UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No._____)

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

ROYAL BANCSHARES OF PENNSYLVANIA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing party: |

| | (4) | Date filed: |

April 3, 2012

Dear Shareholders:

In an effort to reduce expenses and fully utilize available technology, we have opted to make our 2012 Annual Meeting materials available to shareholders via the Internet under Securities and Exchange Commission rules that permit distribution of proxy materials in that manner. You have received or will shortly receive a notice regarding availability of the proxy materials on the Corporation’s website at www.royalbankamerica.com under the “Regulatory Filings” heading located on the “Investor Relations” page. The notice also contains voting instructions relating to your shares. As provided in the notice, you may also receive paper or email copies of the proxy materials if you so request in the manner provided in the notice. Requests should be made by May 2, 2012 to facilitate timely delivery.

You are cordially invited to attend the 2012 Annual Meeting of Shareholders of Royal Bancshares of Pennsylvania, Inc. The meeting will be held at the Hilton Hotel Philadelphia, located at 4200 City Avenue, Philadelphia, Pennsylvania 19131, on Wednesday, May 16, 2012, at 10:00 a.m. local time, for the following purposes:

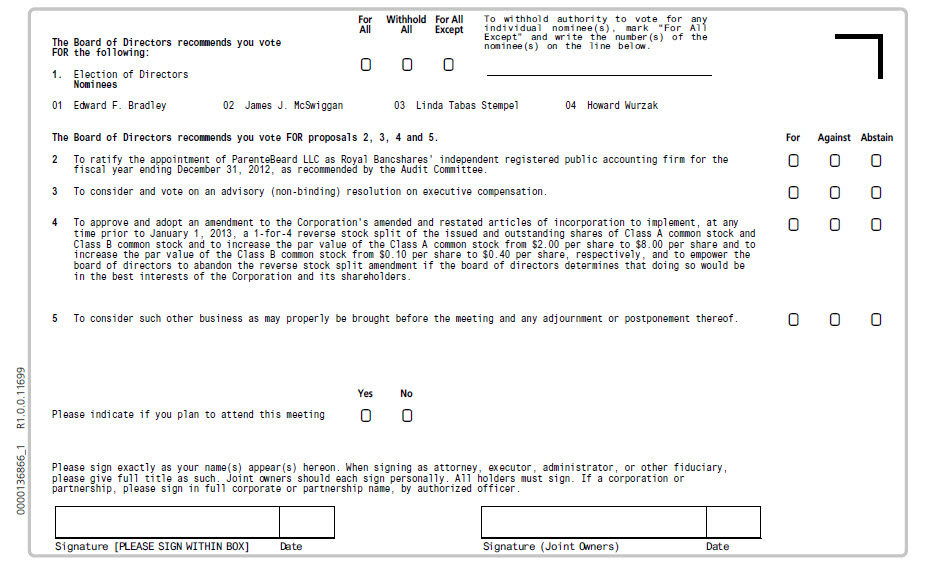

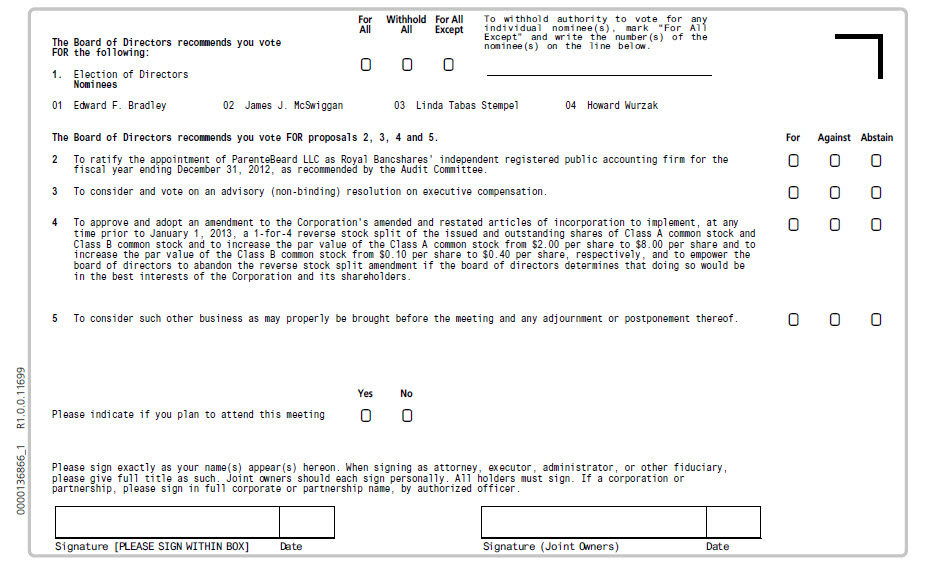

1. To elect the four Class I director nominees of the board of directors to serve a term of three years and until their successors are elected and qualified.

2. To ratify the appointment of ParenteBeard LLC as Royal Bancshares’ independent registered public accounting firm for the fiscal year ending December 31, 2012, as recommended by the Audit Committee.

3. To consider and vote on an advisory (non-binding) resolution to approve executive compensation.

4. To consider and vote on an amendment to the Corporation’s amended and restated articles of incorporation to implement, at any time prior to January 1, 2013, a 1-for-4 reverse stock split of the issued and outstanding shares of Class A common stock and Class B common stock and to increase the par value of the Class A common stock from $2.00 per share to $8.00 per share and to increase the par value of the Class B common stock from $0.10 per share to $0.40 per share, respectively, and to empower the board of directors to abandon the reverse stock split amendment if the board of directors determines that doing so would be in the best interests of the Corporation and its shareholders.

5. To consider such other business as may properly be brought before the meeting and any adjournment or postponement thereof.

Only shareholders of record at the close of business on March 19, 2012, are entitled to notice of and to vote at the meeting, either in person or by proxy. Your vote is important regardless of the number of shares that you own. Please submit your vote either by mail or by person at the meeting. Giving your proxy by mail does not affect your right to vote in person if you attend the meeting. You may revoke your proxy at any time before it is exercised as explained in the proxy statement.

For directions to the Hilton Hotel Philadelphia to attend the meeting, please contact Investor Relations by telephone at (610) 668-4700.

If you plan to attend the meeting in person and your shares are held in the name of a broker or other nominee, please bring with you a letter (and a legal proxy if you wish to vote your shares in person) from the broker or nominee confirming your ownership as of the record date.

Your continued support of and recommendations to Royal Bancshares of Pennsylvania, Inc. are sincerely appreciated.

Very truly yours,

| /s/ Robert R. Tabas |

| Robert R. Tabas |

| Chairman and Chief Executive Officer |

ROYAL BANCSHARES OF PENNSYLVANIA, INC.

732 Montgomery Avenue

Narberth, Pennsylvania 19072

610-668-4700

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| DATE AND TIME: | | Wednesday, May 16, 2012 at 10:00 a.m. local time |

| | | | |

| PLACE: | | Hilton Hotel Philadelphia |

| | | 4200 City Avenue |

| | | Philadelphia, Pennsylvania 19131 |

| | | | |

| ITEMS OF BUSINESS: | | Our annual meeting of shareholders will be held for the following purposes, all of which are more completely set forth in the accompanying Proxy Statement: |

| | | (1) | To elect four (4) Class I director nominees of the board of directors for a three-year term and until their successors are elected and qualified; |

| | | (2) | To ratify appointment of ParenteBeard LLC as independent registered accounting firm for the fiscal year ending December 31, 2012; |

| | | (3) | To consider and vote on an advisory (non-binding) resolution to approve executive compensation; |

| | | (4) | To consider and vote on an amendment to the Corporation’s amended and restated articles of incorporation to implement, at any time prior to January 1, 2013, a 1-for-4 reverse stock split of the issued and outstanding shares of Class A common stock and Class B common stock and to increase the par value of the Class A common stock from $2.00 per share to $8.00 per share and to increase the par value of the Class B common stock from $0.10 per share to $0.40 per share, respectively, and to empower the board of directors to abandon the reverse stock split amendment if the board of directors determines that doing so would be in the best interests of the Corporation and its shareholders; and |

| | | (5) | To transact such other business as may properly come before the meeting or at any adjournment therefore. We are not aware of any other such business. |

| | | | |

| RECORD DATE: | | Our shareholders of record as of close of business on March 19, 2012, the voting record date, are entitled to notice of and to vote at the annual meeting and at any adjournment or postponement of the annual meeting. |

| | | | |

| ANNUAL REPORT: | | The Royal Bancshares 2011 Annual Report to Shareholders is available at our website, www.royalbankamerica.com under the “Regulatory Filings” heading located on the “Investor Relations” page or by mail free of charge, by writing to Investor Relations, Royal Bancshares of Pennsylvania, Inc., 732 Montgomery Avenue, Narberth, Pennsylvania 19072, or by calling Investor Relations directly at (610) 668-4700. Your request should be received by May 2, 2012 to facilitate timely delivery prior to the annual meeting. |

| PROXY VOTING: | | Even if you plan to be present you are urged to complete, sign, date and return the enclosed proxy promptly in the envelope provided. Any proxy given may be revoked by you in writing or in person at any time prior to the exercise of the proxy. |

| | | BY ORDER OF THE BOARD OF DIRECTORS |

| | | |

| | | /s/ George J. McDonough |

| | | George J. McDonough, Secretary |

PROXY STATEMENT

OF

ROYAL BANCSHARES OF PENNSYLVANIA, INC.

We furnish this proxy statement in connection with the solicitation of proxies by the board of directors of Royal Bancshares of Pennsylvania, Inc. (the “Corporation”), for the Annual Meeting of Shareholders of the Corporation to be held on May 16, 2012, and any adjournment or postponement of the meeting. The Corporation will bear the expense of soliciting proxies. Directors, officers and employees of the Corporation may solicit proxies personally or by telephone. To the extent that any proxy materials are distributed by mail, arrangements will be made with brokerage houses and other custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of stock held of record by these persons and, upon request, the Corporation will reimburse them for their reasonable forwarding expenses.

The execution and return of a proxy will not affect your right to attend the meeting and vote in person. You may revoke your proxy by delivering written notice of revocation to George J. McDonough, Secretary of the Corporation, at the Corporation's address at any time before the proxy is voted at the meeting. Unless revoked, the proxy holders will vote your proxy in accordance with your instructions. In the absence of instructions, proxy holders will vote all proxies FOR the election of the four (4) Class I director nominees of the board of directors, FOR the appointment of ParenteBeard LLC as independent registered public accounting firm for the fiscal year ending December 31, 2012, FOR the vote on an advisory (non-binding) resolution to approve executive compensation and FOR the 1-for-4 reverse stock split.

Although the board of directors knows of no other business to be presented, in the event that any other matters are brought before the meeting, proxy holders will vote any proxy in accordance with the recommendations of the board of directors of the Corporation.

Shareholders of record at the close of business on March 19, 2012, are entitled to vote at the meeting and any adjournment or postponement of the meeting. On the record date, there were 10,864,008 shares of Class A common stock ($2.00 par value per share), issued and outstanding, and 2,080,574 shares of Class B common stock ($0.10 par value per share), issued and outstanding.

Each shareholder is entitled to one vote for each share of Class A common stock and ten votes for each share of Class B common stock on all matters to be acted upon at the meeting, except that in the election of directors, shareholders are entitled to vote their shares cumulatively. See “ELECTION OF DIRECTORS -- CUMULATIVE VOTING.”

The presence, in person or by proxy, of the holders of a majority of the aggregating power of the Class A common stock and Class B common stock entitled to vote constitutes a quorum for the conduct of business. A majority of the votes cast at a meeting, at which a quorum is present, is required to approve any matter submitted to a vote of the shareholders, except in cases where the vote of a greater number of votes is required by law or under the Articles of Incorporation or Bylaws of the Corporation. For purposes of determining the presence or absence of a quorum, we intend to count as present shares present in person but not voting and shares for which we have received proxies but for which holders thereof have abstained. Furthermore, shares represented by proxies returned by a broker holding the shares in nominee or “street” name will be counted as present for purposes of determining whether a quorum is present, even if the shares are not entitled to be voted on matters where discretionary voting by the broker is not allowed (“broker non-votes”). The only matter for which your broker will have discretionary authority to vote your shares will be the ratification of the appointment of our independent registered public accounting firm. You may not vote your shares held by a broker in nominee or “street” name at the Annual Meeting unless you obtain a legal proxy from your broker or holder of record.

In the case of the election of directors, assuming the presence of a quorum, the four (4) candidates receiving the highest number of votes for Class I Director shall be elected to the board of directors. A “Withhold” vote for all or any one Class I Director, will not affect the outcome of the election of the Class I Directors. In the case of the ratification of the appointment of ParenteBeard LLC as independent registered public accounting firm and the advisory (non-binding) resolution on executive compensation, assuming the presence of a quorum, the affirmative vote of a majority of the votes cast at the meeting will be required for approval. In the case of the approval and adoption of the reverse stock split, assuming the presence of a quorum, the affirmative vote of a majority of the votes cast at the meeting by all holders of Class A and Class B common stock in the aggregate is required for shareholders to approve and adopt the proposed reverse stock split amendment. Under Pennsylvania law, abstentions and broker non-votes will not affect the outcome of any of the matters being voted on at the meeting.

The following table shows as of February 29, 2012, the amount of outstanding common stock beneficially owned by each shareholder (including any “group” as the term is used in Section 3(d)(3) of the Securities Exchange Act of 1934) known by the Corporation to be the beneficial owner of more than 5% of such stock. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to ten votes per share and may be converted into shares of Class A common stock at the current rate of 1.15 shares of Class A common stock for each share of Class B common stock. Beneficial ownership is determined in accordance with applicable regulations of the Securities and Exchange Commission and the information is not necessarily indicative of beneficial ownership for any other purpose. For purposes of the table set forth below and the table subsequent to “Information about Nominees, Continuing Directors and Executive Officers,” beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and any shares that the individual has the right to acquire within 60 days of February 29, 2012. In addition, a person is deemed to beneficially own any stock for which he, directly or indirectly, through any contact, arrangement, understanding, relationship or otherwise has or shares voting or investment power.

Unless otherwise indicated in a footnote, shares reported in this table are owned directly by the reporting person. The percent of class assumes all options exercisable within 60 days of February 29, 2012, have been exercised and, therefore, on a pro forma basis, 11,133,026 shares of Class A common stock would be outstanding, net of treasury stock.

| | | Class A Shares | | | Class B Shares | |

| Name and Address of | | Beneficially | | | Percent of | | | Beneficially | | | Percent of | |

| Beneficial Owner | | Owned | | | Class | | | Owned | | | Class | |

| | | | | | | | | | | | | |

Daniel M. Tabas, Trust (1) 915 Montgomery Avenue Narberth, PA 19072 | | | - | | | | 0.00 | % | | | 1,120,779 | | | | 53.87 | % |

| | | | | | | | | | | | | | | | | |

Evelyn R. Tabas (2) (3) 543 Mulberry Lane Narberth, PA 19072 | | | 1,573,679 | | | | 14.14 | % | | | 485,011 | | | | 23.31 | % |

| | | | | | | | | | | | | | | | | |

Lee Evan Tabas (4) 355 W. Lancaster Avenue Haverford, PA 19041 | | | 1,086,115 | | | | 9.76 | % | | | 64,805 | | | | 3.11 | % |

| | | | | | | | | | | | | | | | | |

Carol Tabas (5) 39 Rosemont Lane Pittsburgh, PA 15217 | | | 641,601 | | | | 5.76 | % | | | - | | | | 0.00 | % |

| | | | | | | | | | | | | | | | | |

Susan Tabas Tepper (6) 717 Eagle Farm Road Villanova, PA 19085 | | | 604,995 | | | | 5.43 | % | | | - | | | | 0.00 | % |

| | | | | | | | | | | | | | | | | |

Richard Tabas 1443 Lanes End Villanova, PA 19085 | | | - | | | | 0.00 | % | | | 124,995 | | | | 6.01 | % |

| | (1) | The trustees for the Daniel M. Tabas Trust are, Robert R. Tabas, Linda Tabas Stempel and Nicholas Randazzo, who as a group have voting rights and dispositive control of these shares. |

| | (2) | The shares beneficially owned by Evelyn R. Tabas consist of: (a) 17,867 shares of Class A common stock owned and voted solely by Evelyn R. Tabas and 8,208 options currently exercisable to purchase shares of Class A common stock, (b) 284,564 Class A and 84,857 Class B shares in the Lee Tabas Trust, (c) 265,277 Class A and 82,647 Class B shares in the Susan Tabas Tepper Trust, (d) 249,650 Class A and 82,919 Class B shares in the Linda Tabas Stempel Trust, (e) 239,947 Class A and 76,336 Class B shares in the Joanne Tabas Wurzak Trust, (f) 219,074 Class A and 82,041 Class B shares in the Carol Tabas Stofman Trust, and (g) 207,409 Class A and 76,180 Class B shares in the Robert R. Tabas Trust. |

| | (3) | Evelyn R. Tabas has sole power to vote and dispose of 81,683 shares of Class A common stock and 31 shares Class B common stock from numerous custodial accounts and a trust for the Tabas grandchildren. |

| | (4) | Based on a Schedule 13D filing on November 26, 2008, the shares beneficially owned by Lee Evan Tabas consist of: (a) 604,995 Class A shares acquired pursuant to the 2008 Irrevocable Agreement of Trust for the Family of Lee E. Tabas from Evelyn R. Tabas of which he has sole voting power and dispositive power subject to the terms of the trust agreement; (b) 5,177 Class A and 58,887 Class B shares held by his wife, Nancy Freeman Tabas in her name over which she holds voting and dispositive power; (c) 282,461 Class A shares held by Lee Evan Tabas and Nancy Freeman Tabas as joint tenants in common; and (d) 193,482 Class A and 5,918 Class B shares owned collectively by the Samuel Bradford Tabas Trust, the Elizabeth Rebecca Tabas Trust, the Theodore Herschel Tabas Trust and the Melissa Tamara Tabas Trust. Samuel, Elizabeth, Theodore, and Melissa are the adult children of Lee and Nancy Tabas. Lee and Nancy Tabas share voting and dispositive power over the shares they hold jointly and for the shares held in the trusts in the names of their adult children. Lee Tabas disclaims beneficial interest in, and therefore the table does not include, 284,564 Class A and 84,857 Class B shares held in the Lee Evan Tabas Trust since he does not have voting or dispositive power over the shares. |

| | (5) | The shares beneficially owned by Carol Tabas consist of 604,995 Class A shares acquired pursuant to the 2008 Irrevocable Agreement of Trust for Carol Tabas from Evelyn R. Tabas of which she has sole voting and dispositive power subject to the terms of the trust agreement and 36,606 Class A shares in the Lily Ashley Stofman Trust of which she has sole voting power. |

| | (6) | The shares beneficially owned by Susan Tabas Tepper consist of 604,995 Class A shares acquired pursuant to the 2008 Irrevocable Agreement of Trust for Susan Tabas Tepper from Evelyn R. Tabas of which she has sole voting and dispositive power subject to the terms of the trust agreement. |

ELECTION OF DIRECTORS

The Bylaws of the Corporation provide that the board of directors shall consist of not less than five and not more than 25 persons. The directors are classified with respect to the time they hold office by dividing them into three classes, as nearly equal in number as possible. The Bylaws further provide that the directors of each class are elected for a 3-year term, so that the term of office of one class of directors expires at the annual meeting each year. The Bylaws also provide that the aggregate number of directors and the number of directors in each class of directors is determined by the board of directors. Any vacancy occurring on the board of directors is filled by appointment by the remaining directors. Any director who is appointed to fill a vacancy holds office until the expiration of the term of office of the class of directors to which he or she was appointed. In March 2012, Director Anthony J. Micale resigned as a Class II director and was re-appointed as a Class III director in order to maintain the number of directors in each Class as nearly equal as possible in accordance with Pennsylvania law following the resignation of Jay H. Shah in March of 2012. As required by our Bylaws, a director of the Corporation is no longer eligible to serve as a director of the Corporation and is required to resign effective as of the last day of the calendar year in which the director attains age seventy-five (75).

There are presently twelve members of the board of directors. The Corporation’s board of directors, in accordance with Article 10 of the Corporation’s Bylaws, has fixed the number of directors in Class I at four and in each of Classes II and III at three. Additionally, there are two directors on the board of directors who have been appointed by the United States Department of Treasury (“Treasury”) in accordance with the terms of the Corporation’s outstanding Series A Fixed Rate Perpetual Preferred Stock (“Series A Preferred Stock”) and are not deemed to be members of any Class. The board of directors has affirmatively determined that Edward F. Bradley, William R. Hartman, Wayne Huey, Jr., Anthony J. Micale, Michael J. Piracci, Edward B. Tepper and Gerard M. Thomchick are independent within the meaning of the NASDAQ listing standards. In addition, all members of the board of directors serving on the Audit and Compensation Committees are independent within the meaning of the NASDAQ listing standards applicable to each committee. The board of directors determined that the following directors are not independent within the meaning of the NASDAQ listing standards: James J. McSwiggan, President and Chief Operating Officer of the Corporation, Linda Tabas Stempel, Murray Stempel, III, Vice Chairman of Royal Bank America, Robert R. Tabas, Chairman of the Board and Chief Executive Officer of the Corporation, and Howard Wurzak, President and Chief Executive Officer of Wurzak Management Corporation. Due to an exemption as a “Controlled Company” under NASDAQ Rules, we are not required to meet certain NASDAQ independence standards for our Board of Directors. NASDAQ Rules define a “Controlled Company” as one in which more than 50% of the voting power is held by an individual, group or another company. As shown in the above stock ownership table, through its ownership of Class A and Class B common stock, the Daniel Tabas Trust and Evelyn R. Tabas control more than 50% of the voting power of the Corporation. For more information regarding the familial relationships and the transactions considered, see “INFORMATION ABOUT NOMINEES, CONTINUING DIRECTORS AND EXECUTIVE OFFICERS” and “INTERESTS OF MANAGEMENT AND CERTAIN OTHERS IN CERTAIN TRANSACTIONS”.

The board of directors has determined that a lending relationship resulting from a loan made by the Corporation’s wholly owned banking subsidiary, Royal Bank America, to a director would not affect the determination of independence if the loan complies with Regulation O under the federal banking laws. The board of directors also determined that maintaining with the Corporation’s wholly owned banking subsidiary a deposit, savings or similar account by a director or any of the director’s affiliates would not affect the determination of independence if the account is maintained on the same terms and conditions as those available to similarly situated customers. Additional categories or types of transactions or relationships considered by the board of directors regarding director independence include, but are not limited to: family relationships, existing significant consulting relationships, an existing commercial relationship between the director’s organization and the Corporation, or new business relationships that develop through board membership.

The independent directors meet regularly in executive session without management present.

The board of directors has nominated four existing Class I directors for election as Class I directors for a term of three years. The four nominees of the board of directors for election as Class I directors are:

Edward F. Bradley James J. McSwiggan Linda Tabas Stempel Howard Wurzak

In the election of directors, every shareholder entitled to vote has the right, in person or by proxy, to multiply the number of votes to which he may be entitled by the number of directors in the class to be elected at the annual meeting. Every shareholder may cast his or her whole number of votes for one candidate or may distribute them among any two or more candidates in the class. The four candidates receiving the highest number of votes for Class I director at the meeting will be elected. There are no conditions precedent to the exercise of cumulative voting rights. Robert R. Tabas and George J. McDonough, the persons named as the board of directors’ proxy holders, have the right to vote cumulatively and to distribute their votes among the nominees as they consider advisable, unless a shareholder indicates on his or her proxy how votes are to be cumulated for voting purposes.

Information concerning the directors of the Corporation, including the four persons nominated for election to the board of directors as Class I directors at the meeting, the eight continuing directors and the executive officers of the Corporation and all directors and officers as a group, is set forth in the following table, including the number of shares of common stock of the Corporation beneficially owned, as of February 29, 2012, by each of them. The table includes options exercisable within 60 days of February 29, 2012, stock options unexercised but currently exercisable, and stock beneficially owned. Unless otherwise indicated in a footnote, shares reported in this table are owned directly by the reporting person and such person holds sole voting and investment power with respect to such shares. The percent of class assumes all options exercisable within 60 days of February 29, 2012, have been exercised and, therefore, on a pro forma basis, 11,133,026 shares of Class A common Stock would be outstanding. The information is furnished as of February 29, 2012, on which 2,080,574 Class B shares were issued and outstanding.

| | | | | | | | | Class A Shares | | | Class B Shares | |

| | | | | | Director | | | Beneficially | | | Percent of | | | Beneficially | | | Percent of | |

| Name | | Age | | | Since | | | Owned | | | Class | | | Owned | | | Class | |

| | | | | | | | | | | | | | | | | | | |

| Class I Directors | | | | | | | | | | | | | | | | | | |

| Edward F. Bradley | | | 68 | | | | 2008 | | | | 20,000 | | | | 0.18 | % | | | - | | | | 0.00 | % |

| James J. McSwiggan (1) | | | 56 | | | | 1992 | | | | 121,252 | | | | 1.09 | % | | | - | | | | 0.00 | % |

| Linda Tabas Stempel (2) (3) (4) (5) | | | 60 | | | | 2003 | | | | 688,030 | | | | 6.18 | % | | | - | | | | 0.00 | % |

| Howard Wurzak (3) | | | 57 | | | | 1992 | | | | 710,229 | | | | 6.38 | % | | | - | | | | 0.00 | % |

| Class II Director Nominees | | | | | | | | | | | | | | | | | | | | | | | | |

| William R. Hartman | | | 63 | | | | 2011 | | | | 5,000 | | | | 0.04 | % | | | - | | | | 0.00 | % |

| Murray Stempel, III (3) (5) | | | 57 | | | | 1997 | | | | 734,552 | | | | 6.60 | % | | | - | | | | 0.00 | % |

| Robert R. Tabas (2) (3) (6) | | | 56 | | | | 1988 | | | | 736,390 | | | | 6.61 | % | | | 6,503 | | | | 0.31 | % |

| Class III Directors | | | | | | | | | | | | | | | | | | | | | | | | |

| Anthony J. Micale | | | 74 | | | | 1997 | | | | 27,531 | | | | 0.25 | % | | | - | | | | 0.00 | % |

| Michael J. Piracci | | | 66 | | | | 2010 | | | | - | | | | 0.00 | % | | | - | | | | 0.00 | % |

| Edward B. Tepper | | | 73 | | | | 1986 | | | | 41,171 | | | | 0.37 | % | | | 13 | | | | 0.00 | % |

| Other Directors (7) | | | | | | | | | | | | | | | | | | | | | | | | |

| Wayne R. Huey, Jr. | | | 67 | | | | 2011 | | | | 10,000 | | | | 0.09 | % | | | - | | | | | |

| Gerard M. Thomchick | | | 56 | | | | 2011 | | | | - | | | | 0.00 | % | | | - | | | | 0.00 | % |

| Non-Director Executive Officer | | | | | | | | | | | | | | | | | | | | | | | | |

| Robert A. Kuehl (8) | | | 63 | | | | N/A | | | | 6,900 | | | | 0.06 | % | | | - | | | | 0.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

All directors and executive officers as a group (13 persons) and Daniel M. Tabas Trust (9) | | | | | | | | | | | 2,421,094 | | | | 21.75 | % | | | 1,127,295 | | | | 54.18 | % |

| | (1) | James J. McSwiggan shares with Evelyn R. Tabas and Nicholas Randazzo voting and dispositive control over 1,200,644 shares of Class A common stock and 402,333 shares of Class B common stock held in various Tabas family trusts. These shares are not included in the ownership reported in this table for Mr. McSwiggan. (See footnote (2) on page 3). |

| | (2) | Linda Tabas Stempel, Robert R. Tabas and Nicholas Randazzo share voting and dispositive control over 1,120,779 shares of Class B common stock held in the Daniel M. Tabas Trust. These shares are not included in the share ownership reported in this table for Ms. Stempel or for Mr. Tabas (See footnote (1) on page 3). |

| | (3) | Robert R. Tabas, Murray Stempel, III, Linda Tabas Stempel, Howard Wurzak and members of their immediate families and their affiliates, in the aggregate, own 2,203,286 shares of Class A common stock (19.79% of Class A) and 1,127,282 shares of Class B common stock (54.18% of Class B) or 25.87% of Class A assuming the full conversion of Class B common stock at a current conversion rate of 1.15 shares of Class A common stock for each share of Class B common stock. |

| | (4) | Ms. Stempel disclaims beneficial interest in, and therefore the amount in the table above does not include, 249,650 Class A and 82,919 Class B shares held in the Linda Tabas Stempel Trust since she does not have voting or dispositive power over the shares. |

| | (5) | Linda Tabas Stempel and Murray Stempel, III are married. |

| | (6) | Mr. Tabas disclaims beneficial interest in, and therefore the amount in the table above does not include, 207,409 Class A shares and 76,180 Class B shares held in the Robert Tabas Trust since he does not have voting or dispositive power over the shares. |

| | (7) | As a result of the Company missing the sixth quarterly dividend payment in November of 2010, the Treasury Department exercised its rights under the TARP Capital Purchase Program agreement and appointed two directors to the board of directors. Under the terms of the Series A Preferred Stock instrument issued to Treasury, these directors will serve as directors at a minimum until all accrued and unpaid dividends have been paid in full by the Company. |

| | (8) | Mr. Kuehl was employed as the Corporation’s Chief Financial Officer in October 2008. Prior thereto during the past five years, he served as Chief Financial Officer of Parke Bancorp, Inc. in New Jersey and provided independent financial consulting services. |

| | (9) | The number of shares included in total for directors, officers and the Daniel Tabas Trust has been reduced by 668,687 shares to eliminate the same shares beneficially held by both Linda Tabas Stempel and her husband, Murray Stempel, III. |

The information in the preceding table was furnished by the beneficial owners or their representatives and includes direct and indirect ownership.

For purposes of determining beneficial ownership of Class A common stock, we have assumed full conversion of Class B common stock to Class A common stock at the current conversion factor of 1.15 shares of Class A common stock for each share of Class B common stock.

Set forth below as to each of the nominees for election as a Class I director and as to each of the continuing Class II and Class III directors, are descriptions of his or her principal occupation and business experience for the past five years, and where applicable, family relationships between each such person and the Corporation’s other directors and officers. In addition, we briefly describe the particular experience, qualifications, attributes or skills that led our board of directors to conclude that such director or nominee should serve as a director of the Corporation.

CLASS I DIRECTORS – DIRECTOR NOMINEES

Edward F. Bradley, CPA, is a Director of the Corporation, and is currently a professor at Philadelphia University. He was previously a partner at Grant Thornton, a public accounting firm in Philadelphia, Pennsylvania. Mr. Bradley’s many years of experience in public accounting, particularly in auditing financial institutions, is beneficial to the operations of the Corporation’s Audit Committee and his role as the Audit Committee’s Chairperson and financial expert.

James J. McSwiggan is the President and Chief Operating Officer of the Corporation since December 31, 2008 (and, prior thereto, Chief Operating Officer) and a Director of the Corporation. For the board of directors to run efficiently and effectively, we believe that having the President and Chief Operating Officer as a member of the Board of Directors is necessary and assists the board of directors in keeping current on management’s progress on corporate initiatives and in providing oversight of the Corporation’s operations.

Linda Tabas Stempel is a Director of the Corporation, and was previously Director of Investor Relations for the Corporation. She is the wife of Murray Stempel, III, the sister of Robert R. Tabas and the sister-in-law of Howard Wurzak. Her previous role as Director of Investor Relations provides assistance and expertise to the board of directors in managing shareholder communications. Additionally, her past experience as a licensed securities broker is beneficial to the investment committee of which Mrs. Stempel is a member.

Howard Wurzak is a Director of the Corporation, and is President and CEO of the Hilton Hotel Philadelphia, Westin Hotel and JCB Management, LLC. He is the son-in-law of Evelyn R. Tabas, and the brother-in-law of Robert R. Tabas, Murray Stempel, III and Linda Tabas Stempel. Mr. Wurzak’s real estate development expertise and ability to manage large organizations demonstrates that he possesses the knowledge regarding the industries we serve and the management skills that we value in the members of our board of directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE CLASS I DIRECTOR NOMINEES.

CLASS II DIRECTORS – TERMS EXPIRING IN 2013

William R. Hartman is the lead independent Director of the Corporation, and was previously Chairman of the Board of Citizens Republic Bancorp in 2009, a regional diversified financial services company in Flint, Michigan, and prior thereto was Chairman, President and Chief Executive Officer. Prior to that he was Chairman, President and CEO for two subsidiaries of Banc One Corporation, which was one of the largest regional banks in the United States. He previously held executive positions within other regional and community banks with significant experience in commercial lending. He has served as President and CEO of York County Community Foundation since 2009 and has served as a trustee, executive committee member, chairman of the finance and audit committee and as vice chairman of the board of Kettering University and was formerly a director of the Detroit Branch of the Federal Reserve Bank of Chicago. Mr. Hartman’s prior leadership and lending experience in consumer and commercial banking in much larger financial institutions provides invaluable skills important for the board of directors’ oversight of lending, corporate governance and strategic planning.

Murray Stempel, III is Vice Chairman of the Corporation since December 2008 (and, prior thereto, Executive Vice President of the Corporation and Royal Bank America) and a Director of the Corporation. Mr. Stempel is the husband of Linda Tabas Stempel and the brother-in-law of Robert R. Tabas and Howard Wurzak. From 2004 until 2008, he served as Executive Vice President and Chief Lending Officer at Royal Bank America. Mr. Stempel, is a member of the board of trustees of RAIT Financial Trust (“RAIT”), a publicly traded, self-managed and self-advised real estate investment trust since December 2006 and is Chairman of their Nominating and Governance Committee. RAIT offers a set of debt financing options to the commercial real estate industry, fixed income trading and advisory services, owns and manages a portfolio of commercial real estate properties, and manages real estate-related assets for third parties. Mr. Stempel’s knowledge of Royal Bank America’s lending practices and of commercial real estate investments generally, which remain a substantial portion of the Bank’s loan portfolio, are important to the board of directors’ oversight of the Bank’s lending relationships.

Robert R. Tabas is the Chairman of the Board and Chief Executive Officer since December 2008 (and prior thereto, Chairman of the Corporation and Executive Vice President of Royal Bank America) and a Director of the Corporation; and is the Chairman and Chief Executive Officer of Royal Bank America. He is the brother of Linda Tabas Stempel and the brother-in-law of Howard Wurzak and Murray Stempel, III. For the board of directors to run efficiently and effectively, we believe that Mr. Tabas’ participation on the board of directors is necessary and assists the board of directors in overseeing management’s progress on corporate initiatives and strategic plans, given his previous experience within the Corporation and his role as Chief Executive Officer.

CLASS III DIRECTORS- TERMS EXPIRING IN 2014

Anthony J. Micale is a Director of the Corporation, is President of Micale Management Corporation and owns and operates six McDonald’s franchise restaurants. Mr. Micale’s ability to manage and operate a large franchise operation demonstrates that he possesses the oversight and management skills valuable to our board of directors.

Michael J. Piracci is a Director of the Corporation and is currently President of M. Piracci Consulting, Inc, an independent consulting company providing consulting services to financial institutions primarily related to banking regulations. He was previously the Assistant Regional Director of the New York Office of the FDIC and was an examiner for many years. He also serves on the board of directors for Quontic Bank in Great Neck, New York. Mr. Piracci’s prior experience as an examiner, manager and Assistant Regional Director of the FDIC is important for the board of directors’ oversight in dealing with the regulatory orders, banking regulations and banking operations.

Edward B. Tepper is a Director of the Corporation and the President of Tepper Properties, a real estate investment company in Villanova, Pennsylvania. Because real estate lending relationships are an important part of the Corporation’s business, Mr. Tepper’s experience in real estate investing in the primary region in which the Corporation operates is important for the board of directors’ oversight of lending practices and the development of future lending relationships for the Corporation’s banking subsidiaries.

OTHER DIRECTORS- (APPOINTED BY TREASURY)

Pursuant to the terms of the Corporation’s outstanding Series A Preferred Stock issued to the Treasury on February 18, 2009 in connection with the Corporation’s participation in the TARP Capital Purchase Program, Treasury had the right to appoint up to two directors to the board of directors at any time that dividends payable on the Series A Preferred Stock had not been paid for an aggregate of six quarterly dividend periods. The terms of the Series A Preferred Stock provide that Treasury will retain the right to appoint such directors at subsequent annual meetings of shareholders until all accrued and unpaid dividends for all past dividend periods have been paid. Treasury appointed Gerard M. Thomchick and Wayne R. Huey, Jr. as members of the board of directors in July 2011 and September 2011, respectively.

Wayne R. Huey, Jr. is a Director of the Corporation, and was previously Executive Vice President of Montgomery Chemicals, a regional chemical manufacturer and supplier to specialty industries, and prior thereto was Senior Vice President of Private Banking at Nova Savings Bank, a local community bank from 2004 until 2005. From 1998 until 2004 he was Vice Chairman and Managing Director of Millennium Bank, a community bank that was merged into Harleysville National Corporation. He was also employed as an Executive Vice President by CoreStates Bank and Meridian Bancorp. He previously held executive positions within other community banks with significant experience in retail banking, administration, commercial lending and marketing. He is currently a board member, capital campaign co-chair and member of the executive committee of Paoli Memorial Hospital Foundation. Mr. Huey’s prior leadership and banking experience in community banks and larger financial institutions provides critical skills required for the board of directors’ oversight of retail banking, lending, and corporate governance.

Gerard M. Thomchick is a Director of the Corporation and is currently President of GMT, LLC, a consulting company. Previously he was Chief Operating Officer and Senior Executive Vice President of First Commonwealth Financial Corporation, a regional financial services company in western Pennsylvania from 2005-2007 and was President and CEO of First Commonwealth Bank, a regional bank and subsidiary of the Corporation from 2000 to 2009. Previously he held other executive positions at both the Corporation and the subsidiary Bank. He has served the community during his career in various civic activities including Rotary President. He was previously a board member of the FHLB in Pittsburgh and was acting Chief Risk Officer and Chairman of the Credit Committee for the FHLB in 2009. He was also a member of the American Bankers Executive Council and served on the Financial Services Roundtable. His prior leadership and banking experience in community banks and larger financial institutions provides critical skills required for the board of directors’ oversight of mergers and acquisitions, commercial lending, strategic planning, risk management, and treasury and investment management.

The committees of the board of directors include the Audit Committee, the Compensation Committee, the Nominating and Governance Committee, and the Salary Committee.

The Audit Committee met five times in 2011. The Audit Committee arranges examinations by the Corporation's independent registered public accounting firm, reviews and evaluates the recommendations of the examinations, receives all reports of examination of the Corporation and the Banks by regulatory agencies, analyzes such reports and reports the results of its analysis of the regulatory reports to the Corporation's board of directors. The committee receives reports directly from the Corporation's internal auditors on a quarterly basis, and recommends any action to be taken. The committee is also responsible for, among other things, assisting the board of directors in monitoring (i) the integrity of the financial statements of the Corporation, (ii) the independent auditor's qualification and independence, (iii) the performance of the Corporation's internal audit function and independent auditors, and (iv), the compliance by the Corporation with legal and regulatory matters. The members of the Audit Committee are Edward F. Bradley, Chairperson, William R. Hartman, Michael J. Piracci, and Edward B. Tepper. The board of directors has determined that Edward F. Bradley is an "Audit Committee Financial Expert" and "Independent" under applicable SEC and NASDAQ Rules. The Audit Committee’s charter can be accessed on the Corporation’s website at www.royalbankamerica.com under the heading “Regulatory Filings” located under the “Investor Relations” page.

The Compensation Committee met five times in 2011. During 2011, the members of this committee are Edward B. Tepper, Chairperson, William R. Hartman and Gerard M. Thomchick. The Compensation Committee reviews and determines compensation for all Tier 1 officers (as defined below) and oversees the actions of the Salary Committee, which makes determinations regarding all other employees. The committee also has the authority to manage, administer, amend and interpret the Corporation’s 2007 Long Term Incentive Plan and to recommend to the full board of directors or the independent directors of the Corporation, as applicable, among other things:

| | · | employees to whom awards shall be made under the plan; |

| | · | the type of the awards to be made and the amount, size and terms of the awards; and |

| | · | when awards shall be granted. |

The Compensation Committee’s charter can be accessed on the Corporation’s website at www.royalbankamerica.com under the heading “Regulatory Filings” located on the “Investor Relations” page. The Salary Committee was established in October 2009 and met five times in 2011. The members of the Salary Committee are: the Chief Executive Officer, Robert R. Tabas, the President and Chief Operating Officer, James J. McSwiggan, and the head of Human Resources (in consultation with the Chief Financial Officer with regard to financial projects and in consultation with the Senior Risk Officer with regard to compliance with the compensation-related requirements of the TARP Capital Purchase Program in which the Corporation is participating). The duties of the Compensation Committee and Salary Committee are set forth in further detail under the caption, “Compensation Discussion and Analysis.”

The Nominating and Governance Committee met one time in 2011. The members of this committee are Edward F. Bradley, Chairperson, Robert R. Tabas, Michael J. Piracci, Murray Stempel, III and Edward B. Tepper. Sam Goldstein, who resigned as a director in December of 2011, also served on the committee during 2011. The principal duties of the Nominating and Governance Committee include developing and recommending to the board of directors criteria for selecting qualified director candidates, identifying individuals qualified to become board members, evaluating and selecting, or recommending to the board of directors, director nominees for each election of directors, considering committee member qualifications, appointment and removal, recommending codes of conduct and codes of ethics applicable to the Corporation and providing oversight in the evaluation of the board of each committee.

At a minimum we require our director candidates to be of full age but not yet have attained the age of 75, and possess strength of character, mature judgment, familiarity with the Corporation’s business and industry, independence of thought, and an ability to work collegially. The Nominating and Governance Committee does not maintain a formal diversity policy. As described in its charter, the Nominating and Governance Committee have the discretion to consider all factors they deem appropriate, including, but not limited to, ensuring the board of directors as a whole is diverse and consists of individuals with various and relevant career experience, technical skills, industry knowledge and experience, financial expertise (including expertise that would qualify the director as an Audit Committee financial expert), and local or community ties. The Nominating and Governance maintains the authority to employ the assistance of search firms or advisors in connection with the selection and/or evaluation of director candidates. No such search firm or advisor was used this year in connection with the nominees standing for election at the Annual Meeting.

The Nominating and Governance Committee has no formal process for considering director candidates recommended by shareholders, but its policy is to give the same consideration to any and all such candidates. If a shareholder wishes to recommend a director candidate, the shareholder should mail the name, background and contact information for the candidate to the Nominating and Governance Committee at the Corporation's offices at 732 Montgomery Avenue, Narberth, Pennsylvania, 19072. The Nominating and Governance Committee is responsible for identifying and evaluating all nominees for director, including any recommended by shareholders, and minimum requirements for nomination. The Nominating and Governance Committee has adopted a written charter that can be accessed on the Corporation's website at www.royalbankamerica.com under the heading “Regulatory Filings” located under the “Investor Relations” page.

The board of directors of the Corporation held twelve meetings during 2011. Each director attended at least 75% of the aggregate number of meetings of the board of directors and the various committees on which he or she served except for Mr. Shah. The Corporation has no policy regarding attendance by directors at the Annual Meeting of Shareholders, but all directors attended the 2011 Annual Meeting of Shareholders.

The board of directors utilizes a leadership structure that has the Chief Executive Officer (who is the Corporation’s principal executive officer and a director) who also acts in the capacity as board chairman, while William R. Hartman has been designated independent lead director. This structure creates efficiency in the preparation of the meeting agendas and related board materials as the Corporation’s Chief Executive Officer interacts more directly with those preparing the necessary board materials and is more connected to the overall daily operations of the Corporation. Agendas are also prepared with the permitted input of the full board of directors allowing for any concerns or risks of any individual director to be discussed as deemed appropriate. The designation of a lead independent director also allows the Corporation to benefit from Mr. Hartman’s experience and leadership in previous executive positions within larger financial institutions and as chairman and CEO of a publicly traded company.

Each member of the board of directors has a responsibility to monitor and manage risks faced by the Corporation. At a minimum, this requires the members of the board of directors to be actively engaged in board discussions, review materials provided to them, and know when it is appropriate to request further information from management and/or engage the assistance of outside advisors. Furthermore, because the banking industry is highly regulated, certain risks to the Corporation are monitored by the board of directors through its review of the Corporation’s and the Bank’s compliance with regulations set forth by the banking regulatory authorities. Because risk oversight is a responsibility for each member of the board of directors, the board of directors’ responsibility for risk oversight is not concentrated into a single committee. Instead, oversight is delegated, to a large degree, to the various board committees. These committees meet formally, as needed, to discuss risks and monitor specific areas of the Corporation’s performance with their findings reported at the next scheduled full meeting of the board of directors. In addition, the board of directors’ meeting agendas allow for the continuous oversight of risk by providing an environment which encourages the directors to ask specific questions or raise concerns and allots them sufficient time and materials to do so effectively. The overlap of committee membership provides a broad perspective of various risks and the actions undertaken to manage risks in today’s environment.

Rules and Responsibilities

The primary purpose of the Corporation’s Compensation Committee is to periodically review and recommend to the independent directors of the Corporation the compensation for the Corporation’s directors and certain senior executive officers (the “Tier 1 Executives”), and to periodically review the compensation of the other executive officers and employees of the Corporation as determined by the Salary Committee created during 2009 (discussed below). The Committee also has overall responsibility for recommending, approving and evaluating the compensation plans, policies and programs of the Corporation and its subsidiaries. Direct responsibilities of the Committee include:

| | · | At least annually reviewing and approving corporate goals and objectives relevant to the compensation of the Tier 1 Executives, evaluating the performance of Tier 1 Executives in light of such goals and objectives, and recommending to the independent directors the compensation levels of the Tier 1 Executives, including base salary, annual incentive opportunity level, long-term incentive opportunity level, and the terms of any agreements, based on such evaluation. In recommending the long-term incentive component of the compensation of the Tier 1 Executives, the Committee considers the Corporation’s performance and relative shareholder return, the value of similar incentive awards to senior executive officers at comparable companies, the awards given to the Tier 1 Executives in past years, and other factors it deems appropriate. |

| | · | At least annually reviewing the material performance criteria used by the Salary Committee in evaluating executive officers other than the Tier 1 Executives and the material criteria used in establishing appropriate compensation, retention, incentive, severance, and benefit policies and programs applicable to such executive officers. |

| | · | Periodically reviewing and making recommendations to the board of directors with respect to the adoption of or substantive changes in material employee benefit plans, bonus, incentive compensation, severance, equity-based or other compensation, or incentive plans of the Corporation and its subsidiaries. |

| | · | Administering and having authority to recommend awards, subject to approval of the board of directors, under the Corporation’s long-term incentive plans, subject to the terms of the applicable plans. |

| | · | Annually reviewing and determining the compensation of directors, subject to the approval of independent directors acting in executive session. |

| | · | For so long as the Corporation has outstanding securities issued to the United States Department of the Treasury under the Troubled Asset Relief Program’s (“TARP”) Capital Purchase Program, reviewing executive compensation to ensure compliance with applicable legal requirements of that program. |

The role of management is to provide the Committee with reviews and recommendations for the Committee’s consideration, and to manage the Corporation’s executive compensation programs, policies and governance (as they relate to compensation). Direct responsibilities of management in this process include:

| | · | Providing an ongoing review of the effectiveness of the compensation programs, including competitiveness, and alignment with the Corporation’s objectives. |

| | · | Recommending changes, if necessary, to ensure achievement of all program objectives. |

| | · | Recommending compensation levels and/or incentive awards for key executive officers other than the Tier 1 Executives. |

As described below, the Chief Executive Officer and the President of the Corporation also serve on the Salary Committee, which is responsible for determining certain compensation-related matters for officers of the Bank who are not Tier 1 Executives.

During 2009, the Compensation Committee recommended to the board of directors, and the board of directors approved, the creation of a separate “Salary Committee” to determine certain compensation-related matters for employees other than the Tier 1 Executive Officers. With respect to these other employees, the Salary Committee generally sets: (i) the overall compensation strategy for each of these employees in order to align the compensation mix (including differences in the relative mix of compensation between these various levels of executive management) with the Corporation’s overall philosophy; (ii) the performance standards for each of these employees by title; and (iii) the base and annual target incentive compensation for each of these employees (including the types of performance criteria to be used to determine incentive compensation, which shall align the performance of these employees to the Corporation’s overall performance objectives established by the board of directors). The Salary Committee consist of two inside directors (the Chief Executive Officer and the President) and the head of Human Resources (in consultation with the Chief Financial Officer with regard to financial planning objectives and in consultation with the Senior Risk Officer with regard to TARP Capital Purchase Program compliance) to recommend the appropriate base salary and the qualitative as well as quantitative compensation benchmarks to be used to evaluate the individual performance thresholds.

During 2009, the Committee retained the services of Mosteller and Associates as compensation consultants to assist in the continual development and evaluation of compensation policies and the Committee’s determinations of compensation awards. The role of Mosteller and Associates is to provide independent, third-party advice and expertise in executive compensation issues. Mosteller and Associates was solely an advisor to the Committee, and did not provide other services to the Corporation or Bank. Mosteller and Associates provided salary surveys and other compensation consulting services during 2011 for the Compensation and Salary Committees.

Discussion of the Compensation Discussion and Analysis with Management and Advisors

The Committee Chair has discussed the Compensation Discussion and Analysis with members of management, including the Chairman and Chief Executive Officer and the President and Chief Operating Officer of the Corporation. The Committee Chair has also discussed the Compensation Disclosure and Analysis with the Corporation’s outside legal counsel, Stevens & Lee, P.C. and Mosteller and Associates, a compensation advisor to the Committee.

The chief compensation objectives of the Corporation for executive officers and directors are to (i) establish compensation programs that are competitive in the banking industry so that the Corporation can attract, motivate and retain talented, competent and experienced management and directorship, (ii) set compensation based upon certain performance measurements so that pay is aligned with performance, (iii) benchmark the Corporation’s performance against peer groups (see below for description) to verify that pay levels versus performance are consistent with pay/performance levels in the banking industry, and (iv) align the objectives of the Corporation’s management and directorship with the objectives of the Corporation’s shareholders.

Overall, the Corporation strives to design its compensation program to permit the Corporation to:

| | · | support its business plan and strategy by clearly setting forth what is expected of executives with respect to financial results and goals and by rewarding achievement of said results and goals; |

| | · | allow for recruiting and retaining executive talent; and |

| | · | align management performance and their interests with the interests of the Corporation’s shareholders. |

During 2009, the Committee engaged Mosteller and Associates to update its previous report, issued in June 2007, on executive compensation for the Corporation. The updated Mosteller Report, dated July 14, 2009 and revised in December 2009 (the “Mosteller Report”), included an analysis of the Tier 1 executive positions at the Corporation compared to published databases including Watson Wyatt (regional banks in Mid-Atlantic region and nationwide with asset size from $900 million to $2 billion); CompAnalyst (financial services firms in Mid-Atlantic with average asset size $1-$10 billion); ERI (financial services firms in Mid-Atlantic with average asset size $1.5 billion) and to a custom peer group consisting of 19 regional banks selected by Mosteller which were deemed by Mosteller to be regionally comparable to the Corporation. The data from the custom peer group was accorded the greatest weight by the consultant. The data for the peer group was gathered from each institution’s 2009 proxy statements and included executive compensation reported for 2008.

Of the nineteen regional financial institutions selected by the consultant, thirteen of the institutions were located in Pennsylvania, two in New Jersey, one in Maryland, one in Delaware, and two in New York. The institutions ranged in asset size from $950 million to $2.1 billion.

The depository institutions used in the peer group were as follows:

1st National Community Bancorp | Abington Bancorp | ACNB Corp. |

| Alliance Financial Corp. | AmeriServ Financial Corp. | The Bancorp, Inc. |

| Bryn Mawr Bank Corp. | Canandaigua National Corp. | Center Bancorp, Inc. |

| Citizens & Northern Corp. | First Chester County Corp. | Orrstown Financial Corp. |

| Parkvale Financial Corp. | Peapack-Gladstone Financial Corp. | Metro Bancorp |

| Republic First Bancorp Inc. | Shore Bancshares, Inc. | Univest Corporation of PA. |

| VIST Financial Corp. | | |

Certain of the major conclusions included in the 2009 Mosteller Report utilized by the Committee were as follows:

| | · | Base pay for the five Tier 1 executive positions was competitive with base salaries in the peer group, with the exception of the base salary for the Chief Executive Officer, which was substantially below peer levels. |

| | · | With respect to total compensation, based on peer group comparison, Royal was substantially below market for the Chief Executive Officer and Chief Financial Officer positions and below, but within 20% of, the market for the other three Tier 1 Executive positions. The absence of an annual bonus was a major reason for the disparity between the Corporation’s Tier 1 Executives and comparable peer positions. |

The Corporation has historically sought to achieve its compensation objectives by offering the following key elements of executive compensation:

| | · | performance-based bonus program, paid in cash; |

| | · | periodic (generally annual) grants of long-term, equity-based compensation; This is comprised generally of stock option grants, however, a portion of this element may be paid in the form of restricted stock and other types of long-term, equity-based components (subject to Committee recommendation and independent director approval). Awards of restricted stock will be generally performance-based, requiring the achievement of specific goals; and |

| | · | Supplemental Executive Retirement Plan. |

The Corporation intends that the design of the elements of its compensation program reward executive management and directorship for profitability, longevity, profitable growth, price appreciation of the Corporation’s stock and having high standards of ethics and integrity.

The Corporation recently adopted a policy of tying incentive compensation to the attainment of long-term strategic objectives as approved from time to time by the Board of Directors. Accordingly, the incentive compensation formula and current total compensation parameters have been frozen pending a return to profitability, and, at such time, the ability to receive bonuses or other forms of equity compensation will be aligned with the attainment of specific metric objectives contained in the Corporation’s annually updated strategic plan. All performance pay plans also contains provisions that the amount due an executive under the plan can be reduced or eliminated altogether for unethical behavior.

To encourage employee retention and long-term service to the Corporation, the Corporation offers an omnibus long-term incentive plan, intended to focus executives on market appreciation of the stock price, thereby further aligning the interests of the executives with those of the Corporation’s shareholders under which the Committee could recommend the issuance of stock options, restricted stock (generally performance-based, requiring the achievement of specific goals primarily tied to the Corporation’s long-term strategic plan) and other long term equity compensation (subject to subsequent full Board of Directors approval). In addition, the Corporation provides a Supplemental Executive Retirement Plan and employment contracts to certain executive officers.

As further described herein, certain elements of the Corporation’s executive compensation program are affected by the Corporation’s participation in the TARP Capital Purchase Program. Those restrictions and limitations will generally continue to apply during the time that the Department of the Treasury continues to hold the Series A Preferred Stock issued in February 2009.

Base Salary

The objective of base salary is to reflect job duties, inherent value of the executive to the Corporation, and performance of the executive considering market competitiveness.

The Committee has and continues to rely, in large part, on the Mosteller Report to determine base salary for the Tier 1 Executives. The amount of any increase in the base salaries from year to year and the base salaries are evaluated by the Committee using a number of factors, including the following:

| | · | Requirements and responsibilities of the position along with, if available, salary norms for executives in comparable positions at peers; |

| | · | Expertise of the individual executive; |

| | · | Market competition for services of similar executives; |

| | · | Advice from Mosteller and Associates, and any other third-party advisor that the Committee may engage; and |

| | · | Recommendations of the Chief Executive Officer (except with respect to his own compensation). |

Base salaries are generally reviewed annually, with third-party analysis performed every two to three years. The most recent third-party analysis of base salaries was performed by Mosteller and Associates commencing in the second quarter of 2009 and resulting in the issuance of the Mosteller Report (referenced above).

Mr. Kuehl is employed pursuant to a written employment agreement. The employment agreements for Messrs. Tabas and Stempel, III expired in February, 2011 and the employment agreement for Mr. McSwiggan expired in February, 2012. These agreements are described under the caption Employment Agreements below.

For 2011, the Committee elected not to increase the base salaries of, and not to award any cash or other bonuses or grant any long-term equity based compensation to, the Corporation’s named executive officers.

Performance-Based Bonus Plan

The Corporation’s objective under the Performance-Based Bonus Plan (“Bonus Plan”) is to ensure that executive officers and staff are focused on profitability. The Committee has shifted its emphasis on payouts under the Bonus Plan to the attainment of the long-term strategic objectives of the Corporation as approved by the board of directors, which are updated at least annually. As a result, the Committee intends that executive incentive compensation be tied to the attainment of those strategic objectives as well as the attainment of specific individual milestones in connection with the attainment of such strategic objectives and that; generally, the award of performance-based incentive compensation will be suspended until the Corporation returns to profitability. The Committee reserves the right, however, to recommend to the independent directors an award for exceptional performance in individual circumstances.

For 2011, there were no payments made to any employee, including any of the named executives, under the Bonus Plan or otherwise. In addition, as previously noted, during any time that the Corporation is participating in the TARP Capital Purchase Program, the Corporation would be prohibited from making any bonus payments to its five most highly compensated employees other than in long-term restricted stock. For 2011, the Committee did not recommend the issuance of any long-term restricted stock to any employee in lieu of payments under the Bonus Plan.

Long-term Incentive Compensation (Equity-based Plan)

The long-term incentive program, which is an equity-based omnibus long-term incentive plan approved by shareholders in 2007 (the “LTIP”), provides a periodic award, generally intended to be annual, to the named executive officers and other key staff members. The chief program objective is to align executive officer compensation over a multi-year period directly with the interests of shareholders by rewarding the creation and preservation of long-term shareholder value. In addition to providing for the issuance of incentive and nonqualified stock options, the LTIP contains a restricted stock component, which over the life of the LTIP may not exceed 250,000 shares of the 1,000,000 total shares authorized under the LTIP. A restricted stock award is an award of common stock that is subject to restrictions on transfer until certain vesting requirements, which may include one or more performance goals set by the Committee. The Committee recommends, subject to board of directors approval, the terms and conditions of each restricted stock award. By permitting the use of vesting provisions and performance criteria for awards, the program is intended to encourage executive officers to create and maintain stock value, while also providing an incentive to continue employment with the Corporation, thus helping the Corporation to retain talented, motivated and forward-thinking executives.

Under the 2007 LTIP, if a participant terminates employment or service due to death, disability, retirement, or is involuntarily terminated other than for cause, the participant may exercise a vested stock option at any time within five years after such termination (unless a shorter time period is provided in the grant agreement), up to the expiration date of the term of such stock option. If a participant voluntarily terminates employment or service (other than by reason of retirement), the participant may exercise a vested stock option at any time within three months after such termination (unless a shorter time period is provided in the grant agreement), up to the expiration date of the term of such stock option. If a participant’s termination is for cause, the participant forfeits all outstanding stock options. The board of directors also has the ability to terminate outstanding stock options if the board of directors determines that the participant has engaged in a “harmful activity” in relation to the Corporation (generally, certain unauthorized uses of confidential information or the solicitation of employees or customers during or for a period of six months following employment).

No shares of restricted stock were granted under the LTIP to any participant, including the Tier 1 Executives, during 2011, 2010 or 2009.

No stock options were granted under the LTIP to any participant, including the Tier 1 Executives during 2011, 2010 and 2009.

Under the LTIP, each participant is granted an award by job title within each job title class to which that participant is assigned (Tier 1 or Tier 2). For 2008, the Committee set a percentage mirroring the ratio of the participant’s base salary in relation to the aggregate base salary of all participants with similar job titles. The Committee also sets an aggregate number of stock options to be awarded under the LTIP for a respective year and allocates that aggregate award among the job title classes (“Class Award”). The Class Award is then multiplied by the participant’s individual percentage (calculated as per above) to arrive at the specific stock option award granted to that participant. In 2008, consistent with the Committee’s practice in prior years, the Compensation Committee requested that management propose the amount and value of stock options to be granted to Tier 1 Executives and the Tier 2 employees. Upon review of the proposal submitted by management, the Compensation Committee met with its outside compensation consultant, Mosteller and Associates, to review the proposed option grants. The Committee, considering the advice of its compensation consultant, concluded that a larger benefit should be accorded to Tier 2 employees as an added incentive to direct the Bank’s future performance back to historically high levels. The Committee requested that the consultant prepare a recommendation which reduced Tier 1 executive options by 30%, reduced the non-employee director options by 15% and increased the options to be awarded to Tier 2 employees by the proportionate difference.

The exercise or strike price for a stock option under the LTIP is set at fair market value, defined as the closing trading price for the Corporation’s stock on the NASDAQ Stock Market on the date of grant. The Corporation will not grant stock options with exercise prices below fair market value. The Corporation will not reduce the exercise price of outstanding options below the fair market value exercise price that was set at the original time of grant.

As indicated, there were no awards made to any employee including the Tier 1 Executives, under the LTIP for 2011. Our ability to make such awards is restricted during the period we continue to participate in TARP. See “Compliance with Current Treasury Programs on Executive Compensation” below for more information. For information on outstanding options or restricted stock awards granted to the named executive officers, please see the information below under the caption “Outstanding Equity Awards” table.

Supplemental Executive Retirement Plan

The Corporation maintains a non-contributory, non-qualified, defined benefit pension plan commonly know as a Supplemental Executive Retirement Plan or SERP. Twenty-six persons are currently participants in the SERP of which 14 are active employees and the remaining twelve are either retired or no longer employed. The SERP is a non-qualified, defined benefit plan. The Committee selects key employees to participate in the SERP based on their perceived value to the Corporation, their position and labor market competition for individuals in similar job positions and similar talent. Messrs. Tabas, McSwiggan and Stempel participate in the SERP. The SERP provides retirement benefits under trust contracts, funded by death benefits payable under corporate owned and bank owned life insurance contracts. For additional information, please see the information under the caption “Retirement Plans.”

Benefit and Perquisite Payments

Prior to January 2010, the Corporation had historically made payments in addition to base salary to the Tier 1 Executives for auto allowances, country club dues, and/or director fees. Effective January 1, 2010, for 2010 and for each year thereafter, the Corporation, in order to promote greater transparency and to facilitate comparability to peer group analyses utilized by the Committee, will no longer pay the Tier 1 Executives for these items as such, but will, commencing in 2010 and thereafter, add the cash equivalent to the respective base salary of the affected executive officers. To adjust for the elimination of these benefit and perquisite payments, the base salaries of the Tier 1 Executives were increased for the 2010 calendar year to the following amounts: Robert R. Tabas -- $256,750; James J. McSwiggan -- $367,000; Murray Stempel, III -- $225,560; and Robert A. Kuehl -- $196,000.

In connection with our issuance to the United States Department of the Treasury (“Treasury”) of Series A Preferred Stock and an accompanying warrant on February 20, 2009, we agreed that our compensation, bonus, incentive and other benefit plans, arrangements and agreements, including severance and employment agreements, will comply with the executive compensation and corporate governance requirements of Section 111(b) of the Emergency Economic Stabilization Act of 2008 (the “EESA”) and applicable guidance or regulations issued by the Secretary of the Treasury. Those restrictions include, among other things, limits on compensation to exclude incentives for “senior executive officers,” as defined below, to take unnecessary and excessive risks that threaten the value of the institution receiving funds made available by the Treasury under the Capital Purchase Program or any other obligation arising from financial assistance provided under the TARP created by the EESA during the period while any TARP obligation remains outstanding.

Under the EESA, the applicable executive compensation restrictions apply in 2011 to the compensation of our Chief Executive Officer, Chief Financial Officer and our next three most highly compensated executive officers (collectively, the “senior executive officers”). In some cases, as a result of the passage of the American Recovery and Reinvestment Act of 2009 discussed below, the executive compensation restrictions may also apply to certain non-senior executive officers. In addition, in connection with the issuance of the Series A Preferred Stock to Treasury, each of the senior executive officers and certain other employees were required to execute a waiver of any claim against Treasury or the Corporation for any changes to such person’s compensation or benefits that are required to comply with Treasury regulations.