UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

Blyth, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

BLYTH, INC.

One East Weaver Street

Greenwich, Connecticut 06831

(203) 661-1926

___________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 16, 2012

___________

| To the Stockholders of | April 2, 2012 |

Blyth, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Blyth, Inc. will be held in the Board Room of Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831 on Wednesday, May 16, 2012, at 9:00 a.m. local time, for the following purposes:

| 1. | to elect eight directors to hold office until the next annual meeting of stockholders and until their respective successors are elected and qualified; |

| 2. | advisory approval of the company’s executive compensation; |

| 3. | to ratify the appointment of our independent auditors; and |

| 4. | to transact such other business as may properly come before the meeting or any adjournments thereof. |

As we did last year, we are making the proxy materials for this year’s annual meeting available to our stockholders over the Internet under the “notice and access” rules of the Securities and Exchange Commission. We believe these rules allow us to provide our stockholders with the information they need, while reducing our printing and mailing costs and helping to conserve natural resources. The Notice of Internet Availability of Proxy Materials that you received in the mail contains instructions on how to access this proxy statement and the Transition Report on Form 10-K for the transition period ended December 31, 2011 and vote online. The Notice also includes instructions on how you can request a paper copy of the annual meeting materials.

The board of directors has fixed the close of business on March 22, 2012 as the record date for the determination of stockholders entitled to notice of, and to vote at, the annual meeting. A list of stockholders entitled to vote at the annual meeting will be available for examination by any stockholder, for any purpose relevant to the meeting, on and after May 4, 2012, during ordinary business hours at our principal executive offices located at the address set forth above.

By Order of the Board of Directors

Michael S. Novins

Secretary

Your vote is important. Whether or not you plan to attend the annual meeting, please promptly submit your proxy or voting instructions by Internet, telephone or mail. For specific instructions on how to vote your shares, please refer to the instructions found on the Notice of Internet Availability of Proxy Materials you received in the mail or, if you received a paper copy of the proxy materials, the enclosed proxy/voting instruction card. |

BLYTH, INC.

One East Weaver Street

Greenwich, Connecticut 06831

(203) 661-1926

___________

PROXY STATEMENT

___________

Annual Meeting of Stockholders

To Be Held May 16, 2012

___________

INTRODUCTION

This proxy statement is being furnished to holders of our common stock in connection with the solicitation of proxies by our board of directors for use at the Annual Meeting of Stockholders to be held in the Board Room of Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831 on Wednesday, May 16, 2012, at 9:00 a.m. local time, and at any adjournments thereof. This proxy statement is first being released by us to our stockholders on April 2, 2012.

Our Transition Report on Form 10-K for the transition period ended December 31, 2011 also accompanies this proxy statement. The transition report includes audited financial statements, a discussion by management of our financial condition and results of operations, and other information.

ABOUT THE ANNUAL MEETING

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE 2012 ANNUAL MEETING

Why am I receiving these materials?

The board of directors is providing these proxy materials to you in connection with the 2012 Annual Meeting of Stockholders. The annual meeting will take place in our Board Room at One East Weaver Street, Greenwich, Connecticut 06831 on Wednesday, May 16, 2012, at 9:00 a.m. local time. You are invited to attend the annual meeting and are entitled to and requested to vote on the proposals described in this proxy statement.

What is the purpose of the annual meeting?

At the annual meeting, stockholders will be asked:

| 1. | to elect eight directors to hold office until the next annual meeting of stockholders and until their respective successors are elected and qualified; |

| 2. | advisory approval of the company’s executive compensation; |

| 3. | to ratify the appointment of our independent auditors; and |

| 4. | to transact such other business as may properly come before the meeting or any adjournments thereof. |

What are the recommendations of the board of directors?

The board’s recommendations are set forth together with the description of each item in this proxy statement. The board recommends a vote FOR the election of all of the nominees as directors, FOR the resolution to approve the compensation of our named executive officers and FOR the ratification of the appointment of Ernst & Young LLP as our independent auditors. Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the board of directors. If any other matters are properly presented at the annual meeting for action, including a question of adjourning the meeting from time to time, the persons named in the proxies will have discretion to vote on such matters in accordance with their best judgment.

Who is entitled to vote at the annual meeting?

Only stockholders of record at the close of business on the record date, March 22, 2012, are entitled to notice of and to vote at the annual meeting or any adjournment(s) thereof. Each stockholder is entitled to one vote, exercisable in person or by proxy, for each share held of record on the record date with respect to each matter. On the record date, there were 8,569,187 shares of common stock issued and outstanding. The presence, in person or by proxy, of a majority of those shares will constitute a quorum at the meeting.

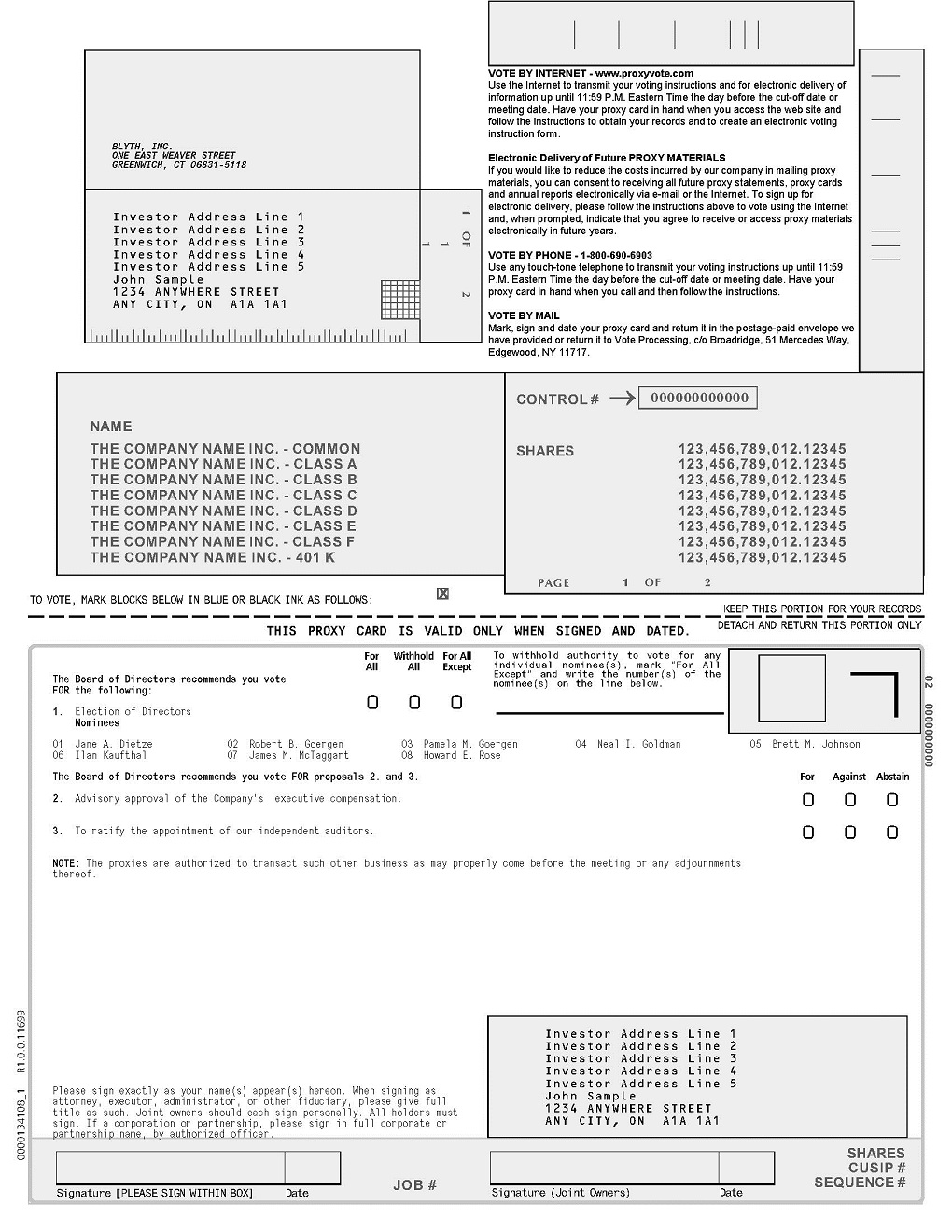

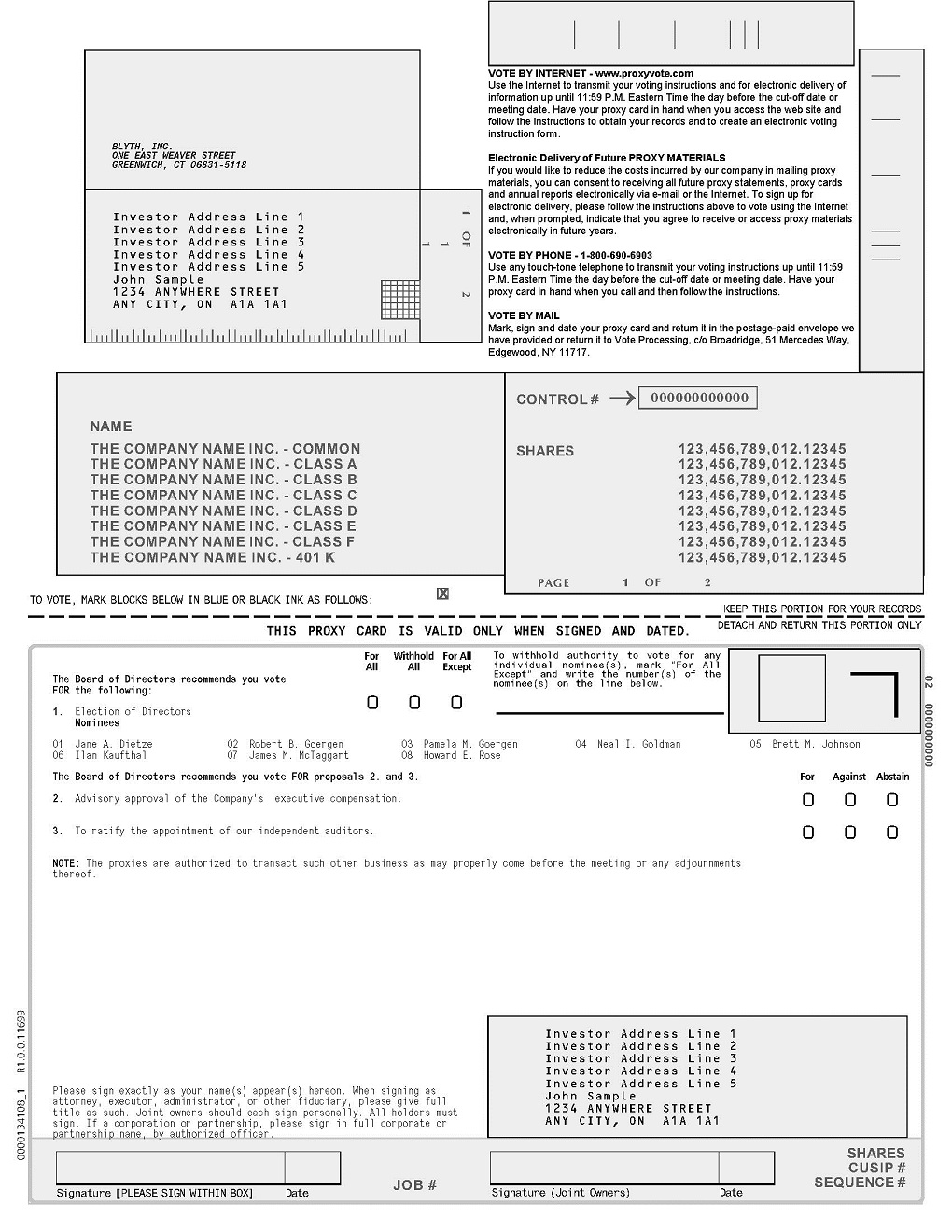

How do I vote?

You may vote either by casting your vote in person at the meeting, by marking, signing and dating each proxy card you receive and returning it in the prepaid envelope, by telephone, or electronically through the Internet by following the instructions included on your proxy card.

The telephone and Internet voting procedures are designed to authenticate votes cast by use of a personal identification number. The procedures, which are designed to comply with Delaware law, allow stockholders to appoint a proxy to vote their shares and to confirm that their instructions have been properly recorded.

If you hold your shares in “street name” through a broker or other nominee, you may be able to vote by telephone or electronically through the Internet in accordance with the voting instructions provided by that institution. Proxies will also be considered to be confidential voting instructions to the trustees of our 401(k) and profit sharing plan with respect to shares of common stock held in accounts under the plan.

To the extent that no direction is indicated, the shares will be voted FOR the election of all of the nominees as directors, FOR the resolution to approve the compensation of our named executive officers and FOR the ratification of the appointment of Ernst & Young LLP as our independent auditors. If any other matters are properly presented at the annual meeting for action, including a question of adjourning the meeting from time to time, the persons named in the proxies will have discretion to vote on such matters in accordance with their best judgment.

Can I change my vote after I return my proxy card?

Any stockholder who has executed and returned a proxy has the power to revoke it at any time before it is voted. A stockholder who wishes to revoke a proxy can do so by attending the annual meeting and voting in person, or by executing a later-dated proxy relating to the same shares or a writing revoking the proxy and, in the latter two cases, delivering such later-dated proxy or writing to our corporate secretary prior to the vote at the annual meeting. Any writing intended to revoke a proxy should be sent to us at our principal executive offices, One East Weaver Street, Greenwich, Connecticut 06831, Attention: Michael S. Novins, Secretary.

What vote is required to approve each item?

Each share of common stock outstanding on the record date is entitled to one vote on each matter to be voted upon.

Election of Directors. Our bylaws and certificate of incorporation provide that a nominee for director in an uncontested election shall be elected to the board of directors if the votes cast for such nominee’s election exceed the votes cast against his or her election. Abstentions from voting, as well as broker non-votes, if any, are not treated as votes cast and, therefore, will have no effect on the proposal to elect directors. In a contested election (a situation in which the number of nominees exceeds the number of directors to be elected), the standard for election of directors will be a plurality of the votes cast at the meeting. If a nominee who is currently serving as a director is not elected at the annual meeting, under Delaware law the director will continue to serve on the board as a “holdover director.” However, under our bylaws and certificate of incorporation, any director who fails to be elected must offer to resign from the board of directors. The director whose resignation is under consideration will abstain from participating in any decision regarding that resignation. The nominating and corporate governance committee shall make a recommendation to the board of directors as to whether to accept or reject the tendered resignation, or whether other action should be taken. The nominating and corporate governance committee and the board may consider any factors they deem relevant in deciding whether to accept a director’s resignation. The board of directors will publicly disclose its decision regarding the resignation within 90 days after results of the election are certified. If the resignation is not accepted, the director will continue to serve until the next annual meeting and until the director’s successor is elected and qualified.

“Say on Pay” Proposal. The advisory vote on executive compensation is non-binding, as provided by law. Our board of directors will, however, review the results of the votes and, consistent with our record of shareholder engagement, will take them into account in making a determination concerning the advisory vote on executive compensation. Approval, on an advisory basis, of the compensation of our named executive officers will be decided by a majority of the votes cast “for” or “against” the proposal. Abstentions and broker non-votes, if any, are not counted as votes “for” or “against” this proposal.

Independent Auditors. The proposal to ratify the selection of our independent auditors will be approved if it receives the affirmative vote of a majority of shares present, in person or by proxy, and entitled to vote on the matter. Abstentions will be included in the vote totals for this matter and therefore will have the same effect as a negative vote; broker non-votes will not be included in the vote totals and therefore will have no effect on the vote.

Who will bear the cost of soliciting votes for the annual meeting?

We are paying for the distribution and solicitation of the proxies. As part of this process, we reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders. Our employees may also solicit proxies on our behalf in person, by telephone, electronic transmission or facsimile, but they do not receive additional compensation for providing those services.

PROPOSAL 1: ELECTION OF DIRECTORS

Nominees for Election as Directors

The board of directors currently consists of six members, to hold office until his or her successor has been elected and qualified or until the director’s earlier resignation or removal. It is intended that the persons named in the enclosed form of proxy, as proxies, will, except as noted below, vote FOR the election of the nominees as directors. The board, upon the recommendation of the nominating and corporate governance committee, has nominated for election as directors at the annual meeting the eight nominees listed below, all of whom are currently members of the board of directors other than Jane A. Dietze and Brett M. Johnson. Pamela M. Goergen, Robert B. Goergen, Neal I. Goldman, James M. McTaggart and Howard E. Rose were most recently elected at the 2011 annual meeting and Ilan Kaufthal was elected by the board of directors in February 2012. The board has determined that each of the nominees listed brings strong skills and extensive experience to the board, giving the nominees as a group the appropriate skills to exercise the board’s oversight responsibilities.

You will notice in reading this proxy statement that Anne M. Busquet, a director since 2007, and Carol J. Hochman, a director since 2002, are not standing for re-election, and that Wilma H. Jordan, a director from 2004, resigned from the board in July 2011. We want to express our deep appreciation to Anne, Carol and Wilma for their valuable contributions to Blyth.

The board does not contemplate that any of such nominees will become unable to serve. If, however, any of the nominees should become unable to serve before the annual meeting, proxies solicited by the board will be voted by the persons named as proxies in accordance with the best judgment of such proxies.

The following sets forth the name, age, business experience for at least the past five years and other directorships of each of the nominees:

Jane A. Dietze (46)

Jane A. Dietze has been the Director of Private Investments at Bowdoin College since April 2012. From July 2006 until March 2012, she was a managing director of Fortress Investment Group, a global alternative investment and asset management firm. Prior thereto, she was a general partner at Nextpoint Partners, an early-stage technology venture fund, from 2004 to 2006, and at Columbia Capital, an information technology and communications fund, from 1998 to 2004. Ms. Dietze was nominated to the board based on her understanding of current digital developments as well as her in-depth understanding and evaluation of asset risk.

Pamela M. Goergen joined the board of directors in 1984. Since 2001 she has served as a managing director of Ropart Investments, LLC, a private equity investment group, and for its predecessor, The Ropart Group Limited, she served as vice president and secretary from 1979 to 2001. Mrs. Goergen has served on our board for more than 25 years and has substantial knowledge about the company and the industries in which we compete. Mrs. Goergen’s family is our largest shareholder, and she brings the perspective of a large shareholder to the board of directors.

Chairman of the Board and Chief Executive Officer

Robert B. Goergen has been our chairman since our inception in 1977. Mr. Goergen has served as our chief executive officer since 1978 and as president from March 1994 to March 2004. Since 1979, he has served as senior managing member of Ropart Investments, LLC and its predecessor entities, a private equity investment group. Mr. Goergen founded the company more than 30 years ago and has substantial knowledge of the company and the industries in which we compete. Mr. Goergen is also the company’s largest shareholder and brings the perspective of a chief executive officer and large shareholder to the board of directors.

Neal I. Goldman joined the board of directors in 1991. From 1985 to the present, he has been the president of Goldman Capital Management, Inc., an investment advisory firm. Mr. Goldman is the president of an investment advisory firm, and as such, has substantial experience in investment banking, investment management and capital structure.

Brett M. Johnson (42)

Brett M. Johnson has been the president and chief executive officer of Forward Industries, Inc., a public company that designs, markets and distributes soft-sided carrying cases and electronic accessories for the handheld consumer electronic and medical industry, since August 2010. Prior to joining Forward Industries, Mr. Johnson was the founder of Benevolent Capital Partners, a diversified holding company, from 2005. From 2001 until 2004, he was the president of Targus Group International, a leading global provider of mobile computing solutions. Mr. Johnson is a member of the board of trustees of Choate Rosemary Hall and is a senior fellow in entrepreneurship and a member of the board of visitors at the Graziadio School of Business of Pepperdine University. Mr. Johnson is a member of the Young Presidents Organization (YPO) and served as an executive director on Targus Group International’s board of directors until December 2009. Mr. Johnson earned his undergraduate degree from Brown University and an Executive Masters of Business Administration (EMBA) from Pepperdine University. Mr. Johnson is the chief executive officer of a public company and brings a hands-on perspective on issues facing public companies in the current environment. He is also a successful entrepreneur with a record of building businesses.

Ilan Kaufthal (64)

Ilan Kaufthal joined the board of directors in February 2012. Mr. Kaufthal is currently Senior Advisor at Irving Place Capital, a private equity firm, and Chairman of East Wind Advisors, a broker dealer. Mr. Kaufthal was the Vice Chairman of Investment Banking at Bear, Stearns & Co. Inc. until June 2008. Prior to joining Bear, Stearns in 2000, Mr. Kaufthal was with Schroder & Co. Incorporated as Vice Chairman and head of mergers and acquisitions for thirteen years. Prior thereto, he was with NL Industries, Inc., a chemicals and petroleum services business, as its Senior Vice President and Chief Financial Officer. Mr. Kaufthal also serves on the boards of directors of Cambrex Corporation (NYSE), a life sciences company, Tronox, Inc., a producer of titanium dioxide pigment, and Edmunds.com, a private company. Mr. Kaufthal’s extensive background in the investment banking community coupled with his business experience as the Chief Financial Officer of NL Industries brings a unique perspective to the board, and his extensive investment banking experience makes him an invaluable advisor, particularly in the context of merger and acquisition activities.

James M. McTaggart joined the board of directors in 2004. Mr. McTaggart is an officer of Charles River Associates, an international management consulting firm that advises senior executives on the issues most impacting company performance and long-term value. In 1978, Mr. McTaggart founded Marakon, Inc., a management consulting firm, which was acquired by Charles River Associates in June 2009. Mr. McTaggart was an officer and director of Trinsum Group, a holding company that he formed to own Marakon and a financial advisory firm, which filed a bankruptcy petition in July 2008. Prior to founding Marakon, he was a vice president of Wells Fargo Bank and co-founded the bank’s corporate finance department. Mr. McTaggart serves on the board of trustees of Greenwich Hospital and Greenwich Health Services. Mr. McTaggart has more than 30 years experience in management consulting, where he advises senior executives on the issues affecting corporate strategy, comparative performance and stockholder value.

Howard E. Rose joined the board of directors in 1998. Mr. Rose served as vice chairman of the board from April 1998 to June 2000. Mr. Rose served as our vice president and chief financial officer from 1978 to April 1998, and served as secretary from 1993 to 1996. Mr. Rose is a certified public accountant, with more than 30 years of accounting experience, and served as the company’s vice president and chief financial officer from 1978 to April 1998. Mr. Rose has substantial experience in accounting and auditing matters.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES.

Corporate Governance Guidelines

As part of its ongoing commitment to good corporate governance, the board of directors has codified its corporate governance practices into a set of corporate governance guidelines. These guidelines assist the board in the exercise of its responsibilities and may be amended by the board from time to time. The corporate governance guidelines are available on our website, www.blyth.com, and are also available in print to any stockholder who makes a request to Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831, Attention: Michael S. Novins, Secretary.

Director Independence

Our corporate governance guidelines require that a majority of the board of directors consist of directors who meet the independence requirements of the listing standards of the New York Stock Exchange, including the requirement that there be no material relationship between the director and us. The board has determined that no relationship between us and a director that arises solely out of the ownership by such director of less than 1% of the outstanding equity interests in an organization that has a relationship with us is a “material” relationship for purposes of the determination by the board as to whether such director has any material relationship with us. The board conducts an annual review as to whether each of our directors qualifies as independent. Based on its most recent annual review, the board has concluded that Neal I. Goldman, Ilan Kaufthal, James M. McTaggart and Howard E. Rose are independent. Based upon information obtained in conjunction with the nomination of Brett M. Johnson and Jane A. Dietze, Mr. Johnson and Ms. Dietze have also been determined to be independent as defined in the New York Stock Exchange listing standards, to meet the additional independence requirements for audit committee members, and to have no other material relationships with Blyth.

The independent directors meet without management present at least twice annually at regularly scheduled executive sessions and at such other times as they may deem necessary or appropriate. The lead director presides at these meetings. Howard E. Rose is currently the lead director.

Family Relationships

Robert B. Goergen, Chairman of the Board and Chief Executive Officer, and Pamela M. Goergen, a director, are husband and wife. Robert B. Goergen, Jr., President, Direct Selling Group and President PartyLite Worldwide, is their son. There are no other family relationships among any of the nominees for election as directors or any executive officers.

Director Compensation

For their services as directors, non-employee directors (that is, all directors other than Robert B. Goergen) receive an annual fee of $30,000, reimbursement of out-of-pocket expenses, plus a fee of $1,500 for each board meeting attended in person and a fee of $500 for each board meeting attended by telephone. Each member of the audit committee, the compensation committee and the nominating and corporate governance committee, including each committee chairman, also receives a fee of $1,500 for each committee meeting attended in person and a fee of $500 for each committee meeting attended by telephone. The chairman of the audit committee receives an annual retainer fee of $10,000 and the chairmen of the compensation committee and the nominating and corporate governance committee each receive an annual retainer fee of $5,000. The full board determines annual equity awards for non-employee directors, and new non-employee directors are currently granted 1,500 restricted stock units and continuing non-employee directors are currently granted 750 restricted stock units, all of which vest in equal annual installments on the first and second anniversaries of the date of grant. Directors who are also employees do not receive any additional compensation for their services as directors.

Director Compensation in 2011 and 2011T

The following table sets forth information regarding the compensation that the non-employee directors earned for the fiscal year ended January 31, 2011 (2011) and the eleven month transition period ended December 31, 2011 (2011T)

Name | Fee Earned or Paid in Cash ($) | Stock Awards ($)1 | All Other Compensation ($) | Total ($) |

| | 2011 | 2011T | 2011 | 2011T | 2011 | 2011T | 2011 | 2011T |

| Pamela M. Goergen | 37,500 | 41,000 | 26,513 | 27,143 | ― | ― | 64,013 | 68,143 |

| Neal I. Goldman | 46,000 | 52,000 | 26,513 | 27,143 | | ― | 72,513 | 79,143 |

| James M. McTaggart | 76,000 | 61,500 | 26,513 | 27,143 | ― | ― | 102,513 | 88,643 |

| Howard E. Rose | 57,500 | 70,500 | 26,513 | 27,143 | 6,3552 | 2,9702 | 90,368 | 100,613 |

Anne M. Busquet3 | 68,000 | 68,083 | 26,513 | 27,143 | ― | ― | 94,513 | 95,226 |

Carol J. Hochman3 | 45,000 | 59,500 | 26,513 | 27,143 | ― | ― | 71,513 | 86,643 |

Wilma H. Jordan3 | 80,500 | 48,917 | 26,513 | 27,143 | ― | ― | 107,013 | 76,060 |

_______________

| (1) | For 2011 and 2011T, represents the aggregate grant date fair value of 750 RSUs issued in June 2010 and 2011, respectively, as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation – Stock Compensation (“FASB ASC Topic 718”). |

| (2) | Represents health insurance premiums paid by us. |

| (3) | Ms. Busquet and Ms. Hochman are not standing for re-election to the board, and Ms. Jordan resigned from the board in July 2011. |

Board Leadership Structure

Our corporate governance guidelines provide that the chairman of the board and chief executive officer can be separate or consolidated positions as the board may determine to obtain the best solution for governance and board functioning. The board does not have a policy, one way or the other, on whether the same person should serve as both the chief executive officer and chairman of the board or, if the roles are separate, whether the chairman should be selected from the non-employee directors or should be an employee. The board believes that it should have the flexibility to make these determinations at any given point in time in the way that it believes best to provide appropriate leadership for the company at that time. Since the formation of the company in 1977, Robert B. Goergen has served as chairman of the board and chief executive officer. The board believes that this leadership structure, with Mr. Goergen serving as both chief executive officer and board chairman, is appropriate given Mr. Goergen’s past experience serving in these roles, the efficiencies of having the chief executive officer also serve in the role of chairman and the company’s strong corporate governance structure. In addition, the board of directors selects an independent director to serve as a lead director. Mr. Rose currently serves as lead director. Mr. Goergen consults periodically with Mr. Rose on board matters and on issues facing the company. In addition, Mr. Rose serves as the principal liaison between the chairman of the board and the independent directors and presides at an executive session of non-management directors at each regularly scheduled board meeting.

In its oversight role, the board of directors annually reviews the company’s strategic plan, which addresses, among other things, the risks and opportunities facing the company. In addition, the company’s senior management, including the chief executive and chief financial officer, furnish monthly materials to the board that discuss, among other things, risks and opportunities. Similarly, the presidents of the business segments, often accompanied by other officers from that segment, make presentations to the board at each of its regularly scheduled meetings during which they discuss, among other things, the risks and opportunities confronting the business units. The board, through the nominating and corporate governance committee, also has overall responsibility for executive officer succession planning and reviews succession plans each year. The board has delegated certain risk management oversight responsibility to the board committees. As part of its responsibilities as set forth in its charter, the audit committee is responsible for discussing with management the company’s major financial risk exposures and the steps management has taken to monitor and control those exposures. The nominating and corporate governance committee annually reviews the company’s corporate governance guidelines and their implementation. Each committee regularly reports to the full board.

Board and Committee Meetings

The board has established three standing committees: the audit committee, the compensation committee and the nominating and corporate governance committee. The charter for each committee is available on our website, www.blyth.com, and is also available in print to any stockholder who makes a request to Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831, Attention: Michael S. Novins, Secretary.

Audit Committee. The audit committee is currently comprised of Howard E. Rose (chairman), Anne M. Busquet and Ilan Kaufthal and assists the board in fulfilling its oversight responsibilities regarding our legal and regulatory compliance, financial statements, internal audit function and independent auditors. Ms. Busquet is not standing for re-election and the board of directors will appoint another independent director to serve on the audit committee following the annual meeting. Each member of the audit committee is an independent director as determined by the board, based on the New York Stock Exchange listing standards. Each member of the audit committee also satisfies the Securities and Exchange Commission’s additional independence requirement for members of audit committees. In accordance with our corporate governance guidelines, none of the members of the audit committee serve on more than two audit committees. In addition, the board has determined that Howard E. Rose, an independent director, is an “audit committee financial expert” as defined by SEC rules. Mr. Rose is a certified public accountant with more than 30 years of accounting experience. Mr. Rose also served as our vice president and chief financial officer from 1978 to April 1998. The audit committee held eight meetings during the fiscal year ended January 31, 2011 and seven meetings during the eleven month transition period ended December 31, 2011.

Compensation Committee. The compensation committee is currently comprised of James M. McTaggart (chairman), Neal I. Goldman and Carol J. Hochman. Ms. Hochman is not standing for re-election and the board of directors will appoint another independent director to serve on the compensation committee following the annual meeting. The compensation committee reviews and makes recommendations to the board with respect to general compensation and benefit levels, determines the compensation and benefits for our executive officers and administers the qualified and non-qualified retirement plans and the omnibus incentive plan. Each member of the compensation committee is an independent director as determined by the board, based on the New York Stock Exchange listing standards. During 2011, the compensation committee engaged AonHewitt to provide advice on specific projects related to executive compensation. AonHewitt also provided consulting services to us related to employee benefit programs in 2011. The compensation committee held four meetings during the fiscal year ended January 31, 2011 and four meetings during the eleven month transition period ended December 31, 2011.

Nominating and Corporate Governance Committee. The nominating and corporate governance committee is currently comprised of James M. McTaggart (chairman), Neal I. Goldman and Howard E. Rose and ensures that the board is appropriately constituted and organized to meet its fiduciary obligations to the stockholders. The nominating and corporate governance committee assesses director performance and board membership needs, makes and evaluates recommendations regarding potential candidates for election to the board, and develops and implements policies regarding corporate governance matters. Each member of the nominating and corporate governance committee is an independent director as determined by the board, based on the New York Stock Exchange listing standards. The nominating and corporate governance committee held thirty meetings during the fiscal year ended January 31, 2011 and eight meetings during the eleven month transition period ended December 31, 2011.

The board of directors held four meetings during the fiscal year ended January 31, 2011 (2011) and nine meetings during the eleven month transition period ended December 31, 2011 (2011T). Each person who was a director in 2011 or 2011T attended at least 75% of the meetings of the board of directors and applicable committee meetings held during that fiscal year or transition period.

We do not have a formal policy regarding board members’ attendance at annual meetings, but all members of the board are encouraged to attend the annual meeting of stockholders. In June 2011, all of the members of the board were present at the annual meeting.

Process for Nominating Directors

Nominations of candidates for director are made by the nominating and corporate governance committee. The committee has identified nominees for directors based on referrals from management, existing directors, advisors and representatives of the company or other third parties. Each of the current nominees for director listed under the caption “Election of Directors” is an existing director standing for re-election other than Jane A. Dietze and Brett M. Johnson. The committee may engage the services of third parties to identify or evaluate or assist in identifying or evaluating potential nominees for director but did not do so with respect to any of the current nominees. As discussed below, the committee will consider nominees proposed by qualified security holders. In connection with the annual meeting, the committee did not receive any recommendation for a nominee from any stockholder or group of stockholders other than Mr. Goergen in his capacity as chief executive officer. Each of Ms. Dietze, Mr. Johnson and Mr. Kaufthal were recommended by the Board’s nominating and corporate governance committee after being recommended by the chief executive officer.

The nominating and corporate governance committee initially evaluates prospective candidates on the basis of their resumes, considered in light of the criteria discussed below. A committee member would contact those prospective candidates that appear likely to be able to fill a significant need of the board to discuss the position; if the candidate showed sufficient interest, the committee would arrange an in-person meeting with one or more committee members. If the committee, based on the results of these contacts, believes it has identified a viable candidate, it will consult with the chairman of the board and submit the nominee to the full board for approval. Any request by management to meet with the prospective candidate would be given appropriate consideration.

Before nominating existing directors for re-election, the nominating and corporate governance committee also considers the individual’s contributions to the board, as reflected in results of the most recent review of individual director performance.

Security holders who, individually or as a group, have held for more than one year at least 5% of our common stock may recommend director nominees to the nominating and corporate governance committee, provided the recommendation is received at least six months prior to the annual meeting, in order to assure time for meaningful consideration by the committee. Recommendations should be sent to the nominating and corporate governance committee at the address listed for security holder communications under the caption “Communications with the Board of Directors” below. Nominees recommended by security holders will be evaluated using the same standards applied to nominees recommended by other processes. Security holders recommending director nominees must provide the following information in their recommending communication:

1. the number of our securities held by the recommending security holder or by each member of a recommending group of security holders, and the holding period or periods for all such securities;

2. if the security holder(s) are not registered owners, proof of their security holdings in the form of either:

(a) a written statement from the “record” holder of the securities (usually a broker or bank) verifying that, at the time the security holder made the recommendation, he or she had held the required securities for at least one year; or

(b) if the security holder has filed a Schedule 13D, Schedule 13G, Form 3, Form 4 and/or Form 5, or amendments to those documents or updated forms, reflecting ownership of the securities as of or before the date of the recommendation, a copy of the schedule and/or form, and any subsequent amendments reporting a change in ownership level, as well as a written statement that the security holder continuously held the securities for the one-year period as of the date of the recommendation;

3. written consent of the nominee and the recommending security holder(s) to being identified in our public communications and filings discussing the recommendation and any action taken with respect to the recommendation; and

4. information about the recommended nominee sufficient for us to comply with Securities and Exchange Commission disclosure requirements if the nominee is proposed for election to our board of directors.

Diversity of the Board of Directors

The board of directors believes that, as a whole, the board should include individuals with a diverse range of experience to give the board depth and breadth in the mix of skills represented for the board to oversee management on behalf of the stockholders. In addition, the board believes that there are certain attributes that each director should possess, as described below. Therefore, the board and the nominating and corporate governance committee consider the qualifications of directors and nominees both individually and in the context of the overall composition of the board.

The nominating and corporate governance committee has adopted the following list of qualities and skills that it believes one or more of our directors should possess:

| · | Financial Acumen — understanding balance sheets, income and cash flow statements, financial ratios and other indices for evaluating performance; experience in financial accounting, corporate finance and trends in debt and equity markets; familiarity with internal financial controls. |

| · | Management Experience — hands-on understanding of corporate management trends in general and in our segments. |

| · | Knowledge Base — unique experience and skills in areas where we do business, including relevant manufacturing, marketing and technology. |

| · | International Vision — experience in global markets, issues and practices. |

| · | Diversity — enhances the board’s perspective through diversity in gender, ethnic background, geographic origin or professional experience (public, private and non-profit sectors). |

Nomination of a candidate should not be based solely on these factors. Our corporate governance guidelines also require the directors to tender their resignation for consideration by the full board in the event of retirement or other substantial change in the nature of their employment or other significant responsibilities.

The nominating and corporate governance committee has also adopted the following standards that it believes must be met by a nominee for a position on the board:

| · | Integrity — shows high ethical standards, integrity, strength of character and willingness to act on and be accountable for his or her decisions. |

| · | Maturity — assertive, responsible, supportive, respectful and open to others. |

| · | Judgment — decisions show intelligence, wisdom, thoughtfulness; willing to discuss issues thoroughly, ask questions, express reservations and voice dissent; record of good decisions shows that duties will be discharged in good faith and in our best interests. |

| · | Leadership — history of skill in understanding, managing and motivating talented managers and employees. |

| · | Standards — history of achievements shows high standards for self and others. |

| · | Strategic Vision — strategic insight and direction in innovation, key trends and challenging us to sharpen our vision. |

| · | Time and Willingness — ability, willingness and energy to prepare fully before meetings, attend and participate meaningfully, and be available to management between meetings, especially in light of any other commitments. |

| · | Continuous Improvement — stays current on major issues and on director’s responsibilities. |

Communications with the Board of Directors

Security holders may send communications to the board by e-mail to HolderCommunications@blyth.com. Communications may be addressed to the entire board, any committee or committee chairman, or any individual director. All communications will be received and reviewed by the chairman of the nominating and corporate governance committee. The decision whether to pass communications on to the rest of the nominating and corporate governance committee, to any other committee or committee chairman or to any individual director to whom the communication is addressed, will be made at the discretion of the nominating and corporate governance committee chairman.

If a security holder communication relates to the nominating and corporate governance committee chairman and is directed to any director other than that chairman, it should be sent by e-mail to AuditCommittee@blyth.com. Communications sent to this address will be received and reviewed by the chairman of the audit committee. The decision of what action if any to be taken with respect to such communications will be made at the discretion of the audit committee chairman.

Security holders may also send such communications by regular mail to either:

[Individual Director Name] ℅

Shareholder Communications

or

Chairman, Audit Committee

at

Blyth, Inc.

One East Weaver Street

Greenwich, CT 06831

Communications so addressed will be delivered unopened to the chairman of the audit committee or to the individual addressed.

Communications by security holders recommending director nominees must comply with the requirements discussed under the caption “Process for Nominating Directors.”

Interested parties may send communications to the nominating and corporate governance committee chairman or the non-management directors as a group by e-mail to IndependentDirectors@blyth.com or by regular mail to:

| | Nominating and Corporate Governance Committee |

Communications so addressed will be delivered unopened to the chairman of the nominating and corporate governance committee.

Code of Conduct

We first adopted our code of conduct in 1999 and it applies to all members of the board of directors and to all of our officers and employees, including our principal executive officer, principal financial officer, principal accounting officer and controller. The code of conduct is available on our website, www.blyth.com, and print copies are available to any stockholder who makes a request to Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831, Attention: Michael S. Novins, Secretary. The code of conduct also serves as our “code of ethics,” as defined in Item 406(b) of Regulation S-K. In addition, we intend to satisfy the disclosure requirements of Item 5.05 of Form 8-K regarding any amendment to, or waiver from, a provision of the code of conduct that applies to our principal executive officer, principal financial officer, principal accounting officer, controller (our vice president of reporting and planning) or any person performing similar functions and relates to any element of the definition of “code of ethics” set forth in Item 406(b) of Regulation S-K by posting such information on our website, www.blyth.com.

Executive Officers

The following sets forth the name, age and business experience for at least the past five years of each of our executive officers (other than Robert B. Goergen (see “— Nominees for Election as Directors”)) as of the date hereof, together with all positions and offices held with us by such executive officers. Officers are appointed to serve until the meeting of the board of directors following the next annual meeting of stockholders and until their successors have been elected and have qualified:

Robert H. Barghaus (58) – Robert H. Barghaus is a vice president and our chief financial officer. Mr. Barghaus joined us as vice president of financial planning in February 2001, and in March 2001 he was elected vice president and chief financial officer. Prior to joining Blyth, he spent more than 25 years in senior operating and financial roles at Cahners Business Information (a division of Reed Elsevier), Labatt USA, Caldor’s (a division of May Department Stores), American Can and Arthur Anderson. Mr. Barghaus is a certified public accountant.

Robert B. Goergen, Jr. (41) – Robert B. Goergen, Jr. is a vice president of Blyth and has been President, Direct Selling Group and President PartyLite Worldwide since January 2012. From September 2006 to December 2011, he served as president of the multi-channel group and the corporate development group. Prior thereto, from August 2002 he served as vice president of acquisitions and business development, overseeing our acquisition strategy and implementation. Mr. Goergen joined us in 2000 as director of our Internet strategy and e-business initiatives group. From 1995 to 1998, Mr. Goergen worked for McCann-Erickson Worldwide, primarily serving as an account director, where he oversaw e-commerce development and Internet marketing efforts for consumer products and services accounts.

PROPOSAL 2: AN ADVISORY VOTE ON EXECUTIVE COMPENSATION

The board of directors recognizes the significant interest of stockholders in executive compensation matters. Pursuant to Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (which were added by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”)), we are providing our stockholders with an opportunity to cast an advisory vote to approve the compensation of our named executive officers as disclosed in the Summary Compensation Table and other tables and the related narratives, as well as in the “Compensation Discussion and Analysis” section of this proxy statement, in accordance with SEC rules.

Our compensation philosophy and framework have resulted in compensation for our named executive officers that is commensurate with both our financial results and the other performance factors described in the section of this proxy statement entitled “Compensation Discussion and Analysis.” Our compensation programs are designed to attract, motivate, reward and retain the broad-based management talent required to achieve our corporate objectives and increase stockholder value, and are intended to reward the achievement of short and long-term financial targets established during our annual budget and strategic planning process, as well as individual performance goals. These programs focus on rewarding the types of performance that increase stockholder value, link executive compensation to our long-term strategic objectives and align executive officers’ interests with those of our stockholders. We believe that our executive compensation programs, which emphasize long-term equity awards and variable compensation, satisfy these goals. A substantial portion of each executive’s total compensation is intended to be variable and delivered on a pay-for-performance basis.

As this is an advisory vote, the result will not be binding on our board of directors, although our compensation committee, which is comprised solely of independent directors, will consider the outcome of the vote when evaluating the effectiveness of our compensation policies and practices. The board believes that our current executive compensation program has been effective at directly linking executive compensation to our performance and aligning the interests of our named executive officers with those of our stockholders. We are asking for stockholder approval of the compensation of our named executive officers as disclosed in this proxy statement in accordance with SEC rules, which disclosures include the disclosures under “Compensation Discussion and Analysis” and “Executive Compensation.” This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the executive compensation policies and practices described in this proxy statement.

Required Vote

The affirmative vote of the majority of the votes cast at the annual meeting is required for the advisory approval of this proposal.

Recommendation

The Board of Directors recommends that the stockholders vote FOR the adoption of the following non-binding resolution:

RESOLVED, that the compensation paid to the company’s named executive officers, as disclosed in Blyth, Inc.’s Proxy Statement for the 2012 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation discussion and analysis, the compensation tables and any related material disclosed in the Proxy Statement, is hereby APPROVED.

Unless a proxy is marked to give a different direction, it is the intention of the persons named in the proxy to vote the shares represented thereby in favor of the approval of the compensation of our named executive officers as disclosed in this proxy statement.

Security Ownership of Management and Certain Beneficial Owners

Security Ownership of Management. The following table sets forth, as of March 31, 2012, the number of outstanding shares of the common stock beneficially owned by each of (i) our current directors, (ii) the nominees for director, (iii) the named executive officers individually and (iv) all directors and executive officers as a group. Except as otherwise indicated, each of the stockholders has sole voting and investment power with respect to the shares reflected as beneficially owned.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class |

| Robert B. Goergen (1) | 3,016,801 | 35.2% |

| Pamela M. Goergen (2) (3) (4) | 698,091 | 8.2 |

| Jane A. Dietze | 0 | — |

| Neal I. Goldman (2) (4) | 7,750 | * |

| Brett M. Johnson | 0 | — |

| Ilan Kaufthal (2) | 0 | — |

| James M. McTaggart (2) | 3,850 | * |

| Howard E. Rose (2) (4) | 14,101 | * |

| Robert H. Barghaus (2) (4) | 5,152 | * |

| Anne M. Butler (2) (5) | 20,572 | * |

| Robert B. Goergen, Jr. (2) (4) (6) | 825,658 | 9.6 |

All directors and executive officers as a group (9 persons) (7) | 3,397,870 | 39.7 |

_______________

* Less than 1%.

| (1) | Includes 2,418,055 shares held by Mr. Goergen, 22,371 shares held by The Goergen Foundation, Inc. (a charitable foundation of which Mr. Goergen is a director, president and sole investment manager) and 576,375 shares held by Ropart Investments LLC (a private investment fund of which Mr. Goergen shares voting and investment power). Excludes 99,345 shares held by Mrs. Goergen, as to which Mr. Goergen disclaims beneficial ownership. The address of Mr. Goergen is ℅ Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831. |

| (2) | The table above excludes unvested RSUs and includes vested RSUs the receipt of which has been deferred until the director retires from our board of directors. As of March 31, 2012, the number of unvested RSUs held by each named executive officer and director (other than Robert B. Goergen, who does not own any RSUs) was as follows: Anne M. Butler (0); Pamela M. Goergen (1,125); Neal I. Goldman (1,125); Ilan Kaufthal (1,500); James M. McTaggart (1,125); Howard E. Rose (1,125); Robert H. Barghaus (11,187); and Robert B. Goergen, Jr. (9,648). As of March 31, 2012, the number of vested RSUs, the receipt of which has been deferred until the director retires from our board of directors, held by each named executive officer and director (other than Robert B. Goergen, who does not own any RSUs) was as follows: Anne M. Butler (0); Pamela M. Goergen (2,625); Neal I. Goldman (2,625); Ilan Kaufthal (0); James M. McTaggart (3,000); Howard E. Rose (2,625); Robert H. Barghaus (0); and Robert B. Goergen, Jr. (5,523). |

| (3) | Includes 94,595 shares held by Mrs. Goergen, 22,371 shares held by The Goergen Foundation, Inc. and 576,375 shares held by Ropart Investments LLC. Excludes 2,418,055 shares held by Mr. Goergen, as to which Mrs. Goergen disclaims beneficial ownership. The address of Mrs. Goergen is ℅ Blyth, Inc., One East Weaver Street, Greenwich, Connecticut 06831. |

| (4) | Includes shares which he or she has the right to acquire within 60 days as of March 31, 2012 through the exercise of stock options, as follows: Pamela M. Goergen (2,125); Neal I. Goldman (2,125); Howard E. Rose (2,125); Robert H. Barghaus (2,500); and Robert B. Goergen, Jr. (2,500). |

| (5) | Effective as of the close of business on December 30, 2011, Anne M. Butler resigned as our vice president and president of PartyLite Worldwide. |

| (6) | Mr. Goergen, Jr.’s security ownership includes 131,988 shares held by him, 576,375 shares held by Ropart Investments, LLC, 22,371 shares held by The Goergen Foundation, Inc. and 86,901 shares held by him in trust for his children, brother and brother’s children. Excludes 3,264 shares held by Mr. Goergen’s spouse, as to which he disclaims beneficial ownership. |

| (7) | The board believes that significant stock ownership by directors further aligns their interests with the interests of our stockholders. Accordingly, the board has established a policy of stock ownership that, within three years after joining the board, each director own common stock valued at five times the annual retainer fee. In addition, in order to preserve the linkage between the interests of our executive officers and our stockholders, participants in the LTIP are expected to use their grants of RSUs to establish a level of direct ownership in the company. Therefore, participants must retain at least 25% of their RSU grants (before satisfying any costs of selling shares and taxes) until separation from the company. We have no mandatory holding period for shares acquired upon the exercise of stock options. |

Security Ownership of Certain Beneficial Owners. To the knowledge of the company, the following table lists each person that beneficially owned more than 5% of the common stock of the company outstanding as of March 31, 2012:

Name and Address of Beneficial Owner | Number of Shares | Percent of Class |

The Goergen Family1 | 3,403,358 | 39.7% |

BlackRock, Inc.2 40 East 52nd Street New York, NY 10022 | 420,649 | 5.12% |

_______________

| (1) | As reported in Amendment No. 1 to Schedule 13D dated March 30, 2012, Robert B. Goergen, Pamela M. Goergen, Ropart Investments, LLC, the Goergen Foundation, Inc., Robert B. Goergen, Jr., Todd A. Goergen (“T. Goergen”), Stacey Goergen (“S. Goergen”) and Emma Goergen (“E. Goergen”) beneficially own, in the aggregate, 3,403,358 shares. The shares so reported as beneficially owned by Mr. Goergen, Mrs. Goergen and Mr. Goergen, Jr. are reflected in the table and footnotes above for management. Ropart Investments, LLC holds 576,375 shares (which are reported as beneficially owned by Mr. Goergen, Mrs. Goergen, Mr. Goergen, Jr. and T. Goergen due to shared power to vote and dispose of, or to direct the voting and disposition of, such shares). The Goergen Foundation, Inc. holds 22,371 shares (which are reported as beneficially owned by Mr. Goergen, Mrs. Goergen, Mr. Goergen, Jr. and T. Goergen due to shared power to vote and dispose of, or to direct the voting and disposition of, such shares). T. Goergen has the sole power to vote and dispose of, or to direct the voting and disposition of, 15,415 shares held directly by him and 415 shares held in trust for his child pursuant to which he is the sole trustee, and, in addition to his shared power to vote and dispose of, or to direct the voting and disposition of, the shares owned by Ropart Investments, LLC and the Goergen Foundation, Inc., has shared power to vote and dispose of, or to direct the voting and disposition of 123,379 shares held in trust for his children, his brother, his brother’s children and a charitable remainder trust. S. Goergen (Mr. Goergen Jr.’s spouse) has the sole power to vote and dispose of, or to direct the voting and disposition of, 3,264 shares held by her. E. Goergen (T. Goergen’s spouse) has the sole power to vote and dispose of, or to direct the voting and disposition of, 2,114 shares held by her. Each spouse disclaims beneficial ownership of shares held by his or her spouse. The address for each of the foregoing beneficial owners is ℅Blyth, Inc. One East Weaver Street, Greenwich, CT 06831. |

| (2) | According to Schedule 13G dated January 20, 2012, BlackRock, Inc. (a parent holding company or control person), located at the address in the table, beneficially owns 420,649 shares (5.12%), with sole voting and dispositive power with respect to those shares. The computation of the percentage of stock owned by BlackRock, Inc. is based on the percentage reported in the Schedule 13G. |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview

We are a direct to consumer business focused on the direct selling and direct marketing channels. We design and market an extensive array of decorative and functional household products, such as candles, home fragrance products, accessories, seasonal decorations, household convenience items and personalized gifts; nutritional supplements such as meal replacement shakes, vitamins and energy mixes; as well as products for the foodservice trade. Our products can be found throughout North America, Europe and Australia.

Our compensation committee develops and oversees compensation policies that are designed to attract, motivate, reward and retain the broad-based management talent required to achieve our corporate objectives and increase stockholder value. The committee believes that corporate performance and, in turn, stockholder value will be enhanced by a compensation system that supports and reinforces our key operating and strategic goals while aligning the financial interests of our management team with those of our stockholders.

Our compensation programs are intended to reward the achievement of short and long-term financial targets established during our annual budget and strategic planning process, as well as individual performance goals.

Our named executive officers (“NEOs”) are:

Robert B. Goergen — Chairman and Chief Executive Officer

Robert H. Barghaus — Vice President and Chief Financial Officer

Robert B. Goergen, Jr. — President, Direct Selling Group and President, PartyLite Worldwide

Anne M. Butler — Former Vice President of Blyth and former President, PartyLite Worldwide (effective as of the close of business on December 30, 2011, Ms. Butler resigned as Vice President of Blyth and President, PartyLite Worldwide).

Elements of Compensation

Our management compensation program consists of the following:

| · | a short-term annual incentive plan (which we refer to as the Management Performance Incentive Plan, or MPIP) |

| · | a long-term incentive plan (LTIP) |

| · | a benefits package of health and welfare programs |

| · | post-employment severance arrangements |

The committee from time to time reviews the compensation practices of broad industry groups using multiple sources of information pertaining to executive compensation, including compensation surveys and peer group proxy data. Our peer group consists of similarly-sized manufacturing, direct selling and direct marketing companies with annual revenue generally ranging from $500 million to $1.5 billion, and depends on the revenue of the business unit of which an executive’s compensation is being benchmarked. Peer group companies are: American Greetings Corporation, Central Garden & Pet Company, Church & Dwight Company, Inc., Herbalife Ltd., CSS Industries, Inc., Elizabeth Arden, Inc., Inter Parfums, Inc., Lancaster Colony Corporation, Libbey Inc., Lifetime Brands, Inc., Nature’s Sunshine Products, Inc., Nu Skin

Enterprises, Inc., Nutrisystem, Inc., Overstock.com, Inc., Prestige Brands Holdings, Inc., Revlon, Inc., Tupperware Brands Corporation, Usana Health Sciences, Inc. and 1-800-Flowers.com, Inc. However, benchmarking effectively against a relevant peer group can be challenging given our structure. Therefore, the committee consults additional compensation and economic surveys that benchmark similar positions in similarly-sized companies, the industries of which vary. In recent years, we have compiled data using surveys from Aon-Hewitt, Towers Watson and Salary.com. The committee, after receiving input from Robert B. Goergen, our chairman and chief executive officer, used these sources to determine an appropriate base salary and annual incentive bonus target for each member of management. The base salary and annual incentive bonus targets are intended to reflect the responsibilities of each officer, the compensation practices at other companies and business conditions within our business units. The committee generally targets the sum of the base salary, annual incentive bonus plan and long-term incentive plan to be at the median level of the combined peer group and survey data. We have also considered peer compensation within our portfolio of companies to help determine appropriate compensation. The objective in allocating between long-term and currently paid compensation is to ensure adequate base compensation to attract, motivate and retain key talent, while providing incentives to maximize long-term value for our company and our stockholders.

In developing compensation plans for 2012, the compensation committee considered the positive “say on pay” vote of our shareholders at our annual meeting of shareholders in June 2011, where 97.7% of shares present and entitled to vote at the meeting cast a vote in favor of our executive compensation.

As discussed below, under the heading “— Employment Contracts,” in August 2000 we entered into an employment contract with Mr. Goergen. His base salary, short-term incentive bonus target and supplemental pension were each established at the time we entered into the employment contract. Amounts were determined following a peer and industry review process similar to that described above. Since that time, Mr. Goergen’s base salary and annual incentive bonus have been reviewed versus the peer group’s salary and annual incentive bonus. Because of his significant share ownership, Mr. Goergen requested that he not receive long-term incentives.

Change in Fiscal Year

In December 2011, our board of directors approved a change in our fiscal year end from January 31 to December 31. Because the compensation committee establishes the compensation programs for each of the NEOs at the beginning of each fiscal year, the current compensation programs were based on financial targets for the fiscal year ended January 31, 2012 (“fiscal 2012”). However, in light of the change in our fiscal year end to December 31, our current financial results have been reported for the eleven month transition period ended December 31, 2011 (“2011T”). Despite the change in our fiscal year end, the compensation committee has looked to the fiscal 2012 financial targets in determining whether or not certain of the MPIP and LTIP objectives have been achieved by the NEOs.

Annual Incentives

We refer to our annual incentive plan as the Management Performance Incentive Plan (“MPIP”). The MPIP is a cash-based, pay-for-performance annual incentive plan that applies to all management-level employees across the company (excluding those participating in a sales incentive plan). The MPIP is implemented under our Amended and Restated 2003 Omnibus Incentive Plan (the “2003 Plan”). The committee considers annual incentives to be a critical means of ensuring management’s focus in achieving its annual operating plan, which, in turn, should enhance stockholder value.

Each of the participants in the MPIP is assigned an individual incentive target, which is expressed as a percentage of that employee’s annual salary. The product of the employee’s annual salary and his or her incentive target yields the “target award.” The target award, which is expressed as a dollar amount, is calculated as follows:

| Base salary | x | Individual incentive target (expressed as a % of base salary) | = | Target award (expressed as a dollar amount) |

The committee designates incentive target percentage levels for each of our NEOs using the process described above in determining base salary. The committee also reviews target levels for all other participants at the vice president level and above, as well as all other incentive compensation for this group of executives. The individual incentive targets and the target awards for each of the NEOs were calculated as follows:

Name | Base Salary (fiscal 2012) ($) | Individual Incentive Target (expressed as a percentage of annual salary) (%) | Target Award (dollar amount) ($) |

| Robert B. Goergen | 794,375 | 100 | 794,375 |

| Robert H. Barghaus | 418,867 | 50 | 209,434 |

| Anne M. Butler | 523,583 | 60 | 314,150 |

| Robert B. Goergen, Jr. | 371,795 | 60 | 223,077 |

The amount of the target award is split into two amounts, one of which is determined by company performance (the “Business Performance Factor”) and the other of which is determined by the employee’s own performance (the “Individual Performance Factor”). The Individual Performance Factor is determined based on the extent to which an executive achieved his or her personal business objectives, which we refer to as “Management by Objective” (or “MBOs”). The weighting of Business and Individual Performance Factor for each of the NEOs is as follows:

Name | Business Performance Factor (expressed as a percentage the entire target award) (%) | Individual Performance Factor (expressed as a percentage the entire target award) (%) |

| Robert B. Goergen | 75 | 25 |

| Robert H. Barghaus | 60 | 40 |

| Anne M. Butler | 70 | 30 |

| Robert B. Goergen, Jr. | 60 | 40 |

Business Performance Factor

The Business Performance Factor is based upon the extent to which the company or a segment, as the case may be, meets or exceeds an established threshold performance level, which is determined by the committee at the beginning of the fiscal year based on the board-approved budget and input from management. Based on the achievement of budgeted financial goals, 4.2% to 175% of the Business Performance Factor component of the target awards can become available for payment.

The Business Performance Factors differ among the NEOs. The Business Performance Factor for both of Mr. Goergen, the Chairman and Chief Executive Officer of Blyth, and Mr. Barghaus, the Chief Financial Officer of Blyth, is solely determined by Blyth’s overall performance, which goal, in fiscal 2012, was at target $29.9 million in consolidated net earnings from continuing operations.

The Business Performance Factor for Ms. Butler, the former President of PartyLite Worldwide, is determined primarily (80%) by PartyLite Worldwide’s earnings before interest and taxes (“EBIT”), which target in fiscal 2012 was $70.3 million. Within this portion of Ms. Butler’s incentive, 50% is based on PartyLite European profit, 30% is based on PartyLite North American profit, 10% is based on PartyLite Worldwide’s inventory days-on-hand and 10% is based on order fill rate. The remaining 20% of Ms. Butler’s

Business Performance Factor is based on the same Blyth performance goal used to determine the Business Performance Factor for Mr. Goergen and Mr. Barghaus.

The Business Performance Factor for Mr. Goergen, Jr., who was until January 2012 the President of the Multi-Channel Group, is determined primarily (75%) by the Multi-Channel Group’s consolidated performance, which goal, in fiscal 2012, was $4.6 million of EBIT. The remaining 25% of his Business Performance Factor is based on the same Blyth performance goal used to determine the Business Performance Factor of Mr. Goergen and Mr. Barghaus.

Individual Performance Factor

The second component of the target award is determined by the executive’s performance against his or her personal business objectives, or MBOs, which are established at the beginning of the fiscal year and typically have a wide variety of additional financial targets (such as sales growth, working capital management, return on equity, as well as other non-financial managerial goals, described below). The nature and extent of each individual’s major accomplishments and contributions are determined through written evaluations compiled by the Chief Executive Officer, the Vice President–Organizational Development and others familiar with the individual’s performance. The Chief Executive Officer evaluates the information and makes recommendations to the committee, which then makes the final determination of management bonuses. In order for any incentive compensation that is determined by the Individual Performance Factor to be earned for all executives, at least 80% of the NEO’s Business Performance Factor must be achieved. Or, said another way, even if an NEO is determined to have achieved all of his or her personal business objectives, no payment will be made under the annual incentive plan unless at least 80% of that executive’s Business Performance Factor has been achieved.

After the completion of the fiscal year, based on the achievement of target financial goals and based on input from management about its assessment of each participant’s individual performance during the year, the committee determines how much, if any, of the participant’s target award will be paid. The committee is under no obligation to pay the entire target award available in any given year. Similarly, the 2003 Plan gives the committee the ability to adjust performance criteria upward or downward for extraordinary factors, as well as to grant discretionary bonuses in recognition of extraordinary performance.

Performance Outcome

For fiscal 2012, Blyth was determined to have achieved 100.8% of its Business Performance Factor, or $30.2 million. This calculation includes upward adjustments totaling $8.6 million primarily for ViSalus equity incentives, as well as costs for PartyLite restructuring and fees generated from board of director projects; also included was a downward adjustment of $1.2 million in foreign exchange benefit, all of which were approved by the compensation committee. Accordingly, Mr. Goergen earned a scaled formula-driven payout for the Business Performance Factor totaling $620,506. In addition, because Blyth achieved more than 80% of its performance goals, Mr. Goergen was eligible to earn his Individual Performance Factors, or MBOs. Mr. Goergen completed most of his MBOs, which included achieving various profitability, cash flow and return on equity targets, updating our strategic plan, determining the CEO succession plan with the board of directors, implementing plans to improve PartyLite North America and building PartyLite Europe, and supporting the growth of ViSalus. With respect to the Individual Performance Factor, the committee determined that Mr. Goergen achieved 93% of his MBOs and granted him a bonus of $184,692, which, when added to the $620,506 he was awarded based on the Business Performance Factor, meant that Mr. Goergen’s total bonus in fiscal 2012 was $805,198.

Based on the same financial goals noted above for Mr. Goergen, Mr. Barghaus earned a scaled formula-driven payout totaling $130,875. Mr. Barghaus completed most of his MBOs, which included achieving certain working capital and cash flow targets, completing the divestiture of Midwest-CBK, serving on the ViSalus management board, meeting certain cash repatriation and cash flow targets, taking certain steps

to enhance the reporting and control function, improving various departmental processes and developing staff members. With respect to the Individual Performance Factor, the committee determined that Mr. Barghaus achieved 95% of his MBOs and granted him a bonus of $79,585, which, when added to the $130,875 he was awarded based on the Business Performance Factor, meant that Mr. Barghaus’ total bonus in fiscal 2012 was $210,460.

For fiscal 2012, PartyLite Europe was determined to have achieved 85.1% of its Business Performance Factor. Accordingly, Ms. Butler earned a scaled formula-driven payout for the Business Performance Factor totaling $53,745. However, a minimum threshold of profitability was not achieved within PartyLite North America. Accordingly, no payment was earned for the portion of her bonus tied to PartyLite North America, nor was any bonus earned on PartyLite Inventory days-on-hand or order fill rate as PartyLite Worldwide did not achieve the minimum profit threshold required to trigger payout of the operations metrics. Ms. Butler received $45,806 for the Business Performance Factor portion of her incentive that was determined by Blyth’s consolidated net earnings from continuing operations. Ms. Butler was eligible for 50% of her bonus compensation related to the 80% of her personal objectives tied to PartyLite since only PartyLite Europe achieved the threshold level of EBIT required for payout. Also, Ms. Butler was eligible for the 20% of her personal objectives tied to Blyth’s consolidated net earnings from continuing operations. The committee determined that Ms. Butler achieved 50% of her MBOs, which included achieving various financial targets, stabilizing the PartyLite North American business, developing additional growth plans for international expansion, improving supply chain performance and increasing PartyLite’s competitive advantage, and granted her a bonus of $28,274, which, when added to the $99,551 she was awarded based on PartyLite Europe and Blyth’s consolidated net earnings, meant that Ms. Butler’s total bonus in fiscal 2012 was $122,481.

For Mr. Goergen, Jr., the Multi-Channel Group was determined to have achieved 112.8% of its performance goal. Accordingly, a formula-driven payout totaling $113,184 was applied to the portion of Mr. Goergen, Jr.’s annual target bonus that is determined by the Multi-Channel Group’s results. Mr. Goergen, Jr. also received a scaled formula-driven payout of $34,850 for the portion of his annual incentive based on Blyth’s consolidated net earnings from continuing operations. Moreover, because the Multi-Channel Group was determined to have reached its minimum required profit threshold and Blyth was determined to have achieved more than 80% of its performance goals, Mr. Goergen, Jr. was eligible to earn the portion of his bonus tied to Individual Performance Factors (MBOs). Mr. Goergen, Jr.’s MBOs included implementing certain new Catalog & Internet profit improvement programs, further developing the health and wellness product categories, driving new product innovation within the wholesale segment, divesting Midwest-CBK and working with the Direct Selling Group’s leadership teams to support sales growth and profit objectives. The committee determined that Mr. Goergen, Jr. achieved 94% of his MBOs and granted him a bonus of $83,877 which, when added to the $148,034 he was awarded based on the Business Performance Factor, meant that Mr. Goergen, Jr.’s total annual bonus in fiscal 2012 was $231,911.

Blyth’s NEOs received a 2.5% merit increase that will apply to their 2012 base salaries beginning in April 2012 with the exception of Mr. Goergen, Jr., whose base salary had been increased to $500,000 to reflect his new Direct Selling Group responsibilities, effective January 1, 2012.

Long-Term Incentives