- TFC Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Truist Financial (TFC) DEF 14ADefinitive proxy

Filed: 13 Mar 23, 6:07am

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

| ☒ | No fee required | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. | |

March 13, 2023

Dear Fellow Owner:

We’re inviting you to attend the Annual Meeting of Shareholders of Truist Financial Corporation on April 25, 2023, at 11:00 a.m. Eastern Time. This year’s meeting will be a “hybrid” meeting, meaning it will be held in person at Truist Center, Innovation and Technology Center, 14th Floor, 214 N. Tryon Street, Charlotte, North Carolina, with concurrent virtual participation for shareholders who choose not to be physically present. Shareholders who choose to attend the meeting online may vote their shares and submit questions during the meeting by visiting the website at www.virtualshareholdermeeting.com/TFC2023. All shareholders as of the close of business on the record date of February 16, 2023 are invited to attend the Annual Meeting.

2022 was a pivotal year for Truist. We continued to lean into our purpose to inspire and build better lives and communities as we completed our final merger milestones and successfully shifted our focus to executional excellence and purposeful growth.

We showed care for our teammates with an industry-leading minimum wage increase, created new ways to meet our clients’ needs through initiatives like Truist One Banking, and enhanced digital offerings like Truist Invest and Truist Trade. And we supported our communities in many ways, including announcing a $120 million commitment to small businesses and moving quickly to help areas in need in the aftermath of Hurricanes Ian and Nicole.

I look forward to further realizing the company’s potential in 2023 as we fully leverage our increased capacity, expanded capabilities, and talent to actualize our purpose.

Once again, we are providing proxy materials to many of our shareholders through the internet to support Truist’s sustainability efforts by saving paper and reducing costs. We believe this will offer you a convenient way to access Truist’s proxy materials. This year, shareholders will be able to submit questions both live and in advance of the Annual Meeting. Please read this proxy statement carefully as it contains important information about the Annual Meeting and the matters on which we ask for your vote.

We encourage you to vote your shares in advance (1) through the internet, (2) by phone, or (3) if you received your proxy materials by mail, by signing, dating, and returning the enclosed proxy card or voting instruction form in the envelope provided for your convenience. If you submit your proxy before the Annual Meeting, but later decide to attend the Annual Meeting, you may still vote at the meeting if you follow the proper procedures described in the accompanying materials. Every vote is important, and we look forward to hearing from you.

Thank you for your support in helping Truist inspire and build better lives and communities.

Sincerely,

|

| |

William H. Rogers, Jr. Chairman and Chief Executive Officer | Thomas E. Skains Independent Lead Director | |

NOTICE OF 2023 ANNUAL MEETING OF SHAREHOLDERS OF

TRUIST FINANCIAL CORPORATION

Date and Time: April 25, 2023 11:00 a.m. Eastern Time | Location: Truist Center and Webcast in a virtual format at www.virtualshareholdermeeting.com/TFC2023

| |

AGENDA

| • | Election of the 21 director nominees named in the proxy statement, each for a one-year term expiring at the 2024 annual meeting of shareholders |

| • | Ratification of the appointment of PricewaterhouseCoopers LLP as Truist’s independent registered public accounting firm for 2023 |

| • | Non-binding advisory vote to approve Truist’s executive compensation program |

| • | Non-binding advisory vote on the frequency of Truist’s “Say-on-Pay” votes |

| • | Shareholder proposal regarding an independent Chairman of the Board of Directors, if properly presented at the Annual Meeting |

| • | Any other business that may properly be brought before the Annual Meeting |

You can vote at the Annual Meeting if you were a shareholder of record at the close of business on February 16, 2023.

The hybrid Annual Meeting will be held in person at Truist Center, Innovation and Technology Center, 14th Floor, 214 N. Tryon Street, Charlotte, North Carolina and online. If you are attending the meeting in person, you will be asked to present proof of stock ownership as of the record date, as well as valid photo identification, such as a driver’s license. To attend the Annual Meeting online, vote, and submit your questions virtually during the Annual Meeting, please visit www.virtualshareholdermeeting.com/TFC2023. You will log into the virtual Annual Meeting by entering your name, a valid email address and unique 16-digit control number found on your Notice of Internet Availability, proxy card or voting instruction form.

By Order of the Board of Directors,

Ellen M. Fitzsimmons

Chief Legal Officer, Head of Public

Affairs and Corporate Secretary

March 13, 2023

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on April 25, 2023:

The solicitation of the enclosed proxy is made on behalf of the Board of Directors for use at the Annual Meeting to be held on April 25, 2023. A copy of this proxy statement, our 2023 Annual Report, and our 2022 Form 10-K are available at: www.proxyvote.com.

Table of Contents

Truist Financial Corporation

214 N. Tryon Street

Charlotte, NC 28202

PROXY STATEMENT

Summary

This summary highlights information contained elsewhere in this proxy statement for Truist Financial Corporation, which we sometimes refer to as the “Company” or “Truist.” This summary does not contain all of the information that you should consider, and you should read this entire proxy statement carefully before you vote. Additional information regarding our 2022 performance can be found in our Annual Report on Form 10-K for the year ended December 31, 2022. The proxy materials were first made available to shareholders on or about March 13, 2023.

The 2023 Annual Meeting of Shareholders of Truist Financial Corporation (the “Annual Meeting”) will be a “hybrid” meeting, meaning it will be held in person in Charlotte, North Carolina, with concurrent virtual participation for shareholders who choose not to be physically present. While Truist has a long history of holding our annual shareholder meetings in-person, we believe that, in light of recent global circumstances, virtual access to shareholder meetings continues to provide expanded shareholder access and participation while protecting the health and safety of our shareholders and teammates.

2023 Annual Meeting of Shareholders

Time and Date April 25, 2023 11:00 a.m. Eastern Time | In-Person Location Truist Center Innovation and Technology Center – 14th Floor 214 N. Tryon Street Charlotte, North Carolina Virtual Location www.virtualshareholdermeeting.com/TFC2023 | Record Date At close of business February 16, 2023 |

Proposals and Voting Recommendations

Shareholders will vote on the following five proposals:

| Proposal No. | Description | Votes Required | Board Recommendation | Page | ||||

1 | Election of 21 director | Majority of votes cast for each nominee | VOTE FOR EACH NOMINEE

| 8 | ||||

2 | Ratify the appointment of our | Majority of votes cast | VOTE FOR

| 45 | ||||

3 | Advisory vote to approve | Majority of votes cast | VOTE FOR

| 47 | ||||

4 | Advisory vote on | Majority of votes cast | VOTE FOR EVERY ONE YEAR

| 89 | ||||

5 | Shareholder proposal | Majority of votes cast | VOTE AGAINST

| 90 | ||||

| 2023 Proxy Statement | | 1 |

Proxy Statement Summary

How to Vote

Proxy Voting Methods

Internet |

Telephone |

|

During the Annual Meeting | |||

Go to www.proxyvote.com and follow the instructions on the website. | Call 1-800-690-6903 and follow the instructions on the proxy card or your voting instruction form

| Sign, date and mail your proxy card or your voting instruction form | While we encourage you to vote before the meeting, shareholders may vote in-person or online during the meeting by following the instructions on page 96.

|

A proxy card that is signed and dated, but which does not contain voting instructions, will be voted as recommended by our Board of Directors on each proposal.

Attending the Annual Meeting

The Company’s Annual Meeting will be conducted through a hybrid meeting model: in person and online.

If you are a registered shareholder or beneficial owner of common stock holding shares at the close of business on February 16, 2023 (the “Record Date”), or are a duly authorized proxy holder of such a registered shareholder or beneficial owner, you may attend the Annual Meeting and will be allowed to ask questions in-person or online before and during the Annual Meeting. Shareholder registration both online and in person will begin at 10:45 a.m. Eastern Time on April 25, 2023, and you should allow ample time for registration procedures.

Shareholders attending the Annual Meeting in person will be required to demonstrate that they were shareholders of record on the Record Date or a duly authorized proxy of such a shareholder. If you are a shareholder of record and received your proxy materials (or Notice of Internet Availability) by mail, your admission ticket is attached to your proxy card (or Notice of Internet Availability). If you received your proxy materials by e-mail and voted your shares electronically via the internet, you may obtain an admission ticket by clicking on the “Attend a Meeting” link at www.proxyvote.com. If you are a beneficial owner, bring the notice or voting instruction form you received from your bank, brokerage firm or other nominee for admission to the meeting. You may also bring your brokerage statement reflecting your ownership of common stock as of February 16, 2023 with you to gain admission to the meeting. Large bags, cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting, and individuals not complying with this request are subject to removal from the Annual Meeting.

Shareholders will be able to attend the Annual Meeting online by visiting www.virtualshareholdermeeting.com/TFC2023 and logging in by entering your name, a valid email address and the 16-digit control number found on your proxy card, Notice of Internet Availability, or voting instruction form, as applicable. You may log into and attend the Annual Meeting online beginning at 10:45 a.m. Eastern Time on April 25, 2023. The Annual Meeting will begin promptly at 11:00 a.m. Eastern Time. Attendance at the Annual Meeting online is subject to capacity limits set by the virtual meeting platform provider. To submit questions in advance of the Annual Meeting, visit www.proxyvote.com before 11:59 p.m. Eastern Time on April 24, 2023 and enter your 16-digit control number.

Shareholders who participate in the Annual Meeting virtually by way of the link provided above will be deemed to be “present in person,” as such term is used in this proxy statement, including for purposes of determining a quorum and counting votes.

For additional information on voting, attendance and submitting questions for the Annual Meeting, please see the sections entitled “How to Vote” and “How to Attend the Annual Meeting” beginning on page 96 of this proxy statement.

Even if you plan to attend the Annual Meeting, we encourage you to vote your shares in advance online, or if you received or requested printed copies of the proxy materials, by phone or by mail, to ensure that your vote will be represented at the Annual Meeting.

No recording of the Annual Meeting is permitted, including audio and video recording.

| 2 | | 2023 Proxy Statement |

|

Proxy Statement Summary

Truist’s Purpose

Truist’s purpose is to inspire and build better lives and communities. We aspire to be a purpose driven financial services institution dedicated to building a better future for clients, teammates, and communities.

Leadership Structure Changes

Last year, Truist made several Executive Leadership changes as we continue to execute our long-term strategies.

| • | In January 2022, Denise DeMaio was appointed as Chief Audit Officer, effective February 28, 2022. She succeeded Dale Jeanes, who retired after more than 33 years of distinguished service to the Company. |

| • | In March 2022, Vice Chair, Hugh S. Cummins III, was given expanded responsibilities, including leadership of Truist’s Corporate Development Group, which includes Truist Ventures, and the Truist Integrated Relationship Management team. |

| • | On March 16, 2022, Truist announced that Dontá L. Wilson would lead Retail, Small Business and Premier Banking for Truist as the Chief Retail and Small Business Banking Officer. In this role, Mr. Wilson oversees Truist’s branches across the Southeast, Mid-Atlantic, and Texas; along with contact centers; ATMs; mortgage; card-based services; retail payments; deposit and loan products; retail and small business loan approval channels; marketing; client analytics; client experience strategy; and digital banking, which includes digital sales, transformation, innovation and strategy. |

| • | In May 2022, Daryl N. Bible announced his retirement from the position of Chief Financial Officer. On September 15, 2022, Michael B. Maguire was appointed to the role of Chief Financial Officer after most recently serving as Chief Consumer Finance and Payments Officer. |

| • | In September 2022, Clarke R. Starnes III was appointed to the additional role of Vice Chair in connection with being given (a) additional leadership responsibilities, including oversight of the corporate function responsible for procurement, third-party risk management, supplier diversity, and unclaimed property and escheatment businesses, and the finance-risk data analytics office tasked with the implementation of the data management framework for Risk, Finance, ESG and sustainability, and (b) oversight of the Corporate Security group and the Wholesale and Retail Credit Risk modeling team. |

In addition, in February 2023, Truist announced that it had reached a definitive agreement to sell a 20% minority stake in its insurance brokerage subsidiary, Truist Insurance Holdings, Inc. (“TIH”), to an investor group led by Stone Point Capital LLC and that in connection with this transaction, John M. Howard will continue as Chief Executive Officer of TIH, reporting to Truist Chief Executive Officer, William H. Rogers, Jr., but Truist will shift some of his enterprise-wide responsibilities in order to support focus on maximizing the success of TIH.

The members of our eleven-person Executive Leadership team are:

| • | Scott E. Case: Chief Information Officer |

| • | Hugh S. “Beau” Cummins III: Vice Chair |

| • | Denise M. DeMaio: Chief Audit Officer |

| • | Ellen M. Fitzsimmons: Chief Legal Officer, Head of Public Affairs and Corporate Secretary |

| • | Michael B. Maguire: Chief Financial Officer |

| • | Kimberly Moore-Wright: Chief Teammate Officer and Head of Enterprise Diversity |

| • | William H. Rogers, Jr.: Chairman and Chief Executive Officer |

| • | Clarke R. Starnes III: Vice Chair and Chief Risk Officer |

| • | Joseph M. Thompson: Chief Wealth Officer |

| • | David H. Weaver: Chief Commercial Community Banking Officer |

| • | Dontá L. Wilson: Chief Retail and Small Business Banking Officer |

| 2023 Proxy Statement | | 3 |

Proxy Statement Summary

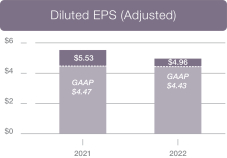

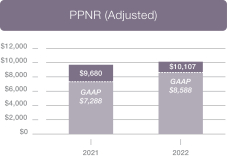

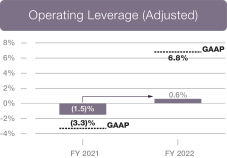

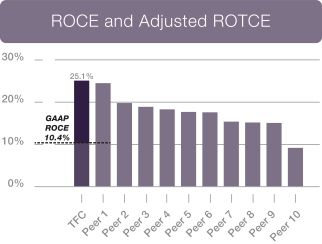

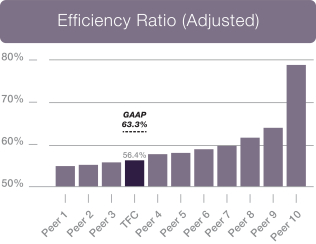

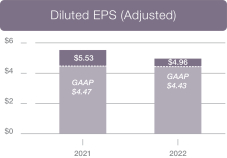

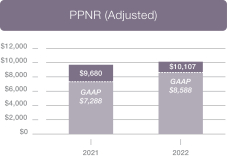

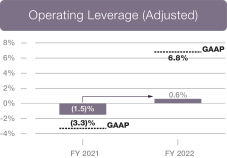

2022 Financial Performance Highlights*

|  |  |

|  |

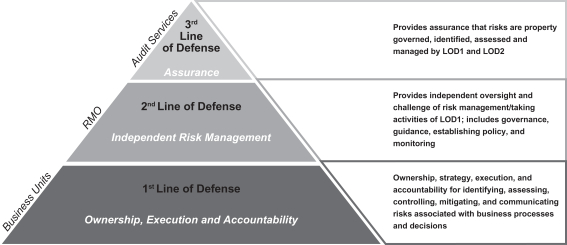

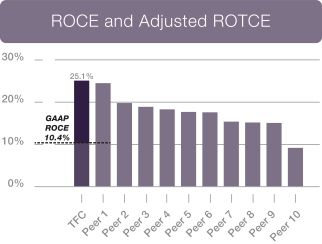

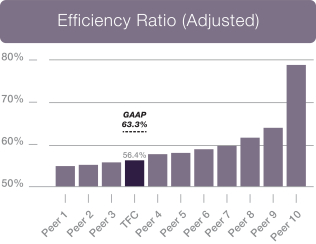

* Adjusted Diluted EPS, Adjusted Pre-Provision Net Revenue (PPNR), Adjusted Operating Leverage, Adjusted Return on Average Tangible Common Equity (ROTCE), and Adjusted Efficiency Ratio are non-GAAP financial measures. Please see Annex A for a reconciliation from GAAP amounts (Earnings Per Share, Pre-Provision Net Revenue, Operating Leverage, Return on Average Common Equity and Efficiency Ratio) to these adjusted amounts. The peer figures presented in the “ROCE and Adjusted ROTCE” and “Efficiency Ratio (Adjusted)” tables above reflect the adjusted ROTCE and adjusted efficiency ratio for such peers.

| 4 | | 2023 Proxy Statement |

|

Proxy Statement Summary

2022 Key Accomplishments

In 2022, we continued to live our purpose to inspire and build better lives and communities. Some purposeful activities included:

| • | We exceeded the $60 billion 3-year 2020-2022 Community Benefits Plan lending and investment commitments. |

| • | Truist Community Capital committed over $2 billion to support affordable housing and community development efforts. |

| • | We increased U.S. minimum wage to $22 per hour for eligible teammates effective October 1, 2022 to attract and retain top talent, were named a “Top 100” performer within Just Capital’s new 2022 Workforce Equity and Mobility Ranking, were recognized as a Top 50 employer by Equal Opportunity Magazine, and were named one of Forbes Best Employers for New Graduates and Best Employers for Diversity. |

| • | Together with the Truist Foundation and the Truist Charitable Fund, we committed $120 million to help historically underserved small businesses gain access to capital and technical assistance, and we provided disaster relief, humanitarian aid, and volunteerism to our impacted teammates, clients, and communities in response to Hurricane Ian, including $1.25 million in grants from the Truist Foundation. |

| • | We exceeded our objective for ethnically diverse senior leadership roles one year early with continued aspirations for growth and surpassed our 10% spend goal with diverse suppliers. |

| • | Launched Truist One Banking—a new approach to the checking account experience, designed to address clients’ direct feedback: provides accounts with no overdraft fees and other solutions to help clients grow and achieve financial success. |

| • | We launched our new Truist Assist, an AI-enhanced virtual assistant within our mobile banking app and online banking platform, combining innovative technology with personalized human touch to enhance the client experience. |

| • | We launched our state-of-the-art Innovation and Technology Center at our Charlotte headquarters to support our ongoing efforts to transform the client experience. |

| • | We published the 2021 Truist ESG & CSR Report, expanding our ESG and sustainability disclosures and highlighting the significant steps we have taken to meet and exceed our ESG and sustainability goals, including progress on our 2030 goals to reduce Scope 1 and Scope 2 emissions by 35% each and to reduce water consumption by 25%, relative to 2019, and we announced our goal to achieve net zero greenhouse gas emissions by 2050, which will help us support our clients’ transition to a low-carbon economy. |

| 2023 Proxy Statement | | 5 |

Proxy Statement Summary

Truist Board of Director Nominees

Please consider the following nominees to our Board of Directors. All of these nominees currently serve as Truist directors. We are proud of the diverse makeup of the Board and the experience, skill and dedication of each director.

| Age | Independent | Principal Occupation | Truist Standing Committee Memberships | |||||

| Jennifer S. Banner | 63 |  | Executive Director at the University of Tennessee Haslam College of Business, Forum for Emerging Enterprises and Private Business | • Audit • Technology | ||||

| K. David Boyer, Jr. | 71 |  | CEO of GlobalWatch Technologies, Inc. | • Audit • Executive • Technology | ||||

| Agnes Bundy Scanlan | 65 |  | President of The Cambridge Group LLC | • Executive • Nominating and Governance (Chair) • Risk | ||||

| Anna R. Cablik | 70 |  | Partner of CK Property Group, LLC and President of Anasteel & Supply Company, LLC | • Compensation and Human Capital • Risk | ||||

| Dallas S. Clement | 57 |  | President and CFO of Cox Enterprises, Inc. | • Audit (Chair) • Executive • Technology | ||||

| Paul D. Donahue | 66 |  | Chairman and CEO of Genuine Parts Company | • Compensation and Human Capital | ||||

| Patrick C. Graney III | 69 |  | President of PCG, Inc. | • Audit • Compensation and Human Capital | ||||

| Linnie M. Haynesworth | 65 |  | Retired Sector Vice President and General Manager, Northrup Grumman Corporation | • Risk • Technology | ||||

| Kelly S. King | 74 | Retired CEO and Executive Chairman of Truist | • Executive • Risk | |||||

| Easter A. Maynard | 52 |  | Director of Community Investment for Investors Management Corporation | • Audit • Nominating and Governance | ||||

| Donna S. Morea | 68 |  | Chairman and CEO of Adesso Group, LLC | • Executive • Risk • Technology (Chair) | ||||

| Charles A. Patton | 66 |  | Managing Member of Patton Holdings, LLC and PATCO Investments, LLC | • Executive • Nominating and Governance • Risk (Chair) | ||||

| Nido R. Qubein | 74 |  | President of High Point University | • Risk • Technology | ||||

| David M. Ratcliffe | 74 |  | Retired Chairman, President, and CEO of Southern Company | • Executive • Nominating and Governance • Risk | ||||

| William H. Rogers, Jr. | 65 | Chairman and CEO of Truist | • Executive (Chair) | |||||

| Frank P. Scruggs, Jr. | 71 |  | Principal, Frank Scruggs P.A. | • Compensation and Human Capital • Risk | ||||

| Christine Sears | 67 |  | Retired CEO of Penn National Insurance | • Audit • Compensation and Human Capital | ||||

| Thomas E. Skains | 66 |  | Retired Chairman, President and CEO of Piedmont Natural Gas Company, Inc. | • Executive • Nominating and Governance • Risk | ||||

| Bruce L. Tanner | 64 |  | Retired EVP and CFO of Lockheed Martin Corporation | • Audit • Technology | ||||

| Thomas N. Thompson | 74 |  | President of Thompson Homes, Inc. | • Nominating and Governance • Risk | ||||

| Steven C. Voorhees | 68 |  | Retired President and CEO of WestRock Company | • Audit • Compensation and Human Capital (Chair) • Executive | ||||

| 6 | | 2023 Proxy Statement |

|

Proxy Statement Summary

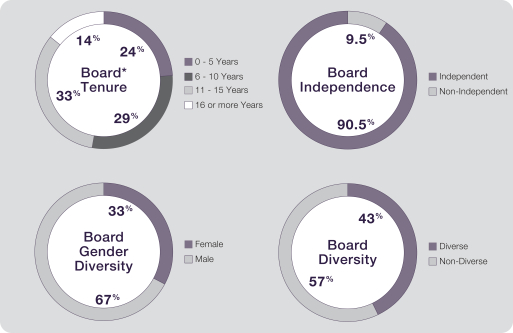

CONTINUING COMMITMENT TO SOUND CORPORATE GOVERNANCE

Truist maintains the following corporate governance framework:

Strong Diversity

| • | Approximately 43% of our directors are women or ethnically diverse. |

| • | Women comprise one-third of the Board. |

| • | Blacks represent almost 20% of the Board and serve as chairs of two Board Committees (Nominating and Governance Committee and Truist Bank Trust Committee), and one of our directors is Hispanic. |

| • | Women hold key Board leadership positions, chairing two Board Committees (Nominating and Governance Committee and Technology Committee). |

Accountability

| • | Majority voting for director elections |

| • | Annual elections for all directors |

| • | Robust stock ownership requirements for directors |

| • | Prohibition on hedging and pledging of Truist securities |

| • | Annual Board and Committee self-evaluations |

Robust Shareholder Rights

| • | Proxy access |

| • | Shareholder right to call a special meeting |

| • | No supermajority voting provisions |

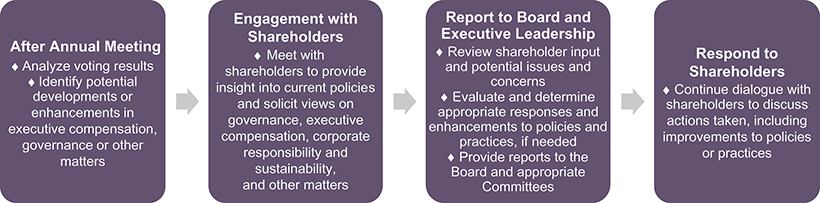

Active and Responsive Shareholder Engagement

| • | Engagement takes place throughout the year to obtain shareholder insight into corporate governance, executive compensation, corporate responsibility practices, and other areas of importance to our shareholders. |

| • | Our engagement program includes meetings with our largest shareholders led by members of our Executive Leadership or senior teams and, in certain cases, our independent Lead Director. |

| • | Feedback received from shareholders is used to inform our directors and Executive Leadership of matters of material interest and to improve governance. |

Corporate Social Responsibility

| • | We aim to be a good corporate citizen through our efforts in sustainability, commitment to communities, by upholding corporate culture, and providing training and development opportunities for our teammates. |

| • | We prioritize human capital management through the Compensation and Human Capital Committee, which oversees Truist’s strategies and initiatives on diversity, equity and inclusion, and employee well-being and engagement. Truist places special emphasis on providing compensation and benefits that foster an environment of financial security and economic mobility for its teammates. |

| • | Our 2021 ESG and CSR Report details Truist’s collective sustainability and corporate responsibility achievements, and we plan to publish our next version of this report in April 2023. |

| • | In 2022, we released a Task Force on Climate-Related Financial Disclosures (TCFD) Brief to provide stakeholders with an update on the Company’s efforts to measure and share climate-related risks, opportunities, goals and progress, with plans to publish our second TCFD Report in April 2023. |

| • | In January 2022, Truist announced a goal of net zero greenhouse gas emissions by 2050. |

| • | In 2022 Truist published its first Climate Lobbying Summary providing an overview of Truist’s climate goals and principles and assessing for alignment with Truist’s views, the climate positions and actions of the major national trade associations of which it is a member. |

| 2023 Proxy Statement | | 7 |

Proposal 1—Election of Directors

We are asking you to elect each of the 21 director nominees listed below to serve on the Board of Directors for a one-year term expiring at the annual meeting of shareholders in 2024. Truist’s bylaws provide that each director nominee requires the affirmative vote of the majority of votes cast to be elected. Although our Board of Directors expects that each of the nominees will be available for election, if a vacancy in the slate of nominees occurs, it is intended that shares of Truist common stock represented by proxies will be voted for the election of a substitute nominee, designated by the Board. Alternatively, the Board may reduce the number of persons to be elected by the number of directors unable to serve.

Each of our director nominees has been identified as possessing good business acumen, strength of character, an independent mind, as well as a reputation for integrity and the highest personal and professional ethics. Sound judgment and community leadership are also important characteristics that our Board members possess. Each nominee additionally brings to us a strong and unique background and set of skills, providing our Board with competence and experience in the wide variety of areas necessary and helpful in overseeing Truist’s strategy, culture and performance. Over the past three years since the merger, our directors have exhibited an unwavering commitment to Truist, building upon the successes of the heritage companies. We also note that four of our directors will reach the mandatory retirement age of 75 during 2023 and are expected to retire from the Board at the end of the year, consistent with our Corporate Governance Guidelines. As a result, we expect to begin 2024 with a Board consisting of approximately 17 members.

Board Diversity and Composition

One of the Board’s goals, which is a focus of the Nominating and Governance Committee, is to include directors with diverse backgrounds, expertise and characteristics that, taken as a whole, will help ensure a strong and effective governing body. The Nominating and Governance Committee regularly reviews the skills and composition of the Board and its committees to determine the appropriate balance of skills, qualifications and backgrounds to best meet the Company’s needs and strategies.

At Truist, we are proud of our long commitment to diversity among our teammates, members of Executive Leadership and Board of Directors. Of our 21 directors, seven are women, representing one-third of our Board, four are Black, comprising almost 20% of our Board, one is Hispanic, and together approximately 43% of our Board is either racially, ethnically or gender diverse. Moreover, women hold key leadership positions on our Board, such as our Nominating and Governance Committee Chair and Technology Committee Chair. Our directors also have a broad range of tenures on our Board and diverse backgrounds and expertise, which offers strong and broad perspectives on the financial services industry and the trends and evolution currently taking place in banking.

* Board tenure includes each Director’s Board service at Truist and either BB&T or SunTrust, as applicable.

Director Commitment and Skills

We believe that the Board’s diverse skillset and commitment to Truist help promote our purpose to “Inspire and build better lives and communities.” The Board invests a substantial amount of time, effort and energy in overseeing the planning and execution of our strategic plan, founded on our Purpose, Mission and Values. As illustrated below, Truist Board members have a broad set of qualifications, attributes, skills and experience that are well suited to oversee the Company’s strategy and correlates closely to the financial industry as a whole.

| 8 | | 2023 Proxy Statement |

|

Proposal 1—Election of Directors

Qualifications, Attributes, Skills and Experience Represented on the Board (as a % of our 21 directors) | ||||||

Financial Services Experience in the financial services industry is vital in understanding, overseeing and reviewing our strategy, including opportunities and challenges facing our businesses. This attribute may include significant leadership roles at financial institutions, service on relevant boards of directors, as well as related experience at other companies as current or former executives, that gives directors specific insight into, and expertise that will foster active participation in, the development and implementation of our operating plan and business strategy. |

| Human Capital Management Maintaining a skilled and motivated workforce is a critical component of Truist’s future success. Similarly, sustaining and growing a company’s unique culture is increasingly significant as many teammates continue to work from home. Directors with experience in areas that include diversity, employee benefits, compensation programs, career growth, and motivating a large and diverse workforce are increasingly important in retaining and acquiring talented teammates and reinforcing Truist’s culture. |

| |||

Executive Leadership We seek directors who have served in significant leadership positions and who possess strong abilities to motivate and manage others. This includes the ability to identify, evaluate and develop leadership qualities in others. Current or recent experience as Chairman, CEO, President, CFO or other senior executive role are strong indicators of skill and expertise in this category. |

| Sustainability Truist recognizes that sustainability issues are important to our shareholders and other stakeholders, and over the past few years, has been increasingly transparent of our efforts in these areas. We seek leaders with experience in ESG matters, including environmental sustainability, climate change, community investment and development, and human rights. |

| |||

Client and Consumer Interfaces and Trends Expertise in these areas is important for reaching tomorrow’s clients, differentiating Truist’s services, understanding the importance of technology and design in attracting and maintaining clients, and enhancing the capabilities and functionalities of our products. |

| Cybersecurity and Information Security Our continued digital evolution requires us to have directors with an understanding of the technological challenges and emerging risks in information security, data privacy, and cybersecurity. |

| |||

Accounting/Financial Experience in these critical areas enables directors to analyze our financial statements, capital structure and complex financial transactions and oversee our accounting and financial reporting processes. NYSE rules require that at least one member of our Audit Committee have accounting or related financial management expertise. |

| Technology and Digital Innovation Truist knows the importance of innovation and digital competitiveness to its growth and sees this as both a challenge and opportunity in communicating with our existing clients and reaching new ones. Leaders with knowledge of technology and innovation will be critical in helping Truist promote our products and services through digital platforms. |

| |||

Regulatory and Enterprise Risk Management Experience in identifying and managing potential areas of risk are necessary to our financial stability. Our Nominating and Governance Committee considers it important that the Risk Committee have at least one member who qualifies as a “risk management expert.” |

| Leadership in Transformation and Disruption Truist directly benefits from leaders who are comfortable and experienced in navigating an ever-changing competitive landscape and who accept transformation and change as a constant. Such leaders provide insight regarding organizational agility and resiliency to address emerging needs and challenges for our business going forward. |

| |||

Corporate Governance and Public Board Service Directors with deep understanding of the Board’s extensive and complex oversight responsibilities further our goals of greater transparency and accountability for management and the Board. Such an understanding helps guide the Company in its governance, corporate responsibility and diversity initiatives. |

|

Public Affairs, Government Relations, Legal and Compliance Directors with demonstrated achievement and expertise in these areas are important in helping Truist navigate the complex political and regulatory landscape in which we operate. |

| |||

| 2023 Proxy Statement | | 9 |

Proposal 1—Election of Directors

Nominees for Election as Directors for a One-Year Term Expiring in 2024

The Board of Directors has nominated the following individuals to serve as directors of Truist until the 2024 annual meeting of shareholders and until their respective successors are elected and qualified. The nominees for election to our Board of Directors and their principal occupations, experience, and key qualifications and skills are set forth below.

| JENNIFER S. BANNER KNOXVILLE, TN |  | K. DAVID BOYER, JR. OAKTON, VA |

Tenure: • Truist since 2003

Age: 63

Board Committees: • Audit • Technology

Public Company Directorship: • Uniti Group • Elme Communities

|

Tenure: • Truist since 2009

Age: 71

Board Committees: • Audit • Executive • Technology • Trust (Chair)—Truist Bank | |||||

Professional Experience:

Since June 2019, Ms. Banner has served as the Executive Director for the University of Tennessee Haslam College of Business Forum for Emerging Enterprises and Private Business. Ms. Banner previously served as President and Chief Executive Officer of Schaad Source, LLC (a privately held managerial and strategic services company) from 2006 through March 2019, Chief Executive Officer of Schaad Companies, LLC (a diversified holding company) from 2008 through 2018, and Chief Executive Officer of Schaad Family Office, LLC (a diversified holding company) from 2012 through 2018. In May 2022, Ms. Banner was elected to the board of directors of Washington Real Estate Investment Trust, now known as Elme Communities (NYSE:ELME).

Qualifications and Skills:

Ms. Banner brings to Truist leadership and management experience and skills in public accounting, financial services, corporate governance, regulatory and risk management from her prior service on the boards of directors of First Vantage Bank and First Virginia Banks, Inc. Ms. Banner’s skills also include knowledge of technology and digital transformation through formal training and research participation as an Industry Research Fellow with the MIT Center for Information Systems Research and other external sources.

| Professional Experience:

Mr. Boyer has served as Chief Executive Officer of GlobalWatch Technologies, Inc. (a privately-held business intelligence, cybersecurity, information assurance, governance and compliance firm) since 2004. Mr. Boyer also has served as a director of Virginia Community Development Corporation (a tax credit fund manager supporting economic development in Richmond) since 2009 and as a Treasury Board Member for the Commonwealth of Virginia from 2002-2014. Mr. Boyer is also a National Association of Corporate Directors (NACD) Board Leadership Fellow and a member of the Presidential Counselors for Pennsylvania State University.

Qualifications and Skills:

Through his experience both as a Board member and from his prior service for more than 11 years on Truist Bank’s local advisory board in Washington, D.C., Mr. Boyer has gained a thorough understanding of Truist’s banking organization, corporate governance structure and its values and culture. Mr. Boyer’s contributions as a Truist director also include his experience with risk management, accounting and finance, as well as information technology services, information management, cybersecurity, data analytics and anti-terrorism assistance services.

|

| 10 | | 2023 Proxy Statement |

|

Proposal 1—Election of Directors

| AGNES BUNDY SCANLAN CAMBRIDGE, MA |  | ANNA R. CABLIK MARIETTA, GA |

Tenure: • Truist since 2019 • SunTrust director since 2017

Age: 65

Board Committees: • Executive • Nominating and Governance (Chair) • Risk • Trust—Truist Bank

Public Company Directorships: • AppFolio, Inc. • R1 RCM Inc.

|

Tenure: • Truist since 2004

Age: 70

Board Committees: • Compensation and Human Capital • Risk • Trust—Truist Bank | |||||

Professional Experience:

Ms. Bundy Scanlan has served as President of The Cambridge Group LLC, a regulatory advisory firm, since May 2020. From 2017 to 2020, she was a senior advisor for Treliant Risk Advisors, counseling financial services firms on risk management, strategic and other regulatory matters. From 2015 to 2017, she served as the Northeast Regional Director of Supervision Examinations for the Consumer Financial Protection Bureau. Previously, she served as Chief Regulatory Officer, Chief Compliance Officer, Chief Privacy Officer, Regulatory Relations Executive, and Director of Corporate Community Development for, and as legal counsel to, a number of banks and financial services firms, and as legal counsel to the United States Senate Budget Committee. Ms. Bundy Scanlan serves on the boards of directors of AppFolio, Inc., a provider of cloud-based business software solutions, services, and data analytics to the real estate industry, and R1 RCM Inc., a revenue cycle management company servicing hospitals, health systems and physician groups in the United States.

Qualifications and Skills:

Ms. Bundy Scanlan brings her demonstrated extensive risk management, regulatory, compliance, legal and government affairs experience to our Board of Directors. With over 20 years of experience, she is also highly regarded as an expert and leader in the fields of governance, regulatory and compliance risk, and information security and contributes these skills to Truist’s Board of Directors.

| Professional Experience:

Ms. Cablik has served as the President of Anasteel & Supply Company, LLC (a privately-held reinforcing steel fabricator) since 1994 and served as President of Anatek, Inc. (a general contractor) from 1982 until the sale of the company in July 2022.

Qualifications and Skills:

Ms. Cablik brings entrepreneurial, accounting and executive experience to Truist, having successfully founded and grown several businesses. Her extensive career managing a diverse portfolio of projects provides risk assessment skills and governance experience to the Truist Board. In addition to these skills, Ms. Cablik’s prior service on the board of Georgia Power Company and her broad understanding of corporate governance matters pertaining to public companies provides valuable experience to the Truist Board.

|

| 2023 Proxy Statement | | 11 |

Proposal 1—Election of Directors

| DALLAS S. CLEMENT ATLANTA, GA |  | PAUL D. DONAHUE ATLANTA, GA |

Tenure: • Truist since 2019 • SunTrust director since 2015

Age: 57

Board Committees: • Audit (Chair) • Executive • Technology

|

Tenure: • Truist since 2019 • SunTrust director since 2019

Age: 66

Board Committees: • Compensation and Human Capital • Trust—Truist Bank

Public Company Directorship: • Genuine Parts Company

| |||||

Professional Experience:

Mr. Clement is President and Chief Financial Officer of Cox Enterprises, Inc., a privately-held media, communications and technology company, responsible for its treasury, financial reporting and control, tax, audit, and financial planning and analysis functions. Previously, he served as Executive Vice President and Chief Financial Officer of Cox Enterprises and Executive Vice President and Chief Financial Officer for Cox Automotive, the largest automotive marketplace and leading provider of software solutions to auto dealers throughout the U.S. He also had accountability for the international businesses and Cox Automotive’s financial services unit, NextGear. Prior to the formation of Cox Automotive, Mr. Clement served as Chief Financial Officer of Autotrader Group. He also spent 20 years at Cox Communications, where he held a variety of roles, including Executive Vice President and Chief Strategy and Product Management Officer.

Qualifications and Skills:

Mr. Clement enriches the Truist Board of Directors through his broad financial and business experience, including service as President and CFO of a large customer-facing company with significant technology operations. Mr. Clement has worked for over 25 years in executive management, strategy, finance, and corporate development across a number of different businesses. Mr. Clement’s experience and expertise provides valuable leadership over a broad range of Board functions, including audit, financial reporting, corporate governance, information technology and corporate strategy.

| Professional Experience:

Mr. Donahue is the Chairman and Chief Executive Officer of Genuine Parts Company, a publicly-traded distribution company, holding the Chairman position since April 22, 2019 and the CEO position since May 1, 2016. Mr. Donahue was elected President of Genuine Parts in 2012. He joined S.P. Richards Company, the office products group of Genuine Parts, as Executive Vice President Sales and Marketing in 2003. He was soon after appointed President and Chief Operating Officer, a position he held until his election to Executive Vice President of Genuine Parts in 2007. From 2009 to 2015, Mr. Donahue was President of the U.S. Automotive Parts Group of Genuine Parts.

Qualifications and Skills:

Mr. Donahue has extensive business, executive and management experience that he brings to the Truist Board of Directors. In addition to his experience as Chairman and CEO at Genuine Parts, Mr. Donahue spent more than two decades with Newell Rubbermaid (now Newell Brands), a publicly-traded consumer products manufacturer and has proven successful in a number of sales, marketing, operations and executive positions. Mr. Donahue’s expertise and experience, including serving as a director and chief executive officer of a large, publicly traded company with significant consumer facing operations, make him a valuable addition to Truist’s Board of Directors.

|

| 12 | | 2023 Proxy Statement |

|

Proposal 1—Election of Directors

| PATRICK C. GRANEY III CHARLESTON, WV |  | LINNIE M. HAYNESWORTH OAKTON, VA | |||||||

Tenure: • Truist since 2018

Age: 69

Board Committees: • Audit • Compensation and Human Capital • Trust—Truist Bank

Public Company Directorship: • Ramaco Resources, Inc.

|

Tenure: • Truist since 2019 • SunTrust director since 2019

Age: 65

Board Committees: • Risk • Technology

Public Company Directorships: • Automatic Data Processing, Inc. • Micron Technology, Inc. • Eastman Chemical Company

| |||||||||

| Professional Experience:

Mr. Graney is currently a private investor and manages several real estate investment companies, including PCG, Inc., of which he is the founder and president. He is a long-standing business leader in the state of West Virginia, having previously owned both Petroleum Products, Inc., a fuel distributor, and One Stop Stores, a chain of convenience stores, each for over 25 years. Mr. Graney also serves as a member of the board of directors of Ramaco Resources, a publicly- traded metallurgical coal company.

Qualifications and Skills:

Mr. Graney’s extensive leadership experience brings valuable strategic and managerial skills to Truist. His financial services experience includes having served as a Class B director representing West Virginia on the board of the Federal Reserve Bank of Richmond from December 2008 to December 2013. Mr. Graney’s financial expertise, his experience as owner of a business similar to those we serve, and his leadership and public company director experience all enhance the overall skill set and expertise on the Truist Board.

| Professional Experience:

Ms. Haynesworth retired in 2019 as the Sector Vice President and General Manager of the Cyber and Intelligence Mission Solutions Division for Northrop Grumman Corporation’s (NGC’s) Mission Systems Sector after assuming this role in 2016. In this position, Ms. Haynesworth had executive responsibility for the overall growth and program activities for the division’s business portfolio, including full spectrum cyber, multi-enterprise data management and integration, as well as mission enabling intelligence, surveillance and reconnaissance (ISR) solutions supporting domestic and international customers. She previously served as Sector Vice President and General Manager of the ISR Division within the former Information Systems sector of NGC, as well as led NGC’s Federal and Defense Technologies Division. Ms. Haynesworth serves on the boards of Automatic Data Processing, Inc. (a global technology company), Micron Technology, Inc. (a memory and storage solutions business), and Eastman Chemical Company (a global specialty materials company).

Qualifications and Skills:

Ms. Haynesworth enriches the Truist Board through her deep background in cybersecurity governance, enterprise strategy, large complex system development and disruptive technology integration. She formerly served on the board of directors of the Intelligence and National Security Alliance and the Northern Virginia Technology Council. Ms. Haynesworth provides Truist’s Board a valuable resource, and offers significant insights as cybersecurity and technology play an increasing role in Truist’s operations and businesses.

| |||||||||

| 2023 Proxy Statement | | 13 |

Proposal 1—Election of Directors

| KELLY S. KING WINSTON-SALEM, NC |  | EASTER A. MAYNARD RALEIGH, NC |

Tenure: • Truist since 2008

Age: 74

Board Committees: • Executive • Risk

|

Tenure: • Truist since 2018

Age: 52

Board Committees: • Audit • Nominating and Governance

| |||||

Professional Experience:

Mr. King served as Executive Chairman of Truist from September 2021 until March 2022. Previously, he served as the Chief Executive Officer of Truist and Truist Bank from 2009 until September 2021, and Chairman of the Board of Directors from 2010 until March 2022.

Qualifications and Skills:

Mr. King has forged a lifetime of leadership experience with Truist, devoting decades of service to Truist as a member of Executive Leadership. He has held leadership roles in commercial and retail banking, operations, insurance, corporate financial services, investment services and capital markets.

Mr. King served as a representative on the Federal Advisory Council of the Board of Governors of the Federal Reserve System from 2013 through 2016, and served as its President in 2016. He previously served as a board member of the Bank Policy Institute, The Clearing House, the Federal Reserve Bank of Richmond, and Foundation for the Carolinas, and currently serves as the Chairman of NCInnovation. Mr. King is an emeritus board member of Business for Educational Success and Transformation (BEST) NC. Mr. King previously served as Chairman of the North Carolina Bankers Association board, Vice Chairman of the American Bankers Council, and as a member of the Charlotte Executive Leadership Council. Mr. King is Chairman Emeritus of the Piedmont Triad Partnership.

Mr. King brings to the Board of Directors his expertise formed through his long-serving leadership at Truist, steering the Company through numerous successful mergers, his strong experience in strategic planning, risk management, corporate governance, and his invaluable contributions to the Board and its committees.

| Professional Experience:

Ms. Maynard has served as Director of Community Investment for Investors Management Corporation (“IMC”) (a diversified holding company) since 2004. She has served on the IMC board since 2017 and was elected chair of the board in February 2023. She is also the chair of the board of its principal subsidiary, Golden Corral Corporation, a national restaurant chain, on which she has served since 2006. Ms. Maynard also is Executive Director of IMC’s charitable arm, the ChildTrust Foundation, and serves in executive and board capacities for a variety of charitable organizations.

Qualifications and Skills:

Ms. Maynard brings extensive strategic planning, management and community service experience and skills to the Truist Board. She has also been a member of the North Carolina State Banking Commission since December 2018. Her executive leadership and governance experience provide valuable expertise to the Truist Board. Ms. Maynard currently serves as board chair for the North Carolina Early Childhood Foundation and on the boards of the North Carolina Network of Grantmakers, and Boys and Girls Clubs of Wake County.

|

| 14 | | 2023 Proxy Statement |

|

Proposal 1—Election of Directors

| DONNA S. MOREA ROYAL OAK, MD |  | CHARLES A. PATTON N. PRINCE GEORGE, VA |

Tenure: • Truist since 2019 • SunTrust director since 2012

Age: 68

Board Committees: • Executive • Risk • Technology (Chair)

Public Company Directorships: • KLDiscovery Inc. • Science Applications International Corporation

|

Tenure: • Truist since 2013

Age: 66

Board Committees: • Executive • Nominating and Governance • Risk (Chair)

| |||||

Professional Experience:

Since 2012 Ms. Morea has been the Chairman and Chief Executive Officer of Adesso Group, LLC, which provides consulting and advisory services, with an emphasis on strategic growth opportunities, for businesses of all sizes. She presently serves as chair of the board of Science Applications International Corporation, a publicly-traded firm which provides technical, engineering, and enterprise information technology services. Ms. Morea is an Operating Executive of The Carlyle Group, where she focuses on technology and business services. She has also served as the chair of the Northern Virginia Technology Council, which has more than 1,000 member organizations.

Qualifications and Skills:

Ms. Morea is a nationally recognized executive in IT professional services management with over 30 years of experience, and provides valuable insight to Truist in today’s changing competitive environment. In addition, she has broad experience in managing business process services for large enterprises, including companies in such diverse and highly regulated industries as financial services, healthcare, telecommunications and government. Ms. Morea also makes important contributions to the Truist Board through her executive management experience and knowledge of information technology, given the increasing importance of technology to our operations and businesses.

| Professional Experience:

Mr. Patton has served as a consultant and manager of Patton Holdings, LLC (a real estate holding company) since 2007 and manager of PATCO Investments, LLC (emphasizing specialty lending and equity participations) since 1998.

Qualifications and Skills:

Mr. Patton has served in leadership positions in the financial services industry, including as the President and Chief Executive Officer of Virginia First Savings Bank. In this role, he gained leadership, oversight and risk management skills, as well as financial industry and banking operations expertise. Mr. Patton brings these skills to Truist’s Board and its committees, along with the considerable corporate governance and risk management expertise gained from his service on the Truist Board of Directors and its committees.

|

| 2023 Proxy Statement | | 15 |

Proposal 1—Election of Directors

| NIDO R. QUBEIN HIGH POINT, NC |  | DAVID M. RATCLIFFE ATLANTA, GA |

Tenure: • Truist since 1990

Age: 74

Board Committees: • Risk • Technology • Trust—Truist Bank

Public Company Directorship: • La-Z-Boy Incorporated

|

Tenure: • Truist since 2019 • SunTrust director since 2011

Age: 74

Board Committees: • Executive • Nominating and Governance • Risk

| |||||

Professional Experience:

Dr. Qubein has served as President of High Point University since 2005, a period of unprecedented growth for the university. Since 2016, he has served as Executive Chairman of Great Harvest Bread Company after serving as Chairman from 2001 through 2015.

Qualifications and Skills:

Dr. Qubein is an experienced author who has written books on leadership, sales, communication and marketing and provides guidance to organizations on how to position their enterprises and create successful leadership programs. His entrepreneurial ventures and service on more than 30 volunteer boards over the course of his career contribute governance and community service skills and experience to Truist. Dr. Qubein’s extensive leadership and experience in marketing and consumer relationships provide valuable contributions to the Truist Board.

| Professional Experience:

Mr. Ratcliffe retired in December 2010 as Chairman, President and Chief Executive Officer of Southern Company, one of America’s largest producers of electricity, a position he had held since 2004. Mr. Ratcliffe previously served as a member, and lead independent director, of the board of directors of CSX Corporation, a publicly-traded railroad company.

Qualifications and Skills:

Mr. Ratcliffe is our former independent Lead Director and brings his valuable experience in that role to continued service on the Truist Board. Mr. Ratcliffe is a director and former Chief Executive Officer of a highly-regulated, publicly-traded energy company and brings his experience related to environmental initiatives to our Board of Directors. He is also a past Chairman of the Federal Reserve Bank of Atlanta and the Georgia Chamber of Commerce. In addition to these qualifications, Mr. Ratcliffe contributes financial experience and familiarity operating in regulated industries to the Truist Board.

|

| 16 | | 2023 Proxy Statement |

|

Proposal 1—Election of Directors

| WILLIAM H. ROGERS, JR. CHARLOTTE, NC |  | FRANK P. SCRUGGS, JR. BOCA RATON, FL |

Tenure: • Truist since 2019 • SunTrust director since 2011

Age: 65

Board Committees: • Executive (Chair) |

Tenure: • Truist since 2019 • SunTrust director since 2013

Age: 71

Board Committees: • Compensation and Human Capital • Risk • Trust—Truist Bank

| |||||

Professional Experience:

Mr. Rogers has been the Chief Executive Officer of Truist and Truist Bank since September 2021 and has served as Chairman of the Board of Directors since March 12, 2022. Previously, he served as President and Chief Operating Officer of Truist and Truist Bank since December 7, 2019. He is the former Chairman and CEO of SunTrust Banks, Inc. He was named Chairman of SunTrust in 2012 after being elected to the board in 2011 and was named Chief Executive Officer in June 2011.

Qualifications and Skills:

Mr. Rogers has served in a leadership capacity with the Bank Policy Institute and served as the Sixth District representative on the Federal Advisory Council of the Board of Governors of the Federal Reserve System from 2017 through 2019. He is currently serving as the Fifth District representative on the Federal Advisory Council. He is also a board member of the Boys & Girls Clubs of America and Charlotte Center City Partners, and serves as a member of the Emory University Board of Trustees and on the Global Board of Advisors for Operation HOPE, Inc. He is also a member of the Charlotte Executive Leadership Council.

Mr. Rogers contributes to the Truist Board in several ways, including his extensive experience in the financial services industry and expertise in risk management strategy and corporate governance.

| Professional Experience:

Mr. Scruggs currently is a principal at the law firm, Frank Scruggs, P.A. Previously, he served as a partner in the law firm of Berger Singerman LLP from November 2007 through November 2020, where he represented companies and executives in employment law matters and commercial disputes. Prior to joining Berger Singerman, he was an Executive Vice President for Office Depot, Inc. and was a shareholder of the law firm Greenberg Traurig LLC. He also previously served as the Florida Secretary of Labor and Employment Security.

Qualifications and Skills:

Mr. Scruggs’ brings his extensive governmental affairs, legal, and regulatory experience to the Truist Board. Mr. Scruggs received the designation, Board Leadership Fellow, from the National Association of Corporate Directors and the Professional Certificate in Cybersecurity Oversight from the Software Engineering Institute of Carnegie Mellon University. Mr. Scrugg’s breadth of experience and expertise in the regulatory, technology and banking fields have proven valuable to the Truist Board.

|

| 2023 Proxy Statement | | 17 |

Proposal 1—Election of Directors

| CHRISTINE SEARS HARRISBURG, PA |  | THOMAS E. SKAINS CHARLOTTE, NC |

Tenure: • Truist since 2015

Age: 67

Board Committees: • Audit • Compensation and Human Capital |

Tenure: • Truist since 2009

Age: 66

Board Committees: • Executive • Nominating and Governance • Risk

Public Company Directorships: • Duke Energy Corporation • National Fuel Gas Company

| |||||

Professional Experience:

Ms. Sears has served as a director of Pennsylvania National Mutual Casualty Insurance Company (Penn National) since 2002 and served as its Chief Executive Officer from 2015 until retiring in August 2020, and as its President from 2015 until January 2020. Prior to being appointed Penn National’s President and Chief Executive Officer, Ms. Sears served as Penn National’s Executive Vice President and Chief Operating Officer after serving as Penn National’s Chief Financial Officer from 1999 to 2010.

Qualifications and Skills:

Ms. Sears’ leadership experience and deep understanding of the insurance industry is valuable to our Board of Directors as Truist’s insurance operations are our largest source of noninterest income. Ms. Sears is a Certified Public Accountant (CPA), holds the Chartered Property Casualty Underwriter designation from the Institute for Chartered Property Casualty Underwriters, and has completed the Insurance Executive Development Course at the University of Pennsylvania’s Wharton School of Business.

| Professional Experience:

Mr. Skains served as Chairman, President and Chief Executive Officer of Piedmont Natural Gas Company, Inc. from 2003 until its acquisition in October 2016 by Duke Energy Corporation.

Qualifications and Skills:

Mr. Skains is our independent Lead Director and brings extensive leadership and strategic planning skills to Truist through his experience as the Chairman, President and Chief Executive Officer of Piedmont Natural Gas, a major natural gas utility in the Southeast. Mr. Skains also brings a wealth of corporate governance and risk management expertise and knowledge of environmental regulations gained through his former role at Piedmont Natural Gas, and as a director of Duke Energy Corporation and National Fuel Gas Company. His experience in the highly regulated natural gas industry is especially valuable given the high degree of regulation that exists in the financial services industry. The Board of Directors believes that Mr. Skains’ extensive experience provides an effective counterbalance to the non-independent members of the Board and well-qualifies him to serve as our independent Lead Director. Mr. Skains has served on the boards of several prominent civic and business associations, providing him with extensive community relations experience.

|

| 18 | | 2023 Proxy Statement |

|

Proposal 1—Election of Directors

| BRUCE L. TANNER COLLEYVILLE, TX |  | THOMAS N. THOMPSON OWENSBORO, KY |

Tenure: • Truist since 2019 • SunTrust director since 2015

Age: 64

Board Committees: • Audit • Technology • Trust—Truist Bank

Public Company Directorship: • American Tower Corporation

|

Tenure: • Truist since 2008

Age: 74

Board Committees: • Nominating and Governance • Risk

| |||||

Professional Experience:

Mr. Tanner retired in August 2019 as an Executive Vice President and Strategic Advisor for Lockheed Martin Corporation. From 2007 to February 2019, he served as Executive Vice President and Chief Financial Officer for Lockheed Martin. As Chief Financial Officer, he was responsible for all aspects of Lockheed’s financial strategies, processes and operations. He also served as Vice President of Finance and Business Operations at Lockheed Martin Aeronautics, where he was responsible for all business aspects of the company, including financial management, accounting, estimating, contracts and program finance. Mr. Tanner also serves on the board of directors of American Tower Corporation, a publicly-traded real estate investment trust.

Qualifications and Skills:

Mr. Tanner brings a wealth of global financial leadership experience from his tenure at Lockheed Martin, where he led the finance organization through an extended period of significant growth, including numerous acquisitions. His public company experience and expertise in both finance and M&A are instrumental and contribute to the Board’s role in overseeing our operations.

| Professional Experience:

Mr. Thompson has served as President of Thompson Homes, Inc. (a home builder) since 1978 and served as a member of the Kentucky House of Representatives from 2003-2016.

Qualifications and Skills:

Mr. Thompson contributes to Truist his risk management and financial services regulatory experience. He is a former member of the Kentucky legislature and served as the Chairman of the House Banking and Insurance Committee. He provides valuable experience in the banking industry, having served as a former director of AREA Bancshares, a bank holding company based in Kentucky and acquired by Truist in 2002. Mr. Thompson’s experience leading a home builder aids Truist in serving that important industry. Mr. Thompson also brings governance and community service skills and experience to the Truist Board, having served as a director of various educational and community organizations.

|

| 2023 Proxy Statement | | 19 |

Proposal 1—Election of Directors

| STEVEN C. VOORHEES JACKSONVILLE BEACH, FL |

|

Tenure: • Truist since 2019 • SunTrust director since 2018

Age: 68

Board Committees: • Audit • Compensation and Human Capital (Chair) • Executive

|

| |||||

Professional Experience:

Prior to his retirement in March 2021, Mr. Voorhees served as the President and Chief Executive Officer and as a director of WestRock Company, an international provider of paper and packaging solutions. Before being named to his role at WestRock, he served as the Chief Executive Officer and as a director of a predecessor entity, RockTenn Company. Before joining Rock-Tenn, he served in various operations and executive roles at Sonat, Inc., a diversified energy company.

Qualifications and Skills:

Mr. Voorhees has extensive business experience that he adds to the Truist Board. In addition, he has broad executive and financial experience, including having served as a director, chief executive officer and chief financial officer of a large, publicly-traded company. His more than 20 years of experience with growing a company and M&A lends to his continued contributions to the Board of Truist. Mr. Voorhees is a trustee of the University of Virginia Darden School Foundation and a director of 3DE by Junior Achievement.

|

|

| 20 | | 2023 Proxy Statement |

|

Proposal 1—Election of Directors

Standing Board Committee Membership and Lead Director Responsibilities

Pursuant to Truist’s Corporate Governance Guidelines, directors are expected to attend the Board meetings, the meetings of the Board committees on which they serve, and the annual meeting of shareholders. All of our directors attended the 2022 annual meeting of shareholders.

The table below shows director membership on each of our six standing committees as of the date of this proxy statement: Audit; Compensation and Human Capital; Executive; Nominating and Governance; Risk; and Technology. The charter for each of these committees is accessible on our website at https://ir.truist.com/Board-Committees, but these charters are not incorporated into this proxy statement by reference. The table also includes the members of the Trust Committee of our principal banking subsidiary, Truist Bank.

Each Board member attended more than 75% of the aggregate number of Board meetings, and meetings of the committees on which he or she served, during his or her tenure in 2022. Our Board members also attend Board development sessions in addition to other Truist events throughout the year. During 2022, the full Board of Directors held ten meetings.

We anticipate that the Board standing committees will perform additional duties that are not specifically set out in their respective charters as may be necessary or advisable in order for us to comply with certain laws, regulations or corporate governance standards. The following pages provide detail on the responsibilities of our independent Lead Director and each standing committee, including the current members, the principal functions and the number of meetings held in 2022.

| Director | Audit Committee |

Compensation | Executive Committee | Nominating and Governance Committee | Risk Committee | Technology Committee | Trust Committee1 | |||||||||||||||||||||||||

Jennifer S. Banner | ✓ | ✓ | ||||||||||||||||||||||||||||||

K. David Boyer, Jr. | ✓ | ✓ | ✓ | Chair | ||||||||||||||||||||||||||||

Agnes Bundy Scanlan | ✓ | Chair | ✓ | ✓ | ||||||||||||||||||||||||||||

Anna R. Cablik | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Dallas S. Clement | Chair | ✓ | ✓ | |||||||||||||||||||||||||||||

Paul D. Donahue | ✓ | ✓ | ||||||||||||||||||||||||||||||

Patrick C. Graney III | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Linnie M. Haynesworth | ✓ | ✓ | ||||||||||||||||||||||||||||||

Kelly S. King | ✓ | ✓ | ||||||||||||||||||||||||||||||

Easter A. Maynard | ✓ | ✓ | ||||||||||||||||||||||||||||||

Donna S. Morea | ✓ | ✓ | Chair | |||||||||||||||||||||||||||||

Charles A. Patton | ✓ | ✓ | Chair | |||||||||||||||||||||||||||||

Nido R. Qubein | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

David M. Ratcliffe | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

William H. Rogers, Jr. | Chair | |||||||||||||||||||||||||||||||

Frank P. Scruggs, Jr. | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Christine Sears | ✓ | ✓ | ||||||||||||||||||||||||||||||

Thomas E. Skains2 | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Bruce L. Tanner | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Thomas N. Thompson | ✓ | ✓ | ||||||||||||||||||||||||||||||

Steven C. Voorhees | ✓ | Chair | ✓ | |||||||||||||||||||||||||||||

1 The Trust Committee is a committee of the Board of Directors of Truist Bank.

2 Independent Lead Director.

| 2023 Proxy Statement | | 21 |

Proposal 1—Election of Directors

Independent Lead Director

Thomas E. Skains |

Key Responsibilities

| |

• Assists the Chairman and other Board members in ensuring effective governance in overseeing the direction and management of Truist.

• Convenes, sets the agenda for, and chairs executive sessions of the non-management directors following each regularly scheduled Board meeting.

• Presides at all Board meetings at which the Chairman is not present (including executive sessions).

• Takes responsibility for feedback and engagement with the Chief Executive Officer on executive sessions.

• Has the authority to call and preside over meetings of the independent directors.

• Leads the Board’s annual review and evaluation of Truist’s Executive Leadership succession plan.

• Acts as Chairman in the event the current Chairman is unable to continue his responsibilities until a successor Chairman can be elected by the Board.

• Collaborates with the Chairman and Chief Executive Officer in developing the agenda for meetings of the Board and approves such agendas.

• Solicits the non-management directors for advice on agenda items for meetings of the Board.

• Consults with the Chairman and Chief Executive Officer on, and approves, information that is sent to the Board in preparation for and at Board meetings.

• Collaborates with the Chairman and Chief Executive Officer and the chairs of the standing committees in developing and managing the schedule of meetings of the Board and approves all Board and committee meeting schedules.

• Facilitates teamwork and communication among the independent directors and the Chairman and Chief Executive Officer.

• If requested by major shareholders, ensures that he is reasonably available for consultation and direct communication. |

Audit Committee

Dallas S. Clement Chair

13 Meetings in 2022

Committee Members:

Jennifer S. Banner K. David Boyer, Jr. Dallas S. Clement Patrick C. Graney III Easter A. Maynard Christine Sears Bruce L. Tanner Steven C. Voorhees |

Key Committee Responsibilities:

| |

| ||

• Assists the Board in its oversight of the integrity of our financial statements and disclosures.

• Responsible for the appointment, compensation, retention and oversight of the work of the independent auditor for the purpose of preparing or issuing an audit report or performing other audit, review or attest services.

• Preapproves all auditing services and permitted non-audit services to be performed by the independent auditor.

• Assists in oversight of Truist’s internal control processes.

• Monitors financial risks and exposures and reviews with management and the auditors the steps management has taken to monitor, minimize or control such risks or exposures.

• Evaluates the qualifications, performance and independence of the independent auditor, including a review and evaluation of the lead audit partner.

• Oversees Truist’s internal audit function and receives regular reports from the Chief Audit Officer.

• Periodically reviews, recommends changes to, and monitors compliance with the Policy and Procedures for Accounting, Securities and Legal Violations.

• Periodically reviews and discusses with management, Truist’s controls and procedures with respect to environmental, social, and governance data disclosed by Truist, including emissions and other climate-related data.

• Discusses with Truist’s Chief Legal Officer legal matters that may be disclosable or that may have a material impact on Truist. |

| 22 | | 2023 Proxy Statement |

|

Proposal 1—Election of Directors

Compensation and Human Capital Committee

Steven C. Voorhees Chair

10 Meetings in 2022

Committee Members:

Anna R. Cablik Paul D. Donahue Patrick C. Graney III Frank P. Scruggs, Jr. Christine Sears Steven C. Voorhees |

Key Committee Responsibilities:

| |

• Manages the duties of the Board related to executive compensation.

• Reviews and approves a statement of Truist’s compensation philosophy, principles and practices.

• Responsible for oversight and review of our compensation and benefit plans, including administering our executive compensation programs.

• Provides input on human capital strategy for Truist, including diversity, equity and inclusion, and talent management.

• Determines the compensation of the CEO and other members of Executive Leadership.

• Recommends compensation and benefits for directors.

• Engages an independent compensation consultant to make recommendations relating to overall compensation philosophy, the peer group to be used for external comparison purposes, short-term and long-term incentive compensation plans, and related compensation matters.

• Oversees and evaluates the design, administration and risk management of material incentive compensation arrangements and programs and recommends any prudent enhancements.

• Oversees the Company’s strategies and initiatives on employee diversity, equity, and inclusion, teammate engagement and well-being, and human capital metrics and reporting, unless otherwise addressed by the Board. |

Executive Committee

William H. Rogers, Jr. Chair

2 Meetings in 2022

Committee Members:

K. David Boyer, Jr. Agnes Bundy Scanlan Dallas S. Clement Kelly S. King Donna S. Morea Charles A. Patton David M. Ratcliffe William H. Rogers, Jr. Thomas E. Skains Steven C. Voorhees

|

Key Committee Responsibilities:

• Authorized to exercise all powers and authority of the Board in the management of the business and affairs of the Company during the intervals between Board meetings, to the extent permitted by applicable law. | |

| 2023 Proxy Statement | | 23 |

Proposal 1—Election of Directors

Nominating and Governance Committee

Agnes Bundy Scanlan Chair

6 Meetings in 2022

Committee Members:

Agnes Bundy Scanlan Easter A. Maynard Charles A. Patton David M. Ratcliffe Thomas E. Skains Thomas N. Thompson |

Key Committee Responsibilities:

| |

| ||

• Reviews the qualifications and independence of members of the Board and its committees.

• Annually reviews and makes recommendations on the composition and structure of the Board and its committees, including the chair of each committee.

• Identifies and recommends to the Board director nominees for election by shareholders at the annual meeting of shareholders.

• Provides guidance and oversight on corporate governance and related matters, including corporate responsibility and sustainability issues.

• Oversees the annual performance of the Board and its committees.

• Oversees Truist’s emergency CEO succession and continuity planning.

• Oversees and evolves as appropriate the Board Development Program, and any other director orientation and continuing education programs.

• Reviews and monitors compliance with Truist’s Code of Ethics.

• Oversees management’s integration of Truist’s purpose, values and culture with its strategy and objectives.

• Reviews feedback from our shareholder engagement program and oversees our corporate responsibility and sustainability reporting.

• Oversees Truist’s policies, programs, strategies and practices related to environmental, social and humanitarian matters.

• Oversees Truist’s policies and practices related to political contributions and lobbying. |

Risk Committee

Charles A. Patton Chair

12 Meetings in 2022

Committee Members:

Agnes Bundy Scanlan Anna R. Cablik Linnie M. Haynesworth Kelly S. King Donna S. Morea Charles A. Patton Nido R. Qubein David M. Ratcliffe Frank P. Scruggs, Jr. Thomas E. Skains Thomas N. Thompson |

Key Committee Responsibilities:

| |

• Assists the Board in its oversight of Truist’s risk management framework, including the significant policies, programs and plans established by management to identify, measure, monitor, assess, manage, and report on risks arising from Truist’s exposures and business activities.

• Reviews processes for identifying, assessing, monitoring and managing compliance, credit, liquidity, market, operational (including information technology and client information), corporate responsibility and sustainability (including climate change), and reputational and strategic risks.

• Oversees the effectiveness of Truist’s risk management policies and procedures and monitors trends in emerging and ongoing risks.

• Receives periodic reports on, and reviews of, Truist’s risk management framework and risk management programs and their results.

• Discusses with management, including the Chief Risk Officer (who reports directly to this Committee), our major risk exposures and reviews the steps management has taken to identify, monitor and control such exposures.