Exhibit (a)(5)(E)

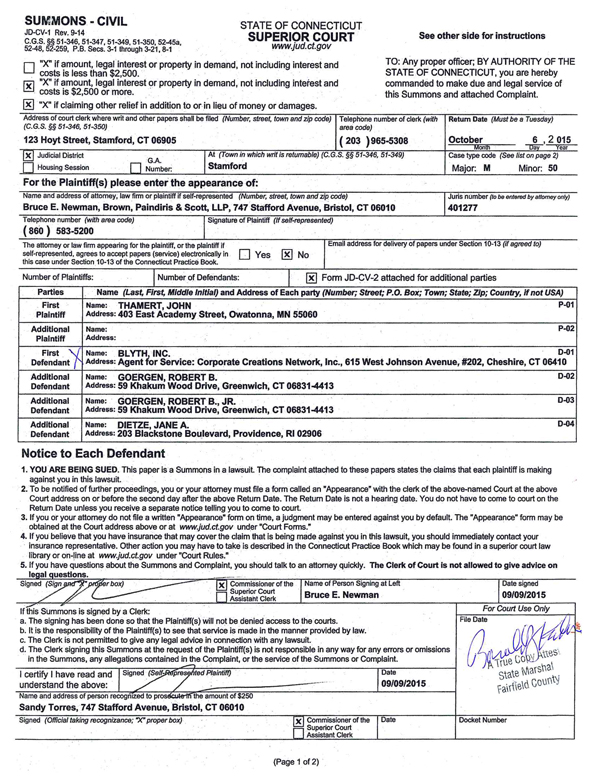

SUMMONS - CIVIL

JD-CV-1 Rev. 9-14

C.G.S. §§ 51-346, 51-347, 51-349, 51-350, 52-45a,

52-48, 52-259, P.B. Secs. 3-1 through 3-21, 8-1

STATE OF CONNECTICUT

SUPERIOR COURT

www.jud.ct.gov

See other side for instructions

[ ] “X” if amount, legal interest or property in demand, not including interest and costs is less than $2,500.

[X] “X” if amount, legal interest or property in demand, not including interest and costs is $2,500 or more.

[X] “X” if claiming other relief in addition to or in lieu of money or damages.

TO: Any proper officer; BY AUTHORITY OF THE STATE OF CONNECTICUT, you are hereby commanded to make due and legal service of this Summons and attached Complaint.

Address of court clerk where writ and other papers shall be filed (Number, street, town and zip code) (C.G.S. §§ 51-346, 51-350)

123 Hoyt Street, Stamford, CT 06905

Telephone number of clerk (with area code)

(203) 965-5308

Return Date (Must be a Tuesday)

October 6, 2015

Month Day Year

[X] Judicial District

[ ] Housing Session

[ ] G.A. Number:

At (Town in which writ is returnable) (C.G.S. §§ 51-346, 51-349)

Stamford

Case type code (See list on page 2)

Major: M

Minor: 50

For the Plaintiff(s) please enter the appearance of:

Name and address of attorney, law firm or plaintiff if self-represented (Number, street, town and zip code)

Bruce E. Newman, Brown, Paindiris & Scott, LLP, 747 Stafford Avenue, Bristol, CT 06010

Juris number (to be entered by attorney only)

401277

Telephone number (with area code)

(860) 583-5200

Signature of Plaintiff (If self-represented)

The attorney or law firm appearing for the plaintiff, or the plaintiff if

self-represented, agrees to accept papers (service) electronically in

this case under Section 10-13 of the Connecticut Practice Book. [ ] Yes [X] No

Email address for delivery of papers under Section 10-13 (if agreed to)

Number of Plaintiffs: Number of Defendants: [X] Form JD-CV-2 attached for additional parties

Parties Name (Last, First, Middle Initial) and Address of Each party (Number; Street; P.O. Box; Town; State; Zip; Country, if not USA)

First Plaintiff

Name: THAMERT, JOHN P-01

Address: 403 East Academy Street, Owatonna, MN 55060

Additional Plaintiff

Name: P-02

Address:

First Defendant

Name: BLYTH, INC. D-01

Address: Agent for Service: Corporate Creations Network, Inc., 615 West Johnson Avenue, #202, Cheshire, CT 06410

Additional Defendant

Name: GOERGEN, ROBERT B. D-02

Address: 59 Khakum Wood Drive, Greenwich, CT 06831-4413

Additional Defendant

Name: GOERGEN, ROBERT B., JR. D-03

Address: 59 Khakum Wood Drive, Greenwich, CT 06831-4413

Additional Defendant

Name: DIETZE, JANE A. D-04

Address: 203 Blackstone Boulevard, Providence, RI 02906

Notice to Each Defendant

1. YOU ARE BEING SUED. This paper is a Summons in a lawsuit. The complaint attached to these papers states the claims that each plaintiff is making against you in this lawsuit.

2. To be notified of further proceedings, you or your attorney must file a form called an “Appearance” with the clerk of the above-named Court at the above Court address on or before the second day after the above Return Date. The Return Date is not a hearing date. You do not have to come to court on the Return Date unless you receive a separate notice telling you to come to court.

3. If you or your attorney do not file a written “Appearance” form on time, a judgment may be entered against you by default. The “Appearance” form may be obtained at the Court address above or at www.jud.ct.gov under “Court Forms.”

4. If you believe that you have insurance that may cover the claim that is being made against you in this lawsuit, you should immediately contact your insurance representative. Other action you may have to take is described in the Connecticut Practice Book which may be found in a superior court law library or on-line at www.jud.ct.gov under “Court Rules.”

5. If you have questions about the Summons and Complaint, you should talk to an attorney quickly. The Clerk of Court is not allowed to give advice on legal questions.

Signed (Sign and “X” proper box)

[X] Commissioner of the

[ ] Superior Court

Assistant Clerk

Name of Person Signing at Left

Bruce E. Newman

Date signed

09/09/2015

If this Summons is signed by a Clerk:

a. The signing has been done so that the Plaintiff(s) will not be denied access to the courts.

b. It is the responsibility of the Plaintiff(s) to see that service is made in the manner provided by law.

c. The Clerk is not permitted to give any legal advice in connection with any lawsuit.

d. The Clerk signing this Summons at the request of the Plaintiff(s) is not responsible in any way for any errors or omissions in the Summons, any allegations contained in the Complaint, or the service of the Summons or Complaint.

I certify I have read and understand the above:

Signed (Self-Represented Plaintiff)

Date

09/09/2015

For Court Use Only

File Date

A True Copy Attest

State Marshal

Fairfield County

Name and address of person recognized to prosecute in the amount of $250

Sandy Torres, 747 Stafford Avenue, Bristol, CT 06010

Signed (Official taking recognizance; “X” proper box)

[X] Commissioner of the

[ ] Superior Court

Assistant Clerk

Date

Docket Number

(Page 1 of 2)

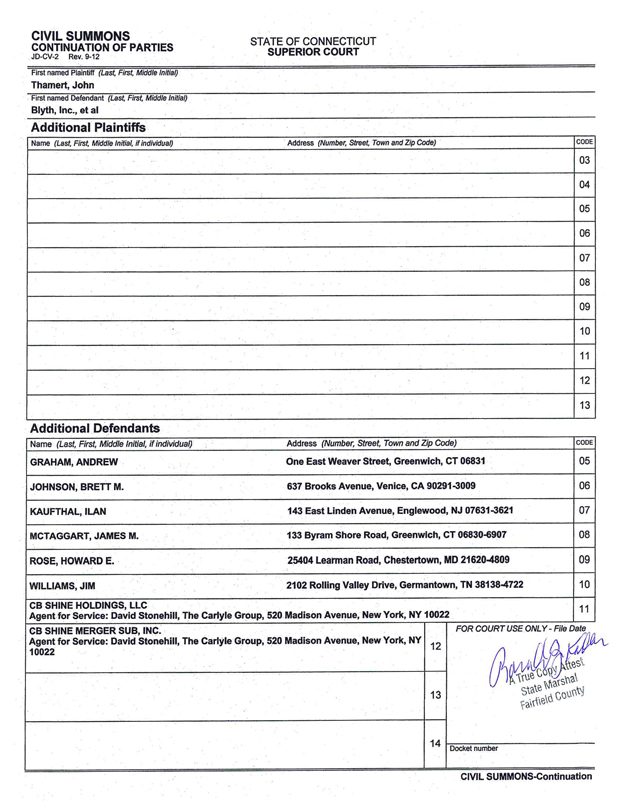

CIVIL SUMMONS

CONTINUATION OF PARTIES

JD-CV-2 Rev. 9-12

STATE OF CONNECTICUT

SUPERIOR COURT

First named Plaintiff (Last, First, Middle Initial)

Thamert, John

First named Defendant (Last, First, Middle Initial)

Blyth, Inc., et al

Additional Plaintiffs

Name (Last, First, Middle Initial, if individual) Address (Number, Street, Town and Zip Code) CODE

03

04

05

06

07

08

09

10

11

12

13

Additional Defendants

Name (Last, First, Middle Initial, if individual)

Address (Number, Street, Town and Zip Code)

CODE

GRAHAM, ANDREW

One East Weaver Street, Greenwich, CT 06831

05

JOHNSON, BRETT M.

637 Brooks Avenue, Venice, CA 90291-3009

06

KAUFTHAL, ILAN

143 East Linden Avenue, Englewood, NJ 07631-3621

07

MCTAGGART, JAMES M.

133 Byram Shore Road, Greenwich, CT 06830-6907

08

ROSE, HOWARD E.

25404 Learman Road, Chestertown, MD 21620-4809

09

WILLIAMS, JIM

2102 Rolling Valley Drive, Germantown, TN 38138-4722

10

CB SHINE HOLDINGS, LLC

Agent for Service: David Stonehill, The Carlyle Group, 520 Madison Avenue, New York, NY 10022

11

CB SHINE MERGER SUB, INC.

Agent for Service: David Stonehill, The Carlyle Group, 520 Madison Avenue, New York, NY 10022

12

13

14

FOR COURT USE ONLY- File Date

A True Copy Attest

State Marshal

Fairfield Country

Docket number

CIVIL SUMMONS-Continuation

| | | | |

| RETURN DATE: OCTOBER 6, 2015 | | : | | SUPERIOR COURT |

| | |

| JOHN THAMERT, individually and on behalf of all others similarly situated, | | : | | |

| | |

| Plaintiff, | | : | | JUDICIAL DISTRICT OF STAMFORD |

| | |

| v. | | : | | AT STAMFORD |

| | |

| BLYTH, INC., ROBERT B. GOERGEN, ROBERT B. GOERGEN, JR., JANE A. DIETZE, ANDREW GRAHAM, BRETT M. JOHNSON, ILAN KAUFTHAL, JAMES M. MCTAGGART, HOWARD E. ROSE, JIM WILLIAMS, CB SHINE HOLDING, LLC, and CB SHINE MERGER SUB, INC., | | : | | |

| | : | | |

| | : | | SEPTEMBER 9, 2015 |

| | |

| Defendants. | | : | | |

CLASS ACTION COMPLAINT

Plaintiff John Thamert (“Plaintiff”), by his attorneys, alleges upon information and belief, except for his own acts, which are alleged on knowledge, as follows:

1. The Court has jurisdiction over this action under Connecticut law.

2. Blyth, Inc. (“Blyth” or the “Company”) maintains its principal place of business in Greenwich, Connecticut, and Blyth’s board, named herein, also conduct business there. Jurisdiction over the herein-named defendants is proper because they have purposely availed themselves of the privilege of conducting business activities in Connecticut and because Blyth and its board maintain systematic and continuous business operations within Connecticut.

3. Venue is proper in this Court under Connecticut law as Blyth maintains its principal place of business in the Town of Greenwich, Fairfield County, Connecticut.

4. Plaintiff is, and has been at all relevant times, the owner of shares of common stock of Blyth. He is a resident of Owatonna, MN.

5. Defendant Blyth is a Delaware corporation with its principal place of business located at One East Weaver Street, Greenwich, Connecticut, 06831. Blyth’s stock is publicly traded on the NYSE exchange under the ticker, “BTH.” Defendant Blyth lists as its registered agent, Corporate Creations Network Inc., 615 West Johnson Avenue #202, Cheshire, CT 06410.

6. Defendant CB Shine Holdings, LLC, is a Delaware limited liability company and a party to the merger agreement at issue.

7. Defendant CB Shine Merger Sub, Inc. is a Delaware corporation and a party to the merger agreement at issue. Defendants CB Shine Holdings, LLC, and CB Shine Merger Sub, Inc., are collectively referred to herein as “The Carlyle Group” and lists this group as its registered agent in New York, NY.

8. Defendant Robert B. Goergen is and has been a director of Blyth at all material times. Defendant Goergen is a resident of Greenwich, CT.

9. Defendant Robert B. Goergen, Jr., is and has been a director of Blyth at all material times. Defendant Goergen, Jr. is a resident of Greenwich, CT.

10. Defendant Jane A. Dietze is and has been a director of Blyth at all material times. Defendant Dietze is a resident of Providence, RI.

11. Defendant Andrew Graham is and has been a director of Blyth at all material times. Defendant Graham is a resident of Greenwich, CT.

12. Defendant Brett M. Johnson is and has been a director of Blyth at all material times. Defendant Johnson is a resident of Venice, CA 90291-3009.

13. Defendant Ilan Kaufthal is and has been a director of Blyth at all material times. Defendant Kaufthal is a resident of Englewood, NJ.

14. Defendant James M. McTaggart is and has been a director of Blyth at all material times. Defendant McTaggart is a resident of Greenwich, CT.

15. Defendant Howard E. Rose is and has been a director of Blyth at all material times. Defendant Rose is a resident of Chestertown, MD.

16. Defendant Jim Williams is and has been a director of Blyth at all material times. Defendant Williams is a resident of Germantown, TN.

17. Blyth’s directors are collectively referred to herein as the “Individual Defendants.”

18. The Individual Defendants, and the other defendants are collectively referred to herein as “Defendants.”

| III. | SUBSTANTIVE ALLEGATIONS |

19. Blyth is a multi-channel company primarily focused on the direct-to-consumer market. Blyth’s products include an extensive array of decorative and functional household products such as candles, accessories, seasonal decorations, household convenience items and personalized gifts, as well as health, wellness and beauty related products. Blyth’s products can be found primarily throughout the United States, Canada, Mexico, Europe and Australia.

| | B. | The Company’s Board Owes Fiduciary Duties to Blyth’s Shareholders |

20. By reason of the Defendants’ positions with the Company as officers, directors, and/or majority stakeholders, and as controlling shareholders, each Defendant is in a fiduciary

relationship with Blyth and its minority stockholders and owe Blyth and its minority stockholders a duty of highest good faith, loyalty, and due care, and were and are required to: (a) act in furtherance of the best interests of the Company and its public stockholders; (b) refrain from abusing their positions of control; and (c) candidly and fully disclose all material information concerning a corporate takeover.

21. Each of the Individual Defendants is required to act in good faith, in the best interests of the Company’s stockholders and with such care, including reasonable inquiry, as would be expected of an ordinarily prudent person. In a situation where the directors of a publicly traded company undertake a transaction that may result in a change in corporate control (particularly when it involves a decision to eliminate the stockholders’ equity investment in a company), applicable law requires the directors to take all steps to adequately inform themselves and ensure that the transaction provides stockholders with fair value, rather than use a change of control to benefit themselves, and to disclose all material information concerning a corporate takeover to enable the stockholders to make an informed decision regarding such a transaction.

22. To diligently comply with this duty, the directors of a corporation may not take any action that: adversely affects the value provided to the corporation’s stockholders; contractually prohibits them from complying with or carrying out their fiduciary duties; discourages or inhibits alternative offers to purchase control of the corporation or its assets; or will otherwise adversely affect their duty to search and secure the best value reasonably available under the circumstances for the corporation’s stockholder.

23. In addition, Defendants have the responsibility to act independently so that the interests of the Company’s public stockholders will be protected and to consider properly all bona fide offers for the Company and to reject offers that are clearly not in the interest of stockholders.

24. Further, the Individual Defendants, as directors of Blyth, must adequately ensure that no conflict of interest exists between Defendants’ own interests and their fiduciary obligations to the Company or, if such conflicts exist, to ensure that all such conflicts will be resolved in the best interests of the Company’s stockholders.

| | C. | The Company’s Board Breached those Fiduciary Duties by Agreeing to an Unlawful Takeover by The Carlyle Group |

25. On August 31, 2015, Defendants announced the sale of Blyth to The Carlyle Group:

The Carlyle Group Announces Agreement to Acquire Blyth Inc. for $98 Million

Acquisition of Direct Seller of Home Fragrance Products and Catalog Retailer to

Focus on Product Innovation and Global Growth

Greenwich, CT and New York, NY (August 31, 2015) – Global alternative asset managerThe Carlyle Group (NASDAQ: CG) and Blyth, Inc. (NYSE: BTH), a direct-to-consumer manufacturer and seller of candles and home fragrance products, today announced they have entered into a definitive agreement under which The Carlyle Group will acquire all of Blyth’s outstanding shares of common stock in a transaction valuing Blyth at $98 million, equating to $6.00 per share, which represents a premium of approximately 105 percent over the closing price of Blyth common stock on Friday, August 28, 2015 and a premium of 65 percent over Blyth’s 30-day average share price as of such date. The transaction has been unanimously approved by Blyth’s board of directors and will be completed by means of a tender offer followed by a merger.

Under the terms of the definitive agreement, an affiliate of The Carlyle Group will commence a tender offer for all of Blyth’s outstanding shares of common stock at $6.00 per share in cash. The tender offer is conditioned on Blyth’s stockholders tendering at least a majority of Blyth’s outstanding shares in the tender offer, early termination or expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act and other customary closing conditions. The acquisition is expected to close in the fourth quarter of 2015. The financing for the transaction will come from Carlyle Equity Opportunity Fund, a $1.1 billion U.S. middle-market buyout fund. Robert B. Goergen, Blyth’s Chairman of the Board, and Robert B. Goergen, Jr., Blyth’s President and Chief Executive Officer, who beneficially own approximately 38% of Blyth’s outstanding shares of common stock, have committed to support the tender offer.

Carlyle Managing Director David Stonehill said, “Blyth is a pioneer in home fragrance with well established brands and extreme customer loyalty. We expect Carlyle’s deep experience in global consumer businesses will help drive Blyth’s product innovation and growth goals. We are particularly impressed with PartyLite’s network of 40,000 independent consultants who have remarkable passion for the company’s products. We are excited to support their efforts as we grow the company together.”

Blyth CEO Robert B. Goergen, Jr. said, “This is an important day in Blyth’s 40-year history. Carlyle understands what our team has accomplished and supports our vision for the future. Building on our strong consumer relationships, Carlyle, with its proven track record of growing companies, is the right partner to take PartyLite and Silver Star Brands to the next level of creativity and global growth.”

The Goergen family has controlled Blyth for nearly 40 years. The company, based in Greenwich, Connecticut, includes PartyLite and Silver Star Brands. PartyLite products, available in 23 countries, include candles, candle holders, flameless fragrance and wax warmers, as well as holiday and home decor. Silver Star Brands is a direct marketer of consumer gifts and household products.

26. This takeover of Blyth is the product of the Board’s breach of fiduciary duties. The takeover price of $6 per share is reported as being a 65 percent premium. However, that is illusory. Blyth’s stock was trading over $10 per share less than a year ago. Moreover, Blyth’s stock price hasn’t reflected its potential.1

27. Further, the merger agreement is designed to deliver the Company and its long-term prospects to The Carlyle Group while depriving Blyth’s shareholders of a fair shopping process that would properly value the Company.

28. The Merger agreement precludes the Company from soliciting topping bidders. A topping bidder would have to emerge on its own.

29. If a topping bidder were to emerge and make a play for the Company, The Carlyle Group has information and matching rights. These rights dissuade potential topping bidders because of, inter alia: (a) the cost of the time the topping bidder will spend during the process, which process the topping bidder has no guarantee of winning; and, (b) given the highly-competitive nature of the industry, these rapid information rights serve to dissuade a topping bidder as it will have to reveal business strategies and interests to The Carlyle Group without any

| 1 | http://seekingalpha.com/article/1497512-blyth-inc-is-nyses-most-hated-stock-should-it-be-your-most-loved (“[A]n in-depth look into the company reveals some key factors that may create an extremely positive risk reward.”). |

recourse or risk to The Carlyle Group. That is on top of the fact that, “Upon the termination of the Merger Agreement under specified circumstances, the Company will be required to pay Carlyle a termination fee of approximately $3,919,986, or under other specified circumstances, a reimbursement of up to $1.5 million of Carlyle’s reasonable out-of-pocket expenses.”

30. The takeover of Blyth, if consummated, will likely result in the Company’s shareholders losing their equity stake in the Company at below the Company’s true value. Unless enjoined by this Court, the Defendants will continue to breach and/or aid the breaches of fiduciary duties owed to plaintiff and the Class, and may consummate the takeover of Blyth, which will deprive Class members of their fair share of Blyth’s valuable assets and businesses to the irreparable harm of the Class.

| IV. | CLASS ACTION ALLEGATIONS |

31. Plaintiff brings this action on his own behalf and as a class action on behalf of all owners of Blyth common stock and their successors in interest, except Defendants and their affiliates (the “Class”).

32. This action is properly maintainable as a class action for the following reasons:

(a) the Class is so numerous that joinder of all members is impracticable. According to the Company’s quarterly filing in August 2015, there were over 16 million common shares as of July 2015.

(b) questions of law and fact are common to the Class, including, inter alia, the following: (i) Whether Defendants misrepresented and omitted material facts in violation of their fiduciary duties owed by them to Plaintiff and the other members of the Class; and, (ii) Whether Plaintiff and the other members of the Class would be irreparably harmed were the transactions complained of herein consummated.

(c) Plaintiff is committed to prosecuting this action, is an adequate representative of the Class, and has retained competent counsel experienced in litigation of this nature.

(d) Plaintiff’s claims are typical of those of the other members of the Class.

(e) Plaintiff has no interests that are adverse to the Class.

(f) The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications for individual members of the Class and of establishing incompatible standards of conduct for the party opposing the Class.

(g) Conflicting adjudications for individual members of the Class might as a practical matter be dispositive of the interests of the other members not parties to the adjudications or substantially impair or impede their ability to protect their interests.

(h) Plaintiff anticipates that there will be no difficulty in the management of this litigation. A class action is superior to other available methods for the fair and efficient adjudication of this controversy.

CAUSES OF ACTION

COUNT I

Claim for Breach of Fiduciary Duties

(Against the Individual Defendants)

33. Plaintiff repeats and realleges each and every allegation as though fully set forth herein.

34. Defendants have knowingly and recklessly and in bad faith violated fiduciary duties of care, loyalty, good faith and independence owed to the public shareholders of Blyth and have acted to put the interests of The Carlyle Group and the Individual Defendants ahead of the interests of Blyth shareholders.

35. By the acts, transactions and courses of conduct alleged herein, Defendants, individually and acting as a part of a common plan, knowingly or recklessly and in bad faith are attempting to unfairly deprive Plaintiff and other members of the Class of the true value of their investment in the Company.

36. As demonstrated by the allegations above, Defendants knowingly or recklessly failed to exercise the care required, and breached their duties of loyalty, good faith and independence owed to the shareholders of the Company because, among other reasons, they failed to:

| | (i) | fully inform themselves of the market value of the Company before entering into the Merger Agreement and fully inform the shareholders of material information; |

| | (ii) | act in the best interests of the public shareholders of Blyth common stock; |

| | (iii) | maximize shareholder value; |

| | (iv) | obtain the best financial and other terms when the Company’s independent existence will be materially altered by the takeover of Blyth; and |

| | (v) | act in accordance with their fundamental duties of good faith, due care and loyalty. |

37. By reason of the foregoing acts, practices and course of conduct, Defendants have knowingly or recklessly and in bad faith failed to exercise ordinary care and diligence in the exercise of their fiduciary obligations toward Plaintiff and the other members of the Class.

38. Unless enjoined by this Court, Defendants will continue to knowingly or recklessly and in bad faith breach their fiduciary duties owed to Plaintiff and the Class, and may consummate the takeover of Blyth which will exclude the Class from the maximized value they are entitled to all to the irreparable harm of the Class.

39. As a result of Defendants’ unlawful actions, Plaintiff and the other members of the Class will be irreparably harmed in that they will not receive the real value of their equity ownership of the Company.

40. Plaintiff and the members of the Class have an inadequate remedy at law. Only through the exercise of this Court’s equitable powers can Plaintiff and the Class be fully protected from the immediate and irreparable injury which Defendants’ actions threaten to inflict.

41. Plaintiff seeks to obtain a non-pecuniary benefit for the Class in the form of injunctive relief against the Defendants. Plaintiff’s counsel are entitled to recover their reasonable attorneys’ fees and expenses as a result of the conference of a non-pecuniary benefit on behalf of the Class, and will seek an award of such fees and expenses at the appropriate time.

COUNT II

Aiding & Abetting the Individual Defendants’ Breach of Fiduciary Duty

(Against The Carlyle Group and Blyth)

42. Plaintiff repeats and realleges each and every allegation as though fully set forth herein.

43. Defendants The Carlyle Group and Blyth are sued herein as aiders and abettors of the breaches of fiduciary duties outlined above by the Individual Defendants, as members of the Board of Blyth.

44. The Individual Defendants breached their fiduciary duties of good faith, loyalty, and due care to the Blyth’s shareholders by failing to:

| | (i) | fully inform themselves of the market value of Blyth before entering into the Merger Agreement and fully inform the shareholders of material information; |

| | (ii) | act in the best interests of the public shareholders of Blyth common stock; |

| | (iii) | maximize shareholder value; |

| | (iv) | obtain the best financial and other terms when the Company’s independent existence will be materially altered by the takeover of Blyth; and |

| | (v) | act in accordance with their fundamental duties of good faith, due care and loyalty. |

45. Such breaches of fiduciary duties could not and would not have occurred but for the conduct of The Carlyle Group and Blyth, which, therefore, aided and abetted such breaches.

46. Defendants The Carlyle Group and Blyth had knowledge that it were aiding and abetting the Individual Defendants’ breach of their fiduciary duties to the Blyth shareholders.

47. Defendants The Carlyle Group and Blyth rendered substantial assistance to the Individual Defendants in their breach of their fiduciary duties to the Blyth shareholders.

48. As a result of The Carlyle Group’s and Blyth’s conduct of aiding and abetting the Individual Defendants’ breaches of fiduciary duties, Plaintiff and the other members of the Class have been and will be damaged in that they have been and will be prevented from obtaining a fair price for their shares.

49. As a result of the unlawful actions of Defendants The Carlyle Group and Blyth, Plaintiff and the other members of the Class will be irreparably harmed in that they will not

receive fair value for Blyth assets and business, will be prevented from obtaining the real value of their equity ownership in the Company. Unless the actions of The Carlyle Group and Blyth are enjoined by the Court, they will continue to aid and abet the Individual Defendants’ breach of their fiduciary duties owed to Plaintiff and the members of the Class, and will aid and abet a process that inhibits the maximization of shareholder value and the disclosure of material information.

50. Plaintiff and the other members of the Class have no adequate remedy at law.

51. Plaintiff seeks to obtain a non-pecuniary benefit for the Class in the form of injunctive relief against Defendants The Carlyle Group and Blyth. Plaintiff’s counsel are entitled to recover their reasonable attorneys’ fees and expenses as a result of the conference of a non- pecuniary benefit on behalf of the Class, and will seek an award of such fees and expenses at the appropriate time.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff demands judgment against defendants jointly and severally as follows:

(A) declaring demand to be excused and therefore futile;

(B) enjoining, preliminarily and permanently, the Merger Agreement and the takeover of Blyth unless or until the Company adopts and implements a procedure or process to obtain the highest possible value in the best interests of Plaintiff and other Blyth shareholders;

(C) in the event that the takeover of Blyth is consummated prior to the entry of this Court’s final judgment, rescinding it or awarding Blyth and its public stockholders rescissory damages;

(D) awarding Plaintiff the costs of this action, including a reasonable allowance for the fees and expenses of Plaintiff s attorneys and experts; and

(E) granting Plaintiff and public stockholders such further equitable relief as the Court deems just and proper.

| | |

| PLAINTIFF JOHN THAMERT |

| |

| By | | /s/ |

| Bruce E. Newman |

| Brown, Paindiris & Scott, LLP |

| 747 Stafford Avenue |

| Bristol, CT 06010 |

| Tel: (860) 583.5200 |

| Fax: (860) 589.5780 |

|

| —and— |

|

| Willie Briscoe, Esq. |

| THE BRISCOE LAW FIRM, PLLC |

| 8150 North Central Expy., Suite 1575 |

| Dallas, Texas, 75206 |

| Tel: (214) 706-9314 |

| Fax: (281)254-7789 |

|

| Patrick W. Powers, Esq. |

| POWERS TAYLOR LLP |

| Campbell Centre II |

| 8150 North Central Expy., Suite 1575 |

| Dallas, Texas, 75206 |

| Tel: (214) 491-5185 |

| Fax: (214) 239-8901 |

|

| Cullin O’Brien, Esq |

| CULLIN O’BRIEN LAW, P.A. |

| 6541 NE 21st Way |

Ft. Lauderdale, Florida 33308 cullin@cullinobrienlaw.com |

| Tel: (561) 676-6370 |

| Fax: (561) 320-0285 |

|

| Attorneys for Plaintiff and the Class |

| | | | |

| RETURN DATE: OCTOBER 6, 2015 | | : | | SUPERIOR COURT |

| | |

| JOHN THAMERT, individually and on behalf of all others similarly situated, | | : | | |

| Plaintiff, | | : | | JUDICIAL DISTRICT OF STAMFORD |

| | |

| v. | | : | | AT STAMFORD |

| | |

| BLYTH, INC., ROBERT B. GOERGEN, ROBERT B. GOERGEN, JR., JANE A. DIETZE, ANDREW | | : | | |

| GRAHAM, BRETT M. JOHNSON, ILAN KAUFTHAL, JAMES M. MCTAGGART, HOWARD E. ROSE, JIM | | : | | |

| WILLIAMS, CB SHINE HOLDING, LLC, and CB SHINE MERGER SUB, INC., | | : | | SEPTEMBER 9, 2015 |

| Defendants. | | : | | |

STATEMENT OF AMOUNT IN DEMAND

The amount, legal interest or property in demand is more than fifteen ($15,000.00) dollars, exclusive of interest and costs and the plaintiff also seeks equitable relief.

| | |

| PLAINTIFF, JOHN THAMERT |

| |

| By | | /s/ |

| | Bruce E. Newman |

| | Brown, Paindiris & Scott, LLP |

| | 747 Stafford Avenue |

| | Bristol, CT 06010 |

| | Tel. (860) 583-5200 |

| | Fax: (860) 589-5780 |

| | Juris No. 401277 |

| |

| | —and— |

| |

| | Willie Briscoe, Esq. |

| | THE BRISCOE LAW FIRM, PLLC |

| | 8150 North Central Expy., Suite 1575 |

| | Dallas, Texas, 75206 |

| | Tel: (214) 706-9314 |

| | Fax: (281) 254-7789 |

| | |

| | Patrick W. Powers, Esq. |

| | POWERS TAYLOR LLP |

| | Campbell Centre II |

| | 8150 North Central Expy., Suite 1575 |

| | Dallas, Texas, 75206 |

| | Tel: (214) 491-5185 |

| | Fax: (214) 239-8901 |

| |

| | Cullin O’Brien, Esq. |

| | CULLIN O’BRIEN LAW, P.A. |

| | 6541 NE 21st Way |

| | Ft. Lauderdale, Florida 33308 cullin@cullinobrienlaw.com |

| | Tel: (561) 676-6370 |

| | Fax: (561) 320-0285 |

|

| Attorneys for Plaintiff and the Class |