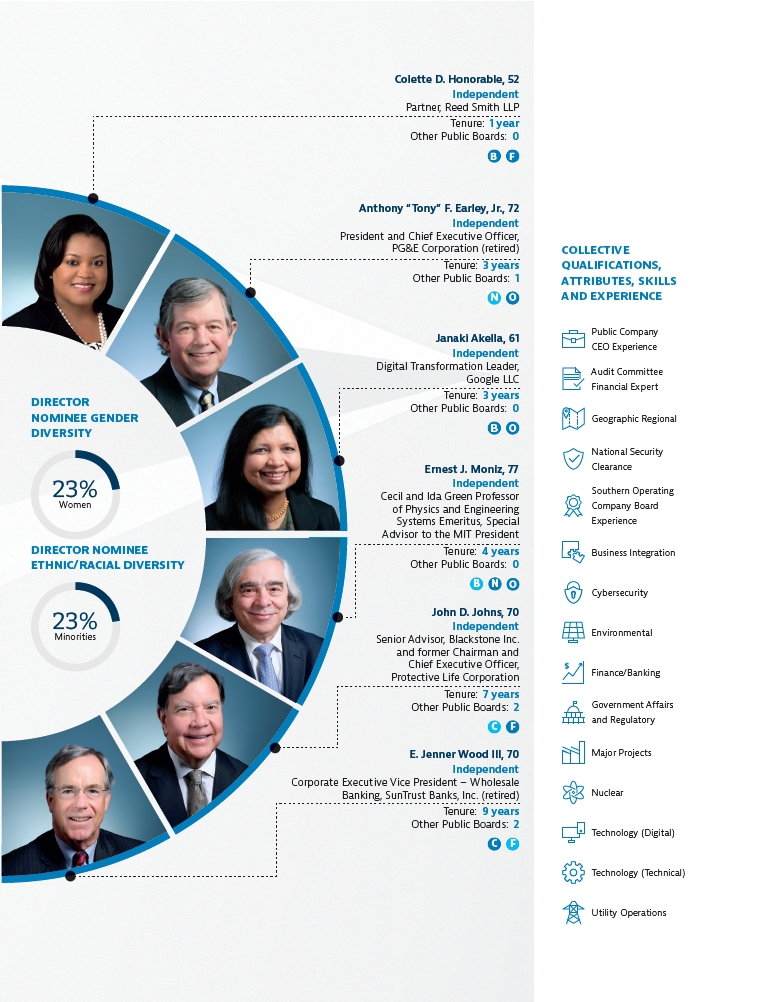

Board Composition and Governance

Board refreshment, Board diversity and meaningful Board succession planning are top of mind for our Board. Since March 2018, we have added five new independent Directors and six Directors have retired.

In 2021, we welcomed Kristine L. Svinicki to our Board. Ms. Svinicki brings nuclear, technology, energy policy, regulatory, cybersecurity and environmental experience and further strengthens our Board’s mix of skills, experiences and perspectives. Effective at the annual meeting, Juanita Powell Baranco will retire from the Board, and we thank her for her many years of dedicated service. The Board aims to further refresh its membership in the coming years, including a continued focus on diverse candidates, and has engaged a leading search firm to assist our evergreen search for Board candidates.

We fulfill our oversight responsibilities through our six standing committees and as a full Board. Each committee provides ongoing oversight for the most significant issues and risks designated to it, reports to the Board on its oversight activities and elevates review of key matters to the Board as appropriate. We continually assess committee structures and responsibilities to help ensure alignment with existing and emerging focus areas, including ESG, for our Company and industry. In this year’s proxy statement, we enhanced disclosure of the individual qualifications, skills, attributes and experience of our Directors to further demonstrate our efforts to maintain a fit-for-purpose Board.

| 4 | Southern Company 2022 Proxy Statement |

Letter from our Independent Directors

Diversity, Equity and Inclusion

We recognize that Southern Company’s talent is one of its greatest strengths, and the Company has a strong track record of employee engagement and retention. Workforce sustainability topics, including DE&I, are regularly discussed by the Board and its committees. As we think longer-term, we believe that a diverse, equitable and inclusive corporate culture brings broader perspectives, greater innovation, richer thinking and wider cultural bandwidth.

We also recognize the importance of racial equity and inclusion within the communities Southern Company serves. At a time of transformation in our industry, we believe that companies with a clear sense of purpose combined with a culture that embraces change, engages in healthy debate and encourages innovation will be the most adaptable.

Stakeholder Engagement

We maintain our focus on understanding and responding to the viewpoints of our investors and other stakeholders. We support management’s efforts to engage with a broad set of stakeholders and its recent enhancements to the Company’s ESG disclosures in response to stakeholder interest. On behalf of the Board, independent Directors also remain committed to direct engagement with our largest stockholders. In 2021 and early 2022, independent Directors directly engaged (without the CEO present) with stockholders representing over 25% of our outstanding shares.

Thank you for the trust you place in us. By helping management address near-term priorities and challenges while maintaining a long-term outlook, we are best able to support our common goal of creating enduring long-term value for customers, employees and stockholders alike. We are grateful for the opportunity to serve Southern Company on your behalf.

|  |  |  |  |

| Dr. Janaki Akella | Juanita Powell Baranco | Henry A. Clark III | Anthony F. Earley, Jr. | David J. Grain |

|  |  |  |  |

| Colette D. Honorable | Donald M. James | John D. Johns | Dr. Dale E. Klein | Dr. Ernest J. Moniz |

|  |  | ||

| William G. Smith, Jr. | Kristine L. Svinicki | E. Jenner Wood III |

5

Notice of Annual Meeting of Stockholders of Southern Company

| DATE AND TIME Wednesday, May 25, 2022 10:00 a.m., ET | Items of Business Stockholders are being asked to vote on the agenda items described below and to consider any other business properly brought before the 2022 annual meeting and any adjournment or postponement of the meeting. 1 Elect 13 Directors 2 Conduct an advisory vote to approve executive compensation, often referred to as a Say on Pay 3 Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2022 4 Consider a stockholder proposal, if properly presented at the meeting |

| PLACE | |

| RECORD DATE On April 15, 2022, these proxy materials and our annual report are being mailed or made available to stockholders. | |

| ||

Every Vote is Important to Southern Company

We have created an annual meeting website at southerncompanyannualmeeting.com to make it easy to access our 2022 annual meeting materials. At the annual meeting website, you can find an overview of the items to be voted, the proxy statement and the annual report to read online or to download, as well as a link to vote your shares.

Even if you plan to attend the annual meeting and vote in person, please vote as soon as possible by internet or by telephone or, if you received a paper copy of the proxy form by mail, by signing and returning the proxy form.

|  |

VOTE BY MAIL If you received a paper copy of the proxy form by mail, you can mark, sign, date and return the proxy form in the enclosed, postage-paid envelope. | VOTE BY INTERNET OR TELEPHONE Voting by internet or by telephone is fast and convenient, and your vote is immediately confirmed and tabulated. Internet www.proxyvote.com (24/7) Telephone 1-800-690-6903 (24/7) |

By Order of the Board of Directors

April 15, 2022

Important Notice Regarding the Availability of Proxy Materials for the 2022 Annual Meeting of Stockholders to be held on May 25, 2022: The proxy statement and the annual report are available at investor.southerncompany.com.

| 6 | Southern Company 2022 Proxy Statement |

We are one of America’s premier energy companies, with approximately 43,000 megawatts (MW) of electric generating capacity and 1,500 billion cubic feet of combined natural gas consumption and throughput volume serving 9 million customers through our subsidiaries, a competitive generation company serving wholesale customers across America and a nationally recognized provider of customized energy solutions, as well as fiber optics and wireless communications.

43,000 MW

of generating capacity

Capabilities in

50 States

9 Million

customers

More than

27,000

employees

7

electric & natural gas utilities

| Major Subsidiaries | ||

1.5 million electric utility customers |

2.7 million electric utility customers |

191,000 electric utility customers |

12,400 MW of wholesale solar, wind, natural gas and clean alternative technology provider in 14 states |

A national leader in distributed infrastructure technologies doing business nationwide |

An innovative leader among the nation’s nuclear energy industry |

Wireless communications service |

4.3 million natural gas distribution customers across four state-regulated, wholesale and retail energy businesses and gas storage facilities in the U.S. | |

| ► Atlanta Gas Light (GA) | ► Nicor Gas (IL) | |

| ► Chattanooga Gas (TN) | ► Virginia Natural Gas (VA) | |

See the inside back cover of this proxy statement for a map of our service territories.

We are one of America’s premier energy companies, delivering clean, safe, reliable and affordable energy to our electric and natural gas customers through our state regulated utilities. Our strategy is to maximize long-term value to stockholders through a customer-, community- and relationship-focused business model that is designed to produce sustainable levels of return on energy infrastructure.

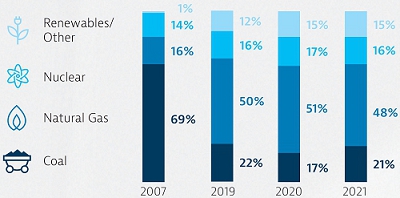

| Our Decarbonization Efforts | |

Southern Company is committed to providing clean, safe, reliable and affordable energy, with a focus on reducing GHG emissions. Since 2007, coal-generated energy as a percentage of our energy mix has declined from 69% to 21%, and energy generated from carbon-free sources has more than doubled from 15% to 31%.

ANNUAL ENERGY MIX

| ► | Annual energy mix represents all of the energy the Southern Company system uses to serve its retail and wholesale customers during the year. It is not meant to represent delivered energy mix to any particular retail customer or class of customers. Annual energy mix percentages include non-affiliate power purchase agreements. |

| ► | Renewables/Other category includes wind, solar, hydro, biomass and landfill gas. |

| ► | With respect to certain renewable generation and associated renewable energy credits (RECs), to the extent an affiliate of Southern has the right to the RECs associated with renewable energy it generates or purchases, it retains the right to sell the energy and RECs, either bundled or separately, to retail customers and third parties. |

| ► | Electric demand in 2020 was reduced by COVID-19 impacts and mild weather. Low natural gas prices in 2020 gave the natural gas generating fleet favorable economics relative to most coal units, displacing additional coal generation. |

7

Our goal is to deliver long-term value to stockholders with appropriate risk-adjusted TSR. During 2021, retail sales recovered to pre-pandemic levels, Georgia Power made meaningful progress at Plant Vogtle Units 3 and 4, we notified state environmental agencies of our intention to retire a number of coal generation units and we executed our financial plan. Underpinning these successes is our commitment to excel at the fundamentals, which includes prioritizing customer service and focusing on the well-being of our employees.

| |

Delivered Strong Financial Results and Created Value for Stockholders

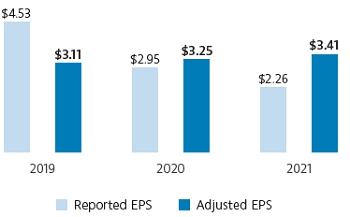

| ► | We reported adjusted EPS above the top end of our guidance range for 2021. Weather-normalized retail sales recovered to 2019 pre-pandemic levels, commensurate with economic recovery from the COVID-19 pandemic in our service territories. In addition, we experienced strong customer growth bolstered by in-migration into the Southeast and we achieved constructive regulatory outcomes. |

| ► | We increased our dividend for the 20th consecutive year, with a dividend yield as of year-end 2021 at 3.8%. |

| ► | We continued to focus on our regulated businesses by divesting of non-core assets such as Sequent Energy and terminating investment in new pipeline construction. |

| ► | We effectively executed our capital plan and maintained discipline around our credit metrics. |

| EARNINGS PER SHARE ($) | DIVIDENDS PAID PER SHARE ($) | |

|  |

For a reconciliation of adjusted EPS to EPS under GAAP, see page 108.

Demonstrated Progress Toward our Net Zero by 2050 Goal

Our strategy includes the continued development of a diverse portfolio of energy resources to serve customers and communities reliably and affordably with a focus on reducing GHG emissions.

| ► | The work of planning, transitioning and operating our system to meet our decarbonization goals will require continued active and constructive engagement with government officials, investors and a wide variety of other public and private stakeholders. Our success will require the support of policies that encourage and advance innovation while protecting the reliability, resiliency and affordability of the service we provide to our customers. |

| ► | We made significant progress toward our interim goal to reduce GHG emissions by 50% from 2007 levels by 2030, as we move forward to our long-term goal of net zero by 2050. We reported that 2021 emissions were 47% below 2007 levels, and we expect to consistently achieve GHG reductions of greater than 50% as early as 2025, a full five years earlier than our interim goal. |

| ► | In 2021, we indicated our intent to retire or repower with natural gas a significant portion of our remaining coal generating fleet. Pending regulatory approval, we expect to have only eight coal units remaining by the end of 2028, down from 66 in 2007, with further reductions expected by 2035. |

| ► | We added 1,100 MW of renewable generation and energy storage in 2021, including projects at our regulated subsidiaries and Southern Power. |

| ► | We continue to enhance our reporting on ESG topics, including climate-related disclosure aligned with the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations. We currently report all material Scope 1 and 2 emissions and have engaged an independent auditor to provide third-party verification for the years 2020 and 2021. We also continue to assess and expand Scope 3 reporting, including working with a consultant to better understand our upstream and downstream emissions from natural gas. |

| 8 | Southern Company 2022 Proxy Statement |

Our 2021 Performance

| |

Excelled at the Fundamentals

| ► | Our operating subsidiaries continued to rank in the top quartile on the Customer Value Benchmark Survey and were recognized among the most highly rated utilities for customer satisfaction by J.D. Power. |

| ► | We remained focused on the reliability of our system and exceeded our targets for electricity generation, power delivery and gas pipelines. |

| ► | We sustained outstanding operational performance throughout the year, with rapid service restoration following Winter Storm Uri. Mississippi Power’s storm team of approximately 1,000 linemen, engineers and support personnel safely and quickly restored power to its customers, with assistance from our Georgia Power and Alabama Power utilities. Our PowerSecure subsidiary, a leading developer, installer and operator of microgrids in the U.S., delivered 97.7% run-time reliability to its customers throughout Texas and the Southwest (including hospitals, nursing homes, military installations, data centers, municipalities and large industrial and retail customers). |

| ► | We continued to enhance our cyber and physical security programs and operational resiliency through targeted technological deployments and all-hazards planning and testing. |

| ► | We continued our long-term commitment to employee safety by concentrating efforts on safety processes, safety culture and risk reduction to prevent injuries. These programs resulted in a reduction to serious injuries and the best safety performance in our history. There were only 16 serious injuries during 2021 for our over 27,000 employees. |

| |

Continued Progress at Georgia Power’s Plant Vogtle Units 3 and 4 Construction Project

| ► | Our priority remains bringing Vogtle Units 3 and 4 safely online to provide Georgia with a reliable carbon-free energy resource for the next 60-80 years. We are committed to taking the time to “get it right” and will not sacrifice safety or quality to meet a schedule. |

| ► | Major milestones were achieved during 2021, despite challenges at the site that led to schedule extensions. |

| ► | We successfully completed Hot Functional Testing for Unit 3, which marked the last major milestone before Fuel Load and represents a significant step towards placing Unit 3 in service. Direct construction of Unit 3 is 99% complete as of January 31, 2022. At Unit 4, we completed the Integrated Flush process, achieved Initial Energization and began Open Vessel Testing. Direct construction on Unit 4 is 92% complete as of January 31, 2022. |

| ► | Related to construction and productivity challenges, Georgia Power’s share of the total project capital cost forecast rose by $1.7 billion. |

| |

Emphasized Employee Well-Being

| ► | Our employees continued to feel the impact of the COVID-19 pandemic throughout 2021. Whether in the field or office, at home or in a hybrid posture, our employees delivered the highest level of customer service, despite significant winter and summer spikes in COVID-19 infection rates in our communities. We continued to dedicate significant resources, both directly and through our benefit plans, to help ensure the physical, financial, and emotional well-being of our workforce. |

| ► | We enhanced training and workforce development opportunities to support employees at all levels and foster retention in an increasingly competitive landscape. |

| ► | In 2021, we increased our efforts to recruit and develop diverse talent, with the goal of enhancing our ability to serve the diverse communities in our footprint. As part of our Moving to Equity framework, we instituted new system wide measures designed to prevent bias in recruiting and hiring practices. |

Our TSR outperformed the Philadelphia Utility Index and the Dow Jones Industrial Average for the three-year period ended December 31, 2021. During 2021, we continued to deliver positive stockholder returns, and we have reliably demonstrated strong TSR performance over the long-term 25-year period, exceeding the other indices.

TOTAL SHAREHOLDER RETURN (ANNUALIZED)

| 1-Year | 3-Year | 5-Year | 25-Year | |||||

| Southern Company | 16.37% | 21.07% | 11.83% | 11.84% | ||||

| Philadelphia Utility Index | 18.24% | 15.44% | 12.45% | 9.64% | ||||

| S&P 500 Index | 28.68% | 26.03% | 18.44% | 9.75% | ||||

| Dow Jones Industrial Average | 20.95% | 18.47% | 15.50% | 9.63% | ||||

| Source: Bloomberg using quarterly compounding as of December 31, 2021. | ||||||||

9

Our Environmental and Social Highlights

Our GHG Reduction Goals

We have set an interim goal to reduce system-wide GHG emissions by 50% by 2030 (from 2007 levels) and a long-term goal of net zero emissions by 2050. In 2021, we achieved a 47% reduction in GHG emissions relative to 2007 levels. We expect to sustainably reach our 50% reduction goal as early as 2025.

We believe our path to net zero will be achieved through:

| ► | Continued coal transition | ► | Negative carbon solutions |

| ► | Utilization of natural gas to enable fleet transition | ► | Enhanced energy efficiency initiatives |

| ► | Further growth in portfolio of zero-carbon resources | ► | Continued investment in R&D focused on clean energy technologies |

During 2021, we indicated our intent to repower or retire a significant portion of our remaining coal generating fleet. By the end of 2028, pending regulatory approval, we expect to have eight coal units remaining, down from 66 in 2007, with further reductions anticipated by 2035.

| Our Progress | Our Goals | ||

|  |  |  |

| 2007 | 2021 | 2030 | 2050 |

| GHG Emissions | 47% | 50% | Net Zero |

| Baseline | Reduction | Reduction | GHG Emissions |

Protecting our Workforce

Over the past two years, our nation faced a global health pandemic, an economic downturn and social and political unrest. These events placed mental, physical and financial burdens on many of our employees. We faced each issue head-on and established a robust communication pipeline that kept employees informed and updated about issues facing the Company and the community.

| ► | In response to the unprecedented pandemic, we developed a COVID-19 Working Safely Playbook for Southern Company subsidiaries that was ultimately leveraged and deployed by several peer utilities. We continue to update this reference as we have learned more information about COVID-19 and how our workforce will coexist with it for the foreseeable future. Key elements included extensive CDC- and OSHA-compliant safety programs at our operational sites, coverage of all COVID-19 testing through our benefit plans, emotional and physical well-being toolkit and tips on maintaining an inclusive workplace while working from home. |

| ► | We continued to leverage our existing innovative and comprehensive benefit programs and technologies for quick and easy remote access to physical, mental and financial help. |

| ► | Throughout the year, we held regular town hall meetings that were led by the CEOs of our operating subsidiaries to facilitate ongoing and transparent communication with our employees. These town hall meetings often provided employees an opportunity to engage directly with leadership in Q&A sessions. |

| ► | We helped ensure that leaders and our workforce were equipped to make the most of hybrid work settings through customized resources including training for managers and individual contributors that cover topics such as performance management, team building, and communication. |

| ► | Through our enterprise-wide Voice of the Employee engagement survey, we continued to monitor employee engagement and sentiment, which remains stable compared to pre-pandemic surveys and above external benchmarks. |

| 10 | Southern Company 2022 Proxy Statement |

Our Environmental and Social Highlights

We are a Citizen Wherever We Serve

We are committed to supporting and improving our communities while conducting business with honesty, integrity and fairness. Our commitments to safety, outreach and engagement allowed us to quickly respond to needs in our communities arising from the pandemic.

| ► | Our operating companies worked closely with customers offering special payment plans for those with past-due account balances and delaying disconnects. |

| ► | We implemented health protocols that helped our field employees protect themselves, our customers and communities while continuing to provide essential electric and gas services and maintain reliability. |

Our Commitment to Equity

In 2021, we strengthened our holistic approach to diversity, equity and inclusion and focused on building a healthy and diverse culture. We are proud of our ongoing commitment to foster racial and social justice in the communities we serve. We are committed to be a role model among companies forging change.

Following events in 2020 and 2021 highlighting racial and social injustice in our society, we have developed our Moving to Equity framework, posted on our website, which confirms our collective commitment to diversity, equity and inclusion. Key efforts include:

| ► | Talent: Committing to a diverse, equitable and inclusive workplace to better serve our customers and communities; increase and improve outreach, recruitment, hiring and retention of diverse groups at all levels of the workforce; help ensure equity in leadership development programs; and seek diverse candidate slates for all positions, including management roles |

| ► | Work Environment: Committing to promote an actively anti-racist culture and to help ensure that all groups, and especially historically underrepresented and marginalized groups, are well-represented, included and fairly treated within all levels of the organization and that everyone feels welcomed, valued and respected |

| ► | Community Investment and Social Justice: Committing $225 million through 2025 to advance racial equity and social justice in our communities with a focus on criminal justice, economic empowerment and the advancement of educational equality and energy justice |

| ► | Political Engagement: Advocating for racial equity through our political engagement, policy positions and ongoing public dialogues |

| ► | Supplier Diversity: Aiming to increase our minority business enterprise spend to 20% and total diverse spend to 30% by 2025 and committing to developing and doing business with more Black-owned businesses in our industry and communities |

$1.5 billion

in diverse spend

We spend approximately $1.5 billion annually with diverse suppliers, representing approximately 25% of sourceable procurement spend.

>$110 million

in total giving for 2021

We make direct corporate contributions and endow and fund independent, non-profit company foundations that contribute to arts and culture, health and human services, civic and community projects, safety, education and the environment. Included in our total for 2021 was $66 million for social justice-related initiatives.

200,000

volunteer hours

In an average year, our retirees and employees dedicate approximately 200,000 hours of volunteer service to improve the communities we serve.

Our recently published 2021 Transformation Report chronicles the progress we are making through our Moving to Equity framework.

11

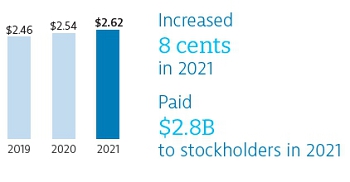

Our Environmental and Social Highlights

Our Commitment to Transparency

We recognize the value our investors and stakeholders place on transparency. Over the past year, we enhanced a number of ESG disclosures that are important to our stakeholders. Our website includes disclosure aligned to TCFD, the standards of the Sustainability Accounting Standards Board (SASB) and the Edison Electric Institute ESG/Sustainability Reporting Template. During 2021, we also began disclosing aggregated workforce representation data from our EEO-1 reports and have committed to update the disclosure annually. In early 2022, we enhanced our transparency around political engagement and expenditures.

In March 2022, we launched an enhanced Sustainability section on our website highlighting our ongoing efforts across our core sustainability priorities: Net Zero and Environmental Priorities; Reliability, Resilience and Affordability; Innovation; Workforce Sustainability; Diversity, Equity and Inclusion; and Community Relationships.

We actively review reports and ratings issued by ESG data providers and identify disclosures that can inform their analyses. As a result of these efforts, we have seen an increase in our ratings over the past few years.

| ► | We received an A rating from MSCI. |

| ► | We earned a score of A- from the CDP Climate Change Disclosure for our environmental transparency and leadership within the North America region and thermal power generation sector. This represents a significant improvement since we restarted reporting to CDP in 2018. Additionally, we are one of only 12 companies in our sector worldwide to have attained a score of A- in 2021. No companies within our sector attained an A score. |

We continue to engage with our investors and stakeholders to focus on providing meaningful and transparent disclosures.

Our Sustainable Financing Framework

In January 2021, we became the first large cap utility in the U.S. to publish a Sustainable Financing Framework, and across 2021 our subsidiaries issued or priced Green, Social and Sustainable bonds totaling $1.85 billion in principal amount. This framework highlights Southern’s ongoing commitment to a wide range of sustainability and social issues and should allow us to leverage our work in these areas to help optimize our balance sheet and benefit customers.

| ► | In January 2021, Southern Power issued a $400 million green bond with net proceeds allocated to fund development of its robust renewable energy portfolio. |

| ► | In February 2021, Georgia Power issued a $750 million sustainability bond, the first for a U.S. domestic utility. With net proceeds allocated to fund sustainable projects such as spending with diverse and small business suppliers and investments in renewable energy projects, the bond aligns with our ongoing commitments to the community and the continued growth of Georgia Power’s solar portfolio, one of the largest voluntary renewable portfolios in the country. |

| ► | In June 2021, Mississippi Power issued a $325 million sustainability bond with net proceeds to be allocated to fund sustainable projects such as spending with diverse and small business suppliers and investments in renewable energy projects. |

| ► | In August 2021, Nicor Gas priced a $375 million social bond, the first for a utility in the U.S. private placement market. With up to a 14-month delayed draw period, the net proceeds will be allocated to fund spending with diverse and small business suppliers. |

$5.3 billion

in green, social or sustainability bonds

Since 2015, the Southern Company system has issued or priced a combined total of nearly $5.3 billion in green, social or sustainability bonds, which ranked within the top five among all U.S. corporate non-financial ESG-labeled bond issuers as of the end of 2021.

| 12 | Southern Company 2022 Proxy Statement |

Our Environmental and Social Highlights

Our Human Capital Pillars

|

Diversity, Equity & Inclusion

We are committed to a diverse, equitable and inclusive workplace in order to best serve the diverse communities in our footprint. Our diversity, equity and inclusion (DE&I) efforts promote an inclusive and actively anti-racist culture as we strive to create a workplace where everyone feels welcomed, valued and respected, and all groups are well-represented, included and fairly treated within all levels of the organization.

We launched our Moving to Equity framework in 2020 that focuses on five key areas: talent, workplace environment, community investment and social justice, political engagement and supplier diversity. We recently published our 2021 Transformation Report to outline how we have and will continue to hold ourselves accountable in Moving to Equity.

|

Rewards & Well-Being

We invest in the well-being and engagement of our employees through a comprehensive total rewards strategy which includes compensation, benefits and employee well-being. Our well-being strategy focuses on:

| ► | Physical Well-Being: Providing employees with access to preventive care, wellness programs and healthcare. |

| ► | Financial Well-Being: Helping employees with financial wellness across all stages of their career, as well as in retirement. |

| ► | Emotional/Social Well-Being: Supporting employees’ emotional wellness and helping them to be fully engaged in life, family, their community and at work. |

Our strategy helps to ensure all employees are paid market competitive salaries, are treated equitably (through regular pay equity, pay gap and glass ceiling studies), are eligible for annual incentive awards and have access to health and retirement benefits and best-in-class well-being programs.

|

Workforce Sustainability

We are meeting the evolving needs of the energy industry by developing a diverse, qualified and sustainable workforce to support community growth and inclusive economic development. We focus on having the right people with the right skills who perform their jobs safely to meet current and future business needs through collaboration with labor unions, skills training and targeted community and education partnerships. These efforts benefit the communities we serve and help provide sustainable jobs.

| ► | Safety First: We believe the safety of our employees and customers is paramount. We strive to perform and maintain every job, every day, safely. We demonstrate Safety First by focusing on safety risk mitigation, meeting and exceeding applicable laws and regulations and investing in research and cutting-edge safety technologies and processes. |

13

Our Environmental and Social Highlights

|

Talent Development

The development of talent is a priority as we consider it critical to employee readiness, engagement and retention. Our talent processes include robust talent identification based on updated leadership competencies, specialized assessments and development, thorough succession planning and successful career planning and placement.

| ► | We focus development on business imperatives: inclusivity, emotional intelligence, innovation and business execution. |

| ► | Our custom internal programs, external partnerships and online resources provide career and leadership development opportunities for employees at all levels, from individual contributors to senior leaders, supporting personal growth and career progression. |

| ► | Through a dynamic succession planning process and strategic external hiring, we help to ensure a well-qualified and diverse pipeline of leaders. |

|

Community

Our employees are inextricably woven into the communities we are privileged to serve. Retirees and employees across our subsidiaries on average dedicate approximately 200,000 hours of volunteer service annually to support and improve our communities. In 2021, our system’s charitable giving totaled over $110 million, including giving to social justice-related initiatives of $66 million. We also form partnerships with businesses, academic and other STEM institutions, charities and government bodies. The Southern Company system and its charitable foundations are committing $225 million through 2025 to advance racial equity and social justice in our communities.

Our Commitment to Human Rights

Southern Company’s foundation is built on being a citizen wherever we serve. We are committed to conducting business with honesty, integrity and fairness.

Southern Company provides energy for the community’s quality of life and economic growth. We are dedicated to public service and setting the standard for corporate citizenship. We respect fundamental human rights to improve our communities, the lives of our employees and other stakeholders.

| ► | We provide a safe, diverse, equitable and inclusive work environment |

| ► | We respect the integrity, dignity and rights of individuals and communities |

| ► | We respect employees’ rights to collective bargaining, freedom of association, equal protection before the law and non-discrimination |

| ► | We prohibit all forms of forced or compulsory labor, child labor and other human rights abuses |

Our commitment to human rights is embodied in Our Mission, Our Values, Our Code of Ethics and in our policies and practices. Our employees, suppliers and partners are expected to act in a manner consistent with Our Values, Our Code of Ethics and U.S. and international law. These commitments are consistent with the general principles of the United Nations Declaration of Human Rights and the International Labour Organization’s Declaration on Fundamental Principles and Rights at Work.

| Commitment to Human Rights |

|

| Our Values and Code of Ethics |

|

| Policies and Practices |

| 14 | Southern Company 2022 Proxy Statement |

Our Environmental and Social Highlights

Significant Recognition for our Accomplishments

From innovating our industry to making strides in sustainable energy, human capital management and corporate culture, we are recognized as a leader by customers, partners, investors and employees as well as the broader business, science and technology communities.

| |||

Human Capital and Corporate Culture No. 2 Best Large Employer in America for 2022 by Forbes Among the Top 50 Companies for Diversity by DiversityInc. (6th consecutive year) 2021 Best Employer for Veterans by The Military Times 2021 Best Places to Work for Disability Inclusion by The Disability Equality Index (100% score for the 5th consecutive year) Southern Company recognized in The Wall Street Journal Management Top 250 Listed on the 2021 Seramount Inclusion Index (formerly Diversity Best Practices Index) A 2021 Best Place to Work for LGBTQ Equality by Human Rights Campaign’s Corporate Equality Index and maintained a 100% rating (6th consecutive year) 2021 Best Places to Work in IT by IDG’s Computerworld 2021 Excellence and Innovation Award from Pensions & Investments for outstanding financial literacy and financial well-being programs for Company employees 2021 DiversityInc Top Companies for Black Executives, Employee Resource Groups, Supplier Diversity, Board of Directors and ESG

| Customer Satisfaction Georgia Power and Nicor Gas named as 2021 Most Trusted Utility Brands and Chattanooga Gas named as 2021 Most Trusted Business Partners in the utility industry by The Cogent Syndicated Utility Trusted Brand & Customer Engagement™: Business study from Escalent Governance & Leadership 2022 World’s Most Admired Companies by FORTUNE magazine for the 11th consecutive year 2021 Most Transparent Utility, No. 1 for Best Proxy Statement in Labrador’s 2021 Transparency Awards Five executives recognized in the 2022 Atlanta 500 for Government & Infrastructure, a list of the city’s top leaders, by Atlanta Magazine Safety, Innovation & Technology Georgia Power won the 2021 Industrial Innovation Award from the South Metro Development Outlook Conference for extraordinary support of businesses and organizations that serve the South Metro Region (includes the counties of Clayton, Coweta, Douglas, Fayette, Henry, and South Fulton counties and southern portion of the city of Atlanta) Kim Greene, Chairman and CEO of Southern Company Gas, received the 2022 Thomas F. Farrell, II Safety Leadership and Innovation Award from the Edison Electric Institute (EEI) | Sustainability & Community Partnerships The National Association of Secretaries of State recognized Mississippi Power with the Medallion Award in 2021 for efforts following Hurricane Zeta to ensure polling locations had power and to facilitate absentee voting for visiting crews assisting with restoration EEI awarded the Emergency Response Award to Alabama Power for power restoration efforts in Texas after Hurricane Nicholas during 2021 NAACP Alabama State Conference named Alabama Power as the 2021 Corporate Partner of the Year Virginia Oil and Gas Association awarded the 2021 Community Outreach Award to Virginia Natural Gas Alabama Power, PowerSecure and Southern Company received the 2021 Top Project from Environment + Energy Leader for Alabama Power’s Smart Neighborhood Project Georgia Department of Natural Resources’ Wildlife Resources Division awarded the 2021 Forestry for Wildlife Partnership to Georgia Power in recognition of its stewardship and land management practices At the Annual International Business Awards, Alabama Power received a 2021 Gold Stevie, the highest award, in the utilities category and a 2021 Silver Stevie in the energy category for its 2020 web-based corporate sustainability report | |

15

| Item 1: | Election of 13 Directors |

| ► | The Board, acting upon the recommendation of the Nominating, Governance and Corporate Responsibility Committee, has nominated 13 of the 14 of the Directors currently serving for re-election to the Southern Company Board of Directors. |

| ► | Janaki Akella | ► | Thomas A. Fanning | ► | Donald M. James | ► | Ernest J. Moniz | ► | Kristine L. Svinicki | |

| ► | Henry A. Clark Ill | ► | David J. Grain | ► | John D. Johns | ► | William G. Smith, Jr. | ► | E. Jenner Wood Ill | |

| ► | Anthony F. Earley, Jr. | ► | Colette D. Honorable | ► | Dale E. Klein |

| ► | Each nominee holds or has held senior executive positions, maintains the highest degree of integrity and ethical standards and complements the needs of the Company and the Board. |

| ► | Through their positions, responsibilities, skills and perspectives, which span various industries and organizations, these nominees represent a Board of Directors that is diverse and possesses appropriate collective qualifications, skills, knowledge and experience. |

| ✔ | The Board recommends a vote FOR each nominee for Director | è See page 17 | |

| Item 2: | Advisory Vote to Approve Executive Compensation (Say on Pay) |

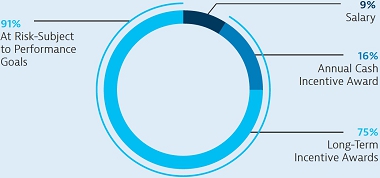

| ► | We believe our compensation program provides the appropriate mix of fixed and at-risk compensation. |

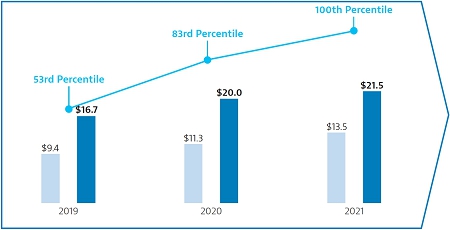

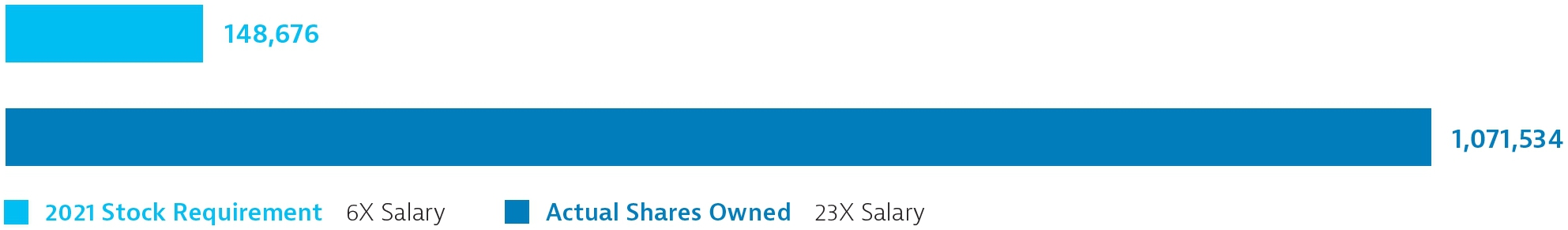

| ► | The short- and long-term performance-based compensation program for our CEO ties pay to Company performance, rewards achievement of financial and operational goals, relative TSR and progress on meeting our GHG reduction goals, encourages individual performance that is in line with our long-term strategy, is aligned with stockholder interests and remains competitive with our industry peers. |

| ✔ | The Board recommends a vote FOR this proposal | è See page 49 | |

| Item 3: | Ratify the Independent Registered Public Accounting Firm for 2022 |

| ► | The Audit Committee appointed Deloitte & Touche as our independent registered public accounting firm for 2022. |

| ► | This appointment is being submitted to stockholders for ratification. |

| ✔ | The Board recommends a vote FOR this proposal | è See page 98 | |

| Item 4: | Vote on a Stockholder Proposal |

| ► | We have been advised that a stockholder proposal regarding simple majority vote is intended to be presented at the annual meeting. |

| ✔ | The Board recommends a vote FOR this proposal | è See page 99 |

| 16 | Southern Company 2022 Proxy Statement |

| Election of 13 Directors | ✔ | ||

1 | ► The Board, acting upon the recommendation of the Nominating, Governance and Corporate Responsibility Committee, has nominated 13 of the 14 of the Directors currently serving for re-election to the Southern Company Board of Directors. | The Board recommends a vote FOR each nominee for Director | |

► Janaki Akella ► Henry A. Clark Ill ► Anthony F. Earley, Jr. ► Thomas A. Fanning ► David J. Grain ► Colette D. Honorable ► Donald M. James ► John D. Johns ► Dale E. Klein ► Ernest J. Moniz ► William G. Smith, Jr. ► Kristine L. Svinicki ► E. Jenner Wood Ill | |||

► Each nominee, if elected, will serve until the 2023 annual meeting of stockholders. ► The proxies named on the proxy form will vote each properly executed proxy form for the election of the 13 Director nominees, unless otherwise instructed. If any named nominee becomes unavailable for election, the Board may substitute another nominee. In that event, the proxy would be voted for the substitute nominee unless instructed otherwise on the proxy form. | |||

17

| 18 | Southern Company 2022 Proxy Statement |

Southern Company Board of Director Nominees

19

Southern Company Board of Director Nominees

Board of Director Nominees Qualifications, Attributes, Skills and Experience

The Nominating, Governance and Corporate Responsibility Committee establishes and regularly reviews with the Board the qualifications, attributes, skills and experience that it believes are desirable to be represented on the Board to help ensure that they align with the Company’s long-term strategy. The most important of these are described below.

We believe our Directors possess a range and depth of expertise and experience to effectively oversee the Company’s operations, risks and long-term strategy.

| Public Company CEO Experience |  | Audit Committee Financial Expert | ||

|  | ||||

Experience serving as a public company CEO with strong business acumen and judgment. | Experience as a principal financial officer, principal accounting officer, controller, public accountant or auditor of a public company or experience actively supervising such person or persons. Experience preparing, auditing, analyzing or evaluating public company financial statements and an understanding of a company’s internal controls and procedures for financial reporting. | ||||

| Geographic Regional |  | National Security Clearance |  | Southern Operating |

|  |  | |||

Understanding and experience working in the business and political environment of the Company’s residential, commercial and industrial customer base. | Holding active national security clearances such that one can provide effective oversight on key securities issues for the Company as an important component of U.S. critical infrastructure. | Experience serving on the board of directors of one of the Company’s operating companies. | |||

| Business Integration |  | Environmental | ||

|  | ||||

Demonstrated leadership and operational experience with the integration and disposition of business divisions. | Exposure and understanding of oversight of environmental policy, regulation, risk and business operation matters in highly regulated industries. Experience reducing environmental risks to provide safe, reliable and responsible business operations. An in-depth understanding of the risks and opportunities for an organization in a low-carbon future. | ||||

| Cybersecurity |  | Finance/Banking |  | Major Projects |

|  |  | |||

Experience and contemporary understanding of asymmetrical cyber threats (both to private and governmental actors), risk mitigation and policy gained through operational experience. | Exposure to deal-making (including in M&A), financial plans and programs and capital allocation experience, and familiarity with Wall Street and/or other major financial institutions. | Experience overseeing, managing or advising on large scale capital projects in the industrial sector. Knowledge of creating long-term value through the financing of and capital allocation for the construction of large-scale capital projects. | |||

| Nuclear |  | Government Affairs and Regulatory | ||

|  | ||||

Deep knowledge and experience in the construction, operations and regulation of nuclear energy. | Exposure to heavily regulated industries, having worked in public policy for a significant institution or leading a corporate function (e.g., government affairs) that influences the public policy and regulatory process, or a senior executive with experience directly managing one or more members of management engaged in such activities. | ||||

| Utility Operations |  | Technology (Digital) |  | Technology (Technical) |

|  |  | |||

Experience in the management of electric and/ or natural gas utilities, including expertise in electric power generation and transmission facilities and natural gas distribution and storage facilities, and proven experience navigating the risks (including financial, resiliency, health, safety and environmental) associated with utility operations. | Demonstrated experience leading digital technology strategy, navigating associated disruption of legacy businesses and/or expertise in social media strategy, including knowledge of data analytics and associated IT infrastructure investments to support digital transformation. | Deep knowledge and experience working with power generation technology, as well as an understanding of recent innovations in utility operational technology and technology disruptions affecting the utility industry. | |||

| 20 | Southern Company 2022 Proxy Statement |

Southern Company Board of Director Nominees

|  |  |  |  |  |  |  |  |  |  |  |  | ||

| Public Company CEO Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Audit Committee Financial Expert | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Geographic Regional | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| National Security Clearance | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Southern Operating Company Board Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Business Integration | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Cybersecurity | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Environmental | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Finance/Banking | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Government Affairs and Regulatory | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Major Projects | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Nuclear | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Technology (Digital) | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Technology (Technical) | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Utility Operations | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Other Current Public Company Boards | 1 | 0 | 0 | 1 | 3 | 0 | 1 | 2 | 1 | 0 | 1 | 0 | 2 | |

| Demographic Information | ||||||||||||||

| Tenure (Completed Whole Years) | 11 | 3 | 12 | 3 | 9 | 1 | 22 | 7 | 11 | 4 | 16 | 0 | 9 | |

| Age | 65 | 61 | 72 | 72 | 59 | 52 | 73 | 70 | 74 | 77 | 68 | 55 | 70 | |

| Gender | ||||||||||||||

| Female | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Male | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Race or Ethnicity | ||||||||||||||

| Asian | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Black / African American | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| White / Caucasian | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

21

Southern Company Board of Director Nominees

Biographical Information about our Nominees for Director

| |||||

| Janaki Akella INDEPENDENT | |||||

| Digital Transformation Leader, Google LLC | |||||

| Age: 61 Director since: January 2019 | Board committees: Business Security and Resiliency; Operations, Environmental and Safety Other public company directorships: None | ||||

DIRECTOR HIGHLIGHTS Dr. Akella’s qualifications include electrical engineering experience and knowledge, global business technology, data and analytics expertise and cybersecurity matters knowledge. Her understanding and involvement with technology market disruptions is particularly valuable to the Board as the Southern Company system continues to develop innovative business strategies. | ►Dr. Akella serves as the Digital Transformation Leader of Google LLC, a multinational technology company specializing in internet-related products, a position she has held since 2017. At Google, Dr. Akella addresses challenges and complex technical issues arising from new technologies and new business models. ►Prior to joining Google, Dr. Akella held a number of leadership positions during a 17-year career at McKinsey & Company, where she most recently served as principal. She led and contributed to over 100 consulting engagements in North America, Europe, Asia and Latin America with multiple project teams and client executives. She began her career with Hewlett-Packard as a member of the system technology technical staff, engineer scientist and technical contributor. ►She previously served on the Boards of the Guindy College of Engineering North American Alumni and the Churchill Club. | ||||

| |||||

| Henry A. “Hal” Clark III INDEPENDENT | |||||

| Senior Advisor of Evercore Inc. (retired) | |||||

| Age: 72 Director since: October 2009 | Board committees: Audit Other public company directorships: None | ||||

DIRECTOR HIGHLIGHTS Mr. Clark’s qualifications include finance and capital allocation knowledge and experience, risk management experience, mergers and acquisitions experience and investment advisory experience specific to the power and utilities industries. The skills Mr. Clark developed with his extensive involvement in strategic mergers and acquisitions and capital markets transactions are particularly valuable to the Board as the Southern Company system continues to finance major capital projects. | ►Mr. Clark was a Senior Advisor with Evercore Inc. (formerly Evercore Partners Inc.), a global independent investment advisory firm, from August 2011 until his retirement in December 2016. As a Senior Advisor, Mr. Clark was primarily focused on expanding advisory activities in North America with a particular focus on the power and utilities sectors. ►With more than 40 years of experience in the global financial and the utility industries, Mr. Clark brings a wealth of experience in finance and risk management to his role as a Director. ►Prior to joining Evercore, Mr. Clark was Group Chairman of Global Power and Utilities at Citigroup, Inc. from 2001 to 2009. He joined Lexicon Partners, LLC in July 2009, which Evercore Partners subsequently acquired in August 2011. ►His work experience includes numerous capital markets transactions of debt, equity, bank loans, convertible securities and securitization, as well as advice in connection with mergers and acquisitions. He also has served as policy advisor to numerous clients on capital structure, cost of capital, dividend strategies and various financing strategies. ►He has served as Chair of the Wall Street Advisory Group of the Edison Electric Institute. | ||||

| 22 | Southern Company 2022 Proxy Statement |

Southern Company Board of Director Nominees

| |||||

| Anthony F. “Tony” Earley, Jr. INDEPENDENT | |||||

| Chairman, President and Chief Executive Officer, PG&E Corporation (retired) | |||||

| Age: 72 Director since: January 2019 | Board committees: Nominating, Governance and Corporate Responsibility (Chair); Operations, Environmental and Safety Other public company directorships: Ford Motor Company | ||||

DIRECTOR HIGHLIGHTS Mr. Earley’s qualifications include public company CEO experience and energy industry expertise including nuclear regulation, generation and technology, as well as cybersecurity matters, environmental matters and major capital projects. His experience as the president and chief executive officer of energy companies and his involvement in electric industry-wide research and development programs are valuable to the Board. | ►Mr. Earley served as Chairman, President and Chief Executive Officer of PG&E Corporation, a public utility holding company providing natural gas and electric services, from 2011 until February 2017, when he became Executive Chairman. He served as Executive Chairman until his retirement from PG&E in December 2017. On January 29, 2019, PG&E Corporation and its subsidiary Pacific Gas and Electric Company filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code as a result of wildfire claims in California. ►Before joining PG&E, Mr. Earley served in several executive leadership roles during his 17 years at DTE Energy, including Executive Chairman, Chairman and Chief Executive Officer. Prior to joining DTE Energy in March 1994, he served in various capacities at Long Island Lighting Company, including President and Chief Operating Officer. He was a partner at the Hunton & Williams LLP law firm as a member of the energy and environmental team. He also served as an officer in the U.S. Navy nuclear submarine program where he was qualified as a chief engineer. Mr. Earley is a member of the Board of Directors of Ford Motor Company and serves as Lead Outside Director and on the Compensation (chairman), the Nominating and Governance and the Sustainability and Innovation Committees. He previously served on the Board of Directors of DTE Energy, PG&E Corporation, Comerica Incorporated, Masco Corporation and Long Island Lighting Company. ►He previously served on the executive committees of the Edison Electric Institute and the Nuclear Energy Institute and served on the Board of the Electric Power Research Institute. | ||||

| |||||

| Thomas A. Fanning | |||||

| Chairman of the Board, President and Chief Executive Officer of Southern Company | |||||

| Age: 65 Director since: December 2010 | Board committees: None Other public company directorships: Vulcan Materials Company | ||||

DIRECTOR HIGHLIGHTS Mr. Fanning’s qualifications include public company CEO experience and electric and natural gas industry knowledge and experience, including nuclear and new technology matters, cybersecurity matters, environmental matters and governmental affairs and financial expertise. His deep knowledge of the Company, based on 40 years of service, as well as his civic participation on a local and national level, are valuable to the Board. | ►Mr. Fanning has held numerous leadership positions across the Southern Company system during his 40 years with the Company. He served as Executive Vice President and Chief Operating Officer of the Company from 2008 to 2010, leading the Company’s generation and transmission, engineering and construction services, research and environmental affairs, system planning and competitive generation business units. He served as the Company’s Executive Vice President and Chief Financial Officer from 2003 to 2008, where he was responsible for the Company’s accounting, finance, tax, investor relations, treasury and risk management functions. In those roles, he also served as the chief risk officer and had responsibility for corporate strategy. ►He served as the co-chair of the Electricity Subsector Coordinating Council, the principal liaison between the federal government and the electric power sector to protect the integrity of the national electric grid. His leadership in the cybersecurity area was recognized by the U.S. Senate in 2019 with an appointment to the Cyberspace Solarium Commission, a group developing a protection strategy for the cyberspace interests of the United States. In 2021, the Cybersecurity and Infrastructure Security Agency appointed Mr. Fanning as chairman of the agency’s newly formed Cybersecurity Advisory Committee, a group that provides recommendations on cybersecurity programs and policies. ►Mr. Fanning is a Director of Vulcan Materials Company, serving as a member of the Audit Committee and the Compensation Committee. He served on the Board of Directors of the Federal Reserve Bank of Atlanta from 2012 to 2018 and is a past chairman. ►He also served on the Board of Directors for the St. Joe Company, a real estate developer and asset manager, from 2005 to 2011. | ||||

23

Southern Company Board of Director Nominees

| |||||

| David J. Grain LEAD INDEPENDENT DIRECTOR | |||||

| Chief Executive Officer and Managing Director, Grain Management, LLC (Grain Management) | |||||

| Age: 59 Director since: December 2012 | Board committees: Finance; Nominating, Governance and Corporate Responsibility Other public company directorships: Dell Technologies, New Fortress Energy LLC, Catalyst Partners Acquisition Corporation | ||||

DIRECTOR HIGHLIGHTS Mr. Grain’s qualifications include capital allocation expertise, financial expertise, major capital projects knowledge and experience, technology innovations knowledge and experience and risk management experience. Mr. Grain’s knowledge and involvement managing large and small businesses and raising and managing investor capital, particularly in a regulated industry, is also valuable to the Board. | ►Mr. Grain is the Chief Executive Officer of Grain Management, a private equity firm focused on global investments in the media and communications sectors, which he founded in 2006. With headquarters in Washington, D.C. and offices in New York City, New York and Sarasota, Florida, the firm manages capital for a number of the country’s leading academic endowments, public pension funds and foundations. ►Mr. Grain also founded and was Chief Executive Officer of Grain Communications Group, Inc. ►Prior to founding Grain Management, he served as President of Global Signal, Inc., Senior Vice President of AT&T Broadband’s New England Region and Executive Director in the High Yield Finance Department at Morgan Stanley. ►Mr. Grain was appointed by President Obama in 2011 to the National Infrastructure Advisory Council. ►He previously served as Chairman of the Florida State Board of Administration Investment Advisory Council as an appointee of former Governor Charlie Crist, where he provided independent oversight of the state board’s funds and major investment responsibilities, including investments for the Florida Retirement System programs. ►Mr. Grain is a Director of Dell Technologies, New Fortress Energy LLC and Catalyst Partners Acquisition Corporation (a special purpose acquisition corporation). ►He is currently a member of the Advisory Board of the Amos Tuck School of Business Administration at Dartmouth College and is a Trustee of the Brookings Institution. | ||||

| |||||

| Colette D. Honorable INDEPENDENT | |||||

| Partner at Reed Smith LLP and former Commissioner of the Federal Energy Regulatory Commission (FERC) | |||||

| Age: 52 Director since: October 2020 | Board committees: Business Security and Resiliency; Finance Other public company directorships: None | ||||

DIRECTOR HIGHLIGHTS Ms. Honorable’s qualifications include extensive energy policy and regulatory experience as a highly regarded thought leader and legal practitioner in the domestic and international energy sectors. Her legal experience along with her leadership and deep industry expertise demonstrated as a former FERC Commissioner, past Chair of the Arkansas Public Service Commission and past president of the National Association of Regulatory Utility Commissioners are all valuable to our Board. | ►Ms. Honorable serves as a Partner at Reed Smith LLP, a law firm, where she is a member of the firm’s Energy and Natural Resources Group and leads the energy regulatory practice. Based in Washington, D.C., Honorable serves as a member of the firm’s Global Executive Committee, Women’s Initiative Network, Sustaining and Training African Americans business inclusion group and Environmental, Social and Governance group. ►Nominated by President Barack Obama in August 2014 and unanimously confirmed by the U.S. Senate, Ms. Honorable served as a FERC Commissioner from January 2015 to June 2017. FERC is an independent U.S. federal agency that regulates the wholesale sale of electricity, natural gas and oil in interstate commerce and reviews and licenses projects in the energy market. ►Prior to joining FERC, she joined the Arkansas Public Service Commission (PSC) as a Commissioner in 2007, served as interim Chair in 2008 and led the PSC as chair from January 2011 to January 2015. ►Ms. Honorable served as president of the National Association of Regulatory Utility Commissioners from 2013 to 2014, becoming that organization’s first African American president. ►Her experience includes service in several state government executive roles, including chief of staff to the Arkansas Attorney General, a member of the Governor’s cabinet and a special judge of the Pulaski County Circuit Court. ►Ms. Honorable is a senior fellow with the Bipartisan Policy Center, an ambassador for the Department of Energy Clean Energy Education & Empowerment Initiative and serves on the global advisory board of Energy Futures Initiative and strategic advisory board for the Energy Regulators Regional Association. | ||||

| 24 | Southern Company 2022 Proxy Statement |

Southern Company Board of Director Nominees

| |||||

| Donald M. James INDEPENDENT | |||||

| Chairman of the Board and Chief Executive Officer of Vulcan Materials Company (retired) | |||||

| Age: 73 Director since: December 1999 | Board committees: Compensation and Management Succession; Finance Other public company directorships: None | ||||

DIRECTOR HIGHLIGHTS Mr. James’ qualifications include public company CEO experience, a legal background as a former public company general counsel and an understanding of corporate governance, risk management, major capital projects and environmental matters. Mr. James brings important perspectives on management, operations and strategy from his experience as the former chief executive officer of a public company. | ►Mr. James joined Vulcan Materials Company, a producer of aggregate and aggregate-based construction materials, in 1992 as Senior Vice President and General Counsel. He next became President of the Southern Division, followed by Senior Vice President of the Construction Materials Group, and then President and Chief Operating Officer. In 1997, he was elected Chairman and Chief Executive Officer. Mr. James retired from his position as Chief Executive Officer of Vulcan Materials Company in July 2014 and Executive Chairman in January 2015. He retired in December 2015 as Chairman of the Board of Directors of Vulcan Materials Company. ►Prior to joining Vulcan Materials Company, Mr. James was a partner at the law firm of Bradley, Arant, Rose & White for 10 years. ►Mr. James is a former director of Vulcan Materials Company, Wells Fargo & Company, Protective Life Corporation, SouthTrust Corporation and Wachovia Corporation. ►Mr. James is a Trustee of Children’s of Alabama, where he serves on the Executive Committee and the Compensation Committee. | ||||

| |||||

| John D. Johns INDEPENDENT | |||||

| Senior Advisor at Blackstone Inc. (Blackstone) and former Chairman and Chief Executive Officer of Protective Life Corporation (Protective Life) | |||||

| Age: 70 Director since: February 2015 | Board committees: Compensation and Management Succession (Chair); Finance Other public company directorships: Genuine Parts Company and Regions Financial Corporation | ||||

DIRECTOR HIGHLIGHTS Mr. Johns’ qualifications include public company CEO experience, financial expertise, capital allocation experience and risk management experience in a highly-regulated industry. His legal background as the former general counsel of a large energy public holding company that included natural gas operations and his prior service for over a decade on the Board of Directors of Alabama Power are also of significant value to the Board. | ►Mr. Johns has served as a Senior Advisor at Blackstone, an investment firm, since April 2022. ►He retired in 2020 as Chairman, DLI North America Inc., the oversight company for Protective Life, a provider of financial services through insurance and investment products. ►He served as Chairman and Chief Executive Officer of Protective Life from 2002 to 2017 and President from 2002 to January 2016. He joined Protective Life in 1993 as Executive Vice President and Chief Financial Officer. ►Before his tenure at Protective Life, Mr. Johns served as general counsel of Sonat, Inc., a diversified energy company. ►Prior to joining Sonat, Inc., Mr. Johns was a founding partner of the law firm Maynard, Cooper & Gale, P.C. ►He previously served on the Board of Directors of Alabama Power from 2004 to 2015. During his tenure on the Alabama Power Board, he was a member of the Nominating and Executive Committees. ►He is a member of the Boards of Directors of Regions Financial Corporation, where he is Chairman of the Risk Committee and a member of the Executive Committee, and Genuine Parts Company, where he serves as Lead Independent Director and chairs the Compensation, Nominating and Governance Committee and the Executive Committee. He is a former director of Protective Life Corporation. ►Mr. Johns has served on the Executive Committee of the Financial Services Roundtable in Washington, D.C. and is a past chairman of the American Council of Life Insurers. ►Mr. Johns has served as the Chairman of the Business Council of Alabama, the Birmingham Business Alliance, the Greater Alabama Council, Boy Scouts of America and Innovation Depot, Alabama’s leading business and technology incubator. | ||||

25

Southern Company Board of Director Nominees

| |||||

| Dale E. Klein INDEPENDENT | |||||

| Associate Vice Chancellor of Research of the University of Texas System and former Commissioner and Chairman, U.S. Nuclear Regulatory Commission | |||||

| Age: 74 Director since: July 2010 | Board committees: Business Security and Resiliency; Compensation and Management Succession; Operations, Environmental and Safety (Chair) Other public company directorships: Pinnacle West Capital Corporation and Arizona Public Service Company | ||||