Exhibit 99.2 S S I M W A V E A C Q U I S I T I O N / S T R A T E G I C U P D A T E S E P T E M B E R 2 0 2 2

F O R W A R D - L O O K I N G S T A T E M E N T S This strategic update contains forward looking statements that are based onIMAX management’s assumptions on Form 10-K and Quarterly Reports on Form 10-Q. The Company undertakes no obligation to update and existing information and involve certainrisks and uncertainties which could cause actual results to differ publicly or otherwise revise any forward-looking statements, whether as a result of new information, future materially from future results expressed or implied by such forward looking statements. These forward looking events or otherwise. statements include, but are not limited to, statementsregarding the benefits of the acquisition, the anticipated products of the combined company, business and technology strategies and measures to implement strategies, competitive strengths, goals, expansion and growth ofbusiness, operations and technology, industry prospects and consumerbehavior, plans and references to the future success of IMAX Corporation together with its consolidated subsidiaries (the “Company”) and expectations regarding the Company’s future operating, financial and technological results.These forward-looking statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate in the circumstances. However, whether actual results and developments will conform with theexpectations and predictions of the Company is subject to a number of risks and uncertainties, including, but not limited to, risks that the acquisition disrupts current plans and operations of the Company or SSIMWAVE and potential difficulties in employee retention as a result of the acquisition; risks related todiverting management’s attention from ongoing business operations; the failure to successfully integrate SSIMWAVE’s operations, products, and technology; failure to implement plans, forecasts, and other expectations with respect to SSIMWAVE’s business after the acquisition and realize additional opportunitiesfor growth and innovation; other factors and risks outlined in our periodic filings with the United States Securities and Exchange Commission or in Canada, the SEDAR; and other factors, many of which are beyond the control of the Company. Consequently, all of the forward-looking statements made in this strategic update are qualified by these cautionary statements, and actual results oranticipated developments by the Company may not be realized, and even if substantially realized, may not have the expected consequences to, or effects on, the Company. These factors, other risks and uncertainties and financial detailsare discussed in IMAX’s most recent Annual Report 2

® Expanding The IMAX Experience to deliver the highest quality images on any screen 3

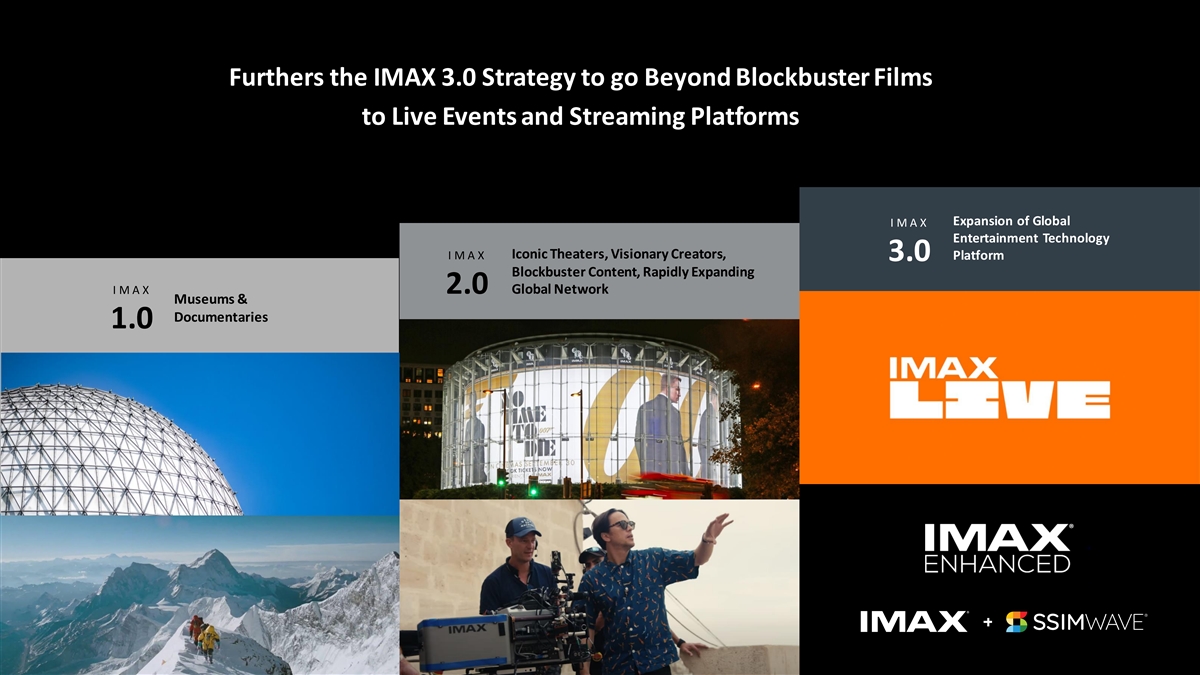

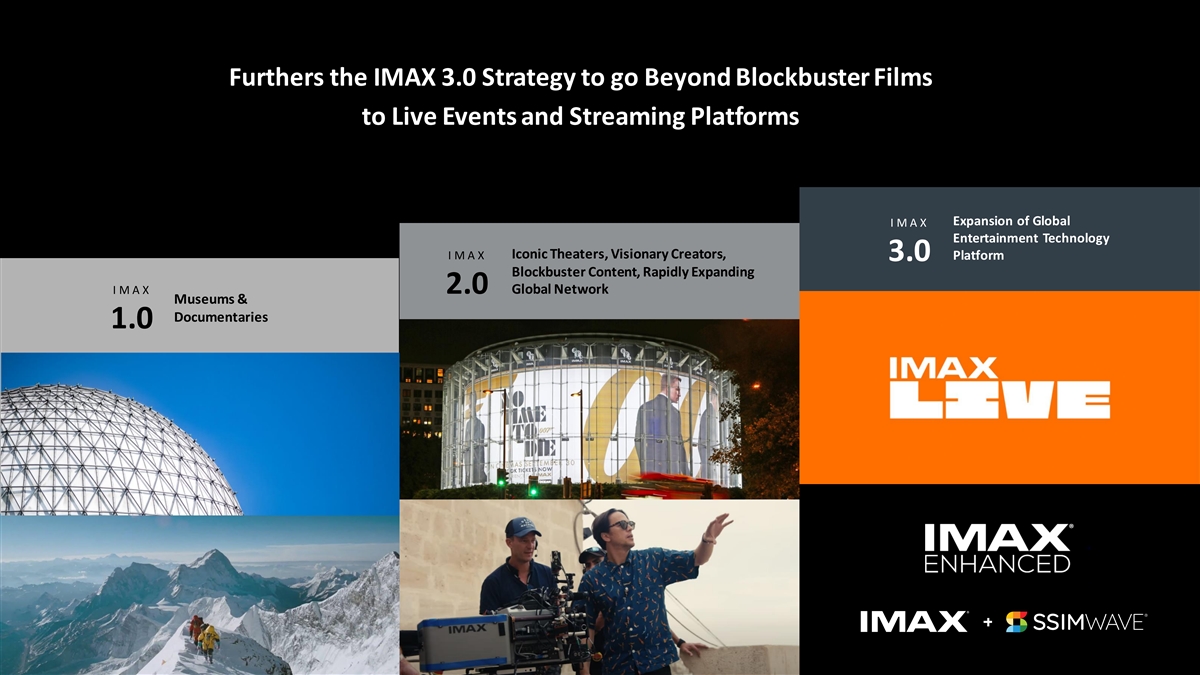

Furthers the IMAX 3.0 Strategy to go Beyond Blockbuster Films to Live Events and Streaming Platforms Expansion of Global I M A X Entertainment Technology Iconic Theaters, Visionary Creators, I M A X Platform 3.0 Blockbuster Content, Rapidly Expanding I M A X 2.0 Global Network Museums & Documentaries 1.0

S T R A T E G I C R A T I O N A L E IMAX + SSIMWAVE grows our global leadership in entertainment technology and diversifies our business with new, non-theatrical recurring revenue Deepen IMAX Technology Accelerate & Scale Revolutionize IMAX's Capabilities to and IP Moat SSIMWAVE's Business Drive New Revenue Leverage IMAX strengths to accelerate Expand our image enhancement capabilities across Leverage SSIMWAVE tech/IP to extend IMAX’s SSIMWAVE's growth platforms - streaming, gaming, VR/AR, the technological differentiation metaverse • Brand reputation for high entertainment • Advanced data mapping of the human visual quality Tap into a large new addressable market system • Deep industry relationships • AI expertise from team of 30 software engineers • Global footprint • Global patent portfolio 5

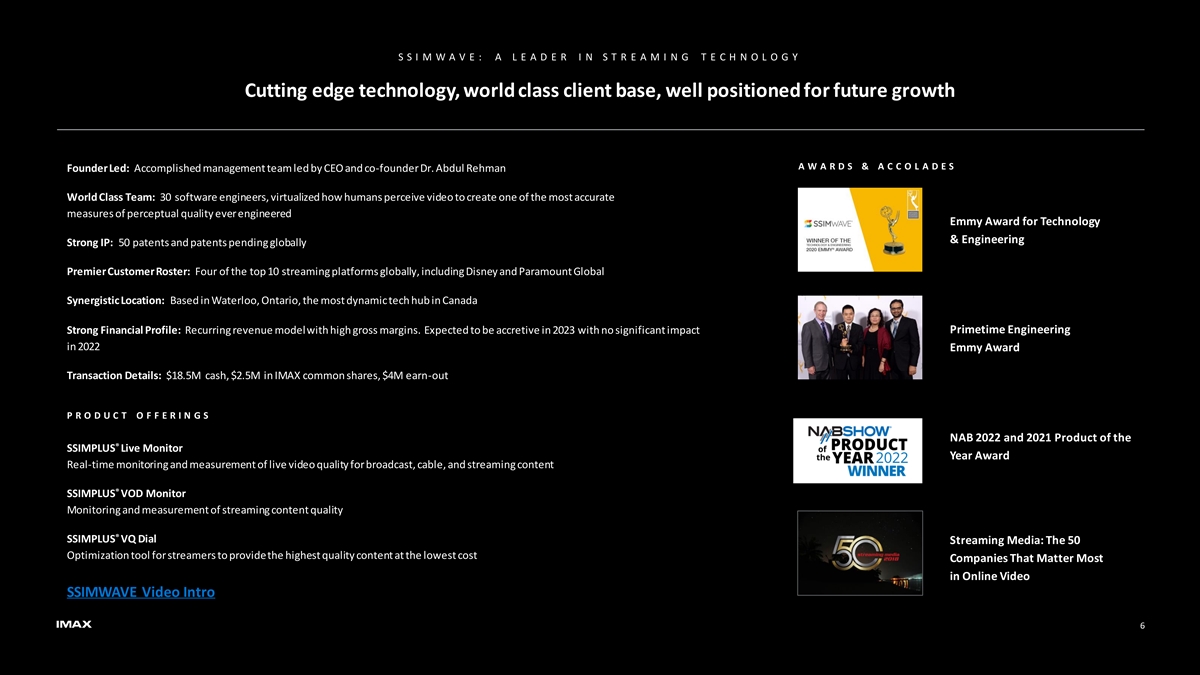

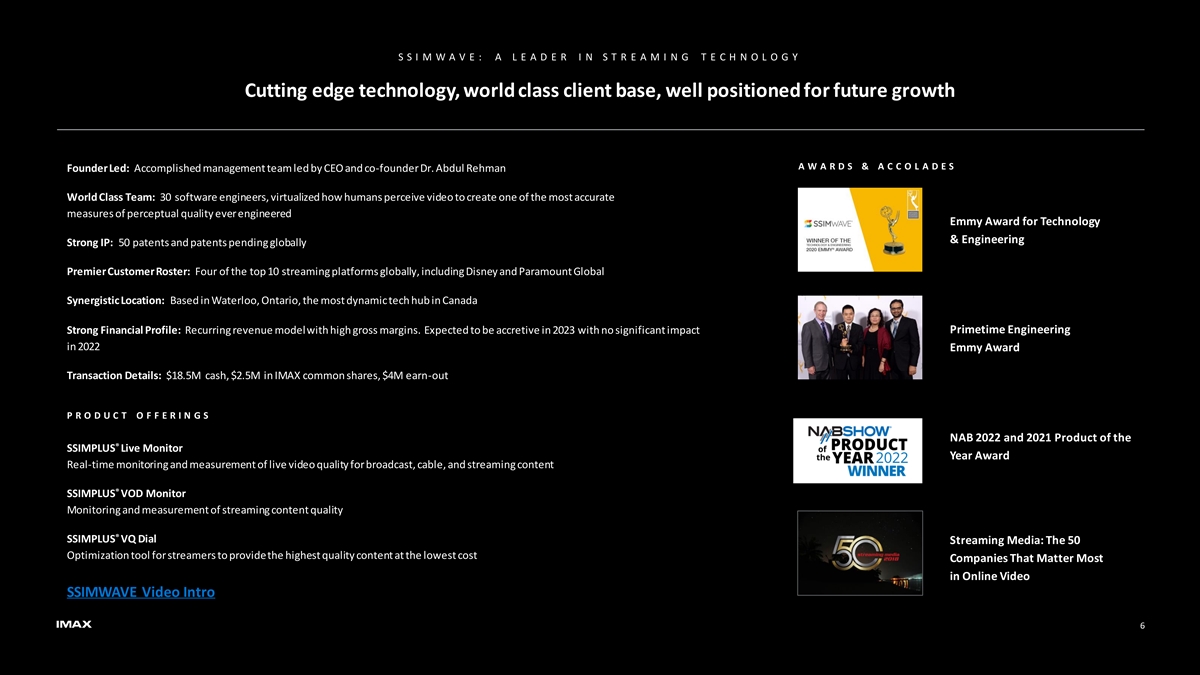

S S I M W A V E : A L E A D E R I N S T R E A M I N G T E C H N O L O G Y Cutting edge technology, world class client base, well positioned for future growth A W A R D S & A C C O L A D E S Founder Led: Accomplished management team led by CEO and co-founder Dr. Abdul Rehman World Class Team: 30 software engineers, virtualized how humans perceive video to create one of the most accurate measures of perceptual quality ever engineered Emmy Award for Technology & Engineering Strong IP: 50 patents and patents pending globally Premier Customer Roster: Four of the top 10 streaming platforms globally, including Disney and Paramount Global Synergistic Location: Based in Waterloo, Ontario, the most dynamic tech hub in Canada Strong Financial Profile: Recurring revenue model with high gross margins. Expected to be accretive in 2023 with no significant impact Primetime Engineering in 2022 Emmy Award Transaction Details: $18.5M cash, $2.5M in IMAX common shares, $4M earn-out P R O D U C T O F F E R I N G S NAB 2022 and 2021 Product of the ® SSIMPLUS Live Monitor Year Award Real-time monitoring and measurement of live video quality for broadcast, cable, and streaming content ® SSIMPLUS VOD Monitor Monitoring and measurement of streaming content quality ® SSIMPLUS VQ Dial Streaming Media: The 50 Optimization tool for streamers to provide the highest quality content at the lowest cost Companies That Matter Most in Online Video SSIMWAVE Video Intro 6

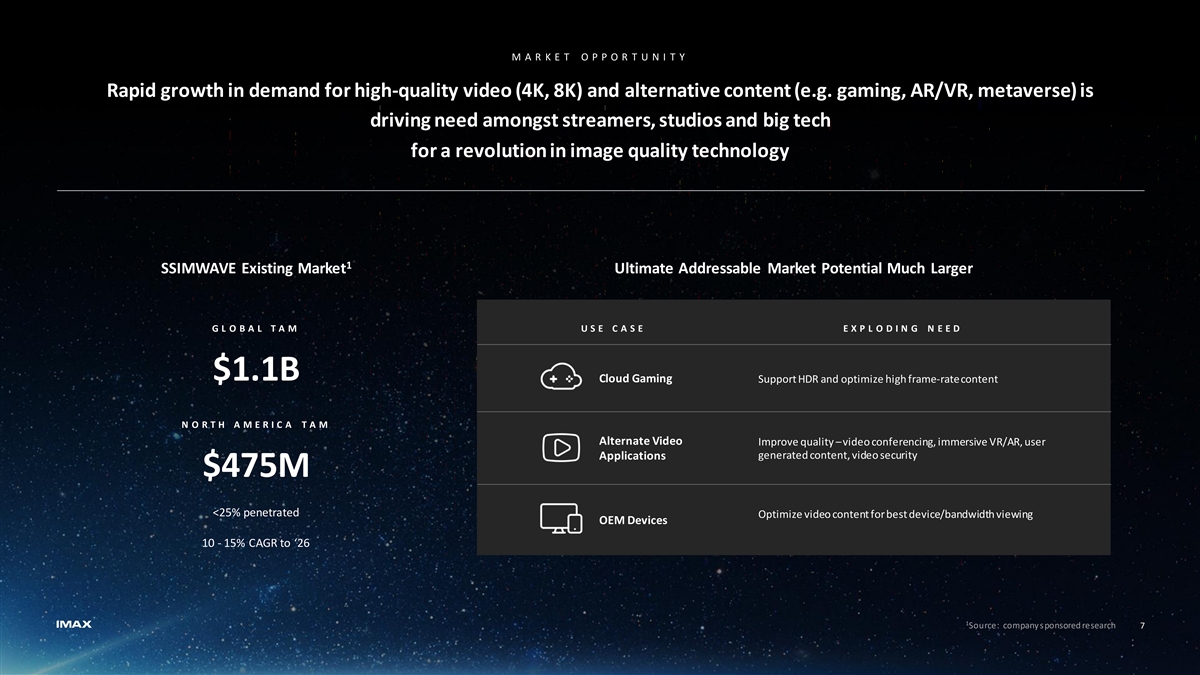

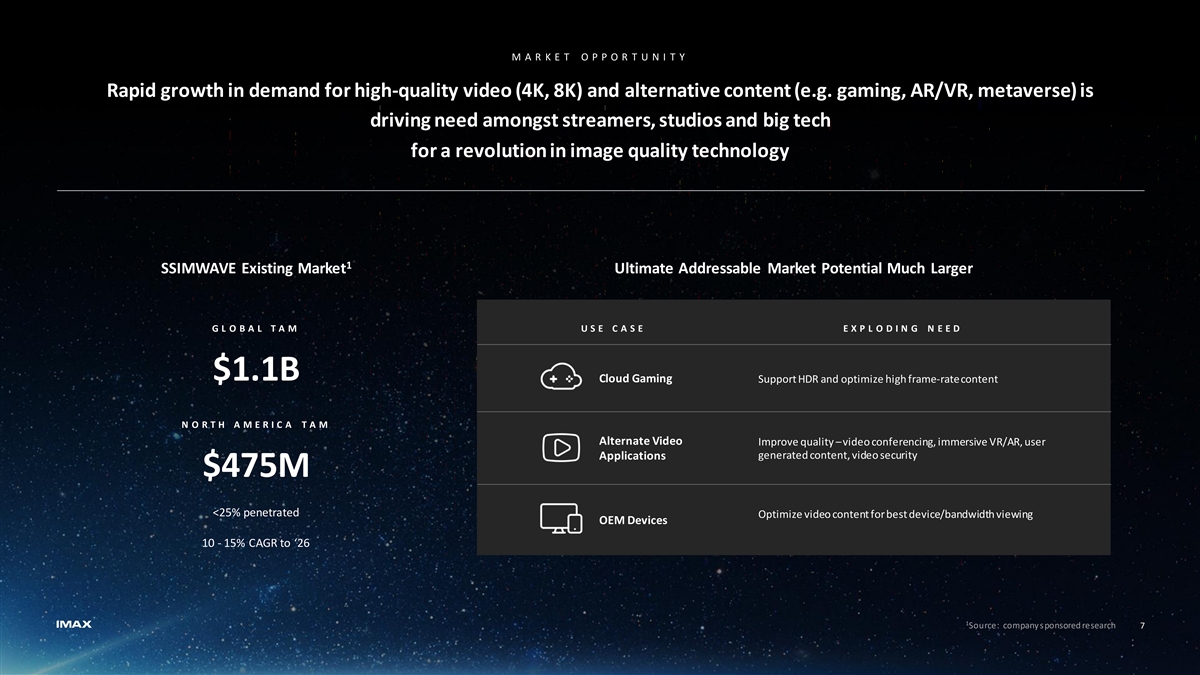

M A R K E T O P P O R T U N I T Y Rapid growth in demand for high-quality video (4K, 8K) and alternative content (e.g. gaming, AR/VR, metaverse) is driving need amongst streamers, studios and big tech for a revolution in image quality technology 1 SSIMWAVE Existing Market Ultimate Addressable Market Potential Much Larger G L O B A L T A M U S E C A S E E X P L O D I N G N E E D $1.1B Cloud Gaming Support HDR and optimize high frame-rate content N O R T H A M E R I C A T A M Alternate Video Improve quality –video conferencing, immersive VR/AR, user Applications generated content, video security $475M <25% penetrated Optimize video content for best device/bandwidth viewing OEM Devices 10 - 15% CAGR to ‘26 1 Source: company sponsored research 7