Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Schedule 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under§240.14a-12 | |

BB&T Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required | |||

☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

Table of Contents

Dear Fellow Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of BB&T Corporation at 11:00 a.m. (EDT) on Tuesday, April 25, 2017. This year’s meeting will be held in Harrisburg, Pennsylvania at the Hilton Harrisburg, on One North Second Street. Shareholders as of the record date of February 15, 2017 are invited to attend.

We are again providing proxy materials to our shareholders primarily through the Internet. We have found this process significantly lowers the cost of our annual proxy campaign. We hope this continues to offer you a convenient way to access our proxy materials. Please read the 2017 proxy statement carefully because it contains important information about the matters we will vote on at our annual meeting.

Separately, on behalf of the Board of Directors, we would like to thank recently retired directors Edward C. Milligan and Edwin H. Welch, Ph.D., and recently retired members of Executive Management, Ricky K. Brown, Steven B. Wiggs and Cynthia A. Williams, for their service and contributions to our company. All were instrumental in executing our vision and mission in the face of meaningful obstacles during the past several years. We benefited from their sound judgement and guidance.

Even if you plan to attend the meeting, we encourage you to vote your shares in advance by following the voting instructions provided. Every vote is important and we look forward to hearing from you.

Sincerely,

|  | |

|  | |

| Kelly S. King | Jennifer S. Banner | |

| Chairman and Chief Executive Officer | Independent Lead Director |

Table of Contents

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS OF

BB&T CORPORATION

Date: |

Time: |

Place: | ||

April 25, 2017 | 11:00 a.m. EDT | Hilton Harrisburg One North Second Street Harrisburg, PA 17101

|

AGENDA:

| · | Election of the 16 directors named in the proxy statement, each for aone-year term expiring at the 2018 Annual Meeting of Shareholders |

| · | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2017 |

| · | Advisory vote to approve BB&T’s executive compensation program, commonly referred to as a “say on pay” vote |

| · | Advisory vote on the frequency of our “say on pay” vote |

| · | Approval of amendments to the BB&T Corporation 2012 Incentive Plan, which include increasing the number of authorized shares, andre-approval of the Plan for purposes of Internal Revenue Code Section 162(m) |

| · | A shareholder proposal requesting the elimination of supermajority voting provisions in BB&T Corporation’s articles and bylaws, if properly presented at the meeting |

| · | Any other business that may properly be brought before the meeting |

Record date: You can vote if you were a shareholder of record on February 15, 2017.

If you are attending the meeting, you will be asked to present your admission ticket and valid photo identification, such as a driver’s license, as described in the proxy statement.

|

By Order of the Board of Directors, | ||||

| ||||

| ||||

| Kelly S. King | ||||

| Chairman and Chief Executive Officer | ||||

March 15, 2017

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be

A copy of this proxy statement is available athttp://www.edocumentview.com/BBT. Also available at this website is the 2016 Annual Report, which highlights summary financial information about BB&T, and our Annual Report on Form10-K for the year ended December 31, 2016.

|

Table of Contents

Table of Contents

|

PROXY STATEMENT TABLE OF CONTENTS

Table of Contents

Table of Contents

| Proxy Statement Summary |  |

This summary highlights information contained elsewhere in this proxy statement for BB&T Corporation, which we sometimes refer to as the “Corporation” or “BB&T.” This summary does not contain all the information that you should consider, and you should read this entire proxy statement carefully before you vote. Additional information regarding our 2016 performance can be found in our Annual Report on Form10-K.

2017 Annual Meeting of Shareholders

Time and Date | Location | Record Date | ||

April 25, 2017, at 11:00 a.m. EDT | Hilton Harrisburg One North Second Street Harrisburg, PA 17101 | February 15, 2017 |

Proposals and Voting

Shareholders will vote on the following six proposals:

| Proposals | Votes Required | Board Recommendation | More Information | |||

| Election of 16 directors named in the proxy statement | Majority of votes cast for each nominee | FOR EACH NOMINEE | Page 8 | |||

| Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2017 | Majority of votes cast | FOR | Page 33 | |||

| Advisory vote to approve BB&T’s executive compensation program, commonly referred to as a “say on pay” vote | Majority of votes cast | FOR | Page 36 | |||

| Advisory vote on the frequency of ���say on pay” votes | Majority of votes cast (in the absence of a majority, we will consider which frequency receives the most votes by shareholders) | EVERY YEAR | Page 80 | |||

| Approval of amendments to the BB&T Corporation 2012 Incentive Plan, which include increasing the number of authorized shares, andre-approval of the Plan for purposes of Internal Revenue Code Section 162(m) | Majority of votes cast | FOR | Page 81 | |||

| A shareholder proposal requesting the elimination of supermajority voting provisions in BB&T Corporation’s articles and bylaws, if properly presented at the meeting | Majority of votes cast | AGAINST | Page 90 |

BB&T Corporation | 2017 Proxy Statement 1

Table of Contents

| Proxy Statement Summary |

How to Vote

A proxy that is signed and dated, but which does not contain voting instructions, will be voted as recommended by our Board of Directors on each proposal. In addition to voting in person at the annual meeting, shareholders may also vote the following ways:

| Voting By Proxy | ||||||

Voting Methods

|

Internet

|

Telephone

|

| |||

| Shareholders of Record (shares registered via Computershare) | www.envisionreports.com/BBT | Call 1-800-652-VOTE (8683) and follow the instructions on the proxy card | Sign, date and mail your proxy card | |||

| Beneficial Owners (shares owned through your bank or brokerage account) | www.proxyvote.com | Call 1-800-454-VOTE (8683) and follow the instructions on your voting instruction form | Sign, date and mail your voting instruction form | |||

2 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Proxy Statement Summary |  |

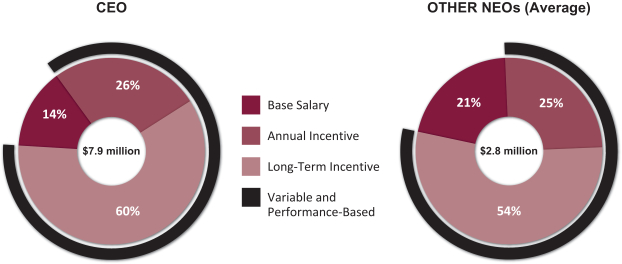

Shareholder Engagement and Changes to our Compensation and Governance Programs

Highlights: Significant Enhancements to Compensation and Governance Programs |

• Performance Share Units—a new compensation vehicle

• Total Shareholder Return—a new long-term incentive metric

• Enhanced Mix of Long-Term Incentives—two-thirds of long-term incentives subject to robust performance criteria

• Proxy Access—allows shareholders to have their nominees appear in our proxy statement.

|

As described under “Corporate Governance Matters—Shareholder Engagement Program,” for the past several years we have conducted a formal shareholder engagement program to discuss issues of importance to our shareholders, with a focus on corporate governance and executive compensation. Historically, shareholders have indicated strong support of our compensation programs through their “say on pay” voting results, but at our last two annual meetings, we received a lower level of shareholder support for that proposal than in prior years. In particular, in 2016, we received 55% of votes in favor of our “say on pay” proposal.

| What We Heard |

Since receiving the results of the 2016 “say on pay” vote, we have contacted our 50 largest shareholders, representing more than 44% of our outstanding shares. We also met with proxy advisory firms followed by some of our largest shareholders. The primary purpose of these discussions was to better understand and address our shareholders’ concerns about our executive compensation and governance programs. We received the following feedback on our compensation and governance programs:

• Our shareholders wanted to see a significant portion of our long-term compensation be tied to robust performance objectives.

• Shareholders suggested adding an additional performance-based metric to our long-term incentive program.

• As a result of our asset size as compared to our peers, shareholders suggested that we consider adding larger banks to our peer group.

• Even though we are above the median of our peers in terms of asset size, compensation should not be targeted above the median of our peers.

• Shareholders expressed concerns that the 2015 Merger Incentive Award would become a regular part of our executive compensation program.

• Shareholders suggested that we increase our CEO stock ownership guideline.

• Shareholders requested that we adopt proxy access.

• Shareholders requested that we publish our Corporate Social Responsibility report on our website.

|

BB&T Corporation | 2017 Proxy Statement 3

Table of Contents

| Proxy Statement Summary |

| What We Did |

As outlined below, the Compensation Committee, the Nominating and Corporate Governance Committee and the Board carefully considered the constructive feedback we received during our engagement sessions and enhanced our executive compensation and governance programs over the course of 2016 and continuing into 2017. These changes fit well within our overall compensation philosophy and the objectives of our executive compensation and governance programs.

Compensation Changes Effective in 2016

• In June 2016, we retroactively added Total Shareholder Return (“TSR”) as a payment modifier that can decrease payments under the previously granted 2016-2018 Long-Term Incentive Performance (“LTIP”) awards based on BB&T’s TSR performance relative to its peer group.

• We increased the CEO’s stock ownership requirement from 5x salary to 6x salary.

• We made no 2016 base salary increases for our 2015 Named Executive Officers (“NEOs”).

• We did not increase compensation target opportunities for our 2015 NEOs.

• We revised the peer group to add one bank larger than us (Wells Fargo) and one bank closer in size (Citizens Financial).

• We continue to reinforce that the 2015 Merger Incentive Award was a one-time event that will not be repeated.

Compensation Changes Effective in 2017*

• We added performance share units to the long-term incentive program to comprise 50% of equity awards.

• We eliminated the use of stock options.

• We adjusted the long-term incentive mix to provide for an equal mix of performance share units, LTIP, and restricted stock units, resulting intwo-thirds of long-term incentives being subject to robust performance criteria and all awards being subject to a performance hurdle.

• We included Total Shareholder Return as a payment modifier in our long-term incentive program, that can increase or decrease the LTIP award and performance share unit award payouts based on BB&T’s TSR performance relative to its peer group.

• We extended our risk-based forfeiture provision to all long-term incentive awards. Awards are subject to reduction or forfeiture if the Compensation Committee determines that there has been a significant negative risk outcome.

• We made no increases in base salaries for our NEOs.

Governance Changes Effective in 2016

• We adopted a proxy access bylaw that allows a shareholder or group of up to 20 shareholders that has held at least 3% of our common stock for at least three years to nominate up to 25% of the Board (but at least two directors) and have those nominees appear in our proxy statement, subject to notice and other specific requirements in our bylaws.

• We published a Corporate Social Responsibility report on our website, highlighting our good stewardship of the natural resources entrusted to us, our promotion of our associates’ and communities’ well-being, and our coherent corporate governance program.

|

| * | See “Compensation Discussion and Analysis—Section 2—2017 Changes to Our Compensation Program” on page 44 for a detailed review of the compensation changes effective in 2017. |

4 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Proxy Statement Summary |  |

Performance Highlights

Strategic Accomplishments | ||

• 2016 was a strong and profitable year with record earnings, expansion into new markets and a healthy return to our shareholders. Our accomplishments in 2016 demonstrate the power of our vision, mission and values.

• We extended our long-standing commitment to leadership development for our clients and communities through our BB&T Leadership Institute, Lighthouse Project community service initiative, and Financial Foundations course to increase the financial proficiency of high school students.

• We ramped up our digital strategy by adding talent and technology to meet our clients’ evolving needs and expectations.

• We have continued to grow our digital platform, U by BB&T, which allows clients to do business with us wherever they are on whatever device they choose.

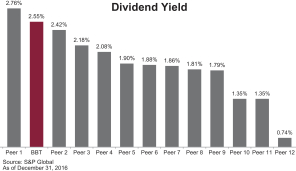

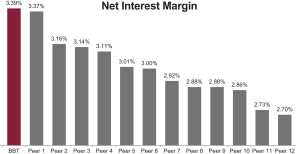

• We were able to approve a 7% increase in our quarterly dividend, achieve a 28.4% total return to | shareholders and were approved to conduct share repurchases totaling $840 million. Our dividend yield and long-term returns are among the best in the industry.

• We successfully integrated our National Penn acquisition and began capitalizing on our earlier acquisitions of Susquehanna Bancshares and The Bank of Kentucky, allowing us to create new capital markets relationships in Philadelphia and Cincinnati.

• We completed our second largest insurance acquisition – Swett & Crawford, a century-old wholesale broker with a strong and talented team of industry specialists.

• We made important changes in our Executive Management team, adding five new leaders, creating the new positions of chief digital officer and chief client experience officer, and appointing new leadership to the role of chief information officer.

• We invested approximately $1 billion in new infrastructure systems over the past three years, positioning us for future growth.

| |

Financial Highlights | ||

2016—A Record Performance Year:

| ||

• Record net income available to common shareholders of $2.3 billion.

• Asset growth of 4.4% year-over-year.

• Average non-interest bearing deposits increased 15% year-over-year, second highest growth rate in our peer group.

• Record revenue of $11.0 billion, up 12.3% from 2015.

• Nonperforming assets represented 0.57% of loan-related assets, best in our peer group (peer group average 0.99%).

| • Strong capital and liquidity ratios.

• Credit ratings that are among the highest in our industry.

• Strong absolute total return to shareholders of 28.4%.

• Total shareholder return exceeded peer average and S&P Financials Index for the 10, 15, and 20 year periods.

• BB&T achieved a record stock price during the calendar year, which as of the record date was $48.26.

| |

BB&T Corporation | 2017 Proxy Statement 5

Table of Contents

| Proxy Statement Summary |

Corporate Governance Highlights

Our Board of Directors believes that maintaining a strong corporate governance framework is essential to the continuing growth and success of BB&T. Below are several notable features of our corporate governance framework: | ||

Proxy Access | In 2016, we adopted a proxy access bylaw that allows a shareholder or group of up to 20 shareholders that has held at least 3% of our common stock for at least three years to nominate up to 25% of the Board (but at least two directors) and have those nominees appear in our proxy statement, subject to notice and other specific requirements in our bylaws. | |

| Active, Independent Board of Directors | Fourteen of our sixteen directors are independent, and our directors attended 98% of the Board and committee meetings held last year. | |

Independent Lead Director | Our Lead Director serves an important governance function by providing strong leadership for thenon-management and independent directors. | |

Strategic Direction and Planning | The Board regularly reviews BB&T’s strategic plan, goals and initiatives for the upcoming year and beyond with a view towards providing oversight, guidance and direction as to our long-term strategy. | |

Stock Ownership Guidelines | By requiring our CEO to own stock equal to 6x his annual salary and directors to own stock equal to 5x their annual retainer, we effectively align their interests to those of our shareholders. | |

Pledging/Hedging of Shares | To reduce conflicts of interest, we have strong limitations on pledging and hedging of our common stock by directors and Executive Management members. | |

| Majority Voting for Director Elections | All director nominees in uncontested elections must be elected by an affirmative vote of the majority of votes cast. | |

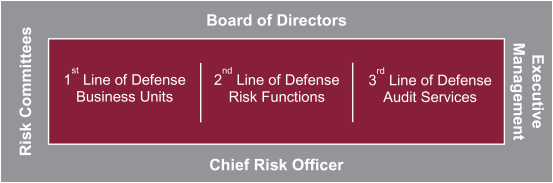

Risk Oversight | We have developed a robust risk management organization, reporting to our Board, with the purpose of providing objective oversight of our risk-taking activities. | |

| Clawbacks and Executive Risk Scorecard | We make all executive awards (cash and equity) subject to recoupment and also may utilize our executive risk scorecard to reduce incentive compensation for negative risk outcomes. | |

Shareholder Engagement | We maintain a robust shareholder engagement program, actively seeking feedback from our shareholders to improve our governance and compensation practices. | |

Statement of Political Activity | We publish on our website a Statement of Political Activity, describing our Board’s oversight of political contributions and political activity. | |

| Corporate Social Responsibility Report | We publish on our website a Corporate Social Responsibility Report, highlighting our good stewardship of the natural resources entrusted to us, our promotion of our associates’ and communities’ well-being, and our coherent corporate governance program. | |

Board Committees | We have five standing board committees, as indicated in the following table. Each standing committee has a written charter adopted by the Board that can be found on our website atwww.bbt.com. | |

6 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Proxy Statement Summary |  |

BB&T BOARDOF DIRECTORSAND COMMITTEES

The table below shows for each of our directors, their memberships in standing committees and their independence status.

| Independent | Audit | Compensation | Nominating and Corporate Governance | Executive | Risk | |||||||

Jennifer S. Banner± |  |  |  | |||||||||

K. David Boyer, Jr. |  |  |  | |||||||||

Anna R. Cablik** |  |  |  | |||||||||

James A. Faulkner*** |  |  | ||||||||||

I. Patricia Henry** |  |  | ||||||||||

Eric C. Kendrick** |  |  |  | |||||||||

Kelly S. King† |  |  | ||||||||||

Louis B. Lynn, Ph.D. |  |  |  | |||||||||

Charles A. Patton |  |  |  | |||||||||

Nido R. Qubein |  |  | ||||||||||

William J. Reuter |  |  |  | |||||||||

Tollie W. Rich, Jr.** |  |  | ||||||||||

Christine Sears |  |  | ||||||||||

Thomas E. Skains |  |  |  | |||||||||

Thomas N. Thompson |  |  |

| |||||||||

Stephen T. Williams* |  |  |

| † | Chairman of the Board of Directors |

| ± | Independent Lead Director |

| Member |

| Chair |

| * | Designated as the “Audit Committee Financial Expert” |

| ** | Serves on the Trust Committee of Branch Banking and Trust Company |

| *** | Chairman of the Trust Committee of Branch Banking and Trust Company |

BB&T Corporation | 2017 Proxy Statement 7

Table of Contents

| Proposal 1—Election of Directors |

PROPOSAL 1—ELECTIONOF DIRECTORS

We are asking you to reelect each of the sixteen director nominees listed below to continue serving on our Board of Directors for aone-year term expiring at the Annual Meeting of Shareholders in 2018. Each director nominee will require the affirmative vote of the majority of votes cast to be elected.

Although our Board of Directors expects that each of the nominees will be available for election, if a vacancy in the slate of nominees occurs, it is intended that shares of BB&T common stock represented by proxies will be voted for the election of a substitute nominee, designated by the Board, or the Board may reduce the number of persons to be elected by the number of persons unable to serve.

The membership of our Board of Directors includes all of the board members of Branch Banking and Trust Company (“Branch Bank,” our banking subsidiary), and vice-versa, resulting in the two boards having identical memberships. Matching the membership of these two boards provides for transparency and information sharing between both boards, which allows for better risk management, provides for administrative efficiencies, and takes advantage of the talent and experience provided by the members of each board. This structure is also in line with that of many of the financial services companies found in our peer group.

Each of our nominees has been identified as possessing good business acumen, strength of character, and an independent mind, as well as a reputation for integrity and the highest personal and professional ethics. Sound judgment and community leadership are also important characteristics that our Board members possess. Each nominee additionally brings to us a strong and unique background and set of skills, providing our Board with competence and experience in a wide variety of areas.

8 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Proposal 1—Election of Directors |  |

Director Commitment and Skills

COMMITMENTTO BB&T

We are proud of our directors’ devotion to BB&T. Our Board invests a substantial amount of time, effort and energy in planning and executing our vision, mission and values. While each Board member has other professional commitments, no Board member is part of more than two other publicly-traded company boards. We believe that this commitment to BB&T helps promote our vision to become “the Best of the Best.” The following skills matrix shows the diverse range of expertise our directors provide to BB&T.

| DIRECTOR SKILLS | ||||||||||||||||||

| Qualifications | Experience | |||||||||||||||||

Executive Leadership |

Public Company Director |

Audit Committee Financial Expert Qualified(1) |

Accounting |

Academia |

Corporate Governance and Supervision |

Financial Services |

Other Bank or Bank | |||||||||||

Jennifer S. Banner |  |  |  |  |  |  | ||||||||||||

K. David Boyer, Jr. |  |  |  | |||||||||||||||

Anna R. Cablik |  |  |  |  | ||||||||||||||

James A. Faulkner |  |  |  |  |  | |||||||||||||

I. Patricia Henry |  |  | ||||||||||||||||

Eric C. Kendrick |  |  |  |  | ||||||||||||||

Kelly S. King |  |  |  |  | ||||||||||||||

Louis B. Lynn, Ph.D. |  |  |  | |||||||||||||||

Charles A. Patton |  |  |  |  | ||||||||||||||

Nido R. Qubein |  |  |  |  |  | |||||||||||||

William J. Reuter |  |  |  |  | ||||||||||||||

Tollie W. Rich, Jr. |  |  |  |  | ||||||||||||||

Christine Sears |  |  |  |  |  |  | ||||||||||||

Thomas E. Skains |  |  |  | |||||||||||||||

Thomas N. Thompson |  |  |  |  | ||||||||||||||

Stephen T. Williams |  |  |  | |||||||||||||||

| (1) | Indicates Audit Committee members who meet the criteria as an “Audit Committee Financial Expert’’ under applicable SEC rules. Stephen T. Williams has been designated by the Board of Directors as its Audit Committee Financial Expert. |

BB&T Corporation | 2017 Proxy Statement 9

Table of Contents

| Proposal 1—Election of Directors |

Nominees for Election as Directors for aOne-Year Term Expiring in 2018

The names of the nominees for election to our Board of Directors and their principal occupations, experience, and key qualifications and skills is set forth below.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE DIRECTOR NOMINEES NAMED BELOW.

|

Jennifer S. Banner Knoxville, TN

|

| |||

Age: 57 Lead Director Tenure: • BB&T since 2003 • Branch Bank since 2013 Board Committees: • Executive • Risk Public Company Directorship: • Communications Sales & Leasing, Inc.

|

Professional Experience: Ms. Banner has served as President and Chief Executive Officer of SchaadSource, LLC (a financial and administrative services company) since 2006, Chief Executive Officer of Schaad Companies, LLC (a diversified holding company) since 2008 and Chief Executive Officer of Schaad Family Office, LLC (a diversified holding company) since 2012.

Qualifications and Skills: Ms. Banner brings to BB&T experience as a Chief Executive Officer and skills in public accounting, as well as financial services, corporate governance and risk management experience from her prior service on the boards of directors of First Vantage Bank and First Virginia Banks, Inc. She served for six years (2010-2015) as a director of the Federal Reserve Bank of Atlanta (Nashville Branch) where she received formal training in monetary policy, the banking system and macroeconomics. In addition, Ms. Banner has experience with community-oriented organizations, construction, real estate development, and serves as a director and chair of the audit committee of Communications Sales & Leasing, Inc., a real estate investment trust in the communications infrastructure space. | |||

K. David Boyer, Jr. Oakton, VA

|

| |||

Age: 65 Tenure: • BB&T since 2009 • Branch Bank since 2013 Board Committees: • Executive • Risk

|

Professional Experience: Mr. Boyer has served as Chief Executive Officer of GlobalWatch Technologies, Inc. (a business intelligence, cybersecurity, information assurance, governance and compliance firm) since 2004. Mr. Boyer also has served as a director of Virginia Community Development Corporation (a tax credit fund manager supporting economic development in Richmond) since 2009 and as a Treasury Board Member for the Commonwealth of Virginia from 2002-2014.

Qualifications and Skills: Prior to his election to the BB&T Board, Mr. Boyer served for over 11 years on Branch Bank’s local advisory board in Washington, D.C. This experience provided Mr. Boyer with a thorough understanding of BB&T’s banking organization, governance structure and its values and culture. Mr. Boyer has extensive experience with risk management, accounting and finance, as well as information technology services, information management, cybersecurity and anti-terrorism assistance services, and brings skills related to this experience to the BB&T Board.

| |||

10 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Proposal 1—Election of Directors |  |

Anna R. Cablik Marietta, GA

|

| |||

Age:64 Tenure: • BB&T since 2004 • Branch Bank since 2013 Board Committees: • Compensation • Nominating and Corporate Governance (Chair) Public Company Directorship: • Georgia Power Company

|

Professional Experience: Ms. Cablik has served as the President of Anasteel & Supply Company, LLC (a reinforcing steel fabricator) since 1994 and as President of Anatek, Inc. (a general contractor) since 1982.

Qualifications and Skills: Ms. Cablik brings entrepreneurial and business-building skills and experience to BB&T, having successfully founded and grown several businesses. Her extensive career managing a diverse portfolio of projects provides risk assessment skills and governance experience to the BB&T Board. Her public company director experience has provided her a broad understanding of corporate governance matters. Additionally, as the owner and operator of a company, Ms. Cablik has over 30 years of experience overseeing the preparation of financial statements and the review of accounting matters. | |||

James A. Faulkner Dahlonega, GA

|

| |||

Age:72 Tenure: • BB&T since 2013 • Branch Bank since 2000 Board Committees: • Audit

|

Professional Experience: Mr. Faulkner is currently retired and previously served as a consultant to Branch Bank from 2000 through 2011.

Qualifications and Skills: Mr. Faulkner brings to BB&T significant financial services leadership, oversight and expertise stemming from his distinguished52-year career in commercial banking, including serving as the top executive of Century South Banks from 1997 until it merged with BB&T in 2000. He has served as a director of four different public companies over a 25+ year period, providing him with meaningful corporate governance perspective and experience. Mr. Faulkner’s long tenure on the Branch Bank board and his extensive service as a bank executive affords him valuable insight as to BB&T’s banking operations and its vision, mission, values and culture. Mr. Faulkner qualifies as an “audit committee financial expert” under SEC guidelines.

| |||

BB&T Corporation | 2017 Proxy Statement 11

Table of Contents

| Proposal 1—Election of Directors |

I. Patricia Henry Stone Mountain, GA

|

| |||

Age:69 Tenure: • BB&T since 2013 • Branch Bank since 1999 Board Committees: • Audit

|

Professional Experience: Ms. Henry is currently retired and previously was the Director of Strategic Projects for Miller Brewing from 2005 to 2008.

Qualifications and Skills: Ms. Henry brings extensive risk management, strategic planning and organizational development experience and skills to the BB&T Board. At Miller Brewing, Ms. Henry became the first woman to hold a lead management position at a major U.S. brewery when she was named Plant Manager of the Eden, North Carolina facility in 1995. In addition, Ms. Henry’s operational business background allows her to bring the perspective of a commercial client into BB&T’s boardroom. Her institutional knowledge and longstanding Branch Bank board service further qualify her to serve as a member of the BB&T Board. | |||

Eric C. Kendrick Arlington, VA

|

| |||

Age:70 Tenure: • BB&T since 2013 • Branch Bank since 2003 Board Committees: • Compensation • Nominating and Corporate Governance

|

Professional Experience: Mr. Kendrick has served as the President of Mereck Associates, Inc. (a real estate management and development firm) since 1989. He is also President of Old Dominion Warehouse Corporation (a warehouse leasing and development firm) since 1991, President of Upton Corporation (a commercial property development company) since 1991, and President of Murteck Construction Company, Inc. (a general contractor) since 1991.

Qualifications and Skills: Mr. Kendrick brings to BB&T significant financial services industry experience and corporate governance perspective from his service on the boards of First Virginia Banks, Inc., where he served as a director from 1986 until it merged with BB&T in 2003, and Branch Bank, where he has served as director since 2003. As a successful executive, Mr. Kendrick also brings to the BB&T Board a high level of business acumen, as well as significant experience and valuable perspective from the construction and real estate development industries. | |||

12 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Proposal 1—Election of Directors |  |

Kelly S. King Winston-Salem, NC

|

| |||

Age:68 Tenure: • BB&T since 2008 • Branch Bank since 1995 Board Committees: • Executive • Risk |

Professional Experience: Mr. King has served as Chairman of BB&T since 2010; Chief Executive Officer of BB&T and Chairman and Chief Executive Officer of Branch Bank since 2009; and Chief Operating Officer of BB&T and Branch Bank from 2004-2008.

Qualifications and Skills: Mr. King has forged a lifetime of leadership experience with BB&T, devoting 33 of his 44 years of service to BB&T as a member of Executive Management. He has assumed leadership roles in commercial and retail banking, operations, insurance, corporate financial services, investment services and capital markets.

Mr. King is credited with leading BB&T to continued profitability and financial stability through the economic downturn beginning in 2008. His unwavering commitment to the company’s vision, mission and values has led to a nationally recognized associate volunteer program, called the Lighthouse Project. Since 2009, the Lighthouse Project completed more than 7,700 projects for the communities we serve.

Mr. King served as the Fifth District representative on the Federal Advisory Council of the Board of Governors of the Federal Reserve System from 2013 through 2016, and served as President of the Federal Advisory Council in 2016. He has been a member of The Financial Services Roundtable since 2010 and he previously served on the Board of the Federal Reserve Bank of Richmond from 2009 to 2011. Mr. King also has served as Chairman of the North Carolina Bankers Association board and as Vice Chairman of the American Bankers Council.

Mr. King was named the Banker of the Year for 2015 byAmerican Banker magazine. His leadership steered the successful completion of our 2015 acquisition of Susquehanna Bancshares—a transaction that was named M&A Deal of the Year (Over $1B to $5B) byThe M&A Advisor. Mr. King was named bySNL Financial as one of its “Most Influential” in banking in 2015 & 2014. In 2011, he was ranked #3 “Best CEO” by sell-side analysts in a study byInstitutional Investor magazine. Since 2009, BB&T has led all U.S. banks in total awards for small business and middle market banking by Greenwich Associates. BB&T was named one of the “2017 Best Banks in America” by Forbes, and one of the “World’s Most Admired Companies” by Fortune, ranking #4 among superregional banks.

| |||

BB&T Corporation | 2017 Proxy Statement 13

Table of Contents

| Proposal 1—Election of Directors |

Louis B. Lynn, Ph.D. Columbia, SC

|

| |||

Age:68 Tenure: • BB&T since 2013 • Branch Bank since 2006 Board Committees: • Compensation • Nominating and Corporate Governance

|

Professional Experience: Dr. Lynn has served as the President and Chief Executive Officer of ENVIRO AgScience, Inc. (a defense contractor and provider of construction, construction management, and landscape and design services) since founding the firm in 1985.

Qualifications and Skills: Dr. Lynn possesses valuable oversight skills and governance experience gained in serving as the top executive of ENVIRO AgScience. He also brings to the BB&T Board government and private sector design and construction experience of sustainable energy efficient facilities. Dr. Lynn has served as a member of the Clemson University Board of Trustees since 1988. He also serves as an Adjunct Professor of Horticulture at Clemson University and served on a number of national and state boards related to agriculture, higher education and business leadership. His familiarity with modern agriculture science and agribusiness imparts an important perspective to the Board, as does his service in the field of higher education. | |||

Charles A. Patton Hopewell, VA

|

| |||

Age:60 Tenure: • BB&T since 2013 • Branch Bank since 1998 Board Committees: • Executive • Risk (Chair)

| Professional Experience: Mr. Patton has served as a consultant and manager of Patton Holdings, LLC (a real estate holding company) since 2007 and manager of PATCO Investments, LLC (emphasizing specialty lending and equity participations) since 1998.

Qualifications and Skills: Over the course of his extensive career in the financial services industry, Mr. Patton has served in a variety of leadership positions, including as the President and Chief Executive Officer of Virginia First Savings Bank. As the top executive of Virginia First, he gained leadership, oversight and risk management skills, as well as financial industry and banking operations expertise, which are valuable as a director of BB&T. His long tenure on the Branch Bank board has imparted him with significant institutional knowledge about BB&T, while also providing corporate governance expertise. Mr. Patton also is a leader in his community, holding leadership positions in a variety of social and civic organizations in the Richmond, Virginia area. He is a Director and the Chairman of the Audit and Finance Committees of Richard Bland College Foundation, Inc.

| |||

14 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Proposal 1—Election of Directors |  |

Nido R. Qubein High Point, NC

|

| |||

Age:68 Tenure: • BB&T since 1990 • Branch Bank since 2013 Board Committees: • Executive • Risk Public Company Directorship: • La-Z-Boy Incorporated | Professional Experience: Dr. Qubein has been a BB&T director since 1990 and a Branch Bank director since 2013. He has served as President of High Point University since 2005 where he transformed the institution from a small college to a thriving university. He is also Executive Chairman of Great Harvest Bread Company (a whole grain bread bakery franchising company) since 2001.

Qualifications and Skills: Dr. Qubein has written a dozen books on leadership, sales, communication and marketing and serves as advisor to businesses and organizations throughout the country on how to position their enterprises and create successful leadership programs. He is a business coach to CEOs and top executives. During his tenure on the BB&T Board, he has provided key leadership and made important contributions to the development and successful execution of BB&T’s strategy to be the “best of the best.” His many entrepreneurial ventures and service on more than 30 volunteer boards over the course of his career contribute governance and community service skills and experience to BB&T. He has been recognized nationally for his entrepreneurial and professional achievements including his induction in three halls of fame, receiving the University of Delaware’s Siegfried Entrepreneurship Award, and membership in the Horatio Alger Association for Distinguished Americans with such notable leaders like Starbuck’s Howard Schultz and General Colin Powell.

| |||

William J. Reuter Lititz, PA

|

| |||

Age:67 Tenure: • BB&T since 2015 • Branch Bank since 2015 Board Committees: • Executive • Risk |

Professional Experience: Mr. Reuter is the retired Chairman and Chief Executive Officer of Susquehanna Bancshares, Inc., having served as Chief Executive Officer and Chairman from 2001 and 2002, respectively, until the merger of the company with BB&T Corporation. He was also Chairman of the Board of its banking subsidiary, Susquehanna Bank, as well as the following subsidiaries: Boston Service Company, Inc. (d/b/a Hann Financial Service Corp.), Valley Forge Asset Management, LLC, The Addis Group, LLC; Stratton Management Company and Semper Trust Company.

Qualifications and Skills: Mr. Reuter brings extensive experience in the financial services industry, beginning his career with Susquehanna in 1973, when he joined one of its predecessor banks in Maryland. He has more than 40 years in leadership roles within the banking industry. Mr. Reuter’s experience as the CEO and Chairman of a large, publicly traded financial services organization and his risk management expertise qualify him to serve as a member of our Board. He joined our Board in August 2015 as a part of the Susquehanna merger. Mr. Reuter has held leadership roles in numerous community organizations throughout his career, including serving as campaign chairman for United Way campaigns in both Hagerstown, MD, and Lancaster, PA.

| |||

BB&T Corporation | 2017 Proxy Statement 15

Table of Contents

| Proposal 1—Election of Directors |

Tollie W. Rich, Jr. Cape Coral, FL

|

| |||

Age:67 Tenure: • BB&T since 2013 • Branch Bank since 2007 Board Committees: • Audit

|

Professional Experience: Mr. Rich retired in 2000 as a senior banking executive at Branch Bank. Prior to that, his banking career spanned over 30 years, culminating with his service as the Executive Vice President, Chief Operating Officer and a director of Life Savings Bank, FSB, which merged with Branch Bank in 1998.

Qualifications and Skills: Mr. Rich brings valuable perspective to the BB&T Board by combining financial industry leadership and expertise with significant corporate governance and supervisory experience. His extensive career in the financial services industry affords a deep understanding of operations and management, while his tenure on the Branch Bank board provides experience on corporate governance matters. Mr. Rich has a longstanding involvement with charitable and community organizations and presently utilizes his leadership skills on various civic and business association boards.

| |||

Christine Sears Harrisburg, PA

|

| |||

Age:61 Tenure: • BB&T since 2015 • Branch Bank since 2015 Board Committees: • Audit | Professional Experience: Ms. Sears has served as the President and Chief Executive Officer of Penn National Insurance since January 1, 2015. Prior to being appointed Penn National’s President and Chief Executive Officer, Ms. Sears served as Penn National’s Executive Vice President and Chief Operating Officer since 2010 after serving as Penn National’s Chief Financial Officer from 1999 to 2010.

Qualifications and Skills: Ms. Sears joined Penn National in 1980 as a financial analyst and held various positions of increasing leadership in the company prior to being named the President and Chief Executive Officer. Her deep understanding of the insurance industry is very valuable to our Board of Directors as BB&T’s insurance operations are our largest source ofnon-interest income. Ms. Sears joined our Board in August 2015 as a part of the Susquehanna merger. Ms. Sears qualifies as an “audit committee financial expert” under SEC guidelines.

Ms. Sears is a Certified Public Accountant, holds the Chartered Property Casualty Underwriter designation from the Institute for Chartered Property Casualty Underwriters, and has completed the Insurance Executive Development Course of the Wharton School of Business at the University of Pennsylvania.

| |||

16 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Proposal 1—Election of Directors |  |

Thomas E. Skains Charlotte, NC

|

| |||

Age:60 Tenure: • BB&T since 2009 • Branch Bank since 2013 Board Committees: • Executive (Chair) • Risk Public Company Directorship: • Duke Energy Corporation • National Fuel Gas

| Professional Experience: Mr. Skains served as Chairman, President and Chief Executive Officer of Piedmont Natural Gas Company, Inc. from 2003 until its acquisition in October 2016 by Duke Energy Corporation.

Qualifications and Skills: Mr. Skains brings extensive leadership and strategic planning experience to BB&T through his experience leading a major natural gas utility in the Southeast. Mr. Skains also brings a wealth of corporate governance and risk management expertise gained through his former role as the President and Chief Executive Officer of Piedmont Natural Gas, a publicly traded corporation, and as a director of Duke Energy Corporation and National Fuel Gas Company, both publicly traded companies. His experience in the highly regulated natural gas industry is especially valuable given the high degree of regulation that currently exists in the financial services industry. Mr. Skains has served on a wide variety of boards for prominent civic and business associations, providing him with extensive community relations experience.

| |||

Thomas N. Thompson Owensboro, KY

|

| |||

Age:68 Tenure: • BB&T since 2008 • Branch Bank since 2013 Board Committees: • Compensation (Chair) • Nominating and

|

Professional Experience: Mr. Thompson has served as President of Thompson Homes, Inc. (a home builder) since 1978 and served as a member of the Kentucky House of Representatives from 2003-2016.

Qualifications and Skills: As a former member of the Kentucky legislature, including serving as the Chairman of the House Banking and Insurance Committee, Mr. Thompson provides BB&T with a unique perspective on risk management and the regulation of the financial services industry. He also has valuable experience in the banking industry, having served as a director of AREA Bancshares, which was acquired by BB&T in 2002. Mr. Thompson also brings governance and community service skills and experience to the BB&T Board, having served as a director of various educational and community organizations.

| |||

BB&T Corporation | 2017 Proxy Statement 17

Table of Contents

| Proposal 1—Election of Directors |

Stephen T. Williams Winston-Salem, NC

|

| |||

Age:57 Tenure: • BB&T since 2007 • Branch Bank since 2013 Board Committees: • Audit (Chair) |

Professional Experience: Mr. Williams has served as a consultant and manager of Williams Development Group, LLC (a real estate development company) since August 2013. He has served as President of A.T. Williams Oil Company (a family investment company) since 1995 and served as President and Chief Executive Officer of WilcoHess, LLC (an operator of gas stations, convenience stores, restaurants and travel centers) from 2001 through January 2014.

Qualifications and Skills: In addition to the management and oversight skills and experiences gained in serving as the top executive of A.T. Williams Oil Company and WilcoHess, Mr. Williams has a unique perspective on the needs of customers within BB&T’s footprint through his experience with the daily operations of a chain of over 400 gas stations, convenience stores, restaurants and travel centers in Alabama, Georgia, Tennessee, Virginia, Pennsylvania, and the Carolinas. In addition, Mr. Williams has gained experience in building ties between business and the local community through his involvement with community-oriented organizations such as the Winston-Salem Alliance. Mr. Williams qualifies as an “audit committee financial expert” under SEC guidelines.

| |||

18 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Corporate Governance Matters |  |

The Board of Directors periodically reviews BB&T’s corporate governance policies, practices and procedures to ensure that we follow best practices and meet or exceed the requirements of applicable laws, regulations and rules. Our ultimate purpose is to create a strong, sound, and profitable financial services company with long-term, sustainable growth and value for our shareholders.

Key Corporate Governance Documents—Please visit our website atwww.bbt.investorroom.comto view the following documents:

• Corporate Governance Guidelines

• Board Committees and Charters

• Codes of Ethics

• Statement of Political Activity

• Accounting, Securities and Legal Violations Policy

• Corporate Social Responsibility Report

|

A shareholder may also request a copy of any of these documents by contacting the Corporate Secretary, BB&T Corporation, 200 West Second Street, Winston-Salem, North Carolina 27101.

Corporate Governance Guidelines

Our Corporate Governance Guidelines provide the framework for fulfillment of the Board’s corporate governance duties and responsibilities, taking into consideration corporate governance best practices and applicable laws and regulations. The Guidelines address a number of matters applicable to directors, including director qualification standards and director independence requirements, share ownership guidelines, Board responsibilities, role of the independent Lead Director, retirement, meetings ofnon-management directors, and director compensation.

In determining director independence, our Board considers the New York Stock Exchange’s (“NYSE”) bright-line independence criteria. Consistent with NYSE rules, our Board of Directors also broadly considers all other relevant facts and circumstances that bear on the materiality of each director’s relationship with BB&T, including the potential for conflicts of interest, when determining director independence. To assist it in making independence determinations, our Board of Directors has adopted categorical standards which are contained in our Corporate Governance Guidelines. These director independence standards reflect, among other items, the NYSE independence requirements and other applicable laws and regulations related to director independence, and address certain relationships that the Board has determined do not affect a director’s independence.

The Nominating and Corporate Governance Committee assists the Board by annually evaluating the independence of each prospective and incumbent director using the foregoing standards and such other factors as the Nominating and Corporate Governance Committee deems appropriate, and makes a recommendation to the Board regarding the independence of each such person. As a part of this evaluation process, the Nominating and Corporate Governance Committee considers each director’s occupation, other publicly held company directorships, personal and affiliate transactions with BB&T and its subsidiaries, certain charitable contributions, relationships considered in accordance with our Related Person Transactions Policy and Procedures, and other relevant direct and indirect relationships that may affect independence. Banking relationships with BB&T or any of

BB&T Corporation | 2017 Proxy Statement 19

Table of Contents

| Corporate Governance Matters |

its subsidiaries (including deposit, investment, lending and fiduciary) that are conducted in the ordinary course of business on substantially the same terms and conditions as otherwise available to nonaffiliated customers for comparable transactions are not considered material in determining independence.

After duly considering all such information, our Board of Directors has affirmatively determined that of the sixteen members of the Board, the following fourteen directors have no disqualifying material relationships with BB&T or its subsidiaries and are independent: Messrs. Boyer, Faulkner, Kendrick, Lynn, Patton, Reuter, Rich, Skains, Thompson and Williams, and Mmes. Banner, Cablik, Henry and Sears. The following two directors were deemed not independent due to certain disqualifying relationships with BB&T: Messrs. King and Qubein.Each member of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee has been determined by the Board to be “independent” in accordance with the requirements of the NYSE and our Corporate Governance Guidelines.

Our Board currently consists of sixteen directors. We believe the Board’s current size provides us with certain advantages. Over the last several years, financial institutions have faced increased regulatory and economic pressure. This has led to additional demands resulting in a greater time commitment on the part of our directors and executive officers. In response, we have expanded the size of our Board committees and increased the responsibilities of each committee. The size of our Board is an advantage when assigning an appropriate number of members to each committee in order to properly analyze and respond to increasingly complex developments, whether regulatory, economic, or otherwise. The diversity of viewpoints on each committee also allows for more effective challenge to proposals from management and directors. In addition, the number of independent directors aids in maintaining the requisite independence standards of the Audit, Compensation, and Nominating and Corporate Governance committees. The Board believes that its current size and structure is appropriate to effectively represent the interests of our shareholders.

CHAIRMANOFTHE BOARDAND CHIEF EXECUTIVE OFFICER

Our Board of Directors is led by the Chairman. Under our bylaws, the Chairman is elected by the Board and presides over each Board meeting and performs such other duties as may be incident to the office of Chairman. Our bylaws and Corporate Governance Guidelines each provide that the Chairman may also hold the position of Chief Executive Officer. BB&T’s Chairman and Chief Executive Officer is not permitted to serve as a member of any standing Board committee, other than the Executive Committee and the Risk Committee. Our Corporate Governance Guidelines provide that when the position of Chairman of the Board is not held by an independent director, the Board will appoint an independent Lead Director.

It is the Board’s current belief that having a unified Chairman and Chief Executive Officer is appropriate and in the best interests of BB&T and our shareholders. The Board believes that combining the Chairman and Chief Executive Officer roles provides the following advantages to us:

| • | our Chief Executive Officer is the director most familiar with our business and industry and is best situated to lead discussions on important matters affecting the business of BB&T; |

| • | combining the Chief Executive Officer and Chairman positions creates a firm link between management and the Board and promotes the development and implementation of corporate strategy; and |

| • | combining the roles of Chief Executive Officer and Chairman contributes to a more efficient and effective Board and does not undermine the independence of the Board. |

20 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Corporate Governance Matters |  |

INDEPENDENT LEAD DIRECTOR

Jennifer S. Banner serves as the Board’s Lead Director. The role of the Lead Director is to assist the Chairman and the remainder of the Board in ensuring effective governance in overseeing the direction and management of BB&T. The Lead Director serves atwo-year term and may serve for one subsequentone-year term at the discretion of the Board. Our Board believes that the Lead Director serves an important corporate governance function by providing separate leadership for thenon-management and independent directors.

Strategic Direction and Planning

One of the Board’s most important and vital functions is to provide oversight, guidance and direction as to BB&T’s long-term strategy. Accordingly, in the first quarter of each year, management provides to the Board a detailed report on our strategic plan, goals and initiatives for the upcoming year and beyond. The process includes an independent risk assessment to ensure all strategic activities are consistent with the Board approved risk appetite parameters. Before it is approved, the Board engages in thorough and detailed discussions and deliberations over the strategic plan. The plan also includes reporting on management’s success in executing on the prior year’s strategic plan to ensure accountability.

Standing Board Committees, Membership and Attendance and Lead Director Responsibilities

Under our Corporate Governance Guidelines, directors are expected to attend all Board meetings, meetings of assigned committees, and annual meetings of shareholders. Each director is required to be sufficiently familiar with the business of BB&T, including our strategy, financial statements, capital structure, business risks and competition, to facilitate active and effective participation in such meetings. During 2016, the full Board of Directors held ten meetings. Each of the directors attended more than 75% of the aggregate meetings of our Board and the committees on which they served in 2016. All of our directors attended the Annual Meeting of Shareholders in 2016.

It is anticipated that the Board standing committees will perform additional duties that are not specifically set out in their respective charters as may be necessary or advisable in order for us to comply with certain laws, regulations or corporate governance standards, as the same may be adopted, amended or revised from time to time. With respect to each standing committee, the current members, the principal functions and the number of meetings held in 2016 are shown below. Also shown below are the responsibilities of our Lead Director.

BB&T Corporation | 2017 Proxy Statement 21

Table of Contents

| Corporate Governance Matters |

Independent Lead Director

Jennifer S. Banner |

• Assists the Chairman and the remainder of the Board in ensuring effective governance in overseeing the direction and management of BB&T. • Organizes and sets the agenda and presides over executive sessions, which meet at least three times per year. • Presides at all Board meetings at which the Chairman is not present (including executive sessions). • Takes responsibility for feedback to/engagement with the Chief Executive Officer on executive sessions. • Suggests matters and issues for inclusion on the Board agenda. • Works with the Chairman and committee chairs to ensure that there is sufficient time for discussion of all agenda items. • Facilitates teamwork and communication among the independent directors and the Chairman. |

Audit Committee

Stephen T. Williams Chair

8 meetings in 2016

|

Committee Members: James A. Faulkner, I. Patricia Henry, Tollie W. Rich, Jr., Christine Sears

• Assists the Board in its oversight of the integrity of our financial statements and disclosures. • Assists in oversight of BB&T’s internal control processes. • Monitors financial risks and exposures and reviews with management and the auditors the steps management has taken to monitor, minimize or control such risks or exposures. • Responsible for the appointment, compensation, retention and oversight of the work of the independent external auditor for the purpose of preparing or issuing an audit report or performing other audit, review or attest services. • Evaluates the qualifications, performance and independence of, the independent registered public accounting firm. • Oversees BB&T’s internal audit function and receives regular reports from the general auditor. |

Compensation Committee

Thomas N. Thompson Chair

7 meetings in 2016

|

Committee Members: Anna R. Cablik, Eric C. Kendrick, Louis B. Lynn

• Manages the duties of the Board related to executive compensation. • Reviews and approves BB&T’s compensation philosophy and practices. • Determines the compensation of the CEO and the highest levels of BB&T management. • Recommends Board compensation and benefits for directors. • Engages an independent compensation consultant to make recommendations relating to overall compensation philosophy, the peer financial group to be used for external comparison purposes, short-term and long-term incentive compensation plans, and related compensation matters. • Oversees risk management with respect to the design and administration of material incentive compensation arrangements. • Responsible for oversight and review of our compensation and benefit plans, including administering our executive compensation programs. |

22 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Corporate Governance Matters |  |

Executive Committee

Thomas E. Skains Chair

4 meetings in 2016 |

Committee Members: Jennifer S. Banner, K. David Boyer, Jr., Kelly S. King, Charles A. Patton, Nido R. Qubein, William J. Reuter

• Authorized to exercise all powers and authority of the Board in management of the business and affairs of the Corporation between Board meetings. |

Nominating and Corporate Governance Committee

Anna R. Cablik Chair

5 meetings in 2016

|

Committee Members: Eric C. Kendrick, Louis B. Lynn, Thomas N. Thompson

• Reviews and recommends the composition and structure of the Board and its committees and evaluates the qualifications and independence of members of the Board on a periodic basis. • Considers the performance of incumbent directors in determining nominations forre-election. • Identifies and reviews qualified candidates for election as directors. • Administers BB&T’s Related Person Transactions Policy and Procedures. • Oversees annual self-assessments for board members. • Oversees Board Committee composition and executive management succession planning processes. • Reviews and monitors compliance with BB&T’s Codes of Ethics. • Oversees management’s integration of BB&T’s values and culture with its strategy and objectives. |

Risk Committee

Charles A. Patton Chair

12 meetings in 2016 |

Committee Members: Jennifer S. Banner, K. David Boyer, Jr., Kelly S. King, Nido R. Qubein, William J. Reuter, Thomas E. Skains

• Reviews processes for identifying, assessing, monitoring and managing compliance, credit, liquidity, market, operational (including information technology and client information risks), reputational and strategic risks. • Assesses the adequacy of BB&T’s risk management policies and procedures. • Receives periodic reports on our risks, approves BB&T’s risk management framework and periodically reviews and evaluates the adequacy and effectiveness of the risk management framework. • Discusses with management, including the Chief Risk Officer, our major risk exposures and reviews the steps management has taken to identify, monitor and control such exposures. • Approves statements defining BB&T’s risk appetite, monitors our risk profile and provides input to management regarding our risk appetite and risk profile. • Oversees management’s implementation and management of, and conformance with, BB&T’s significant risk management policies, procedures, limits and tolerances. |

BB&T Corporation | 2017 Proxy Statement 23

Table of Contents

| Corporate Governance Matters |

Majority Voting and Director Resignation Policy; Director Retirement

Our articles of incorporation require each director to be elected by the majority of the votes cast at a meeting of shareholders. Under our Director Resignation Policy, any director nominee who receives a greater number of votes “withhold” than votes “for” such election shall tender his or her resignation to the Board. The Nominating and Corporate Governance Committee will then consider all of the relevant facts and circumstances and recommend to the Board whether to accept, reject or otherwise act with respect to such resignation. The Board will act on the Committee’s recommendation within 130 days following certification of the shareholder vote and will publicly disclose its decision within this130-day timeframe. A director whose resignation is under consideration will abstain from participating in any recommendation or decision regarding that resignation. If a director’s resignation is not accepted, the director will continue to serve for the remainder of his or her term.

Currently, pursuant to North Carolina law and our bylaws, an incumbent director who is notre-elected remains in office until the director’s successor is elected and qualified or until his or her earlier resignation or removal. Our current Director Resignation Policy addresses this “holdover” issue by requiring any director who does not receive the requisite affirmative majority of the votes cast for his or herre-election to tender his or her resignation to the Board.

Our bylaws require directors to retire at the end of the year in which the director becomes 72 years of age; provided, however, that a director may voluntarily elect to retire earlier.

We are very proud of our culture at BB&T, which has been deliberately developed and consistently articulated for more than 40 years. In a rapidly changing and unpredictable world, we believe individuals and organizations need a clear set of fundamental principles to guide their actions. At BB&T, we know our business will, and should, experience constant change. Change is necessary for progress. In any context, our vision, mission and values, are unchanging because these principles are based on basic truths.

We are a mission-driven organization with a clearly defined set of values. We encourage our employees, who we commonly refer to as associates, to have a strong sense of purpose, a high level of self-esteem and the capacity to think clearly and logically. We believe a competitive advantage is largely in the minds of our associates and their capacity to turn rational ideas into actions help us accomplish of our mission to make the world a better place to live by:

| • | Helping ourclients achieve economic success and financial security; |

| • | Creating a place where ourassociates can learn, grow and be fulfilled in their work; |

| • | Making thecommunities in which we work better places to be; and |

| • | Thereby optimizing the long-term return to ourshareholders, while providing a safe and sound investment. |

We realize our vision—“to create the best financial institution possible”—by meeting our responsibilities to our clients, associates, shareholders and communities. Our 10 values represent our over-arching beliefs. Our values are consistent with one another and integrated into a sound framework of character, judgment, success and happiness. Our focus on values grows from a belief that ideas matter and that an individual’s character is of critical significance.

Executive Management continually reinforces the BB&T culture through a quarterly video, annual regionalin-person visits and other internal communication channels. | BB&T Values

|

24 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Corporate Governance Matters |  |

Ethics matter at BB&T. We believe that the ultimate success of BB&T is directly related to the extent that each one of our associates lives and works every day by adhering to our BB&T values. We are keenly focused on always doing what is right in all interactions with our stakeholders—our clients, associates, senior leaders, directors, communities and shareholders. We also value and respect the opinions and insights of associates at all levels throughout the organization. Accordingly, we encourage associates to raise concerns with their managers, and we also provide other channels such as regional associate relations managers, a BB&T Ethics Hotline and our “Raise a Concern” web reporting form. We appointed a Chief Ethics Officer in 2015 in furtherance of our commitment to sound ethical practices.

We maintain three separate Board-approved Codes of Ethics that apply to our associates, senior financial officers and Directors. These Codes govern our corporate conduct, and each Code is specifically tailored to recognize the importance of each of these groups in maintaining a strong culture based on our values and adherence to ethical business practices. Any future waivers or substantive amendments of the Codes of Ethics applicable to our Directors and certain of our executive officers will be disclosed on our website.

SALES PRACTICES

At BB&T, our performance is driven by our culture. Our culture is based on the central theme of “The Client Comes First.” We believe relationships are built on trust, and over time. We believe in understanding our clients’ needs and then explaining our products and services that may meet those needs. Where there is a need and we have a solution, we believe the client will decide whether to “buy” or not. We don’t want to ever incent an associate to try to make a sale happen. We do, however, as appropriate, want to reward and recognize our associates for doing the right thing (i.e., helping our clients).

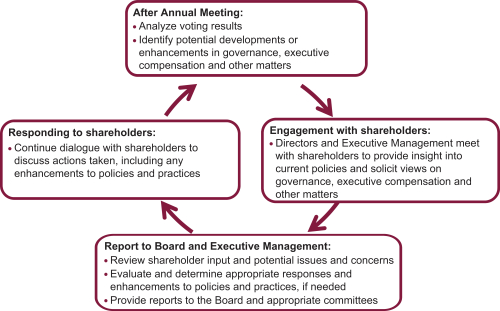

Shareholder Engagement Program

We have a formal shareholder engagement program designed to build and maintain relationships with our largest shareholders. This engagement consists of a year-round dialogue with our shareholders, and regular reports to our Executive Management and Board of Directors. A summary of our shareholder engagement program is set forth below:

BB&T Corporation | 2017 Proxy Statement 25

Table of Contents

| Corporate Governance Matters |

The goals of our shareholder engagement program include, but are not limited to:

| • | Obtaining shareholder insight into our corporate governance, executive compensation, and other policies and practices, including shareholder concerns and priorities; |

| • | Communicating Board and management actions in response to shareholder feedback; |

| • | Discussing current trends in corporate governance and executive compensation matters; and |

| • | Providing insight into our current practices and enhancing communication with our largest shareholders. |

We are committed to ongoing shareholder engagement and expect to continue our shareholder engagement program. We believe that our shareholder engagement program allows Executive Management and the Board to gather information about investor concerns and make educated and deliberate decisions that are balanced and appropriate for our diverse shareholder base and that are in the best interests of BB&T.

GOVERNANCE PROGRAM ENHANCEMENTS

Our continued engagement has led to several changes to our governance practices over the past several years.

Most recently, some of our shareholders have expressed support for proxy access, which allows director nominees of shareholders to be included with our proxy materials under certain circumstances. As a result, in 2016 we amended our bylaws to provide for proxy access.

As another example, last year we began publishing a Corporate Social Responsibility report on our website in response to shareholder requests for insight into our efforts in this area.

COMPENSATION PROGRAM ENHANCEMENTS

In addition, our engagement efforts have prompted several enhancements to our executive compensation program. Please refer to our discussion of compensation-related changes made in response to discussions with our shareholders on page 39 under “Shareholder Engagement and Changes to our Compensation Program”.

Based on input received during our shareholder engagement process, on December 20, 2016, our Board of Directors amended our bylaws to provide for proxy access. Subject to the proxy access requirements in our amended bylaws:

| • | A single shareholder or group of up to 20 shareholders; |

| • | Owning 3% of our common stock for at least 3 years; |

| • | May submit director nominees for up to 25% of our board (but at least 2 board seats) for inclusion in our proxy statement. |

For further information on proxy access, see “Proposals for 2018 Annual Meeting of Shareholders—Director nominations for inclusion in our proxy statement (Proxy Access).”

Nominating and Corporate Governance Committee Director Nominations

The Nominating and Corporate Governance Committee is responsible for selecting individuals who demonstrate the highest personal and professional integrity, have demonstrated exceptional ability and judgment and who are expected to be the most effective in serving the long-term interests of BB&T and its shareholders.

A director candidate is nominated to stand for election based on his or her professional experience, recognized achievement in his or her respective field, an ability to contribute to our business, his or her experience in risk management, and the willingness to make the commitment of time and effort required of a BB&T director over an extended period of time. A director must be “financially literate,” as defined by the Board,

26 BB&T Corporation | 2017 Proxy Statement

Table of Contents

| Corporate Governance Matters |  |

and should understand the intricacies of a public company. A director should possess good judgment, strength of character, and an independent mind, as well as a reputation for integrity and the highest personal and professional ethics. Other factors will be taken into consideration to ensure that the overall composition of our Board is appropriate, such as occupational and geographic diversity and age. An important goal of the Board is to include members with diverse backgrounds, skills, and characteristics that, taken as a whole, will help ensure a strong and effective governing body. The Nominating and Corporate Governance Committee annually assesses these factors in the director selection and nomination process.

Director nominees are recommended to the Board of Directors annually by the Nominating and Corporate Governance Committee for election by the shareholders. The Nominating and Corporate Governance Committee considers candidates submitted by directors and shareholders, subject to the requirements set forth below, and it may consider candidates submitted by a third-party search firm hired for the purpose of identifying director candidates. The Nominating and Corporate Governance Committee conducts an extensive due diligence process to review potential director candidates and their individual qualifications, and all such candidates, including those submitted by shareholders, will be evaluated by the Nominating and Corporate Governance Committee using the Board membership criteria described above. The Committee then reports to the Board its recommendations concerning each director nominee. The Board considers the Nominating and Corporate Governance Committee’s recommendations and selects director nominees to be submitted by BB&T to shareholders for approval at the next annual meeting of shareholders.

Pursuant to our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee also will consider qualified director nominees recommended in writing by shareholders when such recommendations are submitted with the information set forth in Article II, Section 10 of the Corporation’s bylaws and policies regarding director nominations. The written notice must include the following information:

| • | the nominee’s full name, age and residential address; |

| • | the principal occupation(s) of the nominee during the past five years; |

| • | the nominee’s previous and/or current memberships on all public company boards of directors and the amount of all BB&T securities beneficially owned; |

| • | any agreements, understandings or arrangements between the nominee and any other person or persons with respect to the nominee’s nomination or service on the Board of Directors or the capital stock or business of BB&T; |

| • | any bankruptcy filings, criminal convictions, civil actions, actions by the Securities and Exchange Commission (“SEC”) or other regulatory agency or any violation of Federal or State securities law by and against the nominee or any affiliate of the nominee; and |

| • | a signed statement by the nominee consenting to serve as a director if elected. |

The written notice also must be submitted in accordance with the general procedures for shareholder nominations (including deadlines for the notice to be received by the Secretary), which are summarized under the caption “Voting and Other Information-Proposals for 2018 Annual Meeting of Shareholders” below. Shareholders may submit, in writing, the names and qualifications of potential director nominees to the Corporate Secretary, BB&T Corporation, 200 West Second Street, Winston-Salem, North Carolina 27101, for delivery to the Chair of the Nominating and Corporate Governance Committee for consideration.

Corporate Social Responsibility Report

We understand that it is important to our shareholders that we minimize our environmental impact, promote positive social efforts, and implement transparent governance practices. BB&T was a winner of the Financial Services Roundtable award for Corporate Social Responsibility Leadership in 2016. This award emphasizes the positive impact of companies in areas of financial education, support of social causes, products that assist the underserved, and protecting the environment.

BB&T Corporation | 2017 Proxy Statement 27

Table of Contents

| Corporate Governance Matters |

We’ve shown our commitment to these causes through the following:

| Environmental | Education | Community Service | ||