First Quarter 2024 Earnings Conference Call Bill Rogers – Chairman & CEO Mike Maguire – CFO April 22, 2024

2 From time to time we have made, and in the future will make, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “pursue,” “seek,” “continue,” “estimate,” “project,” “outlook,” “forecast,” “potential,” “target,” “objective,” “trend,” “plan,” “goal,” “initiative,” “priorities,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results. In particular, forward looking statements include, but are not limited to, statements we make about: (i) the impact of the sale of Truist’s remaining stake in Truist Insurance Holdings on Truist; (ii) a planned evaluation of balance sheet repositioning; (iii) expectations of being positioned for share repurchases in late 2024 and/or future years; (iv) continued delivery of new digital capabilities; (v) Truist’s expected CET1 ratio in future periods; (vi) guidance with respect to financial performance metrics in future periods, including future levels of revenues, adjusted expenses, and net charge-off ratio; (vii) Truist’s effective tax rate in future periods; (viii) Truist’s strategic priorities for 2024; and (ix) projections of preferred dividends in 2024 and subsequent years. This presentation, including any information incorporated by reference in this presentation, contains forward-looking statements. We also may make forward-looking statements in other documents that are filed or furnished with the SEC. In addition, we may make forward-looking statements orally or in writing to investors, analysts, members of the media, and others. All forward- looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Actual future objectives, strategies, plans, prospects, performance, conditions, and results may differ materially from those set forth in any forward-looking statement. While no list of assumptions, risks, and uncertainties could be complete, some of the factors that may cause actual results or other future events or circumstances to differ from those in forward-looking statements include: • evolving political, business, economic, and market conditions at local, regional, national, and international levels; • monetary, fiscal, and trade laws or policies, including as a result of actions by governmental agencies, central banks, or supranational authorities; • the legal, regulatory, and supervisory environment, including changes in financial-services legislation, regulation, policies, or government officials or other personnel; • our ability to address heightened scrutiny and expectations from supervisory or other governmental authorities and to timely and credibly remediate related concerns or deficiencies; • judicial, regulatory, and administrative inquiries, examinations, investigations, proceedings, disputes, or rulings that create uncertainty for or are adverse to us or the financial-services industry; • the outcomes of judicial, regulatory, and administrative inquiries, examinations, investigations, proceedings, or disputes to which we are or may be subject and our ability to absorb and address any damages or other remedies that are sought or awarded and any collateral consequences; • evolving accounting standards and policies; • the adequacy of our corporate governance, risk-management framework, compliance programs, and internal controls over financial reporting, including our ability to control lapses or deficiencies in financial reporting, to make appropriate estimates, or to effectively mitigate or manage operational risk; • any instability or breakdown in the financial system, including as a result of the actual or perceived soundness of another financial institution or another participant in the financial system; • disruptions and shifts in investor sentiment or behavior in the securities, capital, or other financial markets, including financial or systemic shocks and volatility or changes in market liquidity, interest or currency rates, or valuations; • our ability to cost-effectively fund our businesses and operations, including by accessing long- and short-term funding and liquidity and by retaining and growing client deposits; • changes in any of our credit ratings; • our ability to manage any unexpected outflows of uninsured deposits and avoid selling investment securities or other assets at an unfavorable time or at a loss; • negative market perceptions of our investment portfolio or its value; • adverse publicity or other reputational harm to us, our service providers, or our senior officers; • business and consumer sentiment, preferences, or behavior, including spending, borrowing, or saving by businesses or households; • our ability to execute on strategic and operational plans, including simplifying our businesses, achieving cost-savings targets and lowering expense growth, accelerating franchise momentum, and improving our capital position; • changes in our corporate and business strategies, the composition of our assets, or the way in which we fund those assets; • our ability to successfully make and integrate acquisitions and to effect divestitures, including the ability to successfully (i) close the previously announced sale of TIH, (ii) deploy the proceeds from the sale, and (iii) perform our obligations under the transition services arrangements supporting TIH in a cost-effective and efficient manner; • our ability to develop, maintain, and market our products or services or to absorb unanticipated costs or liabilities associated with those products or services; • our ability to innovate, to anticipate the needs of current or future clients, to successfully compete, to increase or hold market share in changing competitive environments, or to deal with pricing or other competitive pressures; • our ability to maintain secure and functional financial, accounting, technology, data processing, or other operating systems or infrastructure, including those that safeguard personal and other sensitive information; • our ability to appropriately underwrite loans that we originate or purchase and to otherwise manage credit risk, including in connection with commercial and consumer mortgage loans; • our ability to satisfactorily and profitably perform loan servicing and similar obligations; • the credit, liquidity, or other financial condition of our clients, counterparties, service providers, or competitors; • our ability to effectively deal with economic, business, or market slowdowns or disruptions; • the efficacy of our methods or models in assessing business strategies or opportunities or in valuing, measuring, estimating, monitoring, or managing positions or risk; • our ability to keep pace with changes in technology that affect us or our clients, counterparties, service providers, or competitors or to maintain rights or interests in associated intellectual property; • our ability to attract, hire, and retain key teammates and to engage in adequate succession planning; • the performance and availability of third-party service providers on whom we rely in delivering products and services to our clients and otherwise in conducting our business and operations; • our ability to detect, prevent, mitigate, and otherwise manage the risk of fraud or misconduct by internal or external parties; our ability to manage and mitigate physical-security and cybersecurity risks, including denial-of-service attacks, hacking, phishing, social-engineering attacks, malware intrusion, data-corruption attempts, system breaches, identity theft, ransomware attacks, environmental conditions, and intentional acts of destruction; • natural or other disasters, calamities, and conflicts, including terrorist events, cyber-warfare, and pandemics; • widespread outages of operational, communication, and other systems; • our ability to maintain appropriate ESG practices, oversight, and disclosures; • policies and other actions of governments to manage and mitigate climate and related environmental risks, and the effects of climate change or the transition to a lower-carbon economy on our business, operations, and reputation; and • other assumptions, risks, or uncertainties described in the Risk Factors (Item 1A), Management’s Discussion and Analysis of Financial Condition and Results of Operations (Item 7), or the Notes to the Consolidated Financial Statements (Item 8) in our Annual Report on Form 10-K or described in any of the Company’s subsequent quarterly or current reports. Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except as required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, or Current Report on Form 8-K. Forward-Looking Statements

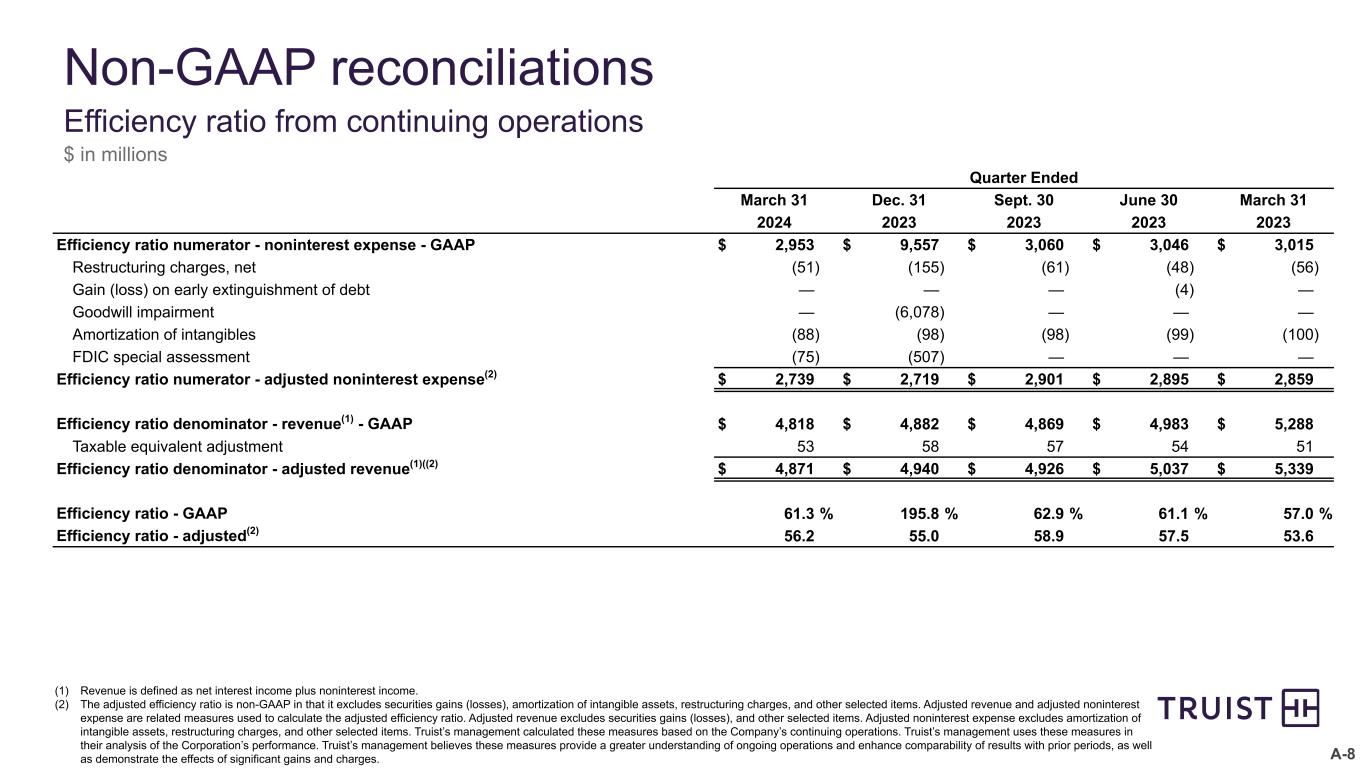

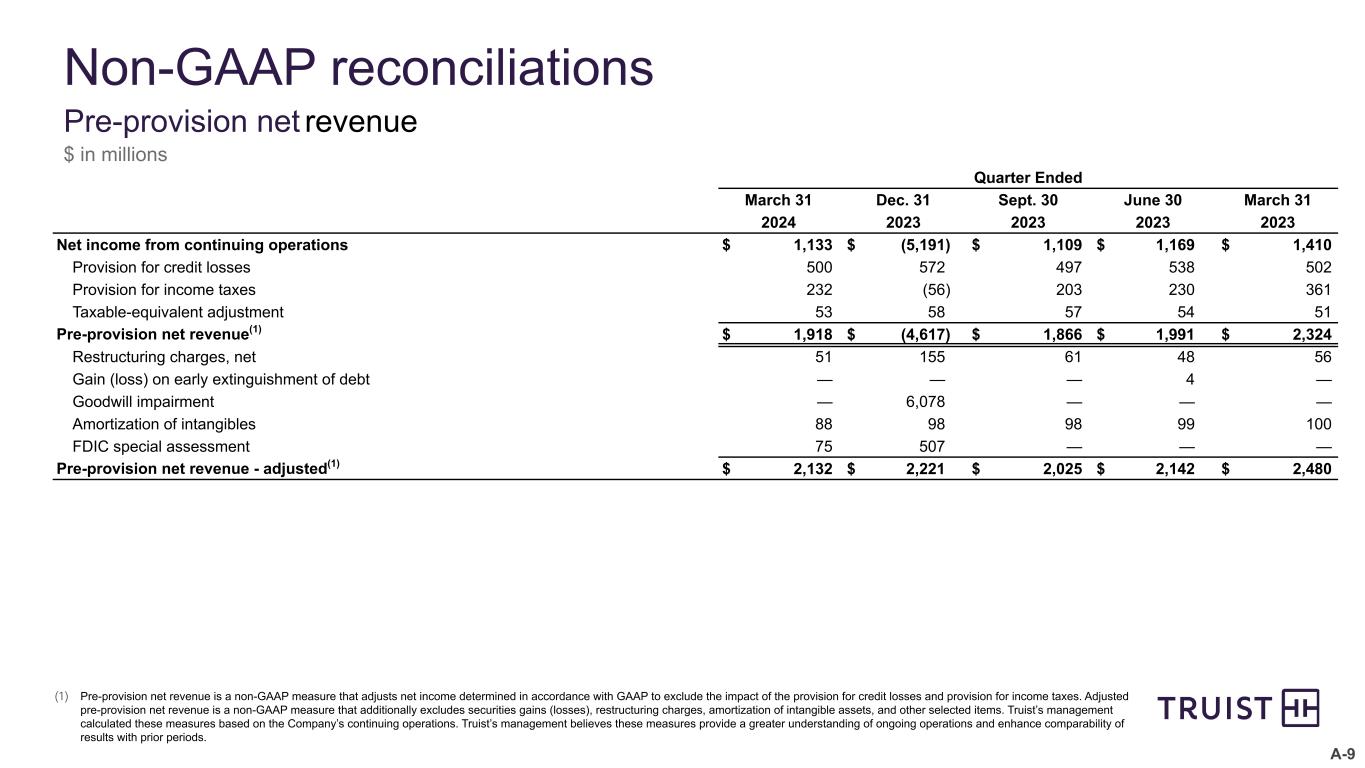

3 Non-GAAP Information This presentation contains financial information and performance measures determined by methods other than in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Truist’s management uses these “non-GAAP” measures in their analysis of the Corporation's performance and the efficiency of its operations. Management believes these non-GAAP measures are useful to investors because they provide a greater understanding of ongoing operations, enhance comparability of results with prior periods and demonstrate the effects of significant items in the current period. The Company believes a meaningful analysis of its financial performance requires an understanding of the factors underlying that performance. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Below is a listing of the types of non-GAAP measures used in this presentation: Adjusted Net income Available to Common Shareholders and Adjusted Diluted Earnings Per Share - Adjusted net income available to common shareholders and diluted earnings per share are non-GAAP in that these measures exclude selected items, net of tax. Truist’s management uses these measures in their analysis of the Corporation’s performance. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges. Adjusted Efficiency Ratio - The adjusted efficiency ratio is non-GAAP in that it excludes securities gains (losses), amortization of intangible assets, restructuring charges, and other selected items. Adjusted revenue and adjusted noninterest expense are related measures used to calculate the adjusted efficiency ratio. Adjusted revenue excludes securities gains (losses), and other selected items. Adjusted noninterest expense excludes amortization of intangible assets, restructuring charges, and other selected items. Truist’s management calculated these measures based on the Company’s continuing operations. Truist’s management uses these measures in their analysis of the Corporation’s performance. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges. Adjusted Revenue and Expense Before the Impact of Discontinued Operations Accounting - Adjusted revenue excludes other selected items. Adjusted noninterest expense excludes amortization of intangible assets, restructuring charges, and other selected items. Truist’s management uses these measures in their analysis of the Corporation’s performance. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges. Pre-Provision Net Revenue (PPNR) - Pre-provision net revenue is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of the provision for credit losses and provision for income taxes. Adjusted pre-provision net revenue is a non- GAAP measure that additionally excludes securities gains (losses), restructuring charges, amortization of intangible assets, and other selected items. Truist’s management calculated these measures based on the Company’s continuing operations. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods. Tangible Common Equity and Related Measures - Tangible common equity and related measures are non-GAAP measures that exclude the impact of intangible assets, net of deferred taxes, and their related amortization and impairment charges. These measures are useful for evaluating the performance of a business consistently, whether acquired or developed internally. Truist’s management uses these measures to assess profitability, returns relative to balance sheet risk, and shareholder value.

4

Financial Results

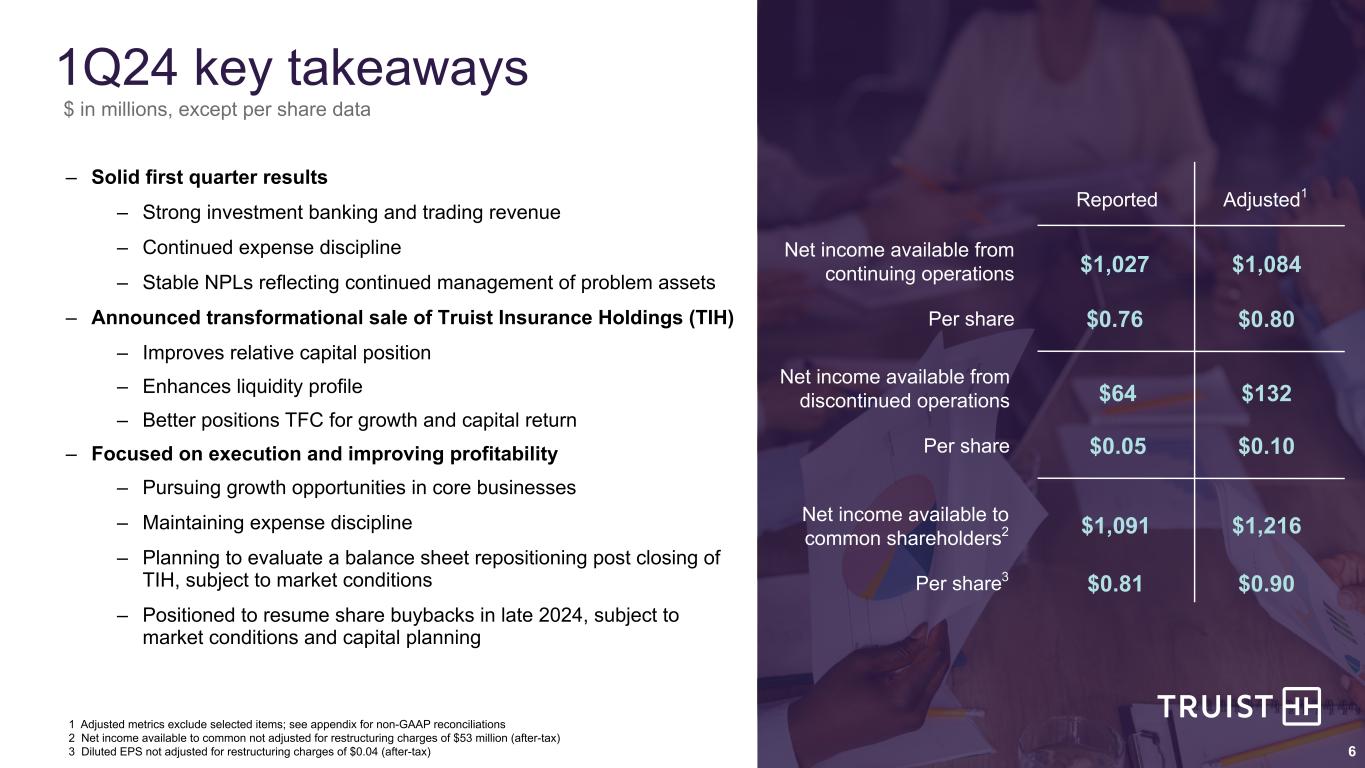

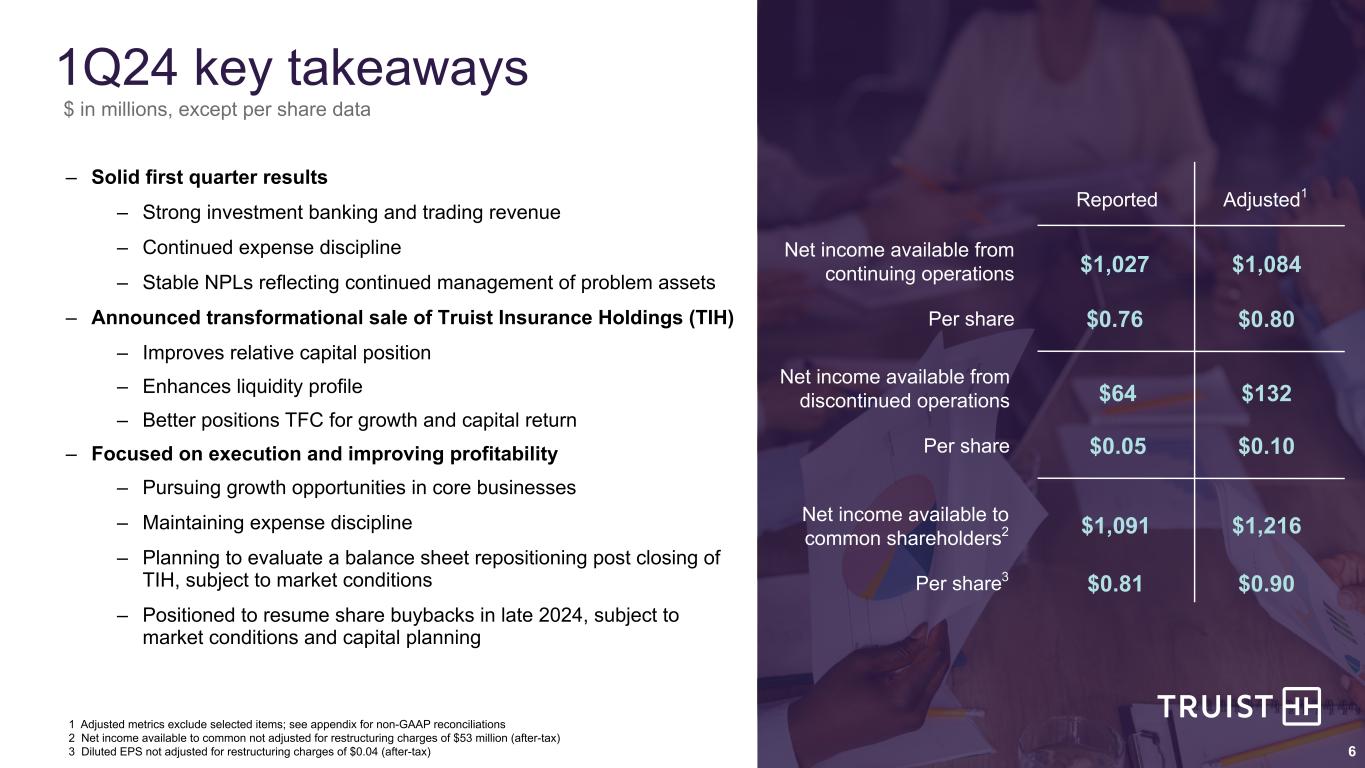

6 – Solid first quarter results – Strong investment banking and trading revenue – Continued expense discipline – Stable NPLs reflecting continued management of problem assets – Announced transformational sale of Truist Insurance Holdings (TIH) – Improves relative capital position – Enhances liquidity profile – Better positions TFC for growth and capital return – Focused on execution and improving profitability – Pursuing growth opportunities in core businesses – Maintaining expense discipline – Planning to evaluate a balance sheet repositioning post closing of TIH, subject to market conditions – Positioned to resume share buybacks in late 2024, subject to market conditions and capital planning 1 Adjusted metrics exclude selected items; see appendix for non-GAAP reconciliations 2 Net income available to common not adjusted for restructuring charges of $53 million (after-tax) 3 Diluted EPS not adjusted for restructuring charges of $0.04 (after-tax) 6 Reported Adjusted1 Net income available from continuing operations Per share $1,084 $0.80 Net income available from discontinued operations Per share $64 $0.05 $132 $0.10 Net income available to common shareholders2 Per share3 $1,091 $0.81 $1,216 $0.90 $1,027 $0.76 1Q24 key takeaways $ in millions, except per share data

7 Frictionless experiences drive client engagement 20 23 25 27 28 1Q23 2Q23 3Q23 4Q23 1Q24 Client preferences shift toward mobile 4.50 4.60 4.72 4.75 4.85 1Q23 2Q23 3Q23 4Q23 1Q24 1 Active users reflect clients that have logged in using the mobile app over the prior 90 days 2 Digital transactions include transfers, Zelle, bill payments, mobile deposits, ACH, and wire transfers 3 Self-service deposits include incoming Zelle, ATM check deposits, and mobile check deposits (including small business online) Mobile app users1 Digital transactions2 Self-service deposits3 Zelle transactions 72% 74% 75% 76% 77% 1Q23 2Q23 3Q23 4Q23 1Q24 +8% +500 bps +40% (in millions) (in millions) – Education and digital activation delivered by Truist teammates coupled with client preferences shift transactions to mobile banking and money movement, driving 76 million digital transactions in 1Q24, a 13% increase over 1Q23 – 77% of deposits occurred in self-service channels, creating additional capacity for branch teammates to develop new client relationships and deliver knowledge and care to our clients – Driving increased client primacy with strong growth in Zelle® adoption; 227K new enrollments, an 11% increase from the previous quarter, with transactions up 40% over 1Q23 – Continue to deliver enhanced self-service capabilities to drive client engagement, including the recent launch of the Zelle® QR code widget that allows users to quickly access their code from their home screen 67 71 72 75 76 1Q23 2Q23 3Q23 4Q23 1Q24 +13% (in millions)

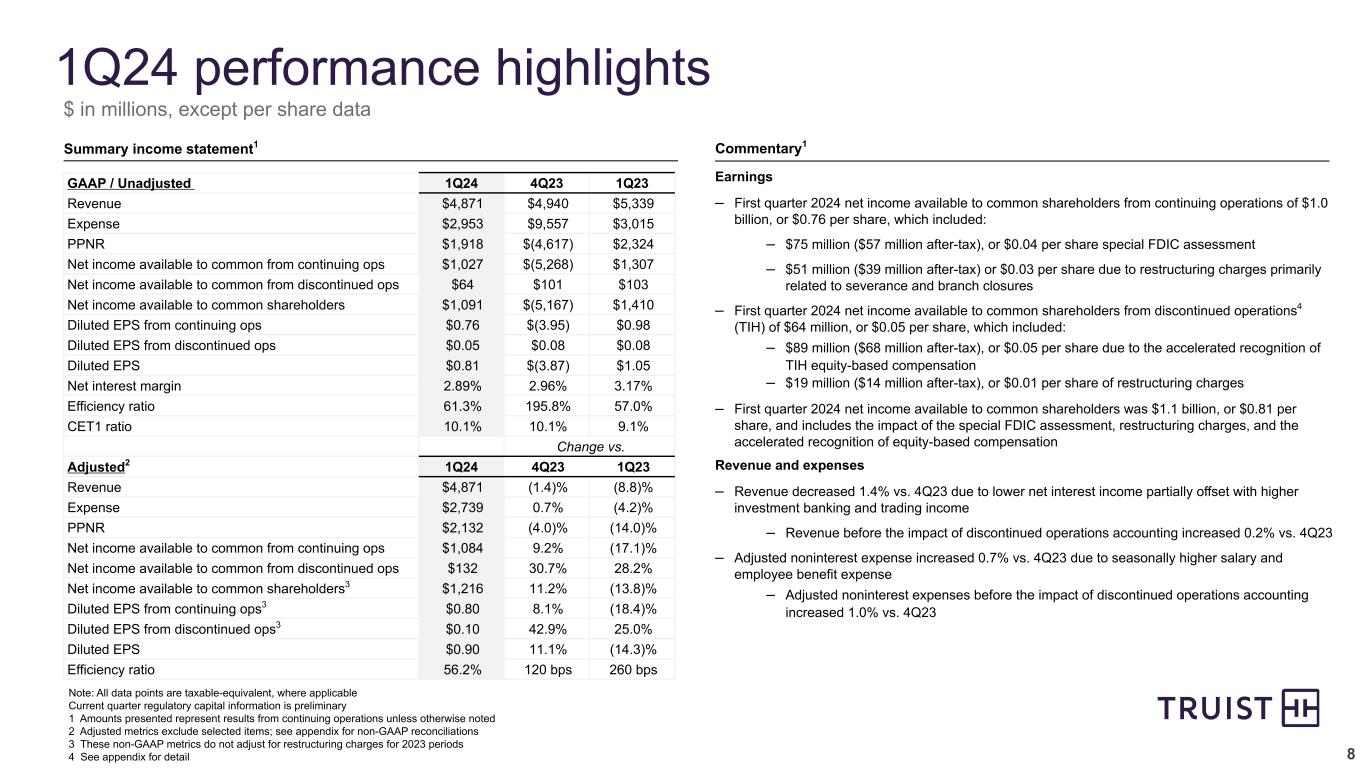

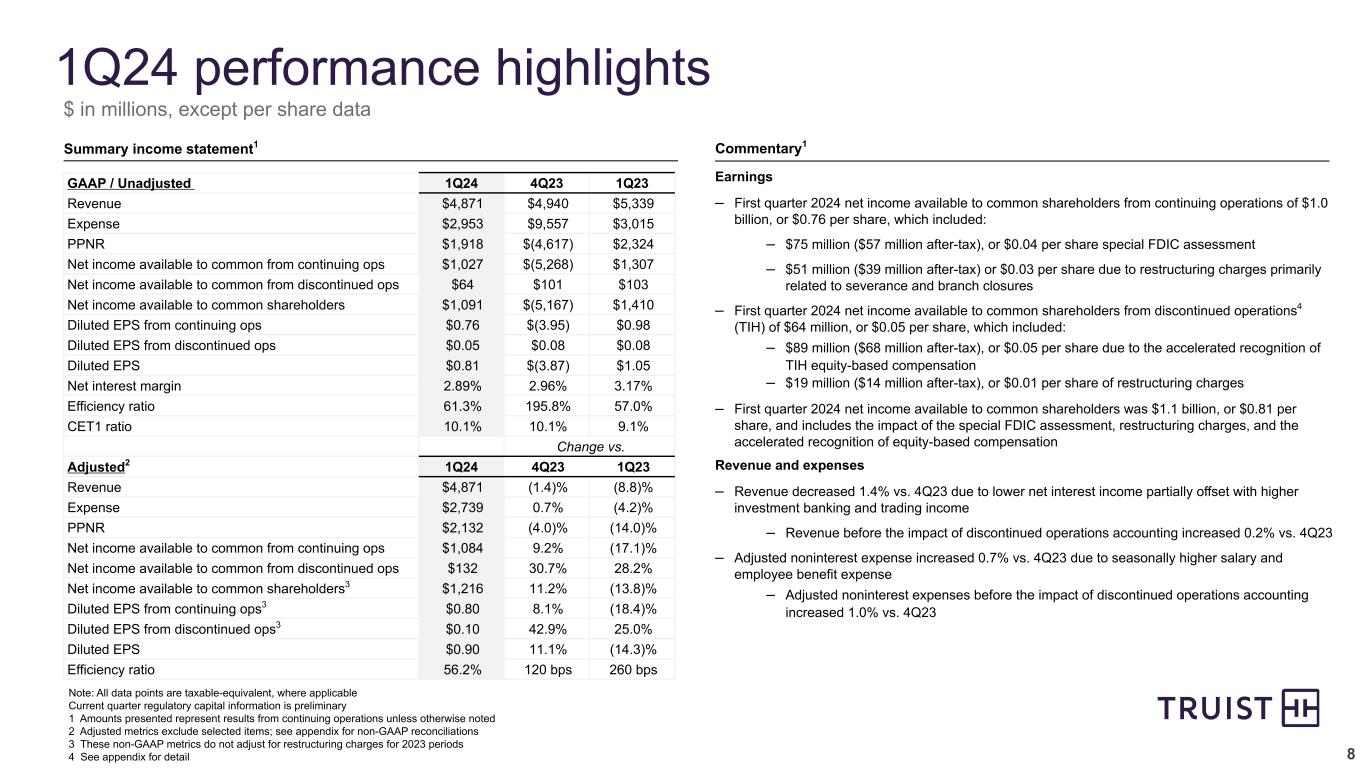

8 Earnings – First quarter 2024 net income available to common shareholders from continuing operations of $1.0 billion, or $0.76 per share, which included: – $75 million ($57 million after-tax), or $0.04 per share special FDIC assessment – $51 million ($39 million after-tax) or $0.03 per share due to restructuring charges primarily related to severance and branch closures – First quarter 2024 net income available to common shareholders from discontinued operations4 (TIH) of $64 million, or $0.05 per share, which included: – $89 million ($68 million after-tax), or $0.05 per share due to the accelerated recognition of TIH equity-based compensation – $19 million ($14 million after-tax), or $0.01 per share of restructuring charges – First quarter 2024 net income available to common shareholders was $1.1 billion, or $0.81 per share, and includes the impact of the special FDIC assessment, restructuring charges, and the accelerated recognition of equity-based compensation Revenue and expenses – Revenue decreased 1.4% vs. 4Q23 due to lower net interest income partially offset with higher investment banking and trading income – Revenue before the impact of discontinued operations accounting increased 0.2% vs. 4Q23 – Adjusted noninterest expense increased 0.7% vs. 4Q23 due to seasonally higher salary and employee benefit expense – Adjusted noninterest expenses before the impact of discontinued operations accounting increased 1.0% vs. 4Q23 1Q24 performance highlights Note: All data points are taxable-equivalent, where applicable Current quarter regulatory capital information is preliminary 1 Amounts presented represent results from continuing operations unless otherwise noted 2 Adjusted metrics exclude selected items; see appendix for non-GAAP reconciliations 3 These non-GAAP metrics do not adjust for restructuring charges for 2023 periods 4 See appendix for detail Summary income statement1 Commentary1 $ in millions, except per share data GAAP / Unadjusted 1Q24 4Q23 1Q23 Revenue $4,871 $4,940 $5,339 Expense $2,953 $9,557 $3,015 PPNR $1,918 $(4,617) $2,324 Net income available to common from continuing ops $1,027 $(5,268) $1,307 Net income available to common from discontinued ops $64 $101 $103 Net income available to common shareholders $1,091 $(5,167) $1,410 Diluted EPS from continuing ops $0.76 $(3.95) $0.98 Diluted EPS from discontinued ops $0.05 $0.08 $0.08 Diluted EPS $0.81 $(3.87) $1.05 Net interest margin 2.89% 2.96% 3.17% Efficiency ratio 61.3% 195.8% 57.0% CET1 ratio 10.1% 10.1% 9.1% Change vs. Adjusted2 1Q24 4Q23 1Q23 Revenue $4,871 (1.4)% (8.8)% Expense $2,739 0.7% (4.2)% PPNR $2,132 (4.0)% (14.0)% Net income available to common from continuing ops $1,084 9.2% (17.1)% Net income available to common from discontinued ops $132 30.7% 28.2% Net income available to common shareholders3 $1,216 11.2% (13.8)% Diluted EPS from continuing ops3 $0.80 8.1% (18.4)% Diluted EPS from discontinued ops3 $0.10 42.9% 25.0% Diluted EPS $0.90 11.1% (14.3)% Efficiency ratio 56.2% 120 bps 260 bps

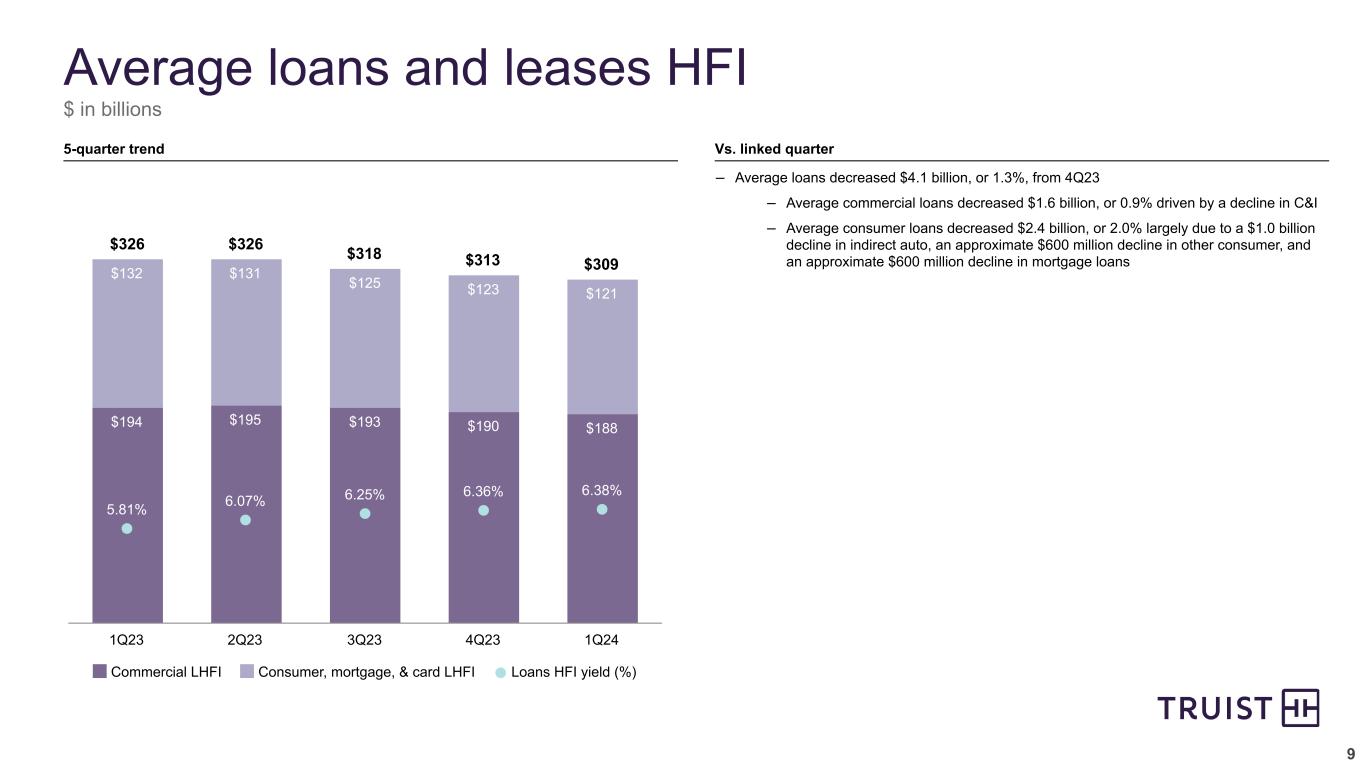

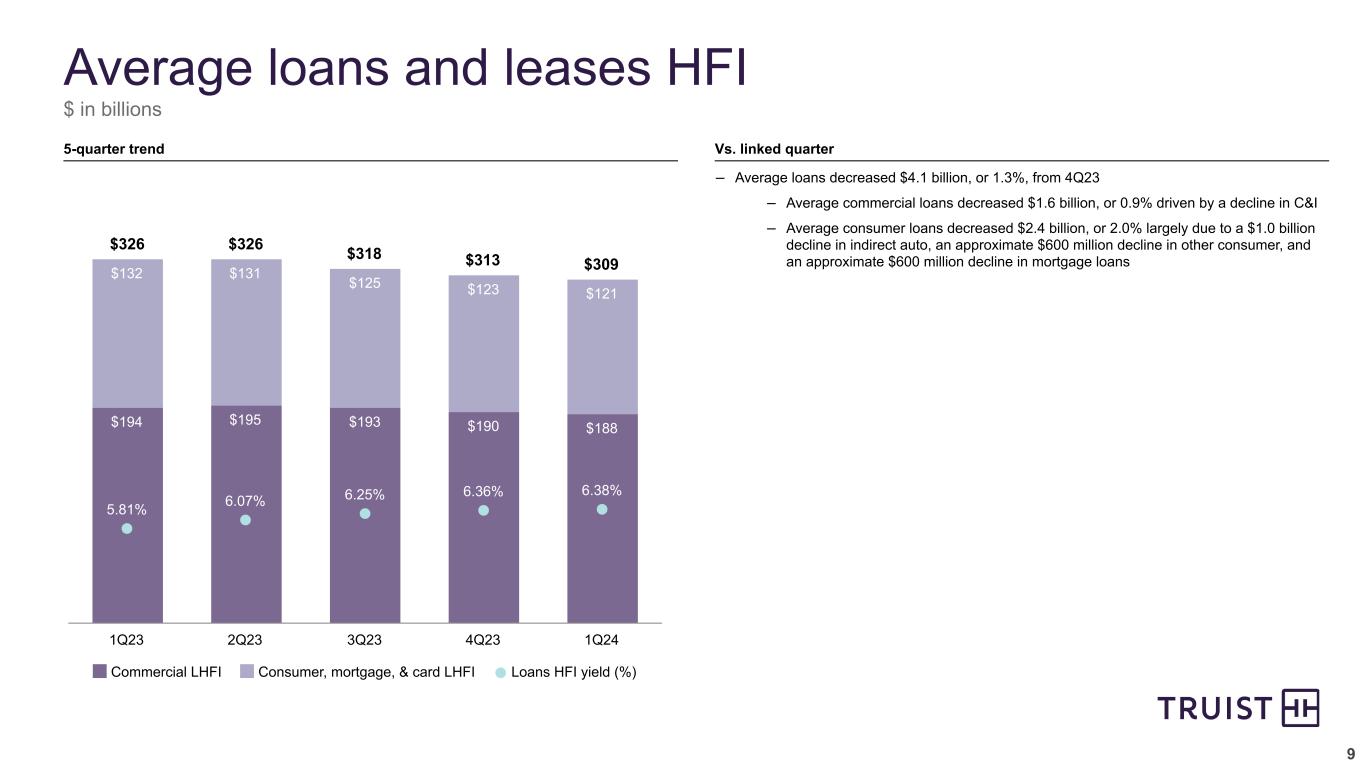

9 $326 $326 $318 $313 $309 $194 $195 $193 $190 $188 $132 $131 $125 $123 $121 5.81% 6.07% 6.25% 6.36% 6.38% Commercial LHFI Consumer, mortgage, & card LHFI Loans HFI yield (%) 1Q23 2Q23 3Q23 4Q23 1Q24 Average loans and leases HFI $ in billions – Average loans decreased $4.1 billion, or 1.3%, from 4Q23 – Average commercial loans decreased $1.6 billion, or 0.9% driven by a decline in C&I – Average consumer loans decreased $2.4 billion, or 2.0% largely due to a $1.0 billion decline in indirect auto, an approximate $600 million decline in other consumer, and an approximate $600 million decline in mortgage loans 5-quarter trend Vs. linked quarter

10 Average deposits $ in billions $408 $400 $401 $395 $389 $277 $276 $282 $281 $280 $131 $124 $119 $115 $109 1.12% 1.53% 1.84% 1.92% 2.03% Interest-bearing deposits Noninterest-bearing deposits Total deposit cost (%) 1Q23 2Q23 3Q23 4Q23 1Q24 Cumulative beta calculations are based on change in average total deposit or interest-bearing deposit cost divided by change in average Fed Funds rate from 4Q21 to 1Q24, respectively May not foot due to rounding – Average deposits decreased $6.3 billion, or 1.6% – Average noninterest-bearing deposits decreased $5.7 billion, or 4.9% – Represented 28% of total deposits vs. 29% in 4Q23 – Average money market and savings deposits decreased $2.8 billion, or 2.0% – Average brokered deposits and negotiable CDs decreased $1.9 billion – Deposit costs increased primarily due to continued mix shift from lower cost deposit accounts – Total cost of deposits was 203 bps, up 11 bps from the prior quarter – Cumulative total deposit beta was 38% in 1Q24 vs. 36% in 4Q23 – Total cost of interest-bearing deposits was 282 bps, up 11 bps from the prior quarter – Cumulative interest-bearing deposit beta was 53% in 1Q24 vs. 51% in 4Q23 Vs. linked quarter 5-quarter trend

11 $3,918 $3,657 $3,592 $3,577 $3,425 3.17% 2.90% 2.93% 2.96% 2.89% Net interest income TE ($ MM) Net interest margin (%) 1Q23 2Q23 3Q23 4Q23 1Q24 – Net interest income decreased 4.2% primarily due to higher funding costs driven by deposit mix shift, lower earning assets, and day count – NIM declined 7 bps to 2.89% – Net interest income decreased 13% as a result of higher funding costs and lower earning assets – NIM declined 28 bps Net interest income and net interest margin Vs. linked quarter5-quarter trend Vs. like quarter $ in millions

12 – Noninterest income increased 1.8% due to higher other, investment banking and trading, and wealth management income, partially offset by lower mortgage banking and service charges on deposits income – Noninterest income increased 6.1% primarily driven by higher investment banking and trading income, partially offset by a decline in lending related fees due to lower leasing-related gains Noninterest income Vs. linked quarter Vs. like quarter Noninterest income 1Q24 4Q23 1Q23 Wealth management income $ 356 $ 346 $ 339 Investment banking and trading income 323 165 261 Service charges on deposits 225 229 250 Card and payment related fees 224 232 230 Mortgage banking income 97 94 142 Lending related fees 96 153 106 Operating lease income 59 60 67 Other income 66 84 26 Total noninterest income $ 1,446 $ 1,363 $ 1,421 $ in millions

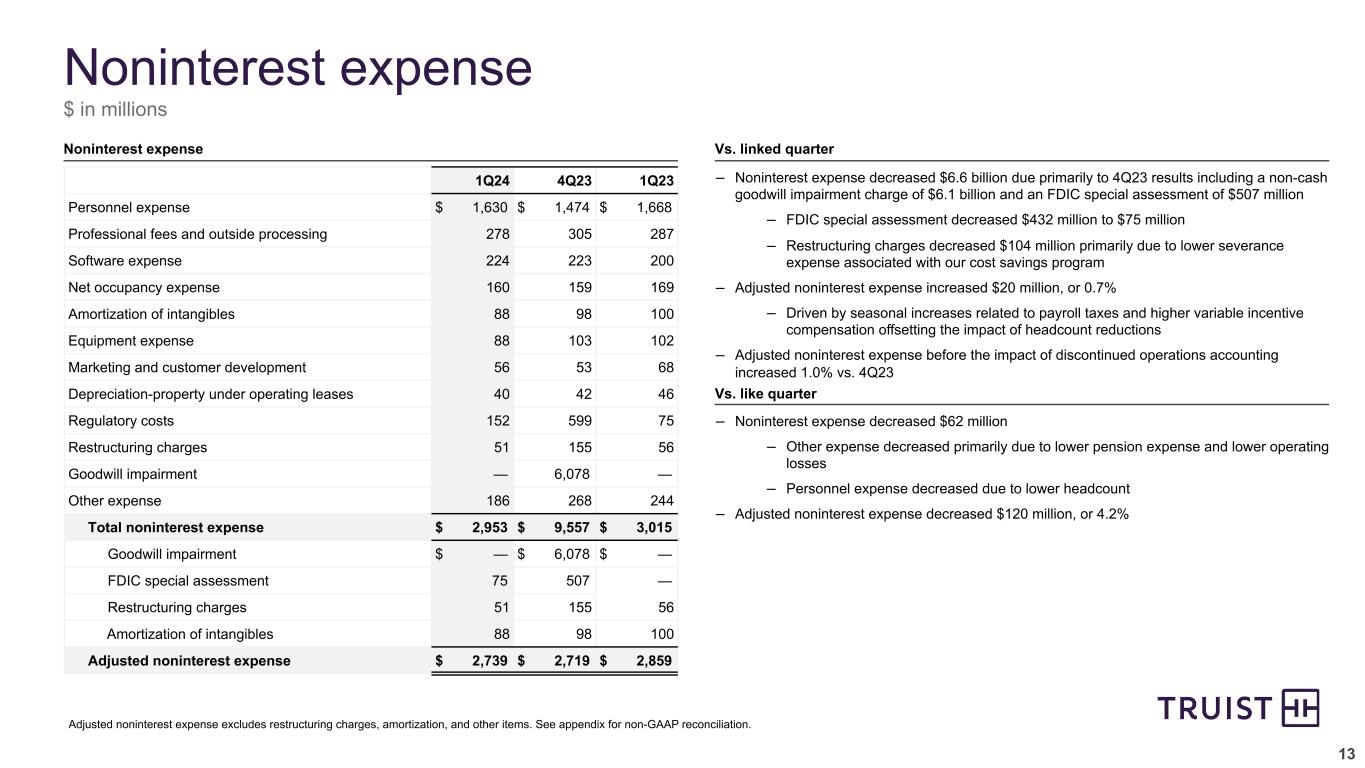

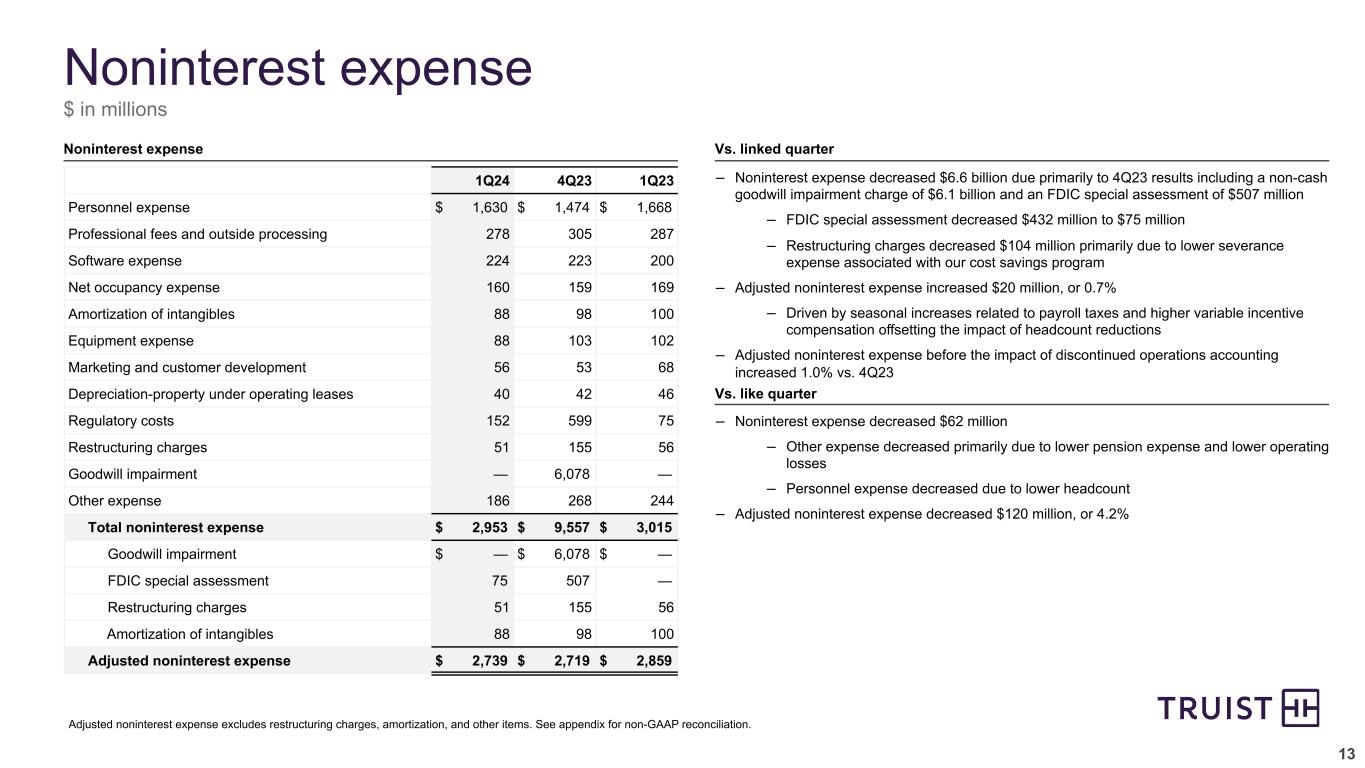

13 – Noninterest expense decreased $6.6 billion due primarily to 4Q23 results including a non-cash goodwill impairment charge of $6.1 billion and an FDIC special assessment of $507 million – FDIC special assessment decreased $432 million to $75 million – Restructuring charges decreased $104 million primarily due to lower severance expense associated with our cost savings program – Adjusted noninterest expense increased $20 million, or 0.7% – Driven by seasonal increases related to payroll taxes and higher variable incentive compensation offsetting the impact of headcount reductions – Adjusted noninterest expense before the impact of discontinued operations accounting increased 1.0% vs. 4Q23 – Noninterest expense decreased $62 million – Other expense decreased primarily due to lower pension expense and lower operating losses – Personnel expense decreased due to lower headcount – Adjusted noninterest expense decreased $120 million, or 4.2% Noninterest expense Vs. linked quarter Vs. like quarter $54 Adjusted noninterest expense excludes restructuring charges, amortization, and other items. See appendix for non-GAAP reconciliation. 1Q24 4Q23 1Q23 Personnel expense $ 1,630 $ 1,474 $ 1,668 Professional fees and outside processing 278 305 287 Software expense 224 223 200 Net occupancy expense 160 159 169 Amortization of intangibles 88 98 100 Equipment expense 88 103 102 Marketing and customer development 56 53 68 Depreciation-property under operating leases 40 42 46 Regulatory costs 152 599 75 Restructuring charges 51 155 56 Goodwill impairment — 6,078 — Other expense 186 268 244 Total noninterest expense $ 2,953 $ 9,557 $ 3,015 Goodwill impairment $ — $ 6,078 $ — FDIC special assessment 75 507 — Restructuring charges 51 155 56 Amortization of intangibles 88 98 100 Adjusted noninterest expense $ 2,739 $ 2,719 $ 2,859 Noninterest expense $ in millions

14 $502 $538 $497 $572 $500 1Q23 2Q23 3Q23 4Q23 1Q24 NPLs were relatively stable on a linked-quarter basis Provision decreased on a linked-quarter basis due to lower loan balances and less allowance build ($ in MM) $297 $440 $405 $453 $490 0.37% 0.54% 0.51% 0.57% 0.64% NCO NCO ratio 1Q23 2Q23 3Q23 4Q23 1Q24 NCO ratio increased 7 bps on a linked-quarter basis reflecting continued normalization within the consumer and commercial portfolios ($ in MM) Asset quality 4.5x 9.0x 8.8x Net charge-offs Provision for credit losses Nonperforming loans / LHFI ALLL $4,479 $4,606 $4,693 $4,798 $4,803 ALLL ALLL ratio ALLL / NCO 1Q23 2Q23 3Q23 4Q23 1Q24 ALLL ratio increased 2 bps on a linked-quarter basis ($ in MM) 0.36% 0.47% 0.46% 0.44% 0.45% 1Q23 2Q23 3Q23 4Q23 1Q24 3.7X 2.6X 2.9X 1.37% 1.43% 1.49% 2.7X 1.54% 2.4X 1.56%

15 4Q23 CET1 Organic capital generation CECL and FDIC special assessment 1Q24 CET1 Capital 9.9% 10.1% ~0.2% 10.1% 1 2 ~2.3% 10.1% Estimated impact of pending TIH sale Pending sale of TIH significantly strengthens Truist’s relative capital position vs. peers 1Q24 capital walk 1 Organic capital generation is retained earnings net of dividend 2 Current quarter regulatory capital information is preliminary Commentary Pending sale of TIH seizes capital advantage – Generates 230 bps of CET1 under current Basel III rules and 255 bps under proposed rules – Increases tangible book value per share by 33% – Transaction on track to close in 2Q24 Capital deployment opportunities post-closing – Pursue growth in our consumer and wholesale banking businesses – Evaluate a potential balance sheet repositioning, subject to market conditions, with a goal of replacing TIH’s earnings – Resume share repurchase activity subject to market conditions, capital planning, and other factors Positioning for regulatory changes after the sale of TIH – Well prepared for fully phased-in Basel III capital requirements – Potential balance sheet repositioning would have no negative impact on tangible book value per share or fully phased in CET1 under proposed Basel III rules – Expect to meet proposed long-term debt requirements through normal course debt issuance ~(0.2%)

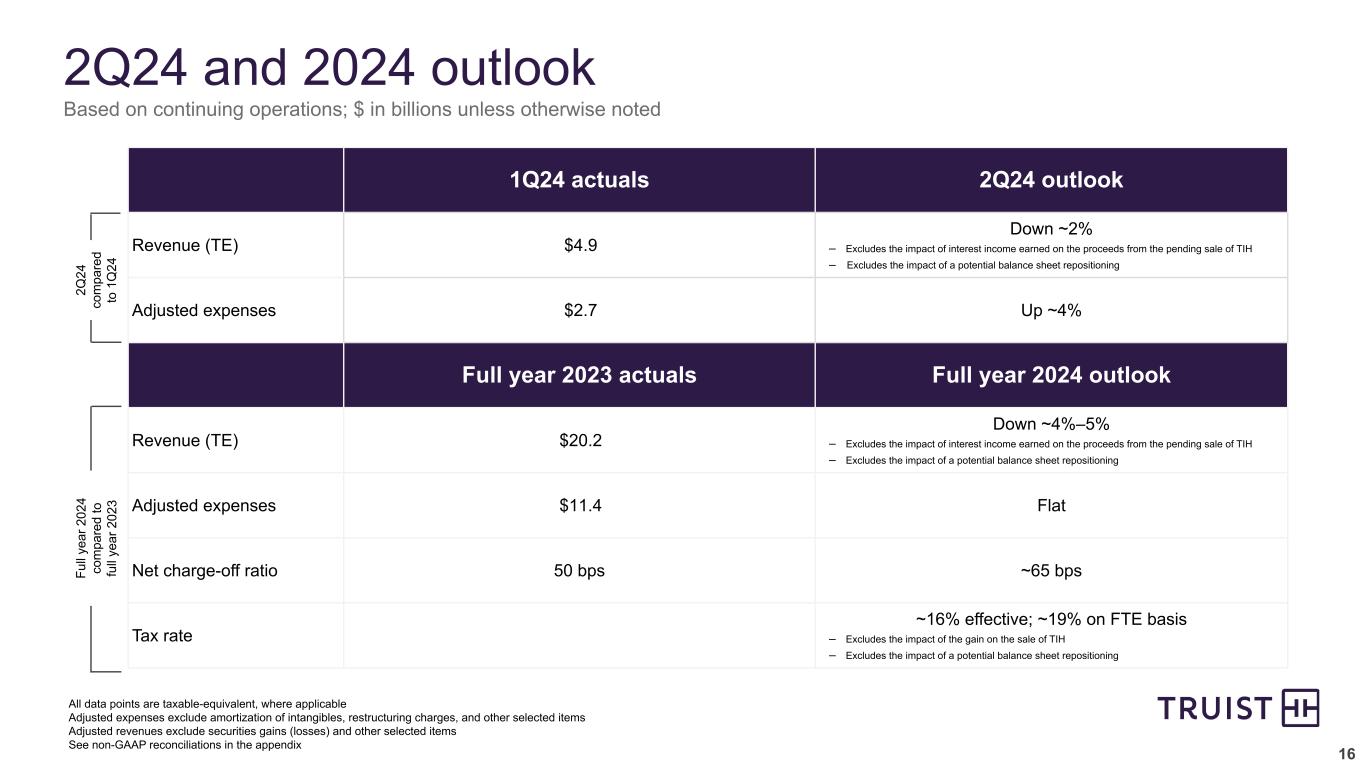

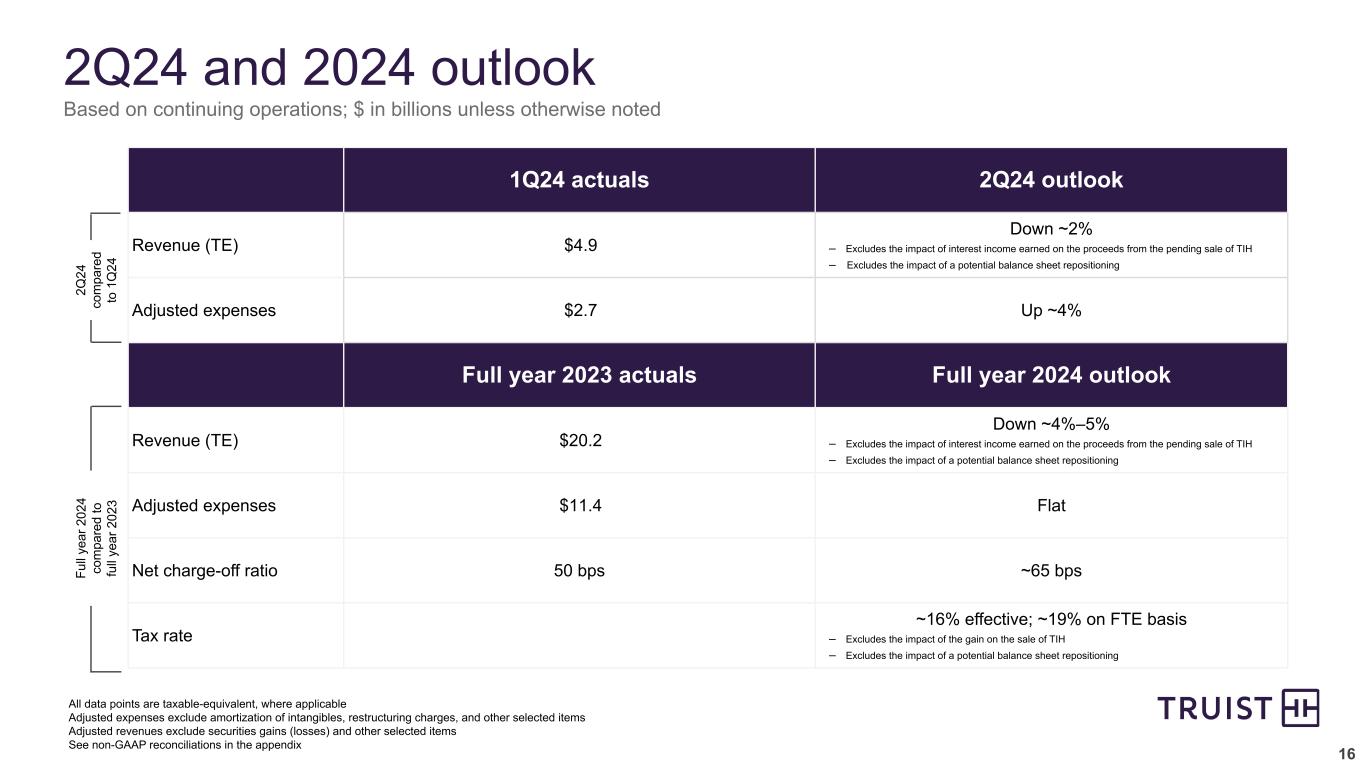

16 13.9% 2Q24 and 2024 outlook All data points are taxable-equivalent, where applicable Adjusted expenses exclude amortization of intangibles, restructuring charges, and other selected items Adjusted revenues exclude securities gains (losses) and other selected items See non-GAAP reconciliations in the appendix 1Q24 actuals 2Q24 outlook Revenue (TE) $4.9 Down ~2% – Excludes the impact of interest income earned on the proceeds from the pending sale of TIH – Excludes the impact of a potential balance sheet repositioning Adjusted expenses $2.7 Up ~4% Full year 2023 actuals Full year 2024 outlook Revenue (TE) $20.2 Down ~4%–5% – Excludes the impact of interest income earned on the proceeds from the pending sale of TIH – Excludes the impact of a potential balance sheet repositioning Adjusted expenses $11.4 Flat Net charge-off ratio 50 bps ~65 bps Tax rate ~16% effective; ~19% on FTE basis – Excludes the impact of the gain on the sale of TIH – Excludes the impact of a potential balance sheet repositioning Fu ll ye ar 2 02 4 co m pa re d to fu ll ye ar 2 02 3 2Q 24 co m pa re d to 1 Q 24 Based on continuing operations; $ in billions unless otherwise noted

17 13.9% 2024 strategic priorities Pursuing growth opportunities in our core businesses Maintaining expense discipline and seeking additional efficiencies Evaluating a balance sheet repositioning post closing of TIH, subject to market conditions Resuming share buybacks, subject to market conditions and capital planning Maintaining and strengthening sound risk controls and strong asset quality metrics Enhancing the client experience through T3 (touch + technology = trust)

Appendix

A-19 Multi Tenant 89% Medical 9% Single Tenant 2% Hotel 8% Industrial 17% Office 16% Multifamily 35% Retail 14% Other 10% 9.7% 11.1% 11.3% 11.7% 13.7% 0.41% 1.01% 1.09% 1.05% 0.96% 0.06% 0.49% 1.02% 0.70% 1.30% Criticized & classified ratio NPL ratio NCO ratio 1Q23 2Q23 3Q23 4Q23 1Q24 CRE 9.6% 22% 27% 16% 14% 20% 2024 2025 2026 2027 2028 and beyond Commercial real estate (CRE) spotlight 5-Quarter Total CRE Trends Total LHFI at 3/31/24 ($307B) CRE Office 1.7% CRE Mix Scheduled Office Maturities CRE Represents 9.6% of Total Loans HFI, Including Office at 1.7% NPL% 5.49% LTM NCO ratio 5.24% Loan loss reserves 9.3% WALTV ~65% % in Truist Southeast/ Mid-Atlantic footprint ~76% Office Spotlight All other loans 90.4% CRE information on this slide includes the commercial construction portfolio Gateway markets include: Washington, DC, San Francisco, New York, Chicago, Los Angeles, Boston, and Miami WALTV based on most recent appraisal conducted A-1 Office Portfolio Primarily Composed of Multi Tenant, Non Gateway Properties Within Footprint Gateway 37% Non Gateway 63% Tenant Type Market Type

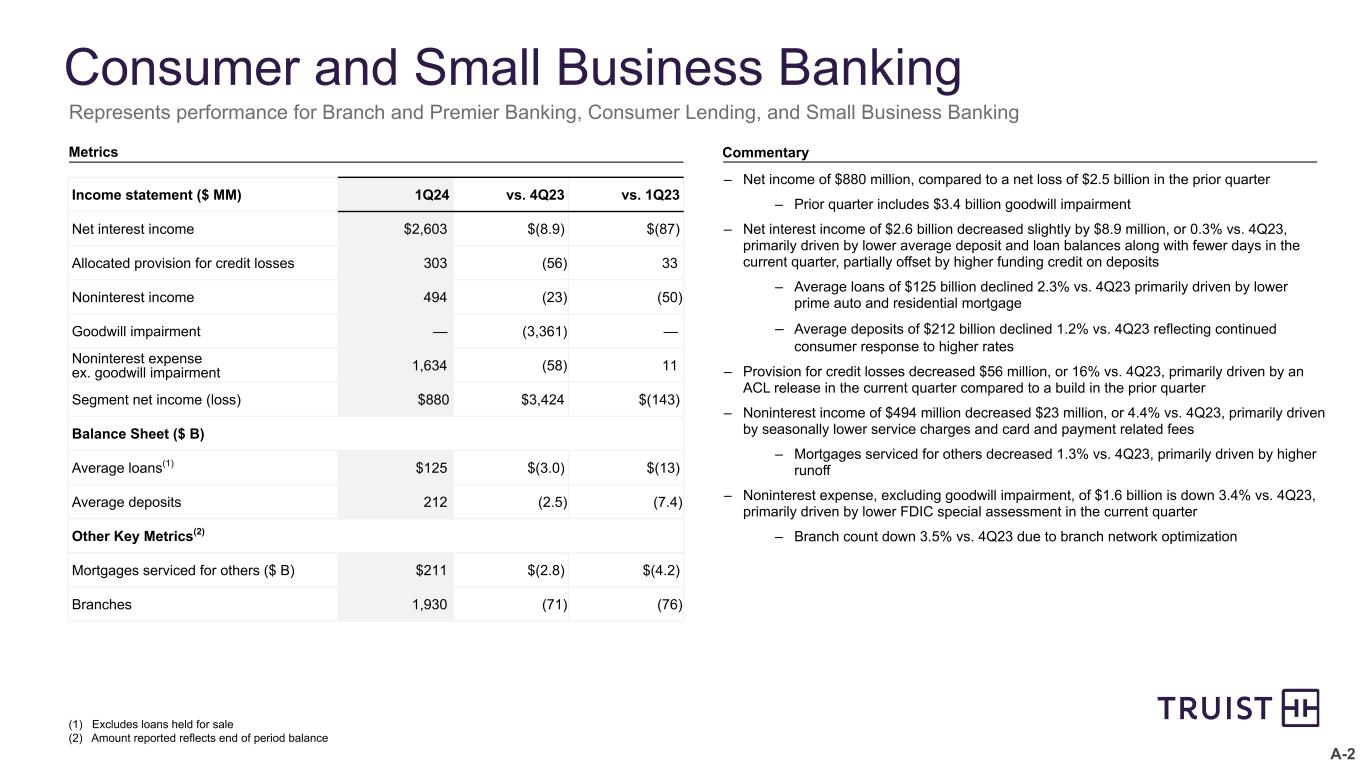

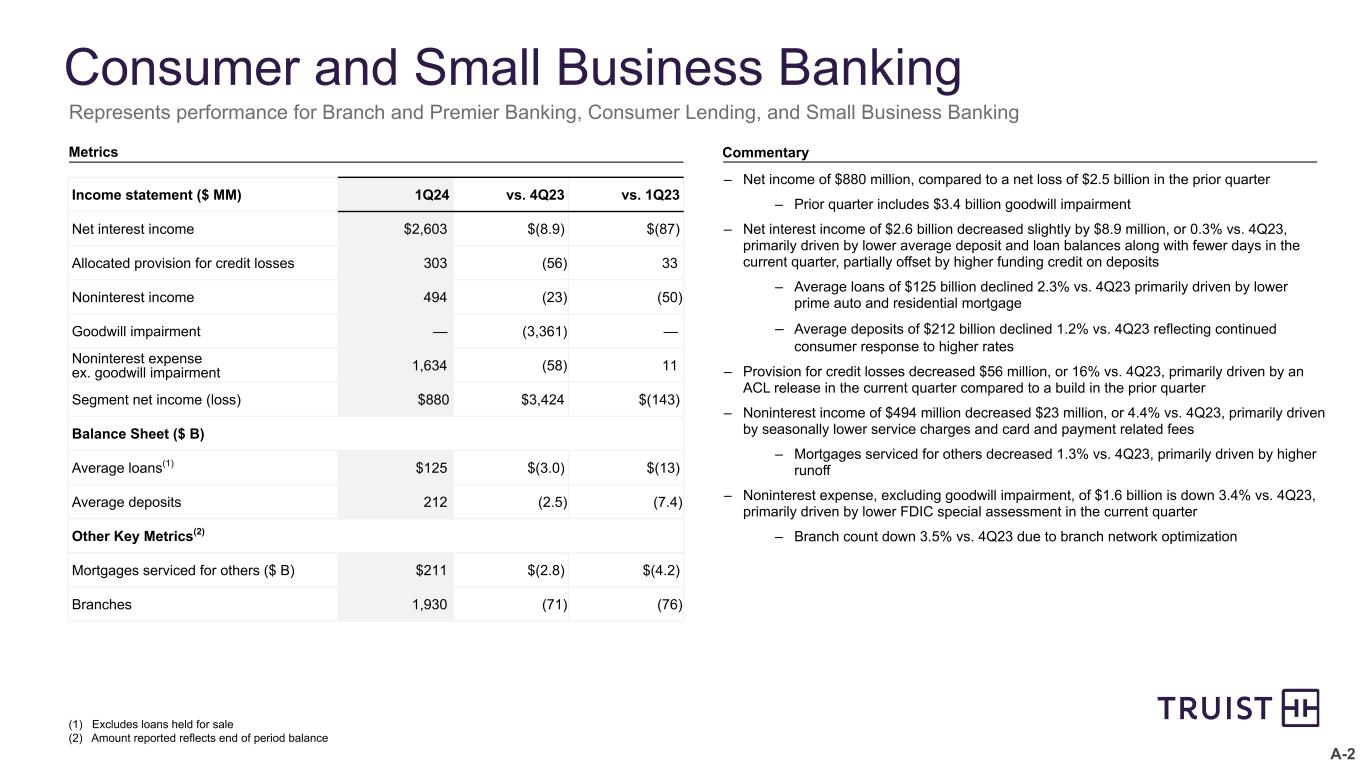

A-2 Consumer and Small Business Banking Income statement ($ MM) 1Q24 vs. 4Q23 vs. 1Q23 Net interest income $2,603 $(8.9) $(87) Allocated provision for credit losses 303 (56) 33 Noninterest income 494 (23) (50) Goodwill impairment — (3,361) — Noninterest expense ex. goodwill impairment 1,634 (58) 11 Segment net income (loss) $880 $3,424 $(143) Balance Sheet ($ B) Average loans(1) $125 $(3.0) $(13) Average deposits 212 (2.5) (7.4) Other Key Metrics(2) Mortgages serviced for others ($ B) $211 $(2.8) $(4.2) Branches 1,930 (71) (76) (1) Excludes loans held for sale (2) Amount reported reflects end of period balance Represents performance for Branch and Premier Banking, Consumer Lending, and Small Business Banking – Net income of $880 million, compared to a net loss of $2.5 billion in the prior quarter – Prior quarter includes $3.4 billion goodwill impairment – Net interest income of $2.6 billion decreased slightly by $8.9 million, or 0.3% vs. 4Q23, primarily driven by lower average deposit and loan balances along with fewer days in the current quarter, partially offset by higher funding credit on deposits – Average loans of $125 billion declined 2.3% vs. 4Q23 primarily driven by lower prime auto and residential mortgage – Average deposits of $212 billion declined 1.2% vs. 4Q23 reflecting continued consumer response to higher rates – Provision for credit losses decreased $56 million, or 16% vs. 4Q23, primarily driven by an ACL release in the current quarter compared to a build in the prior quarter – Noninterest income of $494 million decreased $23 million, or 4.4% vs. 4Q23, primarily driven by seasonally lower service charges and card and payment related fees – Mortgages serviced for others decreased 1.3% vs. 4Q23, primarily driven by higher runoff – Noninterest expense, excluding goodwill impairment, of $1.6 billion is down 3.4% vs. 4Q23, primarily driven by lower FDIC special assessment in the current quarter – Branch count down 3.5% vs. 4Q23 due to branch network optimization Metrics Commentary

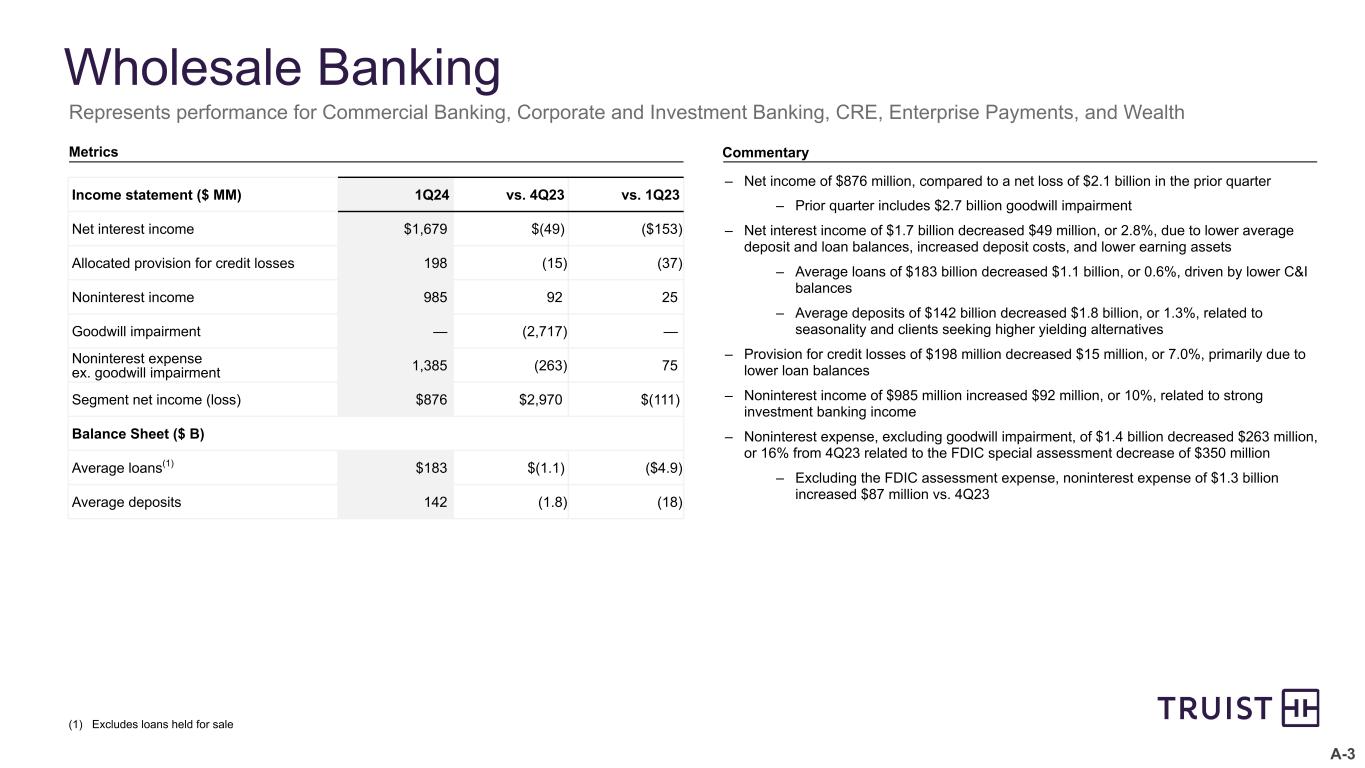

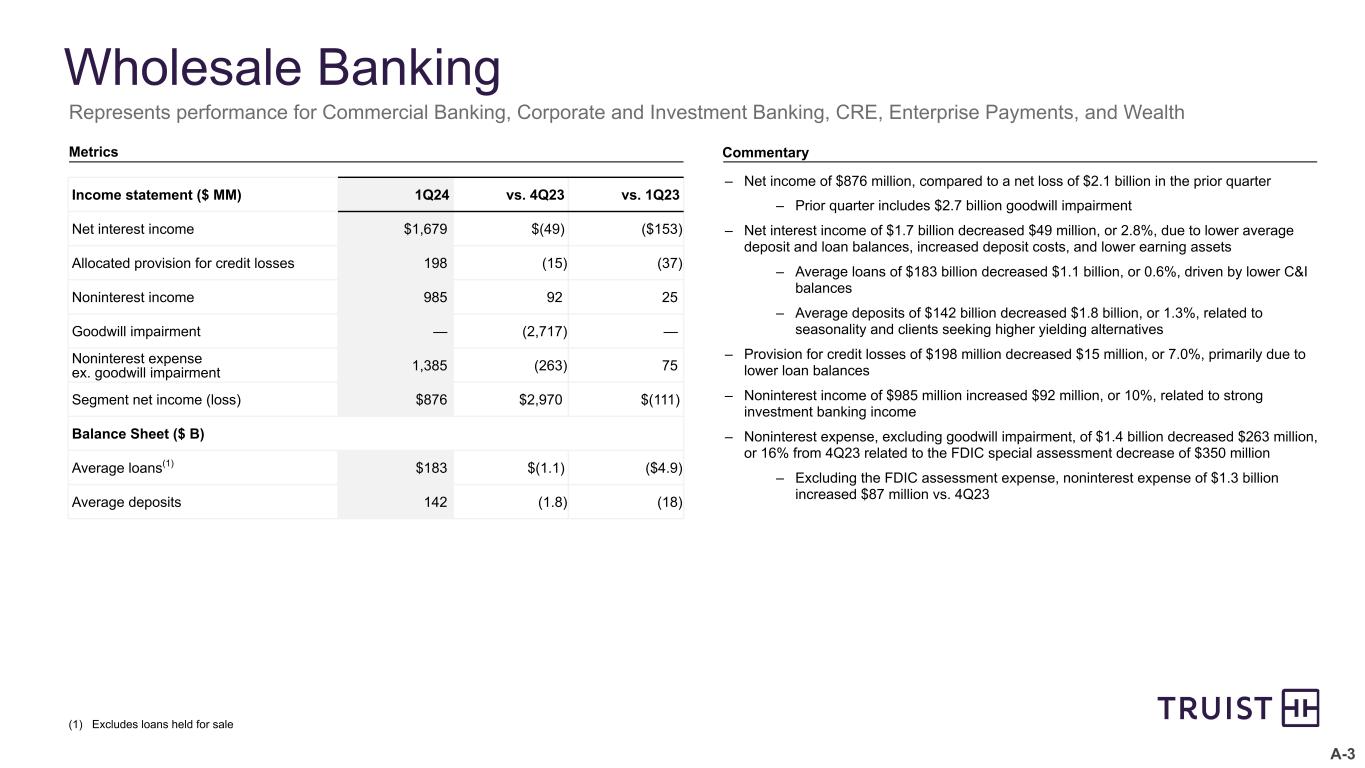

A-3 Wholesale Banking – Net income of $876 million, compared to a net loss of $2.1 billion in the prior quarter – Prior quarter includes $2.7 billion goodwill impairment – Net interest income of $1.7 billion decreased $49 million, or 2.8%, due to lower average deposit and loan balances, increased deposit costs, and lower earning assets – Average loans of $183 billion decreased $1.1 billion, or 0.6%, driven by lower C&I balances – Average deposits of $142 billion decreased $1.8 billion, or 1.3%, related to seasonality and clients seeking higher yielding alternatives – Provision for credit losses of $198 million decreased $15 million, or 7.0%, primarily due to lower loan balances – Noninterest income of $985 million increased $92 million, or 10%, related to strong investment banking income – Noninterest expense, excluding goodwill impairment, of $1.4 billion decreased $263 million, or 16% from 4Q23 related to the FDIC special assessment decrease of $350 million – Excluding the FDIC assessment expense, noninterest expense of $1.3 billion increased $87 million vs. 4Q23 (1) Excludes loans held for sale Metrics Commentary Income statement ($ MM) 1Q24 vs. 4Q23 vs. 1Q23 Net interest income $1,679 $(49) ($153) Allocated provision for credit losses 198 (15) (37) Noninterest income 985 92 25 Goodwill impairment — (2,717) — Noninterest expense ex. goodwill impairment 1,385 (263) 75 Segment net income (loss) $876 $2,970 $(111) Balance Sheet ($ B) Average loans(1) $183 $(1.1) ($4.9) Average deposits 142 (1.8) (18) Represents performance for Commercial Banking, Corporate and Investment Banking, CRE, Enterprise Payments, and Wealth

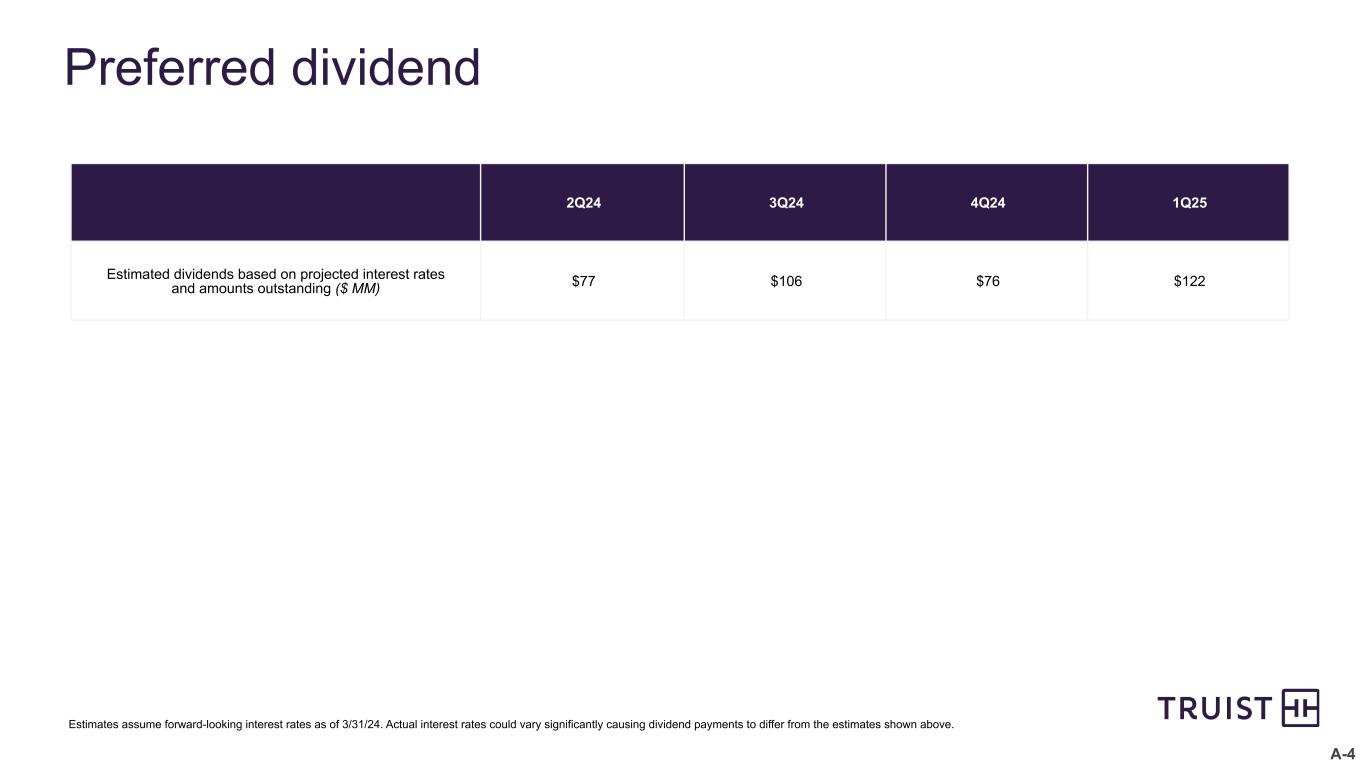

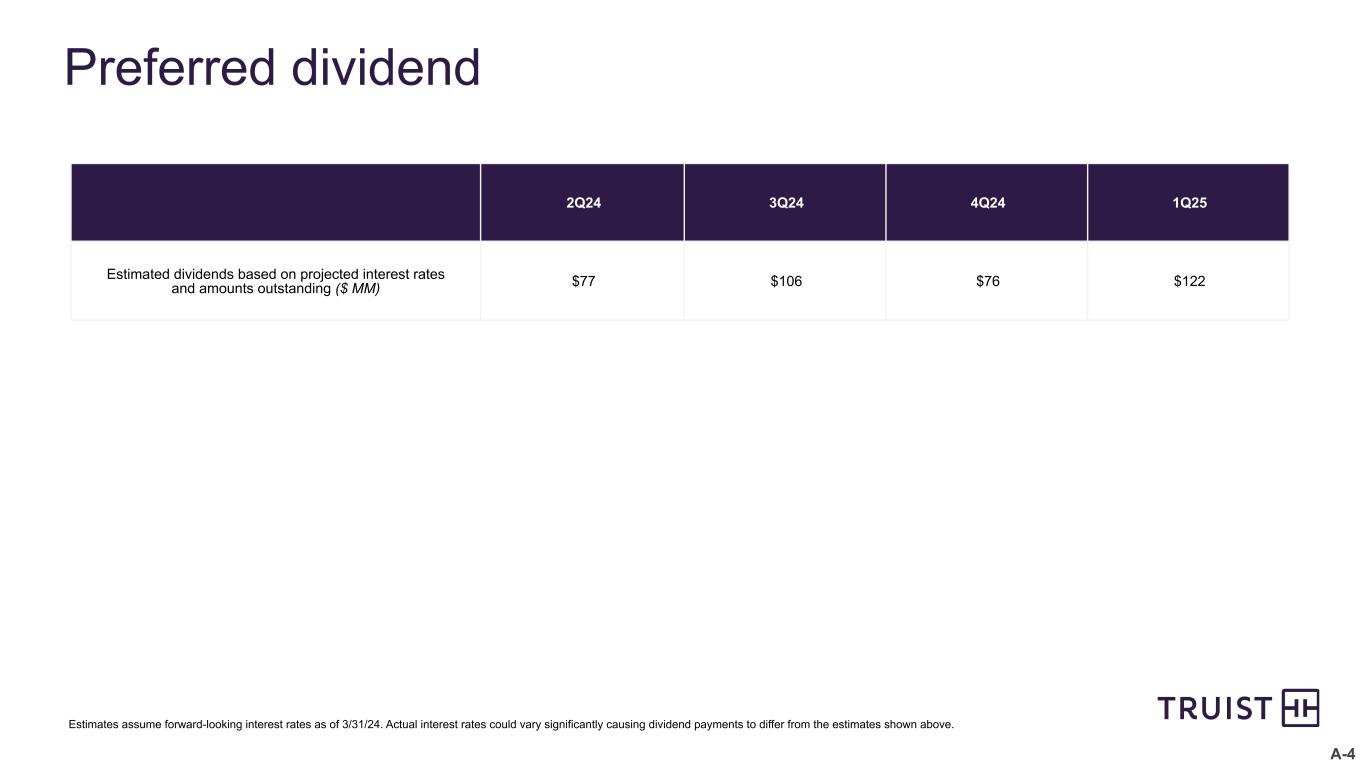

A-4 Preferred dividend 2Q24 3Q24 4Q24 1Q25 Estimated dividends based on projected interest rates and amounts outstanding ($ MM) $77 $106 $76 $122 Estimates assume forward-looking interest rates as of 3/31/24. Actual interest rates could vary significantly causing dividend payments to differ from the estimates shown above.

Non-GAAP Reconciliations

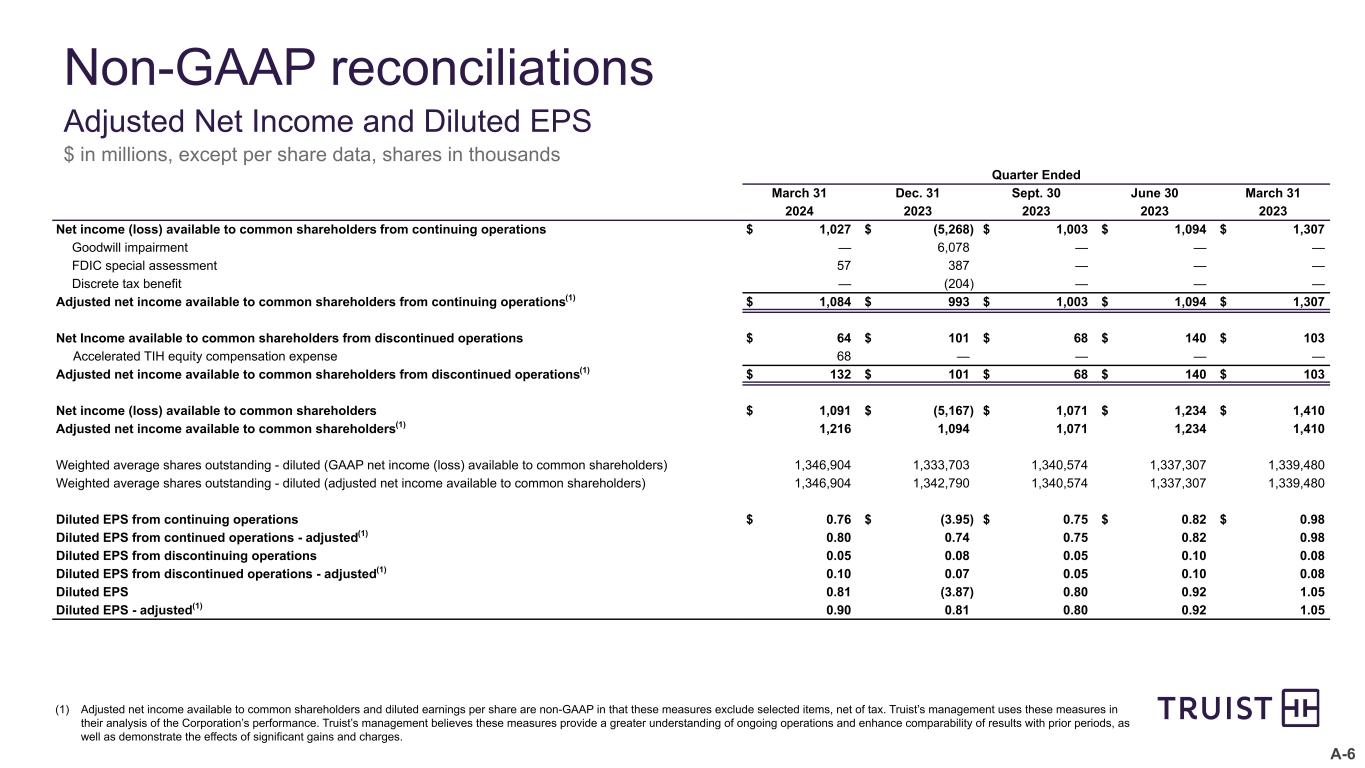

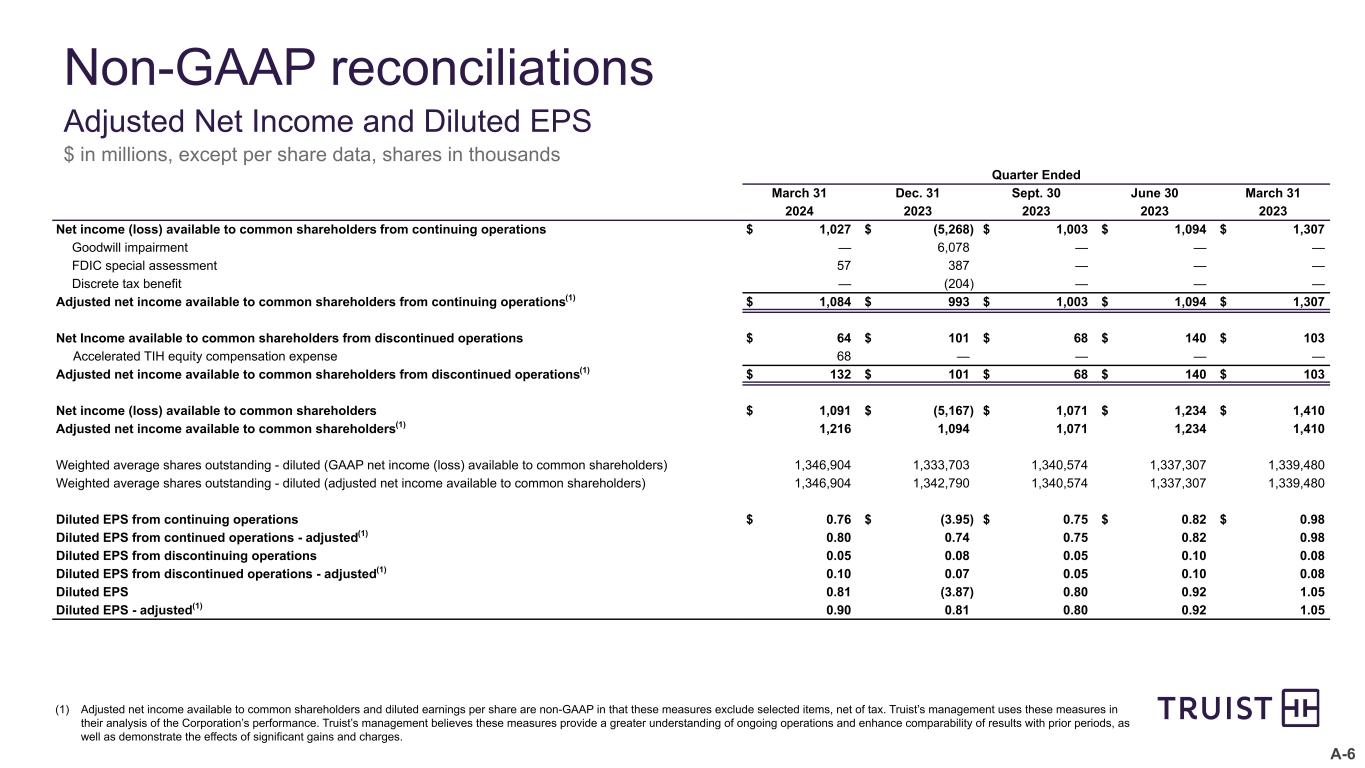

A-6 Quarter Ended March 31 Dec. 31 Sept. 30 June 30 March 31 2024 2023 2023 2023 2023 Net income (loss) available to common shareholders from continuing operations $ 1,027 $ (5,268) $ 1,003 $ 1,094 $ 1,307 Goodwill impairment — 6,078 — — — FDIC special assessment 57 387 — — — Discrete tax benefit — (204) — — — Adjusted net income available to common shareholders from continuing operations(1) $ 1,084 $ 993 $ 1,003 $ 1,094 $ 1,307 Net Income available to common shareholders from discontinued operations $ 64 $ 101 $ 68 $ 140 $ 103 Accelerated TIH equity compensation expense 68 — — — — Adjusted net income available to common shareholders from discontinued operations(1) $ 132 $ 101 $ 68 $ 140 $ 103 Net income (loss) available to common shareholders $ 1,091 $ (5,167) $ 1,071 $ 1,234 $ 1,410 Adjusted net income available to common shareholders(1) 1,216 1,094 1,071 1,234 1,410 Weighted average shares outstanding - diluted (GAAP net income (loss) available to common shareholders) 1,346,904 1,333,703 1,340,574 1,337,307 1,339,480 Weighted average shares outstanding - diluted (adjusted net income available to common shareholders) 1,346,904 1,342,790 1,340,574 1,337,307 1,339,480 Diluted EPS from continuing operations $ 0.76 $ (3.95) $ 0.75 $ 0.82 $ 0.98 Diluted EPS from continued operations - adjusted(1) 0.80 0.74 0.75 0.82 0.98 Diluted EPS from discontinuing operations 0.05 0.08 0.05 0.10 0.08 Diluted EPS from discontinued operations - adjusted(1) 0.10 0.07 0.05 0.10 0.08 Diluted EPS 0.81 (3.87) 0.80 0.92 1.05 Diluted EPS - adjusted(1) 0.90 0.81 0.80 0.92 1.05 Non-GAAP reconciliations Adjusted Net Income and Diluted EPS $ in millions, except per share data, shares in thousands (1) Adjusted net income available to common shareholders and diluted earnings per share are non-GAAP in that these measures exclude selected items, net of tax. Truist’s management uses these measures in their analysis of the Corporation’s performance. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges.

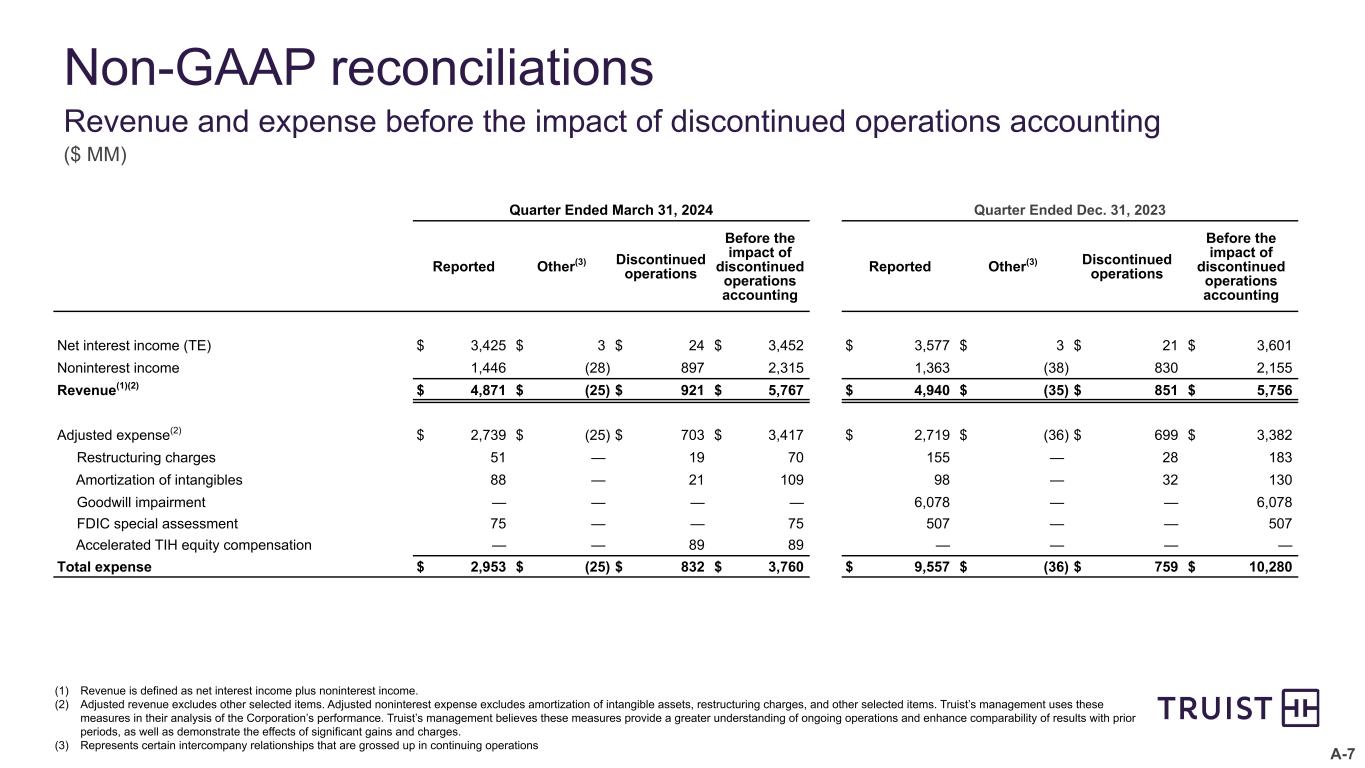

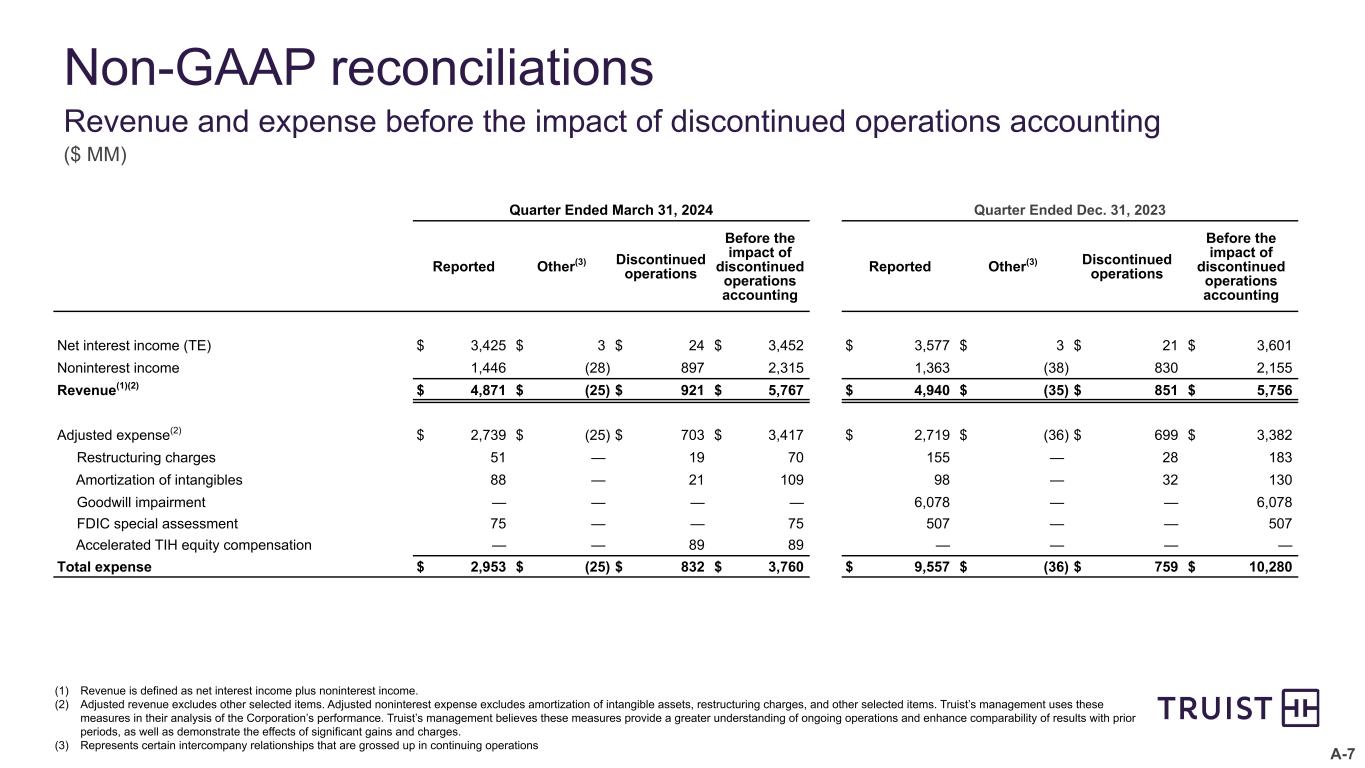

A-7 Non-GAAP reconciliations Revenue and expense before the impact of discontinued operations accounting ($ MM) Quarter Ended March 31, 2024 Quarter Ended Dec. 31, 2023 Reported Other(3) Discontinued operations Before the impact of discontinued operations accounting Reported Other(3) Discontinued operations Before the impact of discontinued operations accounting Net interest income (TE) $ 3,425 $ 3 $ 24 $ 3,452 $ 3,577 $ 3 $ 21 $ 3,601 Noninterest income 1,446 (28) 897 2,315 1,363 (38) 830 2,155 Revenue(1)(2) $ 4,871 $ (25) $ 921 $ 5,767 $ 4,940 $ (35) $ 851 $ 5,756 Adjusted expense(2) $ 2,739 $ (25) $ 703 $ 3,417 $ 2,719 $ (36) $ 699 $ 3,382 Restructuring charges 51 — 19 70 155 — 28 183 Amortization of intangibles 88 — 21 109 98 — 32 130 Goodwill impairment — — — — 6,078 — — 6,078 FDIC special assessment 75 — — 75 507 — — 507 Accelerated TIH equity compensation — — 89 89 — — — — Total expense $ 2,953 $ (25) $ 832 $ 3,760 $ 9,557 $ (36) $ 759 $ 10,280 (1) Revenue is defined as net interest income plus noninterest income. (2) Adjusted revenue excludes other selected items. Adjusted noninterest expense excludes amortization of intangible assets, restructuring charges, and other selected items. Truist’s management uses these measures in their analysis of the Corporation’s performance. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges. (3) Represents certain intercompany relationships that are grossed up in continuing operations

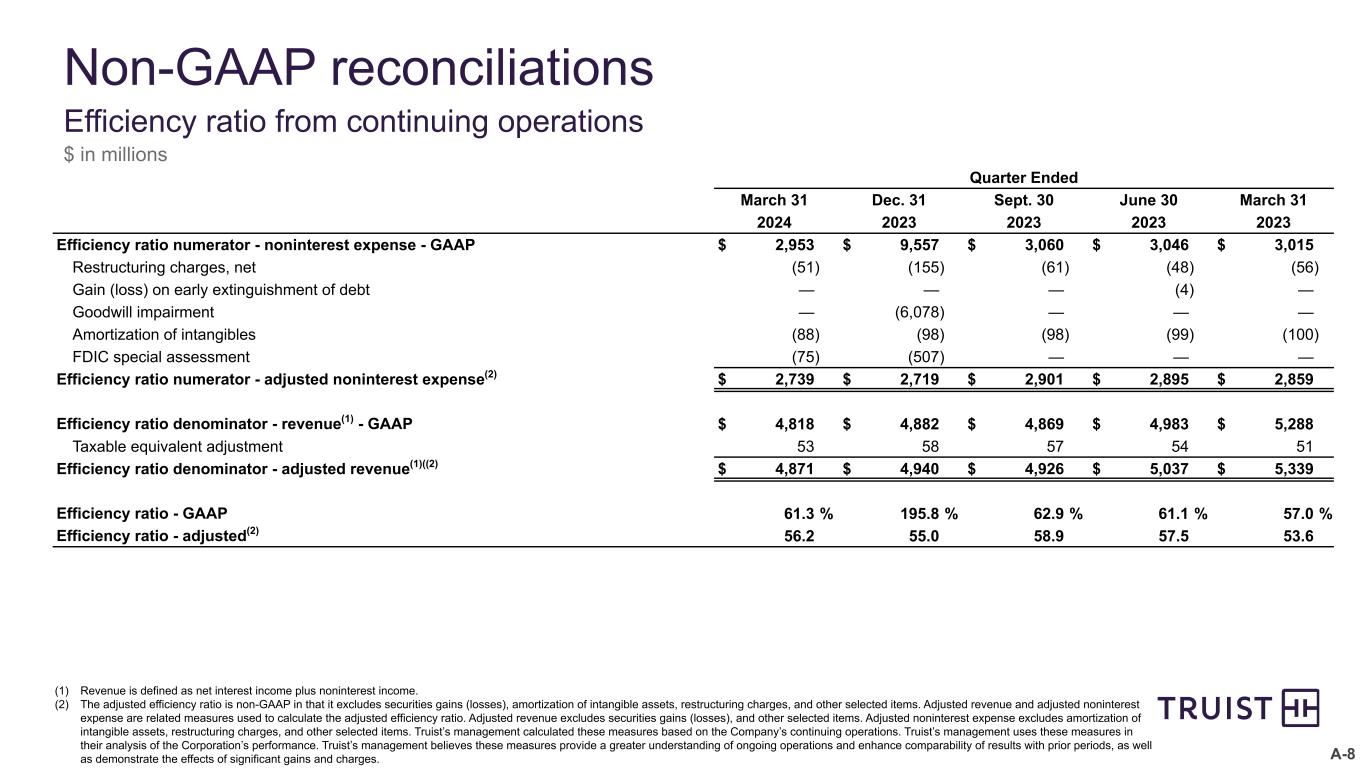

A-8 Non-GAAP reconciliations Efficiency ratio from continuing operations $ in millions (1) Revenue is defined as net interest income plus noninterest income. (2) The adjusted efficiency ratio is non-GAAP in that it excludes securities gains (losses), amortization of intangible assets, restructuring charges, and other selected items. Adjusted revenue and adjusted noninterest expense are related measures used to calculate the adjusted efficiency ratio. Adjusted revenue excludes securities gains (losses), and other selected items. Adjusted noninterest expense excludes amortization of intangible assets, restructuring charges, and other selected items. Truist’s management calculated these measures based on the Company’s continuing operations. Truist’s management uses these measures in their analysis of the Corporation’s performance. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges. Quarter Ended March 31 Dec. 31 Sept. 30 June 30 March 31 2024 2023 2023 2023 2023 Efficiency ratio numerator - noninterest expense - GAAP $ 2,953 $ 9,557 $ 3,060 $ 3,046 $ 3,015 Restructuring charges, net (51) (155) (61) (48) (56) Gain (loss) on early extinguishment of debt — — — (4) — Goodwill impairment — (6,078) — — — Amortization of intangibles (88) (98) (98) (99) (100) FDIC special assessment (75) (507) — — — Efficiency ratio numerator - adjusted noninterest expense(2) $ 2,739 $ 2,719 $ 2,901 $ 2,895 $ 2,859 Efficiency ratio denominator - revenue(1) - GAAP $ 4,818 $ 4,882 $ 4,869 $ 4,983 $ 5,288 Taxable equivalent adjustment 53 58 57 54 51 Efficiency ratio denominator - adjusted revenue(1)((2) $ 4,871 $ 4,940 $ 4,926 $ 5,037 $ 5,339 Efficiency ratio - GAAP 61.3 % 195.8 % 62.9 % 61.1 % 57.0 % Efficiency ratio - adjusted(2) 56.2 55.0 58.9 57.5 53.6

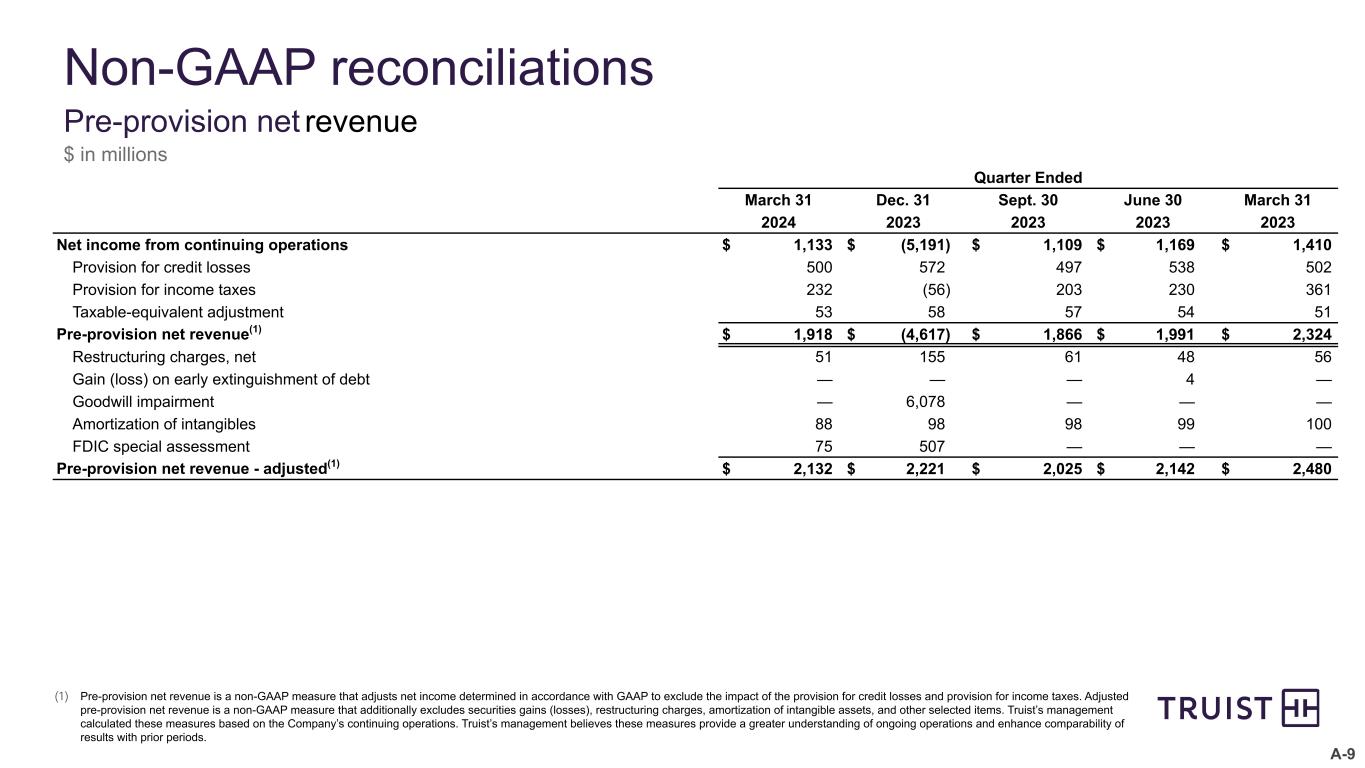

A-9 Non-GAAP reconciliations Pre-provision net revenue $ in millions (1) Pre-provision net revenue is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of the provision for credit losses and provision for income taxes. Adjusted pre-provision net revenue is a non-GAAP measure that additionally excludes securities gains (losses), restructuring charges, amortization of intangible assets, and other selected items. Truist’s management calculated these measures based on the Company’s continuing operations. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods. Quarter Ended March 31 Dec. 31 Sept. 30 June 30 March 31 2024 2023 2023 2023 2023 Net income from continuing operations $ 1,133 $ (5,191) $ 1,109 $ 1,169 $ 1,410 Provision for credit losses 500 572 497 538 502 Provision for income taxes 232 (56) 203 230 361 Taxable-equivalent adjustment 53 58 57 54 51 Pre-provision net revenue(1) $ 1,918 $ (4,617) $ 1,866 $ 1,991 $ 2,324 Restructuring charges, net 51 155 61 48 56 Gain (loss) on early extinguishment of debt — — — 4 — Goodwill impairment — 6,078 — — — Amortization of intangibles 88 98 98 99 100 FDIC special assessment 75 507 — — — Pre-provision net revenue - adjusted(1) $ 2,132 $ 2,221 $ 2,025 $ 2,142 $ 2,480

A-10 Non-GAAP reconciliations Calculations of tangible common equity and related measures $ in millions, except per share data, shares in thousands (1) Tangible common equity and related measures are non-GAAP measures that exclude the impact of intangible assets, net of deferred taxes, and their related amortization and impairment charges. These measures are useful for evaluating the performance of a business consistently, whether acquired or developed internally. Truist’s management uses these measures to assess profitability, returns relative to balance sheet risk, and shareholder value. These measures are not necessarily comparable to similar measures that may be presented by other companies. As of / Quarter Ended March 31 Dec. 31 Sept. 30 June 30 March 31 2024 2023 2023 2023 2023 Common shareholders’ equity $ 52,148 $ 52,428 $ 55,167 $ 56,853 $ 55,699 Less: Intangible assets, net of deferred taxes (including discontinued operations) 23,198 23,306 29,491 29,628 29,788 Tangible common shareholders’ equity(1) $ 28,950 $ 29,122 $ 25,676 $ 27,225 $ 25,911 Outstanding shares at end of period 1,338,096 1,333,743 1,333,668 1,331,976 1,331,918 Common shareholders’ equity per common share $ 38.97 $ 39.31 $ 41.37 $ 42.68 $ 41.82 Tangible common shareholders’ equity per common share(1) 21.64 21.83 19.25 20.44 19.45 Net income available to common shareholders $ 1,091 $ (5,167) $ 1,071 $ 1,234 $ 1,410 Plus: goodwill impairment — 6,078 — — — Plus: amortization of intangibles, net of tax (including discontinued operations) 84 99 99 100 104 Tangible net income available to common shareholders(1) $ 1,175 $ 1,010 $ 1,170 $ 1,334 $ 1,514 Average common shareholders’ equity $ 52,167 $ 56,061 $ 56,472 $ 57,302 $ 55,380 Less: Average intangible assets, net of deferred taxes (including discontinued operations) 23,244 29,377 29,570 29,775 29,889 Average tangible common shareholders’ equity(1) $ 28,923 $ 26,684 $ 26,902 $ 27,527 $ 25,491 Return on average common shareholders’ equity 8.4 % (36.6) % 7.5 % 8.6 % 10.3 % Return on average tangible common shareholders’ equity(1) 16.3 15.0 17.3 19.4 24.1

To inspire and build better lives and communities