© PPL Corporation 2012

31

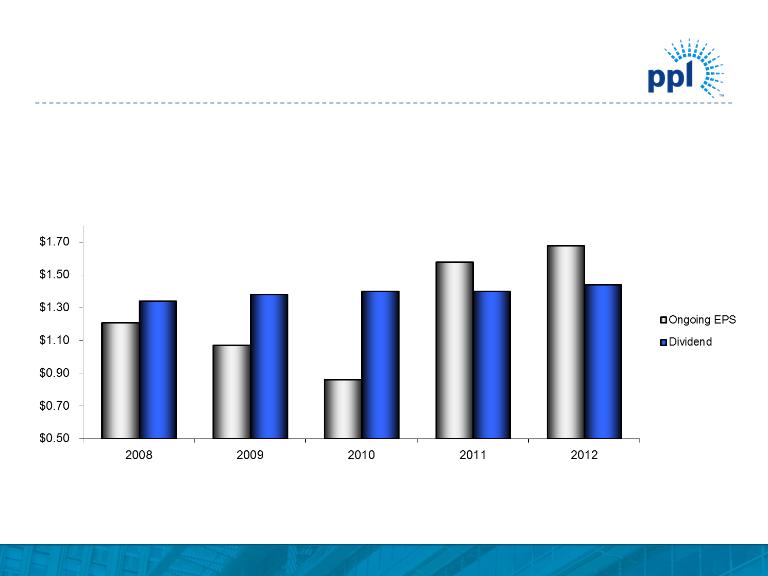

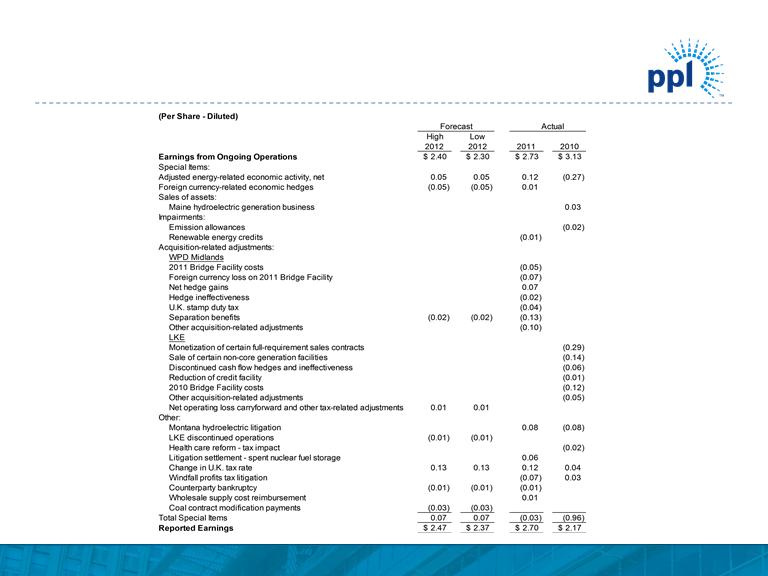

"Earnings from ongoing operations," also referred to as "ongoing earnings," should not be considered as an alternative to reported earnings, or

net income attributable to PPL shareowners, which is an indicator of operating performance determined in accordance with generally accepted

accounting principles (GAAP). PPL believes that "earnings from ongoing operations," although a non-GAAP financial measure, is also useful and

meaningful to investors because it provides management’s view of PPL’s fundamental earnings performance as another criterion in making

investment decisions. PPL’s management also uses “earnings from ongoing operations” in measuring certain corporate performance goals.

Other companies may use different measures to present financial performance.

"Earnings from ongoing operations" is adjusted for the impact of special items. Special items include:

• Adjusted energy-related economic activity (as discussed below).

• Foreign currency-related economic hedges.

• Gains and losses on sales of assets not in the ordinary course of business.

• Impairment charges (including impairments of securities in the company’s nuclear decommissioning trust funds).

• Workforce reduction and other restructuring impacts.

• Acquisition-related adjustments.

• Other charges or credits that are, in management’s view, not reflective of the company's ongoing operations.

Adjusted energy-related economic activity includes the changes in fair value of positions used economically to hedge a portion of the economic

value of PPL's generation assets, full-requirement sales contracts and retail activities. This economic value is subject to changes in fair value due

to market price volatility of the input and output commodities (e.g., fuel and power) prior to the delivery period that was hedged. Also included in

adjusted energy-related economic activity is the ineffective portion of qualifying cash flow hedges, the monetization of certain full-requirement

sales contracts and premium amortization associated with options. This economic activity is deferred, with the exception of the full-requirement

sales contracts that were monetized, and included in earnings from ongoing operations over the delivery period of the item that was hedged or

upon realization. Management believes that adjusting for such amounts provides a better matching of earnings from ongoing operations to the

actual amounts settled for PPL's underlying hedged assets. Please refer to the Notes to the Financial Statements and MD&A in PPL

Corporation’s periodic filings with the Securities and Exchange Commission for additional information on energy-related economic activity.

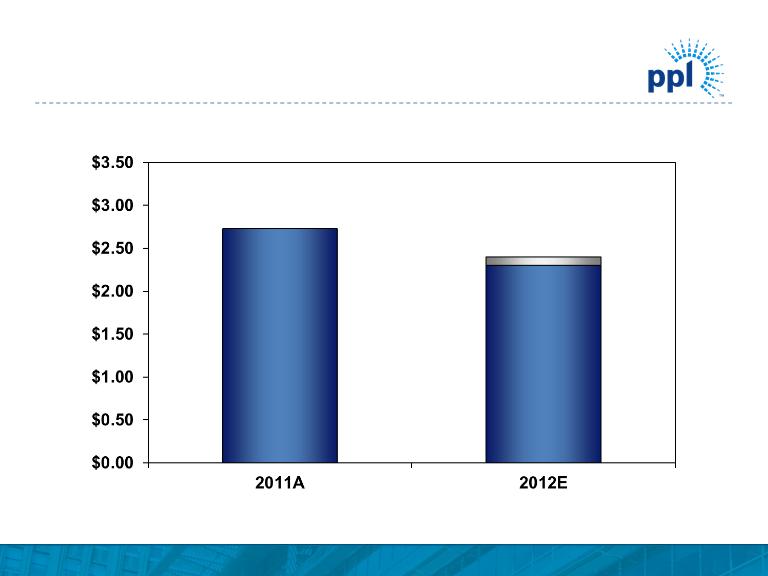

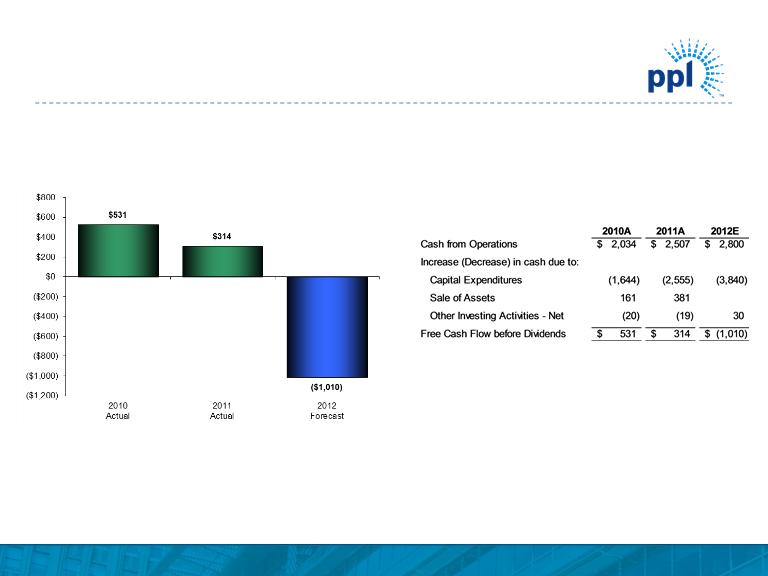

Free cash flow before dividends is derived by deducting capital expenditures and other investing activities-net, from cash flow from operations.

Free cash flow before dividends should not be considered as an alternative to cash flow from operations, which is determined in accordance with

GAAP. PPL believes that free cash flow before dividends, although a non-GAAP measure, is an important measure to both management and

investors, as it is an indicator of the company's ability to sustain operations and growth without additional outside financing beyond the

requirement to fund maturing debt obligations. Other companies may calculate free cash flow before dividends in a different manner.

Definitions of Non-GAAP Financial Measures