Truist Financial (TFC) 8-KRegulation FD Disclosure

Filed: 29 Apr 09, 12:00am

| |

| Annual | |

| Shareholders | |

| Meeting | |

| April 28, 2009 | |

Forward-Looking Information

Thispresentation containscertain forward-lookingstatementswith respect to thefinancial condition,results ofoperationsandbusinessesof BB&T. These forward-lookingstatementsinvolve certain risks anduncertaintiesand are based on the beliefs andassumptionsof themanagementof BB&T, and theinformation availabletomanagementat the time that thispresentationwasprepared.Factors that may cause actual results to differmateriallyfrom thosecontemplatedby such forward-lookingstatements include,among others, thefollowing:(1) generaleconomicorbusiness conditions,eithernationallyorregionally,may be lessfavorablethanexpected, resultingin, among other things, adeteriorationin credit quality and/or areduced demandfor credit or otherservices;(2)changesin the interest rateenvironmentmay reduce net interestmarginsand/or thevolumesand values of loans made or held as well as the value of otherfinancialassets held; (3)competitive pressuresamongdepositoryand otherfinancial in stitutionsmayincrease significantly;(4)legislativeorregulatory changes, including changesinaccounting standards,mayadverselyaffect thebusinessesin which BB&T isengaged;(5) local, state or federal taxingauthoritiesmay take taxpositionsthat areadverseto BB&T; (6)adverse changesmay occur in thesecurities markets;(7)competitorsof BB&T may have greaterfinancial resourcesanddevelop productsthat enable them tocompetemoresuccessfullythan BB&T; (8) costs ordifficultiesrelated to theintegrationof thebusinessesof BB&T and its mergerpartnersmay be greater thanexpected;(9)expectedcostsavings associatedwithcompleted mergersmay not be fullyrealizedorrealizedwithin theexpectedtime frames; and (10) depositattrition, customerloss orrevenuelossfollowing completed mergersmay be greater thanexpected.The forward-lookingstatements includedin thispresentationhave not beenexaminedorcompiledby theindependentpublicaccountantsof BB&T, nor have suchaccountantsapplied anyproceduresthereto.Accordingly,suchaccountantsdo notexpressan opinion or any other form ofassuranceon them.

Non-GAAPInformation

Thispresentation contains financial information determinedbymethodsother than inaccordancewithaccounting principles generally acceptedin the United States ofAmerica (“GAAP”). BB&T’smanagementuses these “non-GAAP”measuresin theiranalysisof theCorporation’s performance.Non-GAAPmeasures typicallyadjust GAAPperformance measurestoexcludethe effects ofcharges, expensesand gains related to theconsummationofmergersandacquisitions,and costs related to theintegrationof mergedentities,as well as theamortizationofintangiblesandpurchase accountingmark-to-marketadjustmentsin the case of “cash basis”performance measures.These non-GAAPmeasuresmay alsoexcludeothersignificantgains, losses orexpensesthat areunusualin nature and notexpectedto recur. Since these items and their impact on BB&T’sperformanceare difficult to predict,management believes presentationsoffinancial measures excludingthe impact of these items provide usefulsupplemental informationthat isimportantfor a properunderstandingof theoperatingresults of BB&T’s corebusinesses.Thesedisclosuresshould not be viewed as asubstituteforoperatingresultsdeterminedinaccordancewith GAAP, nor are theynecessarily comparableto non-GAAPperformance measuresthat may bepresentedby othercompanies.Areconciliationof these non-GAAPmeasuresto the most directlycomparableGAAPmeasureisincludedon theInvestor Relationssection of BB&T’s website(www.bbt.com/investor).

Comments Regarding Disclosure

BB&TCorporationdoes notprovide earnings guidance,but doesdiscusstrendsregardingthe factors thatinfluence potentialfutureperformancein both itsquarterly earnings releaseand itsquarterly earnings conferencecall.

Subsequentto thediscussionof suchinformationin anyquarterly earnings release,BB&Tundertakesnoresponsibilitytoupdatethatinformationshould facts andcircumstances change.

Thispresentation repeats informationthat has beenpreviously disclosed.It should not beinterpretedasprovidingnewinformation,nor asconfirmingorupdating previous disclosures.

BB&T is …

| ||

| • | A value-driven highly profitable growth | |

| organization. During the 90’s and the first part | ||

| of this decade, our growth came largely from | ||

| mergers as the economics of combinations | ||

| were compelling. Recently, our focus has | ||

| been more on organic growth. | ||

| • | Our over-arching purpose is to achieve our | |

| vision and mission, consistent with our values | ||

| with the ultimate goal of maximizing | ||

| shareholder returns. | ||

| • | Our fundamental strategy is to deliver the best | |

| value proposition in our markets. Recognizing | ||

| value is function of quality to price, our focus | ||

| is on creating high quality resulting in the | ||

| perfect client experience. | ||

5

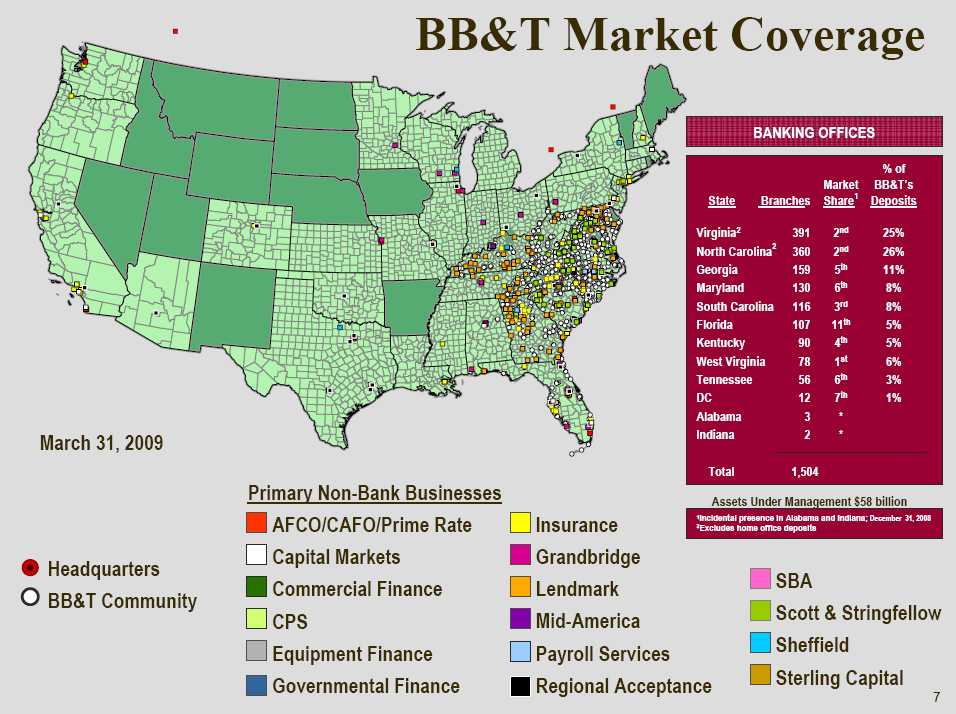

Primary Market Segments

50% Retail / 50%Commercial

| •Small Business | •Wealth Mgt / Private Banking |

| •Commercial Middle Market | •Investment Services |

| •Real Estate Lending | •Asset Management |

| •Retail | •Capital Markets |

| •Home Equity | •Venture Capital |

| •Sales Finance | •Consumer Finance |

| •Home Mortgage | •Commercial Finance |

| •Commercial Mortgage | •Insurance Premium Finance |

| •Leasing | •International |

| •Insurance | •Bank Card |

| •Payment Solutions | •Merchant |

| •Payroll Processing | •Supply Chain Management |

| •Institutional Trust Services |

6

Significant Accomplishments

through 12/31/08

| • | Superior Relative Performance |

| • | Fee Income 10.3% |

| • | Total Loans 8.2% |

| • | Total Deposits 6.4% |

| • | Effective Expense Control |

| • | Asset Quality Better Than Peers |

| • | Net New Transaction Accounts (94,000) |

8

Significant Accomplishments

through 12/31/08

| • | Reduced Employee Turnover from 19.2% to 15.0% |

| • | 5+ Households 34.4% |

| • | Online Banking +21% (3,004,620 Clients) |

| • | Opened 30 DeNovo locations |

| • | Successful advertising campaign (Best Bank In Town Since 1872) |

| • | Maintained superior service quality |

| • | Excellent Results in Bankcard and Merchant |

9

Significant Accomplishments

Successful Acquisitions:

| • | Ott & Company |

| • | Ramsey Title Group |

| • | Burkey Risk Services |

| • | Savannah Reinsurance Underwriting Management LLC |

| • | Premier Benefits Group |

| • | UnionBanc Insurance Services, Inc. |

| • | Puckett, Sheetz & Hogan |

| • | Southern Risk Holdings, Inc. |

| • | Commercial Title Group |

| • | J. Rolfe Davis Insurance Agency |

| • | TapCo Underwriters, Inc. |

| • | Haven Trust Bank |

| • | Live Oak Capital Ltd. |

10

ChallengesandOpportunities

| •Residential Real Estate Downturn: |

| Core Business for BB&T |

| •Unprecedented Market Disruption |

| •Return to Fundamental Banking |

11

Financial Strength

($ in Billions Except for Per ShareInformation)

| (Period-end Balances): | 2004 | 2005 | 2006 | 2007 | 2008 | ||||||||||

| Total Assets | $ | 100.5 | $ | 109.2 | $ | 121.4 | $ | 132.6 | $ | 152.0 | |||||

| Total Shareholders’ Equity | $ | 10.9 | $ | 11.1 | $ | 11.7 | $ | 12.6 | $ | 16.0 | |||||

| BV Per Common Share | $ | 19.76 | $ | 20.49 | $ | 21.69 | $ | 23.14 | $ | 23.16 | |||||

| Tangible Common Equity/Assets | 6.8% | 6.6% | 6.0% | 5.7% | 5.3% | ||||||||||

| Leverage Capital Ratio | 7.1% | 7.2% | 7.2% | 7.2% | 9.9% | ||||||||||

| Tier 1 Capital | 9.2% | 9.3% | 9.0% | 9.1% | 12.3% | ||||||||||

| Total Capital | 14.5% | 14.4% | 14.3% | 14.2% | 17.4% | ||||||||||

| Equity / Assets | 10.8% | 10.2% | 9.7% | 9.5% | 10.5% |

12

| Earnings Power | ||||||||||||||||||||||

| ($ in Millions Except Per Share Information) Year Ended December 31, 2008) | Seven-Year | |||||||||||||||||||||

| Compound | ||||||||||||||||||||||

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | Growth Rate | |||||||||||||||

| Interest income | $ | 4,434 | $ | 4,287 | $ | 4,547 | $ | 5,506 | $ | 6,893 | $ | 7,894 | $ | 7,274 | 6.0 | % | ||||||

| Interest expense | 1,687 | 1,273 | 1,199 | 1,981 | 3,185 | 4,014 | 2,969 | 3.0 | ||||||||||||||

| Net interest income | 2,747 | 3,014 | 3,348 | 3,525 | 3,708 | 3,880 | 4,305 | 8.5 | ||||||||||||||

| Provision for credit losses | 263 | 248 | 249 | 217 | 240 | 448 | 1,445 | 33.8 | ||||||||||||||

| Net interest income after | ||||||||||||||||||||||

| provision credit losses | 2,484 | 2,766 | 3,099 | 3,308 | 3,468 | 3,432 | 2,860 | 3.5 | ||||||||||||||

| Noninterest income | 1,541 | 1,827 | 2,119 | 2,324 | 2,596 | 2,774 | 3,060 | 13.7 | ||||||||||||||

| Noninterest expense | 2,195 | 2,548 | 2,890 | 3,133 | 3,526 | 3,601 | 3,952 | 10.7 | ||||||||||||||

| Income before income taxes | 1,830 | 2,045 | 2,328 | 2,499 | 2,538 | 2,605 | 1,968 | 3.5 | ||||||||||||||

| Provision for income taxes | 512 | 621 | 766 | 825 | 831 | 856 | 571 | 3.4 | ||||||||||||||

| Operating income | 1,318 | 1,424 | 1,562 | 1,674 | 1,707 | 1,749 | 1,397 | 3.5 | ||||||||||||||

| Dividends on preferred stock | 21 | |||||||||||||||||||||

| Operating earnings available | ||||||||||||||||||||||

| to common shareholders | 1,318 | 1,424 | 1,562 | 1,674 | 1,707 | 1,749 | 1,376 | 3.2 | ||||||||||||||

| Merger-related & other items1 | (15 | ) | (359 | ) | (4 | ) | (20 | ) | (179 | ) | (15 | ) | 122 | |||||||||

| Net income available to | ||||||||||||||||||||||

| common shareholders | $ | 1,303 | $ | 1,065 | $ | 1,558 | $ | 1,654 | $ | 1,528 | $ | 1,734 | $ | 1,498 | 6.3 | % | ||||||

| 1Net of taxes | Pre-tax pre-provision earnings had a 7 year CAGR of 10.1% | |||||||||||||||||||||

13

Originally Reported Increase1

| EPS | EPS | ||||

| 1989 | 10.7% | 1999 | 16.6% | ||

| 1990 | 13.9% | 2000 | 13.6% | ||

| 1991 | 3.0% | 2001 | 14.3% | ||

| 1992 | 12.7% | 2002 | 14.6% | ||

| 1993 | 20.1% | 2003 | 0.7% | ||

| 1994 | 12.4% | 2004 | 1.4% | ||

| 1995 | 5.9% | 2005 | 8.2% | ||

| 1996 | 19.2% | 2006 | 5.3% | ||

| 1997 | 17.0% | 2007 | 1.0% | ||

| 1998 | 19.0% | 2008 | (21.5)% |

1Operating

14

GeneratingFeeIncomeandOperating Efficiency1

For the Period Ended

| National2 | ||||||||||||

| 2004 | 2005 | 2006 | 2007 | 2008 | Peers | |||||||

| Noninterest Income/ | ||||||||||||

| Net Revenue (T/E) | 37.8% | 39.1% | 40.6% | 41.3% | 40.3% | 38.8% | ||||||

| Cash Basis Efficiency Ratio | 49.7% | 50.4% | 53.2% | 51.6% | 51.3% | 63.8% | ||||||

| Operating Leverage | (1.36)% | (1.51)% | (4.79)% | 3.03% | 1.05% | (13.0)% | ||||||

1Operating

2NationalPeers: CMA, FITB, HBAN, KEY, M&T, M&I, PNC, BPOP, RF, STI, USB and Zions

15

CreditQuality

| National* | ||||||||||||

| 2004 | 2005 | 2006 | 2007 | 2008 | Peers | |||||||

| Net Charge-offs/ | ||||||||||||

| Average Loans | .36% | .30% | .27% | .38% | .89% | 1.72% | ||||||

| Net Charge-offs without | ||||||||||||

| Specialized Lending | .24% | .19% | .14% | .21% | .69% | n/a | ||||||

| Nonperforming Assets/ | ||||||||||||

| Total Assets | .36% | .27% | .29% | .52% | 1.34% | 1.97% | ||||||

*NationalPeers: CMA, FITB, HBAN, KEY, M&T, M&I, PNC, BPOP, RF, STI, USB and Zions

16

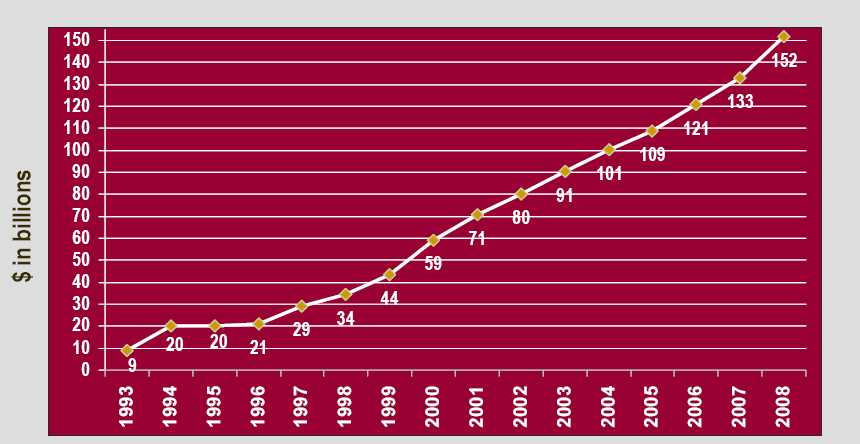

Total Assets

15 yeargrowthtrend

Asoriginally reported15-yearcompoundannual growth rate 20.6%

17

Operating Earnings

AsOriginally Reported

15 yeargrowthtrend

Asoriginally reported15-yearcompoundannual growth rate 19.2%

18

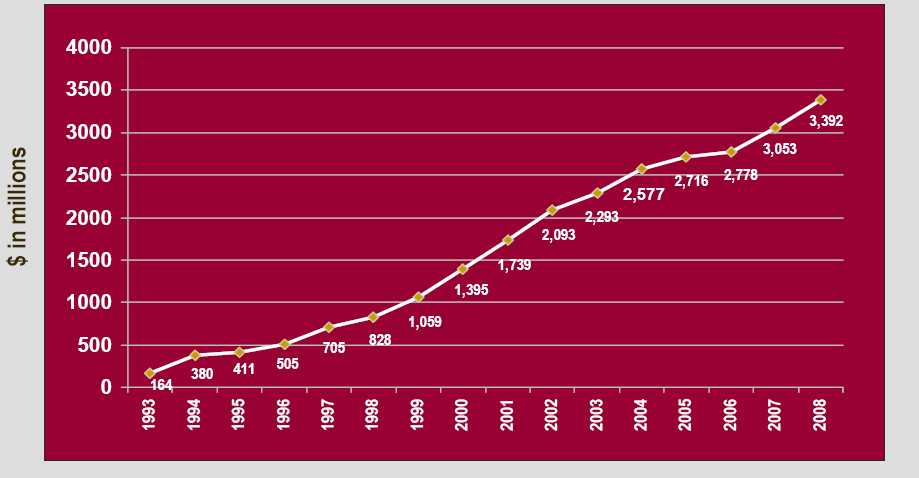

Pre-Tax Pre-Provision Operating Earnings

“EarningsPower”

15 yeargrowthtrend

Asoriginally reported15-yearcompoundannual growth rate 22.4%

19

Relative Financial Performance

| National | ||||

| BB&T | Peers2 | |||

| Earnings Per Share Growth1 | (13.7)% | (204.7)% | ||

| CB ROA | 1.11% | (.12)% | ||

| CB ROE | 19.30% | (2.75)% | ||

| Non Performing Assets / Total Assets1 | 1.34% | 1.97% | ||

1GAAP

2NationalPeers: CMA, FITB, HBAN, KEY, M&T, M&I, PNC, BPOP, RF, STI, USB and Zions

20

1stQuarter Highlights

March 31, 2009

| ÜUnderlying performance very strong | |

| • | Net income $318 million; EPS $.48; beat market expectations |

| • | Net interest income $1.15 billion, up 12.7% |

| • | Continue to benefit from flight to quality |

| • Commercial loans up 11.2% | |

| • | Excellent low-cost client deposit growth |

| • Client deposits increased 9.4% | |

| • | Record mortgage banking originations ($7.4 billion) |

21

1stQuarter Highlights

March 31, 2009

| ÜUnderlying performance very strong | |

| • | Mortgage revenues up more than 200% |

| • | Improved operating efficiency |

| • Cash efficiency improved 100 basis points from last year | |

| • Breaks through 50% at 49.8%, important milestone | |

| • | Positive operating leverage |

| • | Earnings power up 12.6%, faster pace than last quarter |

22

1stQuarter Highlights

March 31, 2009

| ÜFinancial Strength | |

| • | Increased allowance for loan losses to $1.9 billion, or 1.94% of loans and leases; current quarter provision exceeded net charge-offs by $288 million |

| • | Industry leading capital – Tier 1 12.1%, TCE 5.7% |

23

Recognitions

| • | SBA: 2007 Export Lender of the Year |

| • | J.D. Powers Survey: Second Best Small Business Bank |

| • | J.D. Powers Survey: #1 Overall in Mortgage Servicing |

| • | J.D. Powers Survey: #1 Bank Prime Indirect Lender in Auto Dealer Satisfaction |

| • | Greenwich Excellence Award for Distinguished Service and Overall Satisfaction in Middle Market Banking |

| • | Informa Research: Ranked #1 for Branch Employee Customer Acquisition and Sales and Service Skills |

24

Recognitions

| • | Ranked byCROas one of America’s “100 Best Corporate Citizens” |

| • | BB&T Insurance Services Rated 1stin Overall Productivity |

| • | BB&T Capital Markets: Best on Street Analysts |

| • | 2007 and 2008 Import Factor of the Year: By Factors Chain International |

| - Largest U.S. Import Factor in the World | |

| • | ASTD BEST: #2 of Top 40 Learning Organizations |

| • | Ranked by Training Magazine #20 of Training Top 125 Awards |

25

Recognitions

| • | Ranked by Luxury Brand Index #1 Regional Bank for Wealth Management |

| • | Ranked by 401kExchange #1 in Client Service ($1-$10 million) |

| • | Best Practices Award – Only one of five companies |

| • | Scott & Stringfellow/Special Opportunities and Equity Income: Ranked in top 1% for performance by PSN/Informa and Morningstar |

| • | Ranked World’s Safest Banks in Global Finance top 50 – top 5 in US |

26

Recognitions

| • | John Allison – Top 4 Finalist Morningstar 2008 CEO of the year |

| • | John Allison – NC ChamberCorning Award for Distinguished Citizenship |

| • | John Allison – Won Best CEO from Motley Fool for 2008 |

27

TotalCompound Annual ReturntoShareholders

December31, 2008

| BB&T | S&P 500 | National Peers* | ||||

| 1 Year | -4.6% | -36.8% | -40.7% | |||

| 3 Year | -8.7% | -8.3% | -24.5% | |||

| 5 Year | -2.4% | -2.2% | -14.1% | |||

| 10 Year | -0.2% | -1.4% | -5.4% | |||

| 15 Year | 10.7% | 6.4% | 5.5% | |||

| 20 Year | 11.2% | 8.4% | 8.7% | |||

*NationalPeers: CMA, FITB, HBAN, KEY, M&T, M&I, PNC, BPOP, RF, STI, USB and Zions

28

Shareholder Return

Depicts$100investedat12/31/95and heldthrough 12/31/08withdividends reinvestedin thesecurityor index.

29

BB&TDividend Performance

As of / year ended12/31/08

| BB&T | S&P 500 | |||

| •Ten Year Compound Annual Growth Rate | 10.9% | 5.8% | ||

| •Dividend Yield | 6.8% | 3.2% | ||

| • | Paid a cash dividend every year since 1903 |

| • | 37th Consecutive year of dividend increases |

| • | Annual dividend increase in 2008 5.7% |

| • | Mergent Dividend Achiever (Only 2% Qualify) |

| • | S&P: High Yield Dividend Aristocrat |

30

The Future

31

GlobalEconomic Context

| • | Improving Global Productivity: More Global Economic Freedom |

| • | Global Integration Accelerating |

| • | Brutally Competitive |

| • | Imbedded Cost of Excessive Regulation in U.S. |

| • | Increased Geopolitical Risk / Cost of Risk Control |

| • | Volatile / Uncertain |

| • | Merciless /Tough |

| • | Survival of Most Competent / Committed |

| • | Global economic “slowdown” will impact these factors |

32

Economy2009*

| • | Negative growth: Real GDP -1.5% |

| • | Low Inflation CPI 0.45% |

| • | Negative growth -1.05% |

| • | Unemployment (at peak) 9.8% |

| • | At 12/31/09: Fed Funds 0.2%; Prime 3.2%; 10 year treasury 2.9% |

Three years from now are bondmarketsmore likely to bepreoccupiedbyconcernsaboutinflationordeflation?

93% Say Yes

*Blue ChipForecast:as of April 1, 2009

33

USEconomic Framework*

5 YearForecast

(2010 – 2014)

| • | Solid real growth: Real GDP to average 2.8% |

| • | Moderate Inflation: CPI to average 2.5% |

| • | Total annual growth will average 5.3% |

| • | Prime rate will range from 5.0% to 7.25% and average 6.5% |

| • | At 12/31/14; Fed Funds 4.25%; Prime rate 7.25%; 10 year Treasury 5.2% |

*Blue ChipForecast

34

Financial Services Industry

| Primary forces impacting the industry: | ||

| (1) | Credit, Market, and Operational Risk | |

| (2) | Intense Competition / Excess Capacity | |

| (3) | Consolidate / Diversify / Restructure | |

| (4) | Innovation / Productivity Improvement | |

| (5) | Regulation / Corporate Governance | |

FINANCIAL SERVICESIS AWORLD-WIDE,

GROWTH INDUSTRY, WHERETHEENGLISH

SPEAKING WORLD CURRENTLYHAS A

COMPETITIVE ADVANTAGE

35

OutcomeofFinancial Industry Trends

| • | In 10 years there will be 10 to 15 or so Financial Services firms which will dominate the industry.There will be some mid- sized and a number of small institutions who will face a difficult competitive environment. | ||

| • | The winners will be those companies with rational strategies, superior processes and exceptional executional abilities.Due to these attributes, these winners will have superior revenue and earnings per share (EPS) growth and outstanding return on equity (ROE). | ||

BB&T Will Be AWinner

36

BB&T's

Long-Term

Strategy

37

Our Goal

| • | Create a high-performance financialservices organization that can survive andprosper in a rapidly changing, highlycompetitive, globally integrated environment |

| • | CREATETHE BESTFINANCIALINSTITUTION POSSIBLE |

38

AchievingOur Goal

The key tomaximizingourprobabilityof being bothindependentandprosperousover the long term is to create asuperio r EarningsPer Share Growth Rate withoutsacrificingthefundamentalquality and long-termcompetitivenessof ourbusiness,nor takingunreasonablerisk. Ourultimategoal is tomaximize shareholder returns.

39

BB&T Long-TermStrategy

Superior-Balanced Performance

| (1) | Client-driven - Have a passion for consistentlyproviding the client with better value through rationalinnovation and productivity improvement |

| (2) | Rational risk taking and exceptional risk management |

| (3) | Superior earnings growth |

| (4) | Targeted and consistent investments for the future |

40

2009 KeyStrategic Objectives

| (1) | Effectively Manage Through The Credit Cycle |

| (2) | Achieve Superior Revenue Growth |

| (3) | Create The Perfect Client Experience |

| (4) | Control Cost: Maximize Economic Profit |

41

BB&T Culture

Vision

Mission

Values

42

BB&T Vision

To Create the BestFinancial Institution Possible

“The Best of the Best”

43

BB&T Mission

TO MAKE THEWORLDABETTERPLACE TO LIVE BY:

HelpingourCLIENTSachieve economic successandfinancial security;

Creatinga place where ourEMPLOYEEScan learn, grow and befulfilledin their work;

MakingtheCOMMUNITIESin which we work better places to be; andthereby:

Optimizing the long-term return to ourSHAREHOLDERS, whileprovidinga safe and soundinvestment.

44

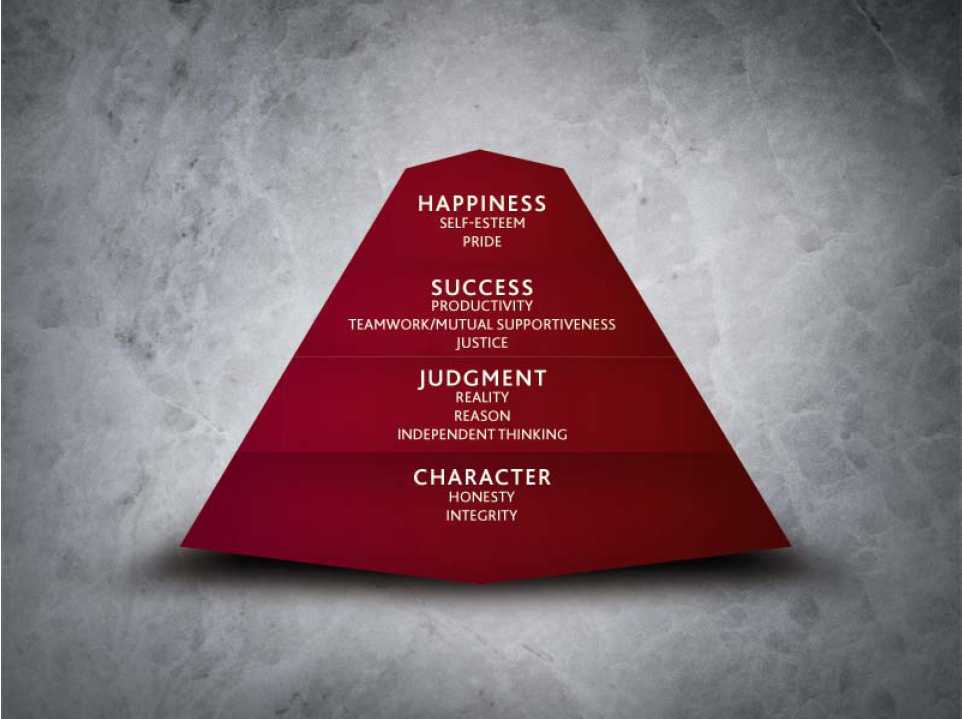

BB&T Values

| • | Valuesarepractical habits that enable us asindividuals to live, be successful and achievehappiness. |

| • | For BB&T, ourValuesenable us to achieve ourmission and corporate purpose. |

| • | Valuesmust be consistent (non-contradictory). |

| • | Valuesare important!! |

45

OurPassions

TOCREATETHE BEST

FINANCIAL

INSTITUTION POSSIBLE

47

Reconciliationsof Non-GAAP

Financial Measures

Originally Reported Increase1

| EPS | EPS | ||||

| 1989 | 10.7% | 1999 | 12.3% | ||

| 1990 | 13.9% | 2000 | (11.4)% | ||

| 1991 | 3.0% | 2001 | 38.6% | ||

| 1992 | 12.7% | 2002 | 28.3% | ||

| 1993 | 20.1% | 2003 | (23.9)% | ||

| 1994 | 172.8% | 2004 | 35.3% | ||

| 1995 | (25.8)% | 2005 | 7.1% | ||

| 1996 | 56.8% | 2006 | (6.3)% | ||

| 1997 | 9.2% | 2007 | 11.7% | ||

| 1998 | 39.0% | 2008 | (13.7)% |

1GAAP

50

GeneratingFeeIncomeandOperating Efficiency1

| For the Years Ended December 31, | |||||||||||||||

| 2004 | 2005 | 2006 | 2007 | 2008 | |||||||||||

| Noninterest Income as a Percentage of Net Revenue | |||||||||||||||

| (T/E) Based on Operating Earnings | 37.8 | % | 39.1 | % | 40.6 | % | 41.3 | % | 40.3 | % | |||||

| Effect of other, net (1) | - | - | - | - | 1.1 | ||||||||||

| Noninterest Income as a Percentage of | |||||||||||||||

| Net Revenue (T/E) Based on GAAP | 37.8 | % | 39.1 | % | 40.6 | % | 41.3 | % | 41.4 | % | |||||

| Cash Basis Efficiency Ratio | 49.7 | % | 50.4 | % | 53.2 | % | 51.6 | % | 51.3 | % | |||||

| Effect of pretax merger-related and restructuring items | .1 | (.2 | ) | .3 | .3 | .2 | |||||||||

| Effect of pretax amortization of intangibles | 2.0 | 1.9 | 1.6 | 1.5 | 1.3 | ||||||||||

| Effect of other, net (2) | - | .8 | ( .4 | ) | .3 | (.7 | ) | ||||||||

| Effect of amortization of mark-to-market adjustments | .2 | .2 | .1 | - | - | ||||||||||

| Efficiency Ratio Based on GAAP | 52.0 | % | 53.1 | % | 54.8 | % | 53.7 | % | 52.1 | % | |||||

| Operating Leverage | (1.36 | )% | (1.51 | )% | (4.79 | )% | 3.03 | % | 1.05 | % | |||||

| Effect of merger-related and restructuring items | |||||||||||||||

| and non-recurring items (3) | 19.77 | (.91 | ) | .24 | (.03 | ) | 2.95 | ||||||||

| Operating Leverage Based on GAAP | 18.41 | % | (2.42 | )% | (4.55 | )% | 3.00 | % | 4.00 | % | |||||

| (1) | Reflects gains from the initial public offering and sale of Visa stock in 2008, and the impact of a nonrecurring item associated with BB&T’s leasing operations in 2003. | |

| (2) | Reflects gains from the initial public offering and sale of Visa stock, a gain from the early extinguishment of debt and nonrecurring professional fees in 2008, a reserve charge relating to the Visasettlement in 2007, a gain on the sale of duplicate facilities in 2006, and a one-time adjustment related to the accounting for property and equipment leases in 2005. | |

| (3) | Reflects the impact of the fluctuations in merger-related and restructuring charges and non-recurring items. |

51

Operating Efficiency

| Annualized Link Quarter | ||||||||||

| 4Q08 vs 3Q08 | 3Q08 vs 2Q08 | 2Q08 vs 1Q08 | 1Q08 vs 4Q07 | |||||||

| Revenue Growth | 7.38% | 3.40% | 22.48% | 10.49% | ||||||

| Effect of other, net (1) | (8.64) | (6.72) | 2.48 | 7.92 | ||||||

| Revenue Growth Based on GAAP | (1.26)% | (3.32)% | 24.96% | 18.41% | ||||||

| Expense Growth | 3.98 | 1.20 | 22.13 | 8.70 | ||||||

| Effect of other, net (1) | (2.01) | 18.24 | (10.96) | (11.26) | ||||||

| Expense Growth Based on GAAP | 1.97 | 19.44 | 11.17 | (2.56) | ||||||

| Operating Leverage | 3.40% | 2.20% | .35% | 1.79 | ||||||

| Effect of other, net (1) | (6.63) | (24.96) | 13.44 | 19.18 | ||||||

| Operating Leverage Based on GAAP | 3.23% | (22.76) | 13.79 | 20.97 | ||||||

| (1) | Reflects the impact of the fluctuations in merger-related and restructuring charges and non-recurring items. |

52

Operating Earnings

Available to Common

Shareholders

asoriginally reported(dollarsinmillions)

| Operating Earnings | Net Income | |||||

| 1993 | $ 98 | $ 98 | ||||

| 1994 | 237 | 237 | ||||

| 1995 | 254 | 178 | ||||

| �� 1996 | 305 | 284 | ||||

| 1997 | 409 | 360 | ||||

| 1998 | 513 | 502 | ||||

| 1999 | 659 | 613 | ||||

| 2000 | 875 | 626 | ||||

| 2001 | 1,100 | 974 | ||||

| 2002 | 1,318 | 1,303 | ||||

| 2003 | 1,424 | 1,065 | ||||

| 2004 | 1,562 | 1,558 | ||||

| 2005 | 1,674 | 1,654 | ||||

| 2006 | 1,707 | 1,528 | ||||

| 2007 | 1,749 | 1,734 | ||||

| 2008 | 1,376 | 1,498 | ||||

| Fifteen-Year Compound AnnualGrowth Rate | 19.2% | 19.9% | ||||

53

Pre-Tax Pre-Provision

Operating Earnings

asoriginally reported(dollarsinmillions)

| Operating | GAAP | |||||

| 1993 | $164 | $164 | ||||

| 1994 | 380 | 380 | ||||

| 1995 | 411 | 295 | ||||

| 1996 | 505 | 472 | ||||

| 1997 | 705 | 637 | ||||

| 1998 | 828 | 813 | ||||

| 1999 | 1,059 | 996 | ||||

| 2000 | 1,395 | 1,033 | ||||

| 2001 | 1,739 | 1,584 | ||||

| 2002 | 2,093 | 1,556 | ||||

| 2003 | 2,293 | 1,865 | ||||

| 2004 | 2,577 | 2,571 | ||||

| 2005 | 2,716 | 2,684 | ||||

| 2006 | 2,778 | 2,713 | ||||

| 2007 | 3,053 | 3,018 | ||||

| 2008 | 3,392 | 3,493 | ||||

| Fifteen-Year Compound AnnualGrowth Rate | 22.4% | 22.6% | ||||

54

| For the Year Ended December 31, | |||||||||||||||||||

| Dollars in Millions | 2004 | 2005 | 2006 | 2007 | 2008 | ||||||||||||||

| Total Revenues Based on Operating Results | 6,666 | 7,830 | 9,489 | 10,668 | 10,334 | ||||||||||||||

| Pretax merger-related and restructuring charges | - | - | - | - | - | ||||||||||||||

| Other, net (1) | - | 2 | (75 | ) | - | 70 | |||||||||||||

| Total Revenues Based on GAAP Results | 6,666 | 7,832 | 9,414 | 10,668 | 10,404 | ||||||||||||||

| Operating Earnings Available to Common Shareholders | 1,562 | 1,674 | 1,707 | 1,749 | 1,376 | ||||||||||||||

| Merger-related and restructuring charges, net of tax | (4 | ) | 7 | (11 | ) | (13 | ) | (10 | ) | ||||||||||

| Other, net (2) | - | (27 | ) | (168 | ) | (2 | ) | 132 | |||||||||||

| Net Income Available to Common Shareholders | 1,558 | 1,654 | 1,528 | 1,734 | 1,498 | ||||||||||||||

| Return on Assets Based on Operating Earnings | 1. 62 | 1.60 | 1.49 | 1. 38 | 1.02 | ||||||||||||||

| Effect of after-tax merger-related and restructuring charges | - | .01 | (.01 | ) | (.01 | ) | (.01 | ) | |||||||||||

| Effect of other, net (2) | - | (.03 | ) | (.14 | ) | - | .10 | ||||||||||||

| Return on Assets Based on Net Income | 1. 62 | 1.58 | 1.34 | 1. 37 | 1.11 | ||||||||||||||

| Return on Common Equity Based on Operating Earnings Available to Common Shareholders | 14. 74 | 15.12 | 14.91 | 14. 37 | 10.51 | ||||||||||||||

| Effect of after-tax merger-related and restructuring charges | (.03 | ) | .07 | (.10 | ) | (.10 | ) | (.08 | ) | ||||||||||

| Effect of other, net (2) | - | (.24 | ) | (1.46 | ) | (. 02 | ) | 1.01 | |||||||||||

| Return on Common Equity Based on Net Income Available to Common Shareholders | 14. 71 | 14.95 | 13.35 | 14. 25 | 11.44 | ||||||||||||||

| Diluted EPS Based on Operating Earnings Available to Common Shareholders | 2. 81 | 3.04 | 3.14 | 3. 17 | 2.49 | ||||||||||||||

| Effect of after-tax merger-related and restructuring charges | (.01 | ) | .01 | (.02 | ) | (.02 | ) | (.02 | ) | ||||||||||

| Effect of other, net (2) | - | (.05 | ) | (.31 | ) | (. 01 | ) | .24 | |||||||||||

| Diluted EPS Based on Net Income Available to Common Shareholders | 2. 80 | 3.00 | 2.81 | 3. 14 | 2.71 | ||||||||||||||

| Cash ROA | 1. 79 | 1.77 | 1.63 | 1. 50 | 1.11 | ||||||||||||||

| Effect of amortization of mark-to-market adjustments, net of tax | (.01 | ) | (.02 | ) | (.01 | ) | - | - | |||||||||||

| Effect of amortization of intangibles, net of tax (3) | (.16 | ) | (.15 | ) | (.13 | ) | (.12 | ) | (.09 | ) | |||||||||

| Return on Assets Based on Operating Earnings | 1. 62 | 1.60 | 1.49 | 1. 38 | 1.02 | ||||||||||||||

| Cash ROCE | 26. 36 | 27.12 | 27.23 | 26. 82 | 19.30 | ||||||||||||||

| Effect of amortization of mark-to-market adjustments, net of tax | (.28 | ) | (.29 | ) | (.13 | ) | (.03 | ) | - | ||||||||||

| Effect of amortization of intangibles, net of tax (3) | (11.34 | ) | (11.71 | ) | (12.19 | ) | (12.42 | ) | (8.79 | ) | |||||||||

| Return on Common Equity Based on Operating Earnings Available to Common Shareholders | 14. 74 | 15.12 | 14.91 | 14. 37 | 10.51 | ||||||||||||||

| Cash Basis Diluted EPS | 2. 96 | 3.20 | 3.27 | 3. 29 | 2.60 | ||||||||||||||

| Effect of amortization of mark-to-market adjustments, net of tax | (.03 | ) | (.04 | ) | (.01 | ) | - | - | |||||||||||

| Effect of amortization of intangibles, net of tax | (.12 | ) | (.12 | ) | (.12 | ) | (.12 | ) | (.11 | ) | |||||||||

| Diluted EPS Based on Operating Earnings Available to Common Shareholders | 2. 81 | 3.04 | 3.14 | 3. 17 | 2.49 | ||||||||||||||

| (1) | Includes gains from the initial public offering and sale of Visa stock, net securities gains and other-than-temporary impairment losses, and an adjustment related to the accounting for leveraged leases in 2008, a loss on sale of securities in 2006, and a one-time adjustment related to the accounting for property and equipment leases in 2005. | |

| (2) | Includes gains from the initial public offering and sale of Visa stock, a gain from the early extinguishment of debt, net securities gains, other-than-temporary impairment losses and nonrecurring professional fees in 2008, a reserve charge relating to the Visa settlement and a credit to the provision for income taxes in 2007, an additional tax provision related to leveraged leases, a loss on the sale of securities, and the impact of a gain on the sale of duplicate facilities in 2006, and a one-time adjustment related to the accounting for property and equipment leases in 2005. | |

| (3) | Excludes average intangibles from average assets and average equity, net of deferred taxes, in the calculation of cash basis ratios. | |

55

Cash-BasisResults

| Quarter Ended | ||||||||||||||||||||

| March 312009 | Dec. 31 2008 | Sept. 30 2008 | June 30 2008 | March 31 2008 | ||||||||||||||||

| Diluted earnings per common share | $ | .48 | $ | .51 | $ | .65 | $ | .78 | $ | .78 | ||||||||||

| Effect of amortization of intangibles, net of tax | .03 | .03 | .03 | .03 | .03 | |||||||||||||||

| Effect of amortization of mark-to-market adjustments, net of tax | - | - | - | - | - | |||||||||||||||

| Cash basis diluted earnings per common share | .51 | .54 | .68 | .81 | .81 | |||||||||||||||

| Return on average assets | .86 | % | .86 | % | 1.05 | % | 1.28 | % | 1.29 | % | ||||||||||

| Effect of amortization of intangibles, net of tax | .08 | .08 | .09 | .10 | .11 | |||||||||||||||

| Effect of amortization of mark-to-market adjustments, net of tax | (.01 | ) | - | .01 | - | - | ||||||||||||||

| Cash basis return on average tangible assets | .93 | .94 | 1.15 | 1.38 | 1.40 | |||||||||||||||

| Return on average common shareholders' equity | 8.29 | % | 8.47 | % | 10.86 | % | 13.27 | % | 13.30 | % | ||||||||||

| Effect of amortization of intangibles, net of tax | 7.39 | 7.09 | 9.10 | 10.94 | 10.96 | |||||||||||||||

| Effect of amortization of mark-to-market adjustments, net of tax | (.06 | ) | .01 | .01 | .01 | .01 | ||||||||||||||

| Cash basis return on average tangible common shareholders' equity | 15.62 | 15.57 | 19.97 | 24.22 | 24.27 | |||||||||||||||

| Efficiency ratio | 50.9 | % | 53.9 | % | 52.7 | % | 49.2 | % | 52.3 | % | ||||||||||

| Effect of amortization of intangibles | (1.2 | ) | (1.3 | ) | (1.4 | ) | (1.3 | ) | (1.5 | ) | ||||||||||

| Effect of amortization of mark-to-market adjustments | .1 | - | - | - | - | |||||||||||||||

| Cash basis efficiency ratio | 49.8 | 52.6 | 51.3 | 47.9 | 50.8 | |||||||||||||||

56