EXHIBIT 99.1

ANNUAL INFORMATION FORM

of

SILVER STANDARD RESOURCES INC.

March 15, 2013

| | Page |

| | |

| 1 |

| 1 |

| 1 |

| 1 |

| 3 |

| 4 |

| 5 |

| 6 |

| 6 |

| 7 |

| 8 |

| 8 |

| 8 |

| 9 |

| 10 |

| 11 |

| 11 |

| 11 |

| Pirquitas Mine | 11 |

| 12 |

| 12 |

| 13 |

| 13 |

| 14 |

| 14 |

| 14 |

| 15 |

| 15 |

| 24 |

| 24 |

| 41 |

| 64 |

| 76 |

| 78 |

| 78 |

| 91 |

| 92 |

| 92 |

| 93 |

| 93 |

| 94 |

| 94 |

| 95 |

| 95 |

| 97 |

| 97 |

| 97 |

| 99 |

| 100 |

| 101 |

| 101 |

| 101 |

| 102 |

| 102 |

| 102 |

| 102 |

| 102 |

| 102 |

| 103 |

| 103 |

| 103 |

| 103 |

| 104 |

| 104 |

| 105 |

| A-1 |

LIST OF TABLES

| 19 |

| 22 |

| 29 |

| 32 |

| 32 |

| 37 |

| 37 |

| 43 |

| 44 |

| 48 |

| 56 |

| 61 |

| 61 |

| 71 |

| 71 |

| 74 |

| 74 |

LIST OF FIGURES

In this Annual Information Form, Silver Standard Resources Inc., together with its subsidiaries, as the context requires, is referred to as “we,” “our,” “us,” the “Company” and “Silver Standard”. All information contained in this Annual Information Form is as at December 31, 2012, unless otherwise stated, being the date of our most recently completed financial year, and the use of the present tense and of the words “is,” “are,” “current,” “currently,” “presently,” “now” and similar expressions in this Annual Information Form is to be construed as referring to information given as of that date.

This Annual Information Form herein contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of Canadian securities laws (collectively, “forward-looking statements”) concerning the anticipated developments in our operations in future periods, our planned exploration activities, the adequacy of our financial resources and other events or conditions that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Generally, forward-looking statements can be identified by the use of words or phrases such as “expects,” “anticipates,” “plans,” “projects,” “estimates,” “assumes,” “intends,” “strategy,” “goals,” “objectives,” “potential,” or variations thereof, or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved, or the negative of any of these terms or similar expressions. These forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied, including, without limitation, the following risks and uncertainties referred to under the heading “Risk Factors”:

| | — | uncertainty of production and cost estimates for the Pirquitas Mine, the Pitarrilla Project and the San Luis Project; |

| | — | future development risks, including start-up delays and operational issues; |

| | — | inability to replace Mineral Reserves; |

| | — | our ability to obtain adequate financing for further exploration and development programs; |

| | — | commodity price fluctuations; |

| | — | the possibility of future losses; |

| | — | general economic conditions; |

| | — | the recoverability of our interest in Pretium Resources Inc. (“Pretium”), including the price of and market for Pretium’s common shares; |

| | — | counterparty and market risks related to the sale of our concentrates; |

| | — | political instability and unexpected regulatory changes; |

| | — | potential export tax on silver concentrate production from the Pirquitas Mine; |

| | — | differences in U.S. and Canadian practices for reporting Mineral Reserves and Mineral Resources; |

| | — | uncertainty in the accuracy of Mineral Reserves and Mineral Resources estimates and in our ability to extract mineralization profitably; |

| | — | uncertainty in acquiring additional commercially mineable mineral rights; |

| | — | lack of suitable infrastructure or damage to existing infrastructure; |

| | — | our revenue being derived from a single operation; |

| | — | delays in obtaining or failure to obtain governmental permits, or non-compliance with permits we have obtained; |

| | — | increased costs and restrictions on operations due to compliance with environmental laws and regulations; |

| | — | reclamation requirements for our exploration properties; |

| | — | unpredictable risks and hazards related to the development and operation of a mine or mine property that are beyond our control; |

| | — | governmental regulations, including environmental regulations; |

| | — | non-compliance with anti-corruption laws; |

| | — | complying with emerging climate change regulations and the impact of climate change; |

| | — | uncertainties related to title to our mineral properties and the ability to obtain surface rights; |

| | — | civil disobedience in the countries where our properties are located; |

| | — | operational safety and security risks; |

| | — | actions required to be taken by us under human rights law; |

| | — | competition for mining services and equipment; |

| | — | competition in the mining industry for properties; |

| | — | competition for qualified personnel and management and potential labour unrest; |

| | — | shortage or poor quality of equipment or supplies; |

| | — | our ability to attract and retain qualified management to grow our business; |

| | — | compliance with the requirements of the Sarbanes-Oxley Act; |

| | — | our adoption of IFRIC 20 - Stripping Costs in the Production Phase of a Mine (“IFRIC 20”); |

| | — | tightened controls over the VAT collection process in Argentina; |

| | — | increased regulatory compliance costs related to the Dodd-Frank Act; |

| | — | conflicts of interest that could arise from some of our directors’ and officers’ involvement with other natural resource companies; |

| | — | claims and legal proceedings; |

| | — | potential difficulty in enforcing judgments or bringing actions against us or our directors or officers outside the United States; |

| | — | certain terms of our convertible notes; |

| | — | our policy of not paying cash dividends for the foreseeable future; and |

| | — | other risks related to our common shares. |

This list is not exhaustive of the factors that may affect any of our forward-looking statements. Our forward-looking statements are based on what management considers to be reasonable assumptions, beliefs, expectations and opinions based on information currently available to management. We cannot assure you that actual events, performance or results will be consistent with these forward-looking statements, and management’s assumptions may prove to be incorrect.

Assumptions have been made regarding, among other things, our ability to carry on our exploration and development activities, our ability to meet our obligations under our property agreements, the timing and results of drilling programs, the discovery of Mineral Resources and Mineral Reserves on our mineral properties, the timely receipt of required approvals and permits including obtaining the necessary surface rights for the lands required for successful project permitting, construction and operation of the Pitarrilla Project, the price of the minerals we produce, the costs of operating and exploration expenditures, our ability to operate in a safe, efficient and effective manner and our ability to obtain financing as and when required and on reasonable terms and our ability to continue operating the Pirquitas Mine. You are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Our forward-looking statements reflect current expectations regarding future events and operating performance and speak only as of the date hereof and we do not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change other than as required by applicable law. For the reasons set forth above, you should not place undue reliance on forward-looking statements.

The following table sets forth, for each period indicated, the high and low exchange rates for Canadian dollars expressed in U.S. dollars, the average of such exchange rates during such period, and the exchange rate at the end of such period. These rates are based on the Bank of Canada noon spot rate of exchange.

| | | Fiscal Year Ended December 31, | |

| | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

Rate at the end of period | | US$ | 0.9555 | | | US$ | 1.0054 | | | US$ | 0.9833 | | | US$ | 1.0051 | |

Average rate during period | | US$ | 0.8757 | | | US$ | 0.9709 | | | US$ | 1.0111 | | | US$ | 1.0004 | |

Highest rate during period | | US$ | 0.9716 | | | US$ | 1.0054 | | | US$ | 1.0583 | | | US$ | 1.0299 | |

Lowest rate during period | | US$ | 0.7692 | | | US$ | 0.9278 | | | US$ | 0.9430 | | | US$ | 0.9599 | |

On March 14, 2013, the noon spot rate of exchange was C$1.00 per US$0.9746.

The disclosure included in this Annual Information Form uses mineral reserves and mineral resources classification terms that comply with reporting standards in Canada and the mineral reserves and mineral resources estimates are made in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards adopted by the CIM Council on November 27, 2010, which were adopted by the Canadian Securities Administrators’ (the “CSA”) National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the CSA that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The following definitions are reproduced from the CIM Standards:

A Mineral Resource is a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

An Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

A Measured Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

A Mineral Reserve is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. Mineral Reserves are sub-divided in order of increasing confidence into Probable Mineral Reserves and Proven Mineral Reserves.

A Probable Mineral Reserve is the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

A Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

Unless otherwise indicated, all mineral reserves and mineral resources estimates included in this Annual Information Form have been prepared in accordance with NI 43-101. These standards differ significantly from the requirements of the SEC set out in Industry Guide 7. Consequently, mineral reserves and mineral resources information included in this

Annual Information Form is not comparable to similar information that would generally be disclosed by domestic U.S. reporting companies subject to the reporting and disclosure requirements of the SEC.

In particular, the SEC’s Industry Guide 7 applies different standards in order to classify mineralization as a reserve. As a result, the definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” used in NI 43-101 differ from the definitions in SEC Industry Guide 7. Under SEC standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC standards. Accordingly, Mineral Reserves estimates included in this Annual Information Form may not qualify as “reserves” under SEC standards.

In addition, this Annual Information Form use the terms “Mineral Resources,” “Measured Mineral Resources,” “Indicated Mineral Resources” and “Inferred Mineral Resources” to comply with the reporting standards in Canada. The SEC’s Industry Guide 7 does not recognize Mineral Resources and U.S. companies are generally not permitted to disclose resources in documents they file with the SEC. Furthermore, disclosure of “contained ounces” is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Investors are specifically cautioned not to assume that all or any part of the mineral deposits in these categories will ever be converted into SEC defined mineral reserves. Further, “Inferred Mineral Resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, investors are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists. In accordance with Canadian rules, estimates of “Inferred Mineral Resources” cannot form the basis of feasibility or pre-feasibility studies. It cannot be assumed that all or any part of “Mineral Resources,” “Measured Mineral Resources,” “Indicated Mineral Resources” or “Inferred Mineral Resources” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part of the “Mineral Resources,” “Measured Mineral Resources,” “Indicated Mineral Resources” or “Inferred Mineral Resources” reported in this Annual Information Form is economically or legally mineable. In addition, the definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” under reporting standards in Canada differ in certain respects from the standards of the SEC. For the above reasons, information included in this Annual Information Form that describes our Mineral Reserves and Mineral Resources estimates is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

The term “Qualified Person” as used in this Annual Information Form means a Qualified Person as that term is defined in NI 43-101.

This Annual Information Form includes certain terms or performance measures commonly used in the mining industry that are not defined under Canadian generally accepted accounting principles before the adoption of IFRS (“Canadian GAAP”) or International Financial Reporting Standards as issued by the International Accounting Standards Board and incorporated in the Handbook of the Canadian Institute of Chartered Accountants (“IFRS”), including cash costs and total costs per ounce of silver and adjusted net income (loss) per share. We believe that, in addition to conventional measures prepared in accordance with Canadian GAAP and IFRS, certain investors use this information to evaluate our performance. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with Canadian GAAP and IFRS. These non-GAAP and non-IFRS measures should be read in conjunction with our financial statements. See “Non-GAAP Financial Measures” in our management’s discussion and analysis for the year ended December 31, 2012 and “Changes to the Presentation of Non-GAAP Financial Measures” in our material change report, dated January 9, 2013.

We were incorporated as a company in British Columbia, Canada, on December 11, 1946 under the name “Silver Standard Mines, Limited (NPL)” and changed our name to “Silver Standard Mines Limited” on July 18, 1979. We changed our name to “Consolidated Silver Standard Mines Limited” and consolidated our common shares on a 1-for-5 basis on August 9, 1984. All share data in this Annual Information Form refer to consolidated shares/data, unless otherwise indicated. We changed our name to “Silver Standard Resources Inc.” on April 9, 1990. On May 12, 2005, our shareholders adopted new articles as required by the new British Columbia Business Corporations Act (the “BCBCA”), under which we are incorporated, and authorized an increase in our authorized capital from 100,000,000 common shares without par value to an unlimited number of common shares without par value.

Our head office and registered and records office is located at Suite 1400 – 999 West Hastings Street, Vancouver, British Columbia, V6C 2W2. Effective April 1, 2013, our head office and registered and records office will be located at Suite 800 – 1055 Dunsmuir Street, Vancouver, British Columbia, V7X 1G4.

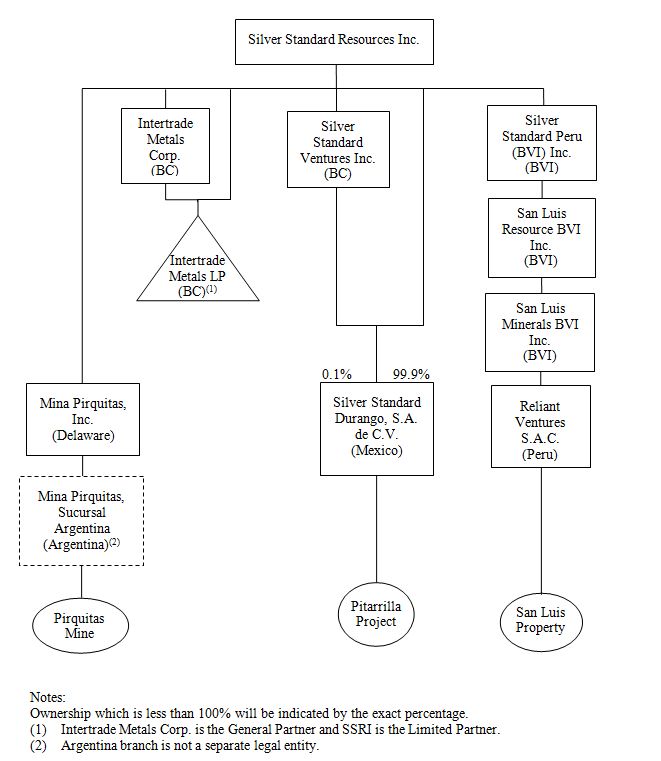

The following is a diagram of the intercorporate relationships among us and our material subsidiaries, each of which is wholly-owned by us.

We are a primary silver resource and production company that has one producing mine and a portfolio of silver resource dominant projects. Our properties are located in six countries in the Americas. We are focused on operating and producing silver from the Pirquitas Mine, which is located in the Province of Jujuy, Argentina, and on advancing the Pitarrilla Project in Durango State, Mexico as well as the San Luis Project in Ancash Department, Peru. In addition, we continue to advance our large portfolio of mineral projects and properties, which are at various stages of exploration and development. A number of these properties have silver mineral resources identified on them. We believe we hold one of the largest silver mineral reserves and silver mineral resources positions of any publicly traded silver company.

On January 8, 2013, we announced our production and cost guidance for 2013. We expect to produce and sell in 2013 between 8.2 and 8.5 million ounces of silver from the Pirquitas Mine, with cash costs of between $17.00 and $18.50 per ounce of silver. In addition, in 2013 the Pirquitas Mine is expected to produce over 20 million pounds of zinc. In 2013, we plan to spend approximately $15 million on exploration, with $7 million budgeted for exploration at our Mexican projects and the balance mainly budgeted for projects in Argentina and Peru. Capital expenditures are expected to be $25 million at the Pirquitas Mine in 2013, including approximately $15 million for a tailings facility expansion but excluding capitalized stripping costs. We expect to spend a minimum of $17 million on development in 2013, with approximately $8 million and $7 million budgeted for the Pitarrilla and San Luis projects, respectively, in line with our goal of advancing these projects to construction decisions. Planned investments in advance of construction decisions include optimization, land acquisition, community agreements, permitting and financing. Should construction decisions be made, we would expect development expenditures to increase significantly.

On January 16, 2013, we completed an offering of $250 million aggregate principal amount of 2.875% convertible senior notes due in 2033 (the “Initial 2013 Notes”). We closed an additional $15 million aggregate principal amount of 2.875% convertible senior notes due 2033 (together with the Initial 2013 Notes, the “2013 Notes”) on February 13, 2013 pursuant to the partial exercise of the over-allotment option granted to the purchasers of the Initial 2013 Notes. The initial conversion rate for the 2013 Notes is 50 common shares per $1,000 principal amount of the 2013 Notes, equivalent to a conversion price of $20.00 per common share, and is subject to adjustment. We used $138 million of the net proceeds from the sale of the 2013 Notes to repurchase our existing convertible notes on March 1, 2013 and the indenture relating to those notes was discharged on March 15, 2013. The remaining net proceeds will be used for general corporate purposes, which may include developing or advancing our property portfolio.

During the first half of 2012, we received aggregate cash proceeds of approximately C$71 million upon the exercise of share purchase warrants of Pretium Resources Inc. (“Pretium”) issued as part of the secondary offering of 11.5 million units of Pretium that closed in April 2011. Upon completion of the exercise of the warrants, our equity interest in Pretium was reduced to approximately 20%.

The Pirquitas Mine produced 8.6 million ounces of silver and 11.2 million pounds of zinc in 2012, which exceeded silver production guidance and was in line with zinc production guidance for the year. The mine produced silver at a cash cost of $19.14 per payable ounce sold. Also in 2012, we completed approximately 53,000 metres of drilling at the Pirquitas Mine. The majority of the planned drilling was designed to expand and better define the Cortaderas Breccia and Cortaderas Valley Mineral Resources and upgrade portions of these Mineral Resources from the Inferred Mineral Resource to the Indicated Mineral Resource category.

We completed long-term silver concentrate contracts in 2012. The sales contracts cover planned production from the Pirquitas Mine through 2013, and enabled us to sell down our silver concentrate inventory balance through the second half of 2012.

In 2012, the regulatory environment in Argentina was challenging. In early 2012, the Argentine Ministry of Economy and Public Finance issued a resolution that reduced the time permitted to repatriate export proceeds from

180 days to 15 days, which caused the Pirquitas Mine to temporarily suspend shipments while we assessed the potential impact of this resolution. Subsequently, the time permitted to repatriate export proceeds was increased to 30 days and then to 140 days for silver and zinc concentrates, which enabled us to recommence shipping. In September 2012, a revised resolution reinstated the 180 day time limit for silver concentrates only. Further, the Argentine Central Bank increased its involvement in U.S. dollar inflows and outflows, and the country continued to experience high inflation along with a weakening currency.

In December 2012, the Federal Court of Appeal (Salta) upheld an injunction granted in our favour by the Federal Court (Jujuy) effective September 29, 2010, which prohibited the Federal Government of Argentina from withholding the 10% export duty imposed upon us by the National Customs Authority of Argentina (Dirección Nacional de Aduanas or “DNA”) in December 2007. However, the Federal Government has sought permission from the Federal Court of Appeal (Salta) to appeal this decision to the Federal Supreme Court of Argentina. See “Foreign Operations – Argentina – Regulatory – Export Controls and Duties”.

On September 10, 2012, the Peruvian government approved the environmental impact assessment (“EIA”) for the mining operation of the Ayelén deposit, completing a significant milestone for the San Luis Project. Long-term land access negotiations are continuing with one of the two local communities that control the rights to surface lands on which the future mine would be located. An agreement with the other community was completed in late 2011. With the EIA approved, completion of the final land access agreement would enable permit applications to be submitted and, once received, a development decision to be made. We may initiate applications with the Peruvian Government in respect of a financial stability agreement in accordance with the Peruvian General Mining Law. See “Foreign Operations – Peru – Regulatory – Stability Agreements”.

In a news release dated December 4, 2012, we announced the results of a feasibility study for the Pitarrilla Project. On December 17, 2012, we filed a technical report entitled “NI 43-101 Technical Report on the Pitarrilla Project, Durango State, Mexico” (the “2012 Pitarrilla Technical Report”) in support of the feasibility study. The 2012 Pitarrilla Technical Report estimates that the Pitarrilla Project will produce 333 million ounces of silver, 582 million pounds of lead and 1,669 million pounds of zinc over a 32 year project life, making the Pitarrilla Project one of the world’s largest undeveloped silver mining projects. Annual silver production is expected to peak at 26 million ounces and average approximately 15 million ounces per year during the first 18 years of production.

In connection with the 2012 Pitarrilla Technical Report, we prepared updated estimates of the Pitarrilla Project’s Mineral Reserves and Mineral Resources. As of December 4, 2012, the deposit is estimated to comprise Probable Mineral Reserves of 157 million tonnes containing 479 million ounces of silver, 1,014 million pounds of lead and 2,722 million pounds of zinc, and Measured and Indicated Mineral Resources (inclusive of Mineral Reserves) of 260 million tonnes containing 695 million ounces of silver, 1,815 million pounds of lead and 4,146 million pounds of zinc, all at a 30 grams per tonne silver cut-off. The updated Mineral Reserves for the Pitarrilla Project represent an increase of approximately 422% from the Mineral Reserves estimate for the project that was reported on September 21, 2009 in a technical report entitled “NI 43-101 Technical Report – Pitarrilla Property Pre-feasibility Study”.

On April 8, 2011, we completed a secondary offering of 11.5 million units of Pretium at a price of C$10.00 per unit for gross proceeds of C$115 million. Each unit consisted of one common share of Pretium owned by us and one-half of one common share purchase warrant of Pretium, with each whole warrant exercisable to purchase one common share of Pretium owned by us at a price of C$12.50 per share for a period of 12 months following the closing. The offering reduced our equity interest in Pretium from 42.3% to approximately 28.9%.

On June 30, 2011, we entered into a share and asset purchase agreement with Esperanza Resources Corp. (“Esperanza”), Esperanza Silver Peru S.A.C. and Reliant Ventures S.A.C. (“Reliant Ventures”), as amended July 28, 2011, pursuant to which we purchased all of Esperanza’s remaining interest in the San Luis Project for C$18 million in cash, the transfer to Esperanza of the 6,459,600 common shares in Esperanza that we owned and the grant of a royalty equal to 1% of net smelter returns on future production from the project. The transaction closed on July 28, 2011 and, accordingly, we own 100% of the San Luis Project subject to the 1% net smelter returns royalty granted to Esperanza.

On September 23, 2011, we completed the sale of the Bowdens Project. The sale was effected pursuant to a share purchase agreement dated August 1, 2011 among Kingsgate Consolidated Limited (“Kingsgate”), Silver Standard and Silver Standard Australia (BVI) Inc., our wholly owned subsidiary, pursuant to which we sold to Kingsgate all of the shares of Silver Standard Australia Pty Limited (which holds the Bowdens Project) for A$35 million in cash, 3,440,367 of Kingsgate’s common shares, with an aggregate value of A$30 million as of the closing date and two deferred cash payments of A$5 million due on December 31, 2011 and June 30, 2012 (both of which were subsequently received).

In October 2011, the Federal Government of Argentina announced a decree that required all funds from mining export sales to be repatriated to Argentina and converted into Argentine pesos within the Sole Foreign Exchange Market in Argentina. Each transfer is subject to a 0.6% transfer tax. See “Foreign Operations – Argentina – Regulatory – Export Controls and Duties”.

In the second half of 2011, the plant at the Pirquitas Mine underwent significant repairs, as additional crushing capacity was installed and the ball mill gearbox was replaced. At several times throughout the year, the plant was offline for repair and maintenance.

On November 9, 2011, we announced a reduction to the estimated Mineral Reserves at Pirquitas and filed a NI 43-101 Technical Report dated December 23, 2011 entitled “NI 43-101 Technical Report on the Pirquitas Mine, Jujuy Province, Argentina” (the “2011 Pirquitas Technical Report”) on SEDAR. The reduction to the estimated Mineral Reserve at Pirquitas resulted in a reduction to the expected mine life.

In June 2010, we completed a NI 43-101 technical report summarizing our feasibility study on the Ayelén Vein, entitled “Technical Report for the San Luis Project Feasibility Study, Ancash Department, Peru” and dated effective June 4, 2010 (the “San Luis Feasibility Study”) and our interest in the project increased from 55% to 70% pursuant to the terms of the joint venture agreement dated September 6, 2005 with Esperanza.

In December 2010, we completed the sale of our 100% interest in the Snowfield Project and the Brucejack Project located in northern British Columbia, Canada to Pretium, a newly formed company that completed its initial public offering concurrently with the closing of the sale, for $211.3 million in gross cash proceeds, 32,537,833 common shares in Pretium, and a non-interest bearing convertible promissory note issued by Pretium in the principal amount of $39.1 million. Pretium subsequently repaid $18 million of the note, with the balance automatically converting into 3,625,500 common shares of Pretium.

Our business is the exploration, development and production of silver-dominant mineral properties, which are located in six countries in the Americas. Our strategic focus is to generate cash flow through optimizing commercial production at the Pirquitas Mine and by advancing the Pitarrilla Project, the San Luis Project and our other projects within our project pipeline towards development and commercial production. In addition, from time to time, we may monetize certain of our non-core assets to accelerate the advancement of more strategically significant properties, as we did when we sold the Bowdens Project to Kingsgate in 2011 and the Snowfield and Brucejack Projects to Pretium in late 2010. Further, we will consider strategic opportunities to grow through targeted acquisitions and we believe that our strong balance sheet (including a retained ownership of approximately 19.7% of Pretium’s issued and outstanding shares as at the date of this Annual Information Form) positions us well to execute on such opportunities. In addition to our Pirquitas Mine, the Pitarrilla Project and the San Luis Project, we also own a large portfolio of mineral projects with estimated silver mineral resources, which includes the Diablillos Project in Argentina, the Berenguela Project in Peru, the Challacollo Project in Chile, the Candelaria Project and Maverick Springs Projects in Nevada, U.S.A., the San Agustin Project in Mexico and the Sunrise Lake Project in the Northwest Territories, Canada. In addition to the projects noted above, we have a number of other mineral property holdings at various stages of exploration, with the majority of these existing in Mexico and Canada.

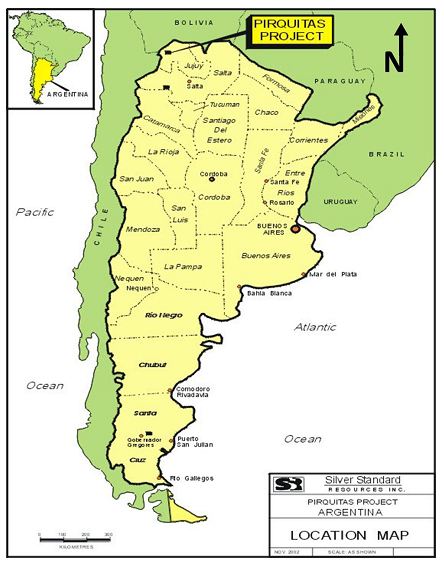

The Pirquitas Mine is a wholly-owned open-pit mine and processing plant that is exploiting a primary silver deposit located in northwestern Argentina near the borders of Bolivia and Chile. The project is held by our wholly-owned subsidiary, Mina Pirquitas, Inc. (“MPI”) (formerly known as Sunshine Argentina, Inc.) and consists of 50 semi-contiguous mineral exploration concessions covering a total area of 3,621 hectares.

As of December 31, 2012, the Pirquitas Mine is estimated to have Proven and Probable Mineral Reserves containing 80.0 million ounces of silver, based on a silver price of US$25.00 per ounce. The 2011 Pirquitas Technical Report estimates daily mine production of a maximum 50,000 tonnes per day of ore and waste and an annual production of approximately 8 to 10 million ounces of silver with the current pit design. Mine sustaining capital expenditures during the life of the mine are estimated to be $142.7 million. A copy of the 2011 Pirquitas Technical Report is available under our profile on SEDAR at www.sedar.com.

The Pirquitas Mine has been in commercial production since December 1, 2009, producing 6.3 million ounces of silver in 2010, 7.1 million ounces of silver and 10.1 million pounds of zinc in 2011 and 8.6 million ounces of silver and 11.2 million pounds of zinc in 2012. The current mine plan has the mine ending in early 2019 (6.25 years mine life – formerly 5.5 years in the 2011 Pirquitas Technical Report). During the mine life a long term low grade stockpile will be developed and this will be used as needed during the mine life, but will constitute the majority of the plant feed source in 2019 and all of the feed source in 2020. Annual production is expected to remain in a range of 8 to 10 million ounces of silver from 2013 to 2018 and plant production in 2019 and 2020 is expected to amount to around 4 million ounces of silver per year.

The Pirquitas Mine is located in an historic mining district and is accessible by public roads from two directions. The mine’s energy requirements are supplied by gas-powered generation utilizing natural gas supplied from a line located approximately 40 kilometres to the south of the property. The Pirquitas Mine site is located approximately 850 kilometres by road from the port of Antofagasta in Chile and approximately 2,000 kilometres by road from the port of Buenos Aires in Argentina.

As part of our search for additional Mineral Resources, in 2012 we completed approximately 53,000 metres of diamond drilling on the Pirquitas Mine property. This drilling campaign was principally designed to expand and better define the Cortaderas Breccia and Cortaderas Valley Mineral Resources (each as defined in the 2011 Pirquitas Technical Report), located approximately 500 metres north of the San Miguel open pit, and upgrade portions of these Mineral Resources from the Inferred Mineral Resource category to the Indicated Mineral Resource category.

Based on the results of the drilling, these areas were merged into a single Cortaderas zone for Mineral Resources estimation. The Mineral Resources estimated for Cortaderas as of December 31, 2012 comprise 3.6 million tonnes totalling 15.6 million ounces of silver and 403 million pounds of zinc in the Indicated category and 2.7 million tonnes totalling 14.1 million ounces of silver and 326 million pounds of zinc in the Inferred category, all reported above a 50 grams per tonne silver cut-off.

We currently have all material surface and water rights, as well as all material permits, necessary for the continued operation of the Pirquitas Mine. As the production of the Pirquitas Mine continues, we may need to obtain additional environmental and other governmental approvals and permits. See “Risk Factors” and “Mineral Properties – Pirquitas Mine”.

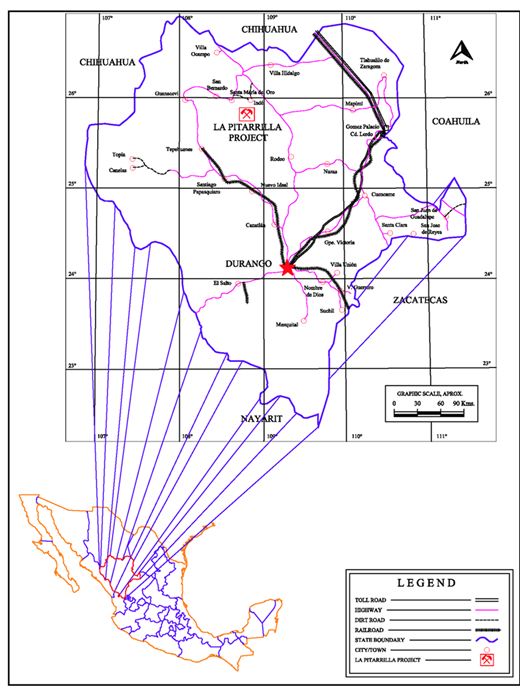

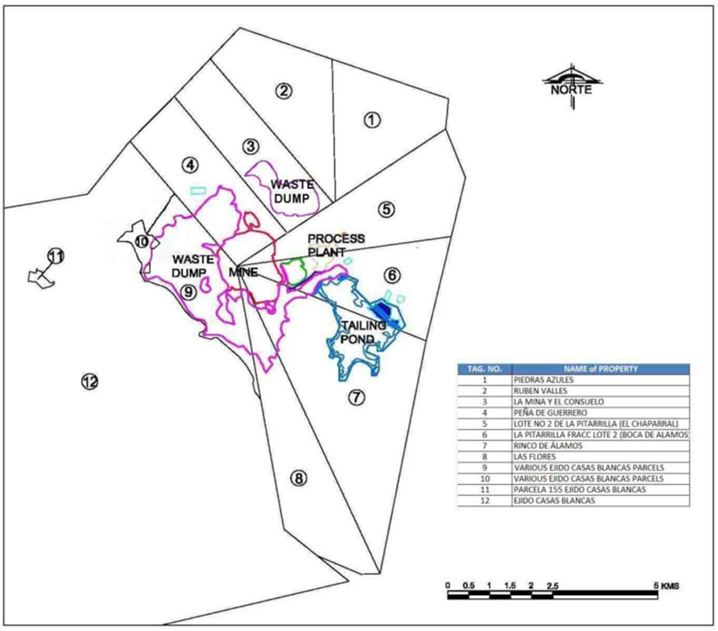

The Pitarrilla Project is a wholly-owned silver project in the northern part of the State of Durango, Mexico. It can be accessed from several all-weather roads. The project is held by our wholly-owned subsidiary, Silver Standard Durango S.A. de C.V. (“SSD”) and comprises 12 contiguous mineral claims covering an area of 136,192 hectares.

On December 17, 2012, we filed the 2012 Pitarrilla Technical Report in accordance with the requirements of NI 43-101 and in support of a feasibility study for the Pitarrilla Project. A copy of the 2012 Pitarrilla Technical Report is available under our profile on SEDAR at www.sedar.com. The 2012 Pitarrilla Technical Report estimates that the Pitarrilla Project will produce 333 million ounces of silver, 582 million pounds of lead and 1,669 million pounds of zinc over a 32 year project life, making the Pitarrilla Project one of the world’s largest undeveloped silver mining projects, with silver production expected to peak at 26 million ounces per year and average approximately 15 million ounces per year during the first 18 years of production. The 2012 Pitarrilla Technical Report estimates that total construction capital for the project is $715 million, including a contingency of $82 million, with total pre-production capital of $741 million, including $131 million of pre-operating revenue. Sustaining capital for the project is estimated to be $404 million, including a $25 million contingency.

In connection with the 2012 Pitarrilla Technical Report, we prepared updated estimates of the Pitarrilla Project’s Mineral Reserves and Mineral Resources. As of December 4, 2012, the deposit is estimated to comprise Probable Mineral Reserves of 156.6 million tonnes containing 478.7 million ounces of silver, 1,013.5 million pounds of lead and 2,721.5 million pounds of zinc and Measured and Indicated Mineral Resources (inclusive of Mineral Reserves) of 260.3 million tonnes containing 695 million ounces of silver, 1,815 million pounds of lead and 4,146 million pounds of zinc at a 30 grams per tonne silver cut-off.

We are actively engaged in obtaining the remaining surface rights required for the permitting, construction and operation of the Pitarrilla Project. As of the date of this Annual Information Form, the surface rights for five tracts of land at the Pitarrilla Project are still required. We plan to submit all outstanding permit applications, and expect to receive all permit approvals, by the end of 2013 upon receipt of clear title to, or access agreements in respect of, all required land. Financing must be secured before the project can be constructed. We intend to utilize the feasibility study as the basis for further discussions with financial institutions and potential partners. At the same time, we will continue to optimize the project through continued engineering design and process development work. Critical infrastructure for the project, including upgrade and maintenance of access roads, a communications system and ground water resources, are expected to be developed during 2013. See “Risk Factors” and “Mineral Properties – Pitarrilla Project”.

The San Luis Project is a wholly-owned high-grade gold-silver project located in the Ancash Department of central Peru, approximately 25 kilometres northwest of Barrick Gold Corporation’s Pierina gold mine. It can be accessed by two all-weather roads. On July 28, 2011, we completed the acquisition of the remaining 30% interest in the San Luis Project from Esperanza, our former joint venture partner. The project is held by our wholly-owned subsidiary, Reliant Ventures, and consists of 43 mineral concessions covering an area of 35,538 hectares.

The Ayelén Vein gold-silver deposit is an epithermal quartz vein deposit sub-class of precious metal deposits. Such quartz vein systems are characterized by their relatively high concentrations of gold and silver with low

concentrations of base metal-rich sulphide minerals. In June 2010, we completed the San Luis Feasibility Study for the development of the San Luis Project, and on September 10, 2012, the Peruvian Ministry of Mines and Energy approved our EIA for the mining operation on the Ayelén Vein.

Long-term land access negotiations are continuing with one of the two local communities that control the rights to surface lands on which the future mine would be located. An agreement with the other community was completed in late 2011. With the EIA approved, completion of the final land access agreement will enable permit applications to be submitted and a development decision to be made.

The San Luis Project comprises Proven and Probable Mineral Reserves of approximately 0.5 million tonnes, containing 7.2 million ounces of silver and 0.29 million ounces of gold within the Ayelén Vein. Other identified veins on the 35,000 hectare property require further exploration. A copy of the San Luis Feasibility Study is available under our profile on SEDAR at www.sedar.com.

During the third quarter of 2012, we received approval for an exploration EIA allowing for an exploration drilling campaign at the BP Zone, a high-potential porphyry copper target, located about 4.5 kilometres southeast of the Ayelén Vein. This target is located in an area where land access for exploration activities has been previously granted by the local community. We plan to commence our 2,500 metre drill campaign once we have received all permits and necessary approvals. See “Mineral Properties – San Luis Project”.

In addition to our three principal projects, we hold interests in a number of other properties that are geographically broadly distributed and at various stages of exploration. With the exception of the Maverick Springs Project in Nevada, USA, in which we hold a 55% interest through a joint venture, all of the properties described immediately below are wholly-owned.

We own the Diablillos Project (a silver-gold project) in northwestern Argentina, located approximately 275 kilometres south of the Pirquitas Mine, the San Agustin Project (a silver-gold project) in Durango State, Mexico, the Berenguela Project (a silver project) in Puno Department, Peru, the Challacollo Project (a silver project) in Region 1, Chile, the Candelaria Project (a former operating silver-gold mine) in Nevada, U.S.A., the Maverick Springs Project (a silver project) in Nevada, U.S.A., the Sunrise Lake Project (a polymetallic project) in the Northwest Territories, Canada, the Veta Colorada Project (a silver project) in Chihuahua State, Mexico and the San Marcial Project (a silver-lead-zinc project) located near Mazatlan, Mexico.

We also own a number of other mineral property holdings in Argentina, Canada, Chile, Mexico and the United States.

Our principal product is silver concentrate, although we also produce and sell zinc concentrate. From initial production until the middle of 2011, we sold our silver and zinc concentrates to a single trading counterparty. In the second half of 2011, we commenced marketing discussions with several third party smelters, refiners, and traders for the sale of our silver concentrate. We completed four long-term and multiple spot sale contracts in 2012 directly with smelting and refining counterparties to diversify our customer base. In the future, the loss of any one smelting and refining client may have a material adverse effect on us if alternate smelters and refiners are not available, although we believe there is sufficient global capacity available to address the loss of any one customer.

Currently, all of our silver and zinc is produced at the Pirquitas Mine.

Our revenue by product category for the financial years ended December 31, 2011 and December 31, 2012 was as follows:

| Product Revenue | 2011 | 2012 |

Silver | 94% | 98% |

Zinc | 6% | 2% |

Additional information related to our segmented information is set forth in Note 21 to our consolidated financial statements for the year ended December 31, 2012 and is referred to in our management’s discussion and analysis for the year ended December 31, 2012 under the heading “Summarized Annual Financial Results”.

Various aspects of our business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, engineering, drilling, metallurgy, permitting, logistical planning and implementation of exploration programs as well as legal compliance, finance and accounting. We face competition for qualified personnel with these specialized skills and knowledge, including at the Pirquitas Mine, which may increase our costs of operating the mine or result in delays.

The precious and base mineral exploration and mining business is competitive. We compete with other exploration and production companies, many of which are better capitalized, have greater financial resources, operational experience and technical capabilities, or are further advanced in their development or are significantly larger and have access to greater Mineral Reserves than us, for the acquisition of mineral claims, leases and other mineral interests. The mining industry as a whole is experiencing a skills deficit; we continue to see increased competition for qualified skilled personnel at all of our operations / projects. The Pirquitas Mine project will also be subject to these pressures and could increase costs of operating the mine or result in delays, to date we have not experienced any shortfalls or delays as a result of personnel. Expatriate employees will also be required in the early stages of the Pitarrilla Project. If we require and are unsuccessful in acquiring additional mineral properties or qualified personnel, we will not be able to grow at the rate we desire, or at all.

As at December 31, 2012, we employed a total of 815 full-time employees and 665 contract employees. The table below sets out our employees at each of the following locations:

| Location | Number of Employees |

| | Full-time | Contract |

| Vancouver Office | 46 | 5 |

| Argentina | 676 | 438 |

| Peru | 44 | 145 |

| Mexico | 45 | 75 |

| U.S. | 4 | -- |

| Chile | -- | 2 |

Our activities are subject to extensive laws and regulations governing the protection of the environment, natural resources and human health. These laws address, among other things, emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. We are required to obtain governmental permits and in some instances provide bonding requirements under federal, state, or provincial air, water quality, and mine reclamation rules and permits. Violations of environmental, health and safety laws are subject to civil sanctions and, in some cases, criminal sanctions, including the suspension or revocation of permits. The failure to comply with environmental laws and regulations or liabilities related to hazardous substance contamination could result in project development delays, material financial impacts or other material impacts to our projects and activities, fines, penalties, lawsuits by the government or private parties, or material capital expenditures.

Additionally, environmental laws in some of the countries in which we operate require that we periodically perform environmental impact studies at our mines. These studies could reveal environmental impacts that would require us to make significant capital outlays or cause material changes or delays in our intended activities.

Currently, we have reclamation obligations at the Pirquitas Mine, as well as the Duthie property and the Silver Standard mine property, both located in British Columbia, Canada. In 2012, our reclamation work program at the Duthie property was carried out at a cost of approximately $0.1 million. Remaining reclamation obligations beyond 2012 include the construction of a wetland for water filtration purposes and the monitoring of the results of the reclamation project in subsequent years. Estimated costs for the remaining reclamation beyond 2012 are approximately $0.9 million. At the Silver Standard mine property we incurred approximately $0.5 million in expenditures for reclamation work completed in 2012. Estimated costs for reclamation work programs on the Silver Standard mine property beyond 2012 are $2.2 million.

Our current closure and reclamation cost estimate at Pirquitas is approximately $50 million. This estimate is based on conceptual level engineering and will be updated periodically to reflect changes in the life of mine plan. The proposed work focuses on diverting storm water around the waste dumps and pit areas as well as capturing and passively treating impacted waters.

All of our current production and revenue is derived from our operations at the Pirquitas Mine in Argentina. The remainder of our material properties are located in developing countries, with the Pitarrilla Project located in Mexico and the San Luis Project located in Peru. Any changes in regulations or shifts in political attitudes in these foreign jurisdictions are beyond our control and may adversely affect our business. Future development and operations may be affected in varying degrees by such factors as government regulations (or changes to such regulations) with respect to the restrictions on production, export controls, income taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, land claims of local people and mine safety. We cannot accurately predict the effect of these factors. See “Risk Factors”.

A summary of the regulatory regimes in the jurisdictions material to our business and affairs is provided below.

Argentina

Regulatory

Land Tenure

Mineral rights in Argentina are owned by the federal or provincial governments, depending on which jurisdiction they are located. Exploitation concessions in Argentina are called minas (or mines), and one or more minas can be grouped together to form a grupo minero (or group of mines), as described below. A mina is comprised of one or more pertenencias, which are the basic units of mining properties in Argentina. Pertenencias must be rectangular in shape and for lode (i.e. vein) deposits can have boundaries, in principle, no greater than 200 metres by 300 metres

for a maximum area of 6 hectares. Pertenencias that are claimed over deposits of disseminated mineralization in the first category (which includes silver, zinc and tin) are allowed to cover up to 100 hectares. Under Argentine mining law, such concessions are considered ‘real property’ and give the concessionaire the rights to recover pre-determined metals from the subsurface vertically underneath the concession for an unlimited period of time provided (i) an annual fee or canon is paid in the amount of ARS $80 per pertenencia and ARS $500 per lode deposit (ii) and the committed investments and exploitation of the mine are performed. The owner or owners of adjacent minas may choose to consolidate them into a group of minas. Each mina within a group of minas is still subject to the same obligations as are the individual minas within the group, namely the annual payment of canons, the committed investment, and the mine exploitation.

A cateo is an exploration lease that allows individuals or companies to explore for minerals. Each cateo has an exclusive right to be convertible into a mina once a mineral discovery has been made. Cateos are subject to a one-time payment or canon of ARS $400 per 500 hectares. The term of a cateo is based on its area: 150 days for the first unit (500 hectares) and an additional 50 days for each unit thereafter, up to a maximum of 20 units. After a period of 300 days, 50% of the area over four units (2,000 hectares) must be dropped. At 700 days, 50% of the area remaining over four units (2,000 hectares) must be dropped. Time extensions may be granted to allow for situations such as bad weather and difficult access. To maintain a cateo, the holder must also present to the mining authority a minimum exploration work program and schedule. The cateo subject to application has the docket number 701-S-2007 and covers an area of 1,658 hectares. MPI has no reason to believe that the cateo will not be registered.

Surface Rights

Access over surface property rights in Argentina is contemplated within the Argentine Mining Code (the “Argentine Mining Code”) and is obtained through the corresponding provincial mining authority, which is required to communicate with surface owners and ensure that they cooperate with the activities of mining companies. Notice to surface owners can be difficult due to delayed filing of personal property title changes and registry as well as limited staffing and mobility of the relevant authorities.

Export Controls and Duties

In December 2007, the DNA levied an export duty of 10% on concentrates for projects, even those with fiscal stability agreements predating 2002. We have challenged the legality of the export duty on silver concentrates and the matter is currently under review by the Federal Court (Jujuy) in Argentina. The Federal Government of Argentina asserts that the Pirquitas Mine is subject to this export duty despite contrary rights detailed under the fiscal stability agreement (the “Fiscal Agreement”) we signed with the Federal Government in 1998 for production from the Pirquitas Mine. In December 2012, the Federal Court of Appeal (Salta) upheld an injunction granted in our favour by the Federal Court (Jujuy) effective September 29, 2010, which prohibited the Federal Government from withholding the 10% export duty imposed upon us by the DNA in December 2007. However, the Federal Government has sought permission from the Federal Court of Appeal (Salta) to appeal this decision to the Federal Supreme Court of Argentina. The Federal Government has also appealed the refund we claimed for the export duties paid before the injunction, as well as matters of procedure related to the uncertainty of the amount reclaimed. At December 31, 2012, we have accrued a liability totaling $35.8 million, with a corresponding increase in cost of sales in the relevant period. If this export duty is successfully overturned, the benefit will be recognized in the Consolidated Statement of Income (Loss) for the full amount of paid and unpaid duty in the period that recovery becomes virtually certain.

On October 26, 2011, the Argentina government announced a decree that requires all funds from export sales to be repatriated to Argentina and converted into Argentine pesos within the Sole Foreign Exchange Market in Argentina. The Argentine pesos can then be exchanged back into the original currency, again through the Sole Foreign Exchange Market, provided the required authorization is granted by the Argentine Central Bank and the Federal Administration of Public Income. Each transfer is subject to a 0.6% transfer tax. The mining industry had previously been exempted from this obligation to bring such foreign currency into Argentina. Although the Fiscal Agreement includes stability over foreign exchange controls, the government removed such benefits with this decree.

In early 2012, the Argentine Ministry of Economy and Public Finance issued a resolution that reduced the time permitted to repatriate export proceeds from 180 days to 15 days, which caused the Pirquitas Mine to temporarily

suspend shipments while we assessed the potential impact of this resolution. Subsequently, the time permitted to repatriate export proceeds was increased to 30 days and then to 140 days for silver and zinc concentrates, which enabled us to recommence shipping. In September 2012, a revised resolution reinstated the 180 day time limit for silver concentrates only. Further, during 2012, the Argentine Central Bank increased its involvement in U.S. dollar inflows and outflows, and the country continued to experience high inflation along with a weakening currency.

Import Restrictions

The Argentina government has introduced measures requiring local sourcing of equipment and supplies wherever possible. As of the date of this Annual Information Form, we have been able to comply with such requirements.

Environmental

The Argentine Mining Code, as amended in 1996, establishes the guidelines for preparing environmental impact statements for mining projects. The applicable mining and environmental authorities within each provice are responsible for the application and enforcement of the Argentine Mining Code, including environmental matters.

A party wishing to commence or modify any exploration or mining-related activity as defined by the Argentine Mining Code, including property abandonment or mine closure activity, must prepare and submit to the Provincial Mining Authority (“PMA”) an Informe de Impacto Ambiental or EIA prior to commencing the work. Each EIA must describe the nature of the proposed work, its potential risk to the environment, and the measures that will be taken to mitigate that risk. The PMA has a sixty-day period to review and either approve or reject the EIA; however, the Argentine EIA is not considered to be automatically approved if the PMA has not responded within that period. If the PMA deems that the EIA does not have sufficient content or scope, the party submitting the EIA is granted a thirty-day period in which to resubmit the document and the PMA has an additional thirty-day period to review.

If accepted by the PMA, the EIA is used as the basis to create a Declaración de Impacto Ambiental or Declaration of Environmental Impact (“DEI”), which the party must agree to uphold during the mining-related activity in question. The DEI must be updated at least once every two years. Sanctions and penalties for non-compliance to the DEI are outlined in the Argentine Mining Code, and may include warnings, fines, suspension of Environmental Quality Certification, restoration of the environment, temporary or permanent closure of activities, and removal of authorization to conduct mining-related activities.

Mexico

Regulatory

Land Tenure

The exploration and exploitation of minerals in Mexico may be carried out by means of obtaining mining concessions, which are granted by the Mexican federal government pursuant to the Mining Law (the “Mexican Mining Law”), a federal statute governing the grant, use, cancellation and expiration of mining concessions. Mining concessions have a term of fifty years from the date of their recording in the Public Registry of Mining. The term of mining concessions previously issued by the Mexican federal government (for exploration and/or exploitation) was automatically extended by the enactment of the recent amendments to the Mexican Mining Law. Due to such amendments, the holders of mining concessions for exploration were automatically authorized to carry out not only exploration work, but also exploitation works.

Holders of concessions may, within the five years prior to the expiration of such concessions, apply for their renewal for the same period of time. Failure to apply prior to the expiration of the term of the concession will result in termination of the concession. Concessions are subject to annual work requirements and payment of mining duties which are assessed and levied on a semi-annual basis. Such concessions may be transferred or assigned by their holders, but such transfers or assignments must comply with the requirements established by the Mexican Mining Law and be registered before the Public Registry of Mining in order to be valid against third parties.

Although the Law of Foreign Investment provides that foreign companies and foreign individuals may hold mineral concessions, in practice, based on the provisions set forth in the Mexican Mining Law, mineral concessions are only granted to Mexican citizens or companies, ejidos and agrarian and indigenous communities. Foreign citizens or corporations may only obtain mineral concessions through the establishment of a subsidiary in Mexico. Foreign investment in Mexican companies must comply with certain requirements set forth in the Law of Foreign Investment.

The Mexican Constitution and federal laws state that mineral activities are of public interest to Mexico, and accordingly, provide the owner of a mineral concession with the legally-preferred right to the overlying surface rights. If the holder of the mineral concession is unable to acquire the surface rights required for operations through negotiation, the concession holder may request the federal government to commence an administrative process to acquire for the mineral concession holder long-term access to the required surface rights through a process known as “temporary occupation”. Concession-holders are also entitled to request the forced expropriation or easement on the relevant surface land, although these two procedures are less used in practice.

The temporary occupation is commenced with the concession-holder applying to the government agency, Administration and Appraisals Institute of National Goods (Instituto de Administración y Avalúos de Bienes Nacionales or “INDAABIN”, for its initials in Spanish), to conduct an appraisal of the value of the surface lands. Our wholly-owned Mexican subsidiary, Silver Standard Durango S.A. de C.V. (“SSD”), completed this application in November 2012. INDAABIN has conducted the appraisal of the Las Flores property and SSD is awaiting the results of this evaluation.

Ejido Land

An ejido is a communal ownership of land declared as such by Presidential Decree , regulated, among other statutes, by the Mexican Agrarian Law, and administered by a representative board (Comisariado Ejidal) formed by members of the ejido. Although ejido land is owned by the ejido community at large, the Agrarian Law permits the ejido community to compartmentalize the land and allocate specific parcels to individual members of the ejido for their exclusive use and usufruct. When plots of ejido land are compartmentalised, the beneficiary ejido members are permitted to enter into lease agreements over the parcels with third parties, but they may only transfer their use and usufruct rights to the parcels to other members of the ejido community.

The Agrarian Law also permits the ejido community to authorize the privatization of the parcels and adoption by the corresponding ejido member of full title over such pieces of land. When the parcel is privatised, the ejido owner may sell the land to third parties, subject to certain rights of first refusal provided by the Agrarian Law in favour of the ejido member’s family and other members of the ejido community, including the ejido itself, in that order.

Stability Agreements

Currently there is no available practice of obtaining financial stability agreements with the Mexican Government.

Environmental and Permitting

Environmental permitting in the mining industry in Mexico is mainly administered by the federal government body Secretaría de Medio Ambiente y Recursos Naturales (“SEMARNAT”), the federal regulatory agency that establishes the minimum standards for environmental compliance. Guidance for the federal environmental requirements including conservation of soils, water quality, flora and fauna, noise emissions, air quality, and hazardous waste management, derives primarily from the Ley General del Equilibrio Ecológico y la Protección al Ambiente (“LGEEPA”), the Ley General para la Prevención y Gestión Integral de los Residuos (“LGPGIR”) and the Ley de Aguas Nacionales (“LAN”). Article 28 of the LGEEPA specifies that SEMARNAT must issue prior approval to parties intending to develop a mine and mineral processing plant.

An Environmental Impact Statement (by Mexican regulations called a Manifestación de Impacto Ambiental, or “MIA”) is the document that must be filed with SEMARNAT for its evaluation and, if applicable, further approval by SEMARNAT through the issuance of an Environmental Impact Authorization, whereby approval conditions are specified where works or activities have the potential to cause ecological imbalance or have adverse effects on the

environment. The Ley de Aguas Nacionales provides authority to the Comisión Nacional del Agua (“CNA”), an agency within SEMARNAT, to issue water extraction concessions, and specifies certain requirements to be met by applicants. In addition, the Ley General de Desarrollo Forestal Sustentable indicates that authorizations must be granted by SEMARNAT for land use changes to industrial purposes. An application for change in land use or Cambio de Uso de Suelo, must be accompanied by a technical study that supports the environmental permit application (Estudio Técnico Justificativo or “ETJ”). In cases requiring a change in forestry land use, a Land Use Environmental Impact Assessment is also required. Mining projects also need to include a risk analysis for the use of regulated substances (Análisis de Riesgo) and an accident prevention program.

Permits, Licenses and Authorizations

There are three main SEMARNAT permits required prior to construction and development of a mining project: MIA, Change of Land Use (with the accompanying ETJ and, if applicable, the land use MIA), and Risk Analysis and Accident Prevention Program. A construction permit is required from the local municipality and an archaeological release letter is required from the National Institute of Anthropology and History (“INAH”). An explosives permit is required from the Ministry of Defense (“SEDENA”) before construction begins. Water discharge and usage must be granted by the CNA. A project-specific environmental license (Licencia Ambiental Única or “LAU”), which states the operational conditions and requirements to be met, is issued by SEMARNAT when the agency has approved the project operations.

The key permits and the stages at which they are required are summarised in Table 1.

Table 1 Key Permits and Status |

| Permit | Mining Stage | Agency |

| Environmental Impact Statement – MIA | Construction/Operation/Post-operation | SEMARNAT |

| Land Use Change – ETJ & Land Use MIA | Construction/Operation | SEMARNAT |

| Risk Analysis | Construction/Operation | SEMARNAT |

| Construction Permit | Construction | Municipality |

| Explosive & Storage Permits | Construction/Operation | SEDENA |

| Archaeological Release | Construction | INAH |

| Water Use Concession | Construction/Operation | CNA |

| Water Discharge Permit | Operation | CNA |

| Project-specific License (LAU) | Operation | SEMARNAT |

| Accident Prevention Plan | Operation | SEMARNAT |

Peru

Regulatory

Mining activities in Peru are subject to the provisions of the Uniform Text of General Mining Law (“General Mining Law”).

General Obligations for Mining Concession Titleholders

Under Peruvian law, the Peruvian State is the owner of all mineral resources in the ground. Rights over such mineral resources are granted through a concession system, consisting of four different types of concessions which grant the titleholder the right to perform different activities related to the mining industry, as follows: (i) mining concessions

grant their titleholder the right to explore and exploit the mineral resources located within the boundaries of said concession, (ii) processing concessions grant their titleholder the right to extract or concentrate the valuable part of an aggregate of minerals extracted and/or to smelt, purify or refine metals, (iii) general work concessions grant their titleholder the right to provide ancillary services to two or more mining concessions, and (iv) mining transport concessions grant their titleholder the right to install and operate non-conventional continuous transportation systems for mineral products between one or several mining centres and a port or processing plant, or a refinery or one or more stretches of these routes.

Titleholders of mining concessions pay an annual validity fee each year in the amount of $3.00 per year and per hectare. Titleholders must also reach a minimum annual production of US$100.00 per year and per hectare granted by the end of the sixth year from the year which title of mining concession was granted. If this minimum production is not reached by the end of this term, annual penalty fees will be applied. Failure to comply with validity or penalty fee payments for two consecutive years causes the termination of the mining concession.

Notwithstanding the foregoing, Legislative Decrees in 2008 amended several articles of the General Mining Law regarding the minimum production obligation, establishing a new regime for compliance with such obligation (“New MPO Regime”). According to the New MPO Regime, titleholders of mining concessions must reach a minimum level of annual production (“Minimum Production”) within a period of ten years, as from January 1st of the year following that in which title was granted. If the titleholder does not reach Minimum Production within the 10 year period, the mining concession will be terminated unless the titleholder complies with the payment of applicable penalties, in which case the concession may remain in force for up to an additional 5 years. If the titleholder does not reach Minimum Production within the 20 year period, the mining concession will be terminated.

There are two exceptions for the potential extinction of mining rights that provide for a limited extension of title: (i) when the titleholder does not reach Minimum Production because of a force major event or an event not caused by the titleholder; or ii) when the titleholder continues paying the annual penalty and also provides evidence of an investment made of no less than ten times the amount of the annual penalty due and payable.

Pursuant to the General Mining Law, mining rights may be forfeited in only a number of enumerated circumstances provided by law, such as non-payment of the validity fees or non-compliance with the Minimum Production obligation in the term provided by law or non-payment of the penalty fees. In addition, equal rights to explore for and exploit minerals by way of concession may be granted to either Peruvian nationals or foreigners (except on concessions located within 50 km of the Peruvian international borderline, in which case foreign owners must obtain express authorization from the government).

Surface Rights

Mining concessions holders are required to negotiate access to the land over which the mining concession is located with the respective surface land owner or holder (agrarian communities), or file an application with the General Bureau of Mines to obtain an easement, temporary occupancy or expropriation of the land, as the case may be.

Royalties

Mining royalties are calculated over a quarterly operating profit obtained by mining agents engaged in the exploitation of mineral resources. The applicable rates for the determination of the mining royalty are ranging from 1% to 12%, depending on the company’s operating margin, with a minimum payment equivalent to 1% of the revenues generated by sales in the quarter. The payment of the mining royalty is considered as an expense for determining the corporate income tax.

Mining Taxes

Since 2011 the Special Mining Tax (“SMT”) has been in force. The SMT is calculated at progressive rates, depending on operating margin. The SMT is considered an expense deductible when determining the corporate income tax payable.

Exports

Under the General Mining Law, the right to sell mining production freely in world markets is established. Peru has become party to agreements with the World Bank’s Multilateral Investment Guarantee Agency and with the Overseas Private Investment Corporation.

Stability Agreements

The General Mining Law provides holders of mining rights the option of signing stability agreements with the Peruvian Government in connection with investments made to commence new mining operations or expand existing mining operations. In order to qualify, companies must submit satisfactory documentation to the government regarding the amount of investment. Stability agreements can apply to several taxes, including income taxes and the general sales tax or value-added tax, as well as mining royalties.

Environmental

The General Bureau of Environmental Affairs (Direcciόn General de Asuntos Ambientales, or “DGAAM” for its initials in Spanish) of the Ministry of Energy and Mines is the governmental agency that approve the appropriate environmental studies required for conducting mining activities in the country, while the Environmental Inspections and Auditing Bureau of the Ministry of the Environment is the governmental agency that inspects and audits mining projects and operations in order to secure compliance with environmental obligations and related commitments.

Mining Exploration Activities

Pursuant to Peruvian environmental regulations, mining exploration projects are classified into the following two categories depending on the size of the exploration activities to be conducted. Category I comprises smaller exploration projects where there are 20 or less drilling platforms to be constructed, disturbed areas do not exceed 10 hectares or the construction of tunnels does not exceed 50 metres in length. In order to conduct exploration activities under this category, titleholders require a simplified Environmental Impact Statement duly approved by the DGAAM. Category II comprises larger exploration projects where there are more than 20 drilling platforms required, disturbed areas exceed 10 hectares or the construction of tunnels exceeds 50 metres in length. In order to conduct exploration activities under this category, titleholders require a semi-detailed EIA duly approved by the DGAAM.

In addition to the approval of the required environmental studies, titleholders of mineral rights are also required to obtain: (i) authorization to start exploration activities that includes the approval of the prior consultation process; (ii) all necessary governmental consents and permits required to conduct the activities detailed in the corresponding environmental study (e.g. authorizations for water use, for hydrocarbon storage, among others), and (iii) the right granted by the owner to use the surface land required for the development of the project.

Mine Development, Exploitation and Processing Activities

Prior to conducting mine development, exploitation and processing activities, titleholders of mining concessions must have a fully-detailed EIA duly approved by the DGAAM. In addition to the approval of the corresponding EIA, titleholders are also required to obtain: (i) the surface rights required for the development of the mining project, (ii) all other permits, licenses, authorizations and approvals required by national law, in accordance with the environmental commitments established in the corresponding EIA, (iii) approval of the prior consultation process for development, exploitation and processing mining activities and (iv) a resolution of approval of the corresponding Mine Closure Plan duly approved by the DGAAM.

Table 2 lists the most common permits, licences and authorizations required for the development, exploitation and processing activities.

Table 2 Common Permits, Licenses and Authorizations |

| Permit, License or Authorization | Agency |

| Water use (License) | National Authority of Water (Autoridad Nacional del Agua or “ANA”) |

| Discharge of industrial wastewaters (Authorization) | ANA |

| Discharge of domestic wastewaters (Authorization) | ANA |

| Operation of septic tanks (Authorization) | General Bureau of Environmental Health |

| Start-up Exploitation Activities (Authorization) | Ministry of Energy and Mines |

| Processing concession (Permit) | Ministry of Energy and Mines |

| Operation of fuel storage facilities (Authorization) | Energy and Mining Investment Supervisory Board |

| Use of controlled chemicals and supplies (Authorization) | Ministry of Production and the Ministry of the Interior |

| Operation of telecom services (Authorization) | Ministry of Transport and Communications |

Summary of Mineral Reserves and Mineral Resources Estimates

The following tables summarize as at December 31, 2012 our estimated Mineral Reserves and Mineral Resources. With the exception of the Maverick Springs Project, all of our projects are wholly-owned.

Mineral Reserves(1)

| Property | | Classification | | Ore | | | Silver | | | Gold | | | Silver | | | Gold | |