Deutsche Bank Energy Utilities and Power Conference May 28, 2009 Exhibit 99.2

Cautionary Statements and Factors That May Affect Future Results Any statements made in this presentationabout future operating results or other futureevents are forward-looking statements underthe Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from suchforward-looking statements. A discussion of factors that could cause actual results or events to vary is contained in the Appendix tothis presentation and in the Company’s SEC filings. 1

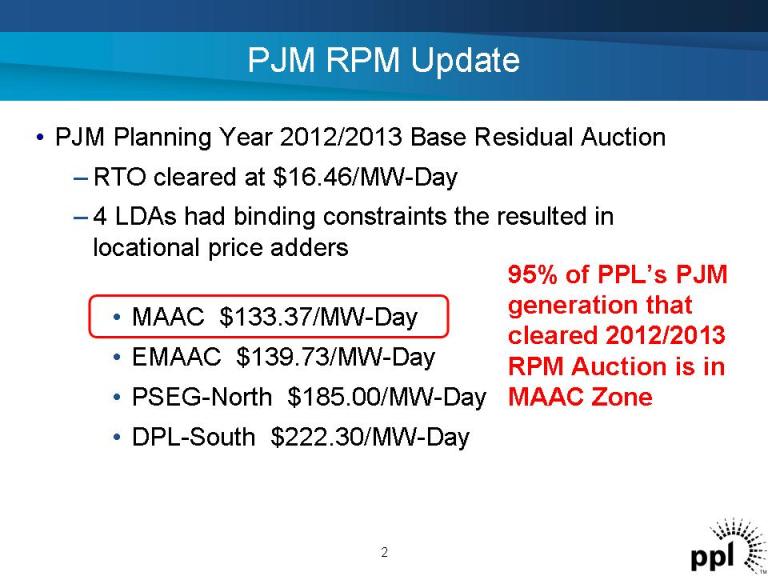

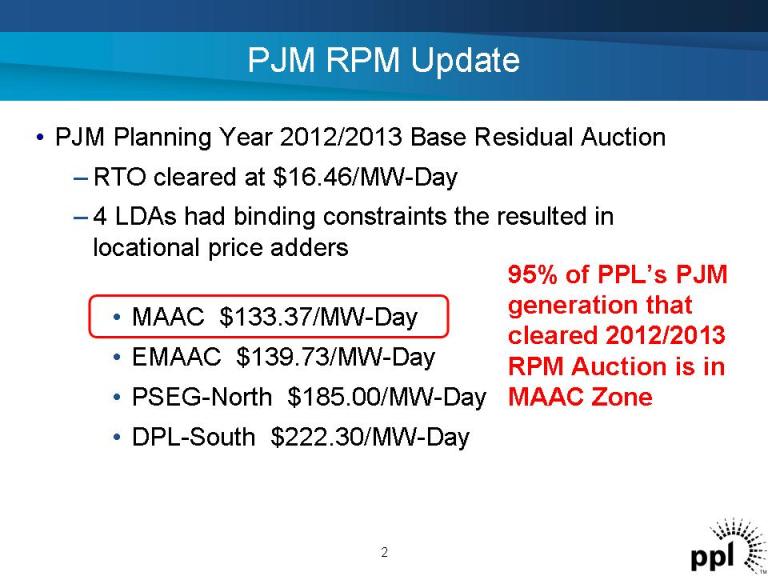

PJM RPM Update • PJM Planning Year 2012/2013 Base Residual Auction – RTO cleared at $16.46/MW-Day – 4 LDAs had binding constraints the resulted in locational price adders • MAAC $133.37/MW-Day • EMAAC $139.73/MW-Day • PSEG-North $185.00/MW-Day • DPL-South $222.30/MW-Day 95% of PPL’s PJM generation that cleared 2012/2013 RPM Auction is in MAAC Zone 2

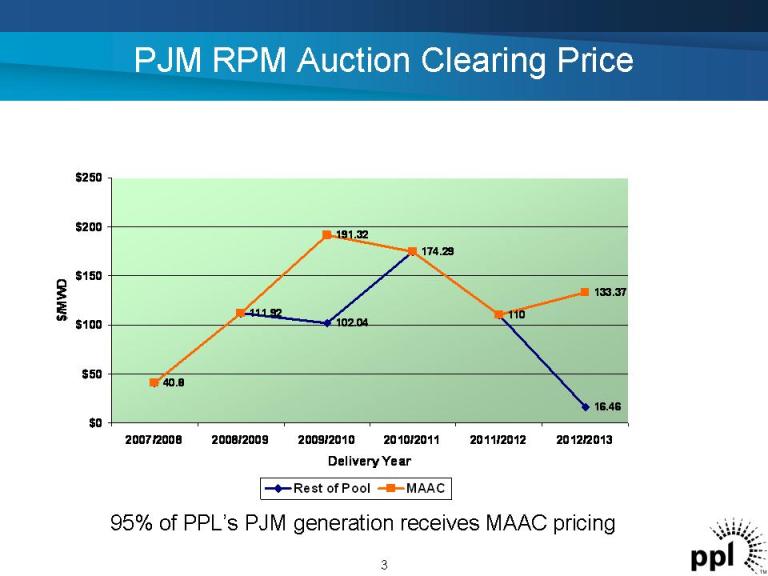

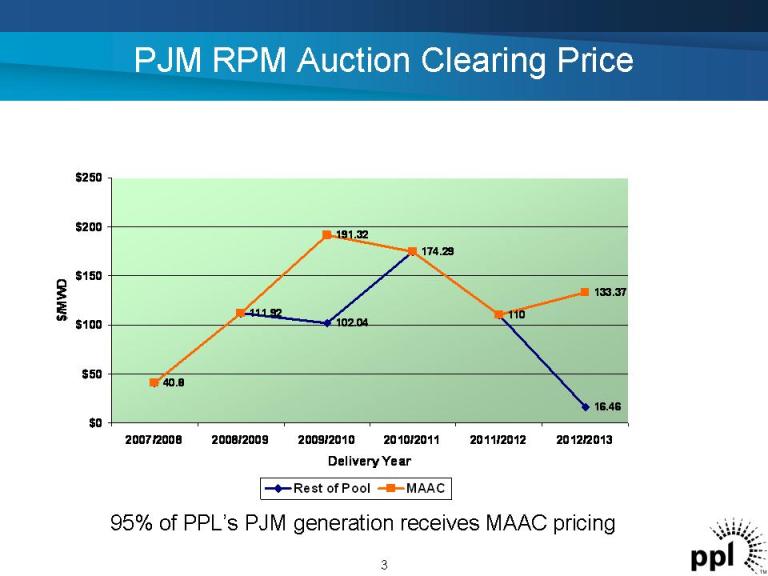

PJM RPM Auction Clearing Price 40.8 111.92 102.04 174.29 110 16.46 40.8111.92191.32 174.29110133.37 $0 $50 $100 $150 $200 $250 2007/2008 2008/2009 2009/2010 2010/2011 2011/2012 2012/2013 Delivery Year $/MWD Rest of Pool MAAC 3 95% of PPL’s PJM generation receives MAAC pricing

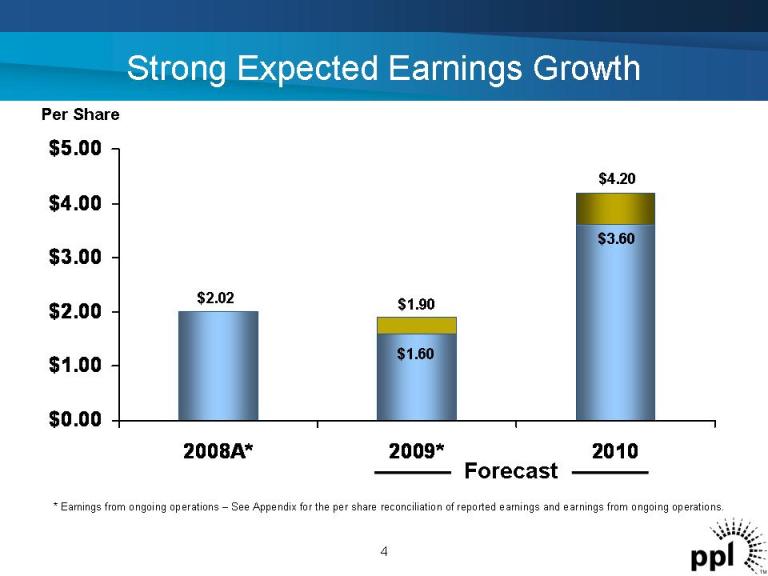

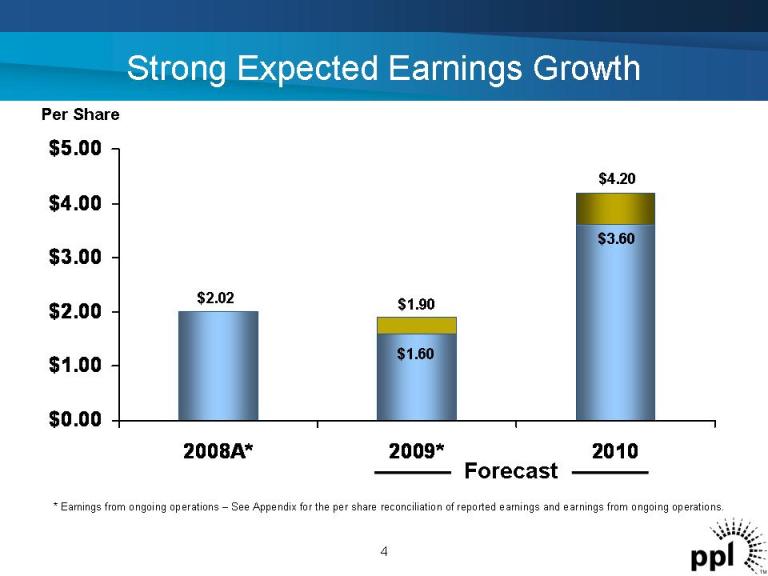

$0.00 $1.00 $2.00 $3.00 $4.00 $5.00 2008A* 2009* 2010 Strong Expected Earnings Growth Forecast 4 * Earnings from ongoing operations – See Appendix for the per share reconciliation of reported earnings and earnings from ongoing operations. $2.02 $4.20 Per Share $1.90 $1.60 $3.60

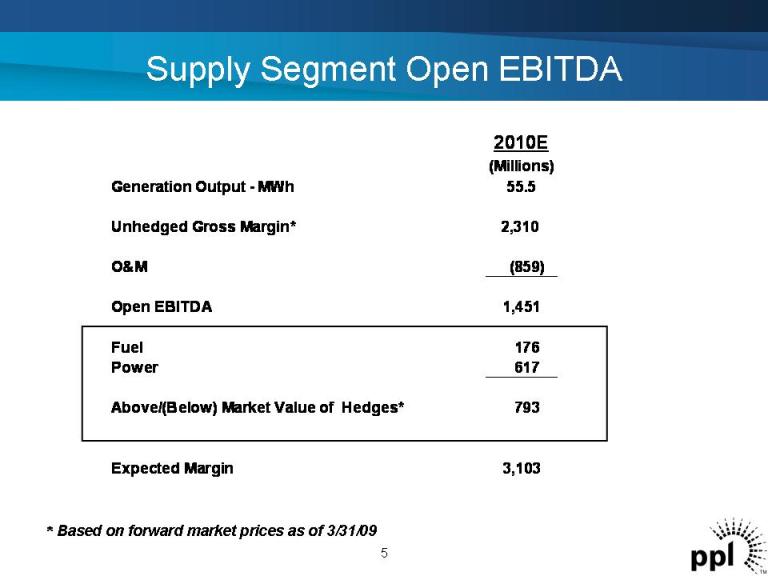

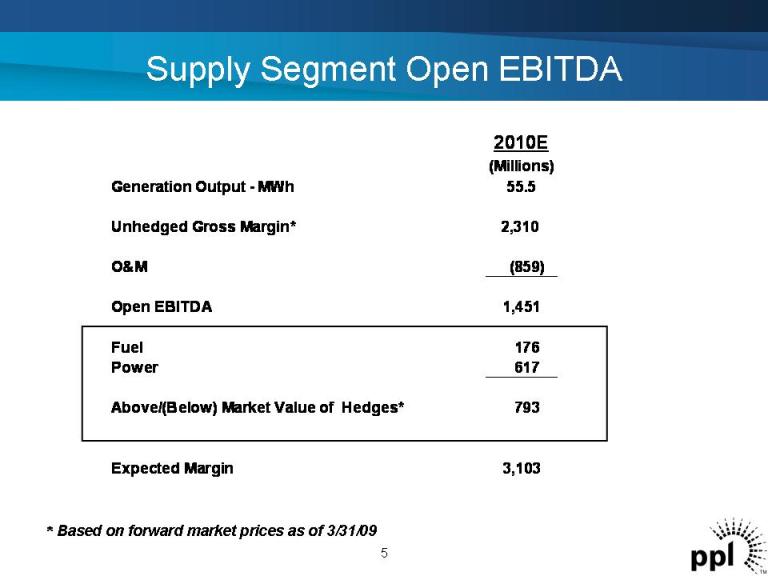

Supply Segment Open EBITDA *Based on forward market prices as of 3/31/09 2010E (Millions) Generation Output - MWh 55.5 Unhedged Gross Margin* 2,310 O&M (859) Open EBITDA 1,451 Fuel 176 Power 617 Above/(Below) Market Value of Hedges* 793 Expected Margin 3,103 5

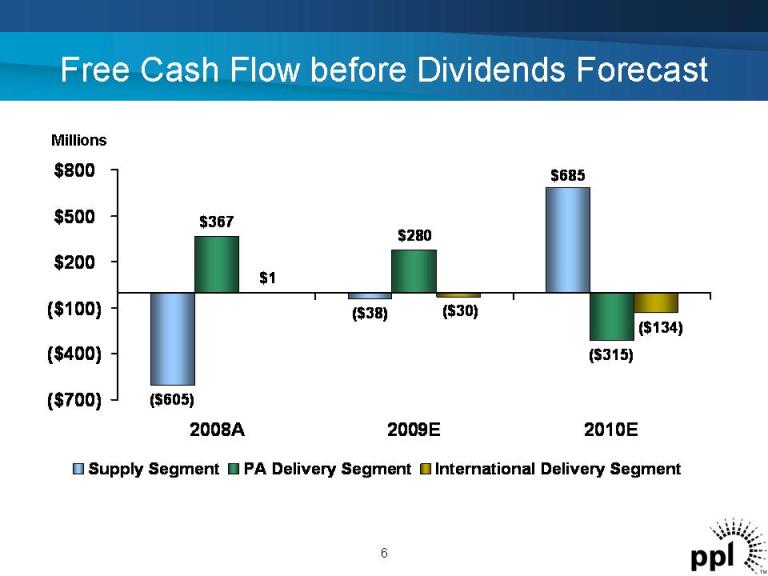

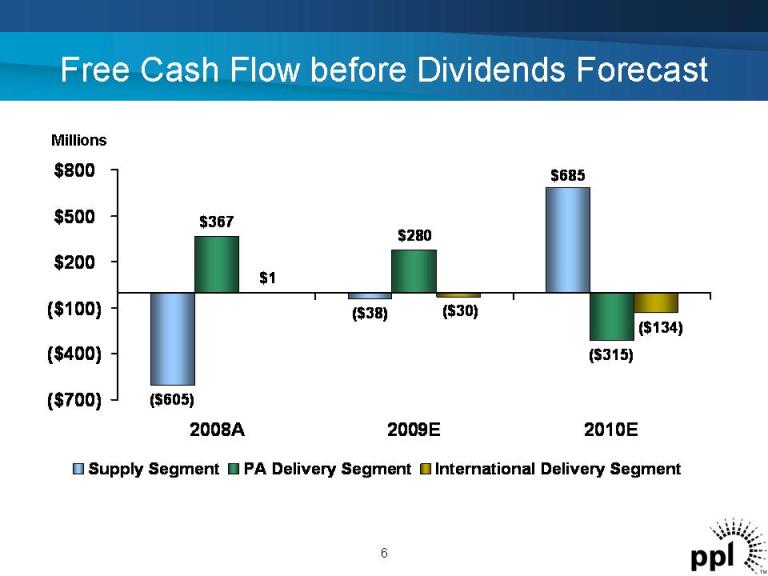

($605) ($38) ($315) $685 $367 $280 ($30) ($134) $1 ($700) ($400) ($100) $200 $500 $800 2008A 2009E 2010E Supply Segment PA Delivery Segment International Delivery Segment Free Cash Flow before Dividends Forecast Millions 6

$1.00 $1.10 $1.22 $1.34 $1.38 $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 2005 2006 2007 2008 2009 $/Share Annualized Continued Dividend Growth 7

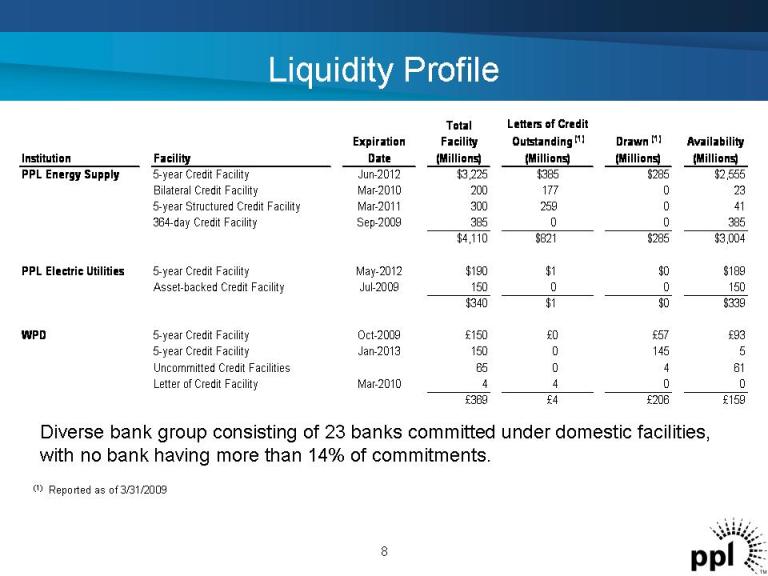

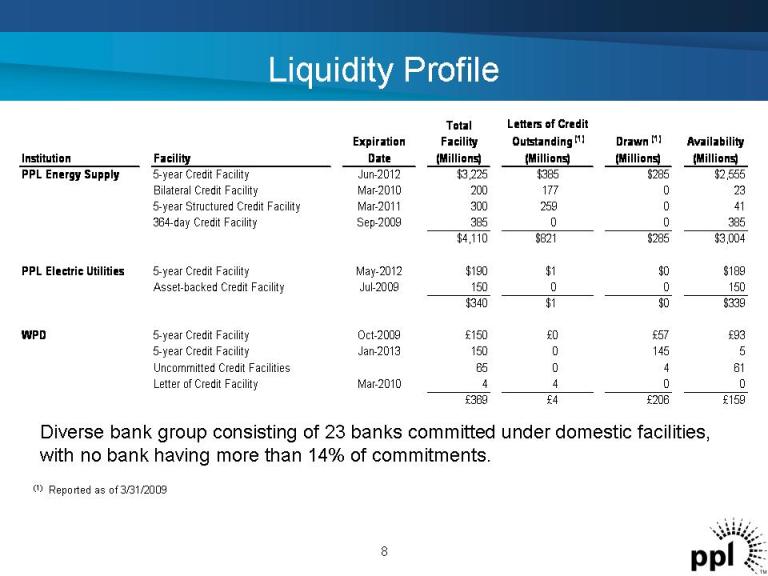

Liquidity Profile (1) Reported as of 3/31/2009 Diverse bank group consisting of 23 banks committed under domestic facilities, with no bank having more than 14% of commitments. 8 Institution Facility Expiration Date Total Facility (Millions) Letters of Credit Outstanding (1) (Millions) Drawn (1) (Millions) Availability (Millions) PPL Energy Supply 5-year Credit Facility Jun-2012 $3,225 $385 $285 $2,555 Bilateral Credit Facility Mar-2010 200 177 0 23 5-year Structured Credit Facility Mar-2011 300 259 0 41 364-day Credit Facility Sep-2009 385 0 0 385 $4,110 $821 $285 $3,004 PPL Electric Utilities 5-year Credit Facility May-2012 $190 $1 $0 $189 Asset-backed Credit Facility Jul-2009 150 0 0 150 $340 $1 $0 $339 WPD 5-year Credit Facility Oct-2009 £150 £0 £57 £93 5-year Credit Facility Jan-2013 150 0 145 5 Uncommitted Credit Facilities 65 0 4 61 Letter of Credit Facility Mar-2010 4 4 0 0 £369 £4 £206 £159

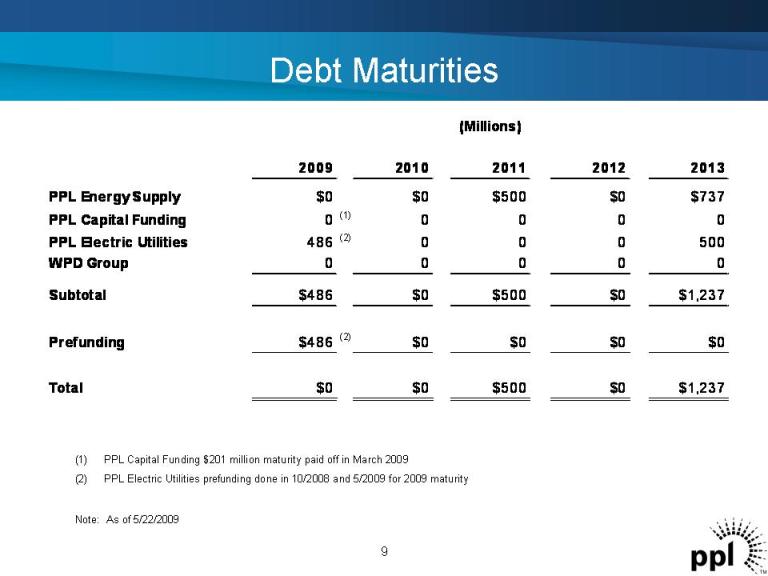

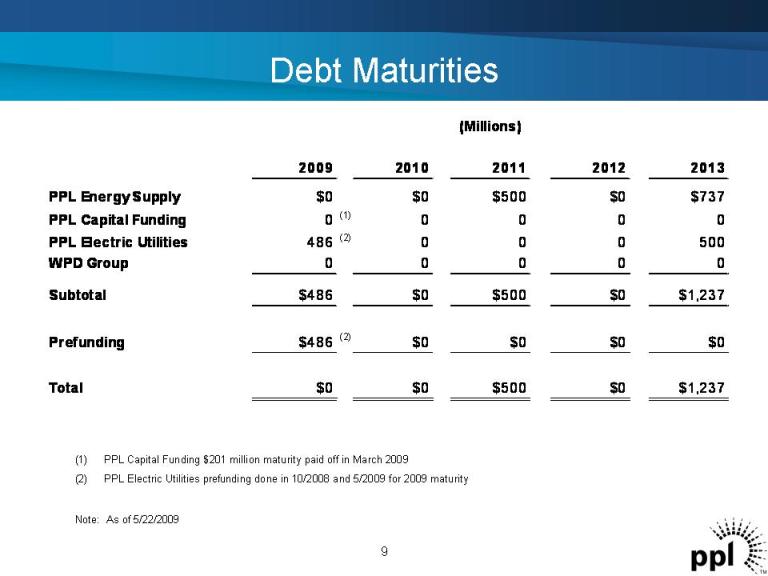

Debt Maturities (1) PPL Capital Funding $201 million maturity paid off in March 2009 (2) PPL Electric Utilities prefunding done in 10/2008 and 5/2009 for 2009 maturity Note: As of 5/22/2009 9 2009 2010 2011 2012 2013 PPL Energy Supply $0 $0 $500 $0 $737 PPL Capital Funding 0 (1) 0 0 0 0 PPL Electric Utilities 486 (2) 0 0 0 500 WPD Group 0 0 0 0 0 Subtotal $486 $0 $500 $0 $1,237 Prefunding $486 (2) $0 $0 $0 $0 Total $0 $0 $500 $0 $1,237 (Millions)

PA and International Delivery Operational Update PA Delivery • PPL EU completed 5 of 6 RFPs • Bids due for final RFP October 5, 2009 with PUC approval expected October 8 • Filed rate deferral plan with the PUC • Act 129 compliance plan filing on target for July 1requirement International Delivery • Distribution Price Control Review (DPCR5) initial proposals expected in July 10

Supply Segment Operational Update • Strong plant performance in Q109 • Susquehanna Unit 2 set generation record with 723 consecutive days generating electricity • Unit 2 up-rate of 45 MW completed in May 2009 • Reapplied for Holtwood hydroelectric plant expansion project • Scrubbers on schedule for completion later this year 11

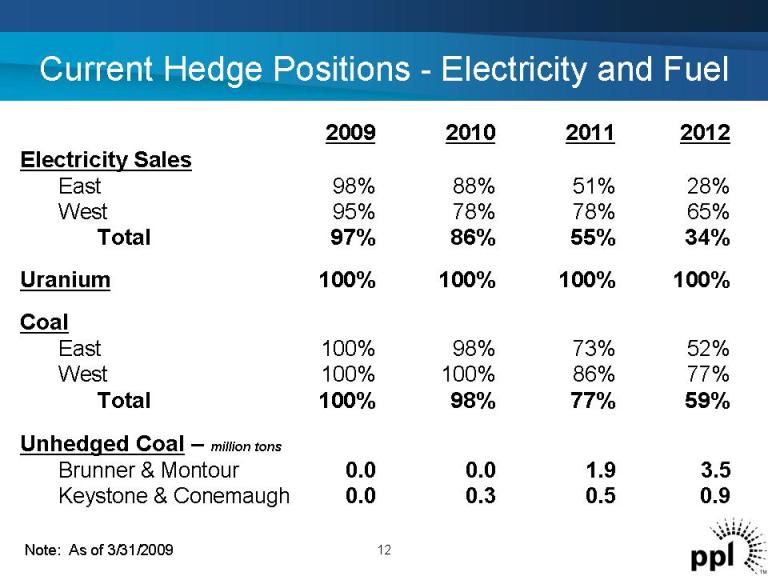

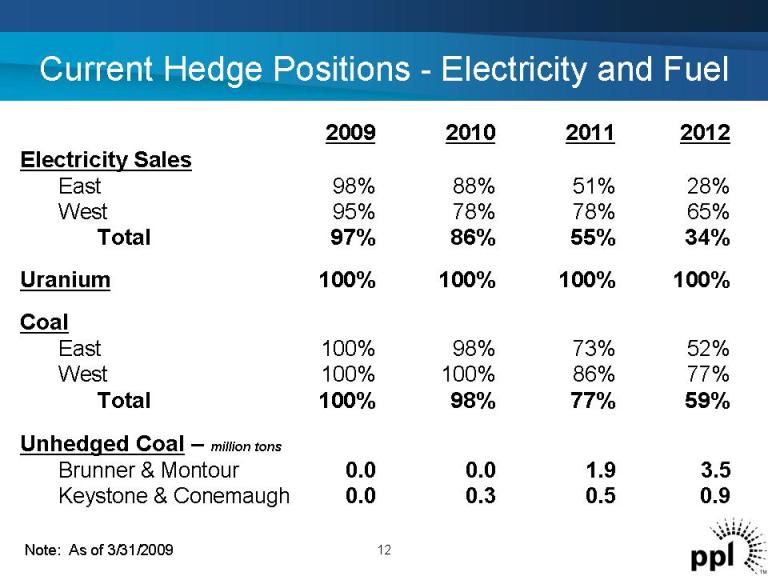

Current Hedge Positions -Electricity and Fuel Note: As of 3/31/2009 12 2009 2010 2011 2012 Electricity Sales East 98% 88% 51% 28% West 95% 78% 78% 65% Total 97% 86% 55% 34% Uranium 100% 100% 100% 100% Coal East 100% 98% 73% 52% West 100% 100% 86% 77% Total 100% 98% 77% 59% Unhedged Coal – million tons Brunner & Montour 0.0 0.0 1.9 3.5 Keystone & Conemaugh 0.0 0.3 0.5 0.9

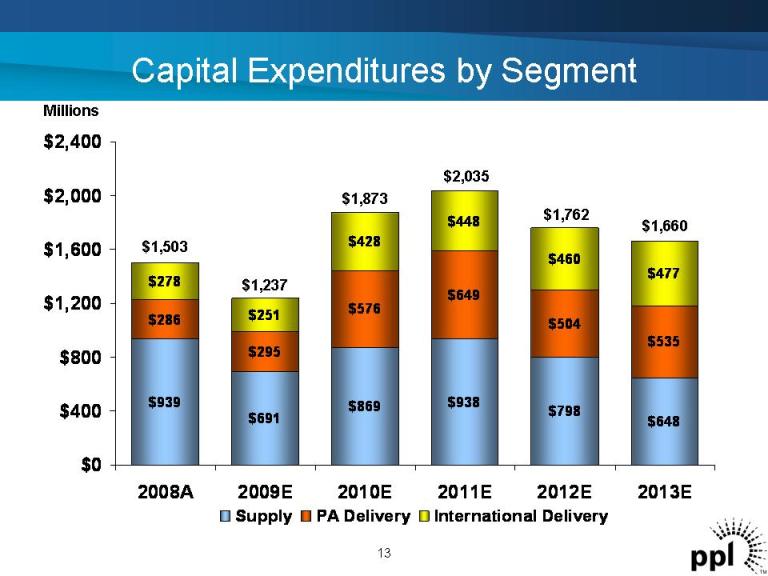

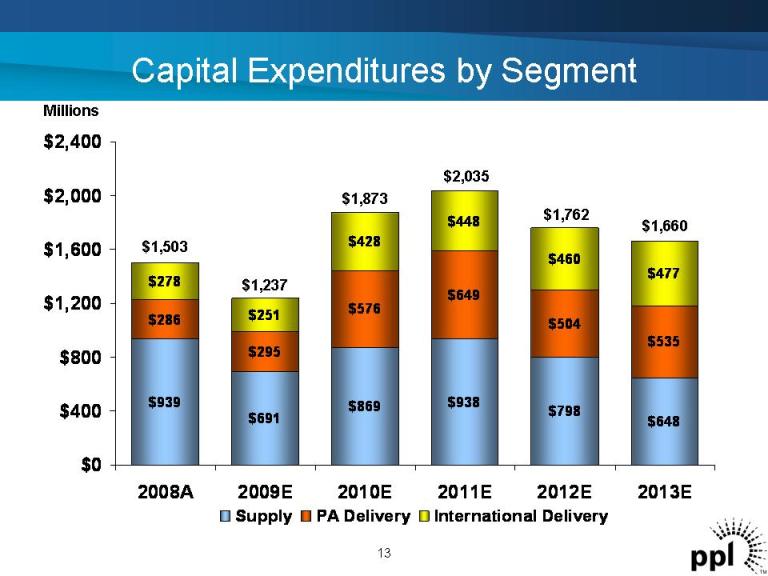

Millions $939 $691 $869 $938 $798 $648 $286 $295 $576 $649 $504 $535 $278 $251 $428 $448 $460 $477 $0 $400 $800 $1,200 $1,600 $2,000 $2,400 2008A 2009E 2010E 2011E 2012E 2013E Supply PA Delivery International Delivery $1,503 $2,035 $1,873 $1,237 Capital Expenditures by Segment 13 $1,762 $1,660

Millions $693 $811 $952 $1,221 $1,469 $1,528 $2,081 $2,207 $2,353 $2,513 $2,664 $2,803 $0 $1,000 $2,000 $3,000 $4,000 $5,000 2008A 2009E 2010E 2011E 2012E 2013E Transmission Distribution & Other Pennsylvania Delivery Rate Base $3,018 $3,305 $3,734 $4,133 $4,331 $2,774 14

ppl

Market Prices ELECTRIC PJM On-Peak Off-Peak ATC(2) Mid-Columbia On-Peak Off-Peak ATC(2) GAS(3) NYMEX TZ6NNY PJM MARKET HEAT RATE(4) CAPACITY PRICES (Per MWD) EQA Actual 2008 2009 2010 2011 2012 $81 $51 $58 $63 $66 $49 $39 $43 $46 $50 $69 $45 $50 $54 $58 $65 $35 $46 $52 $56 $51 $28 $37 $41 $44 $59 $35 $42 $47 $50 $8.84 $4.36 $5.93 $6.67 $6.84 $9.85 $5.19 $6.84 $7.57 $7.72 8.3 9.8 8.5 8.3 8.5 $82.00 $158.24 $181.39 $136.79 $118.75 89.6% 90.7% 92.2% 90.9% 92.1% Forward(1) (1) Market prices based on the average of broker quotes as of 3/31/2009 (2) 24-hour average (3) NYMEX and TZ6NNY forward gas prices on 3/31/2009 (4) Market Heat Rate = PJM on-peak power price divided by TZ6NNY gas price A-1

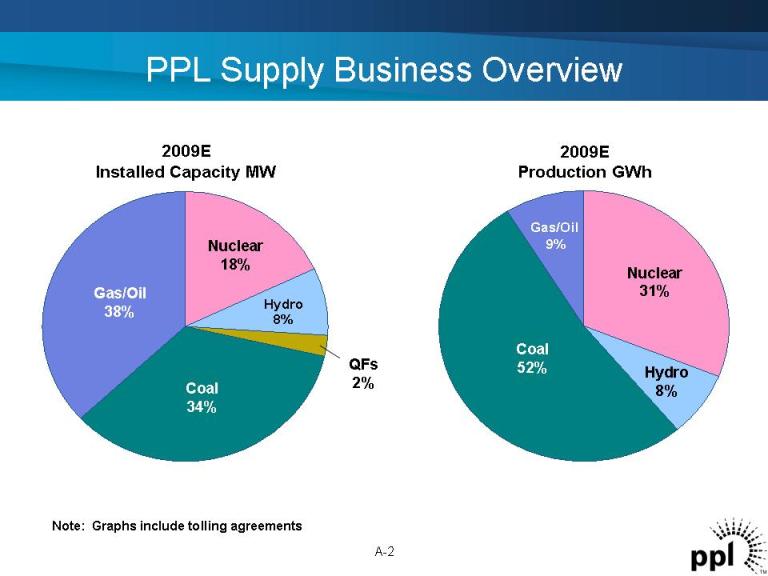

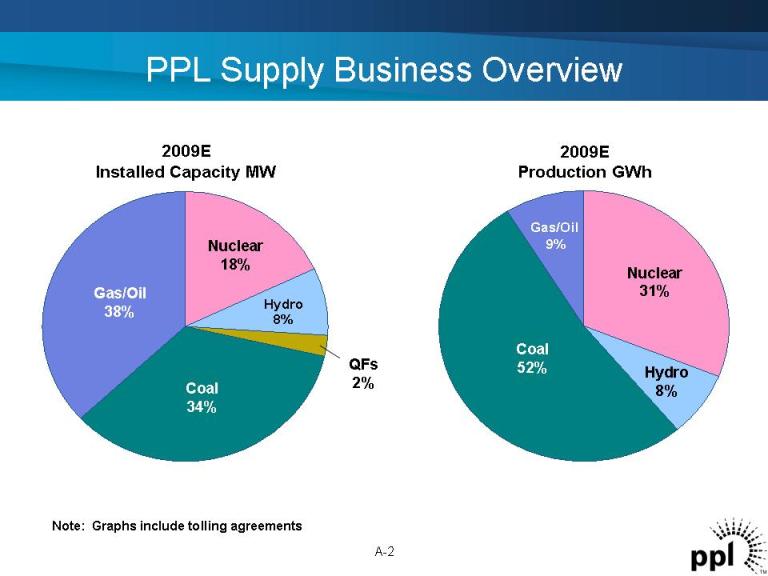

PPL Supply Business Overview 2009E Production GWh A-2 Gas/Oil 38% Coal 34% Nuclear 18% Hydro8% QFs 2% 2009E Installed Capacity MW Gas/Oil 9% Coal 52% Nuclear 31% Hydro 8% Note: Graphs include tolling agreements

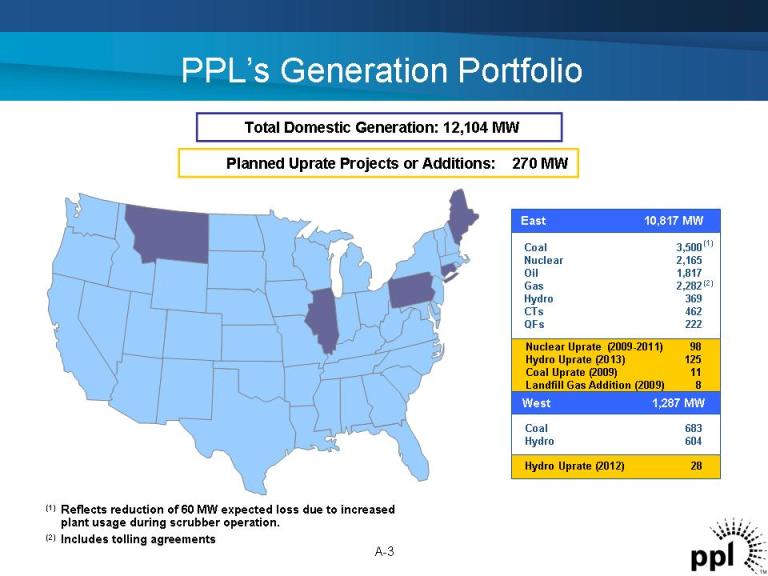

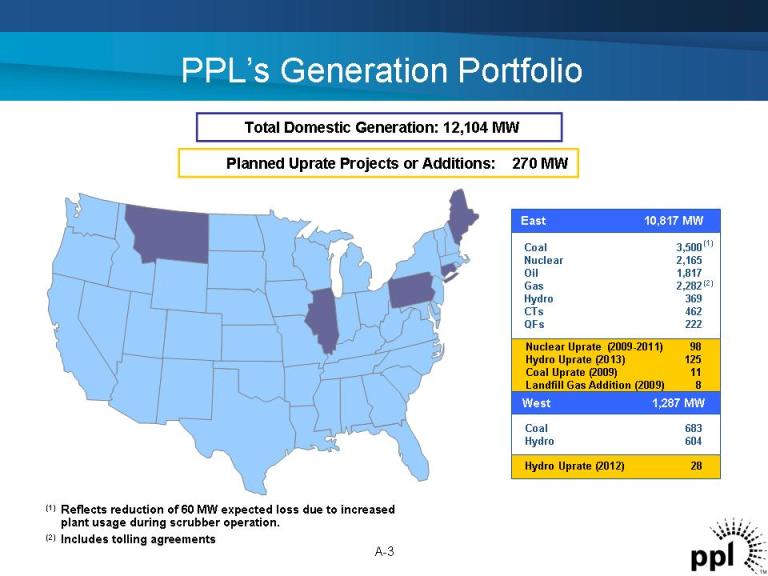

PPL’s Generation Portfolio Total Domestic Generation: 12,104 MW Planned Uprate Projects or Additions: 270 MW (1) Reflects reduction of 60 MW expected loss due to increased plant usage during scrubber operation. (2) Includes tolling agreements A-3 Coal 3,500 Nuclear 2,165 Oil 1,817 Gas 2,282 Hydro 369 CTs 462 QFs 222 Coal 683 Hydro 604 West 1,287 MW Hydro Uprate (2012) 28 Nuclear Uprate (2009-2011) 98 Hydro Uprate (2013) 125 Coal Uprate (2009) 11 Landfill Gas Addition (2009) 8 (1) East 10,817 MW (2)

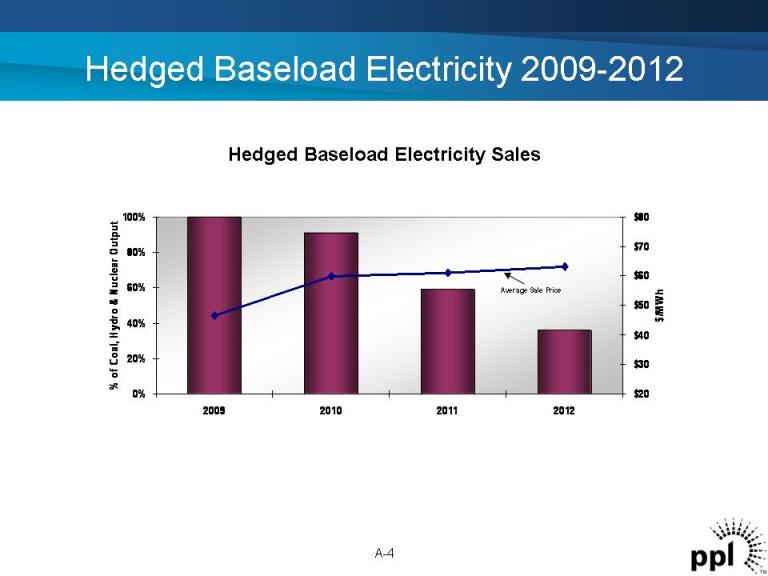

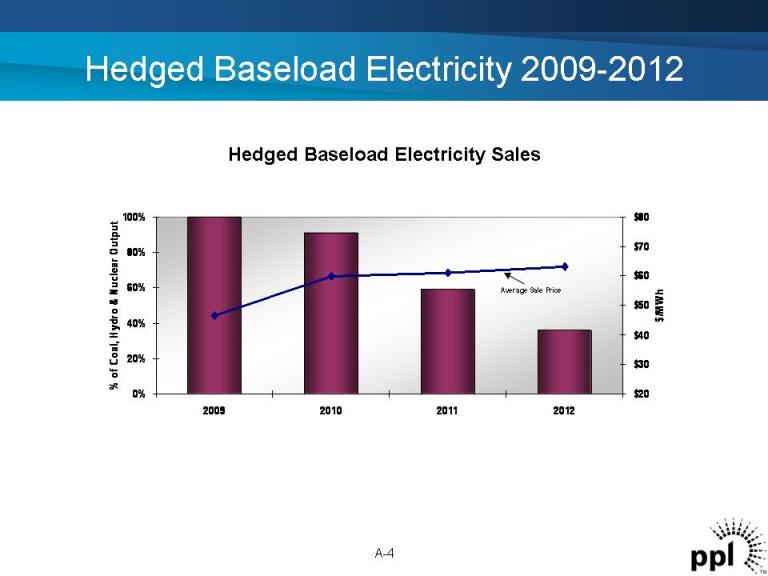

Hedged Baseload Electricity 2009-2012 Hedged Baseload Electricity Sales 0% 20% 40% 60% 80% 100% 2009 2010 2011 2012 % of Coal, Hydro & Nuclear O utput$20 $30 $40 $50 $60 $70 $80 $/M W h Average Sale Price A-4

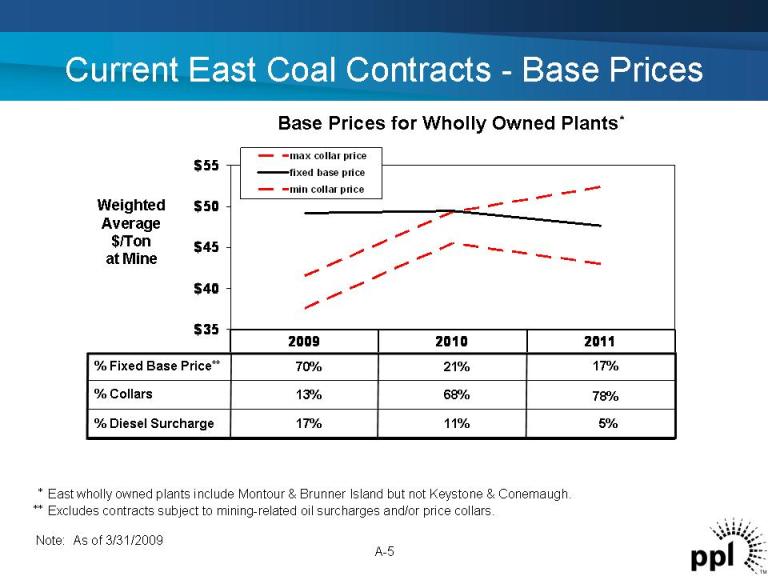

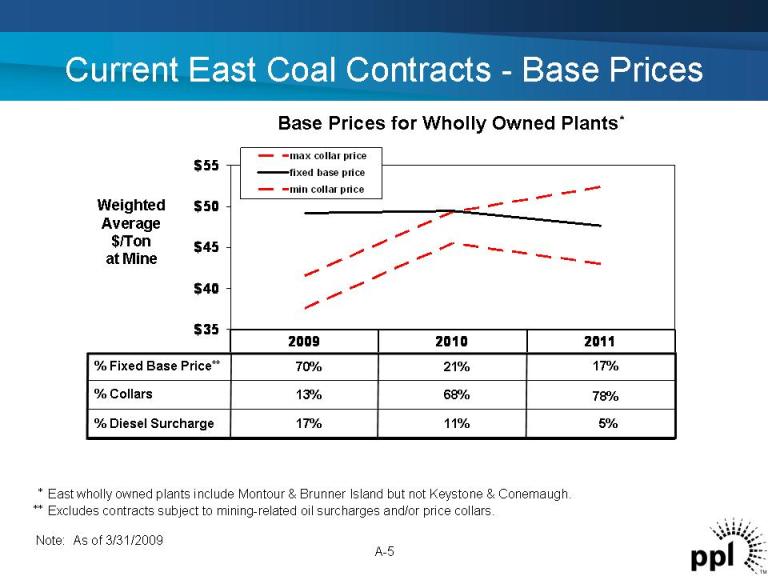

Current East Coal Contracts -Base Prices A-5 Base Prices for Wholly Owned Plants* *East wholly owned plants include Montour & Brunner Island but not Keystone & Conemaugh. **Excludes contracts subject to mining-related oil surcharges and/or price collars. Note: As of 3/31/2009 $35 $40 $45 $50 $55 max collar price fixed base price min collar price 2009 2010 2011 Weighted Average $/Ton at Mine 11% 17%% Diesel Surcharge 78%68% 13%% Collars 21% 70%% Fixed Base Price**17% 5%

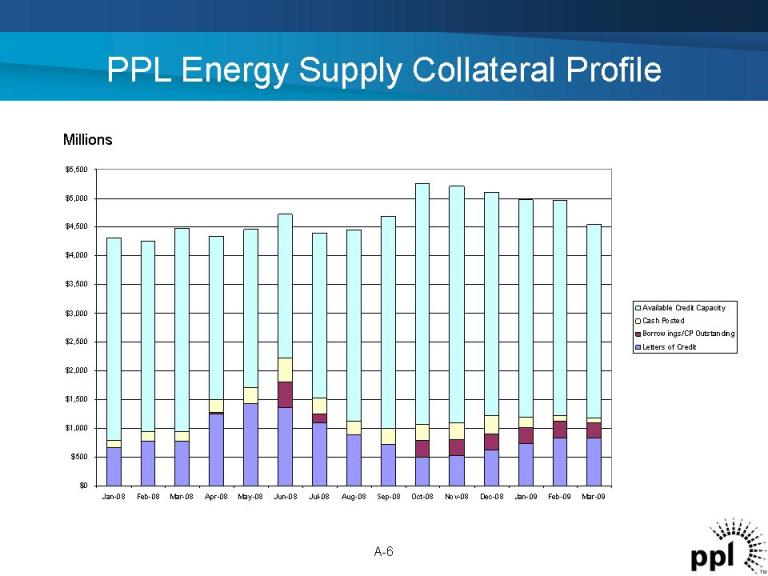

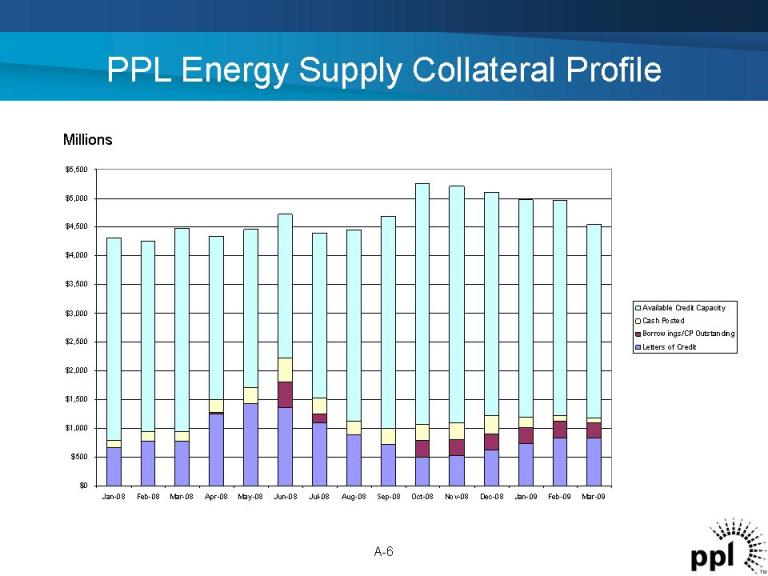

PPL Energy Supply Collateral Profile Millions A-6 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 $5,500 Jan-08 Feb-08 Mar-08 Apr-08 May-08 Jun-08 Jul-08 Aug-08 Sep-08 Oct-08 Nov-08 Dec-08 Jan-09 Feb-09 Mar-09 Available Credit Capacity Cash Posted Borrowings/CP Outstanding Letters of Credit

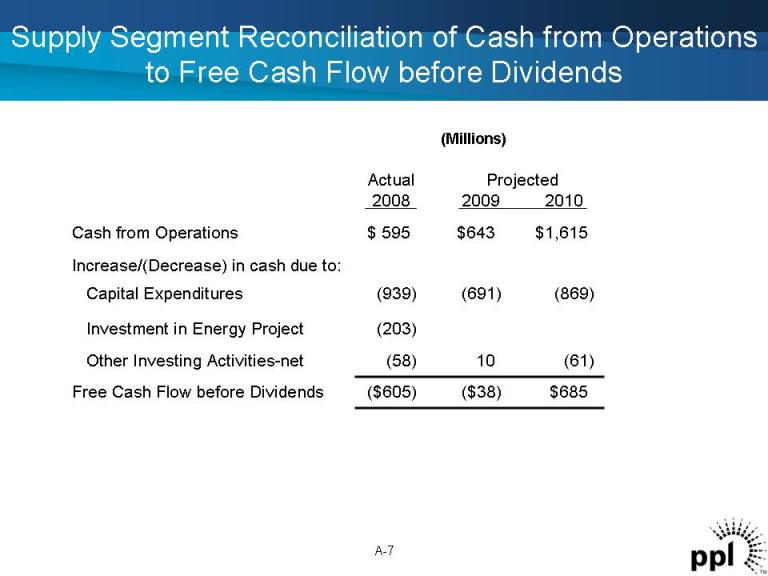

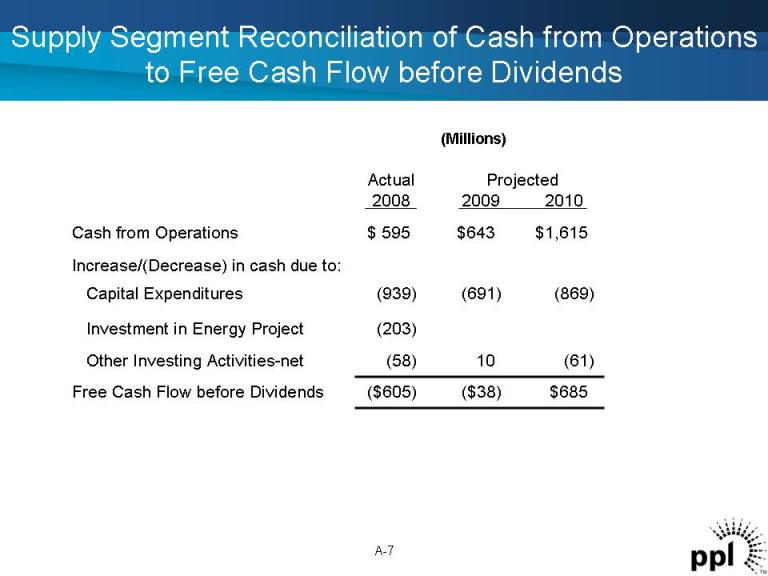

Supply Segment Reconciliation of Cash from Operations to Free Cash Flow before Dividends (Millions) A-7 (203)Investment in Energy Project $685($38)($605)Free Cash Flow before Dividends (61)10(58)Other Investing Activities-net (869)(691)(939)Capital Expenditures Increase/(Decrease) in cash due to: $1,615$643$ 595Cash from Operations 201020092008 Actual Projected

PA Delivery Segment Reconciliation of Cash from Operations to Free Cash Flow before Dividends (Millions) A-8 8303Asset Sales & Other ($315)$280$367Free Cash Flow before Dividends (576)(295)(286)Capital Expenditures (293)Less Transition Bond Repayment Increase/(Decrease) in cash due to: $261$567$ 643Cash from Operations 201020092008 Note: Asset sales in 2008 includes the net proceeds from the sale of gas and propane businesses in 2008. Actual Projected

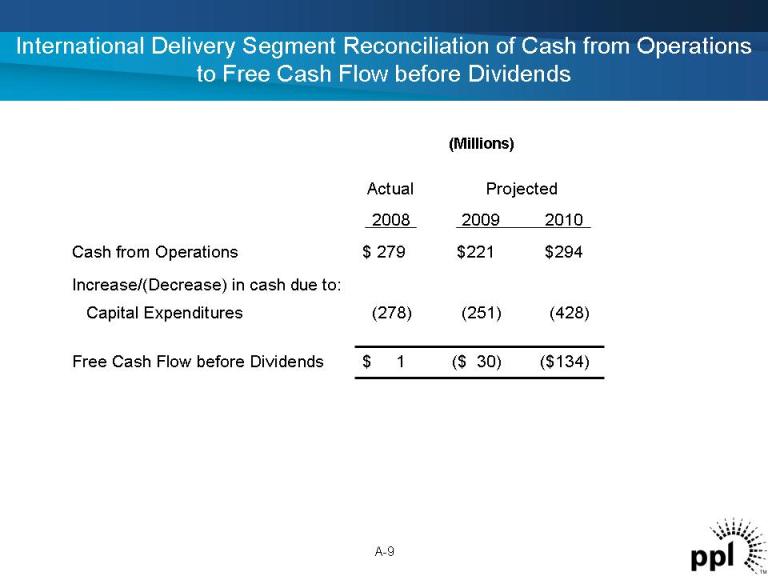

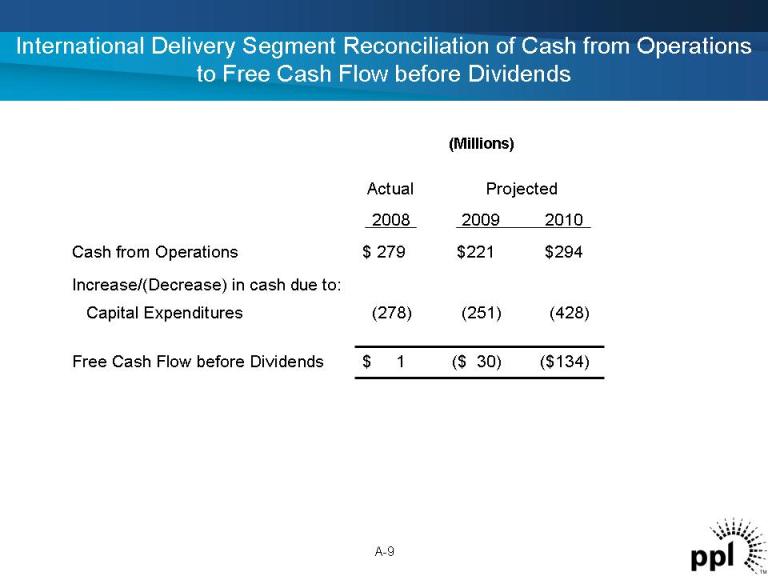

International Delivery Segment Reconciliation of Cash from Operations to Free Cash Flow before Dividends (Millions) A-9 ($134)($ 30)$ 1 Free Cash Flow before Dividends (428)(251)(278)Capital Expenditures Increase/(Decrease) in cash due to: $294 $221 $279 Cash from Operations 2010 2009 2008 Actual Projected

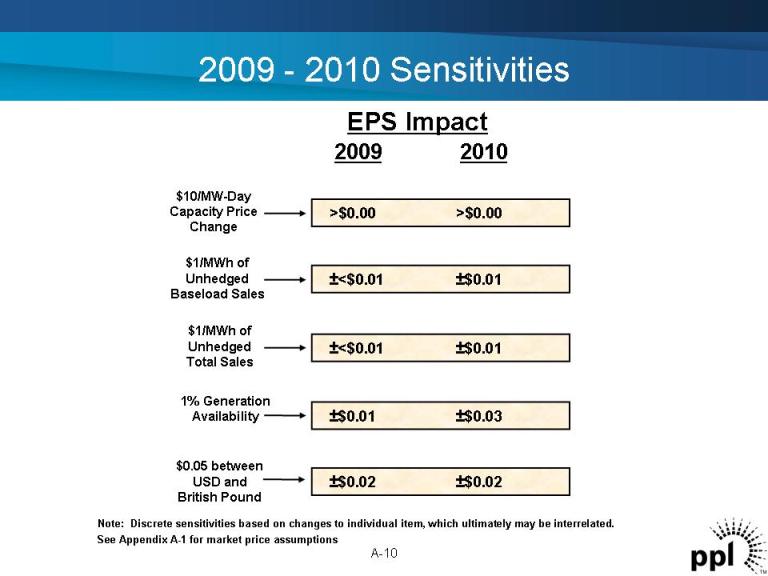

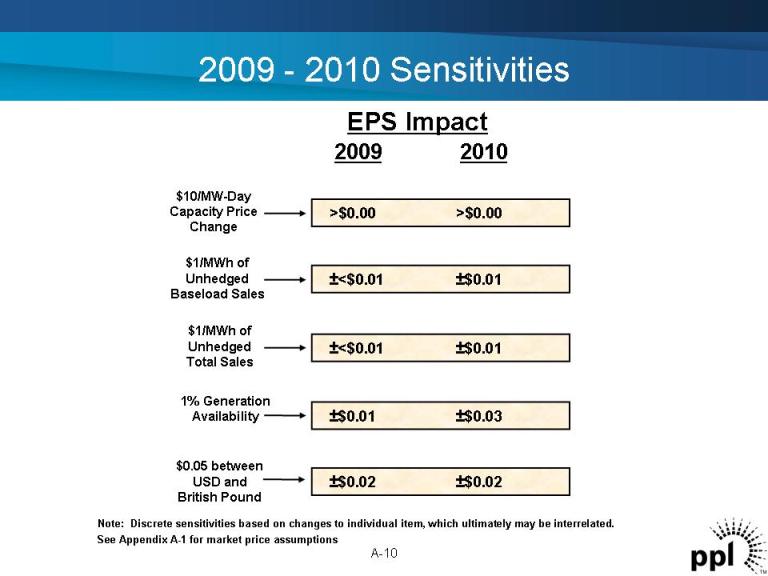

2009 - -2010 Sensitivities EPS Impact See Appendix A-1 for market price assumptions A-10 Note: Discrete sensitivities based on changes to individual item, which ultimately may be interrelated. 2009 2010 $10/MW-Day Capacity Price Change >$0.00 >$0.00 $1/MWh of Unhedged Baseload Sales ±<$0.01 ±$0.01 $1/MWh of Unhedged Total Sales ±<$0.01 ±$0.01 1% Generation Availability ±$0.01 ±$0.03 $0.05 between USD and British Pound ±$0.02 ±$0.02

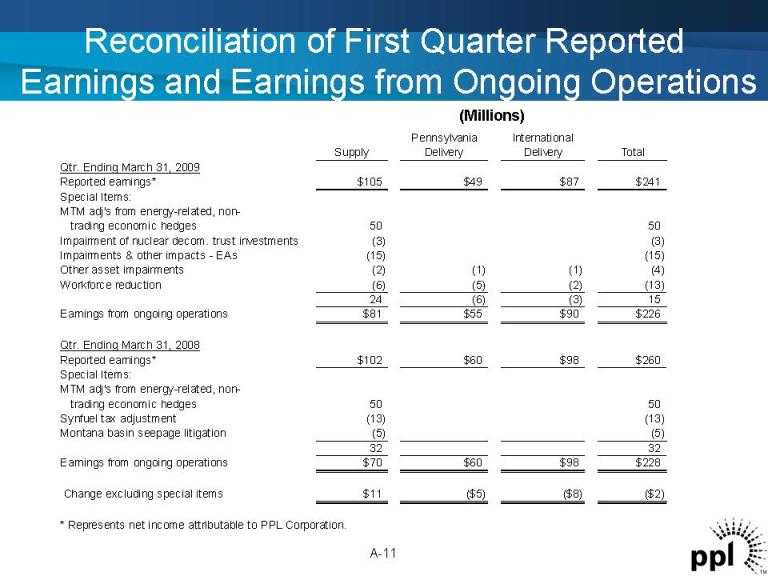

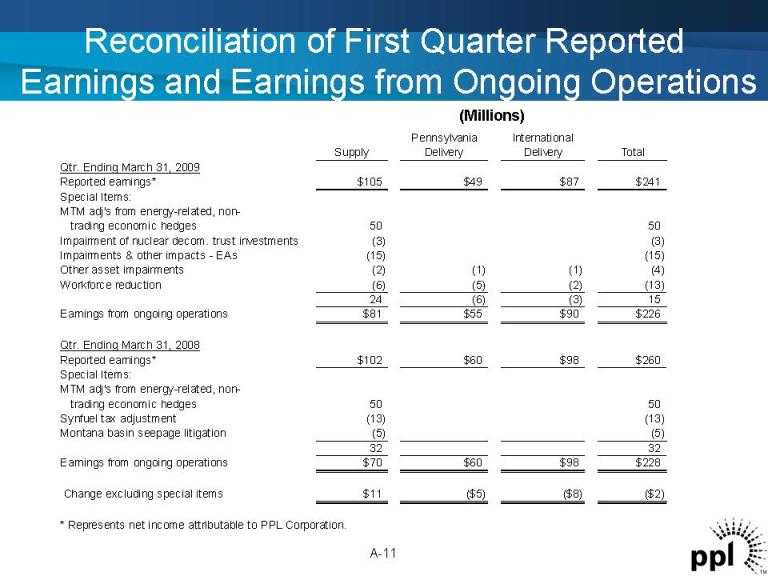

Reconciliation of First Quarter Reported Earnings and Earnings from Ongoing Operations A-11 (Millions) Pennsylvania International Supply Delivery Delivery Total Qtr. Ending March 31, 2009 Reported earnings* $105 $49 $87 $241 Special Items: MTM adj's from energy-related, non- trading economic hedges 50 50 Impairment of nuclear decom. trust investments (3) (3) Impairments & other impacts - EAs (15) (15) Other asset impairments (2) (1) (1) (4) Workforce reduction (6) (5) (2) (13) 24 (6) (3) 15 Earnings from ongoing operations $81 $55 $90 $226 Qtr. Ending March 31, 2008 Reported earnings* $102 $60 $98 $260 Special Items: MTM adj's from energy-related, non- trading economic hedges 50 50 Synfuel tax adjustment (13) (13) Montana basin seepage litigation (5) (5) 32 32 Earnings from ongoing operations $70 $60 $98 $228 Change excluding special items $11 ($5) ($8) ($2) * Represents net income attributable to PPL Corporation.

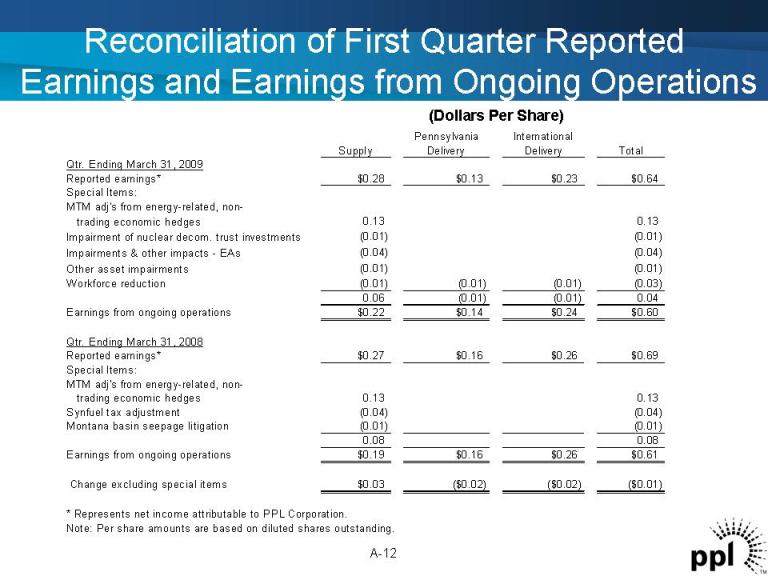

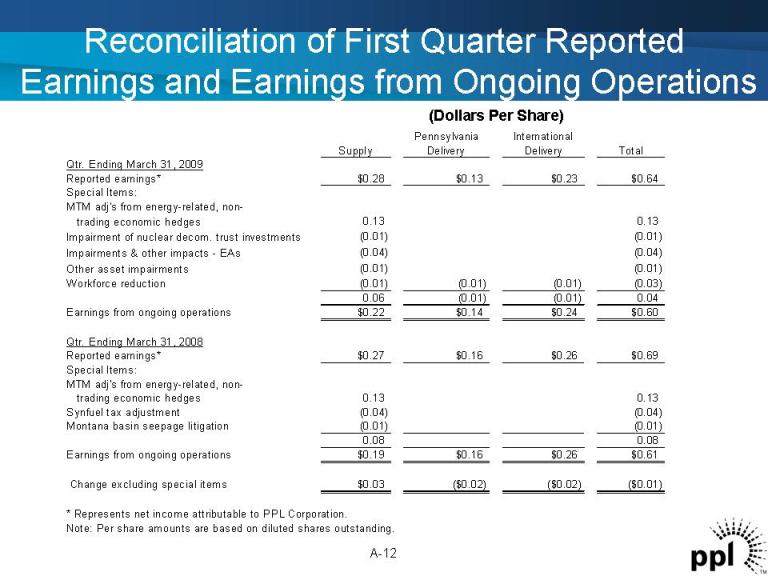

Reconciliation of First Quarter Reported Earnings and Earnings from Ongoing Operations A-12 Pennsylvania International Supply Delivery Delivery Total Qtr. Ending March 31, 2009 Reported earnings* $0.28 $0.13 $0.23 $0.64 Special Items: MTM adj's from energy-related, non- trading economic hedges 0.13 0.13 Impairment of nuclear decom. trust investments (0.01) (0.01) Impairments & other impacts -EAs (0.04) (0.04) Other asset impairments (0.01) (0.01) Workforce reduction (0.01) (0.01) (0.01) (0.03) 0.06 (0.01) (0.01) 0.04 Earnings from ongoing operations $0.22 $0.14 $0.24 $0.60 Qtr. Ending March 31, 2008 Reported earnings* $0.27 $0.16 $0.26 $0.69 Special Items: MTM adj's from energy-related, non- trading economic hedges 0.13 0.13 Synfuel tax adjustment (0.04) (0.04) Montana basin seepage litigation (0.01) (0.01) 0.08 0.08 Earnings from ongoing operations $0.19 $0.16 $0.26 $0.61 Change excluding special items $0.03 ($0.02) ($0.02) ($0.01) * Represents net income attributable to PPL Corporation. Note: Per share amounts are based on diluted shares outstanding. (Dollars Per Share)

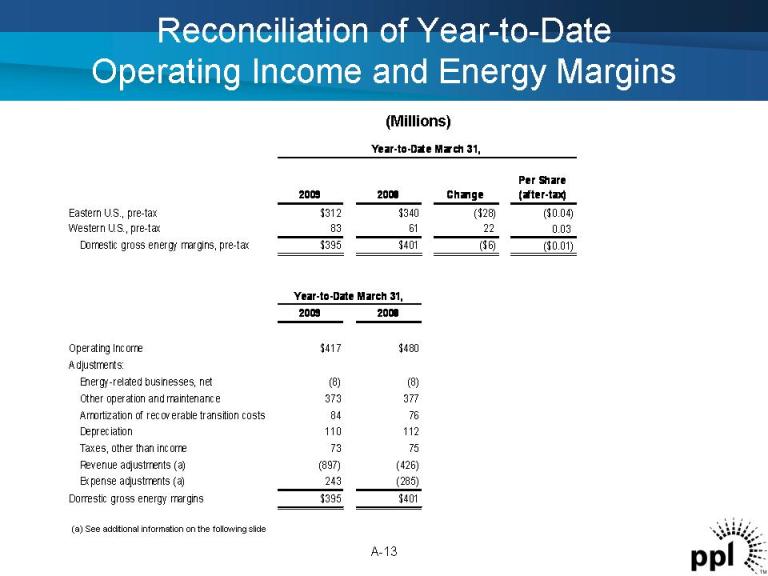

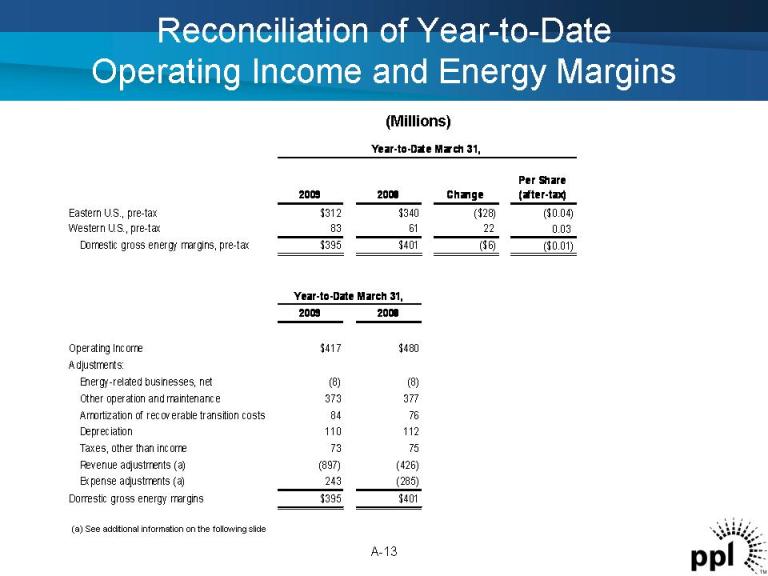

Reconciliation of Year-to-Date Operating Income and Energy Margins A-13 2009 2008 Change Per Share (after-tax) Eastern U.S., pre-tax $312 $340 ($28) ($0.04) Western U.S., pre-tax 83 61 22 0.03 Domestic gross energy margins, pre-tax $395 $401 ($6) ($0.01) 2009 2008 Operating Income $417 $480 Adjustments: Energy-related businesses, net (8) (8) Other operation and maintenance 373 377 Amortization of recoverable transition costs 84 76 Depreciation 110 112 Taxes, other than income 73 75 Revenue adjustments (a) (897) (426) Expense adjustments (a) 243 (285) Domestic gross energy margins $395 $401 Year-to-Date March 31, Year-to-Date March 31, (Millions) (a) See additional information on the following slide

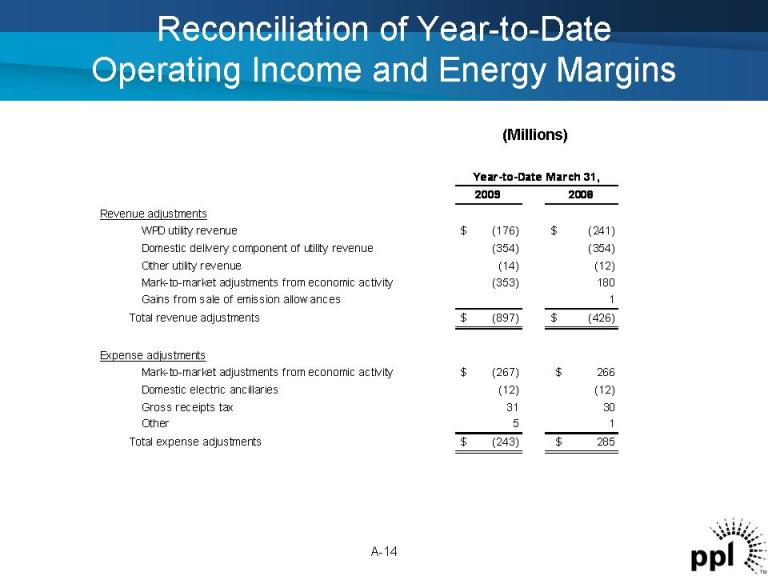

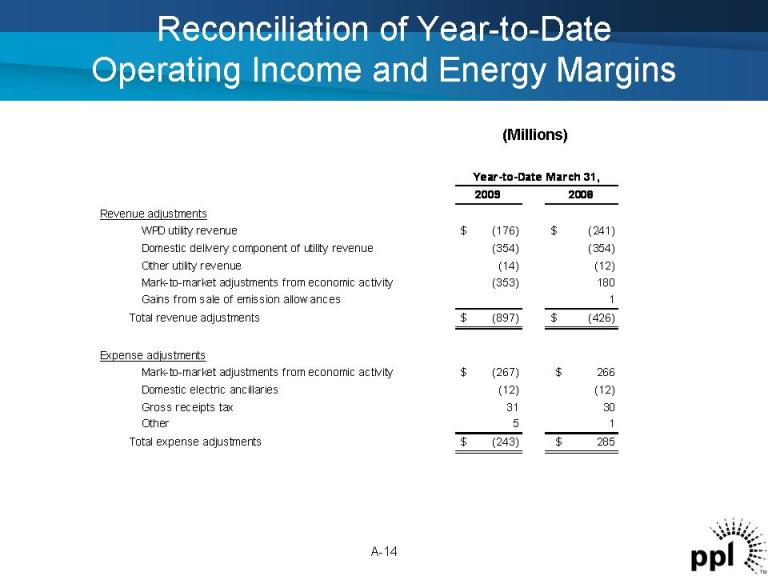

Reconciliation of Year-to-Date Operating Income and Energy Margins A-14 2009 2008 Revenue adjustments WPD utility revenue $(176) $(241) Domestic delivery component of utility revenue (354) (354) Other utility revenue (14) (12) Mark-to-market adjustments from economic activity (353) 180 Gains from sale of emission allowances 1 Total revenue adjustments $(897) $(426) Expense adjustments Mark-to-market adjustments from economic activity $(267) $266 Domestic electric ancillaries (12) (12) Gross receipts tax 31 30 Other 5 1 Total expense adjustments $(243) $285 Year-to-Date March 31, (Millions)

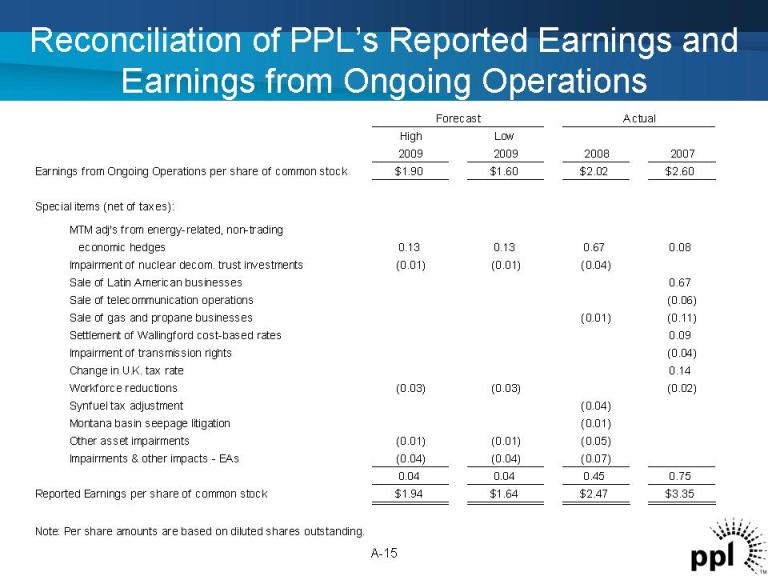

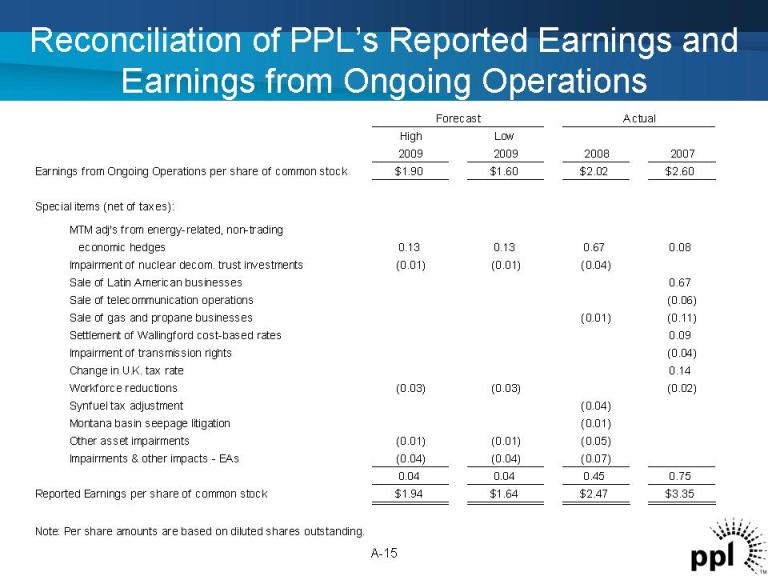

Reconciliation of PPL’s Reported Earnings and Earnings from Ongoing Operations High Low 2009 2009 2008 2007 Earnings from Ongoing Operations per share of common stock $1.90 $1.60 $2.02 $2.60 Special items (net of taxes): economic hedges 0.13 0.13 0.67 0.08 Impairment of nuclear decom. trust investments (0.01) (0.01) (0.04) Sale of Latin American businesses 0.67 Sale of telecommunication operations (0.06) Sale of gas and propane businesses (0.01) (0.11) Settlement of Wallingford cost-based rates 0.09 Impairment of transmission rights (0.04) Change in U.K. tax rate 0.14 Workforce reductions (0.03) (0.03) (0.02) Synfuel tax adjustment (0.04) Montana basin seepage litigation (0.01) Other asset impairments (0.01) (0.01) (0.05) Impairments & other impacts - EAs (0.04) (0.04) (0.07) 0.04 0.04 0.45 0.75 Reported Earnings per share of common stock $1.94 $1.64 $2.47 $3.35 Note: Per share amounts are based on diluted shares outstanding. MTM adj's from energy-related, non-trading Forecast Actual A-15

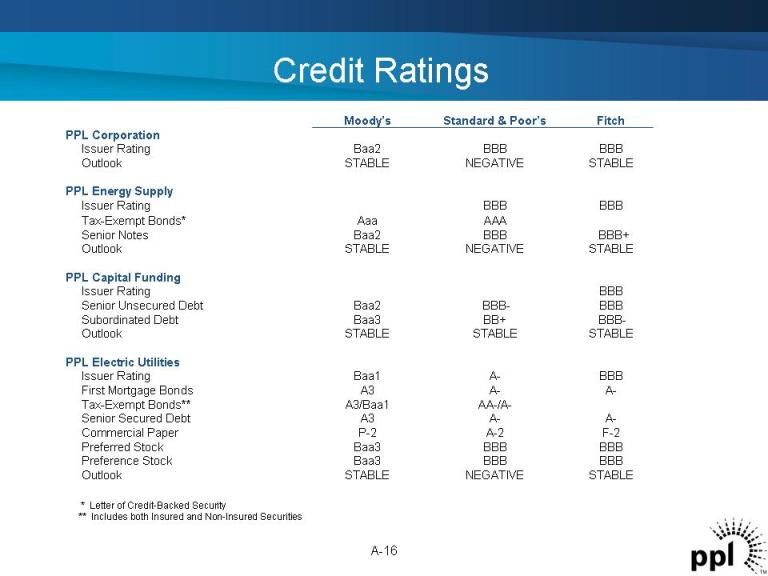

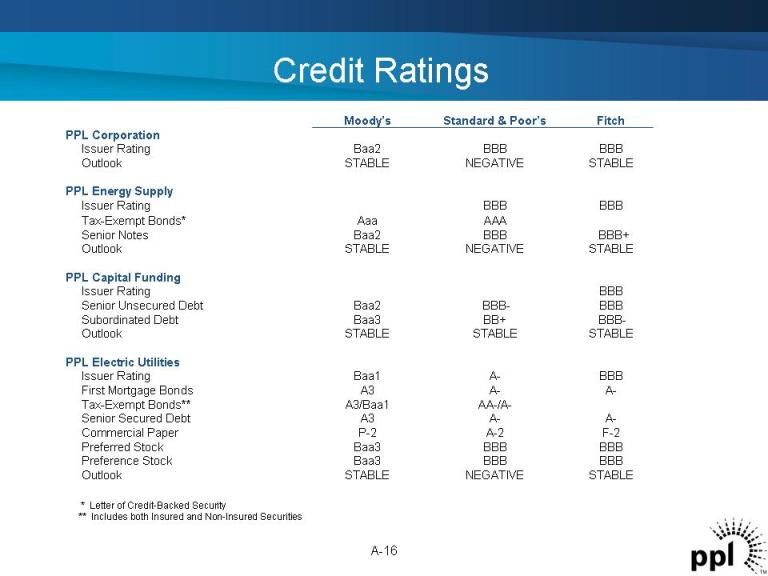

Credit Ratings A-16 BBB Issuer Rating AAAAaa Tax-Exempt Bonds* STABLE NEGATIVE STABLE Outlook A-A-A3Senior Secured Debt F-2A-2P-2Commercial Paper BBBBBBBaa3Preferred Stock BBBA-Baa1Issuer Rating A-A-A3First Mortgage Bonds AA-/A-A3/Baa1Tax-Exempt Bonds** BBBBBBBaa3Preference Stock PPL Electric Utilities BBBBBB-Baa2Senior Unsecured Debt BBB-BB+ Baa3Subordinated Debt STABLE STABLE STABLE Outlook PPL Capital Funding BBBBBB Issuer Rating BBB+ BBBBaa2Senior Notes STABLE NEGATIVE STABLE Outlook PPL Energy Supply STABLE NEGATIVE STABLE Outlook BBBBBBBaa2Issuer Rating PPL Corporation Fitch Standard & Poor’s Moody’s * Letter of Credit-Backed Security ** Includes both Insured and Non-Insured Securities

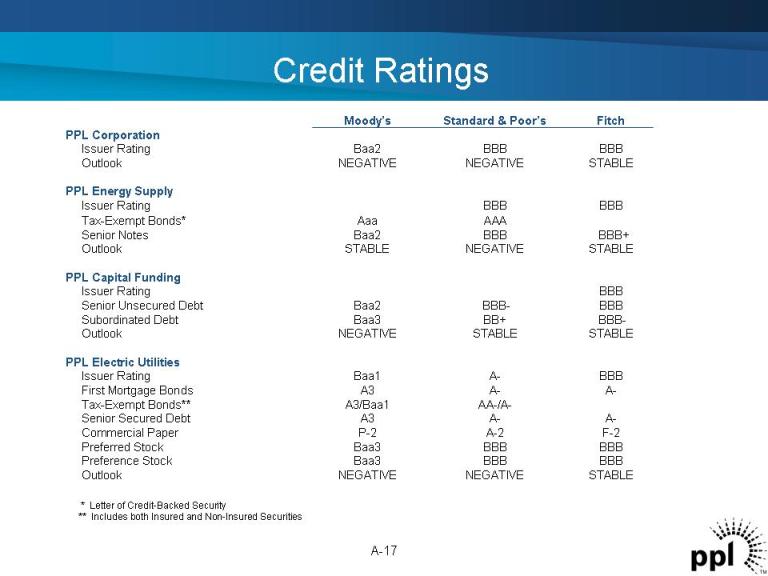

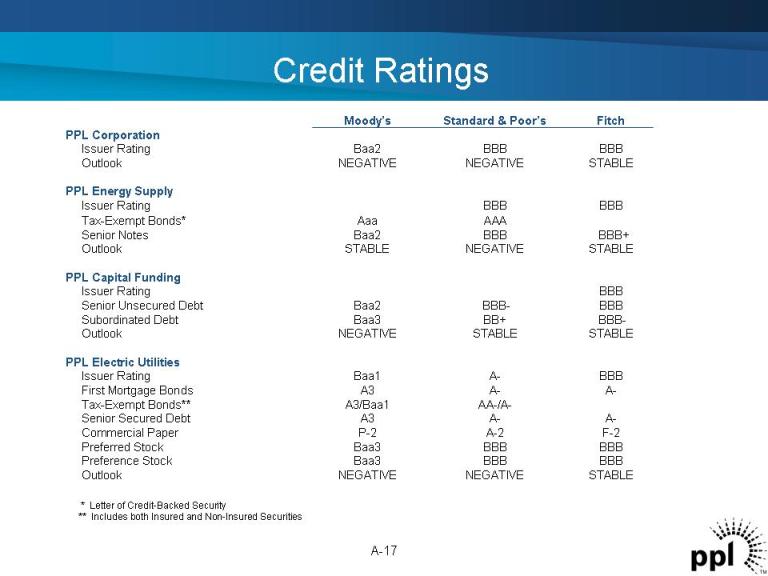

Credit Ratings A-17 BBB Issuer Rating AAAAaa Tax-Exempt Bonds* STABLE NEGATIVE NEGATIVE Outlook A-A-A3Senior Secured Debt F-2A-2P-2Commercial Paper BBBBBBBaa3Preferred Stock BBBA-Baa1Issuer Rating A-A-A3First Mortgage Bonds AA-/A-A3/Baa1Tax-Exempt Bonds** BBBBBBBaa3Preference Stock PPL Electric Utilities BBBBBB-Baa2Senior Unsecured Debt BBB-BB+ Baa3Subordinated Debt STABLE STABLE NEGATIVE Outlook PPL Capital Funding BBBBBB Issuer Rating BBB+ BBBBaa2Senior Notes STABLE NEGATIVE STABLE Outlook PPL Energy Supply STABLE NEGATIVE NEGATIVE Outlook BBBBBBBaa2Issuer Rating PPL Corporation Fitch Standard & Poor’s Moody’s * Letter of Credit-Backed Security ** Includes both Insured and Non-Insured Securities

PPL Corporation (NYSE: PPL) is a Fortune 500 company with headquarters in Allentown, Pa. The Company’s diversified corporate strategy is to achieve growth in energy supply margins while limiting volatility in both cash flows and earnings and to achieve stable, long-term growth in regulated delivery businesses through efficient operations and strong customer and regulatory relations. The strategy is carried out through four principal subsidiaries: PPL EnergyPlus, which markets energy in key U. S. markets. PPL Generation, which operates more than 11,000 megawatts of electricity generating capacity in Pennsylvania, Montana, Maine, Illinois, New York and Connecticut, with an additional 265 megawatts of planned uprate projects. PPL Electric Utilities, which delivers electricity to 1.4 million customers in Pennsylvania. PPL Global, which delivers electricity to 2.6 million customers in the United Kingdom. Security Ratings Moody’s S&P Fitch PPL Corp. Corporate Credit Rating Baa2 BBB BBB PPL Capital Funding, Inc. Senior Unsecured Debt Baa2 BBB-BBB PPL Electric Utilities Corp. First Mortgage Bonds A3 A-A- Senior Secured Bonds A3 A-A- PPL Energy Supply Senior Unsecured Notes Baa2 BBB BBB+ WPD Holdings Limited Senior Unsecured Debt Baa3 BBB-BBB WPD Operating Cos. Senior Unsecured Debt Baa1 BBB+ A- See a complete list of all PPL rated companies in the appendix Contacts Joseph P. Bergstein, Jr. Manager-Investor Relations Phone: (610) 774-5609 Fax: (610) 774-5106 jpbergstein@pplweb.com www.pplweb.com PPL Facts iA-18

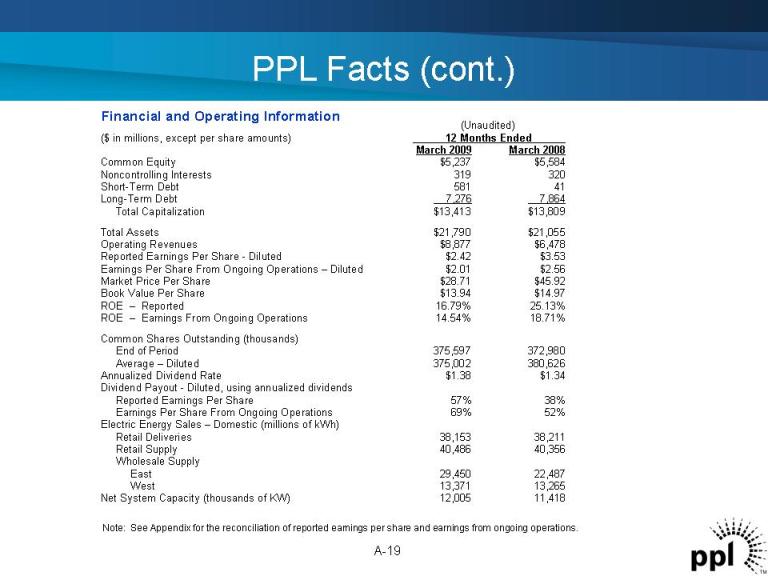

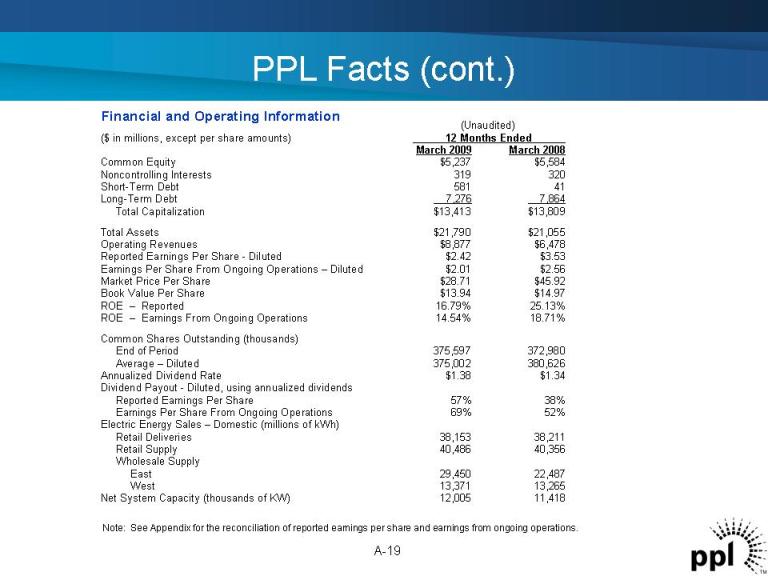

PPL Facts (cont.) Financial and Operating Information Note: See Appendix for the reconciliation of reported earnings per share and earnings from ongoing operations. ii(Unaudited) ($ in millions, except per share amounts) 12 Months Ended March 2009 March 2008 Common Equity $5,237 $5,584 Noncontrolling Interests 319 320 Short-Term Debt 581 41 Long-Term Debt 7,276 7,864 Total Capitalization $13,413 $13,809 Total Assets $21,790 $21,055 Operating Revenues $8,877 $6,478 Reported Earnings Per Share -Diluted $2.42 $3.53 Earnings Per Share From Ongoing Operations – Diluted $2.01 $2.56 Market Price Per Share $28.71 $45.92 Book Value Per Share $13.94 $14.97 ROE – Reported 16.79% 25.13% ROE – Earnings From Ongoing Operations 14.54% 18.71% Common Shares Outstanding (thousands) End of Period 375,597 372,980 Average – Diluted 375,002 380,626 Annualized Dividend Rate $1.38 $1.34 Dividend Payout -Diluted, using annualized dividends Reported Earnings Per Share 57% 38% Earnings Per Share From Ongoing Operations 69% 52% Electric Energy Sales – Domestic (millions of kWh) Retail Deliveries 38,153 38,211 Retail Supply 40,486 40,356 Wholesale Supply East 29,450 22,487 West 13,371 13,265 Net System Capacity (thousands of KW) 12,005 11,418 A-19

Forward-Looking Information Statement A-20 Statements contained in this presentation, including statements with respect to future earnings, energy prices, margins, sales and supply, marketing performance, hedging, growth, revenues, expenses, rates, regulation, cash flows, credit profile, financing, dividends, business disposition, corporate strategy, capital additions and expenditures, and generating capacity and performance, are “forward-looking statements” within the meaning of the federal securities laws. Although PPL Corporation believes that the expectations and assumptions reflected in these forward-looking statements are reasonable, these statements involve a number of risks and uncertainties, and actual results may differ materially from the results discussed in the statements. The following are among the important factors that could cause actual results to differ materially from the forward-looking statements: market demand and prices for energy, capacity and fuel; volatility in financial or commodities markets; weather conditions affecting customer energy usage and operating costs; competition in power markets; the effect of any business or industry restructuring; the profitability and liquidity of PPL Corporation and its subsidiaries; new accounting requirements or new interpretations or applications of existing requirements; operating performance of plants and other facilities; environmental conditions and requirements and the related costs of compliance, including environmental capital expenditures and emission allowance and other expenses; system conditions and operating costs; development of new projects, markets and technologies; performance of new ventures; asset acquisitions and dispositions; any impact of hurricanes or other severe weather on our business, including any impact on fuel prices; receipt of necessary government permits, approvals and rate relief; capital market conditions and decisions regarding capital structure; the impact of state, federal or foreign investigations applicable to PPL Corporation and its subsidiaries; the outcome of litigation against PPL Corporation and its subsidiaries; stock price performance; the market prices of equity securities and the impact on pension income and resultant cash funding requirements for defined benefit pension plans; the securities and credit ratings of PPL Corporation and its subsidiaries; political, regulatory or economic conditions in states, regions or countries where PPL Corporation or its subsidiaries conduct business, including any potential effects of threatened or actual terrorism or war or other hostilities; foreign exchange rates; new state, federal or foreign legislation, including new tax legislation; and the commitments and liabilities of PPL Corporation and its subsidiaries. Any such forward-looking statements should be considered in light of such important factors and in conjunction with PPL Corporation’s Form 10-K and other reports on file with the Securities and Exchange Commission.

“Earnings from ongoing operations” excludes the impact of special items. Special items include charges, credits or gains that are unusual or nonrecurring. Special items also include the mark-to-market impact of energy-related, non-trading economic hedges and impairments of securities in PPL’s nuclear decommissioning trust funds. These energy-related, non-trading economic hedges are used to hedge a portion of the economic value of PPL’s generation assets and PPL’s load-following and retail activities. This economic value is subject to changes in fair value due to market price volatility of the input and output commodities (e.g., coal and power). The mark-to-market impact of these hedges is economically neutral to the company because the mark-to-market gains or losses on the energy hedges will reverse as the hedging contracts settle in the future. Earnings from ongoing operations should not be considered as an alternative to reported earnings, or net income attributable to PPL Corporation, which is an indicator of operating performance determined in accordance with generally accepted accounting principles (GAAP). PPL believes that earnings from ongoing operations, although a non-GAAP measure, is also useful and meaningful to investors because it provides them with PPL’s underlying earnings performance as another criterion in making their investment decisions. PPL’s management also uses earnings from ongoing operations in measuring certain corporate performance goals. Other companies may use different measures to present financial performance. “Free cash flow before dividends” is derived by deducting capital expenditures and other investing activities-net, as well as the repayment of transition bonds, from cash flow from operations. Free cash flow before dividends should not be considered as an alternative to cash flow from operations, which is determined in accordance with GAAP. PPL believes that free cash flow before dividends, although a non- GAAP measure, is an important measure to both management and investors since it is an indicator of the company’s ability to sustain operations and growth without additional outside financing beyond the requirement to fund maturing debt obligations. Other companies may calculate free cash flow before dividends in a different manner. "Domestic Gross Energy Margins" is intended to supplement the investors' understanding of PPL’s domestic non-trading and trading activities by combining applicable income statement line items and related adjustments to calculate a single financial measure. PPL believes that "Domestic Gross Energy Margins" is useful and meaningful to investors because it provides them with the results of PPL's domestic non-trading and trading activities as another criterion in making their investment decisions. "Domestic Gross Energy Margins" is not intended to replace "Operating Income," which is determined in accordance with GAAP, as an indicator of overall operating performance. PPL's management also uses "Domestic Gross Energy Margins" in measuring certain corporate performance goals used in determining variable compensation. Other companies may use different measures to present the results of their non-trading and trading activities. Definitions of Financial Measures A-21