The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(4)

Registration Statement Nos. 333-270851 and 333-270851-01

Subject to completion, dated June 15, 2023

PRELIMINARY PROSPECTUS

$341,450,000 Series 2023-A Senior Secured Securitization Bonds

Southern Indiana Gas and Electric Company

Sponsor, Depositor and Initial Servicer

Central Index Key Number: 0000092195

SIGECO Securitization I, LLC

Issuing Entity

Central Index Key Number: 0001968445

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tranche | | Expected

weighted

average

life

(years) | | | Principal

amount

offered* | | | Scheduled

final

payment

date | | | Final

maturity

date | | | Interest

rate | | | Initial

price

to

public | | | Underwriting

discounts

and

commissions | | | Proceeds

to

issuing

entity

(before

expenses) | | | CUSIP | | | ISIN | |

A-1 | | | | | | $ | 215,000,000 | | | | | | | | | | | | | % | | | | % | | | | % | | $ | | | | | | | | | | |

A-2 | | | | | | $ | 126,450,000 | | | | | | | | | | | | | % | | | | % | | | | % | | $ | | | | | | | | | | |

| * | Principal amounts are approximate and subject to change. |

The total initial price to the public is $ . The total amount of the underwriting discounts and commissions is $ . The total amount of proceeds to the issuing entity before deduction of expenses (estimated to be $ ) is $ . The distribution frequency is semi-annually. The first scheduled payment date is , 2024.

Investing in the Series 2023-A Senior Secured Securitization Bonds involves risks. Please read “Risk Factors” beginning on page 18 to read about factors you should consider before buying the securitization bonds.

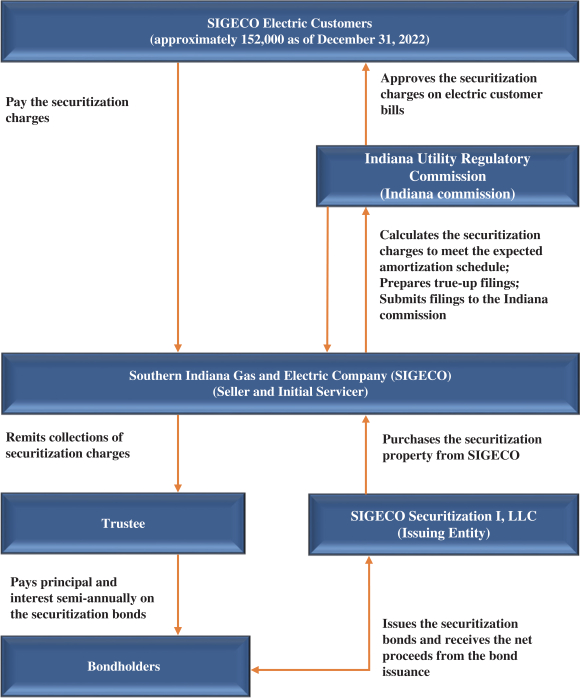

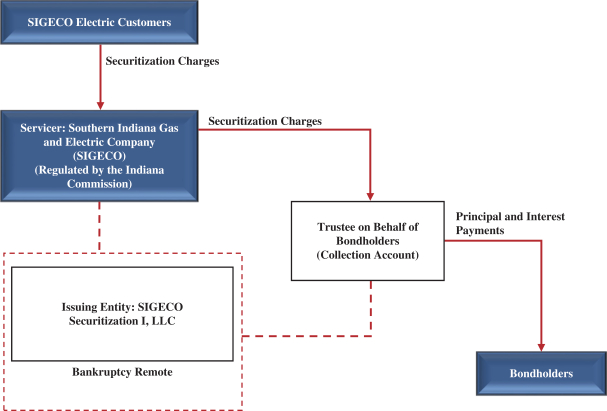

Southern Indiana Gas and Electric Company (“SIGECO”), as “depositor”, is offering up to $341,450,000 aggregate principal amount of Series 2023-A Senior Secured Securitization Bonds (the “securitization bonds”) in two tranches to be issued by SIGECO Securitization I, LLC, a Delaware limited liability company (the “issuing entity” or “us”) and wholly owned subsidiary of SIGECO. SIGECO is the “seller,” the “initial servicer” and the “sponsor” with regard to the securitization bonds. The securitization bonds are senior secured obligations of the issuing entity and will be secured by the securitization property (the “securitization property”) consisting of the right to bill and collect securitization charges (the “securitization charges”) from all retail consumers receiving electric service from SIGECO as of January 4, 2023 (the date of the financing order), including any retail customer of SIGECO that switches to new on-site generation after the date of the financing order, and any future retail electric customers during the term of the securitization bonds. The securitization charges are subject to the true-up mechanism described herein. The true-up mechanism shall be used to make necessary corrections at least annually, to (a) adjust for the over-collection or under-collection of securitization charges, or (b) to ensure the timely and complete payment of the securitization bonds and other required amounts and charges in connection with the securitization bonds. In addition to the annual true-up, at least monthly, the servicer will review, and update as appropriate, the data and assumptions underlying the calculation of the securitization charges, and periodic true-ups as required in the servicing agreement will be performed as necessary to ensure that the amount collected from securitization charges is sufficient to pay principal and interest on the securitization bonds and ensure timely and complete payment of other required amounts and charges in connection with the securitization bonds. There will also be true-up adjustments at least quarterly for the securitization bonds remaining outstanding during the year immediately preceding the scheduled final payment date for the longest maturing tranche of the securitization bonds. The primary forms of credit enhancement for the securitization bonds will be provided by such true-up mechanism, as well as by general, excess funds and capital subaccounts held under the indenture governing the securitization bonds.

Each securitization bond will be entitled to interest on and of each year, beginning on , 2024. The first scheduled payment date is , 2024. Interest on the securitization bonds will accrue from the date of issuance. On each payment date, scheduled principal payments shall be paid sequentially in accordance with the expected sinking fund schedule in this prospectus, but only to the extent funds are available in the collection account after payment of certain fees and expenses and after payment of interest.

The securitization bonds represent obligations only of the issuing entity, SIGECO Securitization I, LLC, and are secured only by the assets of the issuing entity, consisting principally of the securitization property and related assets to support its obligations under the securitization bonds. Please read “Description of the Securitization Bonds—The Security for the Securitization Bonds,” and “Description of the Securitization Property” in this prospectus. The securitization property includes the right to impose, collect and receive securitization charges from SIGECO’s electric customers in amounts sufficient to make payments on the securitization bonds, as described further in this prospectus. SIGECO and its affiliates, other than the issuing entity, are not liable for any payments on the securitization bonds. The securitization bonds are not a debt or obligation of the State of Indiana or any of its political subdivisions, agencies or instrumentalities and are not a charge on its or any of its political subdivisions, agencies or instrumentalities’ full faith and credit or taxing power.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the securitization bonds through the book-entry facilities of The Depository Trust Company for the accounts of its participants including Clearstream Banking, S.A. and Euroclear Banks SA/NV, as operator of the Euroclear System against payment on or about , 2023. There currently is no secondary market for the securitization bonds, and we cannot assure you that one will develop.

| | | | |

| Barclays | | | | Citigroup |

| Structuring advisor and joint bookrunner | | | | Joint bookrunner |

Drexel Hamilton

Co-Manager

The date of this prospectus is , 2023.