© PPL Corporation 2010

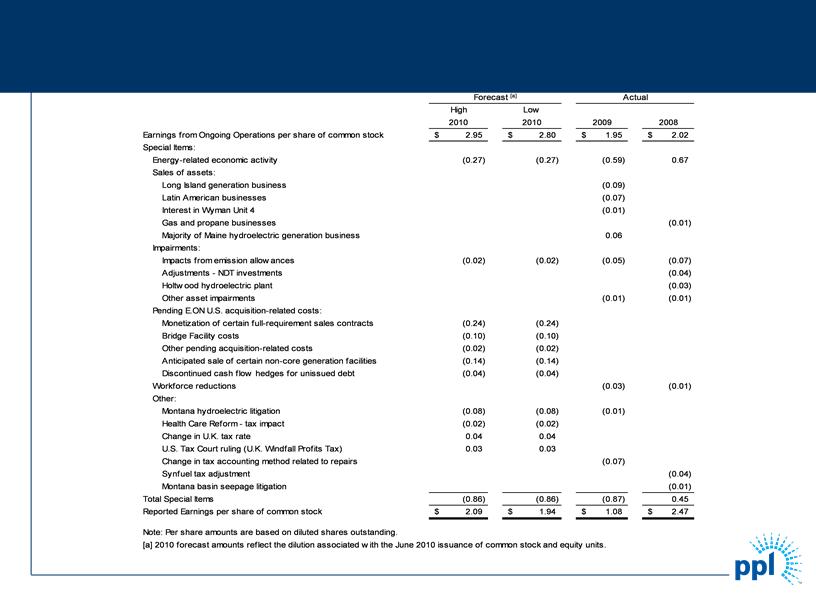

“Earnings from ongoing operations” is adjusted for the impact of special items. Special items include:

• Energy-related economic activity (as discussed below).

• Foreign currency-related economic hedges.

• Gains and losses on sales of assets not in the ordinary course of business.

• Impairment charges (including impairments of securities in the company’s nuclear decommissioning trust funds).

• Workforce reduction and other restructuring impacts.

• Costs and charges related to the pending E.ON U.S. acquisition.

• Other charges or credits that are, in management’s view, not reflective of the company’s ongoing operations.

A-19

Definitions of Non-GAAP Financial Measures

“Earnings from ongoing operations” should not be considered as an alternative to reported earnings, or net income attributable to PPL, which is an indicator of operating performance determined in accordance with generally accepted accounting principles (GAAP). PPL believes that “earnings from ongoing operations,” although a non-GAAP financial measure, is also useful and meaningful to investors because it provides them with management’s view of PPL’s fundamental earnings performance as another criterion in making their investment decisions. PPL’s management also uses “earnings from ongoing operations” in measuring certain corporate performance goals. Other compa nies may use different measures to present financial performance.

Energy-related economic activity includes the changes in fair value of positions used to economically hedge a portion of the economic value of PPL’s generation assets, load-following and retail activities. This economic value is subject to changes in fair value due to market price volatility of the input and output commodities (e.g., fuel and power). Also included in this special item are the ineffective portion of qualifying cash flow hedges and the premium amortization associated with options classified as economic activity. These items are included in ongoing earnings over the delivery period of the item that was hedged or upon realizati on. Management believes that adjusting for such amounts provides a better matching of earnings from ongoing operations to the actual amounts settled for PPL’s underlying hedged assets. Please refer to the Notes to the Consolidated Financial Statements and MD&A in PPL Corporation’s periodic filings with the Securities and Exchange Commission for additional information on energy-related economic activity.

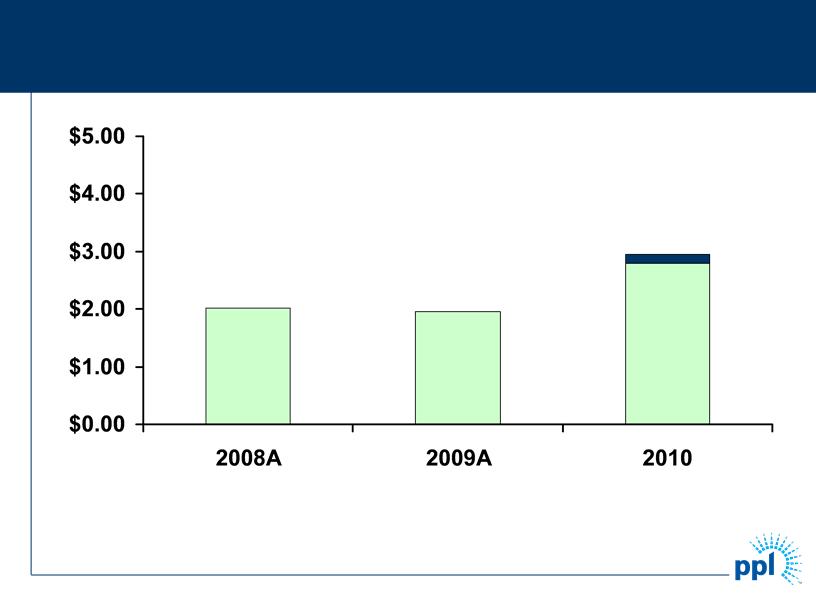

“Free cash flow before dividends” is derived by deducting capital expenditures and other investing activities-net, from cash flow from operations. Free cash flow before dividends should not be considered as an alternative to cash flow from operations, which is determined in accordance with GAAP. PPL believes that free cash flow before dividends, although a non-GAAP measure, is an important measure to both management and investors since it is an indicator of the company’s ability to sustain operations and growth without additional outside financing beyond the requirement to fund maturing debt obligations. Other companies may calculate free cash flow before dividends in a different manner.