QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant /x/

|

| Filed by a party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /x/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

PDS GAMING CORPORATION

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| /x/ | | No fee required |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

/ / |

|

Fee paid previously with preliminary materials. |

/ / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

PDS GAMING CORPORATION

6171 MCLEOD DRIVE

LAS VEGAS, NV 89120

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 10, 2002

TO THE SHAREHOLDERS OF PDS GAMING CORPORATION:

Please take notice that the annual meeting of shareholders of PDS Gaming Corporation (the "Company") will be held at the Alexis Park Hotel, 375 E. Harmon Avenue, Las Vegas, Nevada, on Friday, May 10, 2002, at 3:00 p.m. Pacific Daylight Time, or at any adjournment or adjournments thereof, for the purpose of considering and taking appropriate action with respect to the following:

- 1.

- To elect six directors for the ensuing year.

- 2.

- To ratify the appointment of the firm of Piercy, Bowler, Taylor & Kern, Certified Public Accountants and Business Advisors, a Professional Corporation, as the independent accountants of the Company for the fiscal year ending December 31, 2002.

- 3.

- To approve the 2002 Stock Option Plan.

- 4.

- To act upon any other business that may properly come before the meeting or any adjournments thereof.

Only shareholders of record on April 5, 2002 will be entitled to notice of and to vote at the meeting or any adjournments thereof.

Whether or not you plan to attend the meeting, please sign, date and return your proxy in the reply envelope provided to ensure the presence of a quorum. Your cooperation in promptly signing and returning your proxy will help avoid further solicitation expense. If you later desire to revoke your proxy, you may do so at any time before it is exercised.

By order of the Board of Directors,

PDS Gaming Corporation

Joe S. Rolston IV,

SECRETARY

April 17, 2002

PROXY STATEMENT

OF

PDS GAMING CORPORATION

6171 MCLEOD DRIVE

LAS VEGAS, NV 89120

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 10, 2002

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of PDS Gaming Corporation (the "Company") to be used at the Annual Meeting of Shareholders of the Company to be held May 10, 2002 (the "Meeting"). The approximate date upon which this Proxy Statement and the accompanying Proxy are expected to be first sent or given to shareholders is April 17, 2002. Each shareholder who signs and returns a Proxy in the form enclosed with this Proxy Statement may revoke the same at any time prior to its use by giving notice of such revocation to the Company in writing, in open meeting or by executing and delivering a new Proxy to the Secretary of the Company. Unless so revoked, the shares represented by each Proxy will be voted at the meeting and at any adjournments thereof. Presence at the meeting of a shareholder who has signed a Proxy does not alone revoke that Proxy.

Only shareholders of record at the close of business on April 5, 2002 (the "Record Date") will be entitled to vote at the Meeting or any adjournments thereof. All shares which are entitled to vote and are represented at the Meeting by properly executed proxies received prior to or at the Meeting, and not revoked, will be voted at the Meeting in accordance with the instructions indicated on such proxies.

The total number of votes cast by all shareholders either present at the Meeting or voting by proxy will determine whether an item of business is approved. A majority of the outstanding shares must be represented in person or by proxy in order to consider the items of business at the Meeting. Shares as to which the holder has abstained on any matter (or has withheld authority for a director) will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum at the Meeting and, for purposes of determining the approval of each matter as to which the shareholder has abstained, as having not been voted in favor of such matter. If a broker submits a proxy that indicates the broker does not have discretionary authority as to certain shares to vote on one or more matters, those shares will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum at the Meeting, but will not be considered as present and entitled to vote with respect to such matters.

A shareholder may revoke his or her proxy at any time before it is voted by written notice addressed to the Secretary of the Company at the offices of the Company, by filing another proxy bearing a later date with the Secretary or by appearing at the meeting and voting in person.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The Company's only outstanding class of voting securities is Common Stock, $0.01 par value, of which 3,796,683 shares were outstanding as of the close of business on the Record Date. Each share of Common Stock is entitled to one vote on all matters put to a vote of shareholders.

The following table sets forth certain information regarding the beneficial ownership of the Company's Common Stock as of the Record Date by (i) each person known by the Company to be the beneficial owner of more than five percent (5%) of the outstanding Common Stock, (ii) each director, (iii) each executive officer of the Company included in the Summary Compensation Table set forth under the caption "Executive Compensation" below and (iv) all executive officers and directors as a group.

Unless otherwise indicated, each of the following persons has sole voting and investment power with respect to the shares of Common Stock set forth opposite their respective names:

Name

| | Number(4)

| | Percent of Class

| |

|---|

| Johan P. Finley(1)(2) | | 973,836 | | 25.3 | % |

| Peter D. Cleary(1) | | 105,997 | | 2.7 | % |

| Lona M.B. Finley(1)(3) | | 396,877 | | 10.1 | % |

| Joel M. Koonce(1) | | 23,500 | | * | |

| James L. Morrell(1) | | 20,000 | | * | |

| Patrick R. Cruzen(1) | | 3,000 | | * | |

| Martha Vlcek(1) | | 16,837 | | * | |

| Joe S. Rolston IV(1) | | 24,000 | | * | |

| All officers and directors as a group (8 persons) | | 1,552,847 | | 37.3 | % |

- *

- Less than 1%

- (1)

- The address of such person is 6171 McLeod Drive, Las Vegas, NV 89120.

- (2)

- Includes 11,200 shares held as co-trustee for minor child also claimed by spouse as co-trustee. Mr. Finley disclaims beneficial ownership of the shares held by Lona M.B. Finley, his spouse.

- (3)

- Includes 49,000 shares held by Ms. Finley as custodian for her minor children and 11,200 shares held as co-trustee for minor child also claimed by spouse as co-trustee. Ms. Finley disclaims beneficial ownership of the shares held by Johan P. Finley, her spouse.

- (4)

- Includes shares of Common Stock issuable to the following persons upon exercise of options that are currently exercisable or that will become exercisable within 60 days of the date of this Proxy Statement: Johan P. Finley, 56,250 shares; Peter D. Cleary, 96,000 shares; Lona M.B. Finley, 128,591 shares; Joel M. Koonce, 20,000 shares; James L. Morrell, 20,000 shares; Patrick R. Cruzen, 3,000 shares; Martha Vlcek, 16,000 shares; Joe S. Rolston IV, 24,000 shares; all executive officers and directors as a group, 363,841 shares.

CERTAIN TRANSACTIONS

Johan P. Finley, the Company's Chief Executive Officer, Chairman of the Board and controlling shareholder, received a fee in the amount of $20,000 in 1999 in exchange for providing a personal guarantee of amounts loaned to the Company under certain bank lines of credit.

ITEM 1: ELECTION OF DIRECTORS

The number of directors currently serving on the Company's Board of Directors is six. Each director holds office until the next Annual Meeting of Shareholders or until his or her successor is elected and qualified. The Board of Directors has designated the incumbent directors, Johan P. Finley, Peter D. Cleary, Joel M. Koonce, James L. Morrell, Patrick R. Cruzen and Lona M.B. Finley as nominees for reelection to the Board of Directors of the Company. Each of the nominees has consented to serve as director, if elected.

Certain biographical information furnished by the Company's six incumbent directors, and the directors' respective terms of office, is presented below.

JOHAN P. FINLEY, age 40, is the founder of the Company and has been its Chief Executive Officer and Chairman of the Board of Directors since the Company's inception in February 1988. He was President of the Company from its inception to July 1999. In addition, Mr. Finley was the President and Chief Executive Officer of RCM Inc. and Home Products, Inc. from 1991 to 1994.

2

PETER D. CLEARY, age 44, has been a member of the Company's Board of Directors since January 1996 and has been President and Chief Operating Officer of the Company since July 1999. He was Executive Vice President of the Company from November 1998 to July 1999. Prior to that, Mr. Cleary served as Vice President and Chief Financial Officer from September 1995 to November 1998. From 1980 to 1995, Mr. Cleary served in various positions with Coopers & Lybrand L.L.P. (now PricewaterhouseCoopers LLP), most recently as Audit Manager.

JOEL M. KOONCE, age 63, has been a member of the Company's Board of Directors since April 1994. From 1986 to 1998, he served as Chief Financial and Administrative Officer of CENEX, Inc., a distributor of petroleum and agronomy products and other farm supplies located in St. Paul, Minnesota. Prior to joining CENEX, Mr. Koonce served in various management positions with Land O'Lakes, most recently as Vice President of Administration and Planning for Agricultural Services. Mr. Koonce served in various management positions for General Mills from 1965 to 1981.

JAMES L. MORRELL, age 48, has been a member of the Company's Board of Directors since March 1996. From 1996 to January 2002, he was an independent financial consultant. From 1986 to 1995, Mr. Morrell was employed by Dain Bosworth Inc., where he held a number of management positions, most recently Managing Director, Corporate Finance. From January 2001 through March 2001, Mr. Morrell served as acting Chief Financial Officer of Miller & Schroeder Financial, Inc. and was a director of MI Acquisition Corporation, the parent company of Miller & Schroeder Financial, Inc. Miller & Schroeder Financial, Inc. has provided investment banking services to the Company. From September 2001 through December 2001, Mr. Morrell served as President, Chief Financial Officer and a director of The Marshall Group, an investment banking firm.

PATRICK R. CRUZEN, age 55, has been a member of the Company's Board of Directors since June 2000. He is currently President of Cruzen & Associates, which offers a wide range of project-based services to the gaming industry. Mr. Cruzen was previously President and Chief Operating Officer of Grand Casinos from 1994 to 1996. From 1990 until 1994, Mr. Cruzen served as Senior Vice President of Finance/Administration of MGM Grand, Inc.

LONA M.B. FINLEY, age 37, has been a member of Company's Board of Directors since May 1998, and has been an Executive Vice President and Assistant Secretary since February 2001 and Chief Administrative Officer since July 1998. Ms. Finley has served in various other positions with the Company since 1988, and is the spouse of Johan P. Finley.

COMMITTEES AND MEETINGS OF THE BOARD OF DIRECTORS

The Board of Directors has an Executive Committee, an Audit Committee and a Compensation Committee.

The Executive Committee, which currently consists of Johan P. Finley (Chairman), Peter D. Cleary, Lona M.B. Finley, Joe S. Rolston IV and Martha Vlcek, has been granted the authority by the Board of Directors to make all day-to-day decisions regarding the regular business of the Company. The Executive Committee held five meetings in 2001.

The Audit Committee, which currently consists of Joel M. Koonce (Chairman), James L. Morrell and Patrick R. Cruzen, reviews and makes recommendations to the Board of Directors with respect to designated financial and accounting matters. The Audit Committee held four meetings during 2001.

The Compensation Committee, which currently consists of Patrick R. Cruzen (Chairman), Johan P. Finley and Joel M. Koonce, determines executive compensation of the Company's Executive Officers (as that term is described in the Company's bylaws), except for the Chief Executive Officer, and administers the provisions of the Company's 1993 Stock Option Plan. The Compensation Committee will administer the Company's 2002 Stock Option Plan. The Compensation Committee held three meetings during 2001.

3

The Board of Directors has no standing nominations committee.

During 2001, the Board of Directors held six meetings. All incumbent directors attended 100% of those meetings of the Board and committees on which they were members that were held while they were serving on the Board or on such committees.

COMPENSATION OF DIRECTORS

Each non-employee Board member receives an annual cash retainer of $10,000 and a fee of $1,750 for each in-person Board meeting attended and $875 for each telephone meeting. Upon election or appointment to the Board of Directors, each non-employee director is automatically granted a non-qualified option to purchase 10,000 shares of the Company's Common Stock at its fair market value on the date of grant. Mr. Koonce received an option to purchase 10,000 such options in April 1994 which have an exercise price of $5.00 per share. Mr. Morrell received an option to purchase 10,000 shares in March 1996 with an exercise price of $2.50 per share. These options have a term of ten years and become exercisable as to 2,500 shares on the date of each Annual Meeting of Shareholders at which the director is re-elected or is serving an unexpired term. In June 2000, upon election to the Board of Directors, Mr. Cruzen received an option to purchase 10,000 shares, which have an exercise price of $1.22 per share. This option has a term of ten years and becomes exercisable as to 2,500 shares on the date of each Annual Meeting of Shareholders at which Mr. Cruzen is re-elected or is serving an unexpired term.

Beginning May 14, 1998, the Company implemented a policy to grant a non-qualified stock option to purchase 5,000 shares of the Company's Common Stock at its fair market value on the date of grant to each non-employee director on an annual basis. In May 1998, May 1999, May 2000 and May 2001, Messrs. Morrell and Koonce each received an option to purchase 5,000 shares, which have an exercise price of $9.13, $2.94, $1.34 and $3.35 per share, respectively. In May 2001, Mr. Cruzen received an option to purchase 5,000 shares at the exercise price of $3.35 per share. These options have a term of ten years and become exercisable as to 1,000 shares on the date of each Annual Meeting of Shareholders at which the director is re-elected or is serving an unexpired term. The Company reimburses officers and directors for their authorized expenses.

PROXIES AND VOTING

The affirmative vote of the holders of the greater of (a) a majority of the outstanding shares of Common Stock of the Company present and entitled to vote on the election of Directors or (b) a majority of the voting power of the minimum number of shares entitled to vote that would constitute a quorum for transaction of business at the meeting, is required for election to the Board of the nominees named above.

All shares represented by proxies will be voted for the election of the foregoing nominees unless a contrary choice is specified. If any nominee withdraws or otherwise becomes unavailable for any reason, the proxies that would otherwise have been voted for such nominee will be voted for such substitute nominee as may be selected by the Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF THE NOMINEES.

4

EXECUTIVE OFFICERS

As of the Record Date, the Executive Officers of the Company are:

Name

| | Age

| | Title

|

|---|

| Johan P. Finley | | 40 | | Chief Executive Officer and Chairman of the Board (1) |

| Peter D. Cleary | | 44 | | President and Chief Operating Officer (2) |

| Martha Vlcek | | 41 | | Chief Financial Officer and Treasurer (3) |

| Joe S. Rolston IV | | 38 | | Executive Vice President, General Counsel and Secretary (4) |

| Lona M.B. Finley | | 37 | | Executive Vice President, Chief Administrative Officer and Assistant Secretary (5) |

- (1)

- Mr. Finley is the founder of the Company and has been its Chief Executive Officer and Chairman of the Board of Directors since the Company's inception in February 1988. He was President of the Company from its inception to July 1999.

- (2)

- Mr. Cleary has been a member of the Company's Board of Directors since January 1996 and has been President and Chief Operating Officer of the Company since July 1999. He was Executive Vice President of the Company from November 1998 to July 1999. Prior to that, Mr. Cleary served as Vice President and Chief Financial Officer from September 1995 to November 1998.

- (3)

- Ms. Vlcek has been Chief Financial Officer and Treasurer of the Company since October 2000. Prior to that, she served as Controller since July 1999. From November 1998 until July 1999, Ms. Vlcek was Chief Financial Officer of a Las Vegas homebuilder. From 1993-1998, Ms. Vlcek served as Chief Financial Officer and Treasurer of Dynojet Research, Inc., a mid-size manufacturing concern.

- (4)

- Mr. Rolston has been an Executive Vice President, General Counsel and Secretary of the Company since February 2001. Prior to that, he served as Senior Vice President and General Counsel since March 1999. From October 1997 to March 1999, Mr. Rolston was Associate General Counsel and Executive Director of Compliance for Mikohn Gaming Corporation. From July 1995 to October 1997, Mr. Rolston served as Deputy Attorney General for the State of Nevada where he represented the Nevada Gaming Commission, State Gaming Control Board and the Nevada Athletic Commission, among other agencies.

- (5)

- Ms. Finley has been a member of Company's Board of Directors since May 1998, and has been an Executive Vice President and Assistant Secretary since February 2001 and Chief Administrative Officer since July 1998. Ms. Finley has served in various other positions with the Company since 1988.

5

EXECUTIVE COMPENSATION

The following table sets forth certain information concerning the compensation of the Company's Chief Executive Officer and the other executive officers as of December 31, 2001 who received total salary and bonus in excess of $100,000 in 2001 (the "Named Executive Officers").

| |

| |

| |

| | Long-Term

Compensation

| |

|

|---|

| | Annual Compensation

| |

|

|---|

Name and Principal Position

| | Securities

Underlying

Options

| | All Other

Compensation

|

|---|

| | Year

| | Salary

| | Bonus

|

|---|

Johan P. Finley

Chief Executive Officer and

Chairman of the Board | | 2001

2000

1999 | | $

| 325,000

325,000

325,000 | | $

| 50,000

50,000

— | | 25,000

25,000

25,000 | | $

| 16,166(1)

8,642(1)

32,980(1) |

Peter D. Cleary

President and Chief Operating Officer |

|

2001

2000

1999 |

|

$

|

184,570

140,000

140,000 |

|

$

|

5,430

—

5,430 |

|

—

—

75,000 |

|

$

|

4,217(2)

3,964(2)

4,083(2) |

Martha Vlcek

Chief Financial Officer and

Treasurer |

|

2001

2000

1999 |

|

$

|

124,000

93,000

37,000 |

(5) |

|

—

—

— |

|

—

—

— |

|

$

|

3,179(3)

1,247(3)

— |

Joe S. Rolston IV

Executive Vice President,

General Counsel and Secretary |

|

2001

2000

1999 |

|

$

|

179,800

171,500

104,000 |

(6) |

|

—

—

— |

|

—

—

— |

|

$

|

5,250(4)

3,109(4)

— |

- (1)

- Consists of Company contributions to a 401(k) profit sharing plan in the amount of $3,103, $5,250 and $5,000 in 2001, 2000 and 1999, respectively, Company-paid life insurance premiums in the amount of $12,000, $2,092 and $3,792 in 2001, 2000 and 1999, respectively, an automobile allowance of $1,063, $1,300 and $4,188 in 2001, 2000 and 1999, respectively, and fees in the amount of $20,000 in 1999 paid for personally guaranteeing the Company's bank lines of credit.

- (2)

- Consists of Company contributions to a 401(k) profit sharing plan in the amount of $4,217, $3,964 and $4,083 in 2001, 2000 and 1999, respectively.

- (3)

- Consists of Company contributions to a 401(k) profit sharing plan in the amount of $3,179 and $1,247 in 2001 and 2000, respectively.

- (4)

- Consists of Company contributions to a 401(k) profit sharing plan in the amount of $5,250 and $3,109 in 2001 and 2000, respectively.

- (5)

- Ms. Vlcek joined the Company in July 1999.

- (6)

- Mr. Rolston joined the Company in March 1999.

EMPLOYMENT AGREEMENTS

The following information describes the employment agreements of the Named Executive Officers.

In February 1998, the Company entered into a five-year employment agreement with Johan P. Finley. The agreement provides for a monthly salary of $27,083 that is subject to annual increases as recommended by the Compensation Committee and approved by the Board of Directors. In January 2002, Mr. Finley received a salary increase to $28,437 per month. Mr. Finley also receives a grant of 25,000 stock options each year during the term of the agreement, each of which vests over a five year period. The agreement provides for annual bonuses in increments of $50,000 if the Company meets certain earnings per share projections. The agreement provides that Mr. Finley is entitled to an automobile of his selection,

6

a life insurance policy and certain other benefits that are generally available to salaried employees of the Company. The agreement provides that Mr. Finley is entitled to a payment in the amount of two times his base salary in effect upon a termination of his employment by the Company, change in control of the Company or a sale of the majority of the Company's assets. The agreement also provides that if a majority of the Company's stock is sold to a single purchaser or a group of purchasers at a per share price equal to 130% of the average stock price for the previous 180 days, the Company will pay Mr. Finley a premium bonus equal to two years of base compensation in effect at the time of sale.

In September 1995, the Company entered into an employment agreement with Peter D. Cleary that renewed automatically for a one-year term in September 2000. In January 2002, the Company renewed its employment agreement with Mr. Cleary. Under the terms of this one-year contract, Mr. Cleary receives a salary of $210,000 and a grant of 10,000 stock options in 2002 and is eligible to earn an annual cash and/or stock option bonus based on various factors and in the sole and absolute discretion of the Compensation Committee. Unless terminated by either party, the contract renews automatically each year.

In January 2002, the Company entered into an employment agreement with Martha Vlcek. Under the terms of this one-year contract, Ms. Vlcek receives a salary of $148,500 and 7,500 stock options in 2002 and is eligible to earn an annual cash and/or stock option bonus based on various factors and in the sole and absolute discretion of the Compensation Committee. Unless terminated by either party, the contract renews automatically each year.

In March 1999, the Company entered into an employment agreement with Joe S. Rolston IV. In January 2002, the Company renewed its employment agreement with Mr. Rolston. Under the terms of this one-year contract, Mr. Rolston receives a salary of $200,000 and 7,500 stock options in 2002 and is eligible to earn an annual cash and/or stock option bonus based on various factors and in the sole and absolute discretion of the Compensation Committee. Unless terminated by either party, the contract renews automatically each year.

Each employment agreement is subject to earlier termination for cause or upon disability or death. In the event of termination for cause, each employment agreement provides for the payment of salary through the effective date of the termination. In the event of termination without cause, each employment agreement provides for the accelerated vesting of the employee's unvested options and the lump-sum payment by the Company of the employee's then current annual base salary. In the event of a change of control, each employment agreement permits the employee to either remain an employee of the Company or its successor or terminate the agreement such that the employee's unvested options become vested and the Company becomes obligated to provide the lump-sum payment of the employee's then current annual base salary. Mr. Finley has agreed not to compete with the Company following termination of employment for a period of two years. Mr. Cleary, Mr. Rolston and Ms. Vlcek have agreed not to compete with the Company following termination of employment for a period of six months.

The Company has a 401(k) profit-sharing plan and an employee stock purchase plan for its employees and may adopt additional bonus, pension, profit sharing, retirement or similar plans in the future.

STOCK OPTIONS

In the event of dissolution, liquidation or a change in control of the Company (as described in the Company's stock option plans), all outstanding options under the Company's stock option plans will become exercisable in full and each optionee will have the right to exercise his or her options or to receive a cash payment in certain circumstances.

7

2001 STOCK OPTION GRANTS

The following table summarizes certain information concerning stock option grants made in 2001 to the Named Executive Officers. Shown are hypothetical gains that could be realized for the respective options, based on assumed rates of annual compound stock price appreciation of 5% and 10% from the date the options were granted over the term of the options. Any amount realized upon exercise of the options will depend upon the market price of the Company's common stock at the time the option is exercised relative to the exercise price of the option. There is no assurance that the amounts reflected in this table will be realized.

| |

| |

| |

| |

| | Potential Realizable

Value at Assumed

Annual Rates

of Stock

Price Appreciation

For Option Terms

|

|---|

| |

| | Percent of

Total

Options

Granted to

Employees in

2001

| |

| |

|

|---|

| | Number of

Shares

Underlying

Options

Granted(1)

| | Option Term

|

|---|

Name

| | Exercise or

Base Price

($/Share)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Johan P. Finley | | 25,000 | | 11.5 | % | $ | 2.13 | | 1/31/06 | | $ | 15,000 | | $ | 33,000 |

| Peter D. Cleary | | — | | — | | | — | | — | | | — | | | — |

| Martha Vlcek | | — | | — | | | — | | — | | | — | | | — |

| Joe S. Rolston IV | | — | | — | | | — | | — | | | — | | | — |

- (1)

- Options become exercisable 20% per year over a five-year period beginning one year after the date of the grant.

2001 YEAR-END OPTION VALUE TABLE

The following table sets forth the number and aggregate dollar value of all unexercised options held by the Named Executive Officers as of the end of 2001. On December 31, 2001, the closing bid price of a share of the Company's common stock was $3.20. The value of the unexercised, in-the-money options held by the Named Executive Officers was based on the closing bid price on December 31, 2001 minus the relevant exercise price. There were no options exercised by the Named Executive Officers during 2001.

| | Number of Shares Subject to

Unexercised Options at

December 31, 2001

| | Value of Unexercised

In-the-Money Options at

December 31, 2001

|

|---|

Name

|

|---|

| | Exercisable

| | Nonexercisable

| | Exercisable

| | Nonexercisable

|

|---|

| Johan P. Finley | | 33,750 | | 66,250 | | $ | 17,164 | | $ | 68,741 |

| Peter D. Cleary | | 93,000 | | 51,000 | | | 41,280 | | | — |

| Martha Vlcek | | 16,000 | | 34,000 | | | 14,400 | | | 33,600 |

| Joe S. Rolston IV | | 16,000 | | 24,000 | | | 11,200 | | | 16,800 |

8

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee (the "Committee") of the Board of Directors (the "Board") may exercise the full powers of the Board in all matters relating to the compensation of the Company's Executive Officers (as that term is described in the Company's bylaws) except for the Chief Executive Officer, and also oversees an incentive plan for certain key management personnel. The Board has the full power in all matters relating to the compensation of the Company's Chief Executive Officer. The Committee is composed of two non-employee directors and one employee director. The Board is composed of three non-employee directors and three employee directors.

The following report describes the Company's Executive Officer compensation program and discusses the factors considered by the Committee in determining the compensation of the Company's Executive Officers for its 2001 fiscal year.

COMPENSATION PHILOSOPHY

The goals for the executive compensation program are to:

- •

- Motivate executives to assist the Company in achieving superior levels of financial and stock performance by closely linking executive compensation to performance in those areas; and

- •

- Attract, retain and motivate executives by providing compensation and compensation opportunities that are comparable to those offered by other companies in the gaming and financial services industries.

ELEMENTS OF THE EXECUTIVE COMPENSATION PROGRAM

The elements of the executive compensation program are designed to meet the Company's compensation philosophy. Currently, the Executive Compensation Program is comprised of annual cash compensation and longer-term stock compensation.

Annual cash compensation consists of base salary and performance bonuses. For lower-level employees, salaries are set to be competitive for the industry or marketplace, as appropriate, and bonuses are designed to represent a relatively small percentage of annual cash compensation. For higher-level employees, base salaries are in the low to average range for the gaming and financial services industries and potential bonuses constitute a high percentage of annual cash compensation. The Company's executive compensation bonus program has two components: (1) a bonus of up to a specified percentage of base salary is based upon the Company's earnings performance for the year, and (2) an additional bonus of up to 15% of base salary can be awarded at the discretion of the Committee.

The structure and earnings goals for the executive performance bonus program are reviewed and adjusted annually. Discretionary bonus awards for the Executive Officers are recommended by the Chief Executive Officer and are submitted to the Committee for approval. An Executive Officer's discretionary bonus is based upon the officer's duties and responsibilities, individual performance and future potential. Many of these assessments are subjective in nature and are made annually on a case-by-case basis.

The Company's 1993 Stock Option Plan, as amended, provides for the granting of options ("Options") to purchase up to an aggregate of 1,350,000 shares of Common Stock to certain key employees, officers, directors and consultants of the Company. In May 2001, the plan was amended to provide for the granting of options to purchase an aggregate of 1,600,000 shares. Options granted under the Stock Option Plan may be either Options that qualify as "incentive stock options" within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended ("Incentive Options"), or those that do not qualify as Incentive Options ("Non-Statutory Options"). The Stock Option Plan is administered by the Board and the Committee, which determines the persons who are to receive Options, the terms and

9

number of shares subject to each Option and whether the Option is an Incentive Option or a Non-Statutory Option.

The Company currently anticipates that new Executive Officers would be granted options at the time of hiring, which options would typically vest over a number of years. The Committee believes these grants are in line with external, competitive opportunities and provide a stronger, more direct motivation to executive officers to increase stockholder value. The Company awarded options to purchase a total of 208,800 shares in 2001 and options to purchase 25,000 shares during the period from January 1, 2002 through April 5, 2002, all of which vest over a period of five years.

As of the Record Date, options to purchase 981,391 shares of Common Stock were outstanding, with exercise prices ranging from $1.19 per share to $10.04 per share, to 53 employees, 535,101 of which are currently exercisable. Future grants of options to Executive Officers under the Stock Option Plan will be at least equal to 50,000 shares of common stock per year, in total, according to the terms of their employment contracts. Future grants of stock options to other employees under the Stock Option Plan are not determinable.

CEO COMPENSATION

In evaluating the compensation of Mr. Finley, the Board considered both qualitative and quantitative aspects of the Company's performance. Mr. Finley has served as the Company's Chief Executive Officer since its inception. Mr. Finley's base compensation was established after considering comparable data in the gaming and financial services industries, as well as the ongoing reliance by the Company on the substantial sales efforts of Mr. Finley. The Board negotiated an employment agreement in February 1998 for Mr. Finley, which is described in "Executive Compensation—Employment Agreements" above.

During 2001, the Company met certain of the performance objectives spelled out in Mr. Finley's employment agreement, and a bonus of $50,000 was paid in March 2002 to Mr. Finley accordingly. Additionally, the Board determined to increase his annual base compensation by 5%, or $16,250, to $341,250 per year.

10

COMPARATIVE STOCK PERFORMANCE

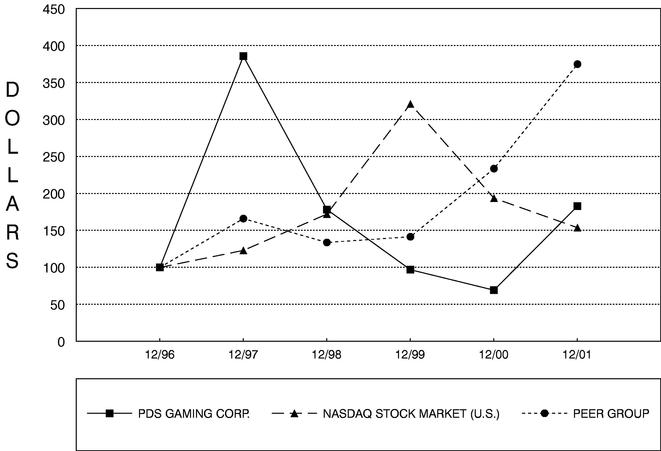

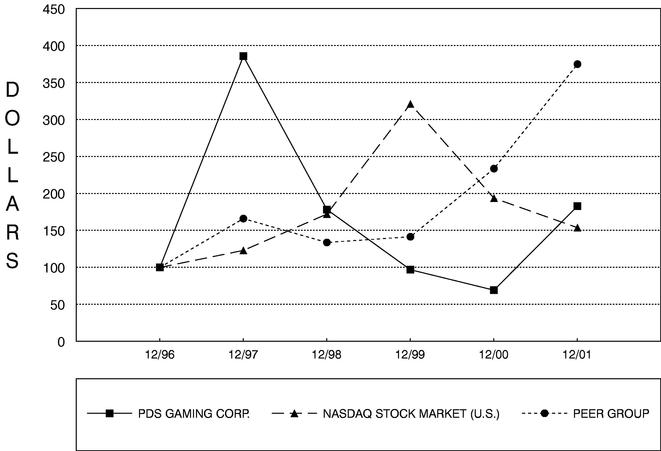

The following graph is a comparison as of December 31, 2001 of cumulative total return on investment among the Company, the NASDAQ Composite Index (the "NASDAQ Index") and an index of peer companies that the Company believes are comparable to the Company in terms of their lines of business (the "Peer Group Index"):

- *

- $100 invested on 12/31/96 in stock or index-including reinvestment of dividends. Fiscal year ending December 31.

- **

- Peer Group Index is comprised of the following companies:

Company

| | Ticker Symbol

|

|---|

| Mikohn Gaming Corp | | MIKN |

| Paul Son Gaming Corp | | PSON |

| PLM International Inc | | PLM |

| Shuffle Master Inc | | SHFL |

The following company, included in the prior year's Peer Group, ceased doing business in 2001, and is therefore no longer included in the peer group:

11

ITEM 2: APPOINTMENT OF INDEPENDENT ACCOUNTANTS

At the meeting, a vote will be taken on a proposal to ratify the appointment of Piercy, Bowler, Taylor & Kern, Certified Public Accountants and Business Advisors, a Professional Corporation ("PBTK"), by the Board of Directors to act as independent accountants of the Company for the fiscal year ending December 31, 2002. PBTK are independent accountants and auditors who have audited the consolidated financial statements of the Company and its subsidiaries beginning with the calendar year ended December 31, 1999.

Representatives of PBTK will attend the shareholder meeting. They will have the opportunity to make a statement if they desire to do so, and will be available to answer appropriate questions that may be asked by shareholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE APPOINTMENT OF PIERCY, BOWLER, TAYLOR & KERN AS INDEPENDENT ACCOUNTANTS.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee is comprised of three members of the Board of Directors and operates under a written charter adopted by the Board. A copy of the charter of the Audit Committee was filed as a part of the Company's proxy statement for its 2001 annual meeting of shareholders. The Board of Directors has reviewed The NASDAQ Stock Market rules and has determined that all members of the Audit Committee are independent as defined under NASDAQ's rules. The Audit Committee hereby reports as follows:

- 1.

- The Audit Committee has reviewed and discussed the audited financial statements with the Company's management.

- 2.

- The Audit Committee has discussed with PBTK, the Company's independent accountants, among other things, the matters required to be discussed by Statement of Accounting Standards No. 61 (Communication with Audit Committees).

- 3.

- The Audit Committee has received the written disclosures and the representations from PBTK required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and have discussed with PBTK their independence.

- 4.

- Based on the review and discussion of the above information, the Audit Committee recommended to the Board of Directors of the Company, and the Board has approved, that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2001, for filing with the Securities and Exchange Commission.

| | | AUDIT COMMITTEE

Joel M. Koonce, Chairman

James L. Morrell

Patrick R. Cruzen |

AUDIT AND NON-AUDIT FEES

For the fiscal year ended December 31, 2001, fees for services provided by PBTK were as follows:

| A. Audit and review of financial statements for fiscal year ended December 31, 2001 and for reviews of financial statements included in the Company's quarterly reports on Form 10-Q | | $ | 150,021 |

| B. Financial information systems design and implementation | | | — |

| C. All other services | | | 45,493 |

The Audit Committee has considered the effect of non-audit services provided by PBTK on PBTK's independence, and does not believe that such independence has been impaired or otherwise compromised.

12

ITEM 3: PROPOSAL TO APPROVE 2002 STOCK OPTION PLAN

The Company's 1993 Stock Option Plan (the "1993 Plan") was instituted in 1993 as a means of promoting the interests of the Company and its stockholders by providing key personnel of the Company and other individuals who are not employees but who provide services to the Company in the capacity of an advisor or consultant, including non-employee directors, with an opportunity to acquire a proprietary interest on the Company and thereby develop a stronger incentive to put forth maximum effort for the continued success and growth of the Company. In addition, the opportunity to acquire a proprietary interest in the Company will aid in attracting and retaining key personnel of outstanding ability. The 1993 Plan will expire in April 2003, prior to the anticipated date of the 2003 Annual Meeting of Shareholders, and currently provides for up to 1,600,000 shares of the Company's common stock to be issued thereunder. Pursuant to the terms of the 1993 Plan, although the 1993 Plan shall expire in April 2003, the options issued under the 1993 Plan shall continue to be exercisable until the relevant dates set forth in the individual stock option grants.

The Board of Directors has approved, subject to shareholder approval, a replacement of the 1993 Plan. The new plan, the 2002 Stock Option Plan (the "2002 Plan"), provides for the issuance of up to 800,000 shares of the Company's common stock. The terms and conditions of the 2002 Plan are substantially similar to the terms and conditions of the 1993 Plan with respect to purpose, administration, eligibility and grant, exercise, transferability and termination of stock options. A copy of the 2002 Plan is provided as Exhibit A.

The 2002 Plan authorizes the granting of Incentive Options within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"), as well as Non-Statutory Options. Options may be granted to employees, including officers and directors who are employees, to non-employee directors and to consultants of the Company or its parents, subsidiaries or affiliates. However, only employees of the Company or its parent or subsidiary companies are eligible to receive Incentive Options. The Code also contains additional limitations restricting the number of shares granted to an optionee that may be treated as Incentive Options. The 2002 Plan will terminate on the ten-year anniversary of its approval by the Company's shareholders. The Code requires shareholder approval of any amendment increasing the number of shares available for issuance pursuant to Incentive Options granted under the 2002 Plan.

The 2002 Plan is administered by the Company's Compensation Committee. The Compensation Committee determines whether each option is to be an Incentive Option or Non-Statutory Option, and determines the terms of options granted under the 2002 Plan, including the exercise price, the number of shares subject to the option and the period of exercisability. No Incentive Option may be exercised more than ten years after its grant date, provided, however, that no Incentive Option granted to a person owning more than 10% of the total combined voting power of all classes of stock of the Company or any parent or subsidiary of the Company (a "Ten Percent Stockholder") may be exercised more than five years from the date the option is granted. To the extent the aggregate fair market value, determined at the time the option is granted, of the Common Stock with respect to which all Incentive Options are exercisable for the first time by an employee during any calendar year exceeds $100,000, such options shall be treated as options which do not qualify as Incentive Options. During the lifetime of the optionee, only the optionee may exercise the option. In the event of a merger of the Company in which the Company is not the surviving corporation or a dissolution, liquidation or sale of substantially all of the Company's assets, all outstanding options will become exercisable at least ten days prior to such event on such terms as the Committee shall determine, unless the successor corporation assumes the outstanding options or substitutes substantially equivalent options. In addition, in the event of a change of control, all restrictions on all outstanding options will lapse and vesting on all unexercised stock options will accelerate to the date of the change of control.

The exercise price of all Incentive Options granted under the 2002 Plan must be not less than the fair market value of the Common Stock at the time the Incentive Options are granted, as determined

13

according to the 2002 Plan. The exercise price of any Incentive Options granted to a Ten Percent Stockholder must be not less than 110% of the fair market value of the Common Stock at the time the Incentive Options are granted, as determined by the Board of Directors or the Compensation Committee in good faith.

Under the 2002 Plan, the Compensation Committee may permit participants, subject to the discretion of the Compensation Committee and upon such terms and conditions as it may impose, to surrender shares of the Common Stock (either shares received upon the exercise of the option or shares previously owned by the optionee) to the Company to satisfy federal and state withholding tax obligations. The shares to be surrendered by the participant must have been acquired in the open market or owned for more than six months. In addition, the Compensation Committee may grant, subject to its discretion and such rules as it may adopt, a bonus to a participant in order to provide funds to pay all or a portion of federal and state taxes due as a result of the exercise of the option. The amount of any such bonus will be taxable to the participant as ordinary income, and the Company will have a corresponding deduction equal to such amount (subject to the tax rules concerning reasonable compensation).

The grant of a stock option pursuant to the 2002 Plan will result in no tax consequences to the optionee or the Company. The holder of an Incentive Option generally will have no taxable income upon exercising an Incentive Option (except that the alternative minimum tax may apply), and the Company generally will receive no tax deduction when an Incentive Option is exercised. Upon exercise of a Non-Statutory Option, the optionee must recognize ordinary income equal to the excess of the fair market value of the shares acquired on the date of exercise over the option price, and the Company will be entitled to a tax deduction for the same amount for its taxable year in which the exercise occurs. The tax consequences to an optionee of a disposition of shares acquired through the exercise of an option will depend on how long the shares have been held and upon whether such shares were acquired by exercising an Incentive Option or a Non-Statutory Option. Generally, there will be no tax consequence to the Company in connection with a disposition of shares acquired under an option except that the Company may be entitled to a tax deduction in the case of a disposition of shares acquired under an Incentive Option before the applicable Incentive Option holding period has been satisfied.

Special rules apply in the case of individuals subject to Section 16(b) of the Securities Exchange Act of 1934. In particular, under current law, shares received pursuant to the exercise of a stock option may be treated as restricted as to transferability and subject to a substantial risk of forfeiture for a period of up to six months after the date of exercise. Accordingly, unless a special tax election is made, the amount of ordinary income recognized and the amount of the employer's deduction may be determined as of such later date.

Although the Board may amend, suspend or discontinue the 2002 Plan, the approval of the Company's stockholders is required to increase the number of shares of the Common Stock authorized for issuance under the 2002 Plan, change the minimum exercise price of an option issued under the 2002 Plan, materially increase the benefits to participants under the 2002 Plan, extend the term of the 2002 Plan or change the terms, conditions or eligibility requirements of an option granted under the 2002 Plan.

The affirmative vote of a majority of the shares of Common Stock entitled to vote and present in person or by proxy at the Annual Meeting is required for the adoption of the 2002 Plan.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ADOPTION OF THE 2002 STOCK OPTION PLAN.

14

OTHER MATTERS

As of this date, the Board of Directors does not know of any business to be brought before the meeting other than as specified above. However, if any other matters properly come before the meeting, it is the intention of the persons named in the enclosed proxy to vote such proxy in accordance with their judgment on such matters.

COMPLIANCE WITH SECTION 16(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's directors, executive officers and persons who beneficially own more than ten percent of a registered class of the Company's equity securities ("ten-percent owners") to file with the Securities and Exchange Commission (the "SEC") initial reports of ownership and monthly reports of changes in ownership of a registered class of the Company's equity securities. Directors, executive officers and ten-percent owners are also required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company's knowledge, based solely on its review of the copies of such reports furnished to the Company and written representations that no other reports were required during the fiscal year ended December 31, 2001, all Section 16(a) filing requirements applicable to its directors, executive officers and ten-percent owners were satisfied.

DEADLINE FOR SUBMISSION OF SHAREHOLDER PROPOSALS

Proposals of shareholders intended to be presented at the next annual meeting of shareholders must be received by the Secretary of the Company, PDS Gaming Corporation, 6171 McLeod Drive, Las Vegas, NV 89120, no later than December 17, 2002, for inclusion in the Proxy Statement for such annual meeting. Management may use discretionary authority to vote against any shareholder proposal presented at the next annual meeting if: (1) such proposal has been properly omitted from the Company's proxy materials under federal securities law; or (2) notice of such proposal was not submitted to the Secretary of the Company at the address indicated on the cover of this proxy statement by December 17, 2002 or does not otherwise comply with requirements in the Company's bylaws; or (3) the proponent has not solicited proxies in compliance with federal securities law for the holders of at least the percentage of the Company's voting shares required to carry the proposal.

SOLICITATION OF PROXIES

The Company will bear the cost of preparing, assembling and mailing the Proxy Statement, Annual Report and other material which may be sent to the shareholders in connection with this solicitation. Brokerage houses and other custodians, nominees and fiduciaries may be requested to forward soliciting material to the beneficial owners of stock, in which case they will be reimbursed by the Company for their expenses in doing so. Proxies are being solicited primarily by mail, but, in addition, officers and regular employees of the Company may solicit proxies personally, by telephone, by facsimile or by special letter.

The Board of Directors does not intend to present to the meeting any other matter not referred to above and does not presently know of any matters that may be presented to the meeting by others. However, if other matters come before the meeting, it is the intent of the persons named in the enclosed Proxy to vote the Proxy in accordance with their best judgment.

| | |

Joe S. Rolston IV,

SECRETARY |

15

EXHIBIT A

PDS GAMING CORPORATION

2002 STOCK OPTION PLAN

1. Purpose of Plan. The purpose of this PDS Gaming Corporation 2002 Stock Option Plan (the "Plan"), is to promote the interests of PDS Gaming Corporation (the "Company"), and its stockholders by providing key personnel of the Company and its subsidiaries, and other individuals who are not employees but who provide services to the Company in the capacity of an advisor or consultant, including non-employee directors, with an opportunity to acquire a proprietary interest in the Company and thereby develop a stronger incentive to put forth maximum effort for the continued success and growth of the Company and its subsidiaries. In addition, the opportunity to acquire a proprietary interest in the Company will aid in attracting and retaining key personnel of outstanding ability.

2. Administration of Plan. This plan shall be administered by a committee of two or more non-employee directors (the "Committee") appointed by the Company's Board of Directors (the "Board"). For the purposes of the Committee, a non-employee director shall have the meaning set forth in Rule 16b-3 or the Securities Exchange Act of 1934. A majority of the members of the Committee shall constitute a quorum for any meeting of the Committee, and the acts of a majority of the members present at any meeting at which a quorum is present or the acts unanimously approved in writing by all members of the Committee shall be the acts of the Committee. Subject to the provisions of this Plan, the Committee may from time to time adopt such rules for the administration of this Plan as it deems appropriate. The decision of the Committee on any matter affecting this Plan or the rights and obligations arising under this Plan or any option granted hereunder, shall be final, conclusive and binding upon all persons, including without limitation the Company, stockholders, employees and optionees. To the full extent permitted by law, no member of the Committee shall be liable for any action or determination taken or made in good faith with respect to this Plan or any option granted hereunder.

3. Shares Subject to Plan. The shares that may be made subject to options granted under this Plan shall be authorized and unissued shares of common stock (the "Common Shares") of the Company, $.01 par value, and they shall not exceed 800,000 Common Shares in the aggregate, except that, if any option lapses or terminates for any reason before such option has been completely exercised, the Common Shares covered by the unexercised portion of such option may again be made subject to options granted under this Plan. Appropriate adjustments in the number of shares and in the purchase price per share shall be made by the Committee to give effect to adjustments made in the number of outstanding Common Shares of the Company through merger, consolidation, recapitalization, reclassification, combination, stock dividend, stock split or other relevant change, provided that fractional shares shall be rounded to the nearest whole share.

4. Eligible Participants. Options may be granted under this Plan to any key employee of the Company or any subsidiary thereof, including any such employee who is also an officer or director of the Company or any subsidiary thereof. Non-statutory stock options, as defined inSection 5(a) hereof, may be granted to individuals or entities who are not "employees" but who provide services to the Company or a parent or subsidiary thereof in the capacity of an advisor or consultant. Options granted to employees and other individuals or entities shall have the terms and conditions specified inSection 5 and elsewhere in this Plan.

5. Terms and Conditions of Employee Options.

- a.

- Subject to the terms and conditions of this Plan, the Committee may, from time to time prior to the termination of the plan, grant to such eligible employees as the Committee may determine options to purchase such number of Common Shares of the Company on such terms and conditions as the Committee may determine. In determining the employees or other individuals to whom options shall be granted and the number of Common Shares to be covered by each option, the Committee may take into account the nature of the services rendered by the

16

respective employees, their present and potential contributions to the success of the Company, and such other factors as the Committee at its sole discretion shall deem relevant. The date and time of approval by the Committee of the granting of an option shall be considered the date and the time of the grant of such option. The Committee in its sole discretion may designate whether an option is to be considered an "incentive stock option" (as that term is defined in Section 422 of the Internal Revenue Code of 1986, as amended, or any amendment thereto (the "Code"), or a non-statutory stock option (an option granted under this Plan that is not intended to be an "incentive stock option"). The Committee may grant both incentive stock options and non-statutory stock options to the same individual. However, if an incentive stock option and a non-statutory stock option are awarded simultaneously, such options shall be deemed to have been awarded in separate grants, shall be clearly identified, and in no event shall the exercise of one such option affect the right to exercise the other. To the extent that the aggregate Fair Market Value (as defined in Section 5(c) below) of Common Shares with respect to which incentive stock options (determined without regard to this sentence) are exercisable for the first time by any individual during any calendar year (under all plans of the Company and its parent and subsidiary corporations) exceeds $100,000, such options shall be treated as non-statutory stock options.

- b.

- The purchase price of each Common Share subject to an option granted pursuant to this Section shall be fixed by the Committee. For non-statutory stock options, such purchase price may be set at not less than 85% of the Fair Market Value (as defined below) of a Common Share on the date of grant. For incentive stock options, such purchase price shall be not less than 100% of the Fair Market Value of a Common Share on the date of grant, provided that if such incentive stock option is granted to an employee who owns, or is deemed under Section 424(d) of the Code to own, at the time such option is granted, stock of the Company (or of any parent or subsidiary of the Company) possessing more than 10% of the total combined voting power of all classes of stock therein (a "10% Stockholder"), such purchase price shall be not less than 110% of the Fair Market Value of a Common Share on the date of grant.

- c.

- For purposes of this Plan, the "Fair Market Value" of a Common Share at a specified date shall, unless otherwise expressly provided in this Plan, mean: (i) the closing price of a Common share on a principal exchange (including the Nasdaq National Market, the Nasdaq SmallCap Market or a successor quotation system) on which the Common Shares are trading or quoted on the date on which the Fair Market Value is determined (if the Fair Market Value is determined on a date which such principal exchange is closed, the Fair Market Value shall be determined on the last immediately preceding trading day); or (ii) if the Common Shares are not traded on an exchange or quoted on a principal exchange (including the Nasdaq National Market, the Nasdaq SmallCap Market or a successor quotation system), the fair market value of a Common Share as determined by the Committee in good faith. Notwithstanding any provision of this Plan to the contrary, no determination made with respect to the Fair Market Value of a Common share subject to an incentive stock option shall be inconsistent with Section 422 of the Code.

- d.

- Each option agreement provided for inSection 12 hereof shall specify when each option granted under this Plan shall become exercisable. Subject to the foregoing, the Committee, at its sole discretion, shall determine when all or any installment of an option is to become exercisable. Notwithstanding anything to the contrary herein, no option will be exercisable (and any attempted exercise will be deemed null and void) if such exercise would create a right of recovery for "short-swing profits" under Section 16 (b) and shall not apply with respect to any particular exercise of an option if this section 5 (d) is expressly waived in writing by the optionee at the time of such exercise.

17

- e.

- Each option granted pursuant to thisSection 5 and all rights to purchase shares thereunder shall cease on the earliest of:

- (i)

- Ten (10) years after the date such option is granted (or in the case of an incentive stock option granted to a 10% Stockholder, five years after the date such option is granted) or on such date prior thereto as may be fixed by the Committee on or before the date such option is granted;

- (ii)

- The expiration of the period after the termination of the optionee's employment within which the option is exercisable as specified inSection 7(b) or 7(d), whichever is applicable; or

- (iii)

- The date, if any, fixed for cancellation pursuant toSection 10 of this Plan.

In no event shall any option be exercisable at any time after its original expiration date. When an option is no longer exercisable, it shall be deemed to have lapsed or terminated and will no longer be outstanding.

6. Manner of Exercising Options. A person entitled to exercise an option granted under this Plan may, subject to its terms and conditions and the terms and conditions of this Plan, exercise it in whole at any time, or in part from time to time, by delivery to the Company at its principal executive office, to the attention of its President, of written notice of exercise, specifying the number of shares with respect to which the option is being exercised, accompanied by payment in full of the purchase price of the shares to be purchased at the time. The purchase price of each share on the exercise of any option shall be paid in full in cash (including check, bank draft or money order) at the time of exercise or, with the consent of the Company, by delivery to the Company of unencumbered Common Shares having an aggregate Fair Market Value on the date of exercise equal to the purchase price, or by a combination of cash and such unencumbered Common Shares. The purchase price may be paid through the delivery of Common Shares that have been acquired in the open market or owned for more than six months, which certificate(s) representing such Common Shares is surrendered to the Company, duly endorsed, and in good form for transfer. Except as otherwise agreed in writing to the contrary, no shares shall be issued until full payment for the shares has been made, and the granting of an option to an individual shall give such individual no rights as a stockholder except as to shares issued to such individual. The Company, at the discretion of the Committee, may provide financing alternatives to facilitate the exercise of options by optionees.

7. Transferability and Termination of Options.

- a.

- During the lifetime of an optionee, only such optionee or his or her guardian or legal representative may exercise options granted under this Plan. No options granted under this Plan shall be assignable or transferable by the optionee otherwise than by will or the laws of descent and distribution.

- b.

- With respect to optionees who are employed by the Company at the time of the grant under this Plan, an option may be exercised only while the optionee is an employee of the Company or of a parent or subsidiary thereof, and only if such optionee has been continuously so employed since the date the option was granted, except that:

- (i)

- after termination of such individual's employment but only to the extent that the option was exercisable immediately prior to such individual's termination of employment, provided, however, that if such individual's employment is terminated by the Company for cause, the option shall terminate immediately;

- (ii)

- In the case of an employee who is disabled (within the meaning of Section 22(e)(3) of the Code) while employed, such individual or his or her legal representative may exercise the option, to the extent exercisable immediately prior to termination by reason of disability, within one year after termination of such individual's employment; and

18

- (iii)

- With respect to optionees who are not employed by the Company at the time of the grant under this Plan, the terms and conditions, which govern such exercise will be determined at the time of such grant and shall be specified as provided inSection 12 of this Plan.

- c.

- An option may be exercised after the death of the optionee by such individual's legal representatives, heirs or legatees, to the extent exercisable immediately prior to such individual's death, but only within one year after the death of such optionee.

- d.

- The Committee may, in appropriate circumstances deemed to be in the best interest of the Company, extend the post-termination exercise periods described in this Section or accelerate the vesting of options.

8. Dissolution, Liquidation, Merger. In the event of (a) a proposed merger or consolidation of the Company with or into any other corporation, regardless of whether the Company is the surviving corporation, unless appropriate provision shall have been made for the protection of the outstanding options granted under this Plan by the substitution, in lieu of such options, of options to purchase appropriate voting common stock (the "Survivor's Stock") of the corporation surviving any such merger or consolidation or, if appropriate, the parent corporation of the Company or such surviving corporation, or, alternatively, by the delivery of a number of shares of the Survivor's Stock which has a Fair Market Value as of the effective date of such merger or consolidation equal of the product of (i) the excess of (x) the Event Proceeds per Common Shares (as hereinafter defined) covered by the option as of such effective date, over (y) the option price per Common Share (as hereinafter defined) covered by the option as of such effective date times (ii) the number of Common Shares covered by such option, or (b) in the event of a proposed dissolution or liquidation of the Company (such merger, consolidation, dissolution or liquidation being herein called and "Event"), the Committee shall declare, at least ten (10) days prior to the actual effective date of an Event, and provide written notice to each optionee of the declaration, that each outstanding option, whether or not then exercisable, shall be canceled at the time, or, immediately prior to the occurrence of, the Event (unless it shall have been exercised prior to the occurrence of the Event) in exchange for payment to each optionee, within ten days after the Event, of cash equal to the amounts (if any), for each Common Share covered by the canceled option, by which the Event Proceed per Common Share (as hereinafter defined) exceeds the exercise price per Common Share covered by such option. At the time of the declaration provided for in the immediately preceding sentence, each option shall immediately become exercisable in full and each optionee shall have the right, during the period preceding the time of cancellation of the option, to exercise his or her option as to all or any part of the Common Shares covered thereby. Each outstanding option granted pursuant to this Plan that shall not have been exercised prior to the Event shall be canceled at the time of, or immediately prior to, the Event, as provided in the declaration, and this Plan shall terminate at the time of such cancellation, subject to the payment obligations of the Company provided in this sub-section (b). For purposes of thisSection 8, "Event Proceeds per Common Share" shall mean the cash plus the fair market value, as determined in good faith by the Committee, of the non-cash consideration to be received per Common Share by the stockholders of the Company upon the occurrence of the Event.

9. Tax Withholding. Delivery of Common Shares upon exercise of any non-statutory stock option granted under this Plan shall be subject to arrangements satisfactory to the Company regarding payment of any federal, state or local taxes of any kind required by law to be withheld with respect to the option. In lieu of all or any part of a cash payment, the Committee may cause the Company to pay a cash amount equal to any amount required, to permit the individual to elect to cover all or any part of the required withholdings, and to cover any additional withholdings up to the amount needed to cover the individual's full FICA and federal, state and local income tax liability with respect of income arising from the exercise of the option, through a reduction of the number of Common Shares delivered to the person exercising the option or through a subsequent return to the Company of shares delivered to the person exercising the option. Any such election shall be in accordance with all applicable Federal and State laws, rules and regulations.

19

10. Termination of Employment. Neither the transfer of employment of an individual to whom an option is granted between any combination of the Company, a parent corporation or a subsidiary thereof, nor a leave of absence granted to such individual and approved by the Committee, shall be deemed a termination of employment for purposes of this Plan. The terms "parent" or "parent corporation" and "subsidiary" as used in this Plan shall have the meaning ascribed to "parent corporation" and "subsidiary corporation", respectively, in Sections 424(e) and (f) of the Code.

11. Other Terms and Conditions. The Committee shall have the power, subject to the limitations contained herein, to fix any other terms and conditions for the grant or exercise of any option under this Plan. Nothing contained in the Plan, or in any option granted pursuant to this Plan, shall confer upon any employee holding an option any right to continued employment by the Company or any parent or subsidiary of the Company or limit in any way the right of the Company or any such parent or subsidiary to terminate an employee's employment at any time.

12. Option Agreements. All options granted under this Plan shall be evidenced by a written agreement in such form or forms as the Committee may from time to time determine, which agreement shall, among other things, designate whether the options being granted thereunder are non-statutory stock options or incentive stock options under Section 422 of the Code.

13. Amendment and Discontinuance of Plan. The Board may at any time amend, suspend or discontinue this Plan; provided, however, that no amendment by the Board shall, without further approval of the stockholders of the Company, unless required in order for the Plan to continue to satisfy the conditions of Rule 16b-3 promulgated under the Act, or any successor statute or regulation comprehending the same subject matter or to meet the requirements of the Code or any other applicable laws, regulations or rules:

- a.

- Except as provided inSection 3 hereof, increase the total number of Common Shares of the Company which may be made subject to options granted under this Plan;

- b.

- Except as provided inSection 3 hereof, change the minimum purchase price for the exercise of an option;

- c.

- Increase the maximum period during which options may be exercised or otherwise materially increase the benefits accruing to participants under this Plan;

- d.

- Extend the term of this Plan beyond May 10, 2012; or

- e.

- Except as provided specifically in this Plan, change the terms, conditions or eligibility requirements of an option granted under this Plan.

No amendment to this Plan shall, without the consent of the holder of the option, alter or impair any options previously granted under this Plan.

14. Effective Date. This Plan shall be effective on the date approved by stockholders and the Board of Directors of the Company and shall expire on ten (10) year anniversary of such effective date.

15. General Provisions.

- a.

- The Committee may require each person purchasing shares pursuant to the Plan to represent to and agree with the Company in writing that the optionee is acquiring the shares without a view to distribution thereof. The certificates for such shares may include any legend, which the Committee deems appropriate to reflect any restrictions on transfer. Including restrictions arising under the Securities Act of 1933.

- b.

- All certificates for shares of Stock delivered under the Plan shall be subject to such stock-transfer orders and other restrictions as the Committee may deem advisable under the rules, regulations, and other requirements of the Securities and Exchange Commission, and any applicable federal

20

16. Each individual who is serving as a non-employee director immediately following the adoption of thisSection 16 by the Board, or who is first elected or appointed as a non-employee director thereafter, shall be automatically awarded, on such date, a non-statutory option to purchase 10,000 shares of the Company's common stock with the purchase price determined as set forth inSection (b) below. In addition, after the initial grant, each non-employee director shall be awarded a non-statutory option to purchase 5,000 shares of the Company's common stock upon the director's re-election to the Board.

21

- a.

- Non-Statutory Options. All options granted to non-employee directors hereunder shall be designated as non-statutory options and shall be subject to the same terms and provisions as are then in effect with respect to granting of non-statutory options to officers and key employees of the Company. No other options shall be granted to non-employee directors under this Plan or any other stock plan of the Company. All provisions of this Plan not inconsistent with the terms of this formula shall apply to non-statutory options granted to non-employee directors.

- b.

- The purchase price of each Common Share subject to an option granted pursuant to this Section 16 shall be equal to 100% of the Fair Market Value of a Common Share on the date of grant.

- c.

- Term and Exercisability. Each non-employee director option granted hereunder shall have a term of ten (10) years and will be exercisable as to 2,500 shares on and after the date of the first annual meeting of stockholders at which the optionee is re-elected to the Board of Directors or is serving an unexpired term, and shall become exercisable with respect to an additional 2,500 shares on the date of each annual meeting of stockholders at which the optionee is re-elected to the Board or is serving and unexpired term.

- d.

- Effect of Termination of Board Membership.

- (i)

- Should an optionee cease to be a member of the Board for any reason (other than death) prior to the expiration of his or her automatic grant under this paragraph 16, then such grant shall remain exercisable for a period of ninety (90) days following the date of such cessation of Board membership. Each such option shall, during such period, be exercisable only to the extent of the number of shares (if any) for which the option is exercisable on the date of such cessation of Board membership.

- (ii)

- Should an optionee cease to be a member of the Board by reason of optionee's death, then any outstanding automatic grant held by the optionee at the time of death may be subsequently exercised, but only to the extent of the number of shares (if any) for which the option is exercisable on the date of the optionee's death, by the personal representative of the optionee's estate or by the person or persons to whom the option is transferred pursuant to the optionee's will or in accordance with the laws of descent and distribution. Any such exercise must, however, occur within one (1) month after the date of the optionee's death.

- (iii)

- In no event shall any option granted pursuant to thisSection 16 remain exercisable after ten (10) years from the date of grant. Upon the expiration of the applicable exercise period specified in subparagraphs (1) and (2) above or (if earlier) upon the expiration of the option term, the option shall terminate and cease to be exercisable.

- e.

- Amendment. This formula shall not be amended more than once every six (6) months, other than to comport with changes in the Internal Revenue Code of 1986, as amended, the Employee Retirement Income Security Act of 1974, as amended, or the rules thereunder, or any other applicable laws, regulations or rules.

22

|

|

|

PDS GAMING CORPORATION

6171 MCLEOD DRIVE, LAS VEGAS, NV 89120 | | PROXY |