© PPL Corporation 2015 PPL: A Diverse Pure-Play, Electric Transmission & Distribution Company Goldman Sachs Power, Utilities, MLP and Pipeline Conference August 11, 2015 Exhibit 99.1

© PPL Corporation 2015 2 Cautionary Statements and Factors That May Affect Future Results Anystatementsmadeinthispresentationaboutfutureoperating resultsorotherfutureeventsareforward-lookingstatements under the Safe Harbor Provisions of the Private Securities LitigationReformActof1995.Actualresultsmaydiffermaterially fromsuchforward-lookingstatements.Adiscussionoffactors thatcouldcauseactualresultsoreventstovaryiscontainedin theAppendixtothispresentationandintheCompany’sSEC filings.

© PPL Corporation 2015 Investment Highlights 100% rate-regulated business model • Pure-play utility modelwith strong earnings and dividend growth potential • Top 10 U.S. utility market capitalization and part of the S&P 500 • Annual total return proposition of 8% –11% • Diversified by region, regulator and customer class (Pennsylvania, Kentucky and United Kingdom) • Strong growth in regulated utilitybusinesses in the U.S. and U.K. drives projected rate base growth of ~7% CAGR through 2019 • Rate base/Regulated Asset Value (RAV) expected to grow over $9 billion to ~$32 billion by 2019 • Significant Transmission footprint with over 16% CAGR in Transmission rate base through 2019 Diverse asset mix with robust growth • Constructive rate recovery mechanisms in PA and KY support top in sector domestic earnings growth • Regulatory framework in the U.K. provides long-term certainty and creates a premiumjurisdiction • Over 80% of total capital expenditures through 2019 earn returns subject to no or minimal regulatory lag Strong regulatory jurisdictions • Strong investment-grade credit ratings from S&P and Moody’s (A-& Baa2 at PPL; A-& A3/Baa1 at utilities) • Disciplined currency hedging program results in more predictable U.K. earnings • Attractive dividend yield of 4.9% (1) , with continued dividend growth expected Solid financial position 3 Attractive future growth prospects • Annual regulated Cap Ex of ~$3.5 billion through 2019 (~$18 billion over 5 years) • Target 4%-6% in EPS growth through at least 2017, driven by 8%-10% earnings growth in U.S. utilities (1) Dividend yield as of 07/24/2015.

© PPL Corporation 2015 Significant Investment Opportunity with Constructive Rate Mechanisms Drives Earnings Growth (2) Earnings from Ongoing Operations based on 2014 adjusted actual earnings and midpoint of 2015 forecast. (3) Projection based on midpoint of 4% -6% CAGR off 2014 adjusted earnings. Does not represent earnings forecast or guidance for 2017. S t r o n g R e g u l a t e d R a t e B a s e G r o w t h R e a l - t i m e R e c o v e r y o f C a p E x 4% -6% Compound Annual EPS (2) Growth 4 Greater than 12 months 18% 0-6 months 76% 0-6 months 76% $28.0 (3) (1) “0-6 months” primarily consists of 100% of WPD capital expenditures and domestic capital expenditures where the investment occurs within six months of that spend being included in rates, and CWIP Incentive on the Northeast Pocono project. “7-12 months” and “Greater than 12 months” primarily consist of domestic capital expenditureswhere the investment occurs within 7 to 12 months or greater than 12 months of that spend being included in rates. 2015E –2017E Capital Recovery, Earning on Investment (1) ($bn) $22.8

© PPL Corporation 2015 Summary of Drivers of 4% to 6% EPS Growth Through 2017 8% -10% Domestic Utility Earnings Growth: PA Regulated • Transmission Cap Ex of $2.0 billion at 11.68% base ROE, 12.93% for $630 million Susquehanna Roseland project drives transmission rate base growth of 18.9% through 2017 • 2015 Distribution Rate Case with rates effective early 2016 • DSIC Cap Ex of $500 million with 2016 DSIC Cap Ex in Base Rates • ~ 70% of gross margin subject to minimal or no volumetric risk KY Regulated • Environmental investment of $1.2 billion at 10% ROE • Gas Line Tracker investment of ~ $150 million at 10% ROE • $132 million 2014 Rate Case with rates effective July 1, 2015 • Assumed minimal load growth Corporate and Other • Corporate restructuring to achieve $75 million in cost reductions essentially complete • Expect no more than $200 million per year in Equity issuances through 2017 (1) Based on 2015-2017 projections. Excludes the effects of Goodwill and OCI. (2) Earnings from Ongoing Operations based on 2014 adjusted actual earnings and midpoint of 2015 forecast. (3) Projection based on midpoint of 4% -6% CAGR off 2014 adjusted earnings. Does not represent earnings forecast or guidance for 2017. 5 U.K. Regulated • No volumetric risk • Flat earnings growth from 2014 –2017 during transition to RIIO-ED1 • Average expected segment earned ROE of 15% to 18% (1) • Expected RAV growth of 5.8% through 2017 • Incentive revenue assumptions: 2015 -$125M; 2016 -$120- $130M; 2017 -$80-$100M; 2018 -$60-$90M • Assumed exchange rate of $1.60/£ for 2015 –2017 • Assumed RPI (inflation rate) –2.6% for 2015/16; 3.0% thereafter (3) 4% -6% Compound Annual EPS (2) Growth

© PPL Corporation 2015 Leading Energy Delivery Platform with Scale and Diversity Pennsylvania Regulated Segment • Customers: 1.4 million Electricity Distribution • Allowed Distribution ROE: 10.40% • Rate Base: $4.9 billion (1) • 5-Year Transmission Rate Base CAGR: 16.3% • 5-Year Distribution Rate Base CAGR: 7.0% • Regulatory Entity: Pennsylvania PUC Kentucky Regulated Segment • Customers: 0.9 million Electricity Distribution; 0.3 million Natural Gas • No stated ROE for Kentucky Base Rates, ECR ROE: 10% • Rate Base: $8.3 billion (1),(2) • 5-Year Rate Base CAGR: 5.6% • Regulated Capacity: 8.0 GW • Regulatory Entities: Kentucky PSC, Virginia SCC PA U.K. KY (1) Year-end Rate Base as of December 31, 2014 (2) Represents capitalization for KY Regulated, as LG&E and KU rate constructs are based on capitalization. (3) Based on 2015-2017 projections. Excludes the effects of Goodwill and OCI. Business Composition by Region 2015E Rate Base -$24.6 bn 6 Customers –10.4 mm KY Gas 3% WPD 64% KY 23% PA 17% WPD 75% PA 13% WPD 42% KY 36% 2015E Ongoing Earnings -$2.20 midpoint U.K. Regulated Segment • Customers: 7.8 million Electricity Distribution • Average expected earned ROE of 15% to 18% (3) • Regulatory Asset Value (RAV): $9.7 billion (1) • 5-Year Rate Base CAGR: 5.7% • Regulatory Entity: Ofgem

© PPL Corporation 2015 Rate Base (2015E) Equity Ratio (1) Allowed ROE PPL Electric Utilities D: $3.0 billion T: $2.5 billion 51.60% D: 10.40% T: 11.68% (2) LG&E $3.7 billion 52.75% 10.00% (3) Kentucky Utilities $5.1 billion 53.02% 10.00% (3) Constructive Regulatory Framework Supports Robust Financial Performance Focus on rate structure optimization with constructive recovery mechanisms. EU LG&E KU Environmental Cost Recovery DSIC NA 7 Forward test year methodology CWIP includedin rate base (5)(6) Gas Line Tracker Pass through of Purchased Power Fuel and Gas Supply Adj. Clause Storm Recovery (7) NA Smart Meter Rider (4) NA NA Tracker/Mechanism Transmission Formula Rate Transmission Incentive Adder (2) NA NA NA NA NA NA NA NA Energy Efficiency/DSM (1) As filed in most recent rate cases. (2) Allowed ROE of 12.93% for Susquehanna-Roseland project. (3) No stated ROE for Kentucky Base Rates. However, the Environmental Cost Recovery Mechanism and Gas Line Tracker wasawarded a 10% ROE. (4) Pending PAPUC approval. (5) CWIP included in forward test year rate base for LG&E and KU. (6) For PPL EU Transmission, CWIP included for Northeast Pocono reliability project totaling $335 million in capital investment. (7) LG&E and KU have historically been able to recover costs from extraordinary storms, but no formal tracker is in place.

© PPL Corporation 2015 The U.K.; a PremiumRegulatory Jurisdiction The U.K. OFGEM’s RIIO framework (Revenue = Incentives + Innovation + Outputs) allows Distribution Network Operators (DNOs) to earn premium returns for strong performance and innovation. WPD Investment Advantage Regulatory cycle Fast track incentive Benefit sharing Inflation –adjusted revenues • Revenues set for 8 year period, commencing April 2015 through March 2023 • No volumetric risk in amount of electricity delivered • Ability to collect additional annualrevenue equivalent to 2.5% of total annual expenditures • Ability to retain 50% -70% of cost efficiencies; with benefits shared with customers • RPI Indexation of allowed revenues and Regulatory Asset Value (RAV) • Provides certainty and visibility • Ofgem accepted business plan spend over 8 years drives RAV growth • WPD only 4 DNOs awarded fast-track status • Estimated $43 million of annual fast-track revenue • Fast-track status allows WPD to retain 70% of cost efficiencies (O&M and Capital savings), compared to only 53% to 58% for the slow track DNOs • RPI plan assumptions –2.6% for 2015/16; 3% thereafter (20 year historical average for RPI is 2.9%) Funding & leverage • Regulation requires funding to support investment grade credit ratings • Debt leverage set at 65% of Debt/RAV at the DNO level • U.K. is a self-funding operation; does not require any equity from PPL • Holding company structure provides for higher earned ROEs • PPL targets 80%-85% Debt/RAV at consolidated U.K. level • Expected ability to annually repatriate $300 -$500 million of cash back to the U.S. in a tax efficient manner Incentive regulation • WPD has a proven track record of outperformance • Additional opportunity to improve earned ROEs; mid-to- upper teens earned ROEs (1) expected through 2017 8 • Incentive revenues available for outstanding customer service and reliability RIIO-ED1 Framework (1) U.S. GAAP ROEs exclude the effects of Goodwill and OCI.

© PPL Corporation 2015 9 Note: Corporate and Other capital expenditures average approximately $5million per year. (1) WPD figures based on assumed exchange rate of $1.60 / £. (2) Expect between 80% and 90% to receive timely returns via ECR mechanism based on historical experience and future projections. (3) Pending PAPUC approval. Significant Ongoing Capital Expenditure Program… ($ in billions) $3.61 $3.33 $3.33 $3.53 $3.78 (1) (2) ~$18 billion of Capital Expenditures from 2015 –2019 to strengthen safety and reliability of T&D systems and address environmental regulations in Kentucky. • Over 80% of Regulated capital expenditures earn returns subject to minimal or no lag • PA –Implementation of ~$450 million Smart Meter Program to be recovered through a rider mechanism (~$328 million of Capital; ~$122 million O&M) (3) • PA and KY –Continued focus on improving reliability on both Transmission and Distribution systems • KY –Environmental spending in response to regulations for Mercury, SO2, NOX, Ozone, Particulates, Water Discharge and CCRs (excludes proposed CO2 regulation) • U.K. –Continued focus on asset replacement, faults and overheads and general system reinforcement

© PPL Corporation 2015 10 ( $ i n b i l l i o n s ) (1) WPD figures based on assumed exchange rate of $1.60 / £ for 2015 -2019. (2) Represents capitalization for LKE, as LG&E and KU rate constructs are based on capitalization. Represents Regulatory Asset Value (RAV) for WPD. Strong regulated rate base growth will drive EPS growth. …Critical to Driving Strong Rate Base Growth $32.1 $30.1 $28.0 $26.2 $24.6 $22.8 (2) (1)

© PPL Corporation 2015 $2.1 $2.5 $2.9 $3.5 $4.1 $4.5 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 $5.0 2014A 2015E 2016E 2017E 2018E 2019E ( $ i n B i l l i o n s ) Pennsylvania: Continuing to Grow Transmission Projected Transmission Rate Base Growth • Excellent growth in Transmission business with over 16% CAGR in Transmission rate base through 2019 • CAGR of 16.3% in transmission rate base through 2019 driven by initiatives to improve aging infrastructure • Base ROE of 11.68% earned through FERC Formula Rate Mechanism • Base ROE of 12.93% for $630 million Susquehanna-Roseland project • Return on CWIP for $335 million Northeast Pocono Reliability project • No volumetric risk • Project Compass provides potentially significant incremental opportunity beyond 2019 (1) 11 PA 22% 2015E PA Regulated Rate Base Total: $24.6 bn Trans 53% Total: $5.5 bn KY P2 WPD % P2 Dist% (1) If all approvals are received.

© PPL Corporation 2015 Proven Track Record of Transmission Capability • Susquehanna –Roseland • $630 million Project • 150 miles from Berwick, PA into New Jersey including through Delaware Water Gap • Successful partnership with a neighboring utility in New Jersey • Cooperation with multiple state regulatory and government agencies • Strengthen reliability for millions in the Mid-Atlantic region • Created significant economic development benefits, including creation of 2,200 construction jobs • Northeast Pocono Reliability Project • $335 million project • 58 miles of transmission lines and substations • Reliability Projects • Designed to strengthen existing transmission system • Significant asset modernization • Greater Scranton, PA reliability project 12

© PPL Corporation 2015 $2.8 $3.0 $3.2 $3.5 $3.7 $3.9 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 2014A 2015E 2016E 2017E 2018E 2019E ( $ i n B i l l i o n s ) Pennsylvania: Strong Distribution Growth Platform Projected Distribution Rate Base Growth Total: $24.6 bn • Reliability initiatives drive distribution rate base growth at a projected CAGR of ~7% through 2019 • Constructive regulatory jurisdiction with improved regulation that reduces regulatory lag • DSIC Mechanism (less than six monthslag on qualifying investment) • Projected future test year for rate cases • Smart Meter Program (less than six months lag on capital investment) • Rate design that results inapproximately 57% of Distribution gross margin subject to minimal or no volumetric risk 13 Total: $5.5 bn 2015E PA Regulated Rate Base PA 22% Dist 47% KY P2 WPD % P2 Trans %

© PPL Corporation 2015 $8.3 $8.8 $9.2 $9.5 $10.1 $10.9 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 2014A 2015E 2016E 2017E 2018E 2019E ( $ i n B i l l i o n s ) Kentucky: Strong Rate Base Growth Driven By Environmental Investments • Constructive regulatory environment that provides a timely return on a substantial amount of planned capex over the next 5 years • Environmental Cost Recovery (ECR): $2.2 billion estimated spend on projects approved by the KPSC with a 10.0% ROE –virtually no regulatory lag (two month lag) • Other supportive recovery mechanisms • Return mechanisms include Construction Work In Progress and Gas Line Tracker • Pass through clauses include Purchased Power, Fuel and Gas Supply Adjustment Clause and Energy Efficiency/Demand Side Management recovery • Return on Capitalization vs. Rate Base further reduces regulatory lag • Capital expenditure plans exclude spending related to the Clean Power Plan Significant Rate Base Growth Kentucky Delivery Territories VA KY Frankfort Lexington Louisville Owensboro LG&E Service Area (Electric) LG&E Service Area (Gas) KU Service Area ODP Service Area Total: $24.6 bn 14 KY 36 % 2015E KY Regulated Rate Base KY 36% PA P2 WPD % (1) (1) Old Dominion Power

© PPL Corporation 2015 WPD: Top Performing Electricity Distribution Business in the U.K. • Highly attractive regulated business • Regulator-accepted 8 year forward-looking revenues based on future business plan, including capital expenditures and O&M plus incremental financial adjustments to base revenues covering inflation, tax, pension and cost of debt • Real-time return of and return on capital investment –no lag • No volumetric risk • Additional incentives for operational efficiency and high-quality service • Best-in-class management team with track record of outperformance Projected RAV Growth Top Performing Electricity Distribution Business in the U.K. Total: $24.6bn • WPD named “Utility of the Year” in 2014 • WPD only 4 DNOs to be fast-tracked by Ofgem for RIIO- ED1 • WPD has earned over $540 (1) million in annual performance awards over the past 10 regulatory years • Expected earned ROE’s in the 15% -18% (2) range through 2017, including Holding Company leverage • Total spend of $19 billion over the 8 year regulatory period, of which ~$11 billion will drive growth in RAV (1) 2005/06 –2014/15 regulatory years. (2) Based on 2015-2017 projections. Excludes the effects of Goodwill and OCI. 15 2015E U.K. Regulated Rate Base P2 PA WPD 42% KY ( $ i n B i l l i o n s ) Note: WPD figures based on assumed exchange rate of $1.60/£ for 2015-2019.

© PPL Corporation 2015 Foreign Currency Risk Management • 3-year forward hedging program to manage PPL’s GBP vs. USD earnings translation risk • The program consists of declining hedge percentage ratios on a “rolling” 36-month basis allocated into 12-month periods • Hedge bands provide flexibility for management decisions • Defined minimum hedge percentages require disciplined hedging • Program reduces volatility and results in a more predictable USD earnings stream that meets investor expectations 16

© PPL Corporation 2015 Foreign Currency Hedging Status and RPI Sensitivity Note: FX hedging status as of 07/15/2015. (1) Sensitivity includes the net effects on revenue, O&M and interest expense on index-linked debt. 17 GBP Foreign Currency 2015 2016 2017 Percentage Hedged 100% 90% 40% Hedged Rate (GBP/USD) $1.58 $1.61 $1.62 Budgeted Rate on Open Position (GBP/USD) $1.60 $1.60 $1.60 EPS Sensitivities: Decrease in Rate (USD/GBP) 0.05 $0.00 ($0.01) ($0.03) 0.10 $0.00 ($0.02) ($0.05) Decrease in 2015/2016 RPI (1) (budget assumption 2.6%) 0.5% $0.00 $0.00 ($0.02) Change in EPS

© PPL Corporation 2015 Funding the Growth Strong domestic operating cash flows plus the U.K. dividend sufficient to fund the PPL dividend. Domestic debt and equity issuances fund domestic utility growth. 18 (5) 2013A (3) 2014A (3) 2015E (4) Domestic Cash from Operations $1,707 $2,219 $1,610 Domestic Maintenance Capex (1) (861) (900) (650) Dividend From U.K. Regulated 261 277 290 Cash Available for Distribution $1,107 $1,596 $1,250 Common Dividend (878) (967) (1,000) Cash Available for Reinvestment $229 $629 $250 Domestic Growth Capex ($2,142) ($1,816) ($1,615) Debt Maturities ($747) ($546) ($1,000) Debt Issuances and Change in Cash (2) 1,343 (159) 2,243 Equity Issuances 1,330 1,063 200 Other Investing & Financing Activities (13) 829 (78) Additional Funding Sources for Domestic Growth Capex $1,913 $1,187 $1,365 Note: Information provided on this slide to be updated on an annual basis. See appendix for the reconciliation of Domestic Cash from Operations. (1) Represents book depreciation. (2) Includes domestic issuances (short and long term), net of issue costs. (5) Includes approximately $900 million of proceeds from sale of the Montana hydros. (3) Includes results of PPL Energy Supply, LLC. (4) Full year projections do not include activity related to PPL Energy Supply, LLC for any portion of 2015. ($ in millions)

© PPL Corporation 2015 Strong Financial Foundation Limited maturity schedule and strong liquidity profile provide financial flexibility. Debt Maturity Distribution 2015 -2019 as of June 30, 2015 Liquidity Profile as of June 30, 2015 ($ in millions) Note: GBP debt maturities converted at 5/31/2015 spot rate of 1.526 Note: GBP credit facilities converted at 5/31/2015 spot rate of 1.526 19 ($ in millions)

© PPL Corporation 2015 Appendix 20

© PPL Corporation 2015 PPL Fact Sheet CORPORATE DATA Ticker symbol and stock exchange PPL-NYSE At July31, 2015 Average daily trading volume (3 mos.) 4.73mm shares Closing price $31.81 52-week price range $29.05 –$35.39 Annualized dividend per share $1.51 ($0.3775/qtr) Enterprise value ~$39.7billion Market cap ~$21.3billion At June30,2015 2015Estimated earnings from ongoing operations per share (Non-GAAP)-Midpoint $2.20 per share Total assets $38.2billion Common shares O/S 669,514 million Book value per share (1)(2) $14.85 Capitalization: ($ millions) Total debt $19,203.0 66% Common equity $9,941.0 34% Total Capitalization $29,144.0 100% Employees 12,752 Long-term debt $18,103 million Short-term debt $1,100 million Lettersof Credit and Commercial paper $880 million ANALYST CONTACT: Investor Relations Joe Bergstein –Vice President-Investor Relations & Financial Planning 610-774-5609 Lisa Pammer –Investor Relations Manager 610-774-3316 invrel@pplweb.com ADDRESS: 2 North Ninth Street Allentown, PA 18101 WEB SITE: www.pplweb.com 21 (1) Based on 669,514 shares of common stock outstanding. (2) 2015 reflects the impact of the spinoff of the Supply segment and a $3.2 billion related dividend.

© PPL Corporation 2015 $0.00 $1.00 $2.00 $3.00 2014 Adj Previous 2015E Revised 2015E $2.15 22 P e r S h a r e Increasing 2015 Ongoing Earnings Forecast $2.25 $2.03 Note: See Appendix for the reconciliation of 2014 reported earnings (loss) to earnings from ongoing operations. (1) 2015 earnings and 2014 earnings (adjusted) presented here excludes any earnings from the Supply segment. However, the Supply segment is part of PPL Corporation’s consolidated reported earnings for the first five months of 2015. (2) For 2014, earnings from ongoing operations (adjusted) reflects the full impact of dissynergies related to the spinoff of the Supply segment: Indirect O&M ($0.07), Interest ($0.05) and Depreciation ($0.01). Segment 2014 Earnings (Adjusted) Previous 2015E Midpoint (1) Revised 2015E Midpoint U.K. Regulated $1.37 $1.38 $1.41 Kentucky Regulated 0.47 0.48 0.51 Pennsylvania Regulated 0.40 0.39 0.38 Corporate and Other (0.21) (0.10) (0.10) Total $2.03 $2.15 $2.20 $2.25 (2) $2.05

© PPL Corporation 2015 23 $1.40 $1.44 $1.47 $1.49 $1.51 $0.50 $0.75 $1.00 $1.25 $1.50 $1.75 2011 2012 2013 2014 2015E (1) $/Share Annualized Continued Dividend Growth (1) Annualized dividend based on 8/3/2015 announced increase. Actual dividends to be determined by Board of Directors.

© PPL Corporation 2015 24 Pennsylvania Rate Case Schedule Timing Milestone 04/2015 Discovery phase begins 06/02/2015 Public input hearings 06/23/2015 Direct of other parties by 07/01/2015 First settlement conference 07/20/2015 Rebuttal testimony due 07/28/2015 Second settlement conference 07/31/2015 Surrebuttal testimony 08/06-07-10-11/2015 Evidentiary hearings and oral rejoinder 08/11/2015 Close of record 09/01/2015 Main briefs 09/11/2015 Reply briefs 12/17/2015 Public meetings Completed

© PPL Corporation 2015 Kentucky Environmental Controls 25 Low Nox Burners SCR/SNCR Scrubbers Closed Cycle Cooling Tower Dry Handling/Disposal/Beneficial Use Baghouses NO x NO x SO 2 Water Intake Coal Combustion Residuals (CCRs) (2) Hg (Particulates) Unit 1 x x x x (1) (3) Unit 2 x x x x (1) x Unit 1 x x x x x x Unit 2 x (4) x x x (3) Unit 3 x x x x x x Unit 4 x x x x x x Unit 1 x (4) x x (1) (4) Unit 2 x (4) x x (1) (4) Unit 3 x x x x (1) (3a) Unit 1 x (4) x (5) x (3b) Unit 2 x (4) x x x (3b) Unit 3 x x x x x (3) Unit 4 x x x x x x Unit 4 (6) (6) (6) (6) (6) (6) Unit 5 (6) (6) (6) (6) (6) (6) Unit 6 (6) (6) (6) (6) (6) (6) Unit 3 x (7) (7) (7) (7) (7) Unit 4 x (7) (7) (7) (7) (7) G r e e n R i v e r C a n e R u n Control Device Addresses T r i m b l e C o u n t y G h e n t B r o w n M i l l C r e e k x Environmental control equipment already installed. (1) Dry handling disposal construction approved by KPSC and permitting or construction underway at Trimble and Brown. Portions of Ghent systems are operational at this time as other construction activity continues. (2) Wet ash impoundments exist at all plants. (3) Baghousesconstruction approved by KPSC and construction activity underway at Trimble, Ghent, Brown, and Mill Creek. (3a) Brown 3's commissioning scheduled to start in July 2015. (3b) Mill Creek 1's and 2's systems expect to begin commissioning in third quarter 2015. (4) Standards are station and company based. KU and LG&E Systems are already in compliance. (5) Current systems are in compliance and future compliance requirements are being evaluated. (6) Cane Run units 4 and 5 were retired in June 2015. Cane Run unit 6 was retired in March 2015. (7) As part of the company’s generation capacity plans and EPA regulations, these units are expected to be retired before end of April 2016.

© PPL Corporation 2015 U.K. Regulated Segment EPS from Ongoing Operations Projection ($ Per Share) Note: See Appendix for the 2014 reconciliation of reported earnings (loss) to earnings from ongoing operations. Assumes foreign currency exchange rate of $1.60/£ for 2015E and 2016E on open positions. 26

© PPL Corporation 2015 U.K. Regulated Segment Cash Repatriation Note: Assumes foreign currency exchange rate of $1.60/£ for 2015E, 2016E and 2017E. ($ in millions) Flexible strategy for meaningful U.K. cash repatriation. 27

© PPL Corporation 2015 WPD Holding Company LKE Holding Company PPL Electric UtilitiesLKE Operating Companies PPL Capital Funding Credit Rating Secured Unsecured Long-term Issuer Outlook S&P NR BBB+ NR Stable Moody’s NR Baa2 NR Stable Credit Rating Secured Unsecured Long-term Issuer Outlook S&P NR BBB+ A- Stable Moody’s NR Baa3 Baa3 Stable WPD Operating Companies Credit Rating Secured Unsecured Long-term Issuer Outlook S&P NR A- A- Stable Moody’s NR Baa1 Baa1 Stable Credit Rating Secured Unsecured Long-term Issuer Outlook S&P A NR A- Stable Moody’s A1 A3 A3 Stable Credit Rating Secured Unsecured Long-term Issuer Outlook S&P NR BBB+ A- Stable Moody’s NR Baa1 Baa1 Stable Credit Rating Secured Unsecured Long-term Issuer Outlook S&P A NR A- Stable Moody’s A2 Baa1 Baa1 Positive PPL Corporation Credit Rating Secured Unsecured Long-term Issuer Outlook S&P NR NR A- Stable Moody’s NR NR Baa2 Stable Strong Credit Ratings Strong credit profile at our utilities, holding companies and PPL Corporation. 28

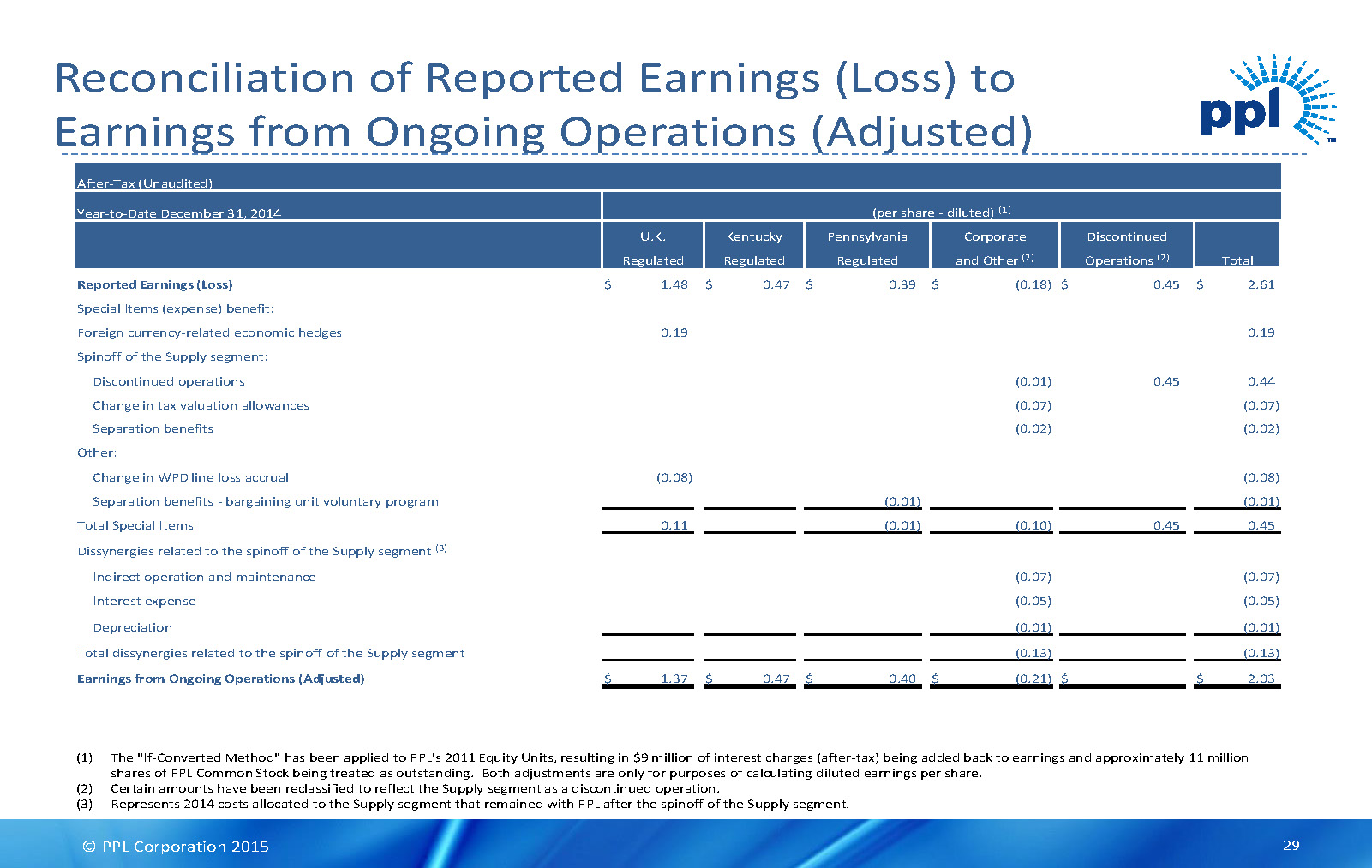

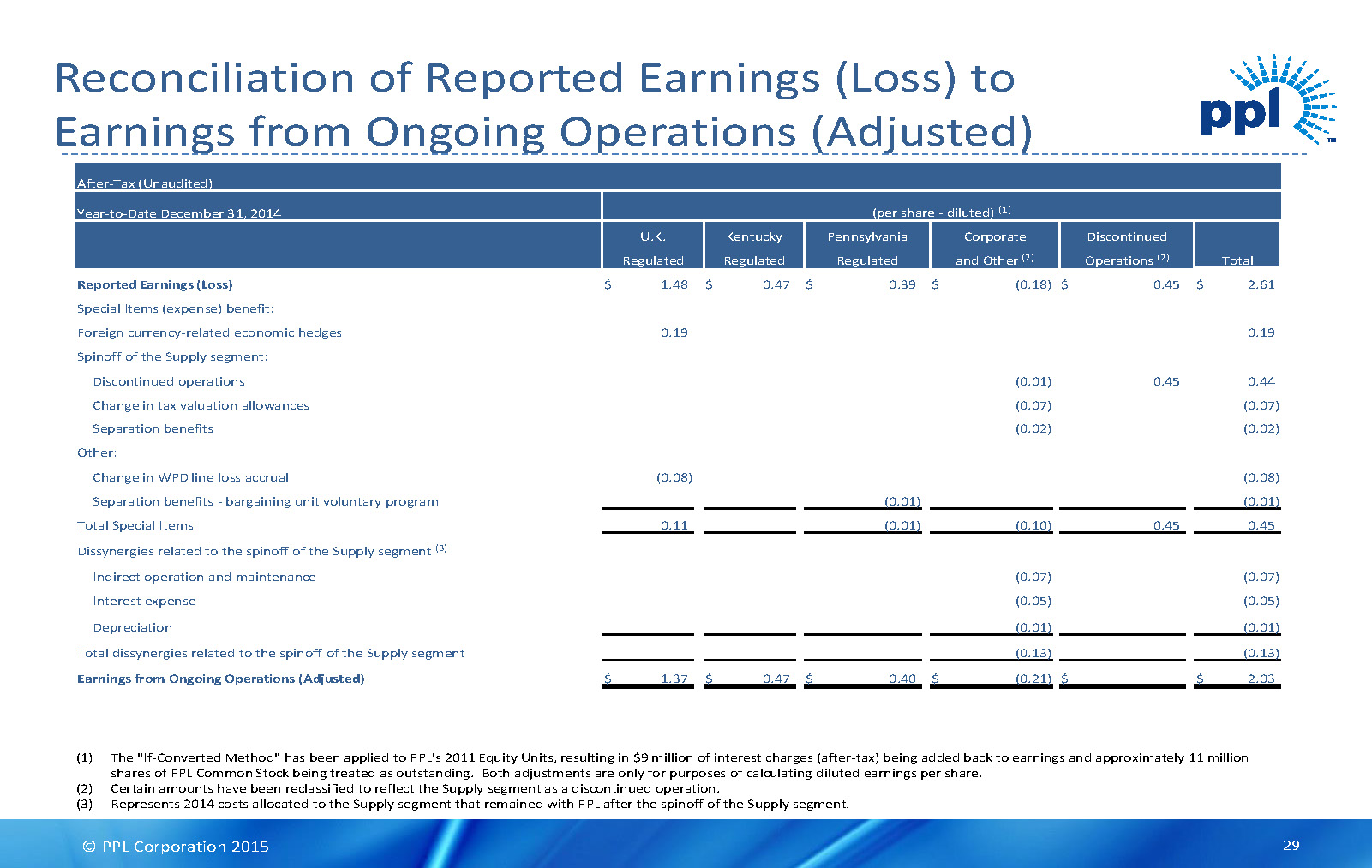

© PPL Corporation 2015 29 Reconciliation of Reported Earnings (Loss) to Earnings from Ongoing Operations (Adjusted) (1) The "If-Converted Method" has been applied to PPL's 2011 Equity Units, resulting in $9 million of interest charges (after-tax) being added back to earnings and approximately 11 million shares of PPL Common Stock being treated as outstanding. Both adjustments are only for purposes of calculating diluted earnings per share. (2) Certain amounts have been reclassified to reflect the Supply segment as a discontinued operation. (3) Represents 2014 costs allocated to the Supply segment that remained with PPL after the spinoff of the Supply segment. After-Tax (Unaudited) Year-to-Date December 31, 2014 (per share -diluted) (1) U.K. Kentucky Pennsylvania Corporate Discontinued Regulated Regulated Regulated and Other (2) Operations (2) Total Reported Earnings (Loss) $ 1.48 $ 0.47 $ 0.39 $ (0.18) $ 0.45 $ 2.61 Special Items (expense) benefit: Foreign currency-related economic hedges 0.19 0.19 Spinoff of the Supply segment: Discontinued operations (0.01) 0.45 0.44 Change in tax valuation allowances (0.07) (0.07) Separation benefits (0.02) (0.02) Other: Change in WPD line loss accrual (0.08) (0.08) Separation benefits -bargaining unit voluntary program (0.01) (0.01) Total Special Items 0.11 (0.01) (0.10) 0.45 0.45 Dissynergies related to the spinoff of the Supply segment (3) Indirect operation and maintenance (0.07) (0.07) Interest expense (0.05) (0.05) Depreciation (0.01) (0.01) Total dissynergies related to the spinoff of the Supply segment (0.13) (0.13) Earnings from Ongoing Operations (Adjusted) $ 1.37 $ 0.47 $ 0.40 $ (0.21) $ $ 2.03

© PPL Corporation 2015 30 Reconciliation of PPL’s Forecast of Reported Earnings (Loss) to Earnings from Ongoing Operations (After-Tax) Unaudited Forecast (per share -diluted) Midpoint U.K. Kentucky Pennsylvania Corporate Discontinued High Low Regulated Regulated Regulated and Other Operations Total 2015 2015 Reported Earnings (Loss) (1) $ 1.39 $ 0.49 $ 0.38 $ (0.13) $ (1.36) $ 0.77 $ 0.82 $ 0.72 Special Items (expense) benefit: Foreign currency-related economic hedges (0.05) (0.05) (0.05) (0.05) Spinoff of the Supply segment: Discontinued operations (1) (1.36) (1.36) (1.36) (1.36) Transition and transaction costs (0.02) (0.02) (0.02) (0.02) Employee transitional services (0.01) (0.01) (0.01) (0.01) Other: Settlement of certain income tax positions 0.03 0.03 0.03 0.03 Certain valuation allowances (0.01) (0.01) (0.01) (0.01) LKE acquisition-related adjustment (0.01) (0.01) (0.01) (0.01) Total Special Items (0.02) (0.02) - (0.03) (1.36) (1.43) (1.43) (1.43) Earnings from Ongoing Operations $ 1.41 $ 0.51 $ 0.38 $ (0.10) $ - $ 2.20 $ 2.25 $ 2.15 (1) Includes an $879 million charge reflecting the difference between PPL's recorded value for the Supply segment and the estimated fair value determined in accordance with applicable rules under GAAP.

© PPL Corporation 2015 31 Reconciliation of Domestic Cash Flows Note: For 2015, due to the generalized and forward-looking nature of this information, the Company has not reconciled the presented non-GAAP financial measures to the most directly comparable GAAP financial measures. (1) Primarily represents PPL Global, LLC items that eliminate in PPL’s consolidation. (2) Adjustment to exclude domestic change in cash and cash equivalents included in total domestic growth funding.

© PPL Corporation 2015 32 Statementscontainedinthispresentation,includingstatementswithrespecttofutureearnings,cashflows,financing,regulationandcorporate strategyare"forward-lookingstatements"withinthemeaningofthefederalsecuritieslaws.AlthoughPPLCorporationbelievesthatthe expectationsandassumptionsreflectedintheseforward-lookingstatementsarereasonable,thesestatementsaresubjecttoanumberofrisksand uncertainties,andactualresultsmaydiffermateriallyfromtheresultsdiscussedinthestatements.Thefollowingareamongtheimportantfactors thatcouldcauseactualresultstodiffermateriallyfromtheforward-lookingstatements:marketdemandforenergyinourserviceterritories, weatherconditionsaffectingcustomerenergyusageandoperatingcosts;theeffectofanybusinessorindustryrestructuring,includingtheability ofPPLCorporationtorealizeallorasignificantportionoftheanticipatedcostsavingsfromthecorporaterestructuringfollowingtheSupply businessspinoff;theprofitabilityandliquidityofPPLCorporationanditssubsidiaries;newaccountingrequirementsornewinterpretationsor applicationsofexistingrequirements;operatingperformanceofourfacilities;thelengthofscheduledandunscheduledoutagesatourgenerating plants;environmentalconditionsandrequirementsandtherelatedcostsofcompliance;systemconditionsandoperatingcosts;developmentof newprojects,marketsandtechnologies;performanceofnewventures;assetorbusinessacquisitionsanddispositions;anyimpactofhurricanesor othersevereweatheronourbusiness;receiptofnecessarygovernmentpermits,approvals,ratereliefandregulatorycostrecovery;capitalmarket conditionsanddecisionsregardingcapitalstructure;theimpactofstate,federalorforeigninvestigationsapplicabletoPPLCorporationandits subsidiaries;theoutcomeoflitigationagainstPPLCorporationanditssubsidiaries;stockpriceperformance;themarketpricesofequitysecurities andtheimpactonpensionincomeandresultantcashfundingrequirementsfordefinedbenefitpensionplans;thesecuritiesandcreditratingsof PPLCorporationanditssubsidiaries;political,regulatoryoreconomicconditionsinstates,regionsorcountrieswherePPLCorporationorits subsidiariesconductbusiness,includinganypotentialeffectsofthreatenedoractualterrorismorwarorotherhostilities;Britishpoundsterlingto U.S.dollarexchangerates;newstate,federalorforeignlegislation,includingnewtaxlegislation;andthecommitmentsandliabilitiesofPPL Corporationanditssubsidiaries.Anysuchforward-lookingstatementsshouldbeconsideredinlightofsuchimportantfactorsandinconjunction withPPLCorporation'sForm10-KandotherreportsonfilewiththeSecuritiesandExchangeCommission. Forward-Looking Information Statement

© PPL Corporation 2015 33 Definitions of Non-GAAP Financial Measures “Earningsfromongoingoperations,”shouldnotbeconsideredasanalternativetoreportedearnings,ornetincome,whichisanindicatorof operatingperformancedeterminedinaccordancewithU.S.generallyacceptedaccountingprinciples(GAAP). PPLbelievesthat“earningsfrom ongoingoperations,”althoughanon-GAAPfinancialmeasure,isalsousefulandmeaningfultoinvestorsbecauseitprovidesmanagement’sview ofPPL’searningsexcludingtheSupplysegment,asthespinoffwascompletedJune1,2015.Othercompaniesmayusedifferentmeasuresto presentfinancialperformance.“Earningsfromongoingoperations”isadjustedfortheimpactofspecialitemsasdescribedbelow,which includestheSupplysegment’searningsnowreflectedindiscontinuedoperations,asPPLcompletedthespinoffoftheSupplysegmentonJune1, 2015.AlsoincludedinspecialitemsisthelossonspinoffresultingfromthefairvalueoftheSupplysegmentbeinglessthanPPL’srecordedvalue asofJune1,2015,thedateofthespinoff.“Earningsfromongoingoperations(adjusted)”for2014alsoreflects,withintheCorporateandOther category,theimpactofspinoffdissynergiesthatwouldremainwithPPLafterthecompletionofthetransaction,ifleftunmitigated. “Earnings from ongoing operations” is adjusted for the impact of special items. Special items include: • Unrealized gains or losses on foreign currency-related economic hedges. • Supply segment earnings. • Loss on the spinoff of the Supply segment. • Gains and losses on sales of assets not in the ordinary course of business. • Impairment charges. • Workforce reduction and other restructuring effects. • Acquisition and divestiture-related adjustments. • Other charges or credits that are, in management’s view, not reflective of the company’s ongoing operations.