- PPL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

PPL (PPL) DEF 14ADefinitive proxy

Filed: 7 Apr 21, 1:17pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☑ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |||

| ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☑ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

(2)

| Aggregate number of securities to which transaction applies:

| |||

| ||||

(3)

| Per unit or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

(4)

| Proposed maximum aggregate value of transaction:

| |||

| ||||

(5)

| Total fee paid:

| |||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

(2)

| Form, Schedule or Registration Statement No.:

| |||

| ||||

(3)

| Filing Party:

| |||

| ||||

(4)

| Date Filed:

| |||

| ||||

Message to Our Shareowners

Dear Shareowner,

2020 was a year of unprecedented challenge as COVID-19 created a public health and economic crisis, families and businesses struggled, and racism and injustice spurred social unrest. It was a year that reminded us of how interconnected we all are in this world. With that in mind, PPL was determined to deliver for those we serve. As our enclosed materials highlight, we:

| • | Provided electricity and gas safely and reliably to over 10 million customers. |

| • | Invested more than $3 billion in infrastructure improvements. |

| • | Ranked among the best for customer satisfaction in the regions we serve. |

| • | Achieved our earnings guidance despite the economic impact of COVID-19. |

| • | Increased our dividend for the 18th time in 19 years. |

| • | Added ownership of more than 90 megawatts of solar generation capacity. |

| • | Donated $12 million in support of our communities, including over $2 million in direct support for COVID-19 relief. |

As our Board and executive leadership team collaborated to ensure we met our commitments to a broad range of stakeholders in 2020, we also acted to best position PPL for long-term growth and success.

Focused on unlocking value for shareowners, we launched a process to sell our U.K. utility business, Western Power Distribution (WPD), and reposition PPL as a high-growth, U.S.-focused energy company. This resulted in recent agreements to sell WPD to National Grid for £7.8 billion, or $10.2 billion,* and acquire National Grid’s Rhode Island electric and gas utility for $3.8 billion —transactions that will strengthen our credit metrics, enhance long-term earnings growth and predictability, and provide us greater financial flexibility to invest in sustainable energy solutions.

Recognizing that diversity, equity and inclusion (DEI) are essential to our long-term success, we adopted an enterprise-wide DEI strategy and commitments, as well as the “Rooney Rule” to ensure diverse candidates are considered for open board seats. And to complement the strengths of our diverse and experienced Board and support refreshment, we added a new director with more than four decades of experience in the utility industry.

Lastly, understanding the opportunity we have to shape our shared energy future, we continued to advance a multi-pronged clean energy strategy to reduce our carbon emissions, support increased electrification, enable large-scale connection of distributed energy resources, and advance research and development into clean energy solutions.

Additional performance highlights can be found throughout this proxy statement and our annual report to shareowners.

In closing, we are incredibly proud of how PPL has risen to the challenge of COVID-19 and delivered for our customers and the communities we serve. In addition, we are excited by the tremendous opportunities ahead for PPL and our ability to deliver long-term value for our shareowners. As always, we welcome your feedback on the direction we’re headed, we encourage you to vote your shares, and we invite you to join us during the live webcast of our annual meeting at 9 a.m. on Tuesday, May 18. Additional details can be found in the pages that follow.

Thank you for your continued support.

Sincerely,

|

Craig A. Rogerson |  |

Vincent Sorgi |

| * | Net of transaction-related taxes and fees, and based on an average foreign currency rate of $1.35/£ as of March 12, 2021, inclusive of hedges. |

PPL CORPORATION

Two North Ninth Street

Allentown, Pennsylvania 18101

Notice of Annual Meeting of Shareowners

| Date | May 18, 2021 | |

| Time | Online check-in begins: 8:30 a.m. Eastern Time Meeting begins: 9:00 a.m. Eastern Time | |

| Place | Meeting live via the internet. Please visit: www.virtualshareholdermeeting.com/PPL2021 | |

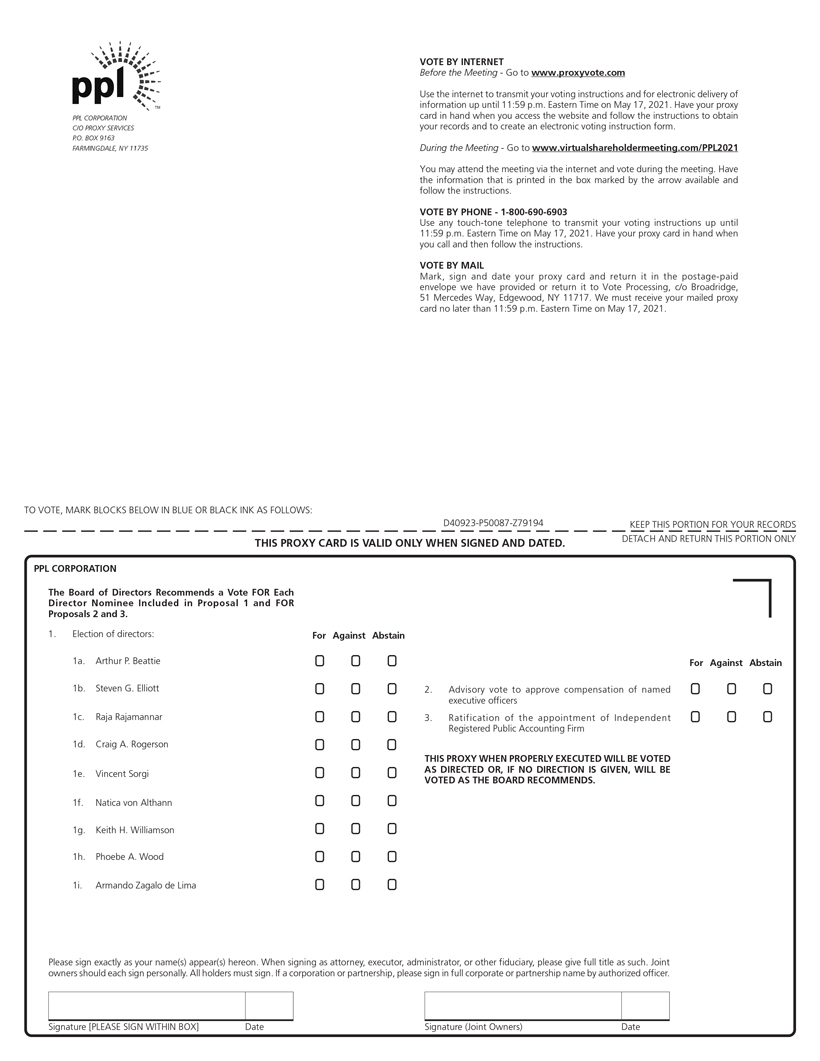

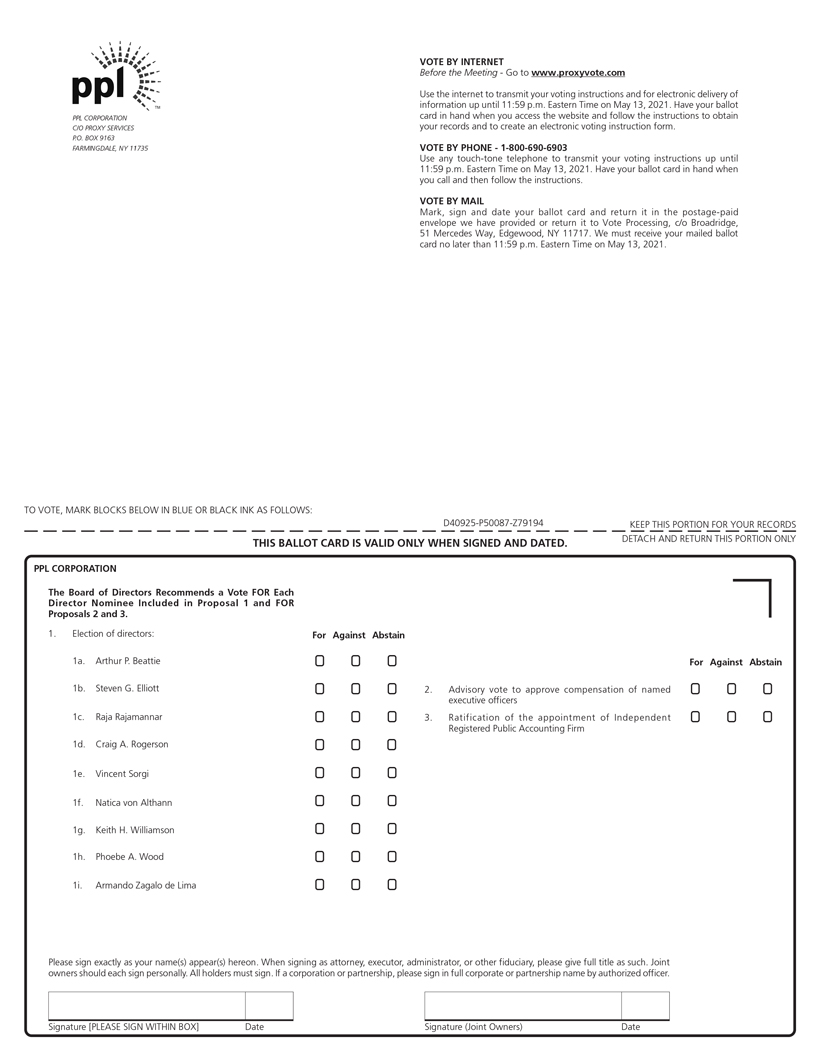

| Items of Business | • To elect nine directors, as listed in this Proxy Statement, for a term of one year.

• To conduct an advisory vote to approve the compensation of our named executive officers.

• To ratify the appointment of Deloitte & Touche LLP as the company’s independent registered public accounting firm for the year ending December 31, 2021.

• To consider such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. | |

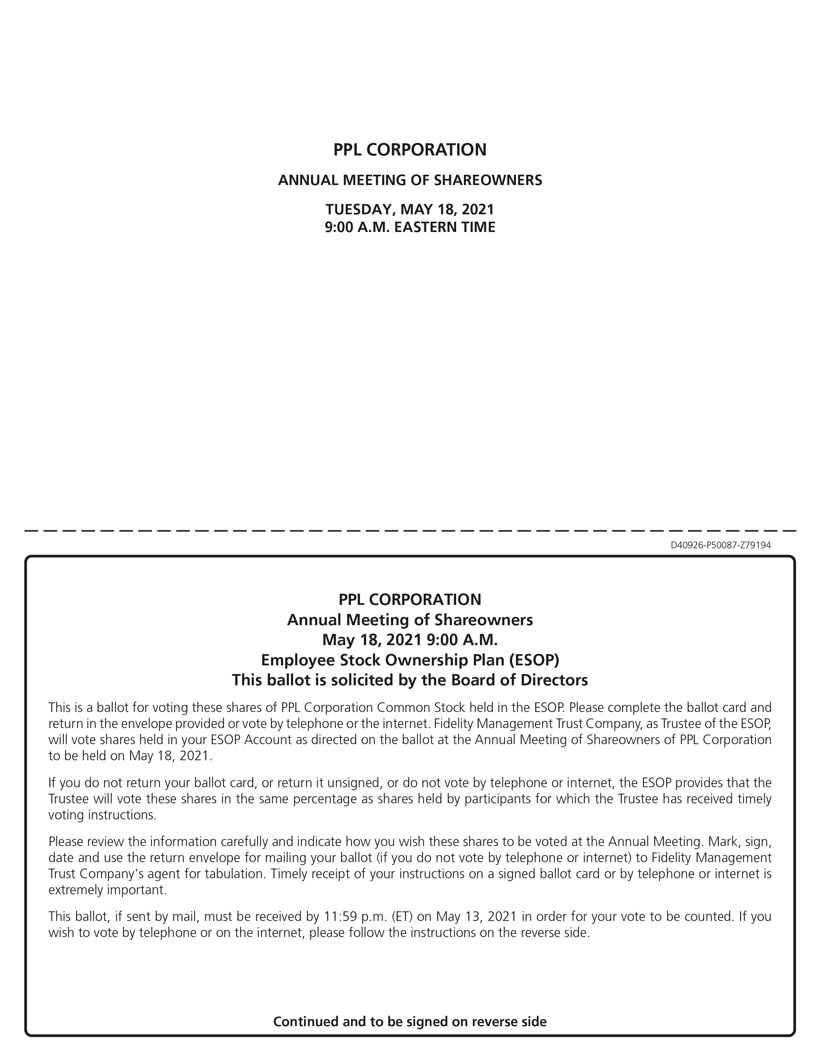

| Record Date | You can vote if you were a shareowner of record on February 26, 2021. | |

| Proxy Voting | Your vote is important. Please vote your shares by voting on the internet or by telephone or by completing and returning your proxy card. For more details, see the information beginning on page 78. | |

Due to continued COVID-19 concerns and for the safety of our employees and shareowners, this year’s Annual Meeting will be held in a virtual meeting format only, which will be conducted live through an audio webcast on the internet. You will not be able to attend the Annual Meeting in-person. The virtual meeting affords shareowners the same rights as if the meeting were held in person, including the ability to vote your shares electronically during the meeting and ask questions in accordance with our rules of conduct for the meeting. You will be able to attend the Annual Meeting online and submit your questions before and during the meeting by visiting www.virtualshareholdermeeting.com/PPL2021 and entering the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card or the voting instructions that accompanied your proxy materials.

On Behalf of the Board of Directors, |

|

Joanne H. Raphael Executive Vice President, General Counsel and Corporate Secretary |

April 7, 2021

Important Notice Regarding the Availability of Proxy Materials for the Shareowner Meeting to Be Held on May 18, 2021:

This Proxy Statement and the Annual Report to Shareowners are available at www.pplweb.com/PPLCorpProxy |

QUICK INFORMATION

The following charts provide quick information about PPL Corporation’s 2021 Annual Meeting and our corporate governance and executive compensation practices. These charts do not contain all of the information provided elsewhere in the proxy statement; therefore, you should read the entire proxy statement carefully before voting.

We first released this proxy statement and the accompanying proxy materials to shareowners on or about April 7, 2021.

Annual Meeting Information

DATE & TIME Tuesday, May 18, 2021 9:00 a.m. Eastern Time |

LOCATION Meeting live via the internet. Please visit: www.virtualshareholdermeeting.com/PPL2021 |

RECORD DATE February 26, 2021 |

Proposals That Require Your Vote

| Proposal | Voting Options | Board Recommendation | More Information | |||

Proposal 1 Election of Directors | FOR, AGAINST or ABSTAIN for each Director Nominee | FOR each Nominee | Page 5 | |||

Proposal 2 Advisory Vote to Approve Compensation of Named Executive Officers | FOR, AGAINST or ABSTAIN | FOR | Page 25 | |||

Proposal 3 Ratification of the Appointment of Independent Registered Public Accounting Firm | FOR, AGAINST or ABSTAIN | FOR | Page 74 |

See information beginning on page 78 on how you can vote.

Corporate Governance and Compensation Facts

Corporate Governance or Compensation Matter

| PPL’s Practice

| |

Board Composition, Leadership and Operations

| ||

Current Number of Directors | 10 | |

Director Independence | 90% | |

Standing Board Committee Membership Independence | Yes | |

Independent Chair of the Board | Yes | |

Voting Standards in Director Elections | Majority with plurality carve-out for contested elections | |

Frequency of Director Elections | Annual | |

Resignation Policy | Yes | |

Classified Board | No | |

Mandatory Retirement Age | Yes (75) | |

Mandatory Tenure | No | |

Average Nominee Age | 64 | |

| Corporate Governance or Compensation Matter | PPL’s Practice | |

Board Composition, Leadership and Operations

| ||

| Average Nominee Tenure | 7.8 years | |

| Total Diversity of Nominees | 56% (based on gender, race and ethnicity) | |

| Directors Attending Fewer than 75% of Meetings | 1 (medical leave due to the COVID-19 virus) | |

| Annual Board and Committee Self-Evaluation Process | Yes | |

| Independent Directors Meet without Management Present | Yes | |

| Number of Board Meetings Held in 2020 | 7 | |

| Total Number of Board and Committee Meetings Held in 2020 | 25 | |

| Proxy Access Bylaw | Yes | |

Sustainability and Other Governance Practices

| ||

| Board and Committee Oversight of ESG | Yes | |

| Board Oversight of Corporate Culture | Yes | |

| Board Oversight of Cybersecurity | Yes | |

| Sustainability Strategy and Commitments | Yes | |

| ESG Considered in Enterprise Risk Management | Yes | |

| Environmental Commitment | Yes | |

| Human Rights Statement | Yes | |

| Code of Conduct for Directors, Officers and Employees | Yes | |

| Supplier Code of Conduct | Yes | |

| Shareowner Engagement Practice | Yes | |

| Corporate Political Contribution Policy | Yes | |

| Political Contributions Disclosed | Yes | |

| Voluntary Disclosures Using Frameworks (GRI, CDP Climate, TCFD, SASB & EEI-AGA) | Yes | |

| Anti-hedging and Anti-pledging Policy | Yes | |

| Robust Stock Ownership Policies | Yes | |

| Family Relationships | None | |

| Material Related-Party Transactions with Directors | None | |

| Independent Auditor | Deloitte & Touche LLP | |

Compensation Practices

| ||

| CEO Pay Ratio | 64:1 | |

| Clawback Policy | Yes | |

| Employment Agreements for Executive Officers | No | |

| Repricing of Underwater Options | No | |

| Excessive Perks | No | |

| Pay-for-Performance | Yes | |

| Frequency of Say-on-Pay Advisory Vote | Annual | |

| Double-Trigger Change-in-Control Provisions | Yes | |

| Percentage of Incentive Compensation at Risk | 100% | |

| Performance-based Percentage of Long-term Incentive Compensation | 80% | |

| Dividend Equivalents Paid on Unvested Equity Awards Granted to Executive Officers | None | |

| Tax “Gross-ups” for NEO Perquisites or in Change-in-Control Severance Agreements | None | |

| Annual Risk Assessment of Compensation Policies and Practices | Yes | |

| Independent Compensation Consultant | Frederic W. Cook & Co., Inc. | |

PROXY SUMMARY

| ||||||||||||

|

| Page 1

|

| ||||||||||

PROPOSAL 1: ELECTION OF DIRECTORS

|

| |||||||||||

|

| Page 5

|

| ||||||||||

| NOMINEES FOR DIRECTOR | 6 | |||||||||||

GOVERNANCE OF THE COMPANY

|

| |||||||||||

|

| Page 11

|

| ||||||||||

| BOARD OF DIRECTORS | 11 | |||||||||||

| 11 | ||||||||||||

| 11 | ||||||||||||

| 11 | ||||||||||||

| 11 | ||||||||||||

| 11 | ||||||||||||

| 11 | ||||||||||||

| 11 | ||||||||||||

| 12 | ||||||||||||

| 12 | ||||||||||||

| BOARD COMMITTEES | 13 | |||||||||||

| 13 | ||||||||||||

| 14 | ||||||||||||

| 14 | ||||||||||||

| 14 | ||||||||||||

| 14 | ||||||||||||

| 15 | ||||||||||||

| 15 | ||||||||||||

| 15 | ||||||||||||

| 16 | ||||||||||||

| 16 | ||||||||||||

| 17 | ||||||||||||

| THE BOARD’S ROLE IN RISK OVERSIGHT | 18 | |||||||||||

| 18 | ||||||||||||

| 18 | ||||||||||||

| COMPENSATION OF DIRECTORS | 20 | |||||||||||

| 20 | ||||||||||||

| 20 | ||||||||||||

| 20 | ||||||||||||

| 21 | ||||||||||||

STOCK OWNERSHIP

| ||||||||||||

|

| Page 22

|

| ||||||||||

DIRECTORS, EXECUTIVE OFFICERS AND CERTAIN BENEFICIAL OWNERS

| 22 | |||||||||||

|

|

|

| ||||||||||

TRANSACTIONS WITH RELATED PERSONS

|

| |||||||||||

|

| Page 24

|

| ||||||||||

EXECUTIVE COMPENSATION

|

| |||||||||||

|

| Page 25

|

| ||||||||||

| PROPOSAL 2: ADVISORY VOTE TO APPROVE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS | 25 | |||||||||||

| COMPENSATION COMMITTEE REPORT | 26 | |||||||||||

| COMPENSATION DISCUSSION AND ANALYSIS (CD&A) | 26 | |||||||||||

| 26 | ||||||||||||

| NAMED EXECUTIVE OFFICERS | 27 | |||||||||||

| 2020 PERFORMANCE ACHIEVEMENTS AND PAY ALIGNMENT | 27 | |||||||||||

| 27 | ||||||||||||

| 29 | ||||||||||||

| 31 | ||||||||||||

| 31 | ||||||||||||

Changes to the Long-Term Portion of the Compensation Program for 2020 and 2021 | 31 | |||||||||||

| OVERVIEW OF PPL’S EXECUTIVE COMPENSATION PROGRAM FRAMEWORK | 32 | |||||||||||

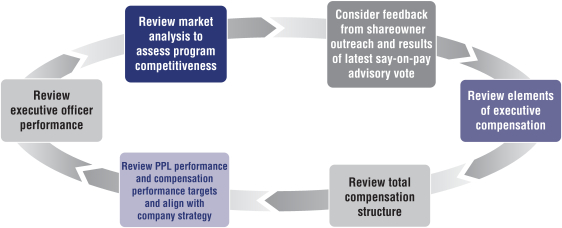

Aligning Employees and Compensation Strategies with Our Corporate Strategic Framework | 32 | |||||||||||

| 32 | ||||||||||||

| 34 | ||||||||||||

| 34 | ||||||||||||

| 35 | ||||||||||||

| 2020 NAMED EXECUTIVE OFFICER COMPENSATION | 35 | |||||||||||

| 35 | ||||||||||||

| 36 | ||||||||||||

| 42 | ||||||||||||

| 45 | ||||||||||||

PPL CORPORATION 2021 Proxy Statement i |

TABLE OF CONTENTS

| GOVERNANCE POLICIES UNDERPINNING OUR COMPENSATION FRAMEWORK | 49 | |||||||||||

| 49 | ||||||||||||

| 50 | ||||||||||||

| 50 | ||||||||||||

| 50 | ||||||||||||

| ADDITIONAL INFORMATION | 50 | |||||||||||

| 50 | ||||||||||||

| 51 | ||||||||||||

| EXECUTIVE COMPENSATION TABLES | 52 | |||||||||||

| 52 | ||||||||||||

| 54 | ||||||||||||

| 56 | ||||||||||||

| 59 | ||||||||||||

| 59 | ||||||||||||

| 63 | ||||||||||||

| POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL OF PPL CORPORATION | 65 | |||||||||||

| 65 | ||||||||||||

| 65 | ||||||||||||

| 66 | ||||||||||||

| 66 | ||||||||||||

| 67 | ||||||||||||

| 67 | ||||||||||||

| 67 | ||||||||||||

| 67 | ||||||||||||

| 68 | ||||||||||||

| CEO Pay Ratio | 73 | |||||||||||

PROPOSAL 3: RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

| |||||||||||

|

| Page 74

|

| ||||||||||

| 74 | ||||||||||||

| 75 | |||||||||||

| GENERAL INFORMATION |

| |||||||||||

|

| Page 77

|

| ||||||||||

ANNEX A

|

| |||||||||||

|

| Page A-1

|

| ||||||||||

Forward-looking Statements and Non-GAAP Financial Measures

This proxy statement contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may be identified by the use of words such as “believe,” “expect,” “plans,” “intends,” “may,” “strategy,” “target,” “goals,” “anticipate,” and other similar words, and include, without limitation, statements regarding our previously announced sale of PPL’s U.K. business, the acquisition of The Narragansett Electric Company, and the anticipated effects of those transactions. These statements are subject to certain risks, uncertainties, and other factors, which could cause actual results to differ materially from those anticipated. Such risks include those contained in PPL’s Annual Report on Form 10-K for the year ended December 31, 2020 and other documents PPL files with the Securities and Exchange Commission. These risks are not comprehensive and given these and other possible risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Any forward-looking statements made by PPL speak only as of the date on which they are made. PPL is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise.

This proxy statement, including the “Compensation Discussion and Analysis” section, contains references to “earnings from ongoing operations” of PPL. This is a measure of financial performance used by PPL, among other things, in making incentive compensation grants and awards to executive officers. It is not, however, a financial measure prescribed by generally accepted accounting principles, or GAAP. This non-GAAP financial measure adjusts “net income” (which is a GAAP financial measure) for certain special items, with further adjustments for compensation purposes. For a reconciliation of earnings from ongoing operations to net income, as well as a description and itemization of the special items and other adjustments used to derive earnings from ongoing operations for PPL and each of its business segments for compensation purposes, please see Annex A to this proxy statement.

ii PPL CORPORATION 2021 Proxy Statement |

This summary highlights information found elsewhere in this proxy statement. It does not contain all of the information you should consider in voting your shares. Please refer to the complete proxy statement and 2020 Annual Report before you vote.

We first released this proxy statement and the accompanying proxy materials to shareowners on or about April 7, 2021.

Voting Matters and Board Voting Recommendations

Election of Directors ... Page 5.

| ||

✓

| Your Board recommends a vote FOR each nominee. |

Management Proposals

| ||

• Advisory vote to approve the compensation of our named executive officers ... Page 25. | ||

• Ratification of Deloitte & Touche LLP as independent auditor for 2021 ... Page 74.

| ||

✓

| Your Board recommends a vote FOR both proposals. |

Performance Highlights for 2020

| Superior | >$3 billion | 18th | Earnings | |||

| customer satisfaction, with 3 new J.D. Power awards in the U.S. and over 9-out-of-10 ratings by U.K. customers at each of our network operators | in infrastructure investment to make the grid smarter, more reliable and more resilient and to advance a cleaner energy future | dividend increase in 19 years, with our final dividend of the year marking our 300th consecutive quarterly dividend paid since 1946 | from ongoing operations within 2020 guidance despite the significant economic impacts of COVID-19 in the U.S. and U.K. | |||

| $12 million | Best | CO2 | Trendsetter | |||

| in contributions from our companies and foundations to build strong communities, including $2 million in COVID-19 relief | place to work for LGBTQ equality and disability inclusion, earning perfect scores on Corporate Equality Disability Equality indexes | reduction of nearly 60% from 2010 levels as we pursue our goal of cutting carbon emissions 70% by 2040 and 80% by 2050 | ranking by the CPA-Zicklin Index, which evaluates political disclosure and accountability policies and practices | |||

See page 27 for additional information on PPL’s performance highlights for 2020.

PPL CORPORATION 2021 Proxy Statement 1 |

PROXY SUMMARY

Director Nominees

Name | Age | Director Since | Principal Occupation | Independent | Committee Memberships(1) | |||||

Arthur P. Beattie | 66 | 2020 | Retired Executive Vice President, Chief Financial Officer and Chief Risk Officer, The Southern Company | X | AC, FC | |||||

Steven G. Elliott | 74 | 2011 | Retired Senior Vice Chairman, The Bank of New York Mellon Corporation | X | AC, EC, FC | |||||

Raja Rajamannar | 59 | 2011 | Chief Marketing & Communications Officer and President, Healthcare, MasterCard Incorporated | X | CC, GNC | |||||

Craig A. Rogerson | 64 | 2005 | Chairman, President and Chief Executive Officer, Hexion Holdings Corporation and Hexion Inc. | Independent Chair of the | CC, EC | |||||

Vincent Sorgi | 49 | 2020 | President and Chief Executive Officer, PPL Corporation | Management Director | EC | |||||

Natica von Althann | 70 | 2009 | Former financial and risk executive at Bank of America and Citigroup | X | CC, EC, FC | |||||

Keith H. Williamson | 68 | 2005 | President, Centene Charitable Foundation, and former Executive Vice President, Secretary and General Counsel, Centene Corporation | X | AC, GNC | |||||

Phoebe A. Wood | 67 | 2018 | Principal of CompaniesWood and former Chief Financial Officer of Brown-Forman Corporation | X | AC, EC, GNC | |||||

Armando Zagalo de Lima | 62 | 2014 | Retired Executive Vice President, Xerox Corporation | X | EC, FC, GNC | |||||

| (1) | Board Committees: AC – Audit CC – Compensation EC – Executive FC – Finance GNC – Governance and Nominating |

|  |  |

2 PPL CORPORATION 2021 Proxy Statement |

PROXY SUMMARY

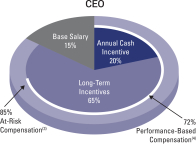

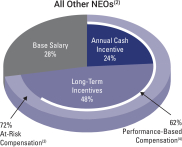

Executive Compensation Program

Overview

Our executive compensation program reflects the company’s ongoing commitment to pay for performance. The compensation of our named executive officers, or NEOs, is aligned with our Corporate Strategic Framework, which links executive compensation with the interests of our shareowners. In 2020, 85% of both the CEO’s and former CEO’s target compensation opportunity was “at-risk” and 72% was performance-based. |

CEO’s 2020 Target Total Direct Compensation Mix

|

Compensation Element

| Features for 2020

| |

| Base Salary | • Reviewed annually

• Compensation Committee applies judgment in setting salary to reflect performance, experience and responsibility and also considers market data | |

| Annual Cash Incentive | • Paid in cash

• Combination of corporate and business segment financial and operational performance

• Capped at two times target payout for top performance | |

Long-term Equity Incentives (LTI)

| ||

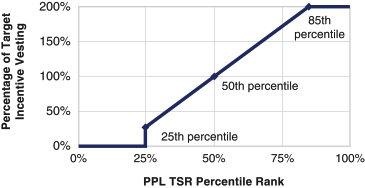

Performance Units Based on TSR and ROE 80%of LTI | • Payable in shares of PPL common stock

• Payout range from 0% to 200% of target, subject to certification of performance at the end of the three-year performance period

• Dividends accrue quarterly in the form of additional performance units, and vest according to the applicable level of achievement of the performance goal, if any

TSR-based Performance Units (50% of Performance Units)

• Based on three-year total shareowner return (TSR) performance relative to the Philadelphia Stock Exchange Utility Index (UTY)

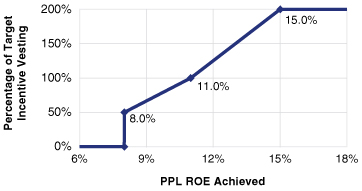

ROE-based Performance Units (50% of Performance Units)

• Based on the average of PPL’s annual corporate return on equity (ROE) for each year of a three-year performance period | |

Restricted Stock Units 20% of LTI | • Payable in shares of PPL common stock

• Restricted for three years following grant

• Dividends accrue quarterly in the form of additional restricted stock units, but are not paid unless and until underlying award vests | |

Other Elements | • Limited perquisites

• Retirement plans

• Deferred compensation plans | |

PPL CORPORATION 2021 Proxy Statement 3 |

PROXY SUMMARY

Pay for Performance

For 2020, we based performance-related compensation for the NEOs primarily on (1) our earnings per share from ongoing operations as adjusted for compensation purposes, or Corporate EPS, (2) net income from ongoing operations of each business segment as adjusted for compensation purposes, (3) corporate and business segment operational goals, (4) relative TSR, and (5) corporate ROE. All of our goals align with our commitment to shareowners to create value and deliver long-term earnings growth.

Our 2020 performance resulted in:

| • | Annual cash incentive award payouts ranging from 85.41% to 115.24% of target. |

| • | 2018-2020 performance awards were paid out at 100% of target in the aggregate. |

| • | TSR-based performance units, which comprised 40% of the total LTI grants made to our NEOs in 2018, were forfeited due to below threshold level performance for the 2018-2020 performance period. |

| • | ROE-based performance units, which comprised 40% of the total LTI grants made to our NEOs in 2018, paid out at 200% of target for the 2018-2020 performance period. |

Recent Corporate Governance Highlights

| • | Effective June 1, 2020, Mr. Spence retired from the company as CEO and continued to serve as non-executive Chairman of the Board until his retirement from the Board effective March 1, 2021. Mr. Sorgi was promoted to President and CEO effective June 1, 2020. |

| • | Effective October 1, 2020, the Board elected Mr. Beattie to the Board as an independent director. Mr. Beattie retired in 2018 as The Southern Company’s Executive Vice President, Chief Financial Officer and Chief Risk Officer and has more than four decades of experience in the utility industry. |

| • | To reflect its commitment to diversity, the Board amended the company’s Guidelines of Corporate Governance in January 2021 to require the pool of candidates considered by the Governance and Nominating Committee to include qualified persons who reflect diverse backgrounds, including diversity of gender and race or ethnicity and if any third-party search firm is used, it will be specifically instructed to include such candidates. |

| • | Effective March 1, 2021, the Board appointed Mr. Rogerson to be its independent Chair. |

4 PPL CORPORATION 2021 Proxy Statement |

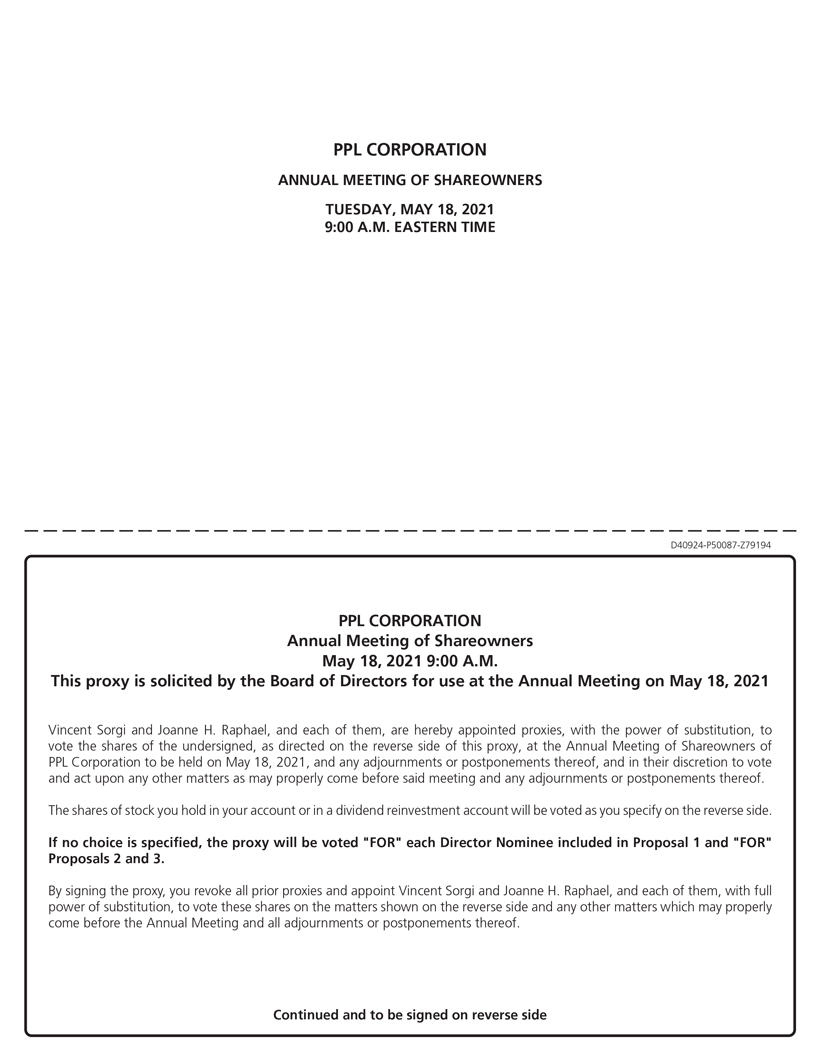

| What are you voting on? | The Board of Directors is asking you to elect the nine director nominees listed below to hold office until the next Annual Meeting of Shareowners. Each nominee elected as a director will continue in office until his or her successor has been elected and qualified, or until his or her earlier death, resignation or retirement. |

The Board of Directors has no reason to believe that any of the nominees will become unavailable for election. If, however, any nominee should become unavailable prior to the Annual Meeting, the accompanying proxy will be voted for the election of such other person as the Board of Directors may recommend in place of that nominee. The proxies appointed by the Board of Directors intend to vote the proxy for the election of each of the nominees unless you indicate otherwise on the proxy or ballot card.

In compliance with the company’s Guidelines for Corporate Governance, John W. Conway was not renominated and will continue to serve on the Board until immediately prior to the 2021 Annual Meeting of Shareowners, which follows his 75th birthday. Mr. Conway served as independent Lead Director until March 1, 2021 and is a member of the Compensation and Finance Committees. We thank Mr. Conway for his effective and thoughtful service to our company. At the time of the meeting, the Board size will be reduced from the current ten to nine directors consistent with the number of nominees.

The table below summarizes, in no particular order, the primary experiences, qualifications and skills that our nominees for director bring to the Board.

|

|

|

|

|

|

|

|

| ||||||||||

Global Business Perspective | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

| Risk Management | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| Regulated Industry | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| Customer Relationships and Marketing | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||

| Operations Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| Finance and Accounting | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

| Technology/Cybersecurity | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

Environmental/Sustainability | ✓ | ✓ | ✓ | |||||||||||||||

Senior Executive Leadership | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

PPL CORPORATION 2021 Proxy Statement 5 |

PROPOSAL 1: ELECTION OF DIRECTORS

| ARTHUR P. BEATTIE

Age: 66

Director since: 2020

Independent Director | Board Committees:

• Audit • Finance | ||||

Professional Experience:

| • | Retired Executive Vice President, Chief Financial Officer and Chief Risk Officer (2010–2018), The Southern Company, an American gas and electric utility holding company based in the southern United States (Southern) |

| • | Executive Vice President and Chief Financial Officer (2005-2010), Alabama Power Company, a utility subsidiary of Southern |

| • | Prior to 2005, served in various executive, officer and management positions for nearly three decades at Alabama Power Company, including as a Vice President, Comptroller and Treasurer |

| • | Serves as an independent director of Southwest Water Company |

Experience and Qualifications: With over 42 years of experience in the utility industry, and having served as chief financial officer and chief risk officer of a publicly traded utility holding company, Mr. Beattie brings to our Board a wealth of knowledge regarding the regulated utility industry as to debt and equity capital markets, financial planning and reporting, and enterprise risk management. He has industry experience in mergers, acquisitions and divestitures, and has served in various leadership positions on diverse Southern operating subsidiaries and charitable foundations. Mr. Beattie also has public board experience, having served on the board of Emageon, Inc. as an independent director and Chair of its Audit Committee before the company was acquired in 2009.

| STEVEN G. ELLIOTT

Age: 74

Director since: 2011

Independent Director | Board Committees:

• Audit (Chair) • Executive • Finance | Other Public Directorships:

• Huntington Bancshares Incorporated

Former Public Directorships within the Last Five Years:

• AllianceBernstein Corporation |

Professional Experience:

| • | Retired Senior Vice Chairman (1998–2010), Vice Chairman (1992–1998), Chief Financial Officer (1990–1992) and Executive Vice President and head of the finance department (1987–1990), The Bank of New York Mellon Corporation, an investment management and investment servicing company |

| • | Prior to joining Mellon, held senior officer positions at First Commerce Corporation, Crocker National Bank, Continental Illinois National Bank and First Interstate Bank of California |

Experience and Qualifications: With his long and distinguished career in the financial services industry, as well as his accounting background, Mr. Elliott brings to our Board extensive knowledge of organizational and operational management from a regulated industry perspective, as well as risk management expertise. Mr. Elliott has experience leading strategic acquisitions, divestitures and restructurings, as well as in asset servicing, securities lending, foreign exchange, capital markets, global cash management and institutional banking technology.

6 PPL CORPORATION 2021 Proxy Statement |

PROPOSAL 1: ELECTION OF DIRECTORS

| RAJA RAJAMANNAR

Age: 59

Director since: 2011

Independent Director | Board Committees:

• Compensation • Governance and Nominating | ||||

Professional Experience:

| • | Chief Marketing & Communications Officer and President, Healthcare (2016–present), and Chief Marketing Officer (2013–2016), MasterCard Incorporated, a technology company in the global payments industry |

| • | Executive Vice President, Senior Business, and Chief Transformation Officer of WellPoint, Inc. (2012–2013) |

| • | Senior Vice President and Chief Innovation and Marketing Officer for Humana Inc. (2009–2012) |

| • | Various senior management marketing and sales positions with Citigroup (1994–2009) |

| • | Various sales and product management roles with Unilever (1988–1994) |

Experience and Qualifications: With years of demonstrated leadership and business experience in a variety of regulated industry and international positions, Mr. Rajamannar brings to our Board valuable insight into global organizational and operational management, as well as marketing, data and digital technologies expertise. He also received a post graduate certificate in environmental studies.

| CRAIG A. ROGERSON

Age: 64

Director since: 2005

Independent Director

Chair of the Board | Board Committees:

• Compensation • Executive (Chair) | Former Public Directorships within the Last Five Years:

• Ashland Global Holdings Inc. • Chemtura Corporation |

Professional Experience:

| • | Chairman, President and Chief Executive Officer (July 1, 2019–present), Hexion Holdings Corporation, and continues to serve as Chairman, President and Chief Executive Officer (2017–present), Hexion Inc., a global producer of thermoset resins as well as other chemical platforms serving a wide range of market applications. In April 2019, Hexion Inc. filed for reorganization under Chapter 11 of the U.S. Bankruptcy Code and successfully emerged in July 2019. |

| • | Chairman, President and Chief Executive Officer (2008–2017), Chemtura Corporation, a global manufacturer and marketer of specialty chemicals |

| • | President, Chief Executive Officer and director, Hercules Incorporated (2003–2008) |

| • | Serves as a Director for: American Chemistry Council; Society of Chemical Industry; Pancreatic Cancer Action Network; and Advisory Board of the Chemical Engineering & Materials Science College of Michigan State University |

Experience and Qualifications: With years of demonstrated managerial ability as a CEO of large global chemical manufacturing companies, Mr. Rogerson brings to our Board significant organizational, operational and risk management expertise, as well as extensive environmental oversight and board leadership experience.

PPL CORPORATION 2021 Proxy Statement 7 |

PROPOSAL 1: ELECTION OF DIRECTORS

| VINCENT SORGI

Age: 49

Director since: 2020

Management Director | Board Committees:

• Executive | ||||

Professional Experience:

| • | President and Chief Executive Officer (June 2020-present), PPL Corporation |

| • | President and Chief Operating Officer (July 2019-May 2020), Executive Vice President (January 2019-June 2019) and Chief Financial Officer (2014-2019), Senior Vice President (2014-2019) and Vice President and Controller (2010-2014), PPL Corporation |

| • | Controller for PPL’s former energy supply and marketing segment (2007-2010) and financial director of the former PPL Generation subsidiary (2006-2007) |

| • | Prior to joining PPL, worked for Public Service Enterprise Group for nine years and prior to that, Deloitte & Touche LLP for four years |

| • | Member, American Institute of Certified Public Accountants |

| • | Serves as a Director for the Electric Power Research Institute, the Edison Electric Institute and St. Luke’s Health Network |

Experience and Qualifications: With more than 25 years of experience in the utility industry, Mr. Sorgi brings to our Board extensive finance and accounting expertise, providing valuable insight into the areas of financial reporting, accounting and controls. He also provides a wealth of knowledge on risk management, financial planning, and strategic development from a regulated utility industry perspective.

| NATICA VON ALTHANN

Age: 70

Director since: 2009

Independent Director | Board Committees:

• Compensation (Chair) • Executive • Finance | Other Public Directorships:

• FuelCell Energy, Inc. |

Professional Experience:

| • | Independent director for several public and private companies |

| • | Founding Partner (2009–2013), C&A Advisors, a consulting firm in the areas of financial services and risk management |

| • | Retired Senior Credit Risk Management Executive, Bank of America after U.S. Trust was acquired by Bank of America (2007–2008) |

| • | Retired Chief Credit Officer, U.S. Trust (2003–2008) |

| • | 26 years at Citigroup in various senior management roles including managing director and co-head of Citigroup’s U.S. Telecommunications – Technology group, managing director and global industry head of the Retail and Apparel group and division executive and market region head for Latin America in the Citigroup private banking group |

| • | Director, TD Bank US Holding Company and its two bank subsidiaries, TD Bank, N.A. and TD Bank USA, N.A. |

Experience and Qualifications: With her extensive background in the banking industry, including operating responsibilities and senior management experience for international businesses, Ms. von Althann brings to our Board a wealth of knowledge regarding organizational and operational management from a regulated industry perspective, as well as financial and risk management expertise.

8 PPL CORPORATION 2021 Proxy Statement |

PROPOSAL 1: ELECTION OF DIRECTORS

| KEITH H. WILLIAMSON

Age: 68

Director since: 2005

Independent Director | Board Committees:

• Audit • Governance and Nominating |

Professional Experience:

| • | President, Centene Charitable Foundation (2020–present) |

| • | Executive Vice President, Secretary and General Counsel (2012–2020), Centene Corporation, a provider of managed healthcare services, primarily through Medicaid, commercial and Medicare products |

| • | Senior Vice President, Secretary and General Counsel, Centene Corporation (2006–2012) |

| • | President, Capital Services Division, Pitney Bowes Inc. (1999–2006) and various positions in tax, finance and legal groups, including oversight of the treasury function and rating agency activity (1988–1998) |

Experience and Qualifications: With decades of demonstrated leadership and international business experience in a variety of industry positions with publicly traded companies, Mr. Williamson brings to our Board a combination of general business and finance experience, including from a regulated industry, as well as customer relationship expertise.

| PHOEBE A. WOOD

Age: 67

Director since: 2018

Independent Director | Board Committees:

• Audit • Executive • Governance and Nominating (Chair) | Other Public Directorships:

• Invesco Ltd. • Leggett & Platt, Incorporated • Pioneer Natural Resources Company

Former Public Directorships within the Last Five Years:

• Coca-Cola Enterprises, Inc. (2010-2016) |

Professional Experience:

| • | Principal (2008–present), CompaniesWood, a consulting firm specializing in early-stage investments |

| • | Vice Chairman and Chief Financial Officer (2006-2008) and Executive Vice President and Chief Financial Officer (2001–2006), Brown-Forman Corporation |

| • | Vice President and Chief Financial Officer and director, Propel Corporation (2000–2001) |

| • | Almost 24-year tenure at Atlantic Richfield Corporation in various financial management capacities |

Experience and Qualifications: With her extensive experience as a financial executive, including in the energy industry, and board service with publicly traded companies in other industries, Ms. Wood brings to our Board a wealth of experience in finance, accounting, strategic planning, capital markets and risk management. She has been actively engaged in environmental, health and safety matters through work experience and through board oversight. She has also overseen management of information technology. Through her longstanding experience on various public company boards, Ms. Wood has been actively involved with sustainability reporting, ESG ratings and has served on several panels regarding sustainability topics.

PPL CORPORATION 2021 Proxy Statement 9 |

PROPOSAL 1: ELECTION OF DIRECTORS

| ARMANDO ZAGALO DE LIMA

Age: 62

Director since: 2014

Independent Director | Board Committees:

• Executive • Finance (Chair) • Governance and Nominating |

Professional Experience:

| • | Retired Executive Vice President (2010–2015), Xerox Corporation, a multinational enterprise for business process and document management |

| • | President, Xerox Technology (2012–2014) |

| • | President of Global Customer Operations (2010–2012), Xerox Corporation |

| • | President (2004–2010) and Chief Operating Officer (2001–2004), Xerox Europe |

| • | Various sales, marketing and management positions for Xerox across Europe (1983–2001) |

Experience and Qualifications: Having served as a senior executive of a public technology company, Mr. Zagalo de Lima provides critical insight to our Board in emerging technologies and services, customer service and global business operations and associated risks in these areas.

* * *

Vote Required for Approval. The affirmative vote of a majority of the votes cast, in person or by proxy, by all shareowners voting as a single class, is required to elect each director. For more information about voting, see “General Information – What vote is needed for these proposals to be adopted?” beginning at page 81.

| Your Board of Directors recommends that you vote FOR each nominee included in Proposal 1 |

10 PPL CORPORATION 2021 Proxy Statement |

Attendance. The Board of Directors met seven times during 2020. Each director, other than Mr. Rogerson, attended at least 75% of the meetings held in 2020 by the Board and the committees on which he or she served during the period for which he or she was a director. Mr. Rogerson’s attendance fell below 75% while he was on medical leave due to the COVID-19 virus, which prevented him from attending Board and committee meetings in person or virtually for more than five months. Directors are expected to attend all meetings of shareowners, the Board and the committees on which they serve. All of our directors attended the 2020 Annual Meeting of Shareowners, except for Mr. Rogerson and Mr. Beattie, who joined as a director on October 1, 2020.

Independence of Directors. The Board has established guidelines to assist it in determining director independence, which conform to the independence requirements of the New York Stock Exchange, or NYSE, listing standards. In addition to applying these guidelines, which are available in the Corporate Governance section of our website (www.pplweb.com/governance), the Board considers all relevant facts and circumstances in making an independence determination, including transactions and relationships between each director or members of his or her immediate family and the company and its subsidiaries. The Board determined that nine directors, constituting all of PPL’s non-employee directors, are independent from the company and management pursuant to its independence guidelines: Messrs. Beattie, Conway, Elliott, Rajamannar, Rogerson, Williamson and Zagalo de Lima, and Mses. von Althann and Wood.

Executive Sessions; Independent Chair of the Board. The independent directors meet in regular executive sessions during each regularly scheduled Board meeting without management present. During 2020 and through February 28, 2021, Mr. Conway served as the presiding director for these executive sessions and also served as the independent Lead Director of the Board. Effective March 1, 2021, Mr. Rogerson was appointed by the Board as its independent Chair of the Board and he now leads the executive sessions.

Board Leadership Structure. Consistent with its commitment to regularly evaluate its leadership structure, effective March 1, 2021, the Board appointed Mr. Rogerson as independent Chair of the Board upon the retirement of Mr. Spence as non-executive Chairman of the Board. Mr. Spence had served as the non-executive Chairman of the Board since June 1, 2020, coincident with his retirement as CEO of the company. From 2011 and throughout the duration of Mr. Spence’s tenure as non-executive Chairman through February 28, 2021, Mr. Conway served as independent Lead Director. Since the appointment of Mr. Rogerson as independent Chair of the Board, there is no longer a lead director.

At this time, the Board believes it is most effective for PPL to have an independent Chair. Mr. Rogerson has substantial knowledge of our company through his longstanding service on our Board and significant organizational, operational and risk management expertise, as well as extensive environmental oversight and board leadership experience. The Board will continue to evaluate the effectiveness of the Board’s leadership structure, including by reviewing the need or desire for an independent Chair, on at least an annual basis, and will make any future decisions based upon the best interests of the company and its shareowners at that time. The Board believes the company and its shareowners are best served by maintaining the flexibility for the Board to determine who should serve in the roles of Chair and CEO, and whether those roles should be combined or separated.

Board and Committee Evaluations. Each year, the Board and each committee, other than the Executive Committee, evaluate Board and committee performance. We use a director questionnaire to facilitate the annual evaluation of topics such as Board dynamics, Board and committee effectiveness and engagement, assessment of director performance, access to management, agenda requests and the like, encouraging a broad range of commentary from each director. The Board Chair reviews the results and shares them with the entire Board in executive session at the next Board meeting. During 2020, the Chair of the GNC and the CEO also met individually with each Board member to seek additional input as to Board leadership roles and processes. As a result of these discussions, the Board appointed Mr. Rogerson as independent Chair and made certain changes to the composition of the committees, including appointing Ms. von Althann as Chair of the Compensation Committee and Mr. Zagalo de Lima as Chair of the Finance Committee. While every Board member is encouraged to provide comments as to the structure and operation of Board committees, each committee conducts its own annual assessment as well.

Guidelines for Corporate Governance. The full text of our Guidelines for Corporate Governance can be found in the Corporate Governance section of our website (www.pplweb.com/governance).

Communications with the Board. Shareowners or other parties interested in communicating with the Board, the independent Chair, any Board member or with the independent directors as a group may write to the person or persons at the following address:

c/o Corporate Secretary’s Office

PPL Corporation

Two North Ninth Street

Allentown, Pennsylvania 18101

PPL CORPORATION 2021 Proxy Statement 11 |

GOVERNANCE OF THE COMPANY

The Corporate Secretary’s Office assists the Board with all correspondence, including providing communications to Board members where appropriate, with the general exception of ordinary course business communications from customers and vendors, commercial solicitations, advertisements or obvious “junk” mail. Concerns relating to accounting, internal controls or financial statement fraud are to be brought immediately to the attention of the Corporate Audit group and are handled in accordance with procedures established by the Audit Committee with respect to such matters.

Code of Ethics. We maintain a code of business conduct and ethics, our Standards of Integrity, which is applicable to all Board members and employees of the company and its subsidiaries, including the principal executive officer, the principal financial officer and the principal accounting officer of the company. You can find the full text of the Standards of Integrity in the Corporate Governance section of our website (www.pplweb.com/governance).

Shareowner Engagement. We engage with our shareowners throughout the year in a variety of forums involving our directors, senior management, investor relations group, sustainability officer and legal department. We meet with our shareowners in person, by telephone or videoconference and at external venues, and attend conferences and other forums at which shareowners are present. During 2020, the Chair of the Compensation Committee regularly joined management in its governance-focused outreach with our larger investors. Our engagement covers a broad range of governance and business topics, including business strategy and execution, board composition and refreshment, executive compensation practices, risk oversight, climate change, sustainability, employee engagement and culture and workforce development. These meaningful exchanges provide us with a valuable understanding of our shareowners’ perspectives as well as an opportunity to share our views with shareowners.

12 PPL CORPORATION 2021 Proxy Statement |

GOVERNANCE OF THE COMPANY

The Board of Directors has five standing committees: Audit Committee; Compensation Committee; Executive Committee; Finance Committee; and Governance and Nominating Committee.

Each non-employee director usually serves on one or more committees. Except for the Executive Committee, all of our committees are composed entirely of independent directors under the listing standards of the NYSE and the company’s standards of independence described under the heading “Independence of Directors.” In addition, all members of the Audit Committee qualify as “audit committee financial experts.” (See the biographies of our Audit Committee members within Proposal 1.) Each committee has a charter, all of which are available in the Corporate Governance section of the company’s website (www.pplweb.com/governance).

The following table shows the directors who are currently members or chairs of each of the standing Board Committees and the number of meetings each committee held in 2020.

| Director | Audit | Compensation | Executive | Finance | Governance and Nominating | |||||||||||||||||||||||||

Arthur P. Beattie(1) (2) | I | ✓ | ✓ | |||||||||||||||||||||||||||

John W. Conway | I | ✓ | ✓ | |||||||||||||||||||||||||||

Steven G. Elliott(1) | I | Chair | ✓ | ✓ | ||||||||||||||||||||||||||

Raja Rajamannar | I | ✓ | ✓ | |||||||||||||||||||||||||||

Craig A. Rogerson(3) | I/● | ✓ | Chair | |||||||||||||||||||||||||||

Vincent Sorgi(4) | ✓ | |||||||||||||||||||||||||||||

Natica von Althann(5) | I | Chair | ✓ | ✓ | ||||||||||||||||||||||||||

Keith H. Williamson(1) | I | ✓ | ✓ | |||||||||||||||||||||||||||

Phoebe A. Wood(1) | I | ✓ | ✓ | Chair | ||||||||||||||||||||||||||

Armando Zagalo de Lima(6) | I | ✓ | Chair | ✓ | ||||||||||||||||||||||||||

Number of Meetings in 2020 |

7 |

6 |

3 |

4 |

5 | |||||||||||||||||||||||||

I Independent Director ● Chair of the Board

| (1) | Designated as an “audit committee financial expert” as defined by the rules and regulations of the Securities and Exchange Commission, or SEC. |

| (2) | Joined the Audit Committee on October 1, 2020 and the Finance Committee on March 1, 2021. |

| (3) | Became independent Chair of the Board and Chair of the Executive Committee on March 1, 2021; previously served as Chair of the Compensation Committee. |

| (4) | Joined the Executive Committee on March 12, 2021. |

| (5) | Became Chair of the Compensation Committee on March 1, 2021; previously served as Chair of the Finance Committee. |

| (6) | Joined and became Chair of the Finance Committee on March 1, 2021. |

PPL CORPORATION 2021 Proxy Statement 13 |

GOVERNANCE OF THE COMPANY

Principal Functions of Each Committee

The following table describes the principal functions of each committee.

Committee

| Principal Function | |

Committee | • Oversee:

• the integrity of the financial statements of the company and its subsidiaries;

• the effectiveness of the company’s disclosure controls and procedures and internal control over financial reporting;

• the identification, assessment and management of risk;

• the company’s compliance with legal and regulatory requirements and the company’s compliance and ethics program;

• the independent registered public accounting firm’s, or “independent auditor’s,” qualifications, independence and selection; and

• the performance of the company’s independent auditor and internal audit function. | |

• Oversee the company’s executive compensation philosophy, policies and programs and how these policies and programs align with the company’s overall business strategy;

• Oversee management’s executive officer succession planning;

• Discuss results of annual say-on-pay vote and periodically recommend the frequency of such vote;

• Review and evaluate the performance of the CEO and other executive officers of the company, including setting goals and objectives, and approving their compensation, including incentive awards;

• Review and approve the stock ownership requirements for the company’s directors and executive officers;

• Review the fees and other compensation paid to outside directors for their services on the Board and its committees; and

• Undertake independence and conflicts of interest assessments of its compensation consultant. | ||

• Exercise all of the powers of the Board of Directors during periods between Board meetings, with the exception of:

• submission to shareowners of any action requiring approval of shareowners;

• creation or filling of vacancies on the Board;

• changing the membership of and filling of vacancies on any committee of the Board;

• adoption, amendment or repeal of the Bylaws;

• amendment or repeal of any resolution of the Board that by its terms is amendable or repealable only by the Board;

• action on matters committed by the Bylaws or resolution of the Board exclusively to another committee of the Board; and

• taking any action as may not be exercised by a committee under the Pennsylvania Business Corporation Law or the Bylaws. | ||

14 PPL CORPORATION 2021 Proxy Statement |

GOVERNANCE OF THE COMPANY

Committee

| Principal Function | |

• Review and approve annually the business plan (for not less than three years), which includes the annual financing plan, as well as the five-year capital expenditure plan for the company and its subsidiaries;

• Approve company financings, guarantees or other credit or liquidity support in excess of $100 million, to the extent not contemplated by the annual financing plan approved by the Finance Committee;

• Approve reductions of the outstanding securities of the company in excess of $100 million;

• Authorize capital expenditures in excess of $100 million;

• Authorize acquisitions and dispositions in excess of $100 million; and

• Review, approve and monitor the policies and practices of the company and its subsidiaries in managing financial risk. | ||

• Oversee corporate governance for the company;

• Oversee the company’s policies and practices to further its corporate citizenship, including sustainability, environmental and corporate social responsibility initiatives;

• Review, approve and ratify, as applicable, any related-person transactions consistent with the company’s Related-Person Transaction Policy;

• Establish and administer programs for evaluating the performance of Board members and committees;

• Recommend to the Board any changes in size or composition of the Board;

• Recommend to the Board the composition of each committee of the Board; and

• Identify and recommend to the Board candidates for election to the Board. | ||

Compensation Processes and Procedures

The Compensation Committee undertakes to compensate executive officers effectively and in a manner consistent with our stated compensation and corporate strategies. The Compensation Committee has the exclusive authority to grant equity awards to executive officers and delegates specified administrative functions to certain officers, including the CEO and the Chief Human Resources Officer, or CHRO. The Compensation Committee has strategic and administrative responsibilities with respect to our executive compensation arrangements, including:

| • | reviewing and approving the design of the executive compensation program and practices; |

| • | monitoring new rules and regulations and assessing evolving best practices concerning executive compensation; |

| • | determining the elements of compensation and the financial and other metrics to be used to measure performance for the upcoming year; |

| • | setting annual goals and targets for each executive officer, including the NEOs; |

| • | evaluating the performance and leadership of the CEO, seeking input from all independent directors, and reviewing the performance of the other executive officers against their established goals and objectives; and |

| • | determining and approving the annual compensation of the executive officers based on such evaluations. |

The Compensation Committee has retained Frederic W. Cook & Co., Inc., or FW Cook, as its independent compensation consultant to assist the committee in determining whether the company’s executive compensation program is reasonable and consistent with competitive practices. FW Cook provides advice and counsel on executive and director compensation matters and provides information and advice regarding market trends, competitive compensation programs and strategies including as described below.

| • | Reports regularly on current trends in utility industry executive compensation and provides data analyses, market assessments or other information as requested to assist in the administration of the executive compensation programs. |

PPL CORPORATION 2021 Proxy Statement 15 |

GOVERNANCE OF THE COMPANY

| • | Provides a detailed analysis of competitive pay levels and practices to the Compensation Committee, which the Compensation Committee uses to understand current market practices when it assesses performance and considers salary levels and incentive awards at its January meeting following the conclusion of the performance year. |

| • | Reviews the pay program for the company’s non-employee directors relative to a group of utility companies and to a broad spectrum of general industry companies. |

| • | Provides a review of compensation for the executive officer positions at PPL, including each of the NEOs. This review includes information for both utility and general industry and results in a report on the compensation of executive officers and competitive market data. A detailed discussion of the competitive market comparison process is provided in the CD&A, beginning on page 26. |

Although the Compensation Committee considers analysis and advice from its independent consultant when making compensation decisions for the CEO and other NEOs, the committee uses its own independent judgment in making final decisions concerning compensation paid to the executive officers.

FW Cook and its affiliates did not provide any services to the company or any of the company’s affiliates other than advising the Compensation Committee on executive officer and director compensation during 2020. In addition, the Compensation Committee annually evaluates whether any work provided by FW Cook may present a conflict of interest and, for 2020, determined that there was no conflict of interest.

The Compensation Committee can also seek the input of management to inform decision-making. Each year, senior management develops a strategic business plan, which includes recommendations on the proposed goals for the annual cash incentive and long-term incentive programs. The Compensation Committee takes this into account when establishing and setting all incentive goals for executive officers.

No individual is present when matters pertaining to their own compensation are being discussed, and neither the CEO nor any of the other executive officers discusses their own compensation with the Compensation Committee or the Compensation Committee’s independent compensation consultant.

CEO and Other Management Succession

At least annually, consistent with its charter, the Compensation Committee reviews the company’s plan for management succession, both in the ordinary course of business and in response to emergency situations, recognizing the importance of continuity of leadership to ensure a smooth transition for its employees, customers and shareowners. As part of this process, the Compensation Committee reviews the top and emerging talent internally, their level of readiness and development needs. This process is conducted not only for the CEO position but also for other critical senior level positions in the company. The Compensation Committee also reviews external successor candidates for the CEO position, with assistance periodically from an independent third-party consultant.

Effective June 1, 2020, Mr. Spence retired as CEO and became the non-executive Chairman of the Board. Mr. Sorgi assumed the role of CEO as of June 1, 2020 and continues to serve as President.

On December 1, 2020, the company announced that Joanne H. Raphael, Executive Vice President, General Counsel and Corporate Secretary, and a named executive officer, will retire effective June 1, 2021. On March 22, 2021, the company announced that Wendy E. Stark will be joining the company on April 12 as Senior Vice President, General Counsel and Corporate Secretary. Effective the same date, Ms. Raphael will become Executive Vice President and Chief Legal Officer until her retirement.

Director Nomination Process and Proxy Access

The GNC establishes guidelines for new directors and evaluates director candidates. In its evaluation, the GNC will consider the qualifications, qualities and skills of director candidates as outlined in our Guidelines for Corporate Governance, including:

| • | strong personal and professional ethics, high standards of integrity and values, independence of thought and judgment and who have senior corporate leadership experience; |

| • | prior business experience at a senior executive level; |

| • | diverse experience relevant to serving on the Board, such as financial, operating, executive management, technology and regulated industry experience; |

16 PPL CORPORATION 2021 Proxy Statement |

GOVERNANCE OF THE COMPANY

| • | a broad range of demonstrated abilities and accomplishments beyond corporate leadership, including the skill and expertise sufficient to provide sound and prudent guidance with respect to all of the company’s operations and interests; and |

| • | capability to devote the required amount of time to serve effectively, including preparation time and attendance at Board, committee and shareowner meetings. |

To reflect its commitment to diversity, the Board amended the Guidelines of Corporate Governance in January 2021 to require the pool of candidates considered by the GNC to include qualified persons who reflect diverse backgrounds, including diversity of gender and race or ethnicity and if any third-party search firm is used, it will be specifically instructed to include such candidates. The GNC will assess the effectiveness of this policy as part of its annual review of the Guidelines of Corporate Governance.

Requests to be considered for election as a director may be made by the Board of Directors, the GNC or any shareowner entitled to vote in the election of directors generally. The GNC screens all candidates in the same manner regardless of the source of the recommendation.

When considering whether the Board’s directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of the company’s business and structure, the Board focused primarily on the information discussed in each of the Board members’ biographical information set forth beginning on page 6, their past contributions to the company’s success and their expected future engagement and contributions in furtherance of PPL’s strategic goals.

If the GNC or management identifies a need to add a new Board member to fulfill a special requirement or to fill a vacancy, the GNC may retain a third-party search firm to identify a candidate or candidates. The GNC also seeks prospective nominees through personal referrals and independent inquiries by directors. Once the GNC has identified a prospective nominee, it generally requests the third-party search firm to gather additional information about the prospective nominee’s background and experience. The Chair of the Board, the CEO, the Chair of the GNC and other members of the GNC, as well as additional directors, if available, then interview the prospective candidate. After completing the interview and evaluation process, which includes evaluating the prospective nominee against the standards and qualifications set out in the company’s Guidelines for Corporate Governance, the GNC makes a recommendation to the full Board as to any persons who should be nominated by the Board. The Board then votes on whether to approve the nominee after considering the recommendation and report of the GNC. As a result of this process, the GNC recommended that Mr. Beattie be nominated by the Board, and the Board elected Mr. Beattie effective October 1, 2020.

The Board of Directors adopted proxy access in 2015. Pursuant to the Bylaws, a shareowner, or a group of up to 25 shareowners, owning 3% or more of PPL’s outstanding common stock continuously for at least three years, may nominate, and include in PPL’s proxy materials, directors constituting up to the greater of (1) 20% of the Board or (2) two directors, provided that the shareowner(s) and the nominee(s) satisfy the requirements specified in the Bylaws.

Shareowners interested in recommending nominees for directors should submit their recommendations in writing to:

Corporate Secretary

PPL Corporation

Two North Ninth Street

Allentown, Pennsylvania 18101

In order to be considered, we must generally receive nominations by shareowners at least 75 days prior to the 2022 Annual Meeting. In order to be included in our proxy statement under the proxy access provisions of our Bylaws, the nominations must be received by the company no earlier than November 8, 2021 and no later than December 8, 2021.

The nominations must also contain the information required by our Bylaws, such as the name and address of the shareowner making the nomination and of the proposed nominees and certain other information concerning the shareowner and the nominee. The exact procedures for making nominations are included in our Bylaws, which can be found at the Corporate Governance section of our website (www.pplweb.com/governance).

Annually, the GNC reviews a succession plan for the chair of the board and prior to the appointment of Mr. Rogerson as an independent Chair, the lead director position. The review covers key skills and competencies of the chair and possible lead director positions, the risk of loss of the current chair, an assessment of the current board members relative to key skills and competencies and the identification of potential chair successors. As part of the regular review of attributes and skills for any potential director candidate, the GNC also considers possible qualification as a future chair or lead director in the succession pipeline.

PPL CORPORATION 2021 Proxy Statement 17 |

GOVERNANCE OF THE COMPANY

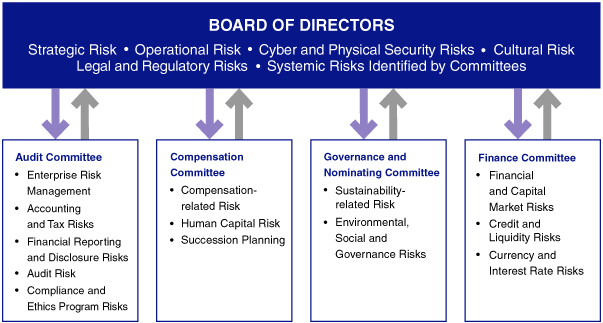

THE BOARD’S ROLE IN RISK OVERSIGHT

Overview. The Board, together with its committees, oversees the company’s risk management practices with the aid and input of our senior management and professional advisors. The Board regularly reviews the material risks associated with the company’s business plans and activities as part of its consideration of the ongoing operations and strategic direction of the company.

Throughout 2020, the Board exercised continuous oversight of the company’s strategy and response to the COVID-19 pandemic, receiving frequent updates from management. These updates and regular discussions provided the Board with opportunities to effectively exercise its oversight function and to provide leadership, guidance and support to management during unprecedented times.

While systemic risk oversight is a function of the full Board, the Board recognizes that material risks may arise from or impact multiple areas of the organization. As such, the Board retains primary oversight of certain risks, including strategic, operational, cultural, legal, regulatory, cyber-related and physical security risks, and tasks its Audit Committee, Compensation Committee, Finance Committee and GNC with principal oversight of the company’s management of material risks within each respective committee’s areas of responsibility. In turn, each committee reports to the Board regularly, including with respect to material risks within its purview, fostering awareness and communication of significant matters among all directors, and promoting a coordinated approach to risk oversight.

At meetings of the Board and its committees, directors receive updates from management regarding our risk profile and risk management activities. Outside of formal meetings, the Board, its committees and individual Board members have full access to senior executives and other key employees, including the CEO, CFO, COO, General Counsel, Global Chief Compliance Officer, Chief Information Security Officer, or CISO, CHRO, Vice President-Corporate Audit and Senior Director of Risk Management, or SDRM. In addition, the Board, and each committee, may request information from the company’s professional advisors or engage its own independent advisors.

| • | Oversight of Cybersecurity Risks. Cybersecurity and the effectiveness of the company’s cybersecurity strategy are regular topics of discussion at Board meetings. The company’s strategy for managing cyber-related risks is risk-based and, where appropriate, integrated within the company’s enterprise risk management processes. The company’s CISO, who reports directly to the CEO, leads a dedicated cybersecurity team and is responsible for the |

18 PPL CORPORATION 2021 Proxy Statement |

GOVERNANCE OF THE COMPANY

| design, implementation, and execution of cyber-risk management strategy. The CISO provides periodic reports to the Board, no less than twice a year, regarding the company’s cybersecurity risk exposures and mitigation strategies. |

| • | Oversight of Environmental, Social and Governance (ESG) Risks. The Board has delegated to the GNC responsibility for overseeing the company’s practices and positions to further ESG performance and sustainability. The committee receives updates, which include climate-related issues, at regularly scheduled meetings, and the full Board receives sustainability updates as significant issues arise. The company has also established a Corporate Sustainability Committee, which includes senior leaders throughout the company. The committee is responsible for reviewing and guiding the development of a sustainability strategy, providing oversight and establishing priorities and performance metrics. The sustainability strategy, commitments and priorities are reviewed and approved by the Corporate Leadership Council and presented to the Board. The company also maintains a robust enterprise risk management (ERM) process that provides a business portfolio view of material risks that may impact achievement of the company’s business strategy. As part of the ERM process, representatives from the company’s operating companies and service groups identify, assess, monitor and report on ongoing and emerging risks, including climate-related and broader ESG risks. The company’s Risk Management group oversees this process and reports quarterly to the Audit Committee. |

PPL CORPORATION 2021 Proxy Statement 19 |

GOVERNANCE OF THE COMPANY

2020 Director Pay Components. Directors who are company employees do not receive any separate compensation for service on the Board of Directors or committees of the Board. During 2020, compensation for non-employee directors consisted of the elements described in the table below. The independent Lead Director, the non-executive Chairman and committee chairs received additional compensation due to the increased workload and additional responsibilities associated with these critical board leadership positions. PPL reimburses each director for usual and customary travel expenses.

Annual Retainer Components |

Non- Directors |

Incremental Awards for Board Leadership | |||||||||||||||||||||||

| Independent Lead Director |

Non- executive Fee(3)

| Audit Committee Chair Fee | All Other Committee Chair Fees (Excluding Executive Committee)

| ||||||||||||||||||||||

Cash(1) | $115,000 | $30,000 | $150,000 | $25,000 | $20,000 | ||||||||||||||||||||

Deferred Stock Units(2) | $150,000 | N/A | N/A | N/A | N/A | ||||||||||||||||||||

| (1) | The annual cash retainer and other fees are payable in quarterly installments to each director unless voluntarily deferred to the director’s deferred stock account or deferred cash account under the Directors Deferred Compensation Plan, or DDCP. |

| (2) | Each deferred stock unit represents the right to receive a share of PPL common stock and is fully vested upon grant but is not paid to the director until after retirement (as discussed below with respect to payments under the DDCP). Deferred stock units do not have voting rights, but accumulate quarterly dividend equivalents, which are reinvested in additional deferred stock units and are also not paid to the director until retirement. |

| (3) | Effective June 1, 2020, the Compensation Committee established an annual non-executive Chairman of the Board fee of $150,000 when the roles of Chairman and CEO were separated. |

The Compensation Committee assesses the compensation of directors annually and, if applicable, makes recommendations to the Board. As part of this assessment, FW Cook, the Compensation Committee’s independent compensation consultant, provides a Director Pay Analysis, which reviews the pay program for PPL’s non-employee directors relative to a group of utility companies and to a broad spectrum of general industry companies. Effective January 1, 2020, the Compensation Committee recommended, and the Board authorized, an increase in the annual retainer to the current $265,000 from $250,000 for all non-employee directors, consisting of an increase of $5,000 to the annual cash portion and an increase of $10,000 to the annual mandatory deferred stock unit portion.

Directors Deferred Compensation Plan. Pursuant to the DDCP, non-employee directors may elect to defer all or any part of their fees or any retainer that is not part of the mandatory stock unit deferrals. Under this plan, directors can defer compensation other than the mandatory deferrals into a deferred cash account or the deferred stock account. The deferred cash account earns a return as if the funds had been invested in one or more of the core investment options offered to employees under the PPL Deferred Savings Plan at Fidelity Investments. These investment accounts include large, mid and small cap index and investment funds, international equity index funds, target date funds, bond funds and a stable value fund, with returns that ranged from 2.02% to 10.80% during 2020. Payment of the amounts allocated to a director’s deferred cash account and accrued earnings, together with deferred stock units and accrued dividend equivalents, is deferred until after the director’s retirement from the Board of Directors, at which time the deferred cash and stock is disbursed in one or more annual installments for a period of up to 10 years, as previously elected by the director.