UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☒ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

SSR MINING INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

| | | | | |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| SSR Mining Inc. |

|

| 2023 Proxy Statement |

6900 E. Layton Avenue, Suite 1300, Denver, Colorado 80237

www.ssrmining.com

April 14, 2023

Dear Shareholder:

We are pleased to invite you to the Annual Meeting of the Shareholders of SSR Mining Inc., which will be held virtually on May 25, 2023 at 10:00 a.m. MDT (Denver).

The Annual Meeting provides us with a valuable opportunity to consider matters of importance to the Company with Shareholders (as defined below), and we look forward to your participation. The accompanying Notice of Annual Meeting of Shareholders and proxy statement (the “Proxy Statement”) describes the business to be conducted at the meeting and provides information on SSR Mining Inc.’s approach to executive compensation and governance practices. We invest significant time and effort to ensure our compensation programs are competitive in the market and appropriately aligned with the achievement of business results and long-term Shareholder interests. Annually, we conduct a robust Shareholder outreach program and the disclosures contained in the accompanying Proxy Statement reflect feedback received during our outreach program.

Your participation in the affairs of the Company is important to us and we encourage you to vote your Shares.

If you have any questions about the information contained in this Proxy Statement or require assistance in voting your Shares, please contact Laurel Hill Advisory Group, our proxy solicitation agent, by calling toll-free at 1-877-452-7184 (for Shareholders in Canada or the United States) or 1-416-304-0211 (for Shareholders outside North America) or by e-mail at assistance@laurelhill.com. If you are a holder of SSR Mining Inc.’s CHESS depositary interests in Australia, you can contact Laurel Hill by calling toll-free at 1-800-861-409 or by e-mail at assistance@laurelhill.com.

The Board and management look forward to your participation at the Annual Meeting and thank you for your continued support.

Sincerely,

/s/ Rod Antal

Rod Antal

President & Chief Executive Officer

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | | | | |

| Date and Time: | May 25, 2023, 10:00 a.m. MDT (Denver) . |

| Place: | The Annual Meeting will be held as a virtual meeting via live webcast on the Internet. Because the meeting is completely virtual and being conducted via the Internet, shareholders will not be able to attend the meeting in person. You will be able to attend the Annual Meeting, vote and submit your questions on the day of the meeting via the Internet by visiting 'https://meetnow.global/MWX2WMC and entering the control number included on your proxy card. . |

| Items of Business: | •Elect the directors named in this Proxy Statement, each to serve until the next annual meeting of shareholders and until their respective successors are elected and qualified, or until their earlier resignation or removal; •To approve on an advisory (non-binding) basis, the compensation of the Company’s named executive officers disclosed in this Proxy Statement; •To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year ending December 31, 2023; and •To transact other business that may properly come before the Annual Meeting, or any adjournments or postponements thereof. . |

| Record Date: | The Board of Directors set March 28, 2023 as the record date for the Annual Meeting (the “Record Date”). Only shareholders of record at the close of business on the Record Date are entitled to receive notice of, and to vote at, the Annual Meeting. . |

| Voting: | Your vote is very important. Whether or not you plan to attend the Annual Meeting virtually, we encourage you to read the Proxy Statement and submit your proxy or voting instructions as soon as possible. You can vote your shares electronically via the Internet, by telephone or by completing and returning the proxy card or voting instruction card if you requested paper proxy materials. Voting instructions are printed on your proxy card and included in the accompanying proxy statement. You can revoke a proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the Proxy Statement. |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Company is sending out proxy-related materials to Shareholders using the notice-and-access mechanism that came into effect on February 11, 2013 under National Instrument 54-101 – Communications with Beneficial Owners of Securities of a Reporting Issuer. Notice-and-access is a set of rules that allows issuers to post electronic versions of proxy-related materials (such as proxy statements and annual financial statements) online rather than mailing paper copies of such materials to Shareholders. Our annual report on Form 10-K for the year ended December 31, 2022 and the 2023 Proxy Statement are available free of charge at www.ssrmining.com, and the Company's page on EDGAR (www.sec.gov/edgar.shtml) and on SEDAR (www.SEDAR.com). You can also request copies of these documents by contacting the Company’s transfer agent, Computershare Investor Services Inc. (“Computershare”), by telephone at 1-866-962-0498.

By order of the Board of Directors,

/s/ Michael J. Sparks

Michael J. Sparks

Chief Legal and Administrative Officer and Secretary

April 14, 2023

ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS CDI VOTING PROCESS

The 2023 Annual and Special Meeting (the “Meeting”) of holders of common shares (“Shareholders”) of SSR Mining Inc. (the “Company”) will be held virtually on May 25, 2023 at 10:00 a.m. MDT (Denver). The Meeting provides Shareholders with an opportunity to participate directly in the affairs of the Company. Please see the accompanying Notice of Annual and Special Meeting for further details.

As the common shares of the Company are listed on the Australian Securities Exchange (the “ASX”) in the form of CHESS Depositary Interests (“CDIs”), the Company would like to remind CDI holders of the particular requirements and restrictions that their votes will be subject to. Each CDI represents a beneficial interest in one common share of the Company. CDI holders do not actually own direct legal title to common shares, which is held for and on behalf of CDI holders by CHESS Depositary Nominees Pty Ltd. (“CDN”), a wholly owned subsidiary of ASX Limited. This structure exists because the Company is listed on a Canadian exchange with a right to have its securities traded on the ASX by way of CDIs.

This arrangement impacts how CDI holders can record their votes for the matters to be tabled at the Meeting. As CDIs are technically rights to common shares held on behalf of CDI holders by CDN, CDI holders need to provide confirmation of their voting intentions to CDN before the Meeting. CDN will then exercise the votes on behalf of CDI holders. If a CDI holder wishes to vote, they must register their vote with CDN by using the CDI Voting Instruction Form (“VIF”) provided.

CDI holders who have questions about the information contained in this Proxy Statement or require assistance with voting can contact our proxy solicitation agent, Laurel Hill Advisory Group, for assistance by calling toll-free at 1-800-861-409 or by e-mail at assistance@laurelhill.com.

To have a CDI vote counted, CDI holders must return their completed VIF to CDN no later than 12:00 p.m. on May 22, 2023. This deadline has been set to allow CDN sufficient time to collate the votes of CDI holders and submit them to the Company no later than 5:00 p.m. MDT (Denver) on the second business day preceding the date of the Meeting or any adjournment thereof.

The Company appreciates your support and your interest in the Company and looks forward to your continued support. The Company encourages CDI holders to lodge their votes ahead of the Meeting in the manner specified above.

Yours Sincerely,

SSR MINING INC.

/s/ Rod Antal

Rod Antal

President & Chief Executive Officer

| | | | | | | | | | | | | | |

TABLE OF CONTENTS TABLE OF CONTENTS |

|

| LETTER TO SHAREHOLDERS | i | | PROPOSAL No. 2 - Approval, on an Advisory (Non- | 29 |

| NOTICE OF ANNUAL MEETING OF | ii | | Binding) Basis, of the Compensation of the Company’s | |

| SHAREHOLDERS | | | Named Executive Officers Disclosed in the 2022 Proxy | |

| CDI VOTING PROCESS | iii | | Statement | |

| TABLE OF CONTENTS | iv | | REPORT OF THE COMPENSATION & LEADERSHIP | 30 |

| BUSINESS OF THE MEETING | 1 | | DEVELOPMENT COMMITTEE | |

| Meeting Format | 1 | | Shareholder Outreach | 30 |

| Record Date and Entitlement to Vote | 1 | | Recommendations | 30 |

| Items of Business | 1 | | COMPENSATION DISCUSSION AND ANALYSIS | 31 |

| Voting Policies | 2 | | Named Executive Officers | 31 |

| General Information | 2 | | Compensation Philosophy | 32 |

| Annual Report on Form 10-K and Additional | 2 | | Board Oversight and Compensation Governance | 33 |

| Information | | | Compensation-Related Risk | 33 |

| ENVIRONMENTAL, HEALTH, SAFETY, | 3 | | Compensation Decision-Making Process | 34 |

| SUSTAINABILITY AND COMMUNITY | | | Elements of Compensation | 35 |

| Commitment to Sustainability | 3 | | 2022 Compensation Results | 38 |

| Sustainability Report | 3 | | Executive Share Ownership Guidelines | 40 |

| Environment and Climate Change | 3 | | Employment Agreements | 41 |

| Health and Safety | 4 | | EXECUTIVE COMPENSATION TABLES | 42 |

| Community Relations | 5 | | Summary Compensation Table | 42 |

| HUMAN CAPITAL MANAGEMENT | 6 | | Grants of Plan-Based Awards | 43 |

| PROPOSAL No. 1 - Election of Directors | 8 | | Outstanding Equity Awards at Fiscal Year-End | 44 |

| NOMINEES FOR ELECTION TO THE BOARD OF | 9 | | Option Exercises and Stock Vested | 45 |

| DIRECTORS | | | Securities Authorized for Issuance under Equity | 45 |

| Our Board of Directors | 9 | | Compensation Plan | |

| Skills Composition of the Board | 19 | | Pension Benefits and Nonqualified Deferred | 45 |

| CORPORATE GOVERNANCE | 20 | | Compensation Tables | |

| Board Tenure and Term Limits | 20 | | Potential Payments upon Termination or Change in | 46 |

| Director Independence | 21 | | Control | |

| Inclusion and Diversity | 21 | | CEO Pay Ratio | 48 |

| Director Share Ownership Guidelines | 22 | | Pay Versus Performance | 49 |

| Nomination of Directors and Criteria for Board | 22 | | PROPOSAL No. 3 - Ratification of Appointment of | 52 |

| Membership | | | Independent Registered Public Accounting Firm | |

| Board Leadership Structure | 23 | | REPORT OF THE AUDIT COMMITTEE | 53 |

| Director Independence and Categorical Standards | 23 | | Risk Management and Conflicts of Interest | 53 |

| Performance of the Board | 23 | | Independent External Auditor | 53 |

| Director Orientation and Continuing Education | 23 | | Recommendations | 55 |

| Board Meetings | 24 | | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL | 56 |

| Board and Committee Chair Position Descriptions | 24 | | OWNERS AND MANAGEMENT | |

| Board Committees | 25 | | Certain Beneficial Owners | 57 |

| Procedures for Approval of Related Persons | 26 | | CERTAIN RELATIONSHIPS AND RELATED PARTY | 58 |

| Transactions | | | TRANSACTIONS | |

| Anti-Hedging Policy | 26 | | Related Party Transactions | 58 |

| Communications with the Board | 26 | | Interest of Certain Persons in Matters to be Acted Upon | 58 |

| DIRECTOR COMPENSATION | 27 | | Management Contracts | 58 |

| | | | | | | | | | | | | | |

| Indebtedness of Officers and Directors | 58 | | VOTING INSTRUCTIONS | 63 |

| OTHER MATTERS | 58 | | Registered Shareholder Voting | 63 |

| GENERAL VOTING MATTERS | 59 | | Non-Registered Shareholder Voting | 64 |

| Voting Rights | 59 | | Canada – Voting Instructions | 65 |

| How to Vote | 59 | | Australia – Voting Instructions | 66 |

| Revoking a Proxy | 60 | | Appointment of a Third-Party as Proxy | 66 |

| Solicitation | 60 | | To Register your Proxyholder | 66 |

| Votes Required | 60 | | Deadlines for Voting | 67 |

| Quorum | 60 | | Revoking your Proxy | 67 |

| Notice-and-Access | 61 | | Revocation of Voting Instruction Forms and Proxies | 67 |

| Householding | 61 | | APPENDIX A - Non-GAAP Financial Measures | A-1 |

| Shareholder Proposals for the 2024 Annual Meeting of | 61 | | APPENDIX B - How to Participant in the Meeting | B-1 |

| Shareholders | | | Online | |

| Future Annual Meeting Business | 61 | | PROXY CARD | |

The 2023 Annual Meeting of Shareholders (the “Annual Meeting”) of SSR Mining Inc. (“SSR Mining,” the “Company,” “we,” “us” and “our”) will take place on May 25, 2023 at 10:00 a.m. MDT (Denver).

This Proxy Statement references policies, guidelines and other documents of the Company that are located on the Company’s website. The information on our website, including specific documents we reference, are not, and shall not be deemed to be, a part of this Proxy Statement or incorporated into any other filings we make with the United States Securities and Exchange Commission (the “SEC”) on EDGAR or with Canadian regulatory authorities through SEDAR.

Meeting Format

This year’s Annual Meeting will be a completely virtual meeting of Shareholders through an audio webcast live over the Internet. There will be no physical meeting location. The meeting will only be conducted via an audio webcast. Please go to https://meetnow.global/MWX2WMC to access and participate in the Annual Meeting. Any shareholder may attend and listen live to the webcast of the Annual Meeting over the Internet at such website. Shareholders as of the record date may vote and submit questions while attending the Annual Meeting via the Internet by following the instructions listed on your proxy card. The webcast starts at 10:00 a.m. MDT, on May 25, 2023. We encourage you to access the meeting prior to the start time.

You may vote by telephone, over the Internet or by completing, signing, dating and returning your proxy card as soon as possible. For more information on how to attend and participate in the Meeting online, please refer to the “General Voting Information” section of this Proxy Statement.

Record Date and Entitlement to Vote

Only holders of the Company’s common shares (the “Shares”) as recorded in our stock register at the close of business on March 28, 2023 (the “Record Date”), may vote at the annual meeting. On March 28, 2023, there were 206,868,001 Shares issued and outstanding. As of the date of this Proxy Statement, the Company has not issued any shares of preferred stock, no Shares have multiple voting rights and there are no non-voting Shares. Each Share is entitled to one vote per share on any matter submitted to a vote of our Shareholders.

Items of Business

| | | | | | | | |

| | Voting Recommendation |

| Proposal 1: | Elect the directors named in this Proxy Statement, each to serve until the next annual meeting of shareholders and until their respective successors are elected and qualified, or until their earlier resignation of removal. | FOR each nominee |

| Proposal 2: | To approve on an advisory (non-binding) basis, the compensation of the Company’s named executive officers disclosed in this Proxy Statement. | FOR |

| Proposal 3: | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. | FOR |

Aside from the aforementioned voting matters, the Company’s board of directors (“Board of Directors” or the “Board”) knows of no matters to be presented at the Annual Meeting. If any other matter is properly brought before the Annual Meeting, shares represented by all proxies received by the Board will be voted with respect thereto in accordance with the judgment of the persons appointed as proxies.

Voting Policies

Under the Company’s majority voting policy, all general business matters to be considered at the Meeting will each be determined by a majority of votes cast at the Meeting by proxy or in person. General business matters

include the election of each nominee proposed for election as a director of the Company in an uncontested election, the advisory say-on-pay vote, and the ratification of the Company’s auditors, among other general business matters as set forth in the Company’s Articles.

Special business matters to be considered at the Meeting will each be determined by two-thirds of votes cast at the Meeting by proxy or in person. Special business matters include, but are not limited to, approval of mergers or business combinations and approval of amendments to the Company’s Articles.

General Information

Common Shares Outstanding

As of the close of business on March 28, 2023, there were 206,868,001 Shares outstanding. The Shares trade under the symbol “SSRM” on the Toronto Stock Exchange (“TSX”) and the Nasdaq Global Market (“NASDAQ”), and the symbol “SSR” on the Australian Securities Exchange (“ASX”).

Principal Holders of Voting Securities

Based on information available to the Company and to the knowledge of the directors and executive officers of the Company, other than those Shareholders identified in the “Security Ownership of Certain Beneficial Owners and Management” section of this Proxy Statement, no person, firm or Company beneficially owns, directly or indirectly, or exercises control or direction over, voting securities of the Company carrying more than 5% of the voting rights attaching to the total number of issued and outstanding Shares of the Company.

Currency

Unless otherwise specified, all dollar amounts herein are expressed in United States dollars. Canadian dollars will be designated as “C$.” The rates of exchange, as reported by the Bank of Canada, on December 31, 2022 and March 28, 2023, were:

| | | | | | | | | | | | | | | | | | | | |

| December 31, 2022 | | March 28, 2023 |

| US$ | $1.00 | $0.74 | | US$ | $1.00 | $0.73 |

| C$ | C$1.35 | C$1.00 | | C$ | C$1.36 | C$1.00 |

Date of Information

Except as otherwise stated, the information contained herein is given as of March 28, 2023.

Annual Report on Form 10-K and Additional Information

A copy of our annual report on Form 10-K for the year ended December 31, 2022, as filed with the SEC, is available to Shareholders without charge upon written request directed to the Corporate Secretary of SSR Mining Inc. at 6900 E. Layton Avenue, Suite 1300, Denver, Colorado 80237. The Company makes available on or through our website, free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to such reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after filing. Such filings are also available, free of charge, through the SEC’s EDGAR system and SEDAR.

Additional information relating to SSR Mining is available on our website at www.ssrmining.com, and under the Company’s profile on EDGAR (www.sec.gov/edgar.shtml) and on SEDAR (www.SEDAR.com). Financial and other information of SSR is provided in its audited consolidated financial statements and management’s discussion and analysis for the financial year ended December 31, 2022, and in our annual report of Form 10-K which can be found under our profile on SEDAR and will be sent without charge to any security holder upon request by contacting the Corporate Secretary of SSR Mining Inc. at 6900 E. Layton Avenue, Suite 1300, Denver, Colorado 80237, or by telephone at (303) 292-1299.

| | |

| ENVIRONMENTAL, HEALTH, SAFETY, SUSTAINABILITY AND COMMUNITY |

Commitment to Sustainability

Our vision is to deliver sustainable value for all stakeholders through responsible mining. People and the environment are our most important resources, and we are committed to safeguarding them both now and for the future. We recognize the catalyst role our operations can play in local communities and commit to leaving a positive legacy. We take a long-term view of our sustainability responsibilities and are committed to having the highest sustainability standards and targets, as well as plans, procedures and metrics in place, to ensure our commitments are met every single day.

At SSR Mining, ultimate responsibility for our sustainability programs and performance sits with the Board of Directors. The Board is supported in this regard by the Environmental, Health, Safety and Sustainability Committee (the “EHS&S Committee”), which oversees, monitors, and reviews our practice and performance in areas of safety, health, community and stakeholder relationships and environmental management (including areas of water management, and climate change). The EHS&S Committee meets formally at least four times a year, with additional meetings held as required. The charter of the EHS&S Committee is available on our website.

Sustainability is also a key responsibility for our executive and site teams. Our approach to sustainability is underpinned by the principle of collective responsibility and a belief that every employee must contribute to achieving our sustainability commitments. To reflect our commitment to sustainability, for employees eligible to receive annual short-term incentive compensation, a material component of the annual short-term incentive compensation performance metrics for the business are linked to the achievement of EHS&S targets across the business.

We also expect our suppliers to respect our commitment to sustainability and the principles outlined in our Code of Conduct. We also encourage our major suppliers to be certified to industry best practice standards and require evidence that they have health and safety management plans in place.

Sustainability Report

Annually, the Company publishes an ESG and Sustainability Report that sets out in detail the Company’s environmental, health, safety and sustainability initiatives and policies, including our approach to ESG. A copy of the latest SSR Mining ESG and Sustainability Report can be found on our website at: http://www.ssrmining.com/corporate_responsibility. Shareholders are encouraged to read our full ESG and Sustainability Report for more detailed information.

Environment and Climate Change

Being responsible environmental stewards is a critical part of our business. By using natural resources and energy efficiently, recycling waste, and working to protect biodiversity, we expect to be able to deliver long term value to all stakeholders and leave a positive legacy. Our approach to environmental management is set out in our Environmental and Sustainability Policy, which is available on our website.

We manage our operations in strict compliance with all relevant environmental standards. One way we monitor our environmental performance is by tracking the number of environmental incidents related to our activities, even when they are minor and contained within the mine site. In 2022, we updated the classifications system across the Company, following an incident that occurred at Çöpler. In June 2022, Türkiye's Ministry of Environment, Urbanization and Climate Change (“Ministry of Environment”) temporarily suspended operations at the Çöpler mine site as a result of a leak of leach solution containing a small amount of diluted cyanide. The leak occurred from a pipeline that pumps diluted cyanide solution to Çöpler’s heap leach pad. The Ministry of Environment visited site and ordered remediation and improvement initiatives to be undertaken. SSR completed these

initiatives and received the required regulatory approvals from Türkiye's government authorities in September 2022, at which time all operations were restarted at the Çöpler mine.

At SSR Mining, we are committed to being part of the global solution to the climate change challenge. In 2020, we made a commitment to immediate climate action, releasing a commitment on climate change that sets a net zero operational greenhouse gas emissions goal by 2050. To date, each mine operation site has completed a climate change physical risk assessment. In 2022, we progressed the work of understanding opportunities for emissions reduction potential at each one of our sites and developed an internal assessment and visualization tool will allow us to better support operational decision-making and maintain a focus on the performance of each operation. SSR’s vision to deliver on its Net Zero commitment by 2050 is to deliver the greatest emissions reductions for the most efficient cost and operational strain.

At each site we track our energy data to understand our total consumption of energy, which has a direct correlation to greenhouse gas emissions. In 2022, our total energy use was 4,724,530 GJ and our scope 1 (direct) emissions were 308,333 tonnes of CO2-e, and our scope 2 (indirect) emissions were 92,947 tonnes of CO2-e. Our total scope 1 & 2 emissions for 2022 were 401,280 tonnes of CO2-e.

We also maintain comprehensive water quality monitoring programs to help ensure that we meet all applicable regulatory requirements and disclose our water stewardship performance through the CDP Water Security questionnaire. In 2022, the Company established a group-wide water stewardship strategy based on our active water balance models and watershed-level assessments across all sites. This three-pronged strategy is focused on efficiency, by optimizing our water management to reduce freshwater withdrawal, consumption and discharge; responsibility, by managing and mitigating negative impacts on water quality and quantity; and sustainability, by operating in partnership with our external stakeholders to meet both the needs of today and the future.

Tailings are a common waste product generated by the mining process. We manage our tailings facilities responsibly and in line with international standards and local regulations to meet site specific conditions. In February 2019, the International Council on Mining and Metals (ICMM), the Principles for Responsible Investment (PRI) and the UN Environment Programme began developing the Global Industry Standard on Tailings Management (GISTM). During 2022, we continued to align our operations and practices to the expectations of the GISTM. As we assess our compliance with the GISTM, we will continue to use the ESG and Sustainability Report to disclose information.

Safe and responsible cyanide management is critical to our operations and our social license to operate. We use cyanide in the plants at our gold operations to separate the gold from the ore. Proper and robust cyanide management is essential to prevent risk to both human health and the environment. We strive to adhere to good practice for the safe transportation, storage, use and disposal of cyanide. The foundation of our approach to cyanide management is built on strict operating standards, and governed by legal requirements. It is also informed by industry best practices and the requirements of International Cyanide Management Code (ICMC). Our Marigold mine in Nevada was the first mine certified to ICMC standard and we are committed to aligning and certifying over time all our operations to ICMC standard.

Health and Safety

The Company is committed to the overall health and safety of its employees, contractors, and the communities in which they operate. We believe that our employees and business partners are critical to our success as a business, and we are committed to providing a safe working environment for them. We remain committed to the principle of safe production and firmly believe occupational injuries and illnesses are preventable, and to provide a workplace that fulfills such objectives. Our Health and Safety policy applies to all employees and contractors working across our business. The policy is backed up by robust enterprise and site-specific safety management plans and systems which align with the international best practice standards OHSAS18001 and ISO45001. We regularly assess the safety and health-related risks across each part of our mines. These assessments ensure that we are aware of the specific risks in each part of the mine and inform us that the most appropriate critical controls are in place. Further to this, our safety plans follow a risk mitigation hierarchy of control which includes the identification of risk, assessment of controls and the implementation of controls.

Our number-one objective, above anything else, is to reduce harm and the incidents that hurt our employees and business partners. It is clear by our performance in 2022 that we have more work to do. Puna suffered a fatality in January 2022, when a vehicle contracted to transport mine personnel home at the end of a work rotation left a public road approximately 20 kilometers from the mine. While this incident did not occur on our operations, it took place while people were in our care, and as such, we treated it as our own. A full investigation was carried out following the incident to identify the root case and any necessary corrective actions. Following the investigation, key changes were made to the transport of personnel during the rainy season. The safety performance at our operations also saw a decline this year. Our Total Recordable Injury Frequency Rate (TRIFR) per million hours worked, increased from 2.47 in 2021 to 3.97 in 2022. To improve performance and realign with our targets we developed and began implementation of a revised safety plan to influence continuous improvement in safety performance for future years. Key aspects of the plan include employee engagement, embedding our Integrated Management System, developing a three-year strategy, developing and implementing a risk management framework, and improving incident reporting and investigations. Further details of the plan can be found in the ESG and Sustainability Report.

We also recognize that there is more to ensuring worker and community health and well-being than simply working to prevent injuries. We are taking a proactive approach to health through environmental, biological and medical monitoring and quantifying occupational exposure risk. Our goal is to minimize health risks to employees, business partners, visitors and communities.

Community Relations

We recognize the important role our operations can play as catalysts for social and economic development in the communities we operate in and beyond. All our operations support a wide range of community development initiatives, which are based on the local socioeconomic environment and community needs. Our approach to community investment is set out in our ESG and Sustainability Policy. We support local social and economic development in three key ways: hiring from the local community, prioritizing local suppliers, and supporting community projects and initiatives. In 2022, we continued our practice of direct investment in the local community infrastructure where we operate and in related social programs.

For local communities, employment opportunities are a primary benefit of our presence. Hiring workers from the communities nearest our mines and the countries we operate in is one of the most important contributions we make to social and economic development. We strive to maximize local hiring at all our operations. We also provide skills development programs for our workers, contractors, and local communities to help them develop the skills needed to work at the mine.

Each year we contribute to the development of our local communities by making direct investments in community infrastructure and social programs. We provide scholarships to local community members around our Çöpler mine, supporting students ranging from vocational high school students to one pursuing a Master’s degree. Marigold has provided both financial support to the University of Nevada, Reno, and individual scholarships to dependents of Marigold employees and students from local communities. Through the Colorado School of Mines, we also provide annual Women in Mining Scholarships to support a female mine engineering student to advance her career. At Seabee, we fund a breakfast program in the Gorden Deny School in the nearby town of La Ronge, providing a nutritious breakfast in an inclusive caring environment for students. In rural Jujuy near our Puna Operations, we partner with local schools to improve educational outcomes and, since 2012, we have supported the renovation of six local schools. In collaboration with the Argentina Ministry of Education we helped to create a program to enable community members, including our employees, to complete their secondary education.

Alongside the direct investments noted above, at our operations in Argentina and Türkiye we have dedicated Social Development Funds. These funds aim to support sustainable projects in the local communities to help diversify economic activity in the local area and reduce reliance on the mine. At our the Çöpler mine in Türkiye, the Social Development Fund provides financial support to local entrepreneurs so they can set up or grow their own businesses. Projects are selected based on a set of development priorities agreed in consultation with the community and aligned with local development plans and priorities. The Company contributes a portion of the profits from gold produced annually by the Çöpler mine, thereby linking the benefits we share with the community to our success as a company. Our Puna Operations in Argentina also partnered with the local regional government to invest in local communities through a Social Development Fund. This innovative partnership

between the mine and the host communities aims to promote financial inclusion and create opportunities for local entrepreneurs and support a wide-range of social and community development projects. Management of the fund is participatory in nature, and the board of directors consists of representatives of local communities to evaluate, approve and deliver financing for the projects.

In 2022, the Company launched a suite of inclusion initiatives at the Company’s corporate office in Denver, which included a variety of in-person events and long-term initiatives designed to celebrate diversity and inclusion and create more opportunities for employees to come together. The program kicked off with a combination of cultural heritage events, volunteer events, and community engagement initiatives.

People are our core strength. More than any other factor, our success depends on their capabilities and commitment. We are focused on attracting and retaining experienced and skilled talent with a culture that puts safety at its core and supports people to reach their potential.

We believe that transparent communication with workers and unions is critical to the effective execution of our operations. We do not impose restrictions on union representation, and we respect the rights of freedom of association and collective bargaining. In total, 37% of our workforce are union members and have collective bargaining agreements in place. In 2022, we enjoyed positive labor relations across all sites. As an example, at our Çöpler mine we invite union and workforce representatives to attend site level EHS&S committee meetings on a regular basis.

In 2022, the Company undertook several initiatives designed to positively impact its workforce. For its United States-based workforce, the Company adopted a revised U.S. Parental Leave Policy for Births and Adoptions. Under the revised policy, eligible employees are entitled to six consecutive weeks of fully paid parental leave in a rolling 12-month period. In addition, mothers who have given birth are entitled to an additional six to eight weeks of fully paid leave, as determined by the applicable health care provider, under the Company’s Short-Term Disability Policy. The Company also undertook a comprehensive redesign of its global performance management review process to ensure employees across our operations are being evaluated on a consistent and standardized basis.

The Company recognizes that a workforce composed of many individuals with a mix of skills, experience, perspectives, backgrounds and characteristics leads to a more robust understanding of opportunities, issues and risks, and to stronger decision-making. Given the broad geographic footprint of the Company’s operations, we benefit from a meaningfully diverse workforce. The Company and the Board of Directors are committed to establishing measurable diversity objectives and assessing on an annual basis the achievement against these objectives, including the representation of women at all levels of the organization. The Company has adopted a Diversity Policy which requires the Company to establish specific diversity initiatives, programs and targets and the Compensation and Leadership Development Committee (the “CLD Committee”) oversees diversity initiatives across the Company. We recognize the industry-wide challenge of attracting women into the mining industry. However, in accordance with our policies we actively seek to increase the number of women we employ at our operations.

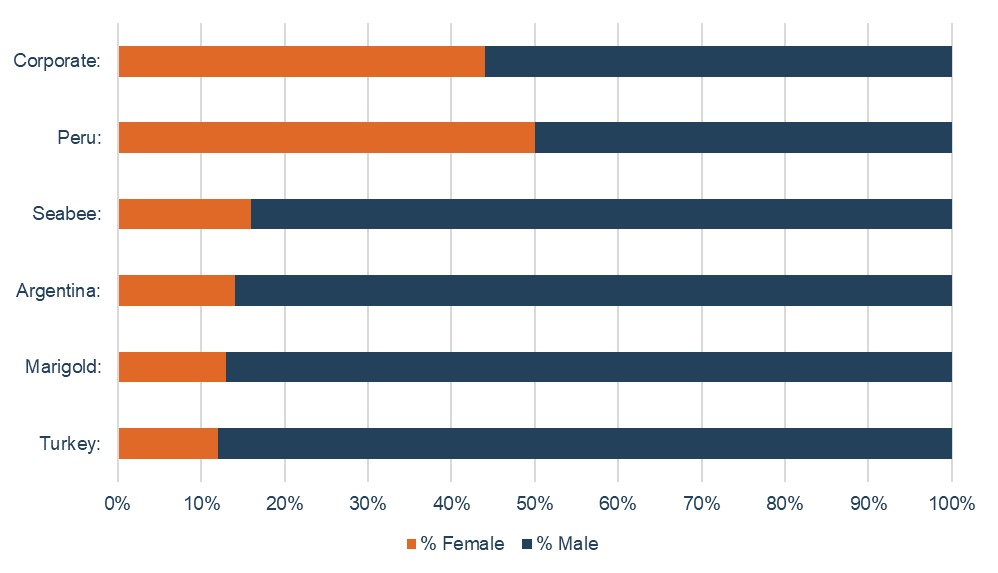

As of December 31, 2022, the Company employed approximately 2,500 full-time employees and 2,050 contract employees throughout the United States, Canada, Peru, Argentina and Türkiye. As of December 31, 2022, 20% of the executive officers of the Company were women, approximately 45% of employees at the Company’s corporate office were women (excluding executives) and approximately 14% of the employees across the business were women.

The table below summarizes the total full-time workforce of the Company by location and gender:

In addition to gender diversity, the Company maintains self-reported ethnicity information for our United States-based and Canadian-based workforce:

| | | | | | | | | | | | | | | | | | | | |

| 2022 US Workforce Ethnicity Self-Disclosure |

| Hispanic or Latino | White | American Indian or Alaska Native | Asian | Black or African American | Two or More Races | Prefer Not to Answer |

| 48 | 475 | 11 | 8 | 4 | 9 | 9 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2022 Canada Workforce Ethnicity Self-Disclosure |

| Hispanic or Latino | Non-Indigenous & Non-Visible Minority | Indigenous | Asian | Black | Native Hawaiian or Other Pacific Islander | Other | Two or More Races | Prefer Not to Answer |

| 5 | 121 | 110 | 11 | 2 | 1 | 65 | 9 | 79 |

The Company also reports employment data in annual U.S. Equal Employment Opportunity Commission EEO-1 reports for our U.S.-based workforce; however, the U.S. EEO-1 reports represent only a small portion of our global workforce.

Additional information regarding human capital management can be found in the Company’s ESG and Sustainability Report, which can be found on our website at: http://www.ssrmining.com/corporate_responsibility.

Election of Directors

Shareholders are asked to elect and/or re-elect nine (9) directors. All nominees have established their eligibility and willingness to serve as directors. The Board has determined that, at the present time, there will be nine (9) directors. For more information on the nominees, please refer to the “Nominees for Election to the Board of Directors” section of this Proxy Statement. Nominees will, subject to the by-laws of the Company and applicable corporate law, hold office until the next annual meeting of Shareholders or until their successors are elected or appointed in accordance with the by-laws of the Company or applicable corporate law.

Majority Voting Policy

The Company’s majority voting policy states that any nominee proposed for election as a director of the Company in an uncontested election must be elected by a majority of the votes cast. If a director is not elected by at least a majority, such director must immediately tender his or her resignation to the Chairman of the Board. The Corporate Governance and Nominating Committee will consider such resignation and will make a recommendation to the Board and, absent exceptional circumstances, the Board will accept the resignation of such nominee. Within 90 days of the meeting, the Board will issue a press release disclosing the Board’s decision to accept or reject the nominee’s resignation. If the Board determines not to accept the nominee’s resignation, the press release will fully state the reasons for that decision. The nominee will not participate in any Committee or Board deliberations regarding their resignation offer.

The Board recommends that Shareholders vote FOR each of the proposed nominees (or for substitute nominees in the event of contingencies not known at present). Unless otherwise instructed, the persons designated on the proxy card intend to vote FOR the proposed nominees (or for substitute nominees in the event of contingencies not known at present).

| | |

NOMINEES FOR ELECTION

TO THE BOARD OF DIRECTORS |

Our Board of Directors

The following pages set out information about the nominees for election as directors, including the specific experience, and qualifications that led to the Board’s conclusion that the person should serve as a director of the Company. The following individuals are proposed for election to the Board:

| | | | | |

| u | A.E. Michael Anglin, Chairman of the Board |

| |

| u | Rod Antal, President and Chief Executive Officer |

| |

| u | Thomas R. Bates, Jr., Chair of the Compensation and Leadership Development Committee |

| |

| u | Brian R. Booth |

| |

| u | Simon A. Fish, Chair of the Corporate Governance and Nominating Committee |

| |

| u | Leigh Ann Fisher |

| |

| u | Alan P. Krusi, Chair of the Environmental, Health, Safety and Sustainability Committee |

| |

| u | Kay Priestly, Chair of the Audit Committee |

| |

| u | Karen Swager |

The following profiles summarize each nominee’s applicable skills, overall Board and committee attendance in 2022, and the the value of their at-risk holdings as of December 31, 2022. While each of the Board members generally attend all committee meetings, the nominee profiles reflect only their required attendance. The overall skills and composition of the nominees is presented in tabular form at the end of this “Nominees for Election to the Board of Directors” section of this Proxy Statement.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| A.E. Michael Anglin |

|

| Mr. Anglin was appointed to the Board of Directors of SSR Mining in August 2008 and is Chairman of the Board and a member of the Corporate Governance and Nominating Committee. Mr. Anglin has also served on the board of Antofagasta PLC, a major Chilean copper producer, since April of 2019. Mr. Anglin spent 22 years with BHP Billiton Ltd., most recently serving as Vice President Operations and Chief Operating Officer of the Base Metals Group based in Santiago, Chile, before retiring in 2008. Mr. Anglin graduated with a Bachelor of Science (Honours) degree in Mining Engineering from the Royal School of Mines, Imperial College, London in 1977 and attained a Master of Science degree from the Imperial College in London in 1985. |

|

| Chairman of the Board | Director Skills |

| u Mergers & Acquisitions | u International |

| Director Since: 2008 | u Strategic Leadership | u Sustainability & ESG |

| u Industry Knowledge | |

| Independent | | | | | |

| Board and Committee Membership | Attendance(1) |

| Age: 67 | Board of Directors | 10/10 |

| Corporate Governance and Nominating Committee | 6/6 |

| Berkeley, California, USA | Environmental, Health, Safety and Sustainability Committee | 5/5 |

| Overall Attendance | 100% |

| |

| Voting Results | | Other Public Company Board |

| Year | For | Withheld | | Antofagasta plc |

| 2022 | 95.68% | 4.32% | | Tulla Resources PLC |

| | |

| Share Ownership Guidelines as of December 31, 2022 |

| Common Shares | DSUs | Total of Common Shares and DSUs | Market Value of Common Shares and DSUs(2) |

| 44,306 | 215,418 | 259,724 | $4,069,875 |

| |

| Minimum Value Required | In Compliance with Share Ownership Guidelines |

| 480,000 | Yes |

| ____________________ |

| (1) Mr. Anglin was appointed to the Environmental, Health, Safety and Sustainability Committee effective April 1, 2022. |

| (2) Assumes a market value of $15.67 for each share, which is the close price on the Nasdaq as of December 30, 2022. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Rod Antal |

|

| Mr. Antal was appointed President and Chief Executive Officer and a member of the Board of SSR Mining following the merger with Alacer Gold in September 2020. Prior to the merger, Mr. Antal held the position of President and Chief Executive Officer with Alacer Gold since August 2013 and prior to that, he served as Alacer Gold’s Chief Financial Officer from May 2012 to August 2013. Mr. Antal has over 30 years of global mining experience in various mineral and metal businesses, including precious metals. This experience spans both corporate roles and at various mine operating sites. Mr. Antal began his mining career working for Placer Dome in Papua New Guinea and then nearly 15 years within the Rio Tinto Group where he held various senior management positions. |

|

| President and CEO | Director Skills |

| u Corporate Finance | u Industry Knowledge |

| Director Since: 2020 | u Mergers & Acquisitions | u International |

| u Strategic Leadership | |

| Age: 57 | |

| Board and Committee Membership | Attendance |

| Denver, Colorado, USA | Board of Directors | 10/10 |

| Overall Attendance | 100% |

| |

| Voting Results | Other Public Company Boards |

| Year | For | Withheld | None |

| 2022 | 99.84% | 0.16% | |

| | |

| Share Ownership Guidelines as of December 31, 2022(1) |

| Common Shares | RSUs | PSUs(2) | Total Shares Held | Market Value of Shares Held(3) |

| 647,333 | 124,781 | 135,907 | 908,021 | $14,228,681 |

| |

| Minimum Value Required | In Compliance with Share Ownership Guidelines |

| $5,000,000 | Yes |

| ____________________ |

| (1) As an executive director, Mr. Antal does not receive compensation for serving on the Board and is not subject to the Share Ownership Guidelines for non-executive directors. Therefore, Mr. Antal’s share ownership reflects his holdings as an executive. |

| (2) Pursuant to our Share Ownership Guidelines for executives, 50% of granted PSUs are included in the calculation to meet the guidelines. |

| (3) Assumes a market value of $15.67 for each share, which is the close price on the Nasdaq as of December 30, 2022. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Thomas R. Bates, Jr. |

|

| Mr. Bates was appointed to the Board of Directors of SSR Mining in September 2020 and is Chair of the Compensation and Leadership Development Committee and a member of the Audit Committee. Mr. Bates was a Director at Alacer Gold from April 2014 to September 2020 and has over 40 years of experience in oil service management and operations. Mr. Bates is currently an adjunct professor and a member of the Board of the Ralph Lowe Energy Institute at the Neeley School of Business at Texas Christian University, a position he has held since 2011. He spent 15 years at Schlumberger in both domestic and international locations, was CEO of Weatherford-Enterra from 1997 to 1998, served as President of the Discovery Group of Baker Hughes from 1998 to 2000, and was later the Managing Director and Senior Advisor for 12 years at Lime Rock Partners, an energy focused private equity investment firm, from 2001 to 2012. Mr. Bates has served on the Board of Directors at Tetra Technologies, Inc. since 2011 and Vantage Drilling International since 2016. |

| |

| Chair of the Compensation and Leadership Development Committee | Director Skills |

u Corporate Finance | u Risk Management |

| u Financial Reporting | u International |

| Director Since: 2020 | u Mergers & Acquisitions | u Human Capital Management |

| u Strategic Leadership | |

| Independent | | | | | | | | |

| Board and Committee Membership | Attendance |

| Age: 73 | Board of Directors | 10/10 |

| Audit Committee | 5/5 |

| Fort Worth, Texas, USA | Compensation and Leadership Development Committee | 6/6 |

| Overall Attendance | 100% |

| |

| Voting Results | | Other Public Company Boards |

| Year | For | Withheld | | Tetra Technologies, Inc. |

| 2022 | 99.01% | 0.99% | | Vantage Drilling International |

| | |

| Share Ownership Guidelines as of December 31, 2022 |

| Common Shares | DSUs | Total of Common Shares and DSUs | Market Value of Common Shares and DSUs(1) |

| 26,230 | 83,942 | 110,172 | $1,726,395 |

| |

| Minimum Value Required | In Compliance with Share Ownership Guidelines |

| 360,000 | Yes |

| ____________________ |

| (1) Assumes a market value of $15.67 for each share, which is the close price on the Nasdaq as of December 30, 2022. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Brian R. Booth | |

| |

| Mr. Booth was appointed to the Board of Directors of SSR Mining in May 2016 and is a member of the Audit Committee and the Environmental, Health, Safety and Sustainability Committee. Mr. Booth is retired from Element29 Resources Inc. where he was the President, CEO and a director, roles in which he served since 2019, and he has served as a director on numerous public and private mining companies for over 15 years. Prior to joining Element29, he was President, CEO and a director of Pembrook Copper Corp. from 2008 to 2018 and LakeShore Gold Corp from 2005 to 2008. Previous to that, Mr. Booth held various exploration management positions at Inco Limited over a 23-year career, including Manager of Exploration - North America and Europe, Manager of Global Nickel Exploration and Managing Director PT Ingold for Australasia. Mr. Booth holds a B.Sc. in Geological Sciences from McGill University (1983) and was awarded an honorary lifetime membership in the Indonesian Mining Association for service as Assistant Chairman of the Professional Division. | |

| |

| Director Since: 2016 | Director Skills | |

| u Mergers & Acquisitions | u International | |

| Independent | u Strategic Leadership | u Sustainability & ESG | |

| u Industry Knowledge | | |

| Age: 63 | | | | | | | | | |

| Board and Committee Membership | Attendance | |

| West Vancouver, BC, Canada | Board of Directors | 10/10 | |

| Audit Committee | 5/5 | |

| Environmental, Health, Safety and Sustainability Committee | 6/6 | |

| Overall Attendance | 100% | |

| | |

| Voting Results | Other Public Company Boards | |

| Year | For | Withheld | | | GFG Resources Inc. | |

| 2022 | 99.58% | 0.42% | | | Peninsula Energy Limited | |

| | | |

| Share Ownership Guidelines as of December 31, 2022 | |

| Common Shares | DSUs | Total of Common Shares and DSUs | Market Value of Common Shares and DSUs(1) | |

| 18,724 | 51,104 | 69,828 | $1,094,205 | |

| | |

| Minimum Value Required | In Compliance with Share Ownership Guidelines | |

| 300,000 | Yes | |

| ____________________ | |

| (1) Assumes a market value of $15.67 for each share, which is the close price on the Nasdaq as of December 30, 2022. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Simon A. Fish | |

| |

| Mr. Fish is a corporate director. He was appointed to the Board of Directors of SSR Mining in 2018. He serves as Chair of the Corporate Governance and Nominating Committee and a member of the Compensation and Leadership Development Committee. He has more than 30 years of experience as a senior executive in the mining, energy and financial services sectors. He is currently Chair of the BMO Climate Institute. He serves as director of Heritage Environmental Services Inc., and Alexa Translations A.I. Previously, he served as Executive Vice-President & Chief Legal Officer at Bank of Montreal (2008-2020), Vale Base Metals (2005-2008) and Shell Canada Limited (2002-2005). Prior to that, he held various senior positions within the Royal Dutch Shell group of companies in the UK, the Netherlands, South Africa and Canada. Earlier in his career, Mr. Fish practiced corporate and securities law with Dechert LLP, an international law firm. | |

| |

| Chair of the Corporate Governance and Nominating Committee | Director Skills | |

u Mergers & Acquisitions | u International | |

u Strategic Leadership | u Sustainability & ESG | |

| Director Since: 2018 | u Risk Management | u Industry Knowledge | |

| | |

| Independent | Board and Committee Membership | Attendance | |

| Board of Directors | 10/10 | |

| Age: 62 | Compensation and Leadership Development Committee | 6/6 | |

| Corporate Governance and Nominating Committee | 6/6 | |

| Wellington, ON, Canada | Overall Attendance | 100% | |

| | |

| Voting Results | Other Public Company Boards | |

| Year | For | Withheld | | None | |

| 2022 | 87.25% | 12.75% | | | |

| | | |

| Share Ownership Guidelines as of December 31, 2022 | |

| Common Shares | DSUs | Total of Common Shares and DSUs | Market Value of Common Shares and DSUs(1) | |

| Nil | 63,055 | 63,055 | $988,072 | |

| | |

| Minimum Value Required | In Compliance with Share Ownership Guidelines | |

| 345,000 | Yes | |

| ____________________ | |

| (1) Assumes a market value of $15.67 for each share, which is the close price on the Nasdaq as of December 30, 2022. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Leigh Ann Fisher |

|

| Ms. Fisher was appointed to the Board of Director of SSR Mining in March 2022. Ms. Fisher served as Executive Vice President and Chief Administrative Officer of Alcoa Corporation from 2016 until her retirement in 2020. As Chief Administrative Officer, Ms. Fisher had responsibility for Human Resources, Procurement, Information Technology and Automation Solutions, Global Shared Services and Business Process Optimization. She was a member of the Alcoa Executive Team, responsible for setting strategic direction for the company. From 2013 to 2016, Ms. Fisher held the role of Chief Financial Officer for Alcoa's Global Primary Products Group, responsible for managing finance and business analysis for Alcoa’s worldwide primary products system. Throughout her 31 year career with Alcoa, Ms. Fisher held finance and leadership roles in all Alcoa business groups, as well as corporate finance. |

|

| Director Since: 2022 | Director Skills |

| u Corporate Finance | u Risk Management |

| Independent | u Financial Reporting | u Industry Knowledge |

| u Strategic Leadership | u Human Capital Management |

| Age: 56 | |

| Board and Committee Membership | Attendance(1) |

| Louisville, Tennessee, | Board of Directors | 8/8 |

| USA | Audit Committee | 4/4 |

| Compensation and Leadership Development Committee | 5/5 |

| Overall Attendance | 100% |

| |

| Voting Results | Other Public Company Boards |

| Year | For | Withheld | | None |

| 2022 | 99.75% | 0.25% | | |

| | |

| Share Ownership Guidelines as of December 31, 2022 |

| Common Shares | DSUs | Total of Common Shares and DSUs | Market Value of Common Shares and DSUs(1) |

| Nil | 7,696 | 7,696 | $120,596 |

| |

| Minimum Value Required | In Compliance with Share Ownership Guidelines |

| $300,000 | Yes(2) |

| ____________________ |

| (1) Assumes a market value of $15.67 for each share, which is the close price on the Nasdaq as of December 30, 2022. |

| (2) Ms. Fisher has until March 3, 2027, five (5) years from the date of her election, to meet the Share Ownership Guidelines. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Alan P. Krusi |

|

| Mr. Krusi was appointed to the Board of Directors of SSR Mining in September 2020. He is Chair of the Environmental, Health, Safety and Sustainability Committee and a member of the Corporate Governance and Nominating Committee. Mr. Krusi was a Director at Alacer Gold from September 2014 to September 2020. He has nearly four decades of management experience in the engineering and construction industries. Mr. Krusi began his career as a project geologist with Dames & Moore where he gained significant experience and international exposure as lead project engineer and geologist in Latin America and Asia from 1977 to 1983. Throughout his career, Mr. Krusi managed a number of successively larger engineering and consulting businesses, culminating as CEO of Earth Tech, Inc, a global water and environmental services firm with operations in 13 countries, from 2002 to 2008. Most recently, Mr. Krusi was President, Strategic Development at AECOM from 2008 to 2015, where he oversaw the firm's M&A activities and served on the executive committee. Mr. Krusi has served on the Board of Directors of Comfort Systems USA since 2008 and Granite Construction since 2018. |

|

| Chair of the Environmental, Health, Safety and Sustainability Committee | Director Skills |

u Mergers & Acquisitions | u Sustainability & ESG |

u Strategic Leadership | u Technical Innovation / Information Security |

| Director Since: 2020 | u International | |

| |

| Independent | Board and Committee Membership | Attendance |

| Board of Directors | 10/10 |

| Age: 68 | Environmental, Health, Safety and Sustainability Committee | 6/6 |

| Corporate Governance and Nominating Committee | 5/6 |

| Maple Valley, Washington, USA | Overall Attendance | 95% |

|

| Voting Results | Other Public Company Boards |

| Year | For | Withheld | | | Comfort Systems USA, Inc. |

| 2022 | 96.18% | 3.82% | | | Granite Construction, Inc. |

| | |

| Share Ownership Guidelines as of December 31, 2022 |

| Common Shares | DSUs | Total of Common Shares and DSUs | Market Value of Common Shares and DSUs(1) |

| 25,091 | 81,930 | 107,021 | $1,677,019 |

| |

| Minimum Value Required | In Compliance with Share Ownership Guidelines |

| 345,000 | Yes |

| ____________________ |

| (1) Assumes a market value of $15.67 for each share, which is the close price on the Nasdaq as of December 30, 2022. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kay Priestly | |

| |

| Ms. Priestly was appointed to the Board of Directors of SSR Mining in September 2020 and is Chair of the Audit Committee and a member of the Corporate Governance and Nominating Committee. Ms. Priestly was a Director at Alacer Gold from August 2019 to September 2020. Ms. Priestly served as Chief Executive Officer of Turquoise Hill Resources Ltd. from 2012 until her retirement in 2015 and as Chief Financial Officer of Rio Tinto Copper from 2008 until 2012. She was Vice President, Finance and Chief Financial Officer of Rio Tinto’s Kennecott Utah Copper operations from 2006 to 2008. Ms. Priestly also served in executive management roles at American Nursing Services, Inc. and Entergy Corporation. Ms. Priestly began her career with Arthur Andersen where she progressed from Staff Accountant to Partner, holding various management and leadership positions, including serving on the global executive team as Global Managing Partner - People. During her 24 years with Arthur Andersen, she provided tax, consulting and M&A services to global companies across many industries, including energy, mining, manufacturing and services. Ms. Priestly has served as a board member of TechnipFMC plc since January 2017 and Stericycle, Inc. since June, 2018. She previously served on the Board of Directors of FMC Technologies, Inc. from October 2015 to January 2017, New Gold Inc. from June 2015 to April 2018, and Stone Energy Corporation from May 2006 to February 2017. | |

| |

| Chair of the Audit Committee | Director Skills | |

u Corporate Finance | u Risk Management | |

| Director Since: 2020 | u Financial Reporting | u Industry Knowledge | |

| u Mergers & Acquisitions | u International | |

| Independent | u Strategic Leadership | | |

| | |

| Age: 67 | Board and Committee Membership | Attendance | |

| Board of Directors | 10/10 | |

| Park City, Utah, USA | Audit Committee | 5/5 | |

| Corporate Governance and Nominating Committee | 6/6 | |

| Overall Attendance | 100% | |

| | |

| Voting Results | Other Public Company Boards | |

| Year | For | Withheld | | | TechnipFMC plc | |

| 2022 | 97.28% | 2.72% | | | Stericycle, Inc. | |

| | | |

| Share Ownership Guidelines as of December 31, 2022 | |

| Common Shares | DSUs | Total of Common Shares and DSUs | Market Value of Common Shares and DSUs(1) | |

| Nil | 22,849 | 22,849 | $358,044 | |

| | |

| Minimum Value Required | In Compliance with Share Ownership Guidelines | |

| $375,000 | Yes(2) | |

| ____________________ | |

| (1) Assumes a market value of $15.67 for each share, which is the close price on the Nasdaq as of December 30, 2022. | |

| (2) Ms. Priestly has until September 16, 2025, five (5) years from the date of her election, to meet the Share Ownership Guidelines. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Karen Swager | |

| |

| Ms. Swager was appointed to the Board of Directors of SSR Mining in January 2023. Ms. Swager currently serves as Senior Vice President-Supply Chain for The Mosaic Company. In this role, Ms. Swager is responsible for the movement of raw materials and finished production, and strategic sourcing activities, as well as leading the Environment, Health and Safety organization. Previously, Ms. Swager held various leadership positions at Mosaic, including Senior Vice President, Potash, Vice President, Phosphates, as well as management roles at multiple operations within the Mosaic portfolio. Ms. Swager has over 28 years of mining experience in various minerals. Ms. Swager is a licensed professional engineer in Florida and holds a Bachelor of Science degree in metallurgical engineering and a Master of Science in metallurgical engineering from Michigan Technological University, where she is a member of the Department of Chemical Engineering’s Distinguished Academy. In addition, Ms. Swager holds an MBA from Northwestern University Kellogg School of Management. | |

| |

| Director Since: 2023 | Director Skills | |

| u Mergers & Acquisitions | u Industry Knowledge | |

| Independent | u Strategic Leadership | u International | |

| u Risk Management | u Sustainability & ESG | |

| Age: 52 | | |

| Board and Committee Membership | Attendance(1) | |

| Steinhatchee, Florida, | Board of Directors | N/A | |

| USA | Environmental, Health, Safety and Sustainability Committee | N/A | |

| Overall Attendance | N/A | |

| | |

| Voting Results(1) | Other Public Company Boards | |

| Year | For | Withheld | | | None | |

| 2022 | N/A | N/A | | | | |

| | | |

| Share Ownership Guidelines as of December 31, 2022(1) | |

| Common Shares | DSUs | Total of Common Shares and DSUs | Market Value of Common Shares and DSUs | |

| Nil | Nil | Nil | $— | |

| | |

| Minimum Value Required | In Compliance with Share Ownership Guidelines | |

| $300,000 | Yes(2) | |

| ____________________ | |

| (1) Ms. Swager was appointed to the Board of Directors as of January 16, 2023. | |

| (2) Ms. Swager has until January 16, 2028, five (5) years from the date of her election, to meet the Share Ownership Guidelines. | |

Skills Composition of the Board

The director nominees possess the qualifications, skills and experiences essential to direct and oversee the company’s long-term strategy and performance. All directors have senior executive leadership experience leading large, complex organizations. In particular, all directors have a broad range of experience and expertise in the resources sector. Additionally, strategic leadership, international experience, industry knowledge, risk management, ESG, human capital management, and corporate governance competencies are notable strengths of several directors. All such experiences are invaluable in setting priorities and appraising strategic actions and performance. This matrix is reviewed annually to identify opportunities among the collective skills of the Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Overview of our Board's Profile | A.E. Michael Anglin | Rod Antal | Thomas R. Bates, Jr. | Brian R. Booth | Simon A. Fish | Leigh Ann Fisher | Alan P. Krusi | Kay Priestly | Karen Swager | Total |

| Skills and Core Capabilities | | Corporate Finance | | P | P | | | P | | P | | 4 |

| Risk Management | | | P | | P | P | P | P | P | 6 |

| Mergers & Acquisitions | P | P | P | P | P | | P | P | P | 8 |

| International | P | P | P | P | P | | P | P | P | 8 |

| Strategic Leadership | P | P | P | P | P | P | P | P | P | 9 |

| Human Capital Management | | | P | | | P | P | | | 3 |

| Industry Knowledge | P | P | | P | P | P | P | P | P | 8 |

| Financial Reporting | | | P | | | P | | P | | 3 |

| Sustainability & ESG | P | | | P | P | | P | | P | 5 |

| Board Composition | Age | 67 | 57 | 73 | 63 | 62 | 56 | 68 | 67 | 52 | Average |

| 63 |

| Board Tenure | 15 | 3 | 3 | 7 | 5 | 1 | 3 | 3 | — | Average |

| 4 |

| Independence | P | CEO | P | P | P | P | P | P | P | 8 |

| 89% |

| Current Membership on Other Public Boards | 2 | 0 | 2 | 2 | 0 | 0 | 2 | 2 | 0 | Average |

| 1 |

| | | | | | | | | | | |

| Corporate Finance – Proficiency in the allocation of capital to ensure superior risk-adjusted financial returns, including strengthening capital structure, evaluating capital investment decisions, setting thresholds for financial returns, and optimizing asset portfolios. | | Human Capital Management – First-hand experience in human capital management including attracting, motivating, and retaining top talent. Sound knowledge of objective setting, compensation plan design, succession planning, and organizational design. |

| Risk Management – Knowledge of risk management principles and practices, an understanding of the key risk areas that a company faces, and an ability to identify, assess, manage, and report on risk controls and exposures. | | Industry Knowledge – Executive experience at a major public or private mining company with operating and mineral processing experience, including production, exploration, reserves, capital projects, logistics and related technology. |

| Mergers & Acquisitions – Hands-on experience in evaluating, negotiating, and executing significant mergers, acquisitions, and assets sales and/or disposals. | | Financial Reporting – Senior executive or equivalent experience in financial accounting and reporting, risk and internal controls. |

| International – Insight gained through foreign assignments in conducting business internationally, including exposure to a range of political, cultural, and regulatory requirements. Familiarity with the critical role of partnerships with host governments, local communities, indigenous people, non-governmental organizations, and other stakeholders. | | Sustainability & ESG – Demonstrable understanding of key environmental impacts for a global mining company, including climate change risks and opportunities, sustainable development, workplace health and safety, social performance, license to operate, community engagement, human rights, and governance of these matters. |

| Strategic Leadership – Executive or board experience driving strategic direction and growth of an organization. Experience leading significant change management/integration across a global business unit. | | |

| | | |

In addition to the skills of the Board members set forth above, the Board regularly engages subject matter experts from time to time to supplement the Board’s skills, including compensation consultants, cyber security and information security experts, governance advisors and environmental specialists.

SSR Mining, its Board, and its management are committed to the highest standards of corporate governance and transparency. As part of the Company’s commitment to establishing best corporate governance practices, the standing Corporate Governance and Nominating Committee (the “Governance Committee”) actively assists the Board throughout the year by developing and monitoring the Company’s overall approach to corporate governance issues, monitoring regulatory developments and public disclosures, and implementing and administering the system.

At SSR Mining, we are committed to operating in an ethical, legal, environmentally sensitive and socially responsible manner, while creating long-term value for our Shareholders. Our governance structure enables independent, experienced and accomplished directors to provide advice, insight and oversight to advance the interests of SSR Mining and our Shareholders. We strive to maintain sound governance standards, to be reflected in our Governance Guidelines, Code of Business Conduct and Ethics, our systematic approach to risk management, and our commitment to transparent financial reporting and strong internal controls. The full text of the Company’s corporate governance policies is available to Shareholders and others on the Company’s website at www.ssrmining.com.

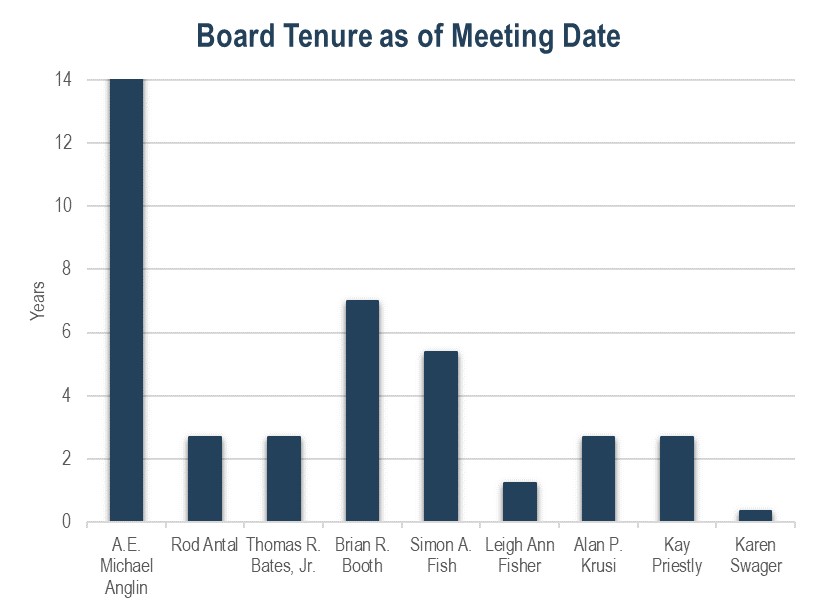

Board Tenure and Term Limits

The following chart provides a summary of the tenure of the Board as of the Meeting date. Following the Meeting, should all director nominees be elected, the average Board tenure will be approximately 4.4 years.

The Company believes that imposing term limits on its directors would be unduly restrictive and not in the best interests of the Company and could become an arbitrary mechanism for removing directors, which could result in valuable and experienced directors being forced to leave the Board solely because of length of service. Therefore, the Company has not adopted specific term limits for the directors on its Board, and instead relies upon the effective annual assessment process to ensure the ongoing efficacy of individual directors and the Board and its committees as a whole. The Company does not have a mandatory retirement age.

Director Independence

The Board of Directors Charter, which is posted on our website at www.ssrmining.com requires directors to exercise independent judgment, regardless of the existence of relationships or interests which could interfere with the exercise of independent judgment. Directors are also required to disclose any conflict of interest in any issue brought before the Board and must refrain from participating in the Board’s discussion and voting on the matter. The Board assesses the independence of new directors prior to appointment and reviews the independence of all directors at least annually to ensure compliance with all applicable requirements of NASDAQ, the TSX and Canadian and U.S. securities laws.

Inclusion and Diversity

Our Board recognizes that a board composed of individuals with a mix of differing skills, experience, perspectives, age and characteristics leads to a more robust understanding of opportunities, issues and risks, and to stronger decision-making. A copy of the Company’s Diversity Policy is available on its website at www.ssrmining.com. In March 2019, the Company became a member of each of the Catalyst Accord 2022 and the 30% Club Canada, which are initiatives aimed at accelerating the advancement of women in the workplace with a target goal of at least 30% representation of women on public-company boards. In 2021, the Company also joined the CEO Action for Diversity and Inclusion, an initiative aimed at accelerating the advancement of women in boardrooms and strategic executive roles in Canada. Three of the eight independent nominees for the Board, or 37.5% of the independent Board, are women.

The following table details the gender and diversity characteristics self-identified by the nominees to the Board:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board Diversity Matrix (as of April 14, 2023) |

| A.E. Michael Anglin | Rod Antal | Thomas R. Bates, Jr. | Brian R. Booth | Simon A. Fish | Leigh Ann Fisher | Alan P. Krusi | Kay Priestly | Karen Swager | TOTAL |

| Total Number of Directors | | | | | | | | | | 9 |

| Gender Identity | | | | | | | | | | |

| Female | | | | | | P | | P | P | 3 |

| Male | P | P | P | P | P | | P | | | 6 |

| Did Not Disclose Gender | | | | | | | | | | 0 |

| Demographic Background | | | | | | | | | | |

| African American or Black | | | | | | | | | | 0 |

| Alaskan Native or Native American or First Nations | | | | | | | | | | 0 |

| Asian | | | | | | | | | | 0 |

| Hispanic or Latinx | | | | | | | | | | 0 |

| White | P | P | P | P | P | P | P | P | P | 9 |

| Two or More Races or Ethnicities | | | | | | | | | | 0 |

| LGBTQ+ | | | | | | | | | | 0 |

| Persons with Disabilities | | | | | | | | | | 0 |

| Military Veteran | | | | | P | | P | | | 2 |

| Did Not Disclose Demographic Background | | | | | | | | | | 0 |

The Company is committed to developing a diverse workforce and is continually assessing opportunities to progress all levels of diversity across the organization. While the Company does not believe that adopting numerical quotas is in the best interest of its business nor its Shareholders, the Company has adopted specific and measurable objectives to ensure that the pool of candidates it considers for positions throughout the organization, including its Board of Directors, consists of the most diverse and qualified candidates available. To achieve this goal, the Board has adopted the following measurable objectives which are reviewed annually:

u Diversity on the Board: The Governance Committee will require that a thorough outreach and search process be conducted for new positions or vacancies on the Board that ensures that the candidate pool reviewed by the Committee consists of a qualified and diverse group of individuals. The Board has identified the following key areas of focus for Board candidates: experience or skill sets that complement the Board; experience or nationalities related to the geographical regions where the Company has or anticipates business interests; and increasing the representation of female Board members.

u Diversity in Executive Management and across the Business: The recruitment and development programs instituted by the Company will focus on ensuring that the Company has a diverse and qualified workforce at all levels of the organization. Recruitment measures will ensure that the pool of candidates considered consists of a group of qualified and diverse individuals and a key focus of the Company’s development programs will be the identification and development of diverse individuals, including local nationals at the Company’s mines.

Director Share Ownership Guidelines

The Board has established share ownership guidelines for directors. We expect each director to accumulate at least three (3) times the value of their annual cash retainer in the Common Shares and/or DSUs, valued based on the greater of the closing market price of the Shares on the TSX, or the value at the time of the grant or purchase. These guidelines are to be satisfied by the date that is five (5) years from the date the applicable director is appointed or elected as a director of the Company.

Nomination of Directors and Criteria for Board Membership

The Board recognizes that a diverse board of directors makes prudent business sense and enhances oversight and corporate governance. The Board is committed to a merit-based process, which is based on objective criteria, solicits multiple perspectives and is free of conscious or unconscious bias and discrimination, for the identification and selection of nominees to the Board.

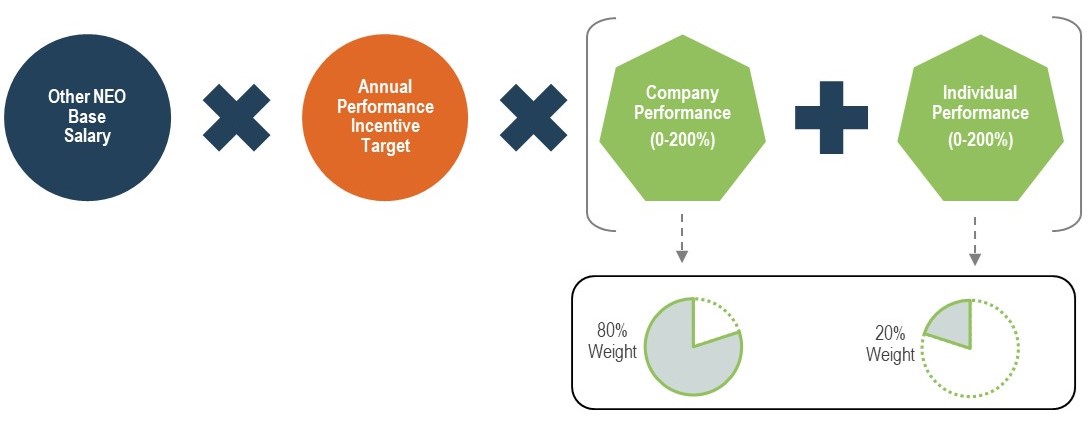

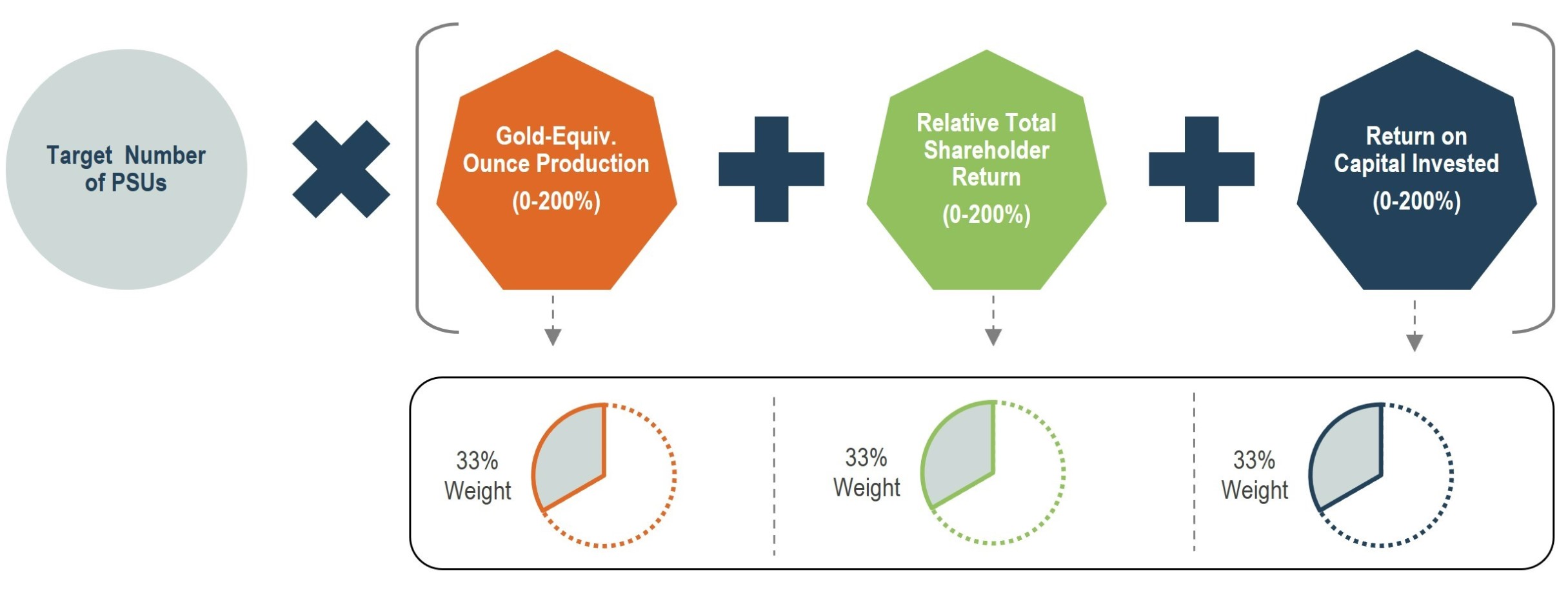

A core responsibility of the Governance Committee is to identify prospective Board members, consistent with Board-approved criteria, and to recommend such individuals to the Board for nomination. The Governance Committee believes that the Board should be comprised of directors who possess a mix of experience and expertise that is relevant to the Company and its operations. As a result, while the emphasis on filling Board vacancies is on finding the best-qualified candidates who exhibit the highest degree of integrity, professionalism, values and independent judgment, a nominee’s diversity of gender, race, nationality or other attributes may also be considered favorably in his or her assessment.