Investor Presentation

March 2006

Certain statements in this presentation, including, without limitation, statements containing

the words “believes”, “anticipates”, “intends”, and “expects”, and words of similar import,

constitute “forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such

forward looking statements involve known and unknown risks, uncertainties and other

factors that may cause the actual results, performance or achievements of the Company to

be materially different from any future results, performance or achievements expressed or

implied by such forward-looking statements. Such factors include, among others, the

following; general economic and business conditions in those areas in which the Company

operates, demographic changes, competition, fluctuations in interest rates, changes in

business strategy or developments plans, changes in governmental regulation, credit

quality, the availability of capital to fund the expansion of the Company’s business, and

other factors referenced in the Company’s filings with the SEC and this presentation. The

Company disclaims any obligation to update any such factors or to publicly announce the

results of any revisions to any of the forward-looking statements contained herein to

reflect future events or developments.

2

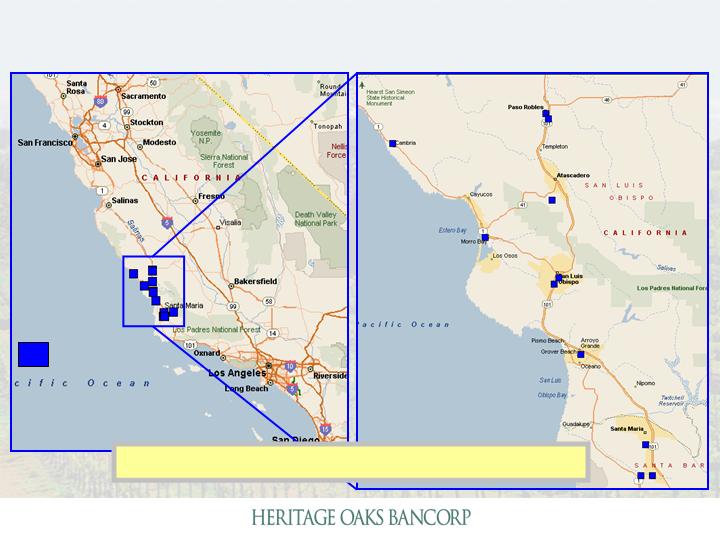

Company Overview

The Leading community bank on California’s

Central Coast

Headquartered in Paso Robles, CA with $490

million in assets as of December 31, 2005

Covering the growing markets of San Luis

Obispo and Northern Santa Barbara Counties

Heritage is Focused on Building Core Deposit Relationships

3

Source: SNL Securities

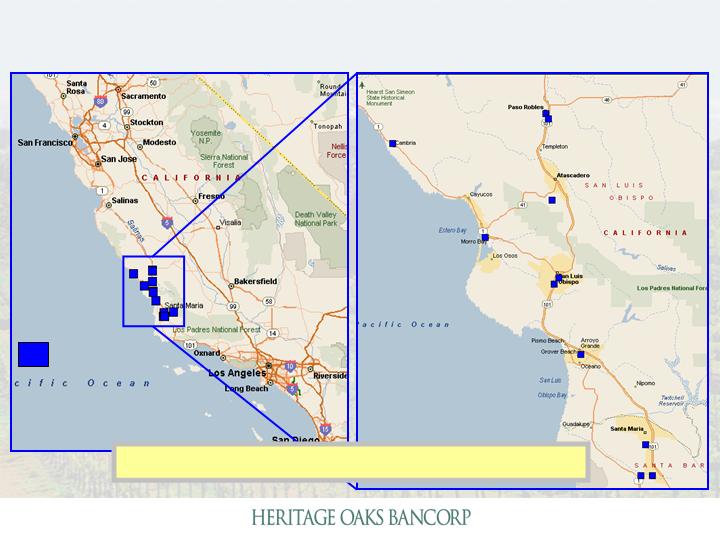

Market Areas: Branch Locations

11 Branches

Operating in California’s “Sweet Spot”

4

Market Areas: Distinct Markets

Our Growing Home Market – Three Branches

Paso Robles to Atascadero

The Progressive Village – Two Branches

San Luis Obispo

The Gold Coast – Two Branches Cambria to

Morro Bay, One Branch in Arroyo Grande

Sideways Country – Three Branches

Northern Santa Barbara County

Heritage is Capitalizing on Market Diversity and Poised for Growth

5

Market Areas: Our Growing Home Market

Paso Robles, Templeton and Atascadero

Small town environment with transitioning culture and

diversifying industry

A pocket of “relatively” affordable housing and one of

California’s least populated Coastal areas

Halfway between San Francisco and Los Angeles on

US101 and on the main Hwy 46 corridor to the coast

from rapidly growing Fresno and Bakersfield

Heritage Oaks had 23% Market Share in Paso Robles at June 2005

6

Market Areas: Our Growing Home Market

Paso Robles - The Next Napa

What the world’s top wine critic says about Paso Robles:

“… there is vast untapped potential in the limestone

hillsides west of California Route 101. ”

“…a stunning wine that showcases the magnificent

fruit that emerges from some of the vineyards planted

on Paso Robles’ limestone ridges”

- Robert M. Parker, Jr.

The Wine Advocate

The Wine Industry has Sparked Commercial Development and Lending

7

Market Areas: The Progressive Village

San Luis Obispo

California State Polytechnic University – Tops in the

Nation and the CA State University System

Active Real Estate Market – A highly attractive mix

of Culture, Country and Coast

Dynamic environment of growth and cultural evolution

Heritage Effectively Competing in an “Over-Banked” Market by Earning

the Fierce Loyalty of Clients through World-Class Service

8

Market Areas: The Gold Coast

Cambria, San Simeon, Morro Bay, Pismo

Beach and Arroyo Grande

Some of the finest and most underdeveloped and

accessible coastline left in California

At the ocean terminus of Hwy 46 from the Central

Valley, these enclaves have attracted investment by

many living in growing Fresno, Bakersfield and other

Valley communities

Necessary Ingredients Intact for Economic Transition and Development

9

Market Areas: Sideways Country

Santa Maria

Combination of family communities, resort

destinations and agricultural zones

Largest developable coastal area in the region

Santa Maria is the largest city in the Central Coast

region

This Market Presents Market Share and Market Extension Opportunities

in Both Business and Retail Client Relationships

10

Source: SNL Securities and FDIC

Deposit

Deposit

June

Market

Pro

June

Market

1998 Rank

Institution

Share

Forma

2005 Rank

Institution

Share

1

Mid-State Bank*

21.1%

24.1%

1

Mid-State Bank

21.5%

2

Bank of America

19.4%

2

Washington Mutual

17.2%

3

Washington Mutual*

15.0%

23.2%

3

Bank of America

16.2%

4

Home Savings*

8.2%

4

Heritage Oaks Bank

7.9%

5

Wells Fargo

5.5%

5

Wells Fargo

7.5%

6

CalFed

5.4%

6

First Bank of SLO

5.8%

7

First Bank of SLO

5.1%

7

Santa Lucia Bank

4.4%

8

Heritage Oaks Bank*

4.0%

5.9%

8

Los Padres Bank

3.5%

9

Los Padres Bank

3.8%

9

Coast National Bank

3.5%

10

Santa Lucia Bank

3.4%

10

San Luis Trust

3.3%

11

Bank of Santa Maria*

3.0%

11

Downey Savings

3.1%

12

Union Bank

2.0%

12

Mission Community

2.7%

13

Westamerica*

1.9%

13

Citibank

1.8%

14

Coast National Bank

1.8%

14

Union Bank

1.6%

15

Mission Community Bk

0.5%

* Mid-State Bank acquired Bank of Santa Maria; Washington Mutual acquired Home Savings; Heritage Oaks acquired Westamerica's in-market branches

Heritage has Achieved Growth in a Competitive Environment

Deposit Market Share (June 1998 vs. June 2005)

San Luis Obispo County

11

2005 YTD Financial Highlights

Net income increased 45% to $6.6 million

Revenues increased 21% to $30.1 million

Net interest margin improved 68 basis points to 5.78%

Pre-tax income rose 46% to $10.7 million

Return on average equity was 16.06% and return on

average assets was 1.38%

Net loans increased 8% to $363 million

Non-performing loans were just 0.01% of total loans

Non-interest demand deposits increased 14% to $164

million Compared to YTD 2004 results

Heritage Oaks, Earning the Respect of Our Community, Clients,

Employees and Shareholders Alike

12

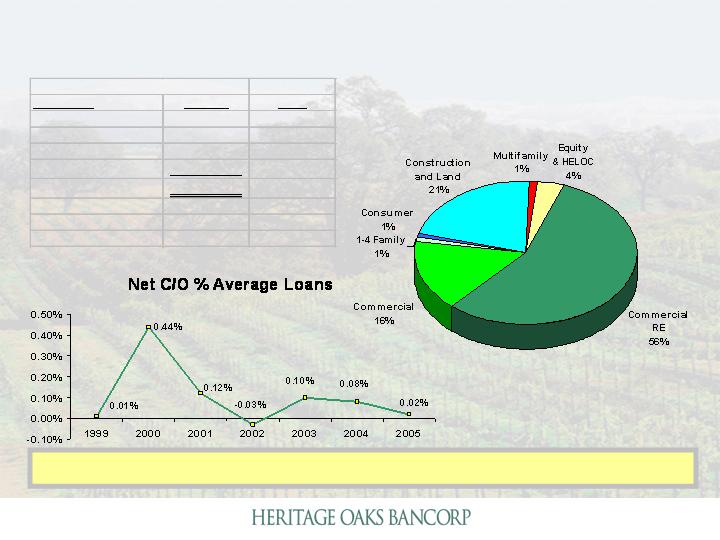

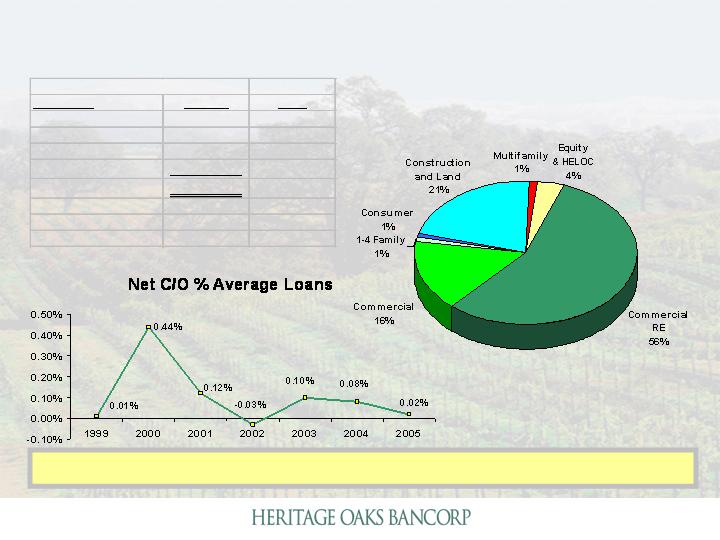

13

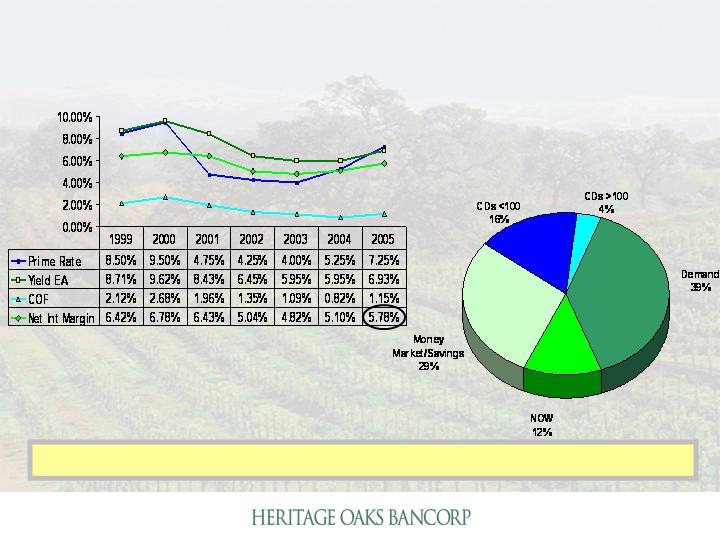

Prime-Based Lending Contributes to an Asset Sensitive Balance Sheet

Loan Portfolio at December 2005

% of

Re-Pricing

Balance

Total

< 1 Year

218,619

$

59%

1-3 Years

92,926

25%

3-5 Years

42,315

11%

> 5 Years

14,273

4%

368,133

$

100%

Non-performing Loans

54

$

% Gross Loans

0.01%

Gross Loans

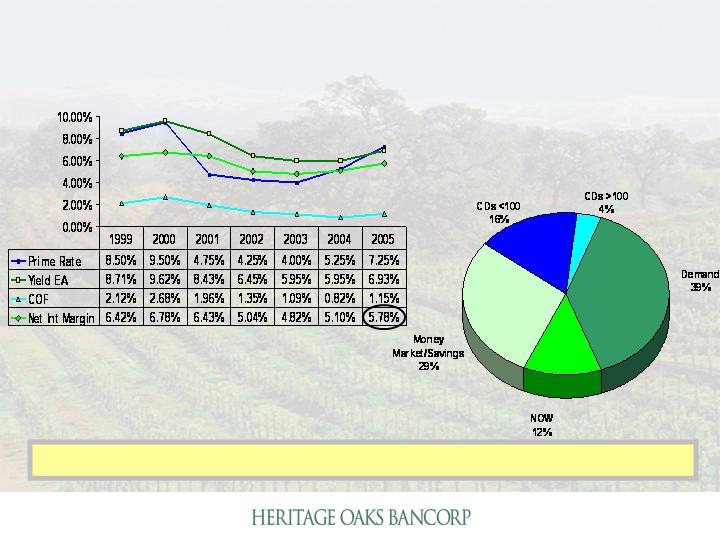

Deposit Mix at December 2005

Increasing Margins

An 0.87% Average Cost of Deposits for 2005

80% of Deposits are Low-Cost

14

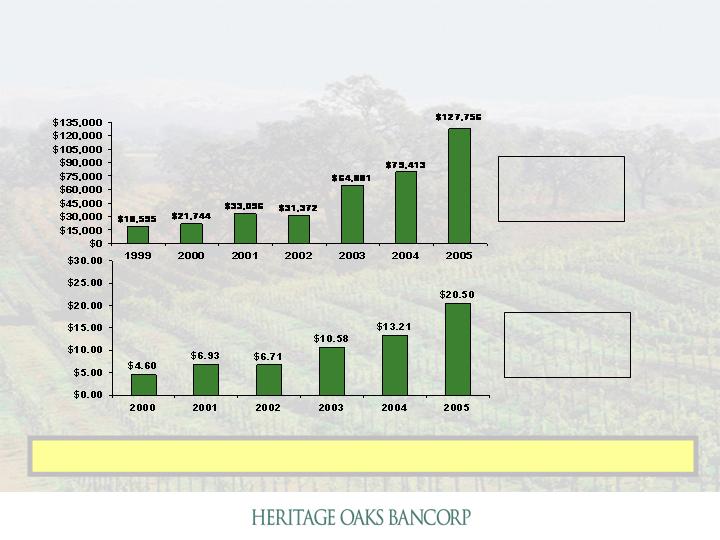

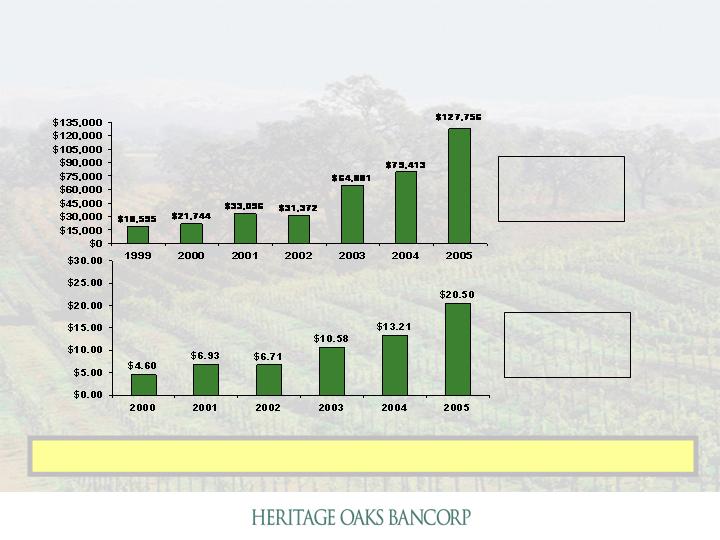

Net Income

24.2%

CAGR

2000-2005

($ in thousands)

17.6%

CAGR

2000-2005

Diluted EPS

Efficiency Ratio

Heritage Oaks has Delivered Shareholder Value through Performance

15

Market Capitalization and Stock Price

(Adj. for Stock Dividend Activity)

At December 31

($ in thousands)

34.8%

CAGR

2000-2005

42.5%

CAGR

2000-2005

Growth in Earnings has Resulted in a Deserved Valuation

16

Financial Targets

17

By Serving the Best Interests of our Clients, We are committed to being

the Best Community Bank in California

200

5

Q4

200

4

Q

4

2005

YTD

2004

YTD

2007

Targets

Return on Average Assets

1.

47

%

1.

18

%

1.

38

%

1.

02

%

1.50%

Return on Average Equity

16.38

%

1

4.77

%

16.06

%

13.15

%

20.00%

Efficiency Ratio

6

0

.6

5

%

6

7

.

64

%

6

2.04

%

6

8.93

%

<60.00%

Leverage Ratio

9

.

4

8%

8.34%

Tier 1 Risk

-

Based Capital Ratio

1

1.01

%

9.78%

Total Risk

-

Based Capital Ratio

11.96

%

10.65%