First Quarter 2023 Earnings Conference Call Bill Rogers – Chairman & CEO Mike Maguire – CFO April 20, 2023

2 This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, regarding the financial condition, results of operations, business plans and the future performance of Truist. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should,” “would,” “could” and other similar expressions are intended to identify these forward-looking statements. In particular, forward looking statements include, but are not limited to, statements we make about: (i) the benefits of Truist’s shift from integrating to operating and being “One Truist”, (ii) guidance with respect to financial performance metrics in future periods, including future levels of revenues, adjusted expenses, adjusted operating leverage and net charge-off ratio, (iii) Truist’s ability to perform well through a range of economic scenarios, (iv) Truist’s effective tax rate in future periods, (v) the financial impact of recently completed acquisitions in 2023, (vi) projections of preferred stock dividends in 2023, (vii) Truist goal to more fully activate digital capabilities with clients in 2023 to improve client acquisition and retention and reduce costs, (viii) loan growth in future periods, (ix) the effects of purchase accounting accretion in future periods, (x) expected declines in overdraft fees through 2024, (xi) anticipated restructuring costs and expense rationalization efforts, (xii) expectations for organic capital generation in 2023, and (xiii) Truist’s goal to produce strong growth and profitability with less volatility than peers. Forward-looking statements are not based on historical facts but instead represent management’s expectations and assumptions regarding Truist’s business, the economy and other future conditions. Such statements involve inherent uncertainties, risks and changes in circumstances that are difficult to predict. As such, Truist’s actual results may differ materially from those contemplated by forward-looking statements. While there can be no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those contemplated by forward-looking statements include the following, without limitation, as well as the risks and uncertainties more fully discussed under Part I, Item 1A-Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2022 and in Truist’s subsequent filings with the Securities and Exchange Commission: • changes in the interest rate environment, including the replacement of LIBOR as an interest rate benchmark, could adversely affect Truist’s revenue and expenses, the value of assets and obligations, and the availability and cost of capital, cash flows, and liquidity; • Truist is subject to credit risk by lending or committing to lend money, may have more credit risk and higher credit losses to the extent that loans are concentrated by loan type, industry segment, borrower type or location of the borrower or collateral, and may suffer losses if the value of collateral declines in stressed market conditions; • inability to access short-term funding or liquidity, loss of client deposits or changes in Truist’s credit ratings could increase the cost of funding, limit access to capital markets, or negatively affect Truist’s overall liquidity or capitalization; • Truist may be impacted by the soundness of other financial institutions, including as a result of the financial or operational failure of a major financial institution, or concerns about the creditworthiness of such a financial institution or its ability to fulfill its obligations, which can cause substantial and cascading disruption within the financial markets and increased expenses, including FDIC insurance premiums; • general economic or business conditions, either globally, nationally or regionally, may be less favorable than expected, including as a result of supply chain disruptions, inflationary pressures and labor shortages, and instability in global geopolitical matters, including due to an outbreak or escalation of hostilities, or volatility in financial markets could result in, among other things, slower deposit or asset growth, a deterioration in credit quality, or a reduced demand for credit, insurance, or other services; • the monetary and fiscal policies of the federal government and its agencies, including in response to higher inflation, could have a material adverse effect on the economy and Truist’s profitability; • the effects of COVID-19 adversely impacted the Company’s operations and financial performance and similar adverse impacts resulting from pandemics could occur in future periods; • risk management oversight functions may not identify or address risks adequately, and management may not be able to effectively manage credit risk; • there are risks resulting from the extensive use of models in Truist’s business, which may impact decisions made by management and regulators; • deposit attrition, client loss or revenue loss following completed mergers or acquisitions may be greater than anticipated; • Truist could fail to execute on strategic or operational plans, including the ability to successfully complete or integrate mergers and acquisitions; • increased competition, including from (i) new or existing competitors that could have greater financial resources or be subject to different regulatory standards or compliance costs, and (ii) products and services offered by non-bank financial technology companies, may reduce Truist’s client base, cause Truist to lower prices for its products and services in order to maintain market share or otherwise adversely impact Truist’s businesses or results of operations; • failure to maintain or enhance Truist’s competitive position with respect to new products, services, and technology, whether it fails to anticipate client expectations or because its technological developments fail to perform as desired or do not achieve market acceptance or regulatory approval or for other reasons, may cause Truist to lose market share or incur additional expense; • negative public opinion could damage Truist’s reputation and adversely impact business and revenues; • regulatory matters, litigation or other legal actions may result in, among other things, costs, fines, penalties, restrictions on Truist’s business activities, reputational harm, negative publicity, or other adverse consequences; • Truist faces substantial legal and operational risks in safeguarding personal information; • evolving legislative, accounting and regulatory standards, including with respect to climate, capital, and liquidity requirements, which may become more stringent in light of recent bank failures, and results of regulatory examinations may adversely affect Truist’s financial condition and results of operations; • increased scrutiny regarding Truist’s consumer sales practices, training practices, incentive compensation design, and governance could damage its reputation and adversely impact business and revenues; • accounting policies and processes require management to make estimates about matters that are uncertain, including the potential write down to goodwill if there is an elongated period of decline in market value for Truist’s stock and adverse economic conditions are sustained over a period of time; • Truist faces risks related to originating and selling mortgages, including repurchase and indemnity demands from purchasers related to representations and warranties on loans sold, which could result in an increase in the amount of losses for loan repurchases; • there are risks relating to Truist’s role as a loan servicer, including an increase in the scope or costs of the services Truist is required to perform without any corresponding increase in servicing fees or a breach of Truist’s obligations as servicer; • Truist’s success depends on hiring and retaining key teammates, and if these individuals leave or change roles without effective replacements, Truist’s operations could be adversely impacted, which could be exacerbated in the increased work-from-home environment as job markets may be less constrained by physical geography; • Truist’s operations rely on its ability, and the ability of key external parties, to maintain appropriate-staffed workforces, and on the competence, trustworthiness, health and safety of teammates; • Truist faces the risk of fraud or misconduct by internal or external parties, which Truist may not be able to prevent, detect, or mitigate; • security risks, including denial of service attacks, hacking, social engineering attacks targeting Truist’s teammates and clients, malware intrusion, data corruption attempts, system breaches, cyberattacks, which have increased in frequency with geopolitical tensions, identity theft, ransomware attacks, and physical security risks, such as natural disasters, environmental conditions, and intentional acts of destruction, could result in the disclosure of confidential information, adversely affect Truist’s business or reputation or create significant legal or financial exposure; and • widespread outages of operational, communication, or other systems, whether internal or provided by third parties, natural or other disasters (including acts of terrorism and pandemics), and the effects of climate change, including physical risks, such as more frequent and intense weather events, and risks related to the transition to a lower carbon economy, such as regulatory or technological changes or shifts in market dynamics or consumer preferences, could have an adverse effect on Truist’s financial condition and results of operations, lead to material disruption of Truist’s operations or the ability or willingness of clients to access Truist’s products and services. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. Except to the extent required by applicable law or regulation, Truist undertakes no obligation to revise or update any forward-looking statements. Forward-Looking Statements

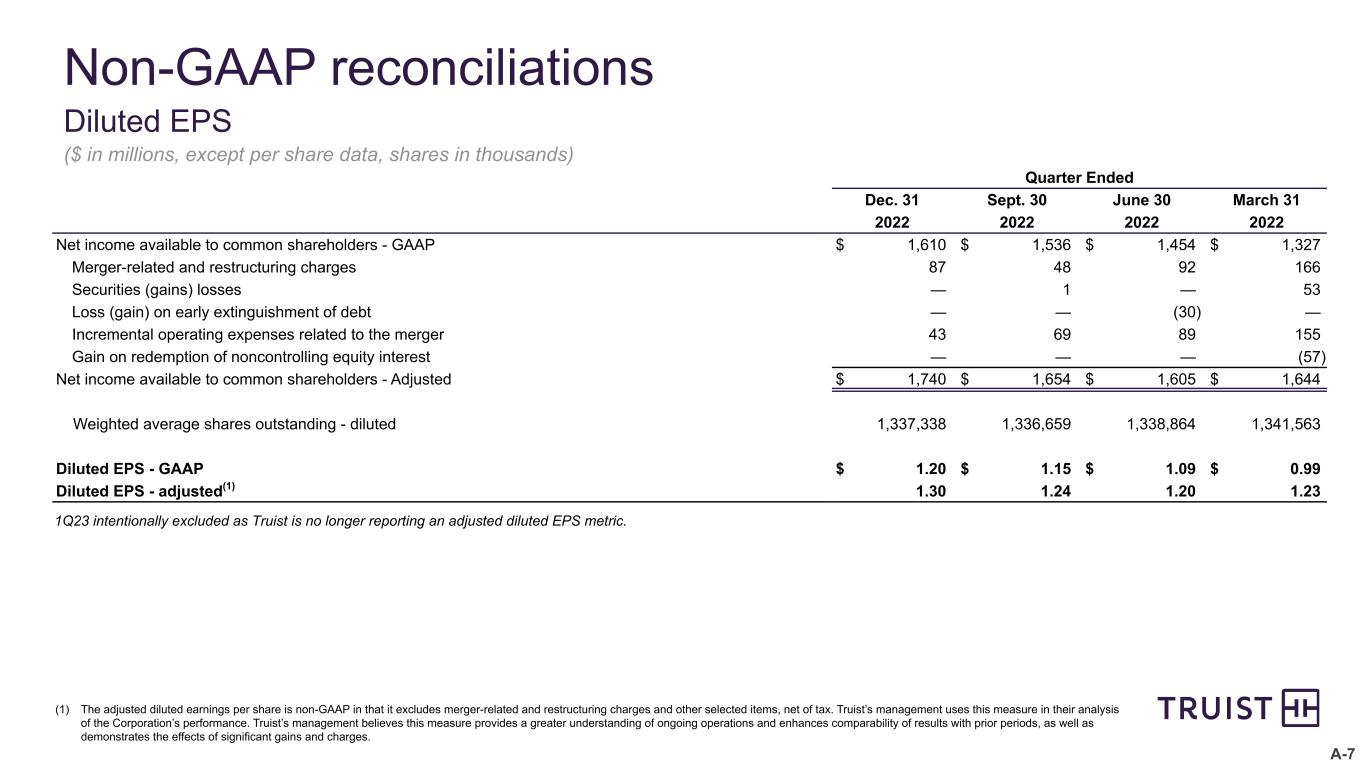

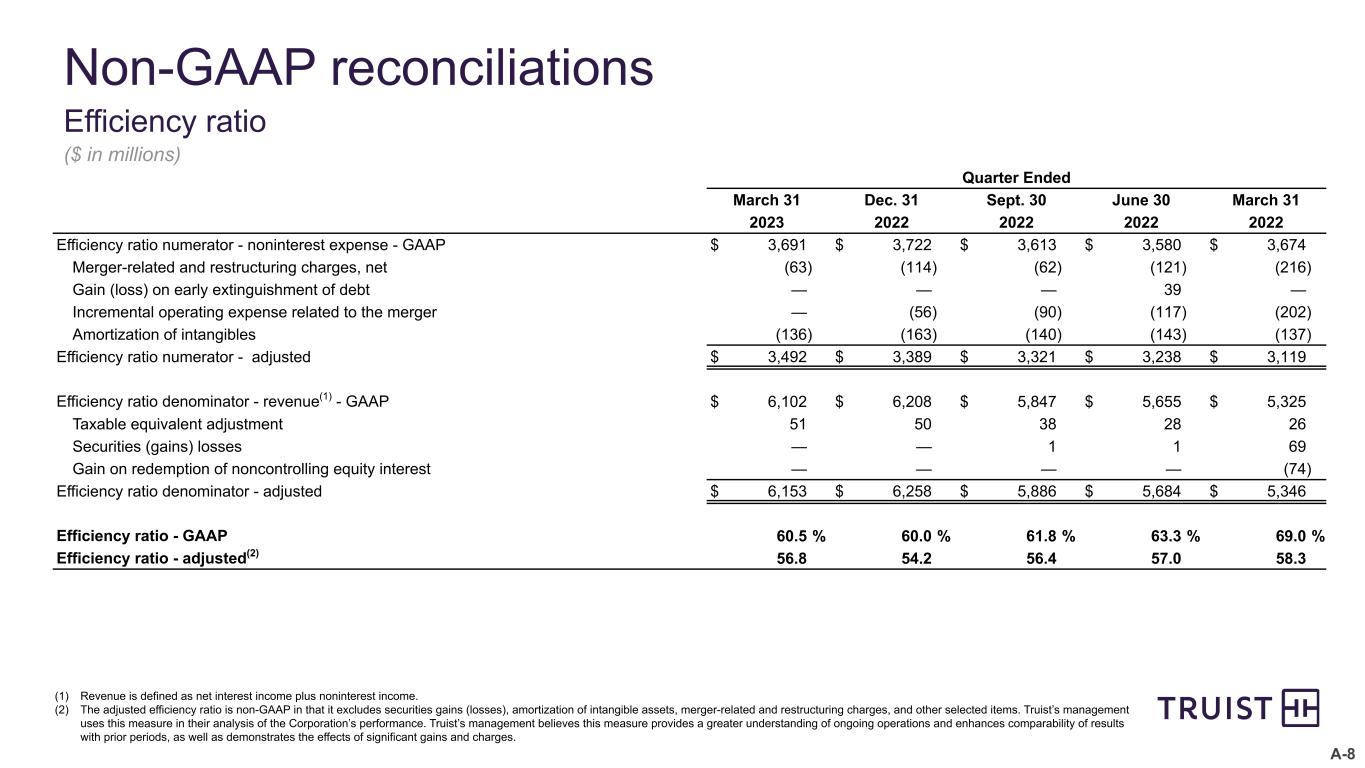

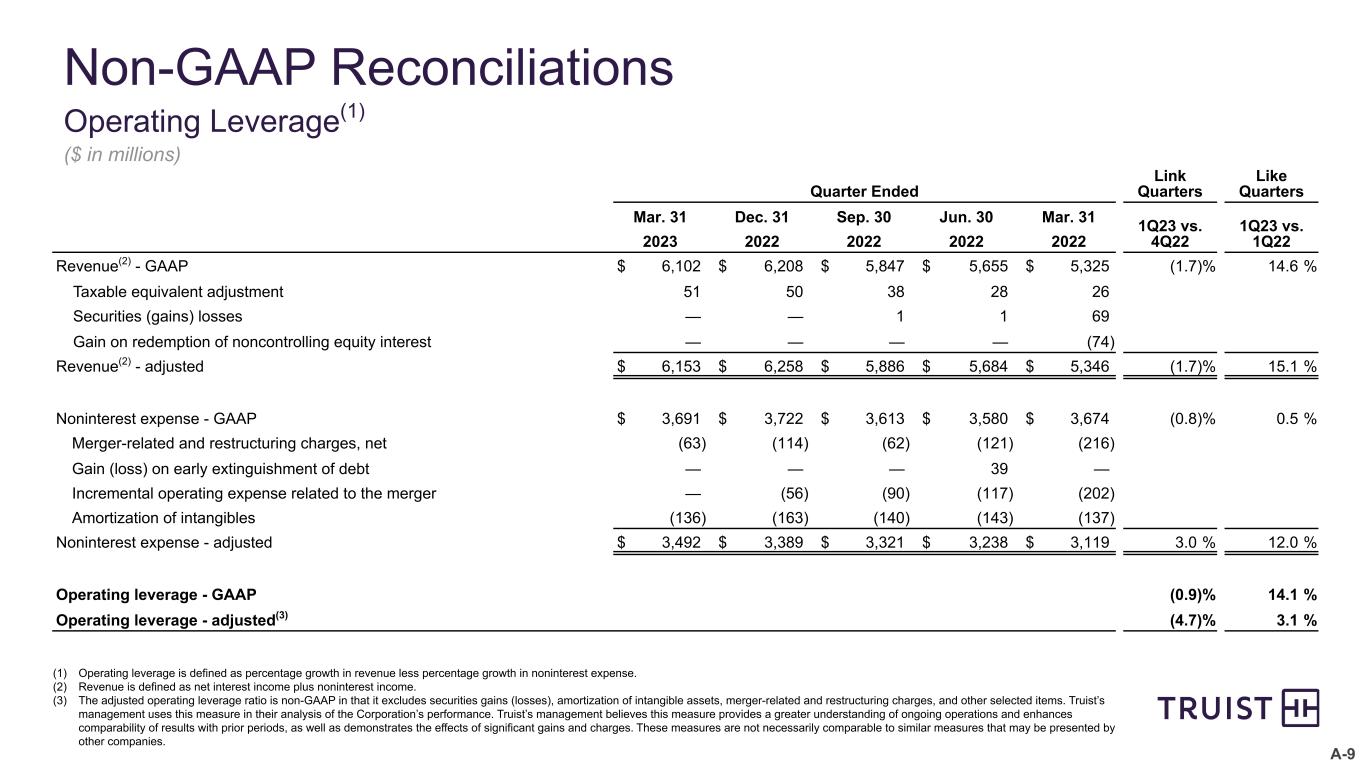

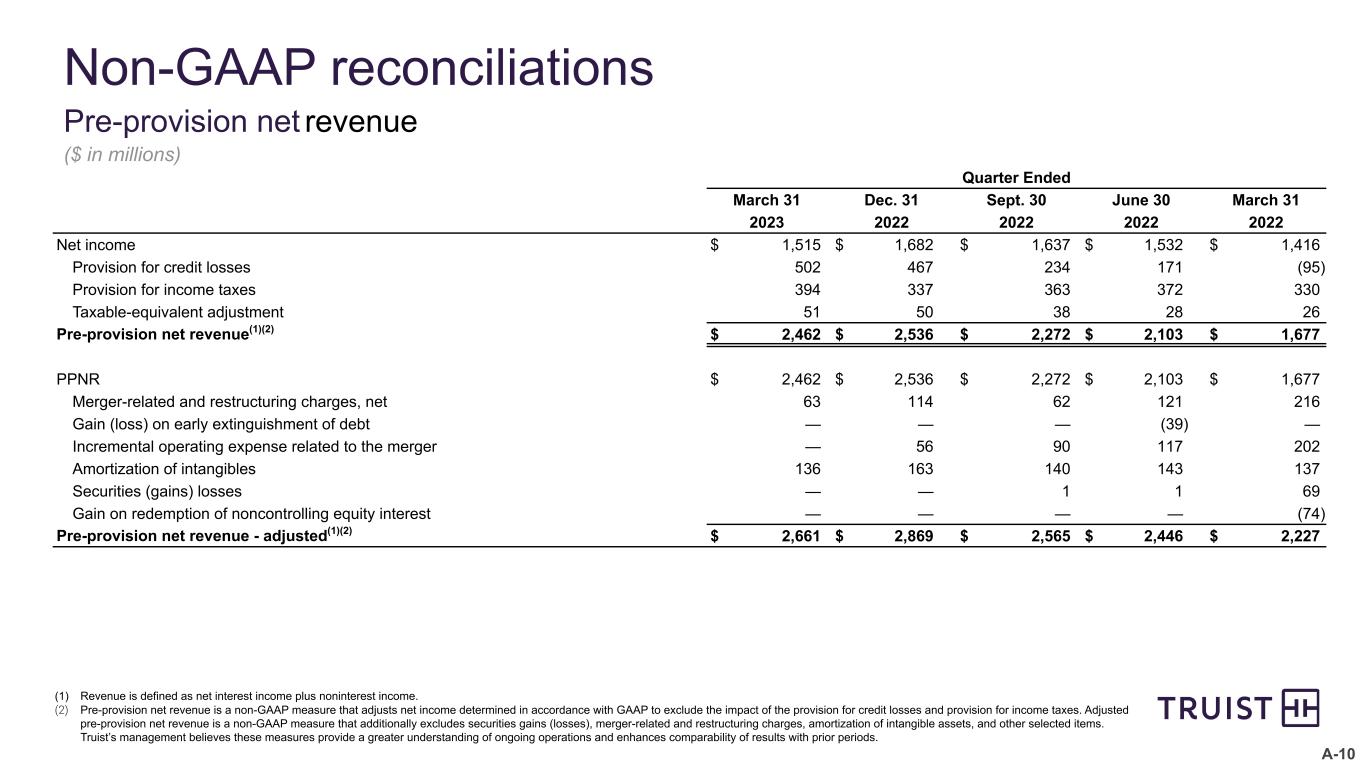

3 Non-GAAP Information This presentation contains financial information and performance measures determined by methods other than in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Truist’s management uses these “non-GAAP” measures in their analysis of the Corporation's performance and the efficiency of its operations. Management believes these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results with prior periods and demonstrate the effects of significant items in the current period. The Company believes a meaningful analysis of its financial performance requires an understanding of the factors underlying that performance. Truist’s management believes investors may find these non-GAAP financial measures useful. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non- GAAP performance measures that may be presented by other companies. Below is a listing of the types of non-GAAP measures used in this presentation: Adjusted Performance Measures - The adjusted performance measures, including adjusted diluted earnings per share, return on average tangible common shareholders’ equity, adjusted efficiency ratio, adjusted operating leverage, and adjusted noninterest expense, are non-GAAP in that they exclude merger-related and restructuring charges, other selected items, and amortization of intangible assets, as applicable to tangible measures. Truist’s management uses these measures in their analysis of the Corporation’s performance. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges. Pre-Provision Net Revenue (PPNR) - Pre-provision net revenue is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of the provision for credit losses and provision for income taxes. Adjusted pre-provision net revenue is a non-GAAP measure that additionally excludes securities gains (losses), merger-related and restructuring charges, amortization of intangible assets, and other selected items. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhances comparability of results with prior periods. Tangible Common Equity and Related Measures - Tangible common equity and related measures are non-GAAP measures that exclude the impact of intangible assets, net of deferred taxes, and their related amortization. These measures are useful for evaluating the performance of a business consistently, whether acquired or developed internally. Truist’s management uses these measures to assess profitability, returns relative to balance sheet risk, and shareholder value. Core NIM - Core net interest margin is a non-GAAP measure that adjusts net interest margin to exclude the impact of purchase accounting. The purchase accounting marks and related amortization for loans, deposits, and long-term debt from SunTrust and other mergers and acquisitions are excluded to approximate the yields paid by clients. Truist’s management believes the adjustments to the calculation of net interest margin for certain assets and liabilities acquired provide investors with useful information related to the performance of Truist’s earning assets. Insurance Holdings Adjusted EBITDA - EBITDA is a non-GAAP measurement of operating profitability that is calculated by adding back interest, taxes, depreciation, and amortization to net income. Truist’s management also adds back merger- related and restructuring charges, acquisition retention and change in estimated earn-out incentives, and other selected items. Truist’s management uses this measure in its analysis of the Corporation’s Insurance Holdings segment. Truist’s management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges.

4

5 Living our purpose Inspire and build better lives and communities 5 Living our purpose Inspiring and building better lives and communities In 1Q23, Truist remained a source of strength by: Enhancing the client experience – Significant improvement in our client experience, with Voice of the Client metrics rising since 2Q22, and continued positive momentum with branch satisfaction scores in 1Q23 – Opened T3 Accelerator Lab in the Innovation & Technology Center where we’re redefining the client and teammate experience, putting feedback and ideas to the test in real-world scenarios before rolling out to clients – Continued growth for Truist Momentum, Truist’s financial wellness program, with 200,000+ active employee participants at over 350 companies Supporting our teammates – Launched Truist Long Game, a new mobile app that uses fun to promote long-term financial wellness, to our teammates; available to all clients in spring 2023 – Aspirations to increase female representation by 15%+ and ethnically diverse representation by 20%+ across leadership levels by 2025. Since 12/31/21, we have increased representation by 3% and 9%, respectively Being a responsible corporate citizen – Published 2022 Corporate Responsibility Report, TCFD Report, and ESG Disclosure Summary, highlighting our progress in building our communities across multiple dimensions including community, financial inclusion, DEI, and climate and energy – Committed $282 million in 1Q23 to support 1,686 units of affordable housing, 110 new jobs, and 46,879 people served in LMI communities (through Truist Community Capital) – Announced Where It Starts, a $22 million multiyear strategic initiative of Truist Foundation to strengthen small businesses and create career pathways for communities of color in the U.S. Executing on strategic decisions – Announced strategic agreement and closed on transaction to sell 20% minority stake in Truist Insurance Holdings (“TIH”) to Stone Point Capital and co- investors, positioning TIH for long-term success and growth and providing strategic and financial flexibility for Truist

Financial Results

7 1Q23 performance highlights Earnings and profitability – $1.4 billion of net income available to common ($1.05 per share) and ROTCE of 24% – EPS up 6.1% compared to 1Q22 given strong growth in PPNR and significant decline in merger costs, partially offset by higher provision levels – EPS declined 13% compared to 4Q22 given lower net interest income and typical seasonal impacts – 1Q23 EPS includes $0.04 per share of restructuring charges compared to merger- related costs1 of $0.24 in 1Q22 and $0.10 in 4Q22 – Adjusted PPNR declined 7.2% vs. 4Q22 (as anticipated) due to lower net interest income and higher noninterest expense – Strong YoY momentum – Adjusted PPNR growth of 19% – Adjusted operating leverage of 310 bps – Strong asset quality performance: 37 bps NCO, stable NPLs, and lower delinquencies Balance sheet, capital, and liquidity – Average loan growth of 1.7% and EOP loan growth of 0.5% – Average deposits declined 1.2% and EOP deposits declined 2.1% – Significant access to liquidity and funding – LCR of 113% – Total available liquidity position of $166 billion – Capital ratios remain strong (9.1% CET1 ratio), particularly in context of Truist’s risk profile, diverse business mix, and strong profitability – TIH minority stake sale closed on April 3 (adds ~30 bps of capital) – TBVPS increased 7.8% due to improved AOCI and retained earnings Change vs. 1Q23 4Q22 1Q22 GAAP / Unadjusted Revenue $6,153 (1.7)% 15.0% Expense $3,691 (0.8)% 0.5% PPNR $2,462 (2.9)% 46.8% Provision for credit losses $502 7.5% NM Net income available to common $1,410 (12.4)% 6.3% Diluted EPS $1.05 (12.5)% 6.1% ROCE 10.3% (140) bps 130 bps ROTCE 24.1% (350) bps 550 bps Efficiency ratio 60.5% 50 bps (850) bps TBVPS $19.45 7.8% (11.1)% Adjusted Efficiency ratio 56.8% 260 bps (150) bps PPNR $2,661 (7.2)% 19.5% Note: All data points are taxable-equivalent, where applicable; see non-GAAP reconciliations in the appendix Current quarter regulatory capital information is preliminary 1 Includes merger-related and restructuring charges and incremental operating expenses related to the merger Summary Income Statement Commentary ($ in millions, except per share data)

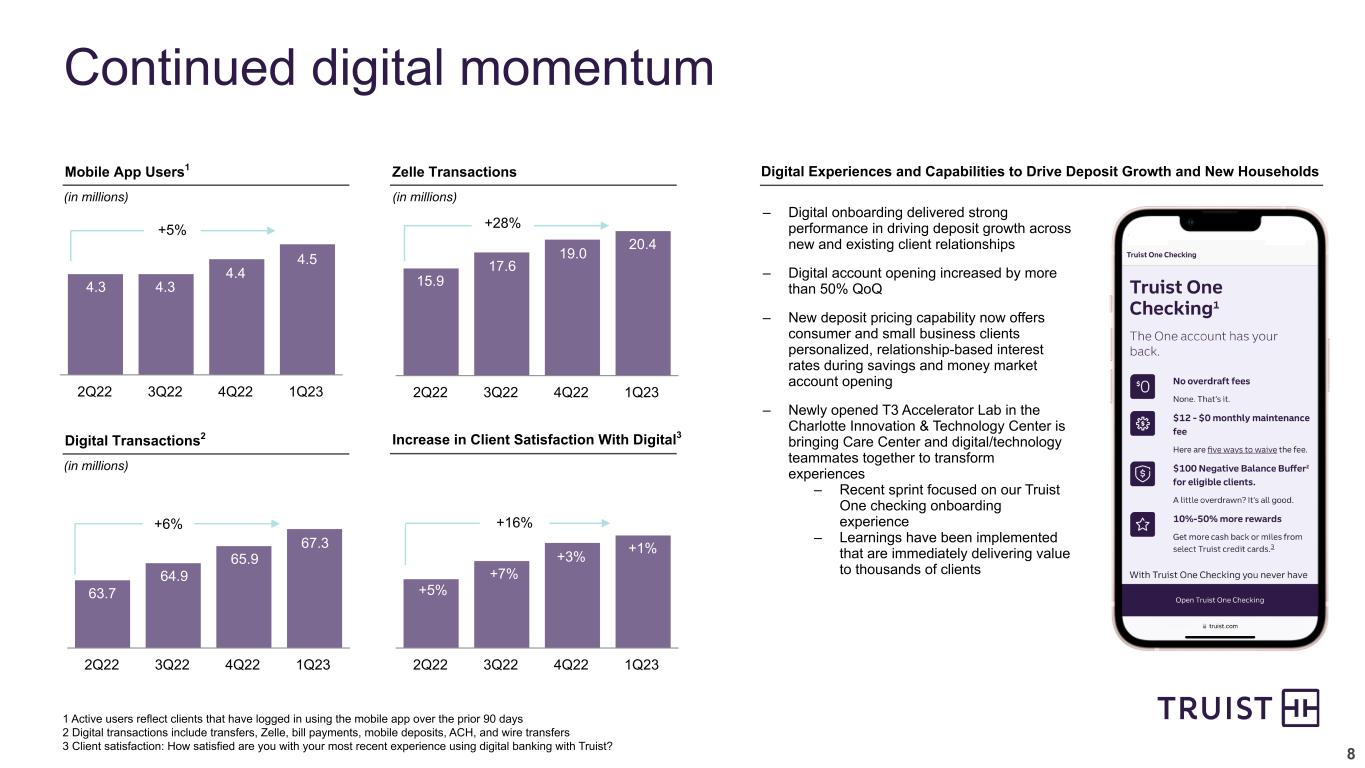

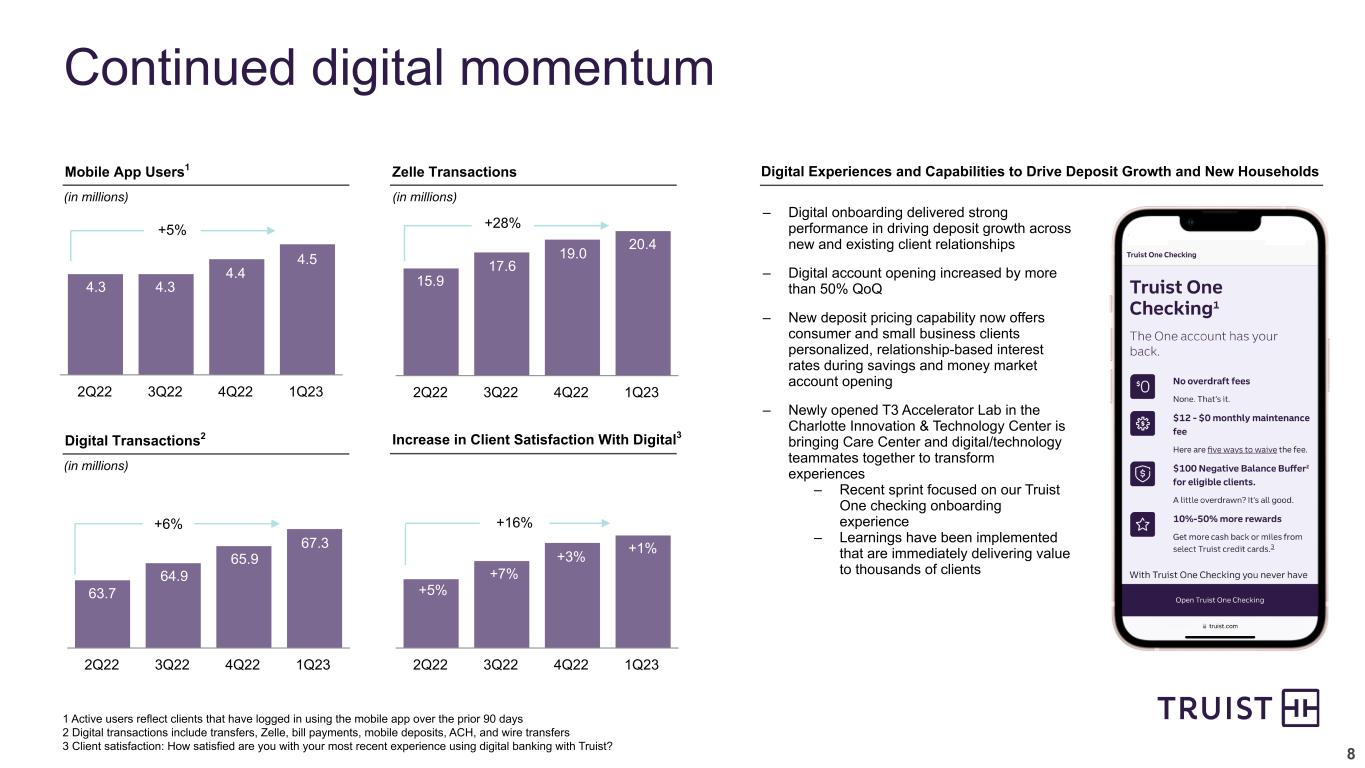

8 2Q22 3Q22 4Q22 1Q23 Digital Experiences and Capabilities to Drive Deposit Growth and New Households 2Q22 3Q22 4Q22 1Q23 Continued digital momentum 2Q22 3Q22 4Q22 1Q23 1 Active users reflect clients that have logged in using the mobile app over the prior 90 days 2 Digital transactions include transfers, Zelle, bill payments, mobile deposits, ACH, and wire transfers 3 Client satisfaction: How satisfied are you with your most recent experience using digital banking with Truist? 4.3 Mobile App Users1 Zelle Transactions Digital Transactions2 Increase in Client Satisfaction With Digital3 2Q22 3Q22 4Q22 1Q23 63.7 64.9 15.9 – Digital onboarding delivered strong performance in driving deposit growth across new and existing client relationships – Digital account opening increased by more than 50% QoQ – New deposit pricing capability now offers consumer and small business clients personalized, relationship-based interest rates during savings and money market account opening – Newly opened T3 Accelerator Lab in the Charlotte Innovation & Technology Center is bringing Care Center and digital/technology teammates together to transform experiences – Recent sprint focused on our Truist One checking onboarding experience – Learnings have been implemented that are immediately delivering value to thousands of clients 65.9 +5% +7% +3% 4.3 4.4 4.5 +5% 17.6 19.0 20.4 +28% 67.3 +6% +1% +16% (in millions) (in millions) (in millions)

9 ($ in billions) $289 $297 $309 $321 $326 $167 $173 $180 $188 $194 $121 $123 $130 $133 $132 3.70% 3.91% 4.49% 5.25% 5.81% 3.42% 3.64% Commercial LHFI ($ B) Consumer, mortgage, & card LHFI ($ B) Loans HFI yield (%) Loans HFI yield ex. PAA (%) 1Q22 2Q22 3Q22 4Q22 1Q23 – Solid 1.7% average loan growth given momentum from the prior quarter across most businesses – C&I up 3.6% on average due to growth across most CIB industry verticals and product groups and most CCB regions, in addition to full quarter impact of BankDirect Capital Finance acquisition – Consumer loans (including mortgage) declined $720 million, or 0.6%, due to continued declines in run-off portfolios (student and partnerships) and lower auto production – EOP loan growth (3/31 vs. 12/31) moderated to 0.5% primarily reflecting production reductions in lower return assets (mortgage and auto) – Truist began reducing production in mortgage and auto in 2H22 – C&I EOP loan growth (3/31 vs. 12/31) was 1.8%, moderating somewhat compared to the prior quarter EOP loan growth (12/31 vs. 9/30), ex. BankDirect Capital Finance, of 2.7% Average loans & leases HFI 5-Quarter Trend vs. Linked Quarter 4.36% May not foot due to rounding 5.14% 5.72%

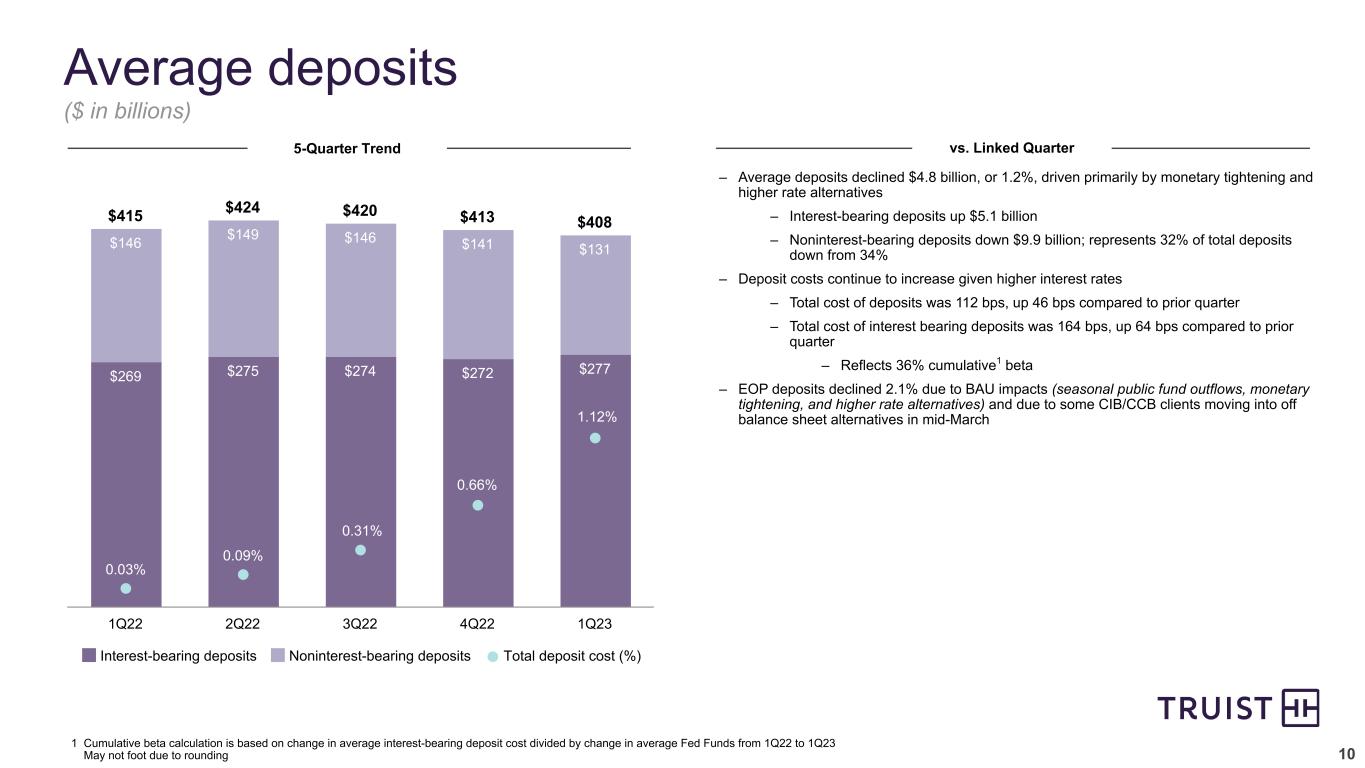

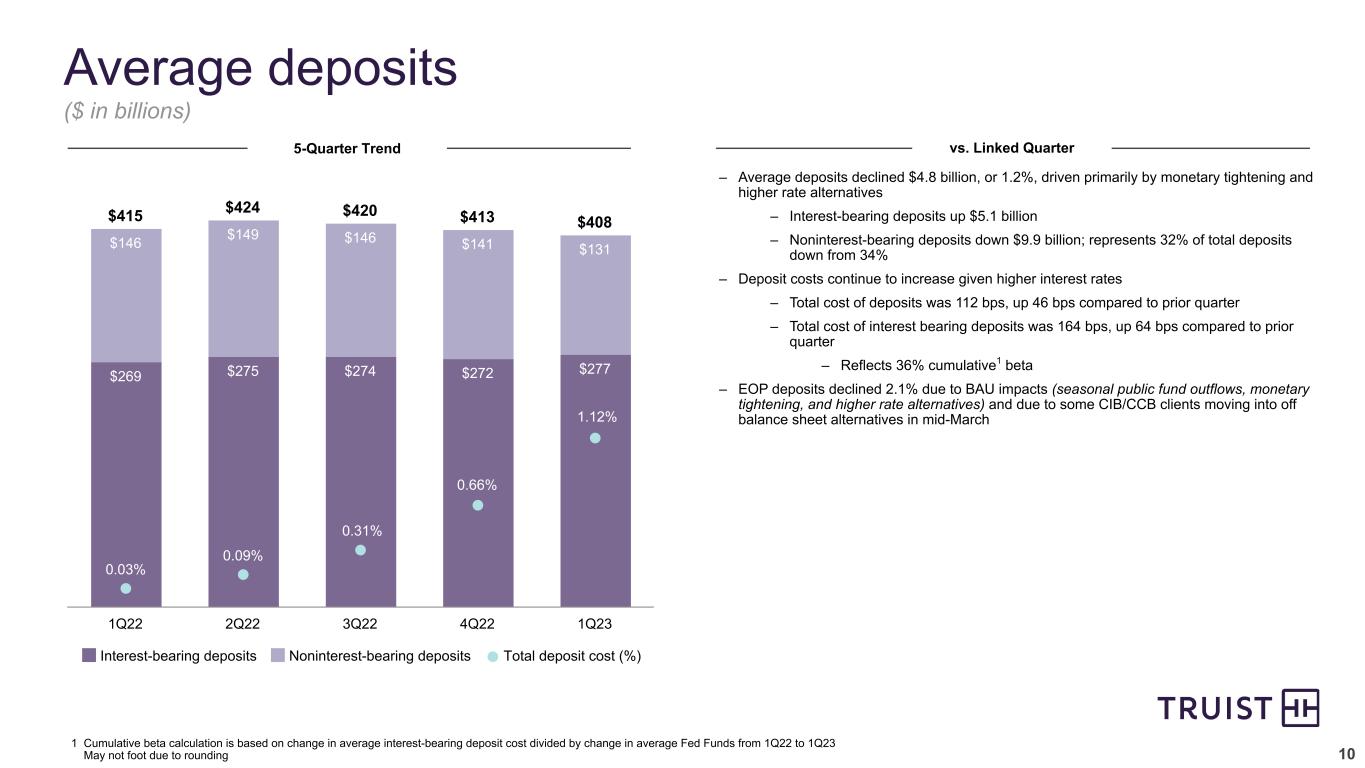

10 ($ in billions) $415 $424 $420 $413 $408 $269 $275 $274 $272 $277 $146 $149 $146 $141 $131 0.03% 0.09% Interest-bearing deposits Noninterest-bearing deposits Total deposit cost (%) 1Q22 2Q22 3Q22 4Q22 1Q23 Average deposits 1 Cumulative beta calculation is based on change in average interest-bearing deposit cost divided by change in average Fed Funds from 1Q22 to 1Q23 May not foot due to rounding – Average deposits declined $4.8 billion, or 1.2%, driven primarily by monetary tightening and higher rate alternatives – Interest-bearing deposits up $5.1 billion – Noninterest-bearing deposits down $9.9 billion; represents 32% of total deposits down from 34% – Deposit costs continue to increase given higher interest rates – Total cost of deposits was 112 bps, up 46 bps compared to prior quarter – Total cost of interest bearing deposits was 164 bps, up 64 bps compared to prior quarter – Reflects 36% cumulative1 beta – EOP deposits declined 2.1% due to BAU impacts (seasonal public fund outflows, monetary tightening, and higher rate alternatives) and due to some CIB/CCB clients moving into off balance sheet alternatives in mid-March vs. Linked Quarter 5-Quarter Trend 0.31% 0.66% 1.12%

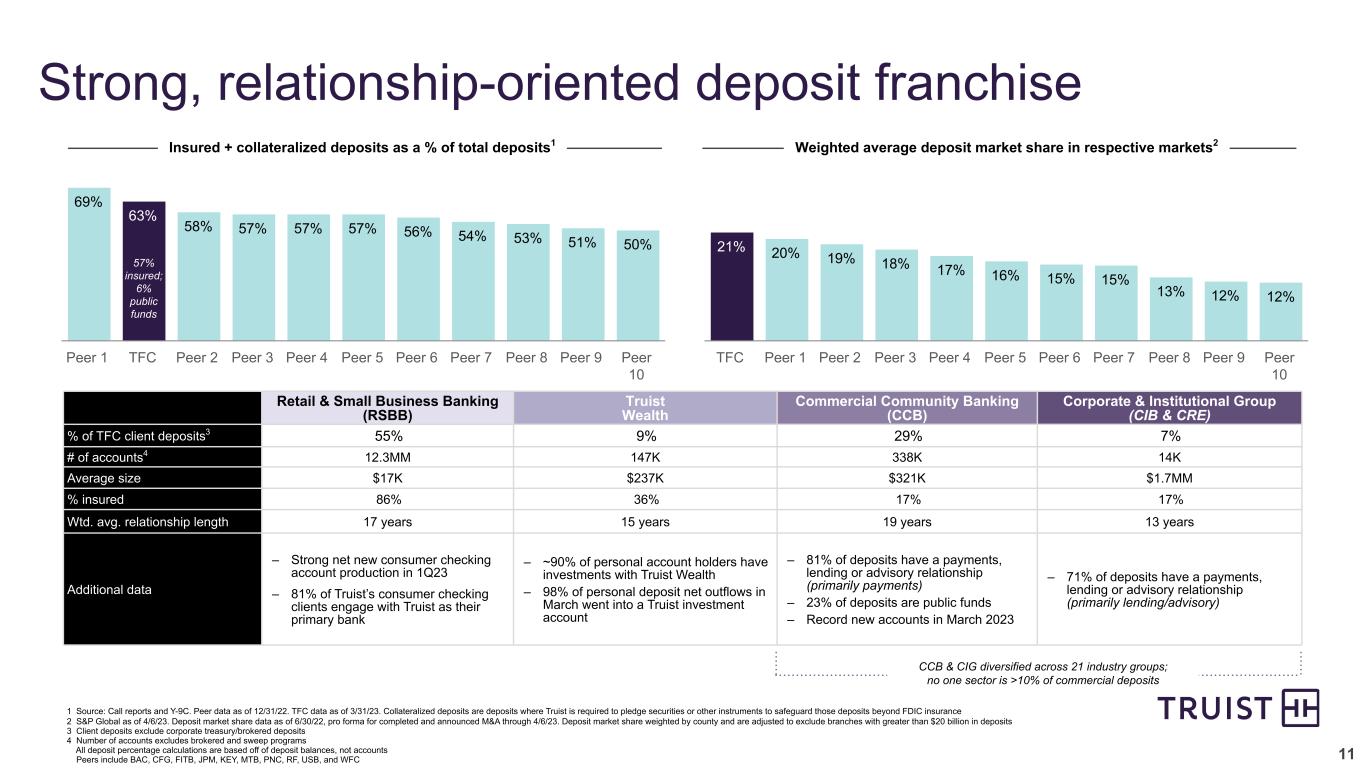

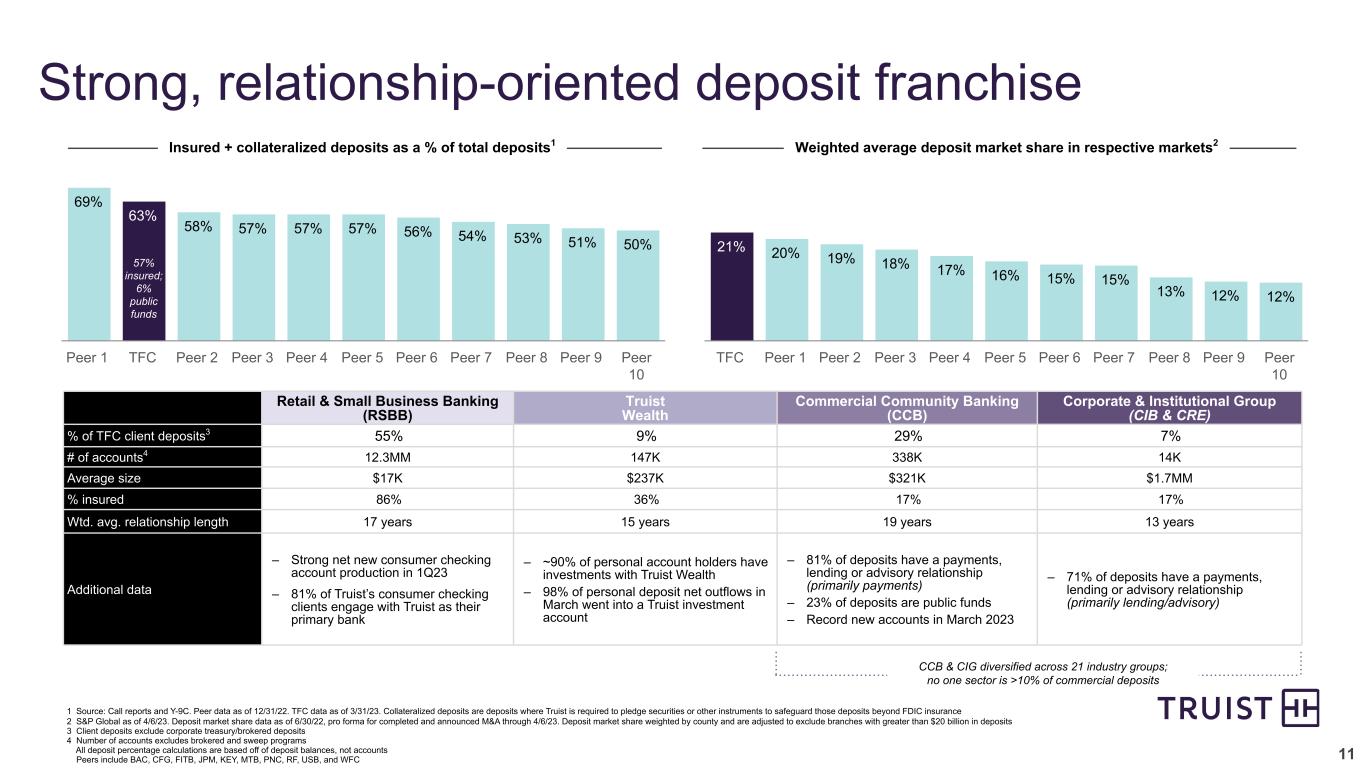

11 Strong, relationship-oriented deposit franchise Insured + collateralized deposits as a % of total deposits1 Weighted average deposit market share in respective markets2 69% 63% 58% 57% 57% 57% 56% 54% 53% 51% 50% Peer 1 TFC Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 21% 20% 19% 18% 17% 16% 15% 15% 13% 12% 12% TFC Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 1 Source: Call reports and Y-9C. Peer data as of 12/31/22. TFC data as of 3/31/23. Collateralized deposits are deposits where Truist is required to pledge securities or other instruments to safeguard those deposits beyond FDIC insurance 2 S&P Global as of 4/6/23. Deposit market share data as of 6/30/22, pro forma for completed and announced M&A through 4/6/23. Deposit market share weighted by county and are adjusted to exclude branches with greater than $20 billion in deposits 3 Client deposits exclude corporate treasury/brokered deposits 4 Number of accounts excludes brokered and sweep programs All deposit percentage calculations are based off of deposit balances, not accounts Peers include BAC, CFG, FITB, JPM, KEY, MTB, PNC, RF, USB, and WFC Retail & Small Business Banking (RSBB) Truist Wealth Commercial Community Banking (CCB) Corporate & Institutional Group (CIB & CRE) % of TFC client deposits3 55% 9% 29% 7% # of accounts4 12.3MM 147K 338K 14K Average size $17K $237K $321K $1.7MM % insured 86% 36% 17% 17% Wtd. avg. relationship length 17 years 15 years 19 years 13 years Additional data – Strong net new consumer checking account production in 1Q23 – 81% of Truist’s consumer checking clients engage with Truist as their primary bank – ~90% of personal account holders have investments with Truist Wealth – 98% of personal deposit net outflows in March went into a Truist investment account – 81% of deposits have a payments, lending or advisory relationship (primarily payments) – 23% of deposits are public funds – Record new accounts in March 2023 – 71% of deposits have a payments, lending or advisory relationship (primarily lending/advisory) CCB & CIG diversified across 21 industry groups; no one sector is >10% of commercial deposits 57% insured; 6% public funds

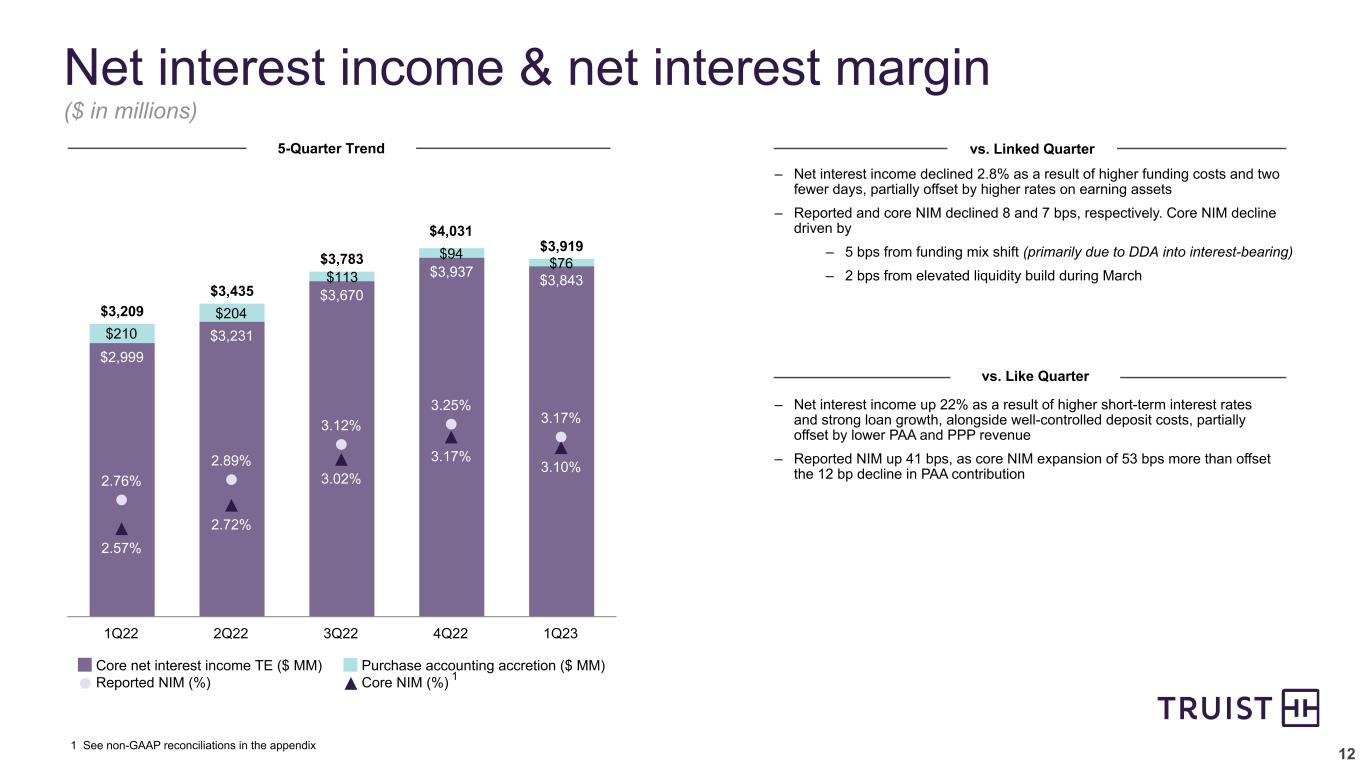

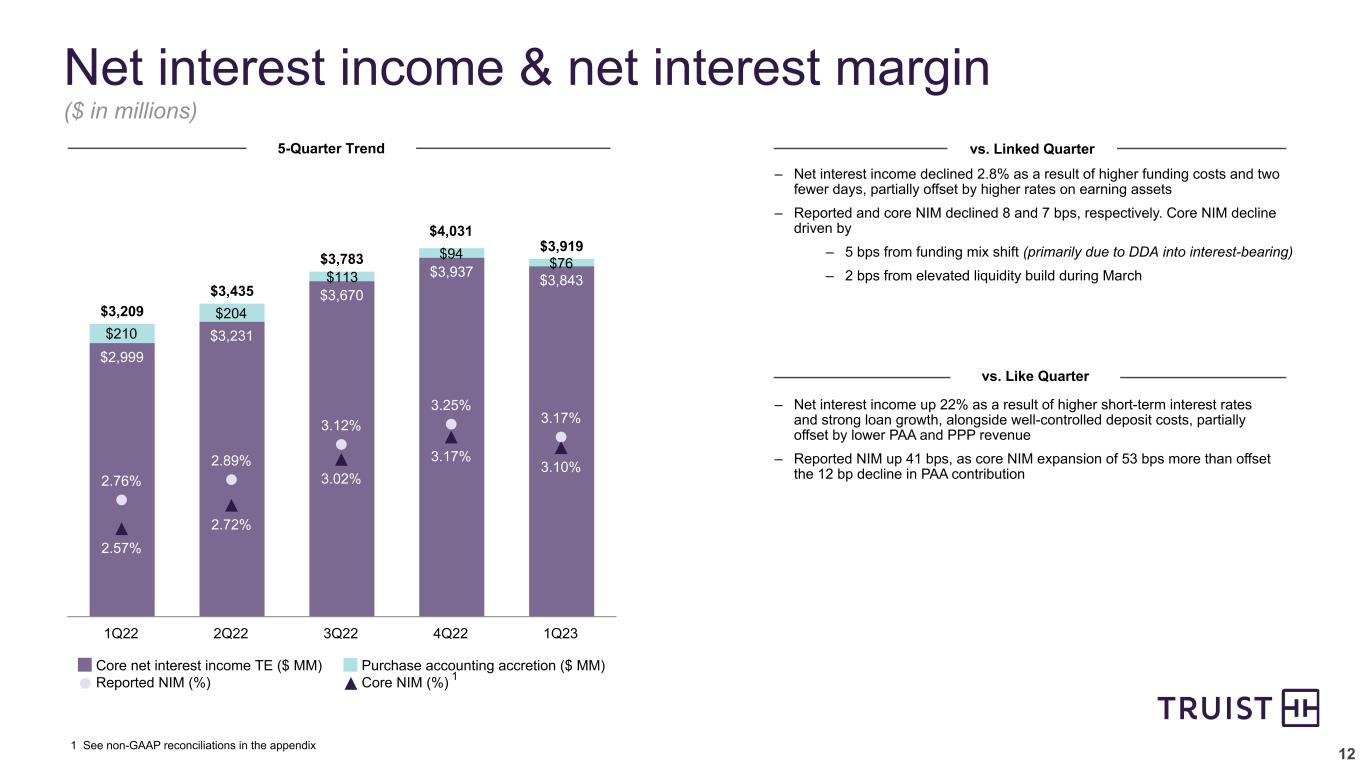

12 $3,209 $3,435 $3,783 $4,031 $3,919 $2,999 $3,231 $3,670 $3,937 $3,843 $210 $204 $113 $94 $76 2.76% 2.89% 3.12% 3.25% 3.17% 2.57% 2.72% 3.02% 3.17% 3.10% Core net interest income TE ($ MM) Purchase accounting accretion ($ MM) Reported NIM (%) Core NIM (%) 1Q22 2Q22 3Q22 4Q22 1Q23 Net interest income & net interest margin 1 See non-GAAP reconciliations in the appendix vs. Linked Quarter5-Quarter Trend 1 – Net interest income declined 2.8% as a result of higher funding costs and two fewer days, partially offset by higher rates on earning assets – Reported and core NIM declined 8 and 7 bps, respectively. Core NIM decline driven by – 5 bps from funding mix shift (primarily due to DDA into interest-bearing) – 2 bps from elevated liquidity build during March vs. Like Quarter – Net interest income up 22% as a result of higher short-term interest rates and strong loan growth, alongside well-controlled deposit costs, partially offset by lower PAA and PPP revenue – Reported NIM up 41 bps, as core NIM expansion of 53 bps more than offset the 12 bp decline in PAA contribution $4,031 ($ in millions)

13 $2,142 $2,248 $2,102 $2,227 $2,234 40.2% 39.7% 36.0% 35.9% 36.6% Fee income Fee income ratio (%) 1Q22 2Q22 3Q22 4Q22 1Q23 Noninterest income vs. Linked Quarter5-Quarter Trend – Noninterest income relatively stable – Seasonally higher insurance revenue and higher residential mortgage income partially offset by lower other income (due to positive NQDCP valuation in 4Q22) – Wealth management income increased due to higher brokerage commissions and fees from higher asset valuations – Card and payment related fees decreased due to seasonally lower transaction volumes vs. Like Quarter – Noninterest income up 4.3% largely as a result of strong 12% growth in insurance revenue (acquisitions and 4.7% organic growth) – Lending related fees increased $21 million, or 25%, primarily due to higher unused commitment fees – Card and payment related fees increased $18 million, or 8.5%, due to higher volumes and acquisitions – Other income declined $125 million, primarily as a result of $74 million gain on redemption of noncontrolling interest in 1Q22 and lower SBIC and other investment income ($ in millions)

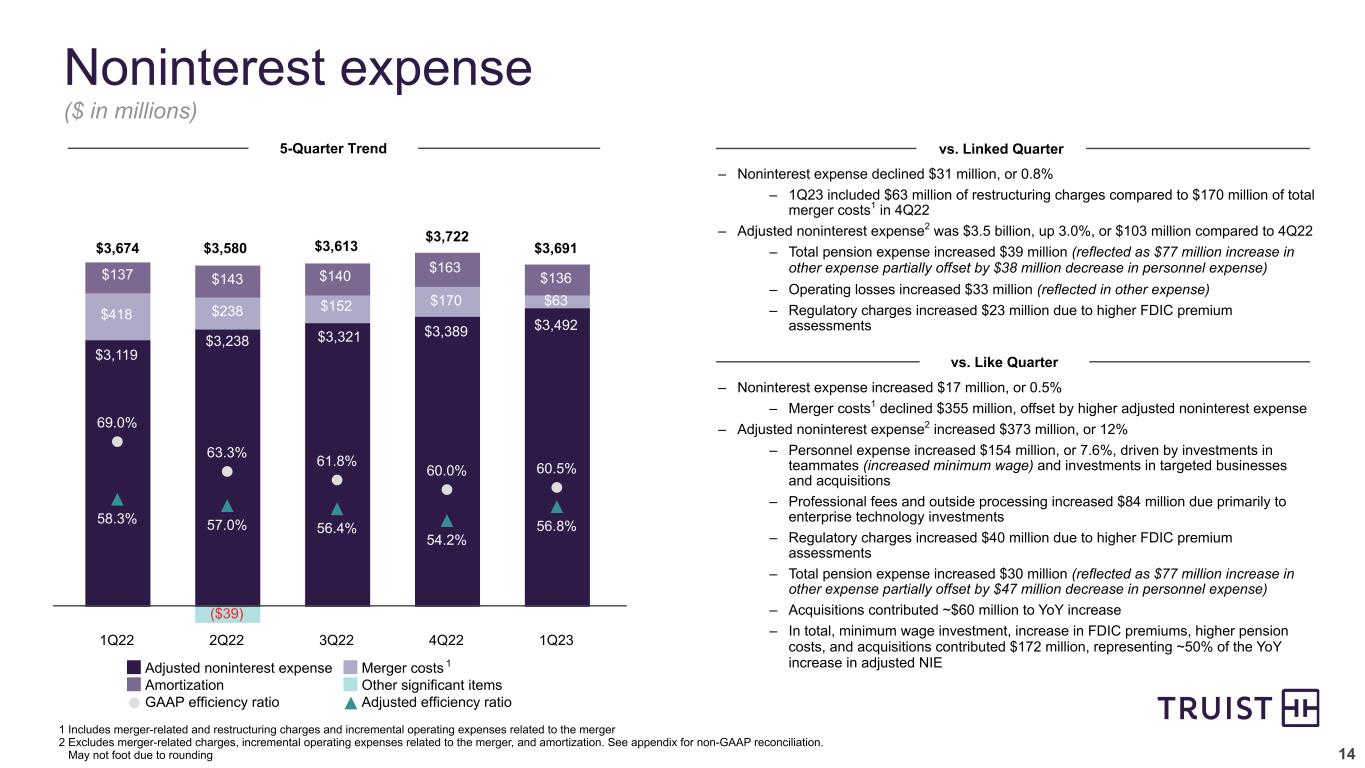

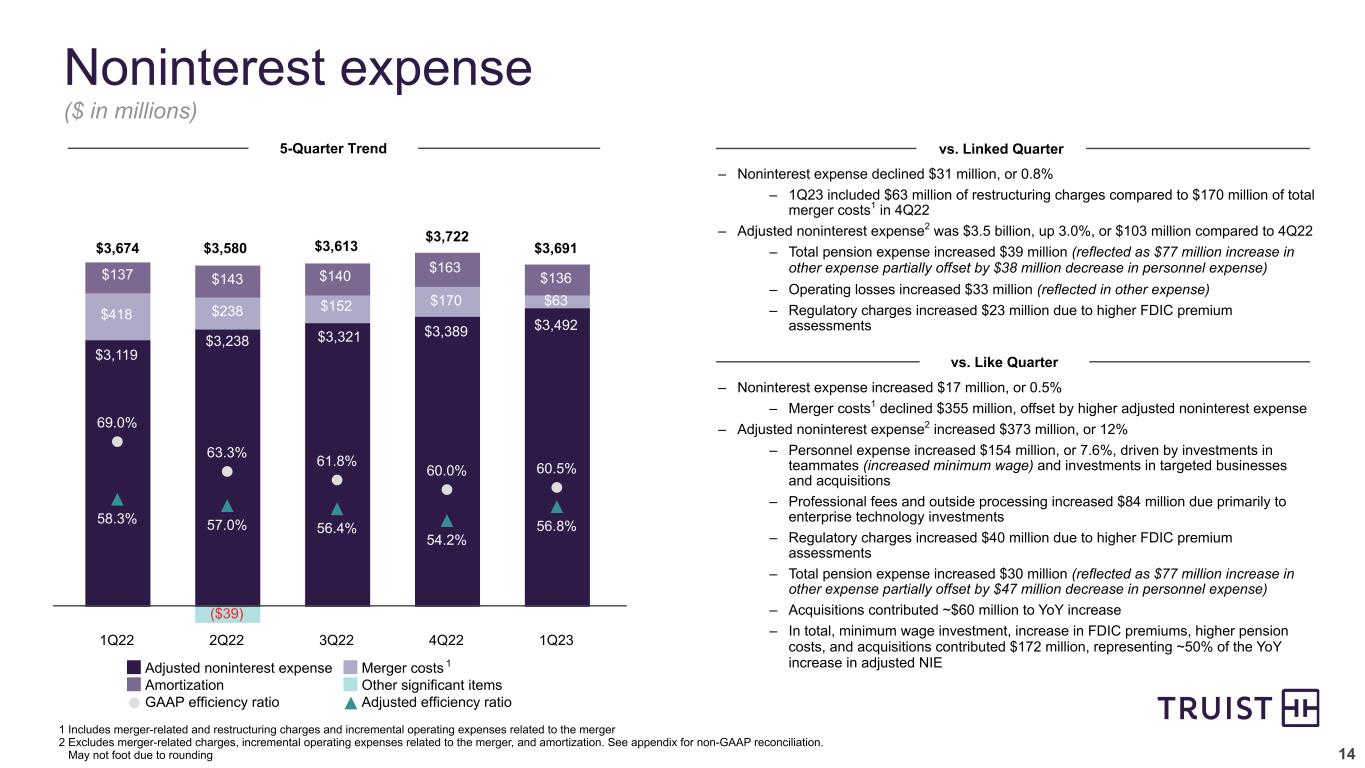

14 – Noninterest expense increased $17 million, or 0.5% – Merger costs1 declined $355 million, offset by higher adjusted noninterest expense – Adjusted noninterest expense2 increased $373 million, or 12% – Personnel expense increased $154 million, or 7.6%, driven by investments in teammates (increased minimum wage) and investments in targeted businesses and acquisitions – Professional fees and outside processing increased $84 million due primarily to enterprise technology investments – Regulatory charges increased $40 million due to higher FDIC premium assessments – Total pension expense increased $30 million (reflected as $77 million increase in other expense partially offset by $47 million decrease in personnel expense) – Acquisitions contributed ~$60 million to YoY increase – In total, minimum wage investment, increase in FDIC premiums, higher pension costs, and acquisitions contributed $172 million, representing ~50% of the YoY increase in adjusted NIE 69.0% 63.3% 61.8% 60.0% 60.5% 58.3% 57.0% 56.4% 54.2% 56.8% Adjusted noninterest expense Merger costs Amortization Other significant items GAAP efficiency ratio Adjusted efficiency ratio 1Q22 2Q22 3Q22 4Q22 1Q23 1 Includes merger-related and restructuring charges and incremental operating expenses related to the merger 2 Excludes merger-related charges, incremental operating expenses related to the merger, and amortization. See appendix for non-GAAP reconciliation. May not foot due to rounding Noninterest expense $137 $418 $3,119 $3,674 $152 $3,238 $3,580 ($39) 1 $3,613 vs. Linked Quarter5-Quarter Trend – Noninterest expense declined $31 million, or 0.8% – 1Q23 included $63 million of restructuring charges compared to $170 million of total merger costs1 in 4Q22 – Adjusted noninterest expense2 was $3.5 billion, up 3.0%, or $103 million compared to 4Q22 – Total pension expense increased $39 million (reflected as $77 million increase in other expense partially offset by $38 million decrease in personnel expense) – Operating losses increased $33 million (reflected in other expense) – Regulatory charges increased $23 million due to higher FDIC premium assessments vs. Like Quarter $238 $3,321 $140 $3,389 $170 $163 $3,722 $143 $3,492 $63 $163$3,691 $136 ($ in millions)

15 $178 $159 $213 $273 $297 0.25% 0.22% 0.27% 0.34% 0.37% NCO NCO ratio 1Q22 2Q22 3Q22 4Q22 1Q23 Asset quality 4.5x 9.0x 8.8x $421Net Charge-Offs Provision / (Benefit) for Credit Losses Nonperforming Loans / LHFI ALLL ($95) $171 $234 $467 $502 1Q22 2Q22 3Q22 4Q22 1Q23 $4,170 $4,187 $4,205 $4,377 $4,479 1.44% 1.38% 1.34% 1.34% 1.37% ALLL ALLL ratio ALLL / NCO 1Q22 2Q22 3Q22 4Q22 1Q23 Continued strong credit performance; YoY increase driven primarily by normalization within consumer portfolios, as well as an increase in the C&I portfolio Provision expense increased slightly vs. 4Q22; prior year results reflect improving economic environment in that period ALLL ratio up 3 bps due to increased economic uncertainty Strong asset quality continues to reflect Truist’s prudent risk culture and diverse loan portfolio Leading indicators (NPL, early stage delinquencies) remain strong 5.8X 6.5X 5.0X 0.36% 0.36% 0.35% 0.36% 0.36% 1Q22 2Q22 3Q22 4Q22 1Q23 3.7X4.1X

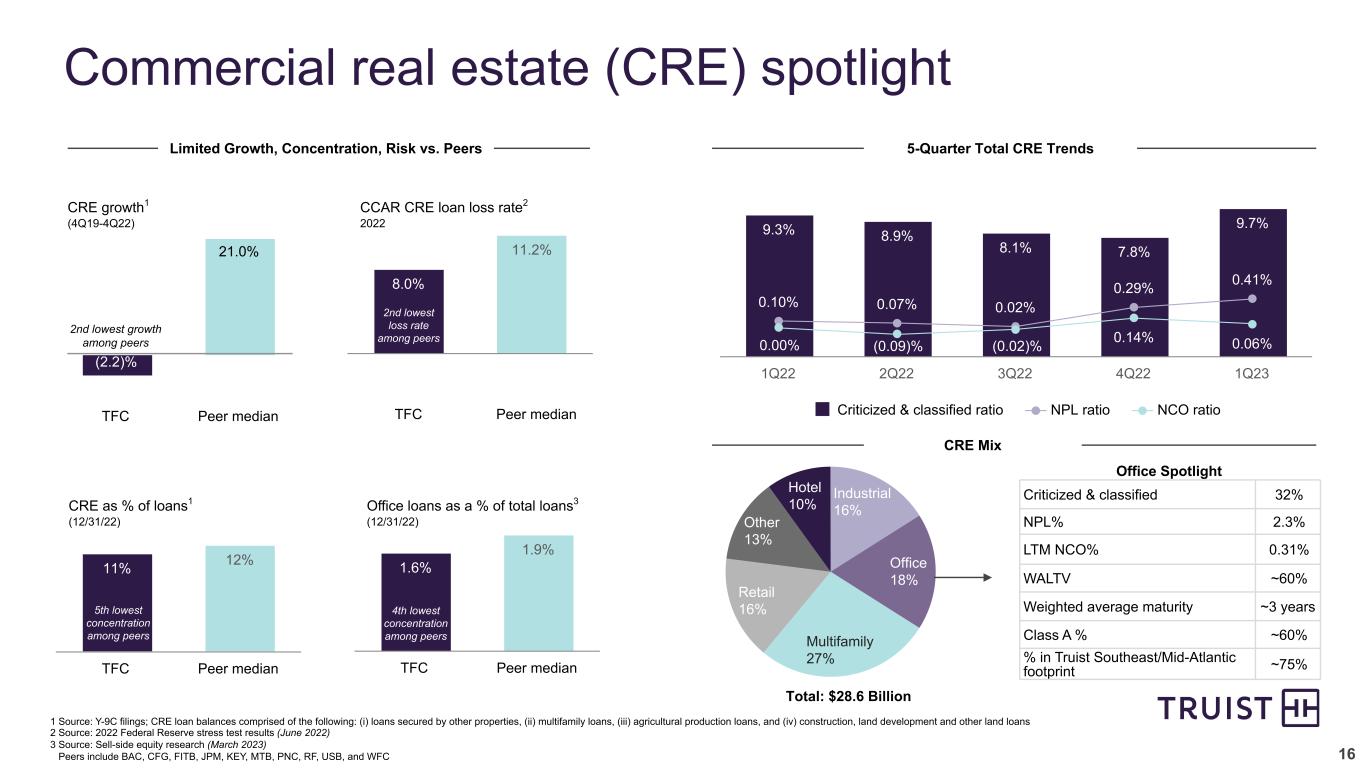

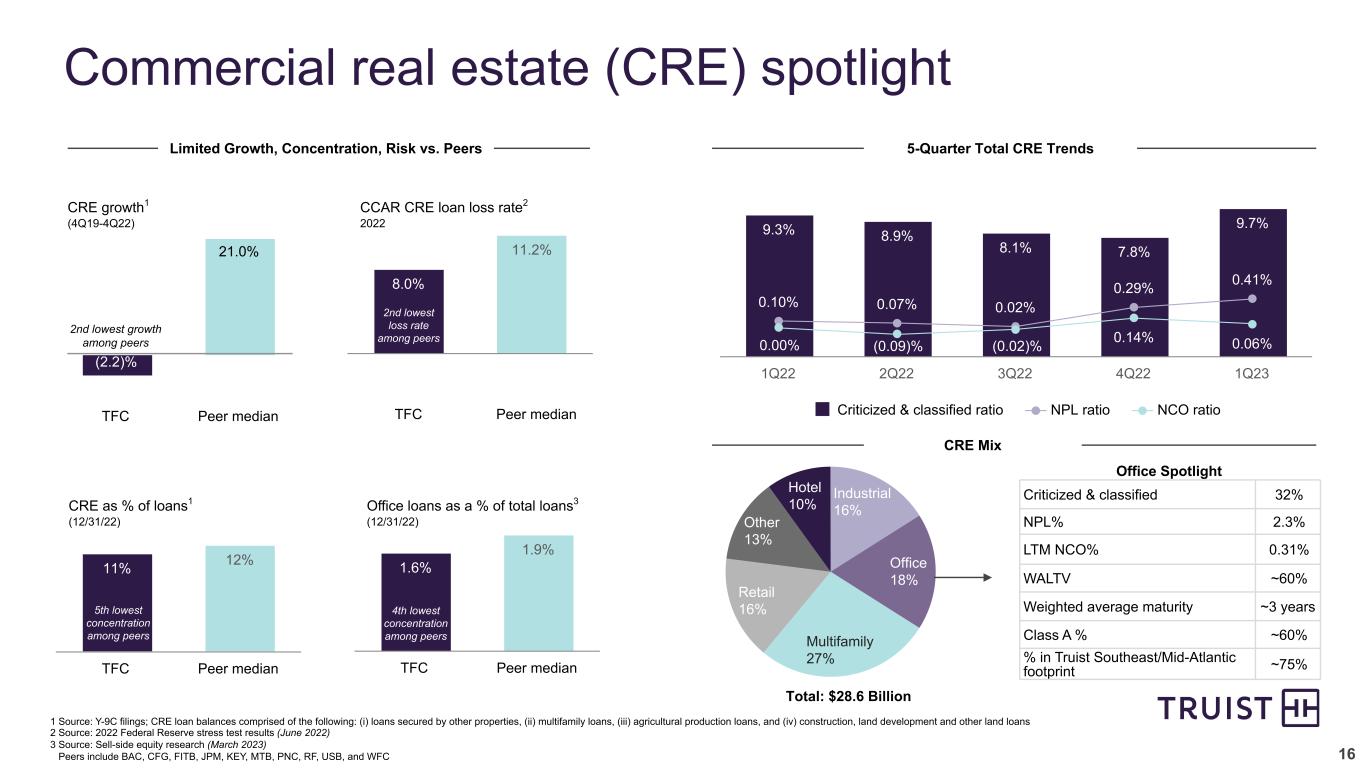

16 Industrial 16% Office 18% Multifamily 27% Retail 16% Other 13% Hotel 10% 8.0% 11.2% TFC Peer median 11% 12% TFC Peer median Commercial real estate (CRE) spotlight Limited Growth, Concentration, Risk vs. Peers 4.36% CRE growth1 (4Q19-4Q22) (2.2)% 13.1% TFC Peer median CRE as % of loans1 (12/31/22) CCAR CRE loan loss rate2 2022 1.6% 1.9% TFC Peer median Office loans as a % of total loans3 (12/31/22) 5-Quarter Total CRE Trends Criticized & classified 32% NPL% 2.3% LTM NCO% 0.31% WALTV ~60% Weighted average maturity ~3 years Class A % ~60% % in Truist Southeast/Mid-Atlantic footprint ~75% TFC Peer median Office Spotlight Total: $28.6 Billion CRE Mix 1 Source: Y-9C filings; CRE loan balances comprised of the following: (i) loans secured by other properties, (ii) multifamily loans, (iii) agricultural production loans, and (iv) construction, land development and other land loans 2 Source: 2022 Federal Reserve stress test results (June 2022) 3 Source: Sell-side equity research (March 2023) Peers include BAC, CFG, FITB, JPM, KEY, MTB, PNC, RF, USB, and WFC 21.0 9.3% 8.9% 8.1% 7.8% 9.7% 0.10% 0.07% 0.02% 0.29% 0.41% 0.14% 0.06% Criticized & classified ratio NPL ratio NCO ratio 1Q22 2Q22 3Q22 4Q22 1Q23 0.00% (0.09)% (0.02)% 2nd lowest growth among peers 2nd lowest loss rate among peers 5th lowest concentration among peers 4th lowest concentration among peers

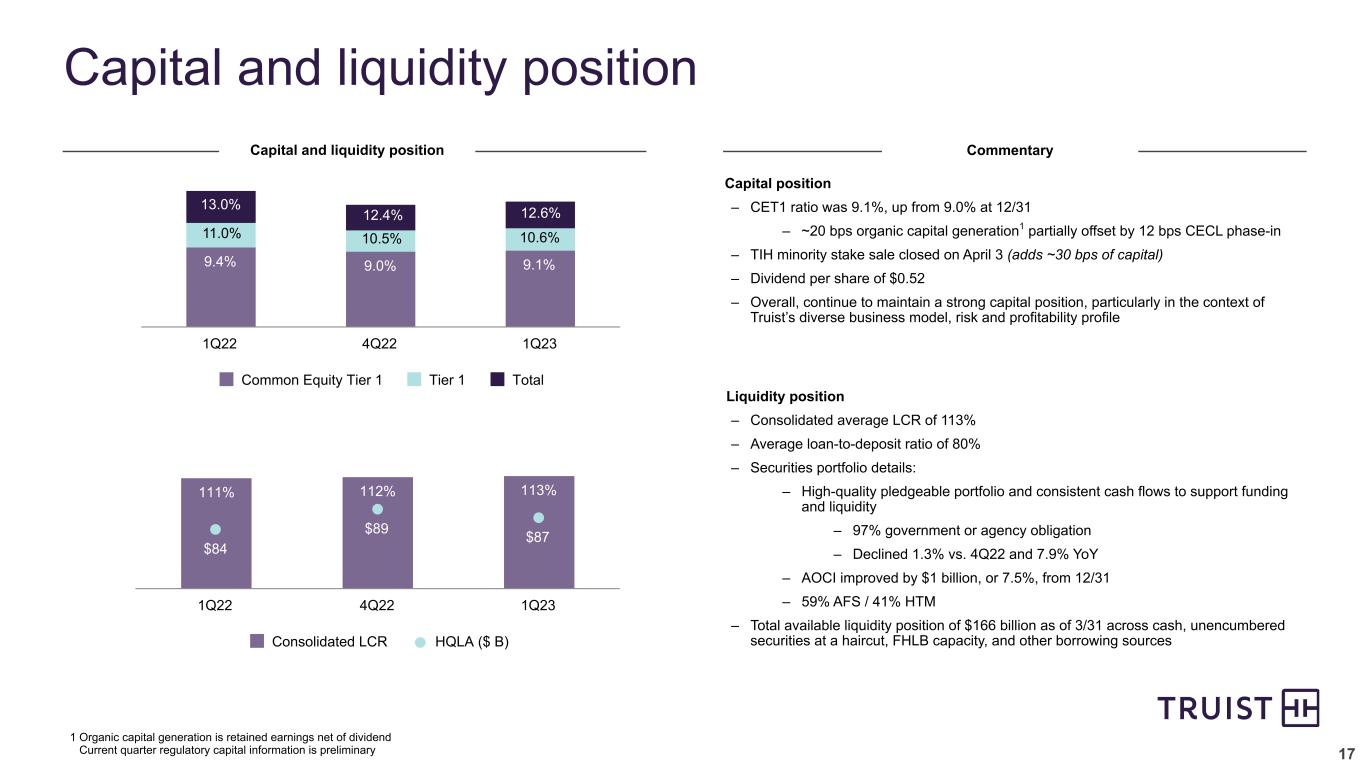

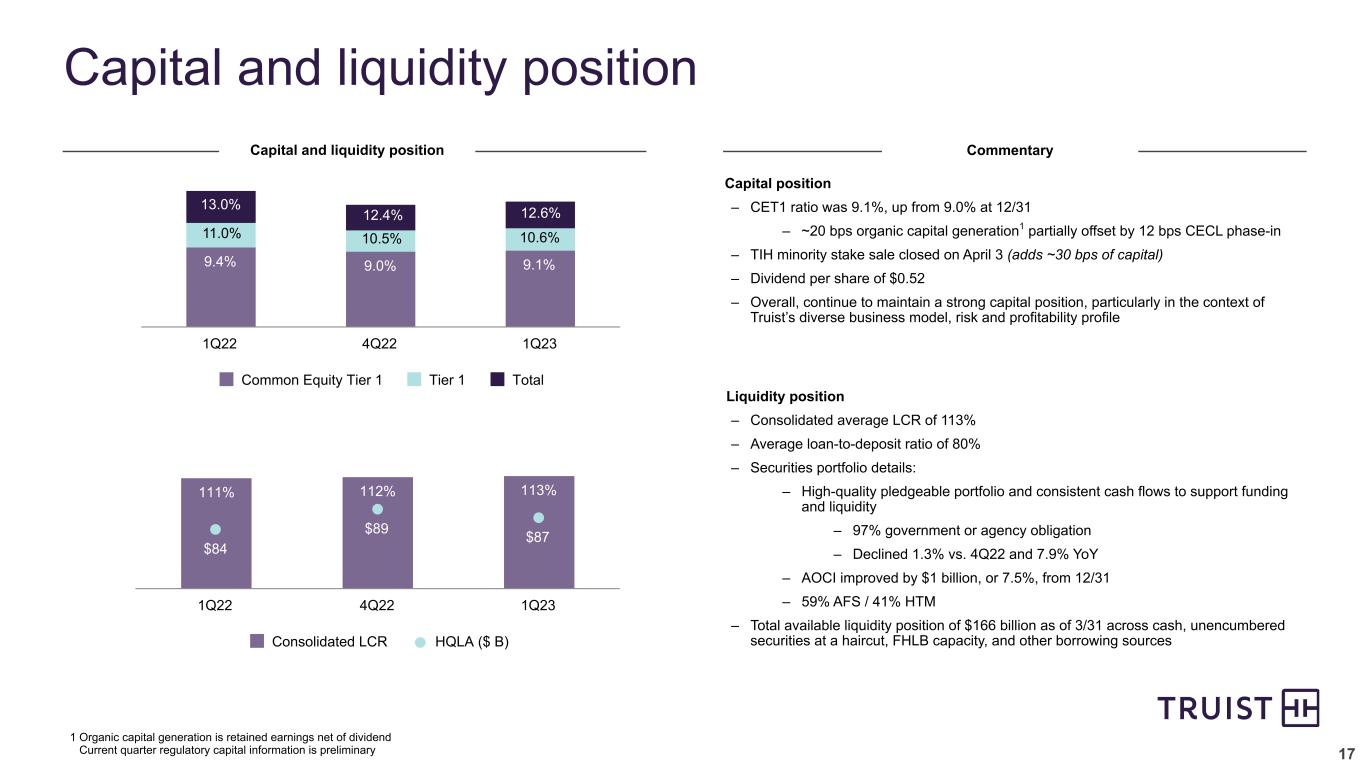

17 Capital and liquidity position 9.4% 9.0% 9.1% Common Equity Tier 1 Tier 1 Total 1Q22 4Q22 1Q23 1 Organic capital generation is retained earnings net of dividend Current quarter regulatory capital information is preliminary 111% 112% 113% $84 $89 $87 Consolidated LCR HQLA ($ B) 1Q22 4Q22 1Q23 12.6% Capital position – CET1 ratio was 9.1%, up from 9.0% at 12/31 – ~20 bps organic capital generation1 partially offset by 12 bps CECL phase-in – TIH minority stake sale closed on April 3 (adds ~30 bps of capital) – Dividend per share of $0.52 – Overall, continue to maintain a strong capital position, particularly in the context of Truist’s diverse business model, risk and profitability profile Liquidity position – Consolidated average LCR of 113% – Average loan-to-deposit ratio of 80% – Securities portfolio details: – High-quality pledgeable portfolio and consistent cash flows to support funding and liquidity – 97% government or agency obligation – Declined 1.3% vs. 4Q22 and 7.9% YoY – AOCI improved by $1 billion, or 7.5%, from 12/31 – 59% AFS / 41% HTM – Total available liquidity position of $166 billion as of 3/31 across cash, unencumbered securities at a haircut, FHLB capacity, and other borrowing sources 11.0% 13.0% Capital and liquidity position Commentary 10.5% 12.4% 10.6% 12.6%

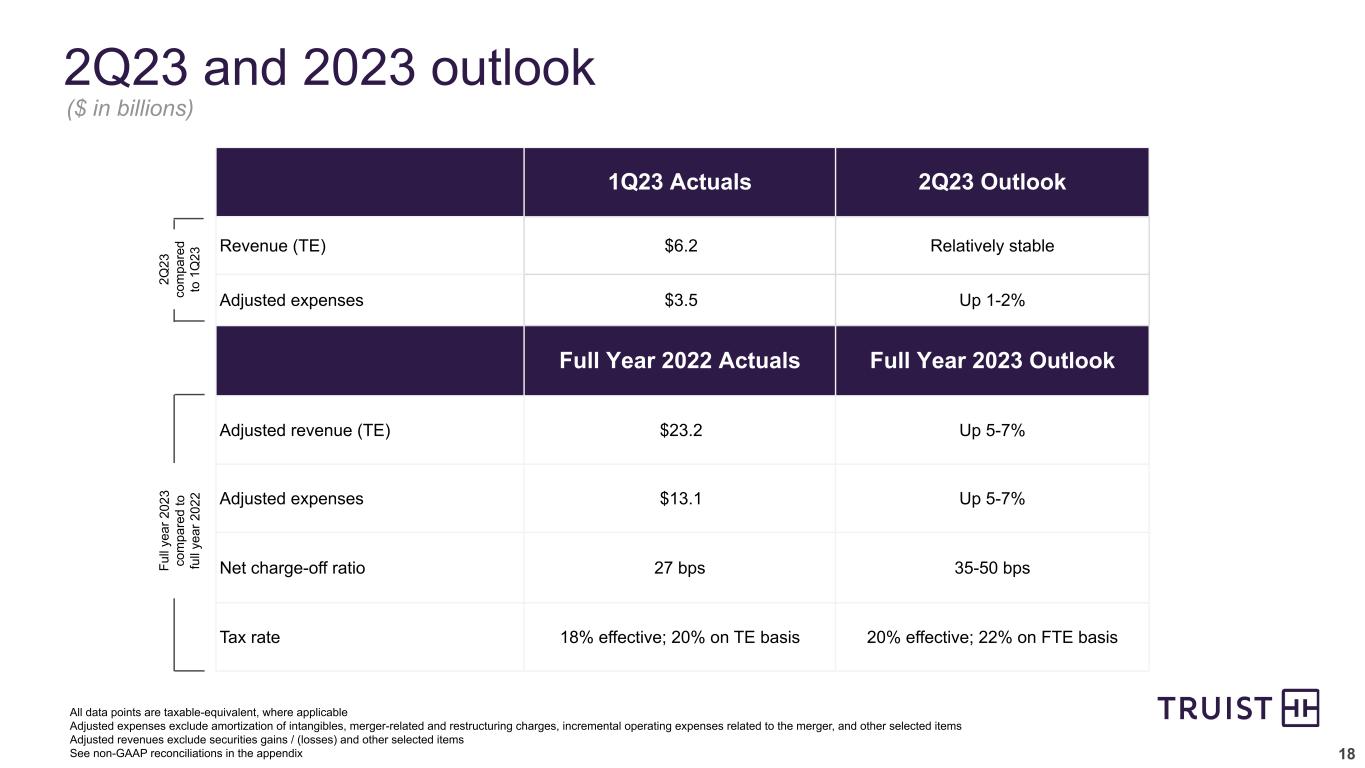

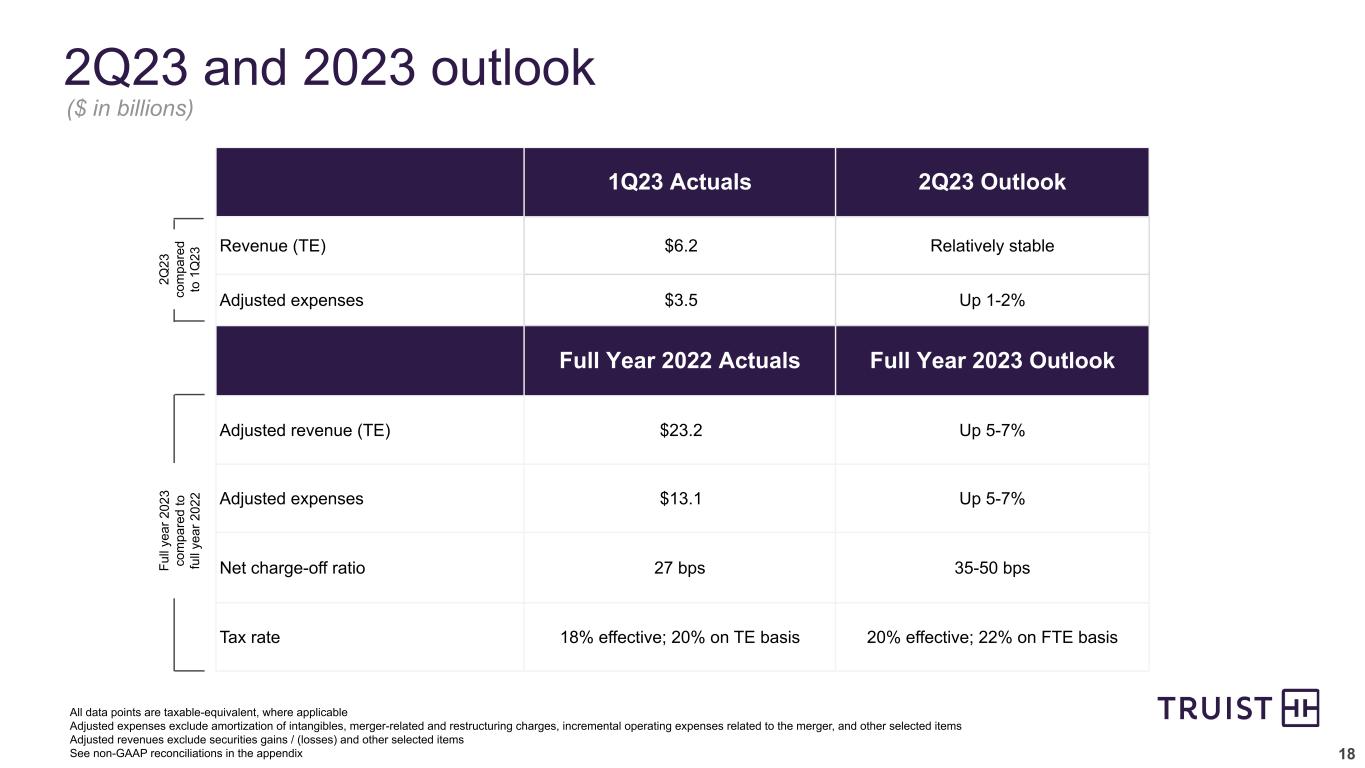

18 13.9% 1Q23 Actuals 2Q23 Outlook Revenue (TE) $6.2 Relatively stable Adjusted expenses $3.5 Up 1-2% Full Year 2022 Actuals Full Year 2023 Outlook Adjusted revenue (TE) $23.2 Up 5-7% Adjusted expenses $13.1 Up 5-7% Net charge-off ratio 27 bps 35-50 bps Tax rate 18% effective; 20% on TE basis 20% effective; 22% on FTE basis 2Q23 and 2023 outlook Fu ll ye ar 2 02 3 co m pa re d to fu ll ye ar 2 02 2 ($ in billions) 2Q 23 co m pa re d to 1 Q 23 All data points are taxable-equivalent, where applicable Adjusted expenses exclude amortization of intangibles, merger-related and restructuring charges, incremental operating expenses related to the merger, and other selected items Adjusted revenues exclude securities gains / (losses) and other selected items See non-GAAP reconciliations in the appendix

19 Investment thesis Why Truist? Purpose-Driven Culture Exceptional Company Investing in the Future Leading Financial Performance – Inspire and build better lives and communities – Optimize long-term value for all stakeholders through safe, sound, and ethical practices – Attract and retain top talent – Continued strong sustainability progress – Top 10 U.S. commercial bank – Strong retail and commercial banking market shares in high growth footprint (South / Mid-Atlantic) with select national businesses – Comprehensive and diverse business mix with distinct capabilities in insurance, investment banking, digital / point-of- sale lending, and advice / industry expertise – Significant IRM potential – Further modernize technology stack – Obsess over enhanced client and teammate experience to drive client acquisition – Enable convenient commerce and strengthen payments capabilities – Fit-for-purpose approach (build, buy, partner) – Increased usage of Open Banking, APIs, and Truist Ventures – Targeting strong growth and profitability relative to peers (with lower volatility) – Disciplined risk and financial management; focus on diversity – Strong risk adjusted capital position

Appendix

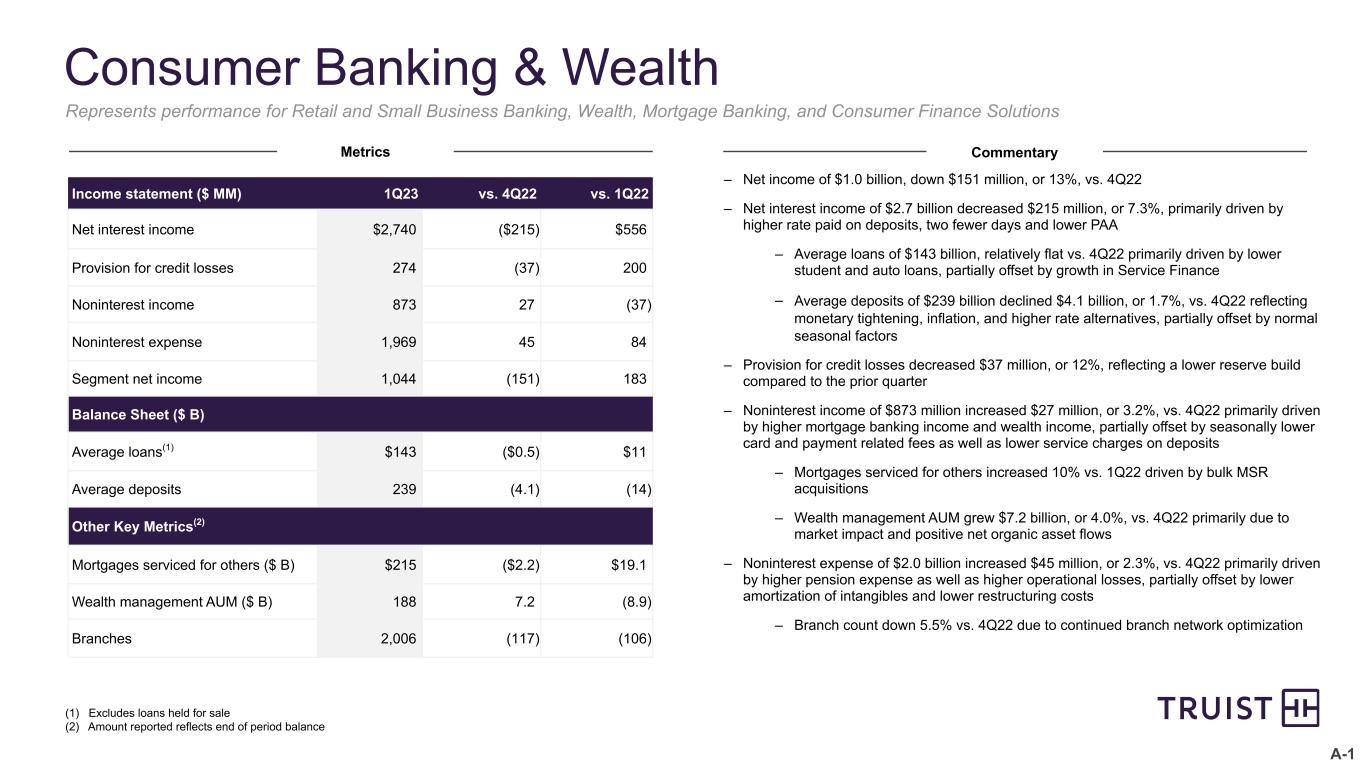

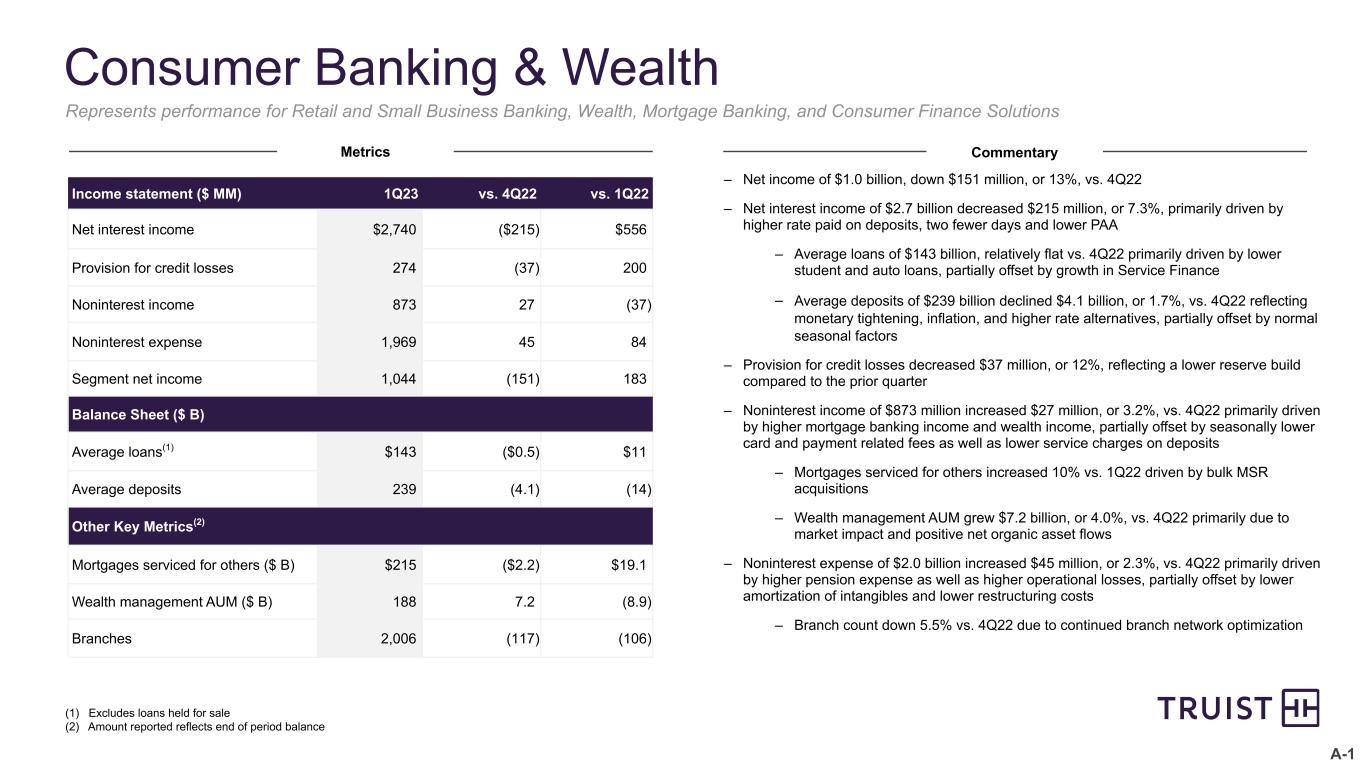

A-1 Consumer Banking & Wealth Income statement ($ MM) 1Q23 vs. 4Q22 vs. 1Q22 Net interest income $2,740 ($215) $556 Provision for credit losses 274 (37) 200 Noninterest income 873 27 (37) Noninterest expense 1,969 45 84 Segment net income 1,044 (151) 183 Balance Sheet ($ B) Average loans(1) $143 ($0.5) $11 Average deposits 239 (4.1) (14) Other Key Metrics(2) Mortgages serviced for others ($ B) $215 ($2.2) $19.1 Wealth management AUM ($ B) 188 7.2 (8.9) Branches 2,006 (117) (106) (1) Excludes loans held for sale (2) Amount reported reflects end of period balance Represents performance for Retail and Small Business Banking, Wealth, Mortgage Banking, and Consumer Finance Solutions – Net income of $1.0 billion, down $151 million, or 13%, vs. 4Q22 – Net interest income of $2.7 billion decreased $215 million, or 7.3%, primarily driven by higher rate paid on deposits, two fewer days and lower PAA – Average loans of $143 billion, relatively flat vs. 4Q22 primarily driven by lower student and auto loans, partially offset by growth in Service Finance – Average deposits of $239 billion declined $4.1 billion, or 1.7%, vs. 4Q22 reflecting monetary tightening, inflation, and higher rate alternatives, partially offset by normal seasonal factors – Provision for credit losses decreased $37 million, or 12%, reflecting a lower reserve build compared to the prior quarter – Noninterest income of $873 million increased $27 million, or 3.2%, vs. 4Q22 primarily driven by higher mortgage banking income and wealth income, partially offset by seasonally lower card and payment related fees as well as lower service charges on deposits – Mortgages serviced for others increased 10% vs. 1Q22 driven by bulk MSR acquisitions – Wealth management AUM grew $7.2 billion, or 4.0%, vs. 4Q22 primarily due to market impact and positive net organic asset flows – Noninterest expense of $2.0 billion increased $45 million, or 2.3%, vs. 4Q22 primarily driven by higher pension expense as well as higher operational losses, partially offset by lower amortization of intangibles and lower restructuring costs – Branch count down 5.5% vs. 4Q22 due to continued branch network optimization Metrics Commentary

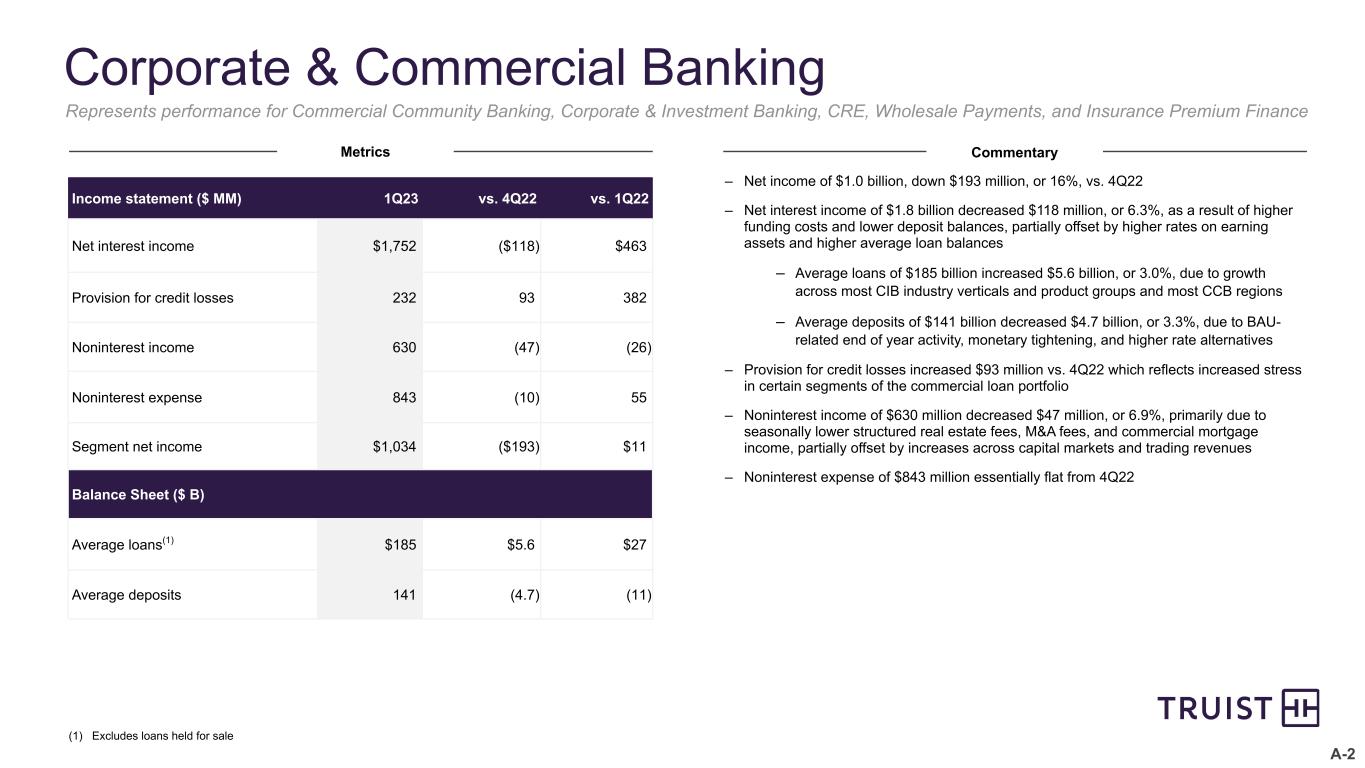

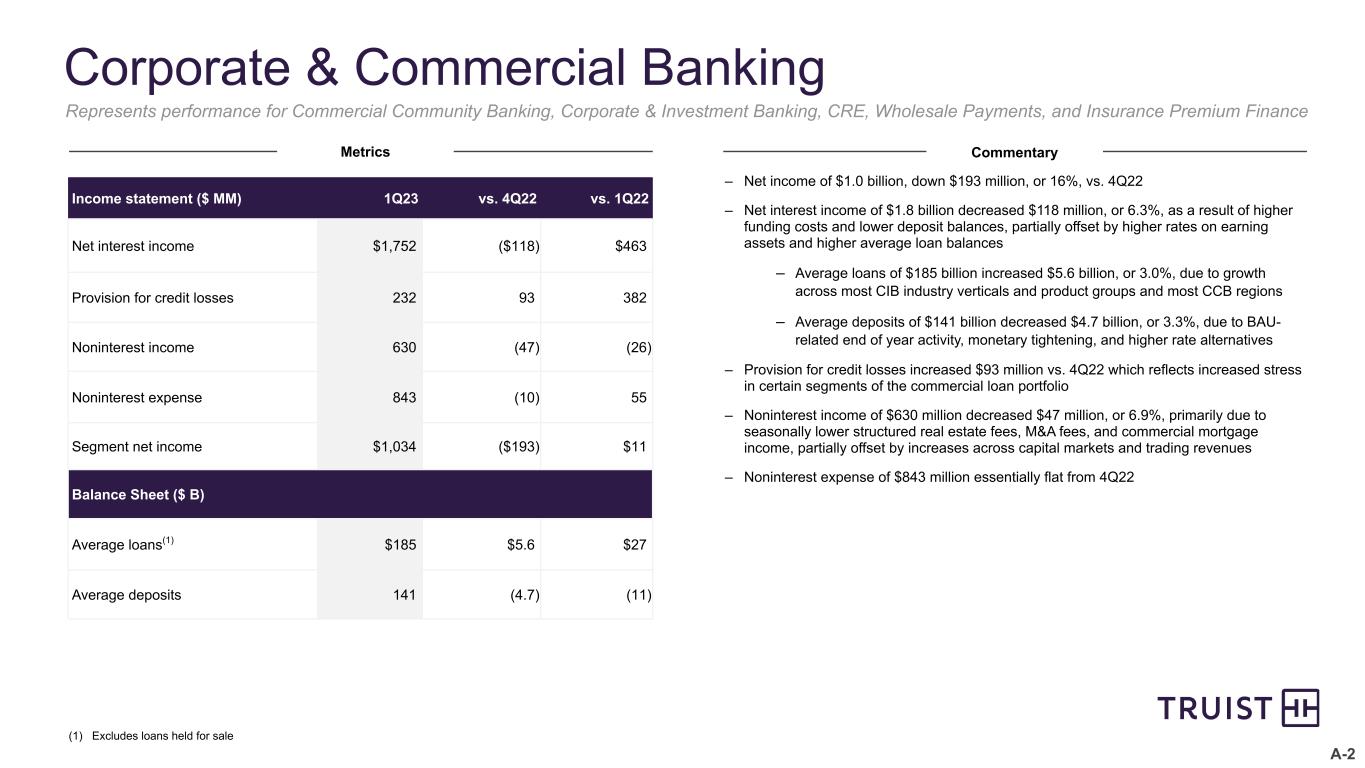

A-2 Corporate & Commercial Banking – Net income of $1.0 billion, down $193 million, or 16%, vs. 4Q22 – Net interest income of $1.8 billion decreased $118 million, or 6.3%, as a result of higher funding costs and lower deposit balances, partially offset by higher rates on earning assets and higher average loan balances – Average loans of $185 billion increased $5.6 billion, or 3.0%, due to growth across most CIB industry verticals and product groups and most CCB regions – Average deposits of $141 billion decreased $4.7 billion, or 3.3%, due to BAU- related end of year activity, monetary tightening, and higher rate alternatives – Provision for credit losses increased $93 million vs. 4Q22 which reflects increased stress in certain segments of the commercial loan portfolio – Noninterest income of $630 million decreased $47 million, or 6.9%, primarily due to seasonally lower structured real estate fees, M&A fees, and commercial mortgage income, partially offset by increases across capital markets and trading revenues – Noninterest expense of $843 million essentially flat from 4Q22 (1) Excludes loans held for sale Represents performance for Commercial Community Banking, Corporate & Investment Banking, CRE, Wholesale Payments, and Insurance Premium Finance Metrics Commentary Income statement ($ MM) 1Q23 vs. 4Q22 vs. 1Q22 Net interest income $1,752 ($118) $463 Provision for credit losses 232 93 382 Noninterest income 630 (47) (26) Noninterest expense 843 (10) 55 Segment net income $1,034 ($193) $11 Balance Sheet ($ B) Average loans(1) $185 $5.6 $27 Average deposits 141 (4.7) (11)

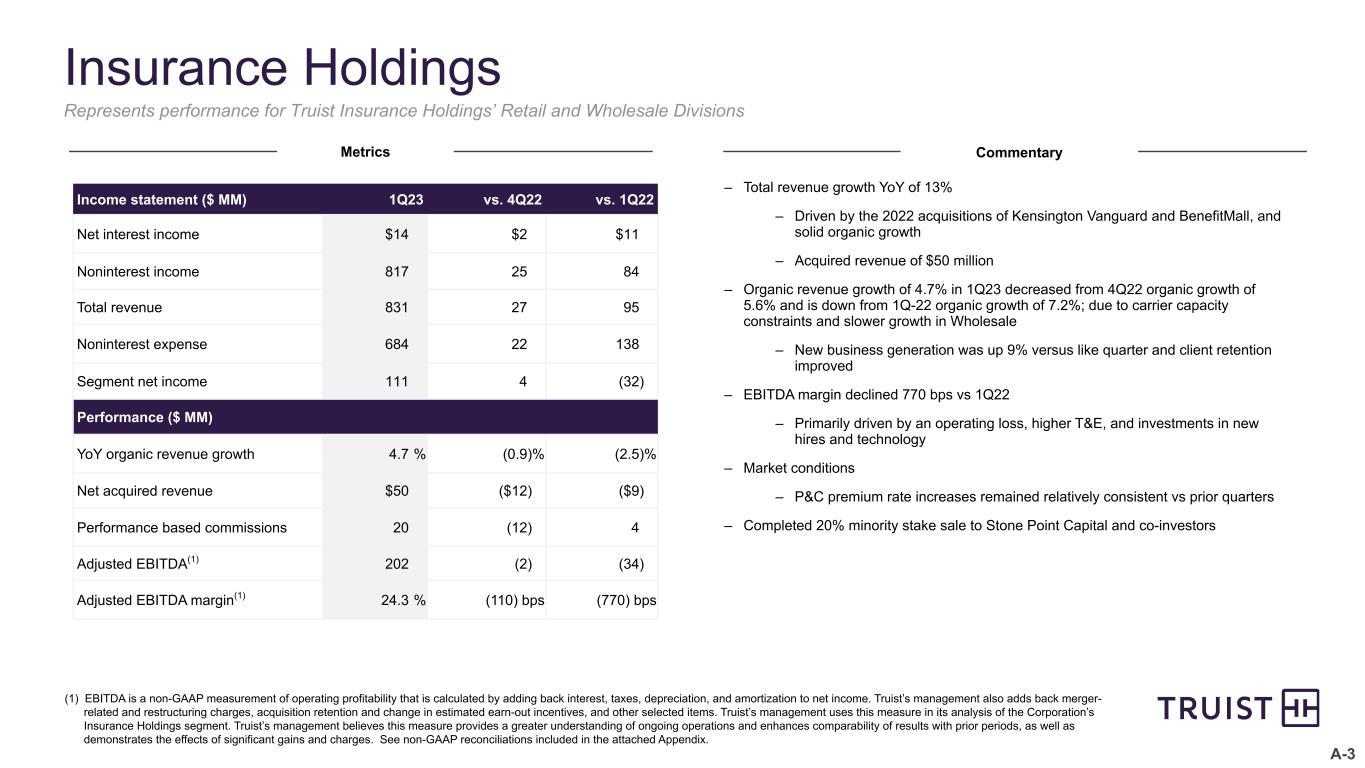

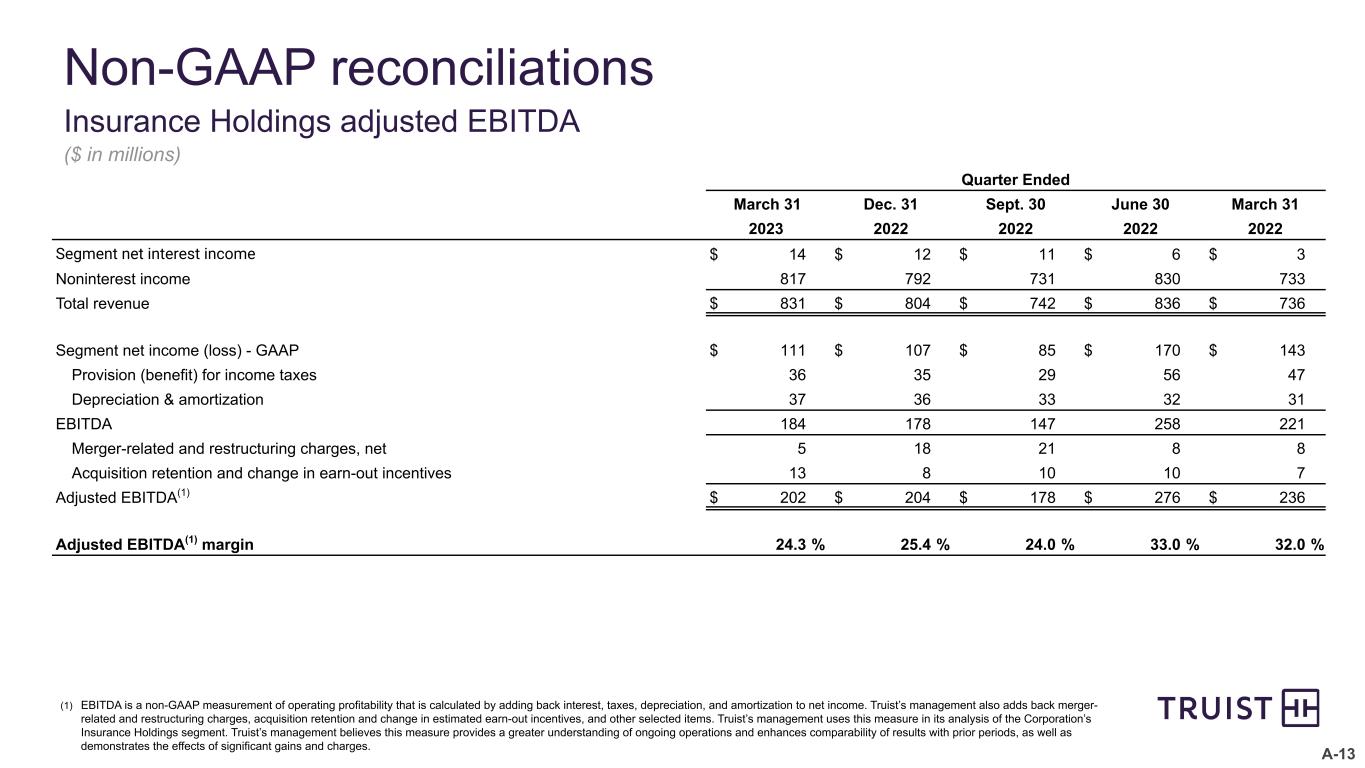

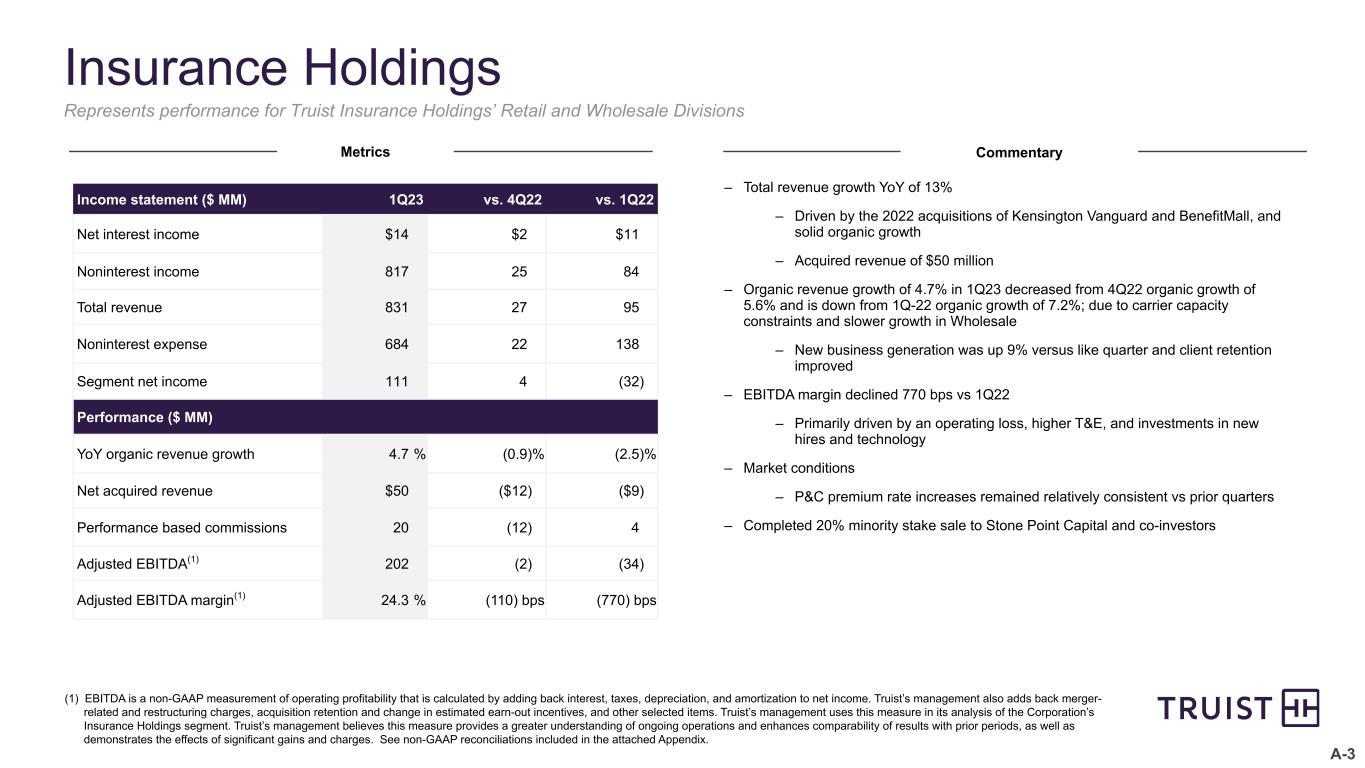

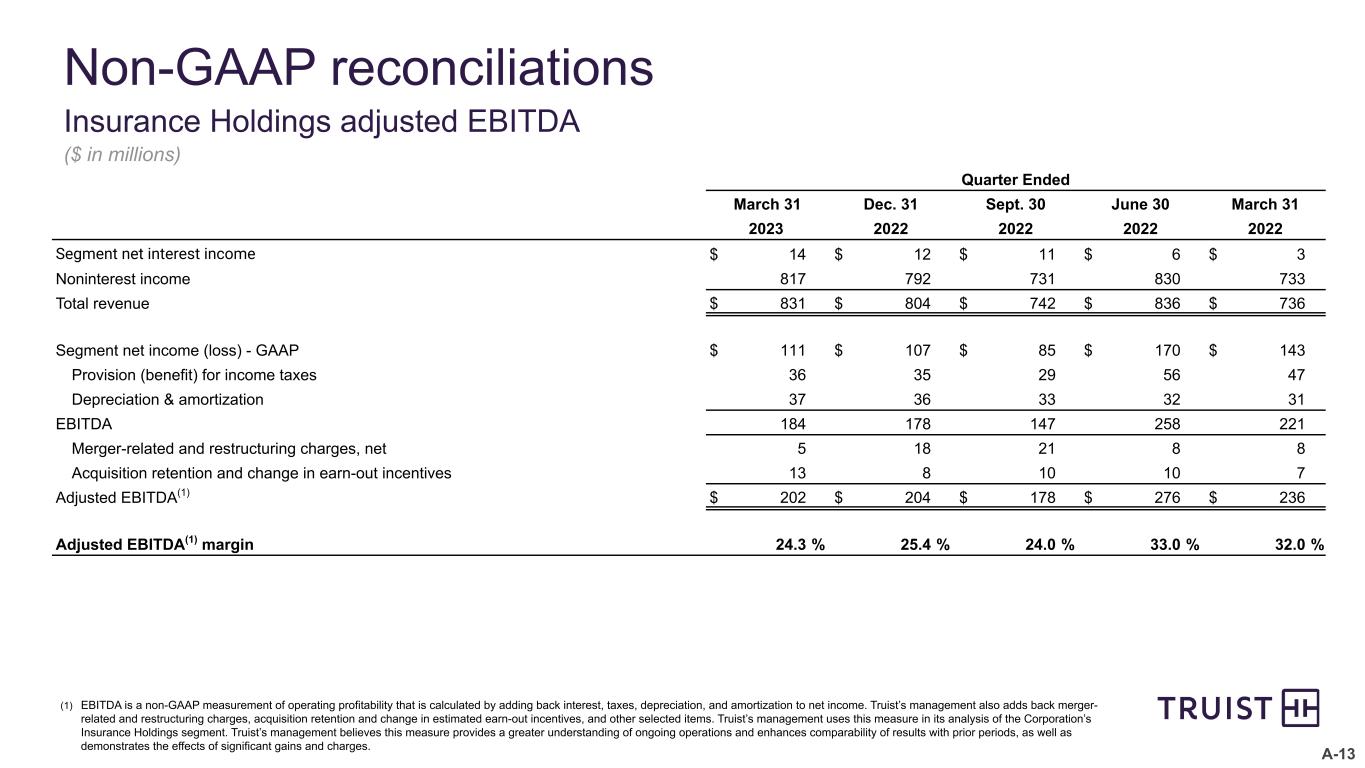

A-3 Insurance Holdings – Total revenue growth YoY of 13% – Driven by the 2022 acquisitions of Kensington Vanguard and BenefitMall, and solid organic growth – Acquired revenue of $50 million – Organic revenue growth of 4.7% in 1Q23 decreased from 4Q22 organic growth of 5.6% and is down from 1Q-22 organic growth of 7.2%; due to carrier capacity constraints and slower growth in Wholesale – New business generation was up 9% versus like quarter and client retention improved – EBITDA margin declined 770 bps vs 1Q22 – Primarily driven by an operating loss, higher T&E, and investments in new hires and technology – Market conditions – P&C premium rate increases remained relatively consistent vs prior quarters – Completed 20% minority stake sale to Stone Point Capital and co-investors (1) EBITDA is a non-GAAP measurement of operating profitability that is calculated by adding back interest, taxes, depreciation, and amortization to net income. Truist’s management also adds back merger- related and restructuring charges, acquisition retention and change in estimated earn-out incentives, and other selected items. Truist’s management uses this measure in its analysis of the Corporation’s Insurance Holdings segment. Truist’s management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. See non-GAAP reconciliations included in the attached Appendix. Represents performance for Truist Insurance Holdings’ Retail and Wholesale Divisions Metrics Commentary Income statement ($ MM) 1Q23 vs. 4Q22 vs. 1Q22 Net interest income $14 $2 $11 Noninterest income 817 25 84 Total revenue 831 27 95 Noninterest expense 684 22 138 Segment net income 111 4 (32) Performance ($ MM) YoY organic revenue growth 4.7 % (0.9) % (2.5) % Net acquired revenue $50 ($12) ($9) Performance based commissions 20 (12) 4 Adjusted EBITDA(1) 202 (2) (34) Adjusted EBITDA margin(1) 24.3 % (110) bps (770) bps

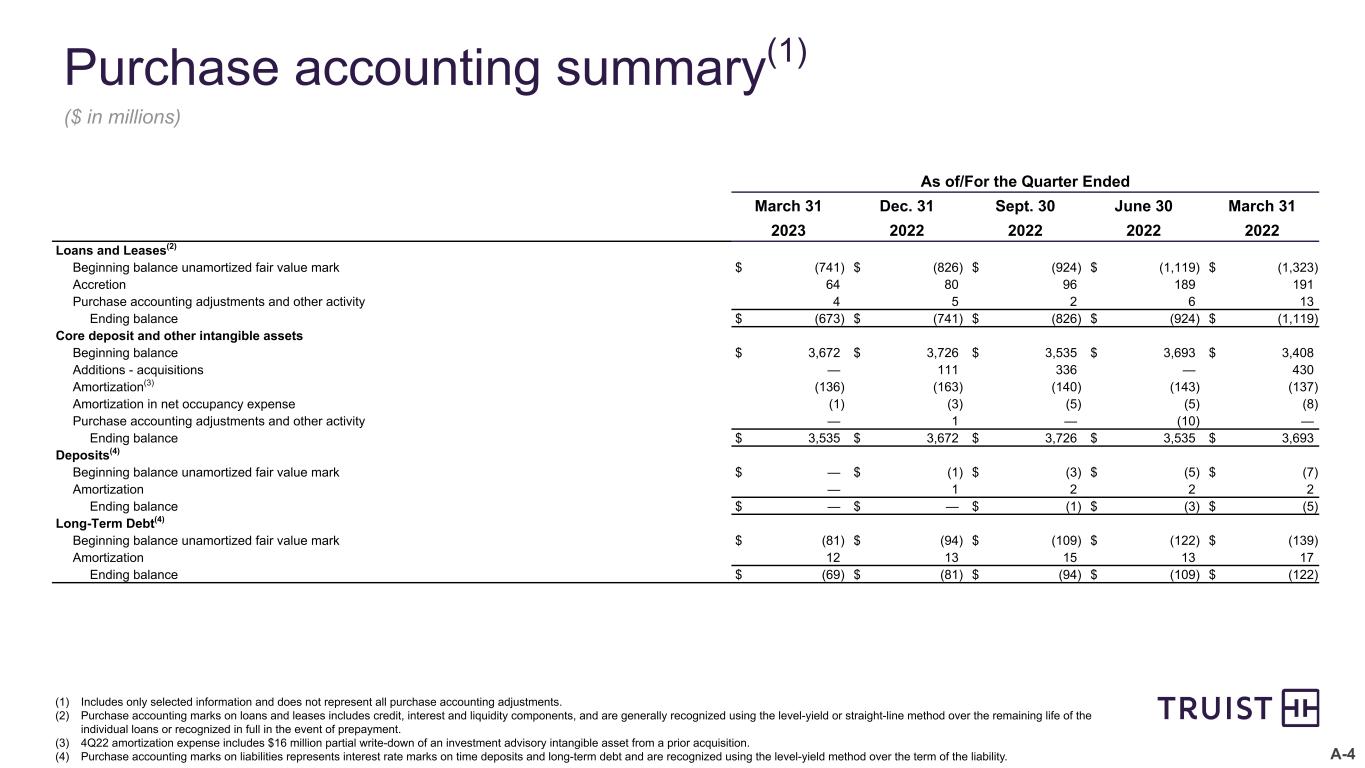

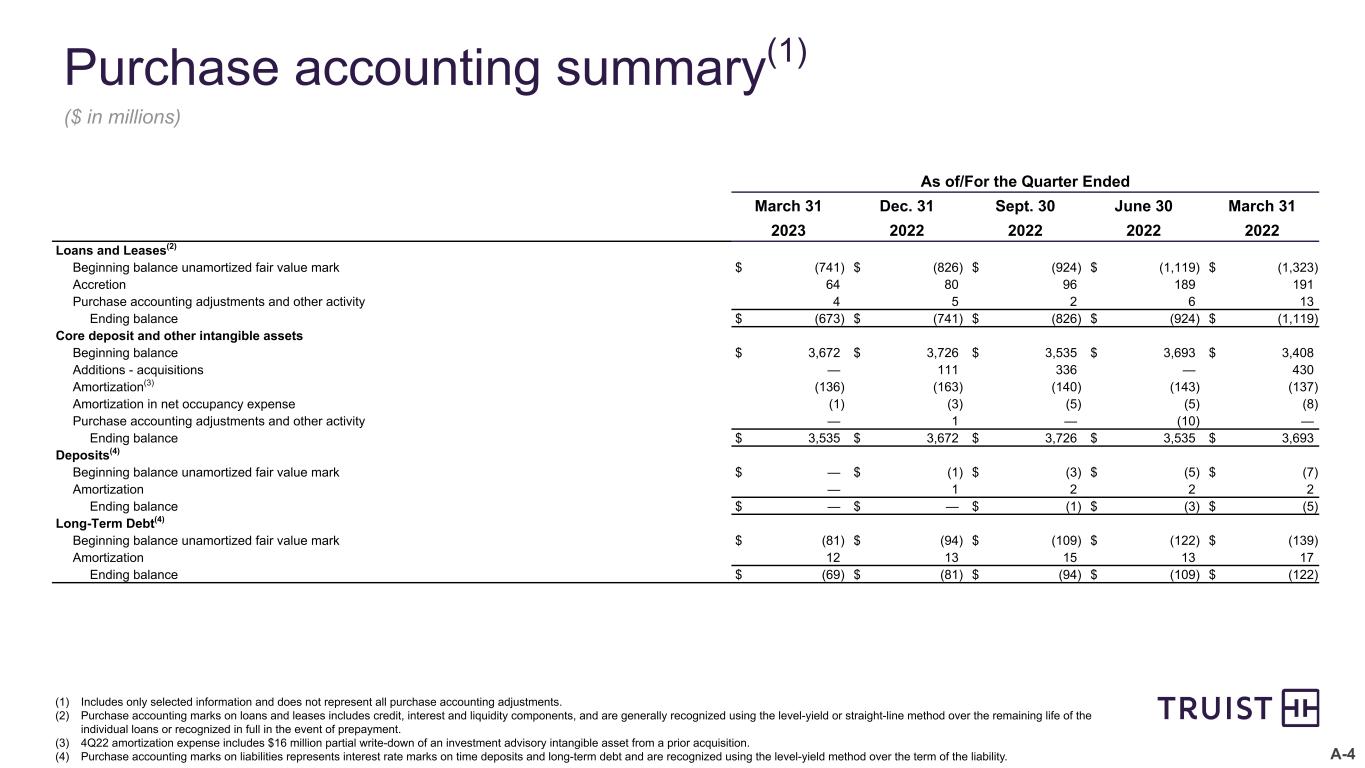

A-4 Purchase accounting summary(1) ($ in millions) As of/For the Quarter Ended March 31 Dec. 31 Sept. 30 June 30 March 31 2023 2022 2022 2022 2022 Loans and Leases(2) Beginning balance unamortized fair value mark $ (741) $ (826) $ (924) $ (1,119) $ (1,323) Accretion 64 80 96 189 191 Purchase accounting adjustments and other activity 4 5 2 6 13 Ending balance $ (673) $ (741) $ (826) $ (924) $ (1,119) Core deposit and other intangible assets Beginning balance $ 3,672 $ 3,726 $ 3,535 $ 3,693 $ 3,408 Additions - acquisitions — 111 336 — 430 Amortization(3) (136) (163) (140) (143) (137) Amortization in net occupancy expense (1) (3) (5) (5) (8) Purchase accounting adjustments and other activity — 1 — (10) — Ending balance $ 3,535 $ 3,672 $ 3,726 $ 3,535 $ 3,693 Deposits(4) Beginning balance unamortized fair value mark $ — $ (1) $ (3) $ (5) $ (7) Amortization — 1 2 2 2 Ending balance $ — $ — $ (1) $ (3) $ (5) Long-Term Debt(4) Beginning balance unamortized fair value mark $ (81) $ (94) $ (109) $ (122) $ (139) Amortization 12 13 15 13 17 Ending balance $ (69) $ (81) $ (94) $ (109) $ (122) (1) Includes only selected information and does not represent all purchase accounting adjustments. (2) Purchase accounting marks on loans and leases includes credit, interest and liquidity components, and are generally recognized using the level-yield or straight-line method over the remaining life of the individual loans or recognized in full in the event of prepayment. (3) 4Q22 amortization expense includes $16 million partial write-down of an investment advisory intangible asset from a prior acquisition. (4) Purchase accounting marks on liabilities represents interest rate marks on time deposits and long-term debt and are recognized using the level-yield method over the term of the liability.

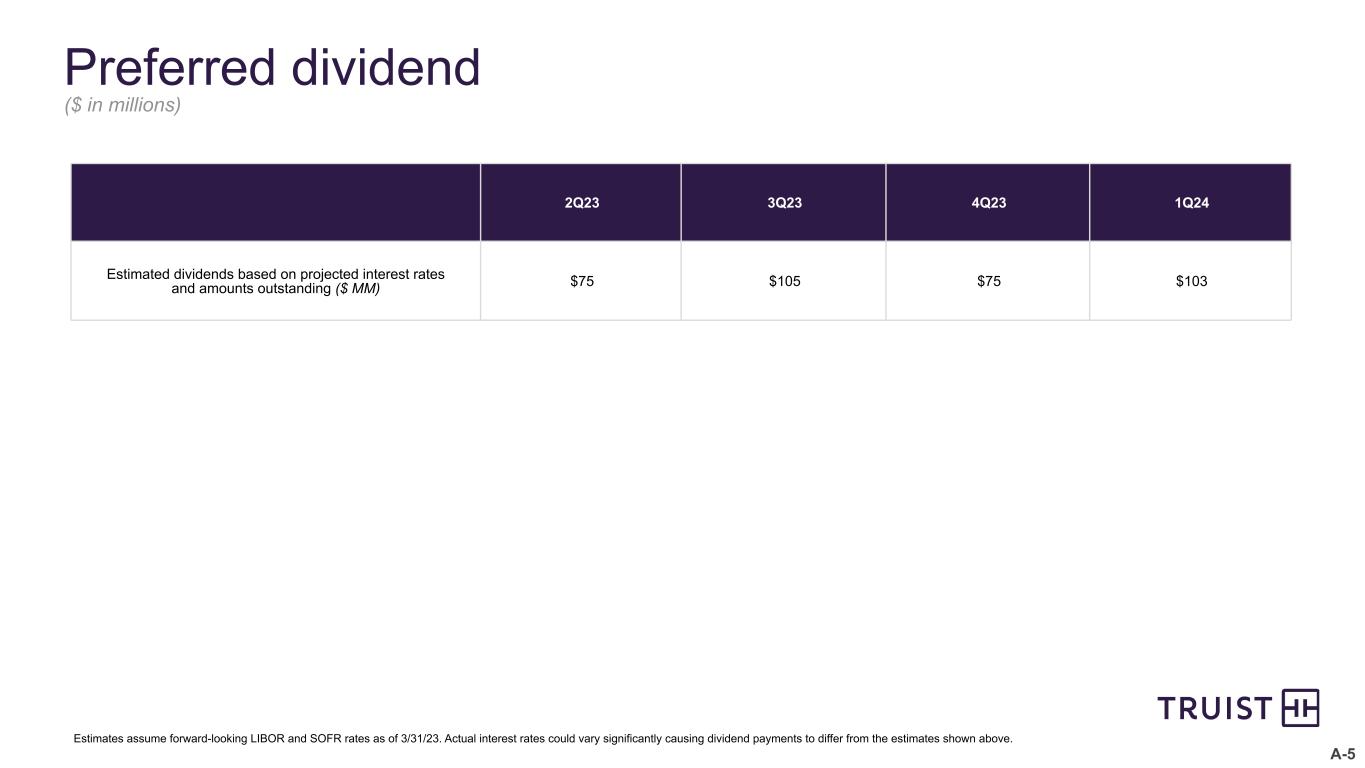

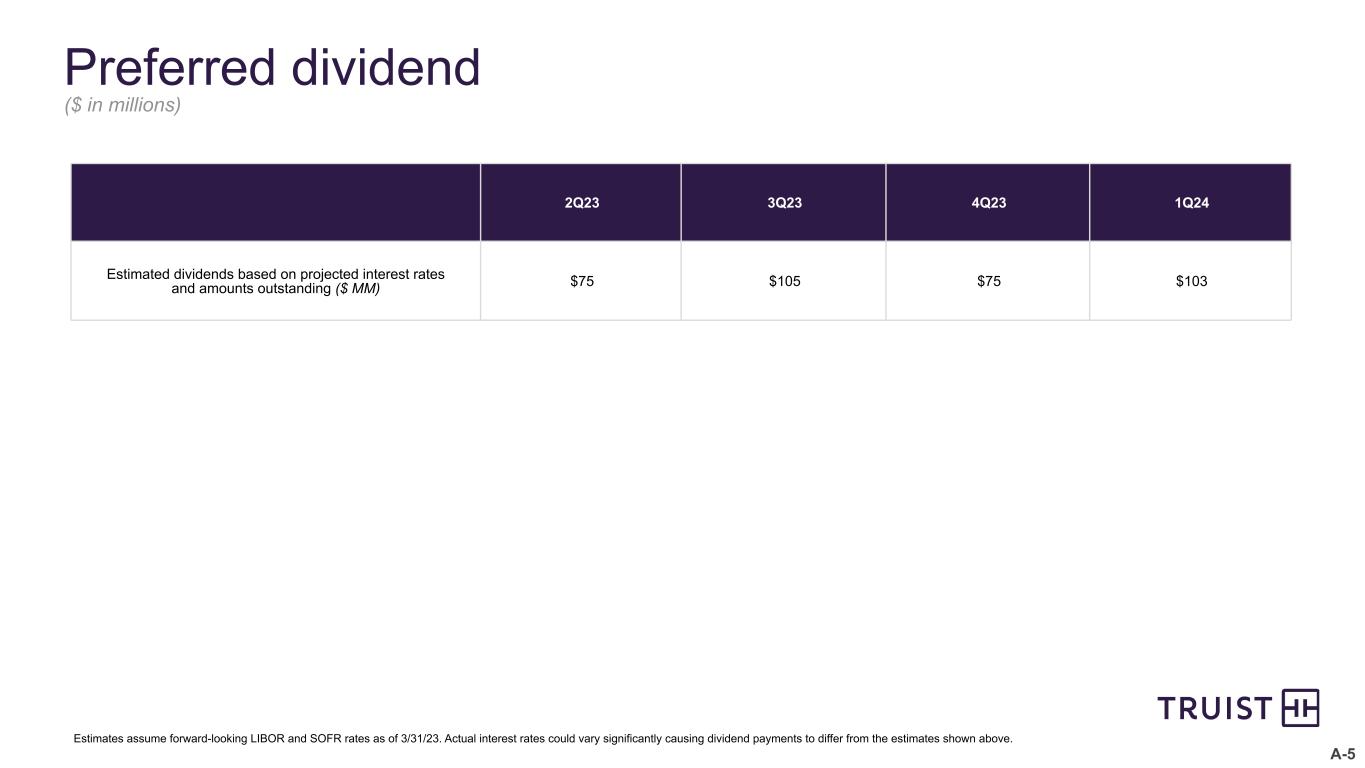

A-5 Preferred dividend ($ in millions) 2Q23 3Q23 4Q23 1Q24 Estimated dividends based on projected interest rates and amounts outstanding ($ MM) $75 $105 $75 $103 Estimates assume forward-looking LIBOR and SOFR rates as of 3/31/23. Actual interest rates could vary significantly causing dividend payments to differ from the estimates shown above.

Non-GAAP Reconciliations

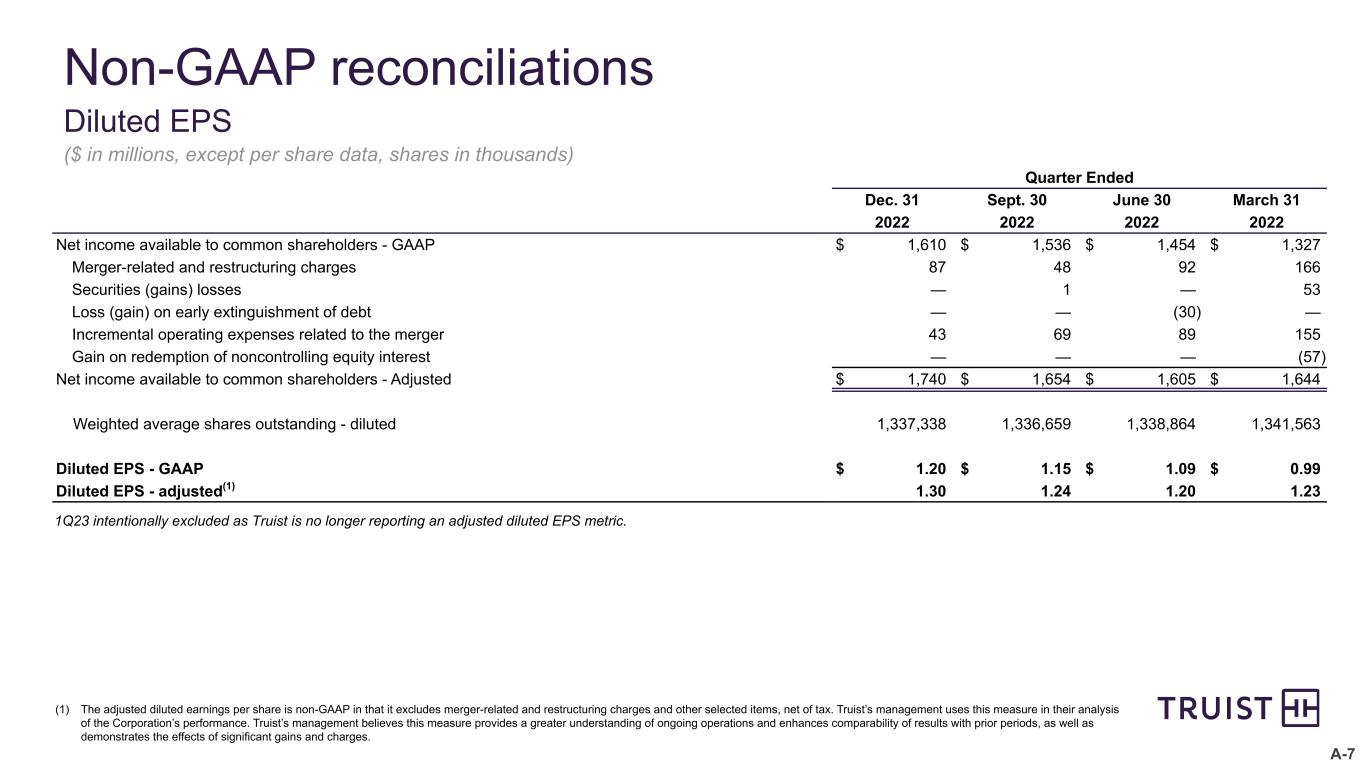

A-7 Quarter Ended Dec. 31 Sept. 30 June 30 March 31 2022 2022 2022 2022 Net income available to common shareholders - GAAP $ 1,610 $ 1,536 $ 1,454 $ 1,327 Merger-related and restructuring charges 87 48 92 166 Securities (gains) losses — 1 — 53 Loss (gain) on early extinguishment of debt — — (30) — Incremental operating expenses related to the merger 43 69 89 155 Gain on redemption of noncontrolling equity interest — — — (57) Net income available to common shareholders - Adjusted $ 1,740 $ 1,654 $ 1,605 $ 1,644 Weighted average shares outstanding - diluted 1,337,338 1,336,659 1,338,864 1,341,563 Diluted EPS - GAAP $ 1.20 $ 1.15 $ 1.09 $ 0.99 Diluted EPS - adjusted(1) 1.30 1.24 1.20 1.23 Non-GAAP reconciliations Diluted EPS ($ in millions, except per share data, shares in thousands) (1) The adjusted diluted earnings per share is non-GAAP in that it excludes merger-related and restructuring charges and other selected items, net of tax. Truist’s management uses this measure in their analysis of the Corporation’s performance. Truist’s management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. 1Q23 intentionally excluded as Truist is no longer reporting an adjusted diluted EPS metric.

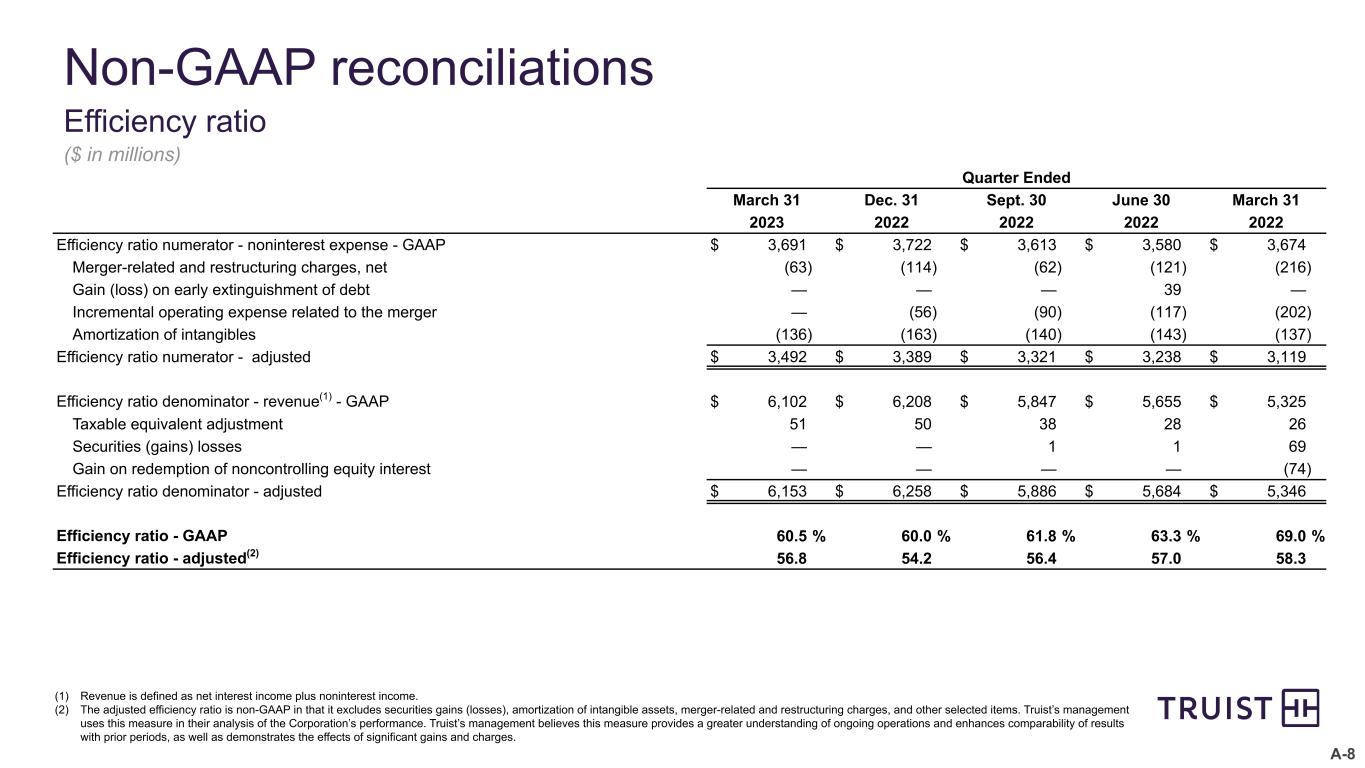

A-8 Non-GAAP reconciliations Efficiency ratio ($ in millions) (1) Revenue is defined as net interest income plus noninterest income. (2) The adjusted efficiency ratio is non-GAAP in that it excludes securities gains (losses), amortization of intangible assets, merger-related and restructuring charges, and other selected items. Truist’s management uses this measure in their analysis of the Corporation’s performance. Truist’s management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. Quarter Ended March 31 Dec. 31 Sept. 30 June 30 March 31 2023 2022 2022 2022 2022 Efficiency ratio numerator - noninterest expense - GAAP $ 3,691 $ 3,722 $ 3,613 $ 3,580 $ 3,674 Merger-related and restructuring charges, net (63) (114) (62) (121) (216) Gain (loss) on early extinguishment of debt — — — 39 — Incremental operating expense related to the merger — (56) (90) (117) (202) Amortization of intangibles (136) (163) (140) (143) (137) Efficiency ratio numerator - adjusted $ 3,492 $ 3,389 $ 3,321 $ 3,238 $ 3,119 Efficiency ratio denominator - revenue(1) - GAAP $ 6,102 $ 6,208 $ 5,847 $ 5,655 $ 5,325 Taxable equivalent adjustment 51 50 38 28 26 Securities (gains) losses — — 1 1 69 Gain on redemption of noncontrolling equity interest — — — — (74) Efficiency ratio denominator - adjusted $ 6,153 $ 6,258 $ 5,886 $ 5,684 $ 5,346 Efficiency ratio - GAAP 60.5 % 60.0 % 61.8 % 63.3 % 69.0 % Efficiency ratio - adjusted(2) 56.8 54.2 56.4 57.0 58.3

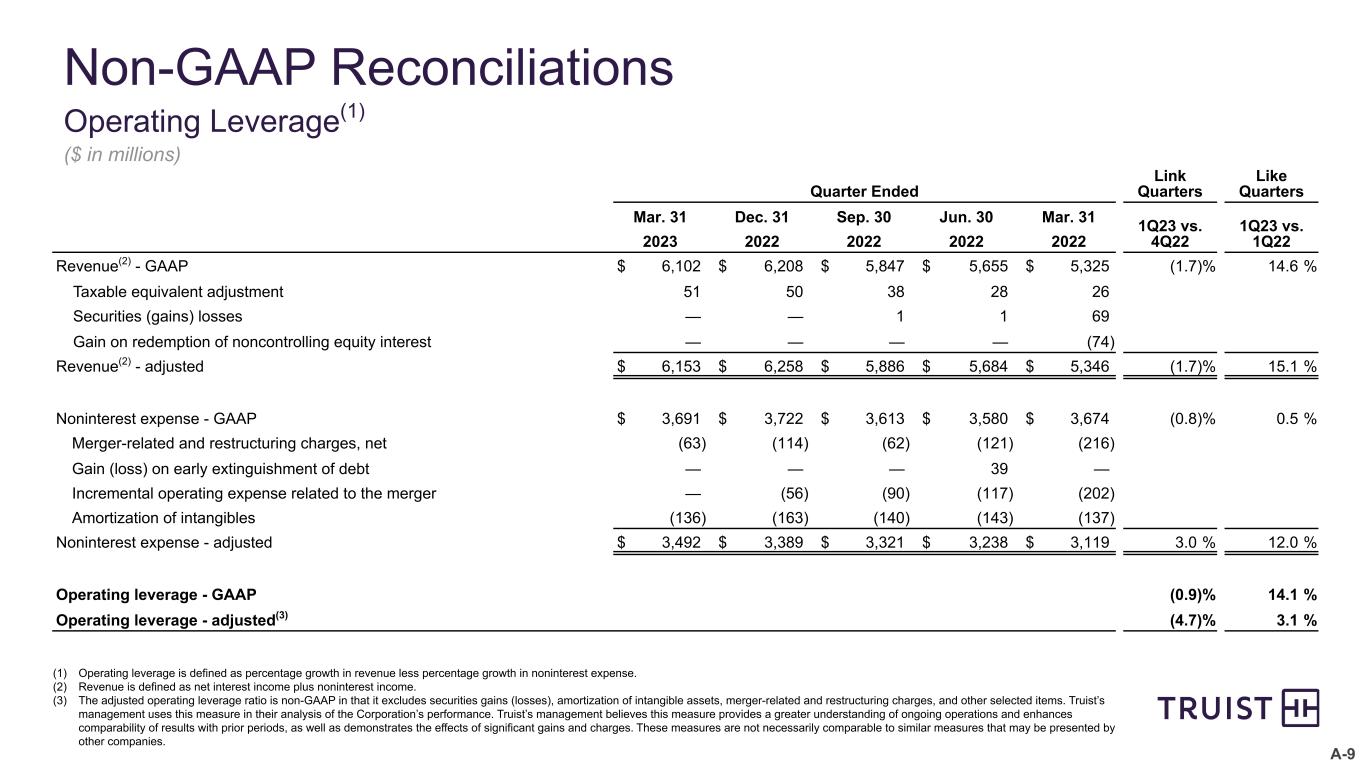

A-9 Non-GAAP Reconciliations Operating Leverage(1) ($ in millions) Quarter Ended Link Quarters Like Quarters Mar. 31 Dec. 31 Sep. 30 Jun. 30 Mar. 31 1Q23 vs. 4Q22 1Q23 vs. 1Q222023 2022 2022 2022 2022 Revenue(2) - GAAP $ 6,102 $ 6,208 $ 5,847 $ 5,655 $ 5,325 (1.7) % 14.6 % Taxable equivalent adjustment 51 50 38 28 26 Securities (gains) losses — — 1 1 69 Gain on redemption of noncontrolling equity interest — — — — (74) Revenue(2) - adjusted $ 6,153 $ 6,258 $ 5,886 $ 5,684 $ 5,346 (1.7) % 15.1 % Noninterest expense - GAAP $ 3,691 $ 3,722 $ 3,613 $ 3,580 $ 3,674 (0.8) % 0.5 % Merger-related and restructuring charges, net (63) (114) (62) (121) (216) Gain (loss) on early extinguishment of debt — — — 39 — Incremental operating expense related to the merger — (56) (90) (117) (202) Amortization of intangibles (136) (163) (140) (143) (137) Noninterest expense - adjusted $ 3,492 $ 3,389 $ 3,321 $ 3,238 $ 3,119 3.0 % 12.0 % Operating leverage - GAAP (0.9) % 14.1 % Operating leverage - adjusted(3) (4.7) % 3.1 % (1) Operating leverage is defined as percentage growth in revenue less percentage growth in noninterest expense. (2) Revenue is defined as net interest income plus noninterest income. (3) The adjusted operating leverage ratio is non-GAAP in that it excludes securities gains (losses), amortization of intangible assets, merger-related and restructuring charges, and other selected items. Truist’s management uses this measure in their analysis of the Corporation’s performance. Truist’s management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. These measures are not necessarily comparable to similar measures that may be presented by other companies.

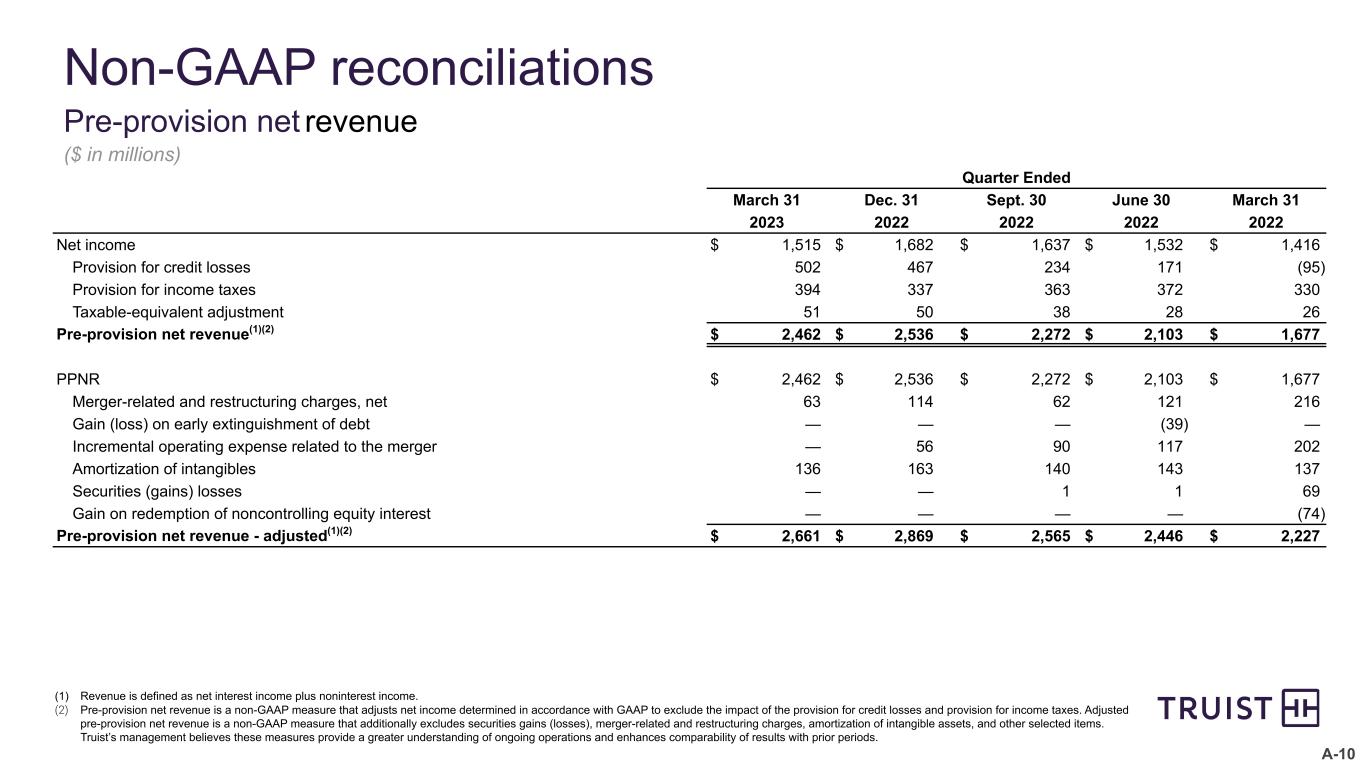

A-10 Non-GAAP reconciliations Pre-provision net revenue ($ in millions) (1) Revenue is defined as net interest income plus noninterest income. (2) Pre-provision net revenue is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of the provision for credit losses and provision for income taxes. Adjusted pre-provision net revenue is a non-GAAP measure that additionally excludes securities gains (losses), merger-related and restructuring charges, amortization of intangible assets, and other selected items. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhances comparability of results with prior periods. Quarter Ended March 31 Dec. 31 Sept. 30 June 30 March 31 2023 2022 2022 2022 2022 Net income $ 1,515 $ 1,682 $ 1,637 $ 1,532 $ 1,416 Provision for credit losses 502 467 234 171 (95) Provision for income taxes 394 337 363 372 330 Taxable-equivalent adjustment 51 50 38 28 26 Pre-provision net revenue(1)(2) $ 2,462 $ 2,536 $ 2,272 $ 2,103 $ 1,677 PPNR $ 2,462 $ 2,536 $ 2,272 $ 2,103 $ 1,677 Merger-related and restructuring charges, net 63 114 62 121 216 Gain (loss) on early extinguishment of debt — — — (39) — Incremental operating expense related to the merger — 56 90 117 202 Amortization of intangibles 136 163 140 143 137 Securities (gains) losses — — 1 1 69 Gain on redemption of noncontrolling equity interest — — — — (74) Pre-provision net revenue - adjusted(1)(2) $ 2,661 $ 2,869 $ 2,565 $ 2,446 $ 2,227

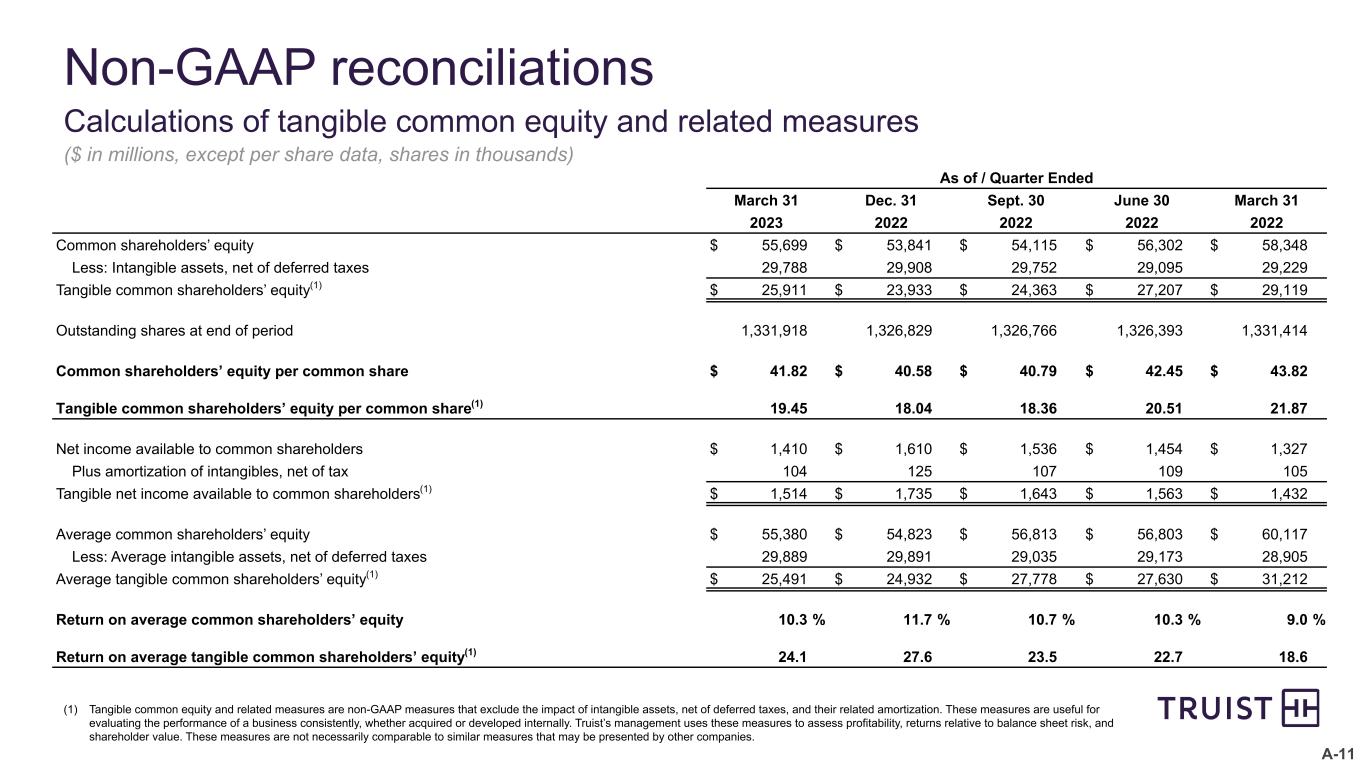

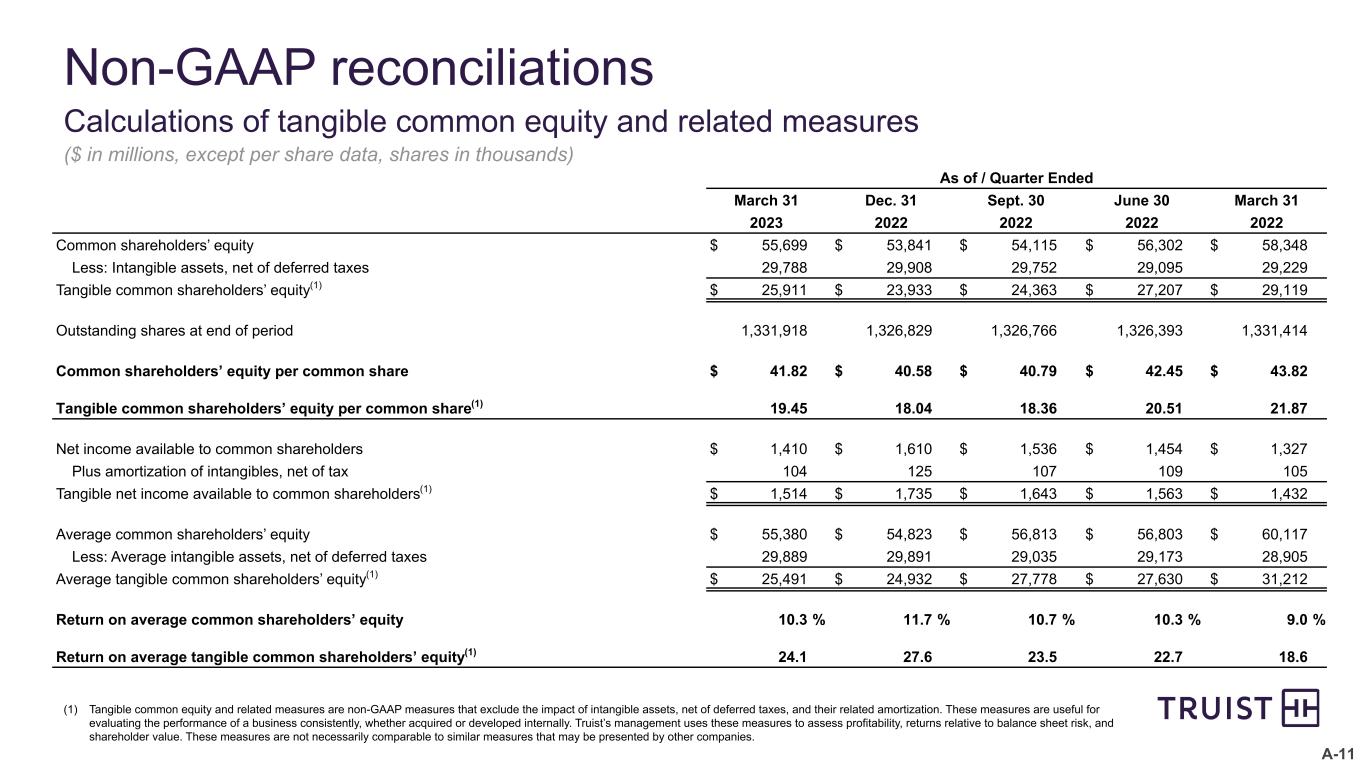

A-11 Non-GAAP reconciliations Calculations of tangible common equity and related measures ($ in millions, except per share data, shares in thousands) (1) Tangible common equity and related measures are non-GAAP measures that exclude the impact of intangible assets, net of deferred taxes, and their related amortization. These measures are useful for evaluating the performance of a business consistently, whether acquired or developed internally. Truist’s management uses these measures to assess profitability, returns relative to balance sheet risk, and shareholder value. These measures are not necessarily comparable to similar measures that may be presented by other companies. As of / Quarter Ended March 31 Dec. 31 Sept. 30 June 30 March 31 2023 2022 2022 2022 2022 Common shareholders’ equity $ 55,699 $ 53,841 $ 54,115 $ 56,302 $ 58,348 Less: Intangible assets, net of deferred taxes 29,788 29,908 29,752 29,095 29,229 Tangible common shareholders’ equity(1) $ 25,911 $ 23,933 $ 24,363 $ 27,207 $ 29,119 Outstanding shares at end of period 1,331,918 1,326,829 1,326,766 1,326,393 1,331,414 Common shareholders’ equity per common share $ 41.82 $ 40.58 $ 40.79 $ 42.45 $ 43.82 Tangible common shareholders’ equity per common share(1) 19.45 18.04 18.36 20.51 21.87 Net income available to common shareholders $ 1,410 $ 1,610 $ 1,536 $ 1,454 $ 1,327 Plus amortization of intangibles, net of tax 104 125 107 109 105 Tangible net income available to common shareholders(1) $ 1,514 $ 1,735 $ 1,643 $ 1,563 $ 1,432 Average common shareholders’ equity $ 55,380 $ 54,823 $ 56,813 $ 56,803 $ 60,117 Less: Average intangible assets, net of deferred taxes 29,889 29,891 29,035 29,173 28,905 Average tangible common shareholders’ equity(1) $ 25,491 $ 24,932 $ 27,778 $ 27,630 $ 31,212 Return on average common shareholders’ equity 10.3 % 11.7 % 10.7 % 10.3 % 9.0 % Return on average tangible common shareholders’ equity(1) 24.1 27.6 23.5 22.7 18.6

A-12 Quarter Ended March 31 Dec. 31 Sept. 30 June 30 March 31 2023 2022 2022 2022 2022 Net interest income - GAAP $ 3,868 $ 3,981 $ 3,745 $ 3,407 $ 3,183 Taxable-equivalent adjustment 51 50 38 28 26 Net interest income - taxable-equivalent 3,919 4,031 3,783 3,435 3,209 Accretion of mark on acquired loans (64) (80) (96) (189) (191) Accretion of mark on acquired liabilities (12) (14) (17) (15) (19) Net interest income - core(1) $ 3,843 $ 3,937 $ 3,670 $ 3,231 $ 2,999 Average earning assets - GAAP $ 499,149 $ 492,805 $ 482,349 $ 475,818 $ 469,940 Average balance - mark on acquired loans 617 787 875 1,029 1,247 Average earning assets - core(1) $ 499,766 $ 493,592 $ 483,224 $ 476,847 $ 471,187 Annualized net interest margin: Reported - taxable-equivalent 3.17 % 3.25 % 3.12 % 2.89 % 2.76 % Core(1) 3.10 3.17 3.02 2.72 2.57 Non-GAAP reconciliations Core NIM ($ in millions) (1) Core net interest margin is a non-GAAP measure that adjusts net interest margin to exclude the impact of purchase accounting. The purchase accounting marks and related amortization for loans, deposits, and long-term debt from SunTrust and other mergers and acquisitions are excluded to approximate the yields paid by clients. Truist’s management believes the adjustments to the calculation of net interest margin for certain assets and liabilities acquired provide investors with useful information related to the performance of Truist’s earning assets. These measures are not necessarily comparable to similar measures that may be presented by other companies.

A-13 Non-GAAP reconciliations Insurance Holdings adjusted EBITDA ($ in millions) (1) EBITDA is a non-GAAP measurement of operating profitability that is calculated by adding back interest, taxes, depreciation, and amortization to net income. Truist’s management also adds back merger- related and restructuring charges, acquisition retention and change in estimated earn-out incentives, and other selected items. Truist’s management uses this measure in its analysis of the Corporation’s Insurance Holdings segment. Truist’s management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. Quarter Ended March 31 Dec. 31 Sept. 30 June 30 March 31 2023 2022 2022 2022 2022 Segment net interest income $ 14 $ 12 $ 11 $ 6 $ 3 Noninterest income 817 792 731 830 733 Total revenue $ 831 $ 804 $ 742 $ 836 $ 736 Segment net income (loss) - GAAP $ 111 $ 107 $ 85 $ 170 $ 143 Provision (benefit) for income taxes 36 35 29 56 47 Depreciation & amortization 37 36 33 32 31 EBITDA 184 178 147 258 221 Merger-related and restructuring charges, net 5 18 21 8 8 Acquisition retention and change in earn-out incentives 13 8 10 10 7 Adjusted EBITDA(1) $ 202 $ 204 $ 178 $ 276 $ 236 Adjusted EBITDA(1) margin 24.3 % 25.4 % 24.0 % 33.0 % 32.0 %

To inspire and build better lives and communities