Third Quarter 2018 Earnings Conference Call October 18, 2018 Kelly S. King Chairman and Chief Executive Officer Daryl N. Bible Chief Financial Officer

Forward-Looking Information This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, regarding the financial condition, results of operations, business plans and the future performance of BB&T. Forward- looking statements are not based on historical facts but instead represent management's expectations and assumptions regarding BB&T's business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances difficult to predict. BB&T's actual results may differ materially from those contemplated by the forward-looking statements. Words such as "anticipates," "believes," "estimates," "expects," "forecasts," "intends," "plans," "projects," "may," "will," "should," "could," and other similar expressions are intended to identify these forward-looking statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results. While there is no assurance any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation, as well as the risks and uncertainties more fully discussed under Item 1A-Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2017 and in any of BB&T’s subsequent filings with the Securities and Exchange Commission: = general economic or business conditions, either nationally or regionally, may be less favorable than expected, resulting in, among other things, slower deposit and/or asset growth, and a deterioration in credit quality and/or a reduced demand for credit, insurance or other services; = disruptions to the national or global financial markets, including the impact of a downgrade of U.S. government obligations by one of the credit ratings agencies, the economic instability and recessionary conditions in Europe, the eventual exit of the United Kingdom from the European Union; = changes in the interest rate environment, including interest rate changes made by the Federal Reserve, as well as cash flow reassessments may reduce net interest margin and/or the volumes and values of loans and deposits as well as the value of other financial assets and liabilities; = competitive pressures among depository and other financial institutions may increase significantly; = legislative, regulatory or accounting changes, including changes resulting from the adoption and implementation of the Dodd-Frank Act may adversely affect the businesses in which BB&T is engaged; = local, state or federal taxing authorities may take tax positions that are adverse to BB&T; = a reduction may occur in BB&T's credit ratings; = adverse changes may occur in the securities markets; = competitors of BB&T may have greater financial resources or develop products that enable them to compete more successfully than BB&T and may be subject to different regulatory standards than BB&T; = cybersecurity risks could adversely affect BB&T's business and financial performance or reputation, and BB&T could be liable for financial losses incurred by third parties due to breaches of data shared between financial institutions; = higher-than-expected costs related to information technology infrastructure or a failure to successfully implement future system enhancements could adversely impact BB&T's financial condition and results of operations and could result in significant additional costs to BB&T; = natural or other disasters, including acts of terrorism, could have an adverse effect on BB&T, materially disrupting BB&T's operations or the ability or willingness of customers to access BB&T's products and services; = costs related to the integration of the businesses of BB&T and its merger partners may be greater than expected; = failure to execute on strategic or operational plans, including the ability to successfully complete and/or integrate mergers and acquisitions or fully achieve expected cost savings or revenue growth associated with mergers and acquisitions within the expected time frames could adversely impact financial condition and results of operations; = significant litigation and regulatory proceedings could have a material adverse effect on BB&T; = unfavorable resolution of legal proceedings or other claims and regulatory and other governmental investigations or other inquiries could result in negative publicity, protests, fines, penalties, restrictions on BB&T's operations or ability to expand its business and other negative consequences, all of which could cause reputational damage and adversely impact BB&T's financial conditions and results of operations; = risks resulting from the extensive use of models; = risk management measures may not be fully effective; = deposit attrition, customer loss and/or revenue loss following completed mergers/acquisitions may exceed expectations; and = widespread system outages, caused by the failure of critical internal systems or critical services provided by third parties, could adversely impact BB&T's financial condition and results of operations. Non-GAAP Information This presentation contains financial information and performance measures determined by methods other than in accordance with accounting principles generally accepted in the United States of America ("GAAP"). BB&T's management uses these "non-GAAP" measures in their analysis of the Corporation's performance and the efficiency of its operations. Management believes these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results with prior periods and demonstrate the effects of significant items in the current period. The company believes a meaningful analysis of its financial performance requires an understanding of the factors underlying that performance. BB&T's management believes investors may find these non-GAAP financial measures useful. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Below is a listing of the types of non-GAAP measures used in this presentation: = The adjusted efficiency ratio is non-GAAP in that it excludes securities gains (losses), amortization of intangible assets, merger-related and restructuring charges and other selected items. BB&T's management uses this measure in their analysis of the Corporation's performance. BB&T's management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. = Tangible common equity and related measures are non-GAAP measures that exclude the impact of intangible assets and their related amortization. These measures are useful for evaluating the performance of a business consistently, whether acquired or developed internally. BB&T's management uses these measures to assess the quality of capital and returns relative to balance sheet risk and believes investors may find them useful in their analysis of the Corporation. = Core net interest margin is a non-GAAP measure that adjusts net interest margin to exclude the impact of purchase accounting. The interest income and average balances for PCI loans are excluded in their entirety as the accounting for these loans can result in significant and unusual trends in yields. The purchase accounting marks and related amortization for a) securities acquired from the FDIC in the Colonial acquisition and b) non-PCI loans, deposits and long-term debt acquired from Susquehanna and National Penn are excluded to approximate their yields at the pre-acquisition rates. BB&T's management believes the adjustments to the calculation of net interest margin for certain assets and liabilities acquired provide investors with useful information related to the performance of BB&T's earning assets. = The adjusted diluted earnings per share is non-GAAP in that it excludes merger-related and restructuring charges and other selected items, net of tax. BB&T's management uses this measure in their analysis of the Corporation's performance. BB&T's management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. = The adjusted operating leverage ratio is non-GAAP in that it excludes securities gains (losses), amortization of intangible assets, merger-related and restructuring charges and other selected items. BB&T's management uses this measure in their analysis of the Corporation's performance. BB&T's management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. = The adjusted performance ratios are non-GAAP in that they exclude merger-related and restructuring charges and, in the case of return on average tangible common shareholders' equity, amortization of intangible assets. BB&T's management uses these measures in their analysis of the Corporation's performance. BB&T's management believes these measures provide a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. = The adjusted net interest margin is a non-GAAP measure in that it estimates the impact on taxable-equivalent net interest income as if the tax reform legislation had not been enacted. BB&T's management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of tax reform. A reconciliation of these non-GAAP measures to the most directly comparable GAAP measure is included in the Appendix. Capital ratios are preliminary.

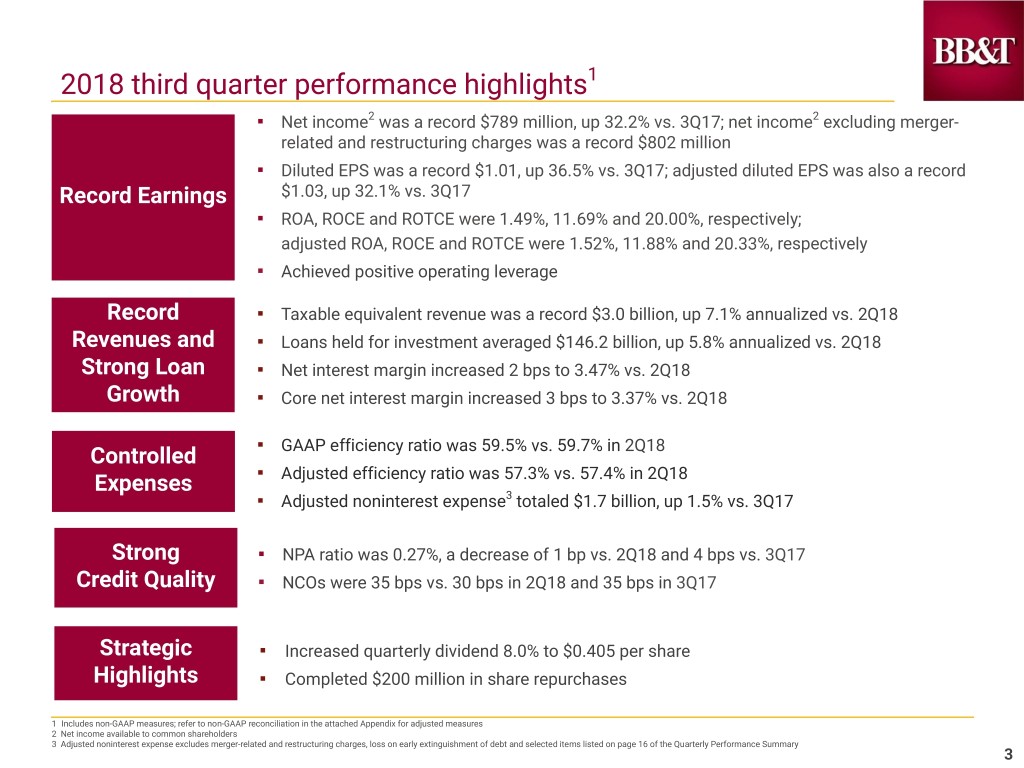

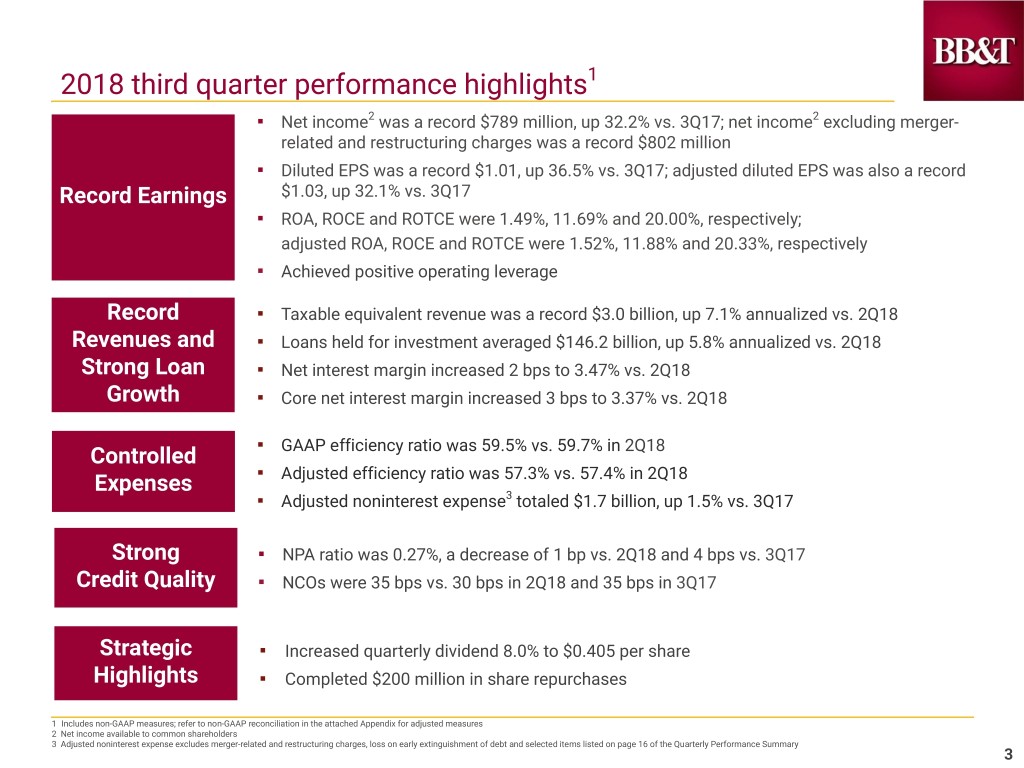

2018 third quarter performance highlights1 ▪ Net income2 was a record $789 million, up 32.2% vs. 3Q17; net income2 excluding merger- related and restructuring charges was a record $802 million ▪ Diluted EPS was a record $1.01, up 36.5% vs. 3Q17; adjusted diluted EPS was also a record Record Earnings $1.03, up 32.1% vs. 3Q17 ▪ ROA, ROCE and ROTCE were 1.49%, 11.69% and 20.00%, respectively; adjusted ROA, ROCE and ROTCE were 1.52%, 11.88% and 20.33%, respectively ▪ Achieved positive operating leverage Record ▪ Taxable equivalent revenue was a record $3.0 billion, up 7.1% annualized vs. 2Q18 Revenues and ▪ Loans held for investment averaged $146.2 billion, up 5.8% annualized vs. 2Q18 Strong Loan ▪ Net interest margin increased 2 bps to 3.47% vs. 2Q18 Growth ▪ Core net interest margin increased 3 bps to 3.37% vs. 2Q18 ▪ GAAP efficiency ratio was 59.5% vs. 59.7% in 2Q18 Controlled ▪ Adjusted efficiency ratio was 57.3% vs. 57.4% in 2Q18 Expenses ▪ Adjusted noninterest expense3 totaled $1.7 billion, up 1.5% vs. 3Q17 Strong ▪ NPA ratio was 0.27%, a decrease of 1 bp vs. 2Q18 and 4 bps vs. 3Q17 Credit Quality ▪ NCOs were 35 bps vs. 30 bps in 2Q18 and 35 bps in 3Q17 Strategic ▪ Increased quarterly dividend 8.0% to $0.405 per share Highlights ▪ Completed $200 million in share repurchases 1 Includes non-GAAP measures; refer to non-GAAP reconciliation in the attached Appendix for adjusted measures 2 Net income available to common shareholders 3 Adjusted noninterest expense excludes merger-related and restructuring charges, loss on early extinguishment of debt and selected items listed on page 16 of the Quarterly Performance Summary 3

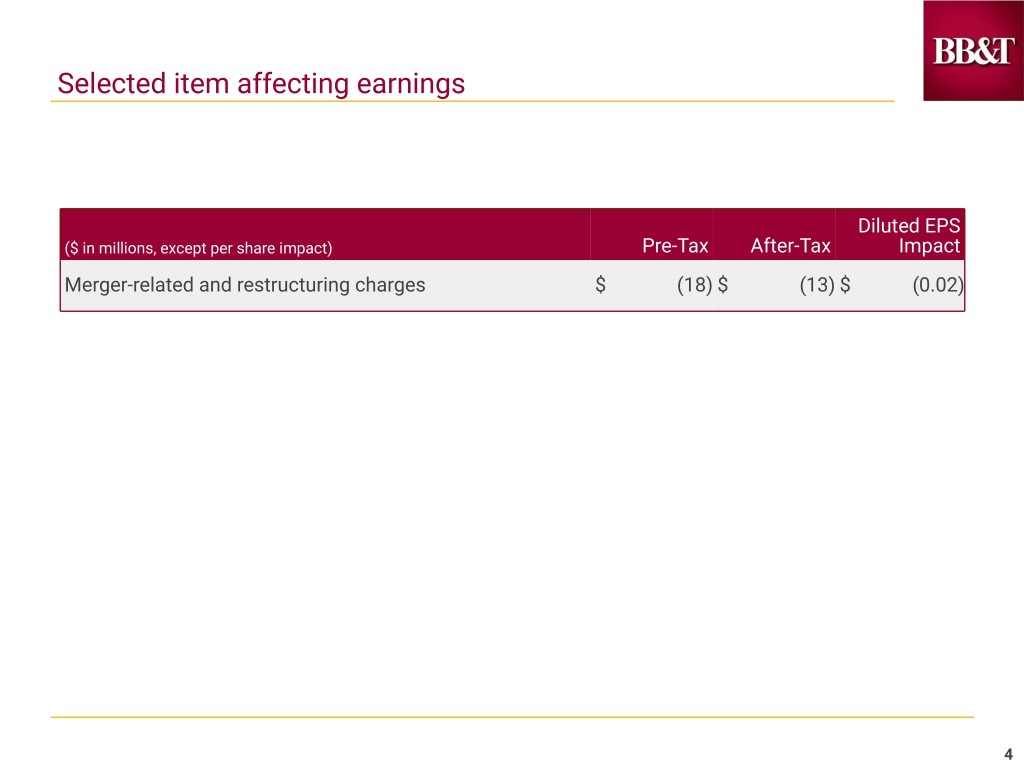

Selected item affecting earnings Diluted EPS ($ in millions, except per share impact) Pre-Tax After-TaxDiluted EPSImpact Pre -Tax After Tax Impact Merger-related and restructuring charges $ (18) $ (13) $ (0.02) 4

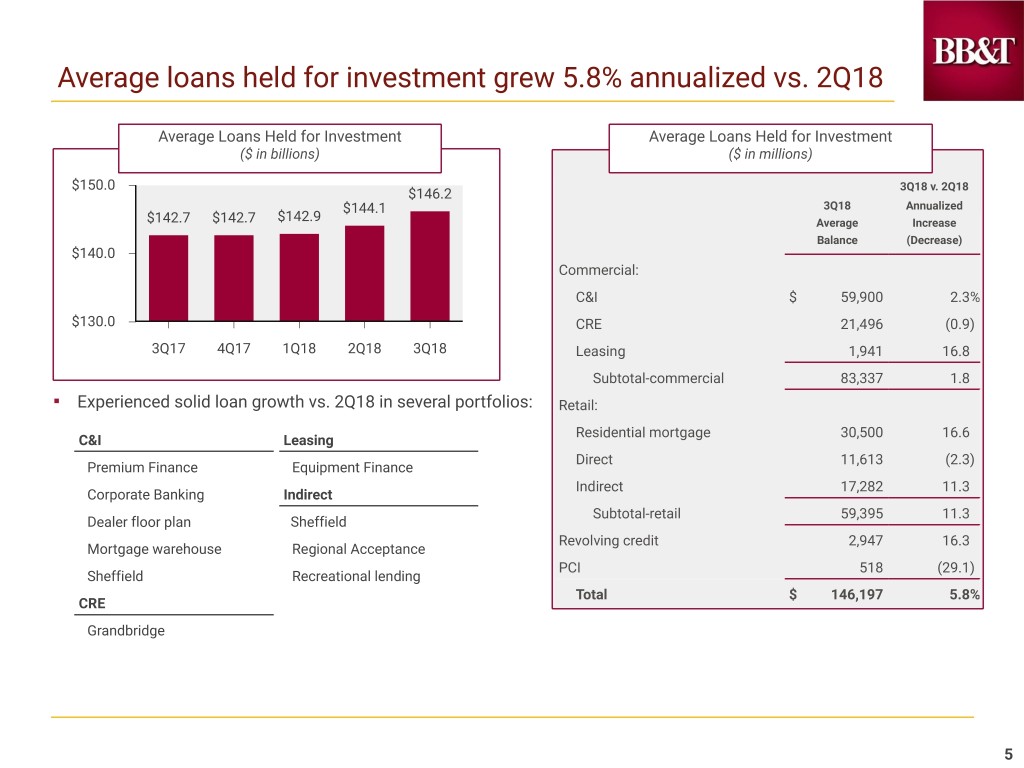

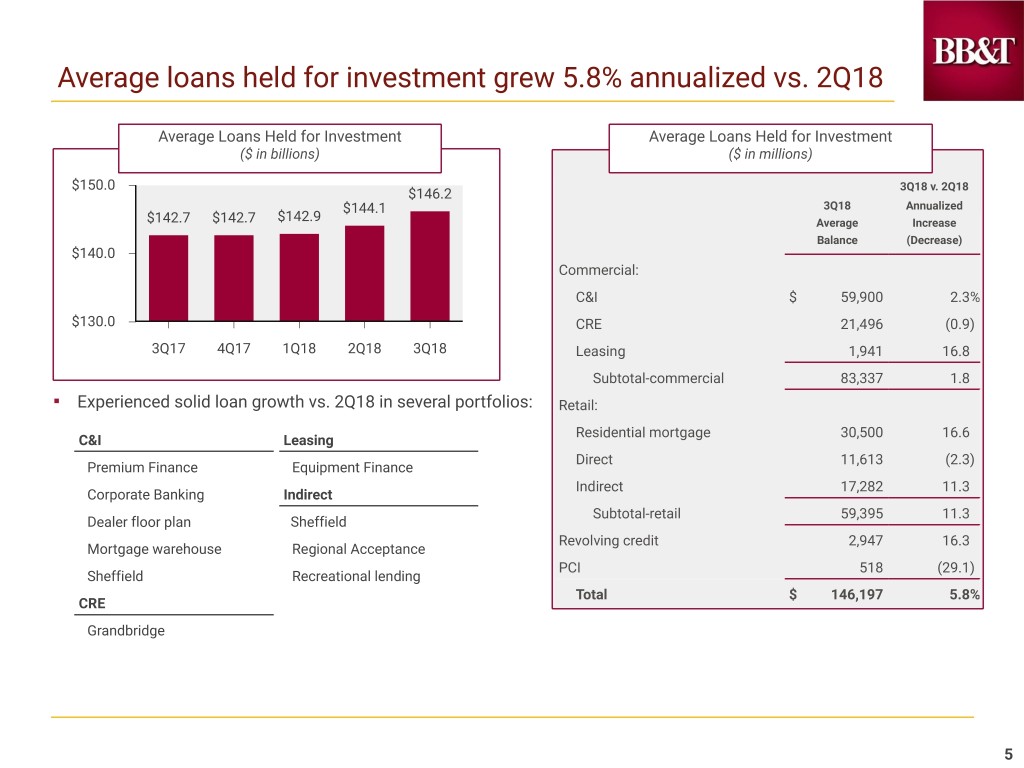

Average loans held for investment grew 5.8% annualized vs. 2Q18 Average Loans Held for Investment Average Loans Held for Investment ($ in billions) ($ in millions) $150.0 3Q18 v. 2Q18 $146.2 $144.1 3Q18 Annualized $142.7 $142.7 $142.9 Average Increase Balance (Decrease) $140.0 Commercial: C&I $ 59,900 2.3% $130.0 CRE 21,496 (0.9) 3Q17 4Q17 1Q18 2Q18 3Q18 Leasing 1,941 16.8 Subtotal-commercial 83,337 1.8 ▪ Experienced solid loan growth vs. 2Q18 in several portfolios: Retail: Residential mortgage 30,500 16.6 C&I Leasing Direct 11,613 (2.3) Premium Finance Equipment Finance Indirect 17,282 11.3 Corporate Banking Indirect Subtotal-retail 59,395 11.3 Dealer floor plan Sheffield Revolving credit 2,947 16.3 Mortgage warehouse Regional Acceptance PCI 518 (29.1) Sheffield Recreational lending Total $ 146,197 5.8% CRE Grandbridge 5

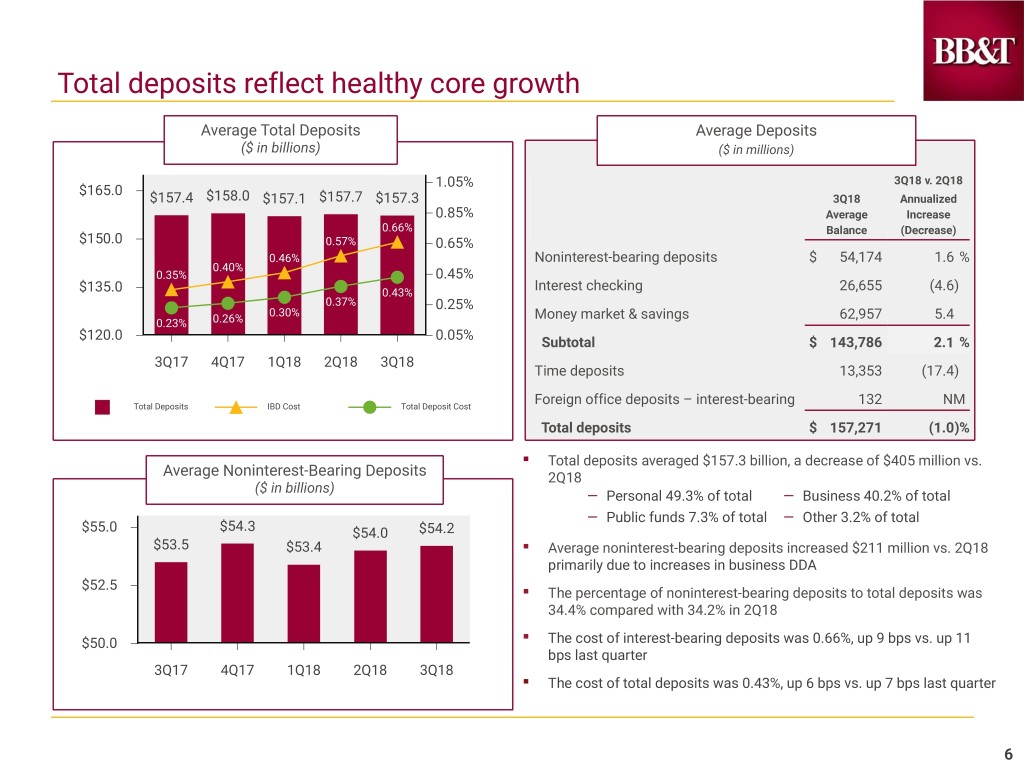

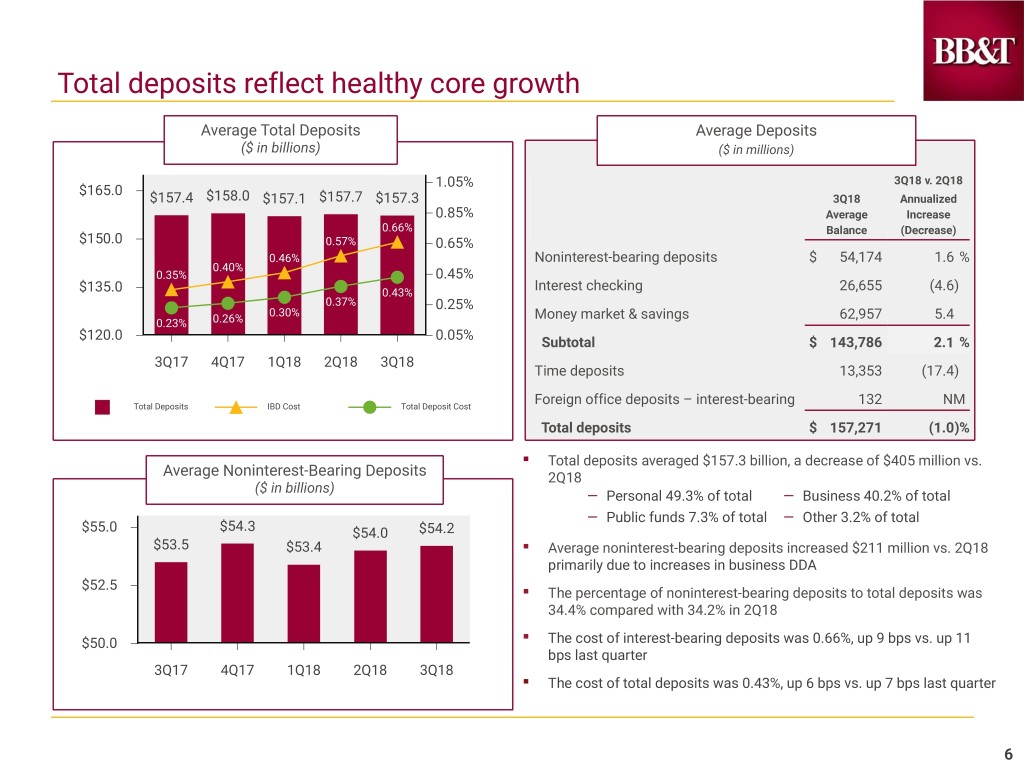

Total deposits reflect healthy core growth Average Total Deposits Average Deposits ($ in billions) ($ in millions) 1.05% 3Q18 v. 2Q18 $165.0 $157.4 $158.0 $157.1 $157.7 $157.3 3Q18 Annualized 0.85% Average Increase 0.66% Balance (Decrease) $150.0 0.57% 0.65% 0.46% Noninterest-bearing deposits $ 54,174 1.6 % 0.40% 0.35% 0.45% $135.0 0.43% Interest checking 26,655 (4.6) 0.37% 0.25% 0.30% Money market & savings 62,957 5.4 0.23% 0.26% $120.0 0.05% Subtotal $ 143,786 2.1 % 3Q17 4Q17 1Q18 2Q18 3Q18 Time deposits 13,353 (17.4) Total Deposits IBD Cost Total Deposit Cost Foreign office deposits – interest-bearing 132 NM Total deposits $ 157,271 (1.0)% ▪ Total deposits averaged $157.3 billion, a decrease of $405 million vs. Average Noninterest-Bearing Deposits 2Q18 ($ in billions) — Personal 49.3% of total — Business 40.2% of total — Public funds 7.3% of total — Other 3.2% of total $55.0 $54.3 $54.0 $54.2 $53.5 $53.4 ▪ Average noninterest-bearing deposits increased $211 million vs. 2Q18 primarily due to increases in business DDA $52.5 ▪ The percentage of noninterest-bearing deposits to total deposits was 34.4% compared with 34.2% in 2Q18 $50.0 ▪ The cost of interest-bearing deposits was 0.66%, up 9 bps vs. up 11 bps last quarter 3Q17 4Q17 1Q18 2Q18 3Q18 ▪ The cost of total deposits was 0.43%, up 6 bps vs. up 7 bps last quarter 6

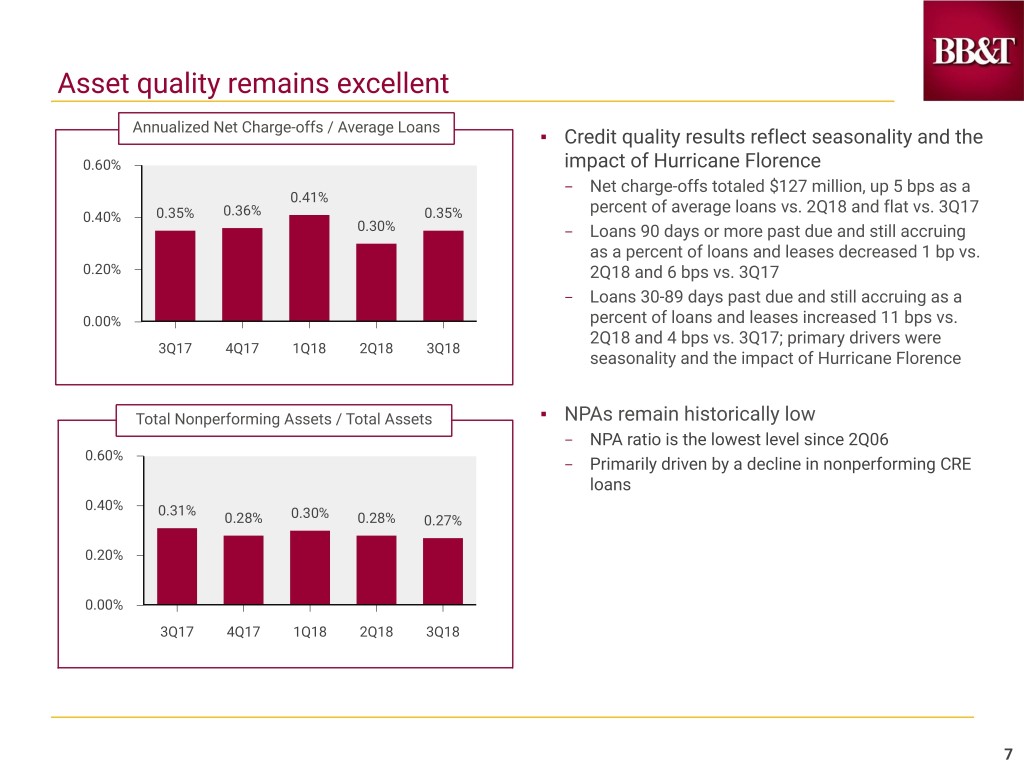

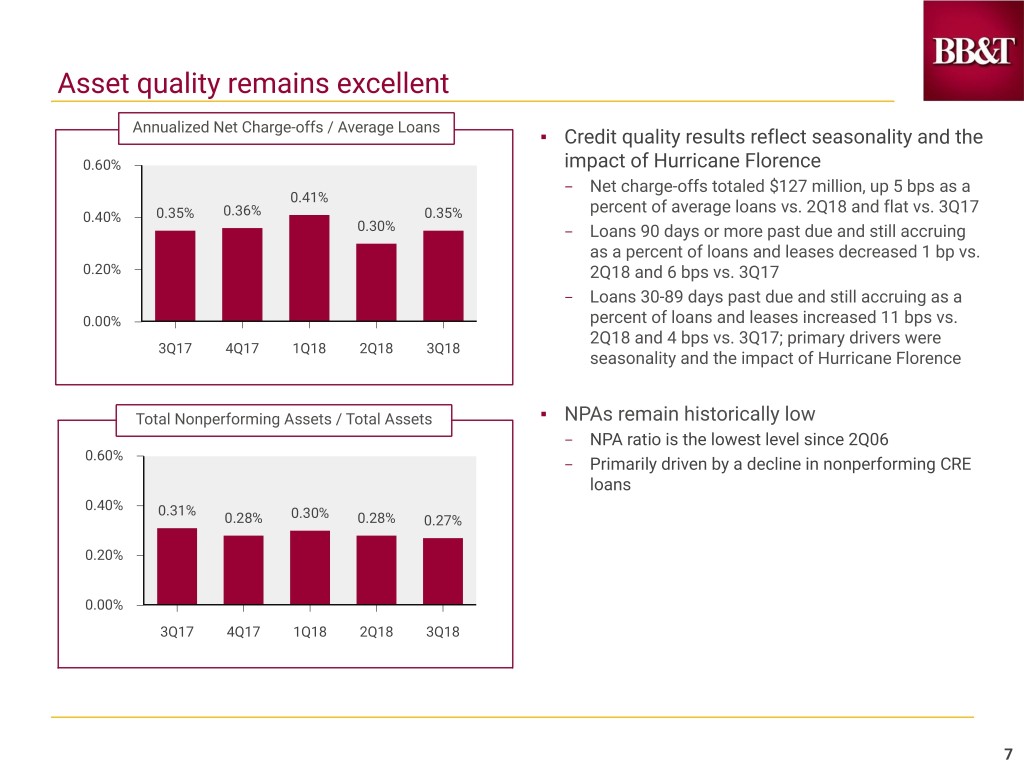

Asset quality remains excellent Annualized Net Charge-offs / Average Loans ▪ Credit quality results reflect seasonality and the 0.60% impact of Hurricane Florence – Net charge-offs totaled $127 million, up 5 bps as a 0.41% percent of average loans vs. 2Q18 and flat vs. 3Q17 0.40% 0.35% 0.36% 0.35% 0.30% – Loans 90 days or more past due and still accruing as a percent of loans and leases decreased 1 bp vs. 0.20% 2Q18 and 6 bps vs. 3Q17 – Loans 30-89 days past due and still accruing as a 0.00% percent of loans and leases increased 11 bps vs. 2Q18 and 4 bps vs. 3Q17; primary drivers were 3Q17 4Q17 1Q18 2Q18 3Q18 seasonality and the impact of Hurricane Florence Total Nonperforming Assets / Total Assets ▪ NPAs remain historically low – NPA ratio is the lowest level since 2Q06 0.60% – Primarily driven by a decline in nonperforming CRE loans 0.40% 0.31% 0.30% 0.28% 0.28% 0.27% 0.20% 0.00% 3Q17 4Q17 1Q18 2Q18 3Q18 7

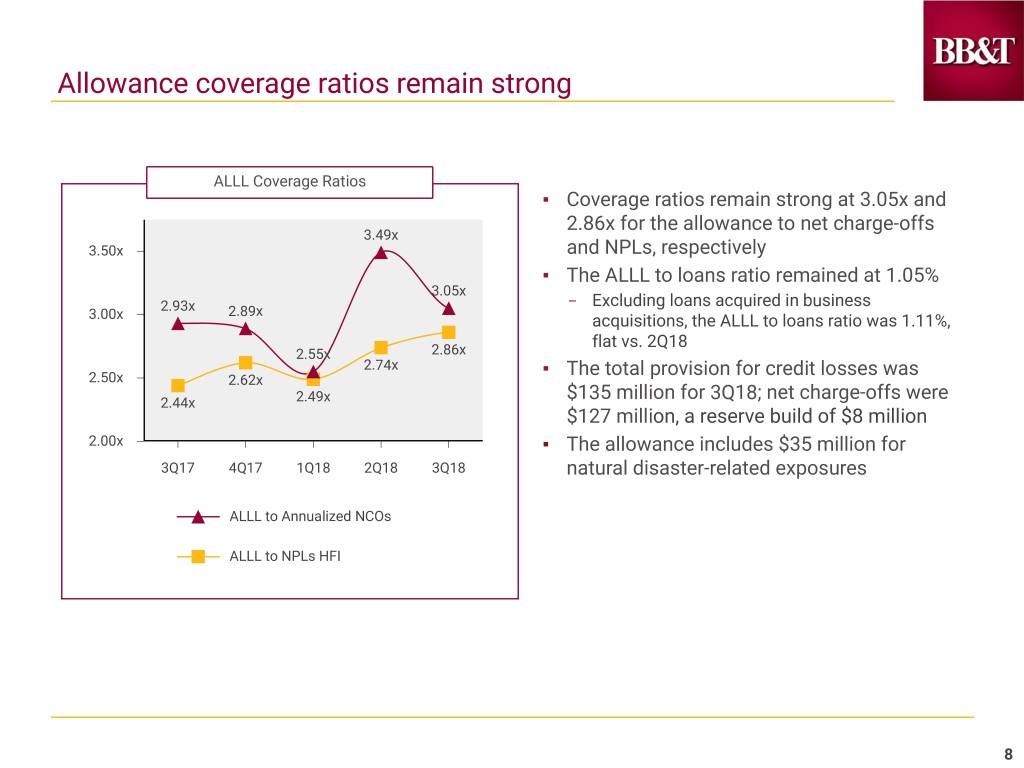

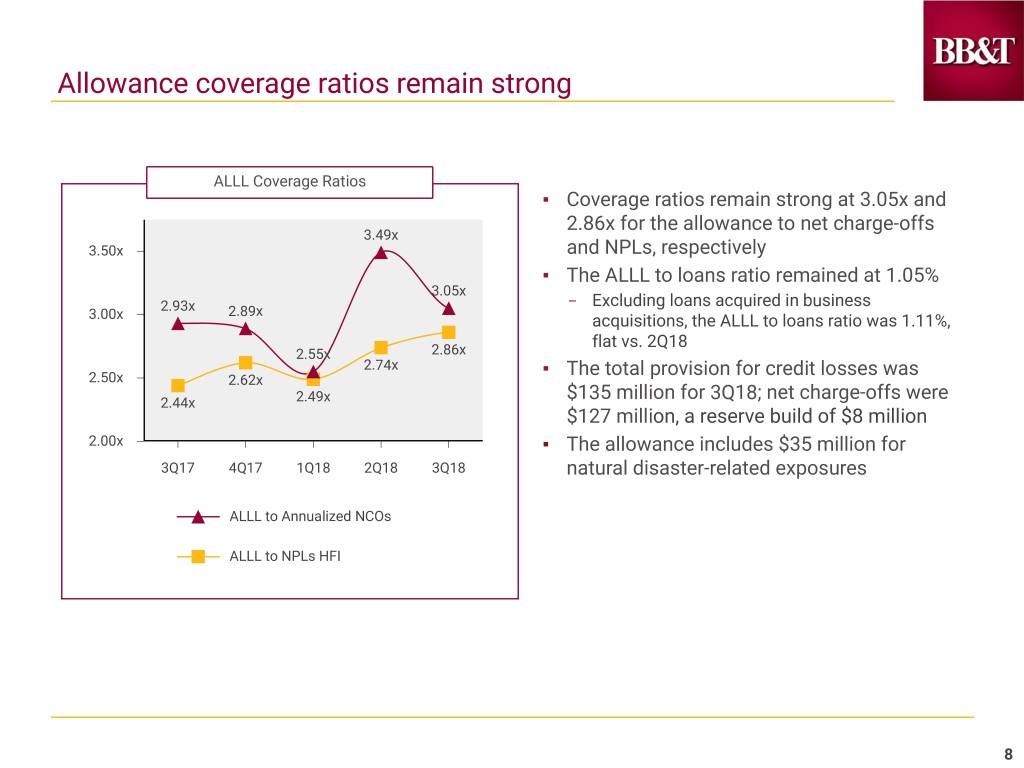

Allowance coverage ratios remain strong ALLL Coverage Ratios ▪ Coverage ratios remain strong at 3.05x and 2.86x for the allowance to net charge-offs 3.49x 3.50x and NPLs, respectively ▪ The ALLL to loans ratio remained at 1.05% 3.05x – Excluding loans acquired in business 2.93x 2.89x 3.00x acquisitions, the ALLL to loans ratio was 1.11%, flat vs. 2Q18 2.55x 2.86x 2.74x ▪ The total provision for credit losses was 2.50x 2.62x $135 million for 3Q18; net charge-offs were 2.44x 2.49x $127 million, a reserve build of $8 million 2.00x ▪ The allowance includes $35 million for 3Q17 4Q17 1Q18 2Q18 3Q18 natural disaster-related exposures ALLL to Annualized NCOs ALLL to NPLs HFI 8

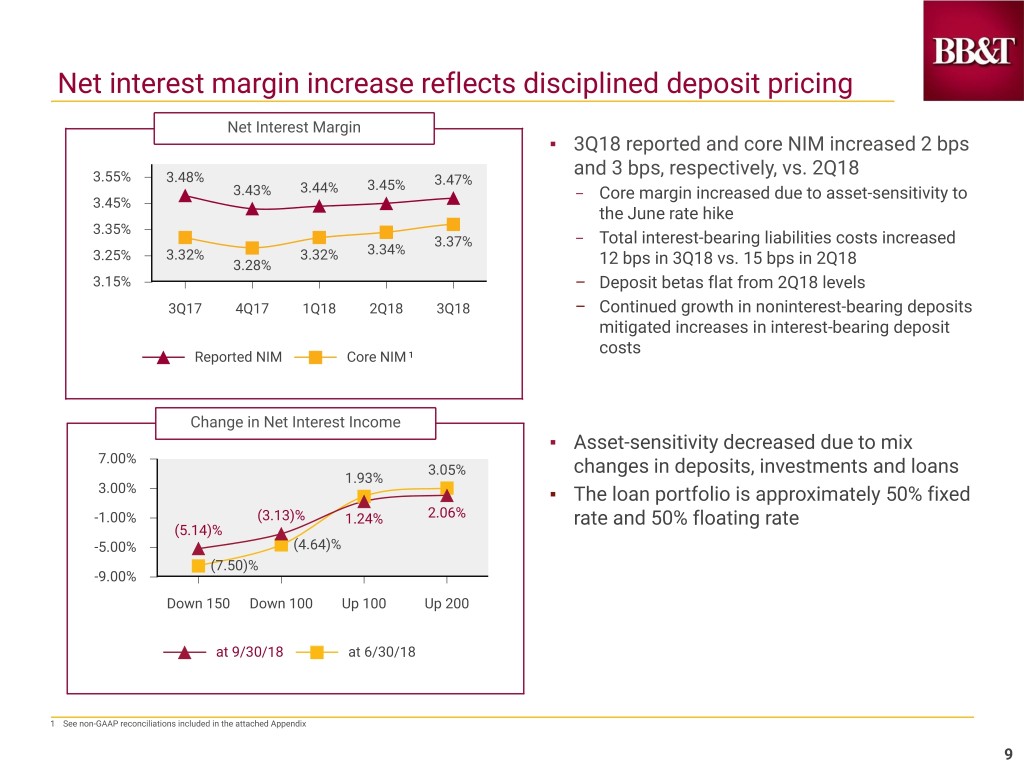

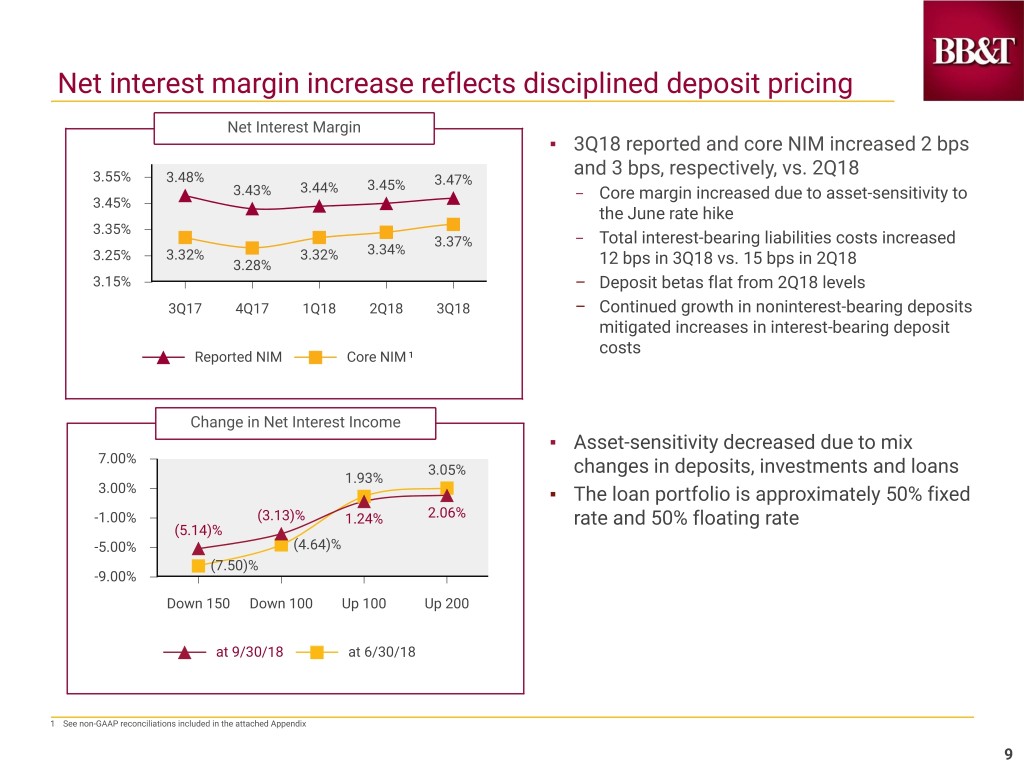

Net interest margin increase reflects disciplined deposit pricing Net Interest Margin ▪ 3Q18 reported and core NIM increased 2 bps 3.55% 3.48% and 3 bps, respectively, vs. 2Q18 3.45% 3.47% 3.43% 3.44% – Core margin increased due to asset-sensitivity to 3.45% the June rate hike 3.35% 3.37% – Total interest-bearing liabilities costs increased 3.25% 3.32% 3.32% 3.34% 3.28% 12 bps in 3Q18 vs. 15 bps in 2Q18 3.15% – Deposit betas flat from 2Q18 levels 3Q17 4Q17 1Q18 2Q18 3Q18 – Continued growth in noninterest-bearing deposits mitigated increases in interest-bearing deposit costs Reported NIM Core NIM 1 Change in Net Interest Income ▪ Asset-sensitivity decreased due to mix 7.00% 3.05% changes in deposits, investments and loans 1.93% 3.00% ▪ The loan portfolio is approximately 50% fixed -1.00% (3.13)% 1.24% 2.06% rate and 50% floating rate (5.14)% -5.00% (4.64)% (7.50)% -9.00% Down 150 Down 100 Up 100 Up 200 at 9/30/18 at 6/30/18 1 See non-GAAP reconciliations included in the attached Appendix 9

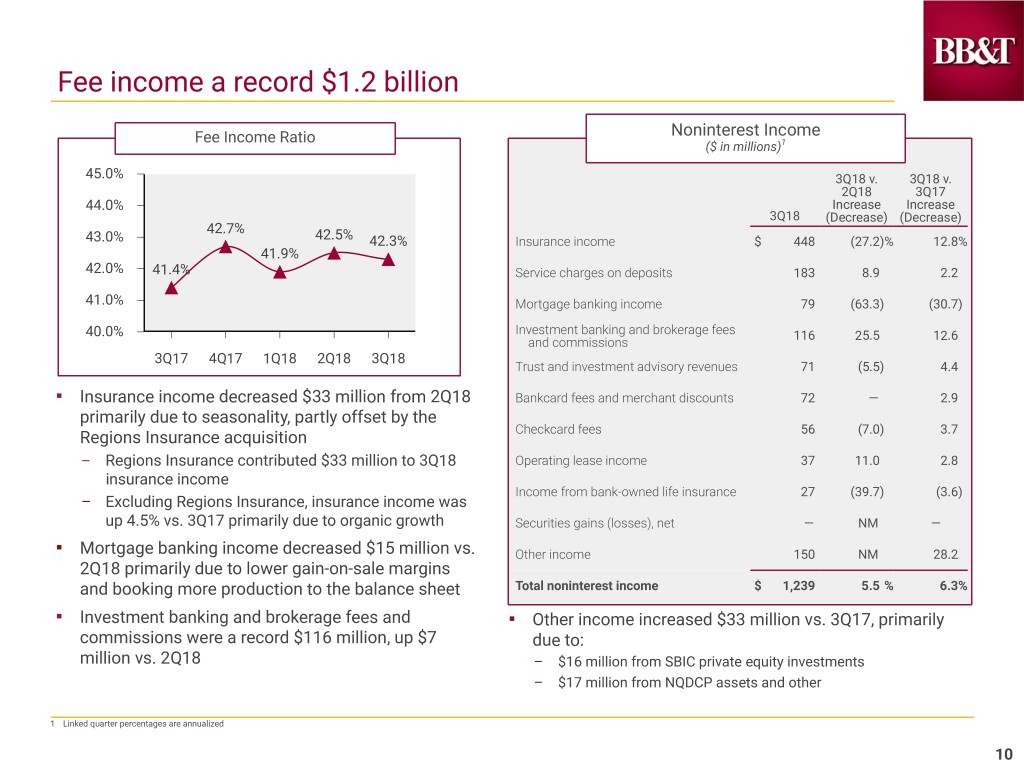

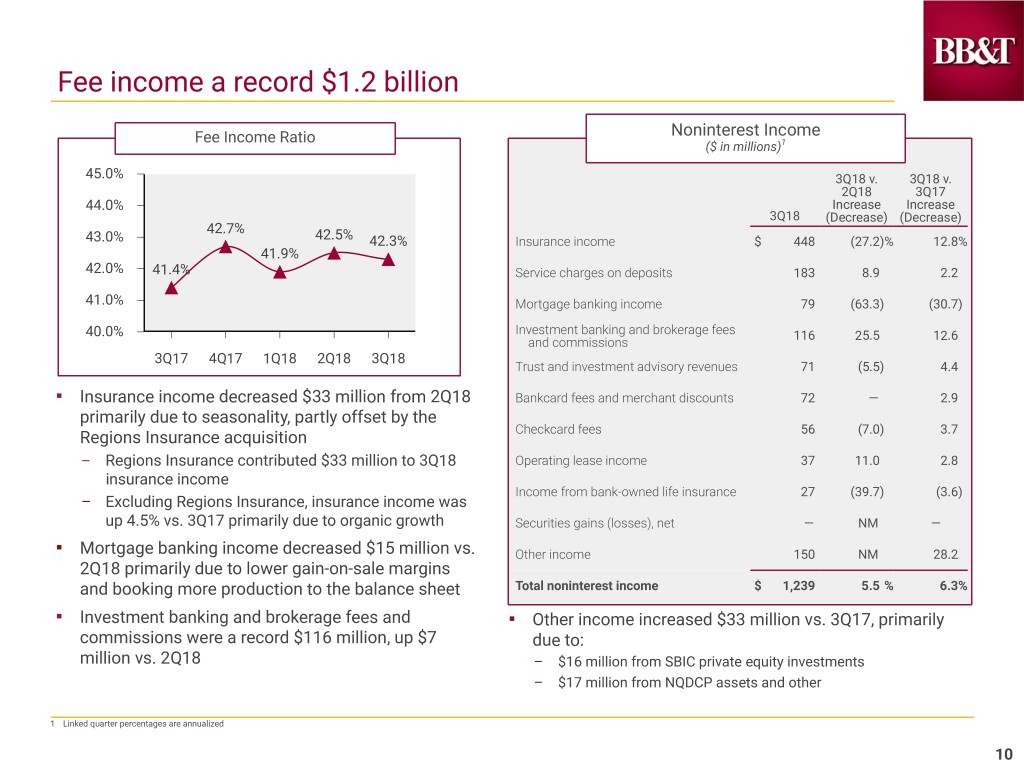

Fee income a record $1.2 billion Fee Income Ratio Noninterest Income ($ in millions)1 45.0% 3Q18 v. 3Q18 v. 2Q18 3Q17 44.0% Increase Increase 3Q18 (Decrease) (Decrease) 42.7% 43.0% 42.5% 42.3% Insurance income $ 448 (27.2)% 12.8% 41.9% 42.0% 41.4% Service charges on deposits 183 8.9 2.2 41.0% Mortgage banking income 79 (63.3) (30.7) 40.0% Investment banking and brokerage fees 116 25.5 12.6 and commissions 3Q17 4Q17 1Q18 2Q18 3Q18 Trust and investment advisory revenues 71 (5.5) 4.4 ▪ Insurance income decreased $33 million from 2Q18 Bankcard fees and merchant discounts 72 — 2.9 primarily due to seasonality, partly offset by the Regions Insurance acquisition Checkcard fees 56 (7.0) 3.7 – Regions Insurance contributed $33 million to 3Q18 Operating lease income 37 11.0 2.8 insurance income Income from bank-owned life insurance 27 (39.7) (3.6) – Excluding Regions Insurance, insurance income was up 4.5% vs. 3Q17 primarily due to organic growth Securities gains (losses), net — NM — ▪ Mortgage banking income decreased $15 million vs. Other income 150 NM 28.2 2Q18 primarily due to lower gain-on-sale margins and booking more production to the balance sheet Total noninterest income $ 1,239 5.5 % 6.3% ▪ Investment banking and brokerage fees and ▪ Other income increased $33 million vs. 3Q17, primarily commissions were a record $116 million, up $7 due to: million vs. 2Q18 – $16 million from SBIC private equity investments – $17 million from NQDCP assets and other 1 Linked quarter percentages are annualized 10

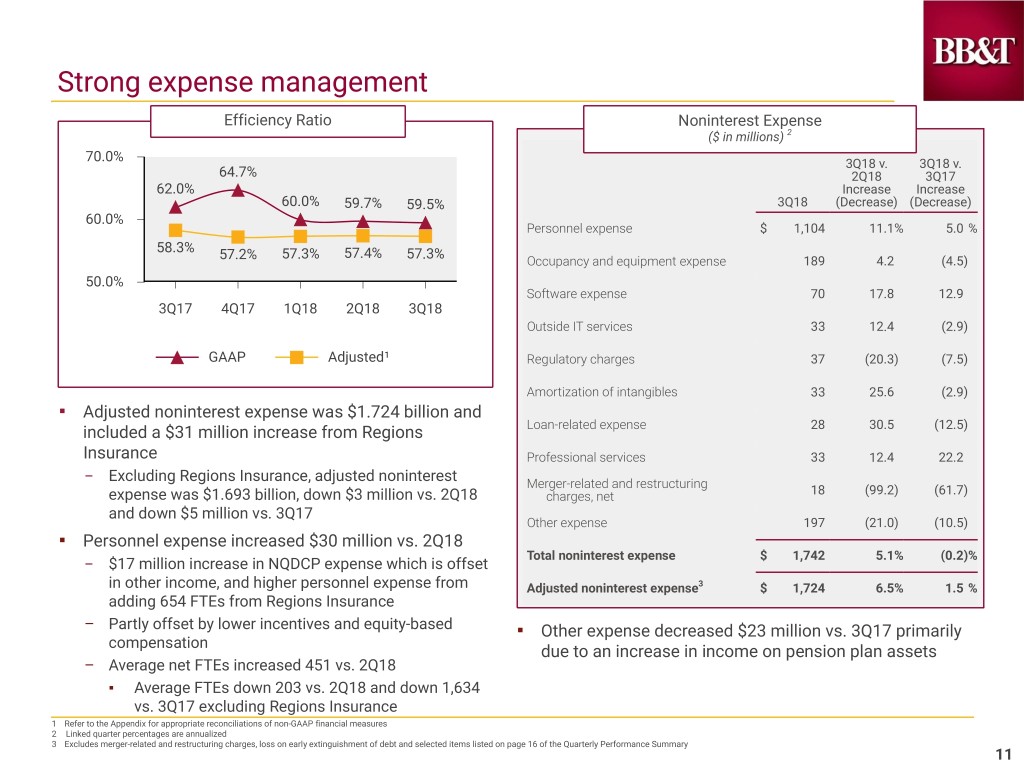

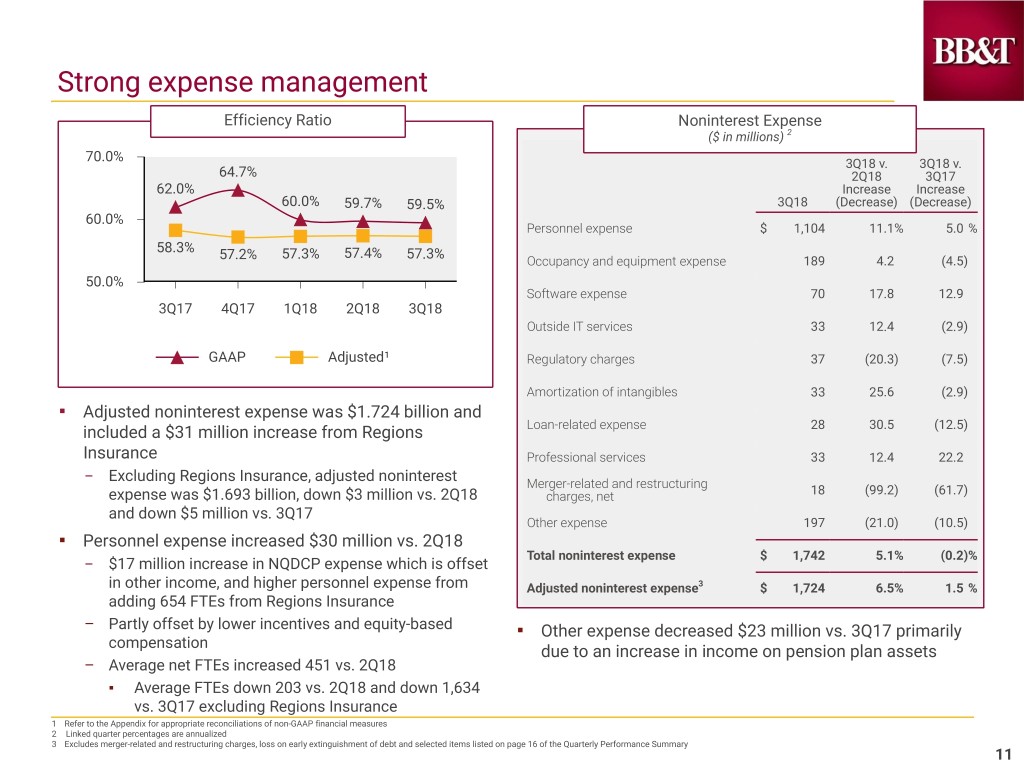

Strong expense management Efficiency Ratio Noninterest Expense ($ in millions) 2 70.0% 3Q18 v. 3Q18 v. 64.7% 2Q18 3Q17 62.0% Increase Increase 60.0% 59.7% 59.5% 3Q18 (Decrease) (Decrease) 60.0% Personnel expense $ 1,104 11.1% 5.0 % 58.3% 57.3% 57.4% 57.3% 57.2% Occupancy and equipment expense 189 4.2 (4.5) 50.0% Software expense 70 17.8 12.9 3Q17 4Q17 1Q18 2Q18 3Q18 Outside IT services 33 12.4 (2.9) GAAP Adjusted1 Regulatory charges 37 (20.3) (7.5) Amortization of intangibles 33 25.6 (2.9) ▪ Adjusted noninterest expense was $1.724 billion and included a $31 million increase from Regions Loan-related expense 28 30.5 (12.5) Insurance Professional services 33 12.4 22.2 – Excluding Regions Insurance, adjusted noninterest Merger-related and restructuring expense was $1.693 billion, down $3 million vs. 2Q18 charges, net 18 (99.2) (61.7) and down $5 million vs. 3Q17 Other expense 197 (21.0) (10.5) ▪ Personnel expense increased $30 million vs. 2Q18 Total noninterest expense $ 1,742 5.1% (0.2)% – $17 million increase in NQDCP expense which is offset in other income, and higher personnel expense from Adjusted noninterest expense3 $ 1,724 6.5% 1.5 % adding 654 FTEs from Regions Insurance – Partly offset by lower incentives and equity-based ▪ Other expense decreased $23 million vs. 3Q17 primarily compensation due to an increase in income on pension plan assets – Average net FTEs increased 451 vs. 2Q18 ▪ Average FTEs down 203 vs. 2Q18 and down 1,634 vs. 3Q17 excluding Regions Insurance 1 Refer to the Appendix for appropriate reconciliations of non-GAAP financial measures 2 Linked quarter percentages are annualized 3 Excludes merger-related and restructuring charges, loss on early extinguishment of debt and selected items listed on page 16 of the Quarterly Performance Summary 11

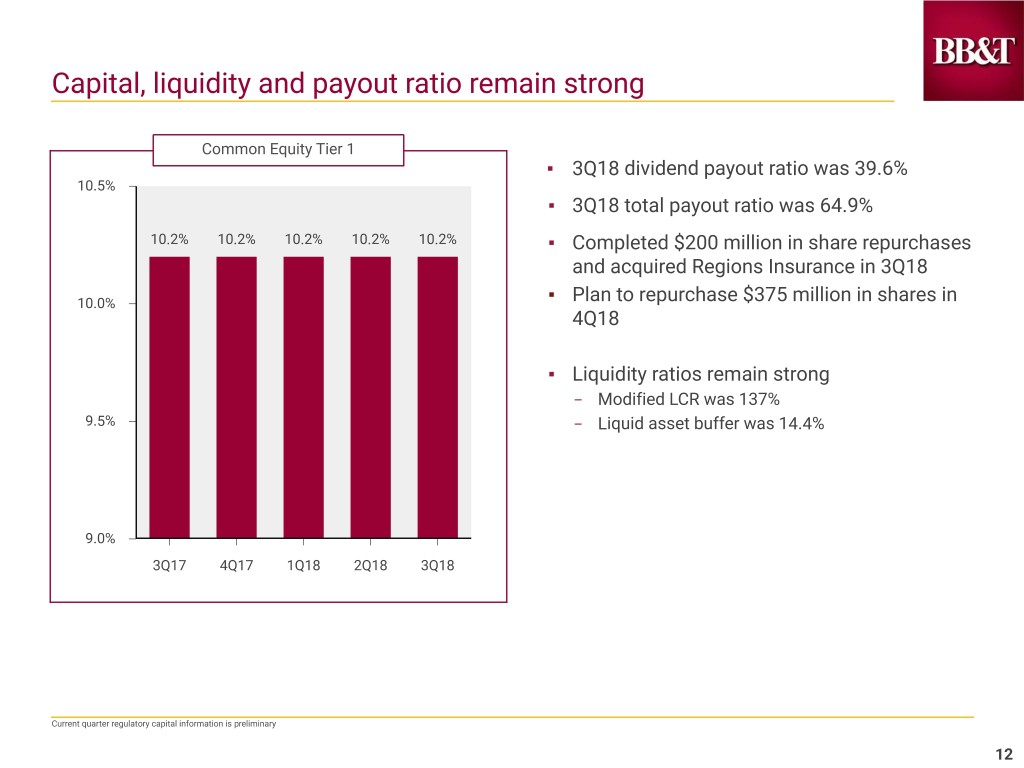

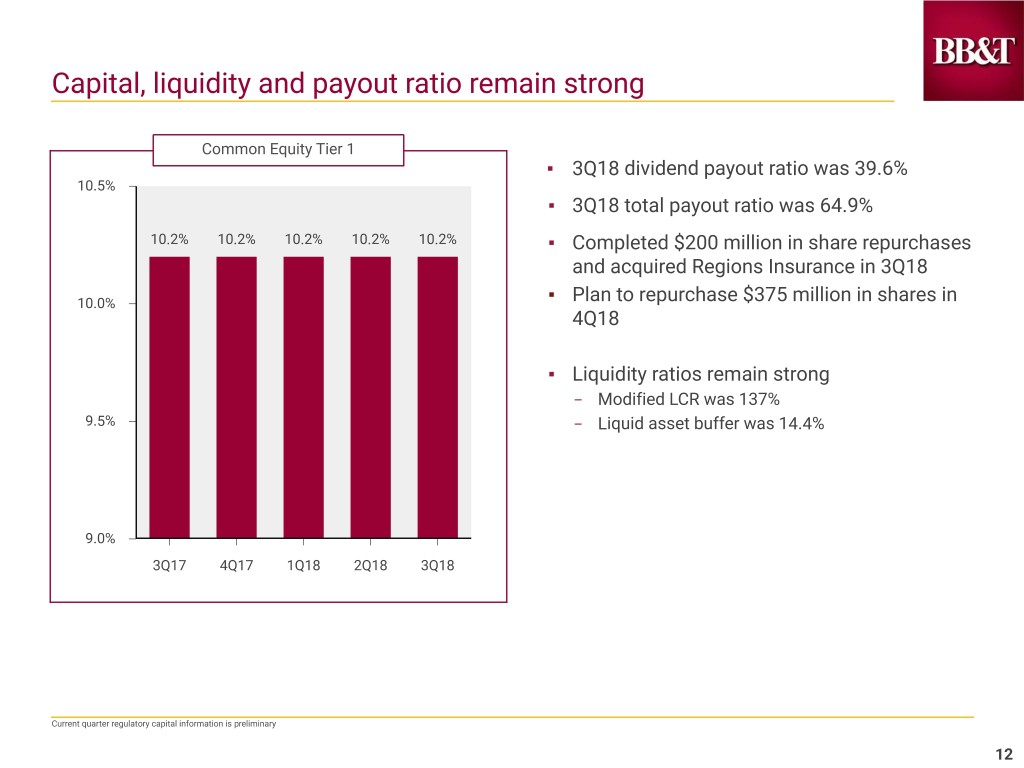

Capital, liquidity and payout ratio remain strong Common Equity Tier 1 ▪ 3Q18 dividend payout ratio was 39.6% 10.5% ▪ 3Q18 total payout ratio was 64.9% 10.2% 10.2% 10.2% 10.2% 10.2% ▪ Completed $200 million in share repurchases and acquired Regions Insurance in 3Q18 10.0% ▪ Plan to repurchase $375 million in shares in 4Q18 ▪ Liquidity ratios remain strong – Modified LCR was 137% 9.5% – Liquid asset buffer was 14.4% 9.0% 3Q17 4Q17 1Q18 2Q18 3Q18 Current quarter regulatory capital information is preliminary 12

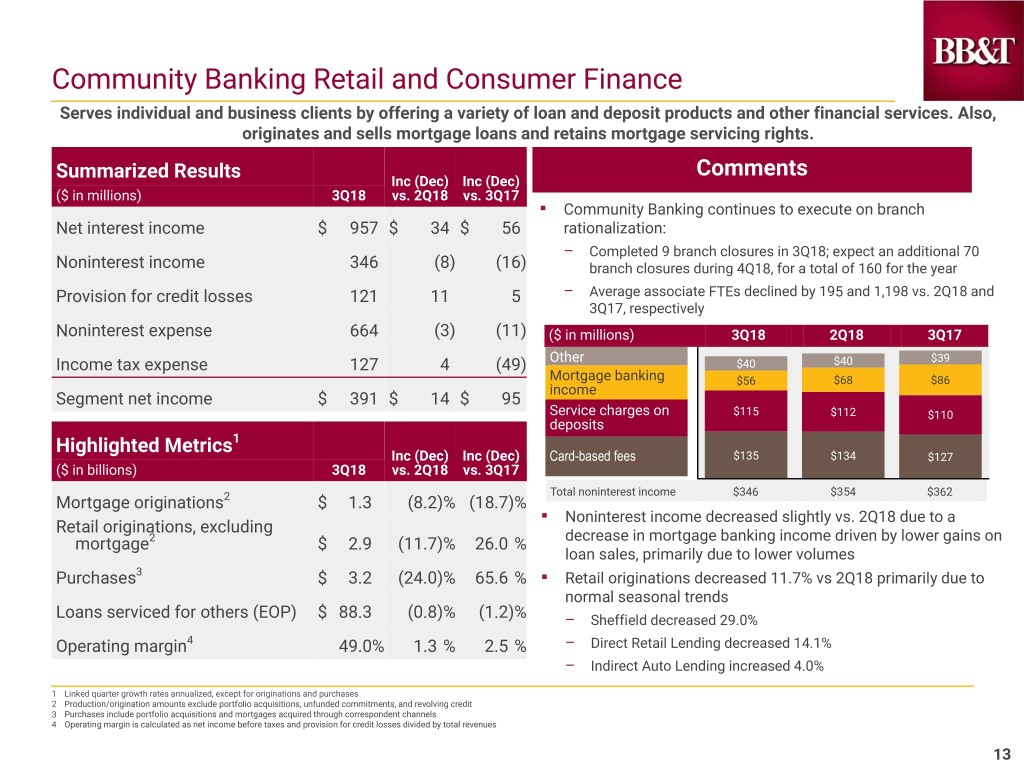

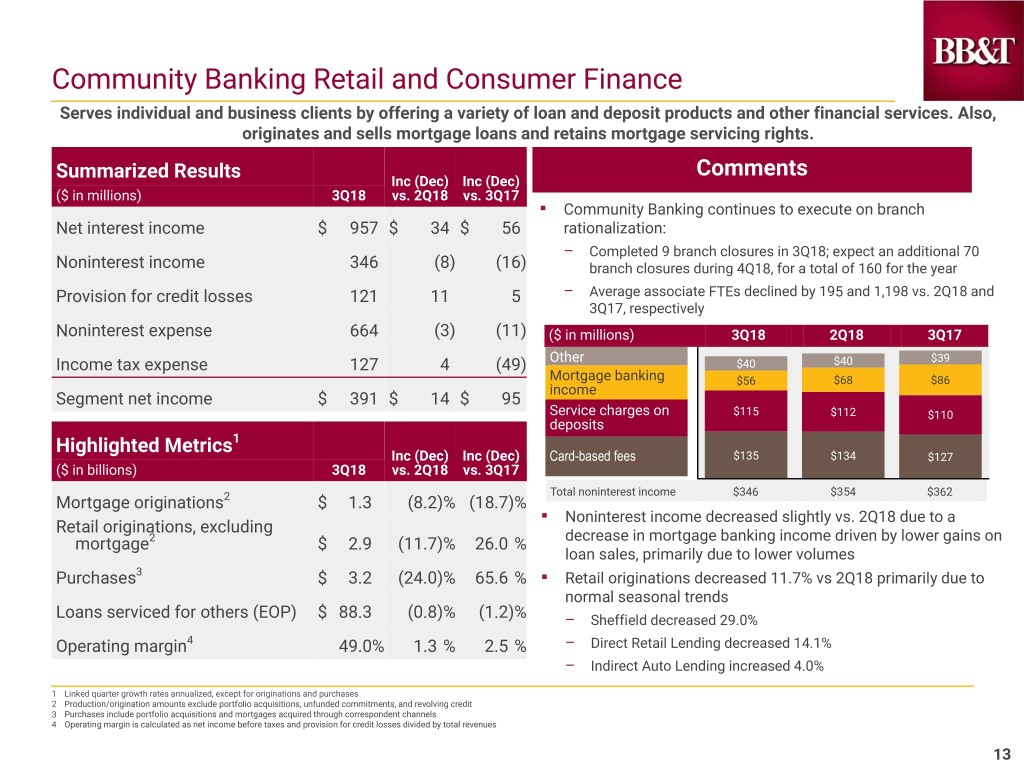

Community Banking Retail and Consumer Finance Serves individual and business clients by offering a variety of loan and deposit products and other financial services. Also, originates and sells mortgage loans and retains mortgage servicing rights. Comments Summarized Results Inc (Dec) Inc (Dec) ($ in millions) 3Q18 vs. 2Q18 vs. 3Q17 ▪ Community Banking continues to execute on branch Net interest income $ 957 $ 34 $ 56 rationalization: – Completed 9 branch closures in 3Q18; expect an additional 70 Noninterest income 346 (8) (16) branch closures during 4Q18, for a total of 160 for the year Provision for credit losses 121 11 5 – Average associate FTEs declined by 195 and 1,198 vs. 2Q18 and 3Q17, respectively Noninterest expense 664 (3) (11) ($ in millions) 3Q18 2Q18 3Q17 Other $39 Income tax expense 127 4 (49) $40 $40 Mortgage banking $56 $68 $86 income Segment net income $ 391 $ 14 $ 95 Service charges on $115 $112 $110 deposits Highlighted Metrics1 Inc (Dec) Inc (Dec) Card-based fees $135 $134 $127 ($ in billions) 3Q18 vs. 2Q18 vs. 3Q17 Total noninterest income $346 $354 $362 Mortgage originations2 $ 1.3 (8.2)% (18.7)% ▪ Noninterest income decreased slightly vs. 2Q18 due to a Retail originations, excluding mortgage2 $ 2.9 (11.7)% 26.0 % decrease in mortgage banking income driven by lower gains on loan sales, primarily due to lower volumes Purchases3 $ 3.2 (24.0)% 65.6 % ▪ Retail originations decreased 11.7% vs 2Q18 primarily due to normal seasonal trends Loans serviced for others (EOP) $ 88.3 (0.8)% (1.2)% – Sheffield decreased 29.0% Operating margin4 49.0% 1.3 % 2.5 % – Direct Retail Lending decreased 14.1% – Indirect Auto Lending increased 4.0% 1 Linked quarter growth rates annualized, except for originations and purchases 2 Production/origination amounts exclude portfolio acquisitions, unfunded commitments, and revolving credit 3 Purchases include portfolio acquisitions and mortgages acquired through correspondent channels 4 Operating margin is calculated as net income before taxes and provision for credit losses divided by total revenues 13

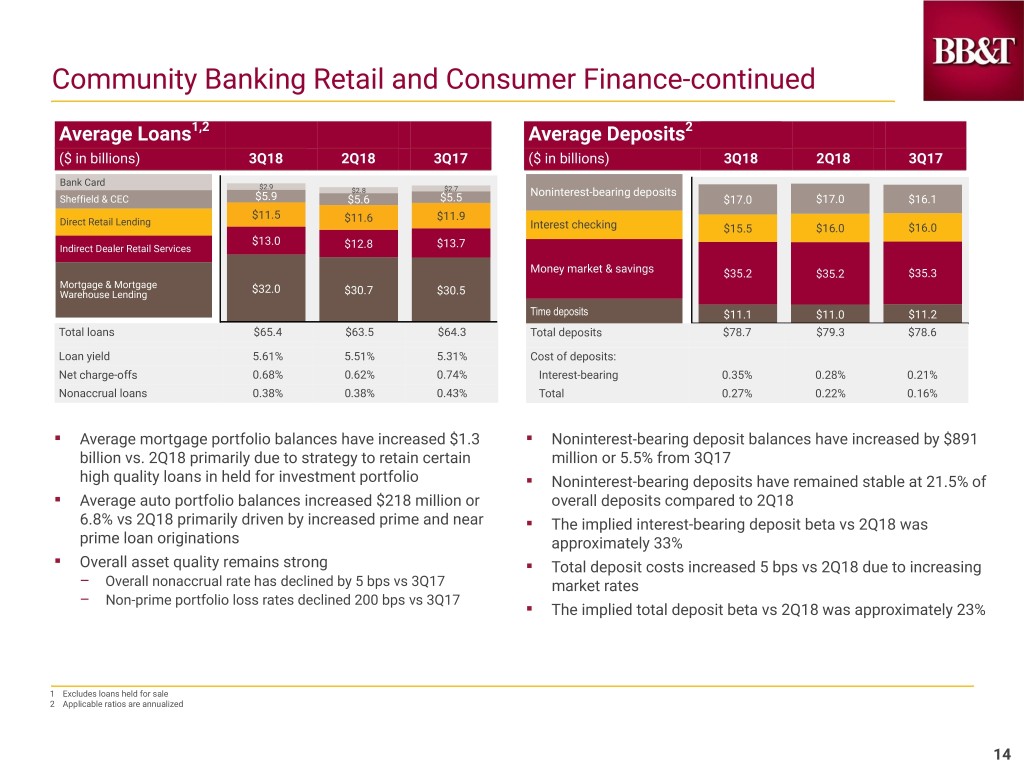

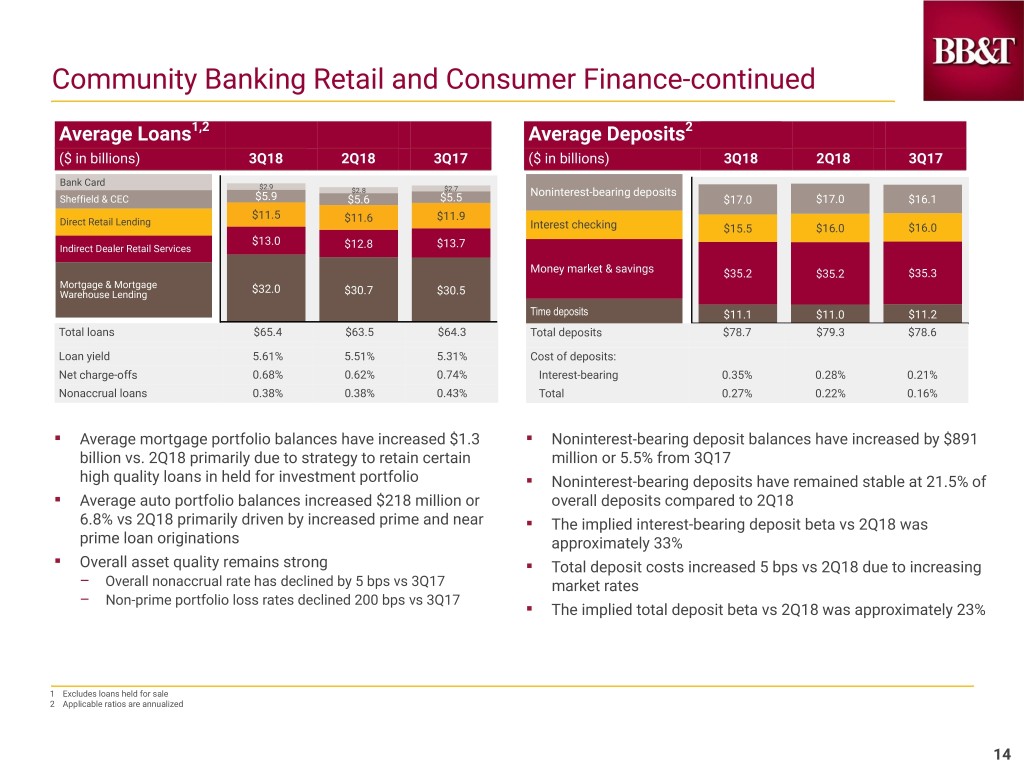

Community Banking Retail and Consumer Finance-continued Average Loans1,2 Average Deposits2 ($ in billions) 3Q18 2Q18 3Q17 ($ in billions) 3Q18 2Q18 3Q17 Bank Card $2.9 $2.8 $2.7 Noninterest-bearing deposits Sheffield & CEC $5.9 $5.6 $5.5 $17.0 $17.0 $16.1 $11.5 $11.9 Direct Retail Lending $11.6 Interest checking $15.5 $16.0 $16.0 $13.0 Indirect Dealer Retail Services $12.8 $13.7 Money market & savings $35.2 $35.2 $35.3 Mortgage & Mortgage Warehouse Lending $32.0 $30.7 $30.5 Time deposits $11.1 $11.0 $11.2 Total loans $65.4 $63.5 $64.3 Total deposits $78.7 $79.3 $78.6 Loan yield 5.61% 5.51% 5.31% Cost of deposits: Net charge-offs 0.68% 0.62% 0.74% Interest-bearing 0.35% 0.28% 0.21% Nonaccrual loans 0.38% 0.38% 0.43% Total 0.27% 0.22% 0.16% ▪ Average mortgage portfolio balances have increased $1.3 ▪ Noninterest-bearing deposit balances have increased by $891 billion vs. 2Q18 primarily due to strategy to retain certain million or 5.5% from 3Q17 high quality loans in held for investment portfolio ▪ Noninterest-bearing deposits have remained stable at 21.5% of ▪ Average auto portfolio balances increased $218 million or overall deposits compared to 2Q18 6.8% vs 2Q18 primarily driven by increased prime and near ▪ The implied interest-bearing deposit beta vs 2Q18 was prime loan originations approximately 33% ▪ Overall asset quality remains strong ▪ Total deposit costs increased 5 bps vs 2Q18 due to increasing – Overall nonaccrual rate has declined by 5 bps vs 3Q17 market rates – Non-prime portfolio loss rates declined 200 bps vs 3Q17 ▪ The implied total deposit beta vs 2Q18 was approximately 23% 1 Excludes loans held for sale 2 Applicable ratios are annualized 14

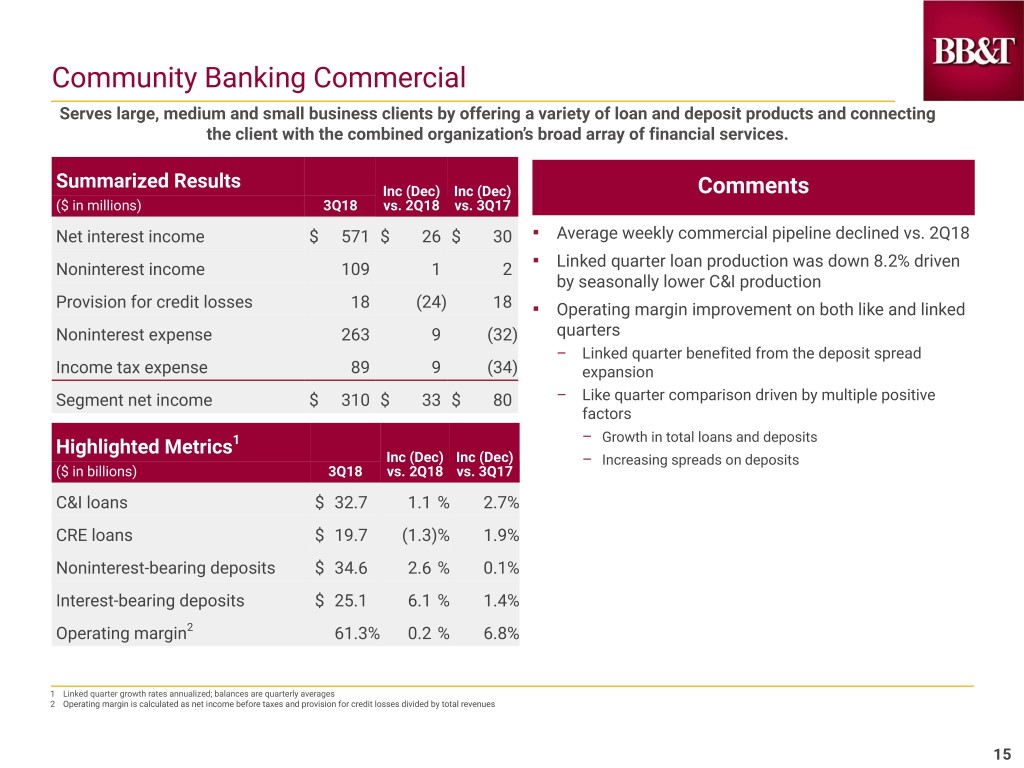

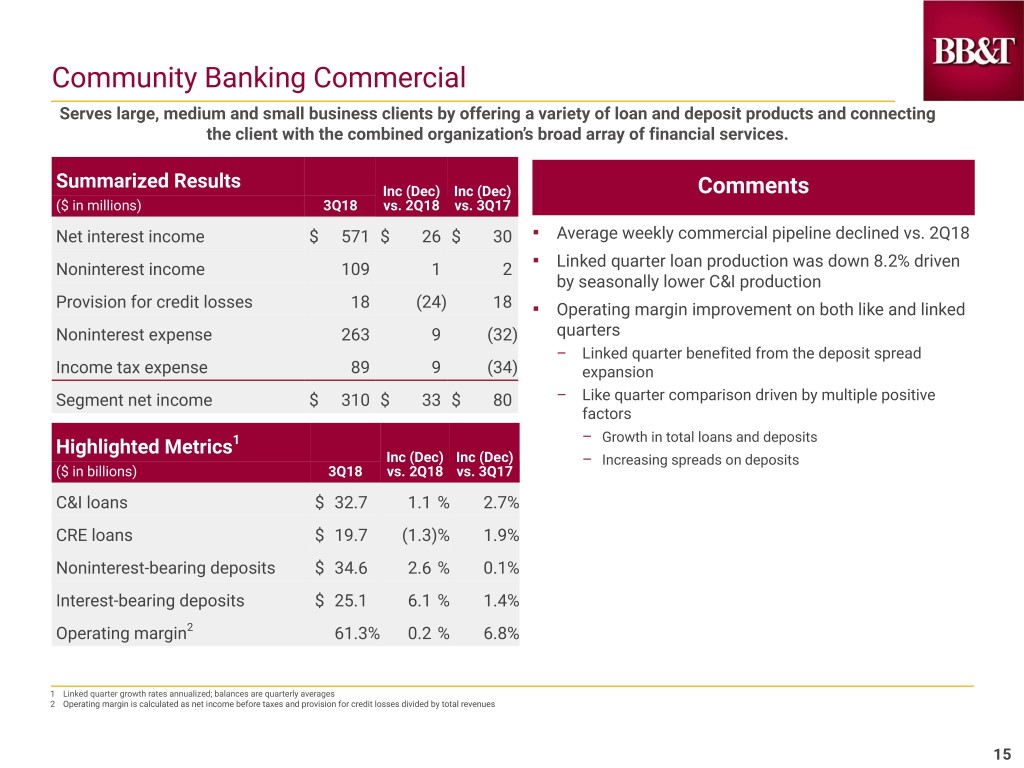

Community Banking Commercial Serves large, medium and small business clients by offering a variety of loan and deposit products and connecting the client with the combined organization’s broad array of financial services. Summarized Results Inc (Dec) Inc (Dec) Comments ($ in millions) 3Q18 vs. 2Q18 vs. 3Q17 Net interest income $ 571 $ 26 $ 30 ▪ Average weekly commercial pipeline declined vs. 2Q18 Noninterest income 109 1 2 ▪ Linked quarter loan production was down 8.2% driven by seasonally lower C&I production Provision for credit losses 18 (24) 18 ▪ Operating margin improvement on both like and linked Noninterest expense 263 9 (32) quarters – Linked quarter benefited from the deposit spread Income tax expense 89 9 (34) expansion Segment net income $ 310 $ 33 $ 80 – Like quarter comparison driven by multiple positive factors – Growth in total loans and deposits Highlighted Metrics1 Inc (Dec) Inc (Dec) – Increasing spreads on deposits ($ in billions) 3Q18 vs. 2Q18 vs. 3Q17 C&I loans $ 32.7 1.1 % 2.7% CRE loans $ 19.7 (1.3)% 1.9% Noninterest-bearing deposits $ 34.6 2.6 % 0.1% Interest-bearing deposits $ 25.1 6.1 % 1.4% Operating margin2 61.3% 0.2 % 6.8% 1 Linked quarter growth rates annualized; balances are quarterly averages 2 Operating margin is calculated as net income before taxes and provision for credit losses divided by total revenues 15

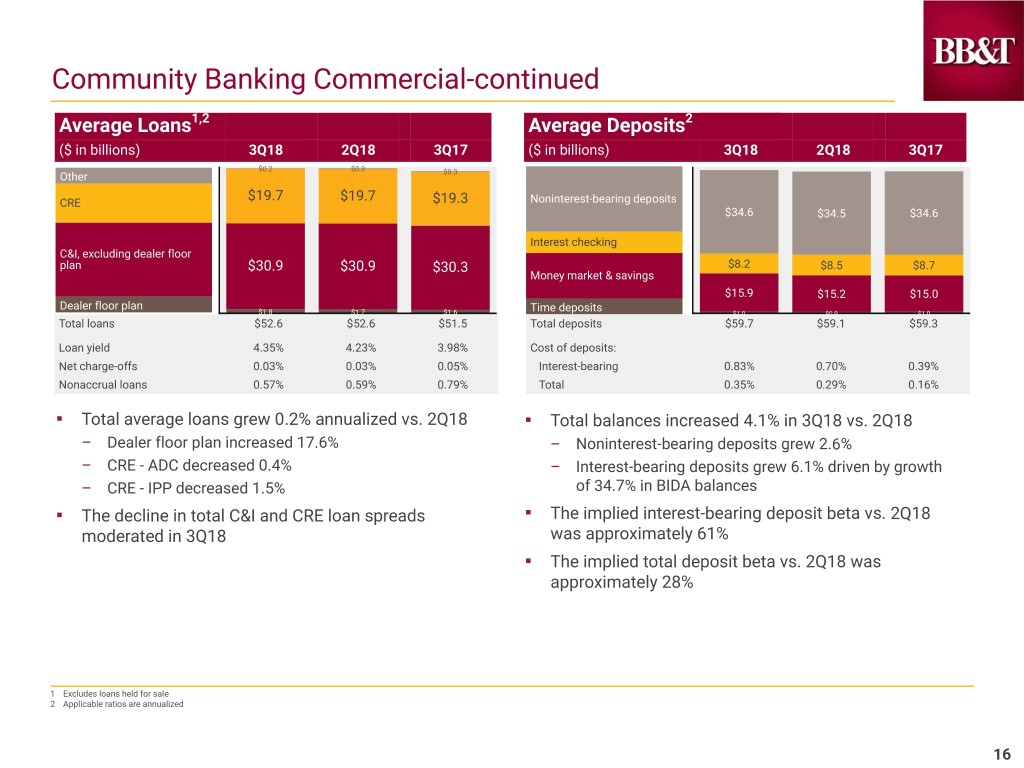

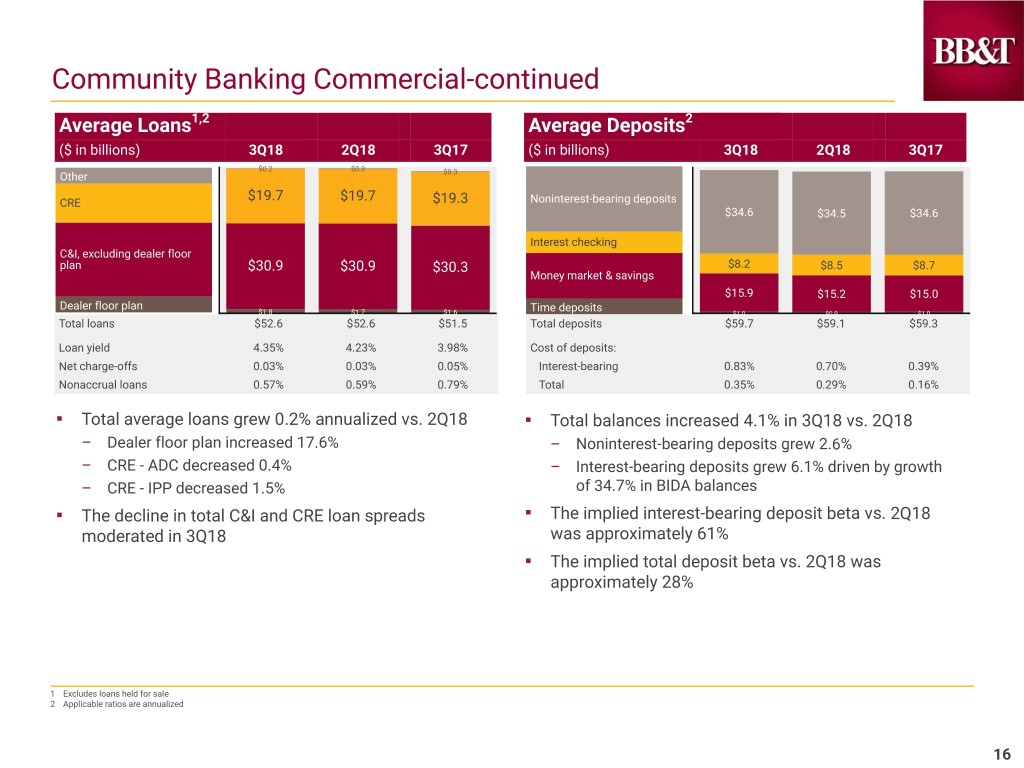

Community Banking Commercial-continued Average Loans1,2 Average Deposits2 ($ in billions) 3Q18 2Q18 3Q17 ($ in billions) 3Q18 2Q18 3Q17 $0.2 $0.3 Other $0.3 $19.7 CRE $19.7 $19.3 Noninterest-bearing deposits $34.6 $34.5 $34.6 Interest checking C&I, excluding dealer floor plan $30.9 $30.9 $30.3 $8.2 $8.5 $8.7 Money market & savings $15.9 $15.2 $15.0 Dealer floor plan Time deposits $1.8 $1.7 $1.6 $1.0 $0.9 $1.0 Total loans $52.6 $52.6 $51.5 Total deposits $59.7 $59.1 $59.3 Loan yield 4.35% 4.23% 3.98% Cost of deposits: Net charge-offs 0.03% 0.03% 0.05% Interest-bearing 0.83% 0.70% 0.39% Nonaccrual loans 0.57% 0.59% 0.79% Total 0.35% 0.29% 0.16% ▪ Total average loans grew 0.2% annualized vs. 2Q18 ▪ Total balances increased 4.1% in 3Q18 vs. 2Q18 – Dealer floor plan increased 17.6% – Noninterest-bearing deposits grew 2.6% – CRE - ADC decreased 0.4% – Interest-bearing deposits grew 6.1% driven by growth – CRE - IPP decreased 1.5% of 34.7% in BIDA balances ▪ The decline in total C&I and CRE loan spreads ▪ The implied interest-bearing deposit beta vs. 2Q18 moderated in 3Q18 was approximately 61% ▪ The implied total deposit beta vs. 2Q18 was approximately 28% 1 Excludes loans held for sale 2 Applicable ratios are annualized 16

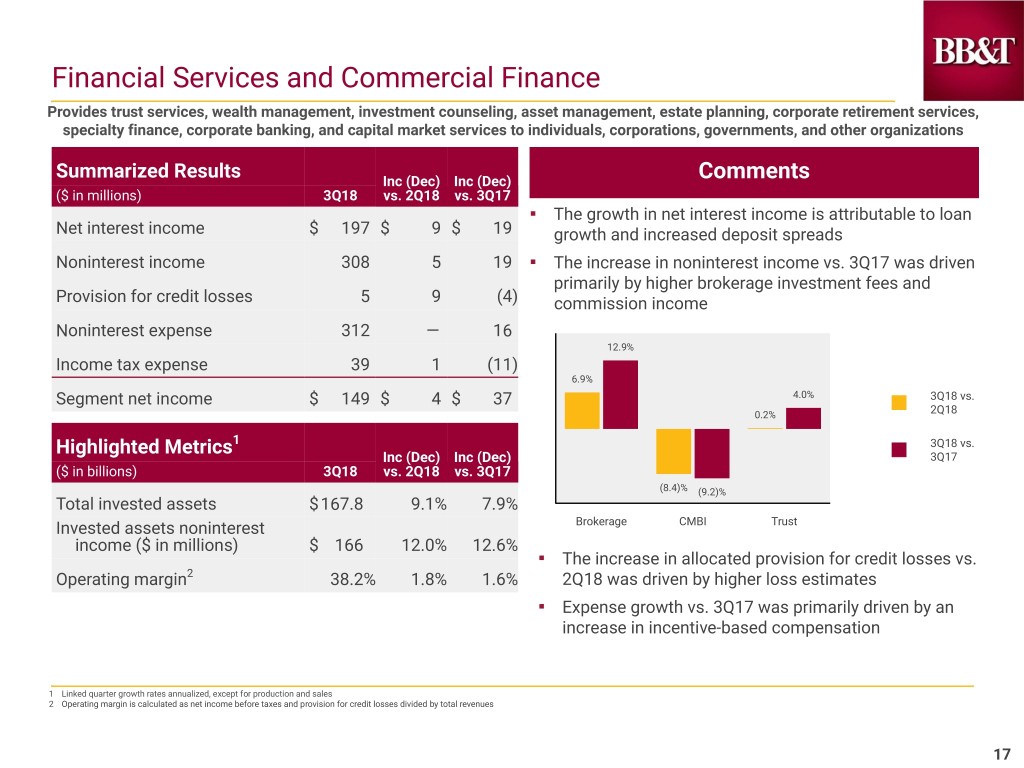

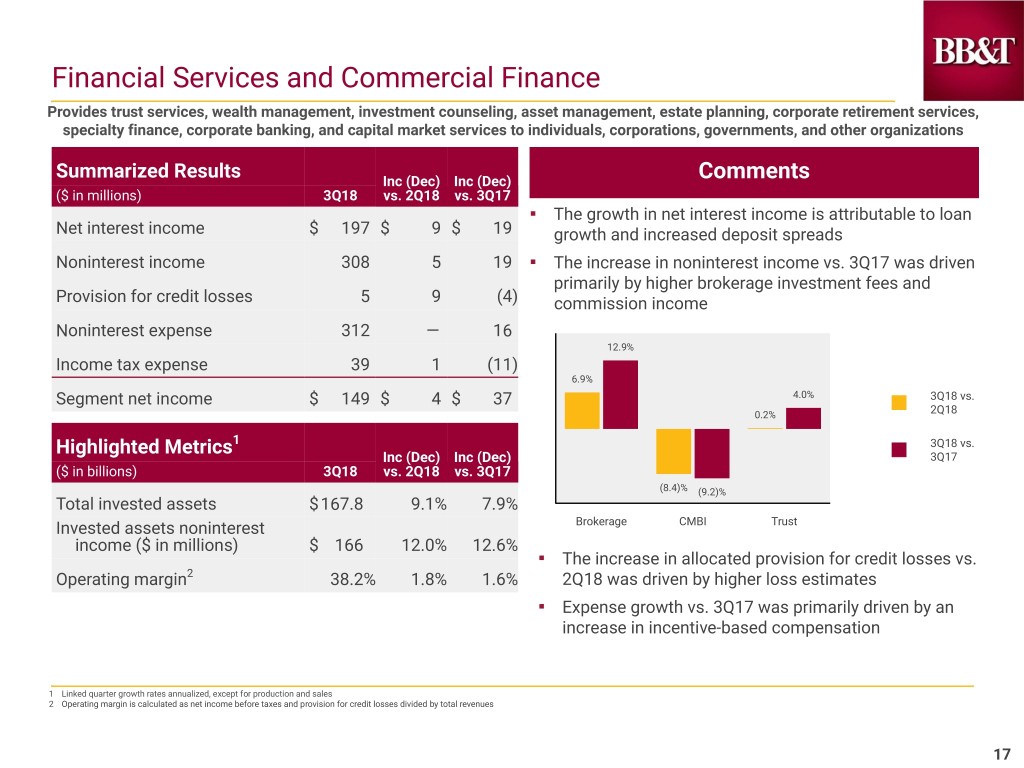

Financial Services and Commercial Finance Provides trust services, wealth management, investment counseling, asset management, estate planning, corporate retirement services, specialty finance, corporate banking, and capital market services to individuals, corporations, governments, and other organizations Summarized Results Inc (Dec) Inc (Dec) Comments ($ in millions) 3Q18 vs. 2Q18 vs. 3Q17 ▪ The growth in net interest income is attributable to loan Net interest income $ 197 $ 9 $ 19 growth and increased deposit spreads Noninterest income 308 5 19 ▪ The increase in noninterest income vs. 3Q17 was driven primarily by higher brokerage investment fees and Provision for credit losses 5 9 (4) commission income Noninterest expense 312 — 16 12.9% Income tax expense 39 1 (11) 6.9% Segment net income $ 149 $ 4 $ 37 4.0% 3Q18 vs. 0.2% 2Q18 Highlighted Metrics1 3Q18 vs. Inc (Dec) Inc (Dec) 3Q17 ($ in billions) 3Q18 vs. 2Q18 vs. 3Q17 (8.4)% (9.2)% Total invested assets $167.8 9.1% 7.9% Invested assets noninterest Brokerage CMBI Trust income ($ in millions) $ 166 12.0% 12.6% ▪ The increase in allocated provision for credit losses vs. Operating margin2 38.2% 1.8% 1.6% 2Q18 was driven by higher loss estimates ▪ Expense growth vs. 3Q17 was primarily driven by an increase in incentive-based compensation 1 Linked quarter growth rates annualized, except for production and sales 2 Operating margin is calculated as net income before taxes and provision for credit losses divided by total revenues 17

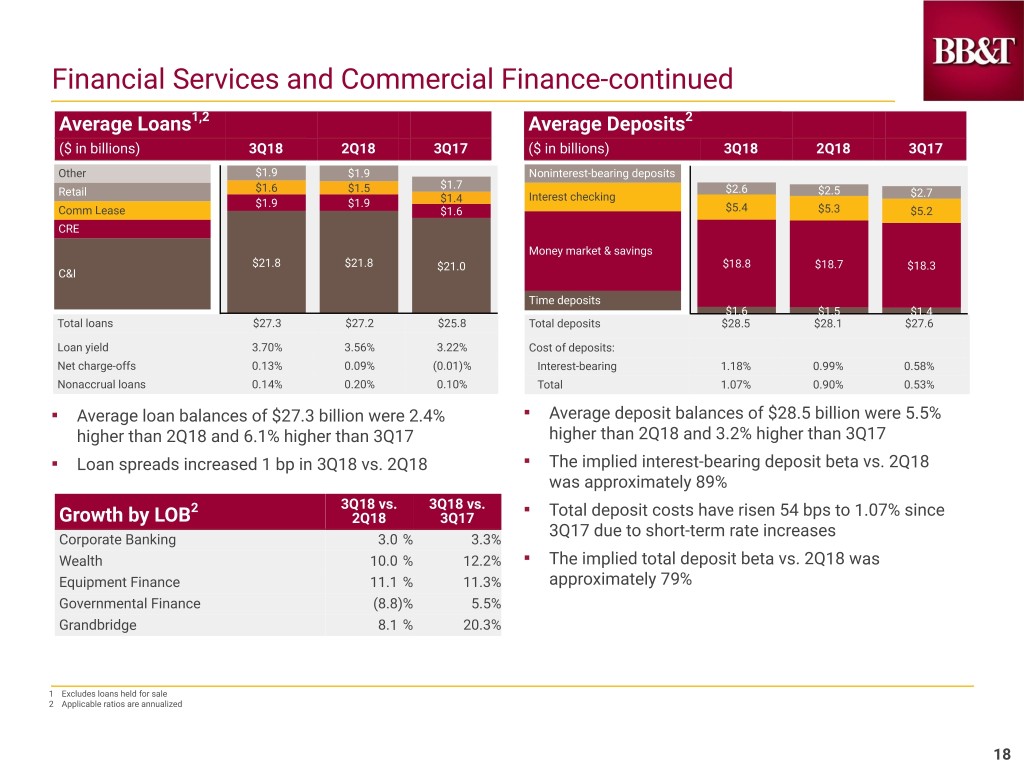

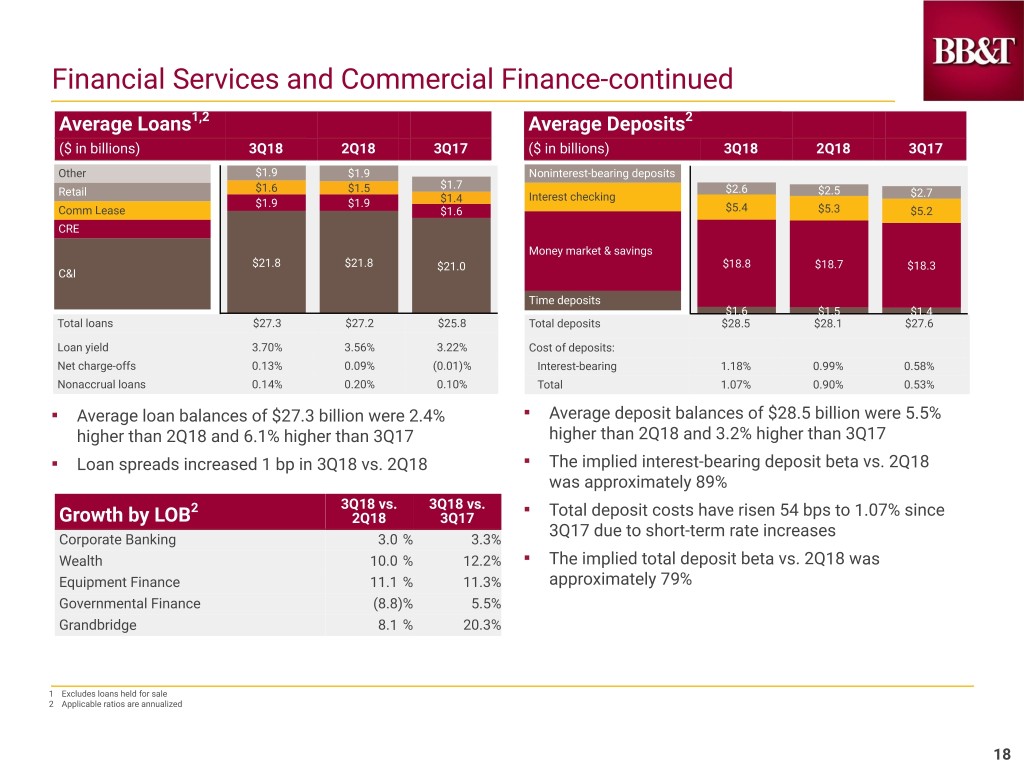

Financial Services and Commercial Finance-continued Average Loans1,2 Average Deposits2 ($ in billions) 3Q18 2Q18 3Q17 ($ in billions) 3Q18 2Q18 3Q17 Other $1.9 $1.9 Noninterest-bearing deposits $1.7 $1.6 $1.5 $2.6 $2.5 Retail Interest checking $2.7 $1.9 $1.9 $1.4 Comm Lease $1.6 $5.4 $5.3 $5.2 CRE Money market & savings $21.8 $21.8 $21.0 $18.8 $18.7 $18.3 C&I Time deposits $1.6 $1.5 $1.4 Total loans $27.3 $27.2 $25.8 Total deposits $28.5 $28.1 $27.6 Loan yield 3.70% 3.56% 3.22% Cost of deposits: Net charge-offs 0.13% 0.09% (0.01)% Interest-bearing 1.18% 0.99% 0.58% Nonaccrual loans 0.14% 0.20% 0.10% Total 1.07% 0.90% 0.53% ▪ Average loan balances of $27.3 billion were 2.4% ▪ Average deposit balances of $28.5 billion were 5.5% higher than 2Q18 and 6.1% higher than 3Q17 higher than 2Q18 and 3.2% higher than 3Q17 ▪ Loan spreads increased 1 bp in 3Q18 vs. 2Q18 ▪ The implied interest-bearing deposit beta vs. 2Q18 was approximately 89% 2 3Q18 vs. 3Q18 vs. Growth by LOB 2Q18 3Q17 ▪ Total deposit costs have risen 54 bps to 1.07% since 3Q17 due to short-term rate increases Corporate Banking 3.0 % 3.3% Wealth 10.0 % 12.2% ▪ The implied total deposit beta vs. 2Q18 was Equipment Finance 11.1 % 11.3% approximately 79% Governmental Finance (8.8)% 5.5% Grandbridge 8.1 % 20.3% 1 Excludes loans held for sale 2 Applicable ratios are annualized 18

Insurance Holdings and Premium Finance Provides property and casualty, life, and health insurance to business and individual clients. It also provides workers compensation and professional liability, as well as surety coverage, title insurance and premium finance. Summarized Results Inc (Dec) Inc (Dec) Comments ($ in millions) 3Q18 vs. 2Q18 vs. 3Q17 ▪ Insurance Holdings organic commission and fee Net interest income $ 23 $ 1 $ 4 revenue3 growth: Noninterest income 452 (32) 51 6.7% 5.0% 3Q18 vs 3Q17 Provision for credit losses 1 1 — YTD18 Noninterest expense 416 8 27 vs YTD17 Income tax expense 15 (10) 3 ▪ Organic revenue growth driven by a 9% like quarter increase in new business; YTD organic growth driven by Segment net income $ 43 $ (30) $ 25 a 12% increase in new business ▪ Insurance Holdings EBITDA margin2: Highlighted Metrics 16.4% Inc (Dec) Inc (Dec) 11.4% ($ in millions) 3Q18 vs. 2Q18 vs. 3Q17 3Q18 1 Total agencies 242 31 28 3Q17 Insurance Holdings EBITDA margin2 16.4% (5.9)% 5.0% ▪ Lower noninterest income vs. 2Q18 primarily reflects seasonality in commercial property and casualty insurance ▪ Higher noninterest income and noninterest expense vs. 3Q17 was primarily due to organic growth and the addition of Regions Insurance Group 1 U.S. locations; count includes shared locations 2 EBITDA margin is a measurement of operating profitability calculated by dividing pre-tax net income adjusted to add back interest, depreciation, intangible amortization and merger-related charges by total revenue 3 Organic commission and fee revenue excludes performance-based commissions and revenue from acquisitions within the previous 12 months 19

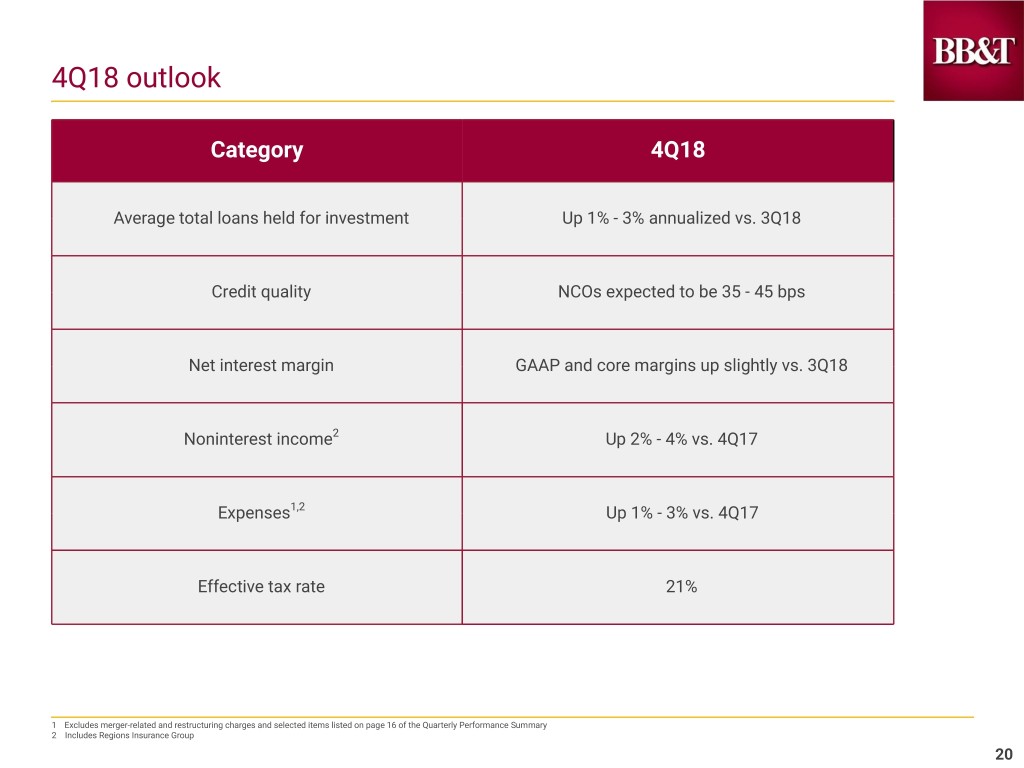

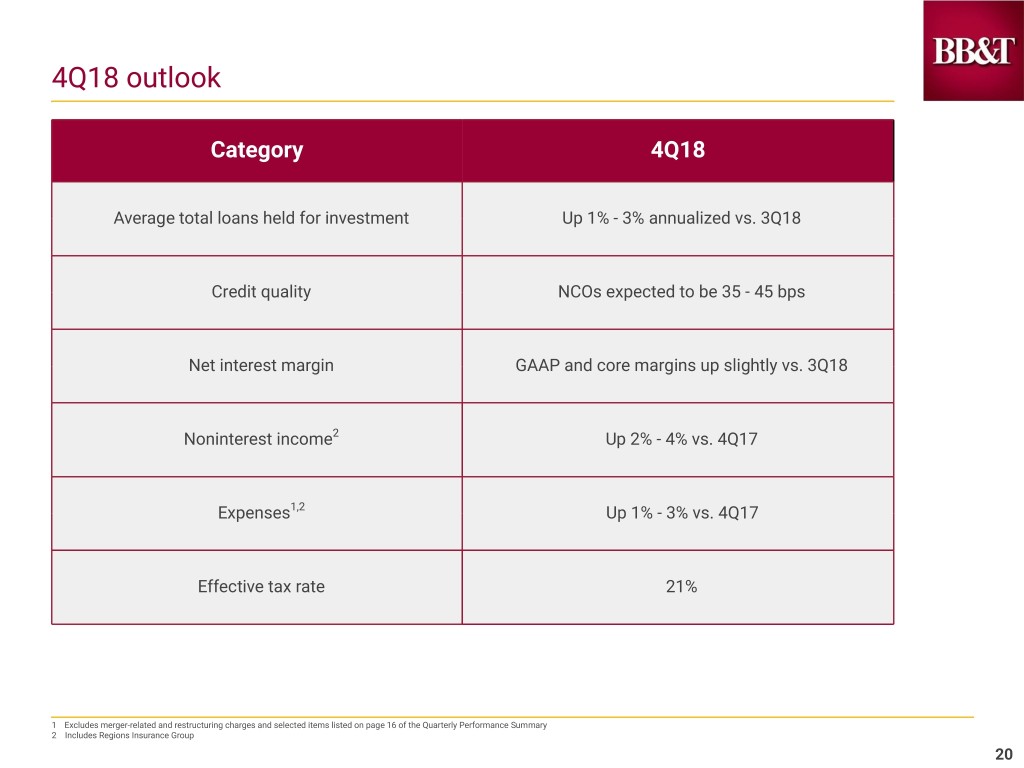

4Q18 outlook Category 4Q18 Average total loans held for investment Up 1% - 3% annualized vs. 3Q18 Credit quality NCOs expected to be 35 - 45 bps Net interest margin GAAP and core margins up slightly vs. 3Q18 Noninterest income2 Up 2% - 4% vs. 4Q17 Expenses1,2 Up 1% - 3% vs. 4Q17 Effective tax rate 21% 1 Excludes merger-related and restructuring charges and selected items listed on page 16 of the Quarterly Performance Summary 2 Includes Regions Insurance Group 20

A-21

Appendix

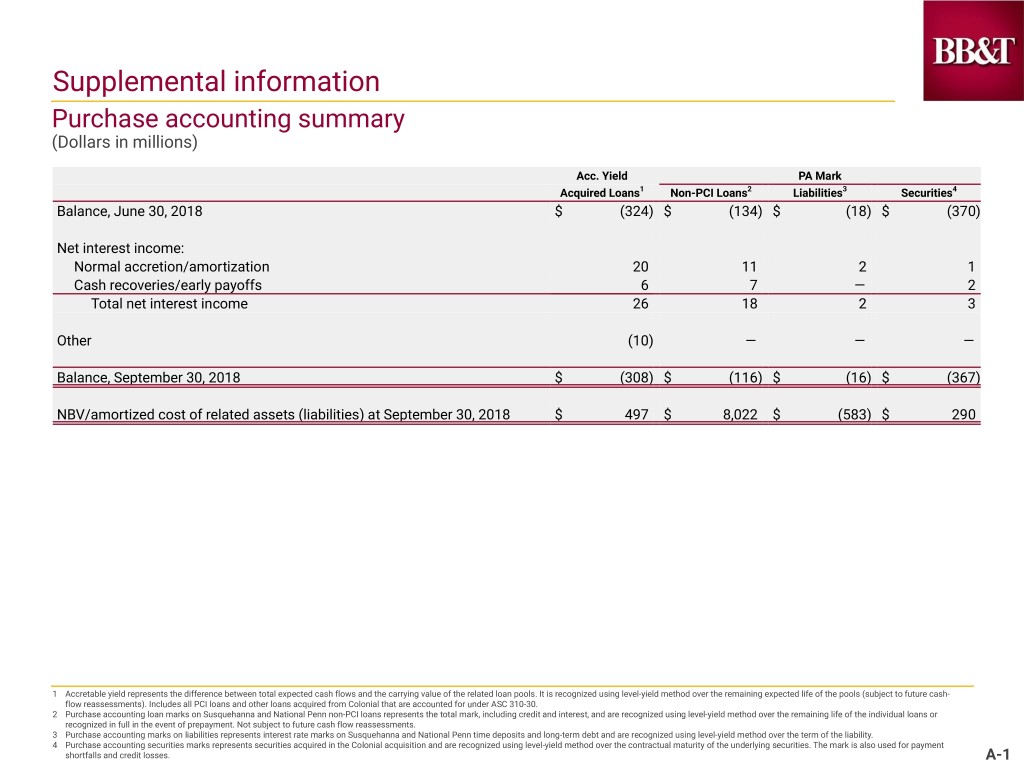

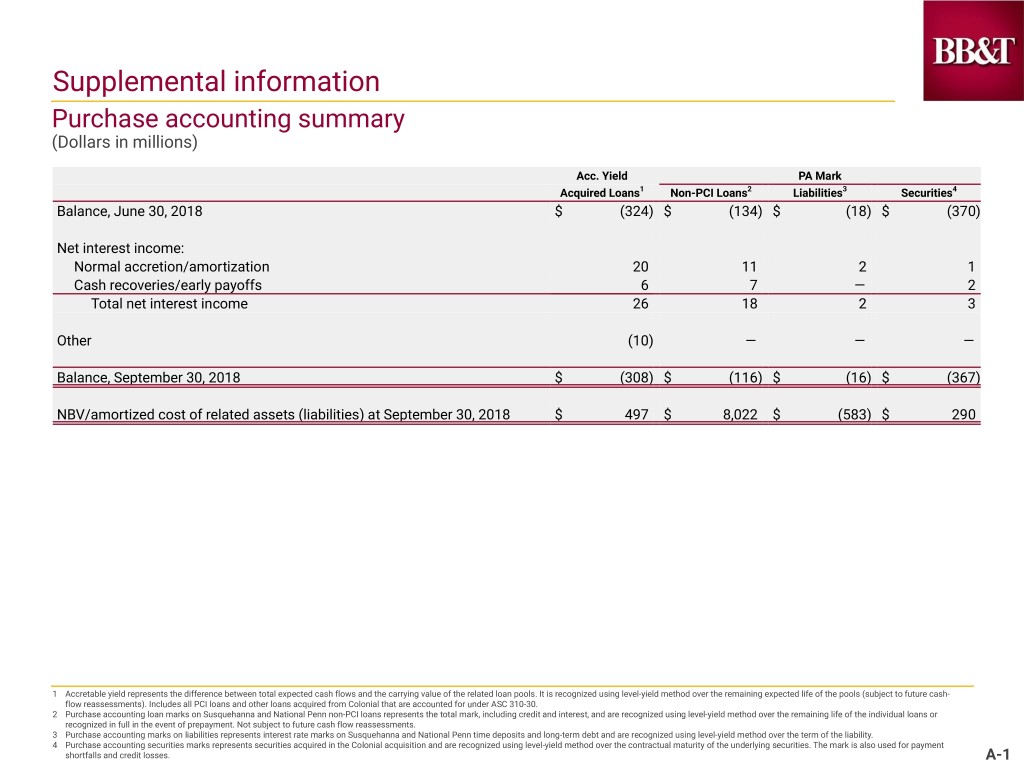

Supplemental information Purchase accounting summary (Dollars in millions) Acc. Yield PA Mark Acquired Loans1 Non-PCI Loans2 Liabilities3 Securities4 Balance, June 30, 2018 $ (324) $ (134) $ (18) $ (370) Net interest income: Normal accretion/amortization 20 11 2 1 Cash recoveries/early payoffs 6 7 — 2 Total net interest income 26 18 2 3 Other (10) — — — Balance, September 30, 2018 $ (308) $ (116) $ (16) $ (367) NBV/amortized cost of related assets (liabilities) at September 30, 2018 $ 497 $ 8,022 $ (583) $ 290 1 Accretable yield represents the difference between total expected cash flows and the carrying value of the related loan pools. It is recognized using level-yield method over the remaining expected life of the pools (subject to future cash- flow reassessments). Includes all PCI loans and other loans acquired from Colonial that are accounted for under ASC 310-30. 2 Purchase accounting loan marks on Susquehanna and National Penn non-PCI loans represents the total mark, including credit and interest, and are recognized using level-yield method over the remaining life of the individual loans or recognized in full in the event of prepayment. Not subject to future cash flow reassessments. 3 Purchase accounting marks on liabilities represents interest rate marks on Susquehanna and National Penn time deposits and long-term debt and are recognized using level-yield method over the term of the liability. 4 Purchase accounting securities marks represents securities acquired in the Colonial acquisition and are recognized using level-yield method over the contractual maturity of the underlying securities. The mark is also used for payment shortfalls and credit losses. A-1

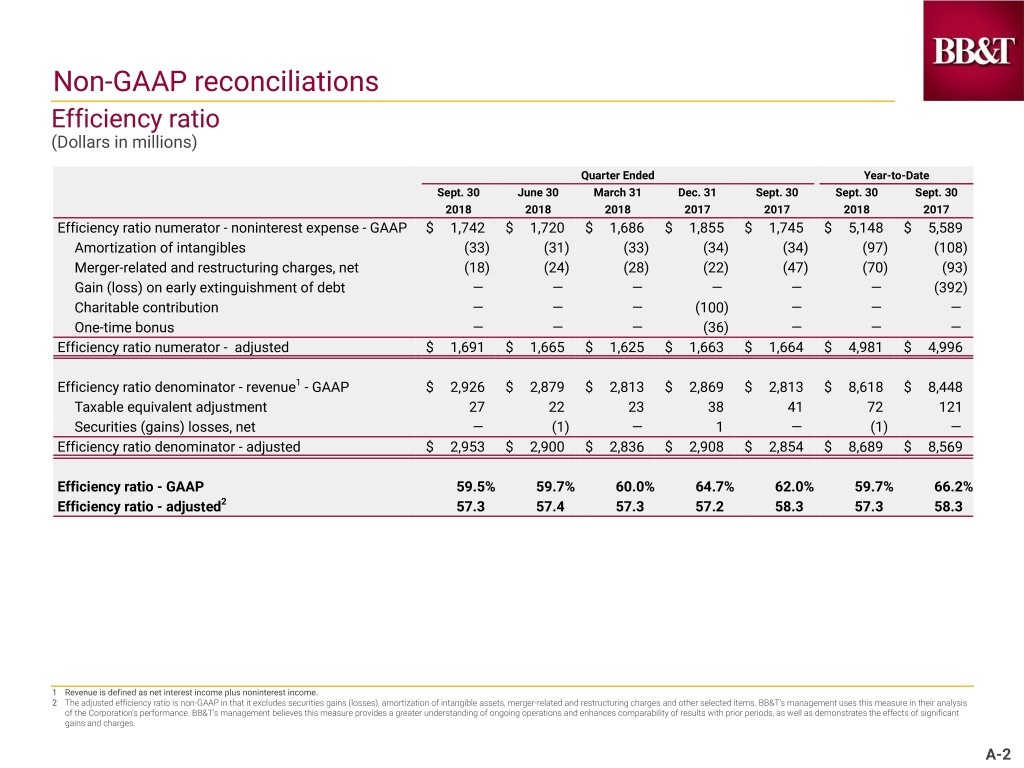

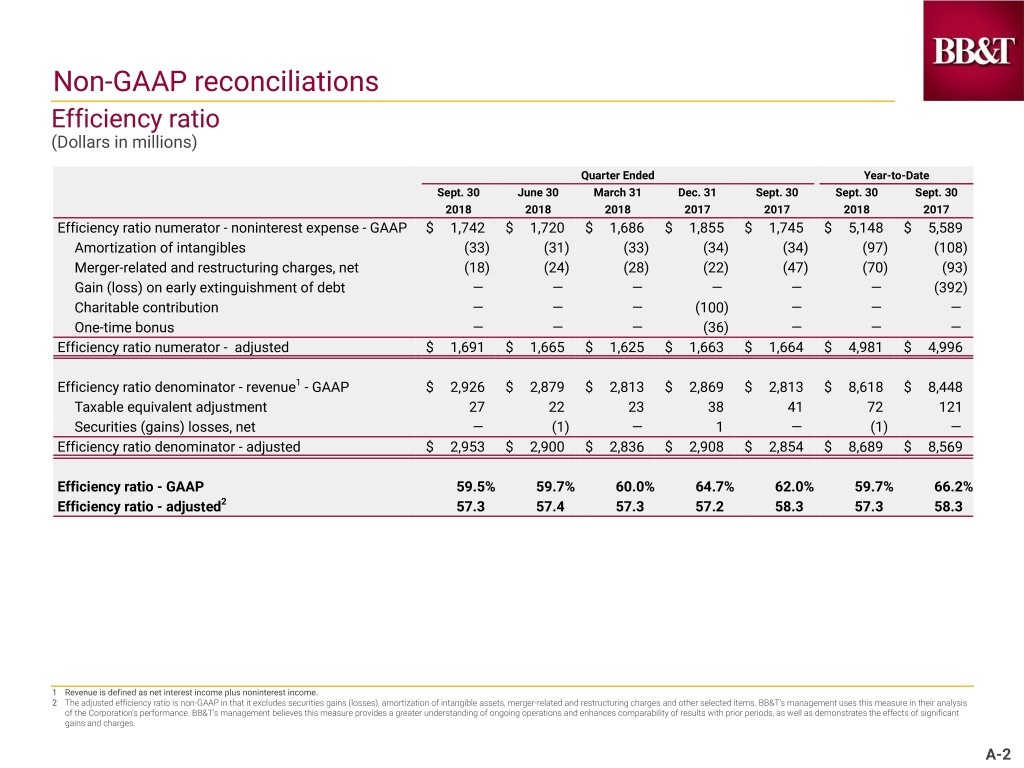

Non-GAAP reconciliations Efficiency ratio (Dollars in millions) Quarter Ended Year-to-Date Sept. 30 June 30 March 31 Dec. 31 Sept. 30 Sept. 30 Sept. 30 2018 2018 2018 2017 2017 2018 2017 Efficiency ratio numerator - noninterest expense - GAAP $ 1,742 $ 1,720 $ 1,686 $ 1,855 $ 1,745 $ 5,148 $ 5,589 Amortization of intangibles (33) (31) (33) (34) (34) (97) (108) Merger-related and restructuring charges, net (18) (24) (28) (22) (47) (70) (93) Gain (loss) on early extinguishment of debt — — — — — — (392) Charitable contribution — — — (100) — — — One-time bonus — — — (36) — — — Efficiency ratio numerator - adjusted $ 1,691 $ 1,665 $ 1,625 $ 1,663 $ 1,664 $ 4,981 $ 4,996 Efficiency ratio denominator - revenue1 - GAAP $ 2,926 $ 2,879 $ 2,813 $ 2,869 $ 2,813 $ 8,618 $ 8,448 Taxable equivalent adjustment 27 22 23 38 41 72 121 Securities (gains) losses, net — (1) — 1 — (1) — Efficiency ratio denominator - adjusted $ 2,953 $ 2,900 $ 2,836 $ 2,908 $ 2,854 $ 8,689 $ 8,569 Efficiency ratio - GAAP 59.5% 59.7% 60.0% 64.7% 62.0% 59.7% 66.2% Efficiency ratio - adjusted2 57.3 57.4 57.3 57.2 58.3 57.3 58.3 1 Revenue is defined as net interest income plus noninterest income. 2 The adjusted efficiency ratio is non-GAAP in that it excludes securities gains (losses), amortization of intangible assets, merger-related and restructuring charges and other selected items. BB&T's management uses this measure in their analysis of the Corporation's performance. BB&T's management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. A-2

Non-GAAP reconciliations Calculations of tangible common equity and related measures (Dollars in millions, except per share data, shares in thousands) As of / Quarter Ended Sept. 30 June 30 March 31 Dec. 31 Sept. 30 2018 2018 2018 2017 2017 Common shareholders' equity $ 26,895 $ 26,727 $ 26,559 $ 26,595 $ 26,757 Less: Intangible assets 10,621 10,264 10,296 10,329 10,363 Tangible common shareholders' equity1 $ 16,274 $ 16,463 $ 16,263 $ 16,266 $ 16,394 Outstanding shares at end of period 770,620 774,447 779,752 782,006 788,921 Common shareholders' equity per common share $ 34.90 $ 34.51 $ 34.06 $ 34.01 $ 33.92 Tangible common shareholders' equity per common share1 21.12 21.26 20.86 20.80 20.78 Net income available to common shareholders $ 789 $ 775 $ 745 $ 614 $ 597 Plus amortization of intangibles, net of tax 26 24 24 21 22 Tangible net income available to common shareholders1 $ 815 $ 799 $ 769 $ 635 $ 619 Average common shareholders' equity $ 26,782 $ 26,483 $ 26,428 $ 26,759 $ 26,857 Less: Average intangible assets 10,622 10,281 10,312 10,346 10,382 Average tangible common shareholders' equity1 $ 16,160 $ 16,202 $ 16,116 $ 16,413 $ 16,475 Return on average common shareholders' equity 11.69% 11.74% 11.43% 9.10% 8.82% Return on average tangible common shareholders' equity1 20.00 19.78 19.36 15.35 14.89 1 Tangible common equity and related measures are non-GAAP measures that exclude the impact of intangible assets and their related amortization. These measures are useful for evaluating the performance of a business consistently, whether acquired or developed internally. BB&T's management uses these measures to assess the quality of capital and returns relative to balance sheet risk and believes investors may find them useful in their analysis of the Corporation. A-3

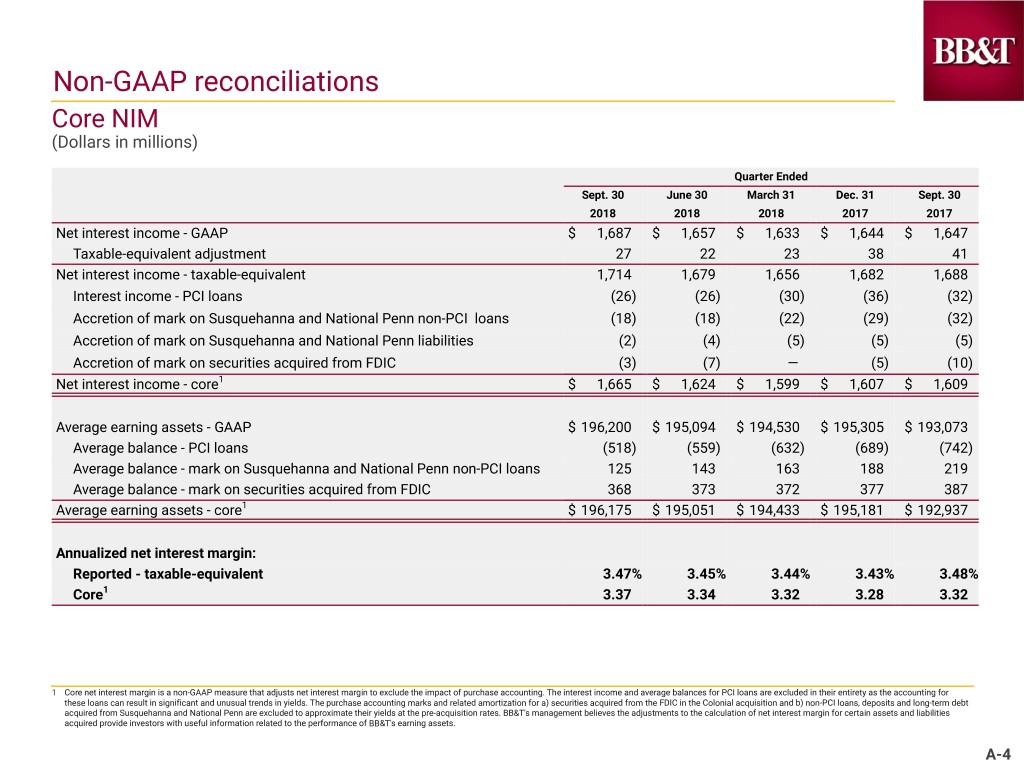

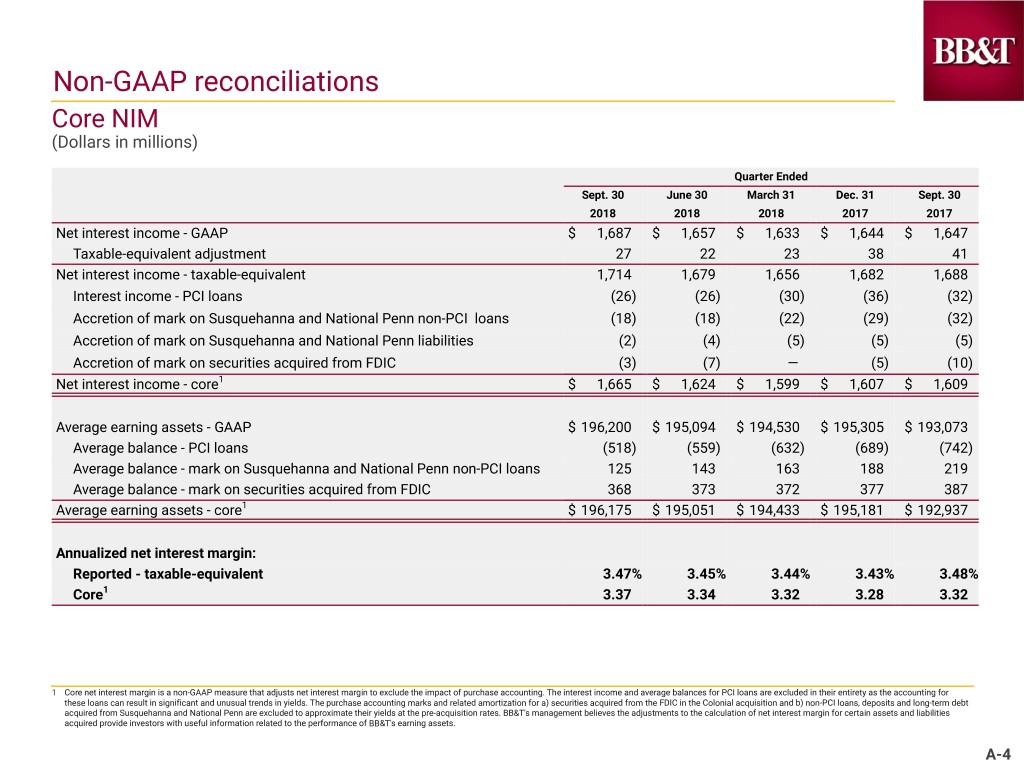

Non-GAAP reconciliations Core NIM (Dollars in millions) Quarter Ended Sept. 30 June 30 March 31 Dec. 31 Sept. 30 2018 2018 2018 2017 2017 Net interest income - GAAP $ 1,687 $ 1,657 $ 1,633 $ 1,644 $ 1,647 Taxable-equivalent adjustment 27 22 23 38 41 Net interest income - taxable-equivalent 1,714 1,679 1,656 1,682 1,688 Interest income - PCI loans (26) (26) (30) (36) (32) Accretion of mark on Susquehanna and National Penn non-PCI loans (18) (18) (22) (29) (32) Accretion of mark on Susquehanna and National Penn liabilities (2) (4) (5) (5) (5) Accretion of mark on securities acquired from FDIC (3) (7) — (5) (10) Net interest income - core1 $ 1,665 $ 1,624 $ 1,599 $ 1,607 $ 1,609 Average earning assets - GAAP $ 196,200 $ 195,094 $ 194,530 $ 195,305 $ 193,073 Average balance - PCI loans (518) (559) (632) (689) (742) Average balance - mark on Susquehanna and National Penn non-PCI loans 125 143 163 188 219 Average balance - mark on securities acquired from FDIC 368 373 372 377 387 Average earning assets - core1 $ 196,175 $ 195,051 $ 194,433 $ 195,181 $ 192,937 Annualized net interest margin: Reported - taxable-equivalent 3.47% 3.45% 3.44% 3.43% 3.48% Core1 3.37 3.34 3.32 3.28 3.32 1 Core net interest margin is a non-GAAP measure that adjusts net interest margin to exclude the impact of purchase accounting. The interest income and average balances for PCI loans are excluded in their entirety as the accounting for these loans can result in significant and unusual trends in yields. The purchase accounting marks and related amortization for a) securities acquired from the FDIC in the Colonial acquisition and b) non-PCI loans, deposits and long-term debt acquired from Susquehanna and National Penn are excluded to approximate their yields at the pre-acquisition rates. BB&T's management believes the adjustments to the calculation of net interest margin for certain assets and liabilities acquired provide investors with useful information related to the performance of BB&T's earning assets. A-4

Non-GAAP reconciliations Diluted EPS (Dollars in millions, except per share data, shares in thousands) Quarter Ended Sept. 30 June 30 March 31 Dec. 31 Sept. 30 YTD Sept. 30 2018 2018 2018 2017 2017 2018 2017 Net income available to common shareholders - GAAP $ 789 $ 775 $ 745 $ 614 $ 597 $ 2,309 $ 1,606 Merger-related and restructuring charges 13 17 22 14 29 52 57 Loss on early extinguishment of debt — — — — — — 246 Securities gains (losses), net — (1) — — — (1) — Charitable contribution — — — 63 — — — One time bonus — — — 23 — — — Excess tax benefit on equity-based awards — — — — — — (35) Impact of tax reform — — — (43) — — — Net income available to common shareholders - adjusted1 $ 802 $ 791 $ 767 $ 671 $ 626 $ 2,360 $ 1,874 Weighted average shares outstanding - diluted 781,867 785,750 791,005 795,867 806,124 786,140 816,029 Diluted EPS - GAAP $ 1.01 $ 0.99 $ 0.94 $ 0.77 $ 0.74 $ 2.94 $ 1.97 Diluted EPS - adjusted1 1.03 1.01 0.97 0.84 0.78 3.00 2.30 1 The adjusted diluted earnings per share is non-GAAP in that it excludes merger-related and restructuring charges and other selected items, net of tax. BB&T's management uses this measure in their analysis of the Corporation's performance. BB&T's management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. A-5

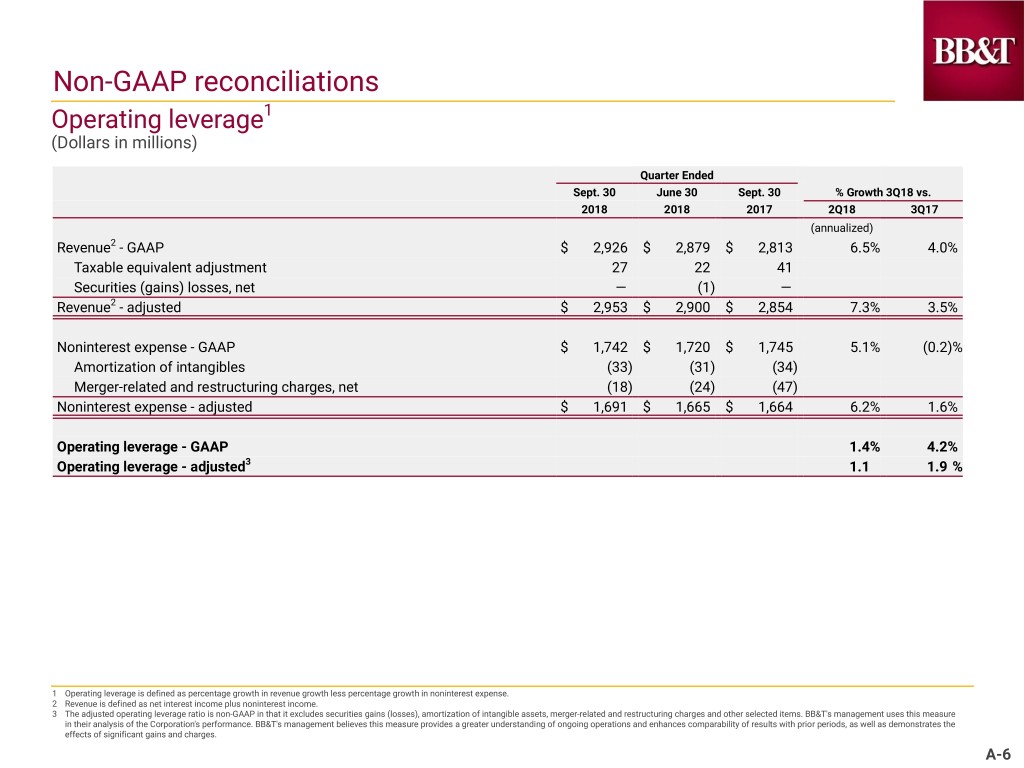

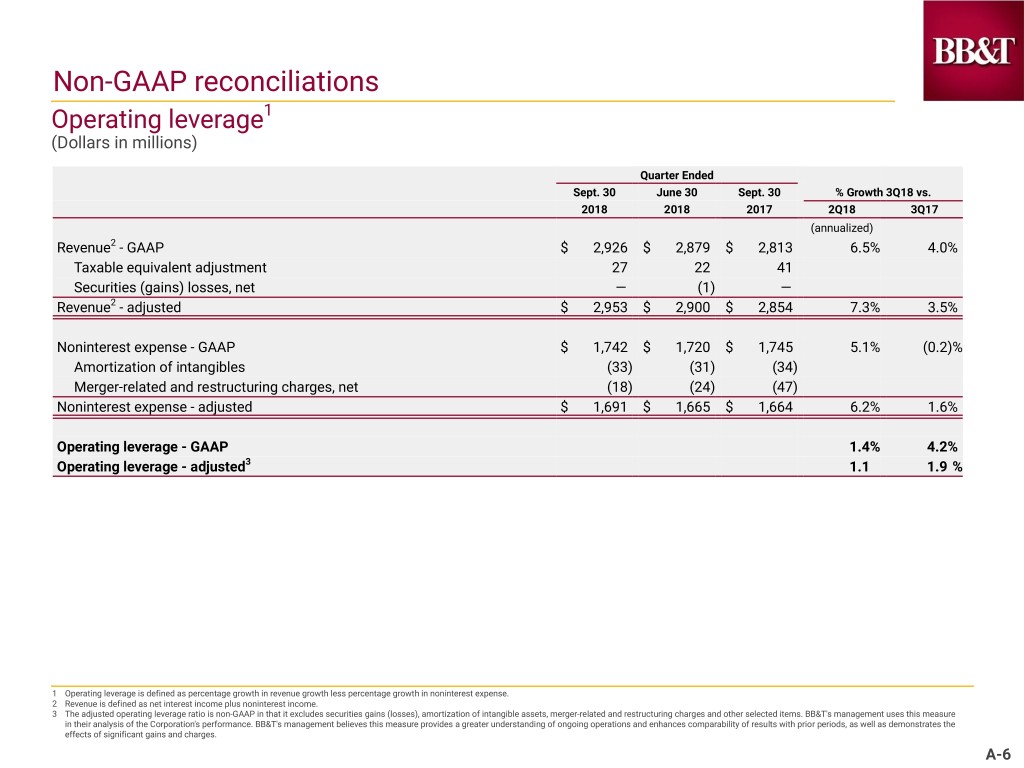

Non-GAAP reconciliations Operating leverage1 (Dollars in millions) Quarter Ended Sept. 30 June 30 Sept. 30 % Growth 3Q18 vs. 2018 2018 2017 2Q18 3Q17 (annualized) Revenue2 - GAAP $ 2,926 $ 2,879 $ 2,813 6.5% 4.0% Taxable equivalent adjustment 27 22 41 Securities (gains) losses, net — (1) — Revenue2 - adjusted $ 2,953 $ 2,900 $ 2,854 7.3% 3.5% Noninterest expense - GAAP $ 1,742 $ 1,720 $ 1,745 5.1% (0.2)% Amortization of intangibles (33) (31) (34) Merger-related and restructuring charges, net (18) (24) (47) Noninterest expense - adjusted $ 1,691 $ 1,665 $ 1,664 6.2% 1.6% Operating leverage - GAAP 1.4% 4.2% Operating leverage - adjusted3 1.1 1.9 % 1 Operating leverage is defined as percentage growth in revenue growth less percentage growth in noninterest expense. 2 Revenue is defined as net interest income plus noninterest income. 3 The adjusted operating leverage ratio is non-GAAP in that it excludes securities gains (losses), amortization of intangible assets, merger-related and restructuring charges and other selected items. BB&T's management uses this measure in their analysis of the Corporation's performance. BB&T's management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. A-6

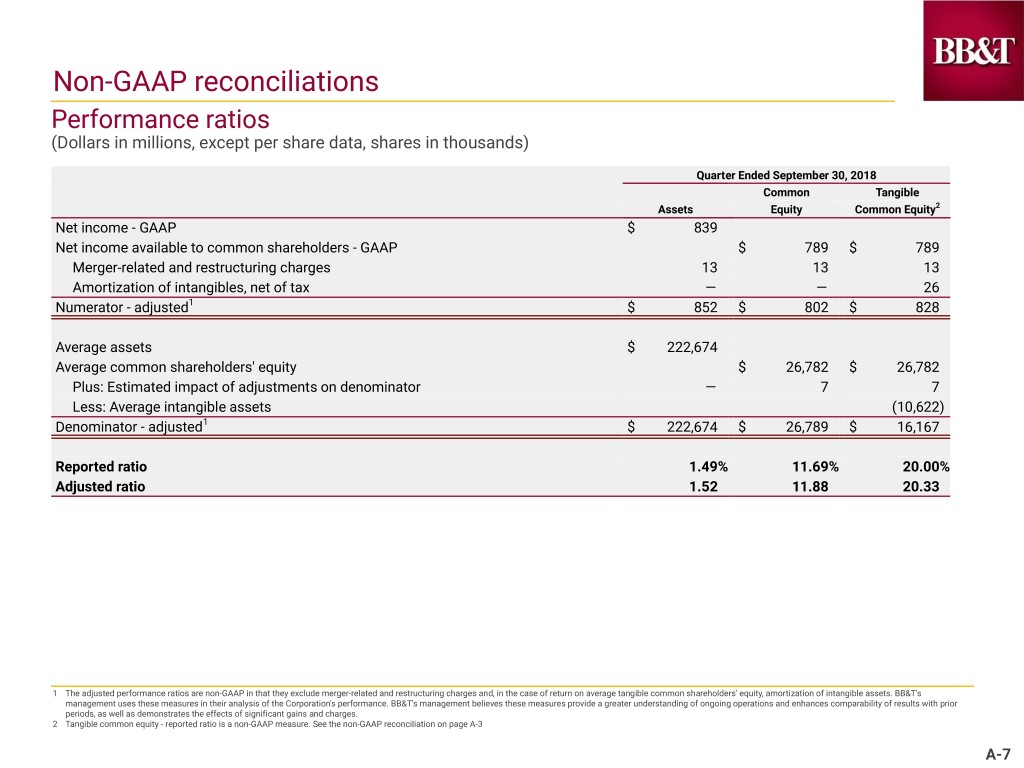

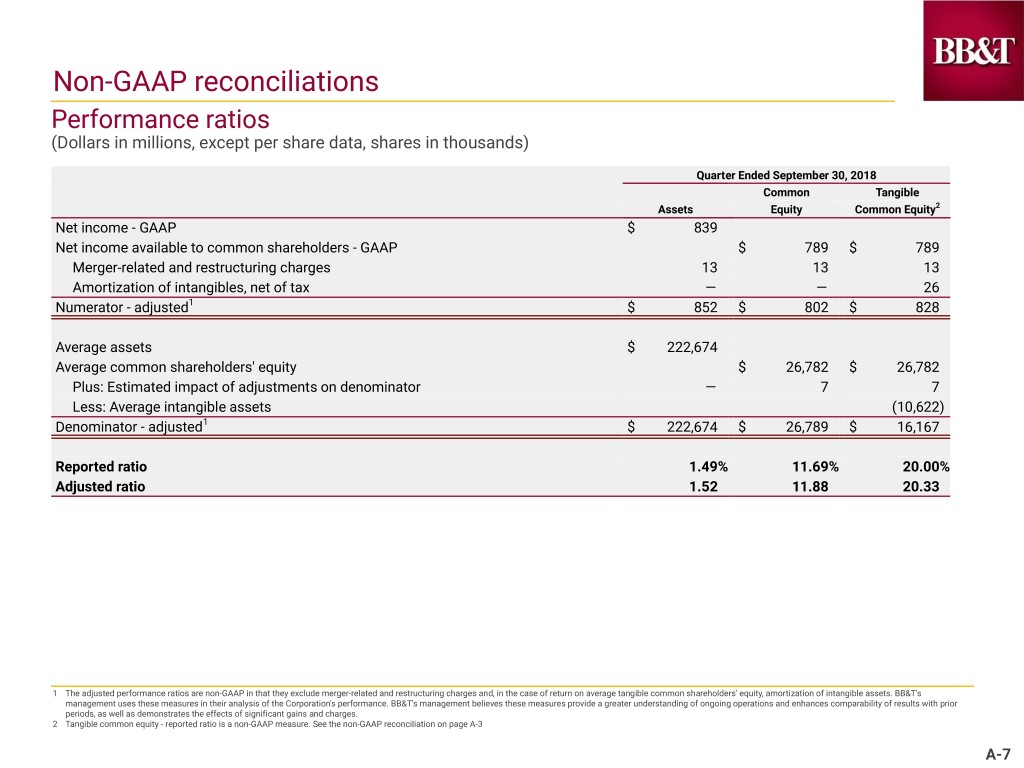

Non-GAAP reconciliations Performance ratios (Dollars in millions, except per share data, shares in thousands) Quarter Ended September 30, 2018 Common Tangible Assets Equity Common Equity2 Net income - GAAP $ 839 Net income available to common shareholders - GAAP $ 789 $ 789 Merger-related and restructuring charges 13 13 13 Amortization of intangibles, net of tax — — 26 Numerator - adjusted1 $ 852 $ 802 $ 828 Average assets $ 222,674 Average common shareholders' equity $ 26,782 $ 26,782 Plus: Estimated impact of adjustments on denominator — 7 7 Less: Average intangible assets (10,622) Denominator - adjusted1 $ 222,674 $ 26,789 $ 16,167 Reported ratio 1.49% 11.69% 20.00% Adjusted ratio 1.52 11.88 20.33 1 The adjusted performance ratios are non-GAAP in that they exclude merger-related and restructuring charges and, in the case of return on average tangible common shareholders' equity, amortization of intangible assets. BB&T's management uses these measures in their analysis of the Corporation's performance. BB&T's management believes these measures provide a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. 2 Tangible common equity - reported ratio is a non-GAAP measure. See the non-GAAP reconciliation on page A-3 A-7