Exhibit 1

Illumina, Inc. (“ILMN”) Case for Change Spring 2023

2 TABLE OF CONTENTS • Executive Summary • Value Destruction & Share Price Underperformance • GRAIL Timeline & Failures • GRAIL Going Forward • Core Illumina Failures • No Accountability • Our Plan • Appendix

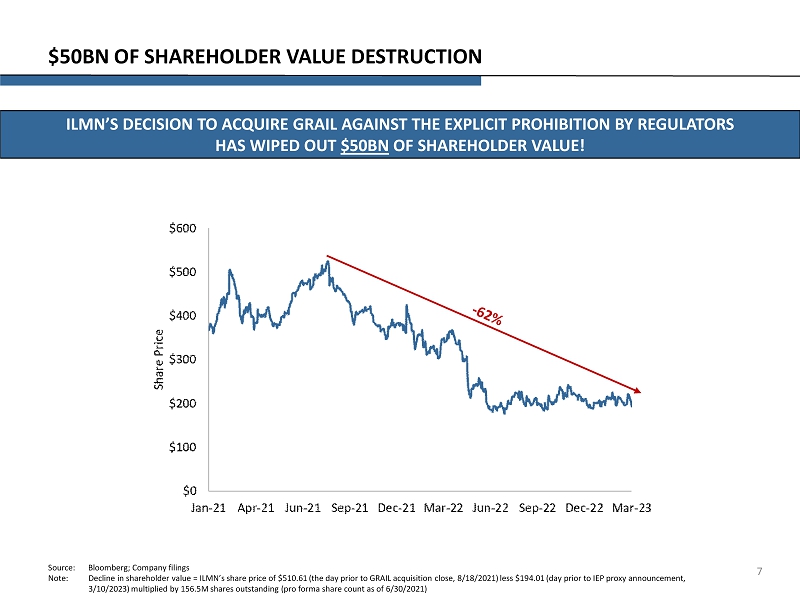

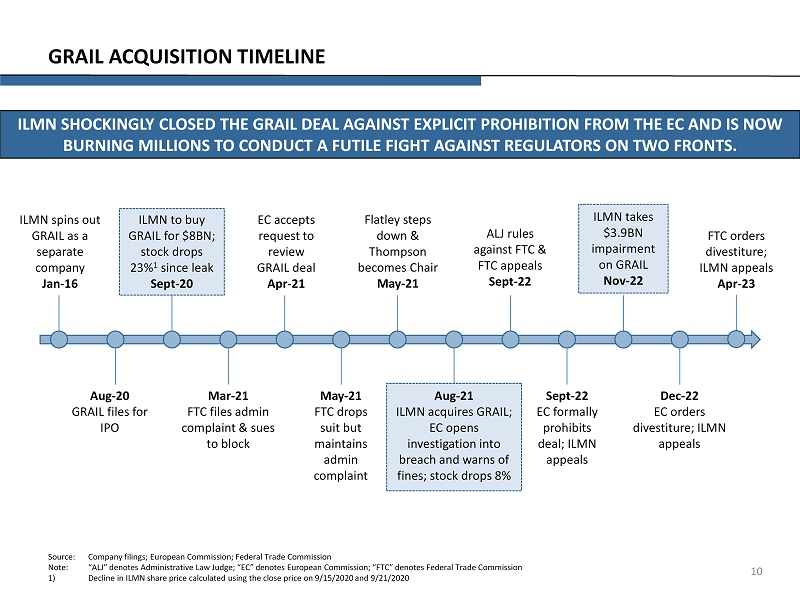

3 EXECUTIVE SUMMARY ILMN’S DESIRE TO OWN GRAIL AT ALL COSTS HAS DESTROYED $50 BILLION OF SHAREHOLDER VALUE. • ILMN created a division, GRAIL, to produce an early - stage cancer detection test. In 2016, GRAIL was spun - out and raised outside capital from billionaires and institutions at a valuation of $1 - 2 billion • In September 2020, only four years later, ILMN’s CEO Francis deSouza announced a deal to reacquire GRAIL for $8 billion (handing a $6 - 7 billion windfall to the billionaires) despite GRAIL not having received FDA approval, rising public doubt of GRAIL’s potential, and GRAIL’s increasing operating losses • ILMN’s announcement to buy GRAIL was questionable at best, but CEO deSouza’s much more egregious and inexplicable decision was to have Illumina actually close the GRAIL deal despite being informed by the EU that ILMN was not permitted to close the deal. The EU also stated that, if ILMN closed the deal over the EU’s objection, ILMN would be subject up to $450 million of fines, GRAIL must be run without any input whatsoever from ILMN, but ILMN would still be forced to fund GRAIL’s operating losses, including ~$800 million in 2023 alone

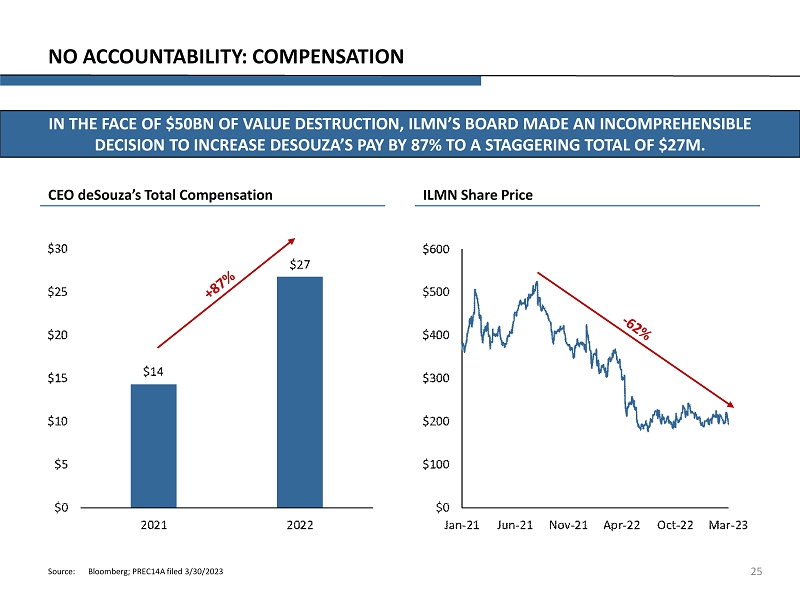

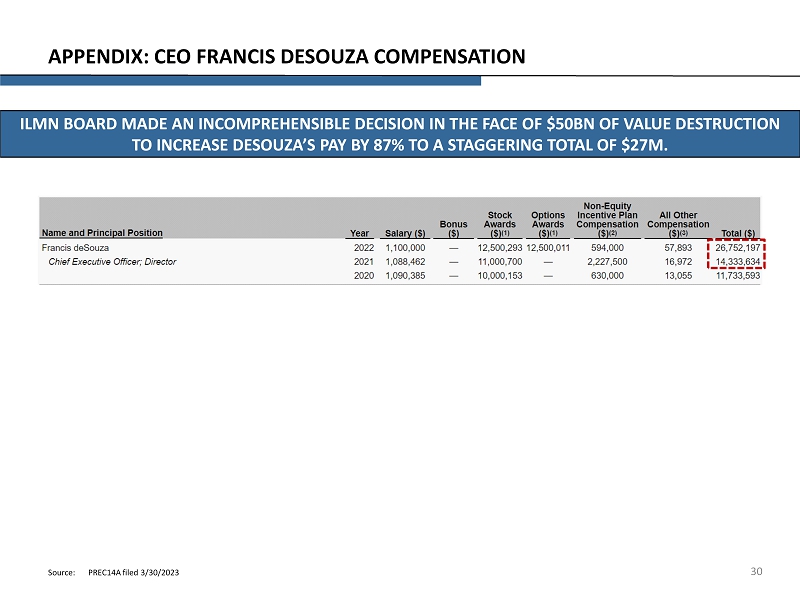

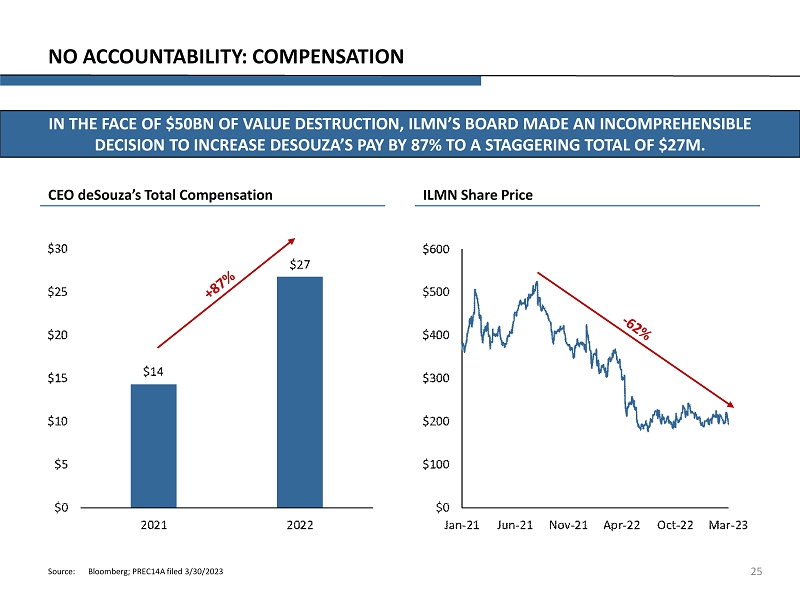

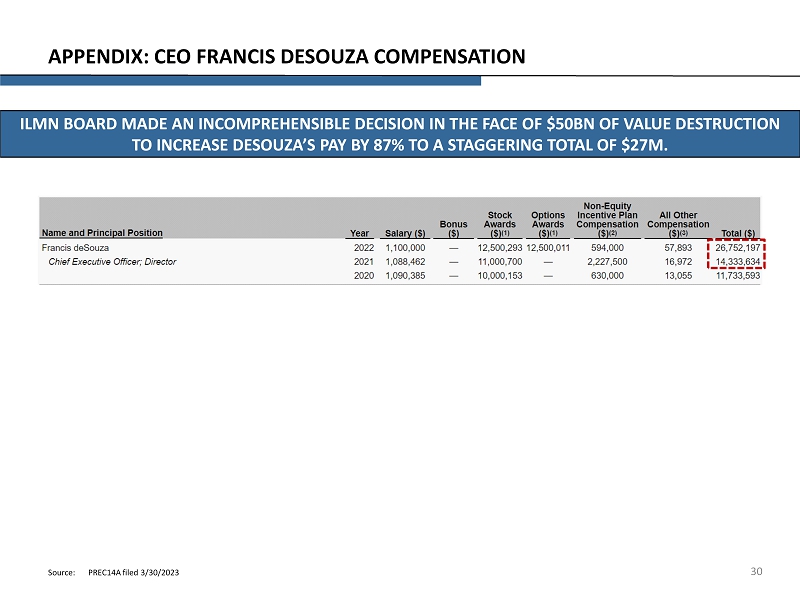

4 EXECUTIVE SUMMARY THE GRAIL DEAL WAS FRAUGHT WITH GOVERNANCE AND DISCLOSURE FAILURES. THE CORE BUSINESS HAS DETERIORATED. YET SOMEHOW THE CEO RECEIVED AN 87% PAY INCREASE. • Since closing the GRAIL acquisition, ILMN’s stock has dropped 62% or $50 billion in value. ILMN has already taken a $4 billion impairment charge, warned of significant tax liabilities upon exiting GRAIL and accrued ~$450 million in fines. ILMN will tell you they will expeditiously divest GRAIL. But the sad truth is, due to their obsession with GRAIL, they will continue appealing against the EU, and more recently, the FTC decision to block the deal. These appeals will go on for years at shareholders’ expense and will, at the very least, absorb the capital needed to defend against Illumina’s rising competition. At worst, these actions by CEO Francis deSouza and the board will become an existential question for ILMN • The GRAIL deal had many process failures, including: (1) conflicted financial advisors, (2) related parties, (3) insider stock sales, (4) no fairness opinion, (5) egregious disclosure lapses, and worst of all (6) special insurance purchased for the board of directors that was not disclosed until months after GRAIL was closed • Under CEO Francis deSouza , ILMN’s core business has also deteriorated due to a talent exodus, decrease in new product cycles, slowing revenue growth, and declining margins • Despite the calamities surrounding ILMN, the board of directors inexplicably just gave him an 87% pay increase to $27 million in 2022 even though he has destroyed $50 billion of value, among many other failures

5 EXECUTIVE SUMMARY ALL SHAREHOLDERS SHOULD ASK: WHERE HAS THE BOARD BEEN? WE BELIEVE THE ILMN BOARD HAS GIVEN A NEW MEANING TO THE TERM GROSS NEGLIGENCE. • The major question is why has the Illumina board allowed CEO Francis deSouza and Chair John Thompson to destroy $50 billion of shareholder value over the last year and a half? What happened to the “duty of care” and “duty of loyalty?” • Why has the board not considered: o Conflicted relationships between Chair John Thompson and a prior owner of GRAIL? o Conflicted relationships between GRAIL and the ILMN board and management team? o Conflicted financial advisor and lack of fairness opinion? o Academic skepticism and criticism regarding GRAIL’s efficacy? o Significant fines, tax liability and annual operating losses? o Shareholders’ negative reaction to the deal? o Poor history of M&A by Chair John Thompson? o The lack of independence between CEO and Chair? o The immediate disclosure of extra insurance demanded in order to sign the deal? • If the directors had delved into the many academic criticisms of GRAIL’s efficacy, they would have been worse than negligent to have paid $10 billion, especially in light of the EU’s stated opposition to the deal. But then again they did demand that extra insurance

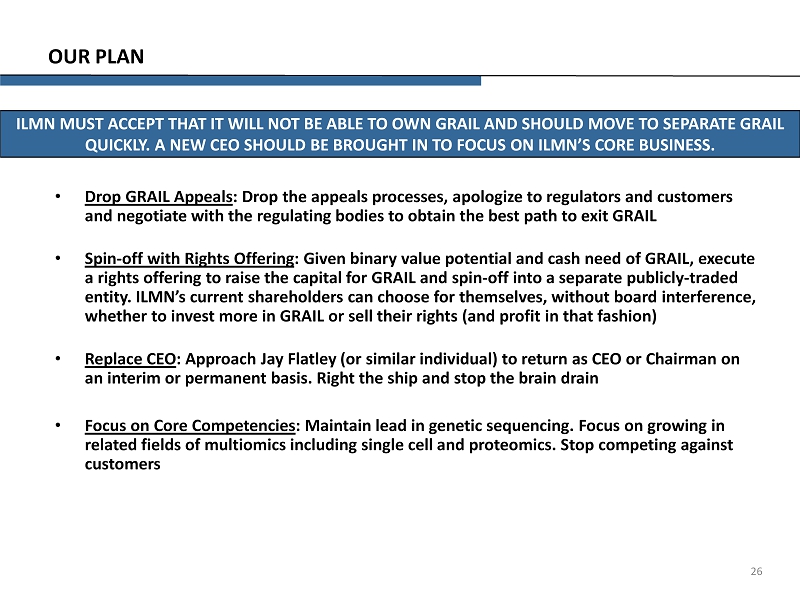

6 EXECUTIVE SUMMARY SOMETHING IS ROTTEN IN THE STATE OF ILLUMINA. IT IS NOW UP TO YOU, THE SHAREHOLDER, TO FIX OUR POTENTIALLY GREAT COMPANY. • Our three director nominees will bring financial and legal acumen, common sense, and a history of fixing companies in crisis • We intend to encourage the board of directors to: 1) Drop the GRAIL appeals process and divest GRAIL in the best manner allowed by regulators (possibly via a spin - off and rights offering to shareholders) 2) Ask Jay Flatley (or similar individual) if he would return as CEO or Chairman on an interim or permanent basis 3) Refocus on the core business and repair relationships with customers and regulators 4) Hold management accountable to a long - term strategic plan 5) Adopt and require management to adhere to a new and more transparent SEC disclosure practice that discourages and punishes the burying of bad news

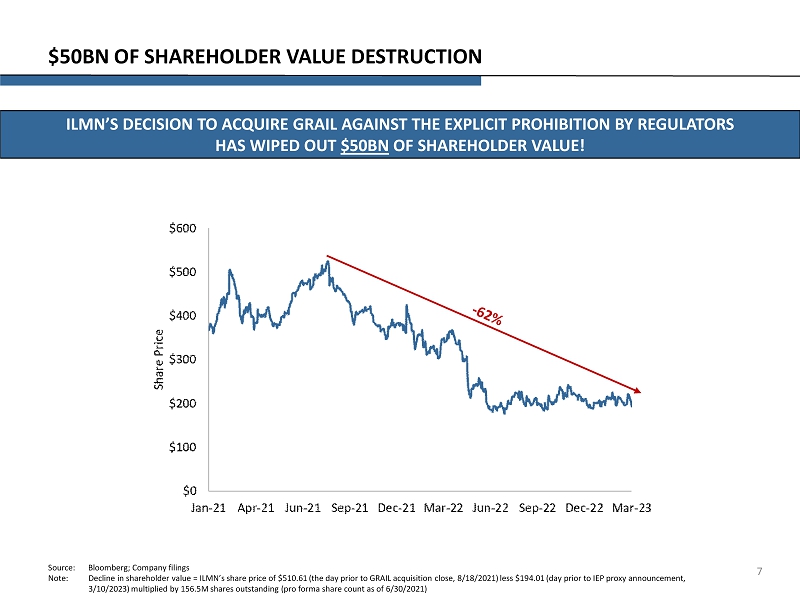

7 $50BN OF SHAREHOLDER VALUE DESTRUCTION ILMN’S DECISION TO ACQUIRE GRAIL AGAINST THE EXPLICIT PROHIBITION BY REGULATORS HAS WIPED OUT $50BN OF SHAREHOLDER VALUE! Source: Bloomberg; Company filings Note: Decline in shareholder value = ILMN’s share price of $510.61 (the day prior to GRAIL acquisition close, 8/18/2021) less $1 94.01 (day prior to IEP proxy announcement, 3/10/2023) multiplied by 156.5M shares outstanding (pro forma share count as of 6/30/2021)

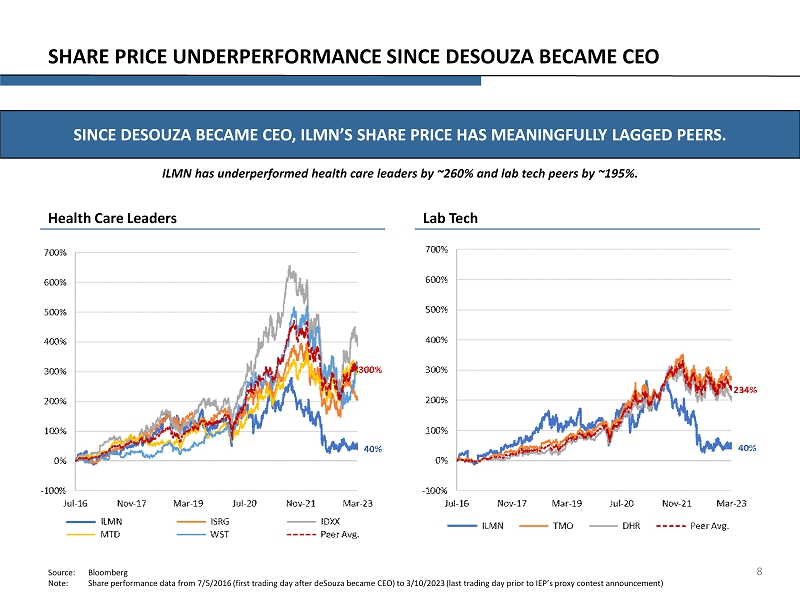

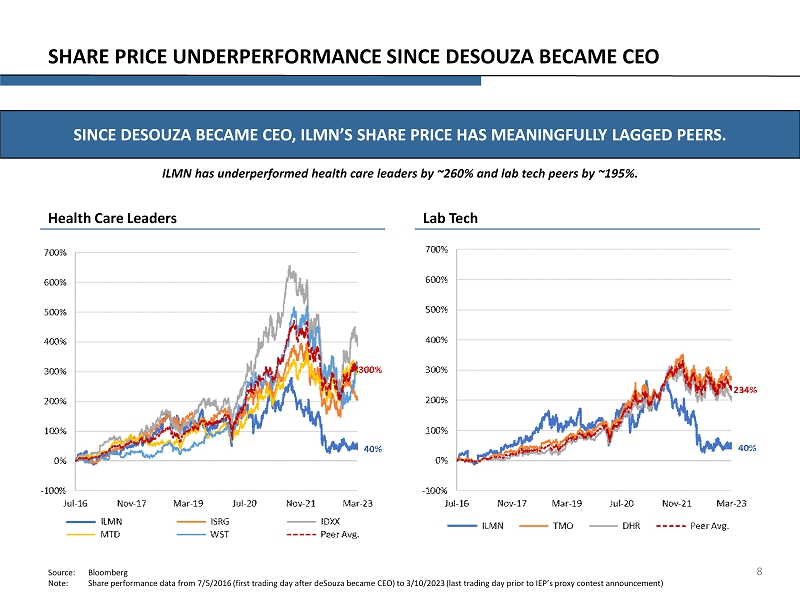

8 SHARE PRICE UNDERPERFORMANCE SINCE DESOUZA BECAME CEO SINCE DESOUZA BECAME CEO, ILMN’S SHARE PRICE HAS MEANINGFULLY LAGGED PEERS. Lab Tech Source: Bloomberg Note: Share performance data from 7/5/2016 (first trading day after deSouza became CEO) to 3/10/2023 (last trading day prior to IEP’s proxy contest announcement) Health Care Leaders ILMN has underperformed health care leaders by ~260% and lab tech peers by ~195%.

9 SHARE PRICE UNDERPERFORMANCE SINCE GRAIL ACQUISITION ILMN HAS MATERIALLY UNDERPERFORMED SINCE SHOCKINGLY CLOSING THE GRAIL DEAL DESPITE REGULATORY PROHIBITIONS. Health Care Leaders Lab Tech Source: Bloomberg Note: Share performance data from 8/18/2021 (last trading day prior to close of GRAIL acquisition) to 3/10/2023 (last trading da y prior to IEP’s proxy contest announcement) ILMN has underperformed health care leaders by ~35% and lab tech peers by ~50%.

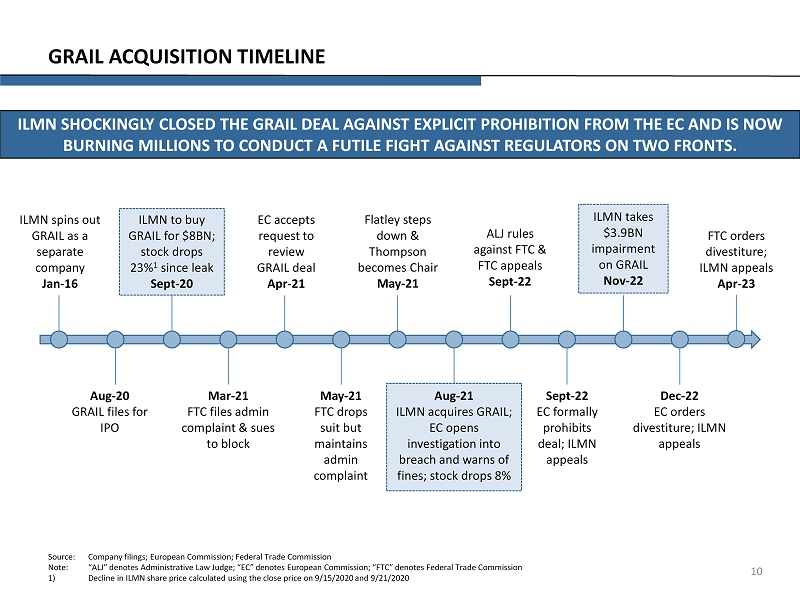

10 GRAIL ACQUISITION TIMELINE ILMN SHOCKINGLY CLOSED THE GRAIL DEAL AGAINST EXPLICIT PROHIBITION FROM THE EC AND IS NOW BURNING MILLIONS TO CONDUCT A FUTILE FIGHT AGAINST REGULATORS ON TWO FRONTS. ILMN spins out GRAIL as a separate company Jan - 16 EC accepts request to review GRAIL deal Apr - 21 Flatley steps down & Thompson becomes Chair May - 21 ALJ rules against FTC & FTC appeals Sept - 22 Aug - 20 GRAIL files for IPO Sept - 22 EC formally prohibits deal; ILMN appeals May - 21 FTC drops suit but maintains admin complaint Dec - 22 EC orders divestiture; ILMN appeals Source: Company filings; European Commission; Federal Trade Commission Note: “ALJ” denotes Administrative Law Judge; “EC” denotes European Commission; “FTC” denotes Federal Trade Commission 1) Decline in ILMN share price calculated using the close price on 9/15/2020 and 9/21/2020 ILMN to buy GRAIL for $8BN; stock drops 23% 1 since leak Sept - 20 Mar - 21 FTC files admin complaint & sues to block FTC orders divestiture; ILMN appeals Apr - 23 Aug - 21 ILMN acquires GRAIL; EC opens investigation into breach and warns of fines; stock drops 8% ILMN takes $3.9BN impairment on GRAIL Nov - 22

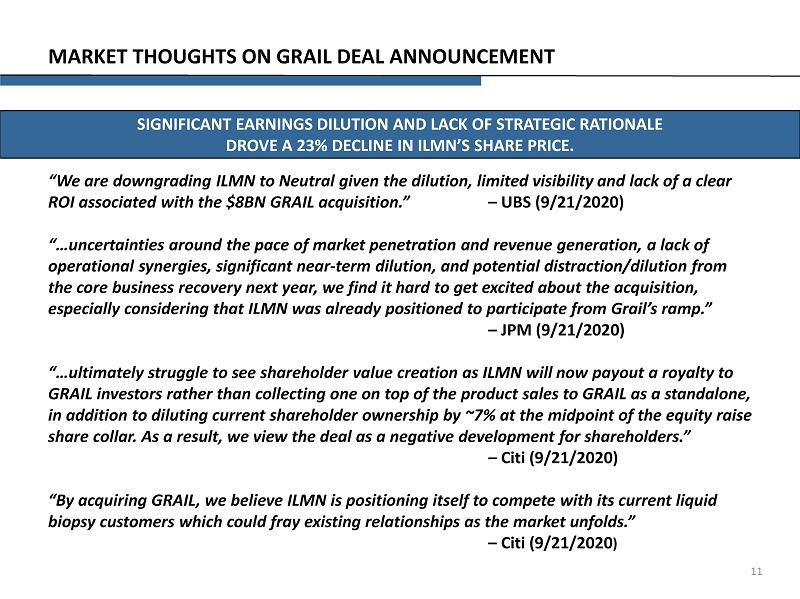

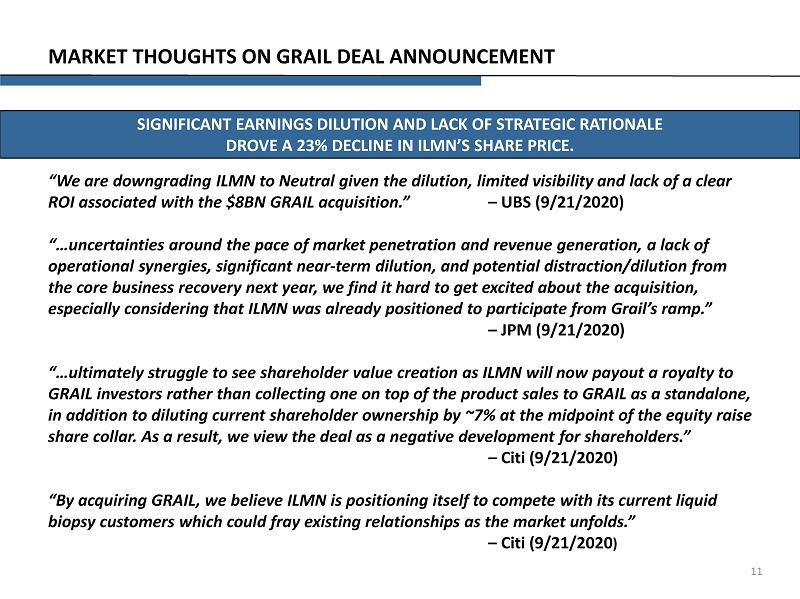

MARKET THOUGHTS ON GRAIL DEAL ANNOUNCEMENT 11 SIGNIFICANT EARNINGS DILUTION AND LACK OF STRATEGIC RATIONALE DROVE A 23% DECLINE IN ILMN’S SHARE PRICE. “We are downgrading ILMN to Neutral given the dilution, limited visibility and lack of a clear ROI associated with the $8BN GRAIL acquisition.” – UBS (9/21/2020) “…uncertainties around the pace of market penetration and revenue generation, a lack of operational synergies, significant near - term dilution, and potential distraction/dilution from the core business recovery next year, we find it hard to get excited about the acquisition, especially considering that ILMN was already positioned to participate from Grail’s ramp.” – JPM (9/21/2020) “…ultimately struggle to see shareholder value creation as ILMN will now payout a royalty to GRAIL investors rather than collecting one on top of the product sales to GRAIL as a standalone, in addition to diluting current shareholder ownership by ~7% at the midpoint of the equity raise share collar. As a result, we view the deal as a negative development for shareholders.” – Citi (9/21/2020) “By acquiring GRAIL, we believe ILMN is positioning itself to compete with its current liquid biopsy customers which could fray existing relationships as the market unfolds.” – Citi (9/21/2020 )

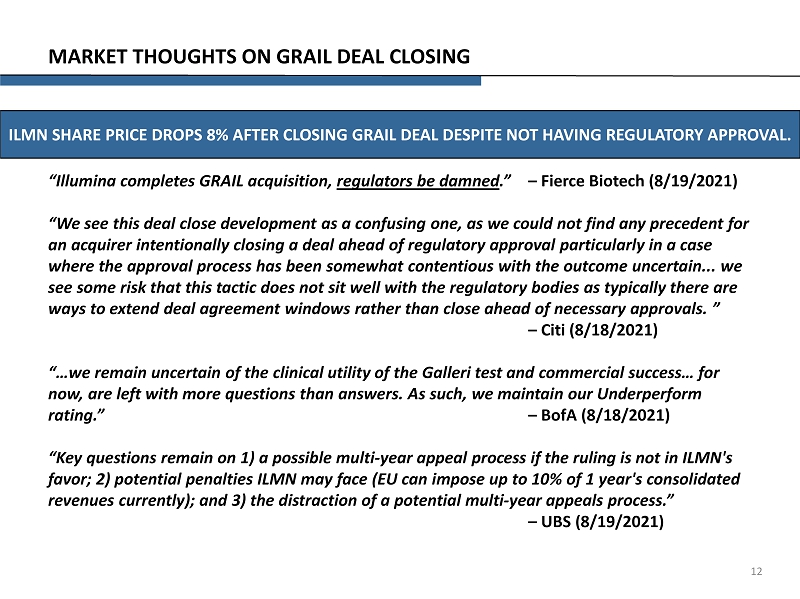

12 MARKET THOUGHTS ON GRAIL DEAL CLOSING ILMN SHARE PRICE DROPS 8% AFTER CLOSING GRAIL DEAL DESPITE NOT HAVING REGULATORY APPROVAL. “Illumina completes GRAIL acquisition, regulators be damned .” – Fierce Biotech (8/19/2021) “We see this deal close development as a confusing one, as we could not find any precedent for an acquirer intentionally closing a deal ahead of regulatory approval particularly in a case where the approval process has been somewhat contentious with the outcome uncertain... we see some risk that this tactic does not sit well with the regulatory bodies as typically there are ways to extend deal agreement windows rather than close ahead of necessary approvals. ” – Citi (8/18/2021) “…we remain uncertain of the clinical utility of the Galleri test and commercial success… for now, are left with more questions than answers. As such, we maintain our Underperform rating.” – BofA (8/18/2021) “Key questions remain on 1) a possible multi - year appeal process if the ruling is not in ILMN's favor; 2) potential penalties ILMN may face (EU can impose up to 10% of 1 year's consolidated revenues currently); and 3) the distraction of a potential multi - year appeals process.” – UBS (8/19/2021)

13 EU COMMISSION ON GRAIL DEAL CLOSING THE EU COMMISSION IS NOT ENTERTAINED BY ILMN’S RECKLESS DECISION. “Companies have to respect our competition rules and procedures. Under our ex - ante merger control regime companies must wait for our approval before a transaction can go ahead. This obligation, that we call standstill obligation, is at the heart of our merger control system and we take its possible breaches very seriously. This is why we have decided to immediately start an investigation to assess whether Illumina's decision constitutes a breach of this important obligation.” – Margrethe Vestager, Executive VP of EU Commission

14 FORMER ILMN CEO, JAY FLATLEY, ON GRAIL DEAL JAY FLATLEY QUESTIONS THE EXECUTION OF THE GRAIL DEAL. Source: Jamie Smyth. “Has Illumina taken the wrong path in its Grail quest?” Financial Times. 1/29/2023 “If nothing happens on this in the next year, I think the grumbling will probably get louder... Francis is at the point of that spear .” “…operationally it had not gone the way management had hoped. It is a huge disappointment and investors want it spun back out.” “In retrospect, it would have been better to wait and realize that the market was sizzling hot at the time and therefore it was overpriced.” “If they had waited a year then it would have been a $2bn acquisition.”

15 GRAIL PROCESS FAILURES THE GRAIL DEAL WAS FRAUGHT WITH CONFLICTS AND RELATED PARTIES. GOLDMAN WAS ON BOTH SIDES OF THE DEAL AND INSIDERS QUICKLY SOLD STOCK. • Conflicted Early Investors and Chairman : GRAIL was spun - off and raised capital at low valuations only to be acquired a few years later for $10BN, handing profit windfalls to the early investors, including billionaires, institutions and related parties. Is it possible the board was unaware of significant conflicts, including Chair Thompson’s relationship with a billionaire investor in GRAIL? • Related Parties : 4 of the 10 GRAIL directors had longstanding ties to ILMN including two former ILMN directors, one former chief medical officer and one current chief technology officer. What role did the personal relationships play in the deal? • Conflicted Advisors : Goldman Sachs was a lead underwriter on the GRAIL IPO. Goldman Sachs was also the exclusive advisor to ILMN on the acquisition of GRAIL. Were there no other banks that could have been used? • Fairness Opinions : GRAIL received a fairness opinion for the sale, but ILMN did not despite the unusually large number of conflicts. How does that make any sense? • Insider Dumping Stock : ILMN’s current CTO, Alex Aravanis , was a founder of GRAIL. He was poached by CEO deSouza four months before the GRAIL acquisition was announced. When the deal closed, Aravanis sold $5M of stock, which was 100% of the equity he received as part of the acquisition. Did his financial interests impact his advice to ILMN and the board?

16 GRAIL PROCESS FAILURES: TAXES DESPITE THE KNOWN DIVESTMENT RISK, ILMN AGREED TO AN OVERLY SELLER - FRIENDLY DEAL STRUCTURE, WHICH COULD LEAD TO BILLIONS IN TAXES EVEN IF GRAIL IS SOLD AT A LOSS. • ILMN closed the GRAIL acquisition for $10 billion of value yet inexplicably structured the deal to provide tax benefits to the sellers. Due to this structure, GRAIL’s tax basis is between $500 million and $1 billion (when it should be much closer to the purchase price) • This is particularly concerning given the board willingly closed on the deal knowing there was a risk that the deal would be unwound. For example, in the case that ILMN is forced to sell GRAIL and miraculously receives the same value that it paid, ILMN would be subject to a $2.2 billion tax! • The fact that the board of directors willingly accepted this risk (or did not know about it) exposed shareholders to billions in losses • The highly suspicious nature of this arrangement is exacerbated by the fact that the board elected not to disclose the disastrous tax problem until months after the closing! Note: $10 billion sale price less $1 billion high - end basis = $9 billion gain. $9 billion gain at 25% tax rate = $2.25 billion o f taxes

17 GRAIL PROCESS FAILURES: QUESTIONABLE EFFICACY WHY WOULD ILMN RUSH TO CLOSE A $10 BILLION DEAL WHEN RESEARCHERS WERE QUESTIONING THE TEST’S EFFICACY? “[I]t is not clear whether the tests performs well enough to improve outcomes for patients with early stage disease, particularly when deployed in a clinical setting . . . [A] vailable evidence is not sufficient to establish the effectiveness and safety of this technology, and determining whether any diagnostic test improves outcomes for patients is challenging. A particular concern is that half of the participants in GRAIL’s case - control study had cancer: the high performance observed may not replicate in real world populations with a far lower prevalence of cancer.” – University of Leeds and University of Cambridge (January 2021)

18 GRAIL PROCESS FAILURES: INSURANCE DIRECTORS WOULD ONLY DEMAND OUTSIZED COVERAGE IF THEY KNEW THERE WAS OUTSIZED RISK. • On the day prior to closing the GRAIL deal (or perhaps after the fact and backdated – we can’t tell and they won’t say), ILMN purchased extra personal liability protection for its directors • We see no reason why this would need to be done given existing insurance coverage, indemnification agreements, and business judgement rule defense • Disclosure of this unprecedented insurance enhancement agreement was either buried for months or, even worse, backdated (and it was filed with no explanation whatsoever) • Was the board refusing to do the deal unless they had extra insurance? If so, how is that not a sign that they knew there were terrible risks ahead? And why were investors purposely kept in the dark for months about the trepidation of their trusted fiduciaries?!

19 MANAGEMENT WILL APPEAL AND APPEAL TO OWN GRAIL NO MATTER WHAT THEY TELL YOU, ILMN’S MANAGEMENT WILL CONTINUE APPEALING (AND APPEALING) BECAUSE THEY SIMPLY WANT TO OWN GRAIL AT ANY COST. 1) ILMN’s 2022 10 - K 2) ILMN press release dated 4/3/2023 3) Foo Yun Chee. “Illumina fights EU order to divest Grail.” Reuters. 2/8/2023; Statement made by ILMN ahead of hearing on 2/8/2 023 “A decision from the full FTC is pending. We intend to continue to vigorously defend against the FTC action.” 1 “We intend to appeal any EC Divestment Decision and, if necessary, to seek interim relief suspending the divestment of GRAIL until the final determination of these appeals.” 1 “Illumina today announced that it will appeal the FTC’s decision ordering the unwinding of Illumina's acquisition of GRAIL” 2 “We disagree that the Commission has jurisdiction to review the GRAIL transaction and believe that divestment is not proportional to the speculative harm the Commission has alleged” 3

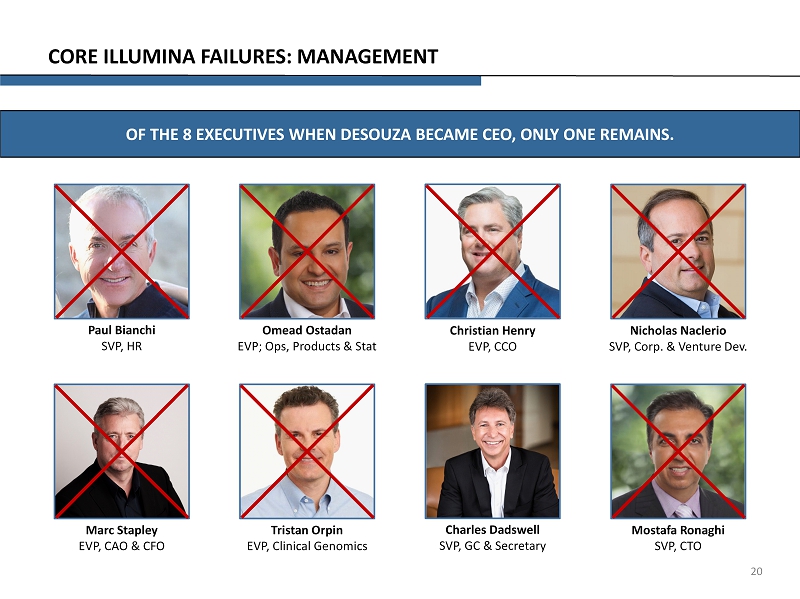

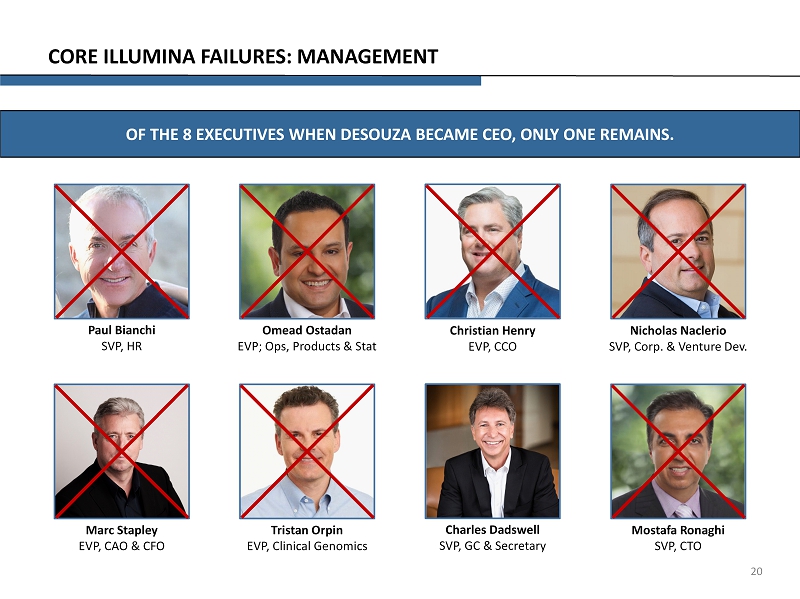

OF THE 8 EXECUTIVES WHEN DESOUZA BECAME CEO, ONLY ONE REMAINS. 20 CORE ILLUMINA FAILURES: MANAGEMENT Charles Dadswell SVP, GC & Secretary Paul Bianchi SVP, HR Nicholas Naclerio SVP, Corp. & Venture Dev. Omead Ostadan EVP; Ops, Products & Stat Tristan Orpin EVP, Clinical Genomics Marc Stapley EVP, CAO & CFO Mostafa Ronaghi SVP, CTO Christian Henry EVP, CCO

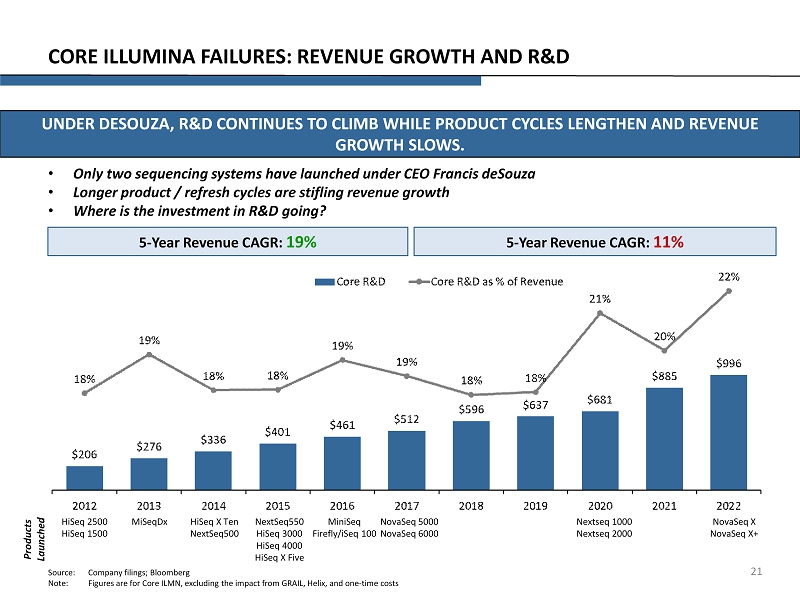

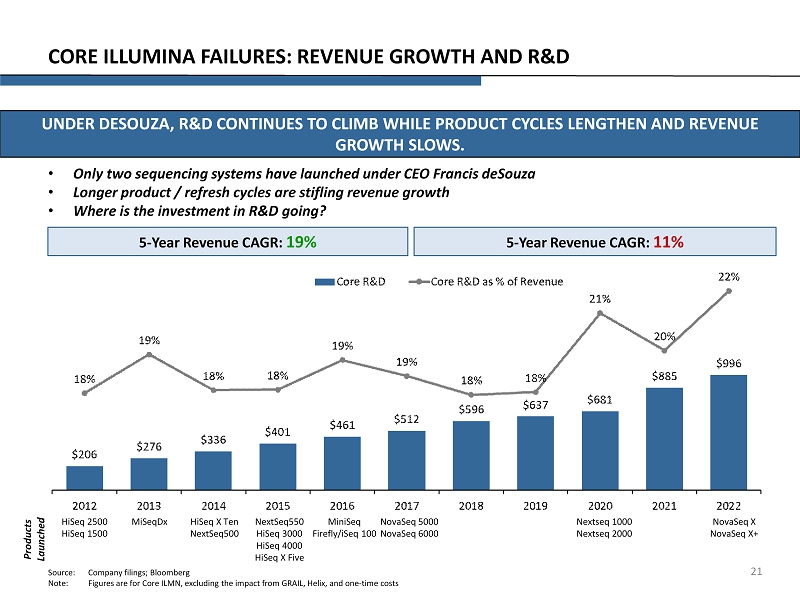

UNDER DESOUZA, R&D CONTINUES TO CLIMB WHILE PRODUCT CYCLES LENGTHEN AND REVENUE GROWTH SLOWS. 21 CORE ILLUMINA FAILURES: REVENUE GROWTH AND R&D Source: Company filings; Bloomberg Note: Figures are for Core ILMN, excluding the impact from GRAIL, Helix, and one - time costs NovaSeq X NovaSeq X+ Nextseq 1000 Nextseq 2000 NovaSeq 5000 NovaSeq 6000 MiniSeq Firefly/ iSeq 100 NextSeq550 HiSeq 3000 HiSeq 4000 HiSeq X Five HiSeq X Ten NextSeq500 MiSeqDx HiSeq 2500 HiSeq 1500 5 - Year Revenue CAGR: 19% 5 - Year Revenue CAGR: 11% • Only two sequencing systems have launched under CEO Francis deSouza • Longer product / refresh cycles are stifling revenue growth • Where is the investment in R&D going? Products Launched

ILMN’S CORE OPERATING MARGINS HAVE DECLINED FROM ~31% TO 22% UNDER DESOUZA’S WATCH. 22 CORE ILLUMINA FAILURES: DETERIORATING CORE MARGINS Source: Company filings; Bloomberg Note: Figures are for Core ILMN, excluding the impact from GRAIL, Helix, and one - time costs

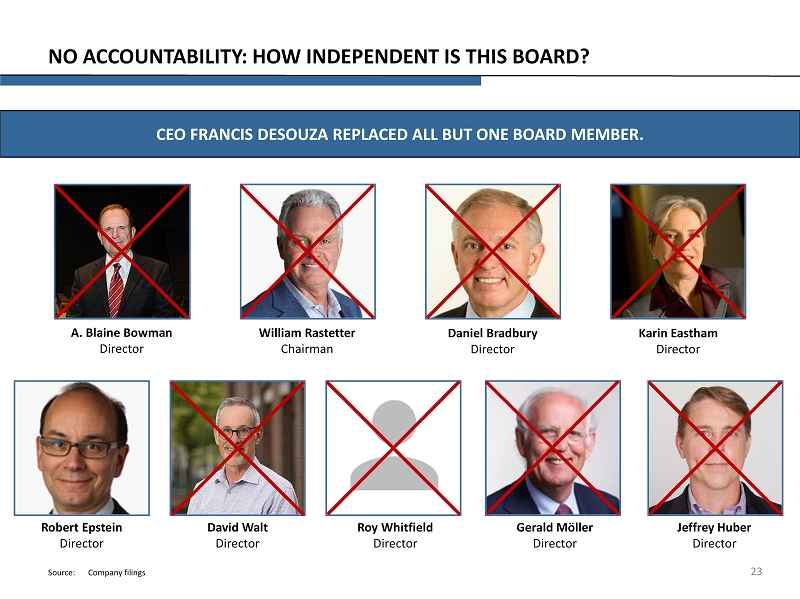

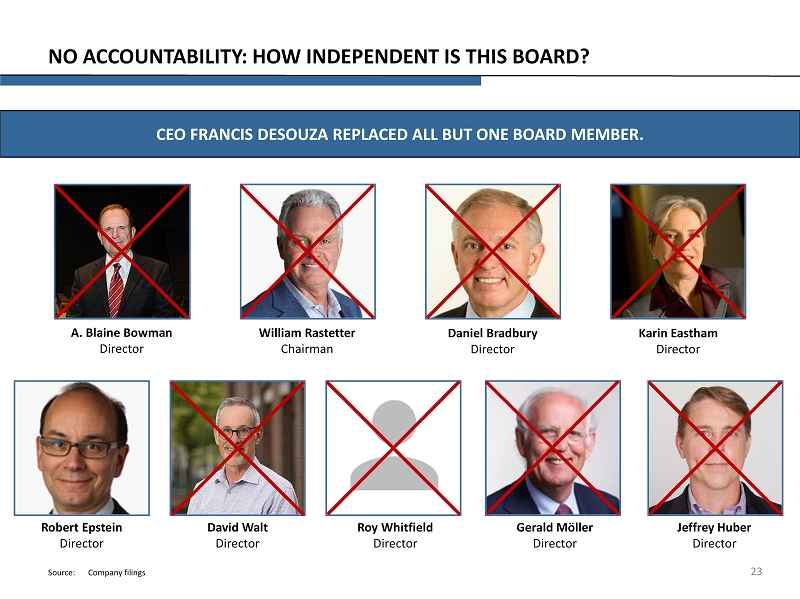

CEO FRANCIS DESOUZA REPLACED ALL BUT ONE BOARD MEMBER. 23 NO ACCOUNTABILITY: HOW INDEPENDENT IS THIS BOARD? A. Blaine Bowman Director Daniel Bradbury Director Karin Eastham Director William Rastetter Chairman David Walt Director Robert Epstein Director Source: Company filings Jeffrey Huber Director Gerald Möller Director Roy Whitfield Director

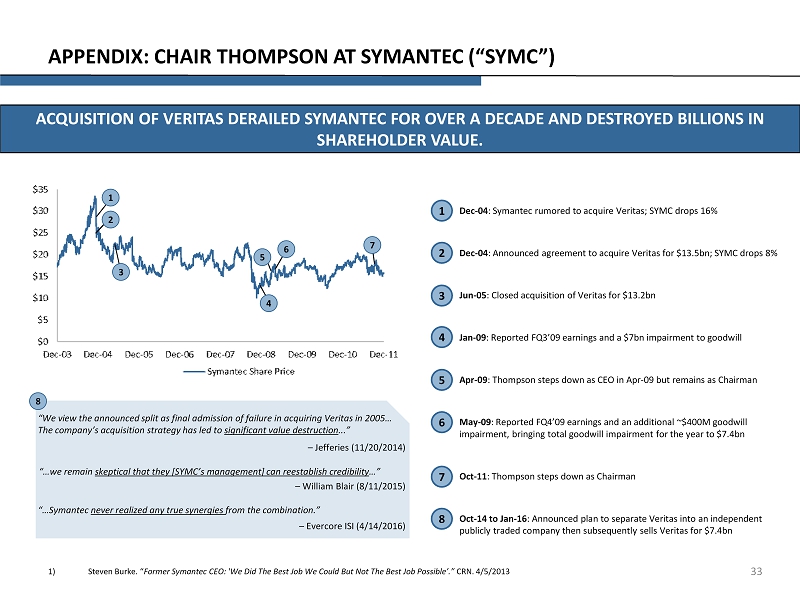

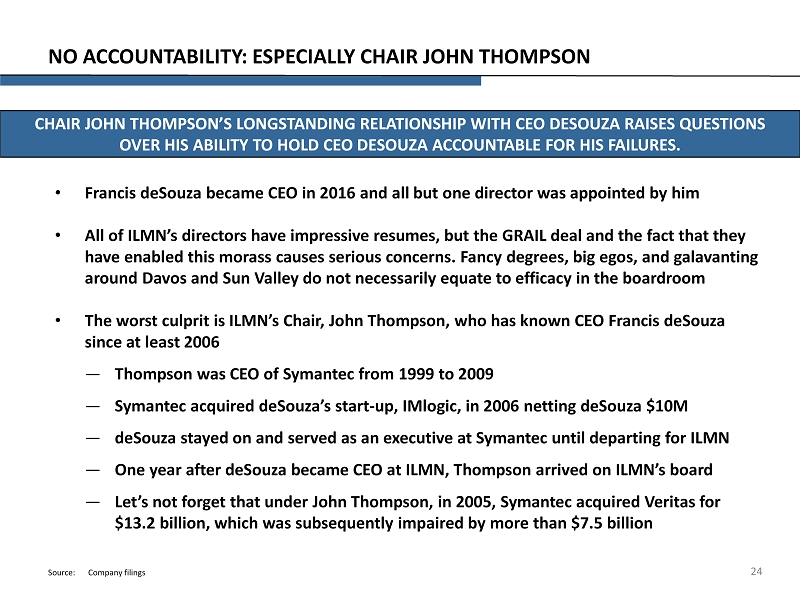

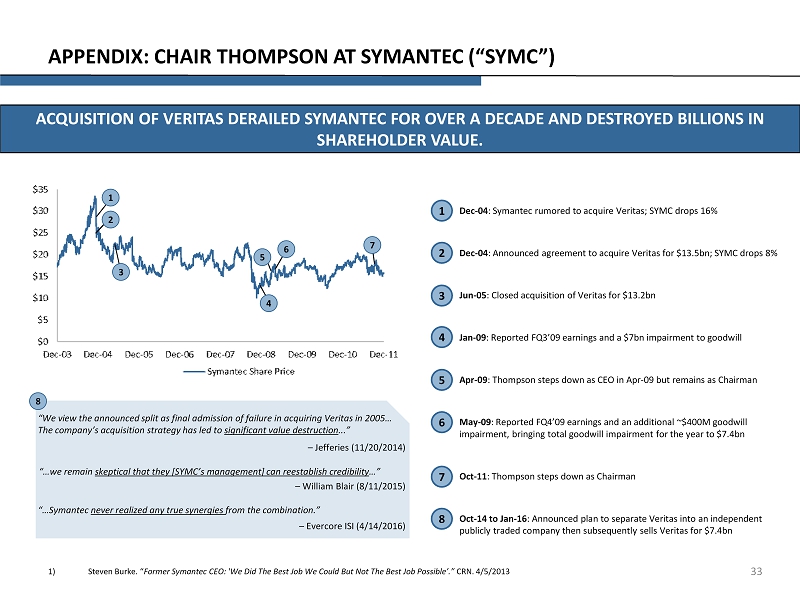

CHAIR JOHN THOMPSON’S LONGSTANDING RELATIONSHIP WITH CEO DESOUZA RAISES QUESTIONS OVER HIS ABILITY TO HOLD CEO DESOUZA ACCOUNTABLE FOR HIS FAILURES. 24 NO ACCOUNTABILITY: ESPECIALLY CHAIR JOHN THOMPSON • Francis deSouza became CEO in 2016 and all but one director was appointed by him • All of ILMN’s directors have impressive resumes, but the GRAIL deal and the fact that they have enabled this morass causes serious concerns. Fancy degrees, big egos, and galavanting around Davos and Sun Valley do not necessarily equate to efficacy in the boardroom • The worst culprit is ILMN’s Chair, John Thompson, who has known CEO Francis deSouza since at least 2006 — Thompson was CEO of Symantec from 1999 to 2009 — Symantec acquired deSouza’s start - up, IMlogic , in 2006 netting deSouza $10M — deSouza stayed on and served as an executive at Symantec until departing for ILMN — One year after deSouza became CEO at ILMN, Thompson arrived on ILMN’s board — Let’s not forget that under John Thompson, in 2005, Symantec acquired Veritas for $13.2 billion, which was subsequently impaired by more than $7.5 billion Source: Company filings

IN THE FACE OF $50BN OF VALUE DESTRUCTION, ILMN’S BOARD MADE AN INCOMPREHENSIBLE DECISION TO INCREASE DESOUZA’S PAY BY 87% TO A STAGGERING TOTAL OF $27M. 25 NO ACCOUNTABILITY: COMPENSATION Source: Bloomberg; PREC14A filed 3/30/2023 ILMN Share Price CEO deSouza’s Total Compensation

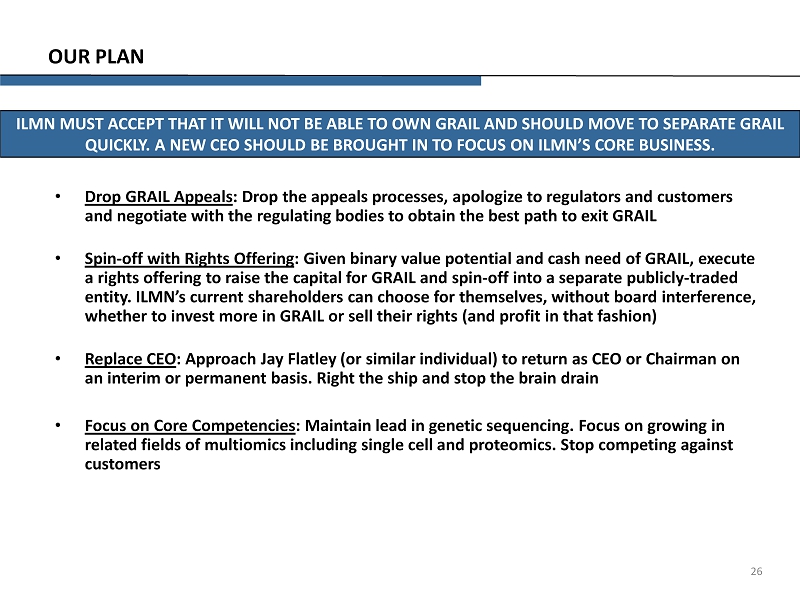

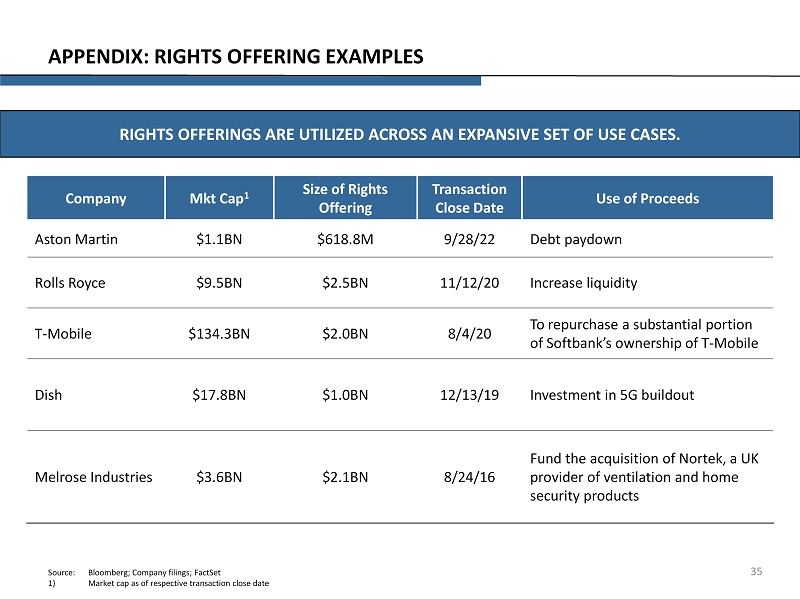

ILMN MUST ACCEPT THAT IT WILL NOT BE ABLE TO OWN GRAIL AND SHOULD MOVE TO SEPARATE GRAIL QUICKLY. A NEW CEO SHOULD BE BROUGHT IN TO FOCUS ON ILMN’S CORE BUSINESS. 26 OUR PLAN • Drop GRAIL Appeals : Drop the appeals processes, apologize to regulators and customers and negotiate with the regulating bodies to obtain the best path to exit GRAIL • Spin - off with Rights Offering : Given binary value potential and cash need of GRAIL, execute a rights offering to raise the capital for GRAIL and spin - off into a separate publicly - traded entity. ILMN’s current shareholders can choose for themselves, without board interference, whether to invest more in GRAIL or sell their rights (and profit in that fashion) • Replace CEO : Approach Jay Flatley (or similar individual) to return as CEO or Chairman on an interim or permanent basis. Right the ship and stop the brain drain • Focus on Core Competencies : Maintain lead in genetic sequencing. Focus on growing in related fields of multiomics including single cell and proteomics. Stop competing against customers

27 APPENDIX • OTHER MARKET THOUGHTS ON GRAIL • ILMN TIMELINE UNDER DESOUZA • CEO COMPENSATION • SMALL GENETICS COMPANIES FINANCIAL COMPARISON VS. ILMN • SMALL GENETICS COMPANIES SHARE PRICE COMPARISON VS. ILMN • REVIEW OF CHAIR JOHN THOMPSON • RIGHTS OFFERING EXAMPLES

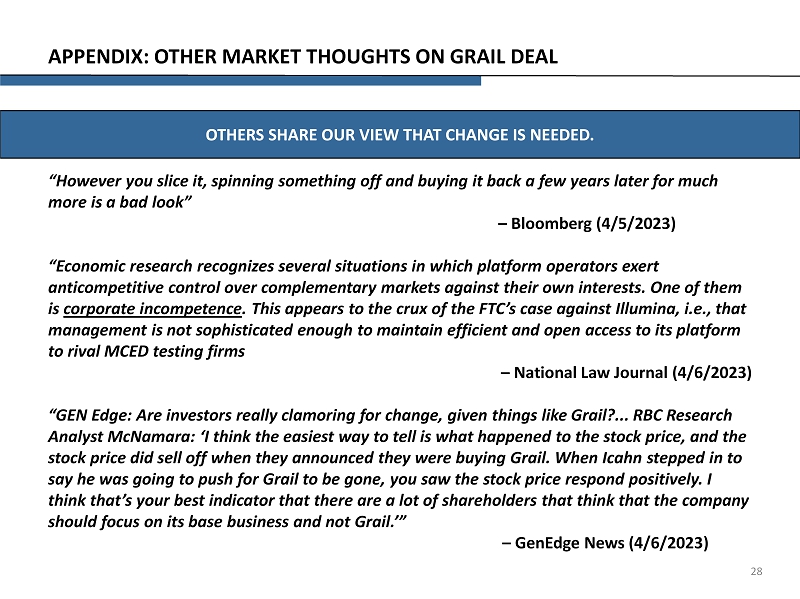

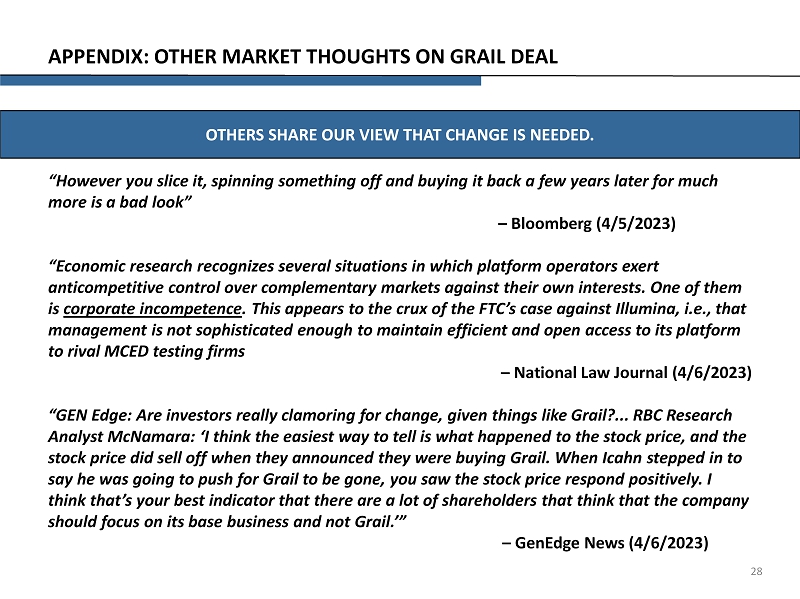

28 APPENDIX: OTHER MARKET THOUGHTS ON GRAIL DEAL OTHERS SHARE OUR VIEW THAT CHANGE IS NEEDED. “However you slice it, spinning something off and buying it back a few years later for much more is a bad look” – Bloomberg (4/5/2023) “Economic research recognizes several situations in which platform operators exert anticompetitive control over complementary markets against their own interests. One of them is corporate incompetence . This appears to the crux of the FTC’s case against Illumina, i.e., that management is not sophisticated enough to maintain efficient and open access to its platform to rival MCED testing firms – National Law Journal (4/6/2023) “GEN Edge: Are investors really clamoring for change, given things like Grail?... RBC Research Analyst McNamara: ‘I think the easiest way to tell is what happened to the stock price, and the stock price did sell off when they announced they were buying Grail. When Icahn stepped in to say he was going to push for Grail to be gone, you saw the stock price respond positively. I think that’s your best indicator that there are a lot of shareholders that think that the company should focus on its base business and not Grail.’” – GenEdge News (4/6/2023)

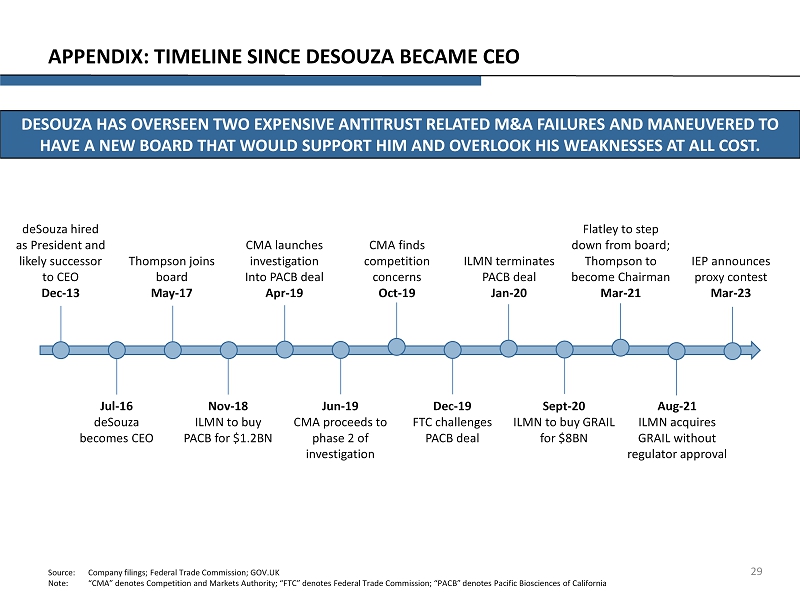

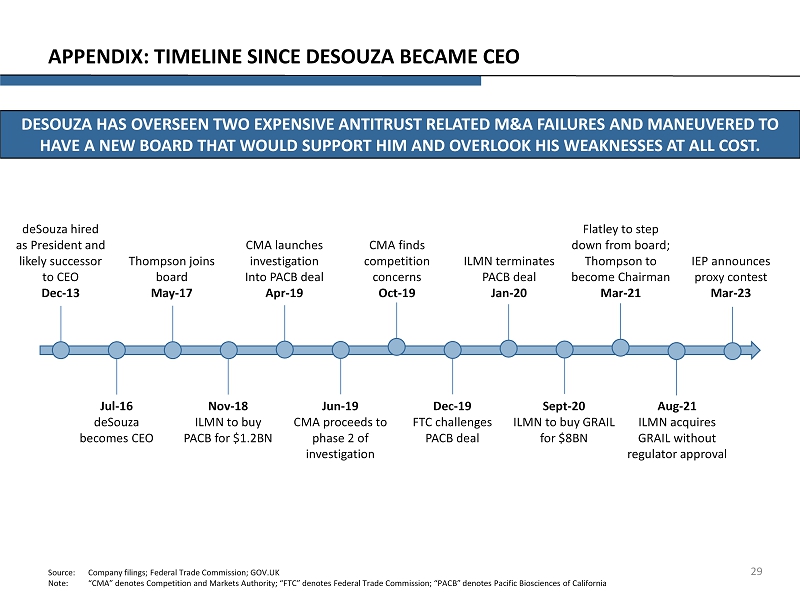

ILMN terminates PACB deal Jan - 20 Source: Company filings; Federal Trade Commission; GOV.UK Note: “CMA” denotes Competition and Markets Authority; “FTC” denotes Federal Trade Commission; “PACB” denotes Pacific Bioscience s of California 29 APPENDIX: TIMELINE SINCE DESOUZA BECAME CEO DESOUZA HAS OVERSEEN TWO EXPENSIVE ANTITRUST RELATED M&A FAILURES AND MANEUVERED TO HAVE A NEW BOARD THAT WOULD SUPPORT HIM AND OVERLOOK HIS WEAKNESSES AT ALL COST. deSouza hired as President and likely successor to CEO Dec - 13 Nov - 18 ILMN to buy PACB for $1.2BN Dec - 19 FTC challenges PACB deal Jul - 16 deSouza becomes CEO Thompson joins board May - 17 Sept - 20 ILMN to buy GRAIL for $8BN Flatley to step down from board; Thompson to become Chairman Mar - 21 Aug - 21 ILMN acquires GRAIL without regulator approval IEP announces proxy contest Mar - 23 CMA launches investigation Into PACB deal Apr - 19 Jun - 19 CMA proceeds to phase 2 of investigation CMA finds competition concerns Oct - 19

ILMN BOARD MADE AN INCOMPREHENSIBLE DECISION IN THE FACE OF $50BN OF VALUE DESTRUCTION TO INCREASE DESOUZA’S PAY BY 87% TO A STAGGERING TOTAL OF $27M. 30 APPENDIX: CEO FRANCIS DESOUZA COMPENSATION Source: PREC14A filed 3/30/2023

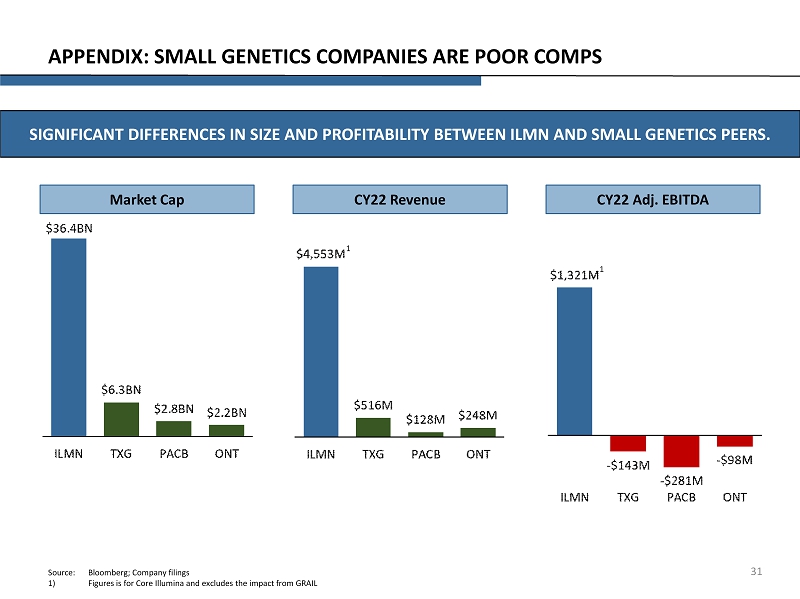

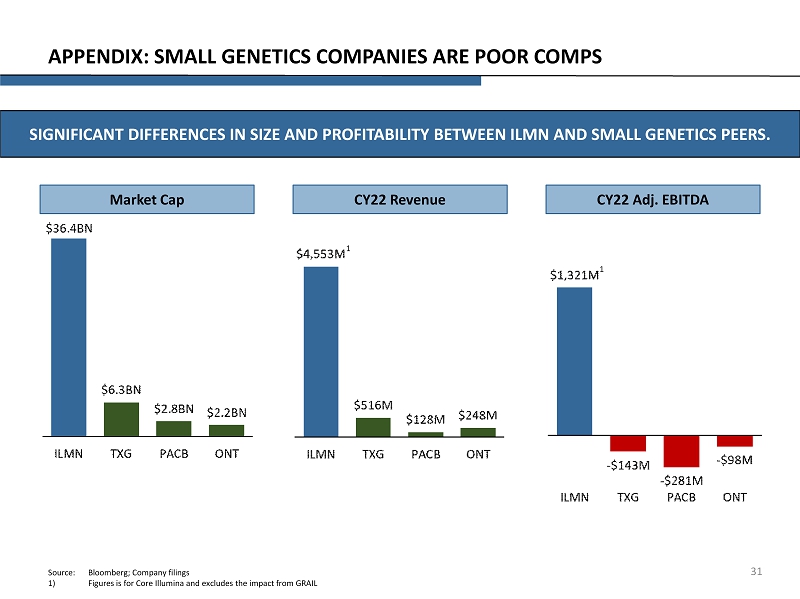

31 APPENDIX: SMALL GENETICS COMPANIES ARE POOR COMPS Market Cap SIGNIFICANT DIFFERENCES IN SIZE AND PROFITABILITY BETWEEN ILMN AND SMALL GENETICS PEERS. CY22 Revenue CY22 Adj. EBITDA Source: Bloomberg; Company filings 1) Figures is for Core Illumina and excludes the impact from GRAIL 1 1

32 APPENDIX: ILMN STOCK PERFORMANCE VS SMALL GENETICS COMPANIES GRAIL’S DRAG ON ILMN HAS DRIVEN SHARE PRICE PERFORMANCE TO BE LARGELY IN LINE WITH SMALL GENETICS COMPS DESPITE THEIR INFERIOR SCALE AND FINANCIAL PROFILE. Performance Since deSouza Became CEO Performance Since Completion of Grail Acquisition

APPENDIX: CHAIR THOMPSON AT SYMANTEC (“SYMC”) ACQUISITION OF VERITAS DERAILED SYMANTEC FOR OVER A DECADE AND DESTROYED BILLIONS IN SHAREHOLDER VALUE. “…Symantec never realized any true synergies from the combination.” – Evercore ISI (4/14/2016) “…we remain skeptical that they [SYMC’s management] can reestablish credibility …” – William Blair (8/11/2015) • Dec - 04 : Symantec rumored to acquire Veritas; SYMC drops 16% 1 • Dec - 04 : Announced agreement to acquire Veritas for $13.5bn; SYMC drops 8% • Jun - 05 : Closed acquisition of Veritas for $13.2bn • Apr - 09 : Thompson steps down as CEO in Apr - 09 but remains as Chairman • Jan - 09 : Reported FQ3’09 earnings and a $7bn impairment to goodwill • May - 09 : Reported FQ4’09 earnings and an additional ~$400M goodwill impairment, bringing total goodwill impairment for the year to $7.4bn • Oct - 11 : Thompson steps down as Chairman • Oct - 14 to Jan - 16 : Announced plan to separate Veritas into an independent publicly traded company then subsequently sells Veritas for $7.4bn 2 3 4 5 6 7 8 2 3 4 6 7 1 5 1) Steven Burke. “ Former Symantec CEO: 'We Did The Best Job We Could But Not The Best Job Possible’.” CRN. 4/5/2013 “We view the announced split as final admission of failure in acquiring Veritas in 2005… The company’s acquisition strategy has led to significant value destruction ...” – Jefferies (11/20/2014) 8 33

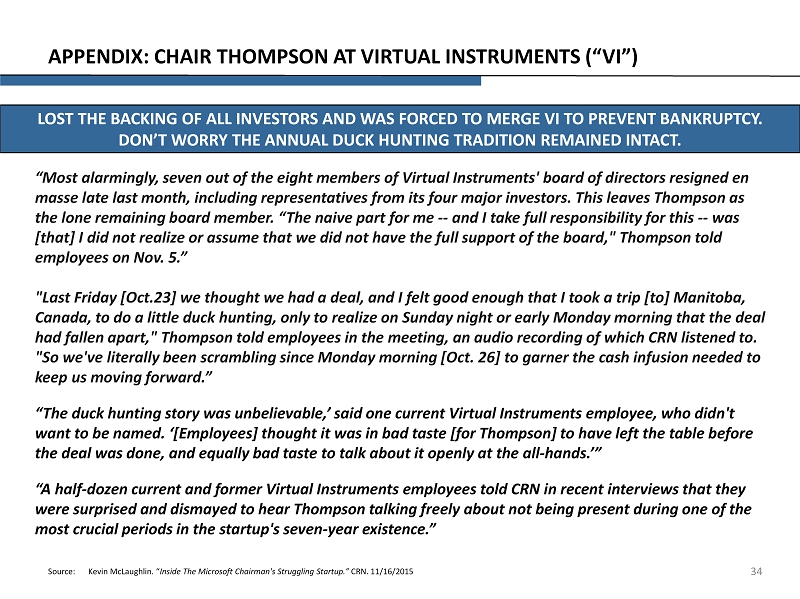

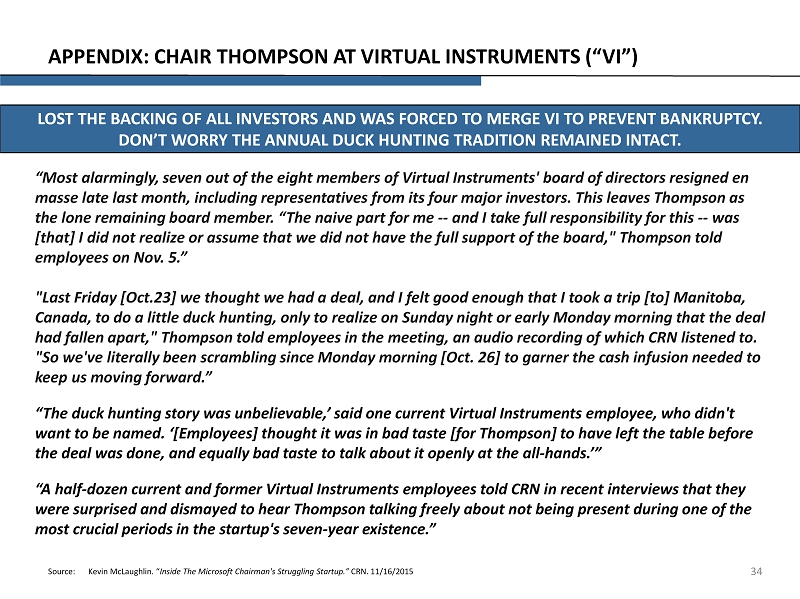

APPENDIX: CHAIR THOMPSON AT VIRTUAL INSTRUMENTS (“VI”) LOST THE BACKING OF ALL INVESTORS AND WAS FORCED TO MERGE VI TO PREVENT BANKRUPTCY. DON’T WORRY THE ANNUAL DUCK HUNTING TRADITION REMAINED INTACT. Source: Kevin McLaughlin. “ Inside The Microsoft Chairman's Struggling Startup.” CRN. 11/16/2015 “Most alarmingly, seven out of the eight members of Virtual Instruments' board of directors resigned en masse late last month, including representatives from its four major investors. This leaves Thompson as the lone remaining board member. “The naive part for me -- and I take full responsibility for this -- was [that] I did not realize or assume that we did not have the full support of the board," Thompson told employees on Nov. 5.” "Last Friday [Oct.23] we thought we had a deal, and I felt good enough that I took a trip [to] Manitoba, Canada, to do a little duck hunting, only to realize on Sunday night or early Monday morning that the deal had fallen apart," Thompson told employees in the meeting, an audio recording of which CRN listened to. "So we've literally been scrambling since Monday morning [Oct. 26] to garner the cash infusion needed to keep us moving forward.” “The duck hunting story was unbelievable,’ said one current Virtual Instruments employee, who didn't want to be named. ‘[Employees] thought it was in bad taste [for Thompson] to have left the table before the deal was done, and equally bad taste to talk about it openly at the all - hands.’” “A half - dozen current and former Virtual Instruments employees told CRN in recent interviews that they were surprised and dismayed to hear Thompson talking freely about not being present during one of the most crucial periods in the startup's seven - year existence.” 34

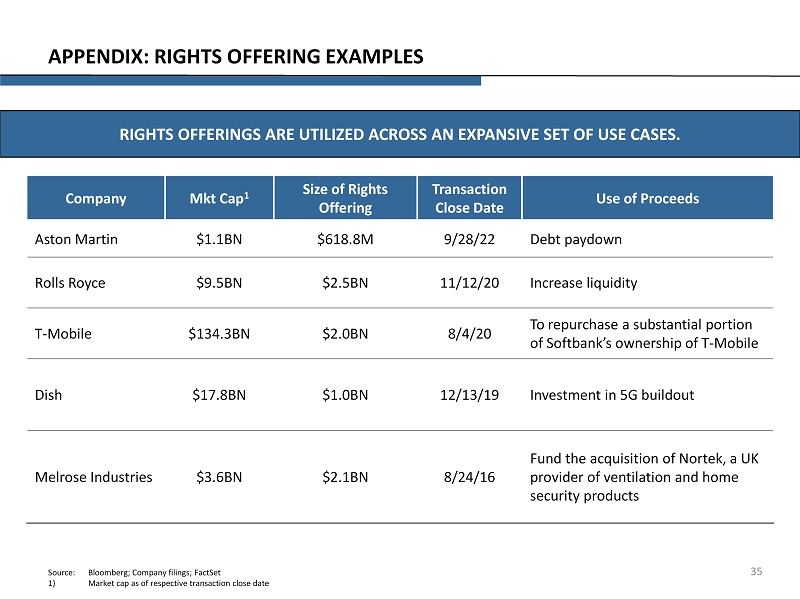

35 APPENDIX: RIGHTS OFFERING EXAMPLES Use of Proceeds Transaction Close Date Size of Rights Offering Mkt Cap 1 Company Debt paydown 9/28/22 $618.8M $1.1BN Aston Martin Increase liquidity 11/12/20 $2.5BN $9.5BN Rolls Royce To repurchase a substantial portion of Softbank’s ownership of T - Mobile 8/4/20 $2.0BN $134.3BN T - Mobile Investment in 5G buildout 12/13/19 $1.0BN $17.8BN Dish Fund the acquisition of Nortek, a UK provider of ventilation and home security products 8/24/16 $2.1BN $3.6BN Melrose Industries Source: Bloomberg; Company filings; FactSet 1) Market cap as of respective transaction close date RIGHTS OFFERINGS ARE UTILIZED ACROSS AN EXPANSIVE SET OF USE CASES.

36 ADDITIONAL INFORMATION; PARTICIPANTS IN THE SOLICITATION Additional Information and Where to Find It; Participants in the Solicitation and Notice to Investors THE SOLICITATION DISCUSSED HEREIN RELATES TO THE SOLICITATION OF PROXIES BY CARL C . ICAHN AND HIS AFFILIATES FROM THE STOCKHOLDERS OF ILLUMINA, INC . (“ILLUMINA”) FOR USE AT ITS 2023 ANNUAL MEETING OF STOCKHOLDERS . STOCKHOLDERS OF ILLUMINA ARE ADVISED TO READ THE PROXY STATEMENT AND RELATED MATERIALS CAREFULLY AND, IN THEIR ENTIRETY, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATED TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION . WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF GOLD UNIVERSAL PROXY CARD WILL BE MAILED TO SHAREHOLDERS OF ILLUMINA AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP : //WWW . SEC . GOV . INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE SCHEDULE 14 A FILED BY CARL C . ICAHN AND HIS AFFILIATES WITH THE SECURITIES AND EXCHANGE COMMISSION ON MARCH 13 , 2023 . EXCEPT AS OTHERWISE DISCLOSED IN THE SCHEDULE 14 A, THE PARTICIPANTS HAVE NO INTEREST IN ILLUMINA . THIS COMMUNICATION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT A RECOMMENDATION, AN OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL SHARES .

37 FORWARD - LOOKING STATEMENTS; SPECIAL NOTE REGARDING PRESENTATION Forward - Looking Statements Certain statements contained in this presentation are forward - looking statements including, but not limited to, statements that are predications of or indicate future events, trends, plans or objectives . Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties . Forward - looking statements are not guarantees of future performance or activities and are subject to many risks and uncertainties . Due to such risks and uncertainties, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward - looking statements . Forward - looking statements can be identified by the use of the future tense or other forward - looking words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “should,” “may,” “will,” “objective,” “projection,” “forecast,” “management believes,” “continue,” “strategy,” “position” or the negative of those terms or other variations of them or by comparable terminology . Important factors that could cause actual results to differ materially from the expectations set forth in this presentation include, among other things, the factors identified in the public filings of Illumina, Inc . Such forward - looking statements should therefore be construed in light of such factors, and we are under no obligation, and expressly disclaim any intention or obligation, to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law . Special Note Regarding this Presentation THIS PRESENTATION CONTAINS OUR CURRENT VIEWS ON THE VALUE OF ILLUMINA, INC . SECURITIES AND CERTAIN ACTIONS THAT ILLUMINA, INC . ’s BOARD MAY TAKE TO ENHANCE THE VALUE OF ITS SECURITIES . OUR VIEWS ARE BASED ON OUR OWN ANALYSIS OF PUBLICLY AVAILABLE INFORMATION AND ASSUMPTIONS WE BELIEVE TO BE REASONABLE . THERE CAN BE NO ASSURANCE THAT THE INFORMATION WE CONSIDERED AND ANALYZED IS ACCURATE OR COMPLETE . SIMILARLY, THERE CAN BE NO ASSURANCE THAT OUR ASSUMPTIONS ARE CORRECT . ILLUMINA, INC . ’ PERFORMANCE AND RESULTS MAY DIFFER MATERIALLY FROM OUR ASSUMPTIONS AND ANALYSIS . WE HAVE NOT SOUGHT, NOR HAVE WE RECEIVED, PERMISSION FROM ANY THIRD - PARTY TO INCLUDE THEIR INFORMATION IN THIS PRESENTATION . ANY SUCH INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN . OUR VIEWS AND OUR HOLDINGS COULD CHANGE AT ANY TIME . WE MAY SELL ANY OR ALL OF OUR HOLDINGS OR INCREASE OUR HOLDINGS BY PURCHASING ADDITIONAL SECURITIES . WE MAY TAKE ANY OF THESE OR OTHER ACTIONS REGARDING ILLUMINA, INC . WITHOUT UPDATING THIS PRESENTATION OR PROVIDING ANY NOTICE WHATSOEVER OF ANY SUCH CHANGES (EXCEPT AS OTHERWISE REQUIRED BY LAW) .