UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | | Preliminary Proxy Statement |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material Pursuant to §240.14a-12 |

Blyth, Inc. |

(Name of Registrant as Specified in its Charter) |

| |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

x | | No fee required. |

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

o | | Fee paid previously with preliminary materials. |

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

BLYTH, INC.

One East Weaver Street

Greenwich, Connecticut 06831

(203) 661-1926

___________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 10, 2009

___________

To the Stockholders of Blyth, Inc.: | April 28, 2009 |

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Blyth, Inc. will be held in the Board Room of Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831 on Wednesday, June 10, 2009, at 8:30 a.m. local time, for the following purposes:

| 1. | to elect two directors, each to hold office until the annual meeting of stockholders to be held in 2012 or until a respective successor is elected and qualified; and |

2. to transact such other business as may properly come before the meeting or any adjournments thereof.

The board of directors has fixed the close of business on April 13, 2009 as the record date for the determination of stockholders entitled to notice of, and to vote at, the annual meeting. A list of stockholders entitled to vote at the annual meeting will be available for examination by any stockholder, for any purpose relevant to the meeting, on and after May 27, 2009, during ordinary business hours at the our principal executive offices located at the address set forth above.

By Order of the Board of Directors

Michael S. Novins

Secretary

BLYTH, INC.

One East Weaver Street

Greenwich, Connecticut 06831

(203) 661-1926

___________

PROXY STATEMENT

___________

Annual Meeting of Stockholders

To Be Held June 10, 2009

___________

INTRODUCTION

This proxy statement is being furnished to holders of our common stock in connection with the solicitation of proxies by our board of directors for use at the annual meeting of stockholders to be held in the Board Room of Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831 on Wednesday, June 10, 2009, at 8:30 a.m. local time, and at any adjournments thereof. This proxy statement is first being released by us to our stockholders on April 28, 2009.

Our Annual Report on Form 10-K for the fiscal year ended January 31, 2009 also accompanies this proxy statement. The annual report includes audited financial statements, a discussion by management of our financial condition and results of operations, and other information.

At the end of January 2009, we effected a 1-for-4 reverse stock split of our common stock. Accordingly, we have adjusted the references to share amounts and common stock prices prior to such time to give effect to the reverse stock split.

ABOUT THE ANNUAL MEETING

PROXY MATERIALS AND THE 2009 ANNUAL MEETING

Why am I receiving these materials?

The board of directors is providing these proxy materials to you in connection with the 2009 annual meeting of stockholders. The annual meeting will take place in our Board Room at One East Weaver Street, Greenwich, Connecticut 06831 on Wednesday, June 10, 2009, at 8:30 a.m. local time. You are invited to attend the annual meeting and are entitled to and requested to vote on the proposals described in this proxy statement.

What is the purpose of the annual meeting?

At the annual meeting, stockholders will be asked:

| 1. | to elect two directors, each to hold office until the 2012 annual meeting or until a respective successor is elected and qualified; and |

| 2. | to transact such other business as may properly come before the meeting or any adjournments thereof. |

What are the recommendations of the board of directors?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the board of directors. The board’s recommendations are set forth together with the description of both items in this proxy statement. The board recommends a vote for the election of both of the nominees as directors. If any other matters are properly presented at the annual meeting for action, including a question of adjourning the meeting from time to time, the persons named in the proxies will have discretion to vote on such matters in accordance with their best judgment.

Who is entitled to vote at the annual meeting?

Only stockholders of record at the close of business on the record date, Monday, April 13, 2009, are entitled to notice of and to vote at the annual meeting or any adjournment(s) thereof. Each stockholder is entitled to one vote, exercisable in person or by proxy, for each share held of record on the record date with respect to each matter. On the record date, there were 8,893,516 shares of common stock issued and outstanding.

How do I vote?

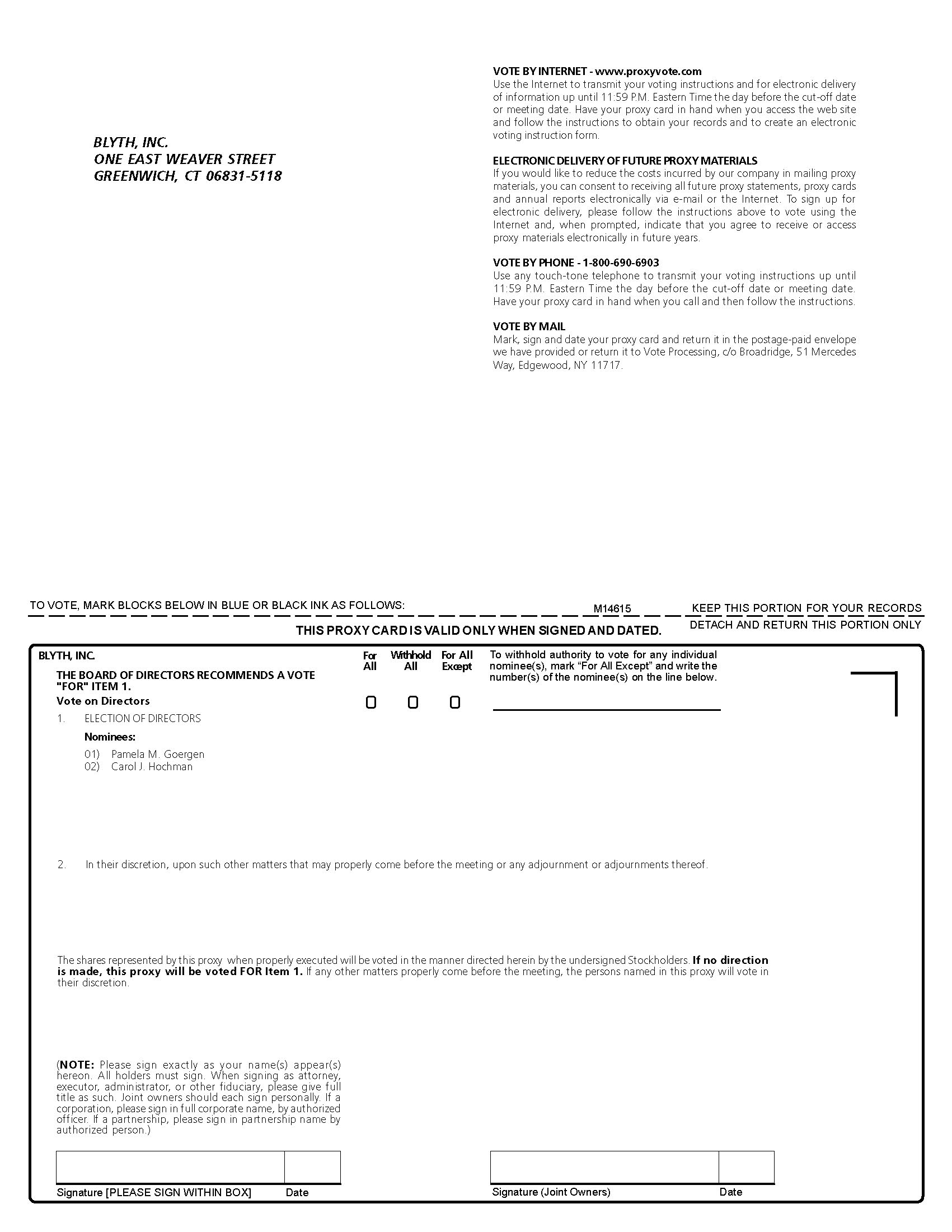

You may vote either by casting your vote in person at the meeting, by marking, signing and dating each proxy card you receive and returning it in the prepaid envelope, by telephone, or electronically through the Internet by following the instructions included on your proxy card.

The telephone and Internet voting procedures are designed to authenticate votes cast by use of a personal identification number. The procedures, which are designed to comply with Delaware law, allow stockholders to appoint a proxy to vote their shares and to confirm that their instructions have been properly recorded.

If you hold your shares in “street name” through a broker or other nominee, you may be able to vote by telephone or electronically through the Internet in accordance with the voting instructions provided by that institution.

Proxies will also be considered to be confidential voting instructions to the trustees of our 401(k) and profit sharing plan with respect to shares of common stock held in accounts under the plan.

To the extent that no direction is indicated, the shares will be voted FOR the election of both of the nominees as directors. If any other matters are properly presented at the annual meeting for action, including a question of adjourning the meeting from time to time, the persons named in the proxies will have discretion to vote on such matters in accordance with their best judgment.

Can I change my vote after I return my proxy card?

Any stockholder who has executed and returned a proxy has the power to revoke it at any time before it is voted. A stockholder who wishes to revoke a proxy can do so by attending the annual meeting and voting in person, or by executing a later-dated proxy relating to the same shares or a writing revoking the proxy and, in the latter two cases, delivering such later-dated proxy or writing to our corporate secretary prior to the vote at the annual meeting. Any writing intended to revoke a proxy should be sent to us at our principal executive offices, One East Weaver Street, Greenwich, Connecticut 06831, Attention: Michael S. Novins, Secretary.

What constitutes a quorum?

A majority of the shares entitled to vote, represented in person or by proxy, constitutes a quorum. Abstentions are considered shares present and entitled to vote, and therefore have the same legal effect as a vote against a matter presented at the annual meeting. Any shares held in street name for which the broker or nominee receives no instructions from the beneficial owner, and as to which such broker or nominee does not have discretionary voting authority under applicable New York Stock Exchange rules, will be considered as shares not entitled to vote and will not be considered in the tabulation of the votes. Under New York Stock Exchange rules, a majority of the shares must vote on certain matters (with abstentions being treated as votes and broker non-votes not being treated as votes).

Subject to the foregoing, a broker non-vote will have no effect with respect to either of Items 1 and 2 of this proxy statement.

What vote is required to approve each item?

If a quorum is present, (i) a plurality vote of the shares present, in person or by proxy, is required for the election of directors and (ii) the affirmative vote of the majority of the shares present, in person or by proxy, is required for approval of Item 2.

Who will bear the cost of soliciting votes for the annual meeting?

We are paying for the distribution and solicitation of the proxies. As part of this process, we reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders. Our employees may also solicit proxies on our behalf in person, by telephone, electronic transmission or facsimile, but they do not receive additional compensation for providing those services.

ITEM 1: ELECTION OF DIRECTORS

Nominees for Election as Directors

The board of directors currently consists of eight members, divided into three classes serving staggered terms of office.

It is intended that the persons named in the enclosed form of proxy, as proxies, will, except as noted below, vote FOR the election of the following nominees as directors, to serve until the 2012 annual meeting:

Pamela M. Goergen

Carol J. Hochman

Both of them currently serve as directors, and were most recently elected at the 2006 annual meeting. The board does not contemplate that either of such nominees will become unable to serve. If, however, either of the nominees should become unable to serve before the annual meeting, proxies solicited by the board will be voted by the persons named as proxies in accordance with the best judgment of such proxies. Pursuant to our bylaws, directors are elected by plurality vote. Our certificate of incorporation does not provide for cumulative voting in the election of directors.

The following sets forth the name, age, business experience for the past five years and other directorships of each of the nominees and the continuing directors:

Nominees for Election at the 2009 Annual Meeting for Terms Expiring in 2012

Pamela M. Goergen joined the board of directors in 1984. From 2001 to the present, she has served as a managing director of Ropart Investments, LLC, a private equity investment group, and for its predecessor, The Ropart Group Limited, she served as vice president and secretary from 1979 to 2001.

Carol J. Hochman (58)

Carol J. Hochman joined the board of directors in 2002. Ms. Hochman is president and chief executive officer of Triumph Apparel Corp. (formerly Danskin, Inc.). Prior to her appointment to Triumph Apparel in 1999, she held the position of Group President – Accessories at Liz Claiborne, Inc., where she held positions of increased responsibility for over 20 years. Prior to her roles at Liz Claiborne, she spent six years in the international division of May Department Stores. Ms. Hochman also sits on the foundation of the board of Queens College, part of the City

University of New York, and is chairman of the board of the American Apparel and Footwear Association and serves on the board of the Sporting Goods Manufacturers Association, both major industry trade associations.

Continuing Directors with Terms Expiring in 2010

Chairman of the Board and Chief Executive Officer

Robert B. Goergen has been our chairman since our inception in 1977. Mr. Goergen has served as our chief executive officer since 1978 and as president from March 1994 to March 2004. Since 1979, he has served as senior managing member of Ropart Investments, LLC and its predecessor entities, a private equity investment group.

Neal I. Goldman joined the board of directors in 1991. From 1985 to the present, he has been the president of Goldman Capital Management, Inc., an investment advisory firm.

Howard E. Rose joined the board of directors in 1998. Mr. Rose served as vice chairman of the board from April 1998 to June 2000. Mr. Rose served as our vice president and chief financial officer from 1978 to April 1998, and served as secretary from 1993 to 1996.

Continuing Directors with Terms Expiring in 2011

Anne M. Busquet (59)

Anne M. Busquet joined the board of directors in August 2007. Since September 2006, and from 2001 to 2002, she was a principal at AMB Advisors, LLC, a business consulting firm. From 2004 to September 2006, she was chief executive officer of IAC Local and Media Services, a division of IAC/InterActiveCorp, and from 2003 to 2004, she was president and senior advisor of IAC’s travel services group. From 1978 to 2001, she served in various positions at American Express Company, and was a member of its planning and policy committee from 1995 to 2001. Ms. Busquet serves on the boards of Pitney Bowes Inc. and Invoke Solutions.

Wilma H. Jordan (59)

Wilma H. Jordan joined the board of directors in 2004. Ms. Jordan is founder and chief executive officer of The Jordan, Edmiston Group, a media investment bank. Ms. Jordan is also a founding general partner and chief executive officer of JEGI Capital, a venture capital affiliate of Jordan, Edmiston. Ms. Jordan served on the board of directors of Lin TV Corporation (NYSE) from May 2002 until September 2007. In addition, she is a director of Guideposts, Inc., a publisher of Guideposts Magazine and a leading provider of other magazines, books and related ministry programs and has served as a director of several privately held companies.

James M. McTaggart joined the board of directors in 2004. Mr. McTaggart is co-founder and partner of Marakon, Inc., an international management consulting firm that advises senior executives on the issues most impacting company performance and long-term value. Prior to co-founding Marakon, he was a vice president of Wells Fargo Bank and co-founded the bank’s corporate finance department. Mr. McTaggart serves on the board of trustees of Greenwich Hospital and Greenwich Health Services.

Other than Robert B. Goergen and Pamela M. Goergen, who are husband and wife, and Robert B. Goergen, Jr., who is their son, there are no family relationships among any of the nominees for election as directors, any continuing directors or any executive officers.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES.

Corporate Governance Guidelines

As part of its ongoing commitment to good corporate governance, the board of directors has codified its corporate governance practices into a set of corporate governance guidelines. These guidelines assist the board in the exercise of its responsibilities and may be amended by the board from time to time. The corporate governance guidelines are available on our website, www.blyth.com, and are also available in print to any stockholder who makes a request to Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831, Attention: Michael S. Novins, Secretary.

Director Independence

Our corporate governance guidelines require that a majority of the board consist of directors who meet the independence requirements of the listing standards of the New York Stock Exchange, including the requirement that there be no material relationship between the director and us. The board has determined that no relationship between us and a director that arises solely out of the ownership by such director of less than 1% of the outstanding equity interests in an organization that has a relationship with us is a “material” relationship for purposes of the determination by the board as to whether such director has any material relationship with us. The board conducts an annual review as to whether each of our directors qualifies as independent. Based on its most recent annual review, the board has concluded that each director other than Robert B. Goergen and Pamela M. Goergen is independent.

The non-management members of the board meet without management present at least twice annually at regularly scheduled executive sessions and at such other times as they may deem necessary or appropriate. The chairman of the nominating and corporate governance committee presides at these meetings. Wilma H. Jordan is currently chairman of the nominating and corporate governance committee.

Director Compensation

For their services as directors, non-employee directors receive an annual fee of $20,000, reimbursement of out-of-pocket expenses, plus a fee of $1,500 for each board meeting attended in person and a fee of $500 for each board meeting attended by telephone. Each member of the audit committee, the compensation committee and the nominating and corporate governance committee, including each committee chairman, also receives a fee of $1,500 for each committee meeting attended in person and a fee of $500 for each committee meeting attended by telephone. The chairman of the audit committee receives an annual retainer fee of $10,000 and the chairmen of the compensation committee and the nominating and corporate governance committee each receive an annual retainer fee of $5,000. In 2009, a committee of independent directors evaluated our acquisition of ViSalus Sciences (see “— Certain Relationships and Related Transactions”) and the members of that committee received a fee of $1,500 for each committee meeting attended in person and a fee of $500 for each committee meeting attended by telephone. The full board determines annual equity awards for non-employee directors, subject to an annual limit of awards of 1,250 shares of common stock or share equivalents for new non-employee directors and 625 shares or share equivalents for continuing non-employee directors. Directors who are also employees do not receive any additional compensation for their services as directors.

Director Compensation in Fiscal 2009

The following table sets forth information regarding the compensation of the directors earned in fiscal 2009.

Name | Fee Earned or Paid in Cash | Stock Awards | All Other Compensation | Total |

| | ($) | ($)1, 2 | ($) | ($) |

| Anne M. Busquet | 44,000 | 28,740 | ― | 72,740 |

| Pamela M. Goergen | 28,500 | 28,740 | ― | 57,240 |

| Robert B. Goergen | ― | ― | ― | ― |

| Neal I. Goldman | 35,000 | 28,740 | ― | 63,740 |

| Carol J. Hochman | 39,500 | 28,740 | ― | 68,240 |

| Wilma H. Jordan | 52,000 | 28,740 | ― | 80,740 |

| James M. McTaggart | 42,833 | 28,740 | ― | 71,573 |

| Howard E. Rose | 52,000 | 28,740 | 6,9513 | 87,691 |

John W. Burkhart4 | 23,167 | ― | ― | 23,167 |

| (1) | These amounts represent the grant date fair value in accordance with Statement of Financial Standards (SFAS) No. 123R “Share-Based Payments” (FAS 123(R)). Information regarding the valuation assumptions used in the calculation of this amount is included in Note 16 to the audited financial statements included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on April 14, 2009. |

| (2) | The grant date fair value of the RSUs issued in fiscal 2009 was $28,740 for all directors, who were issued 375 RSUs in June 2008. |

| (3) | Represents health insurance premiums paid by us. |

| (4) | Mr. Burkhart retired from the board in June 2008. In accordance with the terms of the Amended and Restated 2003 Omnibus Incentive Plan, the vesting of Mr. Burkhart’s RSUs was accelerated upon his retirement. |

Board and Committee Meetings

The board has established three committees: the audit committee, the compensation committee and the nominating and corporate governance committee. The charter for each committee is available on our website, www.blyth.com, and is also available in print to any stockholder who makes a request to Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831, Attention: Michael S. Novins, Secretary.

Audit Committee. The audit committee is comprised of Mr. Rose (chairman), Ms. Busquet and Ms. Jordan and assists the board in fulfilling its oversight responsibilities regarding our legal and regulatory compliance, financial statements, internal audit function and independent auditors. Each member of the audit committee is an independent director as determined by the board, based on the New York Stock Exchange listing standards. Each member of the audit committee also satisfies the Securities and Exchange Commission’s additional independence requirement for members of audit committees. In accordance with our corporate governance guidelines, none of the members of the audit committee serve on more than two audit committees. In addition, the board has determined that Howard E. Rose is an “audit committee financial expert” as defined by Securities and Exchange Commission rules. Mr. Rose is a certified public accountant with more than 30 years of accounting experience. Mr. Rose also served as our vice president and chief financial officer from 1978 to April 1998. The audit committee held seven meetings during fiscal 2009.

Compensation Committee. The compensation committee is comprised of Mr. McTaggart (chairman), Mr. Goldman and Ms. Hochman. The compensation committee reviews and makes recommendations to the board with respect to general compensation and benefit levels, determines the compensation and benefits for our executive officers and administers the qualified and non-qualified retirement plans and the omnibus incentive plan. Each member of the compensation committee is an independent director as determined by the board, based on the New York Stock Exchange listing standards. During fiscal 2009, the compensation committee engaged Mercer Human Resources

Consulting to provide advice on specific projects related to executive compensation. Mercer did not provide any other services to us during fiscal 2009. The compensation committee held three meetings during fiscal 2009.

Nominating and Corporate Governance Committee. The nominating and corporate governance committee is comprised of Ms. Jordan (chairman), Mr. McTaggart and Ms. Busquet and ensures that the board is appropriately constituted and organized to meet its fiduciary obligations to the stockholders. The nominating and corporate governance committee assesses director performance and board membership needs, makes and evaluates recommendations regarding potential candidates for election to the board, and develops and implements policies regarding corporate governance matters. Each member of the nominating and corporate governance committee is an independent director as determined by the board, based on the New York Stock Exchange listing standards. The nominating and corporate governance committee held three meetings during fiscal 2009.

The board of directors held nine meetings during fiscal 2009. In fiscal 2009, each incumbent director attended at least 75% of the meetings of the board of directors and applicable committee meetings.

We do not have a formal policy regarding board members’ attendance at annual meetings, but all members of the board are encouraged to attend the annual meeting of stockholders. In 2008, all of the members of the board were present at the annual meeting.

Process for Nominating Directors

Nominations of candidates for director are made by the nominating and corporate governance committee. The committee has identified nominees for directors based on referrals from management, existing directors, advisors and representatives of the company or other third parties. Both of the current nominees for director listed under the caption “Election of Directors” are existing directors standing for re-election. The committee may engage the services of third parties to identify or evaluate or assist in identifying or evaluating potential nominees for director but did not do so with respect to the current nominees. As discussed below, the committee will consider nominees proposed by qualified security holders. In connection with the annual meeting, the committee did not receive any recommendation for a nominee from any stockholder or group of stockholders.

The nominating and corporate governance committee initially evaluates prospective candidates on the basis of their resumes, considered in light of the criteria discussed below. A committee member would contact those prospective candidates that appear likely to be able to fill a significant need of the board to discuss the position; if the candidate showed sufficient interest, the committee would arrange an in-person meeting with one or more committee members. If the committee, based on the results of these contacts, believes it has identified a viable candidate, it will consult with the chairman of the board and submit the nominee to the full board for approval. Any request by management to meet with the prospective candidate would be given appropriate consideration.

Before nominating existing directors for re-election, the nominating and corporate governance committee also considers the individual’s contributions to the board, as reflected in results of the most recent peer review of individual director performance.

The nominating and corporate governance committee has adopted the following standards that it believes must be met by a nominee for a position on the board:

| · | Integrity — shows high ethical standards, integrity, strength of character and willingness to act on and be accountable for his or her decisions. |

| · | Maturity — assertive, responsible, supportive, respectful and open to others. |

| · | Judgment — decisions show intelligence, wisdom, thoughtfulness; willing to discuss issues thoroughly, ask questions, express reservations and voice dissent; record of good decisions shows that duties will be discharged in good faith and in our best interests. |

| · | Leadership — history of skill in understanding, managing and motivating talented managers and employees. |

| · | Standards — history of achievements shows high standards for self and others. |

| · | Strategic Vision — strategic insight and direction in innovation, key trends and challenging us to sharpen our vision. |

| · | Time and Willingness — ability, willingness and energy to prepare fully before meetings, attend and participate meaningfully, and be available to management between meetings, especially in light of any other commitments. |

| · | Continuous Improvement — stays current on major issues and on director’s responsibilities. |

The nominating and corporate governance committee has also adopted the following list of qualities and skills that it believes one or more of our directors should possess:

| · | Financial Acumen — understanding balance sheets, income and cash flow statements, financial ratios and other indices for evaluating performance; experience in financial accounting, corporate finance and trends in debt and equity markets; familiarity with internal financial controls. |

| · | Management Experience — hands-on understanding of corporate management trends in general and in our segments. |

| · | Knowledge Base — unique experience and skills in areas where we do business, including relevant manufacturing, marketing and technology. |

| · | International Vision — experience in global markets, issues and practices. |

| · | Diversity — enhances the board’s perspective through diversity in gender, ethnic background, geographic origin or professional experience (public, private and non-profit sectors). |

Nomination of a candidate should not be based solely on these factors.

Security holders who, individually or as a group, have held for more than one year at least 5% of our common stock may recommend director nominees to the nominating and corporate governance committee, provided the recommendation is received at least six months prior to the annual meeting, in order to assure time for meaningful consideration by the committee. Recommendations should be sent to the nominating and corporate governance committee at the address listed for security holder communications under the caption “Communications with the Board of Directors” below. Nominees recommended by security holders will be evaluated using the same standards applied to nominees recommended by other processes. Security holders recommending director nominees must provide the following information in their recommending communication:

1. the number of our securities held by the recommending security holder or by each member of a recommending group of security holders, and the holding period or periods for all such securities;

2. if the security holder(s) are not registered owners, proof of their security holdings in the form of either:

(a) a written statement from the “record” holder of the securities (usually a broker or bank) verifying that, at the time the security holder made the recommendation, he or she had held the required securities for at least one year; or

(b) if the security holder has filed a Schedule 13D, Schedule 13G, Form 3, Form 4 and/or Form 5, or amendments to those documents or updated forms, reflecting ownership of the securities as of or before the date of the recommendation, a copy of the schedule and/or form, and any subsequent amendments reporting a change in ownership level, as well as a written statement that the security holder continuously held the securities for the one-year period as of the date of the recommendation;

| | 3. written consent of the nominee and the recommending security holder(s) to being identified in our public communications and filings discussing the recommendation and any action taken with respect to the recommendation; and |

4. information about the recommended nominee sufficient for us to comply with Securities and Exchange Commission disclosure requirements if the nominee is proposed for election to our board of directors.

Communications with the Board of Directors

Security holders may send communications to the board by e-mail to HolderCommunications@blyth.com. Communications may be addressed to the entire board, any committee or committee chairman, or any individual director. All communications will be received and reviewed by the chairman of the nominating and corporate governance committee. The decision whether to pass communications on to the rest of the nominating and corporate governance committee, to any other committee or committee chairman or to any individual director to whom the communication is addressed, will be made at the discretion of the nominating and corporate governance committee chairman.

If a security holder communication relates to the nominating and corporate governance committee chairman and is directed to any director other than that chairman, it should be sent by e-mail to AuditCommittee@blyth.com. Communications sent to this address will be received and reviewed by the chairman of the audit committee. The decision of what action if any to be taken with respect to such communications will be made at the discretion of the audit committee chairman.

Security holders may also send such communications by regular mail to either:

[Individual Director Name] ℅

Shareholder Communications

or

Chairman, Audit Committee

at

Blyth, Inc.

One East Weaver Street

Greenwich, CT 06831

Communications so addressed will be delivered unopened to the chairman of the audit committee or to the individual addressed.

Communications by security holders recommending director nominees must comply with the requirements discussed under the caption “Process for Nominating Directors.”

Interested parties may send communications to the nominating and corporate governance committee chairman or the non-management directors as a group by e-mail to IndependentDirectors@blyth.com or by regular mail to:

| | Nominating and Corporate Governance Committee |

Communications so addressed will be delivered unopened to the chairman of the nominating and corporate governance committee.

Code of Conduct

We first adopted our code of conduct in 1999 and it applies to all members of the board of directors and to all of our officers and employees, including our principal executive officer, principal financial officer, principal accounting officer and controller. The code of conduct is available on our website, www.blyth.com, and print copies are available to any stockholder who makes a request to Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831, Attention: Michael S. Novins, Secretary. The code of conduct also serves as our “code of ethics,” as defined in Item 406(b) of Regulation S-K. In addition, we intend to satisfy the disclosure requirements of Item 5.05 of Form 8-K regarding any amendment to, or waiver from, a provision of the code of conduct that applies to our principal executive officer, principal financial officer, principal accounting officer, controller or any person performing similar functions and relates to any element of the definition of “code of ethics” set forth in Item 406(b) of Regulation S-K by posting such information on our website, www.blyth.com.

Executive Officers

The following sets forth the name, age and business experience for the past five years of each of our executive officers (other than Robert B. Goergen (see “Continuing Directors with Terms Expiring in 2010”)) as of the date hereof, together with all positions and offices held with us by such executive officers. Officers are appointed to serve until the meeting of the board of directors following the next annual meeting of stockholders and until their successors have been elected and have qualified:

Robert H. Barghaus (55) – Robert H. Barghaus is a vice president and our chief financial officer. Mr. Barghaus joined us as vice president of financial planning in February 2001, and in March 2001 he was elected vice president and chief financial officer. Prior to joining Blyth, he spent more than 25 years in senior operating and financial roles at Cahners Business Information (a division of Reed Elsevier), Labatt USA, Caldor’s (a division of May Department Stores), American Can and Arthur Anderson. Mr. Barghaus is a certified public accountant.

Anne M. Butler (60) – Anne M. Butler has been a vice president of the company and president of PartyLite Worldwide since May 2007. Ms. Butler joined PartyLite in 1999 as president of PartyLite Europe, and became president of PartyLite Europe and New Markets in 2000. Ms. Butler was named president of PartyLite International in 2003. Prior to joining PartyLite, she spent more than 25 years at leading companies, including Avon Products, Inc., Aloette Cosmetics, Inc. and Mary Kay Inc.

Robert B. Goergen, Jr. (38) – Robert B. Goergen, Jr. is a vice president and president of the multi-channel group and corporate development group. Mr. Goergen joined us in 2000 as director of our Internet strategy and e-business initiatives group. In August 2002 he was appointed vice president of acquisitions and business development, overseeing our acquisition strategy and implementation. From 1995 to 1998, Mr. Goergen worked for McCann-Erickson Worldwide, primarily serving as an account director, where he oversaw e-commerce development and Internet marketing efforts for consumer products and services accounts.

Security Ownership of Management and Certain Beneficial Owners

Security Ownership of Management. The following table sets forth, as of March 31, 2009, the number of outstanding shares of the common stock beneficially owned by each of (i) the nominees for director, (ii) the other current directors, (iii) the named executive officers individually and (iv) all directors and executive officers as a group. Except as otherwise indicated, each of the stockholders has sole voting and investment power with respect to the shares reflected as beneficially owned by such stockholder.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class |

| Robert B. Goergen (1) | 2,778,251 | 31.2% |

| Anne M. Busquet (2) | — | * |

| Pamela M. Goergen (2) (3) (4) | 2,778,251 | 31.2 |

| Neal I. Goldman (2) (4) | 8,250 | * |

| Carol J. Hochman (2) (4) | 4,000 | * |

| Wilma H. Jordan (2) (5) | 3,250 | * |

| James M. McTaggart (2) | 850 | * |

| Howard E. Rose (2) (4) | 14,513 | * |

| Robert H. Barghaus (2) (4) | 4,017 | * |

| Anne M. Butler (2) (4) | 5,025 | * |

| Robert B. Goergen, Jr. (2) (4) (6) | 756,684 | 8.5 |

All directors and executive officers as a group (11 persons) | 2,998,465 | 33.7 |

________

* Less than 1%.

| (1) | Includes 2,077,659 shares held by Mr. Goergen; 22,372 shares held by The Goergen Foundation, Inc. (a charitable foundation of which Mr. Goergen is a director, president and sole investment manager); 98,595 shares and 3,250 options held by Pamela M. Goergen (Mr. Goergen’s wife); and 576,375 shares held by Ropart Investments LLC (a private investment fund of which Mr. Goergen shares voting and investment power). Mr. Goergen disclaims beneficial ownership of the shares held by Pamela M. Goergen (see footnote (3)). The address of Mr. Goergen is ℅ Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831. |

| (2) | The table above excludes RSUs because RSUs do not afford the holder of such units voting or investment power. As of March 31, 2009, the number of RSUs held by each named executive officer and director (other than Robert B. Goergen, who does not own any RSUs) was as follows: Anne M. Busquet (1,125); Pamela M. Goergen (1,875); Neil I. Goldman (1,875); Carol J. Hochman (1,875); Wilma H. Jordan (1,750); James M. McTaggart (2,250); Howard E. Rose (1,875); Robert H. Barghaus (8,596); Anne M. Butler (7,115); and Robert B. Goergen, Jr. (6,350). |

| (3) | Includes 98,595 shares held by Mrs. Goergen and 2,676,406 shares held by Robert B. Goergen (Mrs. Goergen’s husband). Mrs. Goergen disclaims beneficial ownership of the shares held by her husband, Robert B. Goergen (see footnote (1)). The address of Mrs. Goergen is ℅ Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831. |

| (4) | Includes shares which he or she has the right to acquire within 60 days as of March 31, 2009 through the exercise of stock options, as follows: Pamela M. Goergen (3,250); Neil I. Goldman (3,250); Carol J. Hochman (3,750); Wilma H. Jordan (2,500); Howard E. Rose (2,500); Robert H. Barghaus (2,500); Anne M. Butler (4,775); and Robert B. Goergen, Jr. (3,375). |

| (5) | Ms. Jordan’s security ownership includes 250 shares held by her spouse, as to which she disclaims beneficial ownership. |

| (6) | Mr. Goergen, Jr.’s security ownership includes 90,775 shares held by him, 576,375 shares held by Ropart Investments, LLC, 500 shares held by his spouse and 85,659 shares held by him in trust for his children, brother and brother’s children. |

Security Ownership of Certain Beneficial Owners. To the knowledge of the company, the following table lists each party (other than Mr. Goergen and Mrs. Goergen, whose respective beneficial ownership is disclosed in the immediately preceding table) that beneficially owned more than 5% of the common stock outstanding as of March 31, 2009:

| Name and Address of Beneficial Owner | Number of Shares | Percent of Class |

FMR Corp. and related persons and entities1 | 775,000 | 8.717% |

82 Devonshire Street Boston, MA 02109 Wells Fargo & Company and Evergreen Investment Management Company, LLC2 420 Montgomery Street San Francisco, CA 94163 | 654,910 | 7.37% |

__________

| (1) | According to Amendment No. 7 to Schedule 13G dated February 16, 2009 and giving effect to the 1-for-4 reverse stock split of our common stock at the end of January 2009, FMR LLC beneficially owns 775,000 shares. FMR LLC is a parent holding company of Fidelity Management & Research Company (“Fidelity”), a registered investment adviser and a wholly owned subsidiary of FMR LLC. Fidelity is the beneficial owner of 775,000 shares or 8.717% of the common stock as a result of acting as investment adviser to various investment companies. The ownership of one investment company, Fidelity Low Priced Stock Fund, amounted to 775,000 shares or 8.717% of the common stock. Edward C. Johnson 3d (Chairman of FMR LLC) and FMR LLC, through its control of Fidelity, and the fund each has sole power to dispose of the 775,000 shares owned by the fund. Neither FMR LLC nor Mr. Johnson has the sole power to vote or direct the voting of the shares owned directly by the Fidelity Funds, which power resides with the fund’s Boards of Trustees. Members of Mr. Johnson’s family are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. The computation of the percentage of stock owned by FMR Corp. and related persons is based on the percentages reported in the Schedule 13G |

| (2) | According to a statement on Schedule 13G dated January 22, 2009 and giving effect to the 1-for-4 reverse stock split of our common stock at the end of January 2009, Wells Fargo & Company (a parent holding company or control person), located at the address in the table, beneficially owns 654,910 shares (7.37%), with sole voting power with respect to 654,910 shares and sole dispositive power with respect to 649,588 shares, and Evergreen Investment Management Company (an investment adviser), located at 200 Berkeley Street, Boston, MA 02116, beneficially owns 648,302 shares (7.29%), with sole voting and dispositive power with respect to those shares. The computation of the percentage of stock owned by Wells Fargo & Company and Evergreen Investment Management Company, LLC is based on the percentages reported in the Schedule 13G. |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview

We are a multi-channel organization selling a wide variety of decorative and functional products through the Direct Selling, Catalog & Internet, and Wholesale channels. We design, market and distribute an extensive array of candles, accessories, seasonal decorations, household convenience items and personalized gifts. In addition, we sell nutritional supplements, weight management products and products for the foodservice trade. We compete in a global industry, and our products can be found throughout North America, Europe and Australia. Our financial results are reported in three segments: the Direct Selling segment, the Catalog & Internet segment and the Wholesale segment. These reportable segments are based on similarities in distribution channels, customers and management oversight.

Our compensation committee develops and oversees compensation policies that are designed to attract, motivate, reward and retain the broad-based management talent required to achieve our corporate objectives and increase stockholder value. The committee believes that corporate performance and, in turn, stockholder value will be enhanced by a compensation system that supports and reinforces our key operating and strategic goals while aligning the financial interests of our management team with those of our stockholders.

Our compensation programs are intended to reward the achievement of short and long-term financial targets established during our annual budget and strategic planning process, as well as individual performance goals.

Elements of Compensation

Our management compensation program consists of the following:

| · | a short-term annual incentive program (MPIP) |

| · | a long-term incentive program (LTIP) |

| · | a benefits package of health and welfare programs |

The committee reviews the compensation practices of broad industry groups using multiple sources of information pertaining to executive compensation, including salary surveys and peer group proxy data. Benchmarking effectively against a relevant peer group is challenging given our structure. Therefore, the committee consults additional salary and economic surveys that benchmark similar positions in similarly-sized companies, the industries of which vary. Our peer group generally consists of similarly-sized manufacturing, direct selling and direct marketing companies with annual revenue ranging from $500 million to $1.5 billion, and is dependent upon the revenue of the business unit of which an executive’s compensation is being benchmarked. We compiled data using surveys from Mercer, Towers Perrin, E-Comp and Salary.com. Benchmarking for our total compensation program has also been conducted against a peer group that included Williams-Sonoma Inc., Jarden Corporation, American Greetings Corporation, Herbalife Ltd., Tupperware Brands Corporation, Nu Skin Enterprises, Inc., Lancaster Colony Corporation, Overstock.com, Inc., 1-800-Flowers.com, Inc., The Yankee Candle Company, Inc., Libbey Inc., CSS Industries Inc., Lenox Group Inc., Russ Berrie and Company, Inc. and Enesco LLC. The committee, after receiving input from Robert B. Goergen, our chairman and chief executive officer, uses these sources to determine an appropriate base salary and annual incentive bonus target for each member of management. The base salary and annual incentive bonus targets are intended to reflect the responsibilities of each officer, the compensation practices at other companies and trends in the economy in general. The committee generally targets the sum of the base salary, annual incentive bonus program and long-term incentive program to be at the median level of the combined peer group and survey data. We also consider peer compensation within Blyth’s portfolio to help determine appropriate compensation. The objective in allocating between long-term and currently paid compensation is to ensure adequate base compensation to attract and motivate personnel and retain key talent, while providing incentives to maximize long-term value for our company and our stockholders.

As discussed below, under the heading “—Employment Contracts,” in August 2000 we entered into an employment contract with Mr. Goergen. His base salary, short-term incentive bonus target and supplemental pension were each established at the time we entered into the employment contract. Amounts were determined following a peer and industry review process similar to that described above. Since that time and most recently in fiscal 2008, Mr. Goergen’s base salary and annual incentive bonus were reviewed versus his peer group’s salary and incentive bonus. Based on that data, the committee believes that Mr. Goergen’s compensation is appropriately positioned at the 50th percentile. Because of his significant share ownership, Mr. Goergen requested that he not receive long-term incentives. Moreover, for the past four years, he has requested the committee not to make an annual cost of living adjustment to his base salary, and the committee has honored his request.

Annual Incentives

We refer to our annual incentive plan as the Management Performance Incentive Plan (“MPIP”). The MPIP is a cash-based, pay-for-performance annual incentive plan that applies to all management-level employees across the company (excluding those participating in a sales incentive plan). The MPIP is implemented under our Amended and Restated 2003 Omnibus Incentive Plan (the “2003 Plan”). The committee considers annual incentives to be a critical means of ensuring management’s focus in achieving its annual operating plan, which, in turn, should enhance stockholder value.

Each of the participant’s in the MPIP is assigned an individual incentive target, which is expressed as a percentage of that employee’s annual salary. The product of the employee’s annual salary and his or her incentive target yields the “target award.” The target award, which is expressed as a dollar amount, is calculated as follows:

| Base salary | x | Individual incentive target (expressed as a % of base salary) | = | Target award (expressed as a dollar amount) |

The “individual incentive targets” are based on market-competitive data. The committee designates target levels for each of our named executive officers (“NEOs”) using the process described above in determining base salary. The committee also reviews target levels for all other participants at the vice president level and above, as well as all other incentive compensation for this group of executives. The individual incentive targets (which are expressed as a percentage of annual salary) and the target awards (the product of the incentive target multiplied by the annual salary) for each of the NEOs during fiscal 2009 were calculated as follows:

Name | Base Salary (fiscal 2009) | Individual Incentive Target (expressed as a percentage of annual salary) | Target Award (dollar amount) |

| Robert B. Goergen | $794,375 | 100% | $794,375 |

| Robert H. Barghaus | $410,000 | 50% | $205,000 |

| Anne M. Butler | $512,500 | 60% | $307,500 |

| Robert B. Goergen, Jr. | $362,250 | 50% | $181,125 |

The amount of the target award is split into two amounts, one of which is determined by the company’s performance (we refer to this as the “Business Performance Factor”) and the other of which is determined by the employee’s own performance (we refer to this as the “Individual Performance Factor”). The Individual Performance Factor is determined based on the extent to which an executive achieved his or her personal business objectives, which we refer to as “Management by Objective” (or “MBOs”). The ratio of Business to Individual Performance Factor for each of the NEOs is as follows:

Name | Business Performance Factor (expressed as a percentage the entire target award) | Individual Performance Factor (expressed as a percentage the entire target award) |

| Robert B. Goergen | 75% | 25% |

| Robert H. Barghaus | 50% | 50% |

| Anne M. Butler | 65% | 35% |

| Robert B. Goergen, Jr. | 60% | 40% |

Business Performance Factor

The Business Performance Factor is based upon the extent to which the company or a segment, as the case may be, meets or exceeds an established threshold performance level, which is established by the committee at the beginning of the fiscal year based on the board-approved budget and input from management. Based on the achievement of budgeted financial goals, 50% to 175% of the target awards can become available for payment.

The Business Performance Factors differ among the NEOs. The Business Performance Factor for Mr. Goergen, the Chairman and Chief Executive Officer of Blyth, and Mr. Barghaus, the Chief Financial Officer of Blyth, is solely determined by Blyth’s overall performance, which goal, in fiscal 2009, was at target $55.0 million in consolidated net earnings from continuing operations, with adjustments.

The Business Performance Factor for Ms. Butler, the President of PartyLite Worldwide, is determined primarily (80%) by PartyLite’s overall performance, which goal, in fiscal 2009, was at target $111.1 million of earnings before interest and taxes (“EBIT”). The remaining 20% of her Business Performance Factor is based on the same Blyth performance goal used to determine Mr. Goergen’s and Mr. Barghaus’s Business Performance Factor.

The Business Performance Factor for Mr. Goergen, Jr., the President of the Multi-Channel Group, a diverse group of businesses, is determined primarily (75%) by the Multi-Channel Group’s overall performance, which goal, in fiscal 2009, was (in the aggregate) $12.6 million of EBIT. However, since Mr. Goergen, Jr.’s Business Performance Factor is determined by the results of the various businesses that form the Multi-Channel Group, he could receive a portion of his target award if one or more of the respective businesses achieves its individual goal (which we do not publicly disclose), even though the Multi-Channel Group as a whole does not meet or exceed its performance goal. The remaining 25% of his Business Performance Factor is based on the same Blyth performance goal used to determine Mr. Goergen’s and Mr. Barghaus’s Business Performance Factor.

Individual Performance Factor

The second component of the target award is determined by the executive’s performance against his or her personal business objectives, or MBOs, which are established at the beginning of the fiscal year and typically have a wide variety of additional financial targets (such as sales growth, working capital management, return on equity, as well as other non-financial managerial goals, described below). The nature and extent of each individual’s major accomplishments and contributions are determined through written evaluations compiled by the Chief Executive Officer, the Vice President – Organizational Development and others familiar with the individual’s performance. The Chief Executive Officer evaluates the information and makes appropriate recommendations to the committee, which then makes the final determination of management bonuses. In order for any incentive compensation that is determined by the Individual Performance Factor to be earned, at least 80% of the NEO’s Business Performance Factor must be achieved. Or, said another way, even if an NEO is determined to have achieved all of his or her personal business objectives, no payment will be made under the annual incentive plan unless at least 80% of that executive’s Business Performance Factor has been achieved.

After the completion of the fiscal year, based on the achievement of target financial goals and based on input from management about its assessment of each participant’s individual performance during the year, the committee determines how much, if any, of the participant’s target award will be paid. The committee is under no obligation to pay the entire target award available in any given year. Similarly, the 2003 Plan gives the committee the ability to adjust performance results upward or downward for extraordinary factors, as well as to grant discretionary bonuses in recognition of extraordinary performance.

For fiscal 2009, the minimum threshold (i.e., 80% of performance goal) for our consolidated net earnings from continuing operations, with adjustments, was not achieved and, accordingly, no annual bonus was paid to either Mr. Goergen or Mr. Barghaus.

With respect to Ms. Butler, PartyLite was determined to have achieved 85.7% of its performance goal. Included in this calculation were upward adjustments to PartyLite’s EBIT of $1.2 million for restructuring charges that were approved by the compensation committee. Accordingly, a formula-driven payout totaling $102,656 was applied to the portion of Ms. Butler’s annual target bonus that is determined by PartyLite’s results. Ms. Butler received no bonus for the portion of her incentive bonus that was determined by Blyth’s consolidated net earnings from continuing operations. Because PartyLite was determined to have achieved more than 80% of its performance goal, Ms. Butler was eligible to earn a portion of her bonus that is determined by her Individual Performance Factors, or MBOs. Ms. Butler completed many of her personal objectives, which were to achieve budgeted cash flow, inventory, consultant growth and service level targets; improve internal processes to prepare for accelerated growth; expand geographically; improve PartyLite’s global marketing function; improve product line controls; and making various organizational changes. With respect to the Individual Performance Factor, the committee determined that Ms. Butler achieved 50% of her MBOs and granted her a bonus of $43,050, which, when added to the $102,656 she was awarded based on the Business Performance Factor, meant that Ms. Butler’s total bonus in fiscal 2009 was $145,706.

For Mr. Goergen, Jr., a minimum threshold of profitability was not achieved within the Catalog & Internet segment and certain portions of the Wholesale segment, and, accordingly, no payment was earned for the portion of his bonus tied to those businesses. In our Sterno business, which is part of the Wholesale segment, the committee approved upward adjustments of $1.1 million for restructuring charges, an inventory revaluation and legal fees related to the protection of intellectual property. The committee determined that Sterno achieved the minimum profit threshold for its performance goal, and Mr. Goergen, Jr. was awarded a bonus of $8,314 based on Sterno’s results. Mr. Goergen, Jr. received no bonus for the portion of his incentive that was determined by Blyth’s consolidated net earnings from continuing operations. Mr. Goergen, Jr. was not eligible for bonus compensation related to his personal objectives as his combined businesses did not achieve a threshold level of EBIT required for payout.

Due to a salary freeze in effect for all U.S. management, our NEOs did not receive an annual cost of living adjustment to their salaries in fiscal 2009. Mr. Goergen requested of the committee that he not participate in our fiscal 2010 MPIP, and the committee has honored his request. The committee increased Mr. Goergen, Jr.’s bonus target from 50% to 60% for fiscal 2010.

Long-Term Incentives

Our Long-Term Incentive Plan (“LTIP”) was established in 2003 under our 2003 Plan. The committee considers long-term incentive compensation to be an important means of ensuring management’s ongoing focus on meeting our profitability goals, which should enhance the value of the common stock. In addition, the committee believes that this component of our compensation policy is a retention vehicle for key executives and directly aligns the interests of management with those of our stockholders.

The committee generally awards long-term incentive grants annually at its spring meeting, with the exception of awards to executives who may be hired or promoted in the course of the fiscal year and to whom the committee may grant awards during the year.

In order to align further management’s compensation with company performance, payment against target for the fiscal 2009 cycle is exclusively performance based, with an additional time-vesting function. As described above, Mr. Goergen does not participate in the LTIP. The LTIP award for Mr. Barghaus is determined by Blyth’s net income from continuing operations, with adjustments. The LTIP awards for Ms. Butler and Mr. Goergen, Jr. are determined by the performance of their respective business units using the same weighting as that applied in the Business Performance Factor, and they also have a component of their LTIP that is determined by Blyth’s consolidated net income from continuing operations, with adjustments. As the committee and management intended to focus LTIP participants on near-term profit improvement given that several of our businesses are in turn-around situations, performance is measured over a one-year period. The awards vest in two annual installments based on the executive’s continued

employment with us. Payment, if earned, will be made equally in the form of Restricted Stock Units (50%) and Cash (50%).

Each of the participants in the LTIP is assigned an individual incentive target, which is expressed as a percentage of that employee’s annual salary. As described above, Mr. Goergen does not participate in the LTIP. The individual incentive targets for Mr. Barghaus, Ms. Butler and Mr. Goergen, Jr. are 85%. The product of the employee’s annual salary and his or her incentive target yields the LTIP target award. The LTIP target award, which is expressed as a dollar amount, is calculated as follows:

Name | Base Salary (fiscal 2009) | LTIP Individual Incentive Target (expressed as a percentage of annual salary) | LTIP Target Award (dollar amount) |

| Robert H. Barghaus | $410,000 | 85% | $348,500 |

| Anne M. Butler | $512,500 | 85% | $435,625 |

| Robert B. Goergen, Jr. | $362,250 | 85% | $426,176 |

In order for any payment to be made under the LTIP, at least 80% of the Business Performance Factor must be achieved. Fifty percent of the payout is awarded for minimum performance threshold, which is 80% of the Business Performance Factor. The payout increases straight-line between 80% and 100%. Generally, up to 150% payout is awarded for achievement of above-target performance and will be paid on a straight-line approach from 101% to 120% for a maximum potential payout of 150% at 120% achieved target performance.

The LTIP Business Performance Factor had two requirements in fiscal 2009, as follows:

Requirement No. 1: Achievement of EBIT against budget for business units and net income from continuing operations with adjustments against budget for Blyth, the weighting of which, for each NEO, is the same as in the annual MPIP (as described above under “— Business Performance Factor”).

Requirement No. 2: For the Blyth portion of the LTIP, inventory months-on-hand cannot exceed budgeted months on hand by more than 7.5%. For the PartyLite portion of the LTIP, back orders could not exceed 7%. For the portion of Mr. Goergen Jr.’s LTIP related to the Wholesale segment, certain working capital requirements and positive cash flow were included. For the Catalog & Internet portion of his LTIP, inventory months-on-hand cannot exceed budgeted months on hand by more than 7.5%.

After the completion of the fiscal year in each cycle, based on the achieved of the LTIP Business Performance Factor as described above, the committee will determine what part, if any, of the participant’s target award will be paid. The committee is under no obligation to pay the entire target award available in any given year. Similarly, the 2003 Plan gives the committee the ability to adjust performance results upward or downward for extraordinary factors.

The business units managed by Ms. Butler and Mr. Goergen, Jr. were adjusted for the same factors described above in the annual bonus plan. Accordingly, the committee awarded the amounts noted to each executive based on a formula-driven percentage of target achieved, subject to vesting:

| | % Target Achieved | Value Awarded (subject to vesting) |

| Robert H. Barghaus | <80% | $0 |

| Anne M. Butler | 85.7% | $225,004 |

| Robert B. Goergen, Jr. | * | $23,780 |

_______________

| | *Mr. Goergen, Jr.’s LTIP award is determined by the results of the individual business units reporting to him. His payment is based on the results of the Sterno business unit, which achieved the minimum profit threshold of 80% on an adjusted basis. |

| | In recognition of their leadership and direct ability to influence our financial results, the committee made the following discretionary Restricted Stock Unit awards. The RSUs will vest in full on the third anniversary of their grant date, subject to the continued employment of the executive officer on that date. |

| | Award Value at Grant ($) | RSUs (#) |

| Robert H. Barghaus | 150,000 | 5,223 |

| Anne M. Butler | 200,000 | 6,964 |

| Robert B. Goergen, Jr. | 200,000 | 6,964 |

Share Retention Guidelines

In order to preserve the linkage between the interests of executives and those of our stockholders, participants in the LTIP are expected to use their grants of RSUs to establish a level of direct ownership in the company. Therefore, participants must retain at least 25% of their RSU grants (before satisfying any costs of selling shares and taxes) until separation from the company.

Perquisites

We provide our chief executive officer with perquisites in recognition that he has never and does not currently accept any long-term incentive compensation. Under Mr. Goergen’s employment contract entered into in 2000, he is provided with a car and driver, as well as personal use of the leased airplane. Mr. Goergen pays taxes based on the imputed value of these perquisites, which is reported to the Internal Revenue Service and which totaled $285,761 in fiscal 2009.

Mr. Goergen Jr. utilized the leased airplane for personal use in fiscal 2009 and paid taxes based on the imputed value of its use, which totaled $46,179 in fiscal 2009. Our other NEOs did not utilize perquisites during the fiscal year.

Tax and Accounting Considerations

Favorable accounting and tax treatment of the various elements of our compensation program is an important, but not the sole, consideration in its design. Section 162(m) of the Internal Revenue Code limits the deductibility of certain items of compensation paid to the chief executive officer and certain other highly compensated executive officers to $1.0 million annually. While our MPIP and LTIP awards are intended to qualify as “performance-based” compensation under Section 162(m) of the Code, we reserve the right to approve in the future elements of compensation that are not fully deductible.

We account for equity-based awards in accordance with the requirements of SFAS No. 123(R). We are required to recognize compensation expense relating to equity-based awards in our financial statements. The adoption of this recognition method did not cause us to limit or otherwise significantly change our award practices.

Compensation Committee Report

The compensation committee has reviewed and discussed with management the Compensation Discussion and Analysis included in this proxy statement. Based on this new review and discussion, the compensation committee recommended to the board of directors that the Compensation Discussion and Analysis be included in our proxy statement for the 2009 annual meeting of stockholders.

Submitted by the members of the Compensation Committee of the Board of Directors.

James McTaggart, Chairman

Neal Goldman

Carol Hochman

Summary Compensation Table

The following table summarizes the total compensation awarded to or earned by our chief executive officer, chief financial officer and other executive officers during fiscal 2007, 2008 and 2009.

| Name and Principal Position | Year | Salary | Bonus | Stock Awards(1) | All Other Compensation | Total |

| | ($) | ($) | ($) | ($) | ($) | ($) |

Robert B. Goergen Chairman of the Board and Chief Executive Officer | 2007 2008 2009 | 790,649 794,375 794,375 | 397,188 1,000,000 — | — — — | 291,443(2) 1,154,533(2) 320,114(2) | 1,479,280 2,948,907 1,114,489 |

Robert H. Barghaus Vice President and Chief Financial Officer | 2007 2008 2009 | 367,269 394,833 410,000 | 172,844 286,254 — | 138,575 282,998 250,426 | 23,314(3) 19,738(3) 14,271(3) | 702,002 983,823 674,697 |

Anne M. Butler Vice President of the Company and President of PartyLite Worldwide | 2008(4) 2009 | 448,777 512,500 | 303,668 145,706 | 210,136 237,912 | 224,804(5) 37,437(3) | 1,187,385 933,555 |

Robert B. Goergen, Jr. Vice President of the Company and President, Multi-Channel Group | 2007 2008 2009 | 314,423 341,667 362,250 | 144,658 187,297 8,314 | 89,343 178,140 169,712 | 12,400(6) 104,745(6) 60,464(6) | 560,824 811,849 600,740 |

_______________

| (1) | The amounts in this column do not represent cash payments, but rather reflect the dollar amounts of granted RSUs recognized for financial statement reporting purposes in accordance with FAS 123(R) and include amounts from awards granted in prior fiscal years. Information regarding the valuation assumptions used in the calculation of this amount is included in Note 16 to the audited financial statements for the fiscal year ended January 31, 2009 included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on April 14, 2009. The RSUs vest in equal annual installments on various anniversaries of the date of grant, subject to the continued employment of the executive on each vesting date. |

| (2) | Mr. Goergen’s “all other compensation” consists of the items set forth in the following table. The perquisite value of “Personal Use of Company Airplane” equals the total cost of the company airplane to us in a fiscal year multiplied by the percentage of personal use by Mr. Goergen in that fiscal year. In our proxy statements for the 2007 and 2008 annual meetings of stockholders, we reported the amount for “Personal Use of Company Airplane” based on the Standard Industry Fare Level (SIFL) tables published by the Internal Revenue Service. Due to the change in the methodology that we have used to calculate the aggregate incremental cost to us of the personal use of the company airplane (as described in the second sentence of this footnote), we have recalculated the amounts for fiscal 2007 and 2008, which has resulted in an increase in the amounts. The perquisite value does not equal the amount of compensation income that is imputed to Mr. Goergen for tax purposes for personal use of the company airplane. |

| | Supplemental Pension Benefit ($) | Personal Use of Company Airplane ($) | Driver Services ($) | Automobile Payments ($) | Contributions to the 401(k) and nonqualified plans ($) | Total ($) |

| Fiscal 2007 | — | 159,934 | 56,365 | 46,924 | 28,220 | 291,443 |

| Fiscal 2008 | 790,374 | 216,617 | 57,628 | 47,602 | 42,312 | 1,154,533 |

| Fiscal 2009 | — | 168,609 | 59,660 | 57,492 | 34,353 | 320,114 |

| (3) | Represents contributions to the 401(k) and nonqualified deferred compensation plans. |

| (4) | Ms. Butler was appointed vice president of the company and president of PartyLite Worldwide in May 2007. Information is provided as to all compensation of Ms. Butler for fiscal 2008. |

| (5) | At the time Ms. Butler joined PartyLite, we agreed to pay her an amount equal to that which she would have earned under the long-term incentive plan of her former employer. In September 2007, Ms. Butler satisfied the conditions, |

| | including the delivery of appropriate supporting documentation, necessary for us to make that payment, and we made payment of $204,000 to Ms. Butler in September 2007. Also includes contributions to the 401(k) and nonqualified deferred compensation plans of $20,804. |

| (6) | In fiscal 2007, includes $12,400 for contributions to the 401(k) and nonqualified deferred compensation plans. In fiscal 2008, includes $89,890 for personal use of company airplane and $14,855 for contributions to the 401(k) and nonqualified deferred compensation plans. In fiscal 2009, includes $46,179 for personal use of company airplane and $14,285 for contributions to the 401(k) and nonqualified deferred compensation plans. The perquisite value of “Personal Use of Company Airplane” equals the total cost of the company airplane to us in a fiscal year multiplied by the percentage of personal use by Mr. Goergen, Jr. in that fiscal year. In our proxy statements for the 2007 and 2008 annual meetings of stockholders, we reported the amount for “Personal Use of Company Airplane” based on the Standard Industry Fare Level (SIFL) tables published by the Internal Revenue Service. Due to the change in the methodology that we have used to calculate the aggregate incremental cost to us of the personal use of the company airplane, we have recalculated the amount for fiscal 2008, which has resulted in an increase in the amount. Mr. Goergen, Jr. did not make personal use of the company airplane in fiscal 2007. The perquisite value does not equal the amount of compensation income that is imputed to Mr. Goergen, Jr. for tax purposes for personal use of the company airplane. |

Grants of Plan-Based Awards During Fiscal 2009

The following table sets forth information concerning all grants of plan-based awards made to the named executive officers during fiscal 2009.

Name | Grant Date | Estimated Future Payouts Under Non-Equity Incentive Plan Awards | Estimated Future Payouts Under Equity Incentive Plan Awards1 | Fair Value of Stock and Option Awards ($)2 |

Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) |

| Robert B. Goergen | None | — | — | — | — | — | — | — |

| Robert H. Barghaus | 4/7/08 | 87,550 | 175,100 | 262,650 | 3,048 | 6,097 | 9,145 | — |

| Anne M. Butler | 4/7/08 | 21,888 | 218,875 | 328,313 | 762 | 7,621 | 11,431 | 112,496 |

Robert B. Goergen, Jr. _______________ | 4/7/08 | 3,886(3) | 155,423 | 233,134 | 135 | 5,412 | 8,117 | 11,890 |

| (1) | The number of shares set forth under “Estimated Future Payouts Under Equity Incentive Plan Awards” are based on $28.72 per share (the average trading price for the five trading days up to April 6, 2009, the date the grant was awarded). |

| (2) | On April 7, 2008, Mr. Barghaus, Ms. Butler and Mr. Goergen, Jr. were granted the equity incentive plan awards set forth in the table, all of which were subject to performance-based conditions. In April 2009, the compensation committee confirmed that these performance-based conditions had been met only with respect to Ms. Butler and Mr. Goergen, Jr., and awarded 3,917 shares to Ms. Butler (fair value of $112,496) and 414 shares to Mr. Goergen, Jr. (fair value of $11,890). The number of shares was based on the dollar value of the award divided by $28.72 per share, the average trading price for the five trading days up to April 6, 2009, the date the grant was awarded. The awards are subject to vesting and will be paid in equal installments in April 2010 and 2011, subject to continued employment at such time. |

| (3) | Mr. Goergen, Jr.’s estimated future payments are dependent upon the results of several different business units in our Wholesale and Catalog & Internet segments, and the threshold amounts represent payouts if made with respect to only the smallest business unit. |

Outstanding Equity Awards at January 31, 2009

The following table sets forth information concerning unexercised options and stock that has not vested for each named executive officer as of January 31, 2009.

| | Option Awards | Stock Awards |

| Name | Number of Securities Underlying Unexercised Options1 (#) | Option Exercise Price ($) | Option Expiration Date | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested2 (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested3 ($) |

| Robert B. Goergen | 0 | — | — | 0 | — |

| Robert H. Barghaus | 2,500 | 106.78 | 4/3/12 | 8,595 | 117,236 |

| Anne M. Butler | 750 400 525 1,500 1,600 | 99.38 100.88 91.38 106.78 101.10 | 10/18/09 3/29/10 3/27/11 4/3/12 3/31/13 | 6,775 | 92,411 |

Robert B. Goergen, Jr. _______________ | 500 375 1,000 1,500 | 113.88 91.38 106.78 101.10 | 8/1/10 3/27/11 4/3/12 3/31/13 | 5,991 | 81,717 |

| (1) | All options are exercisable and have been adjusted to give effect to the 1-for-4 reverse stock split of our common stock at the end of January 2009. |

| (2) | Does not include RSUs awarded in April 2009 (see footnote (2) under “— Grants of Plan-Based Awards During Fiscal 2009”). |

(3) Based on the closing sale price for the common stock on the NYSE on January 30, 2009 of $13.64 per share.

Option Exercises and Stock Vested

The following table sets forth information concerning each vesting of restricted stock units for each of the named executive officers on an aggregated basis in the fiscal year ended January 31, 2009 (there were no stock option exercises during fiscal 2009).

| | Stock Awards |

Name | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting1 ($) |

| Robert B. Goergen | — | — |

| Robert H. Barghaus | 487 | 38,941 |

| Anne M. Butler | 3412 | 27,2392 |

| Robert B. Goergen, Jr. | 3612 | 28,8372 |

_______________

| (1) | Represents the number of shares acquired on vesting in March 30, 2008 multiplied by $79.88 (the market price for the common stock on the NYSE on that date). |

| (2) | Ms. Butler and Mr. Goergen, Jr. have elected to defer their receipt of these shares until their separation from the company. |

Nonqualified Deferred Compensation

Name | Executive Contributions in Fiscal 2009 ($) | Registrant Contributions in Fiscal 20091 ($) | Aggregate Earnings (Loss) in Fiscal 2009 ($) | Aggregate Withdrawals / Distributions ($) | Aggregate Balance at January 31, 2009 ($) |

| Robert B. Goergen | 43,896 | 26,672 | (58,029) | 528,411 | 0 |

| Robert H. Barghaus | 0 | 0 | 7,624 | 154,812 | 0 |

| Anne M. Butler | 47,324 | 23,159 | (74,627) | 159,957 | 0 |

Robert B. Goergen, Jr. _______________ | 0 | 0 | 0 | 0 | 0 |

| (1) | These amounts are included as compensation under “All Other Compensation” in the Summary Compensation Table. |

Pension Benefits

Name | Number of Years Credited Service | Present Value of Accumulated Benefit | Payments During Last Fiscal Year |

| Robert B. Goergen | 6 | $2,864,376 | None |