|

|

| |

Technical Report Summary on the

Çöpler Property, Türkiye S-K 1300 Report SSR Mining Inc. SLR Project No.: 138.21581.00006 Effective Date: October 31, 2023 Signature Date: February 12, 2024 Prepared by: SLR International Corporation RSC Consulting Ltd. WSP USA Inc. Ausenco Services Pty Ltd. |

| |

| |

| |

| |

| | Making Sustainability Happen |

Technical Report Summary on the Çöpler Property, Türkiye

SLR Project No.: 138.21581.00006

Prepared by

SLR International Corporation 1658 Cole Blvd, Suite 100 Lakewood, CO 80401 | WSP USA Inc. 7245 West Alaska Drive, Suite 200 Lakewood, CO 80226 USA |

| | |

RSC Consulting Ltd. 24 Smith Street Dunedin 9016 New Zealand | Ausenco Services Pty Ltd. Level 6, 189 Grey Street South Brisbane, Queensland 4101 Australia |

for

SSR Mining Inc.

6900 E. Layton Avenue, Suite 1300

Denver, Colorado 80237

USA

Effective Date - October 31, 2023

Signature Date - February 12, 2024

Distribution: 1 copy - SSR Mining Inc.

1 copy - SLR International Corporation

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

Cautionary Note Regarding Forward-Looking Statements:

Certain statements contained in this report are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and are intended to be covered by the safe harbor provided for under these sections. Forward looking statements can be identified with words such as “may,” “will,” “could,” “should,” “expect,” “plan,” “anticipate,” “believe,” “intend,” “estimate,” “projects,” “predict,” “potential,” “continue” and similar expressions, as well as statements written in the future tense. Forward-looking statements are based on information known at such time and/or with a good faith belief with respect to future events. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the forward-looking statements. Many of these risks and uncertainties cannot be controlled or predicted. Given these risks and uncertainties, readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements include, among things: metal price assumptions, cash flow forecasts, projected capital and operating costs, metal recoveries, mine life and production rates, and other assumptions used in this report.

Such forward-looking information and statements are based on a number of material factors and assumptions, including, but not limited to: the inherent speculative nature of exploration results; the ability to explore; communications with local stakeholders; maintaining community and governmental relations; status of negotiations of joint ventures; weather conditions at our operations; commodity prices; the ultimate determination of and realization of Mineral Reserves; existence or realization of Mineral Resources; the development approach; availability and receipt of required approvals, titles, licenses and permits; sufficient working capital to develop and operate the mines and implement development plans; access to adequate services and supplies; foreign currency exchange rates; interest rates; access to capital markets and associated cost of funds; availability of a qualified work force; ability to negotiate, finalize, and execute relevant agreements; lack of social opposition to our mines or facilities; lack of legal challenges with respect to our properties; the timing and amount of future production; the ability to meet production, cost, and capital expenditure targets; timing and ability to produce studies and analyses; capital and operating expenditures; economic conditions; availability of sufficient financing; the ultimate ability to mine, process, and sell mineral products on economically favorable terms; and any and all other timing, exploration, development, operational, financial, budgetary, economic, legal, social, geopolitical, regulatory and political factors that may influence future events or conditions. While we consider these factors and assumptions to be reasonable based on information currently available to us, they may prove to be incorrect.

The above list is not exhaustive list of the factors that may affect any of the forward-looking statements and information included in this report, and such statements and information will not be updated to reflect events or circumstances arising after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

This technical report summary also contains financial measures which are not recognized under U.S. generally accepted accounting principles.

| | i |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

Table of Contents

| 1.0 Executive Summary | 1-1 |

| 1.1 Summary | 1-1 |

| 1.2 Economic Analysis | 1-9 |

| 1.3 Technical Summary | 1-13 |

| 2.0 Introduction | 2-1 |

| 2.1 Site Visits | 2-1 |

| 2.2 Sources of Information | 2-2 |

| 2.3 List of Abbreviations | 2-4 |

| 3.0 Property Description | 3-1 |

| 3.1 Location | 3-1 |

| 3.2 Land Tenure | 3-5 |

| 3.3 Encumbrances and Royalties | 3-8 |

| 3.4 Required Permits and Status | 3-9 |

| 3.5 Other Significant Factors and Risks | 3-10 |

| 4.0 Accessibility, Climate, Local Resources, Infrastructure, and Physiography | 4-1 |

| 4.1 Accessibility | 4-1 |

| 4.2 Climate | 4-1 |

| 4.3 Local Resources | 4-2 |

| 4.4 Infrastructure | 4-2 |

| 4.5 Physiography | 4-3 |

| 5.0 History | 5-1 |

| 5.1 Prior Ownership | 5-1 |

| 5.2 Exploration and Development History | 5-1 |

| 5.3 Past Production | 5-2 |

| 5.4 Previous NI 43-101 Technical Reports | 5-3 |

| 6.0 Geological Setting, Mineralization, and Deposit | 6-1 |

| 6.1 Regional Geology | 6-1 |

| 6.2 Local Geology | 6-3 |

| 6.3 Property Geology and Mineralization | 6-7 |

| 6.4 Regional Prospects and Targets | 6-21 |

| 6.5 Deposit Types | 6-24 |

| 7.0 Exploration | 7-1 |

| 7.1 Hydrogeological Data | 7-1 |

| | ii |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| 7.2 Geotechnical Data | 7-3 |

| 7.3 Çöpler Deposit Exploration | 7-3 |

| 7.4 Greater Çakmaktepe Exploration | 7-4 |

| 7.5 Drilling | 7-5 |

| 7.6 Sample Collection | 7-13 |

| 8.0 Sample Preparation, Analyses, and Security | 8-1 |

| 8.1 Sample Preparation | 8-1 |

| 8.2 Sample Analysis | 8-1 |

| 8.3 Quality Assurance and Quality Control | 8-2 |

| 8.4 Sample Security | 8-31 |

| 8.5 QP Opinion | 8-31 |

| 9.0 Data Verification | 9-1 |

| 9.1 Site Visit | 9-1 |

| 9.2 Database Validation | 9-1 |

| 9.3 Çöpler Deposit Data Verification | 9-2 |

| 9.4 Greater Çakmaktepe | 9-2 |

| 9.5 Bayramdere Deposit Data Verification | 9-3 |

| 9.6 QP Opinion | 9-3 |

| 10.0 Mineral Processing and Metallurgical Testing | 10-1 |

| 10.1 Oxide Ore for Heap Leaching | 10-1 |

| 10.2 Oxide Ore for Grind / Leach | 10-5 |

| 10.3 Sulfide Ores – Flotation and Pressure Oxidation | 10-8 |

| 10.4 Mineral Processing and Metallurgical Discussion | 10-17 |

| 10.5 QP Opinion | 10-17 |

| 11.0 Mineral Resource Estimates | 11-1 |

| 11.1 Summary | 11-1 |

| 11.2 Çöpler | 11-4 |

| 11.3 Greater Çakmaktepe | 11-28 |

| 11.4 Bayramdere Mineral Resource Estimate | 11-51 |

| 11.5 QP Opinion | 11-62 |

| 12.0 Mineral Reserve Estimates | 12-1 |

| 12.1 Summary | 12-1 |

| 12.2 Mineral Reserves Statement | 12-1 |

| 12.3 Dilution | 12-2 |

| | iii |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| 12.4 Mining Recovery | 12-2 |

| 12.5 Comparison to Previous Estimate | 12-19 |

| 12.6 QP Opinion | 12-19 |

| 13.0 Mining Methods | 13-1 |

| 13.1 Geotechnical | 13-3 |

| 13.2 Mine Plan | 13-20 |

| 13.3 Mine Equipment | 13-37 |

| 13.4 Personnel | 13-38 |

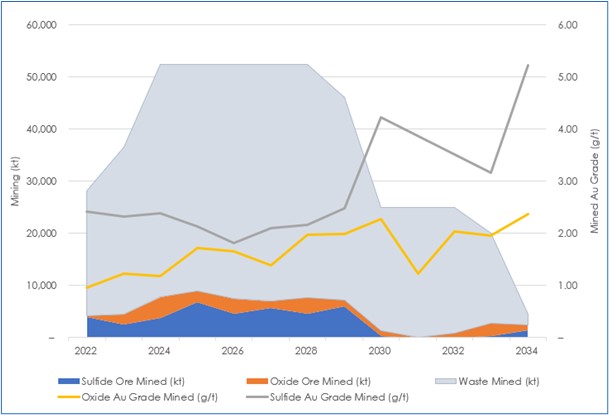

| 13.5 Mine Production Schedule | 13-39 |

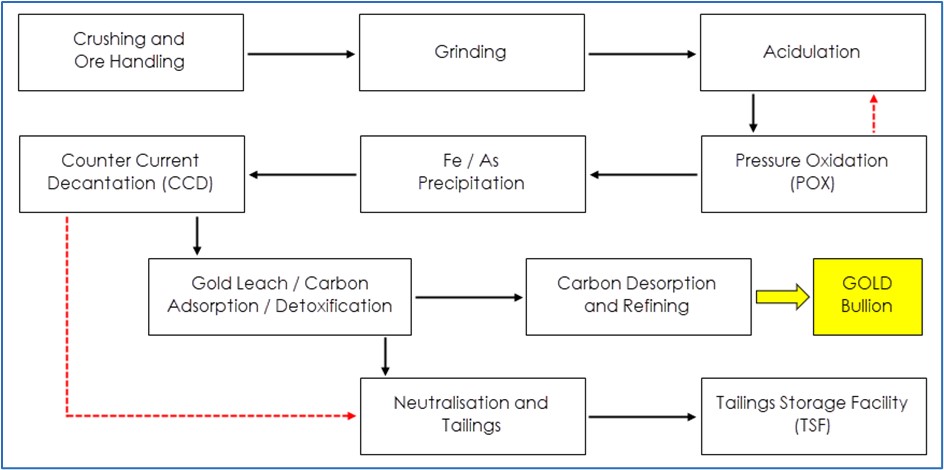

| 14.0 Processing and Recovery Methods | 14-1 |

| 14.1 Sulfide Ore Processing | 14-1 |

| 14.2 Oxide Heap Leach Processing | 14-13 |

| 14.3 Oxide Grind Leach Processing | 14-18 |

| 14.4 Personnel | 14-20 |

| 15.0 Infrastructure | 15-1 |

| 15.1 Access Roads | 15-3 |

| 15.2 Power | 15-3 |

| 15.3 Water | 15-3 |

| 15.4 Accommodation Camps | 15-6 |

| 15.5 Existing Infrastructure | 15-6 |

| 15.6 Communications | 15-8 |

| 15.7 Plant Fire Protection System | 15-8 |

| 15.8 Heap Leach Facility | 15-8 |

| 15.9 Tailings Storage Facility | 15-8 |

| 16.0 Market Studies | 16-1 |

| 16.1 Markets | 16-1 |

| 16.2 Contracts | 16-1 |

| 17.0 Environmental Studies, Permitting, and Social Plans, Negotiations, or Agreements with Local Individuals or Groups | 17-1 |

| 17.1 Permitting | 17-1 |

| 17.2 Environmental Studies, Site Information and Management | 17-3 |

| 17.3 Environmental Management | 17-7 |

| 17.4 Mine Closure | 17-9 |

| 17.5 Social and Community Plans | 17-13 |

| 18.0 Capital and Operating Costs | 18-1 |

| | iv |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| 18.1 Capital Costs | 18-1 |

| 18.2 Operating Costs | 18-2 |

| 19.0 Economic Analysis | 19-1 |

| 19.1 Economic Assumptions | 19-1 |

| 19.2 Cash Flow Analysis | 19-3 |

| 19.3 Sensitivity Analysis | 19-4 |

| 20.0 Adjacent Properties | 20-1 |

| 21.0 Other Relevant Data and Information | 21-1 |

| 22.0 Interpretation and Conclusions | 22-1 |

| 22.1 Geology and Mineral Resources | 22-1 |

| 22.2 Mining and Mineral Reserves | 22-3 |

| 22.3 Mineral Processing | 22-3 |

| 22.4 Infrastructure | 22-5 |

| 22.5 Environment | 22-6 |

| 22.6 Capital and Operating Costs | 22-6 |

| 23.0 Recommendations | 23-1 |

| 23.1 Geology and Mineral Resources | 23-1 |

| 23.2 Mining and Mineral Reserves | 23-1 |

| 23.3 Mineral Processing | 23-1 |

| 23.4 Infrastructure | 23-1 |

| 23.5 Environment | 23-2 |

| 23.6 Capital and Operating Costs | 23-3 |

| 24.0 References | 24-1 |

| 25.0 Reliance on Information Provided by the Registrant | 25-1 |

| 26.0 Date and Signature Page | 26-1 |

| 27.0 Appendix 1 | 27-1 |

Tables

| Table 1-1: Gold Royalty Rates | 1-11 |

| Table 1-2: After-Tax Cash Flow Summary | 1-12 |

| Table 1-3: Summary of Çöpler Mine, Greater Çakmaktepe and Bayramdere Mineral Resources (SSR’s Attributable Share) | 1-16 |

| Table 1-4: Summary of Mineral Reserves as of October 31, 2023 (SSR’s Attributable Share) | 1-19 |

| | v |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| Table 1-5: Capital Cost Summary | 1-23 |

| Table 1-6: Average Operating Costs Unit Rates | 1-23 |

| Table 2-1: Consulting Companies Which Acted as Qualified Persons in Preparing this Report | 2-2 |

| Table 3-1: Granted Licenses and Operating Permits | 3-6 |

| Table 3-2: Gold Royalty Rates | 3-8 |

| Table 5-1: Past Production | 5-2 |

| Table 7-1: Overview of Anagold Exploration at Çöpler Deposit | 7-3 |

| Table 7-2: Overview of Anagold Exploration at Greater Çakmaktepe | 7-4 |

| Table 7-3: Drill Summary by Hole Type for Çöpler Deposit (2000–2023) | 7-6 |

| Table 7-4: Drill Summary by Year for Çöpler Deposit | 7-6 |

| Table 7-5: Drill Summary for Greater Çakmaktepe Deposit (2012–2023) | 7-9 |

| Table 7-6: Greater Çakmaktepe 2012–2023 Drill Summary | 7-9 |

| Table 7-7: Drill Summary for Bayramdere | 7-11 |

| Table 8-1: Summary of Sample Analysis Methods Over Time | 8-1 |

| Table 8-2: Summary of QA and SOP Review | 8-3 |

| Table 8-3: Summary of Çöpler QC Review | 8-6 |

| Table 8-4: Summary of Çakmaktepe Ext QC Review | 8-9 |

| Table 8-5: Summary of Çakmaktepe QC Review | 8-10 |

| Table 8-6: Summary of Bayramdere QC Review | 8-12 |

| Table 8-7: Summary of Çöpler Quality Acceptance Testing | 8-13 |

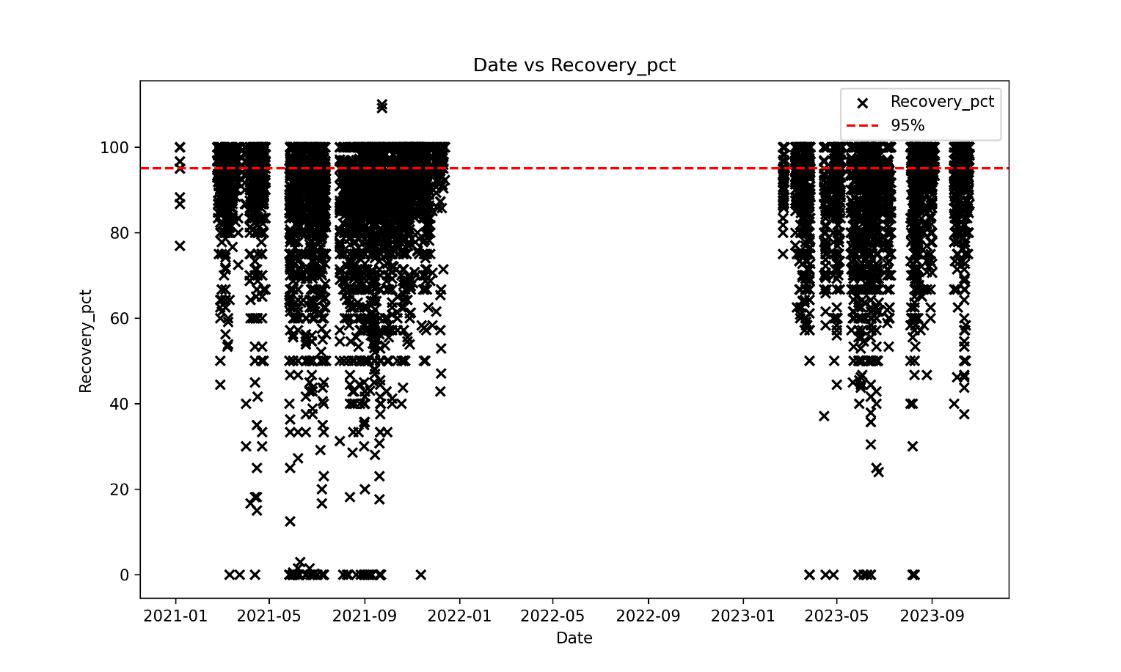

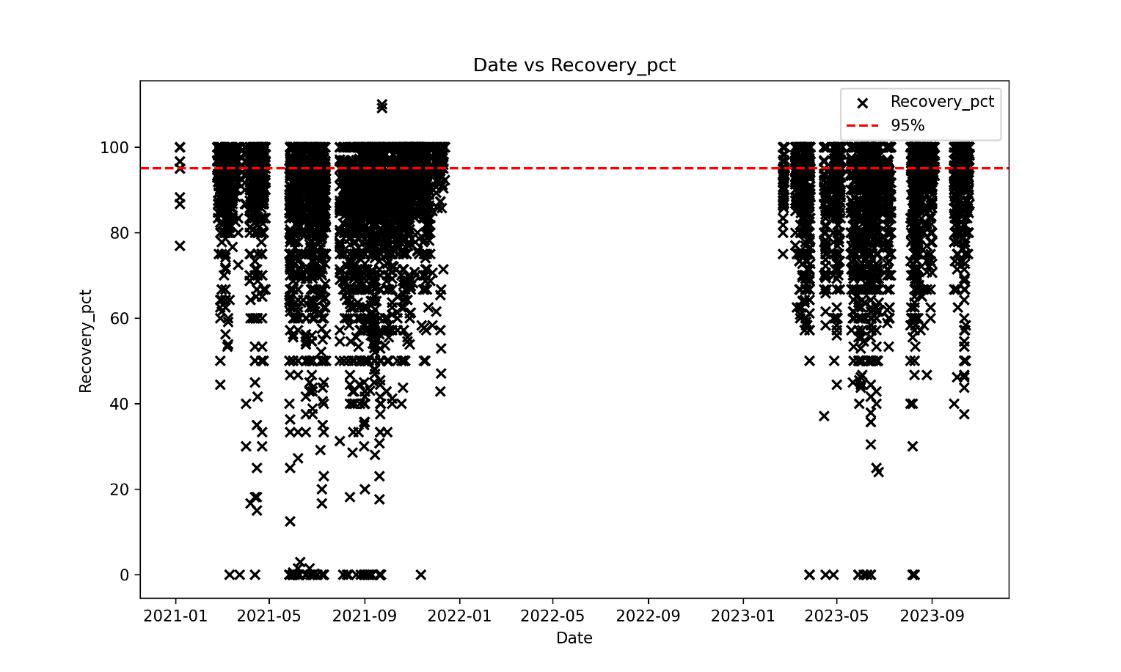

| Table 8-8: Recovery Summary Statistics for Çöpler, 2021–2023. | 8-17 |

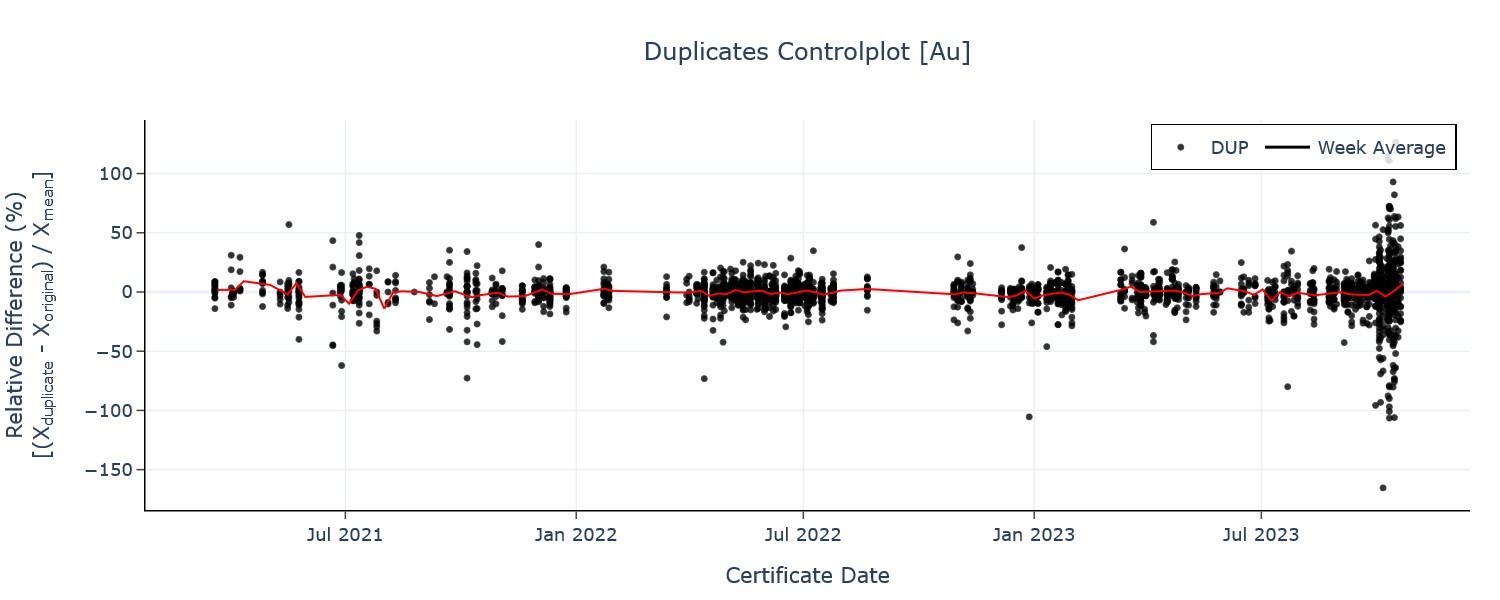

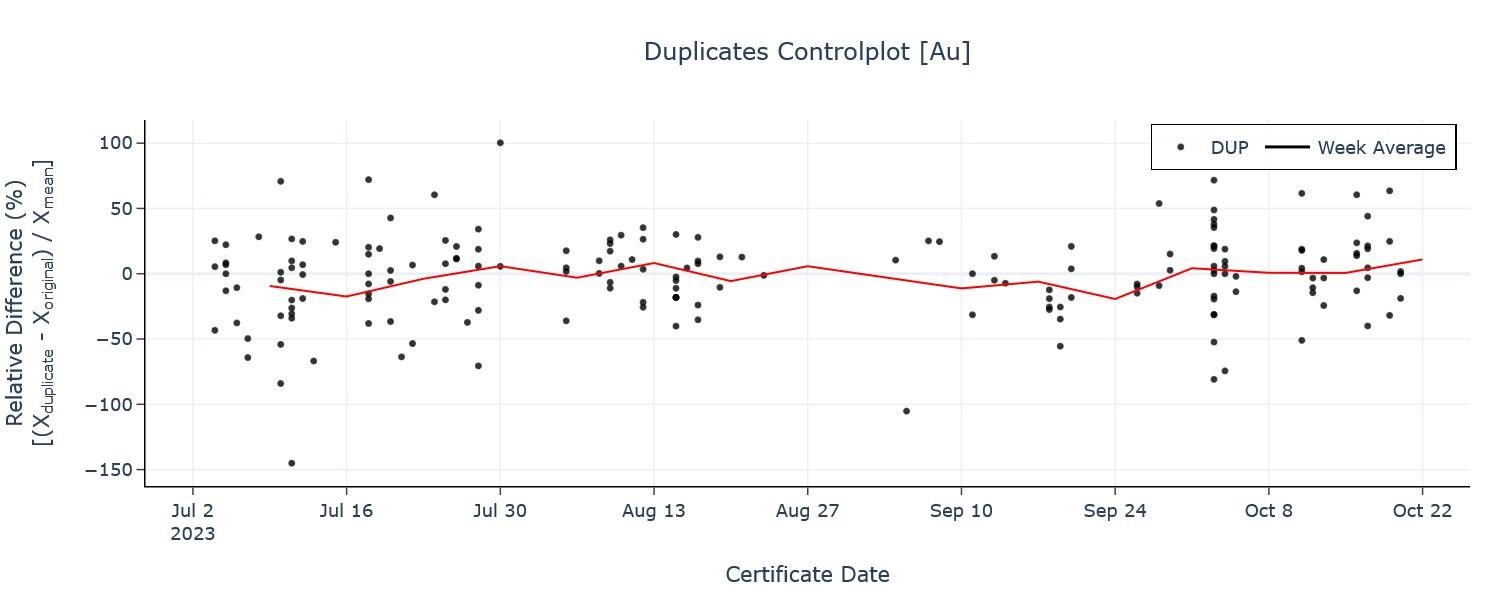

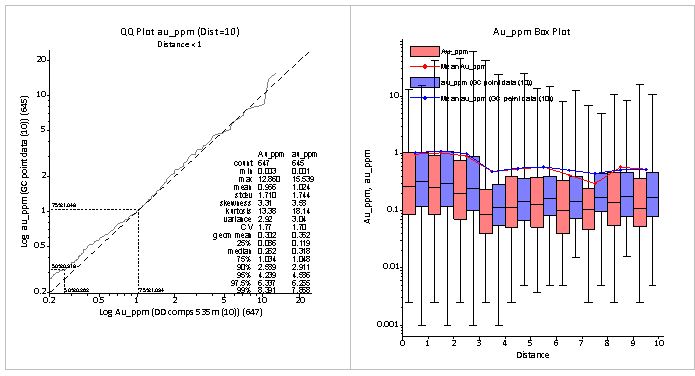

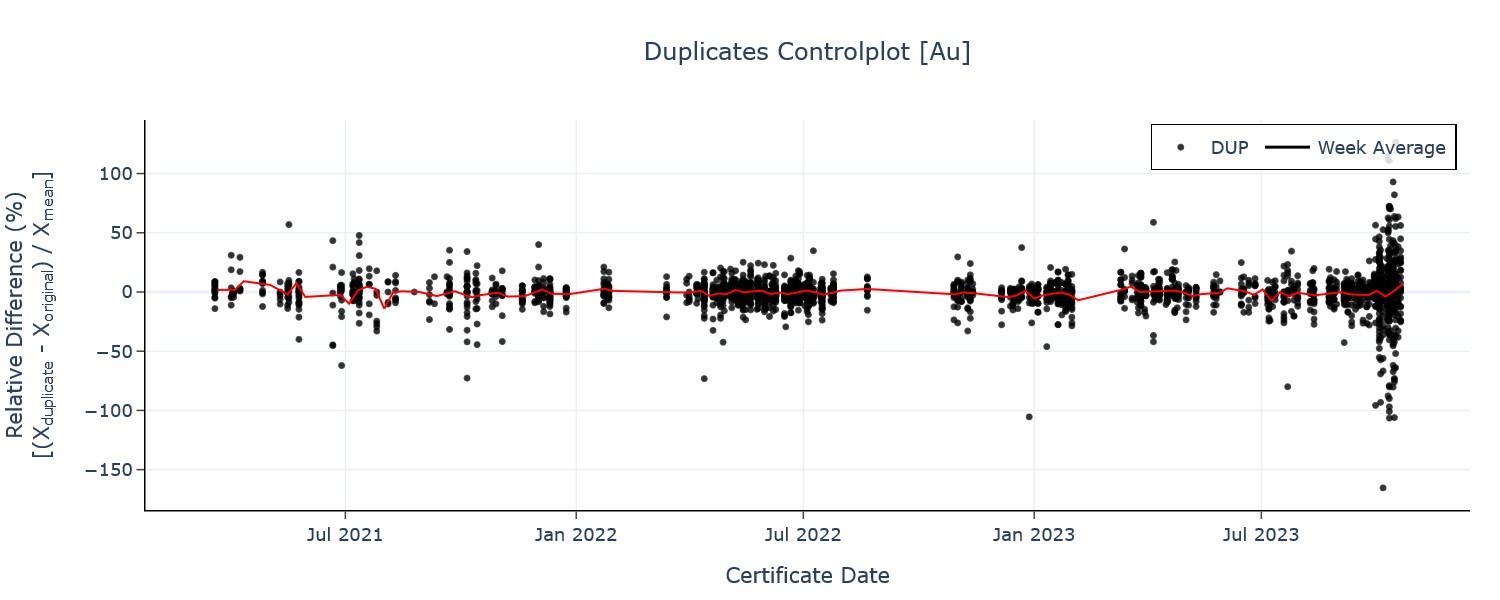

| Table 8-9: Results of Çöpler Distance Buffered QQ-Plot Analysis of Diamond and RC Drilling (Only pairs separated by <1 m) | 8-18 |

| Table 8-10: Quality Acceptance Testing for Çöpler CRMs (2021–2023) | 8-19 |

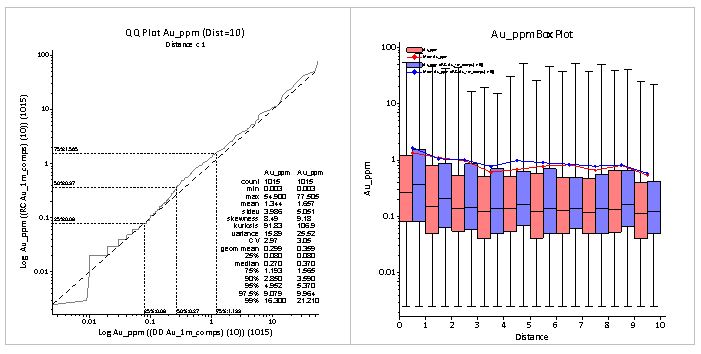

| Table 8-11: Recovery Summary Statistics for Çakmaktepe Ext, May 2020–2023. | 8-22 |

| Table 8-12: Summary of Çakmaktepe Ext Quality Acceptance Testing | 8-24 |

| Table 8-13: Quality Acceptance Testing for Çakmaktepe Ext CRMs, 2021–2023. | 8-25 |

| Table 8-14: Summary of Çakmaktepe Quality Acceptance Testing | 8-28 |

| Table 8-15: Summary of Bayramdere Quality Acceptance Testing | 8-30 |

| Table 10-1: Metallurgical and Analytical Laboratories Contributing to the Project | 10-1 |

| Table 10-2: Summary of Çöpler Samples Selected for Historical Test Work | 10-2 |

| Table 10-3: Summary of Çakmaktepe Ext Oxide Samples Selected for 2019 Test Work | 10-3 |

| Table 10-4: Çöpler Gold Recovery (%) Assumptions for Heap Leaching of Oxide | 10-4 |

| | vi |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| Table 10-5: Çakmaktepe Gold Recovery (%) Assumptions for Heap Leaching of Oxide (incl. Bayramdere) | 10-4 |

| Table 10-6: Çakmaktepe Ext. Gold Recovery (%) Assumptions for Heap Leaching of Oxide | 10-4 |

| Table 10-7: Çakmaktepe Ext. Oxide – Grind Leach – Metallurgical Testwork Summary | 10-5 |

| Table 10-8: McClelland (2018) – Çakmaktepe Ext. Oxide Leaching Test Work Results | 10-5 |

| Table 10-9: ALS Kamloops (2023) – Çakmaktepe Ext. Oxide Leaching Testwork Results | 10-6 |

| Table 10-10: ALS Kamloops (2023) – Çakmaktepe Ext. Oxide Comminution Results | 10-7 |

| Table 10-11: Çakmaktepe Ext. Gold Recovery Estimates for Grind/Leach of Oxide Ore | 10-8 |

| Table 10-12: Gold Deportment in Flotation Separated Streams | 10-9 |

| Table 10-13: ALS Kamloops (2023) – Çakmaktepe Ext. Sulfide Comminution Results | 10-13 |

| Table 10-14: Gold POX Recovery Model Parameters | 10-16 |

| Table 10-15: Commissioning and Ramp-up Allowances | 10-16 |

| Table 11-1: Summary of Çöpler Mine, Greater Çakmaktepe and Bayramdere Mineral Resources (SSR’s Attributable Only) | 11-2 |

| Table 11-2: Summary of Drill Hole Data Informing Çöpler MRE | 11-4 |

| Table 11-3: Compositing Statistics in the Single Au Mineralization Domain (All Sub-Domains Combined) | 11-11 |

| Table 11-4: Domain Statistics (g/t Au) | 11-12 |

| Table 11-5: Block Model Description | 11-15 |

| Table 11-6: Estimation Kriging Neighbourhood and Variography Settings for All Domains (Au) | 11-17 |

| Table 11-7: Çöpler Density Statistics for Lithology Domains | 11-18 |

| Table 11-8: Summary of Key Parameters Used in 2023 Conceptual Pit Shell at Çöpler | 11-23 |

| Table 11-9: Summary of Çöpler Mineral Resources exclusive of Mineral Reserves | 11-25 |

| Table 11-10: Summary of Drill Hole Data Informing Greater Çakmaktepe MRE | 11-28 |

| Table 11-11: Compositing Statistics in Au HG domain | 11-36 |

| Table 11-12: Greater Çakmaktepe Block Model Description | 11-39 |

| Table 11-13: Kriging Neighbourhood and Variography Settings for Au Domains | 11-40 |

| Table 11-14: Çakmaktepe Density Statistics for Lithology Domains | 11-41 |

| Table 11-15: Summary of Key Parameters used in 2023 Conceptual Pit Shell at Greater Çakmaktepe | 11-47 |

| Table 11-16: Summary of Greater Çakmaktepe Mineral Resources exclusive of Mineral Reserves | 11-48 |

| Table 11-17: Summary of Drill Hole Data Informing Bayramdere MRE | 11-51 |

| Table 11-18: Bayramdere Estimation Domain Statistics | 11-52 |

| Table 11-19: Summary of Variography Model Data in the OK estimation | 11-56 |

| | vii |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| Table 11-20: Bayramdere Block Model Description | 11-56 |

| Table 11-21: Estimation settings for Mineralized Domains | 11-56 |

| Table 11-22: Bayramdere Median Density Values for Lithology Domains | 11-57 |

| Table 11-23: Summary of Key Parameters used in 2023 Conceptual Pit Shell at Bayramdere | 11-59 |

| Table 11-24: Summary of Bayramdere Mineral Resources | 11-61 |

| Table 12-1: Summary of Mineral Reserve Estimates as of October 31, 2023 (SSR’s Attributable Share) | 12-3 |

| Table 12-2: Summary of Mineral Reserves by Process Types and Mining Areas (as of October 31, 2023) | 12-5 |

| Table 12-3: Summary of Metallurgical Inputs Used for Cut-off Grade (COG) Analysis and Scheduling | 12-8 |

| Table 12-4: Summary of Costs Inputs Used for Pit Optimization, COG Analysis, and Scheduling | 12-11 |

| Table 12-5: Sulfide Sulfur and Gold Grade Criteria for Establishing Process Methods Routing | 12-12 |

| Table 13-1: Golder Intact Strength Estimates (General) | 13-5 |

| Table 13-2: Çöpler 2023 Recommended Mine Pit Slope Parameters | 13-13 |

| Table 13-3: Greater Çakmaktepe 2023 Recommended Mine Pit Slope Parameters | 13-14 |

| Table 13-4: Çöpler 2023 Hydraulic Conductivities | 13-18 |

| Table 13-5: Heap Leach Recovery – Gold, Silver, and Copper | 13-22 |

| Table 13-6: Oxide Operating Costs | 13-24 |

| Table 13-7: Grind Leach Recovery | 13-24 |

| Table 13-8: Plant Throughput Limits | 13-25 |

| Table 13-9: Sulfide Operating Costs | 13-25 |

| Table 13-10: Au Cut-off Grade Revenue and Royalty Inputs | 13-25 |

| Table 13-11: Internal Au Cut-off Grades | 13-26 |

| Table 13-12: Key Mine Design Factors | 13-27 |

| Table 13-13: Waste Rock Dump (WRD) Capacities | 13-31 |

| Table 13-14: Waste Rock Dump (WRD) Design Factor of Safety (FOS) | 13-34 |

| Table 13-15: Waste Rock Geochemical Classification | 13-35 |

| Table 13-16: Çöpler Mine Contractor’s Mobile Equipment List | 13-38 |

| Table 13-17: Çöpler Project – Mining Personnel Summary | 13-38 |

| Table 13-18: Çöpler Mining Schedule (2023–2036) | 13-42 |

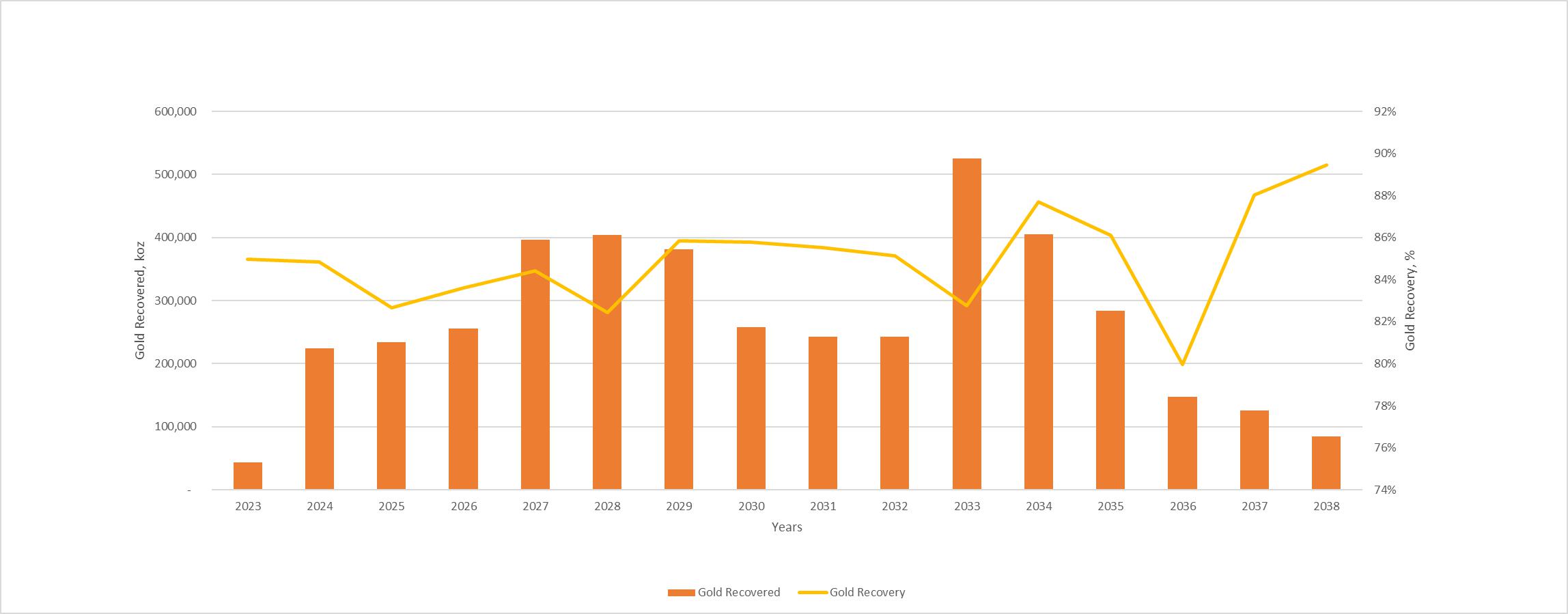

| Table 13-19: Processing Production Schedule (2023–2038) | 13-46 |

| | viii |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| Table 14-1: Sulphide Process Plant Unit Consumptions of Power, Reagents and Materials | 14-13 |

| Table 14-2: Oxide Grind Leach - Process Design Criteria | 14-20 |

| Table 14-3: Çöpler Mine – Processing Personnel Summary | 14-20 |

| Table 16-1: Economic Analysis Metal Price Assumptions | 16-1 |

| Table 18-1: Capital Cost Summary | 18-1 |

| Table 18-2: Growth Capital Cost Summary | 18-1 |

| Table 18-3: Sustaining Capital Summary | 18-2 |

| Table 18-4: Average Operating Costs Unit Rates | 18-3 |

| Table 18-5: Mine Operating Cost Summary | 18-3 |

| Table 18-6: Process Operating Cost Summary | 18-4 |

| Table 18-7: G&A Operating Cost Summary | 18-4 |

| Table 18-8: Current Workforce | 18-4 |

| Table 18-9: LOM Workforce Levels | 18-5 |

| Table 19-1: Gold Royalty Rates | 19-2 |

| Table 19-2: After-Tax Cash Flow Summary | 19-3 |

| Table 19-3: After-Tax Sensitivity Analyses | 19-5 |

Figures

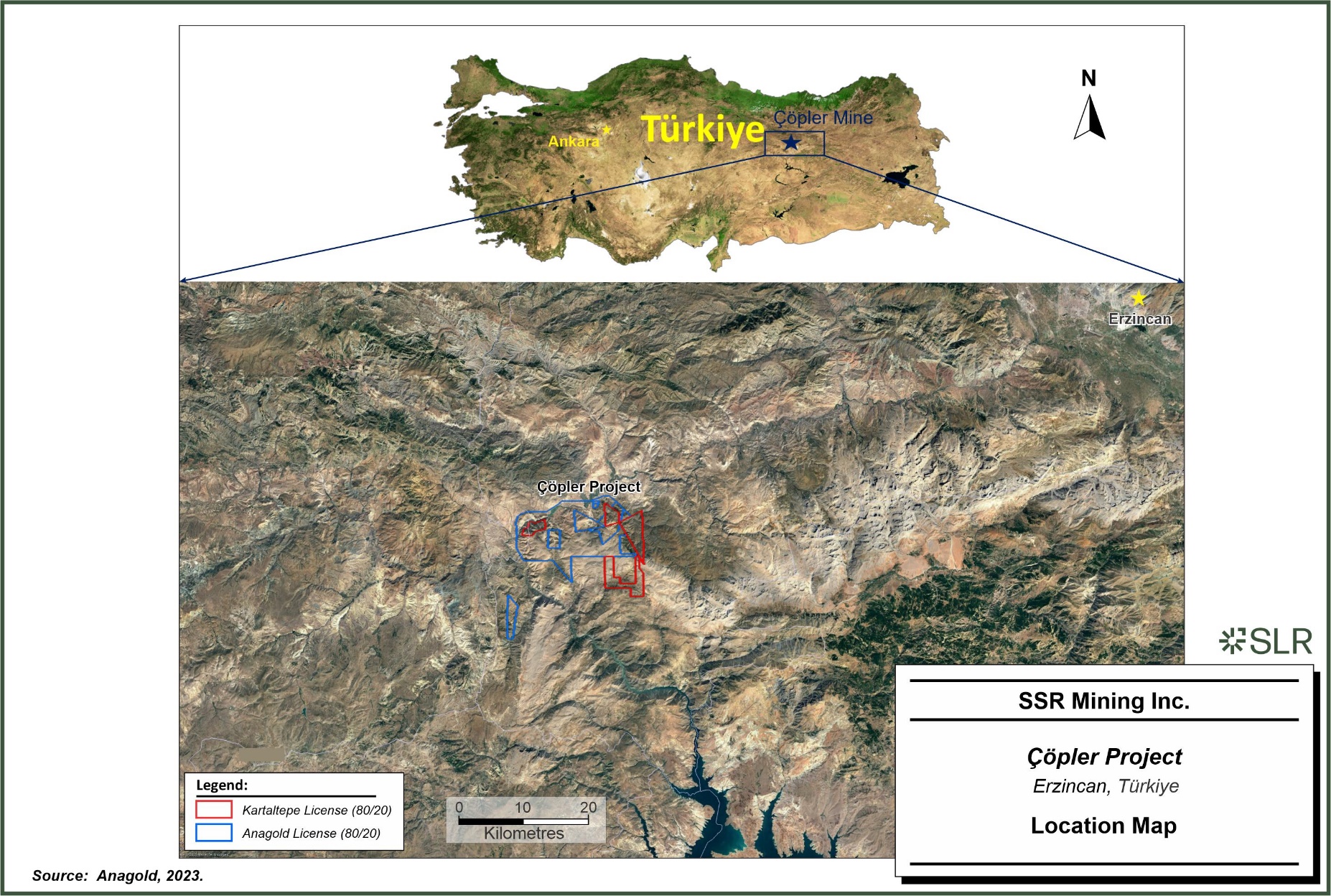

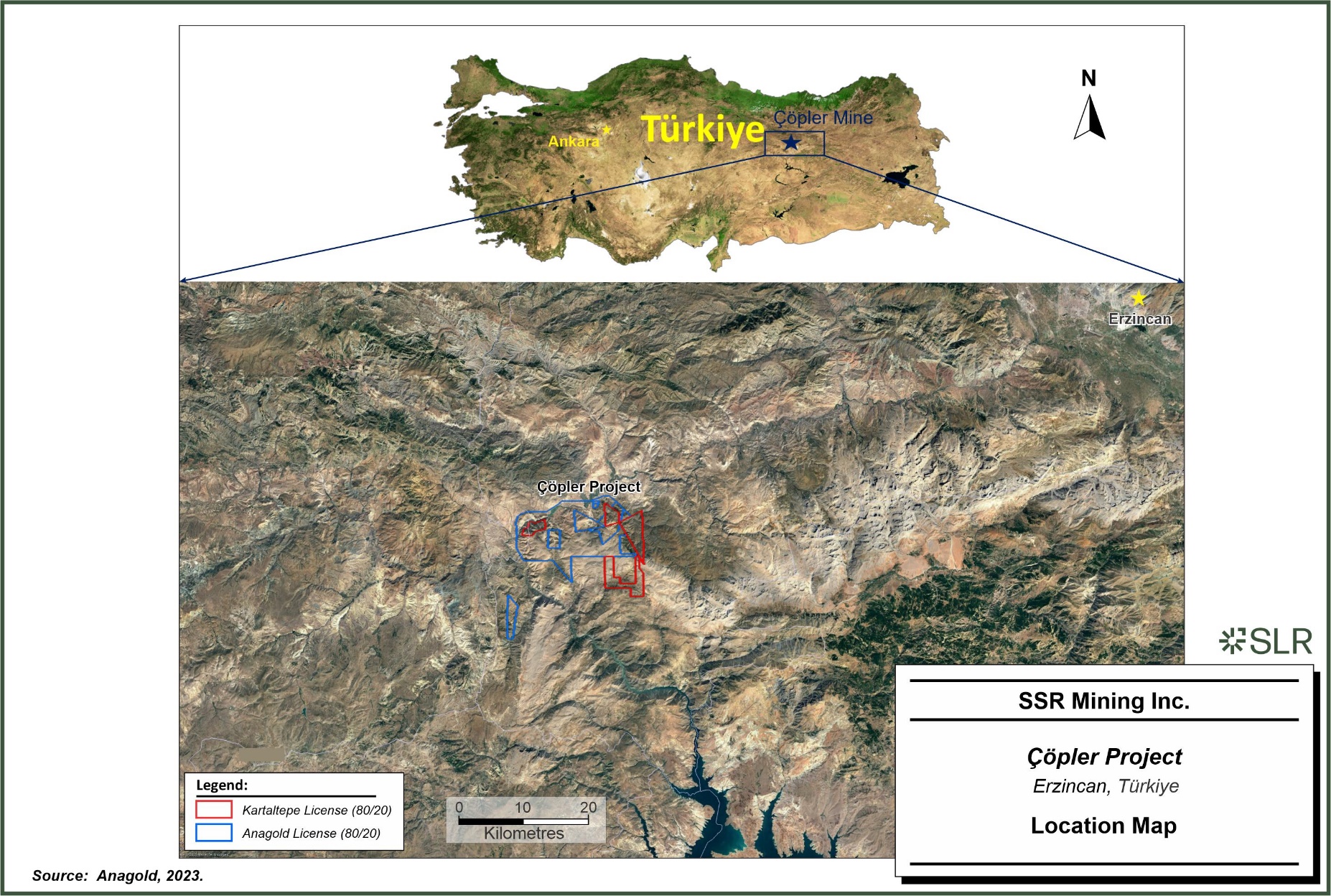

| Figure 3-1: | Location Map | 3-2 |

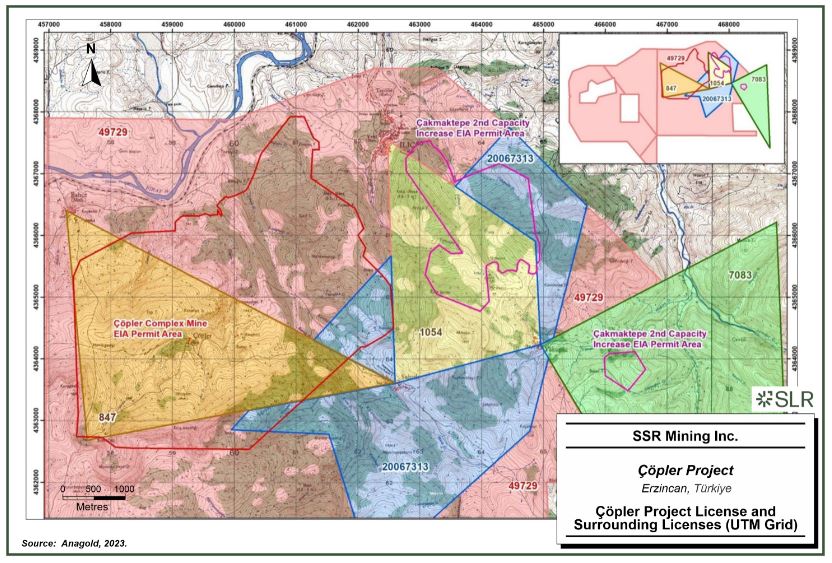

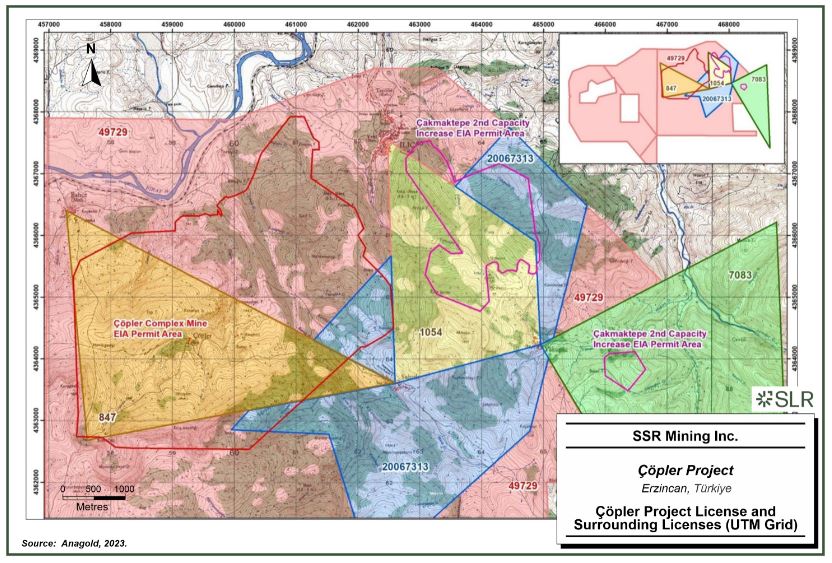

| Figure 3-2: | Çöpler Project License and Surrounding Licenses (UTM Grid) | 3-3 |

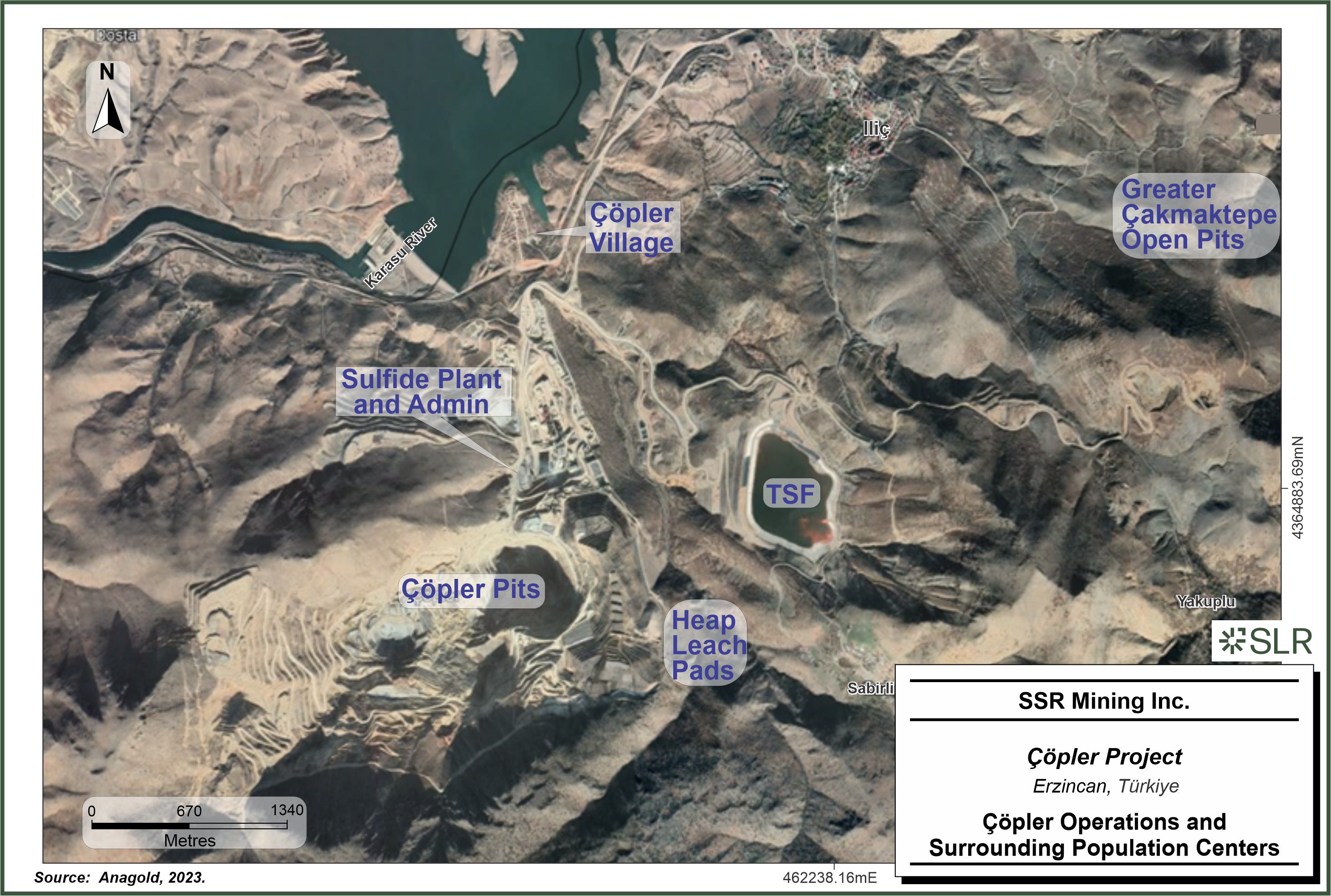

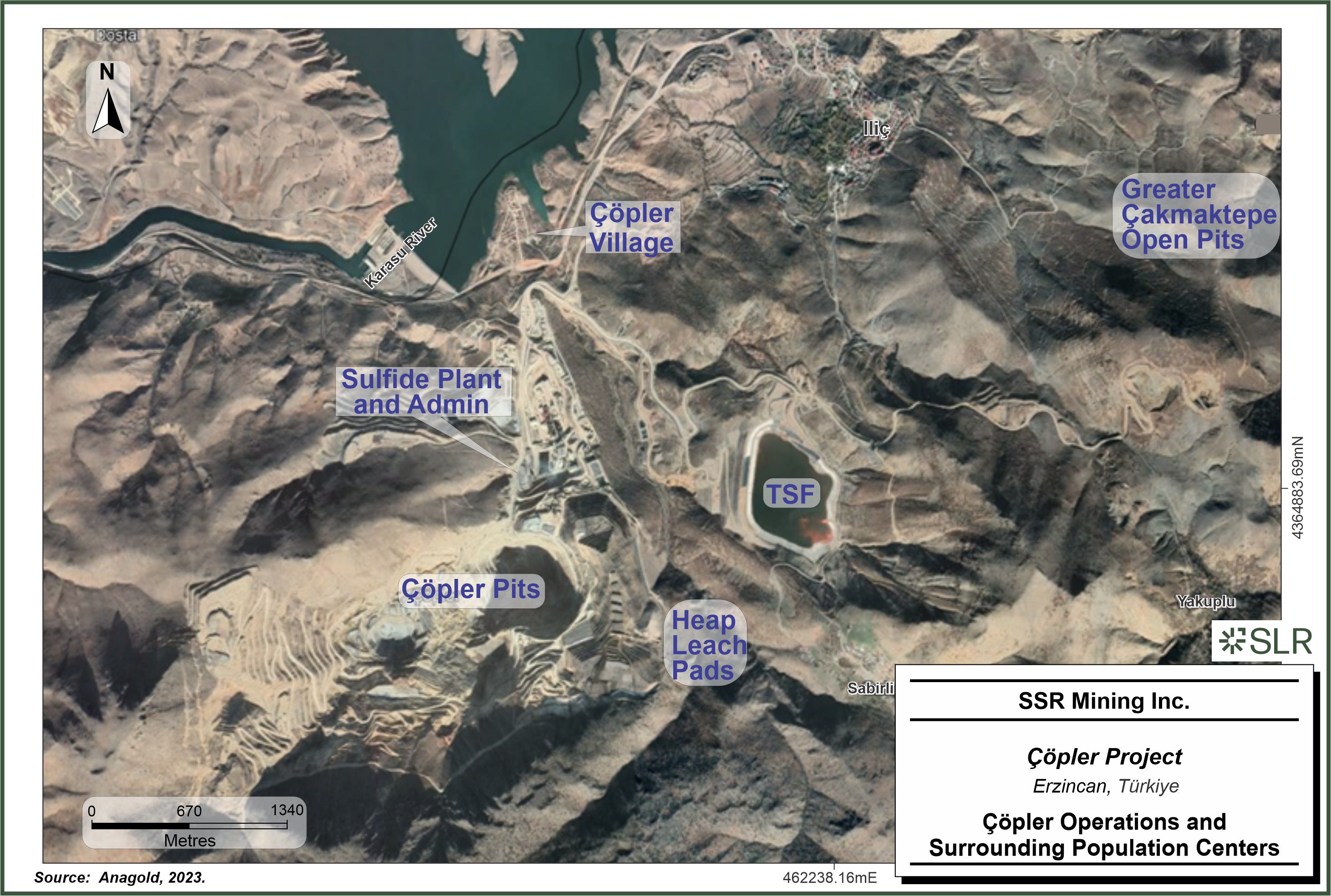

| Figure 3-3: | Çöpler Operations and Surrounding Population Centers | 3-4 |

| Figure 3-4: | Land Tenure Layout | 3-7 |

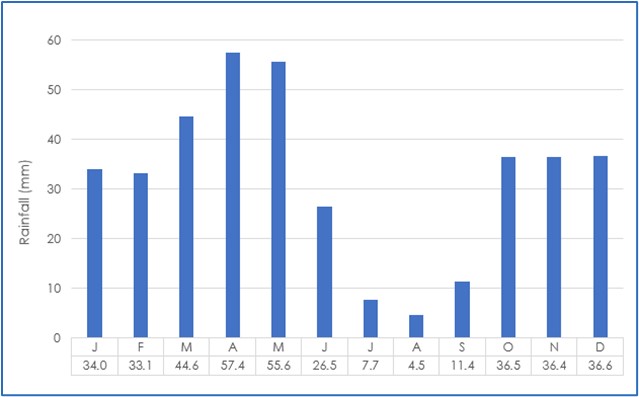

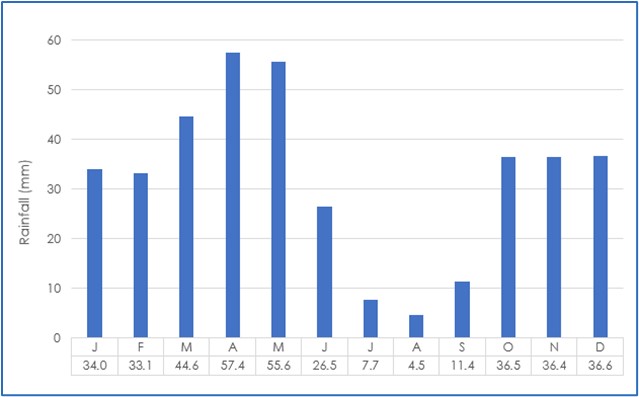

| Figure 4-1: | Average Monthly Rainfall for Çöpler Project Area | 4-2 |

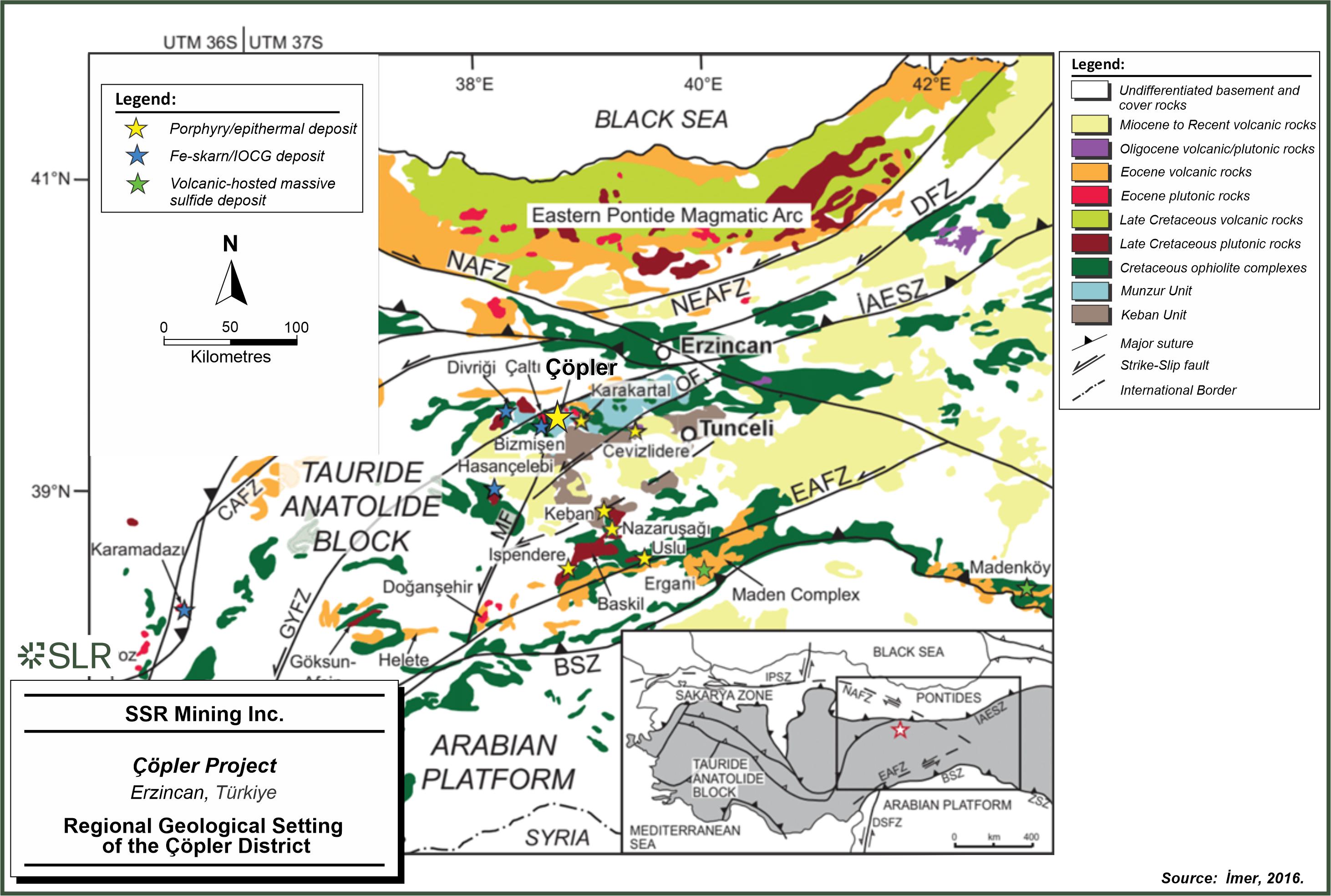

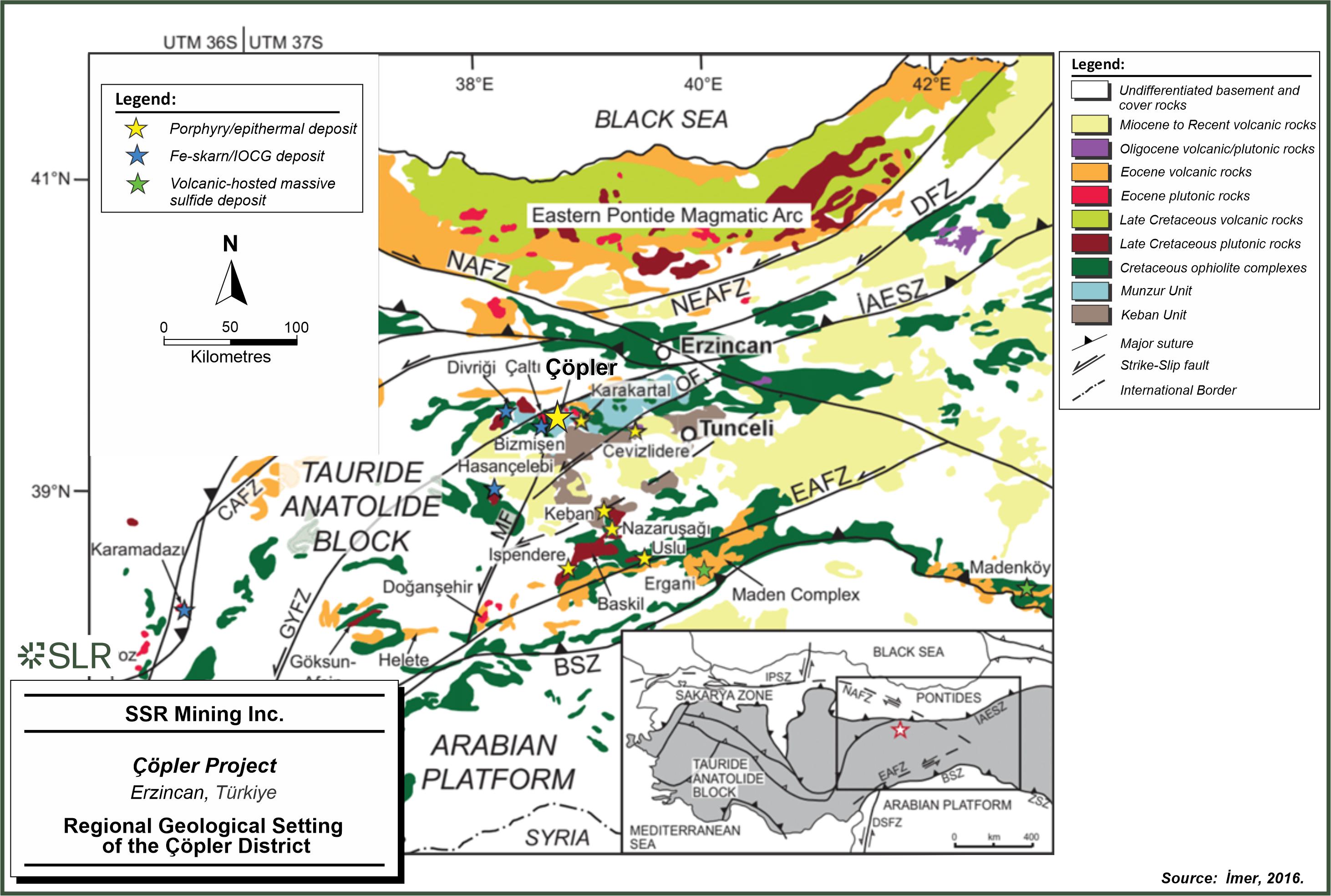

| Figure 6-1: | Regional Geological Setting of the Çöpler District | 6-2 |

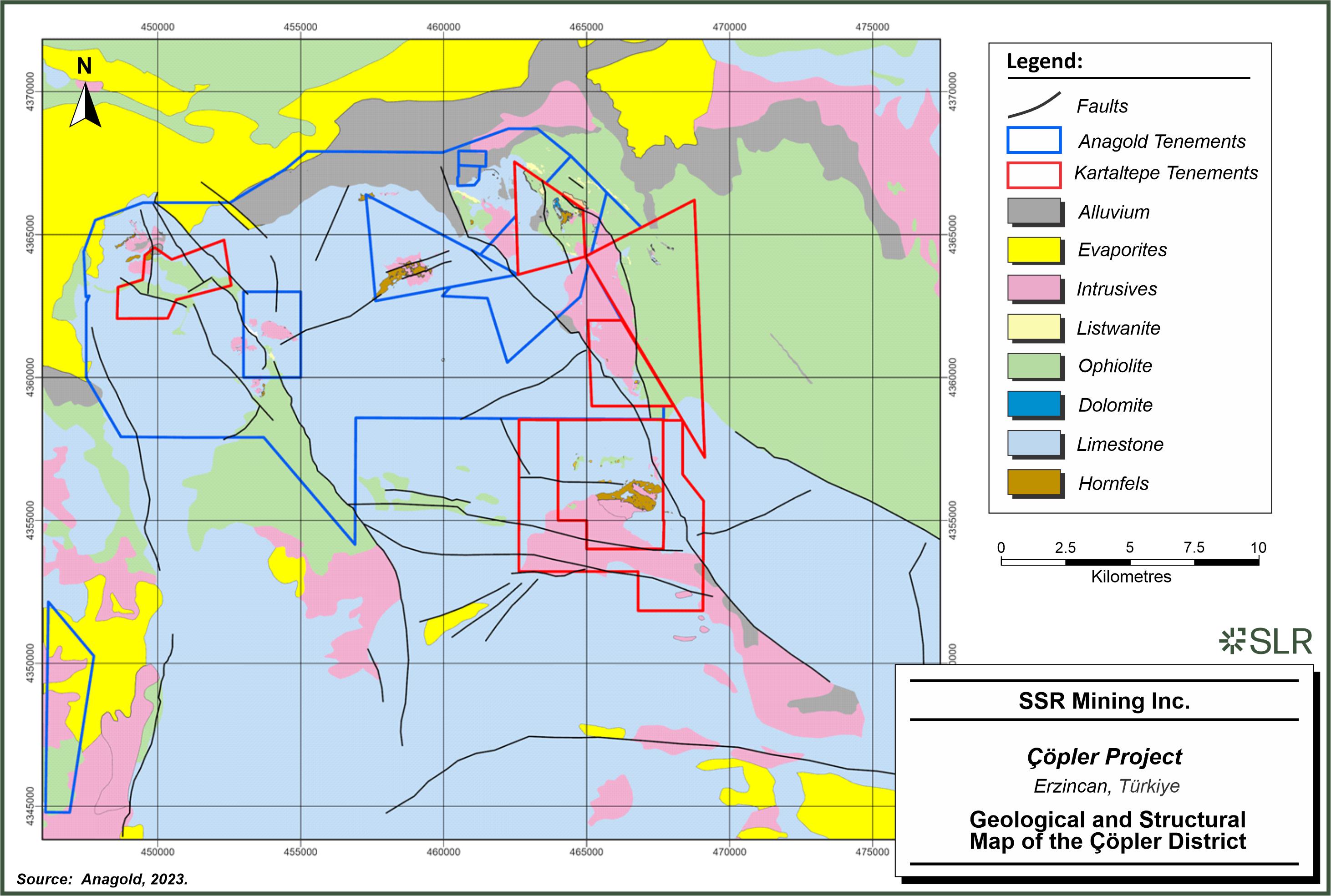

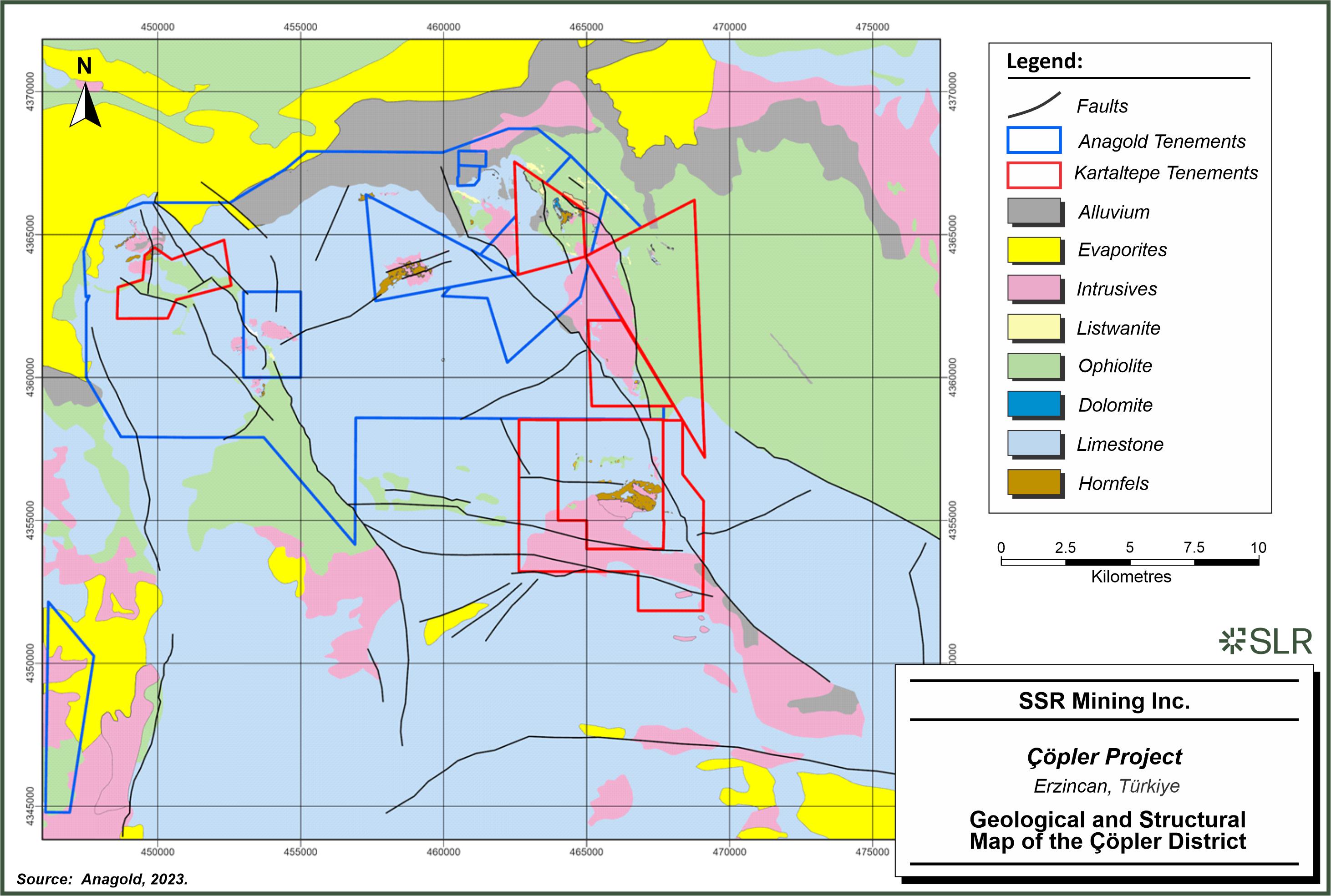

| Figure 6-2: | Geological and Structural Map of the Çöpler District | 6-4 |

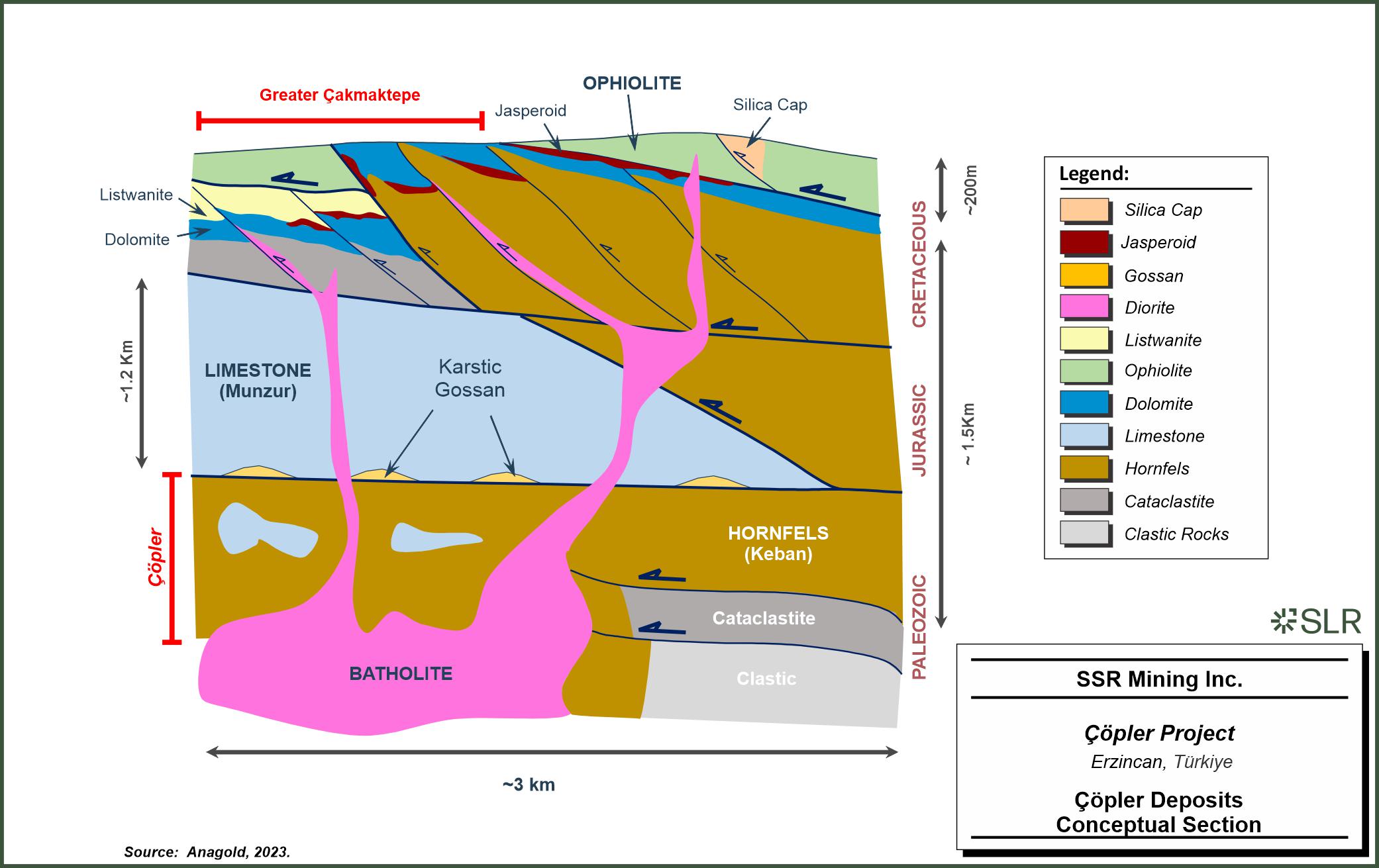

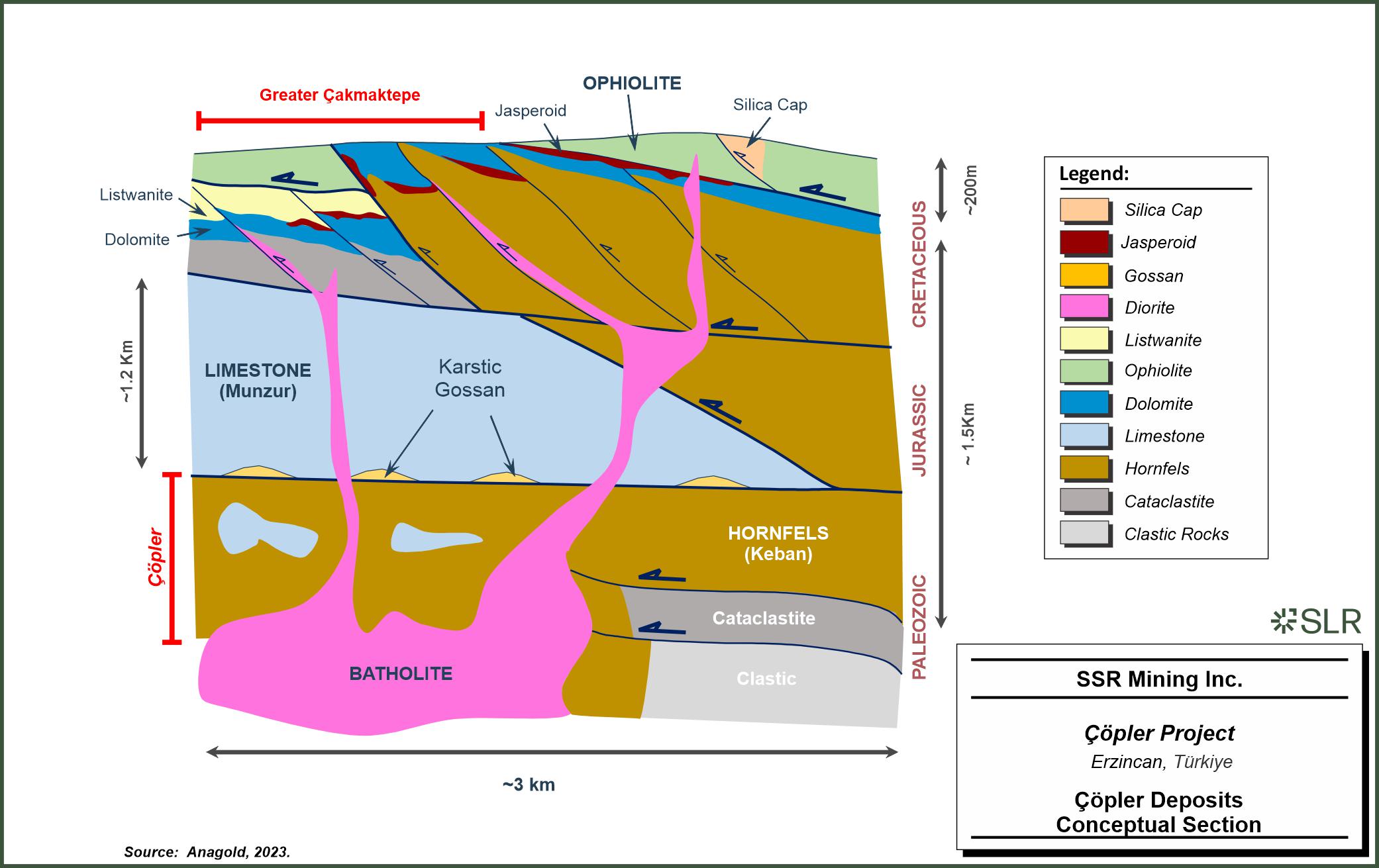

| Figure 6-3: | Çöpler Deposits Conceptual Cross Section | 6-5 |

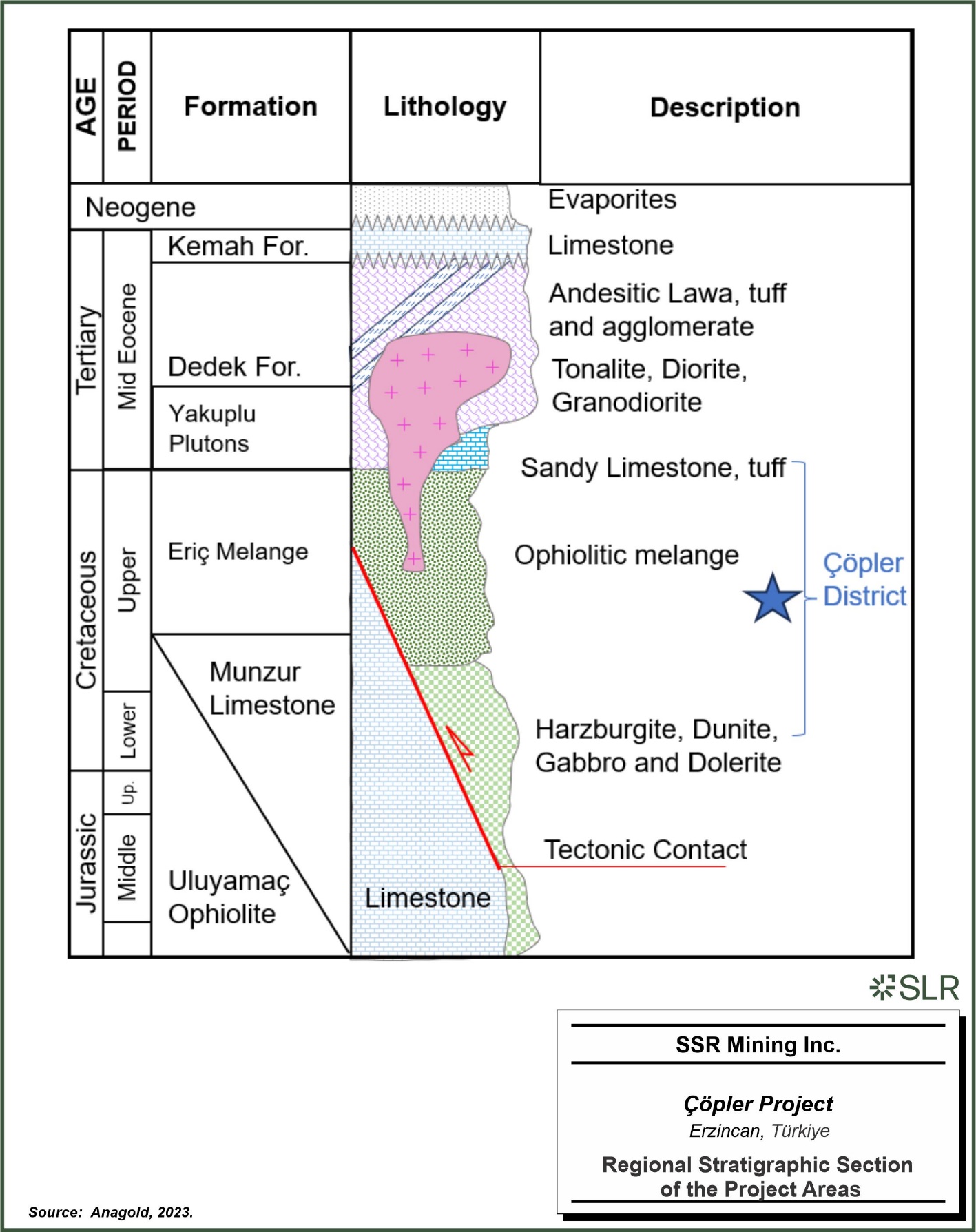

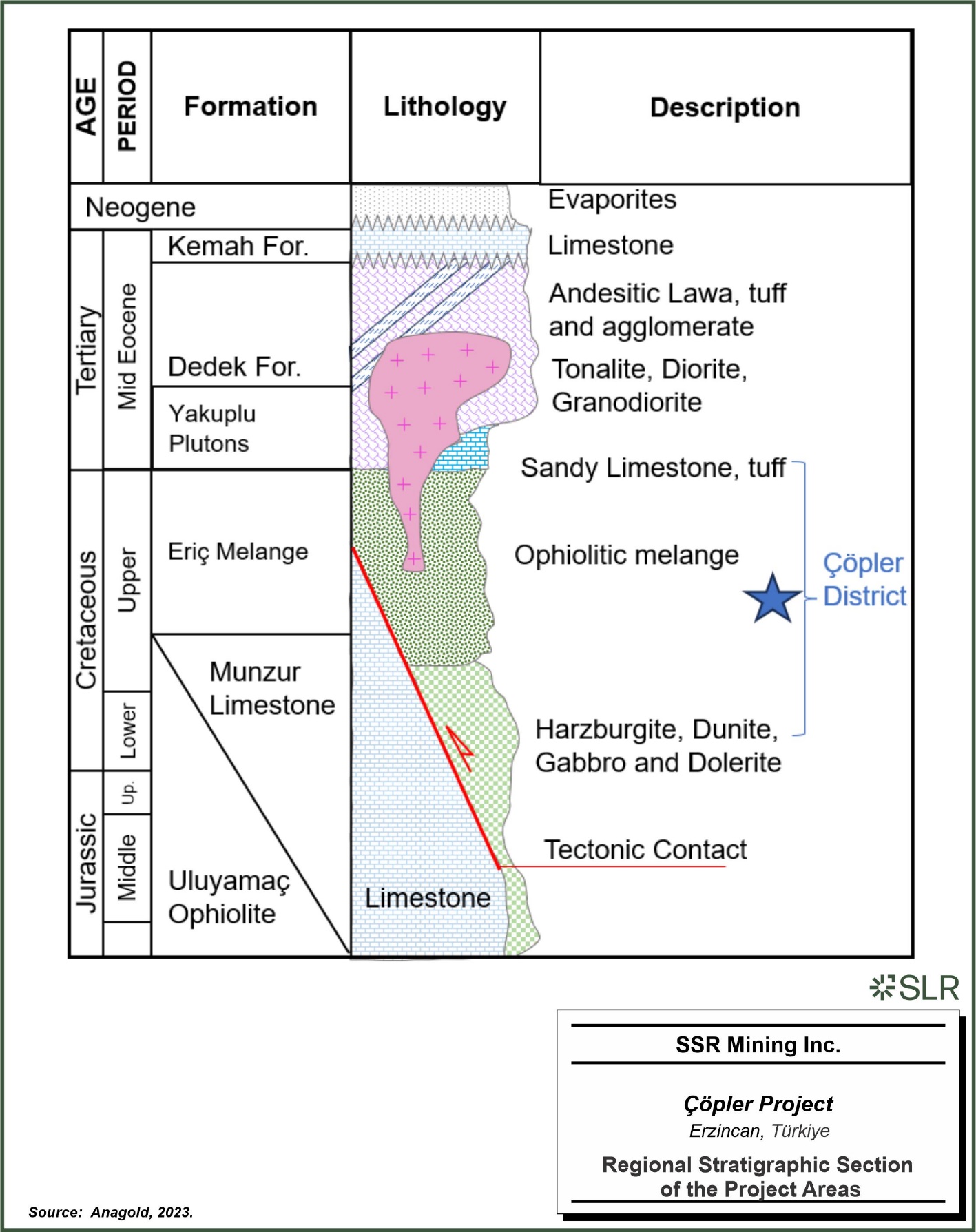

| Figure 6-4: | Regional Stratigraphic Section of the Project Areas | 6-6 |

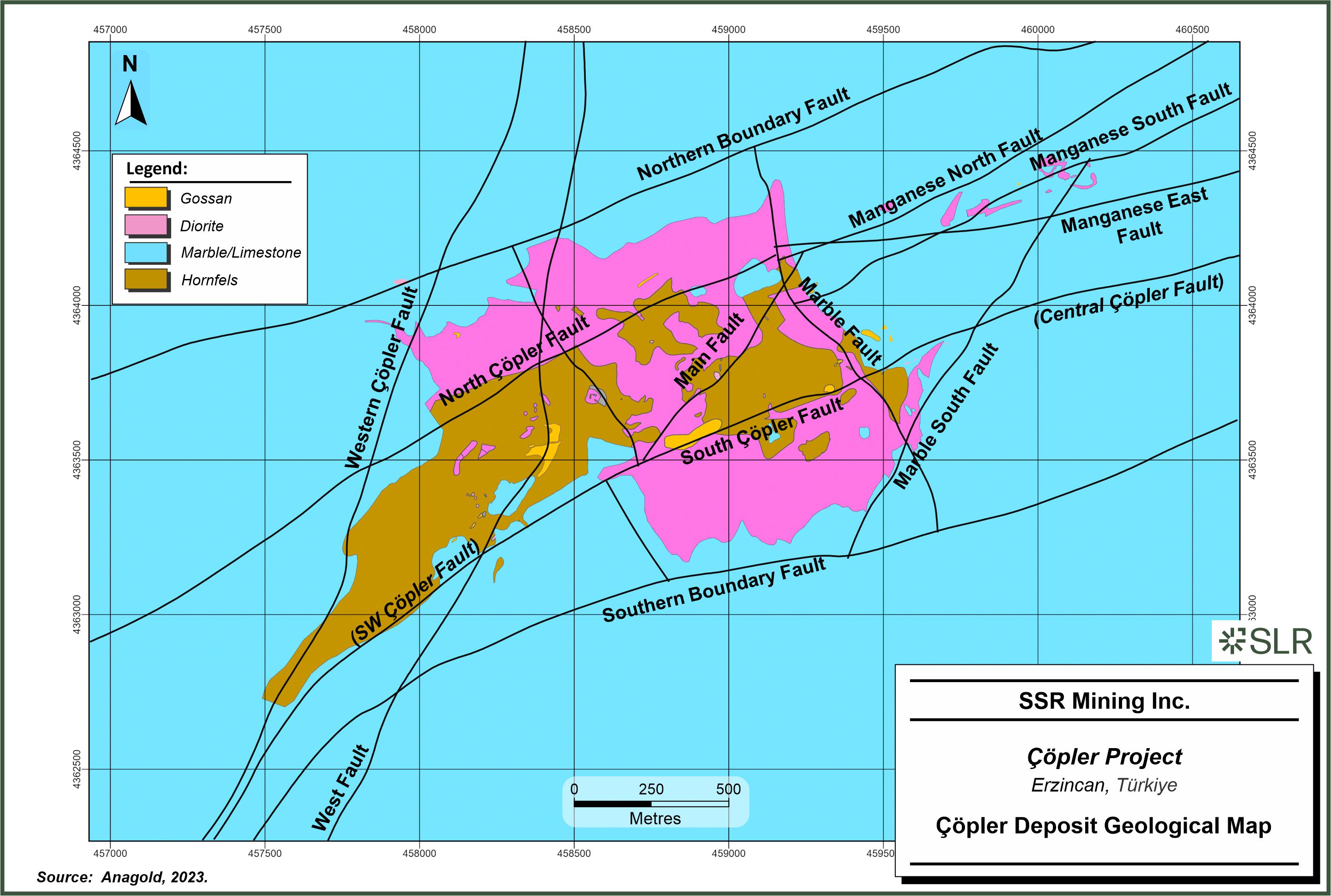

| Figure 6-5: | Çöpler Deposit Geological Map | 6-9 |

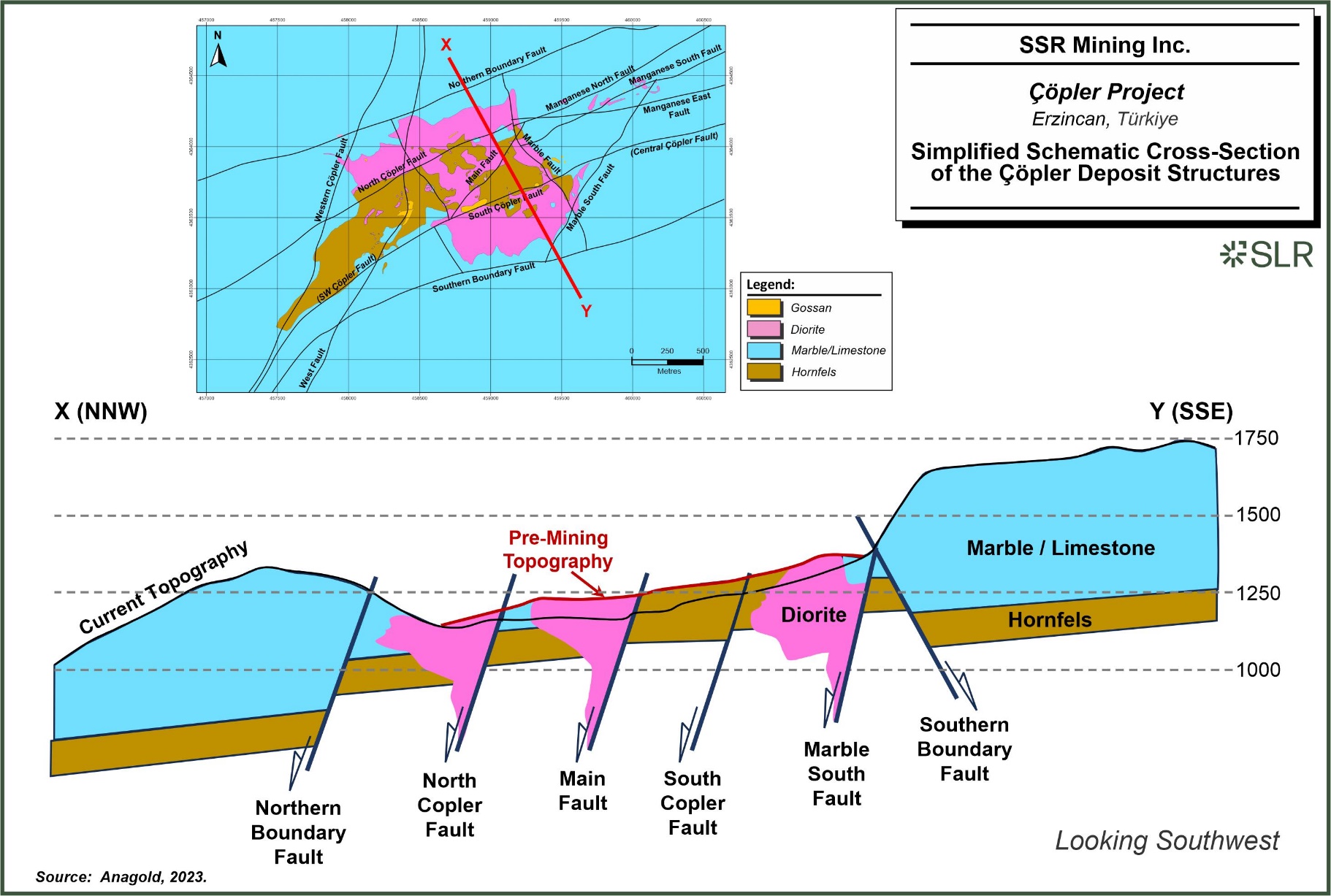

| Figure 6-6: | Simplified Schematic Cross-Section of the Çöpler Deposit Structures (Looking East-Northeast) | 6-11 |

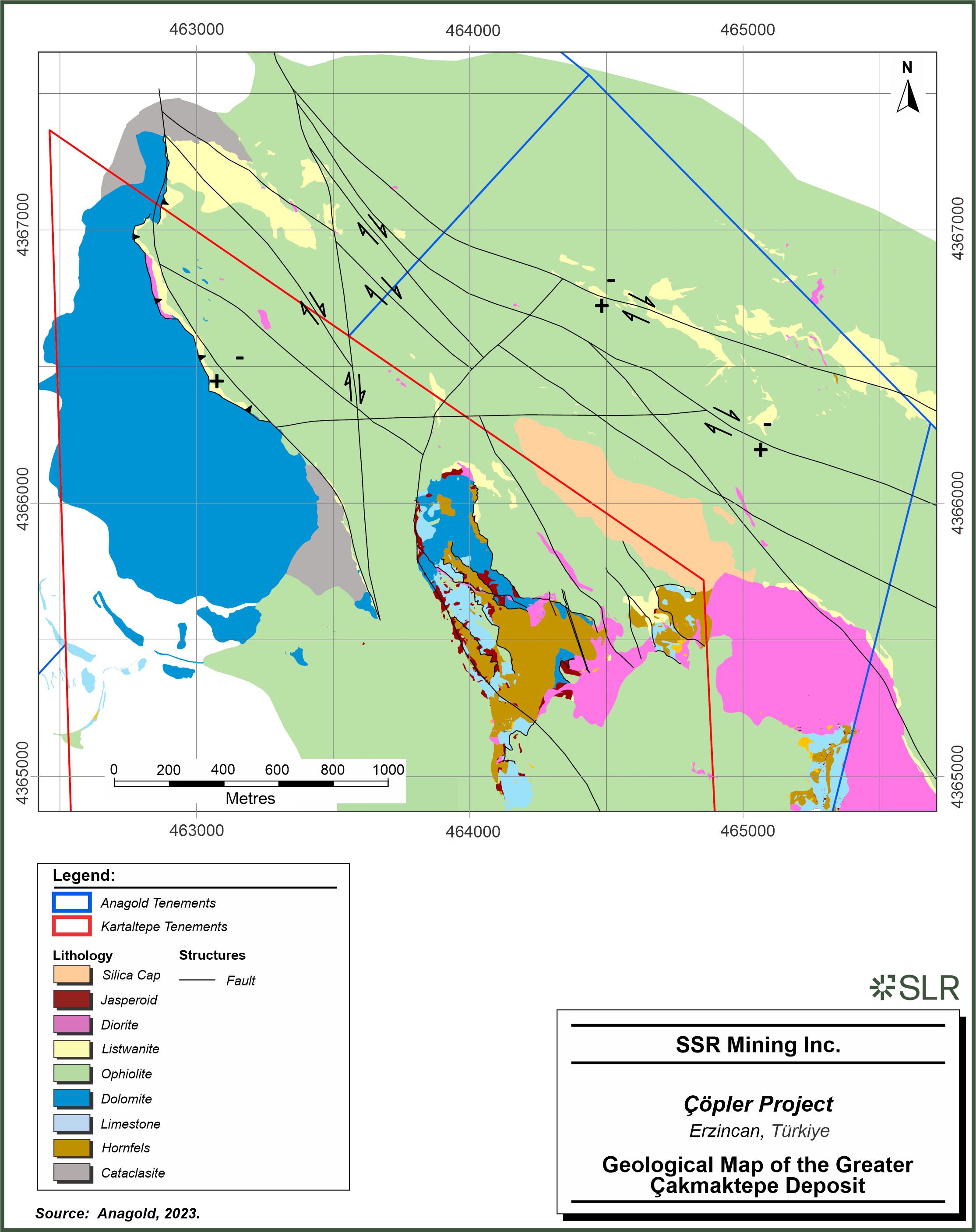

| Figure 6-7: | Geological Map of the Greater Çakmaktepe Deposit | 6-14 |

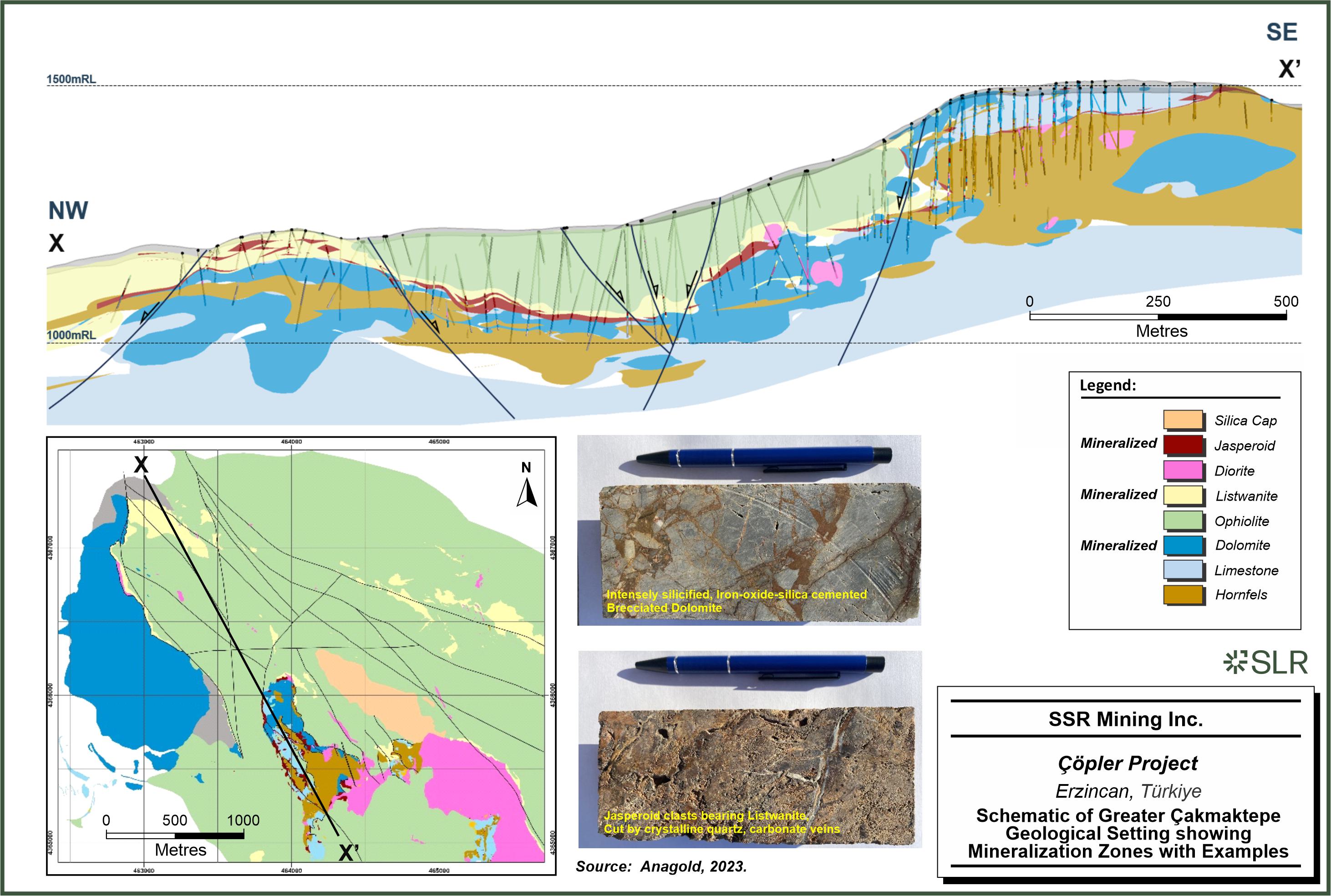

| Figure 6-8: | Schematic of Greater Çakmaktepe Geological Setting showing Mineralized Zones with Examples | 6-17 |

| | ix |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

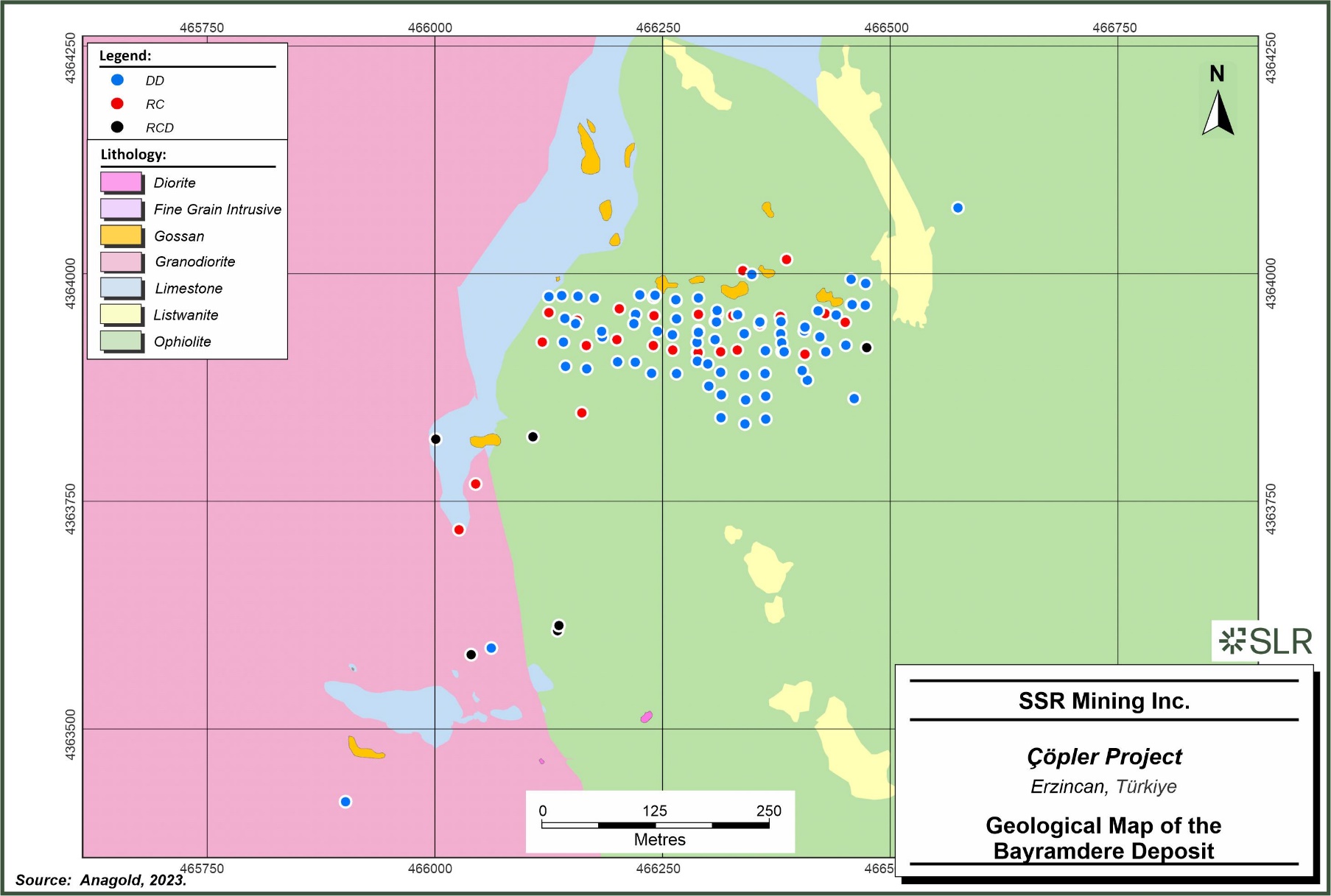

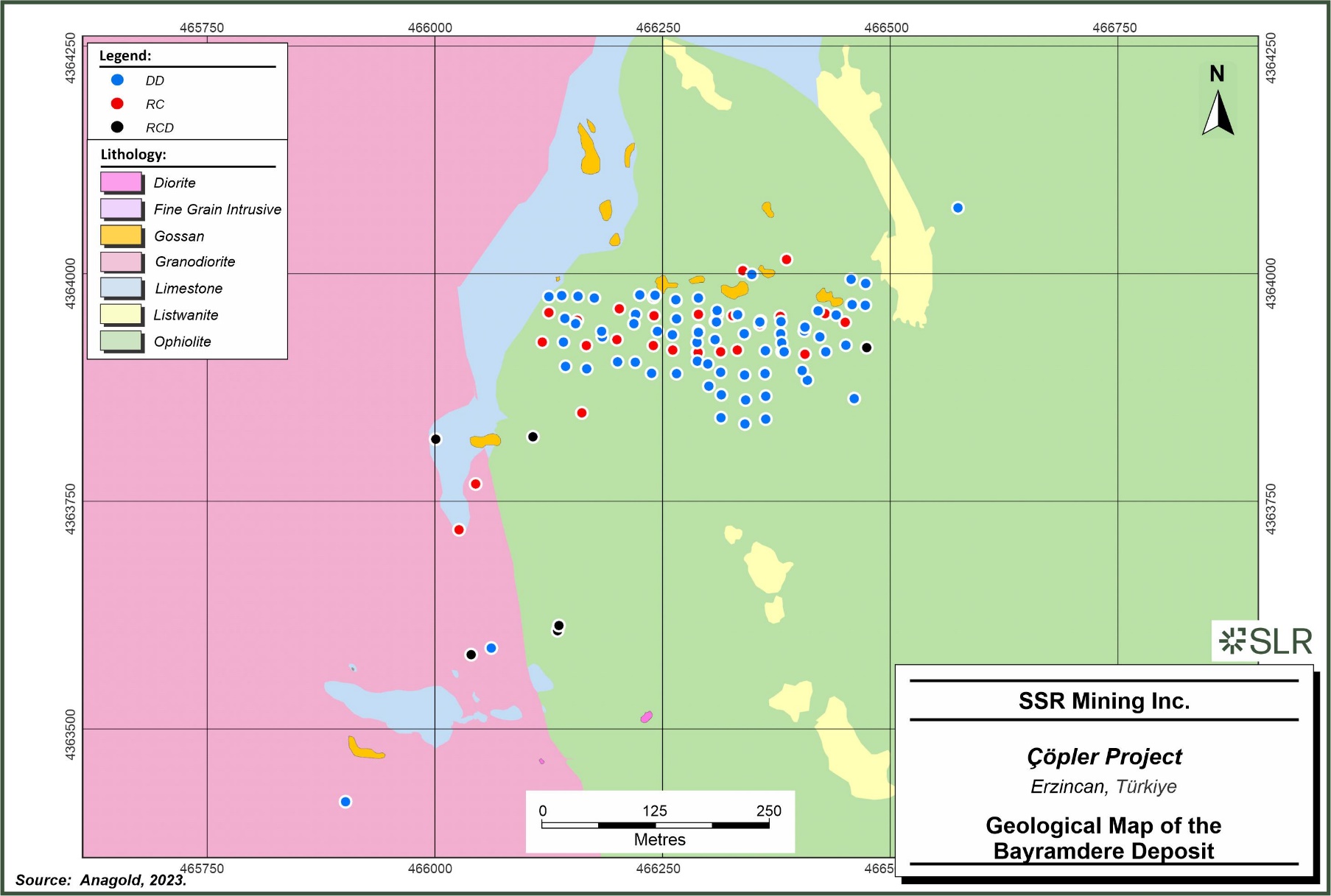

| Figure 6-9: | Geological Map of the Bayramdere Deposit | 6-19 |

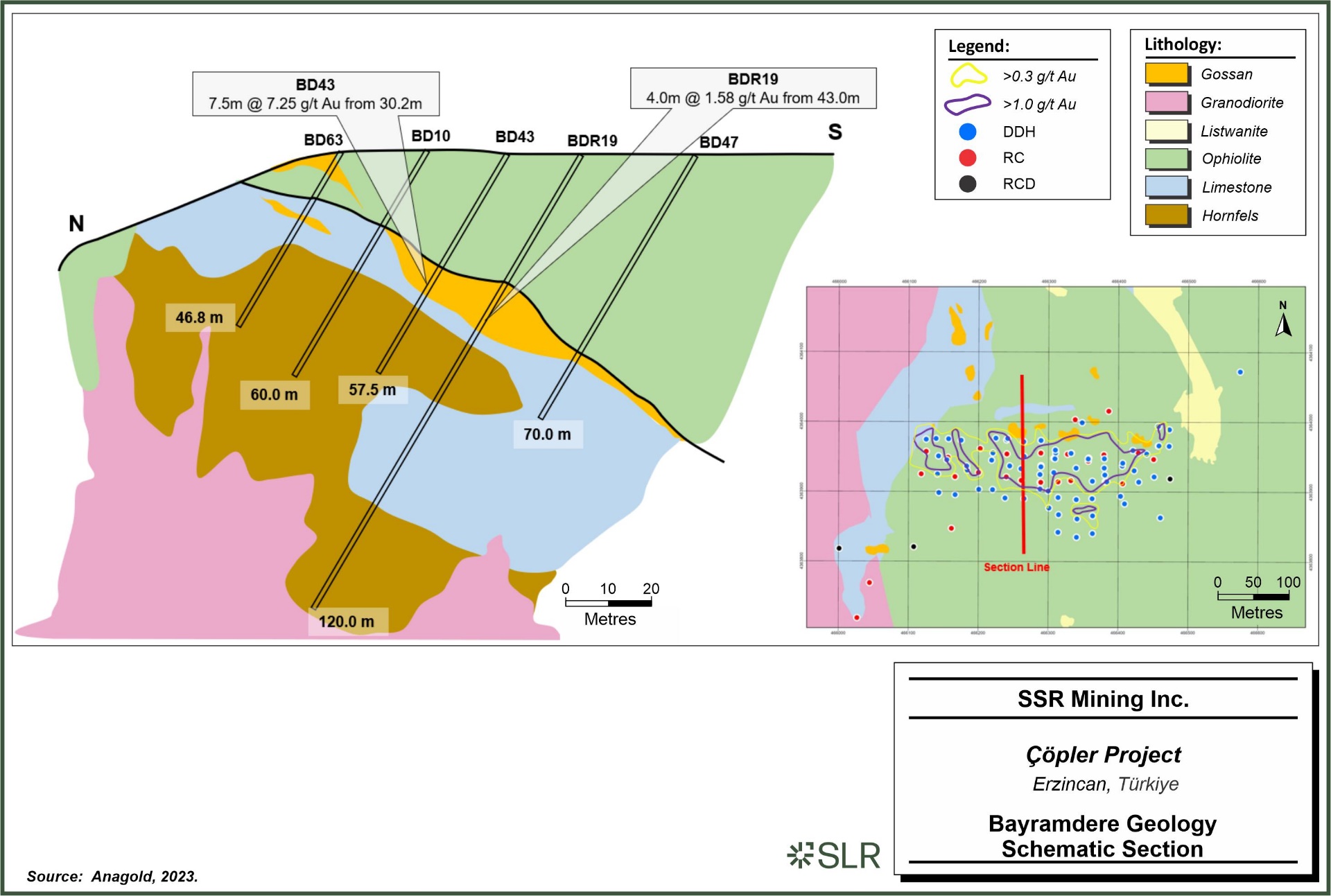

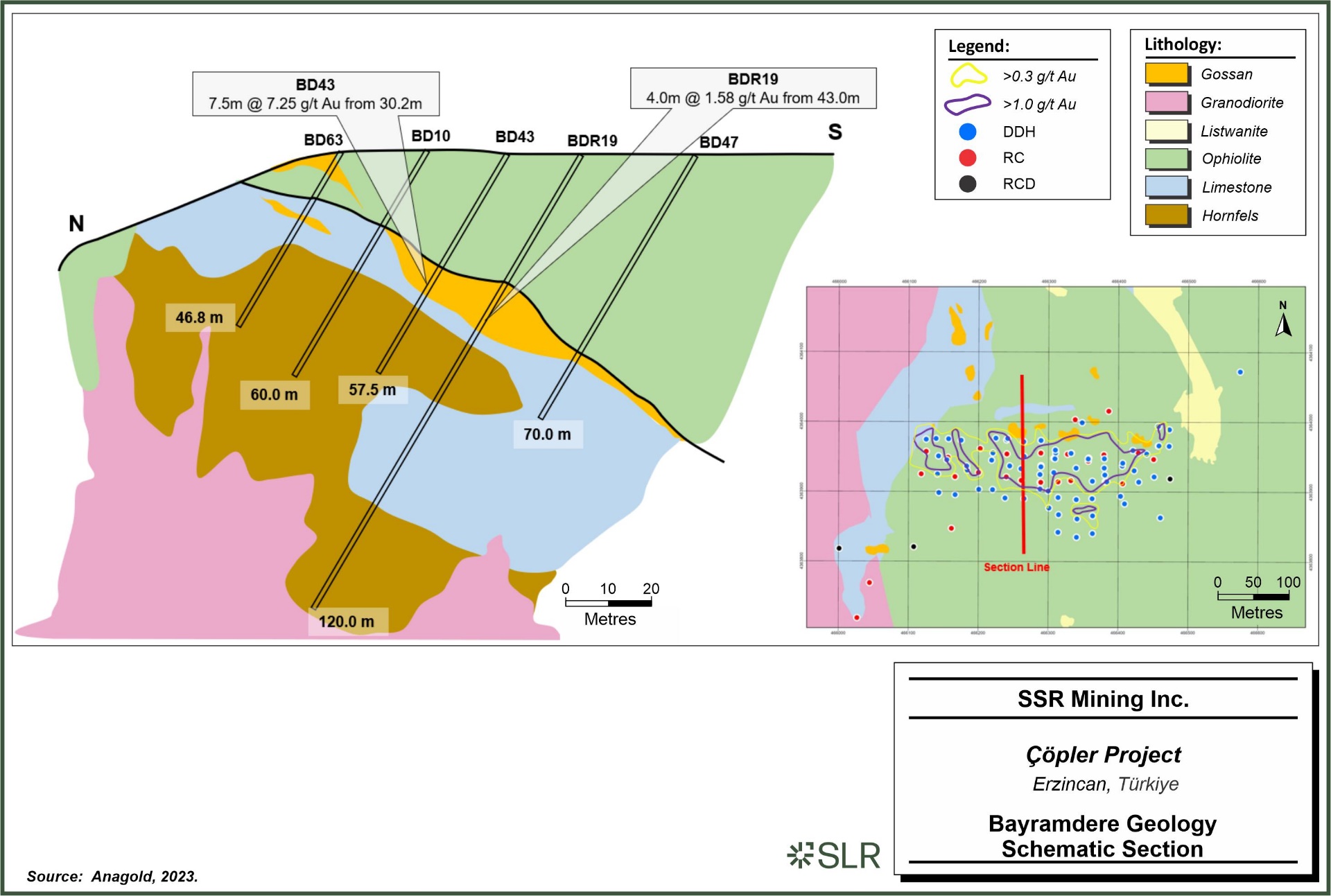

| Figure 6-10: | Bayramdere Geology Schematic Section | 6-20 |

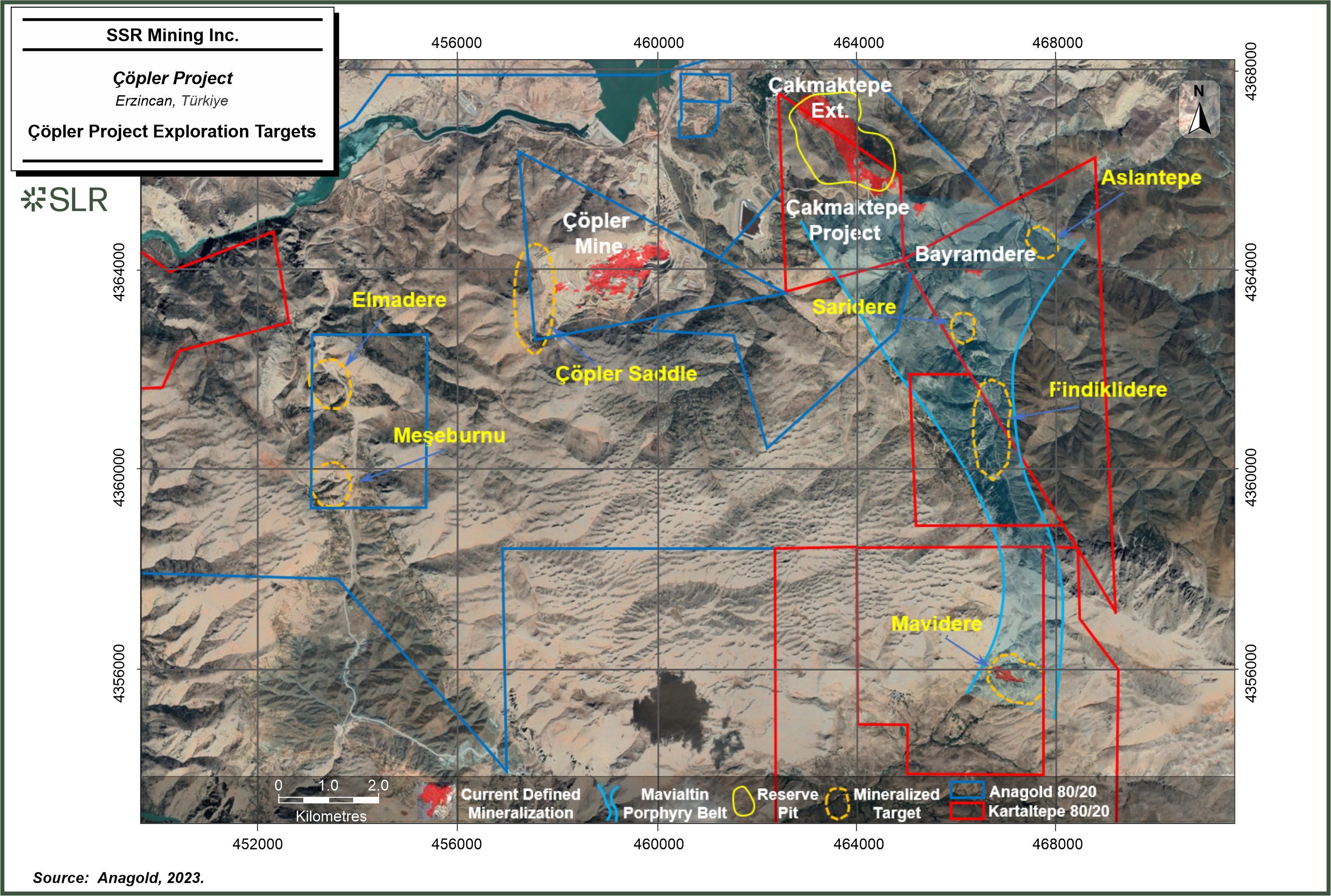

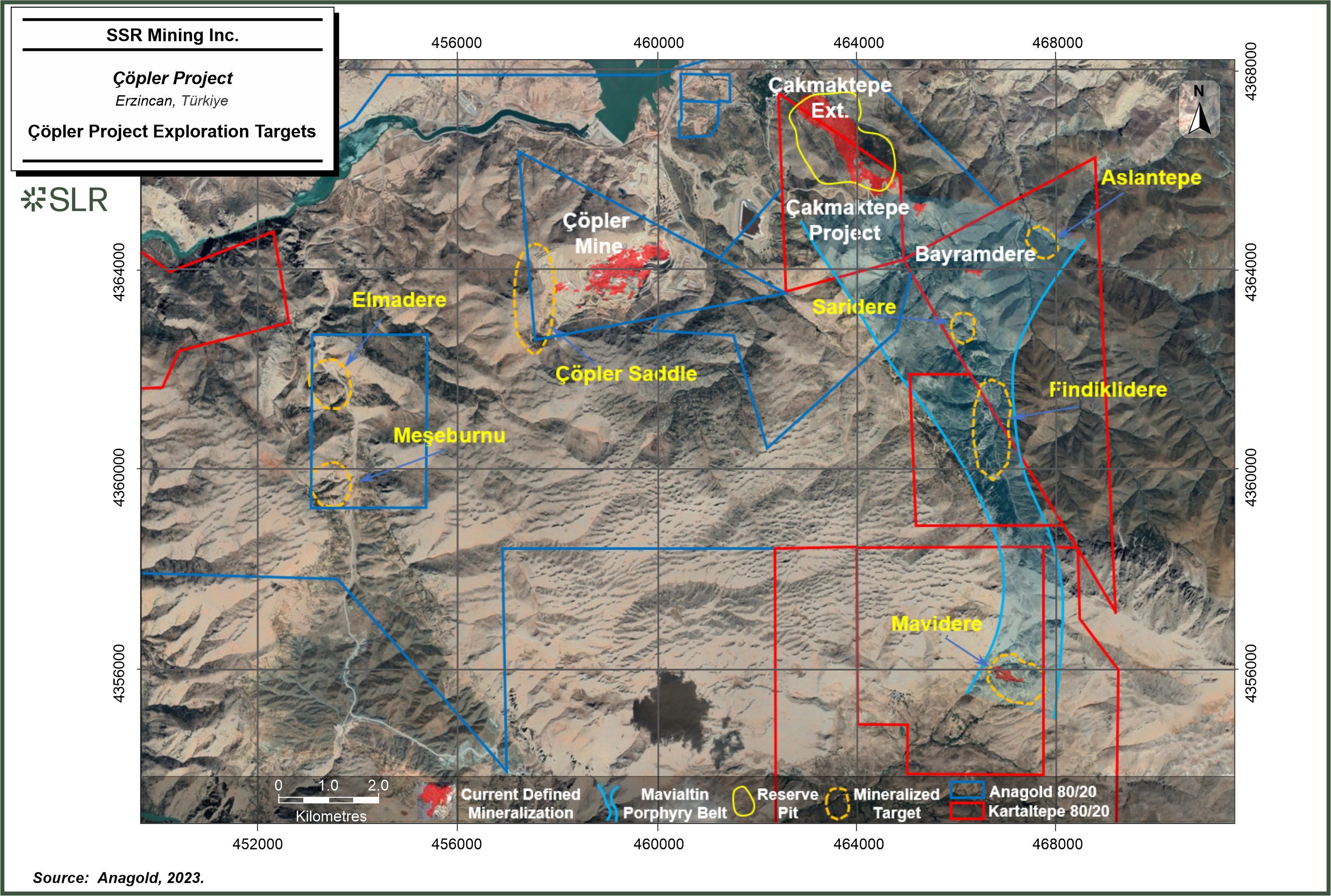

| Figure 6-11: | Çöpler Project Exploration Targets | 6-22 |

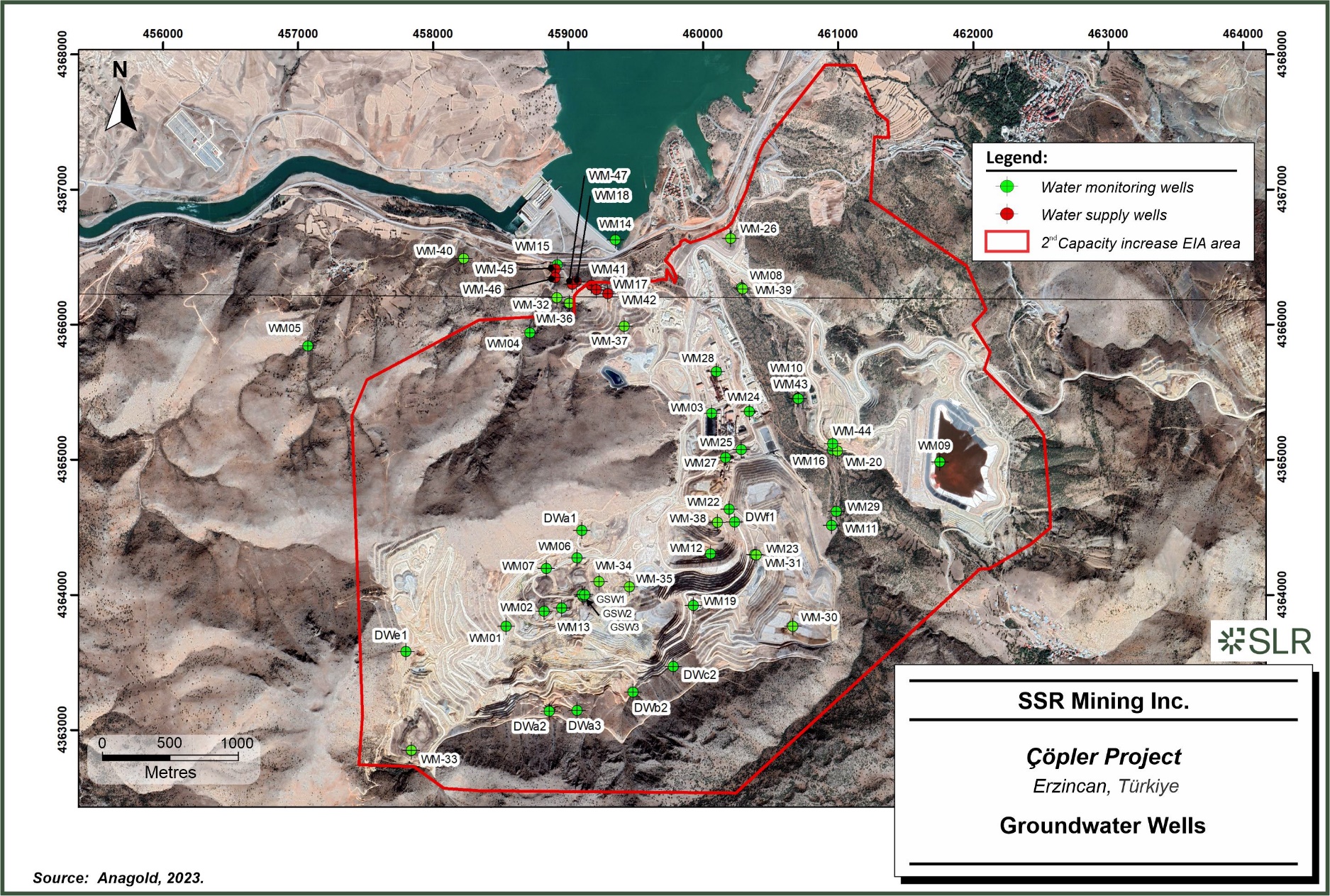

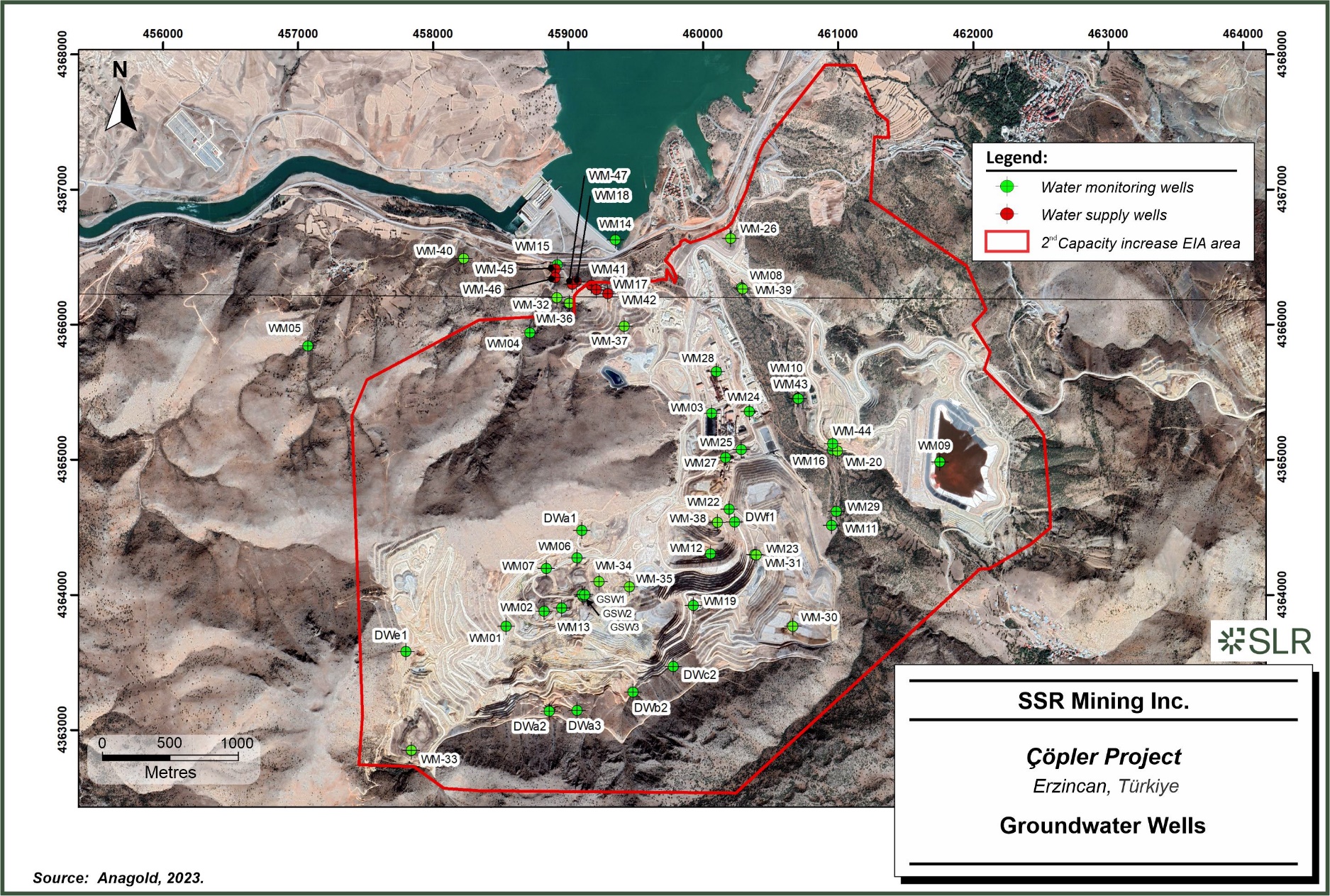

| Figure 7-1: | Groundwater Wells | 7-2 |

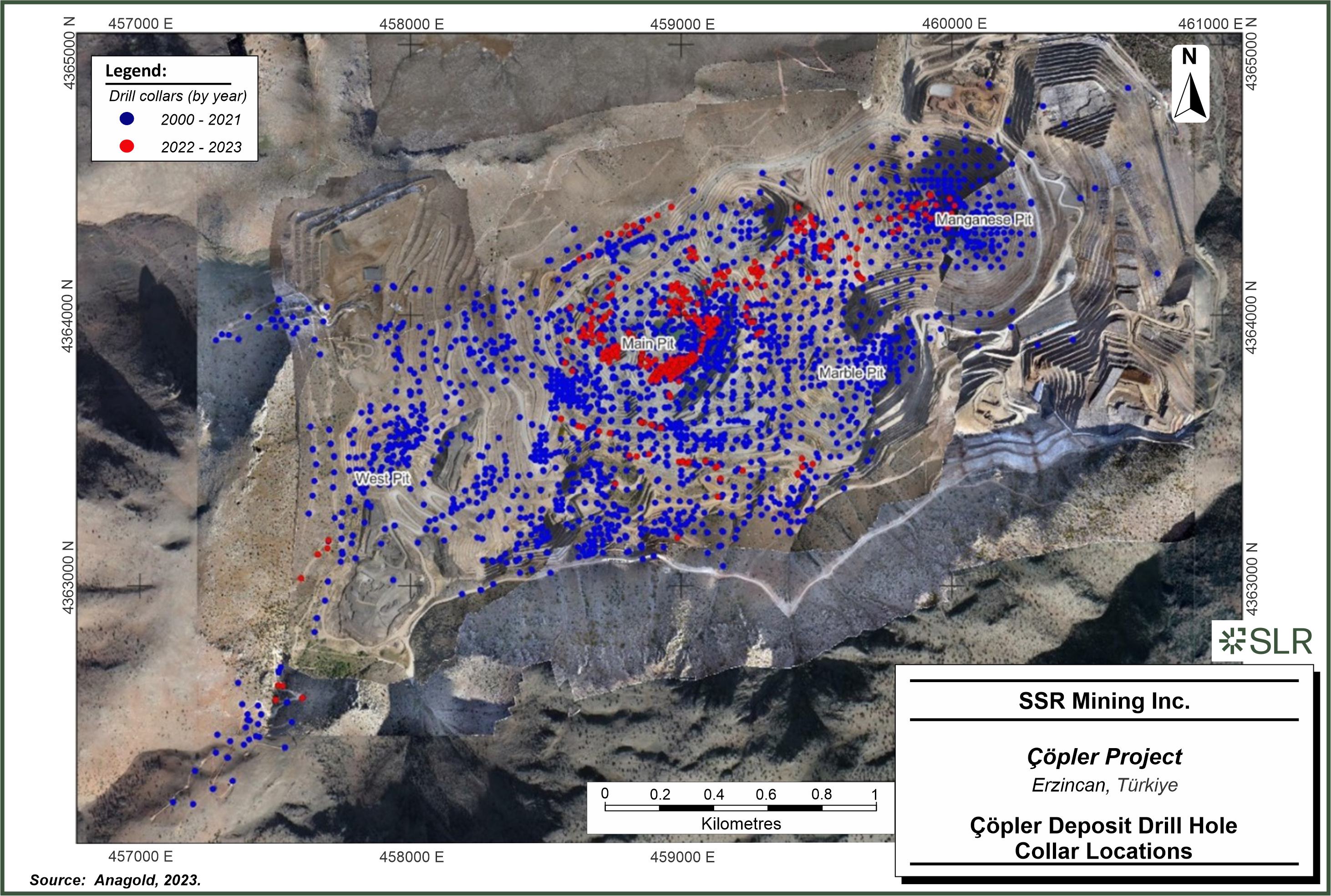

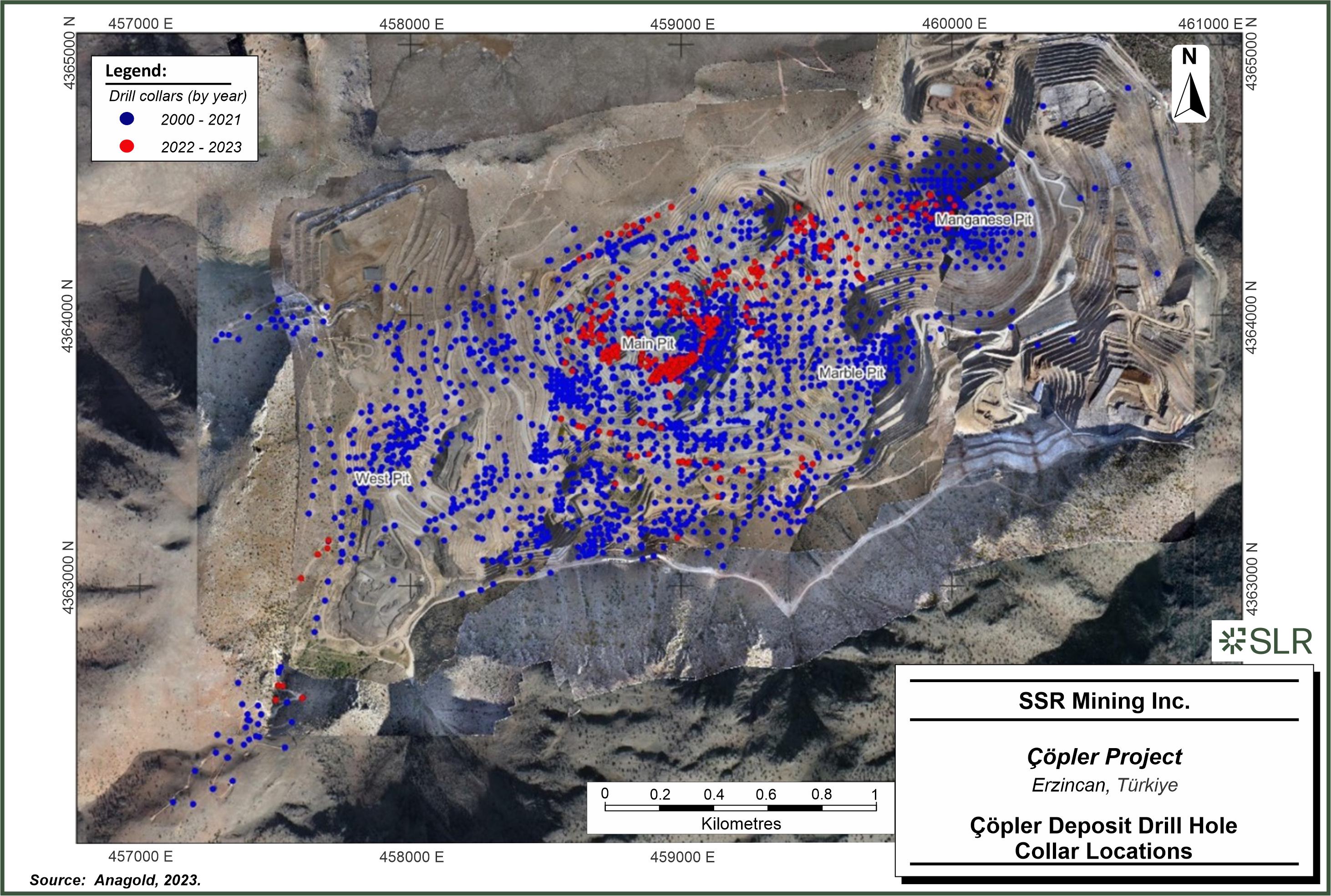

| Figure 7-2: | Çöpler Deposit Drill Hole Collar Locations | 7-8 |

| Figure 7-3: | Greater Çakmaktepe Drill Hole Collar Locations | 7-10 |

| Figure 7-4: | Bayramdere Drill Hole Collars by Hole Type | 7-12 |

| Figure 8-1: | Diamond Core Recovery at Çöpler since January 2021 | 8-7 |

| Figure 8-2: | Relative Difference Plot for Çöpler DD Second Split (2021–2023) | 8-7 |

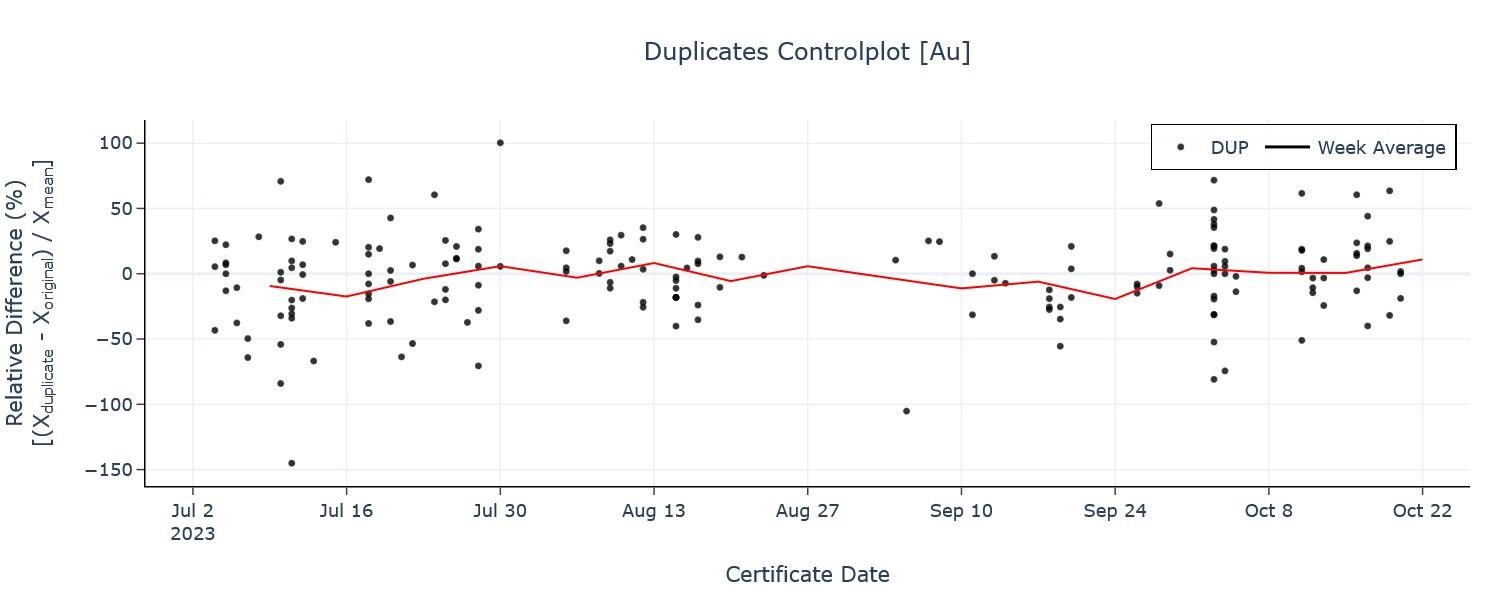

| Figure 8-3: | Relative Difference Plot for Çöpler RC First Split (2023) | 8-8 |

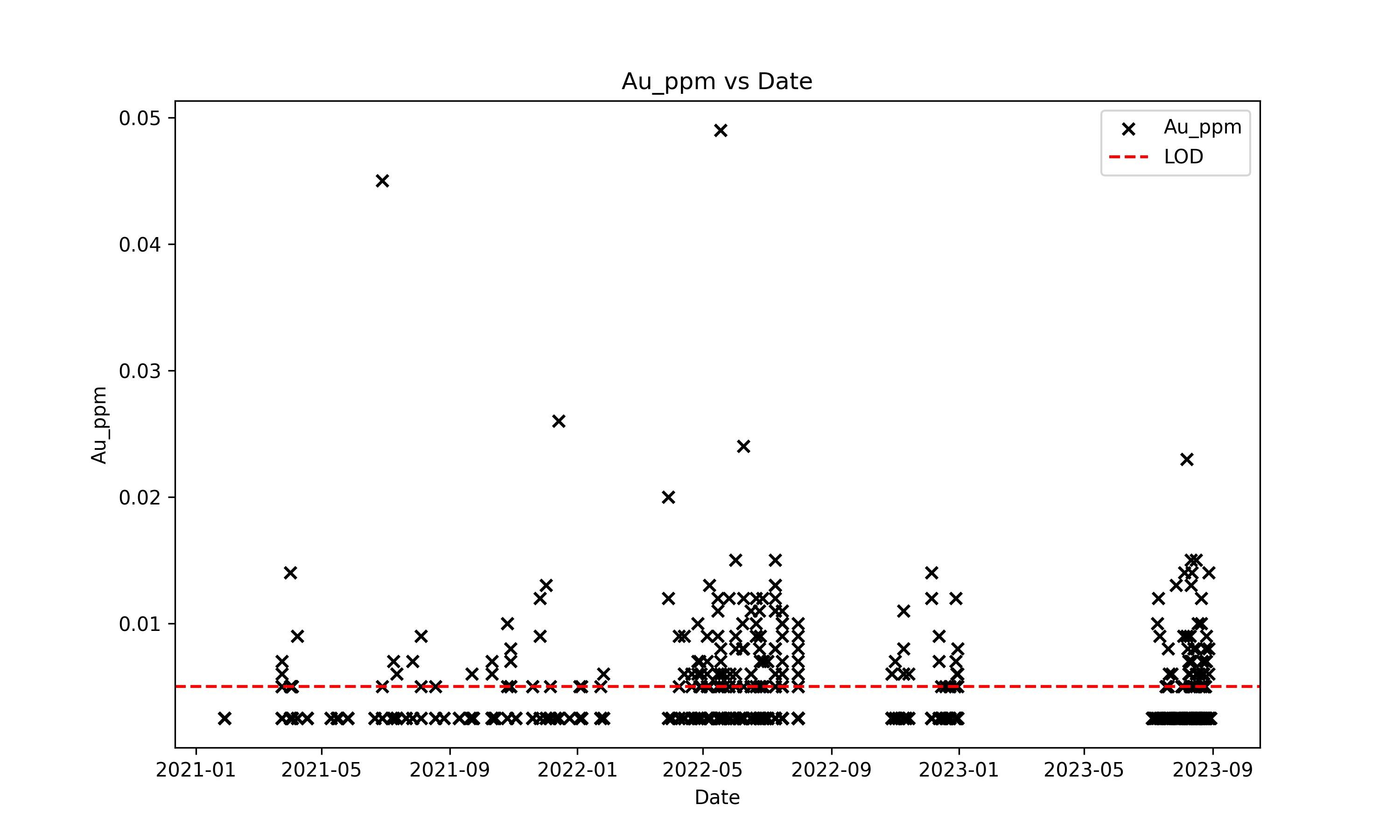

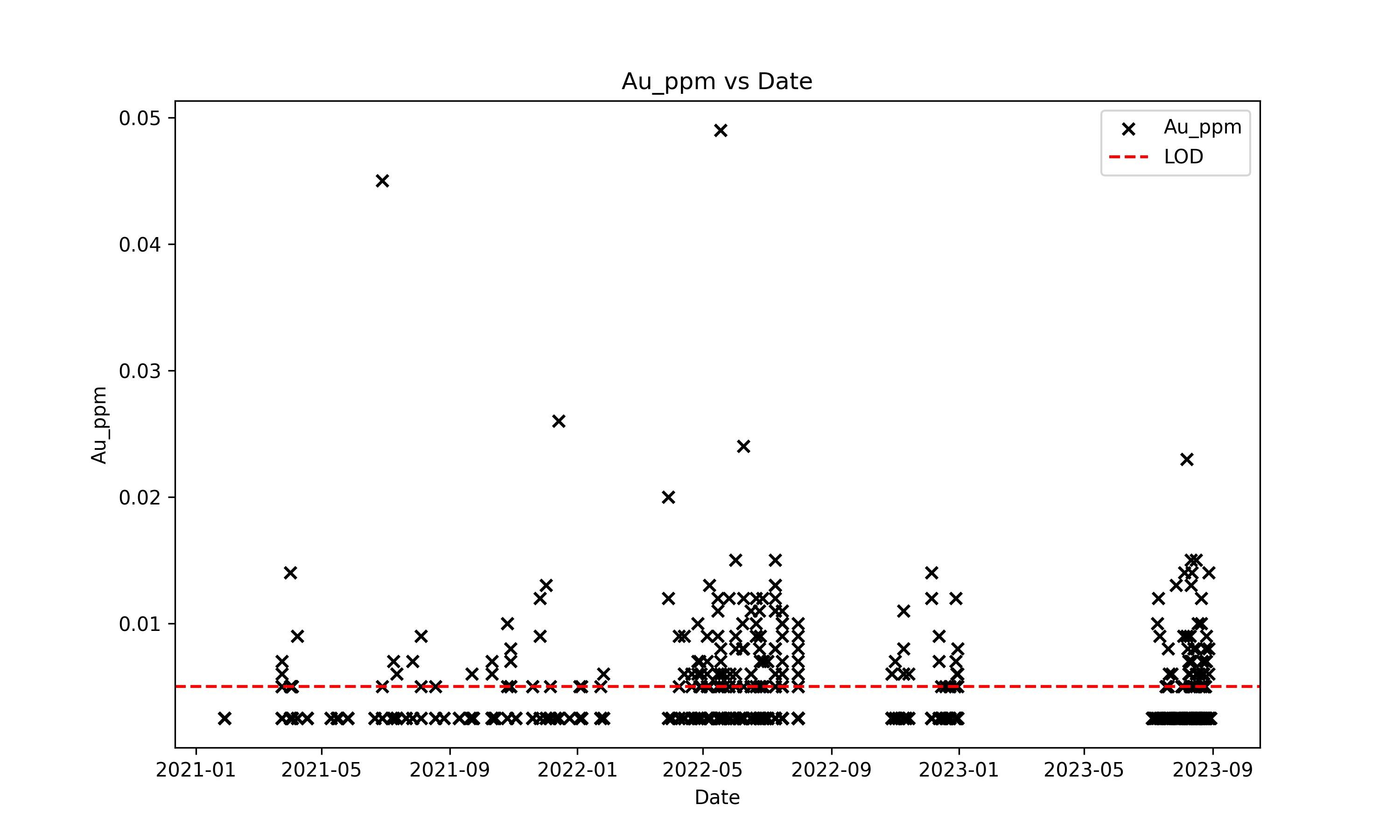

| Figure 8-4: | Çöpler Blank Analyses for Au versus Analysis Date (ALS), 2021–2023 | 8-8 |

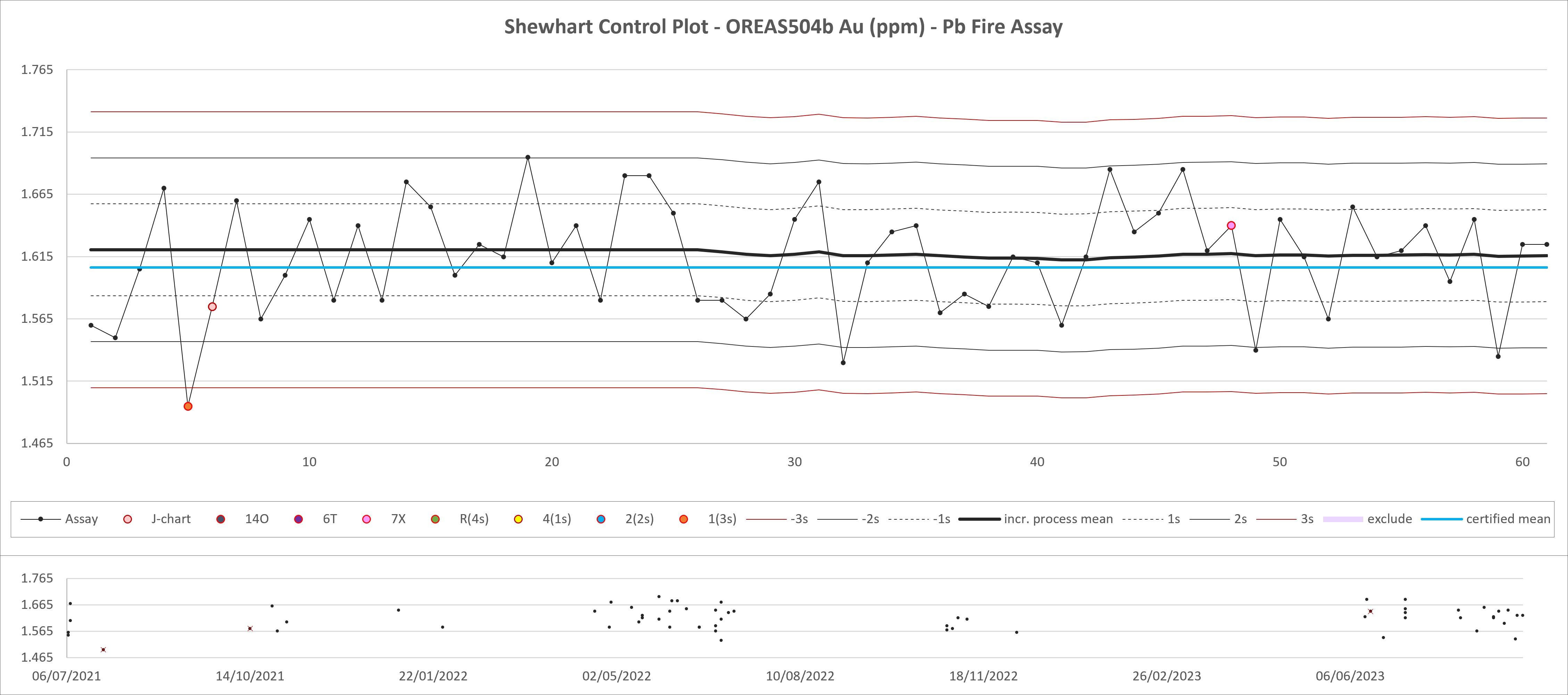

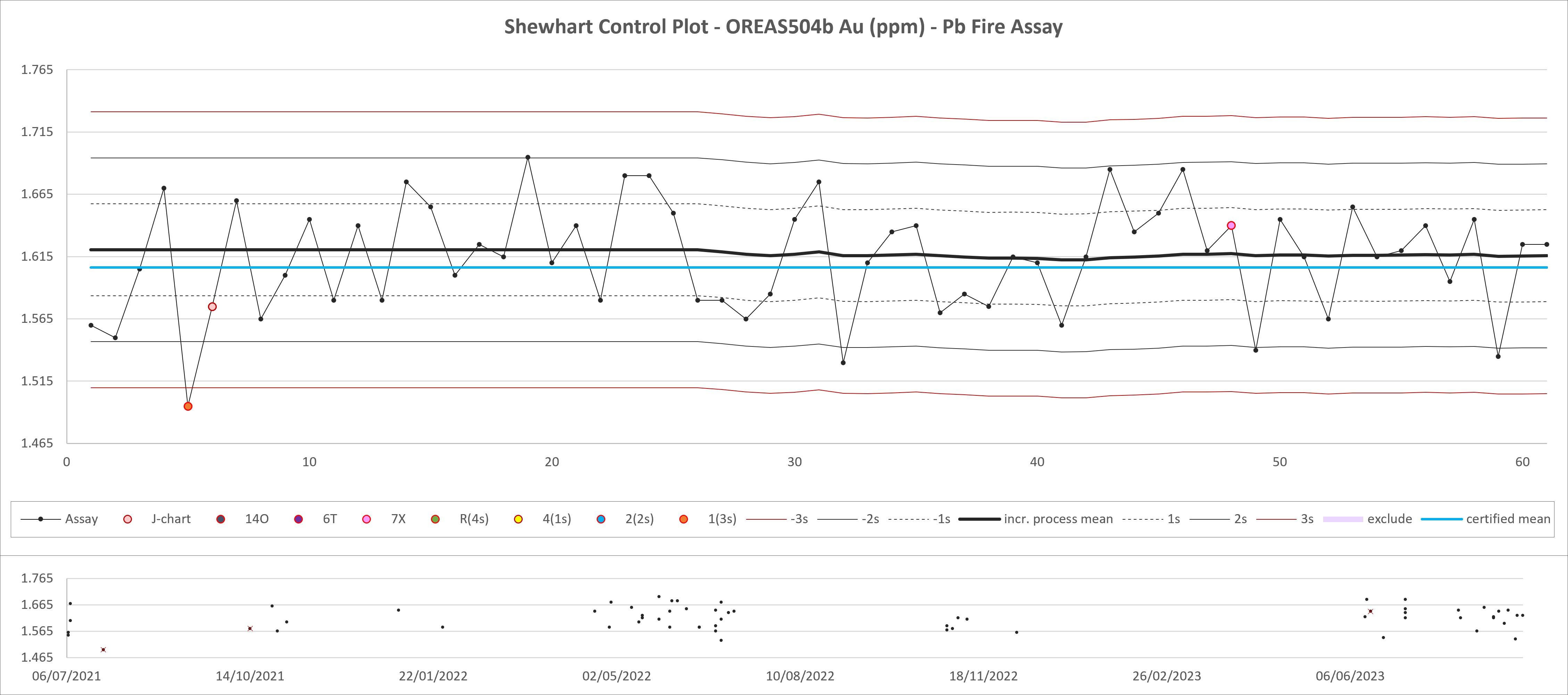

| Figure 8-5: | Shewhart Control Plot for OREAS504b Au in Çöpler Sample Stream (2021–2023) | 8-9 |

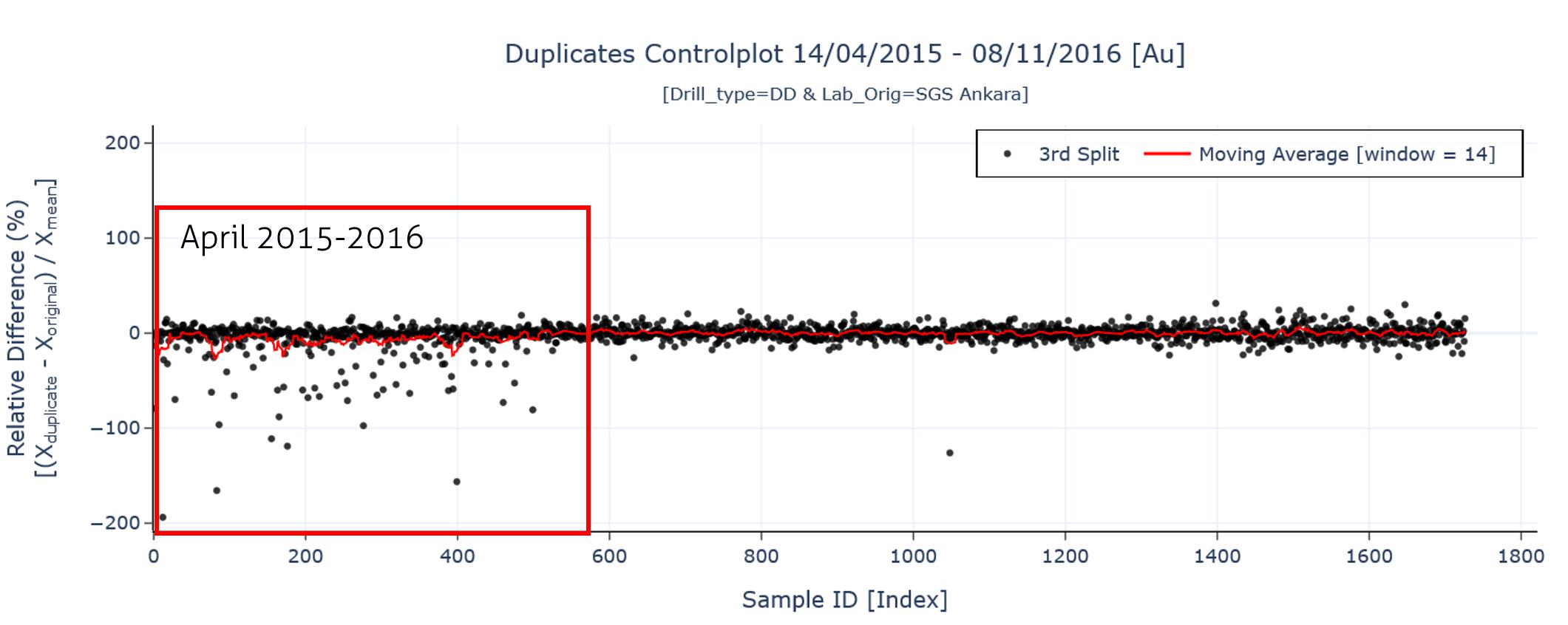

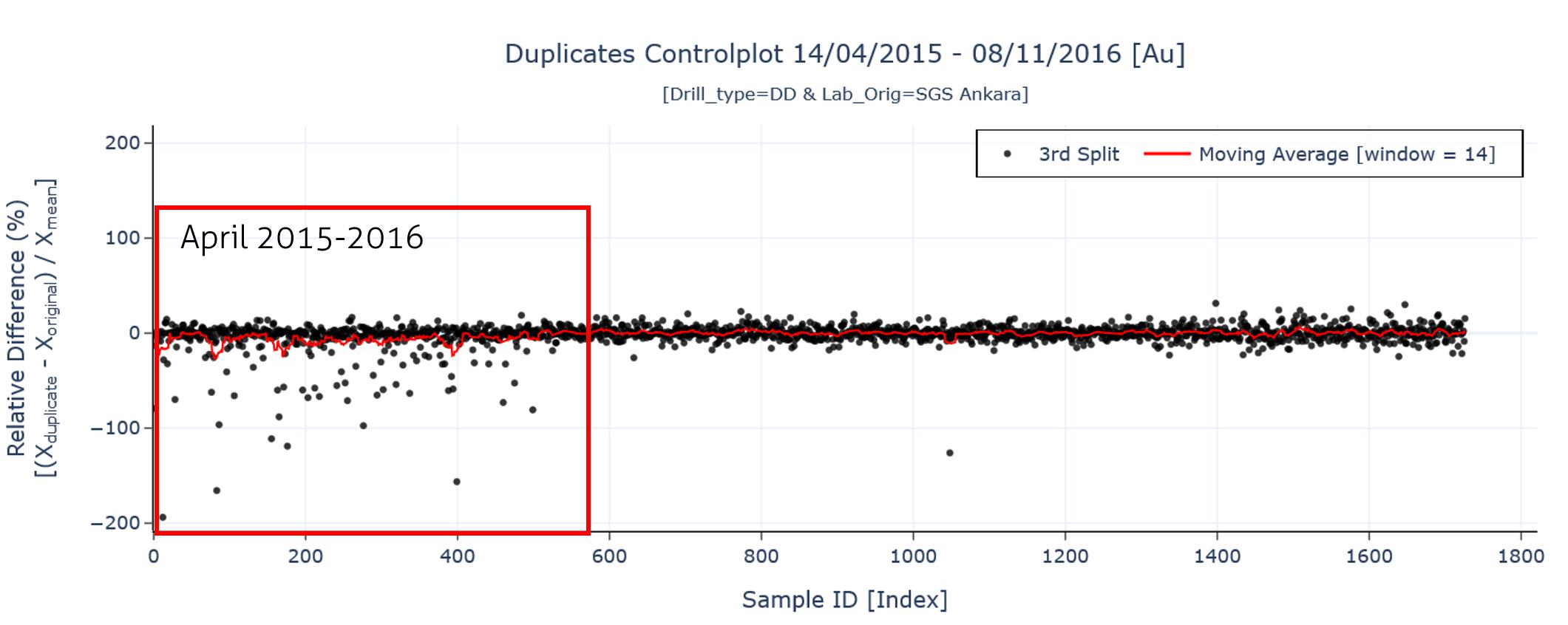

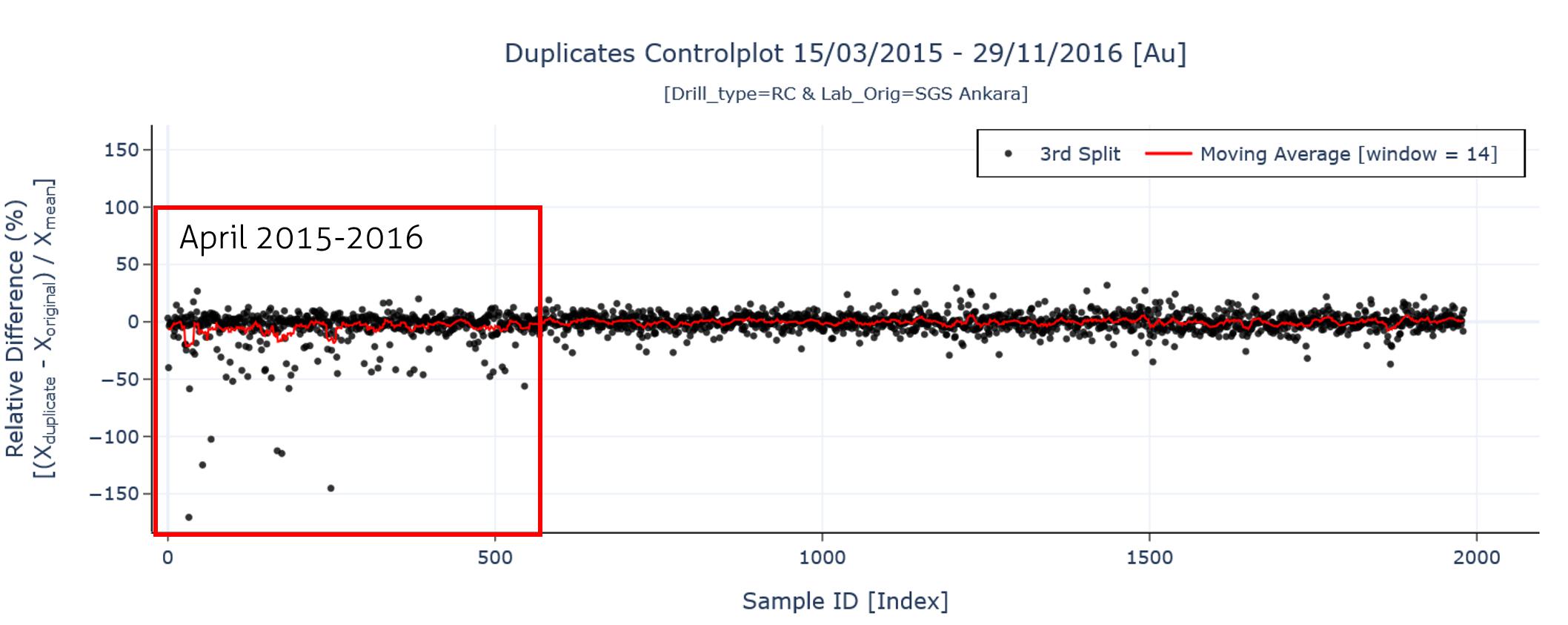

| Figure 8-6: | RD Plot Çakmaktepe DD Third Split (SGS Ankara) | 8-11 |

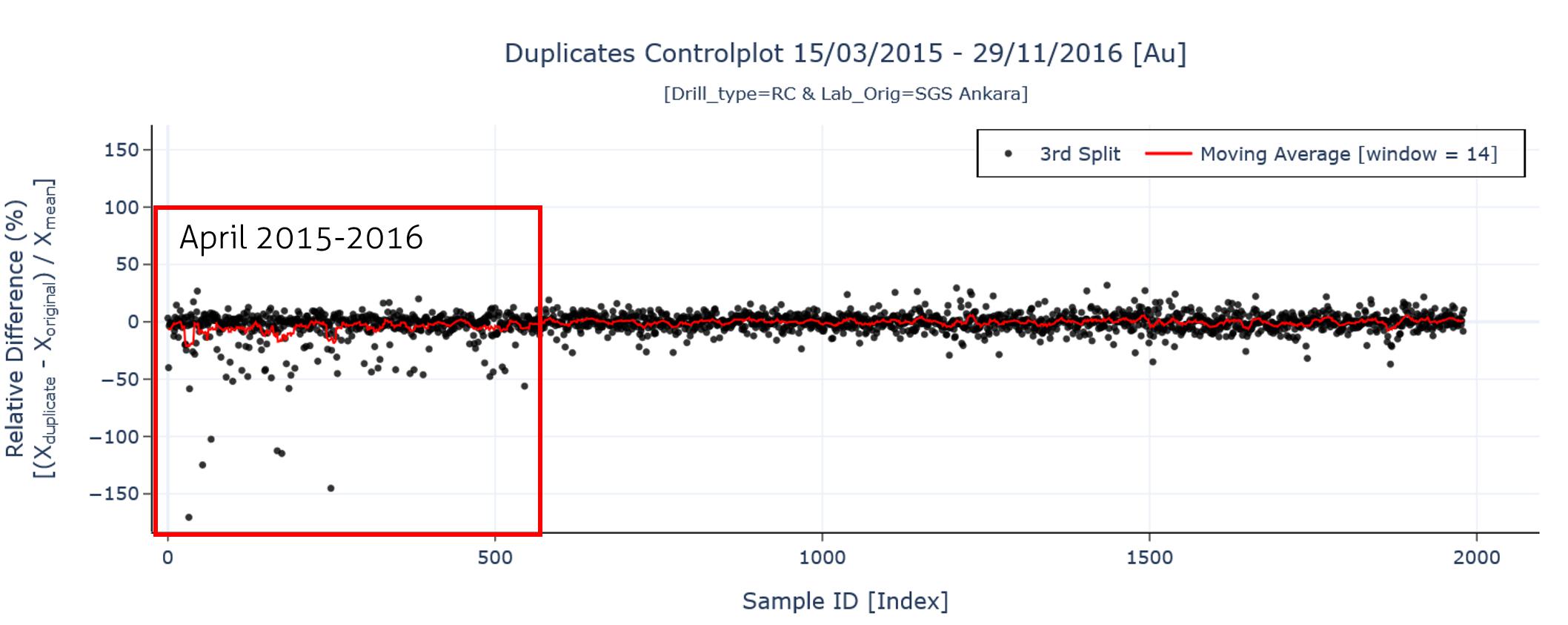

| Figure 8-7: | RD plot Çakmaktepe RC Third Split (SGS Ankara) | 8-11 |

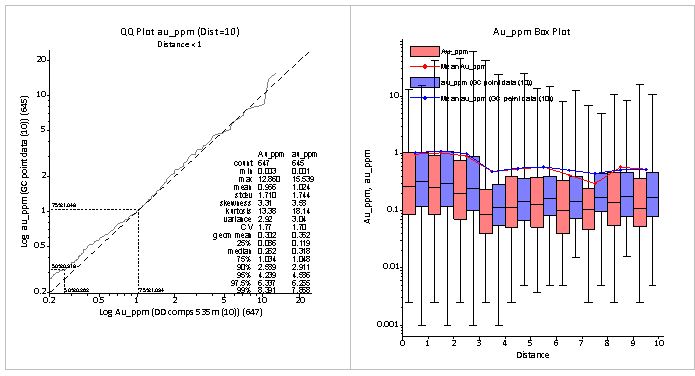

| Figure 8-8: | Çöpler Distance-Buffered QQ-plot for Au from Diamond and Blasthole GC drilling, pairs separated by <1 m (left) and Box-Whisker Plots of Paired DD and GC Distributions at Various Buffer Distances (right) | 8-16 |

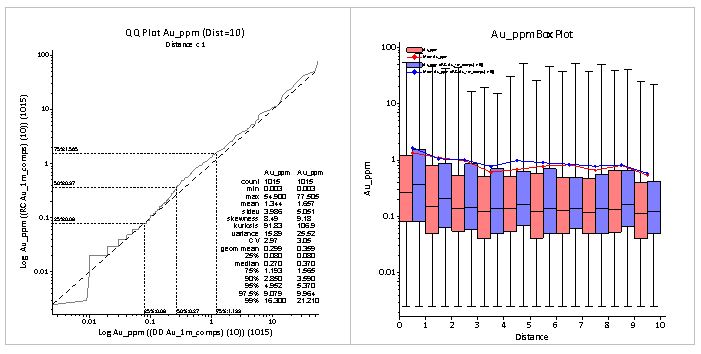

| Figure 8-9: | Çöpler Distance-Buffered QQ-plot for Au from Diamond and RC Drilling, pairs separated by <1 m (left) and Box-Whisker Plots of Paired DD (red) and RC (blue) Distributions at Various Buffer Distances (right) | 8-17 |

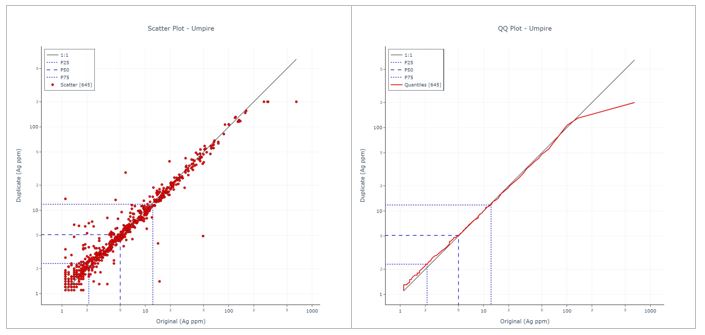

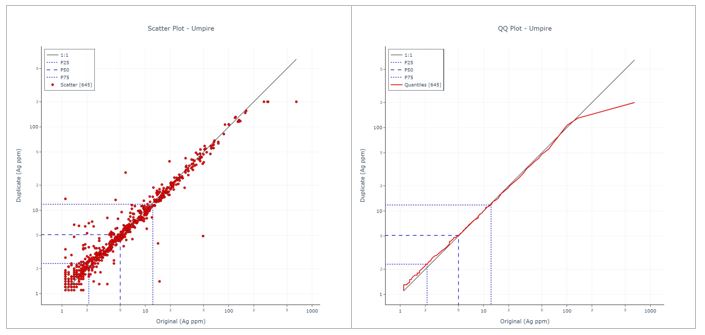

| Figure 8-10: | Scatter and QQ Plot from Çöpler Umpire Analysis for Ag, ALS vs BV (2021–2023) | 8-22 |

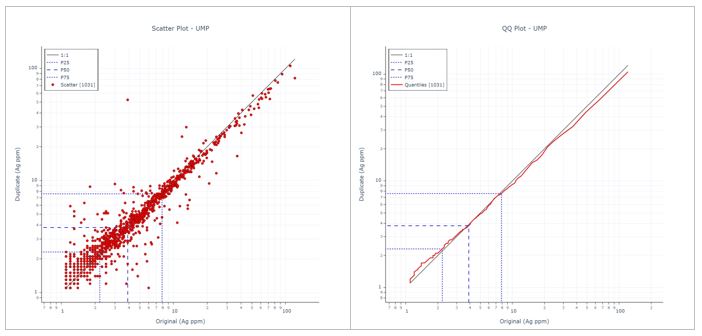

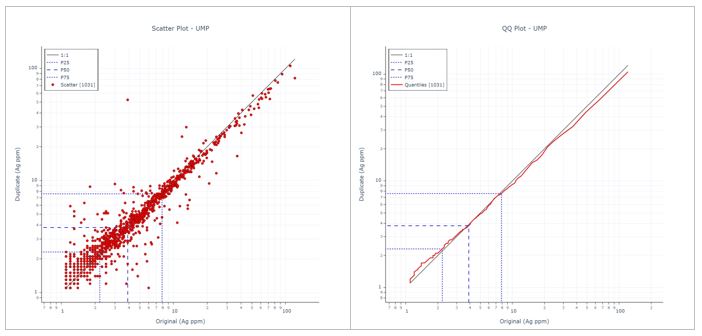

| Figure 8-11: | Scatter and QQ Plot from Çakmaktepe Ext Umpire Analysis for Ag, ALS vs BV, (2021–2023) | 8-28 |

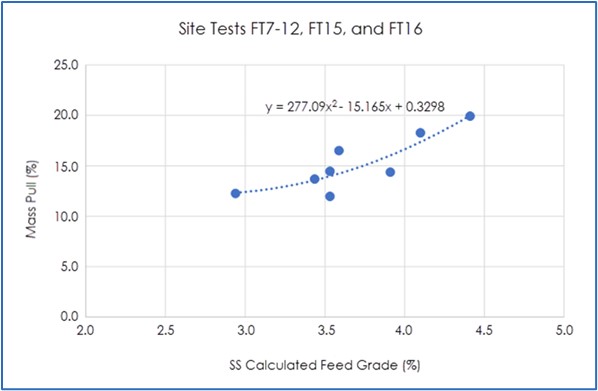

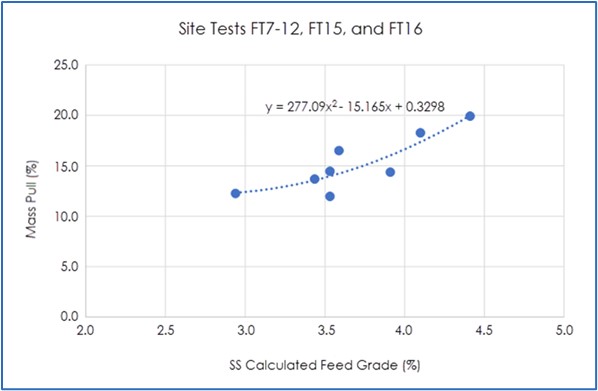

| Figure 10-1: | Feed SS% – Mass Pull Relationship | 10-12 |

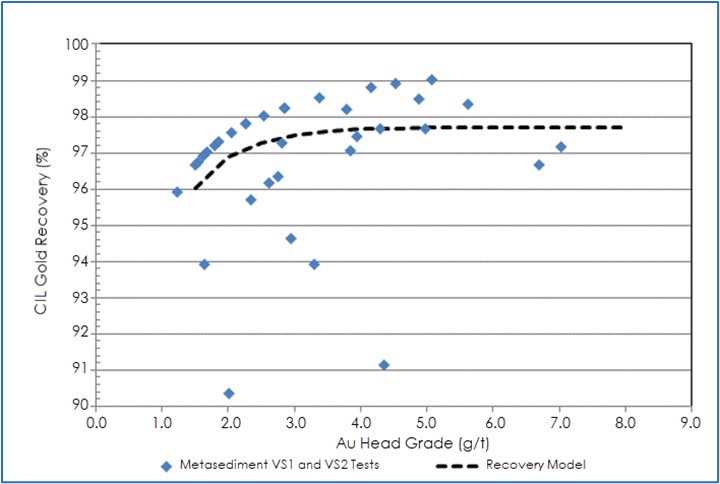

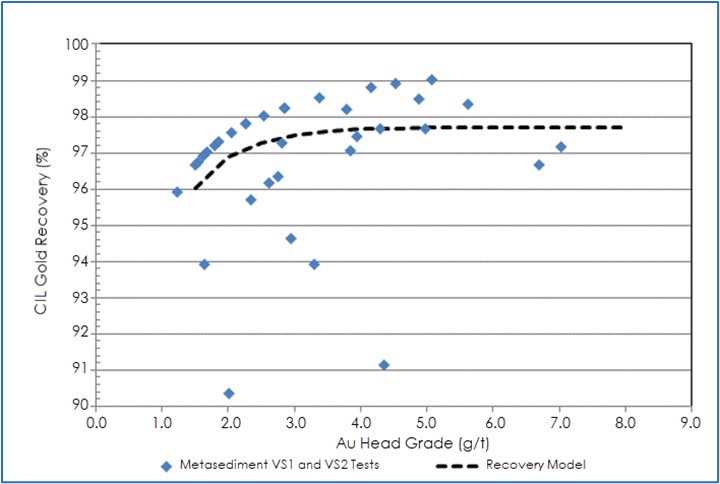

| Figure 10-2: | Metasediment Gold Recovery Results and Model | 10-14 |

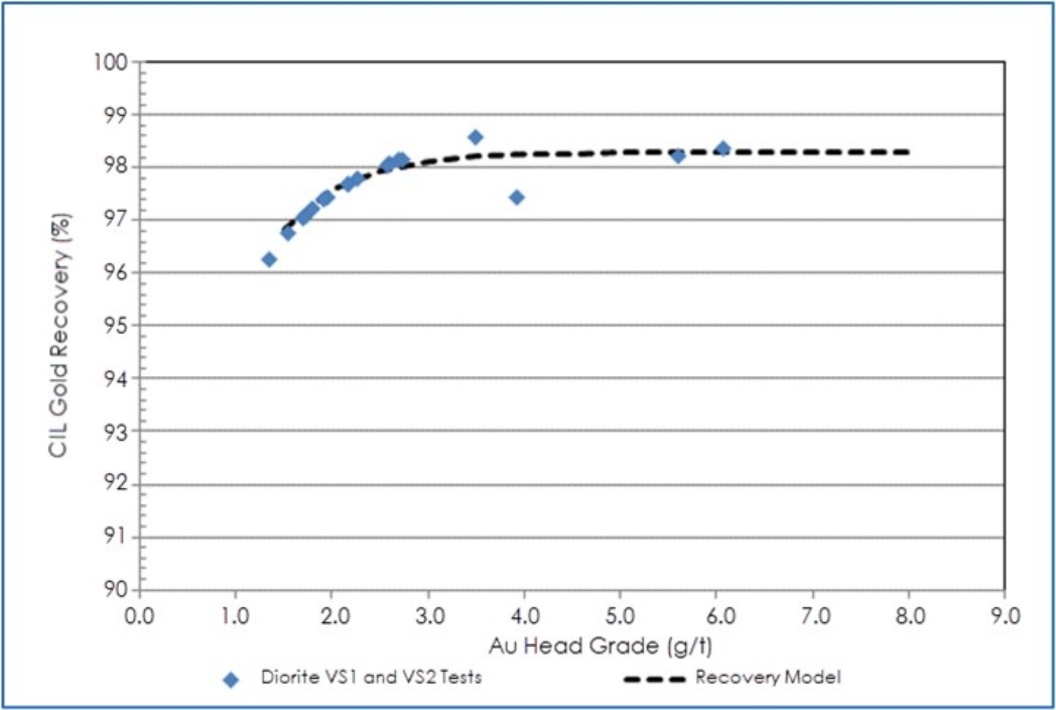

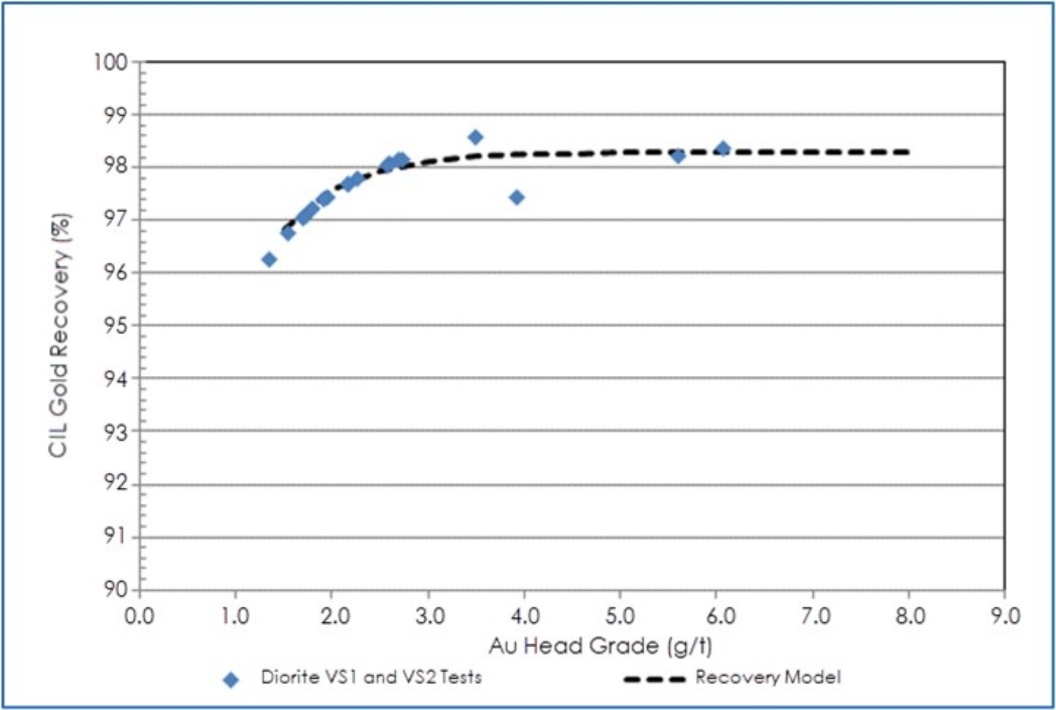

| Figure 10-3: | Diorite Gold Recovery and Model | 10-15 |

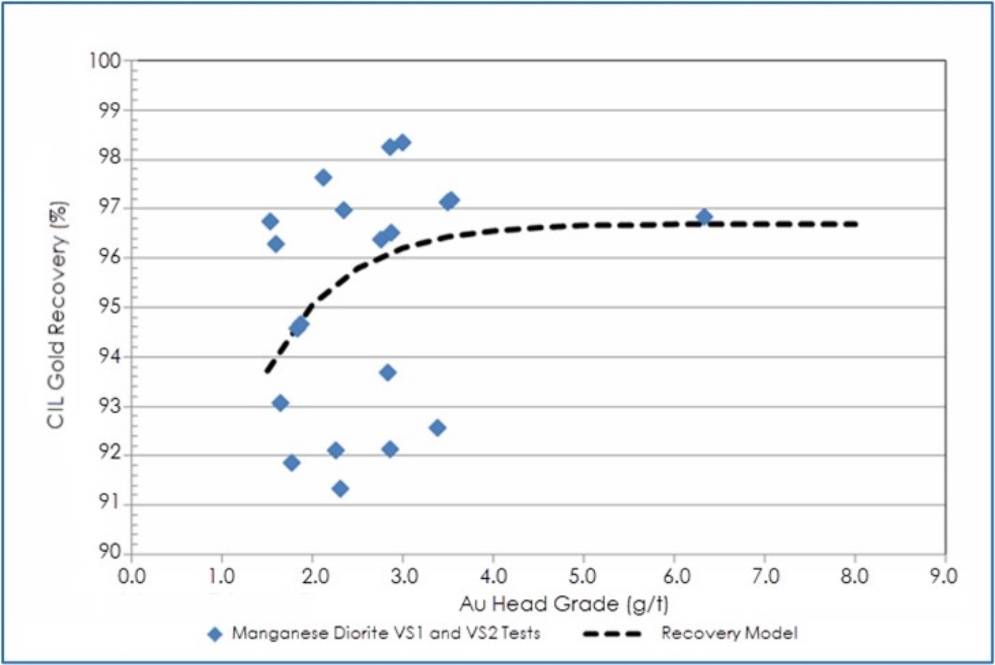

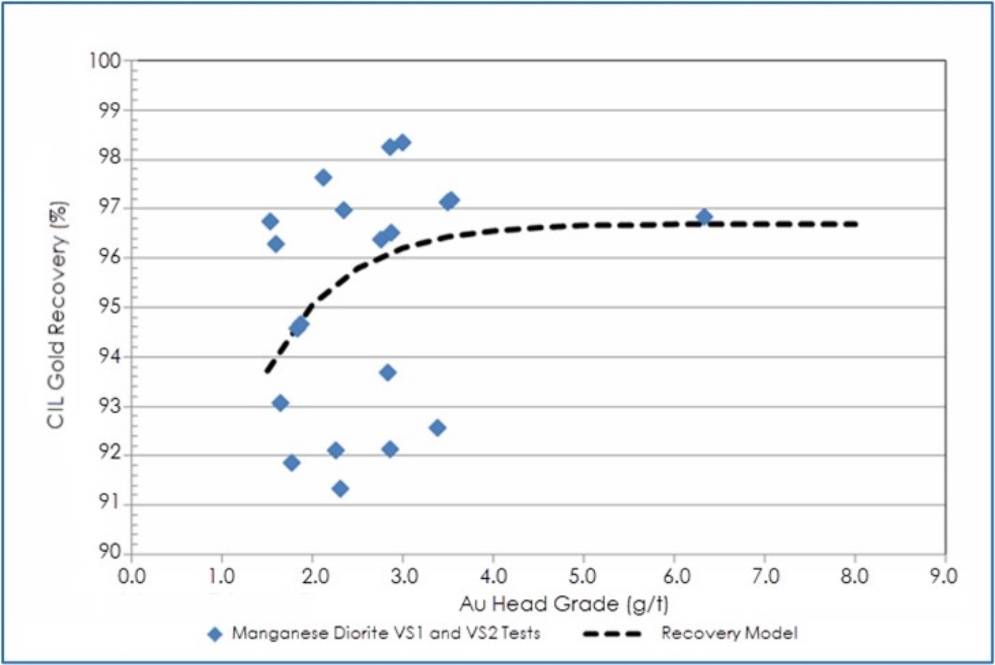

| Figure 10-4: | Manganese Diorite Gold Recovery and Model | 10-15 |

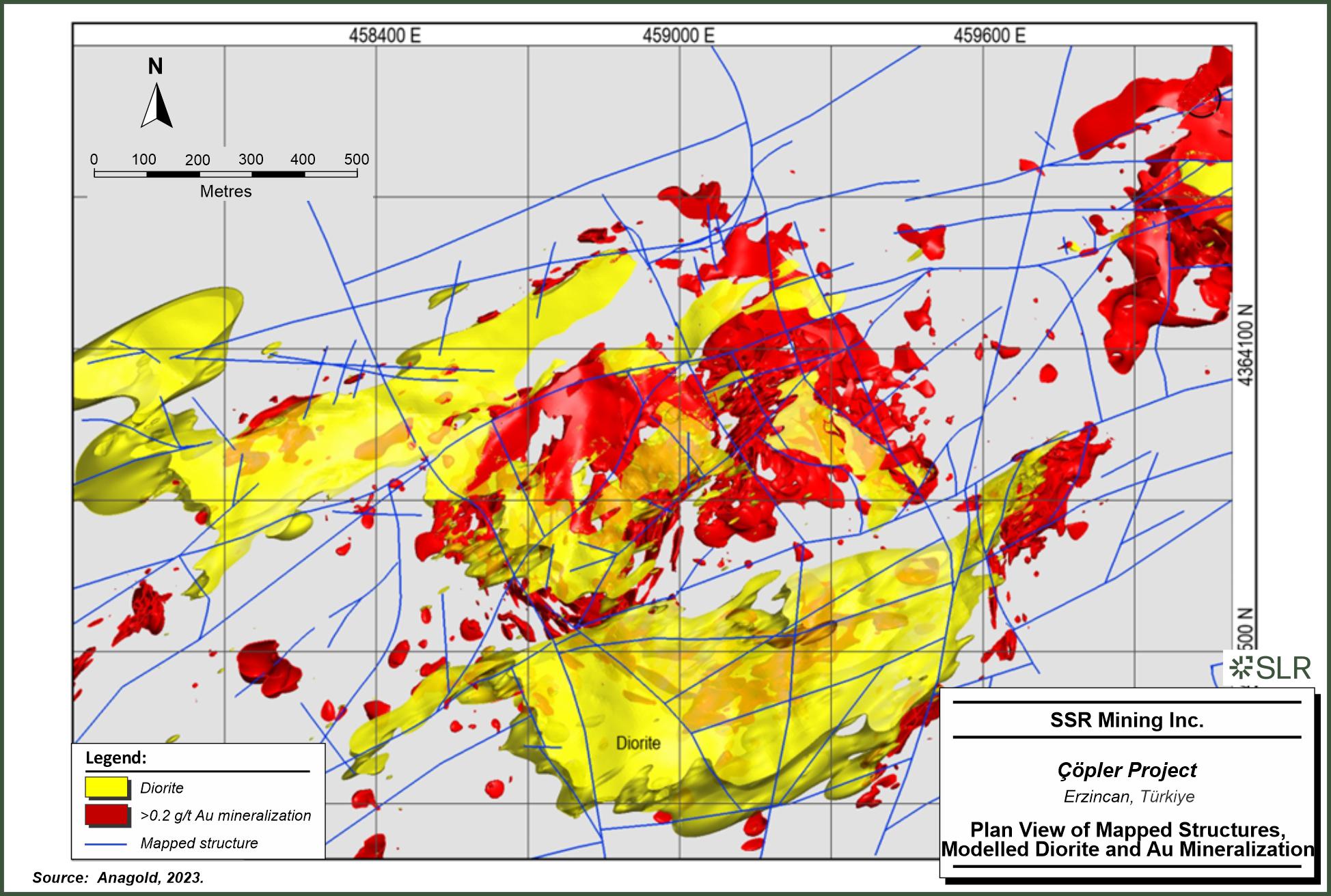

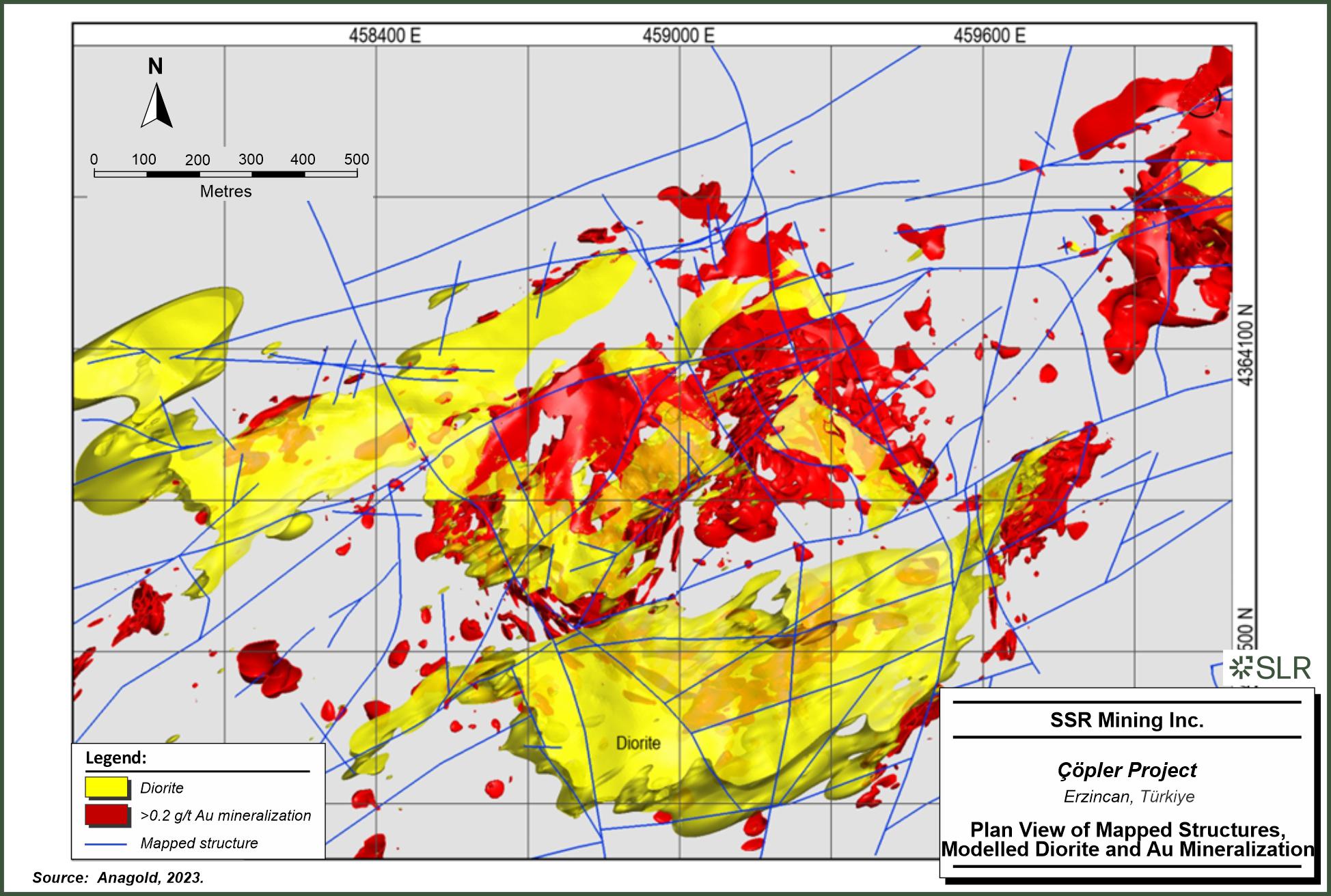

| Figure 11-1: | Plan View of Mapped Structures, Modeled Diorite and Au Mineralization | 11-6 |

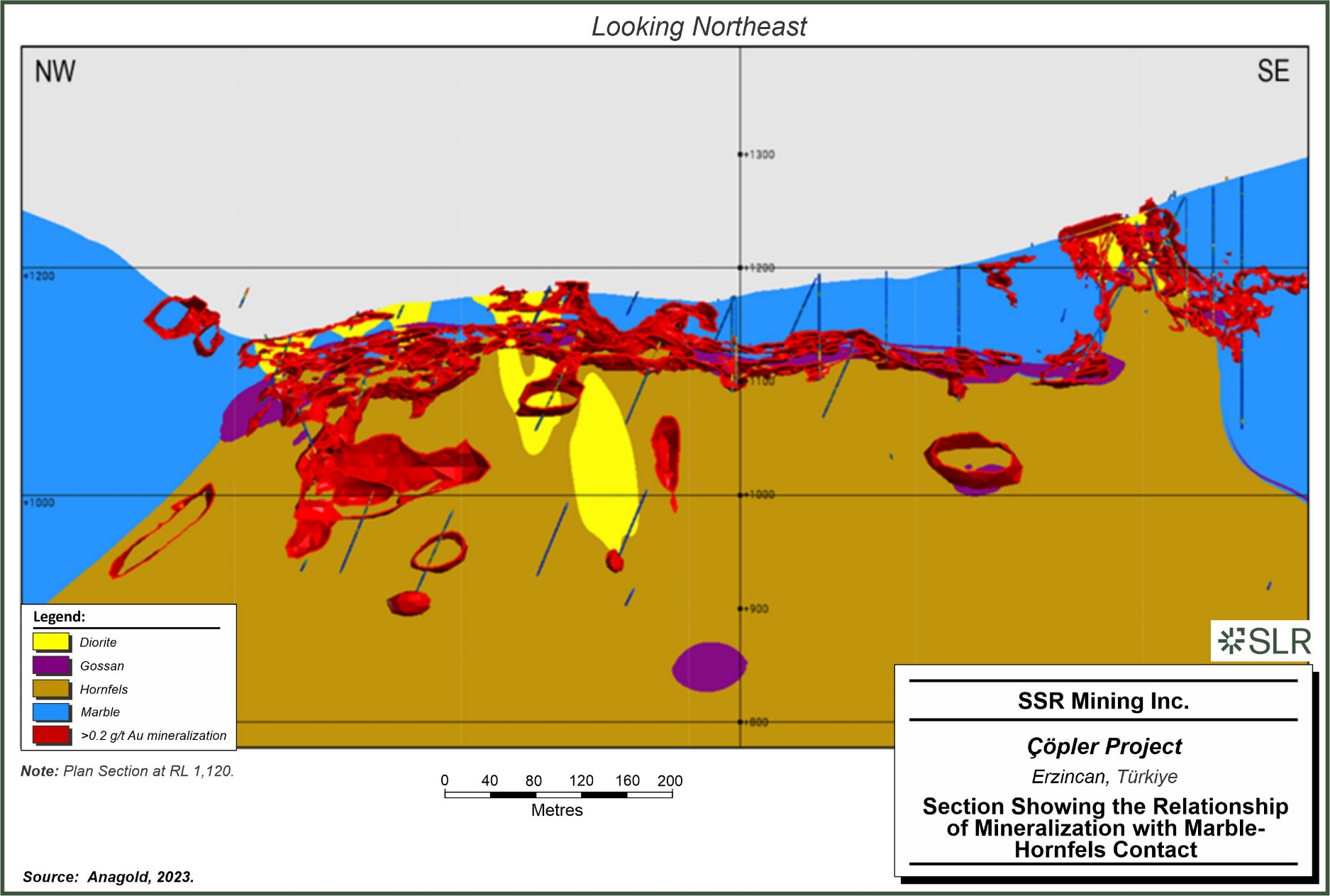

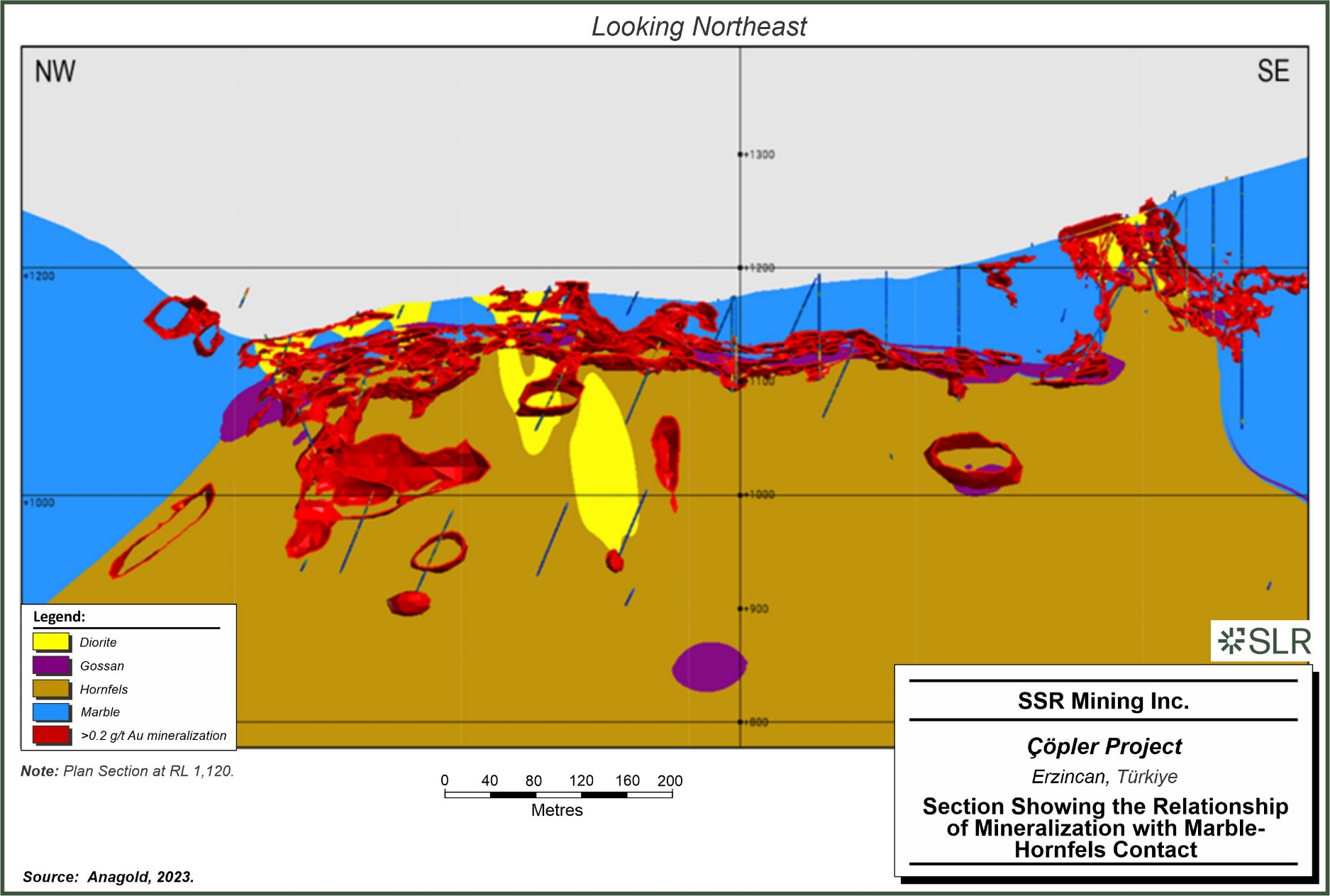

| Figure 11-2: | Section Showing the Relationship of Mineralization with Marble-Hornfels Contact | 11-8 |

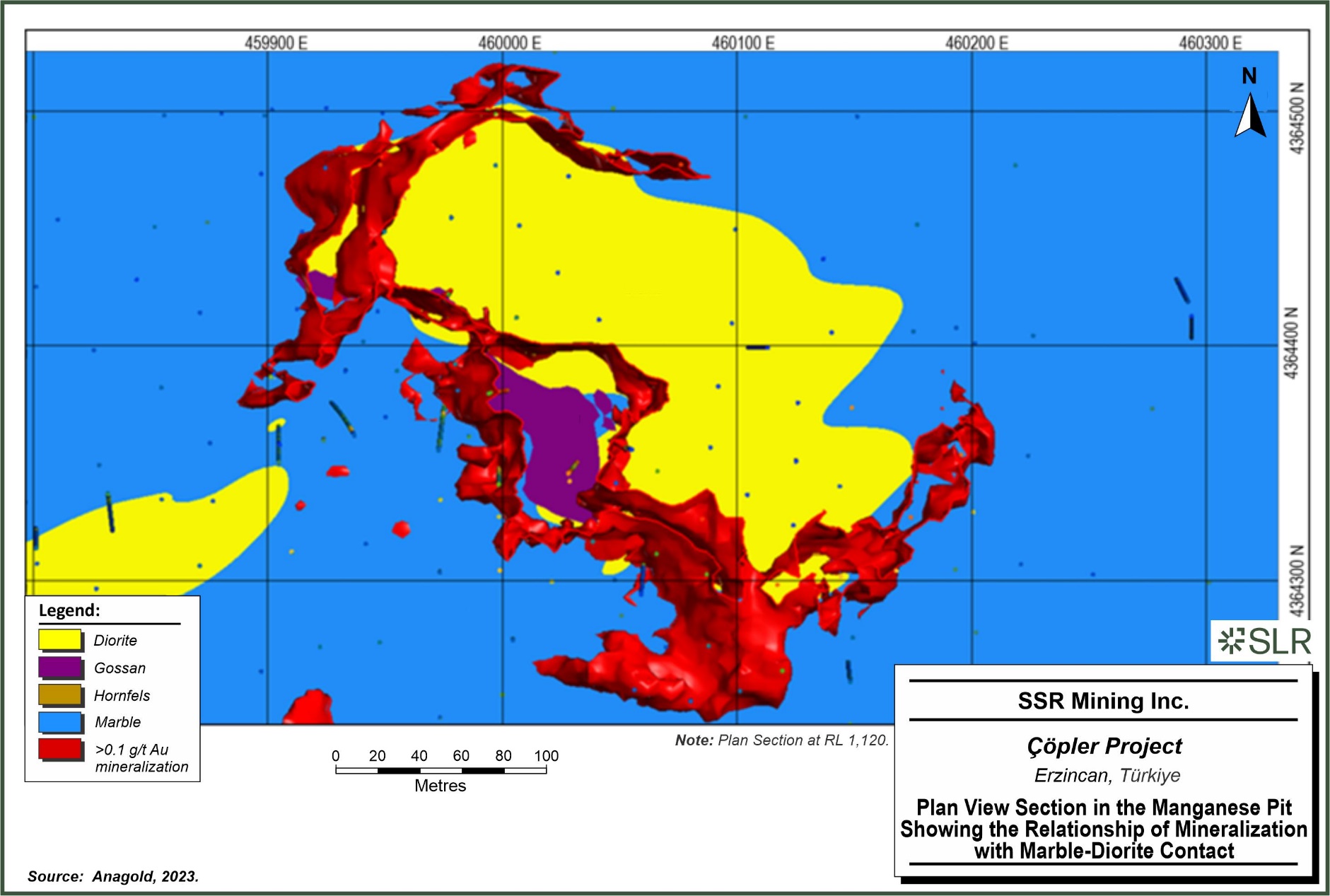

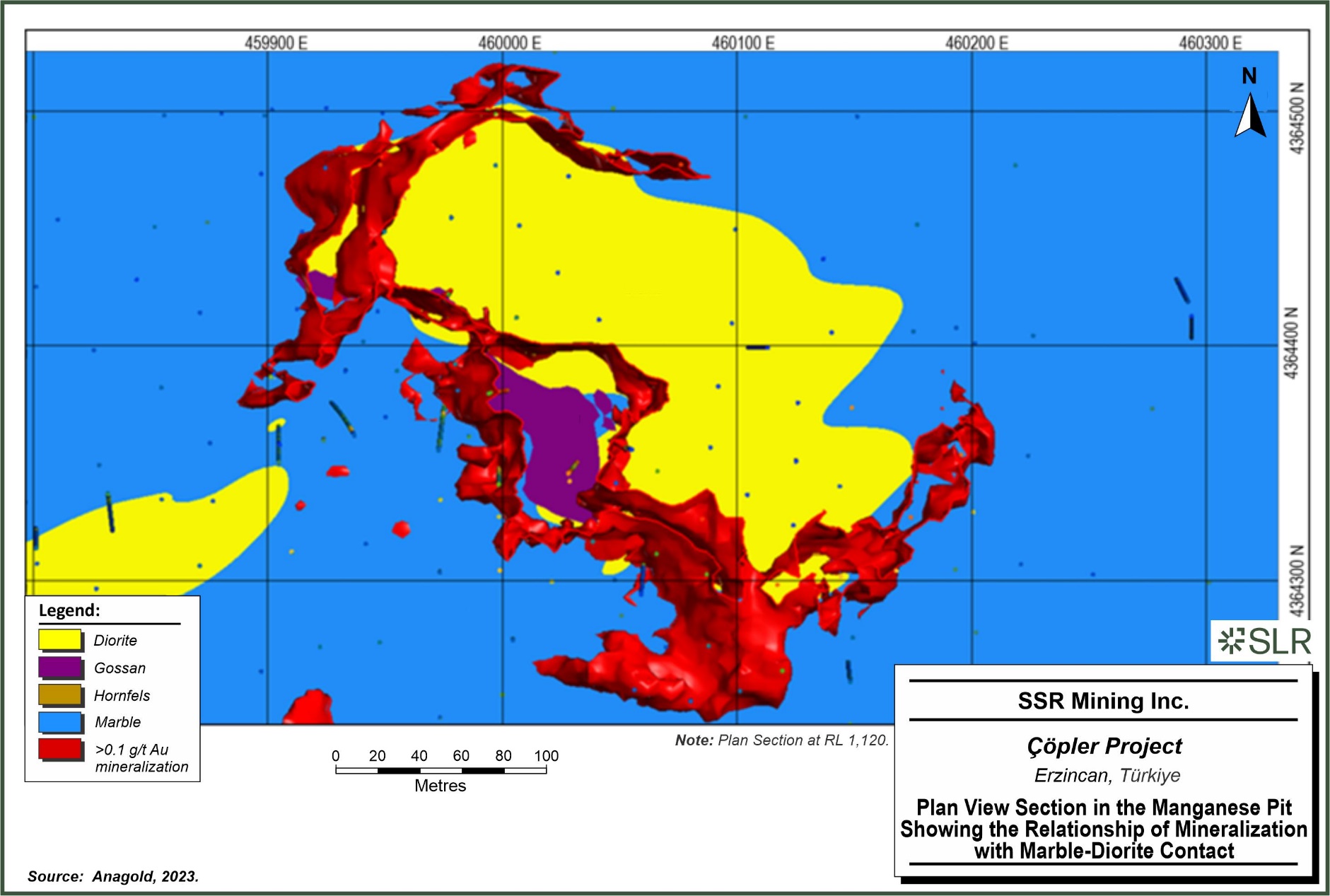

| Figure 11-3: | Plan View Section in the Manganese Pit Showing the Relationship of Mineralization with Marble-Diorite Contact | 11-9 |

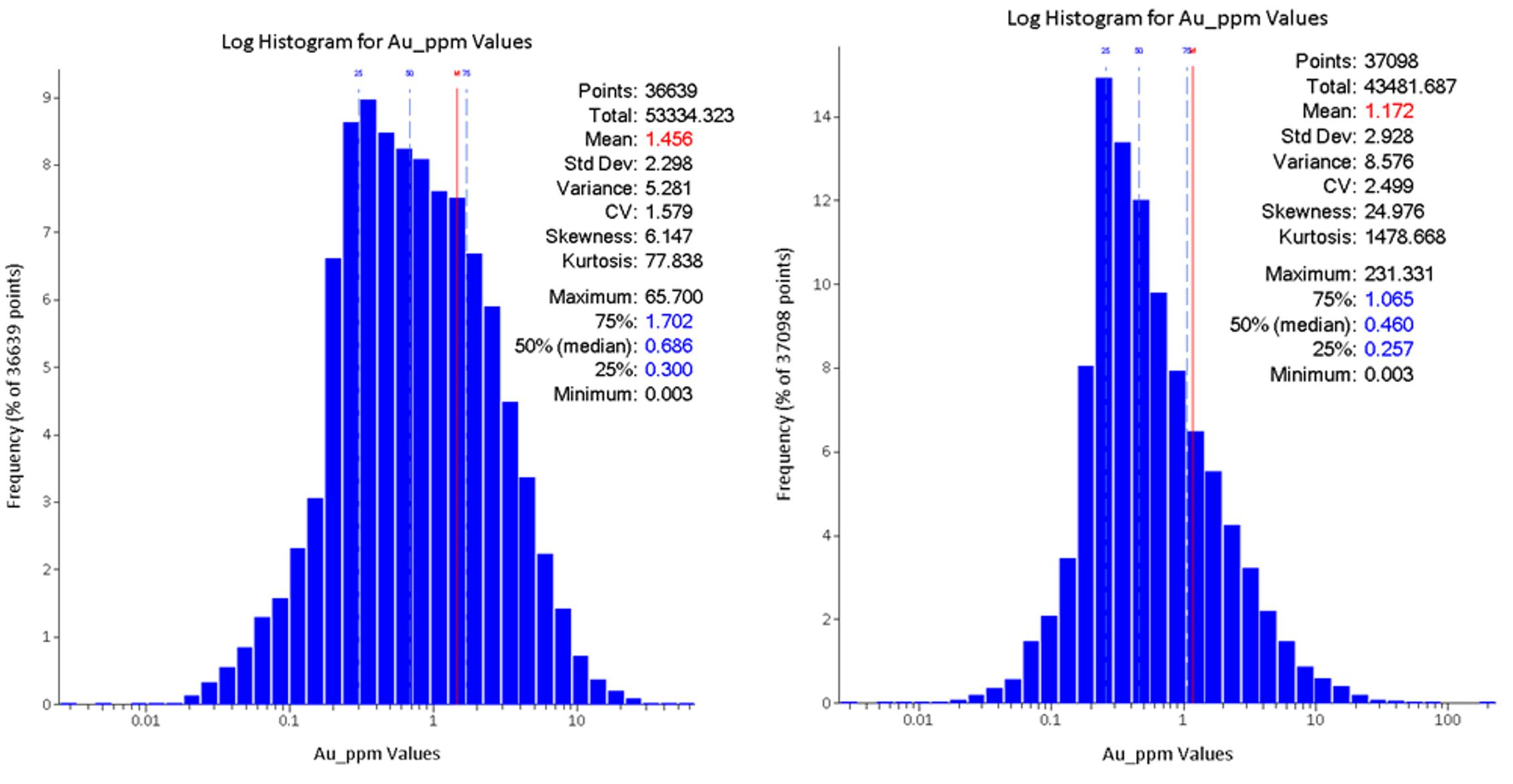

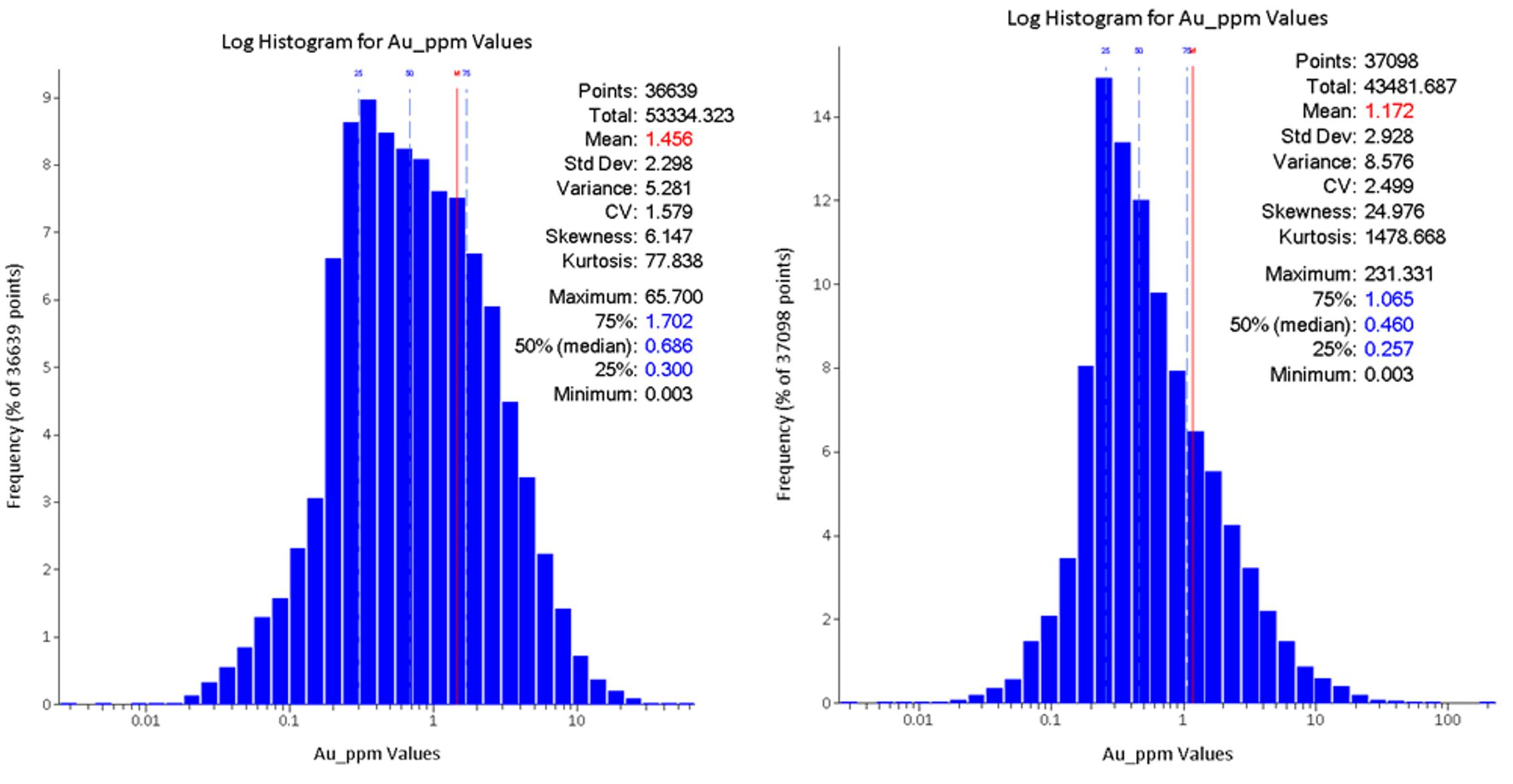

| Figure 11-4: | Log-histograms of Composites within the Hornfels Sulfide (left) and Diorite (right) Domains | 11-12 |

| Figure 11-5: | Experimental and Modelled Variograms for Diorite Domain (Exploration Data only) | 11-14 |

| | x |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| Figure 11-6: | Çöpler North-South Section Showing Resource Classification | 11-20 |

| Figure 11-7: | Trend Plot in Y Direction Showing Raw Sample Grades (Black), 2-m NN-“Declustered” Sample Grades (Blue), and Block OK Grades (Green) | 11-21 |

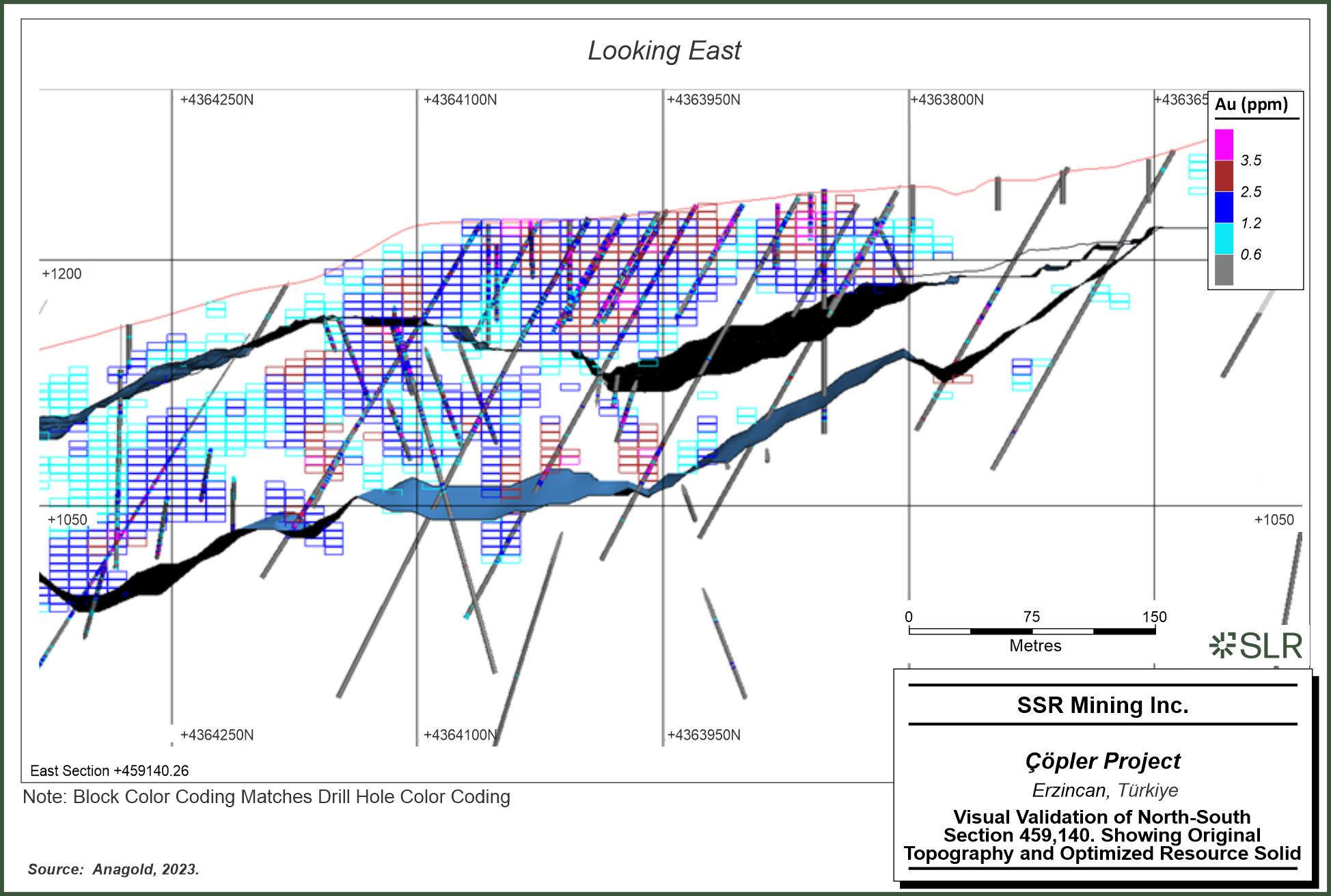

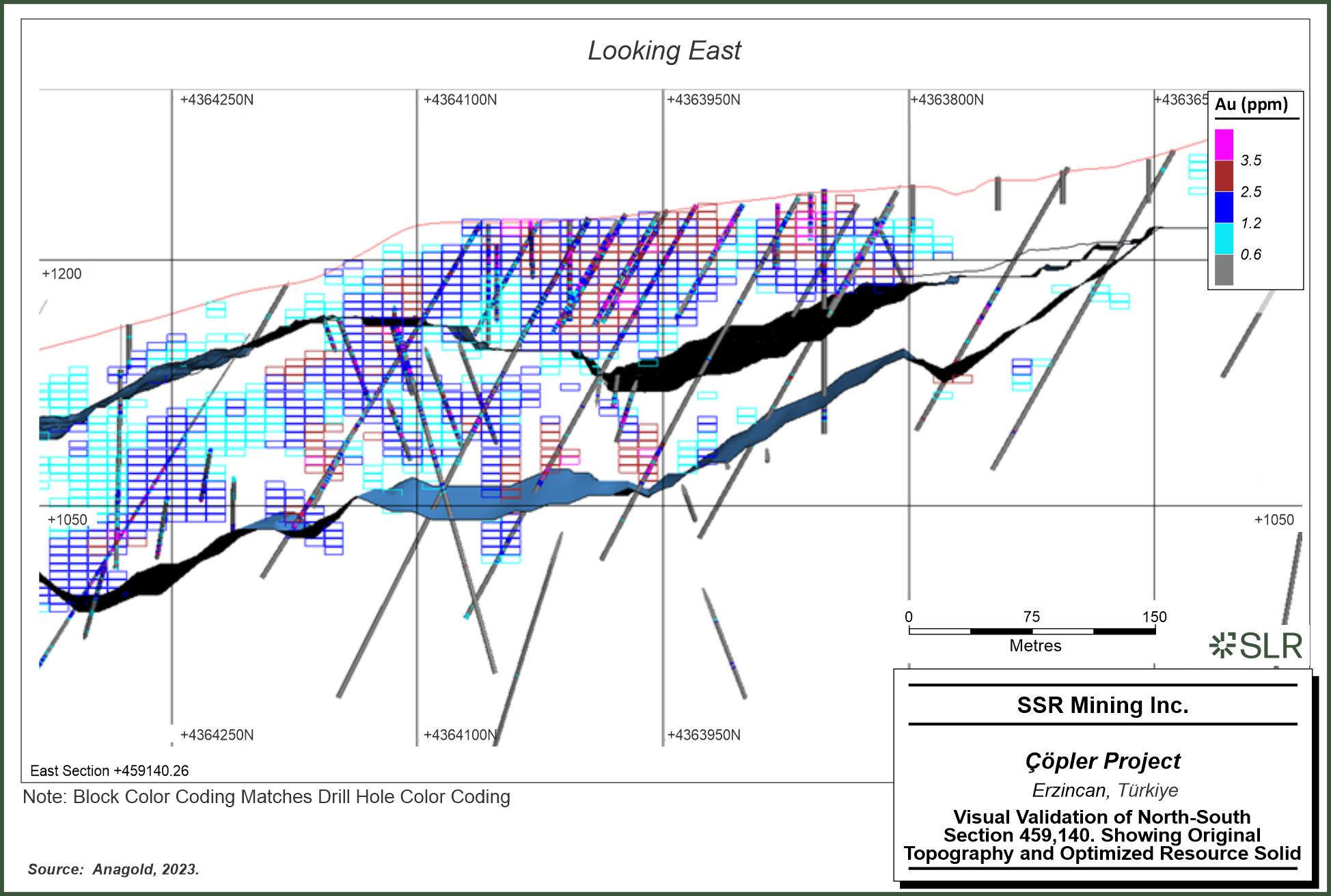

| Figure 11-8: | Visual Validation of North-South Section 459,140, Showing Original Topography and Optimized Resource Solid | 11-22 |

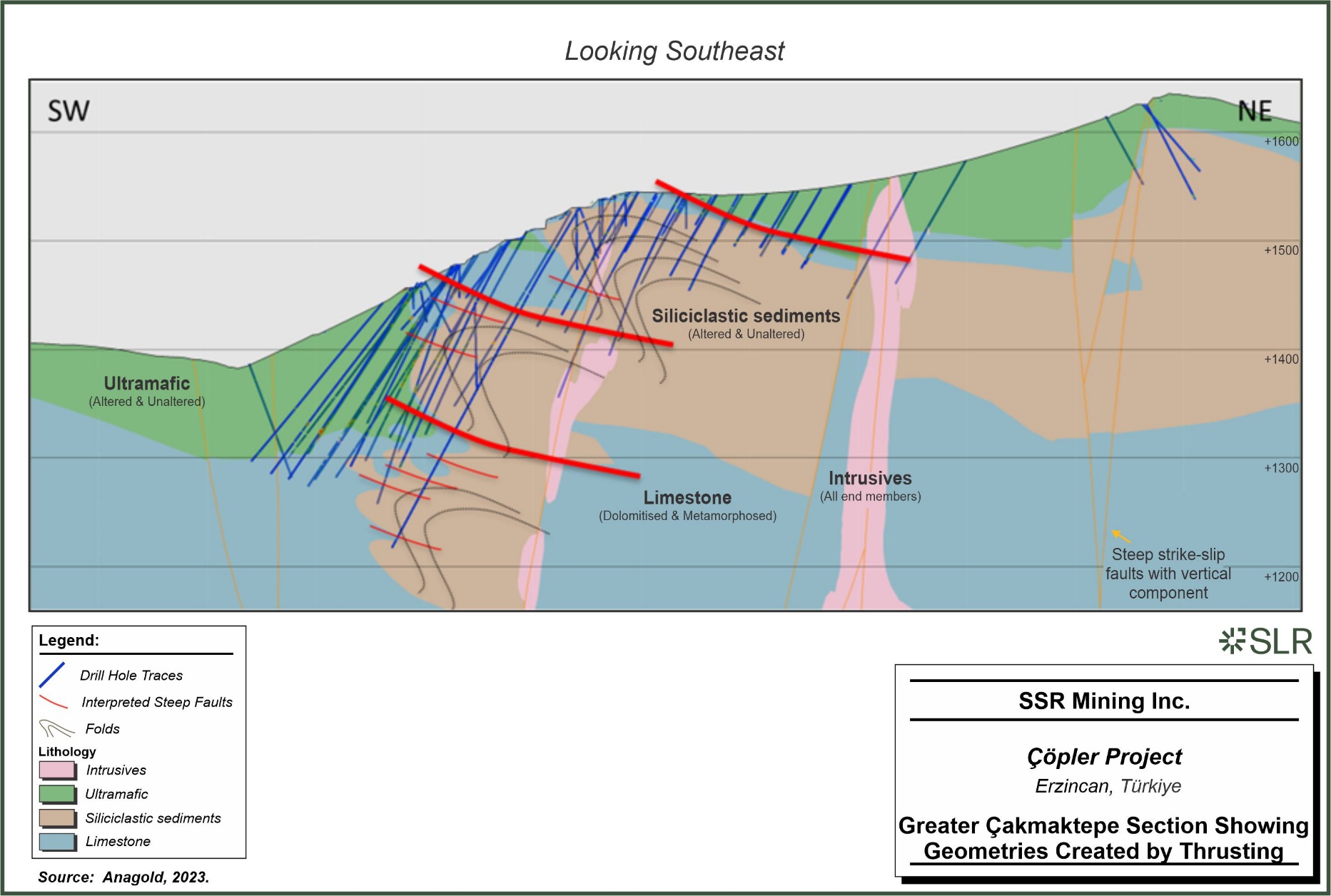

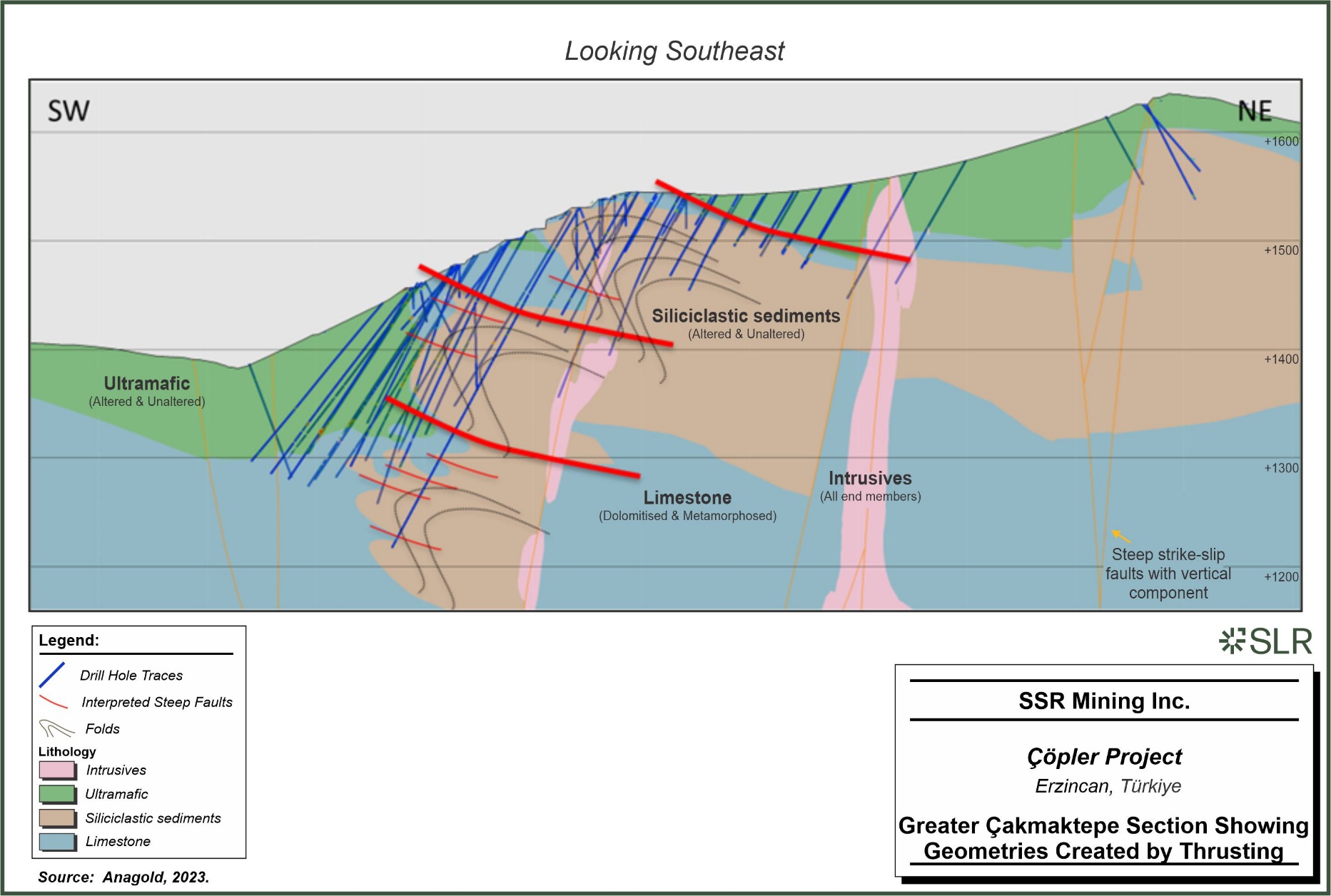

| Figure 11-9: | Greater Çakmaktepe Section Showing Geometries Created by Thrusting | 11-29 |

| Figure 11-10: | Distribution of Mg within Rocks Classified as Ultramafic (left) and Carbonates (right) | 11-30 |

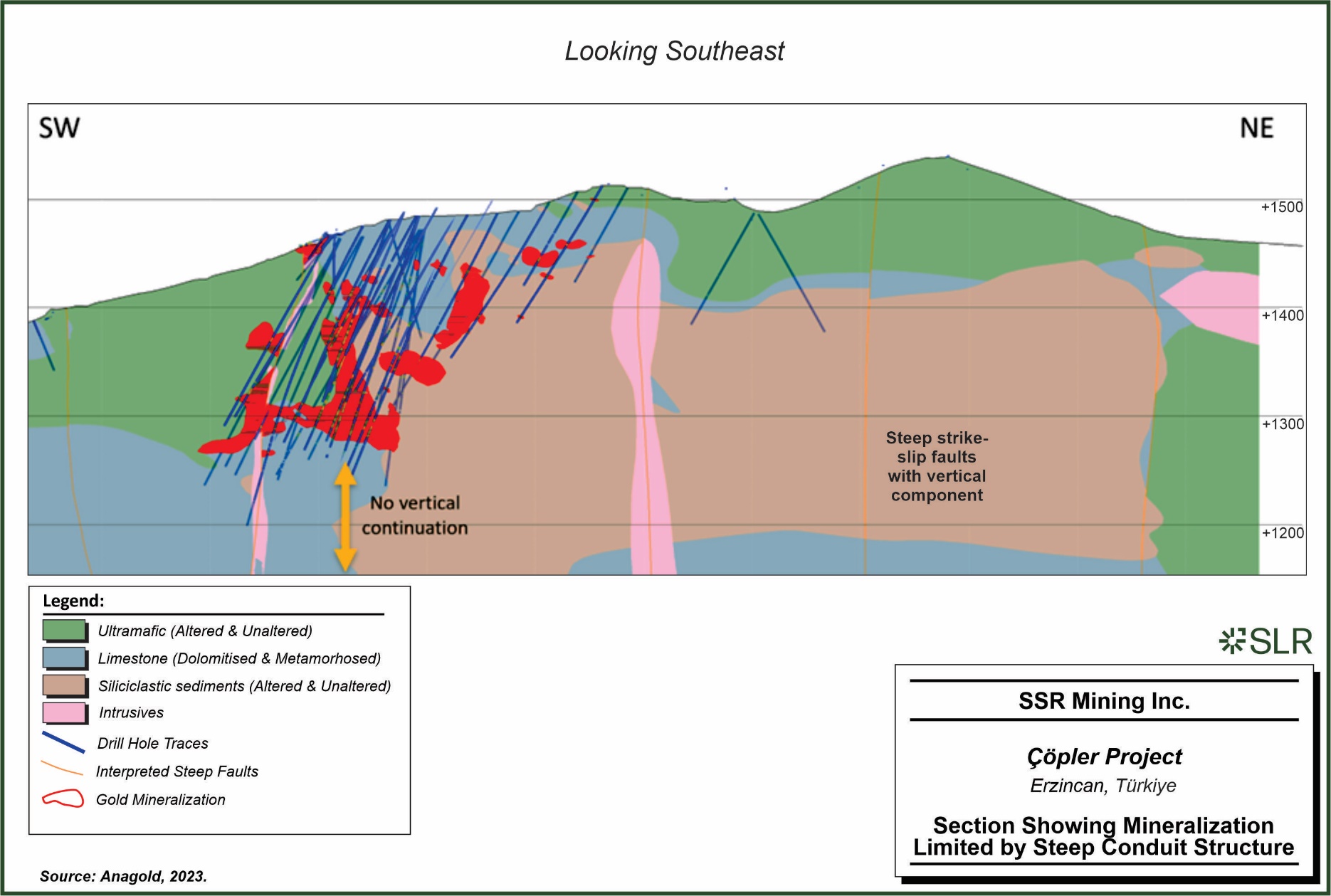

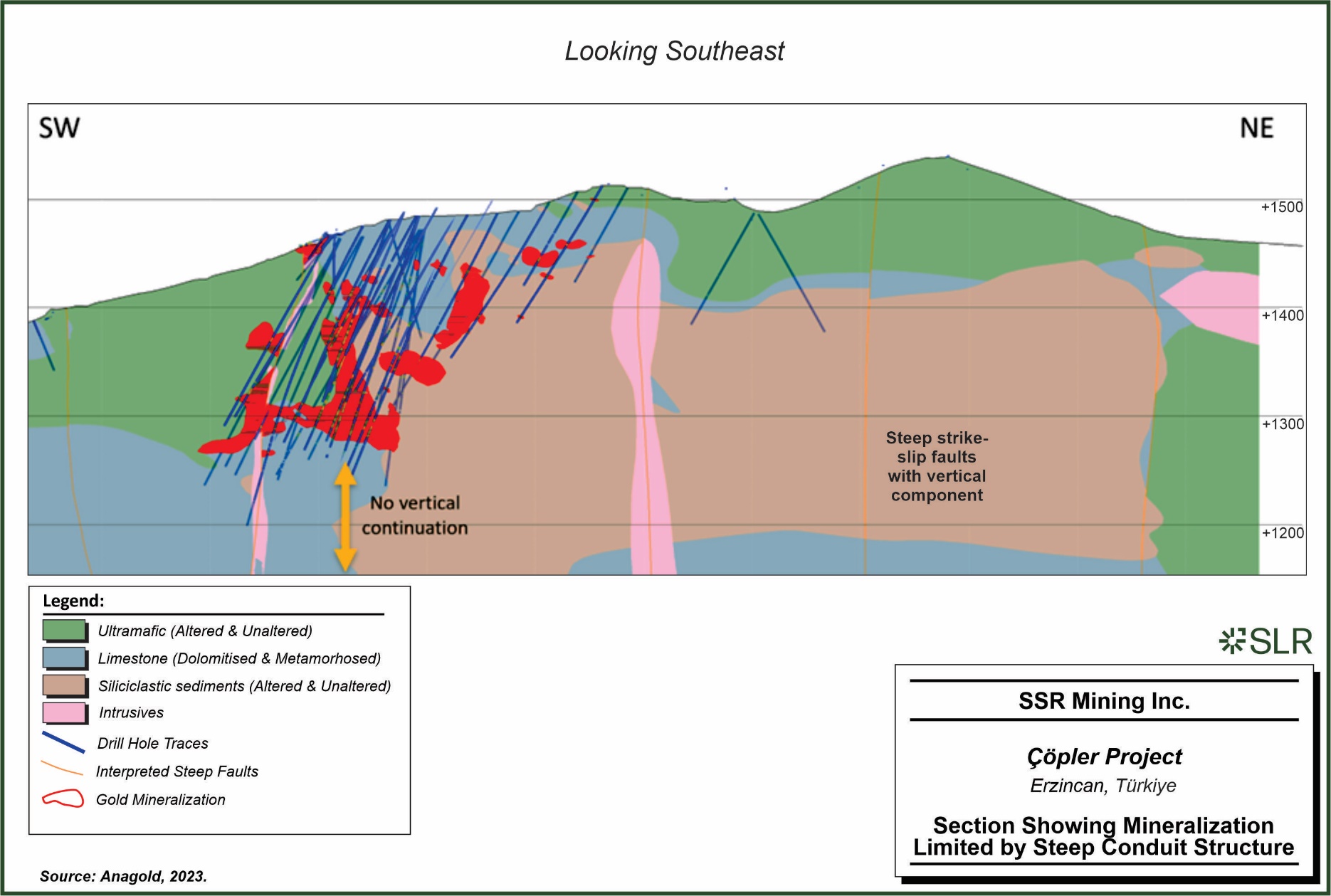

| Figure 11-11: | Section Showing Mineralization Limited by Steep Conduit Structure | 11-32 |

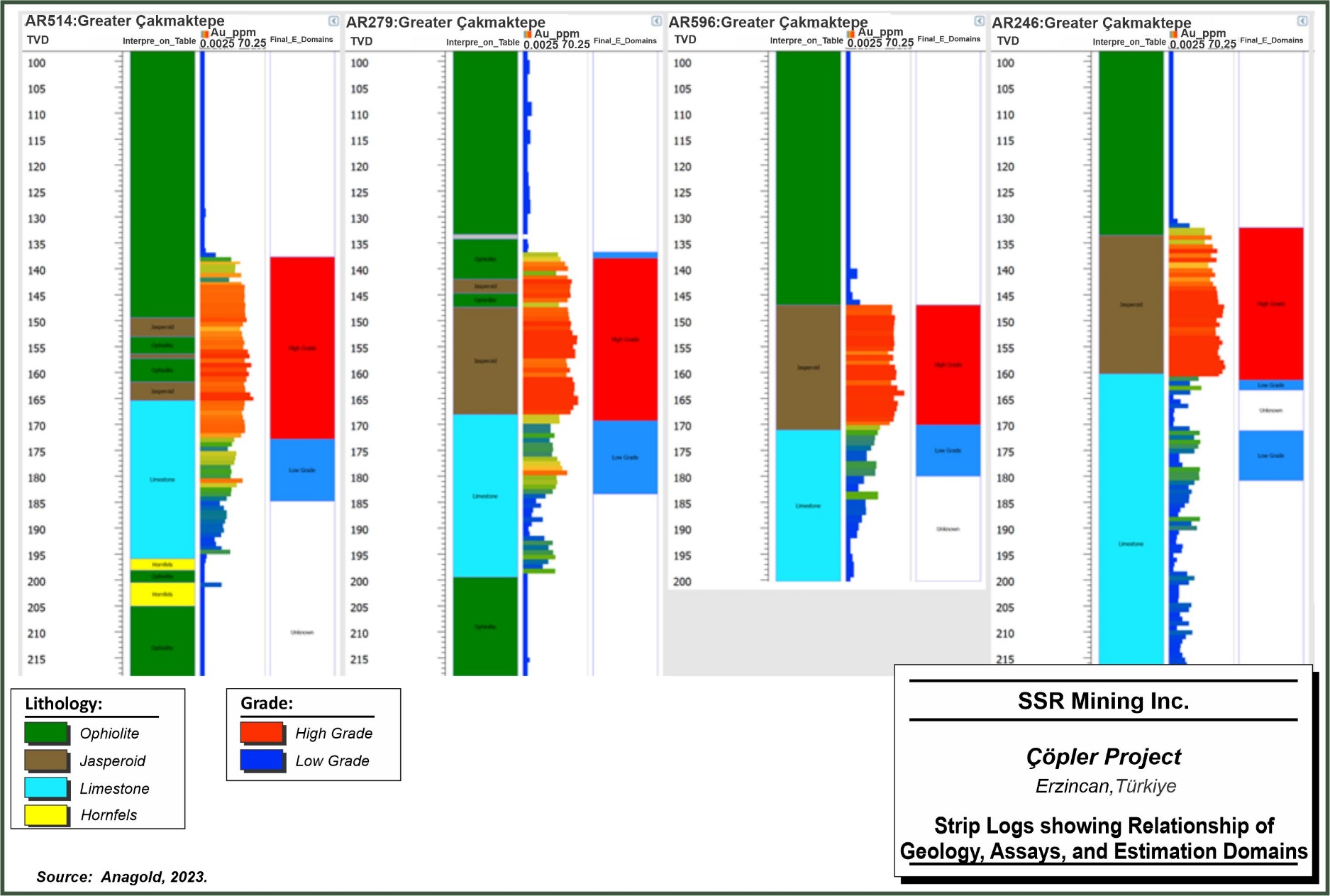

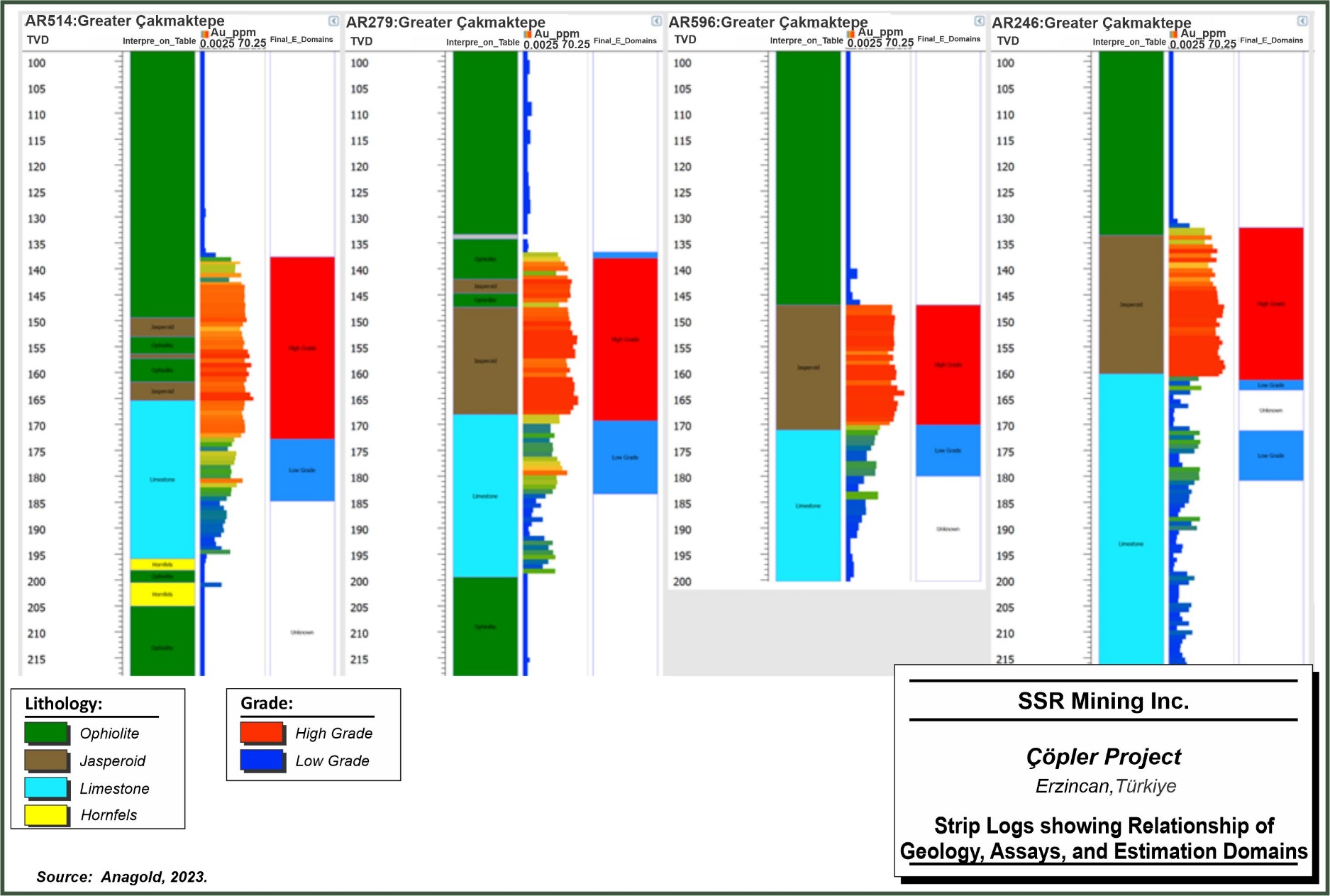

| Figure 11-12: | Strip Logs showing Relationship of Geology, Assays, and Estimation Domains for Greater Çakmaktepe | 11-34 |

| Figure 11-13: | Boundary Analysis | 11-35 |

| Figure 11-14: | Log-histogram of Composites within the LG (left) and HG (right) Domains | 11-36 |

| Figure 11-15: | Experimental and Modeled Variograms | 11-38 |

| Figure 11-16: | Çakmaktepe North-South Section Showing Resource Classification | 11-43 |

| Figure 11-17: | Visual Validation of North-South Section 4,367,180, Showing Original Topography and Optimized Resource Shell | 11-45 |

| Figure 11-18: | Trend Plot in Z Direction Showing Raw Same Grades (black), 2-m NN-“Declustered” Sample Grades (purple), and Block Grades (pink). | 11-46 |

| Figure 11-19: | Log-histograms of Composites Within the Au Low-Grade (left) and High-Grade (right) Estimation Domains | 11-53 |

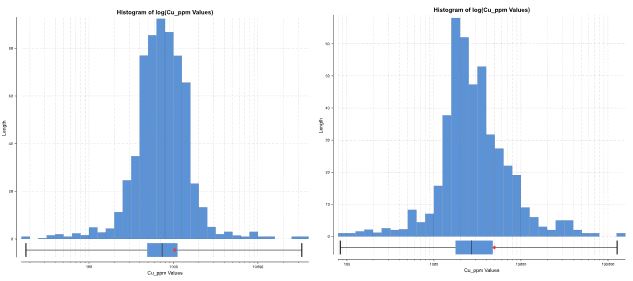

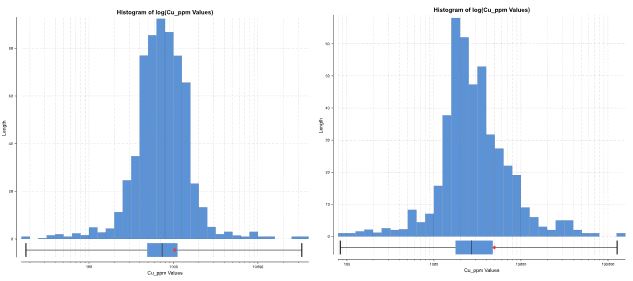

| Figure 11-20: | Log-histograms of Composites Within the Cu Low-Grade (left) and High-Grade (right) Estimation Domains | 11-53 |

| Figure 11-21: | Experimental and Modeled Variograms for Au | 11-55 |

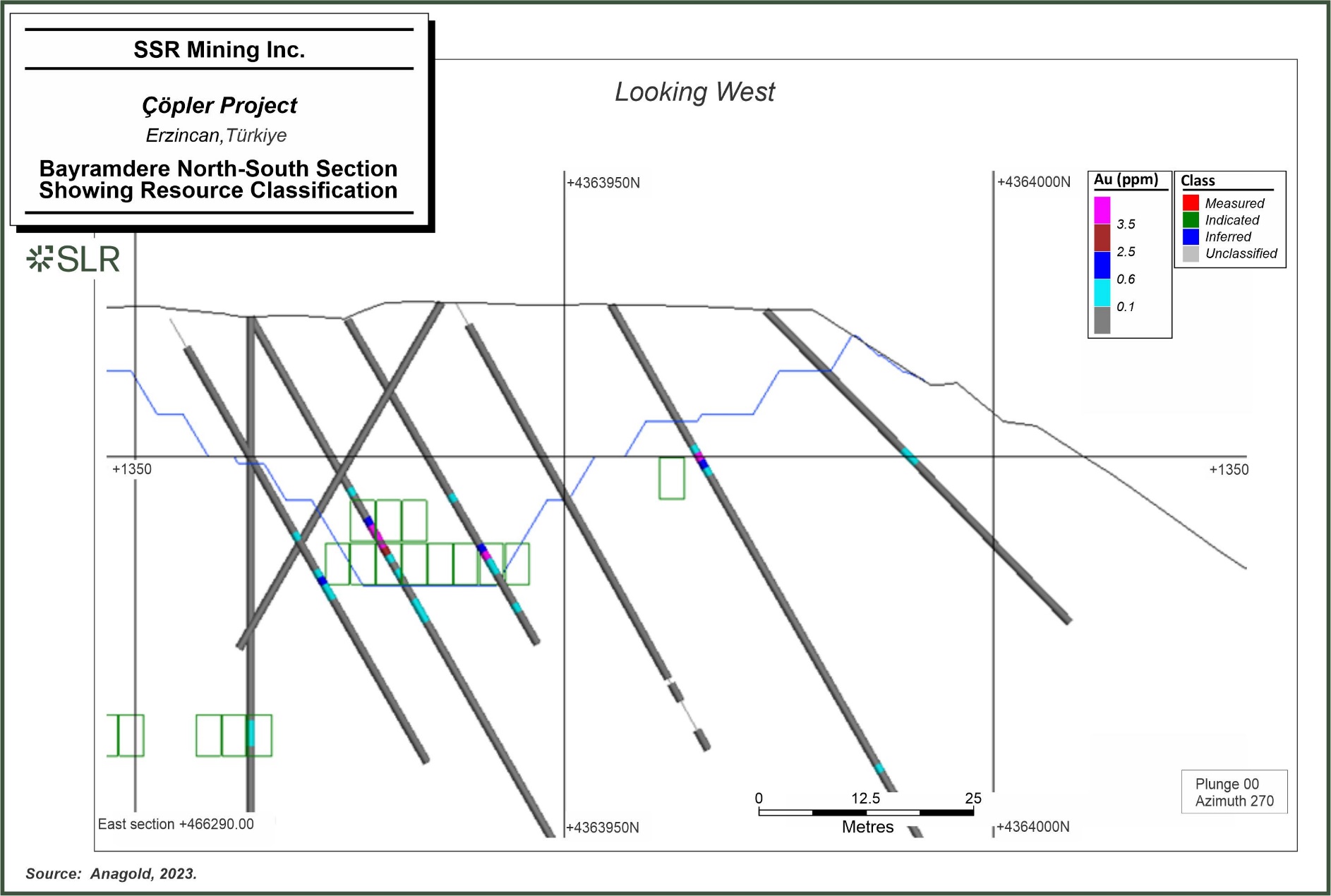

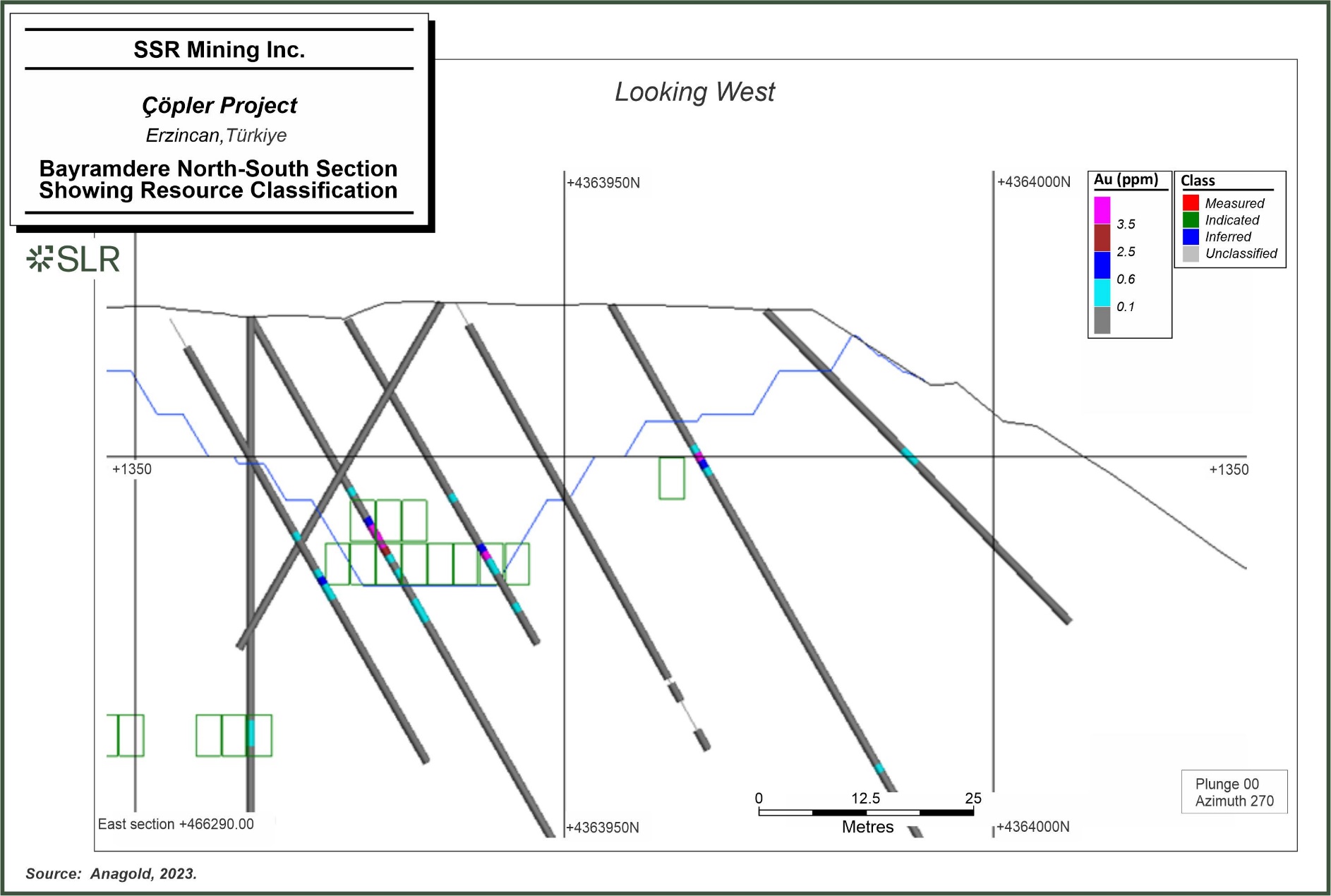

| Figure 11-22: | Bayramdere North-South Section Showing Resource Classification | 11-58 |

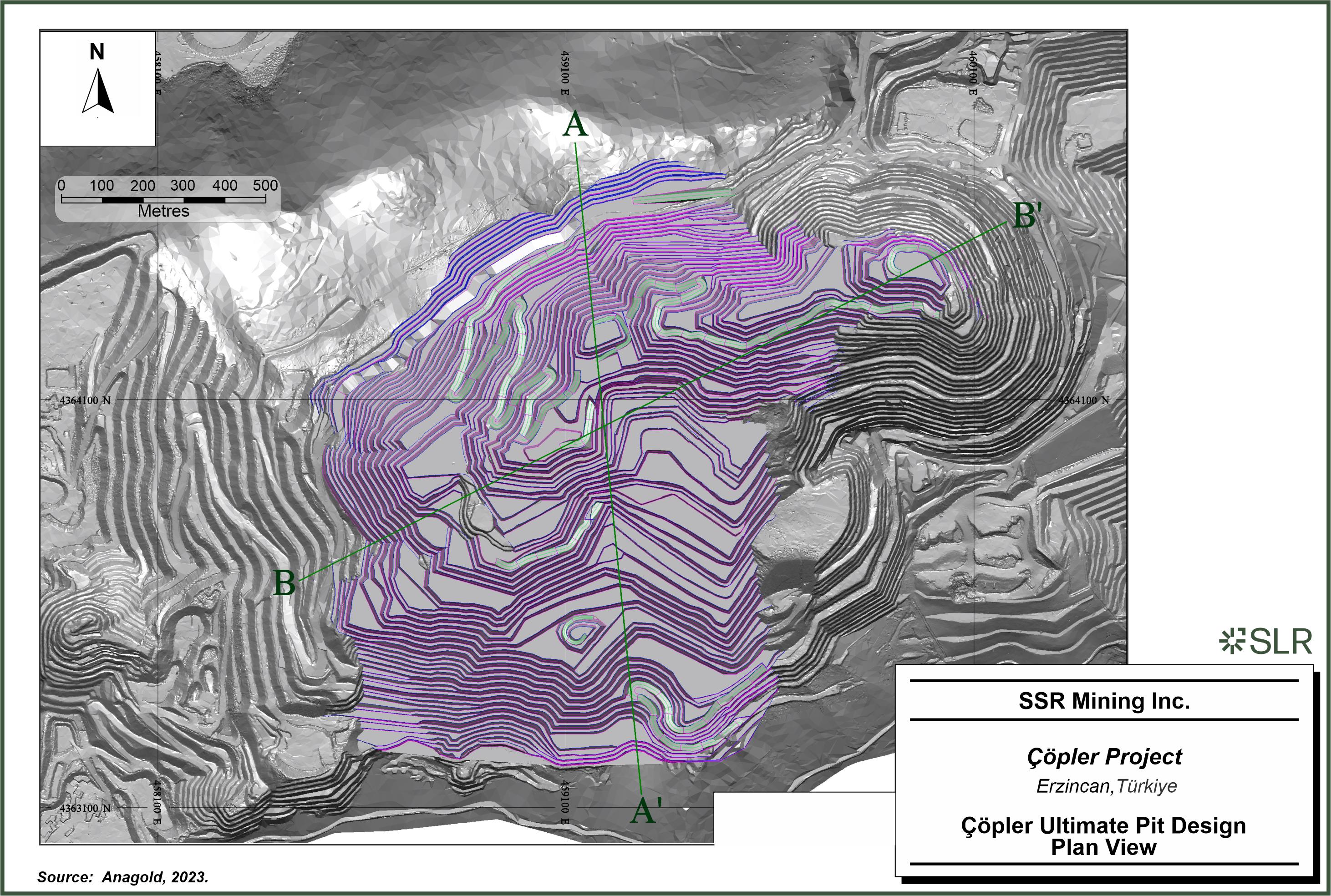

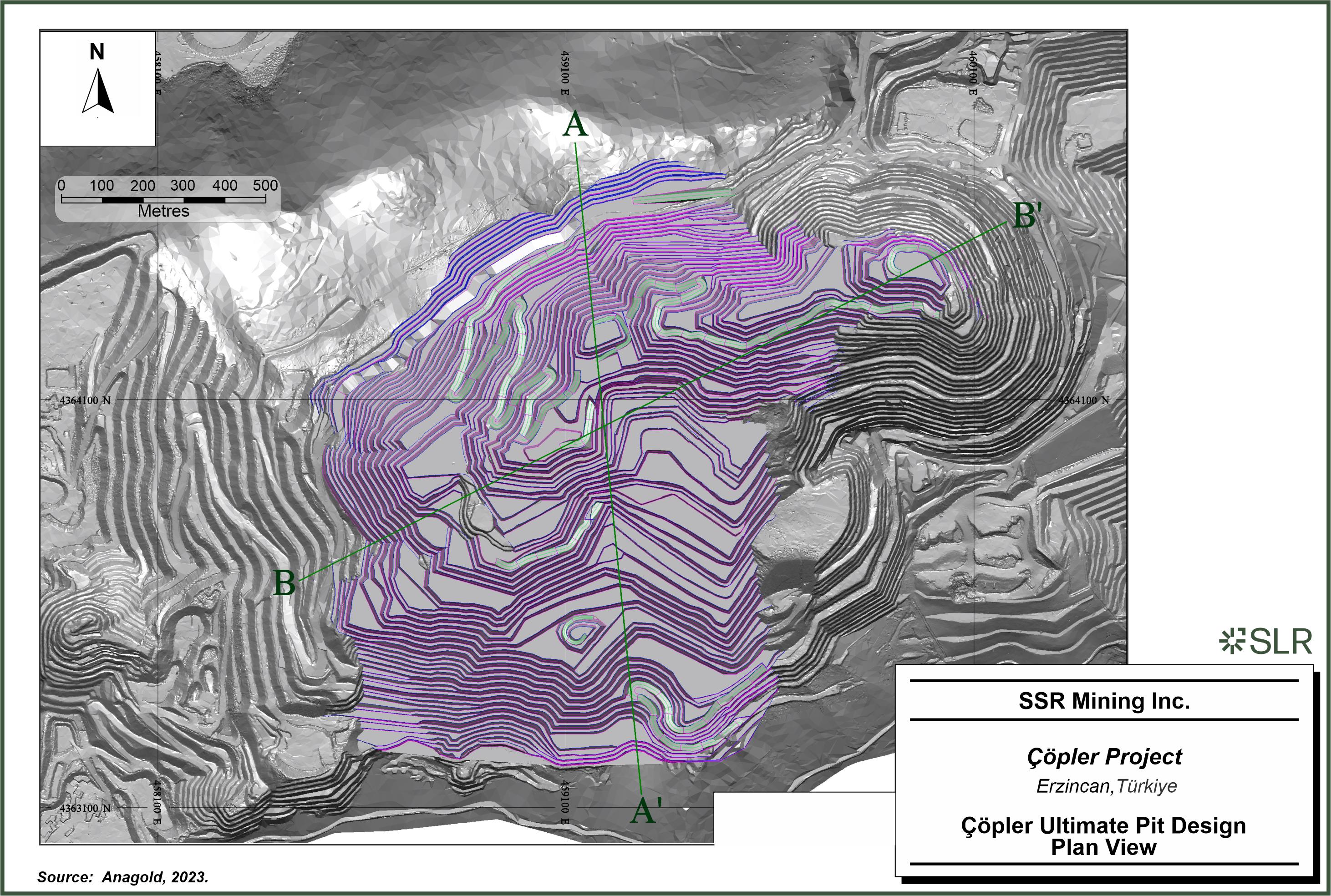

| Figure 12-1: | Çöpler Ultimate Pit Design – Plan View | 12-13 |

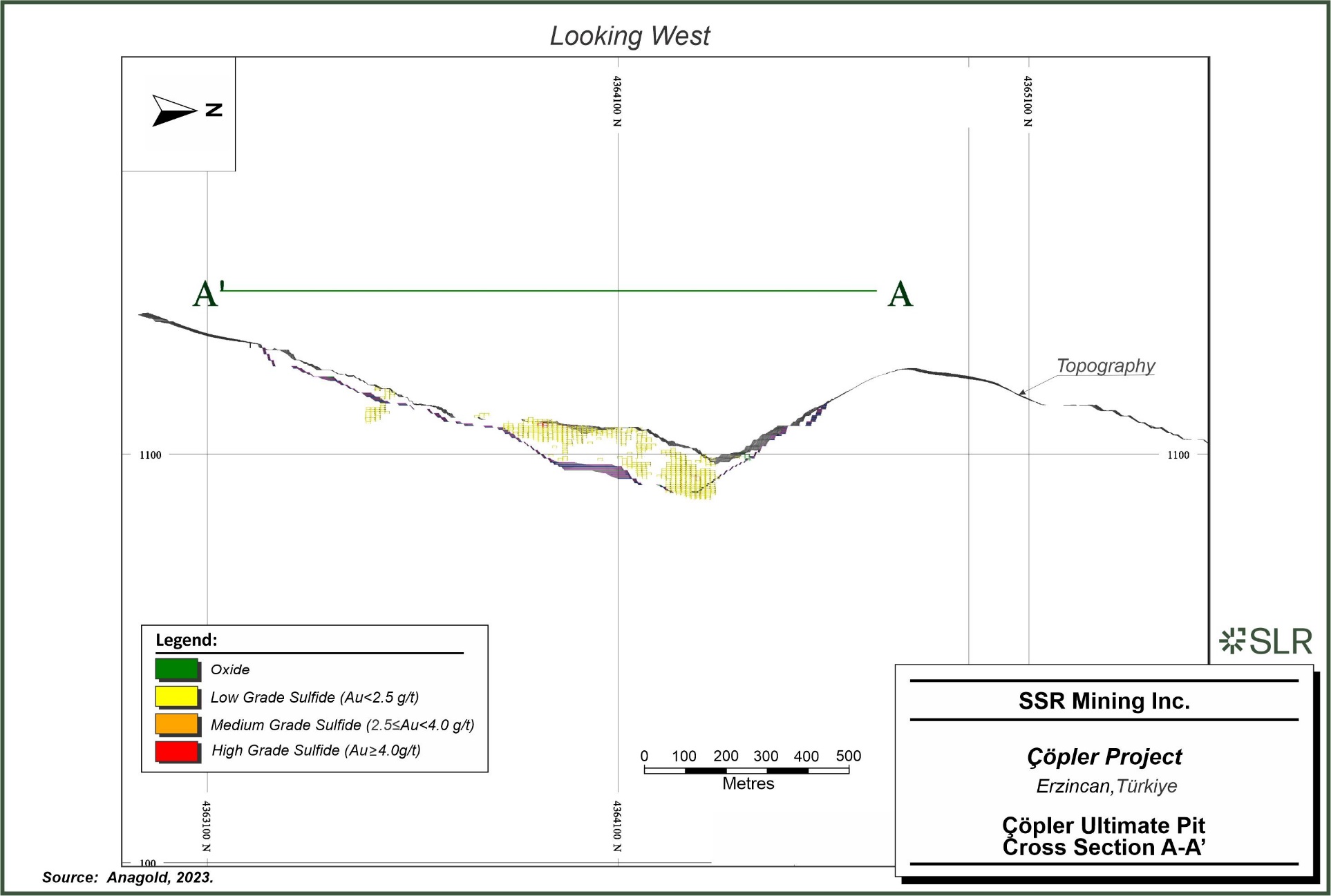

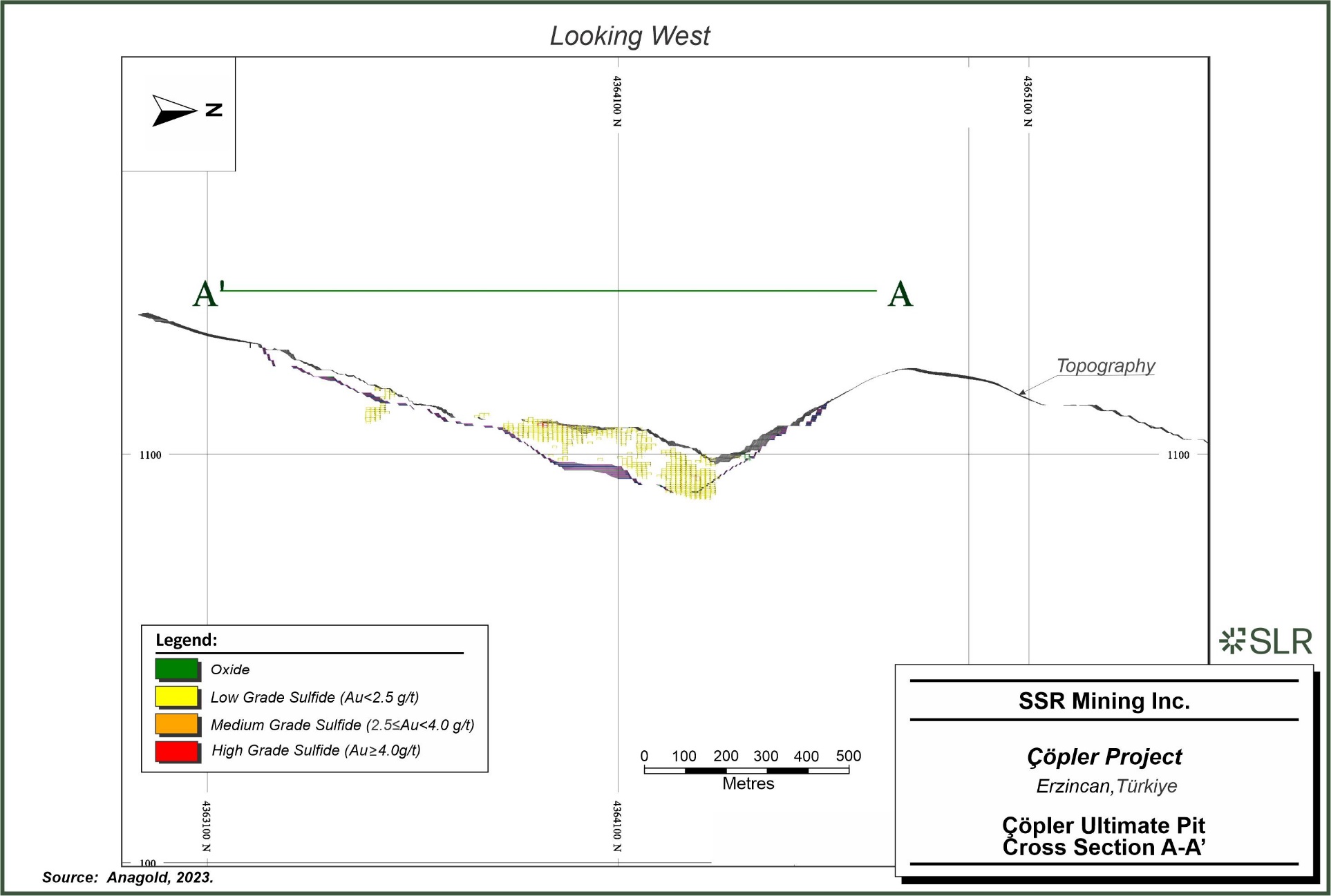

| Figure 12-2: | Çöpler Ultimate Pit – Cross Section A-A’ (Looking West) | 12-14 |

| Figure 12-3: | Çöpler Ultimate Pit - Cross Section B-B' (Looking North) | 12-15 |

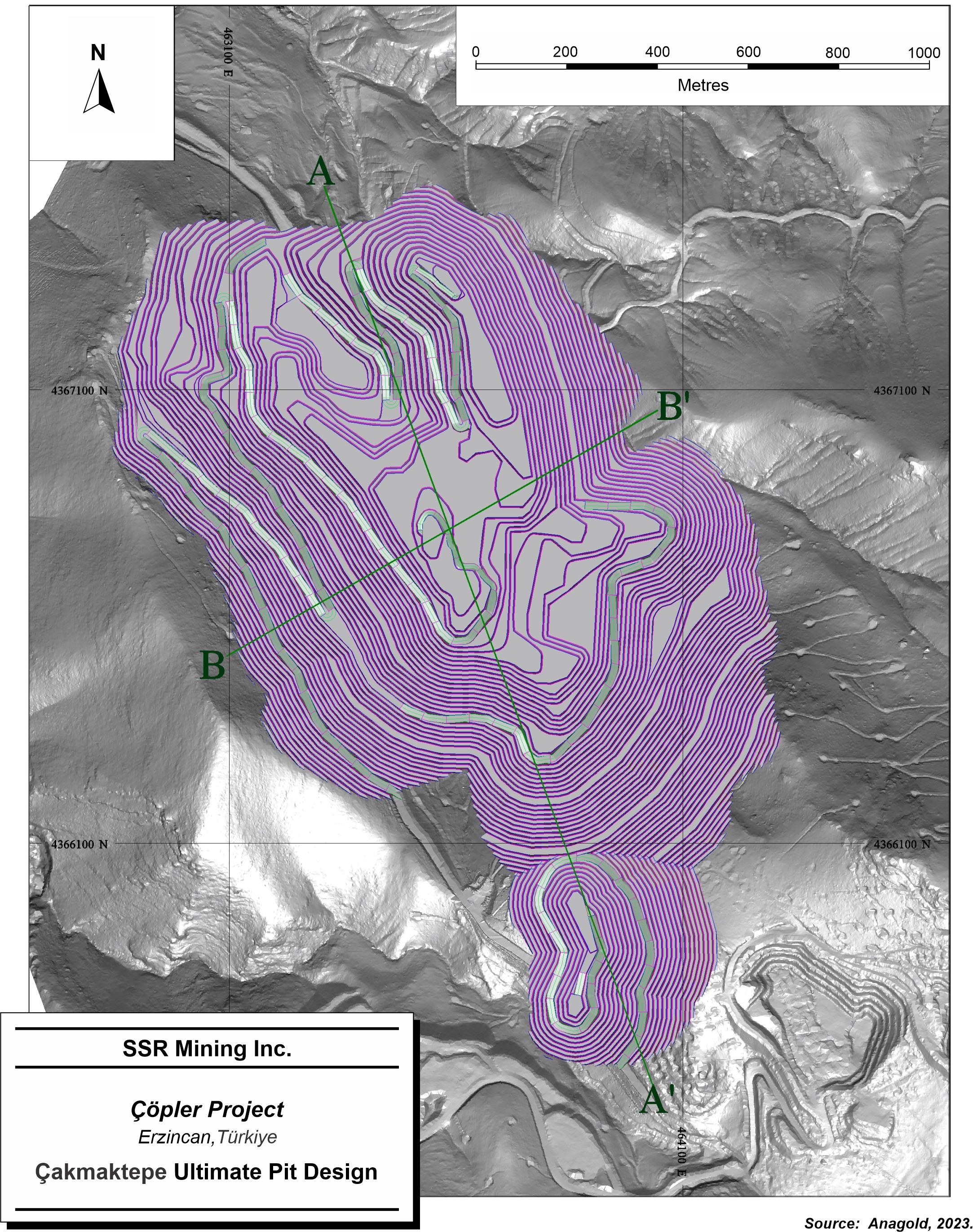

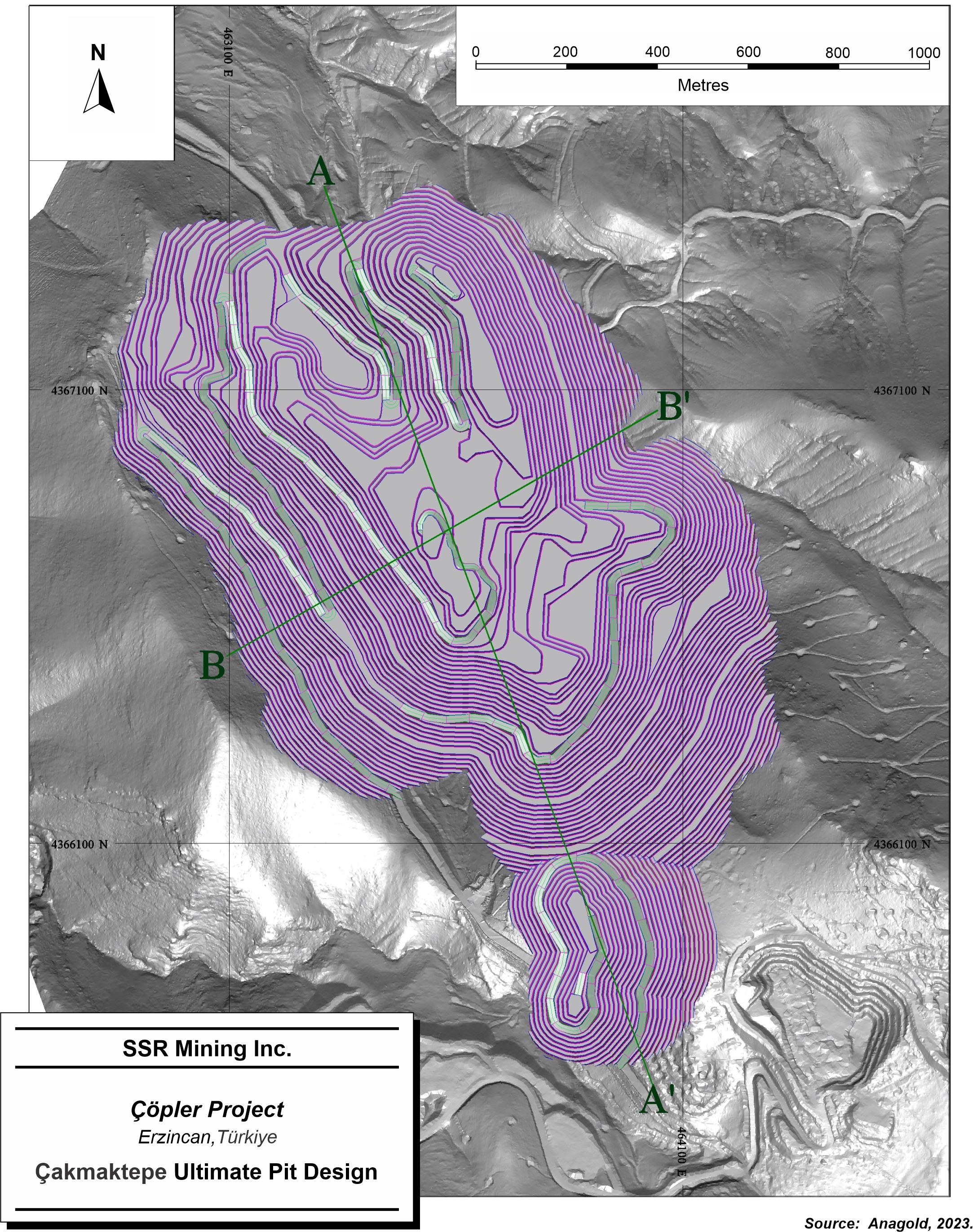

| Figure 12-4: | Çakmaktepe Ultimate Pit Design (Plan View) | 12-16 |

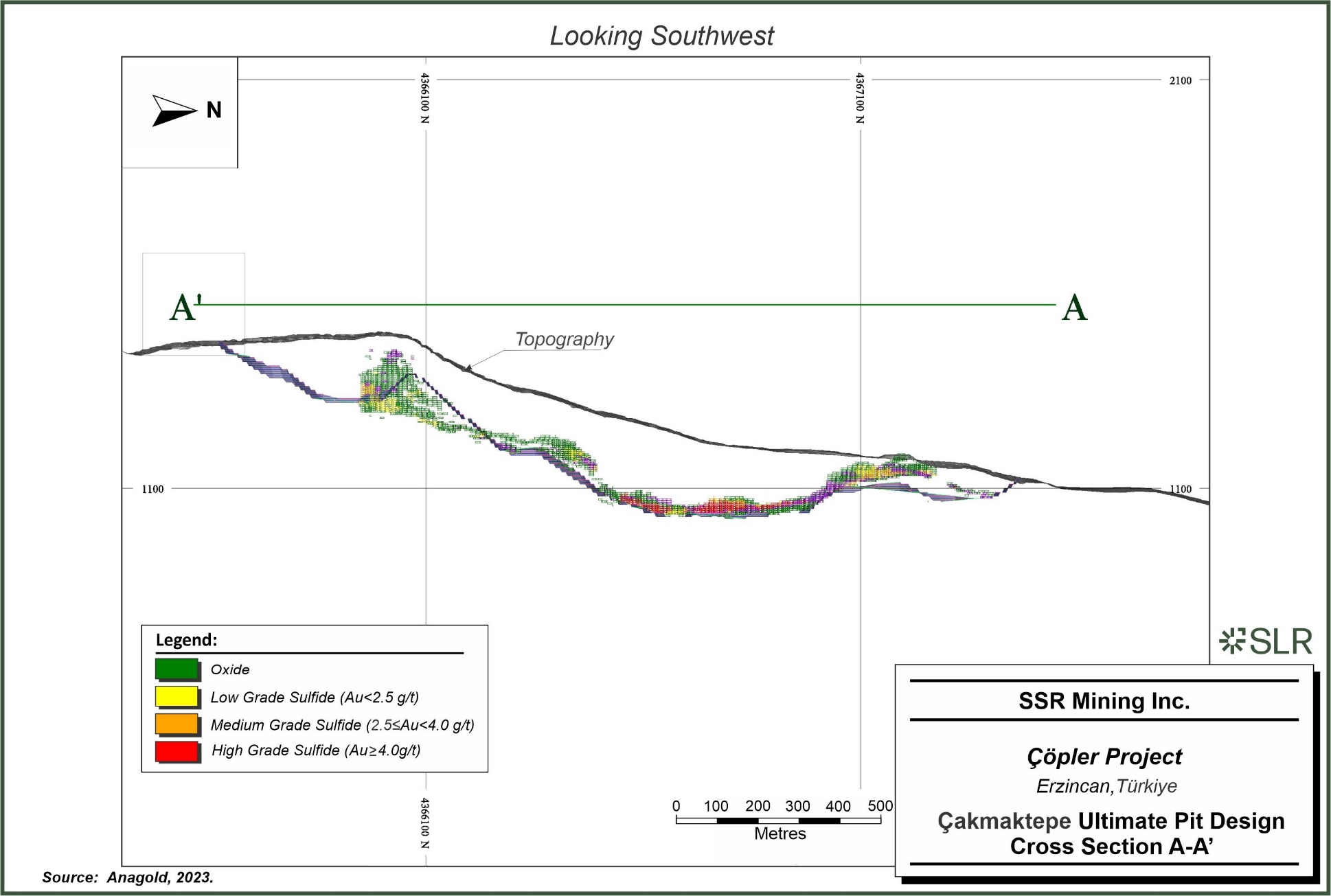

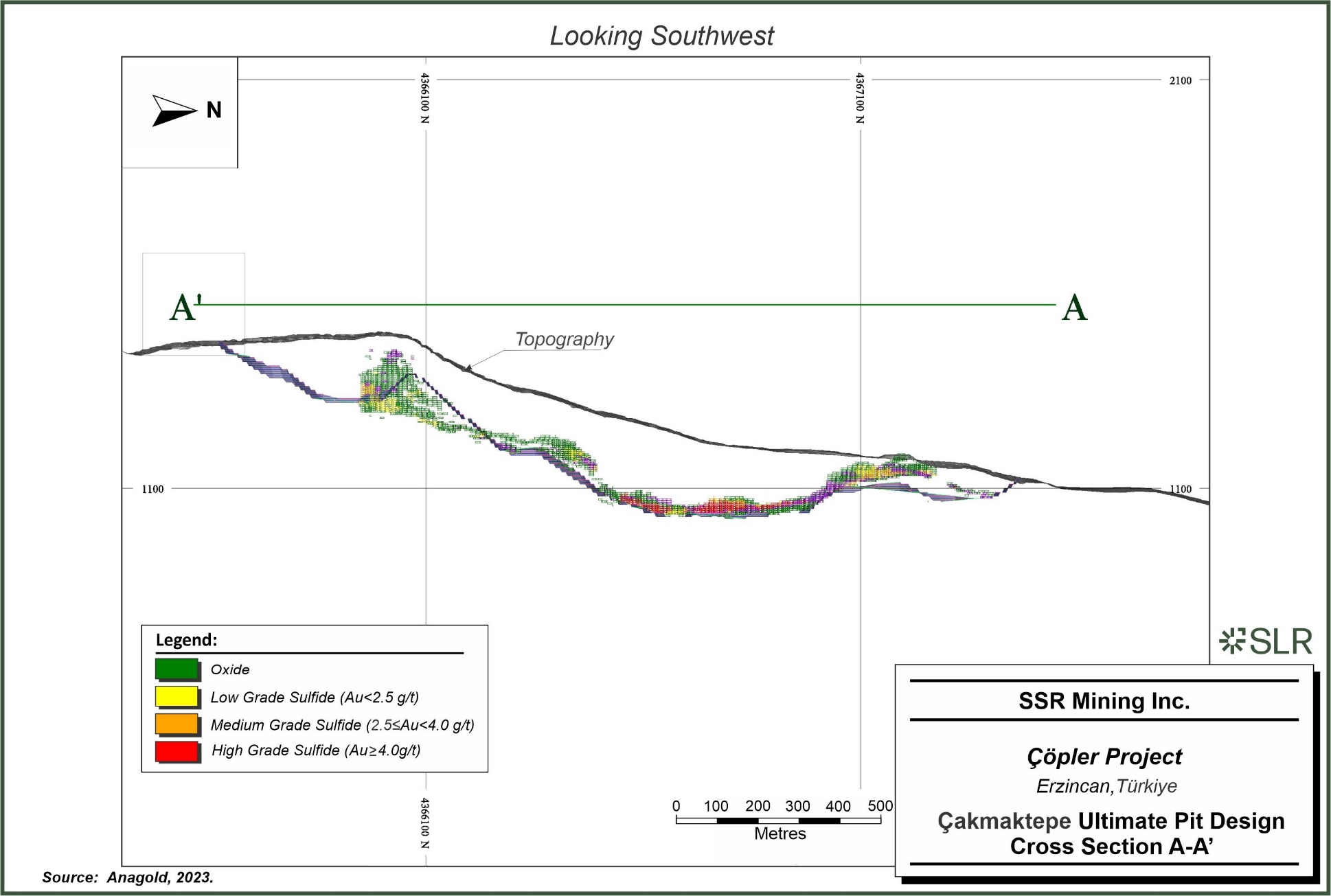

| Figure 12-5: | Çakmaktepe Ultimate Pit Design - Cross Section A-A' (Looking Southwest) | 12-17 |

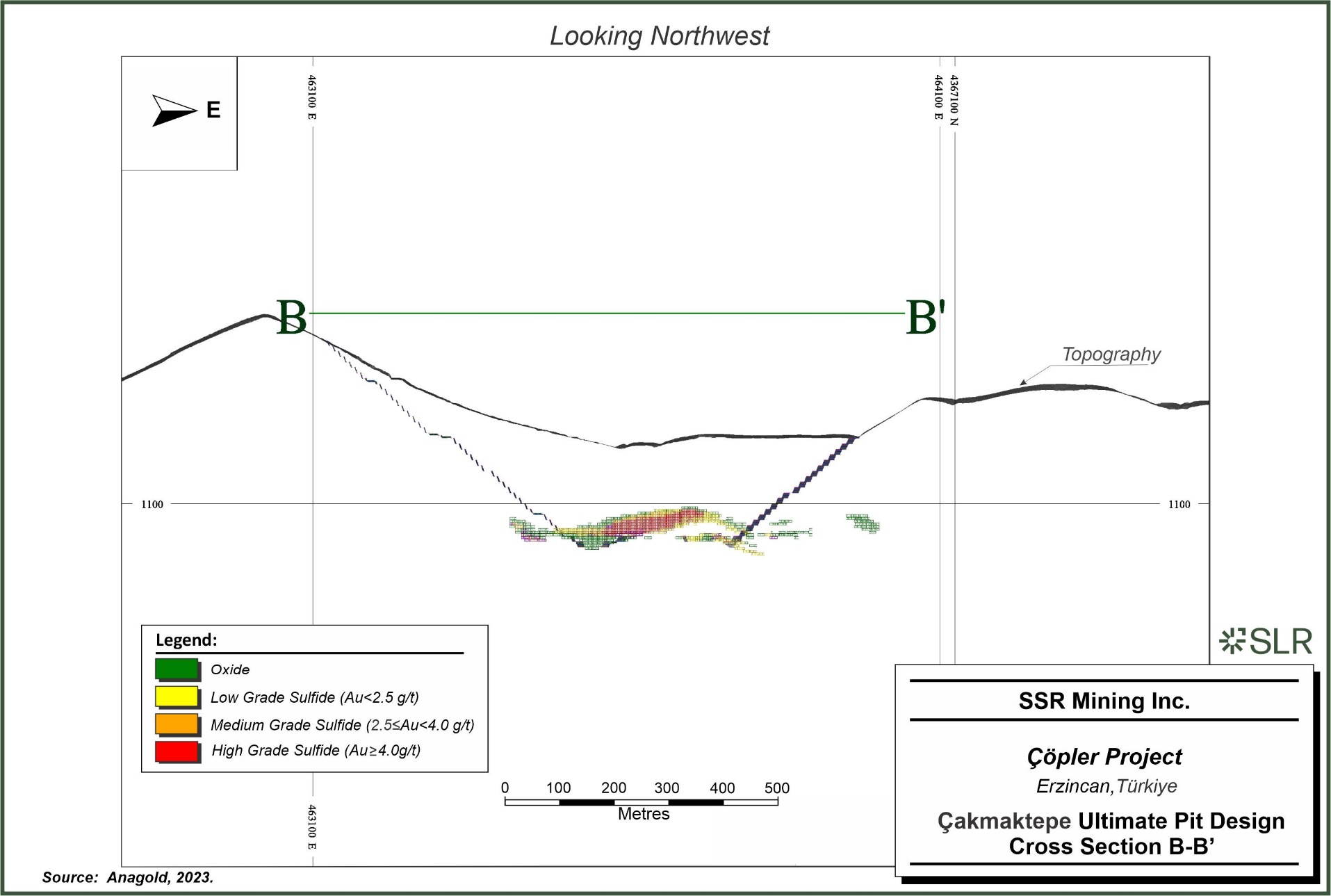

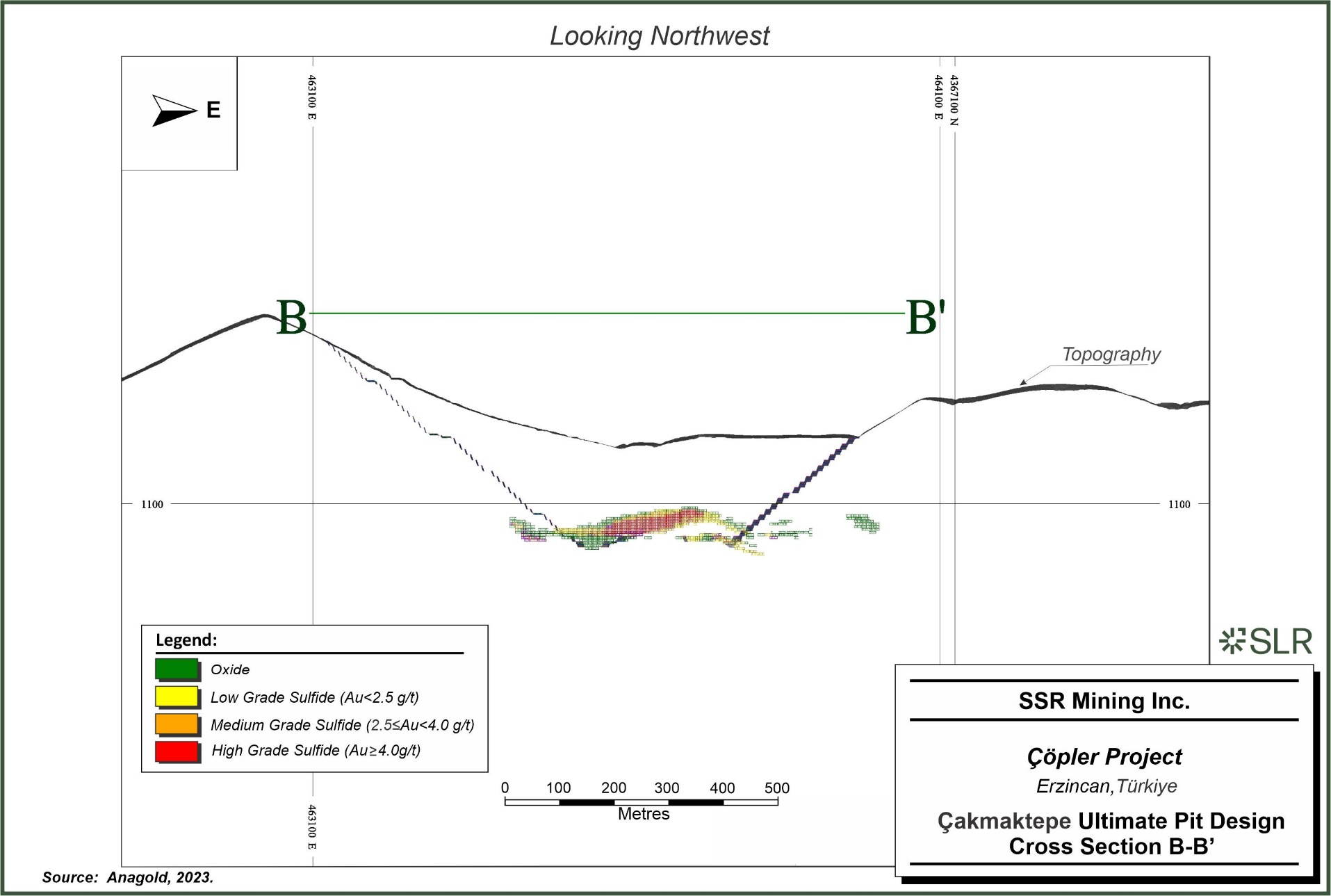

| Figure 12-6: | Çakmaktepe Ultimate Pit Design - Cross Section B-B' (Looking Northwest) | 12-18 |

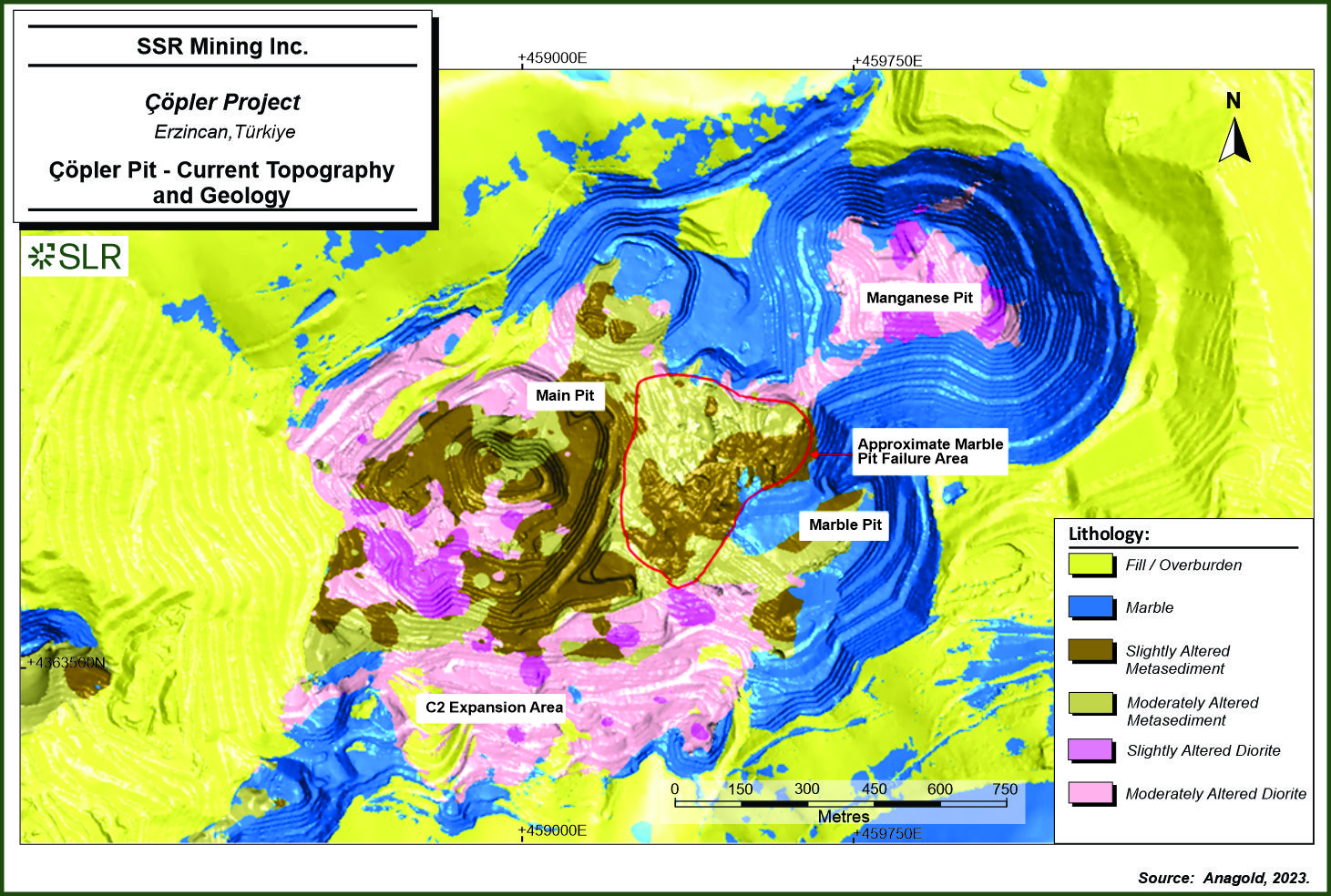

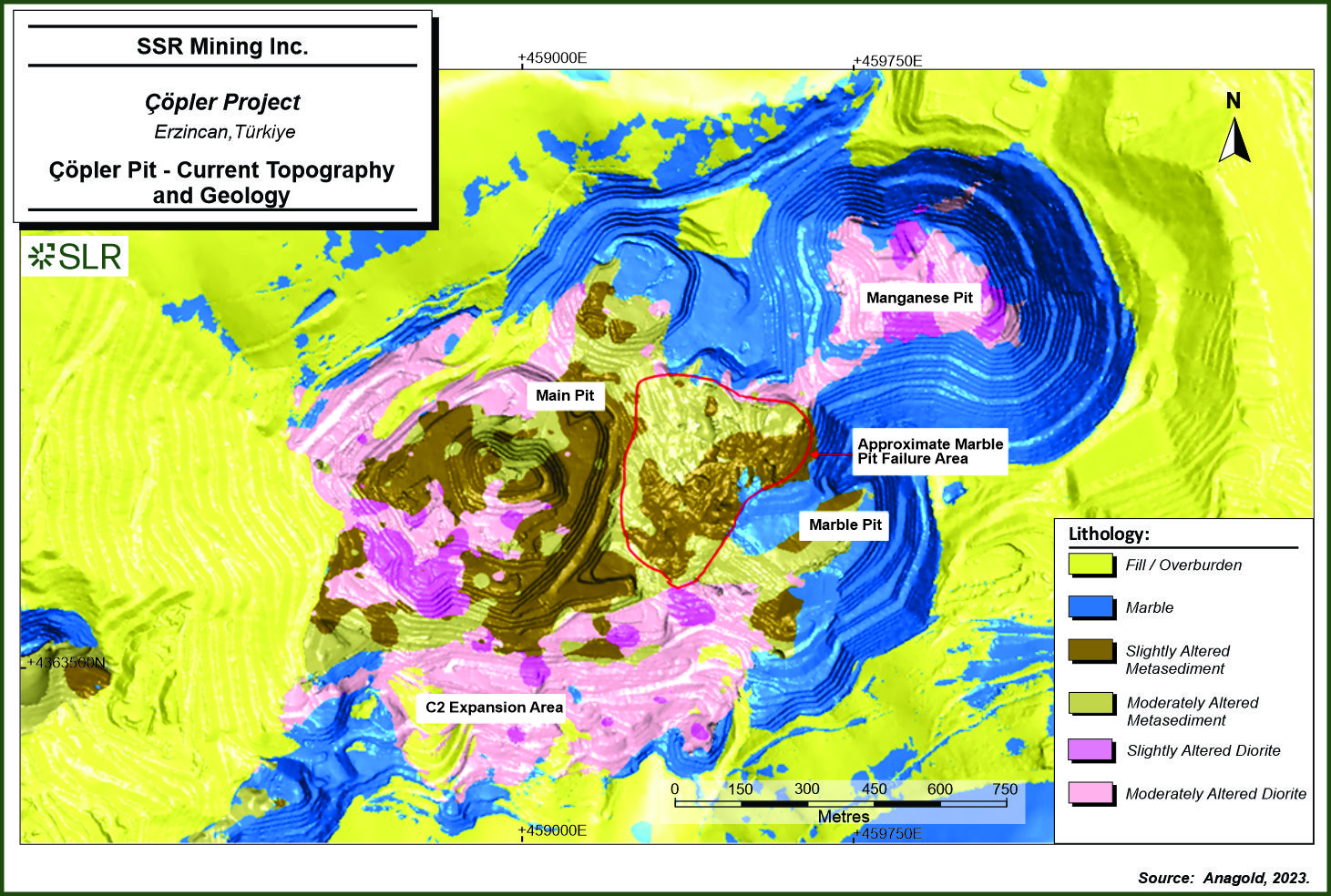

| Figure 13-1: | Çöpler Pit - Current Topography and Geology | 13-2 |

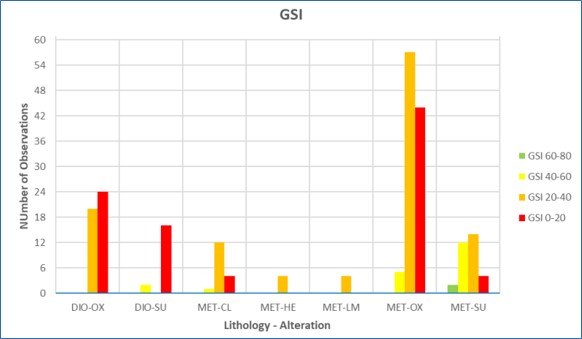

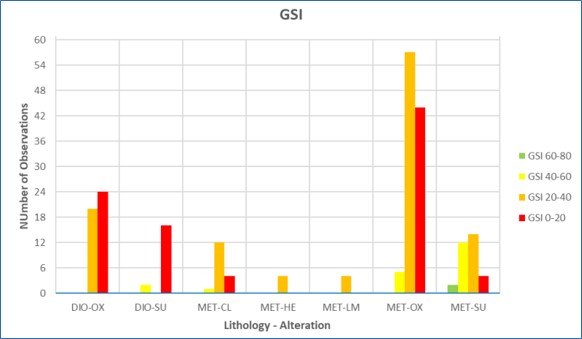

| Figure 13-2: | Geological Strength Index (GSI) Mapping of Çöpler Main Pit | 13-6 |

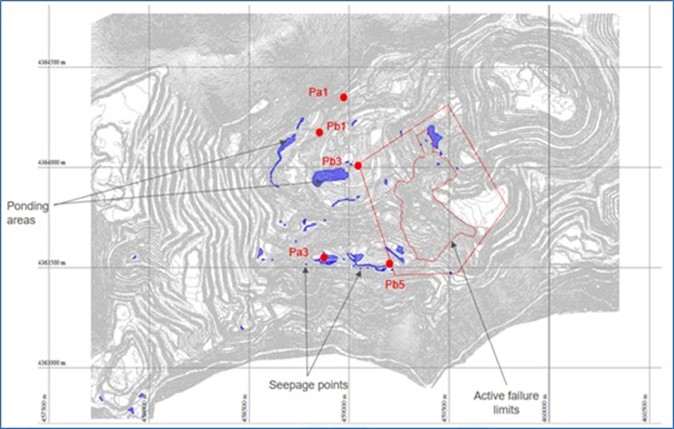

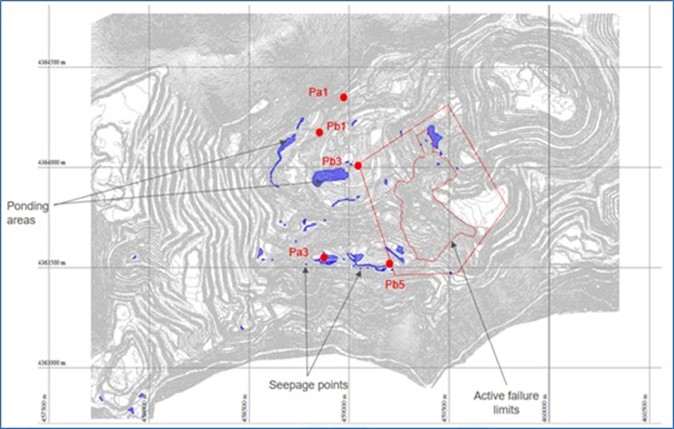

| Figure 13-3: | Locations of Seepage and Ponding in 2021 | 13-8 |

| Figure 13-4: | Çöpler Vibrating Wireline Piezometer (VWP) Data | 13-9 |

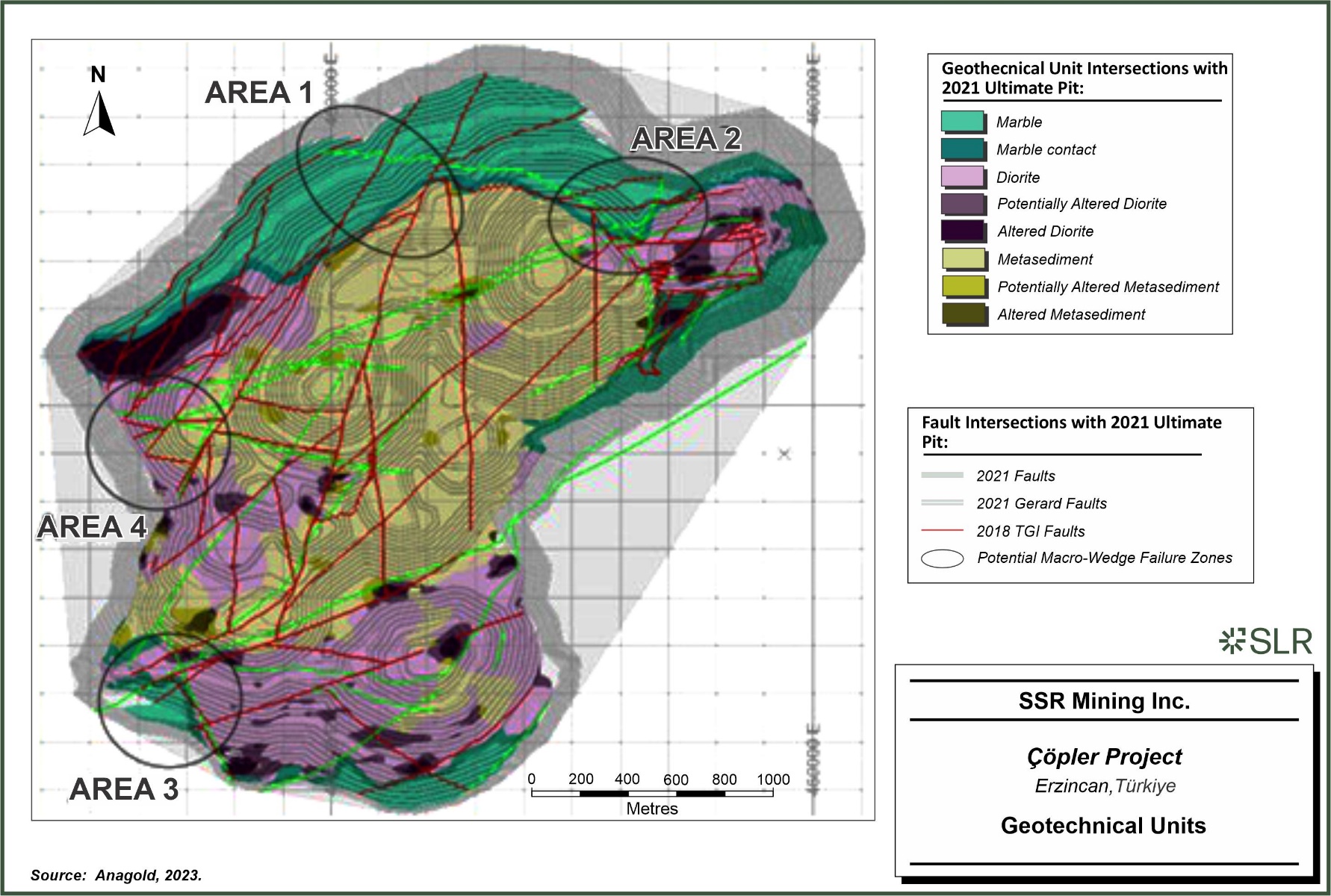

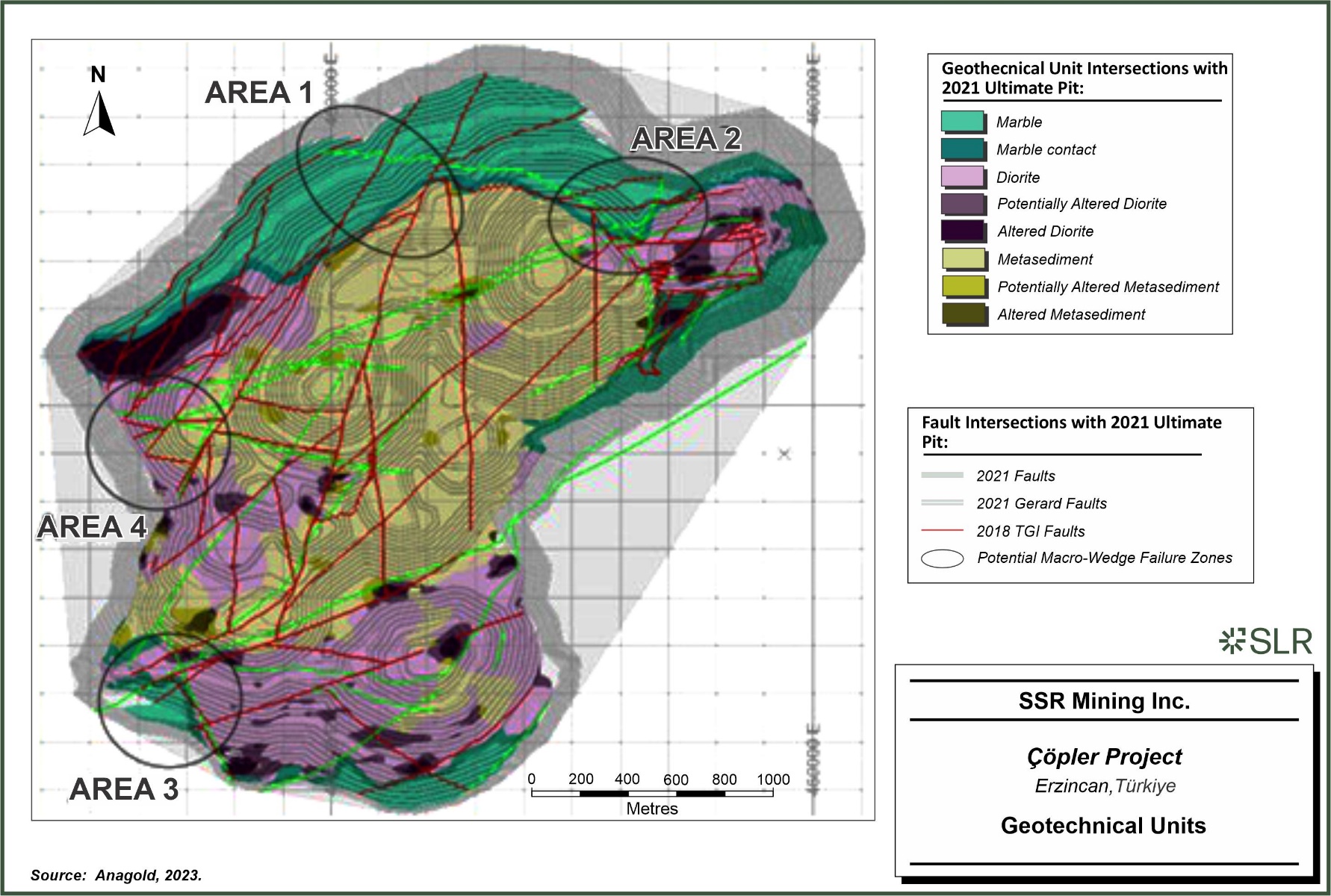

| Figure 13-5: | Çöpler Geotechnical Units | 13-10 |

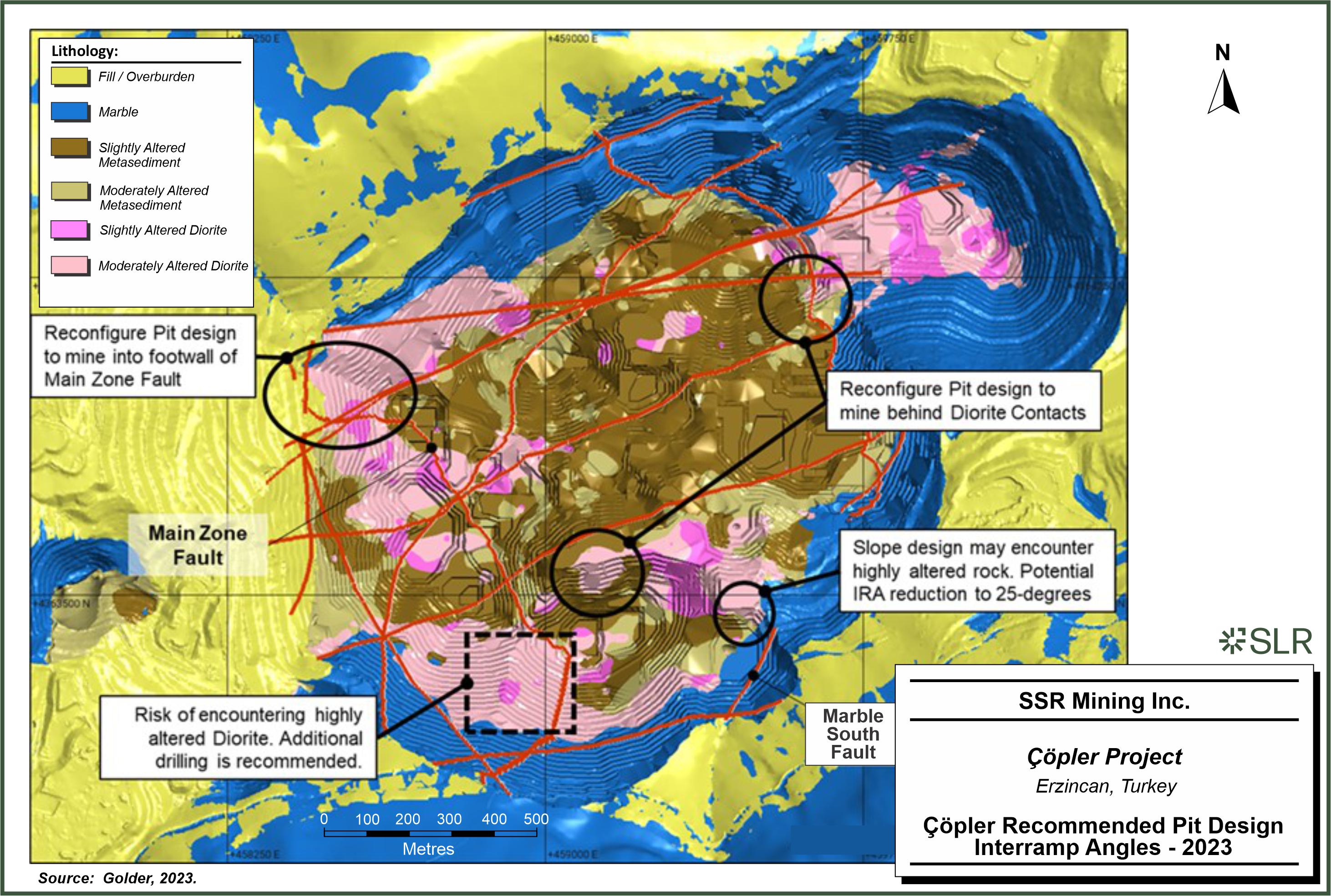

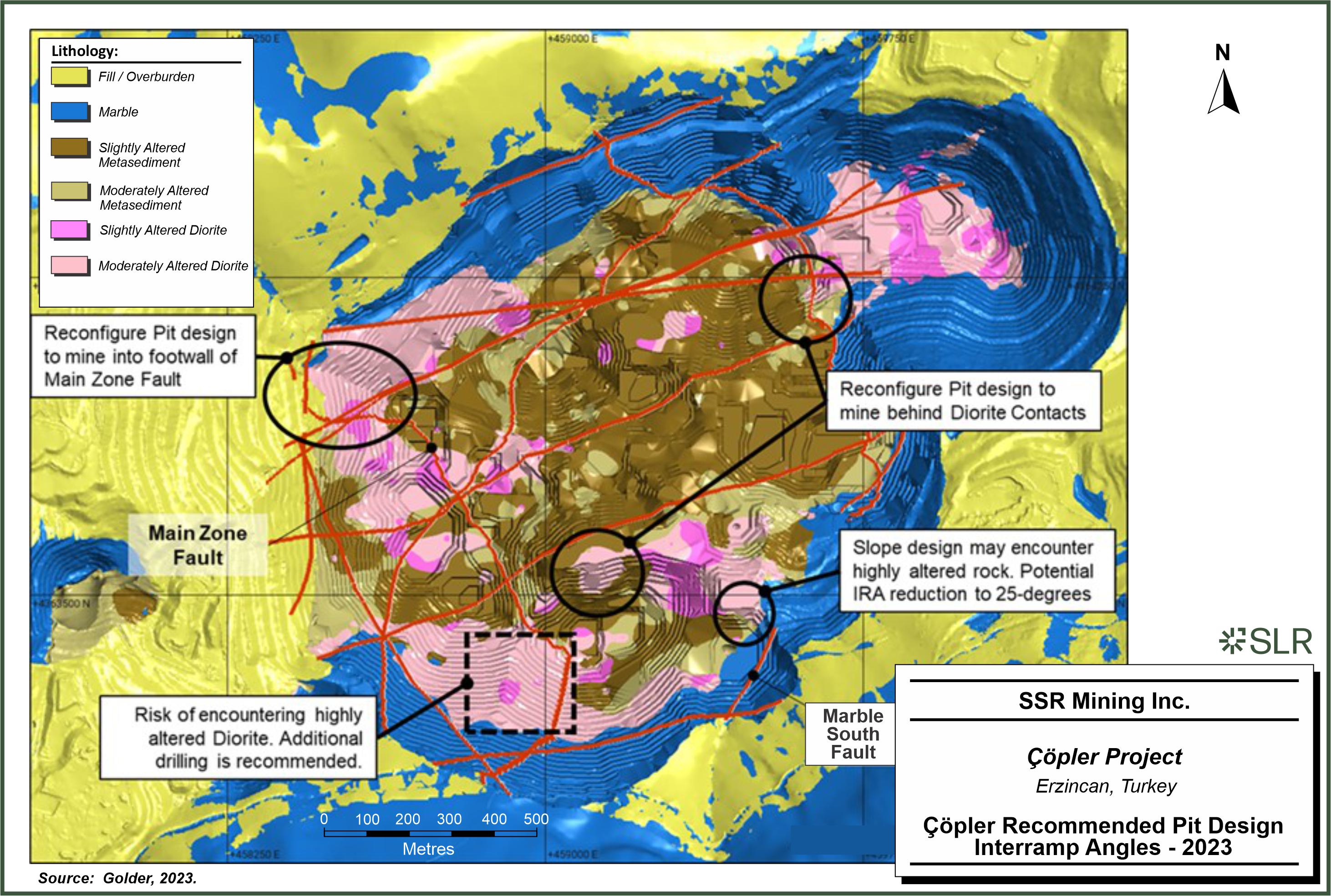

| Figure 13-6: | Çöpler Recommended Pit Design Interramp Angles – 2023 | 13-16 |

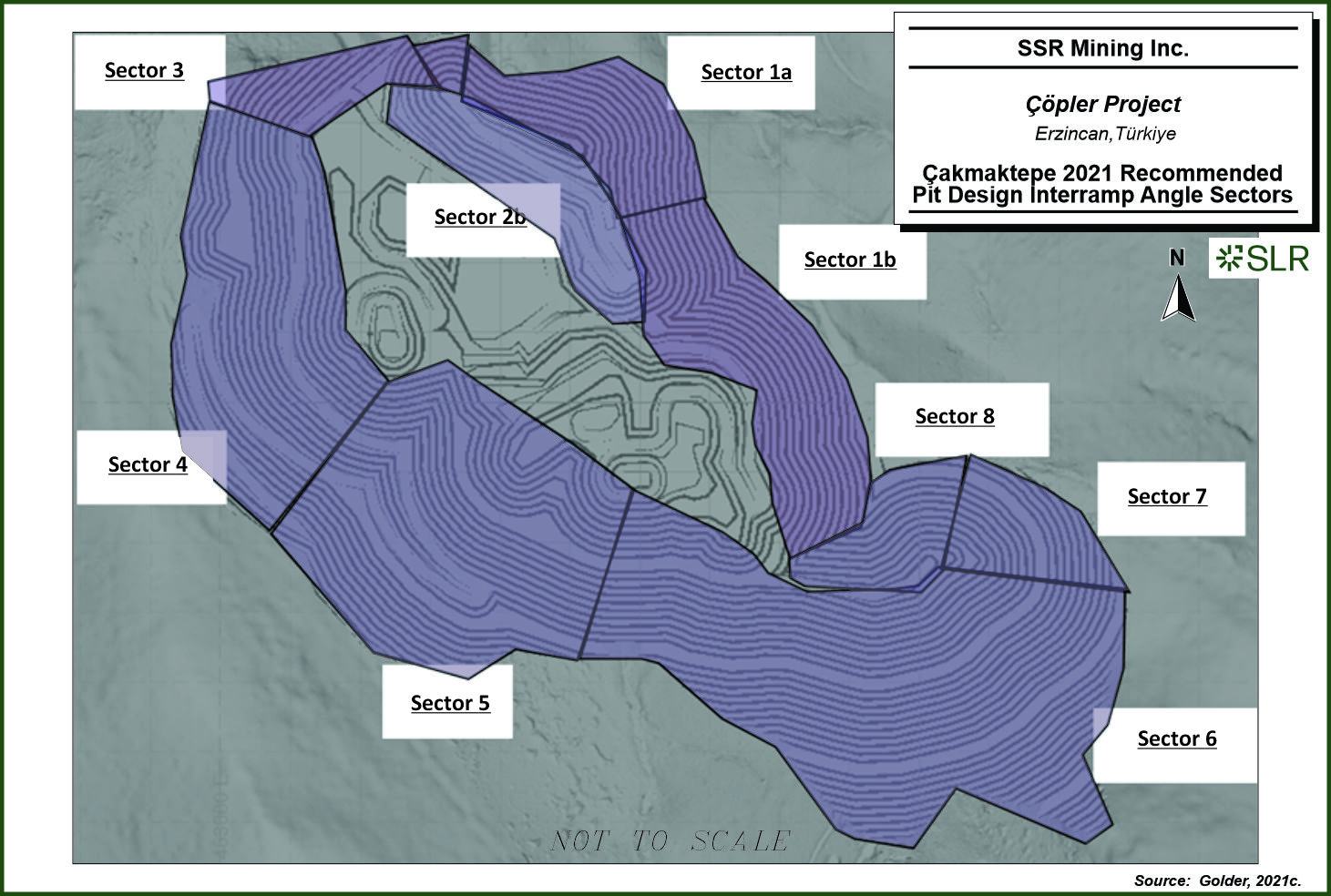

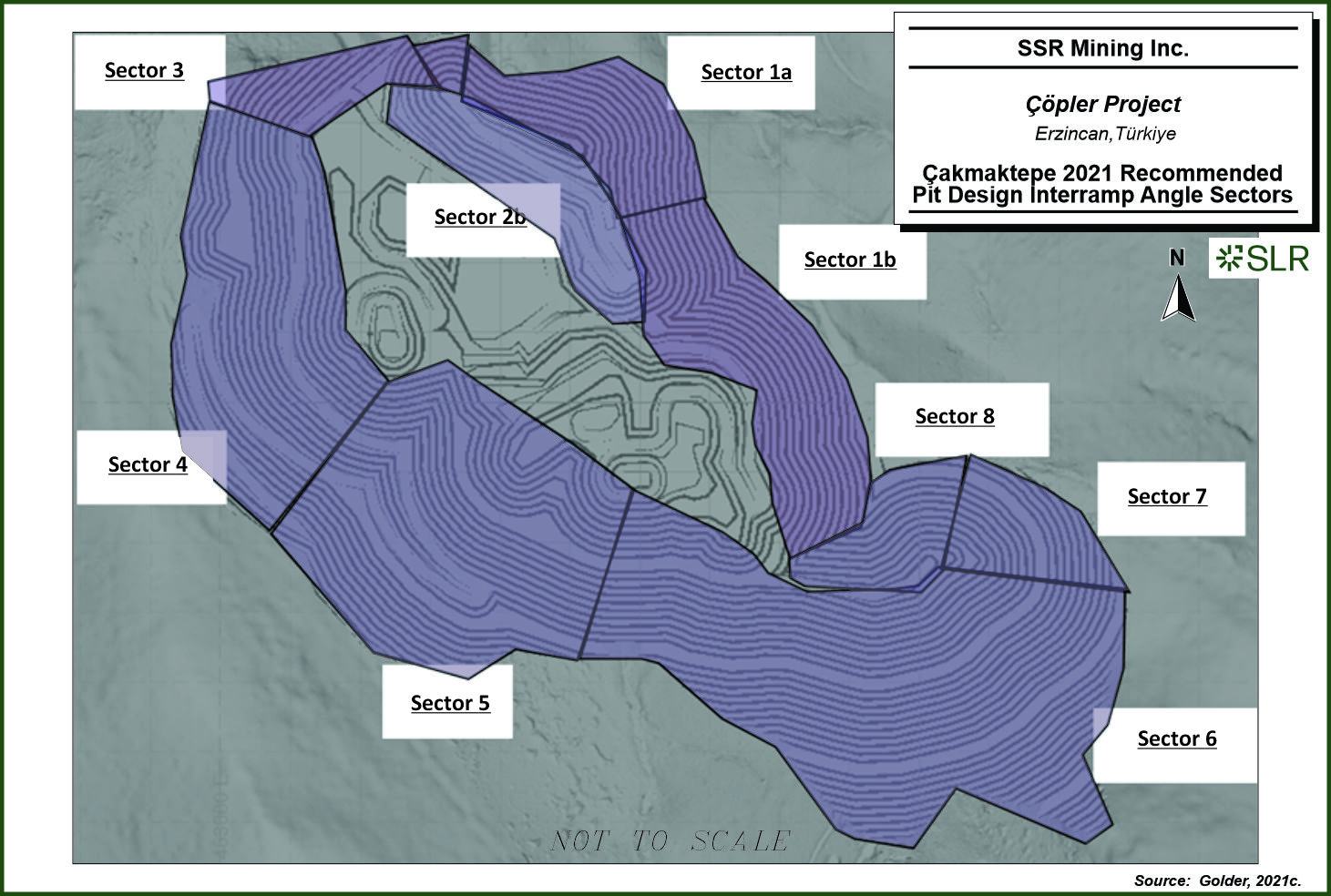

| Figure 13-7: | Çakmaktepe 2021 Recommended Pit Design Interramp Angle Sectors | 13-17 |

| Figure 13-8: | Greater Çakmaktepe Conceptual Groundwater Model | 13-19 |

| Figure 13-9: | Material Routing Definition Decision Tree | 13-21 |

| | xi |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

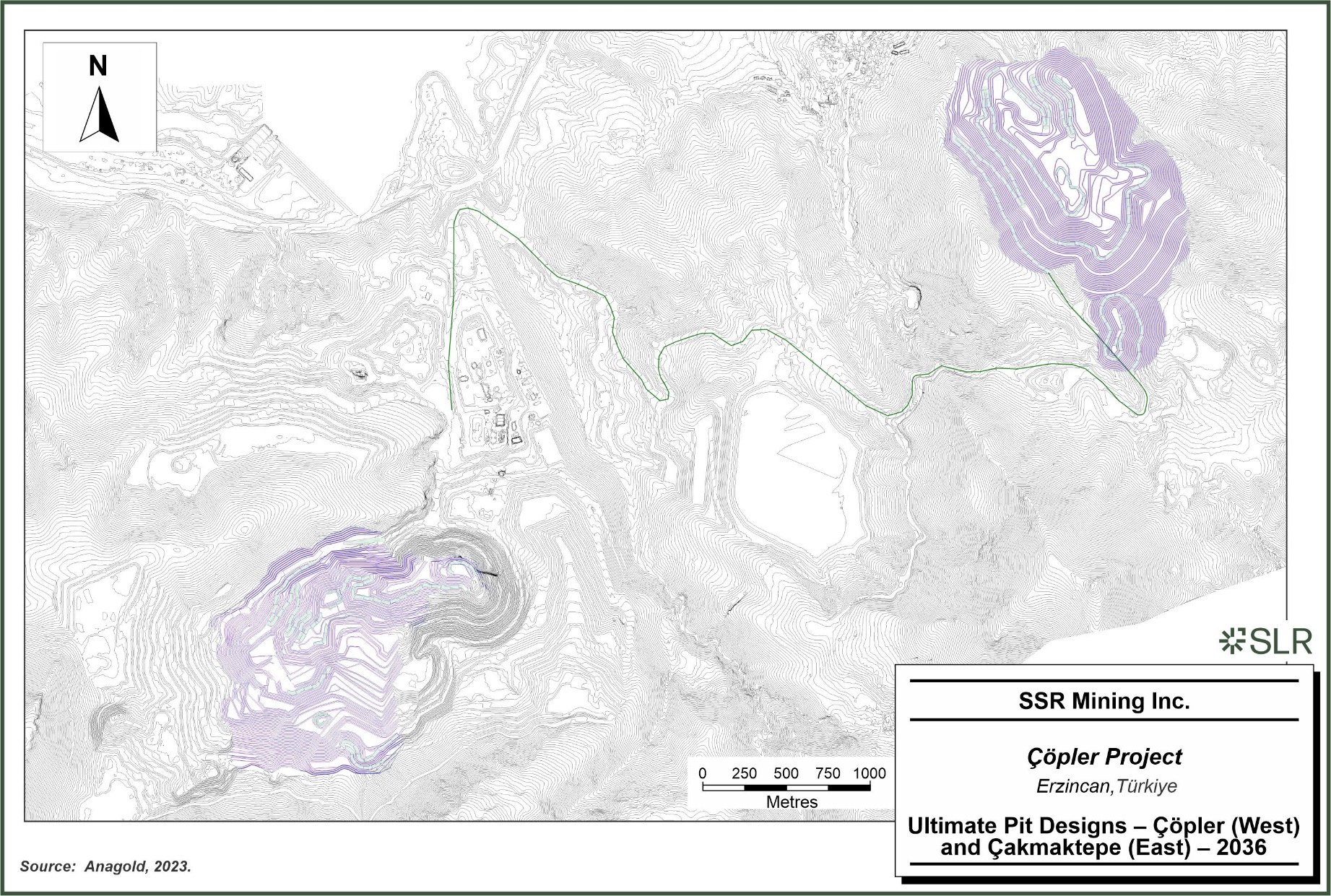

| Figure 13-10: | Ultimate Pit Designs – Çöpler (West) and Greater Çakmaktepe (East) – 2036 | 13-30 |

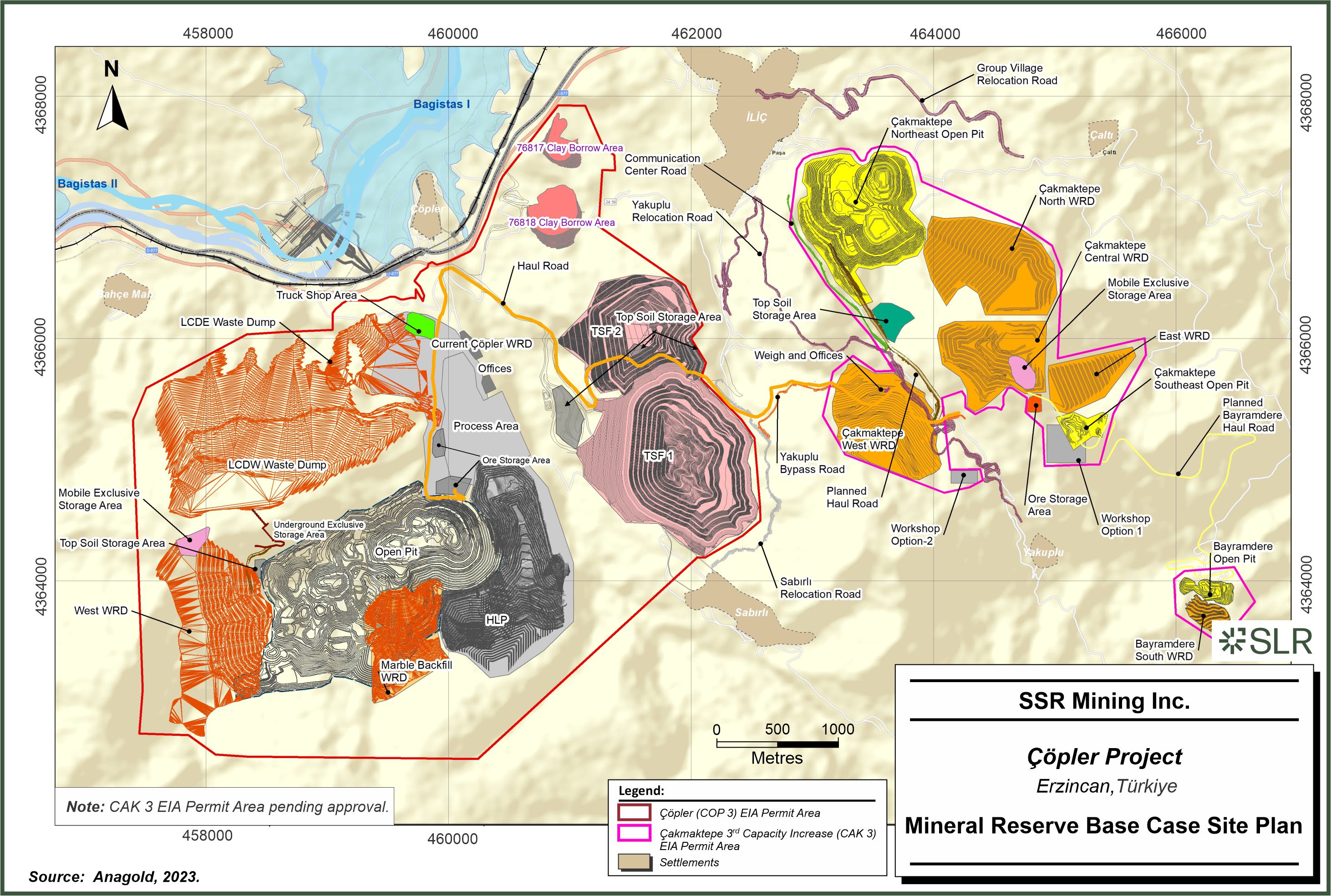

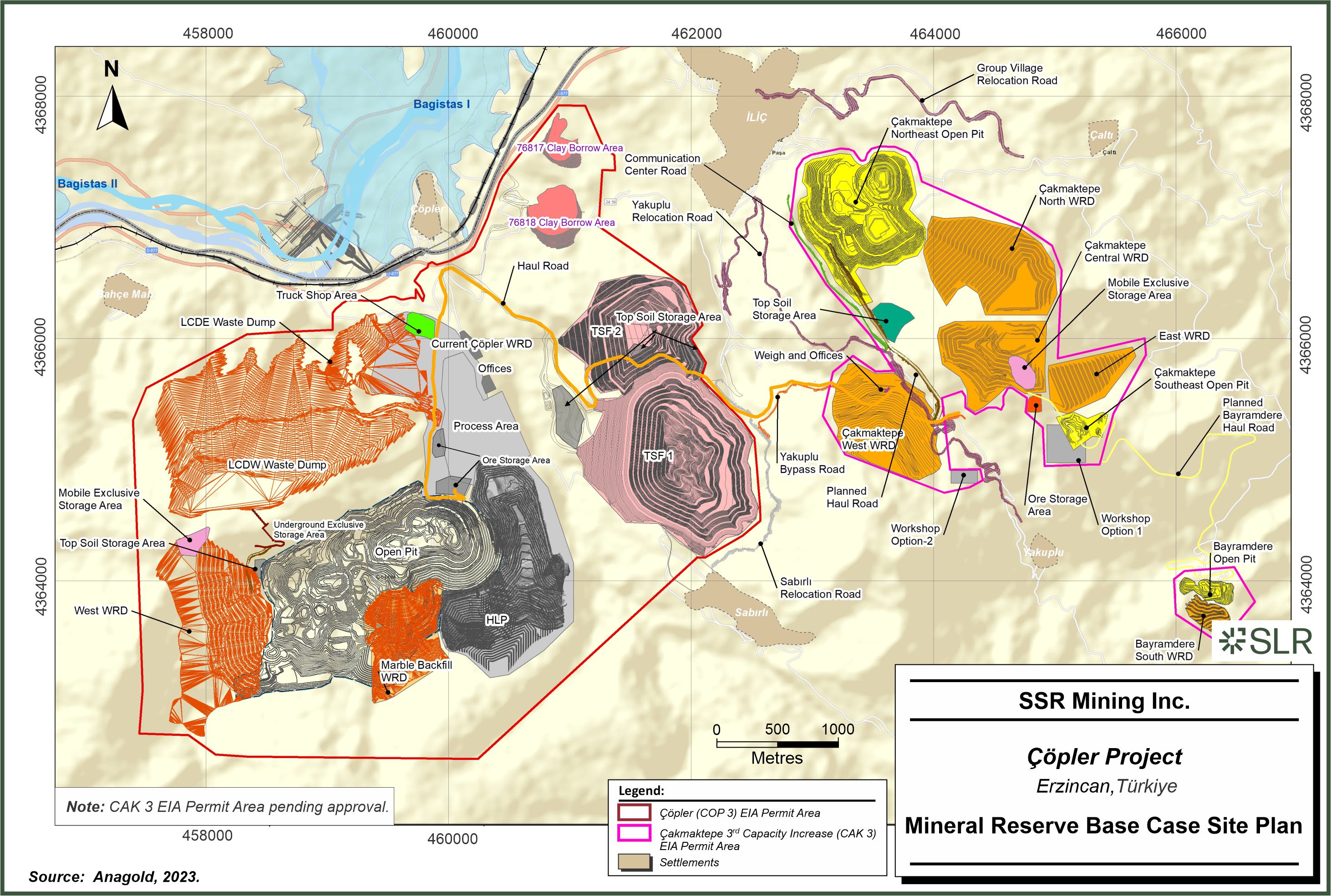

| Figure 13-11: | Mineral Reserve Base Case Site Plan | 13-33 |

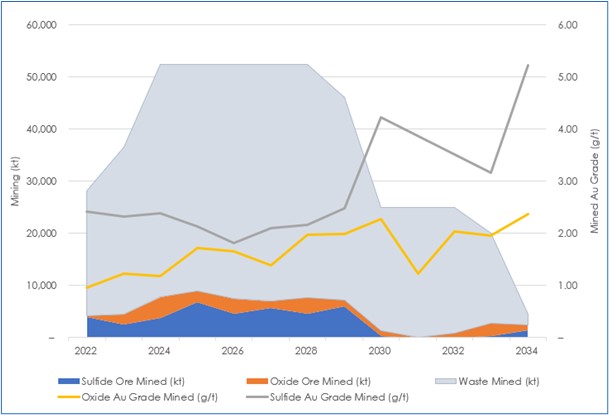

| Figure 13-12: | Çöpler LOM Mining Production | 13-39 |

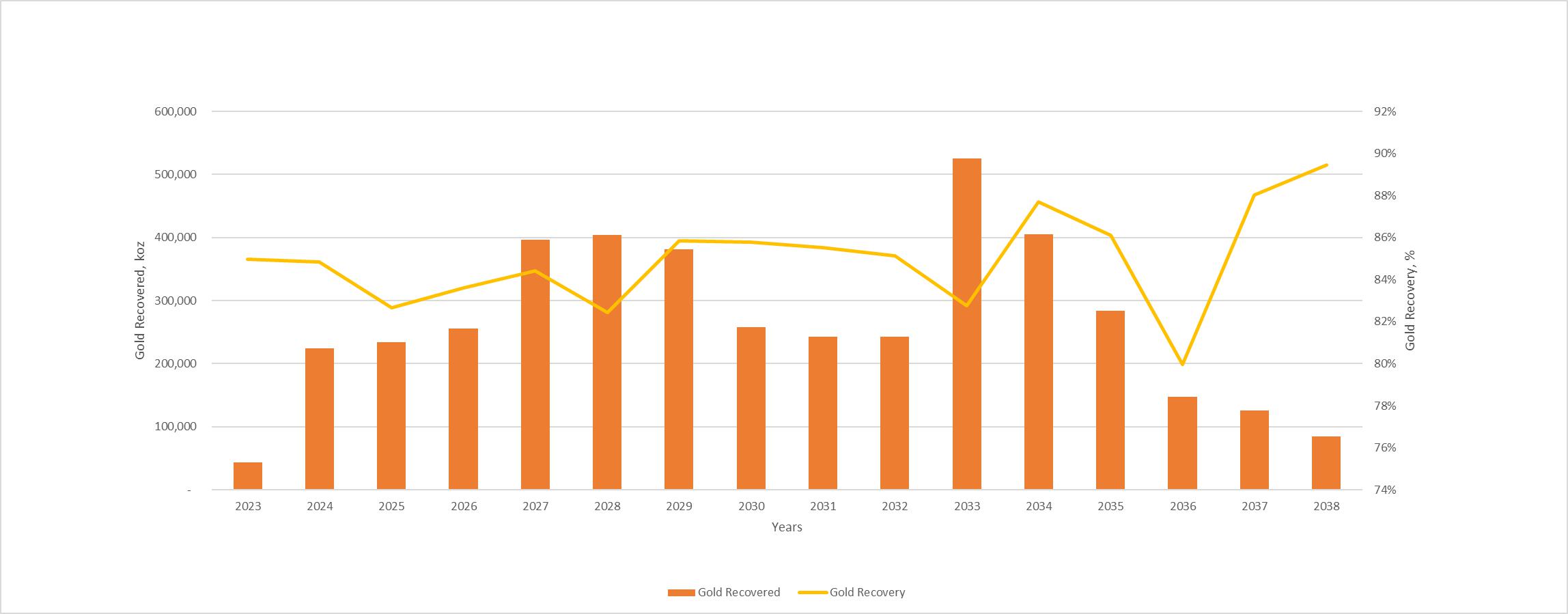

| Figure 13-13: | Mineral Reserve Case Processing Schedule | 13-45 |

| Figure 13-14: | Mineral Reserve Case Gold Production and Recovery | 13-45 |

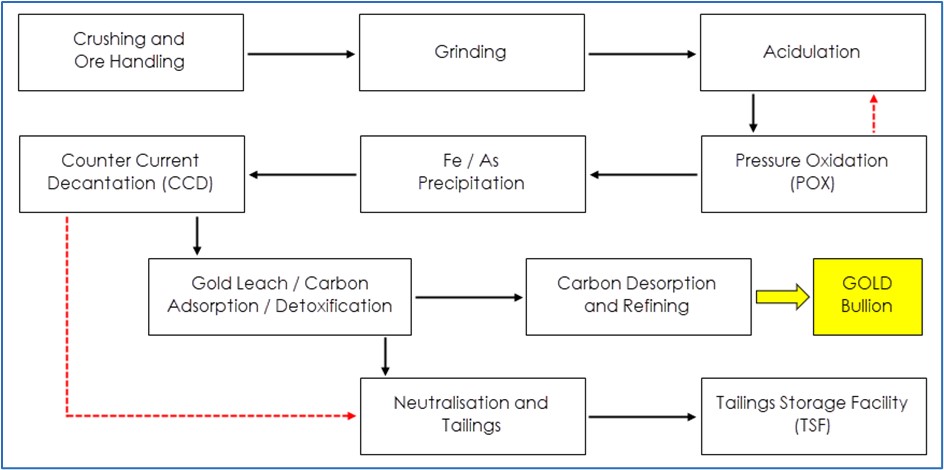

| Figure 14-1: | Çöpler Process Flow Sheet for Sulfide Plant | 14-1 |

| Figure 14-2: | Flotation Block Flow Diagram | 14-2 |

| Figure 14-3: | Gold Recovery and Throughput Comparison | 14-4 |

| Figure 14-4: | Process Flow Sheet for Sulfide Plant | 14-7 |

| Figure 14-5: | Heap Leach Process Flow Sheet | 14-17 |

| Figure 14-6: | Oxide Grind Leach - Simplified Process Flow Diagram | 14-19 |

| Figure 15-1: | Site Layout | 15-2 |

| Figure 15-2: | Mine Water Supply Well Locations | 15-5 |

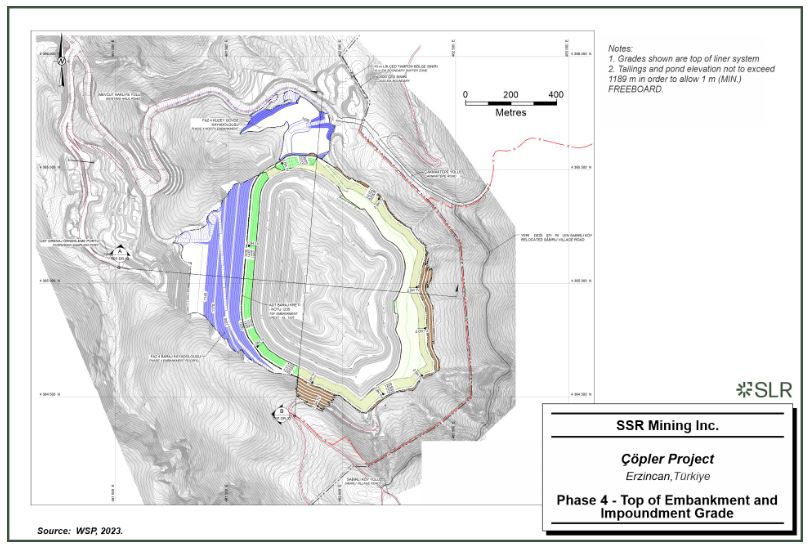

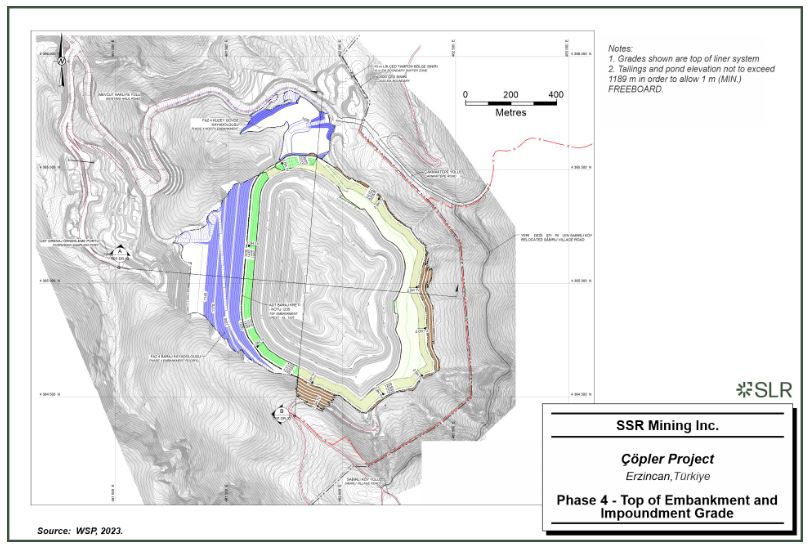

| Figure 15-3: | Phase 4 – Top of Embankment and Impoundment Grade | 15-11 |

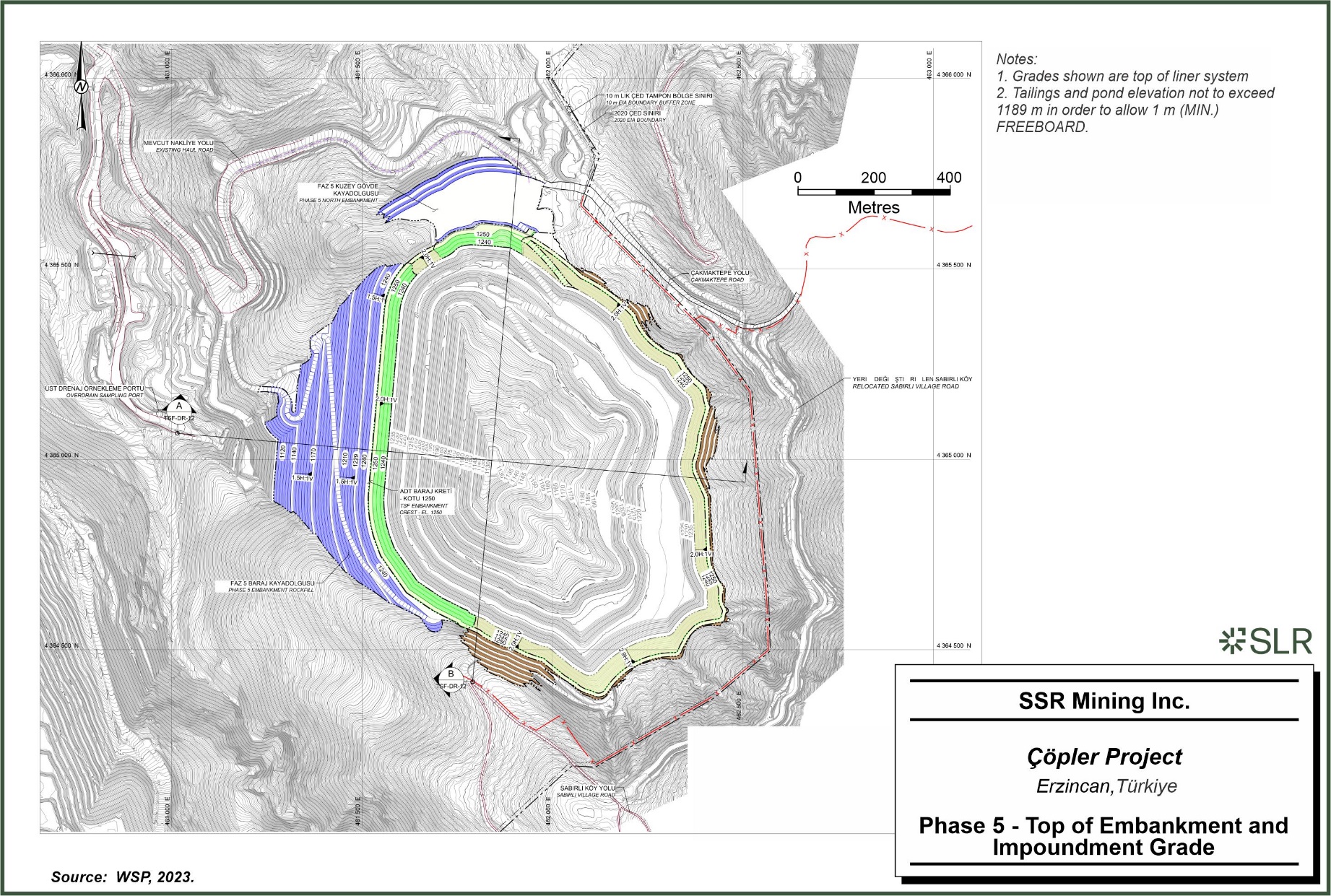

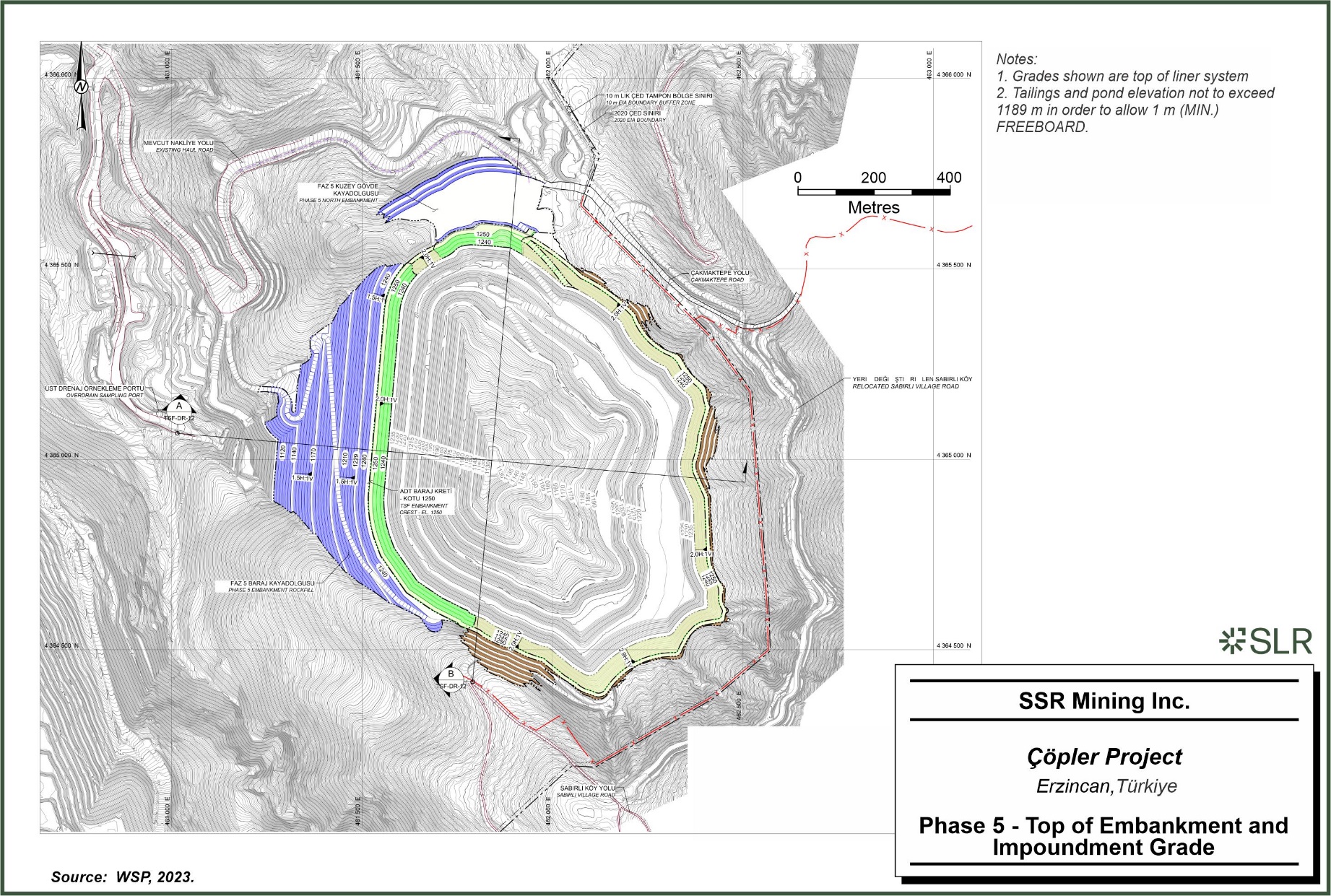

| Figure 15-4: | Phase 5 – Top of Embankment and Impoundment Grade | 15-12 |

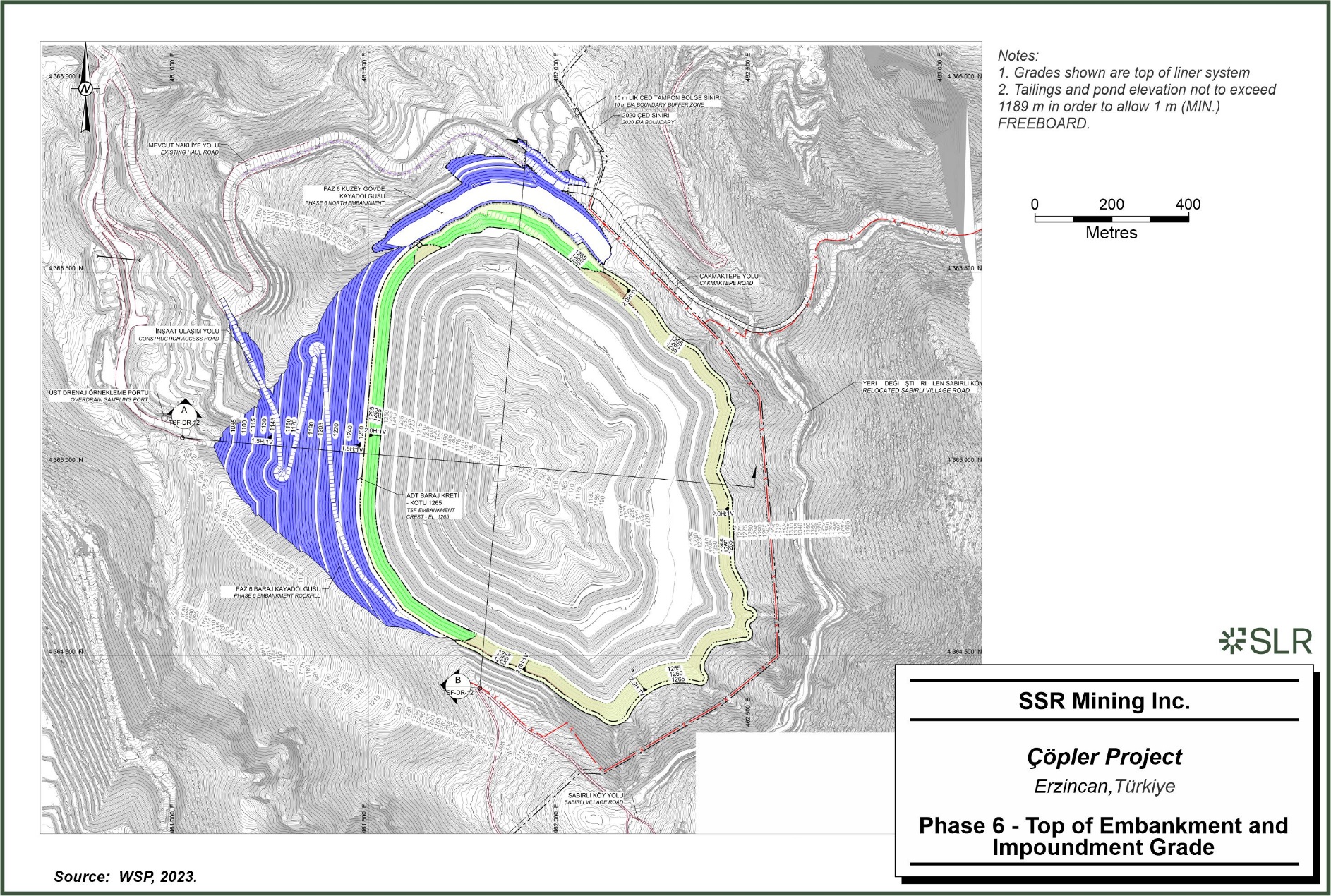

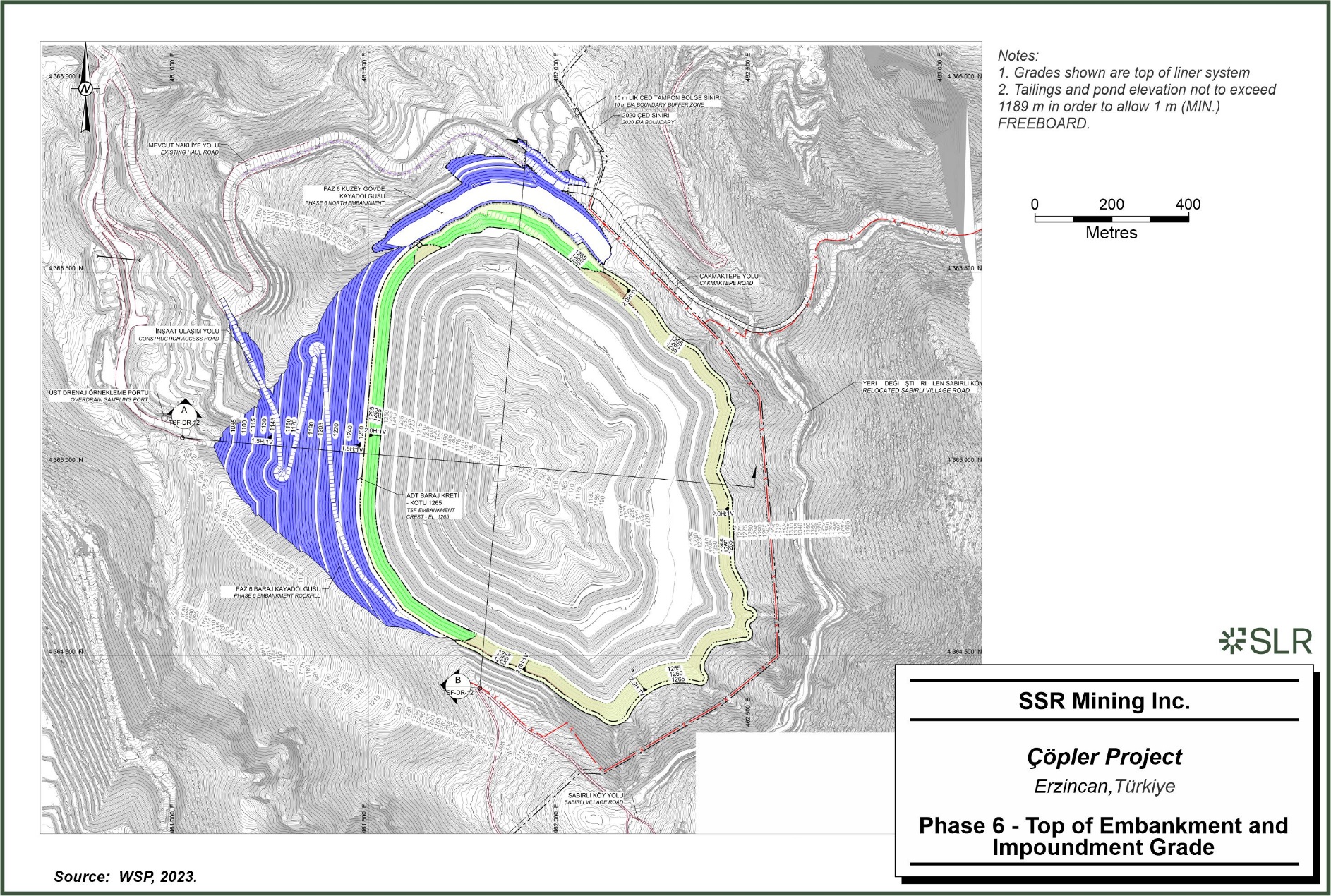

| Figure 15-5: | Phase 6 – Top of Embankment and Impoundment Grade | 15-13 |

| Figure 15-6: | Phase 7 – Top of Embankment and Impoundment Grade | 15-14 |

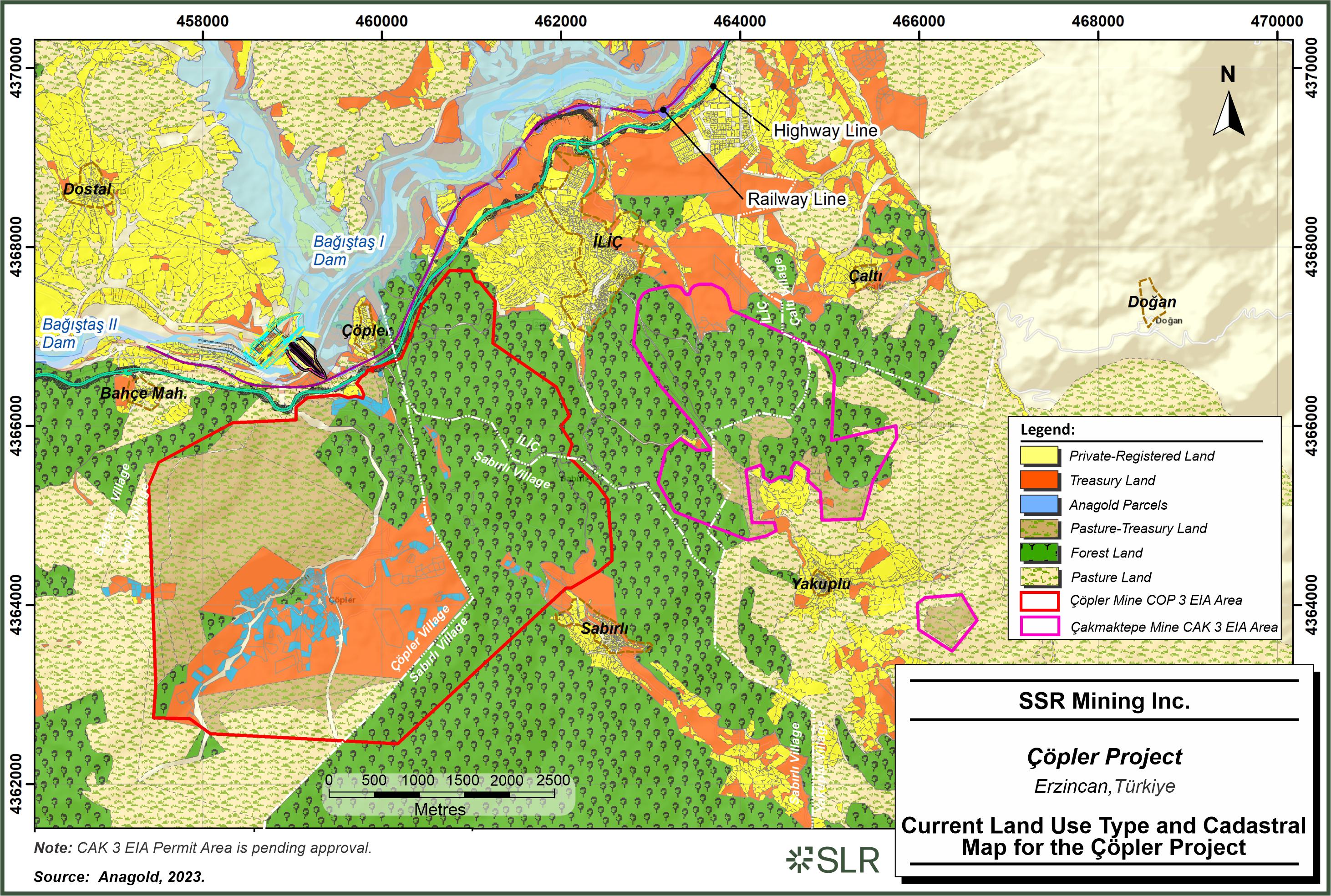

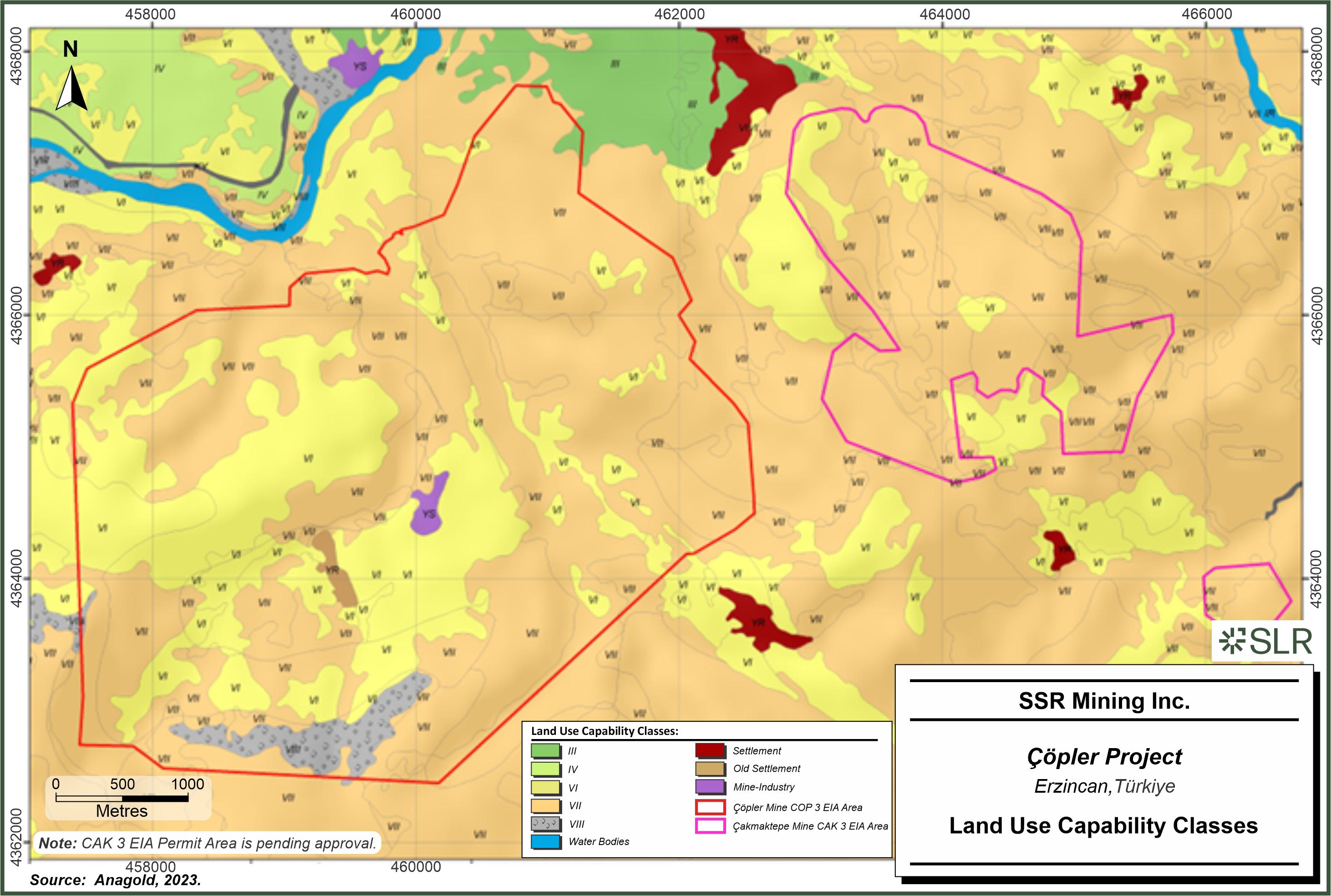

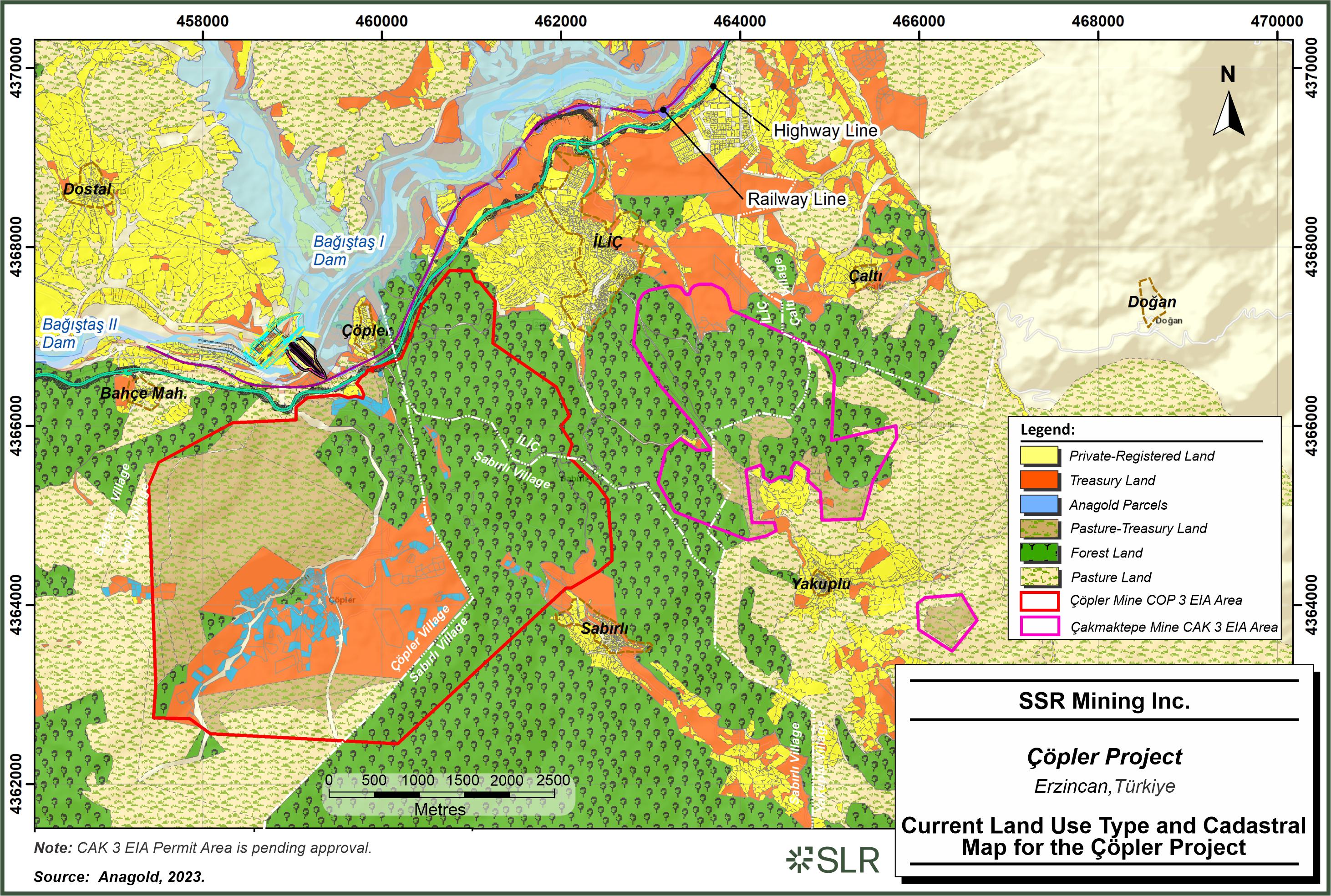

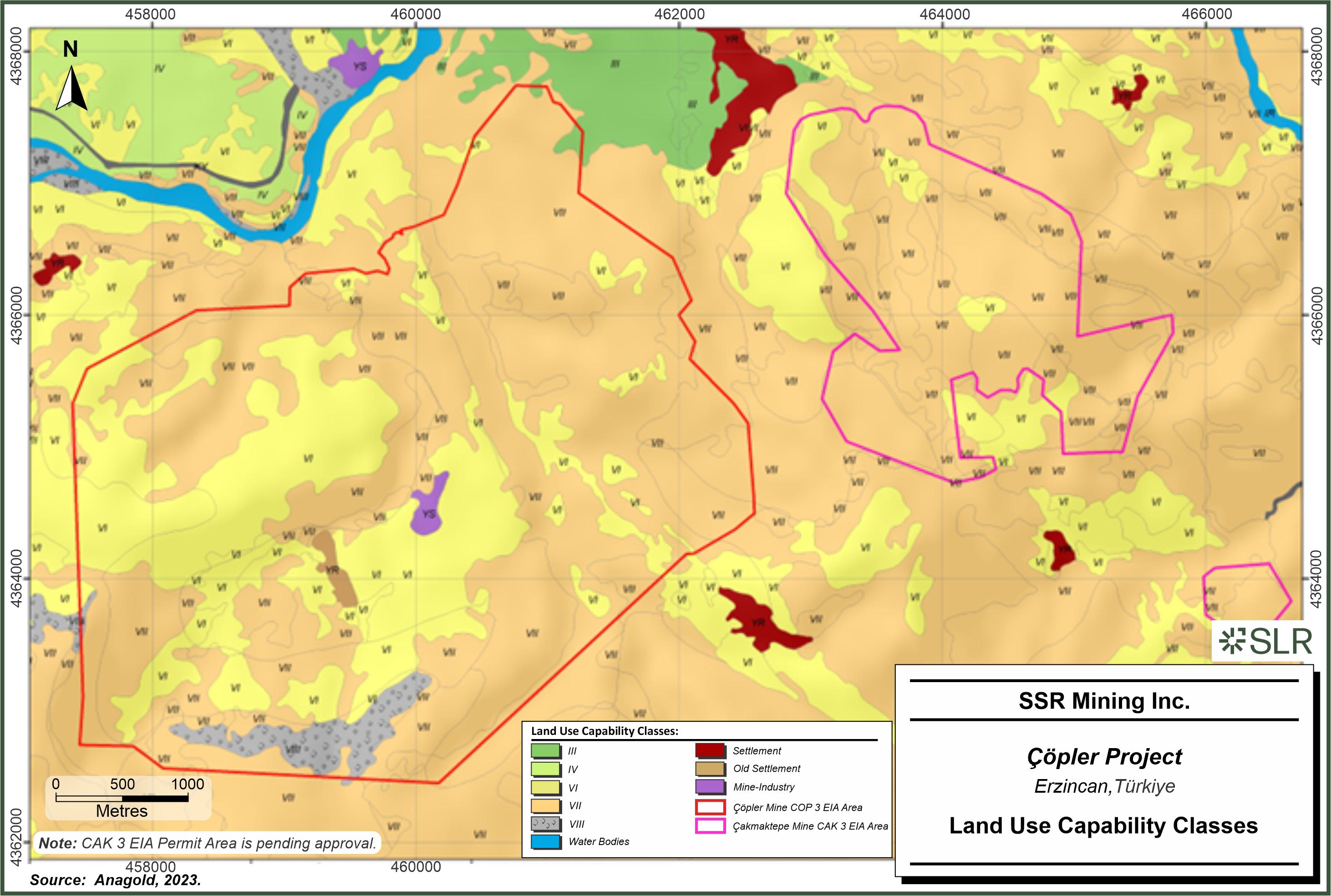

| Figure 17-1: | Current Land Use Types and Cadastral Map | 17-5 |

| Figure 17-2: | Land Use Capability Classes | 17-6 |

| Figure 19-1: | After-Tax Sensitivity Analysis | 19-6 |

| | xii |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

SLR International Corporation (SLR) was retained by SSR Mining Inc.(SSR) to prepare an independent Technical Report Summary (TRS) on the Çöpler Property (the Property or the Project), located in Erzincan Province, Türkiye. The Property is owned and operated by Anagold Madencilik Sanayi ve Ticaret Anonim Şirketi (Anagold). SSR controls 80% of the shares of Anagold, Lidya Madencilik Sanayi ve Ticaret A.Ş. (Lidya), controls 18.5%, and a bank wholly owned by Çalık Holdings A.Ş., holds the remaining 1.5%.

The purpose of this TRS is to disclose the results of the Mineral Resource and Mineral Reserve estimates for the Property with an effective date of October 31, 2023. This TRS conforms to the United States Securities and Exchange Commission’s (SEC) Modernized Property Disclosure Requirements for Mining Registrants as described in Subpart 229.1300 of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (S-K 1300) and Item 601 (b)(96) Technical Report Summary. SLR visited the property on August 29-31, 2023. SLR, RSC Consulting Ltd (RSC), WSP USA Inc. (WSP) and Ausenco Pty Services Limited (Ausenco) are the Qualified Persons (QPs) as required by S-K 1300 for purposes of this TRS.

SSR is a gold mining company with four producing assets located in the USA, Türkiye, Canada, and Argentina, and with development and exploration assets in the USA, Türkiye and Canada. SSR is listed on the NASDAQ (NASDAQ: SSRM), the Toronto Stock Exchange (TSX: SSRM), and the Australian Stock Exchange (ASX: SSR).

The Property consists of several mining licenses covering Mineral Resources on the Çöpler mine, Greater Çakmaktepe (Çakmaktepe and Çakmaktepe Extension (Ext.) - previously referred to as Ardich), and Bayramdere deposits, Mineral Reserves on the Çöpler and Greater Çakmaktepe deposits, oxide and sulfide processing facilities, and supporting infrastructure.

This report is an update of SSR's prior Technical Report Summary for the Property, dated as of September 29, 2022.

The QPs offer the following conclusions by area.

| 1.1.1.1 | Geology and Mineral Resources |

| · | The Çöpler district deposits (Çöpler, Greater Çakmaktepe, and Bayramdere) are best classified as epithermal, disseminated, and skarn deposits related to a porphyry copper-gold system. Mineralizing fluids, derived from the intrusions, were primarily controlled by structural fluid pathways and lithology, including traps controlled by lithological contacts, resulting in replacement, vein and stockwork mineralization. |

| · | The Çöpler property has been the site of considerable mining and exploration, including the drilling and logging of more than 4,800 drill holes totaling over 725,000 metres drilled. |

| · | The QP has estimated and prepared the Mineral Resources in accordance with the U.S. Securities and Exchange Commission (US SEC) Regulation S-K subpart 1300 rules for Property Disclosures for Mining Registrants (S-K 1300). |

| | 1-1 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| · | The QP has classified the Mineral Resources in accordance with the U.S. Securities and Exchange Commission (US SEC) Regulation S-K subpart 1300 rules for Property Disclosures for Mining Registrants (S-K 1300). |

| · | Mineral Resource estimates were prepared using a domain-controlled, predominantly ordinary kriging technique with verified drillhole location, density and sample data derived from exploration activities conducted by various companies from 2000 to 2023. Inverse distance algorithms were used for estimating minor elements, densities, and where kriging results were sub-optimal. |

| · | The QP is of the opinion that the drilling and sampling procedures adopted at Çöpler are consistent with generally recognized industry best practices. The diamond and reverse circulation (RC) samples were collected by competent personnel using common practices. The process was conducted or supervised by qualified geologists. |

| · | Overall, the drilling pattern is sufficiently dense to interpret the geometry and the boundaries of gold mineralization with confidence. Several areas at Çöpler are based on approximately 60-m spaced drilling which carries a moderate risk; the impact of this has been limited by classifying these areas as Inferred. The QP considers the overall risk associated with data location, spacing and distribution to be low to moderate and has considered this risk when classifying the Mineral Resources. |

| · | The data informing the Mineral Resources are collected using RC and core drilling. Overall, the QP is of the opinion that the samples are representative of the source materials. |

| · | In the RSC QP’s opinion, the sample preparation, security, and analytical procedures are adequate and meet industry standards, and the QA/QC program, as designed and implemented at Çöpler is adequate. The assay results within the drillhole database are considered suitable for the purpose of mineral resource estimation and classification in relevant categories. Neither the SSR in-house quality control nor SSR predecessor’s quality control yielded any indication of material quality concerns. |

| · | The QP was provided unlimited access by SSR for data verification purposes during the site visit. The QP is of the opinion that data verification procedures for the Project comply with industry standards and are adequate for the purposes of Mineral Resource estimation. |

| · | Based on the site visit, data validation and the results of quality acceptance testing, the QP is of the opinion that the sampling methods, chain of custody procedures, and analytical techniques are adequate and meet acceptable industry standards. The assay and bulk density databases are of sufficient quality for Mineral Resource estimation at the Çöpler district deposits (Çöpler, Greater Çakmaktepe, and Bayramdere). |

| · | The QP considers that the knowledge of the deposit setting, lithologies, controls on mineralization, and the mineralization style and setting, is sufficient to support the Mineral Resource classifications assigned. Alternative geological interpretations are possible. At Çöpler and Greater Çakmaktepe, the domains were updated to better align with previous mining reconciliation, however, a moderate–high risk is inherently carried in the domaining. It is anticipated that alternative geological interpretations could lead to tonnage or grade swings of up to ±20% in Inferred parts of the Mineral Resources. |

| · | The assumptions, parameters and methods used in the estimations have been transparently reported. The estimation settings are considered conservative and have been reconciled with previous mining at Çöpler and Greater Çakmaktepe to provide a robust result. Sensitivity testing has demonstrated that the estimation settings carry a moderate risk. |

| | 1-2 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| · | The Mineral Resource estimates for Çöpler, Greater Çakmaktepe, and Bayramdere have an effective date of October 31, 2023. |

| · | Appropriate cut-off grades and pit optimization parameters have been used to establish those portions of the block models that meet the requirement for reasonable prospects for economic extraction for this style of gold-copper deposit and mineralization. In assessing the potential of economic extraction, the QP reviewed mining, metallurgical, economic, environmental, social and geotechnical factors. |

| · | The Mineral Resources estimates exclusive of Mineral Reserves at the Property include the following by deposit area (SSR 80% attributable share): |

| · | Çöpler: 5.0 million tonnes (Mt) Measured Mineral Resources at an average grade of 1.31 g/t gold (Au) containing 0.21 million ounces (Moz) Au, 11.1 Mt Indicated Mineral Resources at an average gold (Au) grade of 1.29 g/t containing 0.46 million ounces (Moz) Au and an additional 14.0 Mt at an average grade of 1.53 g/t Au containing 0.69 Moz Au of Inferred Mineral Resources. |

| · | Greater Çakmaktepe: 3.6 Mt Measured Mineral Resources at an average grade of 0.94 g/t Au containing 0.11 Moz Au, 7.3 Mt Indicated Mineral Resources at an average grade of 1.10 g/t Au containing 0.26 Moz Au and an additional 4.8 Mt at an average grade of 1.87 g/t Au containing 0.29 Moz Au of Inferred Mineral Resources. |

| · | Bayramdere: 0.1 Mt Indicated Mineral Resources at an average grade of 2.36 g/t Au containing 0.01 Moz Au. There are no Measured or Inferred Resources at Bayramdere. |

| · | The level of uncertainty has been adequately reflected in the classification of Mineral Resources for the Çöpler Project. The Mineral Resources presented may be materially impacted by any future changes in the break-even cut-off grade, which may result from changes in mining method selection, mining costs, processing recoveries and costs, metal price fluctuations, or significant changes in geological knowledge. |

The QP is of the opinion that with consideration of the recommendations summarized in Sections 1 and 23 of this TRS, any issues relating to all relevant technical and economic factors likely to influence the prospect of economic extraction can be resolved with further work.

| 1.1.1.2 | Mining and Mineral Reserves |

| · | The total Mineral Reserve for the Çöpler Project is estimated to be approximately 67.4 Mt at an average grade of 2.32 g/t gold, totaling 5.1 Moz of contained gold, and SSR’s (80%) portion is 53.9 Mt at an average grade of 2.32 g/t Au, totaling 4.1 Moz of contained gold. Average oxide gold recoveries are 61% and average sulfide gold recoveries range from 81% to 91%. SSR’s portion of the Mineral Reserves for both Çöpler pit and Greater Çakmaktepe pit is 80%. The Çöpler pit represents approximately 41% of the total Mineral Reserve and the Greater Çakmaktepe pit represents the remaining 59%. |

| · | The SLR QP reviewed the assumptions, parameters, and methods used to prepare the Mineral Reserves Statement and is of the opinion that the Mineral Reserves are estimated appropriately and disclosed in accordance with S-K 1300. |

| · | This mine has operated profitably since 2011. Open pit mining at the Çöpler Project is carried out by a mining contractor and managed by Anagold. |

| | 1-3 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| · | The mining method is a conventional open pit method with drill and blast operations and using excavators and trucks operating on bench heights of 5 m. The mining contractor provides operators, line supervisors, equipment, and ancillary facilities required for the mining operation. Anagold provides management, technical, mine planning, engineering, and grade control functions for the mining operation. |

| · | Production schedules and costs associated with the Mineral Reserves have been updated by SSR based on current site performance and contracts. |

| 1.1.1.3 | Mineral Processing |

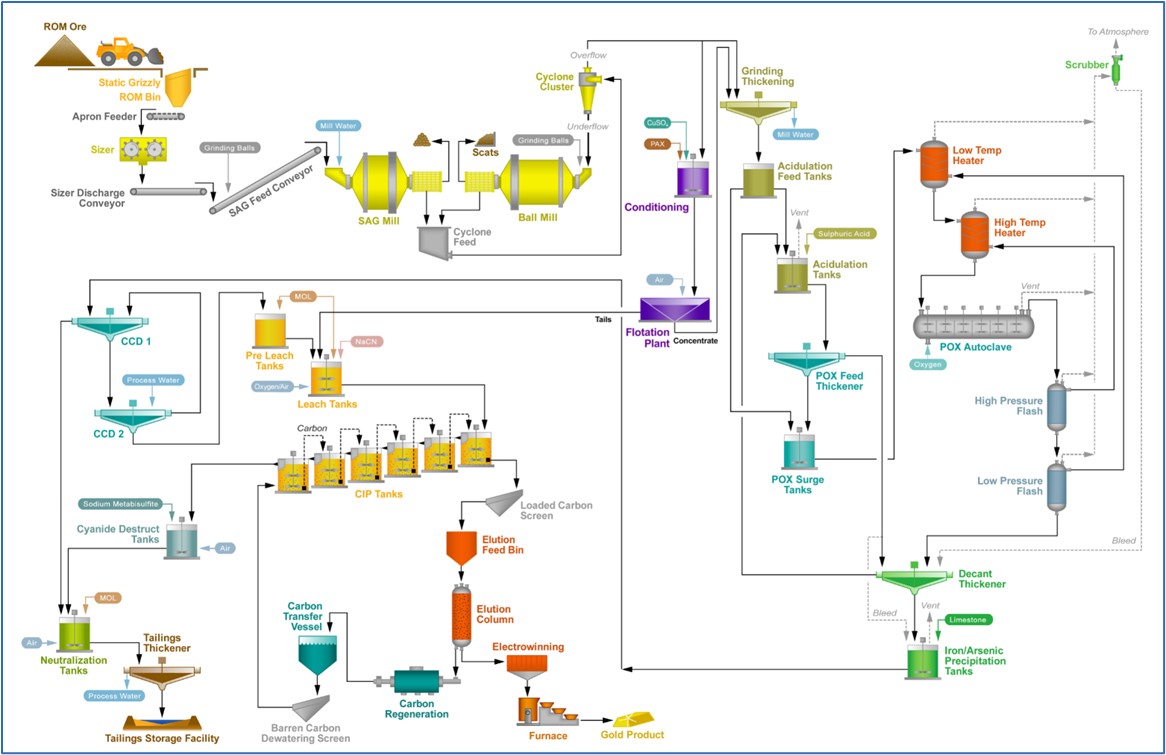

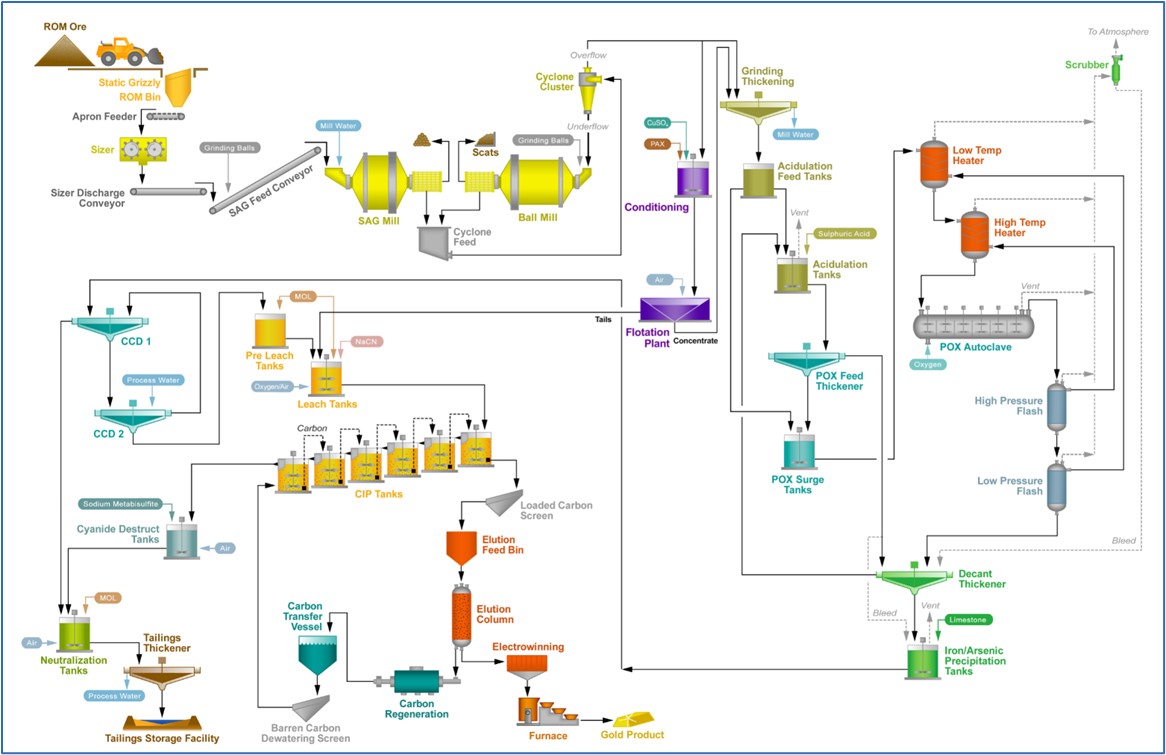

Pressure Oxidation Sulfide Plant

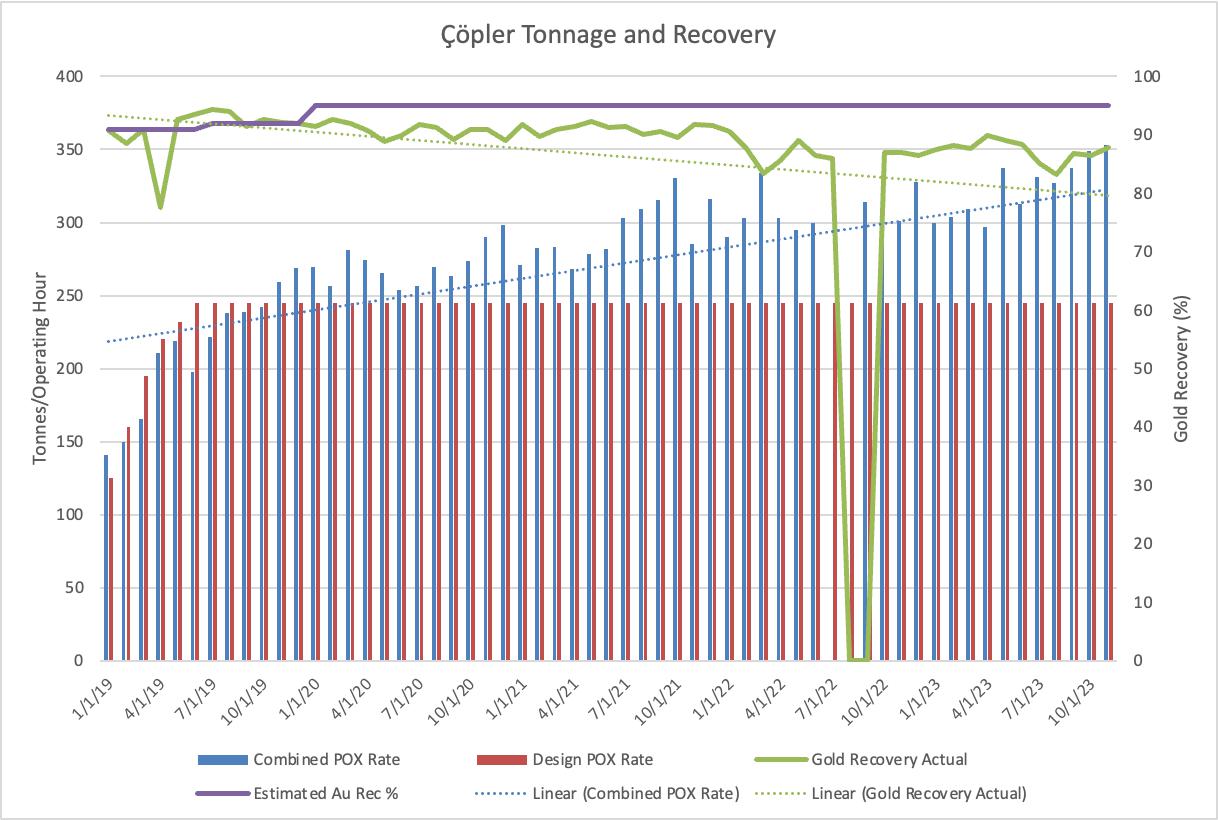

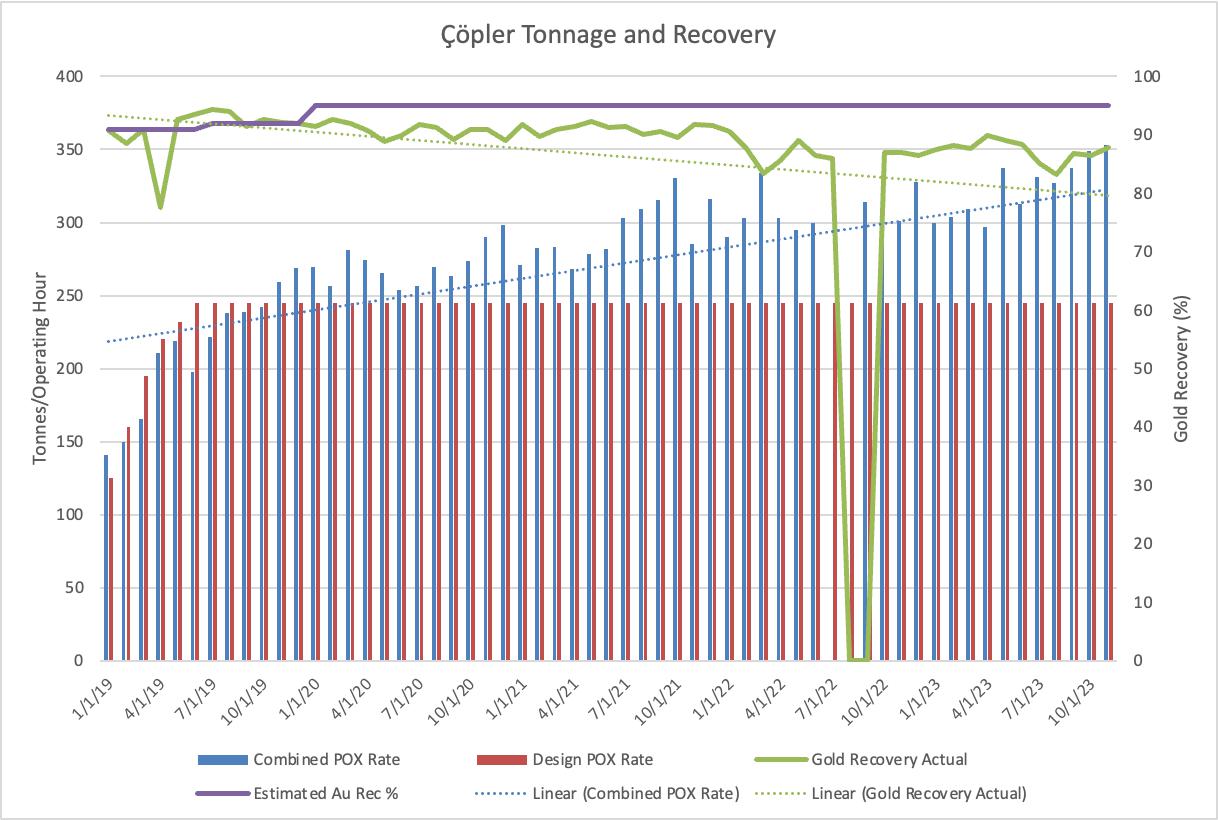

| · | The throughput from crushing and grinding was designed with a nominal capacity of 306 tph which was increased up to a maximum of 400 tph. The pressure oxidation (POX) autoclave circuit has demonstrated it can process a long-term average maximum of 280 tph feed (two autoclaves operating in parallel) and 13.75 tph sulfide sulfur, compared to design of 245 tph and 12.5 tph respectively. The limit of 13.75 tph sulfide sulfur is dictated by the capacity of the oxygen supply to effect oxidation of the sulfides, design 96%. The gold recovery has remained at approximately 87.5%. |

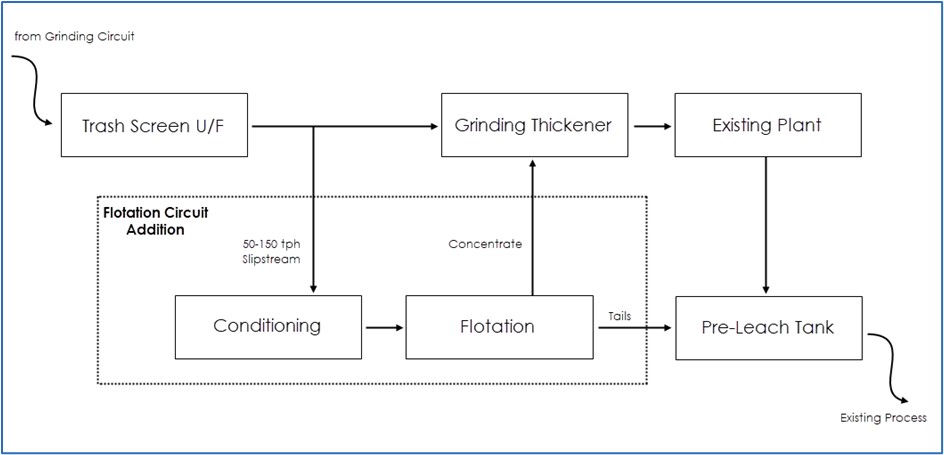

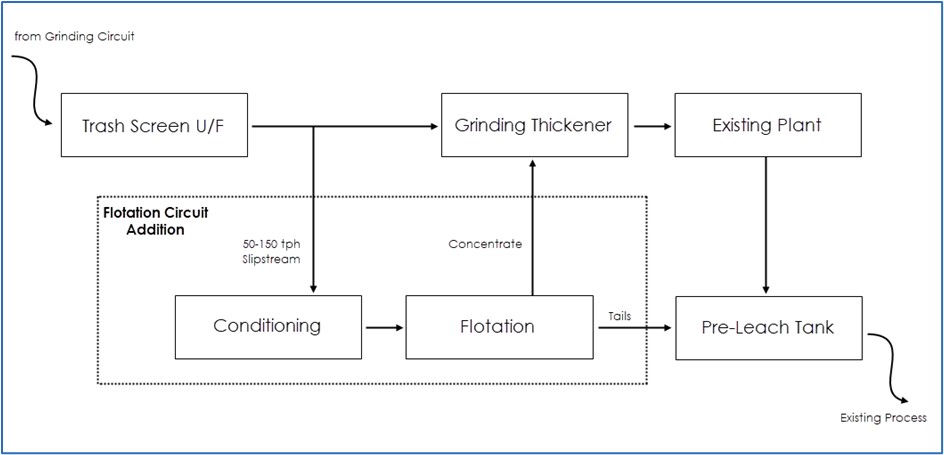

| · | The flotation plant feed rate is variable between 50–150 tph based on sulfide sulfur feed grade and the oxidation capacity of the POX autoclaves to oxidize sulfides. |

| · | The addition of a flotation circuit to the sulfide plant provides stability and flexibility to the POX circuit operation to maximize throughput and oxygen utilization by maintaining optimum sulfur grade to the autoclaves. |

| · | A large amount of POX test work has been performed on Çöpler sulfide ore across several pilot plant campaigns. The current POX process works well, as demonstrated by actual operational performance. |

| · | Comminution test work indicates that Çakmaktepe Ext. sulfide ore (jasperoid) is significantly harder and more abrasive than Çöpler sulfide ores and is not amenable for feeding to the existing Sulfide plant primary sizer. The ore will be crushed using the heap leach crushing plant and then delivered to POX plant grinding circuit. |

| · | No test work has been completed for direct POX processing of Çakmaktepe Ext. sulfide ores or flotation concentrates. |

| · | Further metallurgical testing of Çakmaktepe Ext. material types, both oxide and sulfide, is recommended to optimize the feeds to POX and slip stream flotation circuit. Further mineralogical work is recommended to understand the main gold associations. |

| · | The silver recovery pattern is much less clear than gold because silver is not released by the oxidation process. Silver recovery is determined from actual plant recovery over the period January 2019 through February 2020. The silver recovery calculates to 3.0%. |

| · | From the test work, it is estimated that the flotation concentrate reporting to the POX circuit will achieve the same overall recovery as the ore directly reporting to POX. Gold recovery to the flotation concentrate is estimated to be 55%. |

| · | The flotation tails reporting directly to the leach circuit are estimated to have a gold recovery of 43%, based on test work using samples collected while processing large amounts of formerly stockpiled ore. When processing freshly mined sulfide ore, flotation tails recoveries can vary between 10% and 30% in CIP. |

| | 1-4 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

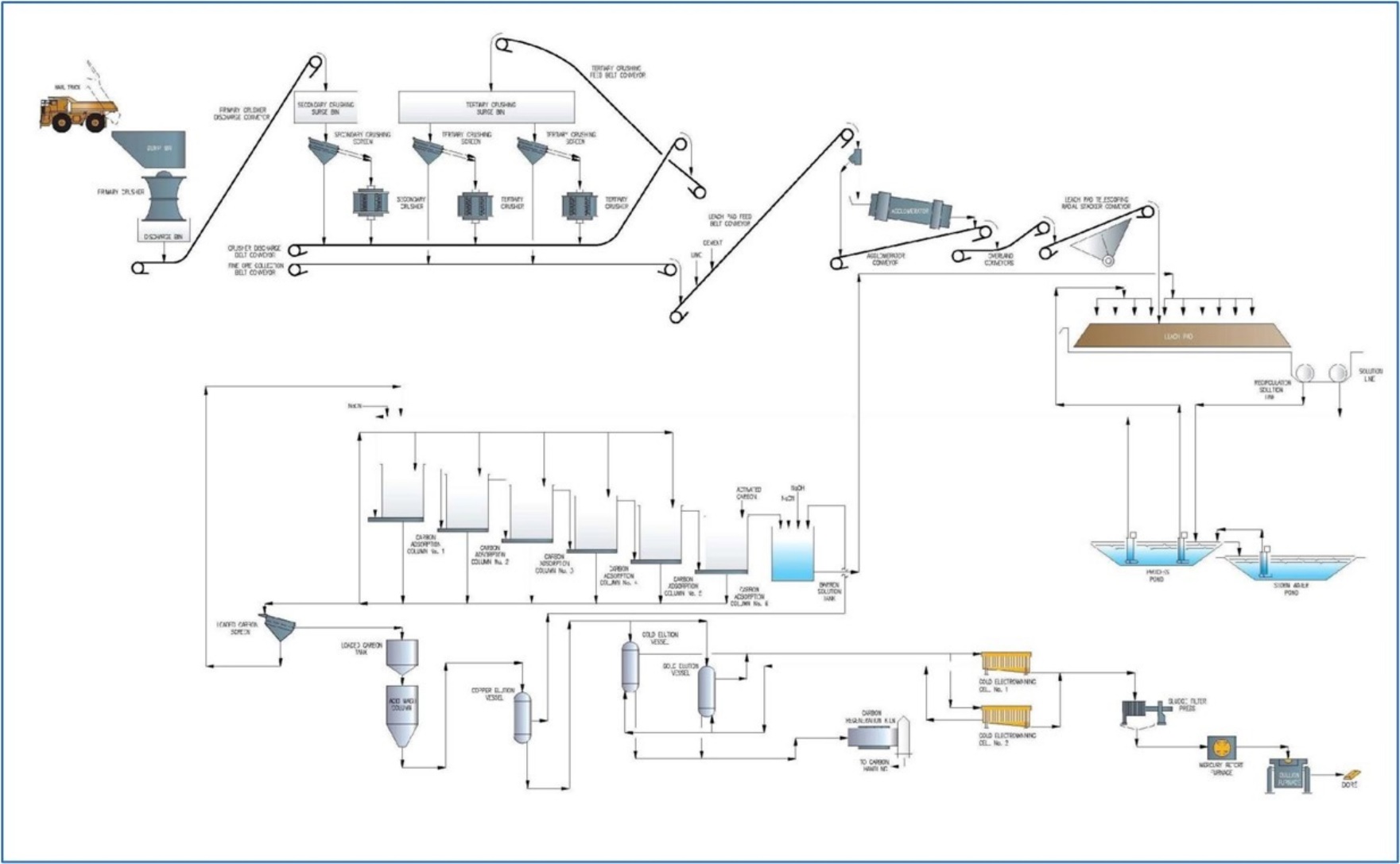

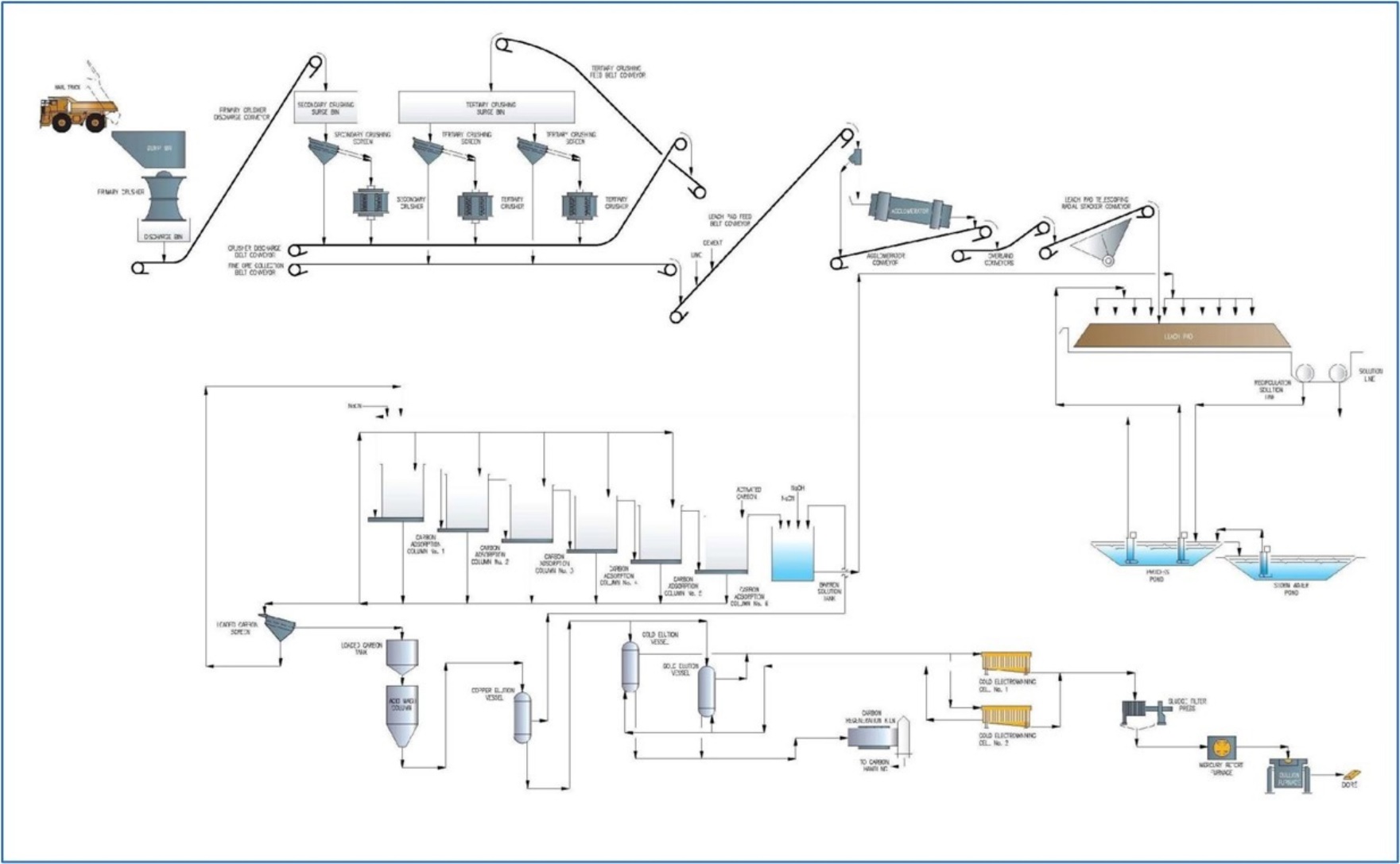

Heap Leach

| · | The oxide heap leaching facilities were commissioned in late 2010. The process was originally designed to treat approximately 6.0 Mtpa of ore by three-stage crushing (primary, secondary, and tertiary) to 80% passing 12.5 mm, agglomeration, and heap leaching on a lined heap leach pad with dilute alkaline sodium cyanide solution. Gold is recovered through a carbon-in-column (CIC) adsorption system, followed by carbon elution, electrowinning and smelting of the precipitate to produce doré ingots for sale. |

| · | The ore contains cyanide soluble copper that consumes cyanide increasing operating cost. Copper cyanide in the leach solutions is treated in a sulfidation, acidification, recycling, and thickening (SART) plant which precipitates the copper as copper sulfide and regenerates sodium cyanide, which is recycled in the leach solutions. |

| · | Metallurgical test work on Çakmaktepe oxide ore for heap leaching was performed in the on-site Çöpler metallurgical laboratory, initially under the supervision of Kappes, Cassiday & Associates (KCA). The results compare to the Çöpler oxide ore, with similar behavior and leach kinetics. Subsequently, Çakmaktepe oxide ore was heap leached together with Çöpler oxide ore. |

| · | Metallurgical test work on Çakmaktepe Ext. oxide material for heap leaching was performed at McClelland Laboratories Inc. and supervised by Metallurgium consulting. The initial program in 2019 identified two distinct domains with respect to gold recovery based on sulfide sulfur (SS) content of <1% and between 1% to 2%. |

| · | Metallurgical heap leach test work has been completed to characterize the Bayramdere oxide mineralization. In the column test, final gold extraction was 84% in the two duplicate columns with reasonable leach kinetics. |

| · | The current heap leaching gold recovery assumptions are summarized for Çöpler oxide zone, Çakmaktepe oxide zone (including Bayramdere), and Çakmaktepe Ext. oxide zone in the report and vary by ore type and location. The main ore types include diorite, metasediment (Hornfels), limestone/marbles, gossan, manganese diorite, Jasperoid and ophiolite. The Çakmaktepe Ext. oxide ores include Jasperite, Listwanite and Dolomite and were extensively tested during 2023 by Ausenco and ALS. |

Grind Leach

| · | The proposed process to treat oxide and low sulfur (< 2% sulfur) ores from the Çakmaktepe Ext. open pit is a conventional grind leach process. The grind leach process plant is designed to treat 248 tph of ore during 8,059 hours per year of operation or 92% availability for a total of 2 Mtpa. The operating availability of the crushing section will be 70%. The process will comprise primary jaw crushing, SAG mill and ball mill grinding closed by hydrocyclones, carbon-in-leach (CIL) cyanidation, carbon elution, electrowinning, and refining of electrowinning precipitate to produce a final precious metal (doré) product. |

| · | In 2023, ALS Metallurgy - Kamloops completed a metallurgical test program supervised by Ausenco to evaluate grind/leach processing of Çakmaktepe Ext. oxide ores. Both standard and CIL bottle roll tests were completed at a grind size P80 of 75 µm. Testing on master composite samples indicated that gold recovery is insensitive to grind size over a range from 53 µm to 212 µm. |

| · | Samples were selected to be representative of spatial, lithological and grade variability. Sample selection also took into consideration the preliminary mining sequence, with higher sample density in areas expected to be mined in the earlier years of the grind/leach plant operation. |

| | 1-5 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| · | Test work is planned to understand metallurgical and mineralogical variability across the deposit. Gold recovery for the Jasperoid, Listwanite, and Dolomite lithologies were 60%, 90%, and 83%, respectively. |

| · | The existing heap leach pad comprises four phases with an estimated capacity of 63 Mt of oxide ore heaps, with a maximum heap height of 100 m above the pad liner. Two additional phases (phase 5 and phase 6), with a total of 18.5 Mt capacity (13.5 Mt and 5.0 Mt, respectively), will be added to accommodate oxide ore extracted from Greater Çakmaktepe. |

| · | The current tailings storage facility (TSF-1) is in the process of development and construction and will have seven phases when it reaches the ultimate phase. Currently the TSF holds 13.3 Mt of tailings as of the Effective Date of this report. Construction of Phase 4 of TSF-1 has been finalized, and it received approval for operation from the Ministry of Environment, Urbanisation and Climate Change (MoEUCC) in November 2023. The design capacity for TSF-1 is currently 65.8 Mt. |

| · | However, the ultimate capacity required for TSF-1 that will have to incorporate the 60.4 Mt of tailings generated from the LOM plan is estimated to be 73.7 Mt (13.3 Mt plus 60.4 Mt). There are a number of options currently being studied to further expand TSF-1 capacity but these have not been finalized. A conceptual design to increase the crest elevation of Phase 7 embankment from 1,275 MASL to 1,280 MASL, thus increasing the total capacity to approximately 77 Mt, has been selected for the LOM plan. |

| · | Limestone and marble overburden are currently used as embankment rockfill for TSF construction. According to the current mine plan, there will be a limestone shortage in 2025 but SSR has plans to quarry limestone near the mine area to produce the required amount required for the TSF expansion. |

| · | The existing infrastructure, as well as the areas designated for tailings storage and the leach pad, will meet the demands of the current Mineral Reserves once the planned expansions are completed. |

| · | The Çöpler mining and processing operations have a well-established and effective environmental, social and permitting management program (10+ years) that follows National and International Standards. |

| · | Site staff is knowledgeable and experienced in site and regulatory requirements and supported by corporate technical and Environmental, Social and Governance (ESG) personnel as well as outside (Türkiye and International) technical experts. |

| · | Budgets and planned schedules for permit development are reasonable and there were no critical path permitting items noted that would limit production and Reserve/Resource development. A reclamation/closure plan and estimates to perform this activity are in place. |

| · | The budgets and staffing to perform required programs are adequate and indicative of site activities, requirements, and responsibilities. |

| | 1-6 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| · | The SLR QP’s opinion is that it is reasonable to rely on the information provided by SSR as outlined above for use in the this TRS because a significant environmental and social analysis has been conducted for the project over an extended period, the Project has been in operation for a number of years, and SSR employs professionals and other personnel with responsibility in these areas and these personnel have a good understanding of the permitting, regulatory, and environmental requirements for the Project. |

| 1.1.1.6 | Capital and Operating Costs |

| · | SSR’s forecasted capital and operating costs estimates related to the development of Mineral Reserves are derived from annual budgets and historical actuals over the long life of the current operation. According to the American Association of Cost Engineers (AACE) classifications, these estimates would be Class 2 with an accuracy range of -5% to -15% to +5% to +20% except where noted elsewhere. |

The QPs offer the following recommendations by area.

| 1.1.2.1 | Geology and Mineral Resources |

| 1. | Carry out an infill drill program of 50,000 m with a proposed budget of US$11.3 million over the next three years at Çöpler and Greater Çakmaktepe. The objective of the infill drill program is to increase orebody knowledge and improve the confidence in resource estimates and classification. |

| 2. | Carry out resource extension drill program of 30,000 m with a proposed budget of US$6.8 million over the next three years at Çöpler and Greater Çakmaktepe. The drill program is planned to convert Inferred Resources to Indicated Resources within the current reserve pit. The drill program will also target higher-grade structures closer to the current resource boundary with an objective of expanding the Mineral Resources. |

| 3. | Carry out continuous pit mapping and updating of the structural and geological model at Çöpler and Greater Çakmaktepe. The data will be incorporated in resource models to increase the confidence in resource estimates and classification. |

| 4. | Audit the grade control process in 2024. Based on the outcomes of the audit, any changes, if warranted, will be implemented. |

The RSC QP agrees with the objectives and overall scope of these planned activities.

| 1.1.2.2 | Mining and Mineral Reserves |

| 1 | Complete the Greater Çakmaktepe pit area hydrological model within the upcoming year (2024). |

| 2. | Update geotechnical model for the Greater Çakmaktepe pit area in 2024. |

| 3. | Pit dewatering should become a higher priority in both the Çöpler and Greater Çakmaktepe pit areas within the next few years as the pits are deepened. |

| 4. | Perform a study to optimize Waste Rock Dump (WRD) locations to improve the haulage profiles. |

| 1.1.2.3 | Mineral Processing |

| 1. | Carry out additional test work to understand the significant metallurgical and mineralogical variability across the deposit, including gold recovery and grind size for the Jasperoid mineralization. |

| | 1-7 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| 2. | Implement further testing to determine optimum circuit design parameters including grind size. |

| 1 | Develop an execution plan for constructing TSF 1 phase 5 within the next 2.5 years to account for the current rate of rise in the facility and to mitigate any risk of reduced tailings capacity in the TSF-1 impoundment driven by excess water from the heap leach operations. |

| 2 | Evaluate and plan for the operation of water treatment facilities to filter the TSF reclaim water and manage discharges as soon as possible. |

| 3. | Expedite the permitting and initiation of limestone quarry operations to avoid delays in the construction of future TSF phases given the projected limestone shortage in 2025 in the current mine plan. |

| 4. | Develop a well-defined closure plan for the current TSF. The closure plan should be integrated with operations and life-of-mine planning. |

| 5. | Conduct further studies and install instrumentation for TSF-1 as the facility is expanded beyond Phase 5. The instrumentation should include inclinometers within the downstream abutments used to supplement the existing monitoring and instrumentation plan. These changes are proposed for the 2024 fiscal year. |

| 6. | Conduct further studies for the proposed TSF options, as listed below, during the next stage of their design. |

| o | Geotechnical Investigation with Boreholes & Test pits |

| o | Tailings Sample (pilot) and testing |

| o | Tailings Large Strain Consolidation Modeling |

| o | Seismic Deformation Modeling |

| o | Probabilistic Water Balance Modeling |

| o | Diversion Channel Design |

| o | Credible Failure Modes Analysis |

| 1 | Evaluate whether there may be an opportunity to use the heap drain-down solution in the sulfide circuit rather than disposing of it by forced evaporation, potentially reducing costs. This would require changes to the design of the evapotranspiration cells included in the current estimate. |

| 2. | Evaluate the technical and regulatory/permitting requirements for treating and discharging water. The SLR QP understands that the current operations are designed as “Zero Discharge”; however, suggests that treating and discharging water may enhance sustainability goals by reducing fresh-water make-up and expedite closure timing. |

| | 1-8 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| 3. | Conduct further studies and design work for the mitigation of potential acid generating (PAG) materials exposed in the pits to verify whether the proposed one metre of non-PAG cover is practical and effective to implement. |

| 4. | Compare the growth media inventory and expected amount to be recovered over the course of the Project to the sum of the growth media requirements of the Project facilities. Further work (as part of a Test Plot Program) is recommended to determine the most sustainable revegetation covers to be employed. |

| 5. | Evaluate and, where possible, implement additional concurrent reclamation opportunities to minimize costs and requirements at the end of operations. |

| 6. | Track and, if necessary, participate in the development of new environmental and mine permitting regulations. |

| 7. | Continue to perform internal and external (independent) ESG Audits. |

| 8. | Continue to update Asset Retirement Obligations (ARO) as well as overall reclamation/closure cost estimates on a regular basis. |

| 1.1.2.6 | Capital and Operating Costs |

| 1. | Evaluate the technical and regulatory/permitting requirements for treating and discharging water. The SLR QP understands that the current operations are designed as “Zero Discharge”; however, suggests that treating and discharging water may enhance sustainability goals by reducing fresh-water make-up and expedite closure timing. |

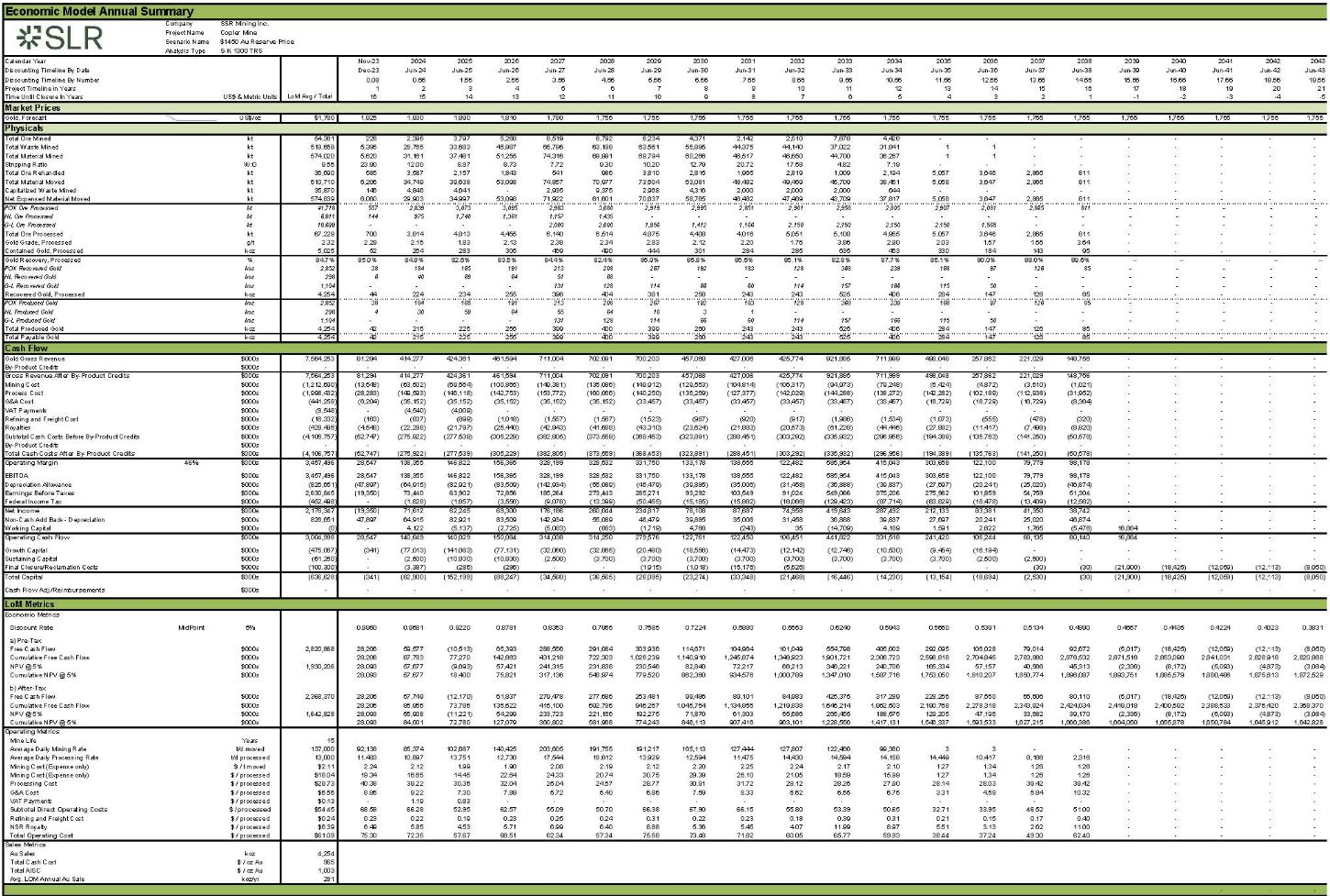

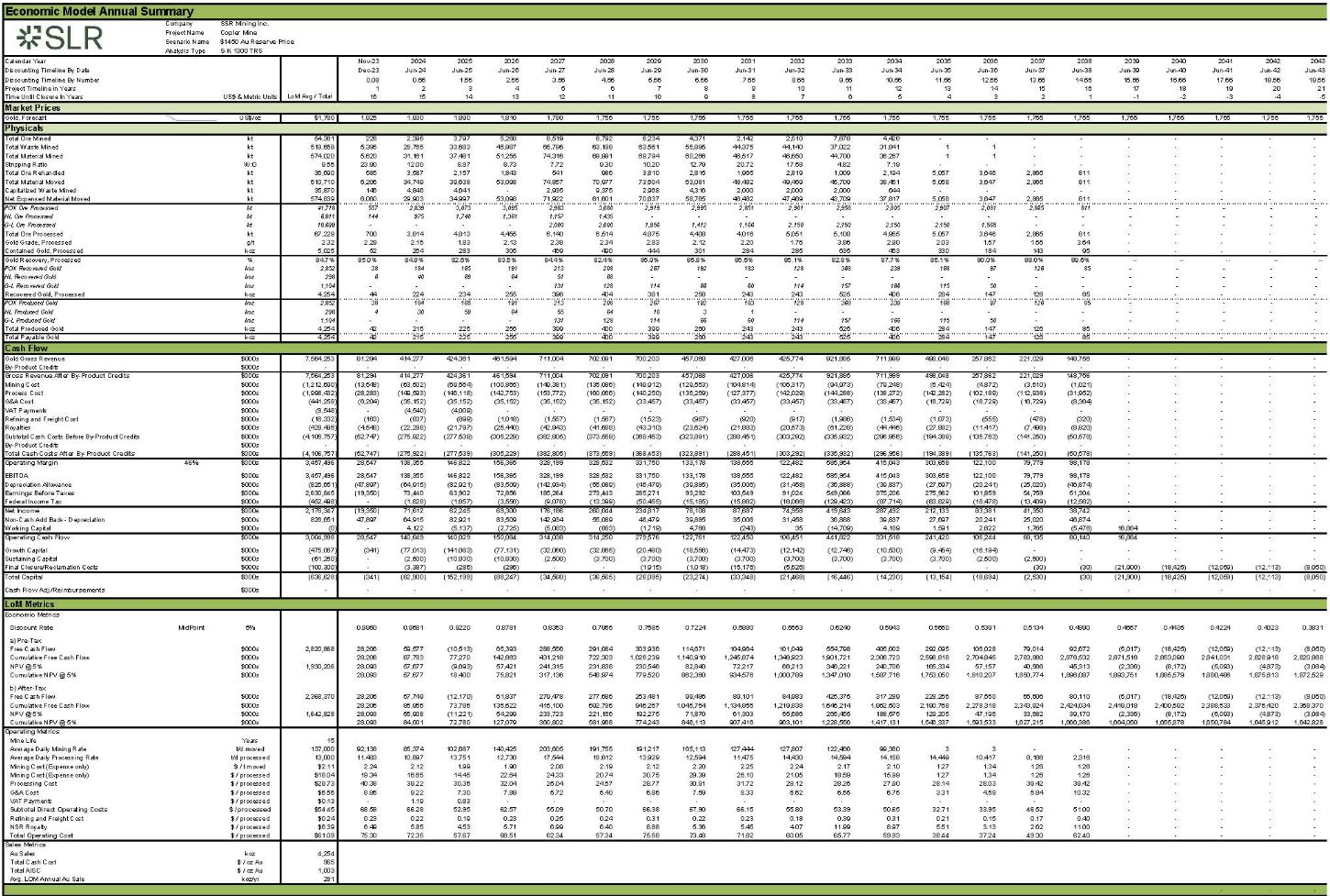

An after-tax Cash Flow Projection has been generated from the Life of Mine production schedule and capital and operating cost estimates and is summarized in Table 1-2. A summary of the key criteria is provided below. The complete cash flow is presented in Section 27.0 Appendix. The analysis is based on Q4 2023 real US dollar basis with no escalation.

| 1.2.1 | Economic Assumptions |

| · | Approximately 13,000 tonnes per day processed (4.5 Mt per year) at an average overall head grade of 2.32 g/t gold, including the following circuits: |

| o | POX: Approximately 7,800 tpd milled (2.7 Mt per year) averaging 2.42 g/t gold, |

| o | Heap Leach: 3,800 tpd stacked (1.3 Mt per year) averaging 1.93 g/t gold, and |

| o | Grind-Leach: 5,340 tpd milled (1.9 Mt per year) averaging 2.26 g/t gold. |

| · | LOM average 281,000 ounces per year gold recovered with LOM recovery averaging 84.7% over the 15 years of full process capacity (2024 to 2038). Total 4.25 Moz gold recovered over LOM with the following recovery rates: |

| o | POX: 87.9%; Heap Leach: 70.4%, and Grind-Leach: 81.3% |

| · | The economic analysis was carried out on a total of 100% basis of Mineral Reserves, of which SSR owns 80%. |

| · | Metal price: US$1,780 per ounce gold (LOM realized), US$1,755 per ounce gold long term price (2028+). |

| | 1-9 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| · | Gold at refinery 100% payable (with de minimis silver and copper production not included in this analysis). |

| · | Net Smelter Return (NSR) of $106/t processed includes freight/transport costs averaging $3.84/oz gold. Refining costs are included in process operating costs. |

| · | Revenue is recognized at the time of gold production. |

| · | Mine life: 15 years (11 years of mining with four years of stockpile processing). |

| · | Life of Mine production plan as summarized in Table 13-18. |

| · | Greater Çakmaktepe starter pit, TSF expansion to 77 Mt, and G-L circuit construction growth capital totals $475.1 million. |

| · | Mine life sustaining capital totals $61.3 million. |

| · | Final reclamation costs total $100 million at end of mine life. |

| · | Average site operating cost over the mine life is $54.45 per tonne processed. |

| 1.2.1.3 | Taxation and Royalties |

| 1.2.1.3.1 | Corporate Income Taxes |

In Türkiye, the standard income tax rate is 25% but some of the site’s income streams qualify for a reduced rate, thus the effective LOM income tax rate is 24.5%.

For tax purposes, a 10 year double declining balance methodology is used for all new and replacement capital starting in 2024 totaling $536 million. For the existing depreciation balance of $290 million as of Q3 2023, a combination of accelerated, straight line, and unit of production depreciation methods is used as modeled by the SSR tax group. All remaining depreciation at the end of the mine life is written off in the last year of production.

Investment incentive certificates (IIC) are available for investments that promote economic development. IIC’s can be classified as strategic in specific circumstances, thereby providing additional incentives. An IIC generates credits that offset corporate income taxes generated by the investment. In this analysis, income tax credits totaling 29% over the LOM were applied to the income tax payable estimate, in 90% credits applied in 2024 and 2025 and 80% credits applied in 2026 to 2028, as modeled by the SSR tax group.

| 1.2.1.3.2 | VAT and Import Duties |

This analysis assumes the annual operating and capital cost are subject to value-added tax (VAT) in Türkiye. VAT is levied at 4% of all operating and capital costs (less labor costs) starting July 2023, and the Project is eligible for the Turkish exemptions for mining projects and mining equipment purchases. VAT payments are expected to end in 2025.

Import duties are not included in the capital cost estimate for mining related imported equipment because they are exempted in the IICs.

| | 1-10 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

Under Turkish Mining Law, the royalty rate for precious metals is variable and tied to metal prices. The Çöpler Project is subject to a mineral production royalty which is based on a sliding scale to gold price and is payable to the Turkish government.

Table 1-1 details the current prescribed royalty rates applicable to POX, heap leach and G-L production (revised September 2020). The royalties are calculated on total revenue with deductions allowed for processing and haulage costs of ore. Royalty rates are reduced by 40% for ore processed in country, as an incentive to process ore locally.

Table 1-1: Gold Royalty Rates

Metal Price ($/oz Gold) | Prescribed Royalty Rate

(%) | Royalty After 40% In-Country Processing Incentive

(%) |

| From | To |

| 0 | 800 | 1.25 | 0.75 |

| 800 | 900 | 2.50 | 1.50 |

| 900 | 1,000 | 3.75 | 2.25 |

| 1,000 | 1,100 | 5.00 | 3.00 |

| 1,100 | 1,200 | 6.25 | 3.75 |

| 1,200 | 1,300 | 7.50 | 4.50 |

| 1,300 | 1,400 | 8.75 | 5.25 |

| 1,400 | 1,500 | 10.00 | 6.00 |

| 1,500 | 1,600 | 11.25 | 6.75 |

| 1,600 | 1,700 | 12.50 | 7.50 |

| 1,700 | 1,800 | 13.75 | 8.25 |

| 1,800 | 1,900 | 15.00 | 9.00 |

| 1,900 | 2,000 | 16.25 | 9.75 |

| 2,000 | 2,100 | 17.50 | 10.50 |

| 2,100 | + | 18.75 | 11.25 |

The Çöpler Project effective LOM royalty rate based on the metal price assumptions and applicable deductions is approximately 8.4%.

Other than the royalty payments, there are no other known back-in rights, payments, or other agreements and encumbrances to which the Project is subject.

Considering the Çöpler Project on a stand-alone basis, the undiscounted after-tax cash flow totals $2,368 million over the mine life. The after-tax Net Present Value (NPV) at a 5% discount rate (midpoint with November 1, 2023 as time zero) is $1,643 million, as shown in Table 1-2. An Internal Rate of Return (IRR) metric is not reported as the operation is cash positive in each year of the mine plan until closure.

| | 1-11 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

Table 1-2: After-Tax Cash Flow Summary

| Description | US$ million |

| Realized Market Prices | |

| Au ($/oz) | $1,780 |

| Payable Metal | |

| Au (koz) | 4,254 |

| Total Gross Revenue | 7,564 |

| Mining Cost | (1,213) |

| Process Cost | (1,998) |

| G & A Cost | (441) |

| VAT Payments | (9) |

| Dore Freight/Insurance | (16) |

| Mining Royalties | (429) |

| Total Operating Costs | (4,107) |

| Operating Margin (EBITDA) | 3,457 |

| Cash Taxes Payable | (452) |

| Working Capital1 | 0 |

| Operating Cash Flow | 3,005 |

| Development Capital | (475) |

| Sustaining Capital | (61) |

| Total Closure/Reclamation Capital | (100) |

| Total Capital | (637) |

| | |

| Pre-tax Free Cash Flow | 2,821 |

| Pre-tax NPV @ 5% | 1,931 |

| | |

| After-tax Free Cash Flow | 2,368 |

| After-tax NPV @ 5% | 1,643 |

Notes:

| 1. | All working capital adjustments net to zero at end of mine life |

The World Gold Council Adjusted Operating Cost (AOC) is US$965/oz Au. The mine life capital unit cost, including sustaining and closure/reclamation, is US$38/oz, for an All in Sustaining Cost (AISC) of US$1,003/oz Au. The average annual gold production during operation is 281,000 ounces per year over ROM operations.

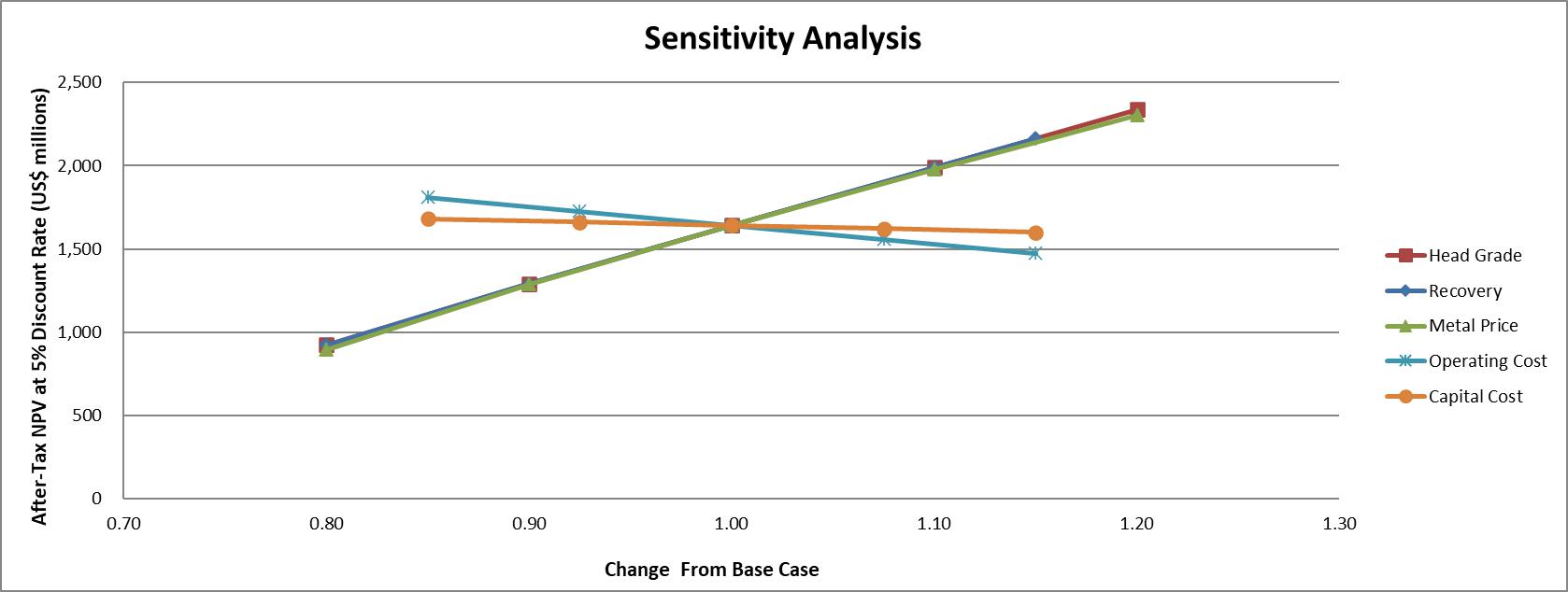

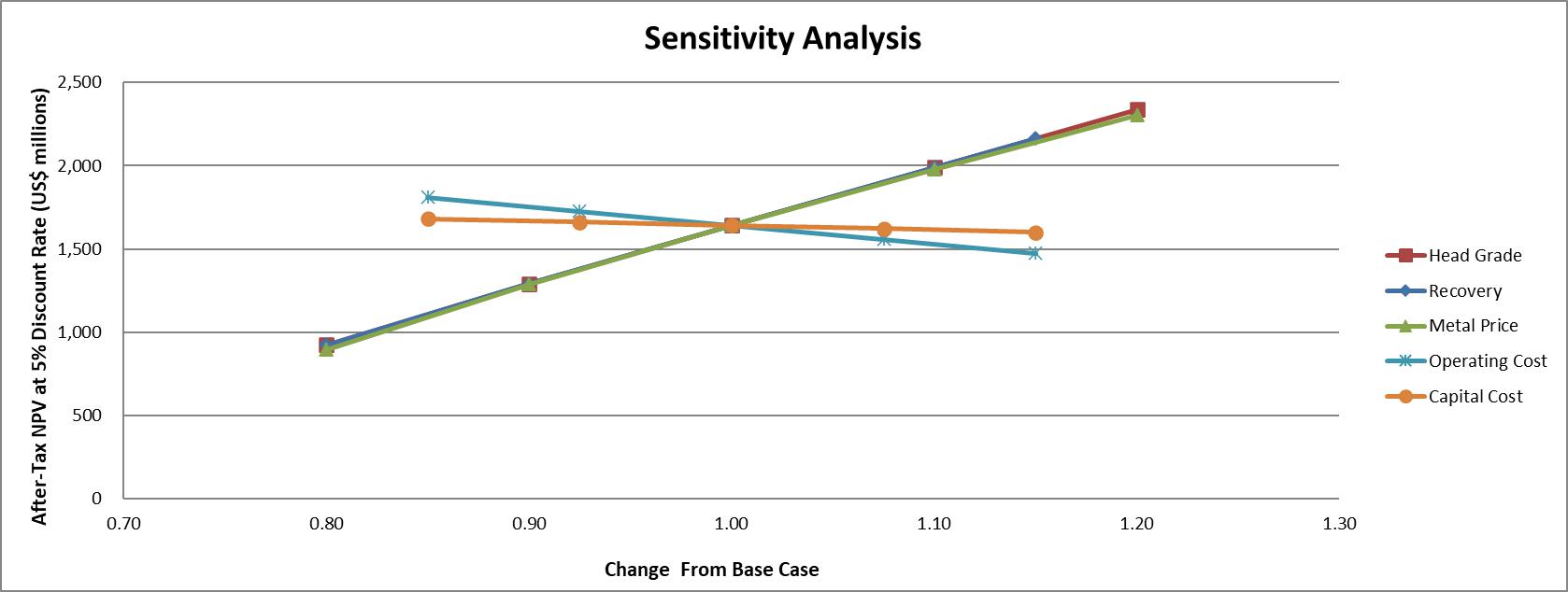

| 1.2.3 | Sensitivity Analysis |

Project risks can be identified in both economic and non-economic terms. Key economic risks were examined by running cash flow sensitivities:

| | 1-12 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

After-tax IRR sensitivity over the base case has been calculated for -20% to +20% variations for head grade, recovery (only -20% to +15% variation), and gold price, and -15% to +15% variations for operating and capital costs. The Project is most sensitive to changes in head grade, metallurgical recovery, and metal price (usually with same magnitude of impact) followed by operating cost and finally capital costs.

| 1.3.1 | Property Description |

The Project is serviced by road and rail networks. The mine is accessed from the main paved highway between Erzincan and Kemaliye. The Project area is in the Eastern Anatolia geographical district of Türkiye. Mining operations are conducted year-round. The climate is typically continental with cold wet, winters and hot dry, summers.

Anagold holds the exclusive right to engage in mining activities within the Çöpler project area. Anagold holds six granted licenses covering a combined area of approximately 16,600 ha. Mineral title is held in the name of Anagold. Kartaltepe holds six licenses covering approximately 7,250 ha. The total near-mine tenement package is approximately 23,850 ha. Anagold currently holds sufficient surface rights to allow continued operation of the mining operation in the Reserve Case.

The Çöpler region has been subject to gold and silver mining dating back at least to Roman times. The Turkish Geological Survey (MTA) carried out regional exploration work in the early1960s that was predominately confined to geological mapping. In 1964, a local Turkish company started mining for manganese, continuing through until closing in 1973. Unimangan Manganez San A.Ş. (Unimangan) acquired the property in January 1979 and re-started manganese production, continuing until 1992. In 1998, Anatolia Minerals Development Ltd (Anatolia) identified several porphyry-style gold–copper prospects in east central Türkiye and applied for exploration licenses for these prospects. During this work, Anatolia identified a prospect in the Çöpler basin. This prospect and the supporting work were the basis for a joint venture agreement for exploration with Rio Tinto and Anatolia and in January 2004, Anatolia acquired the interests of Rio Tinto and Unimangan.

In August 2009, a joint venture agreement between Anatolia and Lidya was executed.

In February 2011, Anatolia merged with Avoca Resources Limited, an Australian company, to become Alacer Gold Corp. (Alacer). In September 2020, Alacer merged with SSR.

Technical Reports have been prepared on the Project in accordance with NI 43-101 Standards for Disclosure for Mineral Projects since 2003. In 2022, a Technical Report Summary was prepared, in accordance with S-K 1300, that presented an Initial Assessment for a copper recovery circuit.

| | 1-13 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| 1.3.3 | Geological Setting, Mineralization, and Deposit |

The Çöpler Project, including Çöpler, Greater Çakmaktepe, and Bayramdere deposits, is within the Tethyan mineral belt, a terrane stretching from Indo-China to Europe through Eurasia that contains economically significant gold, copper, and base metal deposits.

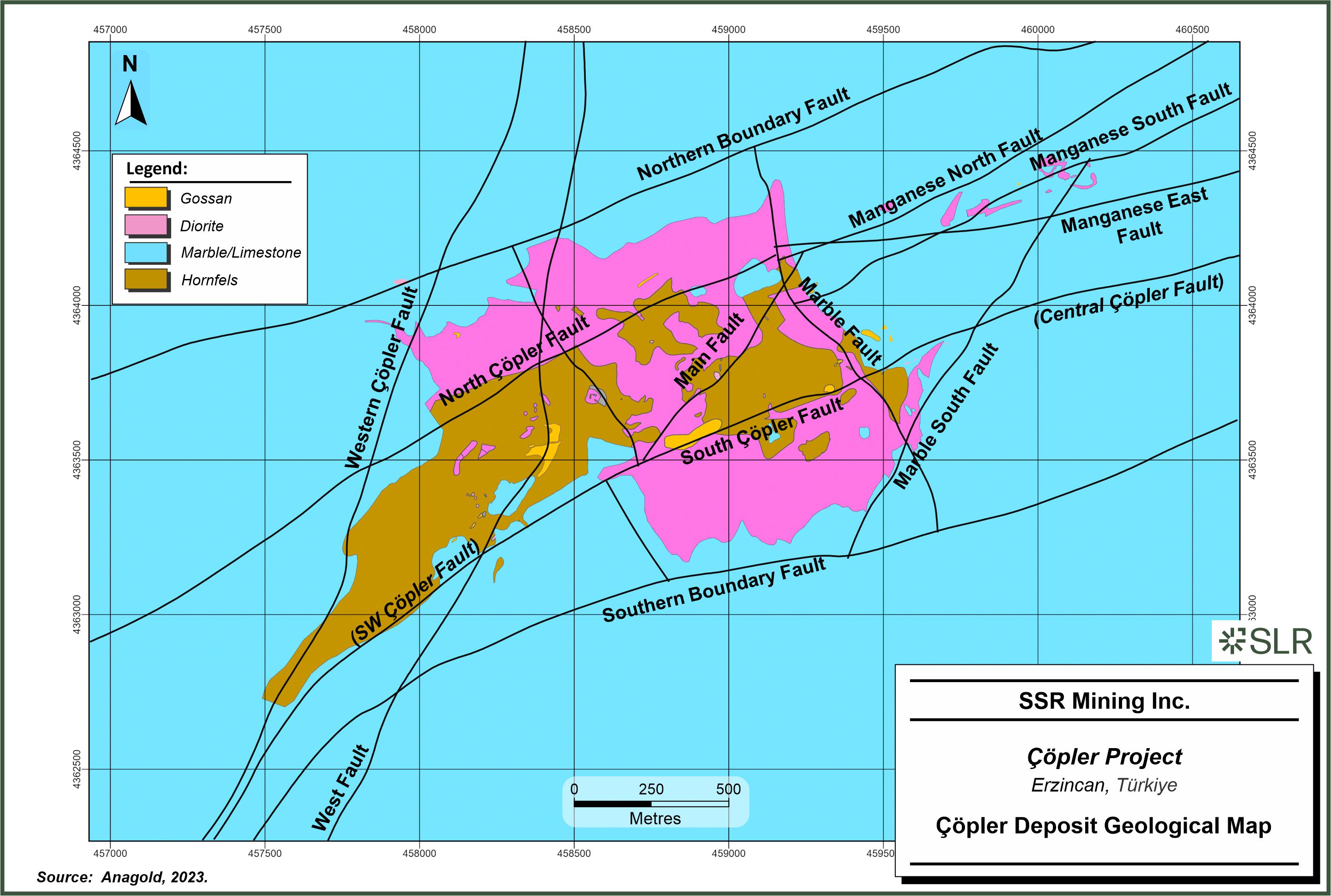

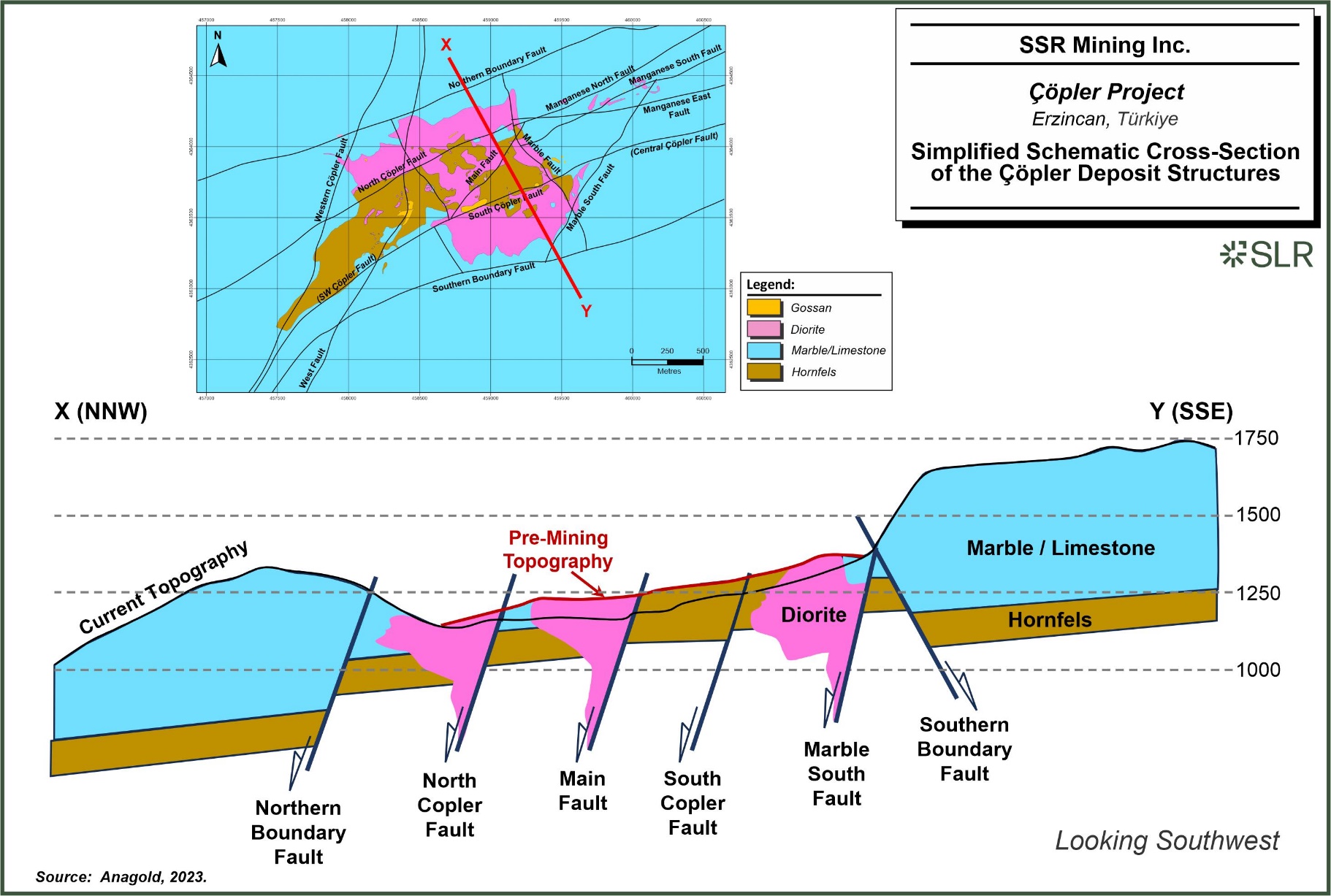

The Çöpler deposit is centred on composite diorite to monzonite porphyry stocks that are part of the Eocene Çöpler Kabataş magmatic complex. The magmatic rocks have intruded into both the Keban and Munzur Formations. The mineralisation is considered to be related to fluids associated with diorite intrusions at depth.

Three types of mineralization are prevalent at the deposits; 1) intermediate sulfidation epithermal gold 2) replacement gold and 3) skarn gold. At Ҫӧpler there is also evidence of an earlier low grade porphyry copper-gold system.

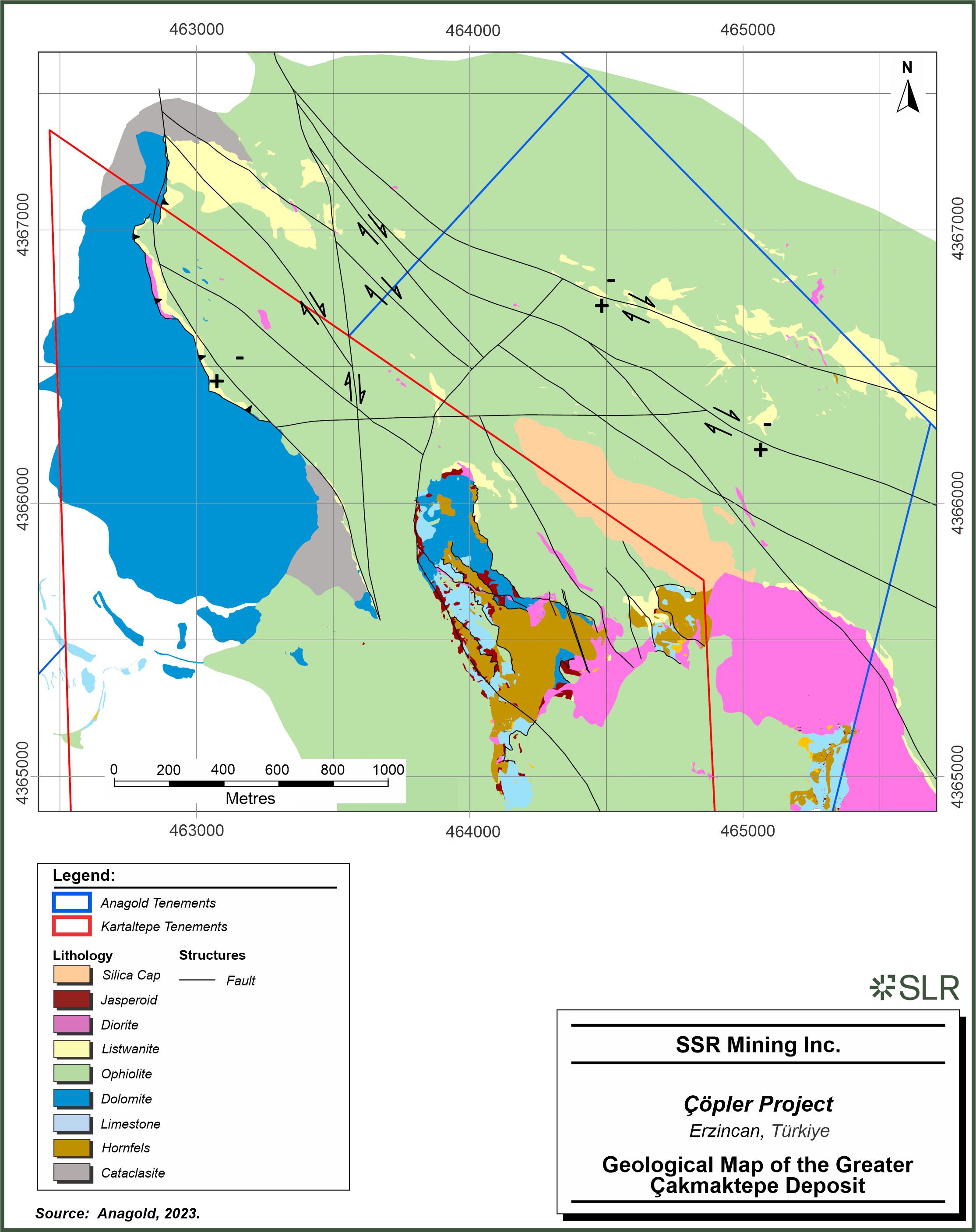

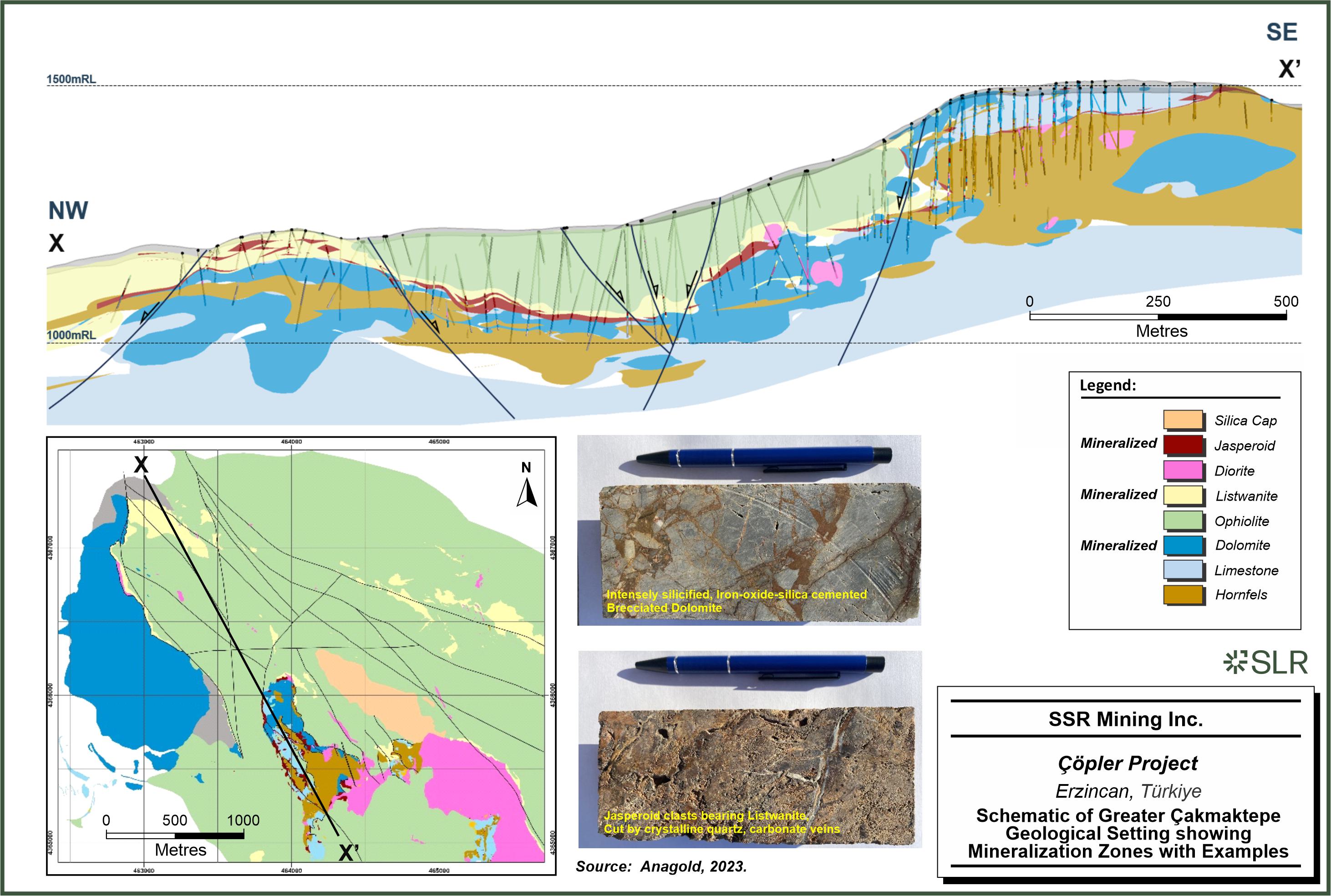

The Greater Çakmaktepe area mainly comprises Palaeozoic metamorphic rocks and marble belonging to the Keban Formation and Mesozoic platform carbonate such as the Munzur Formation limestone. All these units are tectonically overlain by ophiolitic mélange rocks. Mineralisation similar to Çöpler is also thought to be the result of intrusive activity that generated suitable conditions for mineralisation of ophiolite, limestone, and hornfels lithologies. The mineralisation is controlled by a complex system of structural fluid pathways and traps controlled by lithological contacts, in typical replacement-style processes.

The Bayramdere deposit is an oxide gold and copper deposit with similar geological and mineralisation characteristics to Greater Çakmaktepe deposits. The Bayramdere deposit is structurally controlled, displaying a replacement gold (minor copper, minor silver) mineralisation style. The deposit is dominantly represented by near-surface oxide mineralisation, primarily associated with iron-rich gossan.

Core (Diamond Drilling-DD) and RC drilling on the Property is the principal method of exploration and delineation of gold mineralization after initial targeting using soil sampling and geophysical surveys.

As of the effective date of this TRS, SSR and its predecessor companies have completed 725,840 m of drilling in 4,834 drillholes in the property.

| 1.3.5 | Mineral Resource Estimates |

Mineral Resources have been classified in accordance with the definitions for Mineral Resources in S-K 1300. RSC Consulting Ltd. (RSC) has prepared, reviewed, and accepted the Mineral Resource estimates. The Mineral Resource estimates are based on block model values developed from assays on the mineralized properties.

The Mineral Resource estimates were completed using conventional block modelling approach in Seequent’s Leapfrog Geo (Leapfrog Geo) software.

Estimates were validated using standard industry techniques including statistical comparisons with composite samples and parallel nearest neighbor (NN) estimates, swath plots, and visual reviews in cross-section and plan. A visual review comparing blocks to drill holes was completed after the block modelling work was performed to ensure general lithologic and analytical conformance and was peer reviewed prior to finalization. Mineral Resources (SSR ownership 80% only) have been summarised based on deposit, resource classification and processing methodology.

| | 1-14 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

The Mineral Resource estimates are presented in Table 1-3.

| | 1-15 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

Table 1-3: Summary of Çöpler Mine, Greater Çakmaktepe and Bayramdere Mineral Resources (SSR’s Attributable Share)

| Deposit | Measured Mineral Resources | Indicated Mineral Resources | Measured + Indicated Mineral Resources | Inferred Mineral Resources | NSR Cut-off Values |

| Amount | Grade | Rec | Amount | Grade | Rec | Amount | Grade | Rec | Amount | Grade | Rec |

| Gold | (Mt) | (g/t Au) | (%) | (Mt) | (g/t Au) | (%) | (Mt) | (g/t Au) | (%) | (Mt) | (g/t Au) | (%) | ($/t) |

| Ҫӧpler Mine | 5.0 | 1.31 | 40 - 91 | 11.1 | 1.29 | 40 - 91 | 16.2 | 1.29 | 40 - 91 | 14.0 | 1.53 | 40 - 91 | 18.34 - 39.87 |

| Greater Çakmaktepe | 3.6 | 0.94 | 40 - 91 | 7.3 | 1.10 | 40 - 91 | 10.9 | 1.05 | 40 - 91 | 4.8 | 1.87 | 40 - 91 | 18.34 - 44.37 |

| Bayramdere | - | - | - | 0.1 | 2.36 | 75 | 0.1 | 2.36 | 75 | - | - | - | 18.34 |

| Total Gold | 8.6 | 1.15 | 40 - 91 | 18.6 | 1.22 | 40 - 91 | 27.2 | 1.20 | 40 - 91 | 18.9 | 1.61 | 40 - 91 | 18.34 - 44.37 |

| Silver | (Mt) | (g/t Ag) | (%) | (Mt) | (g/t Ag) | (%) | (Mt) | (g/t Ag) | (%) | (Mt) | (g/t Ag) | (%) | ($/t) |

| Ҫӧpler Mine | 5.0 | 3.33 | 0 - 38 | 11.1 | 3.38 | 0 - 38 | 16.2 | 3.36 | 0 - 38 | 14.0 | 4.92 | 0 - 38 | 18.34 - 39.87 |

| Greater Çakmaktepe | 3.6 | 3.75 | 0 - 20 | 7.3 | 2.56 | 0 - 20 | 10.9 | 2.95 | 0 - 20 | 4.8 | 2.26 | 0 - 20 | 18.34 - 44.37 |

| Bayramdere | - | - | - | 0.1 | 25.55 | 0 - 54 | 0.1 | 25.55 | 0 - 54 | - | - | - | 18.34 |

| Total Silver | 8.6 | 3.51 | 0 - 54 | 18.6 | 3.20 | 0 - 54 | 27.2 | 3.29 | 0 - 54 | 18.9 | 4.24 | 0 - 54 | 18.34 - 44.37 |

| Copper | (Mt) | (% Cu) | (%) | (Mt) | (% Cu) | (%) | (Mt) | (% Cu) | (%) | (Mt) | (% Cu) | (%) | ($/t) |

| Ҫӧpler Mine | 5.0 | 0.08 | 0 - 15 | 11.1 | 0.07 | 0 - 15 | 16.2 | 0.07 | 0 - 15 | 14.0 | 0.07 | 0 - 15 | 18.34 - 39.87 |

| Greater Çakmaktepe | 3.6 | 0.03 | 0 | 7.3 | 0.02 | 0 | 10.9 | 0.02 | 0 | 4.8 | 0.02 | 0 | 18.34 - 44.37 |

| Bayramdere | - | - | - | 0.1 | 0.00 | 1 | 0.1 | 0.00 | 1 | - | - | - | 18.34 |

| Total Copper | 8.6 | 0.06 | 0 - 15 | 18.6 | 0.05 | 0 - 15 | 27.2 | 0.05 | 0 - 15 | 18.9 | 0.06 | 0 - 15 | 18.34 - 44.37 |

Notes:

| 1. | The definitions for Mineral Resources in S-K 1300 were followed. |

| 2. | Mineral Resources are reported based on October 31, 2023 topography surface. |

| 3. | Mineral Resources are reported exclusive of Mineral Reserves. |

| 4. | The numbers reflect SSR attributed share of 80%. |

| 5. | Heap Leach Oxide is defined as material <2% total sulfur. |

| 6. | Grind Leach Oxide is defined as material <2% total sulfur. Processing route will be available approximately in 2027. |

| 7. | Sulfide is defined as material ≥2% total sulfur. |

| 8. | Heap leach oxide uses an NSR cut-off $18.34/t, grind leach oxide uses an NSR cut-off value $19.26/t, Çöpler sulfide ore uses a cut-off value of $39.87/t, Greater Çakmaktepe sulfide ore uses a cut-off value of $44.37/t . All cut-off values include allowances for royalty payable. |

| | 1-16 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| 9. | Metallurgical gold recovery for heap leach oxide and grind leach varies between 40–78% and 53–90%, respectively, based on lithology; metallurgical recovery for sulfide varies between 81–91% based on lithology. |

| 10. | Metallurgical silver recoveries for heap leach and grind leach oxide vary between 0 and 54% based on lithology. Metallurgical recovery for sulfide varies between 0 and 3%. |

| 11. | Metallurgical copper recoveries for heap leach and grind leach oxide vary between 0 and 15% based on lithology. Metallurgical recovery for sulfide is 0%. |

| 12. | Metal prices used to report the Mineral Resources are $1,750/oz Au, $22.00/oz Ag, and $3.95/lb Cu with allowances for payability, deductions, transport, and royalties. |

| 13. | The point of reference for Mineral Resources is the point of feed into the processing facility for grind leach and sulfide material; or for Heap Leach oxide, it is the Carbon columns. |

| 14. | All Mineral Resources estimates were constrained within conceptual pit shells to meet reasonable prospects for economic extraction criteria. |

| 15. | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| 16. | Totals may vary due to rounding. |

| | 1-17 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

| 1.3.6 | Mineral Reserve Estimates |

Mineral Reserve estimates as prepared by SSR, and reviewed and accepted by the SLR QP, have been classified in accordance with the definitions for Mineral Reserves in S-K 1300.

The Mineral Reserves were developed based on mine planning work completed in 2023 and estimated based on an October 31, 2023, topography surface. The total Mineral Reserve for the Çöpler Project is estimated to be approximately 67.4 Mt at an average grade of 2.32 g/t Au, totaling 5.1 Moz of contained gold, and SSR’s portion is 53.9 Mt at an average grade of 2.32 g/t Au, totaling 4.1 Moz of contained gold. SSR’s portion of the Mineral Reserves for both Çöpler and Greater Çakmaktepe is 80%.

Average oxide gold recoveries are 61% and average sulfide gold recoveries range from 81% to 91% for the Mineral Reserves.

The Mineral Reserve estimates have an effective date of October 31, 2023. SSR’s 80% attributable portion of the Mineral Reserves have been summarized by pit area and reserve classification category in Table 1-4.

| | 1-18 |  |

SSR Mining Inc. | Çöpler Property S-K 1300 Report | February 12, 2024 SLR Project No.: 138.21581.00006 |

Table 1-4: Summary of Mineral Reserves as of October 31, 2023 (SSR’s Attributable Share)

| | Proven | Probable | Total | Cut-off Value | Metallurgical Recovery |

| Tonnage | Grade | Tonnage | Grade | Tonnage | Grade | Contained Metal |

| Gold | (Mt) | (g/t Au) | (Mt) | (g/t Au) | (Mt) | (g/t Au) | (koz Au) | ($/t) | (%) |

| Çöpler | 5.7 | 2.03 | 10.3 | 1.77 | 16.1 | 1.86 | 962 | 21.32 - 45.58 | 40 - 91 |

| Greater Çakmaktepe | 7.3 | 2.42 | 20.2 | 2.79 | 27.5 | 2.69 | 2,383 | 21.32 - 45.58 | 40 - 91 |

| Stockpiles | - | - | 10.3 | 2.05 | 10.3 | 2.05 | 678 | 21.32 - 45.58 | 40 - 91 |

| Leach Pad Inventory | - | - | - | - | - | - | 49 | - | - |

| Total | 13.0 | 2.25 | 40.9 | 2.35 | 53.9 | 2.32 | 4,072 | 21.32 - 45.58 | 40 -91 |

| Silver | (Mt) | (g/t Ag) | (Mt) | (g/t Ag) | (Mt) | (g/t Ag) | (koz Ag) | ($/t) | (%) |

| Çöpler | 5.7 | 4.85 | 10.3 | 4.97 | 16.1 | 4.93 | 2,547 | 21.32 - 45.58 | 0 - 38 |

| Greater Çakmaktepe | 7.3 | 3.52 | 20.2 | 4.32 | 27.5 | 4.11 | 3,636 | 21.32 - 45.58 | 0 - 20 |

| Stockpiles | - | - | 10.3 | – | 10.3 | – | - | 21.32 - 45.58 | - |

| Total | 13.0 | 4.10 | 40.9 | 3.40 | 53.9 | 3.57 | 6,183 | 21.32 - 45.58 | 0 - 38 |

| Copper | (Mt) | (% Cu) | (Mt) | (% Cu) | (Mt) | (% Cu) | (Mlb Cu) | ($/t) | (%) |

| Çöpler | 5.7 | 0.06 | 10.3 | 0.05 | 16.1 | 0.05 | 18.8 | 21.32 - 45.58 | 0 - 15 |

| Greater Çakmaktepe | 7.3 | 0.02 | 20.2 | 0.01 | 27.5 | 0.01 | 8.7 | 21.32 - 45.58 | - |

| Stockpiles | - | - | 10.3 | – | 10.3 | – | - | 21.32 - 45.58 | - |

| Total | 13.0 | 0.04 | 40.9 | 0.02 | 53.9 | 0.00 | 27.5 | 21.32 - 45.58 | 0 - 15 |

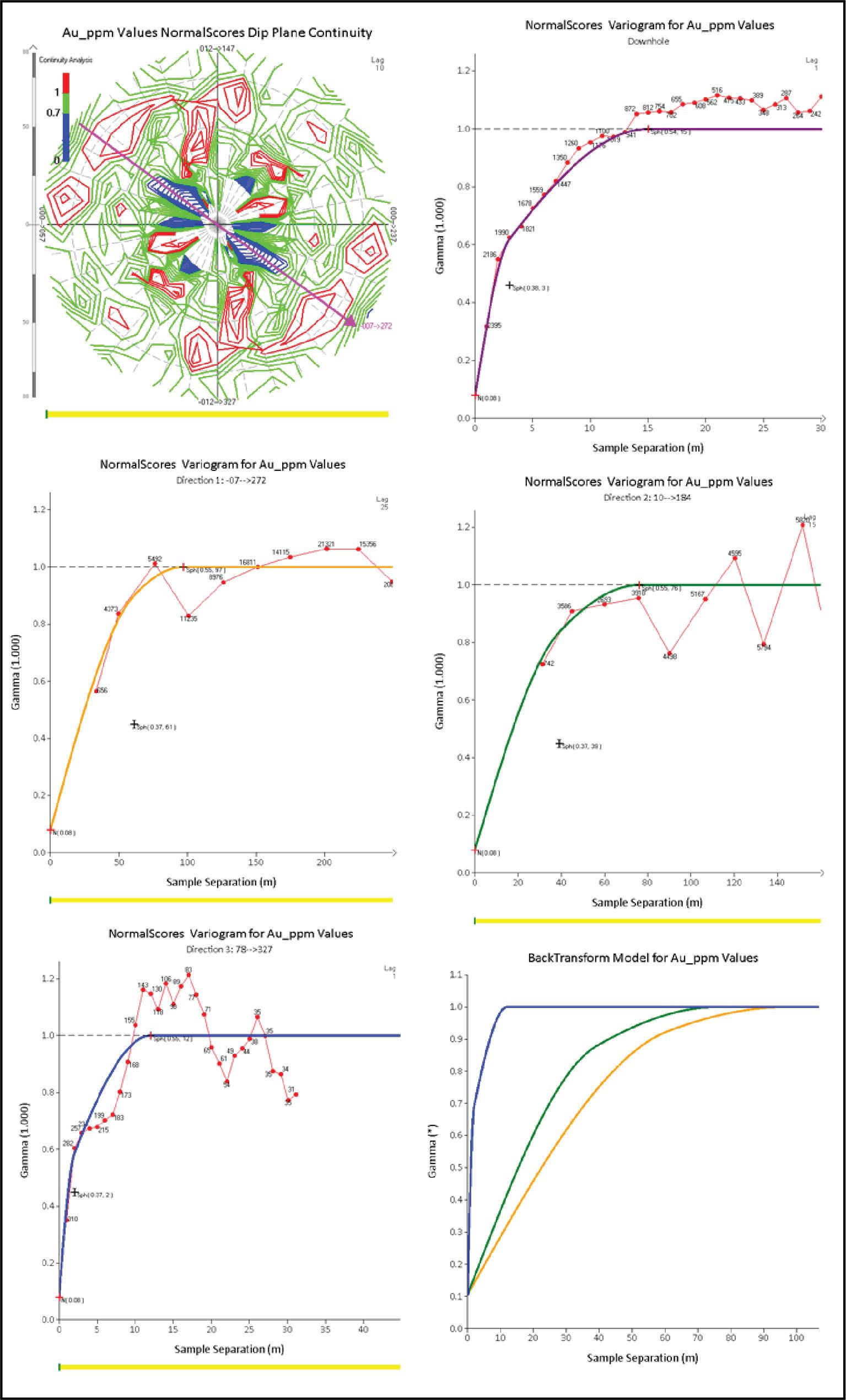

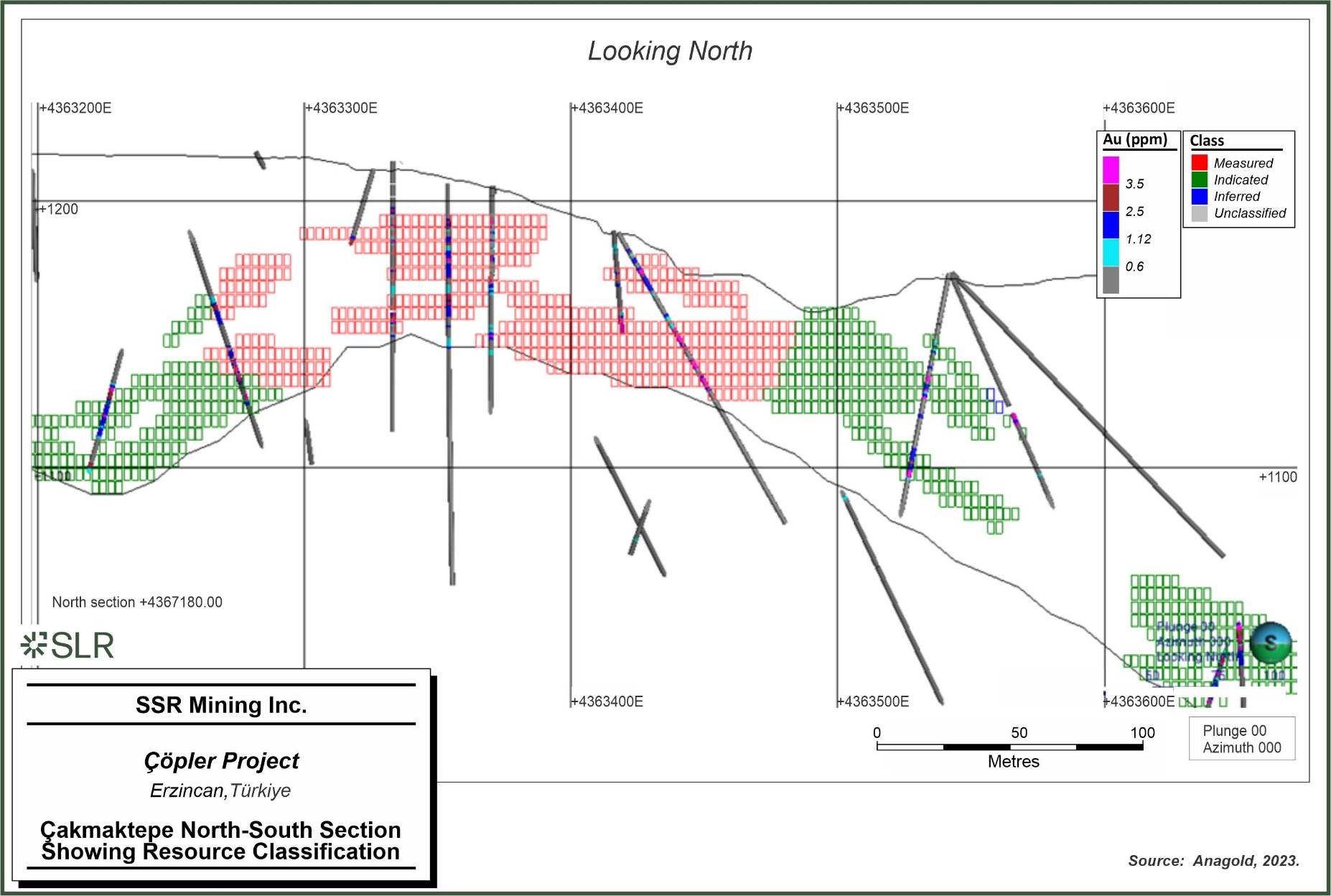

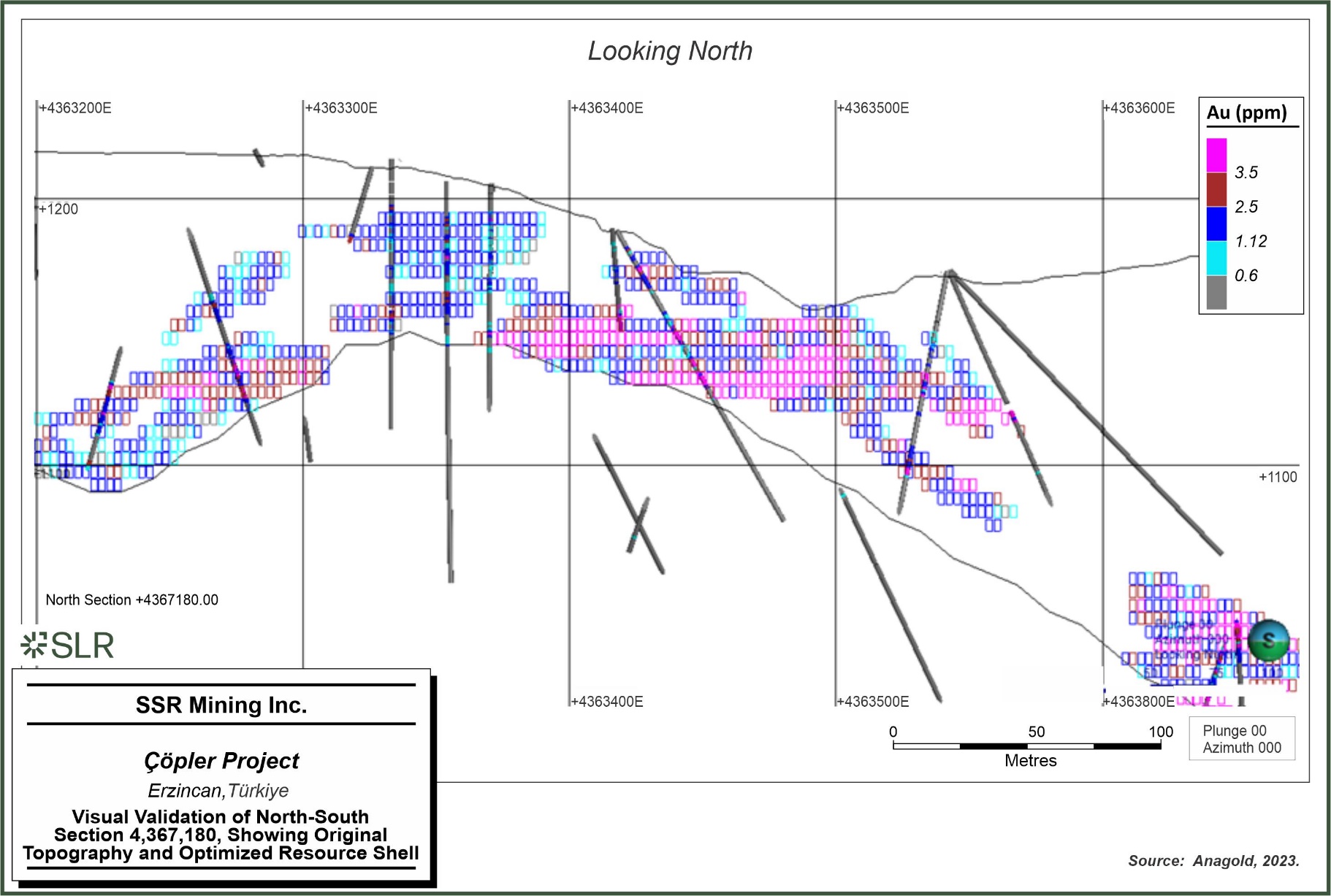

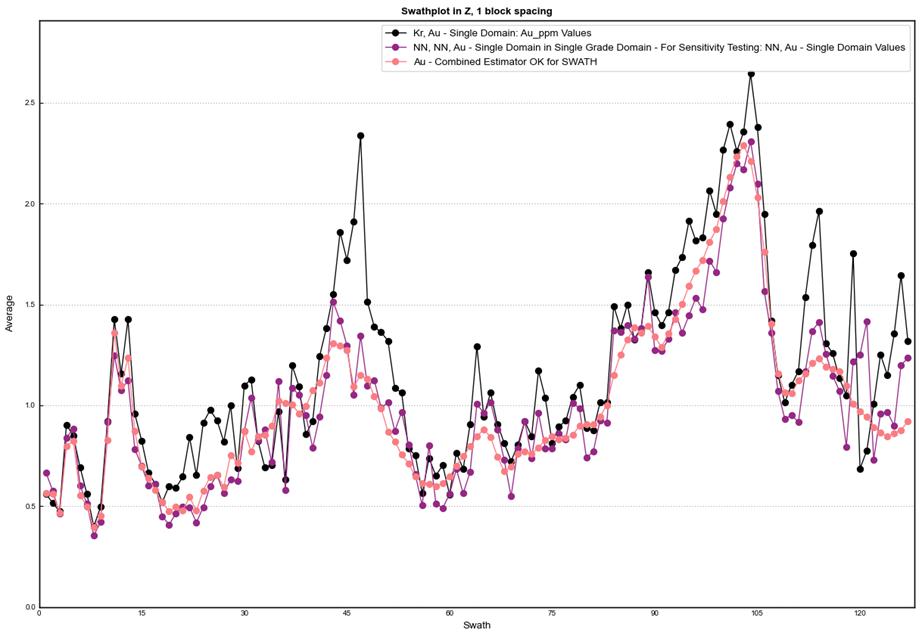

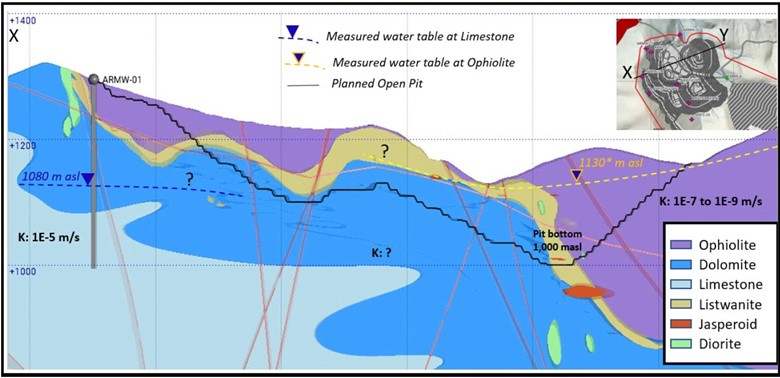

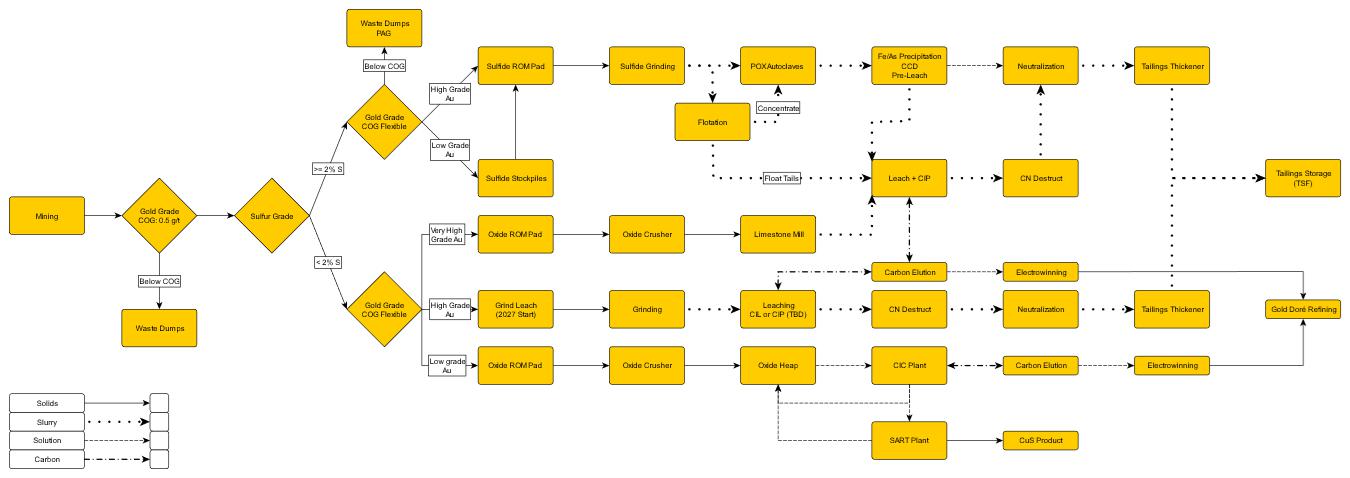

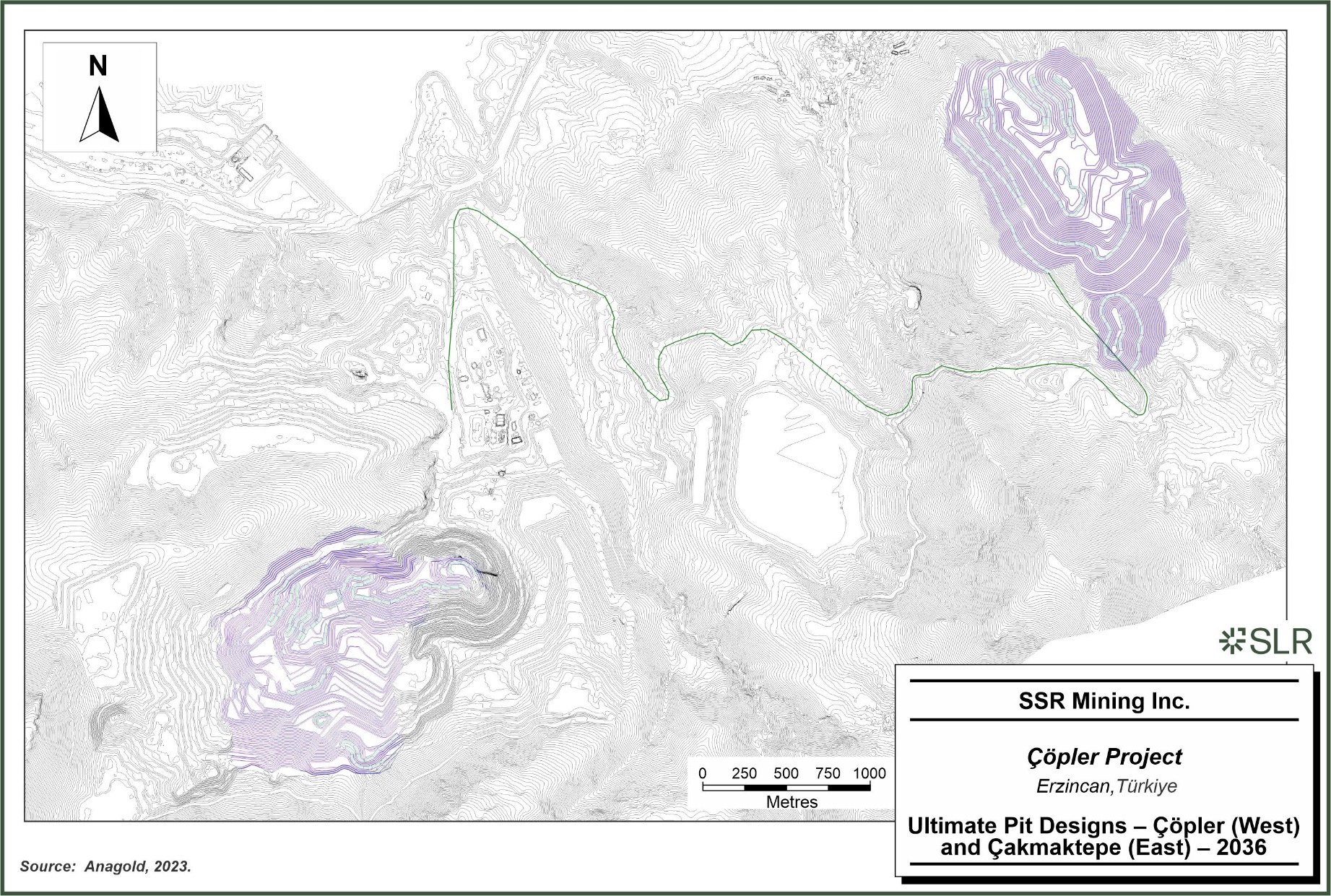

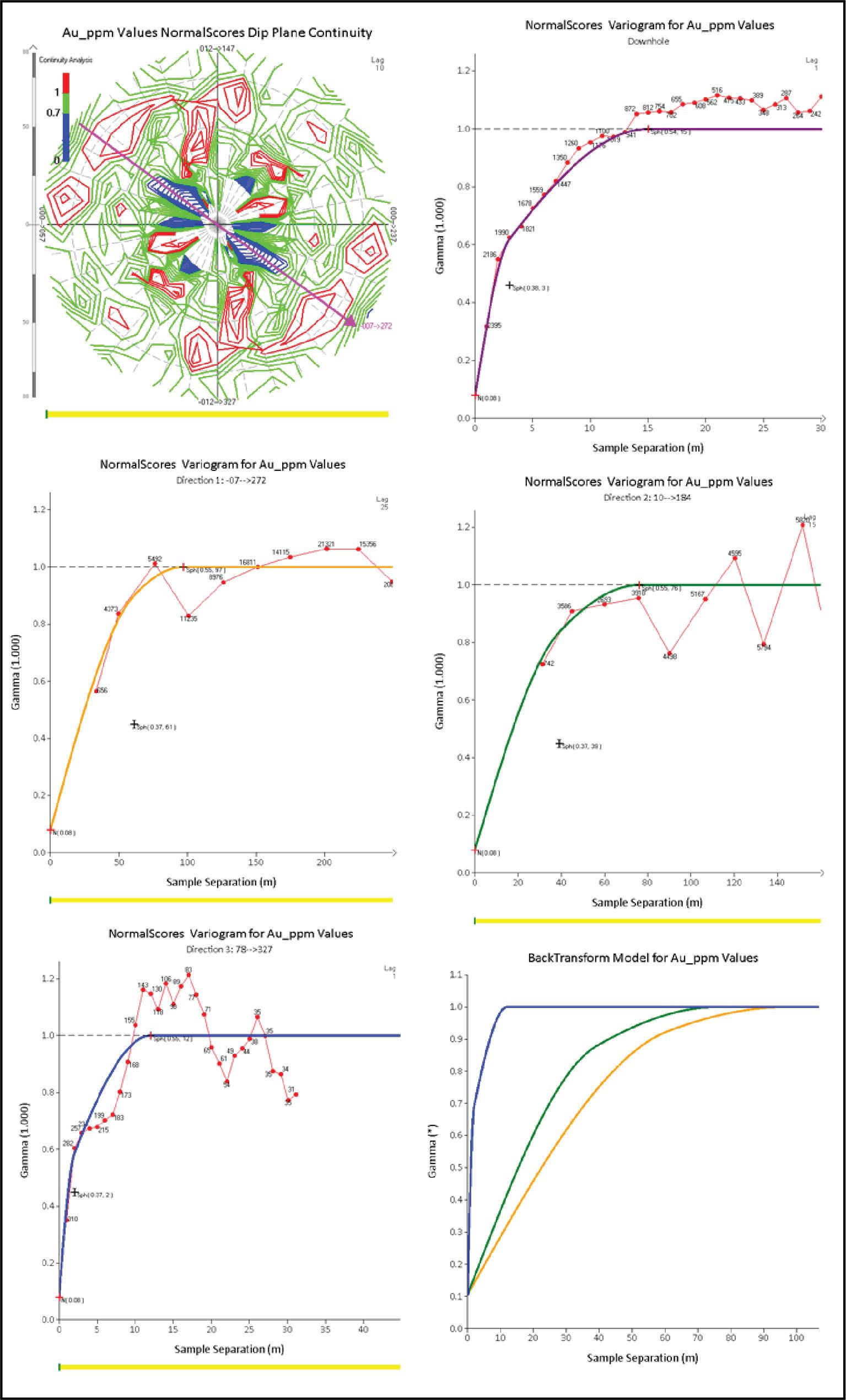

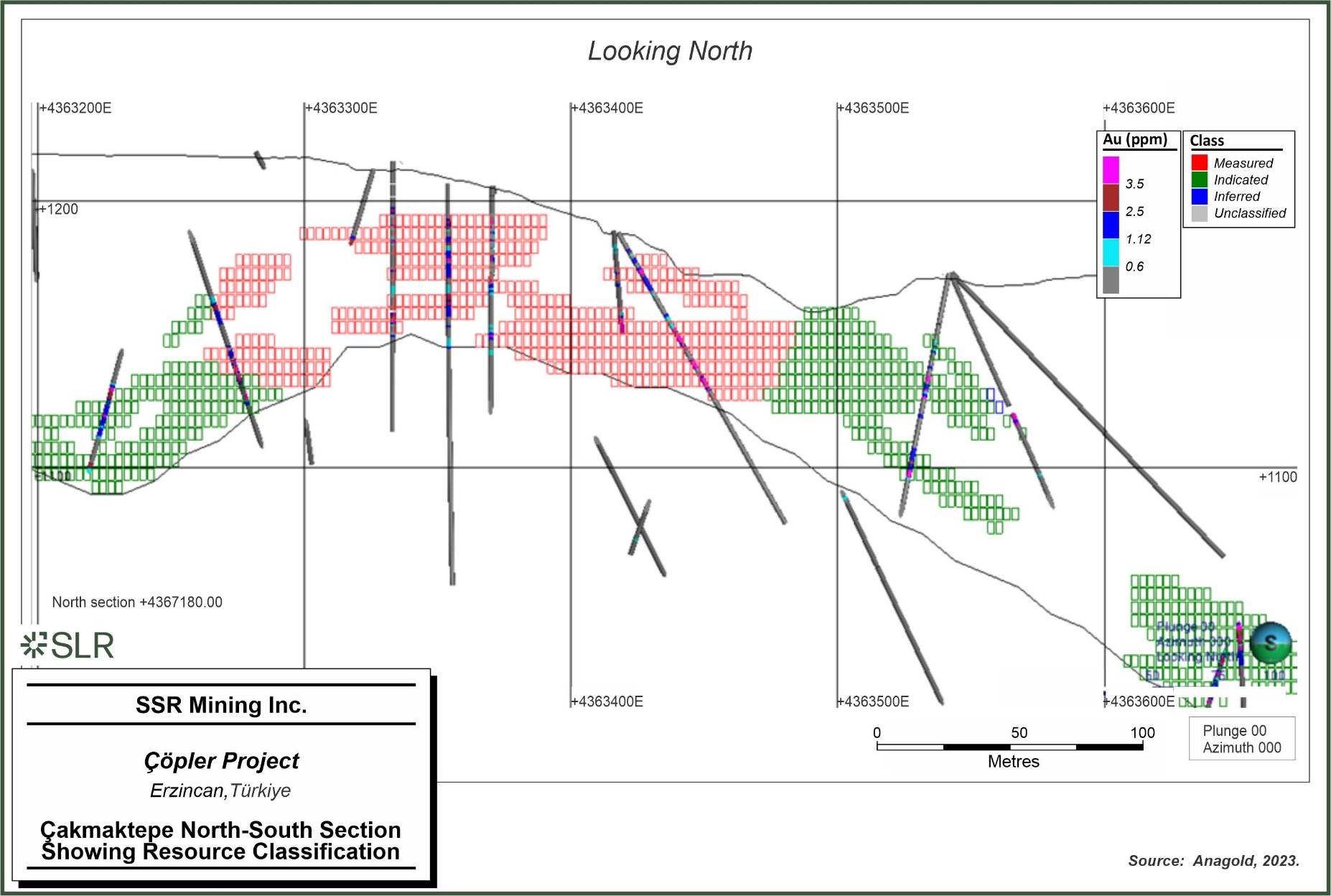

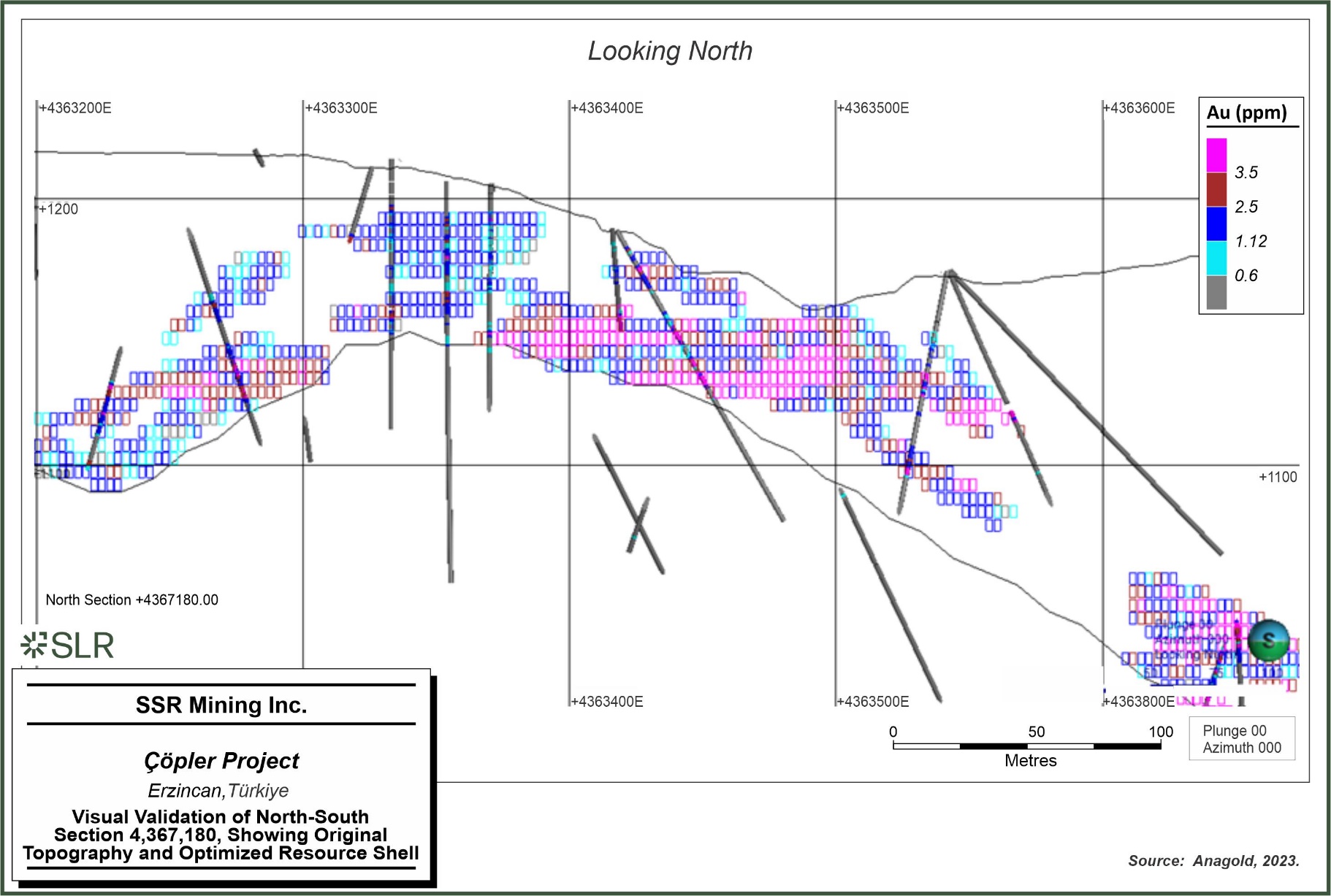

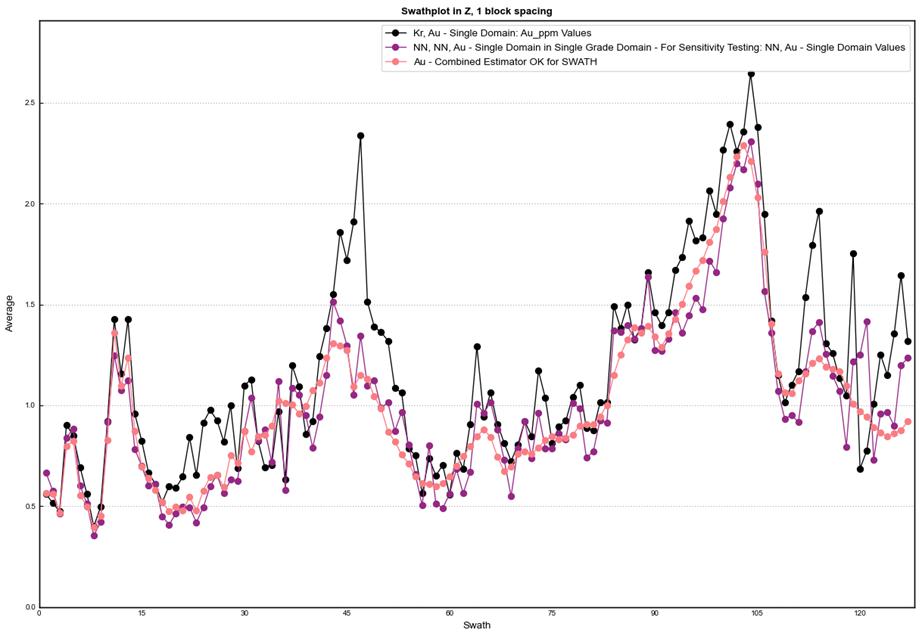

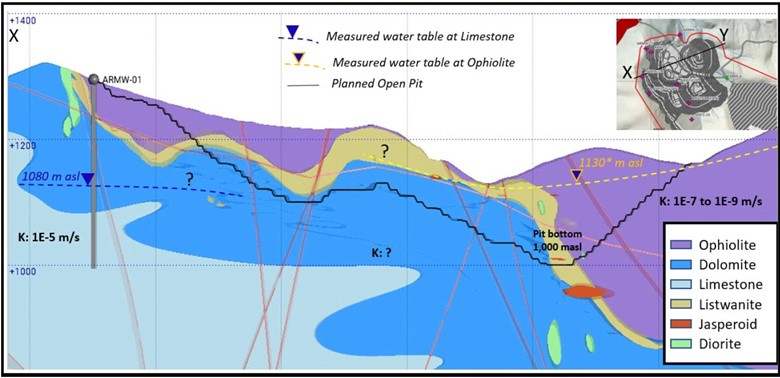

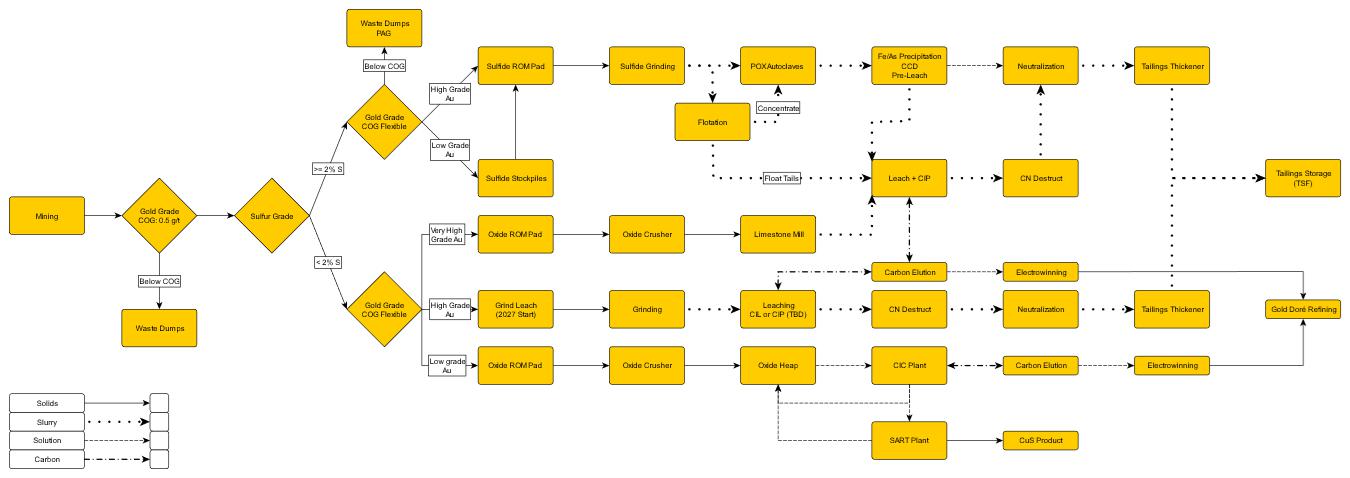

Notes: