UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

o ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

or

| | x | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from February 1, 2011 to December 31, 2011

Commission File number 1-13026

BLYTH, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 36-2984916 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

One East Weaver Street Greenwich, Connecticut | 06831 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (203) 661-1926

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

| Common Stock, par value $0.02 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Non-accelerated filero | Accelerated filer x Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting common equity held by non-affiliates of the registrant was approximately $303.3 million based on the closing price of the registrant’s Common Stock on the New York Stock Exchange on July 31, 2011 and based on the assumption, for purposes of this computation only, that all of the registrant’s directors and executive officers are affiliates.

As of February 29, 2012, there were 8,568,494 outstanding shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the 2012 Proxy Statement for the Annual Meeting of Shareholders to be held on May 16, 2012 (Incorporated into Part III).

| PART I |

Item 1. | | | | 4 |

| Item 1A. | | | | 11 |

| Item 1B. | | | | 18 |

| Item 2. | | | | 18 |

| Item 3. | | | | 18 |

| Item 4. | | | | 18 |

PART II |

Item 5. | | | | 19 |

| Item 6. | | | | 22 |

| Item 7. | | | | 23 |

| Item 7A. | | | | 39 |

| Item 8. | | | | 40 |

| Item 9. | | | | 80 |

| Item 9A. | | | | 80 |

| Item 9B. | | | | 80 |

PART III |

Item 10. | | | | 82 |

| Item 11. | | | | 82 |

| Item 12. | | | | 82 |

| Item 13. | | | | 82 |

| Item 14. | | | | 82 |

PART IV |

Item 15. | | | | 83 |

(a) General Development of Business

Blyth, Inc. (together with its subsidiaries, the “Company,” which may be referred to as “we,” “us” or “our”) is primarily a direct to consumer business focused on the direct selling and direct marketing channels. The Company designs and markets home fragrance products and decorative accessories, as well as weight management products, nutritional supplements and energy drinks. The Company’s products include an extensive array of decorative and functional household products such as candles, accessories, seasonal decorations, household convenience items and personalized gifts; nutritional supplements such as meal replacement shakes, vitamins and energy mixes; as well as products for the foodservice trade. The Company’s products can be found throughout North America, Europe and Australia.

Additional Information

Additional information is available on our website, www.blyth.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments thereto filed or furnished pursuant to the Securities Exchange Act of 1934 are available on our website free of charge as soon as reasonably practicable following submission to the SEC. Also available on our website are our corporate governance guidelines, code of conduct, and the charters for the audit committee, compensation committee, and nominating and corporate governance committee, each of which is available in print to any shareholder who makes a request to Blyth, Inc., One East Weaver Street, Greenwich, CT 06831, Attention: Secretary. The information posted to www.blyth.com, however, is not incorporated herein by reference and is not a part of this report.

Change in fiscal year-end

On December 7, 2011, the Board of Directors approved a change in our fiscal year end from January 31st to December 31st. As a result, we will report our results with an eleven month transition period ended December 31, 2011. In addition, we have eliminated the lag differences in the reporting year-ends of certain of our subsidiaries to align them with our and our other subsidiaries fiscal year end. Refer to Note 2 for further information on this change in accounting principle.

(b) Financial Information about Segments

We report our financial results in three business segments: the Direct Selling segment, the Catalog & Internet segment and the Wholesale segment. These segments accounted for approximately 78%, 15% and 7% of consolidated net sales, respectively, for the eleven months ended December 31, 2011. Financial information relating to these business segments for the eleven months ended December 31, 2011 and fiscal years ended January 31, 2011 and 2010 appears in Note 20 to the Consolidated Financial Statements and is incorporated herein by reference.

(c) Narrative Description of Business

Direct Selling Segment

For the eleven months ended December 31, 2011, the Direct Selling segment represented approximately 78% of total sales. Our principal Direct Selling businesses are PartyLite and ViSalus. PartyLite sells premium candles and home fragrance products and related decorative accessories in North America, Europe and Australia through a network of independent sales consultants using the party plan method of direct selling. These products include fragranced candles, other air care products such as reed diffusers and a broad range of related accessories. PartyLite represented approximately 67% of total sales of the Direct Selling segment for the eleven months ended December 31, 2011.

ViSalus Holding, LLC (“ViSalus”), which interest we acquired in October 2008, is a network marketing company that sells weight management products, nutritional supplements and energy drinks through its network of independent promoters. ViSalus represented approximately 33% of total sales of the Direct Selling segment for the eleven months ended December 31, 2011.

United States Market

Within the United States market, PartyLiteâ brand products are sold through independent consultants who are compensated on the basis of PartyLite product sales at parties organized by them and parties organized by consultants recruited by them. Approximately 19,000 independent U.S. sales consultants were selling PartyLite products at December 31, 2011. PartyLite products are designed, packaged and priced in accordance with their premium quality, exclusivity and the distribution channel through which they are sold.

ViSalus Sciencesâ (“ViSalus”) brand products are also sold directly to consumers by independent sales promoters who are compensated based on the products they sell and products sold by promoters recruited by them. Customers and promoters generally set a fitness goal, known as the Body By Vi 90 Day Challenge, and purchase and consume ViSalus products to help them achieve their goal.

International Market

In 2011, PartyLite products were sold internationally by more than 44,000 independent sales consultants located outside the United States. These consultants were the exclusive distributors of PartyLite brand products internationally. PartyLite’s international markets as of December 31, 2011 were Australia, Austria, Canada, Czech Republic, Denmark, Finland, France, Germany, Italy, Mexico, Norway, Poland, Switzerland, Slovakia and the United Kingdom. ViSalus products are sold in the U.S. and Canada.

We support our independent sales consultants and promoters with inventory management and control, and satisfy delivery requirements through on-line order entry systems, which are available to independent sales consultants and promoters in the United States, Canada, Europe, and elsewhere.

Business Acquisition

In August 2008, we signed a definitive agreement to purchase ViSalus, a direct seller of weight management products, nutritional supplements and energy drinks, through a series of investments.

In October 2008, we completed the initial investment and acquired a 43.6% equity interest in ViSalus for $13.0 million in cash and incurred acquisition costs of $1.0 million for a total cash acquisition cost of $14.0 million.

In April 2011, we completed the second phase of the acquisition of ViSalus for approximately $2.5 million and increased our ownership to 57.5%.

Subsequent to December 31, 2011, we completed the third phase of our acquisition of ViSalus and increased our ownership to 73.5% for approximately $22.5 million in cash and the issuance of 340,662 unregistered shares of our common stock valued at $14.6 million that may not be sold or transferred prior to January 12, 2014. Due to the restrictions on transfer, the common stock was issued at a discount to its trading price. The payments in the third closing were based upon an estimate of the 2011 EBITDA pursuant to the formula in the original purchase agreement, and will be adjusted in April 2012 for the difference between the actual 2011 EBITDA and the estimate used in the third closing. We expect to pay approximately $5.6 million in April 2012 after final determination of the actual 2011 EBITDA, which would bring the total third phase acquisition cost to approximately $42.7 million.

We intend to and may be required to purchase the remaining interest in ViSalus to increase our ownership to 100%. The fourth phase and final purchase of ViSalus is conditioned upon ViSalus meeting the original purchase agreement’s 2012 operating target. We have the option, but are not required, to acquire the remaining interest in ViSalus if it does not meet this operating target. However, as of December 31, 2011, the operating target for 2012 requiring the additional purchase is anticipated to be met. If ViSalus meets its current projected 2012 EBITDA forecast, the total expected redemption cost of the fourth and final phase will be approximately $214 million to be paid in 2013. The purchase price of the additional investment is equal to a multiple of ViSalus’s EBITDA, exclusive of certain unusual items. The payment, if any, may be funded in part using existing cash balances from both domestic and international sources, expected future cash flows from operations and the issuance of common stock and may require us to obtain additional sources of external financing.

Catalog & Internet Segment

For the eleven months ended December 31, 2011, this segment represented approximately 15% of total sales. We design, market and distribute a wide range of household convenience items, personalized gifts and photo storage products, within this segment. These products are sold through the Catalog and Internet distribution channel under brand names that include As We Changeâ, Easy Comfortsâ, Exposuresâ, Miles Kimballâ and Walter Drakeâ.

Wholesale Segment

For the eleven months ended December 31, 2011, this segment represented approximately 7% of total sales. Products within this segment include chafing fuel and tabletop lighting products and accessories for the “away from home” or foodservice trade. Our wholesale products are designed, packaged and priced to satisfy the varying demands of retailers and consumers within each distribution channel. Our sales force supports our customers with product catalogs, samples and merchandising programs. Our sales force also receives training on the marketing and proper use of our products.

Product Brand Names

The key brand names under which our Direct Selling segment products are sold are:

PartyLiteâ GloLite by PartyLiteTM ViSalus GoTM Vi-Shapeâ Vi-Slimâ Nutra-CookieTM | Two Sisters Gourmetâ by PartyLiteâ ViSalus Sciencesâ ViSalus ProTM Vi-Trimâ Vi-Pakâ Body by ViTM |

The key brand names under which our Catalog & Internet segment products are sold are:

As We Changeâ Easy Comfortsâ Exposuresâ | Miles Kimballâ Walter Drakeâ |

The key brand names under which our Wholesale segment products are sold are:

Ambriaâ

New Product Development

Concepts for new products and product line extensions are developed by the marketing departments of our business units, as well as from our independent sales representatives and worldwide product manufacturing partners. The new product development process may include technical research, consumer market research, fragrance or flavor studies, comparative analyses, the formulation of engineering specifications, feasibility studies, efficiency and safety assessments, testing and evaluation.

Manufacturing, Sourcing and Distribution

In all of our business segments, management continuously works to increase value and lower costs through increased efficiency in worldwide production, sourcing, distribution and customer service practices, the application of new technologies and process control systems, and consolidation and rationalization of equipment and facilities. Net capital expenditures over the past five years have totaled $34.3 million and are targeted at technological advancements, significant maintenance and replacement projects at our manufacturing and distribution facilities and customer service capacity increases. We have also closed several facilities and written down the values of certain machinery and equipment in recent years in response to changing market conditions.

We manufacture most of our candles using highly automated processes and technologies, as well as certain hand crafting and finishing, and source nearly all of our home décor and household convenience products, primarily from independent manufacturers in the Pacific Rim, Europe and Mexico. We source our weight management and wellness products from third party manufacturers in the U.S. based on our formulas. Many of our products are manufactured by others based on our design specifications, making our global supply chain approach critically important to new product development, quality control and cost management. We also have highly automated distribution facilities in the U.S. and Europe supporting our PartyLite, Miles Kimball and Sterno businesses. ViSalus relies on third party logistic support for its U.S. and Canada businesses.

Customers

Customers in the Direct Selling segment are individual consumers served by independent sales consultants or promoters. Sales within the Catalog & Internet segment are also made directly to consumers. Wholesale segment customers primarily include mass retailers, foodservice distributors, hotels and restaurants. No single customer accounts for 10% or more of Net Sales.

Competition

All of our business segments are highly competitive, both in terms of pricing and new product introductions. The worldwide market for home décor and health and wellness products is highly fragmented with numerous suppliers serving one or more of the distribution channels served by us. In addition, we compete for direct selling consultants and promoters with other direct selling companies. Because there are relatively low barriers to entry in all of our business segments, we may face increased competition from other companies, some of which may have substantially greater financial or other resources than those available to us. Competition includes companies selling candles manufactured at lower costs outside of the United States and companies selling competitive nutritional supplements through direct selling and retail channels. Moreover, certain competitors focus on a single geographic or product market and attempt to gain or maintain market share solely on the basis of price.

Employees

As of December 31, 2011, we had approximately 1,800 full-time employees, of whom approximately 37% were based outside of the United States. Approximately 60% of our employees are non-salaried. We do not have any unionized employees in North America. We believe that relations with our employees are good. Since our formation in 1977, we have never experienced a work stoppage.

Raw Materials

All of the raw materials used for our candles, home fragrance products and chafing fuel, have historically been available in adequate supply from multiple sources. Ingredients for our nutritional supplements are sourced from a variety of manufacturers. For the eleven months ended December 31, 2011, costs continued to increase for certain raw materials, such as paraffin and other wax products, diethylene glycol (DEG), ethanol, which impacted profitability in all three segments. Some of our ingredients are proprietary to the supplier and may not be easily re-sourced or replaced.

Seasonality

Part of our business is seasonal, with our net sales strongest in the third and fourth fiscal quarters due to increased shipments to meet year-end holiday season demand for our products. For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Seasonality.”

Trademarks and Patents

We own and have pending several trademark and patent registrations and applications in the United States Patent and Trademark Office related to our products. We also register certain trademarks and patents in other countries. While we regard these trademarks and patents as valuable assets to our business, we are not dependent on any single trademark or patent or group thereof.

Regulation

General

In the United States and foreign markets, our Direct Selling business units are affected by extensive laws, regulations, administrative determinations, court decisions and similar constraints. Such laws, regulations and other constraints exist at the federal, state or local levels in the United States and at all levels of government in foreign jurisdictions. They include rules pertaining to: (1) formulation, manufacturing, packaging, labeling, distribution, importation, sale and storage of food and dietary supplement products; (2) product claims and advertising, including direct claims and advertising by us and claims and advertising by consultants or promoters, for which we may be held responsible; and (3) our network marketing programs.

Products

In the United States, the formulation, manufacturing, packaging, storing, labeling, promotion, advertising, distribution and sale of our food and dietary supplement products are regulated by various governmental agencies, including the Food and Drug Administration (“FDA”) and the Federal Trade Commission (“FTC). Our activities also are regulated by agencies of the states, localities and foreign countries in which our products are manufactured, distributed and sold.

| · | The FDA regulates the formulation, manufacture and labeling of foods and dietary supplements. FDA regulations require us and our suppliers to meet current good manufacturing practice (“cGMP”) regulations for product preparation, packing and storage. |

| · | Some products we market in the United States are regulated under the Dietary Supplement Health and Education Act of 1994, or DSHEA, which revised the Federal Food, Drug and Cosmetic Act concerning the composition and labeling of dietary supplements. |

| · | One or more ingredient in our products that are ingested by consumers may become the subject of regulatory action. FDA law requires us to report all serious adverse events occurring within the United States involving dietary supplements. As a result of adverse event reports, we may elect, or be required, to remove a product from a market, either temporarily or permanently. |

| · | Some food products we market are subject to the Nutrition, Labeling and Education Act, or NLEA, and regulations, which regulate health claims, ingredient labeling and claims characterizing the level of a nutrient in the product. |

We have implemented quality control processes to monitor our suppliers and believe we are compliant with the FDA's regulations. If we or our suppliers were to be found not in compliance with FDA regulations, it could have a material adverse effect on our results of operations and financial statements.

In foreign markets, prior to commencing operations and prior to making or permitting sales of our products in the market, we may have to obtain approval, license or certification from the relevant regulators. Product approvals may be conditioned on reformulation of products, or may be unavailable with respect to some products or some ingredients, which may have an adverse effect on our sales. Product labeling and packaging regulations vary from country to country. Failure to comply with these regulations can result in a product being removed from sale in a particular market, either temporarily or permanently.

The FTC, which regulates the advertising of all of our products, has brought enforcement actions against companies selling dietary supplements and weight loss products for false and misleading advertising, often resulting in consent decrees and monetary payments. The FTC also reviews testimonials, expert endorsements and product clinical studies. We have not been a target of FTC enforcement action for the advertising of our products but we cannot be sure that the FTC, or comparable foreign agencies, will not question our advertising or other operations in the future.

In some countries we are, or regulators may assert that we are, responsible for our consultants’ or promoters’ conduct and may be requested or required to take steps to ensure that our consultants or promoters comply with local regulations regarding: (1) representations about our products; (2) income representations by consultants or promoters; (3) public media advertisements, which in foreign markets may require prior approval by regulators; and (4) sales of products in markets in which the products have not been approved, licensed or certified for sale. In some markets improper product claims by consultants or promoters could result in our products being reviewed by regulatory authorities and being classified or placed into another category as to which stricter regulations are applicable or we might be required to make labeling changes.

We can predict neither the nature of any future laws, regulations, interpretations or applications, nor what effect additional regulations or administrative orders would have on our business. They could, however, require

| · | reformulation of some products not capable of being reformulated; |

| · | imposition of additional record keeping requirements; |

| · | expanded documentation of the properties of some products; |

| · | expanded or different labeling; |

| · | additional scientific substantiation regarding product ingredients, safety or usefulness; and/or |

| · | additional consultant or promoter compliance surveillance and enforcement action by us. |

Any or all of these requirements could have a material adverse effect on our results of operations and financial condition.

Network Marketing Program

Our network marketing programs are subject to federal and state regulations administered by the FTC and various state agencies as well as regulations in foreign markets administered by foreign agencies. These regulations generally seek to ensure that product sales are made to consumers and that advancement within an organization is based on sales of products rather than investments in the organization or other non-retail sales related criteria. For instance, in some markets, there are limits on the extent to which consultants or promoters may earn royalty overrides on sales generated by consultants or promoters that were not directly sponsored by the consultant or promoter. We remain subject to the risk, that in one or more markets. our marketing system could be found not to be in compliance with applicable regulations. Failure to comply with these regulations could have a material adverse effect on our business in a particular market or in general.

The FTC could bring an enforcement action based on practices that are inconsistent with its Guides Concerning the Use of Endorsements and Testimonials in Advertising, or Guides. We have adapted our practices and rules regarding the practices of our consultants or promoters to comply with the revised Guides. However, it is possible that our use, and that of our consultants or promoters, of testimonials in the advertising and promotion of our products, including but not limited to our weight management products and of our income opportunity will be significantly impacted and therefore might negatively impact our sales.

We also are subject to the risk of challenges to the legality of our network marketing program, alleging, for instance, that it is an illegal “pyramid scheme” in violation of federal and state laws. Adverse judicial determinations with respect to our program, or in proceedings not involving us directly but which challenge the legality of multi-level marketing systems, could negatively impact our business. We monitor and respond to regulatory and legal developments, including those that may affect our network marketing program. However, the regulatory requirements concerning network marketing programs do not include bright line rules and are inherently fact-based. An adverse judicial determination with respect to our network marketing program, or in proceedings not involving us, could have a material adverse effect on our financial condition and operating results. An adverse determination could:

| · | require us to make modifications to our network marketing program, |

| · | result in negative publicity or |

| · | have a negative impact on consultant or promoter morale. |

Compliance Procedures

We have developed a system to identify specific complaints against consultants or promoters and to remedy any violations of rules by consultants or promoters through appropriate sanctions, including warnings, suspensions and, when necessary, terminations. In our manuals, seminars and other training programs and materials, we emphasize that promoters are prohibited from making therapeutic claims for our products.

To comply with regulations that apply to both us and our consultants or promoters, we research the applicable regulatory framework before entering new markets to identify all necessary licenses and approvals and applicable limitations on our operations in that market and devote substantial resources to obtaining those licenses and approvals and bringing our operations into compliance with applicable limitations. We research laws applicable to consultants or promoter operations and revise or alter our consultant or promoter manuals and other training materials and programs to provide consultants or promoters with guidelines for operating a business and marketing and distributing our products, as required by applicable regulations in each market.

Regulations in existing and new markets often are ambiguous and subject to considerable interpretive and enforcement discretion by the responsible regulators and new regulations regularly are being added and the interpretation of existing regulations is subject to change. Further, the content and impact of regulations to which we are subject may be influenced by public attention directed at us, our products or our network marketing program, so that extensive adverse publicity about us, our products or our network marketing program may result in increased regulatory scrutiny.

We seek to anticipate and respond to new and changing regulations and to make corresponding changes in our operations to the extent practicable. Although we devote considerable resources to maintaining our compliance with regulatory constraints in each market, we cannot be sure that we would be found to be in full compliance with applicable regulations in all of our markets at any given time or the regulatory authorities in one or more markets will not assert, either retroactively or prospectively or both, that our operations are not in full compliance. These assertions or the effect of adverse regulations in one market could negatively affect us in other markets as well by causing increased regulatory scrutiny in those other markets or as a result of the negative publicity generated in those other markets. These assertions could have a material adverse effect on us in a particular market or in general. Furthermore, depending upon the severity of regulatory changes in a particular market and the changes in our operations that would be necessitated to maintain compliance, these changes could result in our experiencing a material reduction in sales in the market or determining to exit the market altogether, which might have an adverse effect on our business and results of operations either in the short or long-term.

Environmental Law Compliance

Most of the manufacturing, distribution and research operations are affected by federal, state, local and international environmental laws relating to the discharge of materials or otherwise to the protection of the environment. We have made and intend to continue to make expenditures necessary to comply with applicable environmental laws, and do not believe that such expenditures will have a material effect on our capital expenditures, earnings or competitive position.

(d) Financial Information about Geographic Areas

For information on net sales from external customers attributed to the United States and international geographies and on long-lived assets located in and outside the United States, see Note 20 to the Consolidated Financial Statements.

We may be unable to increase sales or identify suitable acquisition candidates.

Our ability to increase sales depends on numerous factors, including market acceptance of existing products, the successful introduction of new products, growth of consumer discretionary spending, our ability to recruit new independent sales consultants and promoters, sourcing of raw materials and demand-driven increases in production and distribution capacity. Business in all of our segments is driven by consumer preferences. Accordingly, there can be no assurances that our current or future products will maintain or achieve market acceptance. Our sales and earnings results can be negatively impacted by the worldwide economic environment, particularly the United States, Canadian and European economies. There can be no assurances that our financial results will not be materially adversely affected by these factors in the future.

Our historical growth has been due in part to acquisitions, and we continue to consider additional strategic acquisitions. There can be no assurances that we will continue to identify suitable acquisition candidates, complete acquisitions on terms favorable to us, finance acquisitions, successfully integrate acquired operations or that companies we acquire will perform as anticipated.

We may be unable to respond to changes in consumer preferences.

Our ability to manage our inventories properly is an important factor in our operations. The nature of our products and the rapid changes in customer preferences leave us vulnerable to an increased risk of inventory obsolescence. Excess inventories can result in lower gross margins due to the excessive discounts and markdowns that might be necessary to reduce inventory levels. Our ability to meet future product demand in all of our business segments will depend upon our success in sourcing adequate supplies of our products; bringing new production and distribution capacity on line in a timely manner; improving our ability to forecast product demand and fulfill customer orders promptly; improving customer service-oriented management information systems; and training, motivating and managing new employees. The failure of any of the above could result in a material adverse effect on our financial results.

A downturn in the economy may affect consumer purchases of discretionary items such as our products which could have a material adverse effect on our business, financial condition and results of operations.

Our results of operations may be materially affected by conditions in the global capital markets and the economy generally, both in the United States and elsewhere around the world. Recently, concerns over inflation, energy costs, geopolitical issues, the availability and cost of credit, have contributed to increased volatility and diminished expectations for the economy. A continued or protracted downturn in the economy could adversely impact consumer purchases of discretionary items including demand for our products. Factors that could affect consumers’ willingness to make such discretionary purchases include general business conditions, levels of employment, energy costs, interest rates and tax rates, the availability of consumer credit and consumer confidence. A reduction in consumer spending could significantly reduce our sales and leave us with unsold inventory. The occurrence of these events could have a material adverse effect on our business, financial condition and results of operations.

The turmoil in the financial markets in recent years could increase our cost of borrowing and impede access to or increase the cost of financing our operations and investments and could result in additional impairments to our businesses.

United States and global credit and equity markets have undergone significant disruption in recent years, making it difficult for many businesses to obtain financing on acceptable terms. In addition, in recent years equity markets have experienced rapid and wide fluctuations in value. If these conditions continue or worsen, our cost of borrowing, if needed, may increase and it may be more difficult to obtain financing for our businesses. In addition, our borrowing costs can be affected by short and long term debt ratings assigned by independent rating agencies. A decrease in these ratings by the agencies would likely increase our cost of borrowing and/or make it more difficult for us to obtain financing. In the

event current market conditions continue we will more than likely be subject to higher interest costs than we are currently incurring and may require our providing security to guarantee such borrowings. Alternatively, we may not be able to obtain unfunded borrowings in that amount, which may require us to seek other forms of financing, such as term debt, at higher interest rates and with additional expenses.

In addition, we may be subject to future impairments of our assets, including accounts receivable, investments, inventories, property, plant and equipment, goodwill and other intangibles, if the valuation of these assets or businesses declines.

We face diverse risks in our international business, which could adversely affect our operating results.

We are dependent on international sales for a substantial amount of our total revenue. For the eleven months ended December 31, 2011, and fiscal years ended January 31, 2011 and January 31, 2010, revenue from outside the United States was 48%, 51% and 50% of our total revenue, respectively. We expect international sales to continue to represent a substantial portion of our revenue for the foreseeable future. Due to our reliance on sales to customers outside the United States, we are subject to the risks of conducting business internationally, including:

| · | United States and foreign government trade restrictions, including those which may impose restrictions on imports to or from the United States; |

| · | foreign government taxes and regulations, including foreign taxes that we may not be able to offset against taxes imposed upon us in the United States, and foreign tax and other laws limiting our ability to repatriate funds to the United States; |

| · | the laws and policies of the United States, Canada and certain European countries affecting the importation of goods (including duties, quotas and taxes); |

| · | foreign labor laws, regulations and restrictions; |

| · | difficulty in staffing and managing international operations and difficulty in maintaining quality control; |

| · | adverse fluctuations in world currency exchange rates and interest rates, including risks related to any interest rate swap or other hedging activities we undertake; |

| · | political instability, natural disasters, health crises, war or events of terrorism; |

| · | transportation costs and delays; and |

| · | the strength of international economies. |

We are dependent upon sales by independent consultants and promoters.

A significant portion of our products is marketed and sold via the direct selling method of distribution through independent consultants or promoters to consumers without the use of retail establishments. This distribution system depends upon the successful recruitment, retention and motivation of a large number of independent consultants and promoters to offset frequent turnover. The recruitment and retention of independent consultants and promoters depends on the competitive environment among direct selling companies and on the general labor market, unemployment levels, economic conditions, and demographic and cultural changes in the workforce. The motivation of our consultants and promoters depends, in large part, upon the effectiveness of our compensation and promotional programs, the competitiveness of our programs compared with other direct selling companies and the successful introduction of new products.

Our sales are directly tied to the levels of activity of our consultants and promoters, for many of whom this is a part-time working activity. Activity levels may be affected by the degree to which a market is penetrated by the presence of our consultants and promoters, as well as our competitors’ sales representatives, the margin mix in our product line and the activities and actions of our competitors. The loss of a leading consultant or promoter, together with the associated down line sales organization, or the loss of a significant number of consultants or promoters for any reason, could negatively impact sales of our products, impair our ability to attract new consultants or promoters and harm our financial condition and operating results.

Earnings of independent sales consultants and promoters are subject to taxation, and in some instances, legislation or governmental regulations impose obligations on us to collect or pay taxes, such as value added taxes, and to maintain appropriate records. In addition, we may be subject to the risk in some jurisdictions of new liabilities being imposed for social security and similar taxes with respect to independent sales consultants and promoters. In the event that local laws and regulations or the interpretation of local laws and regulations change to require us to treat independent sales consultants or promoters as employees, or that independent sales consultants and promoters are deemed by local regulatory authorities in one or more of the jurisdictions in which we operate to be our employees rather than independent contractors or agents under existing laws and interpretations, we may be held responsible for social charges and related taxes in those jurisdictions, plus related assessments and penalties, which could harm our financial condition and operating results.

Extensive federal, state and local laws regulate our Direct Selling businesses, products and programs. While we have implemented policies and procedures designed to govern consultant and promoter conduct, it can be difficult to enforce these policies and procedures because of the large number of consultants and promoters and their independent status. Violations by our independent consultants or promoters of applicable law or of our policies and procedures in dealing with customers could reflect negatively on our products and operations and harm our business reputation or lead to the imposition of penalties or claims and could negatively impact our business.

Our profitability may be affected by shortages or increases in the cost of raw materials.

Certain raw materials could be in short supply due to price changes, capacity, availability, a change in production requirements, weather or other factors, including supply disruptions due to production or transportation delays. While the price of crude oil is only one of several factors impacting the price of petroleum wax, it is possible that recent fluctuations in oil prices may have a material adverse effect on the cost of petroleum-based products used in the manufacture or transportation of our products, particularly in the Direct Selling and Wholesale segments. In recent years, substantial cost increases for certain raw materials, such as paraffin, diethylene glycol (DEG), ethanol and paper, negatively impacted profitability of certain products in all three segments. In addition, a number of governmental authorities in the U.S. and abroad have introduced or are contemplating enacting legal requirements, including emissions limitations, cap and trade systems and other measures to reduce production of greenhouse gases, in response to the potential impacts of climate change. These measures may have an indirect effect on us by affecting the prices of products made from fossil fuels, including paraffin and DEG, as well as ethanol, which is used as an additive to gasoline. Given the wide range of potential future climate change regulations and their effects on these raw materials, the potential indirect impact to our operations is uncertain.

In addition, climate change might contribute to severe weather in the locations where fossil fuel based raw materials are produced, such as increased hurricane activity in the Gulf of Mexico, which could disrupt the production, availability or pricing of these raw materials.

We expect not to be disproportionately affected by these measures compared with other companies engaged in the same businesses.

Adverse publicity associated with our products, ingredients or the programs of our Direct Selling entities, or those of similar companies, could harm our financial condition and operating results.

The size of our Direct Selling distribution network and the results of our operations may be significantly affected by the public’s perception of us and similar companies. This perception is dependent upon opinions concerning:

| | • | the safety, efficiency and quality of our products and ingredients; |

| | | |

| | • | the safety, efficiency and quality of similar products and ingredients distributed by other companies; |

| | | |

| | • | our consultants and promoters; |

| | | |

| | • | our promotional and compensation programs; and |

| | | |

| | • | the direct selling business in general. |

Adverse publicity concerning any actual or purported failure by us or our independent consultants or promoters to comply with applicable laws and regulations regarding product claims and advertising, good manufacturing practices, the regulation of our programs, the licensing of our products for sale in our target markets or other aspects of our business, whether or not resulting in enforcement actions or the imposition of penalties, could have an adverse effect on our business and could negatively affect our ability to attract, motivate and retain consultants or promoters, which would negatively impact our ability to generate revenue.

In addition, our consultants’, promoters’ and consumers’ perception of the safety, quality and efficiency of our products and ingredients, as well as similar products and ingredients distributed by other companies, could be significantly influenced by media attention, publicized scientific research or findings, widespread product liability claims or other publicity concerning our products or ingredients or similar products and ingredients distributed by other companies. Adverse publicity, whether or not accurate or resulting from consumers’ use or misuse of our products, that associates consumption of our products or ingredients or any similar products or ingredients with illness or other adverse effects, questions the benefits of our or similar products or claims that any such products are ineffective, inappropriately labeled or have inaccurate instructions as to their use, could lead to lawsuits or other legal challenges and could negatively impact our reputation, the market demand for our products, or our general business.

If we fail to protect our intellectual property, then our ability to compete could be negatively affected, which would harm our financial condition and operating results.

The market for our products depends to a significant extent upon the goodwill associated with our trademarks and trade names. We own the material trademarks and trade name rights used in connection with the packaging, marketing and distribution of our products in the markets where those products are sold. Therefore, trademark and trade name protection is important to our business. Although most of our trademarks are registered in the United States and in certain countries in which we operate, we may not be successful in asserting trademark or trade name protection. In addition, the laws of certain countries may not protect our intellectual property rights to the same extent as the laws of the United States. The loss or infringement of our trademarks or trade names could impair the goodwill associated with our brands and harm our reputation, which would harm our financial condition and operating results.

Our Direct Selling businesses also possess trade secret rights in our consultant or promoter and customer lists and related contact information. Loss of protection for this intellectual property could harm our ability to recruit and retain consultants, promoters or customers, which could harm our financial condition and operating results.

We may incur material product liability claims, which could increase our costs and harm our financial condition and operating results.

We may be subjected to various product liability claims, including claims that relate to the use of candles, chafing fuel and claims that products that are ingested by consumers or applied to their bodies contain contaminants, include inadequate instructions as to their uses, or include inadequate warnings concerning side effects and interactions with other substances. It is possible that widespread product liability claims could increase our costs, and adversely affect our revenues and operating income. Moreover, liability claims arising from a serious adverse event may increase our costs through higher insurance premiums and deductibles, and may make it more difficult to secure adequate insurance coverage in the future.

We are dependent upon our key management personnel.

Our success depends in part on the contributions of our key management, including our Chairman and Chief Executive Officer, Robert B. Goergen, Robert H. Barghaus, Vice President and Chief Financial Officer; and Robert B. Goergen, Jr., President, PartyLite Worldwide and President, Direct Selling Group. The loss of any of the key corporate or operating units' management personnel could have a material adverse effect on our operating results.

Our businesses are subject to the risks from increased competition.

Our business is highly competitive both in terms of pricing and new product introductions. The worldwide markets for decorative and functional products for the home and for nutritional supplements are highly fragmented with numerous suppliers serving one or more of the distribution channels served by us. ViSalus’s Vi-shape meal replacement product constitutes a significant portion of ViSalus’s sales. If consumer demand for this product decreases significantly or ViSalus ceases offering this product without a suitable replacement, then our financial condition and operating results would be harmed. In addition, we compete for independent sales consultants and promoters with other direct selling companies. We may face increased competition from other companies, some of which may have substantially greater financial or other resources than those available to us. Moreover, certain competitors focus on a single geographic or product market and attempt to gain or maintain market share solely on the basis of price.

We depend upon our information technology systems.

We are increasingly dependent on information technology systems to operate our websites, to communicate with our consultants and promoters, process transactions, manage inventory, purchase, sell and ship goods on a timely basis and maintain cost-efficient operations. Previously, we have experienced interruptions resulting from upgrades to certain of our information technology systems that temporarily reduced the effectiveness of our operations. Our information technology systems depend on global communication providers, telephone systems, hardware, software and other aspects of Internet infrastructure that have experienced significant system failures and outages in the past. Our systems are susceptible to outages due to fire, floods, power loss, telecommunication failures, break-ins and similar events. Despite the implementation of network security measures, our systems are vulnerable to computer viruses, break-ins and similar disruptions from unauthorized tampering with our systems. The occurrence of these or other events could disrupt or damage our information technology systems and inhibit internal operations, the ability to provide customer service or the ability of customers or sales personnel to access our information systems.

The Internet plays a major role in our interaction with customers and independent consultants and promoters. Risks such as changes in required technology interfaces, website downtime and other technical failures, security breaches, and consumer privacy regulations are key concerns related to the Internet. Our failure to respond successfully to these risks and uncertainties could reduce sales, increase costs and damage our relationships.

Management uses information systems to support decision making and to monitor business performance. We may fail to generate accurate financial and operational reports essential for making decisions at various levels of management. Failure to adopt systematic procedures to maintain quality information technology general controls could disrupt our business. In addition, if we do not maintain adequate controls such as reconciliations, segregation of duties and verification to prevent errors or incomplete information, our ability to operate our business could be limited.

The circumvention of our security measures could misappropriate confidential or proprietary information, including that of third parties such as our independent consultants and promoters and our customers, cause interruption in our operations, damage our computers or otherwise damage our reputation and business. We may need to expend significant resources to protect against security breaches or to address problems caused by such breaches. Any actual security breaches could damage our reputation and expose us to a risk of loss or litigation and possible liability under various laws and regulations. In addition, employee error or malfeasance or other errors in the storage, use or transmission of any such information could result in a disclosure to third parties. If this should occur we could incur significant expenses addressing such problems. Since we collect and store consultant, promoter, customer, distributor and vendor information, including in some cases credit card information, these risks are heightened.

Changes in our effective tax rate may have an adverse effect on our reported earnings.

Our effective tax rate and the amount of our provision for income taxes may be adversely affected by a number of factors, including:

| | • | | the jurisdictions in which profits are determined to be earned and taxed; |

| | • | | adjustments to estimated taxes upon finalization of various tax returns; |

| | • | | changes in available tax credits; |

| | • | | changes in the valuation of our deferred tax assets and liabilities; |

| | • | | the resolution of issues arising from uncertain positions and tax audits with various tax authorities; |

| | • | | changes in accounting standards or tax laws and regulations, or interpretations thereof; and |

| | • | | penalties and/or interest expense that we may be required to recognize on liabilities associated with uncertain tax positions. |

Our Direct Selling segment is affected by extensive laws and governmental regulations; its failure to comply with those laws and regulations may have a material adverse effect on our financial condition and operating results.

We are affected by extensive laws, governmental regulations, administrative determinations, court decisions and similar constraints. Such laws, regulations and other constraints exist at the federal, state and local levels, including regulations relating to:

| | • | | the formulation, manufacturing, packaging, labeling, distribution, importation, sale and storage of products; |

| | • | | product claims and advertising, including direct claims and advertising by us, as well as claims and advertising by promoters, for which we may be held responsible; |

| | • | | promotional and compensation programs; and |

| | • | | taxation of our independent consultants and promoters (which in some instances may impose an obligation on us to collect the taxes and maintain appropriate records). |

There can be no assurance that we or our consultants and promoters are in compliance with all of these regulations, and the failure by us or our consultants or promoters to comply with these regulations or new regulations could lead to the imposition of significant penalties or claims and could negatively impact our business. In addition, the adoption of new regulations or changes in the interpretations of existing regulations may result in significant compliance costs or discontinuation of product sales and may negatively impact the marketing of our products, resulting in significant loss of sales revenues.

In addition, our promotional and compensation programs are subject to a number of federal and state regulations administered by the Federal Trade Commission and various state agencies in the United States and the equivalent provincial and federal government agencies in Canada. We are subject to the risk that, in one or more markets, our network marketing programs could be found not to be in compliance with applicable law or regulations. Regulations applicable to network marketing organizations generally are directed at preventing fraudulent or deceptive schemes, often referred to as “pyramid” or “chain sales” schemes, by ensuring that product sales ultimately are made to consumers and that advancement within an organization is based on sales of the organization’s products rather than investments in the organization or other non-retail sales related criteria. The regulatory requirements concerning network marketing programs do not include “bright line” rules, and thus, even in jurisdictions where we believe that our promotional and compensation programs are in full compliance with applicable laws or regulations, it is subject to the risk that these laws or regulations or the enforcement or interpretation of these laws and regulations by governmental agencies or courts can change. The failure of our promotional and compensation programs to comply with current or newly adopted regulations could negatively impact our business in a particular market or in general.

Increased cost of our catalog and promotional mailings can reduce our profitability.

Postal rate increases and paper and printing costs affect the cost of our catalog and promotional mailings. Future additional increases in postal rates or in paper or printing costs would reduce our profitability to the extent that we are unable to pass those increases directly to customers or offset those increases by raising selling prices or by reducing the number and size of certain catalog circulations.

Climate change may pose physical risks that could harm our results of operations or affect the way we conduct our business.

Several of our facilities and our suppliers’ facilities are located in areas exposed to the risk of hurricanes or tornadoes. The effect of global warming on such storms is highly uncertain. Based on an assessment of the locations of the facilities, the nature and extent of the operations conducted at such facilities, the prior history of such storms in these locations, and the likely future effect of such storms on those operations and on the Company as a whole, we do not currently expect any material adverse effect on the results of operation from such storms in the foreseeable future.

Failure to comply with Section 404 of the Sarbanes-Oxley Act of 2002 might have an impact on market confidence in our reported financial information.

We must continue to document, test, monitor and enhance our internal control over financial reporting in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002. We will continue to perform the documentation and evaluations needed to comply with Section 404. If during this process our management identifies one or more material weaknesses in our internal control over financial reporting, we will be unable to assert our internal control as effective.

None.

The following table sets forth the location and approximate square footage of our major manufacturing and distribution facilities:

| Location | Use | Business Segment | Approximate Square Feet |

| | | | Owned | Leased |

| Arndell Park, Australia | Distribution | Direct Selling | — | 38,000 |

| Batavia, Illinois | Manufacturing and Research & Development | Direct Selling | 420,000 | — |

| Carol Stream, Illinois | Distribution | Direct Selling | — | 515,000 |

| Cumbria, England | Manufacturing and related distribution | Direct Selling | 90,000 | — |

| Heidelberg, Germany | Distribution | Direct Selling | — | 6,000 |

| Monterrey, Mexico | Distribution | Direct Selling | — | 45,000 |

| Oshkosh, Wisconsin | Distribution | Catalog & Internet | — | 386,000 |

| Texarkana, Texas | Manufacturing and related distribution | Wholesale | 154,000 | 62,000 |

| Tilburg, Netherlands | Distribution | Direct Selling | 442,500 | — |

Our executive and administrative offices are generally located in leased space (except for certain offices located in owned space).

In August 2008, a state department of revenue proposed to assess additional corporate income taxes on the Company for fiscal years 2002 through 2009. In November 2011, we finalized these audits with the state department of revenue covering the years ended January 31, 2002 through 2009. As a result of the settlement, payment was made and charged against the previously established reserves. No additional tax liability exists for these audits.

We are involved in litigation arising in the ordinary course of business. In our opinion, existing litigation will not have a material adverse effect on our financial position, results of operations or cash flows.

Item 4. Mine Safety Disclosure

Not applicable

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our Common Stock is traded on the New York Stock Exchange under the symbol BTH. The following table provides the closing price range for the Common Stock on the New York Stock Exchange:

| | | High | | | Low | |

| Year Ended January 31, 2011 | |

First Quarter | | $ | 59.03 | | | $ | 26.79 | |

Second Quarter | | | 59.22 | | | | 32.57 | |

Third Quarter | | | 46.11 | | | | 36.39 | |

Fourth Quarter | | | 45.71 | | | | 33.39 | |

| | |

| Eleven Months Ended December 31, 2011 | |

| First Quarter | | $ | 47.14 | | | $ | 30.83 | |

| Second Quarter | | | 66.82 | | | | 36.11 | |

| Third Quarter | | | 68.34 | | | | 52.25 | |

Fourth Quarter (2 months) | | | 70.07 | | | | 54.23 | |

Many of our shares are held in “street name” by brokers and other institutions on behalf of stockholders, and we had approximately 1,500 beneficial holders of Common Stock as of February 29, 2012.

During the eleven months ending December 31, 2011 and the year ending January 31, 2011, the Board of Directors declared cash dividends as follows:

| Regular Dividend | | December 31, 2011 | | | January 31, 2011 | |

| Second Quarter | | $ | 0.10 | | | $ | 0.10 | |

Fourth Quarter | | $ | 0.10 | | | $ | 0.10 | |

| | | | | | | | | |

| Special Dividend | | | | | | | | |

Fourth Quarter | | $ | 1.50 | | | $ | 1.00 | |

Our ability to pay cash dividends in the future depends upon, among other things, our ability to operate profitably and to generate significant cash flows from operations in excess of investment and financing requirements that may increase in the future to, for example, fund acquisitions, meet contractual obligations to acquire the remaining portion of ViSalus that we do not own or retire debt.

The following table sets forth, for the equity compensation plan categories listed below, information as of December 31, 2011:

Equity Compensation Plan Information

Plan Category | | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights1 | | | (b) Weighted-average exercise price of outstanding options, warrants and rights1 | | | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| Equity compensation plans approved by security holders | | | 35,050 | | | $ | 109.76 | | | | 795,345 | |

| Equity compensation plans not approved by security holders | | | - | | | | - | | | | - | |

Total | | | 35,050 | | | $ | 109.76 | | | | 795,345 | |

1 The information in this column excludes 142,706 restricted stock units outstanding as of December 31, 2011.

The following table sets forth certain information concerning the repurchases of the Company’s Common Stock made by the Company during the two months ended December 31, 2011.

| | Issuer Purchases of Equity Securities (1) |

| Period | | (a) Total Number of Shares Purchased | | | (b) Price Paid per Share | | | (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | | (d) Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | |

| November 1, 2011 -November 30, 2011 | | | - | | | | - | | | | - | | | | 1,147,398 | |

| December 1, 2011 -December 31, 2011 | | | - | | | | - | | | | - | | | | 1,147,398 | |

| Total | | | - | | | | - | | | | - | | | | 1,147,398 | |

__________________________

1 On September 10, 1998, our Board of Directors approved a share repurchase program pursuant to which we were originally authorized to repurchase up to 250,000 shares of Common Stock in open market transactions. From June 1999 to June 2006 the Board of Directors increased the authorization under this repurchase program five times (on June 8, 1999 to increase the authorization by 250,000 shares to 500,000 shares; on March 30, 2000 to increase the authorization by 250,000 shares to 750,000 shares; on December 14, 2000 to increase the authorization by 250,000 shares to 1.0 million shares; on April 4, 2002 to increase the authorization by 500,000 shares to 1.5 million shares; and on June 7, 2006 to increase the authorization by 1.5 million shares to 3.0 million shares). On December 13, 2007, the Board of Directors authorized a new repurchase program, for 1.5 million shares, which became effective after we exhausted the authorized amount under the old repurchase program. As of December 31, 2011, we have purchased a total of 3,352,602 shares of Common Stock under the old and new repurchase programs. The repurchase programs do not have expiration dates. We intend to make further purchases under the repurchase programs from time to time. The amounts set forth in this paragraph have been adjusted to give effect to the 1-for-4 reverse stock split executed for the year ended January 31, 2009.

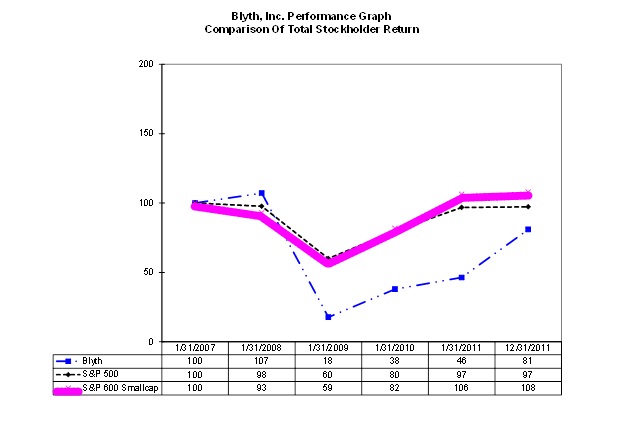

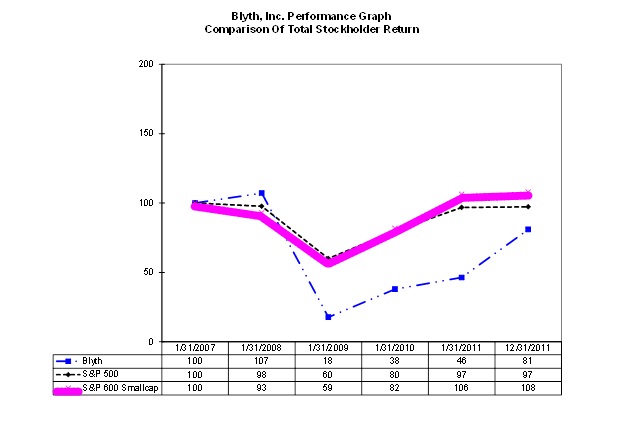

Performance Graph

The performance graph set forth below reflects the yearly change in the cumulative total stockholder return (price appreciation and reinvestment of dividends) on our Common Stock compared to the Standard and Poor’s (“S&P”) 500 Index and the S&P SmallCap 600 Index. The graph assumes the investment of $100 in Common Stock and the reinvestment of all dividends paid on such Common Stock into additional shares of Common Stock and such indexes. Since our competitors are typically not public companies or are themselves subsidiaries or divisions of public companies engaged in multiple lines of business, we believe that it is not possible to compare our performance against that of our competition. In the absence of a satisfactory peer group, we believe that it is appropriate to compare us to companies comprising S&P SmallCap 600 Index, the index we are currently tracked in by S&P.

Set forth below are selected summary consolidated financial and operating data which have been derived from our audited financial statements. The information presented below should be read in conjunction with our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements, including the notes thereto, appearing elsewhere in this Report. The per share amounts and number of shares outstanding have been retroactively adjusted to give effect to the 1-for-4 reverse stock split of our common stock that we implemented on January 30, 2009.

In December 2011, the Company changed its fiscal year-end from January 31 to December 31. In addition, the Company has eliminated the lag differences in its reporting year-ends of certain of its subsidiaries to align it with its parent and other subsidiaries. The operating results for the fiscal years ended January 31, 2010 and 2011 have been adjusted for the retrospective application of this accounting change as more fully discussed in Note 2, “Change in Accounting Principle” to the consolidated financial statements. The results for the fiscal years ended January 31, 2009 and 2008 have not been adjusted as the impact of these changes were not material.

| | | 11 Months ended December 31, | | | Years ended January 31, | |

| (In thousands, except per share and percent data) | | 2011 | | | 2010 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

Statement of Earnings Data: (1) | | | | | (Unaudited) | | | (As adjusted) | | | (As adjusted) | | | | | | | |

| Net sales | | $ | 888,325 | | | $ | 740,862 | | | $ | 796,598 | | | $ | 852,277 | | | $ | 913,531 | | | $ | 955,784 | |

| Gross profit | | | 547,212 | | | | 442,899 | | | | 473,993 | | | | 495,572 | | | | 533,154 | | | | 556,789 | |

| Goodwill and other intangibles impairment | | | - | | | | - | | | | - | | | | 16,498 | | | | 46,888 | | | | 49,178 | |

Operating profit (2) | | | 34,223 | | | | 49,668 | | | | 49,673 | | | | 39,049 | | | | 20,257 | | | | 50,299 | |

| Interest expense | | | 5,705 | | | | 6,381 | | | | 7,150 | | | | 7,719 | | | | 9,885 | | | | 15,184 | |

Earnings from continuing operations before income taxes and noncontrolling interest | | | 29,619 | | | | 44,253 | | | | 42,278 | | | | 31,490 | | | | 4,284 | | | | 41,323 | |

| Earnings (loss) from continuing operations | | | 21,595 | | | | 27,738 | | | | 27,570 | | | | 22,475 | | | | (9,213 | ) | | | 21,222 | |

| Less: Net loss attributable to noncontrolling interests | | | (971 | ) | | | (638 | ) | | | (464 | ) | | | (1,292 | ) | | | 115 | | | | 106 | |

Loss from discontinued operations (3) | | | (6,340 | ) | | | (307 | ) | | | (1,443 | ) | | | (6,763 | ) | | | (6,152 | ) | | | (10,044 | ) |

| Net earnings (loss) attributable to Blyth, Inc. | | | 16,226 | | | | 28,069 | | | | 26,591 | | | | 17,004 | | | | (15,480 | ) | | | 11,072 | |

| Basic net earnings (loss) from continuing operations | | $ | 2.73 | | | $ | 3.35 | | | $ | 3.31 | | | $ | 2.67 | | | $ | (1.04 | ) | | $ | 2.19 | |

| Basic net loss from discontinued operations | | $ | (0.77 | ) | | $ | (0.04 | ) | | $ | (0.17 | ) | | $ | (0.76 | ) | | $ | (0.69 | ) | | $ | (1.04 | ) |

| Basic net earnings (loss) attributable to Blyth, Inc. | | $ | 1.96 | | | $ | 3.31 | | | $ | 3.14 | | | $ | 1.91 | | | $ | (1.73 | ) | | $ | 1.15 | |

| Diluted net earnings (loss) from continuing operations | | $ | 2.71 | | | $ | 3.33 | | | $ | 3.30 | | | $ | 2.66 | | | $ | (1.04 | ) | | $ | 2.17 | |

| Diluted net loss from discontinued operations | | $ | (0.76 | ) | | $ | (0.04 | ) | | $ | (0.17 | ) | | $ | (0.76 | ) | | $ | (0.69 | ) | | $ | (1.03 | ) |

| Diluted net earnings (loss) attributable to Blyth, Inc. | | $ | 1.95 | | | $ | 3.29 | | | $ | 3.13 | | | $ | 1.90 | | | $ | (1.73 | ) | | $ | 1.14 | |

| Cash dividends declared, per share | | $ | 1.70 | | | $ | 1.20 | | | $ | 1.20 | | | $ | 1.20 | | | $ | 2.16 | | | $ | 2.16 | |

| Basic weighted average numberof common shares outstanding | | | 8,274 | | | | 8,480 | | | | 8,462 | | | | 8,912 | | | | 8,971 | | | | 9,648 | |

| Diluted weighted average numberof common shares outstanding | | | 8,329 | | | | 8,525 | | | | 8,508 | | | | 8,934 | | | | 8,971 | | | | 9,732 | |

| Operating Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross profit margin | | | 61.6 | % | | | 59.8 | % | | | 59.5 | % | | | 58.1 | % | | | 58.4 | % | | | 58.3 | % |

| Operating profit margin | | | 3.9 | % | | | 6.7 | % | | | 6.2 | % | | | 4.6 | % | | | 2.2 | % | | | 5.3 | % |

| Net capital expenditures | | $ | 6,318 | | | $ | 7,909 | | | $ | 8,192 | | | $ | 5,195 | | | $ | 6,043 | | | $ | 8,510 | |

| Depreciation and amortization | | | 10,686 | | | | 10,779 | | | | 11,863 | | | | 14,173 | | | | 15,635 | | | | 17,994 | |

| Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 515,294 | | | $ | 507,507 | | | $ | 508,835 | | | $ | 526,357 | | | $ | 574,103 | | | $ | 667,422 | |

| Total debt | | | 99,883 | | | | 110,918 | | | | 110,845 | | | | 110,796 | | | | 145,533 | | | | 158,526 | |

| Total stockholders' equity | | | 153,798 | | | | 251,358 | | | | 252,868 | | | | 254,830 | | | | 248,498 | | | | 299,068 | |

| (1) Statement of Earnings Data includes the results of operations for periods subsequent to the respective purchase acquisitions of As We Change, acquired in August 2008, and ViSalus, acquired in October 2008, none of which individually or in the aggregate had a material effect on the Company’s results of operations. |

| | (2) Fiscal 2008 earnings include restructuring charges recorded in the Wholesale and Direct Selling segments of $24.0 million and $2.3 million, respectively. Fiscal 2009, 2010 and 2011 earnings include changes in estimated restructuring charges recorded in the Direct Selling segment of $1.7 million, $0.1 million and $0.8 million, respectively. |

| | (3) In 2011, the Company sold substantially all of the net assets of Midwest-CBK and disposed of the assets and liabilities of the Boca Java business as more fully detailed in Note 5 to the Consolidated financial statements. The results of operations for these businesses have been reclassified to discontinued operations for all periods presented. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The financial and business analysis below provides information that we believe is relevant to an assessment and understanding of our consolidated financial condition, changes in financial condition and results of operations. This financial and business analysis should be read in conjunction with our consolidated financial statements and accompanying notes to the Consolidated Financial Statements set forth in Item 8 “Financial Statements and Supplementary Data.”

Overview

Blyth designs and markets home fragrance products and decorative accessories, as well as weight management products, nutritional supplements and energy drinks. Our products include an extensive array of decorative and functional household products such as candles, accessories, seasonal decorations, household convenience items and personalized gifts, meal replacement shake mixes, vitamins and energy drinks, as well as products for the foodservice trade. Our products can be found throughout North America, Europe and Australia. Our financial results are reported in three segments: the Direct Selling segment, the Catalog & Internet segment and the Wholesale segment. These reportable segments are based on similarities in distribution channels, customers, operating metrics and management oversight.

Our current focus is driving sales growth and profitability of our brands so we may leverage more fully our infrastructure, as well as supporting new infrastructure requirements of certain of our businesses. New product development continues to be critical to all three segments of our business. In the Direct Selling segment, monthly sales and productivity incentives are designed to attract, retain and increase the earnings opportunity of independent sales consultants and promoters. In the Catalog & Internet channel, product, merchandising and circulation strategy are designed to drive strong sales growth in smaller brands and expand the sales and customer base of our flagship brands. In the Wholesale segment, sales initiatives are targeted to large retailers, food service distributors and hotels.

On December 7, 2011, our Board of Directors approved a change in our fiscal year end from January 31st to December 31st. As a result, we will report our results with an eleven month transition period ended December 31, 2011. In addition, we have eliminated the lag differences in the reporting year-ends of certain of our subsidiaries to align them with our and our other subsidiaries fiscal year end.

In 2011, we sold substantially all of the net assets of Midwest-CBK and disposed of the assets and liabilities of the Boca Java business as more fully detailed in Note 5 to the consolidated financial statements. The results of operations for these businesses have been presented as discontinued operations for all periods.

Recent Developments

Subsequent to December 31, 2011, we completed the third phase of our acquisition of ViSalus and increased our ownership to 73.5% for approximately $22.5 million in cash and the issuance of 340,662 unregistered shares of our common stock valued at $14.6 million that may not be sold or transferred prior to January 12, 2014. Due to the restrictions on transfer, the common stock was issued at a discount to its trading price. The payments in the third closing were based upon an estimate of the 2011 EBITDA pursuant to the formula in the original purchase agreement, and will be adjusted in April 2012 for the difference between the actual 2011 EBITDA and the estimate used in the third closing. We expect to pay approximately $5.6 million in April 2012 after final determination of the actual 2011 EBITDA, which would bring the total third phase acquisition cost to approximately $42.7 million.

Business Acquisition

In August 2008, we signed a definitive agreement to purchase ViSalus, a direct seller of weight management products, nutritional supplements and energy drinks, through a series of investments.

In October 2008, we completed the initial investment and acquired a 43.6% equity interest in ViSalus for $13.0 million in cash and incurred acquisition costs of $1.0 million for a total cash acquisition cost of $14.0 million.

In April 2011, we completed the second phase of the acquisition of ViSalus for approximately $2.5 million and increased its ownership to 57.5%. See Recent Developments for further information.