| STRATEGIC ALLIANCE August 8, 2023 |

| v 2 FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the use of forward-looking terminology such as “expects,” “believes,” “estimates,” “projects,” “intends,” “plans,” “goal,” “seeks,” “may,” “will,” “should,” or “anticipates” or the negative or other variations of these or similar words, or by discussions of future events, strategies or risks and uncertainties. Specifically, forward-looking statements include, but are not limited to, statements regarding: future Adjusted EBITDA; the inclusion of a Hollywood-branded integrated iCasino product in the ESPN Bet Sportsbook; the integration of the ESPN Bet Sportsbook into the ESPN ecosystem; the benefits of the Sportsbook Agreement between the Company and ESPN; the benefit to ESPN Bet of the Company’s experience, market access and technology platform; the expansion of the Company’s digital footprint and growth of its customer ecosystem; the Company’s expectations of future results of operations and financial condition, the assumptions provided regarding the guidance, including the scale and timing of the Company’s product and technology investments; the Company’s expectations regarding results, and the impact of competition, in retail/mobile/online sportsbooks, iCasino, social gaming, and retail operations; the Company’s development and launch of its Interactive segment’s products in new jurisdictions and enhancements to existing Interactive segment products, including the content for the ESPN Bet and theScore Bet Sportsbook and Casino apps and the expected timing of the rebrand of the Barstool Sportsbook as ESPN Bet on our proprietary player account management system and risk and trading platforms; the Company’s expectations regarding its Sportsbook Agreement with ESPN and the future success of its products; and the Company’s expectations with respect to the integration and synergies related to the Company’s integration of theScore and the continued growth and monetization of the Company’s media business. • Such statements are all subject to risks, uncertainties and changes in circumstances that could significantly affect the Company’s future financial results and business. Accordingly, the Company cautions that the forward-looking statements contained herein are qualified by important factors that could cause actual results to differ materially from those reflected by such statements. Such factors include: the effects of economic and market conditions in the markets in which the Company operates; competition with other entertainment, sports content, and casino gaming experiences; the timing, cost and expected impact of product and technology investments; risks relating to international operations, permits, licenses, financings, approvals and other contingencies in connection with growth in new or existing jurisdictions; the Company may not be able to achieve the anticipated financial returns from the Sportsbook Agreement with ESPN, including due to fees, costs, taxes or circumstances beyond the Company’s or ESPN’s control; the rebranding of the Barstool Sportsbook as ESPN Bet or the inclusion of Hollywood-branded iCasino products may be delayed, or in certain jurisdictions may not occur at all, for reasons beyond our control, including due to any delays in the receipt of, or failure to receive, any required regulatory approvals; the ability to successfully integrate ESPN Bet, theScore and PENN’s iCasino products and the costs and fees associated with such integrations; potential adverse reactions or changes to business or regulatory relationships resulting from the announcement or performance of the Sportsbook Agreement with ESPN or the divestiture of Barstool Sports; the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the Company and ESPN to terminate the Sportsbook Agreement between the companies; liabilities, costs and fees in connection with the divestiture of Barstool Sports and the transition from the Barstool Sportsbook and other uses of intellectual property of Barstool Sports, including in the Company’s retail locations; the ability of the Company and ESPN to agree to extend the initial 10-year term of the Sportsbook Agreement on mutually satisfactory terms, if at all, and the costs and obligations of such terms if agreed; the acceleration of the vesting of the warrants issued to ESPN in certain circumstances; the outcome of any legal proceedings that may be instituted against the Company, ESPN or their respective directors, officers or employees; the ability of the Company to retain and hire key personnel; the impact of new or changes in current laws, regulations, rules or other industry standards; and additional risks and uncertainties described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, each as filed with the U.S. Securities and Exchange Commission. The Company does not intend to update publicly any forward-looking statements except as required by law. Considering these risks, uncertainties and assumptions, the forward-looking events discussed in this presentation may not occur. |

| v 3 NON-GAAP FINANCIAL MEASURES The Non-GAAP Financial Measures used in this press release include Adjusted EBITDA. This non-GAAP financial measure should not be considered a substitute for, nor superior to, financial results and measures determined or calculated in accordance with GAAP. We define Adjusted EBITDA as earnings before interest expense, net; interest income; income taxes; depreciation and amortization; stock-based compensation; debt extinguishment charges; impairment losses; insurance recoveries, net of deductible charges; changes in the estimated fair value of our contingent purchase price obligations; gain or loss on disposal of assets; the difference between budget and actual expense for cash-settled stock-based awards; pre-opening expenses; non-cash gains/losses associated with REIT transactions; non-cash gains/losses associated with partial and step acquisitions as measured in accordance with ASC 805 “Business Combinations”; and other non-recurring acquisition costs and finance transformation costs. Adjusted EBITDA is inclusive of income or loss from unconsolidated affiliates, with our share of non-operating items (such as interest expense, net; income taxes; depreciation and amortization; and stock-based compensation expense) added back for Barstool (prior to our acquisition of Barstool on February 17, 2023) and our Kansas Entertainment, LLC joint venture. Adjusted EBITDA is inclusive of rent expense associated with our triple net operating leases with our REIT landlords. Although Adjusted EBITDA includes rent expense associated with our triple net operating leases, we believe Adjusted EBITDA is useful as a supplemental measure in evaluating the performance of our consolidated results of operations. Adjusted EBITDA has economic substance because it is used by management as a performance measure to analyze the performance of our business, and is especially relevant in evaluating large, long-lived casino-hotel projects because it provides a perspective on the current effects of operating decisions separated from the substantial non-operational depreciation charges and financing costs of such projects. We present Adjusted EBITDA because it is used by some investors and creditors as an indicator of the strength and performance of ongoing business operations, including our ability to service debt, and to fund capital expenditures, acquisitions and operations. These calculations are commonly used as a basis for investors, analysts and credit rating agencies to evaluate and compare operating performance and value companies within our industry. In order to view the operations of their casinos on a more stand-alone basis, gaming companies, including us, have historically excluded from their Adjusted EBITDA calculations certain corporate expenses that do not relate to the management of specific casino properties. However, Adjusted EBITDA is not a measure of performance or liquidity calculated in accordance with GAAP. Adjusted EBITDA information is presented as a supplemental disclosure, as management believes that it is a commonly used measure of performance in the gaming industry and that it is considered by many to be a key indicator of the Company’s operating results. Adjusted EBITDA is not calculated in the same manner by all companies and, accordingly, may not be an appropriate measure of comparing performance among different companies. The Company does not provide a reconciliation of projected Adjusted EBITDA because it is unable to predict with reasonable accuracy the value of certain adjustments that may significantly impact the Company’s results, including realized and unrealized gains and losses on equity securities, re-measurement of cash-settled stock-based awards, contingent purchase payments associated with prior acquisitions, and income tax (benefit) expense, which are dependent on future events that are out of the Company’s control or that may not be reasonably predicted. |

| v 4 ESPN BET: THE FUTURE OF SPORTS MEDIA & BETTING Efficient customer acquisition through exclusive ESPN access & deep integrations Exclusive & Integrated Combination of leading gaming operator and #1 U.S. sports media platform Synergistic Relationship ESPN Bet’s success is mutually beneficial through warrants and ongoing collaboration Highly Aligned $500 million to $1 billion+ Interactive Adjusted EBITDA potential with retail cross-sell upside Compelling Value Creation Cutting-edge proprietary tech provides first rate product offering & user experience Best-In-Class Tech Stack x |

| v 5 HIGHLY SYNERGISTIC RELATIONSHIP Leading Gaming Platform 1 Cutting-Edge Proprietary Tech 2 Best-in-Class Operators 3 Robust Market Access 4 27 Million Customer Database 5 Omni-Channel Cross-Sell Leading Sports Media & Content Platform 1 #1 Sports Brand in the U.S. 2 Marquee Sports Programming 3 Engaging Personalities 4 Unrivaled Reach 5 Extensive User Base Operational Expertise Leading Brand Best-in-Class Product Note: App design is illustrative. |

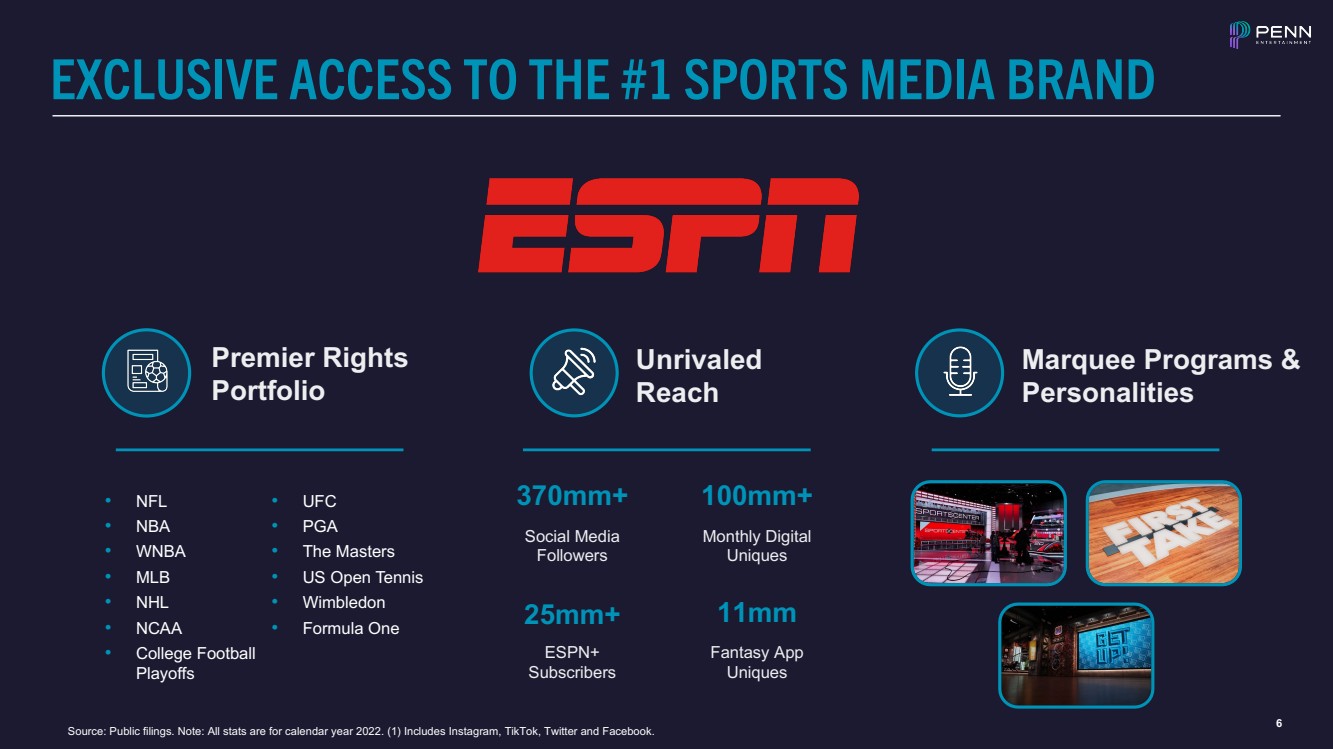

| v 6 Source: Public filings. Note: All stats are for calendar year 2022. (1) Includes Instagram, TikTok, Twitter and Facebook. EXCLUSIVE ACCESS TO THE #1 SPORTS MEDIA BRAND 25mm+ ESPN+ Subscribers 100mm+ Monthly Digital Uniques 11mm Fantasy App Uniques 370mm+ Social Media Followers Premier Rights Portfolio Unrivaled Reach Marquee Programs & Personalities • NFL • NBA • WNBA • MLB • NHL • NCAA • College Football Playoffs • UFC • PGA • The Masters • US Open Tennis • Wimbledon • Formula One |

| v 7 Scalable, Fully-Owned Tech BEST-IN-CLASS USER EXPERIENCE Player Account Management Promotional Engine Risk & Trading Engine Expansive Product / Betting Offering Deep Media & Betting Integration Bespoke Hyper-Personalized Promos x |

| v 8 CLEAR PATH TO ONLINE SPORTS BETTING PODIUM Structured to execute on built-in advantages to achieve podium position in highly compelling Online Gaming business x Source: Internal information. Brand Affinity Customer Reach / Fantasy Database Tech / Product Media Integrations • Strongest sports brand in the U.S., supported by decades of brand affinity • Unparalleled reach, including the largest U.S. fantasy database and casino database of 27 million • Best-in-class technology stack, custom-built for the North American market • Integrated media provides opportunities for highly efficient customer acquisition and organic calls to action |

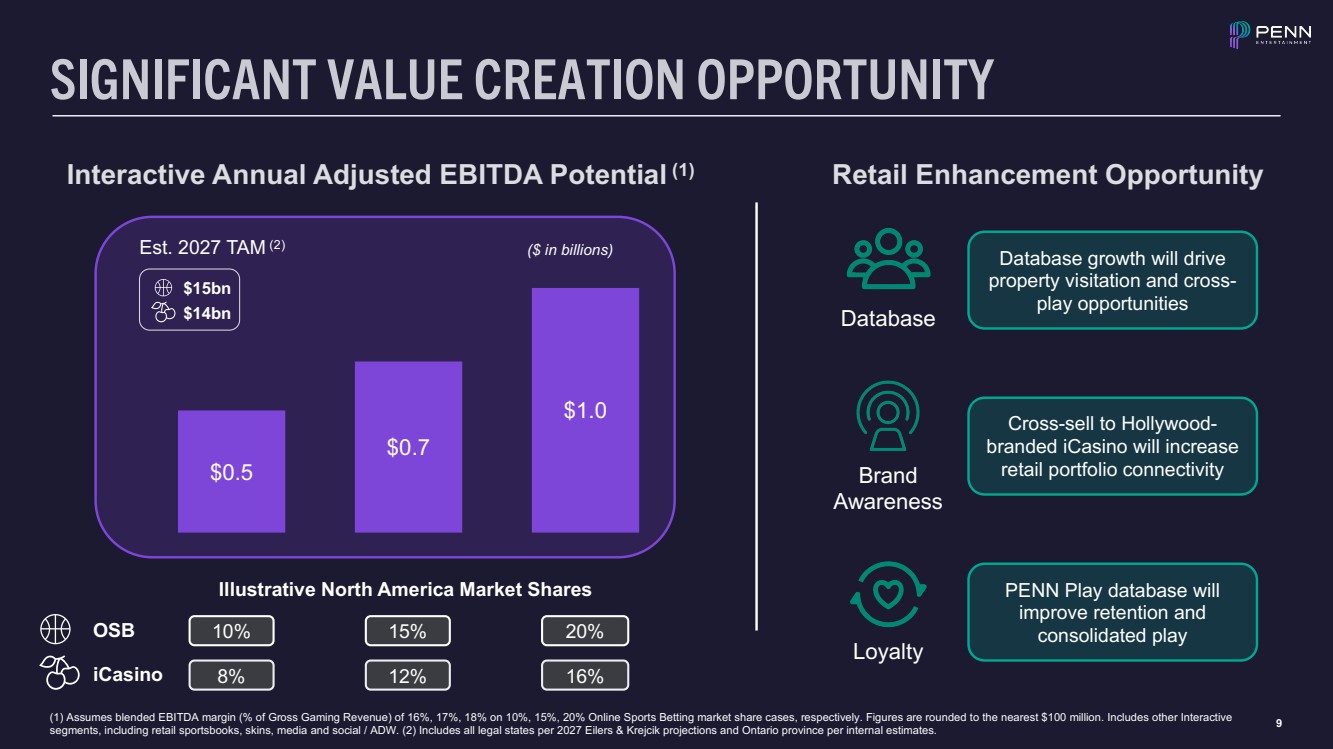

| v 9 $0.5 $0.7 $1.0 SIGNIFICANT VALUE CREATION OPPORTUNITY (1) Assumes blended EBITDA margin (% of Gross Gaming Revenue) of 16%, 17%, 18% on 10%, 15%, 20% Online Sports Betting market share cases, respectively. Figures are rounded to the nearest $100 million. Includes other Interactive segments, including retail sportsbooks, skins, media and social / ADW. (2) Includes all legal states per 2027 Eilers & Krejcik projections and Ontario province per internal estimates. Interactive Annual Adjusted EBITDA Potential (1) ($ in billions) Retail Enhancement Opportunity Database Brand Awareness Loyalty Database growth will drive property visitation and cross-play opportunities Cross-sell to Hollywood-branded iCasino will increase retail portfolio connectivity PENN Play database will improve retention and consolidated play $15bn $14bn Est. 2027 TAM (2) Illustrative North America Market Shares iCasino 8% 12% 16% OSB 10% 15% 20% |

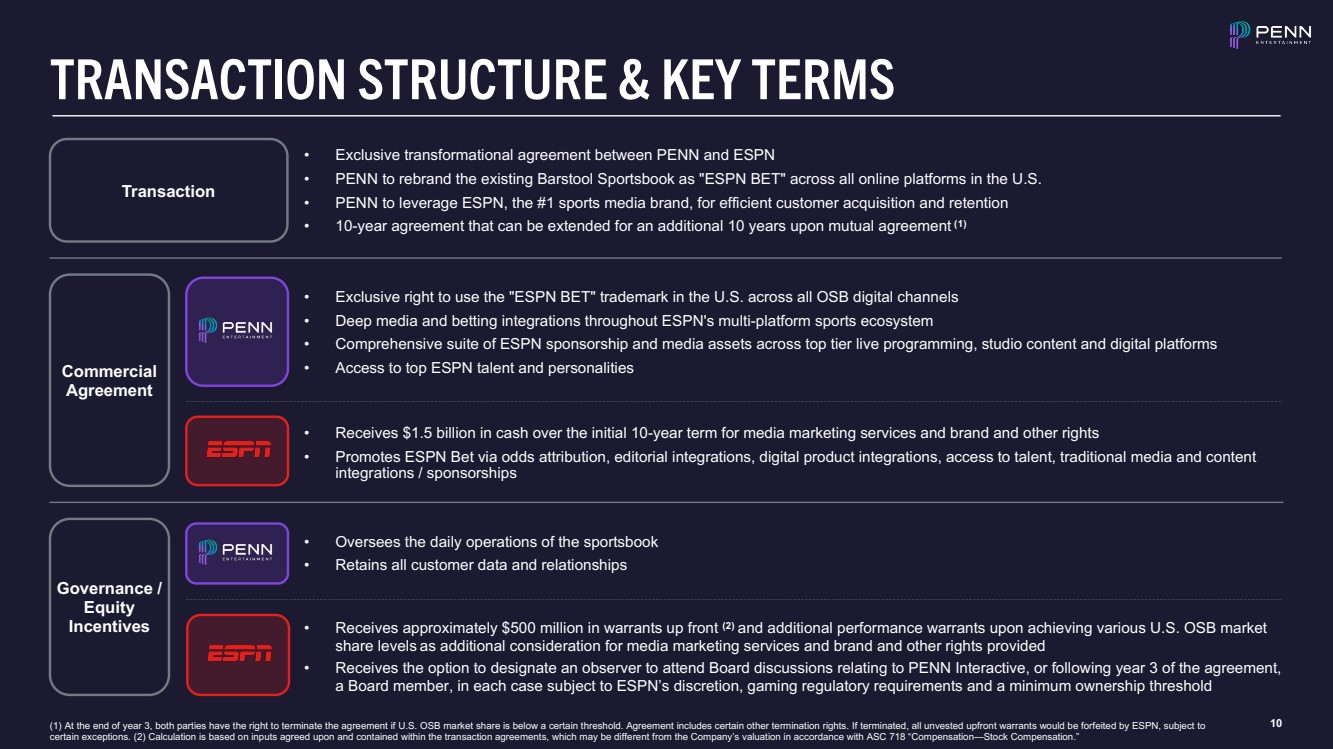

| v 10 Governance / Equity Incentives Commercial Agreement Transaction TRANSACTION STRUCTURE & KEY TERMS (1) At the end of year 3, both parties have the right to terminate the agreement if U.S. OSB market share is below a certain threshold. Agreement includes certain other termination rights. If terminated, all unvested upfront warrants would be forfeited by ESPN, subject to certain exceptions. (2) Calculation is based on inputs agreed upon and contained within the transaction agreements, which may be different from the Company’s valuation in accordance with ASC 718 “Compensation—Stock Compensation.” • Exclusive transformational agreement between PENN and ESPN • PENN to rebrand the existing Barstool Sportsbook as "ESPN BET" across all online platforms in the U.S. • PENN to leverage ESPN, the #1 sports media brand, for efficient customer acquisition and retention • 10-year agreement that can be extended for an additional 10 years upon mutual agreement (1) • Exclusive right to use the "ESPN BET" trademark in the U.S. across all OSB digital channels • Deep media and betting integrations throughout ESPN's multi-platform sports ecosystem • Comprehensive suite of ESPN sponsorship and media assets across top tier live programming, studio content and digital platforms • Access to top ESPN talent and personalities • Oversees the daily operations of the sportsbook • Retains all customer data and relationships • Receives $1.5 billion in cash over the initial 10-year term for media marketing services and brand and other rights • Promotes ESPN Bet via odds attribution, editorial integrations, digital product integrations, access to talent, traditional media and content integrations / sponsorships • Receives approximately $500 million in warrants up front (2) and additional performance warrants upon achieving various U.S. OSB market share levels as additional consideration for media marketing services and brand and other rights provided • Receives the option to designate an observer to attend Board discussions relating to PENN Interactive, or following year 3 of the agreement, a Board member, in each case subject to ESPN’s discretion, gaming regulatory requirements and a minimum ownership threshold |

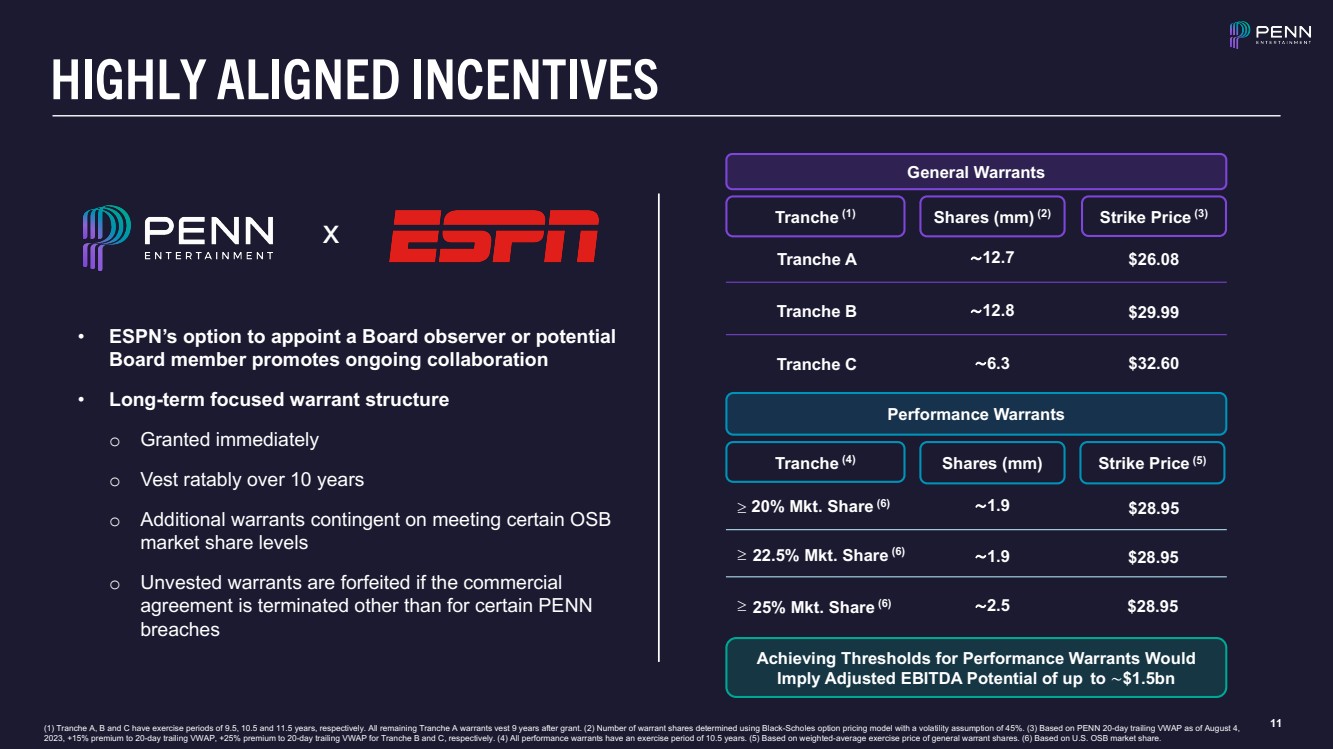

| v 11 HIGHLY ALIGNED INCENTIVES Tranche (1) Tranche A Tranche B Tranche C Strike Price (3) Shares (mm) (2) ∼12.7 ∼12.8 ∼6.3 $26.08 $29.99 $32.60 Tranche (4) 20% Mkt. Share (6) 22.5% Mkt. Share (6) 25% Mkt. Share (6) Strike Price (5) Shares (mm) ∼1.9 ∼1.9 ∼2.5 $28.95 $28.95 $28.95 Performance Warrants General Warrants • ESPN’s option to appoint a Board observer or potential Board member promotes ongoing collaboration • Long-term focused warrant structure o Granted immediately o Vest ratably over 10 years o Additional warrants contingent on meeting certain OSB market share levels o Unvested warrants are forfeited if the commercial agreement is terminated other than for certain PENN breaches x ³ ³ ³ Achieving Thresholds for Performance Warrants Would Imply Adjusted EBITDA Potential of up to ~$1.5bn (1) Tranche A, B and C have exercise periods of 9.5, 10.5 and 11.5 years, respectively. All remaining Tranche A warrants vest 9 years after grant. (2) Number of warrant shares determined using Black-Scholes option pricing model with a volatility assumption of 45%. (3) Based on PENN 20-day trailing VWAP as of August 4, 2023, +15% premium to 20-day trailing VWAP, +25% premium to 20-day trailing VWAP for Tranche B and C, respectively. (4) All performance warrants have an exercise period of 10.5 years. (5) Based on weighted-average exercise price of general warrant shares. (6) Based on U.S. OSB market share. |

| v 12 Best-In-Class Tech Stack Providing Unmatched User Experience Exclusive Access & Integrations With #1 Sports Media Brand Synergistic Alliance Between Industry Leaders ESPN BET: THE FUTURE OF SPORTS MEDIA & BETTING Significant Value Creation Opportunity Across Portfolio Highly Aligned Incentives & Vision for Future x |

|