Exhibit 99.2 |

1 Forward-Looking Statements Important Additional Information and Where to Find It This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 giving National Penn’s and BB&T’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects” or “potential,” by future conditional verbs such as “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections. In addition to factors previously disclosed in National Penn’s and BB&T’s reports filed with the U.S. Securities and Exchange Commission (the “SEC”) and those identified elsewhere in this document, the following factors among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by National Penn shareholders; delay in closing the merger; difficulties and delays in integrating the National Penn business or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of BB&T products and services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and other legislative and regulatory actions and reforms. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. In connection with the proposed merger, BB&T will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of National Penn and a Prospectus of BB&T, as well as other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. SHAREHOLDERS OF NATIONAL PENN ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about BB&T and National Penn, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from BB&T at www.bbt.com under the heading “About BB&T” and then under the heading “Investor Relations” and then under “BB&T Corporation’s SEC Filings” or from National Penn at www.nationalpennbancshares.com under the heading “SEC Filings” and then under “Documents”. Copies of the Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to BB&T Corporation, 150 South Stratford Road, Suite 300, Winston-Salem, North Carolina 27104, Attention: Shareholder Services, Telephone: (336) 733-3065 or to National Penn Bancshares, Inc., 645 Hamilton Street, Suite 1100, Allentown, PA 18101, Attention: Shareholder Services, Telephone: (610) 861-3983. National Penn and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of National Penn in connection with the proposed merger. Information about the directors and executive officers of National Penn and their ownership of National Penn common stock is set forth in the proxy statement for National Penn’s 2015 annual meeting of shareholders, as filed with the SEC on Schedule 14A on March 18, 2015. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. |

Strategic and Compelling Acquisition of National Penn Note: Financial data at or for the six months ended June 30, 2015. Loan and deposit composition based on regulatory filings. National Penn Financial Highlights Loan Composition Deposit Composition Total: $6,168MM Yield on Total Loans: 3.87% Total: $6,733MM Cost of Total Deposits: 0.27% Strategically compelling Significant expansion in Mid-Atlantic Region #4 pro forma market share in Pennsylvania Highly synergistic with recently closed Susquehanna acquisition Consistent with BB&T’s acquisition criteria Financially attractive Approximately $1.8 billion aggregate deal value EPS accretive and exceeds IRR hurdle Compelling use of capital Partial reallocation of approved 2015 CCAR share buyback Significant expansion of attractive Mid-Atlantic footprint Eastern PA and the Philadelphia MSA BB&T well prepared to successfully execute on this acquisition Extensive due diligence process and planning Successful integration of recent acquisitions is well underway including cultural integration Compatible culture with BB&T Client oriented community bank model Experienced management team with deep knowledge of its Pennsylvania markets Assets ($MM) $9,604 Loans ($MM) 6,168 Deposits ($MM) 6,733 Common Equity ($MM) 1,138 YTD ROAA 1.1% YTD ROAE 9.5 YTD ROATE 13.3 TCE / TA 8.9 Common Equity Tier 1 Ratio 12.1 CRE 28% 1-4 Family 22% C&I 14% HELOC 12% Farm & Agriculture 9% Consumer 4% Multifamily 4% Construction 3% Other 3% Transaction / MMDA / Savings 82% Retail Time 13% Jumbo Time 5% 3 |

Key Transaction Terms Purchase Price $1.8 billion aggregate consideration $13.00 per National Penn common share (1) Price / 2016E Street EPS: 16.0x Price / TBV: 2.2x Consideration 70% stock / 30% cash in aggregate National Penn stockholders can elect to receive 0.3206 of a share of BB&T common stock or $13.00 in cash Subject to proration such that total consideration will be approximately $550 million in cash and approximately 31.6 million BB&T common shares (1) Tax free transaction for stock component Cost Savings Approximately $65 million pre-tax (fully phased-in) Approximately 30% of National Penn’s non-interest expense Merger & Integration Costs Approximately $100 million (pre-tax) Credit Mark 3.0% of loans and leases Expected Closing Mid-2016 Closing Conditions National Penn shareholder approval Other customary closing conditions including regulatory approval (1): Based on BB&T’s average closing stock price for the trailing 20 trading days through August 17, 2015. 4 |

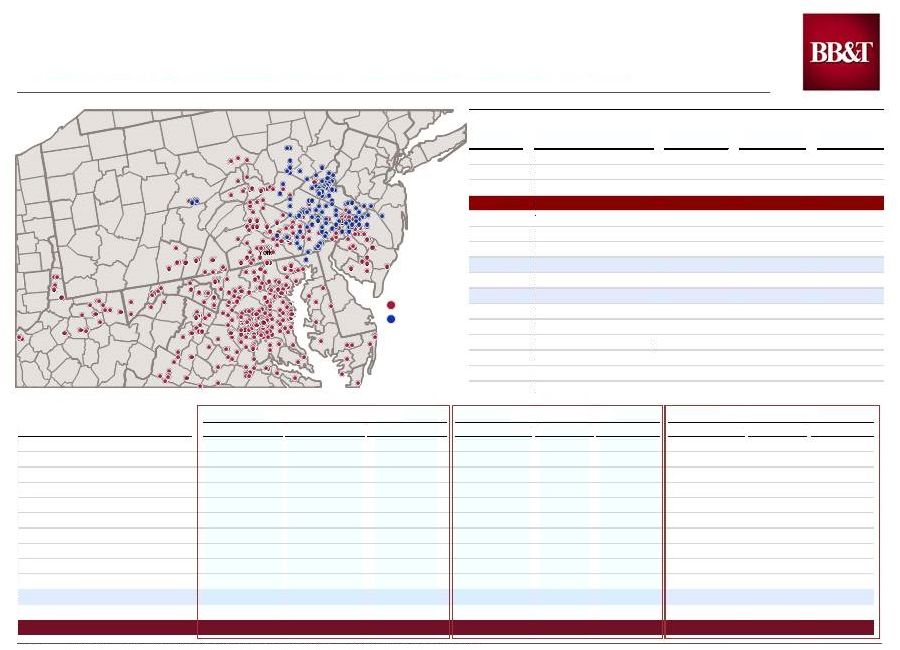

Note: Branches, deposits and deposit market share exclude branches with deposit balances greater than $1 billion. Source: SNL Financial. BB&T branch data as of June 30, 2014; National Penn branch data as of June 30, 2015. Deposit data as of June 30, 2014. Branch and deposit data pro forma for announced BB&T National Penn Significant Penetration in Attractive Mid-Atlantic Region Deposits ($MM) Market Rank Market Share National Penn's Top 10 Counties National Penn BB&T Combined National Penn BB&T Combined National Penn BB&T Combined Berks, PA $1,337 $380 $1,717 2 8 1 18.7% 5.3% 24.0% Northampton, PA 1,042 85 1,126 2 13 2 18.4 1.5 19.9 Chester, PA 831 780 1,612 5 6 2 7.3 6.9 14.2 Lehigh, PA 701 161 862 2 13 2 10.9 2.5 13.4 Bucks, PA 618 173 792 8 19 6 3.9 1.1 5.0 Montgomery, PA 519 994 1,513 12 8 5 2.1 4.0 6.1 Philadelphia, PA 348 122 470 15 22 13 1.7 0.6 2.3 Luzerne, PA 329 152 481 6 11 4 5.6 2.6 8.3 Lancaster, PA 312 2,669 2,981 7 1 1 3.0 25.8 28.8 Centre, PA 310 85 396 3 9 3 11.9 3.3 15.1 Top 10 Counties Total $6,348 $5,600 $11,949 Other Counties 511 150,351 150,862 Total $6,860 $155,952 $162,811 Top 15 Banks in Pennsylvania Deposit Deposits Market Rank Institution Branches ($MM) Share 1. PNC 446 $35,394 14.4% 2. Wells Fargo 280 24,339 9.9 3. Citizens Financial 359 21,673 8.8 BB&T Pro Forma 294 15,715 6.4 4. Toronto-Dominion 97 12,042 4.9 5. M&T Bank 258 11,518 4.7 6. F.N.B. Corporation 196 10,689 4.3 7. BB&T 178 9,106 3.7 8. Fulton Financial 127 7,747 3.1 9. National Penn 116 6,609 2.7 10. Banco Santander 157 6,198 2.5 11. First Niagara 124 5,743 2.3 12. Northwest Bancshares 136 5,003 2.0 13. S&T Bancorp 63 4,617 1.9 14. First Commonwealth 107 4,476 1.8 15. Dollar Bank 37 3,656 1.5 Williamsport Washington D.C. Hagerstown Baltimore Philadelphia Reading Harrisburg Camden Lancaster Ocean City Allentown 5 M&A through August 17, 2015. BB&T pro forma for the acquisition of Susquehanna. |

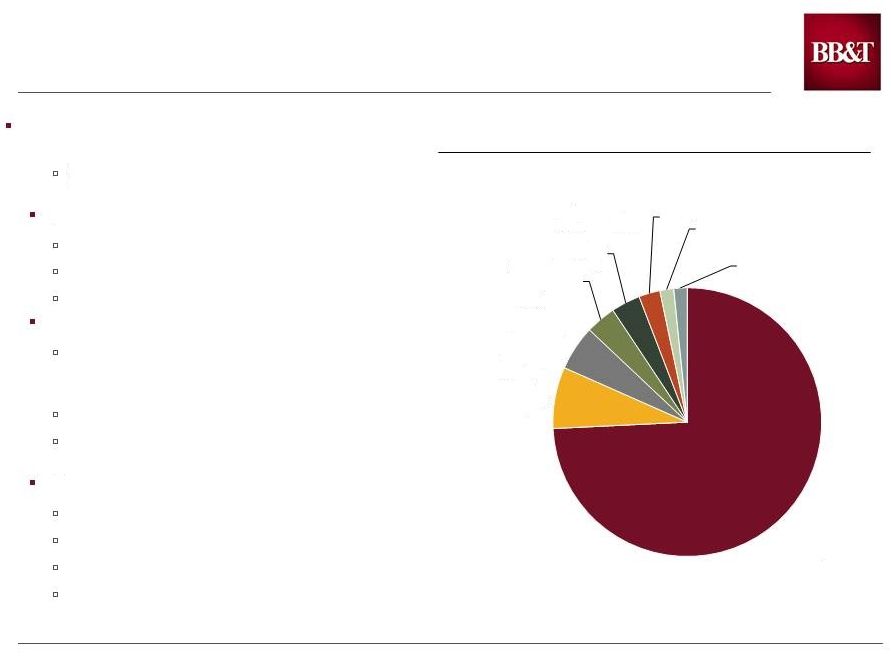

6 National Penn’s Revenue Composition National Penn’s Revenue Profile Source: SNL Financial, Company filings. For the Six Months Ended June 30, 2015. Net Interest Income 74% Wealth Management 7% Cash Management and Electronic Banking Fees 5% Services Charges on Deposits 4% Insurance Commissions and fees 3% Other 3% Mortgage Banking 2% BOLI 2% Complementary business model which fits well with BB&T’s community banking model Several non-bank businesses that will contribute to BB&T’s continuing focus on revenue diversification National Penn Bank Commercial and consumer banking $9.6 billion of assets as of 6/30/15 Operates a regional community banking model National Penn Wealth Management Investment management and fiduciary services for individuals, corporations, government entities and non- profit institutions $2.6 billion AUM as of 6/30/15 Also offers private banking services for high net worth individuals National Penn Insurance Services Group ~11,000 customers Top 20 bank-owned insurance brokerage firm P&C insurance services for retail and business clients Specialized employee benefits consulting services |

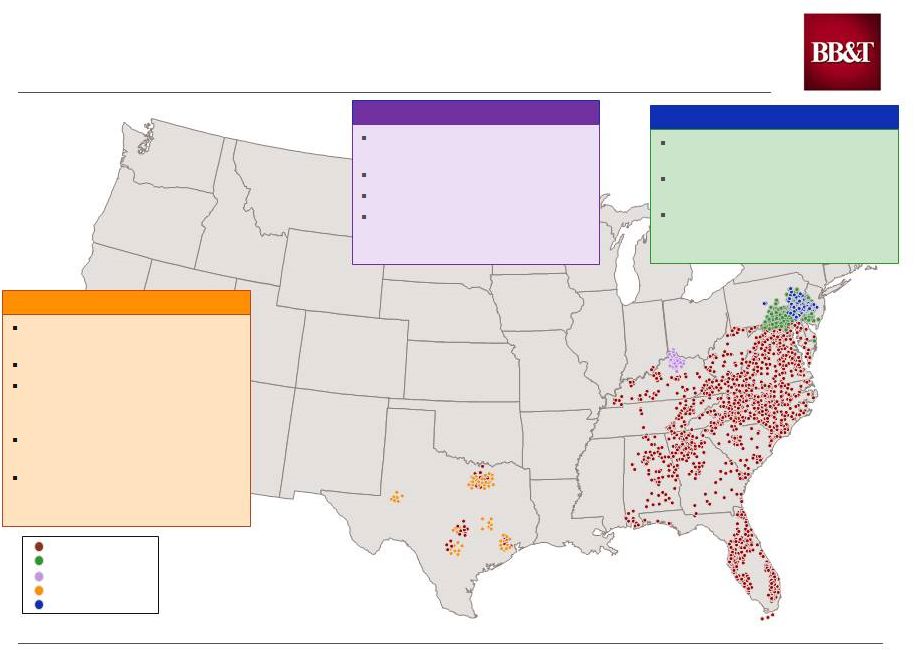

Source: SNL Financial. Branch and deposit data as of June 30, 2014, pro forma for M&A announced through August 17, 2015. Texas Acquisition of 63 branches ($3.5 billion in deposits) from Citibank 37 de novo branches since 2012 Branch presence has grown from 22 to 121 since our Colonial acquisition Fastest growing market in our franchise 28% increase in average June 30, 2015 YTD loan balance vs. June 30, 2014 YTD Cincinnati Acquisition of The Bank of Kentucky ($1.8 billion in assets) #1 in Northern Kentucky #7 in Cincinnati MSA Exciting opportunity to grow around the broader Cincinnati market Pennsylvania Pennsylvania will be BB&T’s 3 rd largest state presence Philadelphia MSA will be BB&T’s 5 th largest market Complementary franchises enhance market penetration and competitive positioning BB&T Susquehanna The Bank of Kentucky Citibank National Penn Leveraging BB&T’s Proven Practices Across a Broader Platform 7 |

BB&T’s Business Model Thrives Across Markets of Widely Differing Characteristics (1): Total estimated population as of January 1, 2015. (2): Number of firms with sales <$50 million as of August 17, 2015. (3): Real Gross Domestic Product as measure on January 1 of each year, adjusted for inflation. (4): Represents the average annual growth rate from 12/31/09 – 12/31/13. (5): Preliminary for June 2015. (6): Non-seasonally adjusted. (7): Median household income estimated for the calendar year 2015 as of January 1, 2015. Note: Branch data as of June 30, 2014, pro forma for announced M&A through August 17, 2015. Source: SNL Financial, Nielsen, Hoovers, U.S. Bureau of Labor Statistics, U.S. Bureau of Economic Analysis. Winston- Washington, Philadelphia Allentown Lancaster Salem DC Miami Dallas Total Population (MM) (1) 6.1 0.8 0.5 0.7 6.1 5.9 7.0 per Bank Branch 3,440 3,057 2,768 4,046 3,609 3,600 4,070 # of Middle Market and Small Businesses (2) 297,621 38,426 26,338 29,205 335,587 470,763 392,568 per Bank Branch 169 142 136 180 200 286 230 2013 GDP ($BN) (3) $358,091 $32,416 $21,587 $25,382 $437,085 $263,115 $413,627 2013 GDP Growth (3) 0.4% 1.4% 1.8% 0.9% (0.8)% 2.4% 2.1% Avg. Annual GDP Growth '09 - '13 (3)(4) 0.8 1.9 2.5 0.7 1.2 1.5 3.9 Current Unemployment Rate (June '15) (5)(6) 5.6% 5.5% 4.5% 5.9% 4.8% 5.7% 4.0% 2009 Peak Unemployment (6) 8.8 9.1 7.6 10.8 6.3 11.2 8.7 Historical Population Growth '10 - '15 1.61% 0.88% 2.83% 2.31% 7.63% 6.50% 8.18% Projected Population Growth '15 - '20 1.63 0.88 2.39 3.30 6.30 6.37 7.12 Median Household Income (7) $62,072 $58,052 $56,243 $44,432 $92,441 $47,423 $58,865 8 |

Community Banking Model is a Key Driver of BB&T’s Success BB&T’s approach to community banking has yielded broad success Collaboration and integration Local, visible leadership Local decision-making Knowing your client Client advocacy: giving voice to the client Partnerships across the bank Seamless perfect client experience Acquisitions are structured to fit with the community banking model Texas – operates in two newly established regions The Bank of Kentucky – newly established Northern Kentucky / Greater Cincinnati region Susquehanna – three newly established regions in Pennsylvania and New Jersey National Penn – newly established Eastern Pennsylvania region, headquartered in Allentown Scott V. Fainor, National Penn CEO, to be named Group Executive and will oversee newly created regions throughout Pennsylvania and contiguous states One newly established region from National Penn and three newly established regions from Susquehanna 9 |

10 BB&T’s Culture is Non-negotiable To Create the Best Financial Institution Possible Be The Best of the Best! Helping our CLIENTS achieve economic success and financial security Creating a place where our ASSOCIATES can learn, grow and be fulfilled in their work Making the COMMUNITIES in which we work better places to be, and thereby Optimizing the long-term return to our SHAREHOLDERS, while providing a safe and sound investment. |

BB&T is Continually Recognized as an Industry Leader BB&T Ranked First for Overall Customer Experience Among U.S. Retail Banking Websites for the Third Straight Year, Placing First in all Four Customer Experience Categories. BB&T was named the 2015 TNS Choice Awards winner for Commercial Banking. This national award names BB&T as the preferred provider for acquiring, developing, and retaining customers. 2015 World’s Strongest Banks: BB&T ranks in the top 3 in the U.S. and in the top 15 globally by Bloomberg Greenwich Associates recognized BB&T as a “Best Brand” award recipient for 2014. BB&T was one of more than 750 banks evaluated by clients and non-clients in their Brand Study. BB&T Retirement and Institutional Services received a top ranking and 33 Best-in-Class awards in the national ‘2014 Defined Contribution Survey,’ conducted by PLANSPONSOR magazine Training Magazine has ranked us #1 among banks in their “Top 125” list. BB&T ranked 18th overall among all companies. 11 |

Summary Observations National Penn is an attractive opportunity to broaden BB&T’s Mid- Atlantic region Exciting build-out of BB&T’s newer Mid-Atlantic markets Solidifies investment in new markets by creating top 4 market share in Pennsylvania Compatible culture will help integrate National Penn markets within BB&T’s community banking model Compelling combination with legacy Susquehanna franchise Value accretive to shareholders Consistent with BB&T’s acquisition criteria Community banking model continues to be a key driver of BB&T’s success Culture has and will continue to be a critical part of all acquisitions Consistency around BB&T’s vision, values and mission is non-negotiable 12 |

|