PART 1. FINANCIAL INFORMATION

The financial statements and notes begin on next page.

The accompanying un-audited condensed consolidated financial statements of Heritage Oaks Bancorp and subsidiaries (the “Company”) have been prepared in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, certain information and notes required by accounting principles generally accepted in the United States of America for annual financial statements are not included herein. In the opinion of Management, all adjustments (which consist solely of normal recurring accruals) considered necessary for a fair presentation of results for the interim periods presented have been included. These interim condensed consolidated financial statements should be read in conjunction with the financial statements and related notes contained in the Company’s 2006 Annual Report on Form 10-K.

The condensed consolidated financial statements include the accounts of the Company and its wholly-owned financial subsidiary, Heritage Oaks Bank (the “Bank”). All significant inter-company balances and transactions have been eliminated. Heritage Oaks Capital Trust II is an unconsolidated subsidiary formed solely for the purpose of issuing trust preferred securities. Operating results for the three and six months ended June 30, 2007 are not necessarily indicative of the results that may be expected for the year ending December 31, 2007. Certain amounts in the consolidated financial statements for the year ended December 31, 2006 and the three and six month period ended June 30, 2006 may have been reclassified to conform to the presentation of the consolidated financial statements in 2007.

The preparation of consolidated financial statements in conformity with the accounting principles generally accepted in the United States of America requires Management to make estimates and assumptions. These estimates and assumptions affect the reported amounts of assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

The following table sets forth the amortized cost and fair values of investment securities available for sale at June 30, 2007 and December 31, 2006:

At June 30, 2007, the securities portfolio had a net unrealized loss of approximately $278 thousand and $167 thousand, net of tax. This, when compared to the net unrealized gain of approximately $133 thousand and $80 thousand, net of tax the portfolio had at December 31, 2006 represents a decline in market value of approximately $411 thousand and $247 thousand, net of tax. The decline in fair value during 2007 can be attributed to an increase of approximately 32bp in the 10 year treasury during the first half of 2007.

An allowance for loan losses has been established by management to provide for those loans that may not be repaid in their entirety for a variety of reasons. The allowance is maintained at a level considered by management to be adequate to provide for probable incurred losses. The allowance is increased by provisions charged to earnings and is reduced by charge-offs, net of recoveries. The provision for loan losses is based upon past loan loss experience and management’s evaluation of the loan portfolio under current economic conditions. Loans are charged to the allowance for loan losses when, and to the extent, they are deemed by management to be un-collectible. The allowance for loan losses is composed of allocations for specific loans and a historical portion for all other loans.

An analysis of the changes in the reserve for possible loan losses for the periods indicated below is as follows:

The Bank recognizes that credit losses will be experienced and the risk of loss will vary with, among other things, general economic conditions; the type of loan being made; the creditworthiness of the borrower over the term of the loan and in the case of a collateralized loan, the quality of the collateral for such loan. The allowance for loan loss represents the Bank’s estimate of the allowance necessary to provide for probable incurred losses in the portfolio. In making this determination, the Bank analyzes the ultimate ability to collect the loans in its portfolio by incorporating feedback provided by internal loan staff, an independent loan review function, and information provided by examinations performed by regulatory agencies. The Bank makes monthly evaluations as to the adequacy of the allowance for loan losses.

The allowance for loan losses is based on estimates, and ultimate losses will vary from current estimates. These estimates are reviewed monthly, and as adjustments, either positive or negative, become necessary, a corresponding increase or decrease is made in the provision for loan losses. The methodology used to determine the adequacy of the allowance for possible loan losses for the three months ended June 30, 2007 is consistent with prior periods. The allowance for loan losses as a percentage of total gross loans was 0.98% as of June 30, 2007 and 0.92% as of December 31, 2006. Management believes that the allowance for loan losses at June 30, 2007 is prudent and warranted, based on information currently available.

Basic earnings per share are based on the weighted average number of shares outstanding before any dilution from common stock equivalents. Diluted earnings per share reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that then shares in the earnings of the entity.

The following table shows the number of shares used to calculate and the earnings per share for the three and six months ending June 30, 2007:

ACCOUNTING FOR CERTAIN HYBRID FINANCIAL INSTRUMENTS: In February 2006, the FASB issued SFAS No. 155, "Accounting for Certain Hybrid Financial Instruments - an amendment of FASB Statements No. 133 and 140." SFAS No. 155 simplifies accounting for certain hybrid instruments currently governed by SFAS No. 133, "Accounting for Derivative Instruments and Hedging Activities," by allowing fair value re-measurement of hybrid instruments that contain an embedded derivative that otherwise would require bifurcation. SFAS No. 155 also eliminates the guidance in SFAS No.133 Implementation Issue No. D1, "Application of Statement 133 to Beneficial Interests in Securitized Financial Assets," which provides such beneficial interests are not subject to SFAS No.133. SFAS No. 155 amends SFAS No. 140, "Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities - a Replacement of FASB Statement No. 125," by eliminating the restriction on passive derivative instruments that a qualifying special-purpose entity may hold. This statement is effective for financial instruments acquired or issued after the beginning of the Company’s fiscal year 2007. The Company does not expect the adoption of this statement to have a material impact on the Company’s financial condition, results of operations or cash flows.

ACCOUNTING FOR SERVICING OF FINANCIAL ASSETS: In March 2006, the Financial Accounting Standards Board (FASB) issued SFAS No. 156, "Accounting for Servicing of Financial Assets- an amendment of FASB Statement No. 140." SFAS No.156 requires an entity to recognize a servicing asset or servicing liability each time it undertakes an obligation to service a financial asset by entering into a servicing contract in specific situations. Additionally, the servicing asset or servicing liability shall be initially measured at fair value; however, an entity may elect the "amortization method" or "fair value method" for subsequent balance sheet reporting periods. SFAS No.156 is effective as of an entity's first fiscal year beginning after September 15, 2006. The adoption of this statement has not had a material impact on its financial condition, results of operations or cash flows as of June 30, 2007.

Note 6. SHARE-BASED COMPENSATION

As of June 30, 2007, the Company had three share-based employee compensation plans, which are more fully described in Note 14 of the Consolidated Financial Statements in the Company's Annual Report filed on Form 10-K for the year ended December 31, 2006. These plans include two stock option plans and the 2005 Equity Based Compensation Plan.

Effective January 1, 2006, the Company adopted the fair value recognition provisions of SFAS No. 123(R), using the modified prospective transition method and, therefore, have not restated results for prior periods.

Prior to January 1, 2006, the Company accounted for stock-based compensation under the recognition, measurement and pro forma disclosure provisions of APB No. 25, the original provisions of SFAS No. 123, and SFAS No. 148, "Accounting for Stock-Based Compensation-Transition and Disclosure". No share-based compensation expense was reflected in net income as all options are required by the plan to be granted with an exercise price equal to the estimated fair value of the underlying common stock on the date of grant.

Share-based compensation expense for all share-based compensation awards granted after January 1, 2006, is based on the grant-date fair value. For all awards except stock option awards, the grant date fair value is either the fair market value per share or book value per share (corresponding to the type of stock awarded) as of the grant date. For stock option awards, the grant date fair value is estimated using the Black-Scholes option pricing model. For all awards the Company recognizes these compensation costs only for those shares expected to vest on a straight-line basis over the requisite service period of the award, for which we use the related vesting term. The Company estimates forfeiture rates based on historical employee option exercise and employee termination experience.

As a result of the Company’s January 1, 2006, adoption of SFAS No.123(R), the impact to the Consolidated Financial Statements for the three and six months ended June 30, 2007 on income before income taxes and on net after tax income were reductions of $92 thousand and $54 thousand and $184 thousand and $108 thousand, respectively. For the three and six months ended June 30, 2007, the change had no impact on basic and $.008 and $0.016 impact on diluted earnings per share, respectively. During the three and six months ended June 30, 2006, share-based compensation expense was $63 thousand and $37 thousand, net of tax and $181 thousand and $106 thousand, net of tax, respectively. For the same periods ended in 2006, the change had no impact on basic and $0.006 and $0.016 impact on diluted earnings per share, respectively. In addition, prior to the adoption of SFAS No. 123(R), the Company presented the tax benefit of stock option exercises as operating cash flows, upon the adoption of SFAS No. 123(R), tax benefits resulting from tax deductions in excess of the compensation cost recognized for those options are classified as financing cash flows.

The amount of expense associated with stock option awards for the three and six months ended June 30, 2007, was $17 thousand and $33 thousand, net of tax, respectively. The amount of expense associated with stock option awards for the first six months of 2006 was $74 thousand and $47 thousand, net of tax. Because the Company recorded compensation expense related to stock option awards above the required amount in the first quarter of 2006, The Company did not recognize any expense during the second quarter of 2006.

The share-based compensation expense recognized in the condensed consolidated statement of operations for the three and six months ended June 30, 2007 and 2006 is based on awards ultimately expected to vest, and accordingly has been adjusted by the amount of estimated forfeitures. SFAS No. 123(R) requires forfeitures to be estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. Forfeitures were estimated based partially on historical experience.

The aggregate intrinsic value in the table below represents the total pretax intrinsic value (the difference between the Company’s closing stock price on the last trading day of the second quarter of 2007 and the exercise price, multiplied by the number of in-the-money options that would have been received by the option holders had all option holders exercised their options on June 30, 2007. The aggregate pretax intrinsic value is subject to change based on the fair market value of the Company's stock. Total intrinsic value of options exercised for the three and six months ended June 30, 2007 was $249 thousand and $1,070 thousand, respectively. The total intrinsic value of options exercised for the three and six month periods ended June 30, 2006, was $184 thousand and $703 thousand, respectively. No options were granted during the three and six month periods ended June 30, 2007 or in the entirety of 2006.

The following table provides a summary of the aggregate intrinsic value of options outstanding and exercisable as well as options granted, exercised, and forfeited during the year-to-date period ended June 30, 2007:

| | | Number of Shares | | Weighted Average Exercise Price | | Average Remaining Contractual Term (in years) | | Total Intrinsic Value (in 000's) | |

| Options outstanding, January 1, 2007 | | | 436,567 | | $ | 5.43 | | | | | | | |

| Granted | | | - | | | - | | | | | | | |

| Exercised | | | (129,764 | ) | | 2.97 | | | | | | | |

| Forfeited | | | (997 | ) | | 10.77 | | | | | | | |

| Options outstanding, June 30, 2007 | | | 305,806 | | $ | 6.46 | | | 4.24 | | $ | 3,545 | |

| Exercisable at June 30, 2007 | | | 264,029 | | $ | 5.71 | | | 3.82 | | $ | 3,257 | |

| Options outstanding, January 1, 2006 | | | 525,916 | | $ | 5.19 | | | | | | | |

| Granted | | | - | | | - | | | | | | | |

| Exercised | | | (46,162 | ) | | 3.54 | | | | | | | |

| Forfeited | | | (2 | ) | | 4.36 | | | | | | | |

| Options outstanding, June 30, 2006 | | | 479,752 | | $ | 5.35 | | | 4.10 | | $ | 5,351 | |

| Exercisable at June 30, 2006 | | | 410,661 | | $ | 4.45 | | | 3.70 | | $ | 4,948 | |

As of June 30, 2007, there was a total of $171 thousand of total unrecognized compensation expense related to non-vested share-based compensation arrangements. That expense is expected to be recognized over a weighted-average period of 1.15 years.

The Company grants restricted share awards periodically for the benefit of employees. These restricted shares generally “cliff vest” after five years of issuance. Recipients of restricted shares have the right to vote all shares subject to such grant, and receive all dividends with respect to such shares, whether or not the shares have vested. Recipients do not pay any cash consideration for the shares. For the three and six months ended June 30, 2007, the Company recorded compensation expense related to restricted share awards of $37 thousand and $75 thousand, net of tax, respectively. The total unrecognized compensation expense related to restricted share awards as of June 30, 2007 is $921 thousand or $542 thousand, net of tax. The remaining amount of compensation expense related to restricted share awards at June 30, 2007 is expected to recognized over the next 3.62 years. For the three and six months ended June 30, 2006, the Company recorded compensation expense related to restricted share awards in the amounts of $37 thousand and $62 thousand, net of tax, respectively. At June 30, 2006, there was a total of $1,163 thousand or $684 thousand, net of tax in unrecognized expense related to restricted share awards.

Note 7. RECLASSIFICATIONS

Certain amounts in the 2006 financial statements have been reclassified to conform to the 2007 presentation.

Forward Looking Statements

Certain statements contained in this Quarterly Report on Form 10-Q (“Quarterly Report”), including, without limitation, statements containing the words “believes”, “anticipates”, “intends”, “expects”, and words of similar impact, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following: general economic and business conditions in those areas in which the Company operates, demographic changes, competition, fluctuations in interest rates, changes in business strategy or development plans, changes in governmental regulation, credit quality, the availability of capital to fund the expansion of the Company’s business, as well as economic, political and global changes arising from the war on terrorism. (Refer to the Company’s December 31, 2006 10-K, ITEM 1A. Risk Factors.) The Company disclaims any obligation to update any such factors or to publicly announce the results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following is an analysis of the results of operations and financial condition of the Company for the periods ending June 30, 2007 and 2006. The analysis should be read in connection with the consolidated financial statements and notes thereto appearing elsewhere in this report.

THE COMPANY

Heritage Oaks Bancorp (the "Company") is a California corporation organized in 1994 to act as a holding company of Heritage Oaks Bank ("Bank"), a 12 branch bank serving San Luis Obispo and northern Santa Barbara Counties. In 1994, the Company acquired all of the outstanding common stock of the Bank in a holding company formation transaction.

In April 2002, the Company formed Heritage Oaks Capital Trust I (the “Trust”). The Trust is a statutory business trust formed under the laws of the State of Delaware. The Trust is a wholly-owned, non-financial, non-consolidated subsidiary of the Company. On April 23, 2007 the Company redeemed all of the Floating Rate Junior Subordinated Debt Securities it held associated with Heritage Oaks Capital Trust I, a wholly-owned subsidiary of Heritage Oaks Bancorp. As a result of the redemption of these securities, the Trust was dissolved on June 1, 2007.

In October 2006, the Company formed Heritage Oaks Capital Trust II (the “Trust”). The Trust is a statutory business trust formed under the laws of the State of Delaware. The Trust is a wholly-owned, non-financial, non-consolidated subsidiary of the Company.

Other than holding the shares of the Bank, the Company conducts no significant activities, although it is authorized, with the prior approval of the Board of Governors of the Federal Reserve System (the "Federal Reserve Board"), the Company's principal regulator, to engage in a variety of activities which are deemed closely related to the business of banking. The Company has also caused to be incorporated a subsidiary, CCMS Systems, Inc. which is currently inactive and has not been capitalized. The Company has no present plans to activate the proposed subsidiary.

Where You Can Find More Information

Under the Securities Exchange Act of 1934 Sections 13 and 15(d), periodic and current reports must be filed with the SEC. The Company electronically files the following reports with the SEC: Form 10-K (Annual Report), Form 10-Q (Quarterly Report), Form 8-K (Current Report), and Form DEF 14A (Proxy Statement). The Company may file additional forms. The SEC maintains an internet site, www.sec.gov, in which all forms filed electronically may be accessed. Additionally, all forms filed with the SEC and additional shareholder information is available free of charge on the Company’s website: www.heritageoaksbancorp.com

The Company posts these reports to its website as soon as reasonably practicable after filing them with the SEC. None of the information on or hyperlinked from the Company’s website is incorporated into this Quarterly Report on Form 10-Q.

EXECUTIVE SUMMARY AND RECENT DEVELOPMENTS

Earnings and Financial Condition Overview

For the three months ended June 30, 2006, the Company earned $1.8 million or $0.27 per diluted share. This, when compared to the $1.7 million or $0.25 per diluted share the Company earned in the year ago period, represents an approximate 7.6% increase in net income. For the first six months of 2007 the Company earned $3.3 million or $0.50 per diluted share. This represents an approximate 1.0% increase in net income when compared to the $3.3 million or $0.49 per diluted share the Company earned in the first six months of 2006. The increase in net income for the current and year to date periods can be attributed to an approximate 25.0% increase in interest income for both periods respectively. The increase in interest income is mainly due to the continued strength the Bank has seen in the loan portfolio when compared to the same period last year as well as a rise in interest rates during 2007.

Interest expense for the current and year to date periods totaled $3.6 million and $6.8 million respectively. This represents approximate increases of $1.5 million and $3.0 million for both the three and six month periods ended June 30, 2007 when compared to the same periods ended in 2006. The increase in interest expense is mainly attributable to the strong deposit growth the Bank has experienced during 2007.

Non-interest expenses for the three and six month periods ended June 30, 2007 were $5.6 million and $11.3 million respectively. This represents approximate increases of 10.2% and 12.2% over the same periods ended in 2006. Increases in non-interest expenses can be attributed in part to higher professional fees and outside services, increased salaries and employee benefits related to the addition of a new full service branch in the town of Templeton, as well as additional advertising and promotional costs related to current promotions designed to attract core deposits.

Increases in interest income helped contribute to a notable decline in the Company’s efficiency ratio when compared to the first quarter. For the three months ended June 30, 2007 the efficiency ratio was 64.32% compared to 68.89% for the first three months of the year and 64.34% for the three months ended June 30, 2006. For the first half of 2007 and 2006 the efficiency ratio was 66.55% and 64.67% respectively.

Return on average equity for the three and six month periods ended June 30, 2007 was 13.84% and 12.99% respectively. This was down slightly from 14.37% and 14.25% for the same periods ended in 2006.

As of June 30, 2007, total assets were $589.9 million. This represents an 8.9% increase from the $541.8 million the Company reported at the end of 2006. The growth in total assets can be attributed to a $14.6 million increase in net loan balances as well as a $39.6 million increase in federal funds sold. The significant rise in federal funds sold can be attributed to significant increases in deposit balances during the first six months of the year. At June 30, 2007, total deposits were $489.1 million. This represents an increase of approximately $68.6 million or 16.3% over the $420.5 million the company reported at December 31, 2006. The growth in deposit balances can be attributed to a $35.7 million or 46.0% increase in money market accounts, which is the result of current promotions the Company rolled out in the first quarter to attract core deposits. Interest bearing demand and time deposit balances also contributed significantly to the rise in total deposits, adding $12.1 million and $20.5 million respectively when compared to the year ended December 31, 2006. The significant rise in total deposits has not only contributed to the rise in federal funds sold, but has also allowed the Bank to pay down higher cost Federal Home Loan Bank (“FHLB”) borrowings by $20.0 million during the first six months of 2007. FHLB borrowings were $30.0 million at June 30, 2007 compared to $50.0 million at December 31, 2006.

Recent Developments

On May 29, 2007 the Company announced that it had entered into an Agreement to Merge and Plan of Reorganization with Business First National Bank (“Business First”). Under the terms of the agreement, Business First will be acquired by Heritage Oaks Bancorp (“Heritage”) and merged into Heritage Oaks Bank, a wholly owned subsidiary of Heritage. Under the terms of the agreement and based on Heritage’s closing stock price as of May 29, 2007, Heritage will pay approximately $20.6 million for Business First, consisting of approximately 75% Heritage common stock and 25% cash. Pursuant to the terms of the agreement, Business First shareholders will receive 0.5758 shares of Heritage common stock for each share of Business First they own and $3.44 in cash. The merger is subject to the approval of Business First shareholders, applicable banking regulators, and other customary closing conditions. The transaction is expected to close in the fourth quarter of this year. Business First is located in Santa Barbara, California with two branches and had assets totaling approximately $154.4 million as of June 30, 2007.

On April 23, 2007 the Company redeemed all of the Floating Rate Junior Subordinated Debt Securities it held associated with Heritage Oaks Capital Trust I, a wholly-owned subsidiary of Heritage Oaks Bancorp. The redemption price was 100% of the principal amount redeemed plus accrued and unpaid interest as of the Redemption Date. The Company paid $379,011 for the standard interest payment due April 22, 2007, plus a payment of $8,248,000 for the principal amount to be redeemed on that date. These amounts were funded from the Company’s general corporate reserves. As a result of the redemption of the securities the Company held associated with Heritage Oaks Capital Trust I, the Trust was dissolved on June 1, 2007.

On May 11, 2007 the Company entered into a material definitive agreement to sell four of the Bank’s properties to First States Group, L.P. (“First States”) in a sale/leaseback transaction for $12,810,000. In connection with the sale, the Bank entered into a separate lease agreement with First States Investors, LLC to lease back three branches and one administrative facility under which the bank will continue to utilize the properties for the normal course of business. The three branches are located in Paso Robles, Arroyo Grande and Santa Maria, California. The administrative facility is located in Paso Robles, California. The initial annual base rents for the Paso Robles, Arroyo Grande, and Santa Maria branches are $198,594, $92,456, and $150,920 respectively. The initial annual base rent for the administrative facility is $454,730. Each of the four leases contain an annual rent escalation clause equal to the lower of CPI-U (Consumer Price Index for all Urban Consumers) or 2.5 percent, commencing in the second year of the lease term. Each of the four leases provide for an initial term of 15 years with the option to renew for two 10 year terms.

In connection with the sale of the properties mentioned, the Bank will recognize a gain of approximately $3.4 million. This gain will be amortized over a fifteen year period in accordance with sale-leaseback accounting rules. The gain had no impact on the Company’s results of operations for the three and six months ended June 30, 2007. However, in addition to deferring the gain on sale, the Company has recorded an income tax liability and a deferred tax asset in the approximate amounts of $1.3 million, directly related to the deferred gain on sale.

The following table provides a brief summary of the gain the Bank will recognize in connection with the sale of the properties previously mentioned:

| Aggregate purchase price | | $ | 12,809,999 | |

| Net book value of properties sold | | | 9,401,087 | |

| Gain on sale | | | 3,408,912 | |

| Yearly amortization of gain | | $ | 227,261 | |

The Company is currently exploring the best use for the funds received in connection with the sale.

On July 18, 2007, the Board of Directors authorized a one year extension of the stock repurchase program that was adopted in July 2006. Under the one year extension the Company may repurchase up to 100,000 shares of its common stock, of which 40,000 shares have already been repurchased under the current plan.

On July 18, 2007, the Board of Directors declared a quarterly cash dividend of $0.08 per share to be paid on August 17, 2007 to shareholders of record on August 3, 2007.

On April 20, 2007, the Board of Directors declared a quarterly cash dividend of $0.08 per share to be paid on May 18, 2007 to shareholders of record on May 4, 2007.

On January 19, 2007, the Board of Directors declared a quarterly cash dividend of $0.08 per share to be paid on February 16, 2007 to shareholders of record on February 2, 2007.

Selected Financial Data

The table below provides selected financial data that highlights the Company’s quarterly performance results:

(dollars in thousands except share data) | | | |

| | | For the quarters ended | |

| | | 06/30/07 | | 03/31/07 | | 12/31/06 | | 09/30/06 | | 06/30/06 | | 03/31/06 | | 12/31/05 | | 09/30/05 | |

| Return on average assets | | | 1.25 | % | | 1.10 | % | | 1.24 | % | | 1.35 | % | | 1.38 | % | | 1.33 | % | | 1.47 | % | | 1.44 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Return on average equity | | | 13.84 | % | | 12.10 | % | | 13.64 | % | | 14.54 | % | | 14.37 | % | | 13.92 | % | | 16.38 | % | | 17.03 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average equity to average assets | | | 9.02 | % | | 9.07 | % | | 9.11 | % | | 9.25 | % | | 9.59 | % | | 9.58 | % | | 8.97 | % | | 8.47 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest margin | | | 5.56 | % | | 5.66 | % | | 5.77 | % | | 6.07 | % | | 6.06 | % | | 5.98 | % | | 6.06 | % | | 5.80 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Efficiency ratio* | | | 64.32 | % | | 68.89 | % | | 67.12 | % | | 65.31 | % | | 64.34 | % | | 65.02 | % | | 60.65 | % | | 61.08 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average loans to average deposits | | | 103.52 | % | | 108.23 | % | | 105.03 | % | | 97.15 | % | | 94.37 | % | | 90.15 | % | | 89.84 | % | | 89.60 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income | | $ | 1,800 | | $ | 1,510 | | $ | 1,649 | | $ | 1,733 | | $ | 1,673 | | $ | 1,606 | | $ | 1,808 | | $ | 1,805 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Earnings Per Share: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.28 | | $ | 0.24 | | $ | 0.26 | | $ | 0.27 | | $ | 0.26 | | $ | 0.26 | | $ | 0.29 | | $ | 0.29 | |

| Diluted | | $ | 0.27 | | $ | 0.23 | | $ | 0.25 | | $ | 0.26 | | $ | 0.25 | | $ | 0.24 | | $ | 0.27 | | $ | 0.28 | |

| Outstanding Shares: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 6,432,687 | | | 6,384,150 | | | 6,355,466 | | | 6,350,727 | | | 6,337,712 | | | 6,283,890 | | | 6,223,500 | | | 6,186,045 | |

| Diluted | | | 6,692,467 | | | 6,605,942 | | | 6,598,355 | | | 6,594,626 | | | 6,670,942 | | | 6,643,432 | | | 6,592,000 | | | 6,499,178 | |

* The efficiency ratio is defined as total non-interest expense as a percent of the combined net interest income plus non-interest income.

The Company’s earnings are highly influenced by changes in short term interest rates. The nature of the Company’s balance sheet can be summarily described as of short duration and asset sensitive. The balance sheet is of short duration because a large percentage of its interest sensitive assets and liabilities re-price immediately with changes in the Federal Funds and Prime interest rates. The Company is asset sensitive, primarily due to its large volume of non-interest bearing demand deposit accounts which effectively never re-price. Therefore, an upward movement in short term interest rates will generally result in higher net interest margin and, conversely, a reduction in short term interest rates will result in reduced net interest margin.

Historically, the largest and most variable source of income for the Company is net interest income. The results of operations for the three and six months ended June 30, 2007 and June 30, 2006 reflect the impact of increases in short term rates as well as growth in the volume of both interest earning assets and interest bearing liabilities during these periods.

Local Economy

The economy in the Company’s service area is based primarily on agriculture, tourism, light industry, oil and retail trade. Services supporting these industries have also developed in the areas of medical, financial and educational services. The population of San Luis Obispo County and the City of Santa Maria (in Northern Santa Barbara County) in 2005 totaled approximately 260,000 and 90,000, respectively, according to economic data provided by local county and title company sources. The moderate climate allows a year round growing season for numerous vegetables and fruits. Vineyards and cattle ranches also contribute largely to the local economy. The Central Coast’s leading agricultural industry is the production of high quality wine grapes and production of premium quality wines. Vineyards in production have grown significantly over the past several years throughout the Company’s service area. Access to numerous recreational activities, including lakes, mountains and beaches, provide a relatively stable tourist industry from many areas including the Los Angeles/Orange County basin, the San Francisco Bay area and the San Joaquin Valley. Principally due to the diversity of the various industries in the Company’s service area, the area, while not immune from economic fluctuations, does tend to enjoy a more stable level of economic activity than many other areas of California.

Critical Accounting Policies

The Company’s significant accounting policies are set forth in the 2006 Annual Report, Note 1 of the NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, which was filed on Form 10-K.

The following is a brief description of the Company’s current accounting policies involving significant management valuation judgments.

Allowance for Loan and Lease Losses

The Company considers its policy regarding the allowance for loan losses to be its most critical accounting policy, because it requires management's most subjective and complex judgments. In addition, changes in economic conditions can have a significant impact on the allowance for loan losses and therefore the provision for loan losses and results of operations. The Company has developed appropriate policies and procedures for assessing the adequacy of the allowance for loan losses, recognizing that this process requires a number of assumptions and estimates with respect to its loan portfolio. The Company's assessments may be impacted in future periods by changes in economic conditions, the impact of regulatory examinations, and the discovery of information with respect to borrowers, which is not known to management at the time of the issuance of the consolidated financial statements.

The allowance for loan and lease losses represents management’s best estimate of losses inherent in the existing loan portfolio. The allowance for loan and lease losses is increased by the provision for loan and lease losses charged to expense and reduced by loans charged-off, net of recoveries. The allowance for loan and lease losses is determined based on management’s assessment of several factors: reviews and evaluation of individual loans, changes in the nature and volume of the loan portfolio, current economic conditions and the related impact on specific borrowers and industry groups, historical loan loss experiences and the level of classified and nonperforming loans.

Loans are considered impaired if, based on current information and events, it is probable that we will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. The measurement of impaired loans is generally based on the present value of expected future cash flows discounted at the historical effective interest rate stipulated in the loan agreement, except that all collateral-dependent loans are measured for impairment based on the fair value of the collateral. In measuring the fair value of the collateral, management uses assumptions and methodologies consistent with those that would be utilized by unrelated third parties. Changes in the financial condition of individual borrowers, economic conditions, historical loss experience and the condition of the various markets in which collateral may be sold may all affect the required level of the allowance for loan and lease losses and the associated provision for loan and lease losses.

See Note 3 to the Consolidated Financial Statements for further discussion on Allowance for Loan Losses.

Securities Available for Sale

The fair values of most securities that are designated available for sale are based on quoted market prices. If quoted market prices are not available, fair values are extrapolated from the quoted prices of similar instruments.

Goodwill and Other Intangible Assets

As discussed in the 2006 Annual Report, Note 1 of the NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, which was filed on Form 10-K, we assess goodwill and other intangible assets each year for impairment. This assessment involves a “carrying amount comparison” that compares the fair value of the reporting unit to its carrying value (stated shareholders’ equity, including goodwill).. If the carrying value of a reporting unit materially exceeds its fair value, the Company would be required to take a charge against earnings to write down the assets to the lower value. The Company determined that there was no impairment at December 31, 2006.

RESULTS OF OPERATIONS

Net Interest Income and Interest Margin

Net interest income, the primary component of the net earnings of a financial institution, refers to the difference between the interest paid on deposits and borrowings, and the interest earned on loans and investments. The net interest margin is the amount of net interest income expressed as a percentage of average earning assets. Factors considered in the analysis of net interest income are the composition and volume of earning assets and interest-bearing liabilities, the amount of non-interest bearing liabilities and non-accrual loans, and changes in market interest rates.

The volume and rate variances table below sets forth the dollar difference in interest earned and paid for each major category of interest-earning assets and interest-bearing liabilities for the three and six month periods ended June 30, 2007, and the amount of such change attributable to changes in average balances (volume) or changes in average interest rates.

(dollars in thousands) | | For the three months ended June 30, 2007 over 2006 | | For the six months ended June 30, 2007 over 2006 | |

| | | Volume | | Rate | | Total | | Volume | | Rate | | Total | |

Interest income: | | | | | | | | | | | | | | | | | | | |

| Loans (1) | | $ | 1,887 | | $ | 309 | | $ | 2,196 | | $ | 3,805 | | $ | 717 | | $ | 4,522 | |

| Investment securities taxable | | | (53 | ) | | 9 | | | (44 | ) | | (124 | ) | | 37 | | | (87 | ) |

| Investment securities non-taxable (2): | | | 3 | | | (5 | ) | | (2 | ) | | 18 | | | (8 | ) | | 10 | |

| Taxable equivalent adjustment (2): | | | (1 | ) | | 2 | | | 1 | | | (6 | ) | | 3 | | | (3 | ) |

| Interest-bearing deposits | | | - | | | - | | | - | | | - | | | 1 | | | 1 | |

| Federal funds sold | | | 14 | | | (8 | ) | | 6 | | | (207 | ) | | 17 | | | (190 | ) |

| Net increase (decrease) | | | 1,850 | | | 307 | | | 2,157 | | | 3,486 | | | 767 | | | 4,253 | |

Interest expense: | | | | | | | | | | | | | | | | | | | |

| Savings, now, money market | | | 72 | | | 342 | | | 414 | | | 16 | | | 498 | | | 514 | |

| Time deposits | | | 440 | | | 174 | | | 614 | | | 820 | | | 383 | | | 1,203 | |

| Other borrowings | | | 465 | | | 33 | | | 498 | | | 1,093 | | | 61 | | | 1,154 | |

| Long term borrowings | | | 23 | | | (15 | ) | | 8 | | | 198 | | | (25 | ) | | 173 | |

| Net increase (decrease) | | | 1,000 | | | 534 | | | 1,534 | | | 2,127 | | | 917 | | | 3,044 | |

| Total net increase (decrease) | | $ | 850 | | $ | (227 | ) | $ | 623 | | $ | 1,359 | | $ | (150 | ) | $ | 1,209 | |

| (1) | Loan fees of $353 and $307 for the three months ending June 30, 2007 and 2006 respectively and $641 and $657 for the six months ending June 30, 2007 and 2006 respectively have been included in interest income computation. |

| (2) | Adjusted to a fully taxable equivalent basis using a tax rate of 34%. |

The tables below set forth the average balance sheet information, interest income and expense, average yields and rates and net interest income and margin for the three and six months ended June 30, 2007 and June 30, 2006. The average balance of non-accruing loans has been included in loan totals.

(dollars in thousands) | | For the three months ending June 30, 2007 | | For the three months ending June 30, 2006 | |

| | | Balance | | Rate (4) | | Income/

Expense | | Balance | | Rate (4) | | Income/

Expense | |

| Interest Earning Assets: | | | | | | | | | | | | | | | | | | | |

| Investments with other banks | | $ | 318 | | | 2.52 | % | $ | 2 | | $ | 318 | | | 2.52 | % | $ | 2 | |

| Investment securities taxable | | | 23,636 | | | 4.53 | % | | 267 | | | 28,309 | | | 4.41 | % | | 311 | |

| Investment securities non-taxable | | | 16,621 | | | 4.30 | % | | 178 | | | 16,446 | | | 4.37 | % | | 179 | |

| Federal funds sold | | | 13,198 | | | 4.92 | % | | 162 | | | 11,791 | | | 5.31 | % | | 156 | |

| Loans (1) (2) | | | 469,719 | | | 8.72 | % | | 10,214 | | | 382,470 | | | 8.41 | % | | 8,018 | |

| Total interest earning assets | | | 523,492 | | | 8.29 | % | | 10,823 | | | 439,334 | | | 7.91 | % | | 8,666 | |

| | | | | | | | | | | | | | | | | | | | |

| Allowance for possible loan losses | | | (4,417 | ) | | | | | | | | (4,077 | ) | | | | | | |

| Other assets | | | 59,619 | | | | | | | | | 51,573 | | | | | | | |

| TOTAL ASSETS | | $ | 578,694 | | | | | | | | $ | 486,830 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Interest Bearing Liabilities: | | | | | | | | | | | | | | | | | | | |

| Savings/NOW/money market | | | 181,654 | | | 2.23 | % | | 1,012 | | | 163,633 | | | 1.47 | % | | 598 | |

| Time deposits | | | 133,377 | | | 4.74 | % | | 1,577 | | | 94,605 | | | 4.08 | % | | 963 | |

| Other borrowings | | | 55,607 | | | 5.55 | % | | 769 | | | 22,652 | | | 5.01 | % | | 283 | |

| Federal funds purchased | | | 1,130 | | | 5.68 | % | | 16 | | | 257 | | | 6.24 | % | | 4 | |

| Long-term debt | | | 10,242 | | | 7.48 | % | | 191 | | | 8,248 | | | 8.90 | % | | 183 | |

| Total interest-bearing liabilities | | | 382,010 | | | 3.74 | % | | 3,565 | | | 289,395 | | | 2.81 | % | | 2,031 | |

| Demand deposits | | | 138,696 | | | | | | | | | 147,058 | | | | | | | |

| Other liabilities | | | 5,818 | | | | | | | | | 3,683 | | | | | | | |

| Stockholders' Equity: | | | | | | | | | | | | | | | | | | | |

| Common stock | | | 29,833 | | | | | | | | | 29,577 | | | | | | | |

| Additional paid in capital | | | 467 | | | | | | | | | - | | | | | | | |

| Retained earnings | | | 21,801 | | | | | | | | | 17,424 | | | | | | | |

| Valuation allowance investments | | | 69 | | | | | | | | | (307 | ) | | | | | | |

| Total stockholders' equity | | | 52,170 | | | | | | | | | 46,694 | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 578,694 | | | | | | | | $ | 486,830 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Net Interest Income | | | | | | | | $ | 7,258 | | | | | | | | $ | 6,635 | |

| Net Interest Margin (3) | | | | | | 5.56 | % | | | | | | | | 6.06 | % | | | |

| (1) | Nonaccrual loans have been included in total loans. |

| (2) | Loan fees of $353 and $307 for the three months ending June 30, 2007 and 2006, respectively have been included in interest income computation. |

| (3) | Net interest margin has been calculated by dividing the net interest income by total average earning assets. |

| (4) | Rate is annualized using actual number of days in period. |

(dollars in thousands) | | For the six months ending June 30, 2007 | | For the six months ending June 30, 2006 | |

| | | Balance | | Rate (4) | | Income/

Expense | | Balance | | Rate (4) | | Income/

Expense | |

| Interest Earning Assets: | | | | | | | | | | | | | | | | | | | |

| Investments with other banks | | $ | 318 | | | 3.17 | % | $ | 5 | | $ | 312 | | | 2.59 | % | $ | 4 | |

| Investment securities taxable | | | 23,924 | | | 4.58 | % | | 543 | | | 29,250 | | | 4.34 | % | | 630 | |

| Investment securities non-taxable | | | 16,636 | | | 4.30 | % | | 355 | | | 16,078 | | | 4.36 | % | | 348 | |

| Federal funds sold | | | 7,834 | | | 4.97 | % | | 193 | | | 16,195 | | | 4.77 | % | | 383 | |

| Loans (1) (2) | | | 465,297 | | | 8.68 | % | | 20,029 | | | 376,308 | | | 8.31 | % | | 15,507 | |

| Total interest earning assets | | | 514,009 | | | 8.29 | % | | 21,125 | | | 438,143 | | | 7.77 | % | | 16,872 | |

| | | | | | | | | | | | | | | | | | | | |

| Allowance for possible loan losses | | | (4,299 | ) | | | | | | | | (4,010 | ) | | | | | | |

| Other assets | | | 58,630 | | | | | | | | | 50,299 | | | | | | | |

| TOTAL ASSETS | | $ | 568,340 | | | | | | | | $ | 484,432 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Interest Bearing Liabilities: | | | | | | | | | | | | | | | | | | | |

| Savings/NOW/money market | | | 170,263 | | | 2.05 | % | | 1,731 | | | 168,064 | | | 1.46 | % | | 1,217 | |

| Time deposits | | | 129,695 | | | 4.66 | % | | 2,998 | | | 92,301 | | | 3.92 | % | | 1,795 | |

| Other borrowings | | | 56,420 | | | 5.44 | % | | 1,521 | | | 17,688 | | | 4.82 | % | | 423 | |

| Federal funds purchased | | | 2,123 | | | 5.70 | % | | 60 | | | 129 | | | 6.25 | % | | 4 | |

| Long-term debt | | | 13,352 | | | 7.91 | % | | 524 | | | 8,248 | | | 8.58 | % | | 351 | |

| Total interest-bearing liabilities | | | 371,853 | | | 3.71 | % | | 6,834 | | | 286,430 | | | 2.67 | % | | 3,790 | |

| Demand deposits | | | 139,878 | | | | | | | | | 147,642 | | | | | | | |

| Other liabilities | | | 5,218 | | | | | | | | | 3,941 | | | | | | | |

| Stockholders' Equity: | | | | | | | | | | | | | | | | | | | |

| Common stock | | | 29,587 | | | | | | | | | 29,465 | | | | | | | |

| Additional paid in capital | | | 419 | | | | | | | | | - | | | | | | | |

| Retained earnings | | | 21,316 | | | | | | | | | 17,159 | | | | | | | |

| Valuation allowance investments | | | 69 | | | | | | | | | (205 | ) | | | | | | |

| Total stockholders' equity | | | 51,391 | | | | | | | | | 46,419 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 568,340 | | | | | | | | $ | 484,432 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Net Interest Income | | | | | | | | $ | 14,291 | | | | | | | | $ | 13,082 | |

| Net Interest Margin (3) | | | | | | 5.61 | % | | | | | | | | 6.02 | % | | | |

| (1) | Nonaccrual loans have been included in total loans. |

| (2) | Loan fees of $641 and $657 for the six months ending June 30, 2007 and 2006, respectively have been included in interest income computation. |

| (3) | Net interest margin has been calculated by dividing the net interest income by total average earning assets. |

| (4) | Rate is annualized using actual number of days in period. |

The tables below set forth changes for the three and six months ending June 30, 2007 compared to the same periods in 2006 for average interest earning assets and their respective average yields.

(dollars in thousands) | | Average Balance for the three months ending June 30, | | Variance | | Average Yield for the three months ending June 30, | | | |

| | | 2007 | | 2006 | | dollar | | percentage | | 2007 | | 2006 | | Variance | |

| Interest Earning Assets: | | | | | | | | | | | | | | | | | | | | | | |

| Time deposits with other banks | | $ | 318 | | $ | 318 | | $ | - | | | 0.00 | % | | 2.52 | % | | 2.52 | % | | 0.00 | % |

| Investment securities taxable | | | 23,636 | | | 28,309 | | | (4,673 | ) | | -16.51 | % | | 4.53 | % | | 4.41 | % | | 0.12 | % |

| Investment securities non-taxable | | | 16,621 | | | 16,446 | | | 175 | | | 1.06 | % | | 4.30 | % | | 4.37 | % | | -0.07 | % |

| Federal funds sold | | | 13,198 | | | 11,791 | | | 1,407 | | | 11.93 | % | | 4.92 | % | | 5.31 | % | | -0.39 | % |

| Loans (1) (2) | | | 469,719 | | | 382,470 | | | 87,249 | | | 22.81 | % | | 8.72 | % | | 8.41 | % | | 0.31 | % |

| Total interest earning assets | | $ | 523,492 | | $ | 439,334 | | $ | 84,158 | | | 19.16 | % | | 8.29 | % | | 7.91 | % | | 0.38 | % |

| (1) | Nonaccrual loans have been included in total loans. |

| (2) | Loan fees of $353 and $307 for the three months ending June 30, 2007 and 2006, respectively have been included in the interest income computation. |

(dollars in thousands) | | Average Balance for the six months ending June 30, | | Variance | | Average Yield for the six months ending June 30, | | | |

| | | 2007 | | 2006 | | dollar | | percentage | | 2007 | | 2006 | | Variance | |

| Interest Earning Assets: | | | | | | | | | | | | | | | | | | | | | | |

| Time deposits with other banks | | $ | 318 | | $ | 312 | | $ | 6 | | | 1.92 | % | | 3.17 | % | | 2.59 | % | | 0.58 | % |

| Investment securities taxable | | | 23,924 | | | 29,250 | | | (5,326 | ) | | -18.21 | % | | 4.58 | % | | 4.34 | % | | 0.24 | % |

| Investment securities non-taxable | | | 16,636 | | | 16,078 | | | 558 | | | 3.47 | % | | 4.30 | % | | 4.36 | % | | -0.06 | % |

| Federal funds sold | | | 7,834 | | | 16,195 | | | (8,361 | ) | | -51.63 | % | | 4.97 | % | | 4.77 | % | | 0.20 | % |

| Loans (1) (2) | | | 465,297 | | | 376,308 | | | 88,989 | | | 23.65 | % | | 8.68 | % | | 8.31 | % | | 0.37 | % |

| Total interest earning assets | | $ | 514,009 | | $ | 438,143 | | $ | 75,866 | | | 17.32 | % | | 8.29 | % | | 7.77 | % | | 0.52 | % |

| (1) | Nonaccrual loans have been included in total loans. |

| (2) | Loan fees of $641 and $657 for the six months ending June 30, 2007 and 2006, respectively have been included in the interest income computation. |

The Company has been able to increase the loan portfolio with continued market penetration by a team of seasoned loan officers who are compensated for production. Additions to the loan portfolio for the three and six months ending June 30, 2007 were achieved under the Company’s established Loan Policy.

For the three and six months ending June 30, 2007 compared to the same period in 2006, the average yield on loans improved by 31 and 37 basis points respectively. This has been primarily due to the rise in market interest rates from 2006 to 2007. From the end of the first quarter of 2006 to the end of the second quarter in 2007, the Prime rate rose by 50 basis points. See “Item 3. Quantitative and Qualitative Disclosure about Market Risk” for further discussion.

The taxable investment portfolio gained in average yield due to extension of average life as the result of rising rates. Balances of taxable investment securities decreased due to regular principal reductions on Mortgage Backed Securities (MBS).

The tables below set forth changes for the three and six months ending June 30, 2007 compared to the same periods in 2006 for average interest bearing liabilities and the respective average rates paid.

(dollars in thousands) | | Average Balance for the three months ending June 30, | | Variance | | Average Rate for the three months ending June 30, | | | |

| | | 2007 | | 2006 | | dollar | | percentage | | 2007 | | 2006 | | Variance | |

| Interest Bearing Liabilities: | | | | | | | | | | | | | | | | | | | | | | |

| Savings/NOW/money market | | $ | 181,654 | | $ | 163,633 | | $ | 18,021 | | | 11.01 | % | | 2.23 | % | | 1.47 | % | | 0.76 | % |

| Time deposits | | | 133,377 | | | 94,605 | | | 38,772 | | | 40.98 | % | | 4.74 | % | | 4.08 | % | | 0.66 | % |

| Other borrowings | | | 55,607 | | | 22,652 | | | 32,955 | | | 145.48 | % | | 5.55 | % | | 5.01 | % | | 0.54 | % |

| Federal funds purchased | | | 1,130 | | | 257 | | | 873 | | | 339.69 | % | | 5.68 | % | | 6.24 | % | | -0.56 | % |

| Long term debt | | | 10,242 | | | 8,248 | | | 1,994 | | | 24.18 | % | | 7.48 | % | | 8.90 | % | | -1.42 | % |

| Total interest-bearing liabilities | | $ | 382,010 | | $ | 289,395 | | $ | 92,615 | | | 32.00 | % | | 3.74 | % | | 2.81 | % | | 0.93 | % |

(dollars in thousands) | | Average Balance for the six months ending June 30, | | Variance | | Average Rate for the six months ending June 30, | | | |

| | | 2007 | | 2006 | | dollar | | percentage | | 2007 | | 2006 | | Variance | |

| Interest Bearing Liabilities: | | | | | | | | | | | | | | | | | | | | | | |

| Savings/NOW/money market | | $ | 170,263 | | $ | 168,064 | | $ | 2,199 | | | 1.31 | % | | 2.05 | % | | 1.46 | % | | 0.59 | % |

| Time deposits | | | 129,695 | | | 92,301 | | | 37,394 | | | 40.51 | % | | 4.66 | % | | 3.92 | % | | 0.75 | % |

| Other borrowings | | | 56,420 | | | 17,688 | | | 38,732 | | | 218.97 | % | | 5.44 | % | | 4.82 | % | | 0.61 | % |

| Federal funds purchased | | | 2,123 | | | 129 | | | 1,994 | | | 1545.74 | % | | 5.70 | % | | 6.25 | % | | -0.55 | % |

| Long term debt | | | 13,352 | | | 8,248 | | | 5,104 | | | 61.88 | % | | 7.91 | % | | 8.58 | % | | -0.67 | % |

| Total interest-bearing liabilities | | $ | 371,853 | | $ | 286,430 | | $ | 85,423 | | | 29.82 | % | | 3.71 | % | | 2.67 | % | | 1.04 | % |

For the three and six months ending June 30, 2007 compared to the same period in 2006, the Company’s average yield on average interest bearing liabilities increased by 93 and 104 basis points respectively.

While the Company’s balance sheet remains asset sensitive a competitive local market has caused deposit costs to outpace loan yields, applying pressure on the net interest margin. For the quarter, the net interest margin was 5.56%, down slightly form 5.66% for the first quarter and 6.06% for the three months ended June 30, 2006. The Company’s recent success in deposit gathering has proved to be beneficial in helping to reduce higher cost sources of funding, but has also contributed to the rise in interest expense, which in turn places pressure on the net interest margin. However, the Company continues to remain committed to aggressively pursuing core deposits in an effort to provide additional sources of inexpensive funding to fuel the continued growth in the loan portfolio. Additionally, the re-branding initiative the Company has undertaken has and is expected to contribute to the acquisition of new low cost deposits.

Non-Interest Income

The tables below set forth changes for the three and six months ending June 30, 2007 compared to the same period in 2006 for non-interest income.

| | | For the three months ended | | | | | |

| | | June 30, | | Variance | |

(dollars in thousands) | | 2007 | | 2006 | | dollar | | percentage | |

| Service charges on deposit accounts | | $ | 684 | | $ | 613 | | $ | 71 | | | 11.6 | % |

| ATM/Debit Card transaction/interchange fees | | | 201 | | | 185 | | | 16 | | | 8.6 | % |

| Bancard | | | 59 | | | 29 | | | 30 | | | 103.4 | % |

| Mortgage origination fees | | | 110 | | | 157 | | | (47 | ) | | -29.9 | % |

| Earnings on cash surrender value life insurance | | | 107 | | | 92 | | | 15 | | | 16.3 | % |

| Other | | | 230 | | | 135 | | | 95 | | | 70.4 | % |

| Total | | $ | 1,391 | | $ | 1,211 | | $ | 180 | | | 14.9 | % |

| | | For the six months ended | | | | | |

| | | June 30, | | Variance | |

(dollars in thousands) | | 2007 | | 2006 | | dollar | | percentage | |

| Service charges on deposit accounts | | $ | 1,295 | | $ | 1,181 | | $ | 114 | | | 9.7 | % |

| ATM/Debit Card transaction/interchange fees | | | 378 | | | 359 | | | 19 | | | 5.3 | % |

| Bancard | | | 117 | | | 54 | | | 63 | | | 116.7 | % |

| Mortgage origination fees | | | 259 | | | 300 | | | (41 | ) | | -13.7 | % |

| Earnings on cash surrender value life insurance | | | 213 | | | 175 | | | 38 | | | 21.7 | % |

| Other | | | 361 | | | 360 | | | 1 | | | 0.3 | % |

| Total | | $ | 2,623 | | $ | 2,429 | | $ | 194 | | | 8.0 | % |

For the three and six months ending June 30, 2007 as compared to the same period in 2006, non-interest income has risen by approximately $180 thousand and $194 thousand respectively. Service charges on deposit accounts and Bancard revenues contributed to the majority of the increase in other income for both the three and six months ended June 30, 2007. These increases are partly attributable to deposit growth and an increase in the number of customer relationships the Bank has obtained during 2007.

Mortgage origination fees declined in the three and six months ended June 30, 2007, when compared to the same periods in 2006. The rise in interest rates during the second quarter of 2007 has made the cost of borrowing less attractive than in previous quarters and as a result there has been a slowdown in resale transactions.

The table below illustrates the change in the number and total dollar volume of loans originated during the three and six months ended June 30, 2007 compared to the same periods ended in 2006.

| | | For the three months ended June 30, | |

(dollars in thousands) | | 2007 | | 2006 | | Variance | |

| | | | | | | | |

| Dollar volume | | $ | 14,477 | | $ | 17,023 | | | -15.0 | % |

| | | | | | | | | | | |

| Number of loans | | | 43 | | | 62 | | | -30.6 | % |

| | | For the six months ended June 30, | |

| | | 2007 | | 2006 | | Variance | |

| | | | | | | | |

| Dollar volume | | $ | 29,620 | | $ | 30,731 | | | -3.6 | % |

| | | | | | | | | | | |

| Number of loans | | | 84 | | | 116 | | | -27.6 | % |

Non-Interest Expenses

The tables below set forth changes for the three and six months ending June 30, 2007 compared to the same period in 2006 for non-interest expense.

| | | For the three months ended | | | | | |

| | | June 30, | | Variance | |

(dollars in thousands) | | 2007 | | 2006 | | dollar | | percentage | |

| Salaries and employee benefits | | $ | 3,194 | | $ | 2,786 | | $ | 408 | | | 14.6 | % |

| Occupany and equipment | | | 706 | | | 665 | | | 41 | | | 6.2 | % |

| Data processing | | | 571 | | | 534 | | | 37 | | | 6.9 | % |

| Advertising and promotional | | | 213 | | | 169 | | | 44 | | | 26.0 | % |

| Regulatory fees | | | 28 | | | 28 | | | - | | | - | |

| Other professional fees and outside services | | | 281 | | | 172 | | | 109 | | | 63.4 | % |

| Legal fees and other litigation expense | | | 18 | | | 43 | | | (25 | ) | | -58.1 | % |

| Loan department costs | | | 28 | | | 49 | | | (21 | ) | | -42.9 | % |

| Stationery and supplies | | | 78 | | | 68 | | | 10 | | | 14.7 | % |

| Director fees | | | 77 | | | 73 | | | 4 | | | 5.5 | % |

| Core deposit intangible amortization | | | 88 | | | 75 | | | 13 | | | 17.3 | % |

| Other | | | 281 | | | 386 | | | (105 | ) | | -27.2 | % |

| Total | | $ | 5,563 | | $ | 5,048 | | $ | 515 | | | 10.2 | % |

| | | For the six months ended | | | | | |

| | | June 30, | | Variance | |

(dollars in thousands) | | 2007 | | 2006 | | dollar | | percentage | |

| Salaries and employee benefits | | $ | 6,444 | | $ | 5,568 | | $ | 876 | | | 15.7 | % |

| Occupany and equipment | | | 1,421 | | | 1,268 | | | 153 | | | 12.1 | % |

| Data processing | | | 1,105 | | | 1,062 | | | 43 | | | 4.0 | % |

| Advertising and promotional | | | 427 | | | 354 | | | 73 | | | 20.6 | % |

| Regulatory fees | | | 55 | | | 57 | | | (2 | ) | | -3.5 | % |

| Other professional fees and outside services | | | 625 | | | 408 | | | 217 | | | 53.2 | % |

| Legal fees and other litigation expense | | | 46 | | | 60 | | | (14 | ) | | -23.3 | % |

| Loan department costs | | | 70 | | | 82 | | | (12 | ) | | -14.6 | % |

| Stationery and supplies | | | 172 | | | 137 | | | 35 | | | 25.5 | % |

| Director fees | | | 147 | | | 148 | | | (1 | ) | | -0.7 | % |

| Core deposit intangible amortization | | | 177 | | | 150 | | | 27 | | | 18.0 | % |

| Other | | | 567 | | | 737 | | | (170 | ) | | -23.1 | % |

| Total | | $ | 11,256 | | $ | 10,031 | | $ | 1,225 | | | 12.2 | % |

Salary and Employee Benefits

Salaries and employee related expense incurred the greatest dollar increase of any non-interest expense category for the three and six months ending June 30, 2007 over the same periods ended in 2006. The increase was primarily a result of increased expenses related to the expansion of our Executive Management team contributing to higher officer salaries as well as additional staff to enhance relationship management. The addition of a full service branch within the bank’s existing footprint in the town of Templeton has resulted in an increase in salary and employee benefits as well as occupancy expenses.

Other Professional Fees and Outside Services

Other professional fees and outside service expenses increased for the quarter and year to date periods ended June 30, 2007 when compared to the same period a year earlier as a result of increases in a number of sub-categories including executive search expenses, consulting fees, audit fees, compliance and insurance costs. As competition within the primary market area has intensified, the Company has found it necessary to use the service of executive search firms when looking to either replace or add staff. The Company also incurred additional expenses within this category related the appraisal of four properties that were evaluated and later sold in connection with the sale-lease back transaction the Company disclosed earlier in the quarter.

Advertising and Promotional

Late in 2006 one of the largest community banks in our market was acquired by a major multi-national financial services institution. The Company feels that this acquisition presents an opportunity for us to acquire new customer relationships, as we are now the largest independently owned community bank in our market. The Company feels the potential to acquire new relationships, and in turn lower cost core deposits, warrants additional advertising and marketing efforts, which have been reflected in this category. During the three and six months ended June 30, 2007, the Company has begun to see significant rises in core deposits which can be attributed in part to the additional expenses incurred within this category.

Provision for Income Taxes

The provision for income taxes was 38.3% and 36.1% and 38.1% and 36.7% of net pre-tax income for the three and six months ending June 30, 2007 and 2006, respectively.

FINANCIAL CONDITION ANALYSIS

Total assets of the Company were $589.9 million at June 30, 2007 compared to $541.8 million at December 31, 2006. This represents an increase of $48.1 million or approximately 8.9%.

Loans

Total gross loans as of June 30, 2007, increased by $15.0 million over the year ended December 31, 2006. The growth in the loan portfolio was primarily attributable to a $13.5 million or 15.8% increase in commercial, financial, and agricultural loan balances during the first six months of 2007.

The table below sets forth changes from December 31, 2006 to June 30, 2007 for the composition of the loan portfolio:

(dollars in thousands) | | June 30, | | December 31, | | Variance | |

| | | 2007 | | 2006 | | dollar | | percentage | |

Loan Classifications: | | | | | | | | | | | | | |

| Commercial, financial, and agricultural | | $ | 98,440 | | $ | 84,976 | | $ | 13,464 | | | 15.84 | % |

| Real estate-construction/land | | | 100,998 | | | 105,712 | | | (4,714 | ) | | -4.46 | % |

| Real estate - other | | | 245,110 | | | 237,401 | | | 7,709 | | | 3.25 | % |

| Home equity lines of credit | | | 9,330 | | | 10,792 | | | (1,462 | ) | | -13.54 | % |

| Installment loans to individuals | | | 5,711 | | | 5,598 | | | 113 | | | 2.01 | % |

| All other loans (including overdrafts) | | | 390 | | | 504 | | | (114 | ) | | -22.64 | % |

| Total loans, gross | | | 459,979 | | | 444,983 | | | 14,996 | | | 3.37 | % |

| | | | | | | | | | | | | | |

| Less - deferred loan fees, net | | | 1,559 | | | 1,625 | | | (66 | ) | | -4.03 | % |

| Less - reserve for possible loan losses | | | 4,520 | | | 4,081 | | | 439 | | | 10.75 | % |

| | | | | | | | | | | | | | |

| Total loans, net | | $ | 453,900 | | $ | 439,277 | | $ | 14,623 | | | 3.33 | % |

| | | | | | | | | | | | | | |

| Loans held for sale | | $ | 3,329 | | $ | 1,764 | | $ | 1,565 | | | 88.74 | % |

Commercial, Financial & Agricultural

The increase in commercial, financial and agricultural loans is attributed primarily to a $2.5 million loan to acquire a chain of hair salons, four loans totaling $2.7 million to an oil field maintenance company for equipment, a $1.5 million loan to a winery, a $1.2 million agricultural property loan, $1.2 million to an accounting firm, $1.1 million to purchase a restaurant and numerous other new $0.5 to $1.0 million business lines of credit to medical groups, contractors and others.

Real Estate - Construction & Land

The decrease in real estate-construction loans can be attributed to construction loans moving into longer term mortgages and to payoffs through outside sources. New loans during the period include: a hotel project for $1.2 million, an addition to a strip center for $1.5 million, a spec residence for $1.4 million, a warehouse for $1.4 million, commercial/industrial buildings for $4.2 million, a hotel for $1.7 million, a land loan for $1.1 million and numerous other smaller projects. Construction loans are typically granted for a one year period and then, with income properties, are amortized over not more than 30 years with 10 to 15 year maturities.

The Bank presently has a concentration of loans in construction/land in the amount of $100.9 million which represents 188% of the Company’s Tier I Capital. Of this, 47% are owner occupied thus the concentration is 141% net of owner occupied. Un-disbursed commitments total $26.6 million which combined with disbursed represent 238% of the Bank’s Tier I Capital with 38% owner occupied. At June 30, 2007 there were 65 construction loans with outstanding balances and remaining commitments of approximately $77.8 million and $24.4 million, respectively. The single largest construction loan has an original commitment amount of approximately $12.6 million with a balance of approximately $7.4 million at June 30, 2007. The loan is for an office complex in San Luis Obispo, California. At June 30, 2007, there were 52 land loans with an aggregate balance of approximately $23.2 million. The single largest land loan is for a residential tract development with a commitment of $4.8 million and balance of $3.0 million. While these loans may be considered somewhat riskier than certain other real estate loans, the construction/land loans are spread throughout our market area and have consistently performed in a satisfactory manner.

Single family residence construction loans represent 20.6% of the total construction and land loan commitments. Land loans account for 20.6%, multiple family income properties for 9.8%, owner-occupied commercial properties for 21.3% and non-owner-occupied commercial properties for 27.7%. At June 30, 2007, there were no tract loans within this category.

Real Estate - Commercial & Other

The increase in commercial real estate loans is attributed to several loans in the construction/land category moving into amortizing loans and to new commercial property loans. However, during the fist six months of 2007, the Bank booked new loans in this category including an airport fuel/service facility for $4.3 million, a medical office for $1.3 million, an auto dealership for $1.5 million, a metal fabrication building for $1.0 million and several smaller real estate loans. Additionally, during the period, numerous loans were also refinanced and paid off through out of area lenders and mortgage brokers.

Hotel loans disbursed are not considered to be a concentration with balances of $46.8 million which represents 95.5% of the Bank’s Tier I Capital. There are several hotel construction loans that increase total commitments to $62.1 million which represents a concentration at 116% of the Bank’s Tier I Capital. At June 30, 2007, there were 35 motel loans. The single largest loan is a construction loan for $9.2 million with $8.8 million disbursed, for luxury suite/spa facility located in Paso Robles, California. The hotel loans are also made to clients throughout our market. These loans have historically paid as agreed.

In September 2004, the Bank issued an $11.7 million irrevocable standby letter of credit to guarantee the payment of taxable variable rate demand bonds. The primary purpose of the bond issue was to refinance existing debt and provide funds for capital improvements and expansion of an assisted living facility in San Luis Obispo. The project is 100% complete with lease up in process. The letter of credit will expire in September 2008.

Summary of Market Condition

The Company’s market area continues to remain attractive with single family residence and commercial real estate prices considerably lower than the major metropolitan areas to the Company’s North and South. However, construction loan demand for both single family and commercial real estate moderated during the first half of 2007, caused primarily by an increase in interest rates, construction costs, and a decrease in consumer demand. As a result of slowing home sales, some builders have begun to offer buyer incentives, competitive mortgage rates, and creative financing options to help spur sales, but with little success. Although growth in the loan portfolio has moderated during the first half of 2007, indirectly related to the slowdown in single family residential sales, the Company believes the desirability of the area and the diversity of the portfolio will provide some insulation against a significant slowing in growth overall. Additionally, the Company has and will continue to monitor lending trends in order to take the appropriate steps if necessary to mitigate any material adverse impact the slowing of the single family residential market may have on the loan portfolio overall.

Business properties have remained in high demand with relatively low vacancies and competitive loan rates. Commercial property values and rental rates increased during 2006 and have remained relatively strong in 2007. Lease absorption rates appear to have slowed during the first half of this year. Investors, many seeking exchange properties, continue to pursue properties in our market area. Capitalization rates have steadily decreased with increased demand. Capitalization rate (the rate at which a stream of future cash flows is discounted to find their present value) ranges over the last three years are: 6.5% to 7.5% in 2004, 5.5% to 6.5% in 2005, and 5.0% to 6.5% in 2006. Low capitalization rate properties typically require larger down payments in order to satisfy bank debt coverage requirements. The Bank has, thus far, experienced continued growth in commercial real estate loans this year. Interest rate margins are expected to decrease somewhat due to competitive pressures and increasing cost of funds.

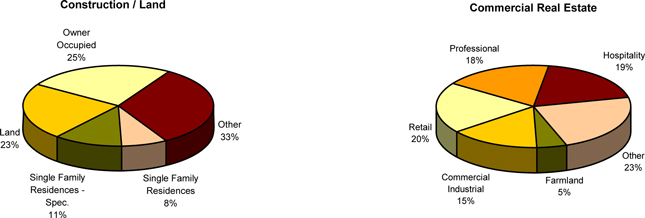

The following charts give a breakdown of types of Construction/Land Loans and types of Commercial Real Estate loans as of June 30, 2007:

Loans held for sale consist of mortgage originations that have already been sold pursuant to correspondent mortgage loan agreements. There is no interest rate risk associated with these loans as the commitments are in place at the time that the Bank funds them. Settlement from the correspondents is typically within 30 to 45 days.

At June 30, 2007, the Bank had no foreign loans outstanding. The Bank did not have any concentrations of loans except as disclosed above.

The Bank’s management is responsible for monitoring loan performance, which is done through various methods, including a review of loan delinquencies and personal knowledge of customers. Additionally, the Bank maintains both a “watch” list of loans that, for a variety of reasons, management believes requires regular review as well as an internal loan classification process. Annually, the loan portfolio is also reviewed by an experienced, outside loan reviewer not affiliated with the Bank. A list of delinquencies, the watch list, loan grades and the outside loan review are reviewed regularly by the Bank’s Board of Directors.

The Bank has a non-accrual policy that requires a loan greater than 90 days past due to be placed on non-accrual status unless such loan is well-collateralized and in the process of collection. When loans are placed on non-accrual status, all uncollected interest accrued is reversed from earnings. Once on non-accrual status, interest on a loan is only recognized on a cash basis. Loans may be returned to accrual status if management believes that all remaining principal and interest is fully collectible and there has been at least six months of sustained repayment performance since the loan was placed on non-accrual. At June 30, 2007 non-accrual loans were $555 thousand. Of this balance, approximately $277 thousand is secured by a first trust deed and approximately $87 thousand is SBA guaranteed.

If a loan’s credit quality deteriorates to the point that collection of principal is believed by management to be doubtful and the value of collateral securing the obligation is sufficient the Bank generally takes steps to protect and liquidate the collateral. Any loss resulting from the difference between the loan balance and the fair market value of the property is recognized by a charge to the reserve for loan losses. When the property is held for sale after foreclosure, it is subject to a periodic appraisal. If the appraisal indicates that the property will sell for less than its recorded value, the Bank recognizes the loss by a charge to non-interest expense.

The following table provides a summary of non-performing loans and assets as of June 30, 2007 compared to December 31, 2006 as well as key asset quality ratios:

| | | June 30, | | December 31, | |

(dollars in thousands) | | 2007 | | 2006 | |

| | | | | | |

| Loans delinquent 90 days or more and still accruing | | $ | - | | $ | - | |

| Non-accruing loans | | | 555 | | | 55 | |

| Total non-performing loans | | $ | 555 | | $ | 55 | |

| Foreclosed collateral | | | - | | | - | |

| Total non-performing assets | | $ | 555 | | $ | 55 | |

| | | | | | | | |

| Ratio of allowance for credit losses to total gross loans | | | 0.98 | % | | 0.92 | % |

| | | | | | | | |

| Ratio of allowance for credit losses to total non-performing loans | | | 814 | % | | 7420 | % |

| | | | | | | | |

| Ratio of non-performing loans to total gross loans | | | 0.12 | % | | 0.01 | % |

| | | | | | | | |

| Ratio of non-performing loans to total assets | | | 0.09 | % | | 0.01 | % |

Total Cash and Due from Banks

Total cash and due from banks was $20.9 million and $19.2 million at June 30, 2007 and December 31, 2006, respectively. This line item will vary depending on cash letters from the previous night and actual cash on hand in the branches.

Investment Securities and Other Earning Assets

Other earning assets are comprised of Federal Home Loan Bank stock, Federal Funds sold (funds the bank lends on a short-term basis to other banks), investments in securities and short-term interest bearing deposits at other financial institutions. These assets are maintained for liquidity needs of the Bank, collateralization of public deposits, and diversification of the earning asset mix.

The table below sets forth changes from December 31, 2006 to June 30, 2007 for the composition of other earning assets.

| | | June 30, | | December 31, | | Variance | |

(dollars in thousands) | | 2007 | | 2006 | | dollar | | percentage | |

| | | | | | | | | | |

| Federal Home Loan Bank stock | | $ | 3,119 | | $ | 2,350 | | $ | 769 | | | 32.72 | % |

| | | | | | | | | | | | | | |

| Available-for-sale securities | | | 36,018 | | | 38,445 | | | (2,427 | ) | | -6.31 | % |

| | | | | | | | | | | | | | |

| Federal funds sold | | | 43,505 | | | 3,870 | | | 39,635 | | | 1024.16 | % |

| | | | | | | | | | | | | | |

| Interest bearing deposits other financial institutions | | | 318 | | | 318 | | | - | | | 0.00 | % |

| | | | | | | | | | | | | | |

| Total other earning assets | | $ | 82,960 | | $ | 44,983 | | $ | 37,977 | | | 84.43 | % |

Investments available-for-sale decreased due to cash flow on Mortgage Backed Securities (MBS) and Collateralized Mortgage Obligations (CMO).

Federal funds sold increased $39.6 million when compared to December 31, 2006. The amount of Fed funds sold can vary widely on a daily basis depending on the cash position of the bank which is affected by numerous variables such as cash letters, incoming and outgoing wire activity, and loan funding needs.