- ERIE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14C Filing

Erie Indemnity (ERIE) DEF 14CInformation statement

Filed: 24 Mar 23, 8:16am

| Check the appropriate box: | ||||

| ☐ | Preliminary Information Statement | |||

| ☑ | Definitive Information Statement only | |||

| ☐ | Confidential, for use of the Commission Only (as permitted by Rule 14c-5(d)(2)) | |||

ERIE INDEMNITY COMPANY | ||||

(Name of Registrant as Specified In Its Charter) | ||||

| Payment of Filing Fee (Check all boxes that apply): | ||||

| ☑ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) of Schedule 14A ( 17 CFR 240.14a-101 ) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11 | |||

Notice of Annual Meeting of Shareholders

To the Holders of Class A Common Stock and

Class B Common Stock of ERIE INDEMNITY COMPANY:

We will hold our 98th annual meeting of shareholders in person at 9:30 a.m., Eastern Daylight Time (EDT), on Tuesday, April 25, 2023, at the Warner Theatre, located at 811 State Street, Erie, Pennsylvania 16501. Shareholders can park in the Erie Insurance Parking Garage located on East 8th Street between French and Holland Streets and should enter the Warner Theatre through the northeast entrance at East 8th and French Streets. This annual meeting of shareholders is being held for the following purposes:

| 1. | To elect 11 persons to serve as directors until our 2024 annual meeting of shareholders and until their successors are elected and qualified; |

| 2. | To approve, on a non-binding advisory basis, the compensation of our named executive officers; |

| 3. | To select, on a non-binding advisory basis, the frequency of future shareholder votes on the compensation of our named executive officers; |

| 4. | To approve the adoption of our Deferred Stock Plan for Outside Directors as Amended and Restated; and |

| 5. | To transact any other business that may properly come before our annual meeting and any adjournment, postponement or continuation thereof. |

This notice and information statement, together with a copy of our annual report to shareholders for the year ended December 31, 2022, are being sent to all holders of Class A common stock and Class B common stock as of the close of business on Friday, February 24, 2023, the record date established by our board of directors. Holders of Class B common stock will also receive a form of proxy. Holders of Class A common stock will not receive proxies because they do not have the right to vote on any of the matters to be acted upon at our annual meeting.

Holders of Class B common stock are requested to complete, sign and return the form of proxy in the envelope provided, whether or not they expect to attend our annual meeting in person.

| By order of our board of directors, |

Brian W. Bolash |

| Executive Vice President, Secretary and General Counsel |

March 24, 2023

Erie, Pennsylvania

NOTICE OF INTERNET AVAILABILITY OF ANNUAL MEETING MATERIALS

Important Notice Regarding the Availability of our Information Statement for the Annual Meeting of Shareholders to be held on April 25, 2023.

Our information statement and annual report are available at:

http://www.erieproxy.com.

Erie Indemnity Company — 2023 Information Statement

Table of Contents

| Introduction | 1 | |||

| 1 | ||||

| 2 | ||||

| Beneficial Ownership of Common Stock | 2 | |||

| Our Board of Directors | 5 | |||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| Director — Shareholder Communications | 9 | |||

| Proposal 1 — Election of Directors | 10 | |||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 15 | ||||

| 15 | ||||

| Compensation Discussion and Analysis | 16 | |||

| 16 | ||||

Say-on-Pay and Frequency of Say-on-Pay Advisory Vote Results | 17 | |||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| Executive Compensation | 27 | |||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| Equity Compensation Plan Table | 36 | |||

| Report of our Executive Compensation and Development Committee | 37 | |||

| CEO Pay Ratio | 38 | |||

| Pay Versus Performance | 39 | |||

| Director Compensation | 44 | |||

| 44 | ||||

| 44 | ||||

| 46 | ||||

| 46 | ||||

| 46 | ||||

| Related Person Transactions | 47 | |||

ERIE INDEMNITY COMPANY

INFORMATION STATEMENT

WE ARE NOT ASKING HOLDERS OF OUR CLASS A COMMON STOCK FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

Introduction

Unless the context indicates otherwise, all references in this information statement to “we,” “us,” “our” or the “Company” mean Erie Indemnity Company. Erie Insurance Exchange, or the “Exchange,” has four property and casualty insurance subsidiaries: Erie Insurance Company, Erie Insurance Company of New York, Erie Insurance Property & Casualty Company and Flagship City Insurance Company. We sometimes refer to the Exchange and its property and casualty insurance subsidiaries as the “Property and Casualty Group.” The Exchange also owns 100 percent of the common stock of Erie Family Life Insurance Company, or “EFL,” a life insurance company.

This information statement, which is first being mailed to the holders of our Class A common stock and our Class B common stock on or about March 24, 2023, is furnished to such holders to provide information regarding us and our 2023 annual meeting of shareholders. This information statement is also being furnished in connection with the solicitation of proxies by our board of directors from holders of Class B common stock to be voted at our 2023 annual meeting of shareholders and at any adjournment, postponement or continuation thereof. Our annual meeting will be held in person at 9:30 a.m., Eastern Daylight Time (EDT), on Tuesday, April 25, 2023 at the Warner Theatre, located at 811 State Street, Erie, Pennsylvania 16501. Holders of Class B common stock will also receive a form of proxy.

Voting at our Annual Meeting

We are not asking holders of our Class A common stock for a proxy and you are requested not to send us a proxy. Only holders of Class B common stock of record at the close of business on February 24, 2023, are entitled to vote at our annual meeting. Each share of Class B common stock is entitled to one vote on each matter to be considered at our annual meeting. Except as otherwise provided in Sections 1756(b)(1) and (2) of the Pennsylvania Business Corporation Law of 1988, as amended, or “BCL,” in the case of adjourned meetings, a majority of the outstanding shares of Class B common stock will constitute a quorum at our 2023 annual meeting.

As of the close of business on February 24, 2023, we had 46,189,068 shares of Class A common stock outstanding, which are not entitled to vote on any matters to be acted upon at our 2023 annual meeting, and 2,542 shares of Class B common stock outstanding, which have the exclusive right to vote on all matters to be acted upon at our 2023 annual meeting.

There are three H.O. Hirt Trusts. Thomas B. Hagen, Jonathan Hirt Hagen and Elizabeth Hirt Vorsheck, or “Mrs. Vorsheck,” all of whom are directors of the Company, are beneficiaries of the trusts. The H.O. Hirt Trusts collectively own 2,340 shares of Class B common stock, which, because such shares represent 92.05 percent of the outstanding shares of Class B common stock entitled to vote at our 2023 annual meeting, is sufficient to determine the outcome of any matter submitted to a vote of the holders of our Class B common stock, assuming all of the shares held by the H.O. Hirt Trusts are voted in the same manner. As of the date of this information statement, the individual trustees of the H.O. Hirt Trusts are Mrs. Vorsheck and Jonathan Hirt Hagen, and the corporate trustee is Sentinel Trust Company, L.B.A., or “Sentinel.” Mrs. Vorsheck and Jonathan Hirt Hagen are both candidates for re-election to the board at our 2023 annual meeting.

Under the provisions of the H.O. Hirt Trusts, the shares of Class B common stock held by the H.O. Hirt Trusts are to be voted as directed by a majority of the trustees then in office. If at least a majority of the trustees then in office of each of the H.O. Hirt Trusts vote for: (i) the election of the 11 candidates for director named below, (ii) approval of the compensation of our named executive officers,(iii) a particular frequency of future shareholder votes on the compensation of our named executive officers, and (iv) approval of the adoption of our Deferred

2023 Information Statement 1

Stock Plan for Outside Directors as Amended and Restated, then such matters will be conclusively determined even if all shares of Class B common stock other than those held by the H.O. Hirt Trusts do not vote for such matters. We have not been advised as of the date of this information statement how the trustees of the H.O. Hirt Trusts intend to vote at our annual meeting.

Description of our Business

Since 1925, we have served as the attorney-in-fact for the policyholders at the Exchange. The Exchange is a reciprocal insurance exchange organized under Article X of Pennsylvania’s Insurance Company Law of 1921 under which individuals, partnerships and corporations are authorized to exchange reciprocal or inter-insurance contracts with each other, or with individuals, partnerships, and corporations of other states and countries, providing indemnity among themselves from any loss which may be insured against under any provision of the insurance laws except life insurance. Each applicant for insurance from the Exchange signs a subscriber’s agreement, which appoints us as the attorney-in-fact for the subscriber (policyholder) to transact the business of the Exchange on their behalf. As attorney-in-fact, we are required to perform certain services relating to the sales, underwriting and issuance of policies on behalf of the Exchange. We also provide management services to the Exchange’s subsidiaries.

The Property and Casualty Group writes personal and commercial lines of property and casualty insurance coverages exclusively through approximately 2,300 independent agencies comprised of more than 13,600 licensed agents. The underwriting results of the Property and Casualty Group are pooled. As a result of the Exchange’s 94.5 percent participation in the reinsurance pooling arrangement and its ownership of the other property and casualty insurance entities, the underwriting risk of the Property and Casualty Group’s business is borne by the Exchange.

We charge the Exchange a management fee calculated as a percentage, limited to 25 percent, of all premiums written or assumed by the Exchange. Management fees accounted for 97.0 percent, 95.6 percent and 98.7 percent, respectively, of our revenues for the three years ended December 31, 2020, 2021 and 2022. The management fee rate was 25 percent during 2020, 2021 and 2022, and beginning January 1, 2023, the rate has been set at 25 percent.

Beneficial Ownership of Common Stock

The following table sets forth, as of February 24, 2023, the amount of our outstanding Class B common stock owned by shareholders known by us to own beneficially more than 5 percent of our Class B common stock.

Name of Individual or Identity of Group

|

Shares of Class B

|

Percent of

| ||||||

H.O. Hirt Trusts(1), Erie, Pennsylvania

|

|

2,340

|

|

|

92.05%

|

| ||

Hagen Family Limited Partnership(2), Erie, Pennsylvania

|

|

153

|

|

|

6.02%

|

| ||

| (1) | There are three H.O. Hirt Trusts. Thomas B. Hagen, Jonathan Hirt Hagen and Mrs. Vorsheck are three of the beneficiaries of the trusts. As of the date of this information statement, the trustees of the H.O. Hirt Trusts are Jonathan Hirt Hagen, Mrs. Vorsheck and Sentinel. The trustees collectively control voting and disposition of the shares of Class B common stock. A majority of the trustees then in office acting together is required to take any action with respect to the voting or disposition of shares of Class B common stock. |

| (2) | Thomas B. Hagen, the chairman of our board of directors, is the general partner of the Hagen Family Limited Partnership. As general partner, Mr. Hagen has sole voting power and investment power over the shares of Class B common stock held by the Hagen Family Limited Partnership. Mr. Hagen is the father of Jonathan Hirt Hagen. Jonathan Hirt Hagen is also a director of the Company. |

2 Erie Indemnity Company

The following table sets forth, as of February 24, 2023, the amount of the outstanding shares of Class A common stock and Class B common stock beneficially owned by (i) each director and candidate for director nominated by our Nominating and Governance Committee, or “nominating committee,” (ii) each executive officer named in the Summary Compensation Table and (iii) all of our executive officers and directors as a group.

Name of Individual or Identity of Group

|

Shares of

|

Vested

|

Percent of

|

Shares of

|

Percent of

| ||||||||||||||||||||

Directors and Nominees for Director:

| |||||||||||||||||||||||||

J. Ralph Borneman, Jr.

| 20,000 | 18,641 | |||||||||||||||||||||||

Eugene C. Connell(6)

| 19,896 | 2,477 | |||||||||||||||||||||||

Salvatore Correnti

| 320 | 1,924 | |||||||||||||||||||||||

LuAnn Datesh

| 410 | 3,232 | |||||||||||||||||||||||

Jonathan Hirt Hagen(7)

| 223,730 | 15,394 | 1 | ||||||||||||||||||||||

Thomas B. Hagen(8)

| 16,762,189 | 12,994 | 36.32 | % | 169 | 6.65 | % | ||||||||||||||||||

C. Scott Hartz

| 2,097 | 17,588 | |||||||||||||||||||||||

Brian A. Hudson, Sr.

| 295 | 2,477 | |||||||||||||||||||||||

George R. Lucore

| 1,725 | 3,232 | |||||||||||||||||||||||

Thomas W. Palmer

| 770 | 14,184 | |||||||||||||||||||||||

Elizabeth Hirt Vorsheck(9)

| 3,960,946 | 12,994 | 8.60 | % | |||||||||||||||||||||

Executive Officers:

| |||||||||||||||||||||||||

Lorianne Feltz

| 4,927 | 2,548 | |||||||||||||||||||||||

Gregory J. Gutting

| 4,248 | 5,123 | |||||||||||||||||||||||

Timothy G. NeCastro

| 15,339 | 12,243 | |||||||||||||||||||||||

Douglas E. Smith

| 5,133 | 0 | |||||||||||||||||||||||

Parthasarathy Srinivasa

| 0 | 0 | |||||||||||||||||||||||

All Directors and Executive Officers as a Group (18 persons)(10)

| 21,149,871 | (11) | N/A | 45.79 | % | 170 | 6.69 | % | |||||||||||||||||

| (1) | Information furnished by the named persons. |

| (2) | Under the rules of the Securities and Exchange Commission, or “SEC,” a person is deemed to be the beneficial owner of securities if the person has, or shares, “voting power,” which includes the power to vote, or to direct the voting of, such securities, or “investment power,” which includes the power to dispose, or to direct the disposition, of such securities. Under SEC rules, more than one person may be deemed to be the beneficial owner of the same securities. Securities beneficially owned also include securities owned jointly, in whole or in part, or individually by the person’s spouse, minor children or other relatives who share the same home. The information set forth in the above table includes all shares of Class A common stock and Class B common stock over which the named individuals, individually or together, have voting power or investment power. |

| (3) | Vested share credits of Class A common stock for directors are granted under the Deferred Stock Plan for Outside Directors. |

| (4) | Vested share credits of Class A common stock for executive officers represent deferrals of short- and long-term incentive compensation under the Company’s Incentive Compensation Deferral Plan. |

| (5) | Less than one percent unless otherwise indicated. |

| (6) | Mr. Connell owns 17,433 shares of Class A common stock directly and 2,477 vested share credits under the Deferred Stock Plan for Outside Directors. Mr. Connell disclaims beneficial ownership of 2,463 shares of Class A common stock owned by his two children who live in his household. |

| (7) | Mr. Jonathan Hagen owns 223,130 shares of Class A common stock directly, one share of Class B common stock directly, and 15,394 vested share credits under the Deferred Stock Plan for Outside Directors. Mr. Jonathan Hagen disclaims beneficial ownership of 600 shares of Class A common stock owned by his children who live in his household. |

| (8) | Mr. Thomas Hagen owns 5,100 shares of Class A common stock directly. Mr. Hagen owns 16,757,089 shares of Class A common stock indirectly of which he disclaims beneficial ownership except to the extent of personal pecuniary interest. Mr. Hagen owns 12,994 vested share credits under the Deferred Stock Plan for Outside Directors. Mr. Hagen owns four shares of Class B common stock directly and 165 shares of Class B common stock indirectly of which he disclaims beneficial ownership except to the extent of pecuniary interest. |

2023 Information Statement 3

| (9) | Mrs. Vorsheck owns 69,716 shares of Class A common stock directly and 3,891,230 shares of Class A common stock indirectly through several trusts. Mrs. Vorsheck owns 12,994 vested share credits under the Deferred Stock Plan for Outside Directors. |

| (10) | Includes Executive Vice President Brian W. Bolash and Executive Vice President Sean D. Dugan. |

| (11) | Includes actual ownership of Class A common stock, vested share credits under the Deferred Stock Plan for Outside Directors, and vested share credits under the Company’s Incentive Compensation Deferral Plan for executives and senior officers of the Company. |

4 Erie Indemnity Company

Our Board of Directors

Introduction

Our board of directors is currently comprised of 11 members, all of whom were elected at our 2022 annual meeting to serve for a term of one year. Vacancies on our board of directors may be filled only by persons elected by a majority of the remaining directors, or by our voting shareholders, in accordance with our bylaws. On February 16, 2023, our board of directors accepted our nominating committee’s recommendation to set the number of directors at 11, effective at the 2023 annual meeting.

All directors hold office until their respective successors are elected and qualified, or until their earlier death, resignation or removal. There are no family relationships between any of our directors or executive officers, except for the following:

| • | Thomas B. Hagen, chairman of our board of directors and chairman of our Executive Committee, or “executive committee,” and Jonathan Hirt Hagen, vice chairman of the board of directors and chairman of our nominating committee, are father and son, respectively; and |

| • | Mrs. Vorsheck, a director and chair of our Charitable Giving Committee, or “charitable giving committee,” is a niece-in-law of Thomas B. Hagen and a first cousin of Jonathan Hirt Hagen. |

During 2022, each director attended more than 75 percent of the number of meetings of our board of directors and the standing committees of our board of directors of which such director was a member.

Board Diversity

Pursuant to the rules of the Nasdaq Stock Market (or “Nasdaq”), listed companies are required to have, or explain why they do not have, two diverse directors on their board of directors, including at least one diverse director who self-identifies as female and one diverse director who self-identifies as an underrepresented minority or LGBTQ+ (subject to the exceptions). Our current board satisfies the Nasdaq diversity requirement.

2023 Information Statement 5

The table below provides certain information regarding the composition of our board. All 11 directors are nominees for election at the 2023 annual meeting. Each of the categories included in the table has the meaning set forth in Nasdaq Rule 5605(f).

Board Diversity Matrix

(As of December 31, 2022)

Total Number of Directors

|

|

11

|

| |||||||||||||

Female

|

Male

|

Non-Binary

|

Did Not

| |||||||||||||

Part I: Gender Identity

| ||||||||||||||||

Directors

|

|

2

|

|

|

9

|

|

|

–

|

|

|

–

|

| ||||

Part II: Demographic Background

| ||||||||||||||||

African American or Black

|

|

–

|

|

|

1

|

|

|

–

|

|

|

–

|

| ||||

Alaskan Native or Native American

|

|

–

|

|

|

–

|

|

|

–

|

|

|

–

|

| ||||

Asian

|

|

–

|

|

|

–

|

|

|

–

|

|

|

–

|

| ||||

Hispanic or Latinx

|

|

–

|

|

|

–

|

|

|

–

|

|

|

–

|

| ||||

Native Hawaiian or Pacific Islander

|

|

–

|

|

|

–

|

|

|

–

|

|

|

–

|

| ||||

White

|

|

1

|

|

|

8

|

|

|

–

|

|

|

–

|

| ||||

Two or More Races or Ethnicities

|

|

–

|

|

|

–

|

|

|

–

|

|

|

–

|

| ||||

LGBTQ+

|

|

–

|

|

|

–

|

|

|

–

|

|

|

–

|

| ||||

Did Not Disclose Demographic Background

|

|

1

|

|

|

–

|

|

|

–

|

|

|

–

|

| ||||

Directors who are Military Veterans: 1

| ||||||||||||||||

Board Leadership and Executive Sessions

The chairman of our board of directors is elected annually by the remaining directors on our board. In addition to presiding over all meetings of shareholders and of our board of directors, the chairman’s duties include setting priorities, establishing agendas for meetings of the board, providing board leadership, and communicating with the chief executive officer, or “CEO,” on matters of strategic direction. The chairman also serves as an ex officio member of all other board committees of which he is not a designated member.

Our board of directors may, but is not required to, annually elect one of its members to serve as vice chairman of the board and may remove or replace such person at any time and for any reason. The vice chairman of the board performs the duties (including ex officio membership on committees) of the chairman of the board when the chairman is absent or unable to act or during such time as no individual is serving as chairman of the board. The vice chairman of the board also performs such other duties as from time to time may be assigned by the board of directors.

Since our incorporation in 1925, we have generally separated the positions of chairman of the board and CEO of the Company. Although our board of directors has no specific policy regarding separation of these offices and our bylaws permit the chairman to serve as CEO, our board has determined that separating these positions is currently in the best interests of the Company and our shareholders. Given the length of time and different capacities in which our current chairman has served the Company, including as a prior president and CEO, and his status as an independent director under Nasdaq rules, our board believes that separating these positions is an important component of our management succession plan, and allows our chairman to lead the board in its independent oversight of management and our CEO to focus on the day-to-day issues affecting our business.

6 Erie Indemnity Company

A majority of the directors on our board meet the definition of an “independent director” under Nasdaq rules. Our independent directors meet in executive session without management directors or management present. These sessions generally take place prior to or following regularly scheduled board meetings. The directors met in such sessions five times during 2022.

Board Oversight of Risk

Our board of directors is responsible for oversight of the Company’s ongoing assessment and management of material risks that impact our business. The Company has a formal enterprise risk management, or “ERM,” program that operates under the leadership of our chief financial officer, or “CFO.” The purpose of this program is to promote risk-intelligent decision making and, in turn, increase the likelihood of achieving our operational objectives. Our board of directors is regularly advised of potential organizational risks as well as policies and actions taken to mitigate those risks. At the board level, risk oversight is primarily accomplished through individual committees of the board and management’s reporting processes. Each committee oversees and manages the risks associated with their substantive areas of responsibility and the individual committees meet regularly and report back to the board. A description of the individual committees and their oversight of risk appears below.

| Risk Committee |

Our Risk Committee, or “risk committee,” is responsible for assisting the board in the development and oversight of the Company’s overall risk appetite and advising on the effectiveness of the Company’s ERM framework. The committee also oversees the Company’s environmental, social and governance, or “ESG,” initiatives and reporting, and its compliance with climate change risk regulation and disclosure.

The risk committee periodically communicates with all board committees as applicable, to confirm that such committees are appropriately addressing the risk within their respective areas of oversight. This committee is also charged with reporting to the Audit Committee, or “audit committee,” any items that may have a material financial statement impact or require financial statement and/or regulatory disclosure. When necessary, the risk committee reports to the audit committee other significant risks, the processes, procedures and controls in place to mitigate material risks, and the overall effectiveness of the risk management process.

| |

| Audit Committee |

Our audit committee focuses on risks related to accounting, internal controls, and financial and tax reporting.

The audit committee also assesses economic and business risks and monitors compliance with ethical standards.

| |

| Compensation Committee |

Our Executive Compensation and Development Committee, or “compensation committee,” identifies and oversees risks associated with our executive compensation policies and practices.

With the assistance of a compensation consultant, the Company periodically conducts a comprehensive compensation risk assessment, including a review of all executive and non-executive incentive plans, and evaluates the risks associated with each plan and the effectiveness of certain risk-mitigating factors. The results of these compensation risk assessments are shared with the compensation committee. See Compensation Discussion and Analysis. | |

Nominating Committee

|

Our nominating committee is responsible for identifying and overseeing risks associated with director independence, related person transactions and the implementation of corporate governance policies.

The nominating committee also has responsibility for monitoring corporate governance issues that may arise from time to time and developing appropriate recommendations for the board.

| |

Investment Committee

|

Our Investment Committee, or “investment committee,” identifies and assesses the business and economic risks relating to the Company’s investments and the investment portfolios of the companies we manage.

These risks include, but are not limited to, market risk, liquidity risk, concentration risk, credit risk, interest rate risk and inflation risk.

|

2023 Information Statement 7

Committees of our Board

Our board of directors met five times in 2022. The standing committees of our board of directors are our executive committee, audit committee, compensation committee, nominating committee, charitable giving committee, investment committee, Strategy Committee, or “strategy committee,” and risk committee.

Our executive committee met once in 2022. This committee has the authority, subject to certain limitations, to exercise the power of our board of directors between regular meetings.

Our audit committee met six times in 2022. Consistent with Section 1405(c)(4) of the Pennsylvania Insurance Holding Companies Act, or the “Holding Companies Act,” and the Sarbanes-Oxley Act of 2002, or “Sarbanes-Oxley,” our audit committee has responsibility for the selection of independent registered public accountants, reviewing the scope and results of their audit and reviewing our financial condition and the adequacy of our accounting, financial, internal and operating controls. Our audit committee operates pursuant to a written charter, a copy of which may be viewed on our website at: http://www.erieinsurance.com.

Our compensation committee met six times in 2022. Consistent with Section 1405(c)(4.1) of the Holding Companies Act and our bylaws, our compensation committee has responsibility for recommending to our board of directors, at least annually, the competitiveness and appropriateness of the salaries, short- and long-term incentive plan awards, terms of employment, non-qualified retirement plans, severance benefits and perquisites of our CEO, executive vice presidents and such other named executives as required by rules of the SEC or Nasdaq listing standards, and such other responsibilities as our board of directors may designate. See Executive Compensation — Compensation Committee Interlocks and Insider Participation. Our compensation committee operates pursuant to a written charter, a copy of which may be viewed on our website at: http://www.erieinsurance.com.

Our nominating committee met three times in 2022. Consistent with Section 1405(c)(4.1) of the Holding Companies Act and our bylaws, our nominating committee has responsibility for identification of individuals believed to be qualified to become members of our board of directors and to recommend to our board of directors nominees to stand for election as directors; identification of directors qualified to fill vacancies on any committee of our board; and evaluation of the procedures and process by which each committee of our board of directors undertakes to self-evaluate such committee’s performance. Our nominating committee operates pursuant to a written charter, a copy of which may be viewed on our website at: http://www.erieinsurance.com.

Board Committee Composition

Members and chairs of the standing committees of our board of directors are identified in the table below.

Name

|

Audit

|

Charitable Giving

|

Executive

|

Compensation

|

Investment

|

Nominating

|

Strategy

|

Risk

| ||||||||||||||||||||||

J. Ralph Borneman, Jr.

|

⬛

|

Chair

| ||||||||||||||||||||||||||||

Eugene C. Connell

|

⬛

| ⬛

|

⬛ |

⬛

|

Chair

| |||||||||||||||||||||||||

Salvatore Correnti

| ⬛ |

Chair

|

⬛

| |||||||||||||||||||||||||||

LuAnn Datesh

|

⬛

|

⬛

| ||||||||||||||||||||||||||||

Jonathan Hirt Hagen(1)

|

⬛

|

⬛

|

⬛

|

Chair

|

⬛

| |||||||||||||||||||||||||

Thomas B. Hagen(2)

|

Chair

| |||||||||||||||||||||||||||||

C. Scott Hartz

|

⬛

|

⬛

| ||||||||||||||||||||||||||||

Brian A. Hudson, Sr.

|

Chair

|

⬛

|

⬛

| |||||||||||||||||||||||||||

George R. Lucore

|

⬛

|

⬛

|

⬛

| |||||||||||||||||||||||||||

Thomas W. Palmer

|

⬛

|

⬛

|

Chair

|

⬛

| ||||||||||||||||||||||||||

Elizabeth Hirt Vorsheck

|

Chair

|

⬛

|

⬛

|

⬛

|

⬛

|

| (1) | As vice chairman of our board of directors, Mr. Jonathan Hagen serves as an ex officio member of the risk committee. |

| (2) | As chairman of the board of directors, Mr. Hagen serves as an ex officio, non-voting member of our audit committee and a voting member of all other committees, except for the risk committee. Mr. Hagen has deferred his ex officio membership on the risk committee to the vice chairman of the board. |

8 Erie Indemnity Company

Director Education

We encourage our directors to further their knowledge and advance their skills as directors of a public company. To that end, we offer a director education program that provides each director with access to various resources to enhance those skills necessary to be an effective director. See Director Compensation — Director Education Program.

Director — Shareholder Communications

Our shareholders may communicate with our board of directors through our corporate secretary. Shareholders who wish to express any concerns to our directors may do so by sending a description of those concerns in writing addressed to a particular director, or in the alternative, to “Non-management Directors” as a group, care of our corporate secretary at our headquarters, 100 Erie Insurance Place, Erie, Pennsylvania 16530. All such communications received by our corporate secretary will be promptly forwarded to the addressee or addressees set forth in the communication.

Recognizing that director attendance at our annual meeting provides our shareholders with an opportunity to communicate with directors about issues affecting us, we actively encourage our directors to attend our annual meeting. All of our current directors attended our 2022 virtual annual meeting.

2023 Information Statement 9

Proposal 1

Election of Directors

Introduction

The election of directors by the holders of our Class B common stock is governed by provisions of the Holding Companies Act, in addition to provisions of the BCL and our bylaws. The following discussion summarizes these statutory and bylaw provisions and describes the process undertaken in connection with the nomination of candidates for election as directors by the holders of Class B common stock at our annual meeting.

Background of our Nominating Committee

Section 1405(c)(4.1) of the Holding Companies Act provides that the board of directors of a domestic insurer must establish one or more committees comprised solely of directors who are not officers or employees of the insurer or of any entity controlling, controlled by or under common control with the insurer. Such committee or committees must have responsibility for, among other things, recommending candidates to be nominated by the board of directors, in addition to any other nominations by voting shareholders, for election as directors by the voting shareholders. Section 1405(c)(5) of the Holding Companies Act provides that the above provisions shall not apply to a domestic insurer if the person controlling such insurer is an insurer, an attorney-in-fact for a reciprocal exchange, a mutual insurance holding company or a publicly held corporation having a board of directors and committees thereof which already meet the requirements of Section 1405(c)(4.1). For purposes of the Holding Companies Act, we are deemed to control the Exchange and its subsidiaries, and our board of directors and its committees are in compliance with Section 1405(c)(4.1).

Section 3.09 of our bylaws is consistent with this statutory provision and provides that (i) our board of directors must appoint annually a nominating committee that consists of not less than three directors, each of whom is not an officer or employee of us or of any entity controlling, controlled by or under common control with us, and (ii) our nominating committee must, prior to each annual meeting of shareholders, determine and nominate candidates for the office of director to be elected by the holders of Class B common stock to serve terms as established by our bylaws and until their successors are elected and qualified.

In accordance with this bylaw provision, on April 26, 2022 our board of directors designated a nominating committee consisting of Jonathan Hirt Hagen, chair, Thomas W. Palmer and Mrs. Vorsheck. As chairman of our board, Thomas B. Hagen also serves ex officio as a voting member of the nominating committee. Consistent with the Holding Companies Act, none of these persons is an officer or employee of us or of any entity controlling, controlled by or under common control with us. Each member of our nominating committee is an independent director as defined in the rules applicable to companies listed on Nasdaq.

Nominating Procedures

Under Section 2.07(a) of our bylaws, nominations of persons for election to our board of directors may be made at any meeting at which directors are to be elected (i) by or at the direction of our board of directors upon the recommendation of our nominating committee or (ii) by any holder of our Class B common stock.

With respect to nominations by or at the direction of our nominating committee, except as is required by rules promulgated by Nasdaq, the SEC or the Holding Companies Act, there are no specific, minimum qualifications that must be met by a candidate for our board of directors, and our nominating committee may take into account such factors as it deems appropriate. Our nominating committee generally bases its nominations on our general needs as well as the specific attributes of candidates that would add to the overall effectiveness of our board of directors. Specifically, among the significant factors that our nominating committee may take into consideration are judgment, skill, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other directors, and the extent to which the candidate would be a desirable addition to our board of directors and any committee of our board of directors.

Although we do not have a formal policy or guidelines regarding diversity of membership of our board of directors, our Company recognizes the value of having a board that encompasses a broad range of skills, expertise,

10 Erie Indemnity Company

contacts, industry knowledge and diversity of opinion. As required by Nasdaq, the Company has collected statistical information regarding certain Nasdaq defined diversity categories with regard to our board of directors (See Board Diversity Matrix — as of December 31, 2022), however, our board has not attempted to define “diversity” or otherwise require that the composition of our board include individuals from any particular background or who possess specific attributes.

Our nominating committee utilizes the following process to identify and evaluate the individuals that it selects, or recommends that our board of directors select, as director nominees:

| • | Reviews the qualifications of any candidates who have been recommended by a holder of Class A common stock or Class B common stock in accordance with our bylaws. |

| • | Considers recommendations made by individual members of our board of directors or, if our nominating committee so determines, a search firm. Our nominating committee may consider candidates who have been identified by management but is not required to do so. |

| • | Evaluates the background, experiences, qualifications and suitability of each candidate, including the current members of our board of directors, in light of the current size and composition of our board of directors and the above discussed significant factors. |

After such review and consideration, our nominating committee recommends a slate of director nominees to the board of directors.

Actions Taken for Nominations

Our nominating committee met on February 14, 2023 for the purposes of evaluating the performance and qualifications of the current and proposed members of our board of directors and nominating candidates for election as directors by the holders of Class B common stock at our annual meeting.

Our bylaws provide that our board of directors shall consist of not less than seven, nor more than 16, directors, with the exact number to be fixed from time to time by resolution of our board of directors. At its meeting on February 14, 2023, our nominating committee recommended that the size of our board of directors be set at 11 persons and that all 11 incumbent directors as of such date be nominated to stand for re-election as directors by the holders of Class B common stock at our annual meeting.

On February 16, 2023, our board of directors accepted the report and recommendation of our nominating committee, set the number of directors to be elected at our annual meeting at 11 and approved the nomination of J. Ralph Borneman, Jr., Eugene C. Connell, Salvatore Correnti, LuAnn Datesh, Jonathan Hirt Hagen, Thomas B. Hagen, C. Scott Hartz, Brian A. Hudson, Sr., George R. Lucore, Thomas W. Palmer and Elizabeth Hirt Vorsheck for election as directors by the holders of Class B common stock at our annual meeting. If elected, such persons would serve until our 2024 annual meeting of shareholders and until their successors are elected and qualified.

Candidates for Election

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the election of the nominees named below. All of the nominees are currently directors of the Company. If a nominee becomes unavailable for any reason, it is intended that the proxies will be voted for a substitute nominee selected by our nominating committee. Our board of directors has no reason to believe the nominees named will be unable to serve if elected.

2023 Information Statement 11

The biography of each director nominee below contains information regarding that person’s principal occupation, positions held with the Company, if applicable, age (as of April 1, 2023), service as a director, business experience, other public company director positions currently held or held at any time during the past five years, involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes or skills that caused our nominating committee to conclude that the person should serve as a member of our board of directors:

| J. Ralph Borneman, Jr., CIC, CPIA

| ||

| Age: 84 Director since 1992 | President, Chief Executive Officer and Chairman of the Board, Body-Borneman Insurance & Financial Services LLC, insurance agency, Boyertown, PA, 2005 to present; President, Chief Executive Officer and Chairman of the Board, Body-Borneman Associates, Inc., insurance agency; President, Body-Borneman, Ltd. and Body-Borneman, Inc., 1967-2005, insurance agencies he co-founded.

Mr. Borneman has extensive knowledge of, and more than 55 years of experience with, the business of insurance, agency matters, sales and marketing, and insurance distribution strategies. He is a past President of the Professional Insurance Agents Association of Pennsylvania, Maryland and Delaware and has prior experience as a director of other public companies. | |

| Eugene C. Connell, FCAS, CFA, CPCU

| ||

| Age: 68 Director since 2017 | Independent Investor and Advisor, Erie, PA, since 2011; Chief Executive Officer, RendrFX, Inc., video software, 2017-2018; Deputy Secretary, Commonwealth of Pennsylvania Department of Labor and Industry, Harrisburg, PA, 2013-2014; Executive Vice President, Property/Casualty Products, Risk Lighthouse, LLC, an economic risk intelligence firm, Atlanta, GA, 2012; Senior Vice President and Chief Actuary (1988-2011) and Chief Risk Officer (2005-2011), Erie Insurance Group, Erie, PA.

Mr. Connell has more than 40 years of experience in the insurance industry, including a 23-year career with the Company during which he held several senior leadership positions, including Chief Actuary and Chief Risk Officer. He has extensive experience in actuarial science; automobile, property and workers compensation insurance; development of property and casualty insurance products; financial planning and modeling; investments; insurance regulation; and risk management. Mr. Connell also satisfies the SEC requirements of an audit committee financial expert and has been so designated by the Company’s board of directors. | |

| Salvatore Correnti, CFA, CCM, FLMI

| ||

| Age: 62 Director since 2018 | Director, Builders Insurance (A Mutual Captive Company), Atlanta, GA, since 2013; Director, Oil Casualty Investment Corporation Ltd, Bermuda, from March 2017 to March 2022; Adjunct Professor, Towson University, Towson, MD, from 2015 to 2021; Non-Executive Vice-Chair of the Board of Directors of Conning Holdings Corporation, Hartford, CT; Conning Holdings Ltd, UK, 2012-2017; Chief Executive Officer of Conning Holdings/Conning Asset Management, 2003-2012.

Mr. Correnti has extensive experience with investments and insurance having held executive positions at USF&G, Swiss Re, and Conning. In his current role as a director of Builders Insurance, he serves as chair of the Investment Committee and serves on the Audit and Governance Committees. Mr. Correnti also has executive management experience serving six years as head of asset-liability management, five years as a chief operating officer, and then nine years as chief executive officer of a global asset management company with more than $120 billion in assets under management. | |

12 Erie Indemnity Company

| LuAnn Datesh, ESQ.

| ||

| Age: 68 Director since 2016 | Vice President, General Counsel and Corporate Secretary, Olympus Energy LLC, an oil and natural gas company, Canonsburg, PA since May 2019; a director and shareholder, Sherrard, German & Kelly, P.C., September 2016-May 2019; Vice President, CNX Gas Corporation, an oil and gas company, Canonsburg, PA, February 2016-September 2016; Vice President, CONSOL Energy, Inc., an energy company, 2011-2016; Assistant General Counsel, CONSOL Energy, Inc., 2009-2011.

Ms. Datesh has significant experience with the legal, governance and risk management aspects of another publicly held, regulated company where she was an officer of multiple subsidiaries. She also has executive management experience overseeing a wide variety of corporate transactions and an extensive background in corporate law, finance, business counseling and managing large real estate holdings. | |

| Jonathan Hirt Hagen, J.D.

| ||

| Age: 60 Director since 2005 | Vice Chairman of the Board of our Company since 2013 and Chairman of the Board of our affiliated insurance companies since 2018; Co-Trustee of the H.O. Hirt Trusts, Erie, PA, since 2015; Vice Chairman, Custom Group Industries, Erie, PA, machining and fabrication manufacturing companies, from 1999-2017; private investor, since 1990.

Mr. Hagen, as the grandson of our late founder and longtime leader of the Company, H.O. Hirt, and son of Chairman Thomas B. Hagen and the late longtime director Susan Hirt Hagen, has a thorough knowledge and understanding of our operations, history and culture. He is one of three trustees of the H.O. Hirt Trusts which control a majority of our voting stock. His extensive business and legal educational background, prior insurance experience and service on our board also give him broad knowledge of the insurance industry, business law and corporate governance issues. In addition, he has experience with his family’s business interests, as a private investor and as a director of another public company. | |

| Thomas B. Hagen

| ||

| Age: 87 Director since 2007 Prior Board Service | Chairman of the Board of our Company (since 2007) and of our affiliated insurance companies (2007-2018), an employee (1953-1995) and former agent of the Company, including service as President (1982-1990) and Chairman and CEO (1990-1993); Owner and Manager, Historic Erie Restorations LLC, since 2018; Chairman, Custom Group Industries, Erie, PA, complex fabrications, heating platens and precision machining manufacturing companies, since 1997; General Partner, Hagen Family Limited Partnership, since 1989.

Mr. Hagen is the son-in-law and close associate of our late co-founder and longtime leader of the Company, H.O. Hirt. Mr. Hagen has extensive ERIE and insurance industry knowledge and experience through his long association with ERIE starting in 1953 and subsequently serving in a variety of leadership roles, including as our CEO. He has held leadership positions in various insurance industry and business trade groups, including past Chairman of the Pennsylvania Chamber of Business & Industry and past Chairman of the Insurance Federation of Pennsylvania. He also has broad executive management and leadership experience having served on various civic and business boards of directors, including the boards of three other public companies, one of them NYSE listed. He has served as Pennsylvania’s Secretary of Commerce and Secretary of Community & Economic Development and is a retired Captain in the U.S. Navy Reserve. He controls the second largest voting and the largest non-voting shareholding interests in our Company. | |

2023 Information Statement 13

C. Scott Hartz, CPA

| ||

| Age: 77 Director since 2003 | Retired senior executive and private investor, principally in start-up technology related ventures; Director of EMMA Health Technologies, a manufacturer of medical devices, since January 2019; Managing Director, InRange Investor Group, LLC, since November 2019; Director, until December 2022 of Averatek, an SRI International “spin out” nano technology-based material science company; Chief Executive Officer, The Hartz Group, strategy and technology consulting, Bala Cynwyd, PA since 2003.

Prior to joining the Company’s board, Mr. Hartz spent 32 years with PwC Consulting, the last seven years as Global Chief Executive Officer for a worldwide organization with a 30,000-person professional staff. Mr. Hartz has a strong background in information technology, cyber-security, consulting and investments. He has prior experience in executive management, as a director of another public company and as an Advisory Board member of a national non-profit organization. | |

Brian A. Hudson, Sr., CPA, CGMA, CTP

| ||

| Age: 68 Director since 2017 | Director, MidPenn Bank, since January 2021; Retired Executive Director and Chief Executive Officer, Pennsylvania Housing Finance Agency, Harrisburg, PA, 2003-February 2020; Director, Federal Home Loan Bank of Pittsburgh, 2007-2017.

Mr. Hudson has 15 years of experience as chief financial officer and 17 years as chief executive officer of a multi-billion dollar corporation and instrumentality of the Commonwealth of Pennsylvania. In addition to being a Certified Public Accountant (CPA) and holding a Chartered Global Management Accountant (CGMA) designation, Mr. Hudson is a Certified Treasury Professional (CTP). Until 2017, he was a member of the Board of Directors, and Chair of the Audit Committee, of the Federal Home Loan Bank of Pittsburgh and has more than 35 years of experience in managing a large investment portfolio and the placement of bond issues. Mr. Hudson satisfies the SEC requirements of an audit committee financial expert and has been so designated by the Company’s board of directors. He also has experience as a director of another public company. | |

George R. Lucore, AAM, AIM, AIT, CIC, CPCU, LUTCF

| ||

| Age: 72 Director since 2016 | Managing Director, PAFLA Properties, LLC, property management, since 2009; Executive Vice President — Field Operations of the Company, 2008-2010.

Mr. Lucore had a 36-year association with the Company during which he held several senior and executive leadership positions in addition to management roles in several of our field offices. He has extensive knowledge of the insurance industry, including agency, marketing and distribution systems; was previously involved with the geographic expansion of the Erie Insurance Group into a number of states; and has taught courses in risk management and life and health insurance at the college level. | |

Thomas W. Palmer, ESQ.

| ||

| Age: 75 Director since 2006 | Of counsel to the law firm of Marshall & Melhorn, LLC, Toledo, OH, since 2019; Member (including service as a managing member) of Marshall & Melhorn, LLC, 1972-2019.

Mr. Palmer has significant experience with business and corporate law, business dispute resolution, corporate governance, financial reporting and family-owned enterprises. He also has prior experience as a director of another public company. | |

14 Erie Indemnity Company

Elizabeth Hirt Vorsheck

| ||

| Age: 67 Director since 2007 | Co-Trustee of the H.O. Hirt Trusts, Erie, PA, since 2007; more than 40 years’ experience as managing principal of family business interests; private investor; and 21 years’ experience as principal of a family charitable foundation and other charitable initiatives.

Mrs. Vorsheck is a granddaughter of H.O. Hirt, the late founder and longtime leader of the Company, a daughter of F.W. Hirt, the late founder of Erie Family Life Insurance Company, who served the Erie Indemnity Company in many distinguished positions, culminating his lifelong career as Chairman of the Board having built and expanded the Erie Insurance Group of companies, and niece of Thomas B. Hagen and the late Susan Hirt Hagen. Mrs. Vorsheck is one of three trustees of the H.O. Hirt Trusts which control a majority of our voting stock. In addition, she individually directly controls a significant shareholding interest in the Company. | |

Independent Directors

Our board of directors has determined that each of the following directors and director nominees satisfies the definition of an “independent director” as set forth in the rules promulgated by Nasdaq:

| Eugene C. Connell | Thomas B. Hagen | Thomas W. Palmer | ||

| Salvatore Correnti | C. Scott Hartz | Elizabeth Hirt Vorsheck | ||

| LuAnn Datesh | Brian A. Hudson, Sr. | |||

| Jonathan Hirt Hagen | George R. Lucore |

Director J. Ralph Borneman, Jr. does not satisfy the Nasdaq definition of an independent director since he is an owner and executive officer of an insurance agency that receives commission payments from the Company. See Related Person Transactions.

Required Vote

Cumulative voting rights do not exist with respect to the election of directors. A director nominee shall only be elected if the total votes cast by the voting shareholders for the election of such director nominee represents a majority of the Class B shares outstanding and entitled to vote at our annual meeting. An abstention will count as a vote against the proposal.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE CANDIDATES FOR DIRECTOR NOMINATED BY OUR NOMINATING COMMITTEE. | ||

2023 Information Statement 15

Compensation Discussion and Analysis

The Compensation Discussion and Analysis describes our executive compensation philosophy and programs, and the decisions the compensation committee of the board of directors has made pursuant to those programs. SEC regulations require disclosure of information about the compensation of our named executive officers, or “NEOs.” This includes our CEO, our CFO, and the next three most highly compensated officers of the Company. The following discussion focuses on the compensation of our NEOs for 2022, identified in the table below.

2022 Named Executive Officers

Principal executive officer | Timothy G. NeCastro

| |

| President and Chief Executive Officer | ||

Principal financial officer |

Gregory J. Gutting | |

| Executive Vice President and Chief Financial Officer | ||

Next three most highly compensated officers |

Lorianne Feltz | |

| Executive Vice President, Claims and Customer Service | ||

| Douglas E. Smith | ||

| Executive Vice President, Sales and Products | ||

| Parthasarathy Srinivasa | ||

Executive Vice President and Chief Information Officer

|

The Summary Compensation Table and supplemental tables thereunder report compensation calculated for our NEOs in accordance with the rules and regulations of the SEC.

Executive Summary

Our executive compensation program is developed and monitored by our compensation committee. The program is designed to support sustainable long-term value for our enterprise through a combination of fixed and variable compensation. Base salary is established after consideration of external competitiveness and the level of experience of each executive. Variable compensation is based on a “pay-for-performance” philosophy and tied to our corporate strategy. The outcome of current year performance is recognized by our Annual Incentive Plan, or “AIP,” and longer-term performance is measured over a three-year period and rewarded by our Long Term Incentive Plan, or “LTIP.”

Our AIP utilizes goals that are based on operational results, or “company performance measures,” and individual accomplishments, or “individual performance goals.” For our 2022 AIP, company performance measures included the Property and Casualty Group’s: (i) growth in direct written premium, or “DWP;” (ii) growth in policies in force, or “PIF;” and (iii) statutory combined ratio.

Due to the continuation of unpredictable results related to statutory combined ratio, we compared our performance of this metric for the first nine months of to the total property and casualty insurance industry for the same period of time, as reported by A.M. Best Rating Services, Inc., or “A.M. Best,” with the target being performance equal to the industry. For the last three months of the year, we compared our results to a quantitative target based on the Company’s operating plan and projections for the fourth quarter of 2022 (see Annual Incentive Plan below for more information). The same methodology was applied to this company performance measure in 2021.

16 Erie Indemnity Company

For 2022, our results were as follows:

AIP Company Performance Measures(1) | 2022 Target | 2022 Year End Result | Payout (as a % of Target) | |||||||||

Direct Written Premium | 6.7 | % | 9.2 | % | 183.3 | % | ||||||

Policies in Force | 3.4 | % | 3.6 | % | 120.0 | % | ||||||

Statutory Combined Ratio(2) | ||||||||||||

January 2022 — September 2022 | 102.7 | % | 113.1 | % | 0.0 | % | ||||||

October 2022 — December 2022 | 100.3 | % | 124.9 | % | 0.0 | % | ||||||

OVERALL COMPANY PERFORMANCE | 82.17 | % | ||||||||||

| (1) | Weightings for company performance measures: Direct Written Premium (35%), Policies in Force (15%), Statutory Combined Ratio (50%) |

| (2) | Performance for statutory combined ratio for the period January 2022 — September 2022 is based upon performance relative to the property and casualty insurance industry. |

The company performance measures for our LTIP are DWP growth, statutory combined ratio and return on invested assets, or “ROIA.” The LTIP is designed to reward participants based upon performance relative to an established peer group (see Long Term Incentive Plan below for the composition of the LTIP peer group). Performance below that of the peer group results in payouts below target; performance equal to that of the peer group results in payouts at target; and performance better than the peer group results in payouts in excess of target. To achieve a maximum payout, our three-year DWP growth must exceed the peer group results by 450 basis points; statutory combined ratio must be lower than the peer group results by 600 basis points; and our ROIA must exceed the peer group results by 262.5 basis points.

To date, we have information on 11 of the 12 measurement quarters for the 2020-2022 LTIP performance period and we expect performance relative to our peer group to be slightly better than the 2019-2021 performance period, as illustrated below.

LTIP Measure | Performance Period | ERIE Result | Peer Group Result | Basis Points Difference | Performance vs. Peers | |||||||||||||

Direct Written Premium | 2019-2021 | 3.4 | % | 5.9 | % | -247.0 | Underperformed | |||||||||||

| 2020-2022 | * | 4.7 | % | 6.6 | % | -187.0 | Underperformed | |||||||||||

Statutory Combined Ratio | 2019-2021 | 100.8 | % | 98.7 | % | 211.8 | Underperformed | |||||||||||

| 2020-2022 | * | 103.5 | % | 101.7 | % | 184.7 | Underperformed | |||||||||||

Return on Invested Assets | 2019-2021 | 7.93 | % | 7.34 | % | 59.3 | Overperformed | |||||||||||

| 2020-2022 | * | 3.78 | % | 2.94 | % | 83.5 | Overperformed | |||||||||||

* Results for the 2020-2022 performance period are projected.

Though we project to underperform our peers in DWP and combined ratio, the basis point difference is less for the 2020-2022 performance period than the 2019-2021 performance period. Our ROIA is expected to be better than the peer group. We expect the overall performance factor used to determine the payments to our NEOs under the LTIP to be greater than the prior year.

Additional information regarding our financial results for the year ended December 31, 2022, is provided in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our annual report on Form 10-K filed with the SEC on March 1, 2023.

Say-on-Pay and Frequency of Say-on-Pay Advisory Vote Results

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or “Dodd-Frank Act,” gives our Class B voting shareholders the right to approve, on a non-binding advisory basis, the compensation paid to our NEOs as disclosed in our information statement. At our 2020 Annual Meeting of Shareholders, our voting shareholders unanimously approved the compensation of the Company’s NEOs. After considering the results of the vote, our compensation committee determined that no material changes to our compensation programs were necessary.

Companies subject to the “say-on-pay” rules are required to hold a shareholder vote at least once every six calendar years to determine on a non-binding, advisory basis, the frequency of future say-on-pay votes — annually, biennially or triennially. In 2017, our Class B voting shareholders selected, on a non-binding advisory

2023 Information Statement 17

basis, “every three years” as the preferred frequency for having the opportunity to vote on the compensation of our NEOs. Accordingly, the advisory votes on (i) executive compensation and (ii) the frequency of such votes in the future will be held at our 2023 Annual Meeting. See Proposal 2—Approval, on a Non-Binding Advisory Basis, of the Compensation of our Named Executive Officers and Proposal 3—Selection, on a Non-Binding Advisory Basis, of the Frequency of Future Shareholder Votes on the Compensation of our Named Executive Officers.

Risk Management in Executive Compensation Plan Design

The compensation committee evaluates the risks associated with the annual and long-term incentive compensation programs for our executive and senior leaders as part of its comprehensive compensation risk assessment. This evaluation, conducted periodically, is intended to minimize the risk that such programs will promote behavior that could negatively impact the value of the Company or the Exchange. The compensation committee ensures that performance measures used in these programs align with our overall business strategy. See Board Oversight of Risk.

Based on the results of these periodic assessments, we conclude that our compensation programs do not create undue material risk to the Company. There have been no material changes to our incentive plans or risk-mitigating factors since our last assessment and we have not identified any new risks that would change this conclusion. Other tools used to manage executive compensation risk and promote effective governance are identified in the table below.

Measures Used to Mitigate Compensation Risk

| Recoupment of Bonuses | Our policy on recoupment of officer bonuses allows us to recover bonuses paid under our AIP and LTIP under certain circumstances. See Policy on Recoupment of Officer Bonuses. | |

| Committee Discretion | Our compensation committee has the discretion to reduce awards to any individual participant in the incentive plans. | |

| Peer Group Comparison(1) | The compensation committee compares our property and casualty insurance results to a peer group of companies in our LTIP. The committee closely monitors our results and those of our peers during each three-year performance period to determine whether we are performing above or below the industry and the impact on plan performance. | |

| AIP Funding Qualifier | Company financial results are considered before making payments to individuals to ensure payouts are not made if the Company is underperforming overall. | |

Multiple Performance Measures | Both the annual and long-term incentive plans use multiple goals, thereby diversifying the risk associated with any single measure of performance. | |

Maximum Payout Opportunity | We limit the amounts that may be earned under any award of performance-based compensation.

| |

Policy for Minimum Stock Ownership Levels | We believe that requiring executives to hold shares of our stock for an extended period of time discourages them from taking risks for short-term or immediate gain. See Policy for Minimum Stock Ownership Levels. | |

| Plan Governance | All of our incentive plans have written plan documents. Depending on the plan, amendments require approval of the board, the compensation committee, and/or our Human Resources Division. | |

| Anti-Hedging Policy | This policy prohibits directors and officers of the Company who are subject to the Policy for Minimum Stock Ownership Levels, as well as their spouses and any individuals residing in the same household, from engaging in transactions that are designed to offset a decrease in the market value of company stock. |

| (1) | We use two peer groups in our executive compensation program. The LTIP peer group, against which our long-term performance is measured, represents a significant share of the industry’s property and casualty premium and our compensation committee believes that this group is representative of our competition. Our executive compensation benchmarking peer group is composed of companies we consider to be competitors for policyholders and employees, and similar to us in terms of lines of business, net premiums written and/or asset size. |

18 Erie Indemnity Company

Executive Compensation Philosophy and Structure

The goal of our executive compensation program is to attract, motivate, retain and reward executives in a fiscally responsible manner that balances the interests of our shareholders with those of the policyholders of the Exchange. To achieve this objective, we design executive compensation programs that reward and incentivize exceptional performance relevant to the industry. We provide a mix of fixed and variable compensation that is intended to motivate our executives to achieve short- and long-term objectives that build sustainable long-term value. We achieve these objectives by providing the elements of executive compensation identified in the table below.

Components of our Executive Compensation Program

| Base Salary | Base Salary represents a fixed level of cash compensation for the executive’s competencies and the regular duties they perform in their role. Base salaries are linked to other compensation elements, including target award opportunities for short- and long-term incentive plans. | |

| AIP | A performance-based annual incentive program that provides each executive an opportunity to earn a cash award based on the achievement of pre-determined goals or other performance objectives over a one-year period. | |

| LTIP | A long-term incentive program that provides an opportunity for each executive to earn an award based on the achievement of performance objectives over a three-year period. Performance is measured against a pre-defined peer group that creates long-term value for our shareholders and the policyholders of the Exchange. | |

| Benefits | Benefits that include an unfunded, non-qualified supplemental retirement plan, or “SERP,” that enables eligible participants to earn benefits in excess of those that can be earned under our tax-qualified defined benefit pension plan, or “pension plan,” and an unfunded, non-qualified deferred compensation arrangement, or “deferred compensation plan,” that enables eligible participants to defer receipt of all or part of their base salary and/or AIP award to a later date. We offer an unfunded, non-qualified “incentive compensation deferral plan” that enables eligible participants to defer receipt of all or part of their AIP and/or LTIP award. We provide the following matching contributions in our 401(k) plan: 100 percent of the first three percent of pay contributed by the employee, and 50 percent of the next two percent of employee contributions. |

Executive Compensation Principles

Our executive compensation program includes industry best practices.

What We Do

| ||||||

| ✓ | Pay for Performance. A significant percentage of total target direct compensation is pay at-risk and connected to performance. | |||||

| ✓ | Link Performance Measures and Strategic Objectives. Performance measures for incentive compensation are linked to operating priorities. | |||||

| ✓ | Consult with Independent Compensation Advisor. The committee retains an independent consultant to review our executive compensation programs and practices. | |||||

| ✓ | Benchmark to Peers. We benchmark our executive compensation program and review the composition of the peer group annually. | |||||

| ✓ | Target Pay at the 50th Percentile of Peers. We target total direct compensation at the 50th percentile of our peers. | |||||

| ✓ | Limit the Maximum Payout Opportunity. We establish maximum amounts that may be earned under any award of performance-based compensation. | |||||

| ✓ | Require Minimum Levels of Stock Ownership. We require executives to hold shares of our stock for an extended period of time because we believe it discourages them from taking risks for short-term or immediate gain. | |||||

| ✓ | Recoup Compensation Under Certain Circumstances. Awards made to executives are subject to recoupment in specified situations.

| |||||

2023 Information Statement 19

| What We Don’t Do

| ||||||

| ✘ | No Accelerated Vesting of Performance Shares. Our LTIP does not provide for accelerated vesting of performance shares in the event of a termination of employment, other than for retirement, death, or disability. |

| ||||

| ✘ | No Excessive Perquisites. Our executives receive minimal perquisites and do not receive tax gross-ups, except for guest travel, residential home security, and personal use of the company aircraft. | |||||

| ✘ | No Stock Options. We do not offer stock options or stock appreciation rights (SARs). | |||||

| ✘ | No Employment Agreements. We do not have employment agreements with any of our executive officers.

| |||||

Relationship Between Pay and Performance

Our variable pay compensation is tied to: (1) each executive’s individual performance and (2) the performance of the Company and the Exchange, thereby supporting our performance-based compensation philosophy. Because our executives have a greater ability to influence our performance and financial results through their decisions, the percentage of their total compensation comprised of variable pay increases with level of responsibility.

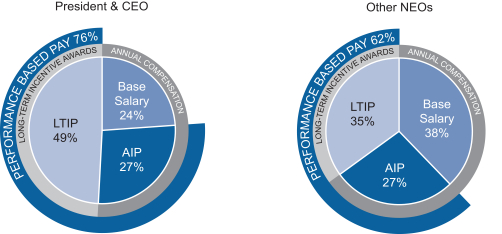

Variable compensation opportunities (long- and short-term incentive target awards) comprised approximately 76 percent of our CEO’s total target annual compensation in 2022, 49 percent of which was in the form of long-term awards tied to company performance. Variable compensation opportunities comprised approximately 62 percent of our other NEOs’ total target annual compensation in 2022, 35 percent of which was in the form of long-term awards. We believe that tying a meaningful portion of our NEOs’ target earnings opportunity to variable compensation, while providing competitive levels of base salary, strikes an appropriate balance between achievement of operational goals and the pay earned by our executives.

20 Erie Indemnity Company

Setting Executive Compensation

Our compensation committee determines the compensation philosophy and policies for our executive officers, including our CEO and executive vice presidents. In doing so, it reviews the performance of each executive and establishes individual compensation levels. The committee considers the nature and extent of each executive’s skills, scope of responsibilities, performance and effectiveness in supporting our long-term goals. The committee engaged Aon, an independent consultant, to assist it with the development and setting of executive compensation for 2022. In preparing the 2022 benchmark and survey data, Aon utilized the following best practice methodologies:

| Benchmark Positions | Competitive compensation levels for our executives were determined by matching each position to survey benchmark positions in the market. | |

| Third-Party Compensation Data | Compensation data was obtained from published insurance industry and general industry sources and from third party consulting firms, including Mercer Consulting and Aon. Our existing compensation levels were analyzed and compared at the 50th percentile on a size-adjusted basis for similar positions. | |

| Peer Group | Compensation data was obtained for a peer group of property and casualty companies. We consider these insurance companies to be our competitors for policyholders, and in some cases employees, and similar to us in terms of lines of business, net premiums written and/or asset size. |

No changes were made to the composition of the peer group used in our base salary analysis for 2022.

2022 Executive Compensation Benchmarking Peer Group

American Family Insurance Group

Amica Mutual Insurance Group

Auto Club Group

The Cincinnati Insurance Companies

CSAA Insurance Exchange

COUNTRY Financial

Farmers Insurance Group

The Hanover Insurance Group

Property and Casualty Companies

Nationwide Insurance

Sentry Insurance Group

USAA Group

Westfield Insurance

In 2022, we paid Aon $43,326 for consulting services and $91,320 for compensation and benchmarking survey participation. Our compensation committee has reviewed these services and determined that they do not impair the independence of Aon.

Principal Components of Executive Compensation

The principal components of our executive compensation program are base salary and bonus opportunities under our AIP and LTIP. Each of these items is discussed below.

Base Salary

The committee set the 2022 base salaries of the NEOs, effective March 1, 2022. The adjustments were based on performance and/or market comparisons.

Name | 2022 Annual Base Salary | 2021 Annual Base Salary | ||

Timothy G. NeCastro | $1,040,000 | $970,000 | ||

Gregory J. Gutting | $580,000 | $560,000 | ||

Lorianne Feltz | $455,000 | $440,000 | ||

Douglas E. Smith | $452,000 | $440,000 | ||

Parthasarathy Srinivasa(1) | $475,000 | N/A |

| (1) | Mr. Srinivasa’s employment with the Company began on April 4, 2022. |

2023 Information Statement 21

Annual Incentive Plan

The 2022 AIP payouts for our NEOs were based on the attainment of company and individual performance goals established at the beginning of 2022. Our compensation committee believes that an appropriate balance of corporate and individual performance goals results in increased differentiation of rewards and improved line of sight among participants. Therefore, the weighting between company and individual performance goals is based on a NEO’s role within the organization. For each of our NEOs, company performance measures are weighted 80 percent and individual performance goals are weighted 20 percent.

Once the target percentages, expressed as a percent of base salary, were determined for the NEOs, our compensation committee, with support from our board of directors, established AIP performance measures intended to drive strong organizational performance. At the end of each year our board of directors and management review our historical results, operating goals, and industry estimates to identify those areas where performance-based incentives would have the greatest impact on achieving our strategic objectives in the following year.