Indigo Redwood City, CA Nareit REITworld 2018 Conference Investor Presentation November 2018

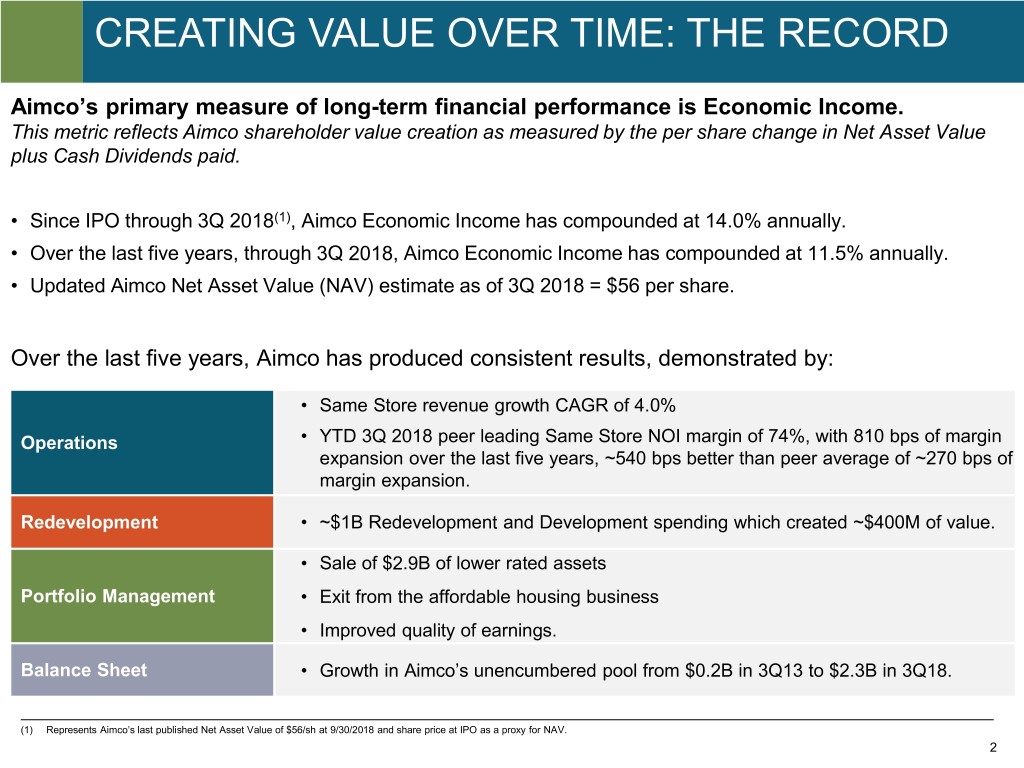

CREATING VALUE OVER TIME: THE RECORD Aimco’s primary measure of long-term financial performance is Economic Income. This metric reflects Aimco shareholder value creation as measured by the per share change in Net Asset Value plus Cash Dividends paid. • Since IPO through 3Q 2018(1), Aimco Economic Income has compounded at 14.0% annually. • Over the last five years, through 3Q 2018, Aimco Economic Income has compounded at 11.5% annually. • Updated Aimco Net Asset Value (NAV) estimate as of 3Q 2018 = $56 per share. Over the last five years, Aimco has produced consistent results, demonstrated by: • Same Store revenue growth CAGR of 4.0% Operations • YTD 3Q 2018 peer leading Same Store NOI margin of 74%, with 810 bps of margin expansion over the last five years, ~540 bps better than peer average of ~270 bps of margin expansion. Redevelopment • ~$1B Redevelopment and Development spending which created ~$400M of value. • Sale of $2.9B of lower rated assets Portfolio Management • Exit from the affordable housing business • Improved quality of earnings. Balance Sheet • Growth in Aimco’s unencumbered pool from $0.2B in 3Q13 to $2.3B in 3Q18. (1) Represents Aimco’s last published Net Asset Value of $56/sh at 9/30/2018 and share price at IPO as a proxy for NAV. 2

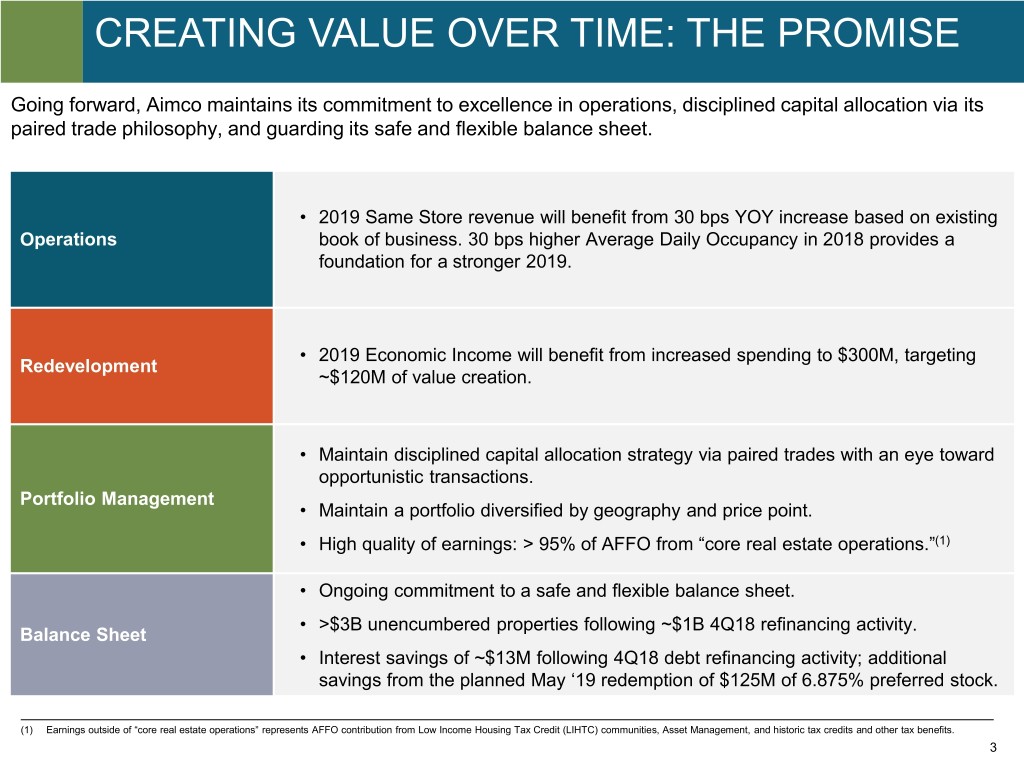

CREATING VALUE OVER TIME: THE PROMISE Going forward, Aimco maintains its commitment to excellence in operations, disciplined capital allocation via its paired trade philosophy, and guarding its safe and flexible balance sheet. • 2019 Same Store revenue will benefit from 30 bps YOY increase based on existing Operations book of business. 30 bps higher Average Daily Occupancy in 2018 provides a foundation for a stronger 2019. • 2019 Economic Income will benefit from increased spending to $300M, targeting Redevelopment ~$120M of value creation. • Maintain disciplined capital allocation strategy via paired trades with an eye toward opportunistic transactions. Portfolio Management • Maintain a portfolio diversified by geography and price point. • High quality of earnings: > 95% of AFFO from “core real estate operations.”(1) • Ongoing commitment to a safe and flexible balance sheet. • >$3B unencumbered properties following ~$1B 4Q18 refinancing activity. Balance Sheet • Interest savings of ~$13M following 4Q18 debt refinancing activity; additional savings from the planned May ‘19 redemption of $125M of 6.875% preferred stock. (1) Earnings outside of “core real estate operations” represents AFFO contribution from Low Income Housing Tax Credit (LIHTC) communities, Asset Management, and historic tax credits and other tax benefits. 3

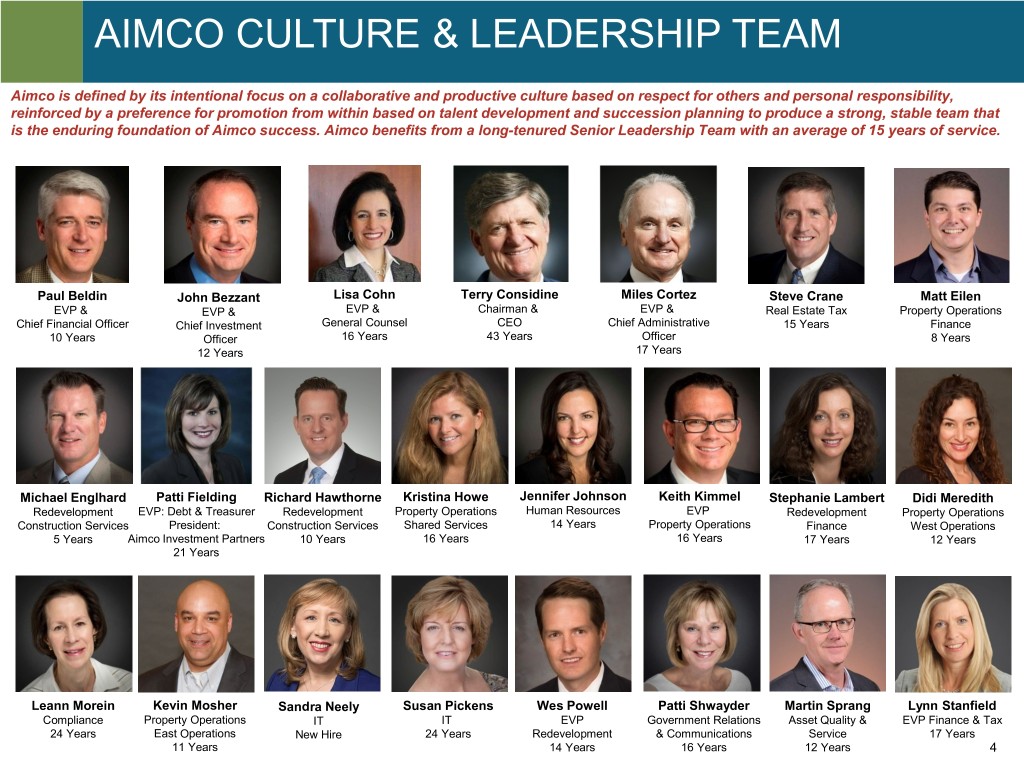

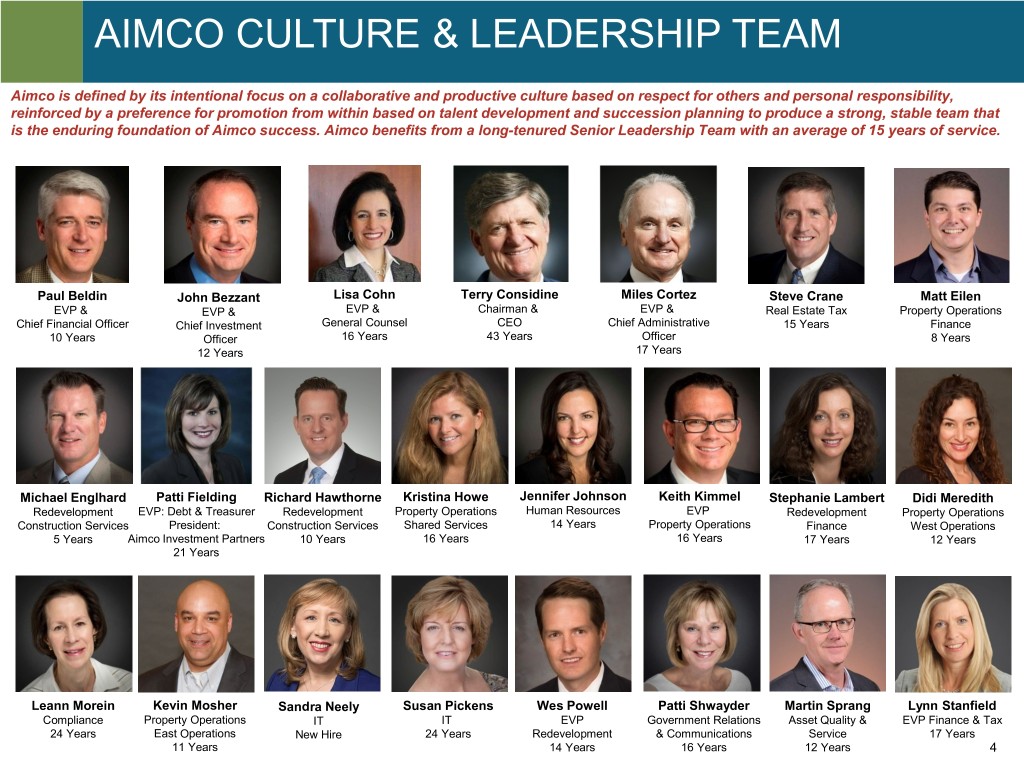

AIMCO CULTURE & LEADERSHIP TEAM Aimco is defined by its intentional focus on a collaborative and productive culture based on respect for others and personal responsibility, reinforced by a preference for promotion from within based on talent development and succession planning to produce a strong, stable team that is the enduring foundation of Aimco success. Aimco benefits from a long-tenured Senior Leadership Team with an average of 15 years of service. Paul Beldin John Bezzant Lisa Cohn Terry Considine Miles Cortez Steve Crane Matt Eilen EVP & EVP & EVP & Chairman & EVP & Real Estate Tax Property Operations Chief Financial Officer Chief Investment General Counsel CEO Chief Administrative 15 Years Finance 10 Years Officer 16 Years 43 Years Officer 8 Years 12 Years 17 Years Michael Englhard Patti Fielding Richard Hawthorne Kristina Howe Jennifer Johnson Keith Kimmel Stephanie Lambert Didi Meredith Redevelopment EVP: Debt & Treasurer Redevelopment Property Operations Human Resources EVP Redevelopment Property Operations Construction Services President: Construction Services Shared Services 14 Years Property Operations Finance West Operations 5 Years Aimco Investment Partners 10 Years 16 Years 16 Years 17 Years 12 Years 21 Years Leann Morein Kevin Mosher Sandra Neely Susan Pickens Wes Powell Patti Shwayder Martin Sprang Lynn Stanfield Compliance Property Operations IT IT EVP Government Relations Asset Quality & EVP Finance & Tax 24 Years East Operations New Hire 24 Years Redevelopment & Communications Service 17 Years 11 Years 14 Years 16 Years 12 Years 4

OPERATIONS UPDATE COMPLETED A STRONG 2018 SUMMER LEASING SEASON • May-September 2018 blended lease rate growth was 3.4% and Average Daily Occupancy (“ADO”) was 96.3%. • 2018 Same Store Revenue growth expected to be 3.0% and Same Store NOI growth between 2.9% and 3.1%. • Strong operating results led to $0.03 per share AFFO guidance increase since 2Q 2018, recovering 2018 dilution from the sale of the Asset Management business(1). 2019 REVENUE OUTLOOK • Market rate growth in Aimco submarkets in 2019 is expected to be SIMILAR to 2018 according to third party forecasts(2). • EARN-IN from Aimco’s year-end 2018 rent roll will contribute an incremental 30 bps to 2019 Same Store revenue growth than the 2017 rent roll contributed to 2018 Same Store revenue growth. • Aimco expects to finish 2018 with Same Store ADO 30 bps HIGHER than in 2017, providing a springboard into 2019. (1) Taken together, the dilution from the sales of Chestnut Hill Village, the Hunters Point properties, and Aimco’s Asset Management business, partially offset by the acquisitions of Bent Tree and the Philadelphia portfolio, was expected to reduce AFFO per share by $0.03 in 2018. (2) REIS and Axiometrics. 5

REDEVELOPMENT REDEVELOPMENT PROVIDES CONSISTENT VALUE CREATION • For the five years ended 2017, Aimco spent $1B on Redevelopment and Development, creating ~$400M of value. • In 2018, Aimco will spend $180M on Redevelopment and Development, targeting 40% value creation. • In 2019, Aimco plans to increase this spending to $300M. • Of the $300M planned for 2019, $200M represents projects that are currently in-process including Parc Mosaic, Flamingo, the Anschutz Expansion, Elm Creek, as well as other smaller projects. • Aimco plans an additional $100M in spending in 2019 on Redevelopment and Development based on Aimco’s deep redevelopment project pipeline. 2019 POTENTIAL REDEVELOPMENT PROJECTS MINNEAPOLIS Calhoun Beach Club (Expanded Scope) DENVER NEW YORK CITY Anschutz Expansion East 88th & 2nd Ave (Additional Phases) PHILADELPHIA BAY AREA Chestnut Hall 707 Leahy GREATER GREATER LA WASHINGTON, DC Villas at Park La Brea Bent Tree SAN DIEGO Mariner's Cove MIAMI Bay Parc (Additional Phases) Flamingo South Beach (Expanded Scope) The menu shown above is representative of the communities whose redevelopment or development is being considered in 2019. Actual projects and their scope may differ materially from the above. 6

PORTFOLIO MANAGEMENT 2018 CAPITAL ALLOCATION DECISIONS • In 2018, Aimco sold $825M of lower-rated properties and issued $65M of OP units at NAV of $53 per share(1) for a total $890M in sources of capital. • 2018 dispositions included the $590M sale of its Asset Management business and Hunters Point affordable communities, completing the five year exit from the affordable housing business. • In 2018, Aimco will have reinvested the $890M of capital sources in accretive uses with higher expected FCF IRRs, including: o Acquisitions: $468M o Redevelopment/Development: $180M o Capital Enhancements: $95M o Net Leverage Reduction: $72M o Stock Buyback: $75M completed in Oct.’18 at $43.89/sh (1) Aimco’s published NAV estimate at the time of Philadelphia acquisition announcement. 7

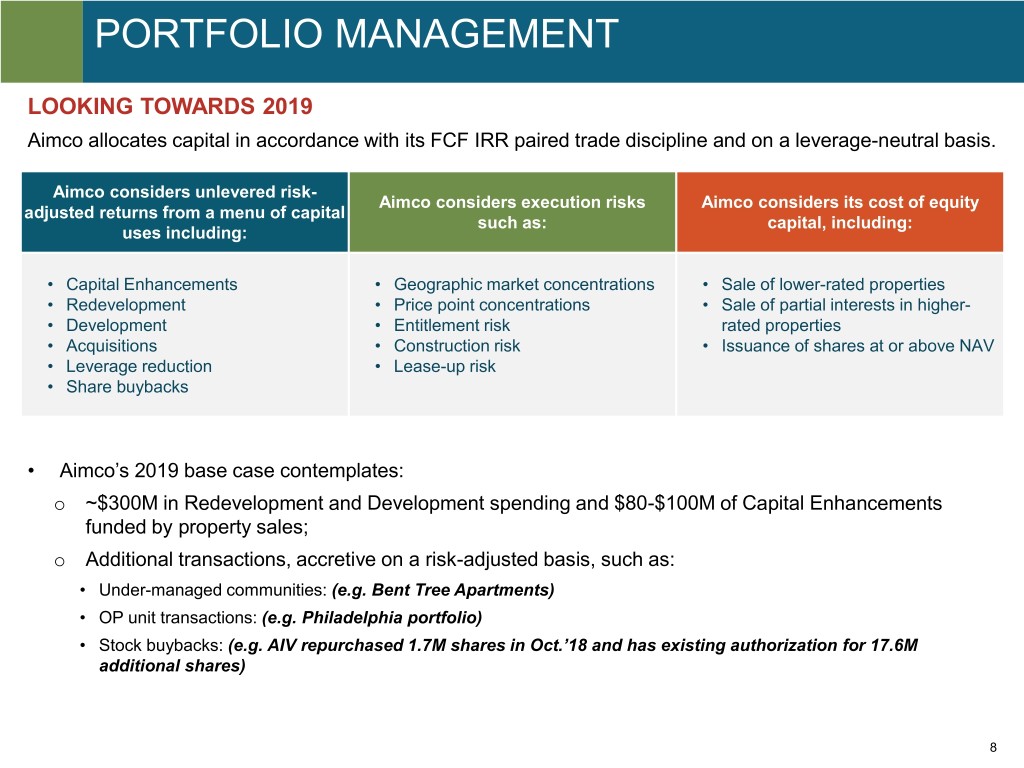

PORTFOLIO MANAGEMENT LOOKING TOWARDS 2019 Aimco allocates capital in accordance with its FCF IRR paired trade discipline and on a leverage-neutral basis. Aimco considers unlevered risk- Aimco considers execution risks Aimco considers its cost of equity adjusted returns from a menu of capital such as: capital, including: uses including: • Capital Enhancements • Geographic market concentrations • Sale of lower-rated properties • Redevelopment • Price point concentrations • Sale of partial interests in higher- • Development • Entitlement risk rated properties • Acquisitions • Construction risk • Issuance of shares at or above NAV • Leverage reduction • Lease-up risk • Share buybacks • Aimco’s 2019 base case contemplates: o ~$300M in Redevelopment and Development spending and $80-$100M of Capital Enhancements funded by property sales; o Additional transactions, accretive on a risk-adjusted basis, such as: • Under-managed communities: (e.g. Bent Tree Apartments) • OP unit transactions: (e.g. Philadelphia portfolio) • Stock buybacks: (e.g. AIV repurchased 1.7M shares in Oct.’18 and has existing authorization for 17.6M additional shares) 8

HIGH QUALITY BALANCE SHEET AIMCO LIMITS RISK THROUGH BALANCE SHEET STRUCTURE • Employ low leverage: 35% property debt loan-to- value at 3Q 2018 • Finance primarily with non-recourse property debt and preferred equity: 94% and 6%, respectively, of Aimco total leverage at 3Q 2018 • Maintain financial flexibility: • Ample committed credit: $593M of $600M available at 3Q 2018 • A pool of unencumbered properties: Valued at $2.3B at 3Q 2018 • Ready access to property market liquidity: ~$1B of lower rated assets offered for sale at 3Q 2018 • Maintain investment grade rating as confirmation of the safety of Aimco’s balance sheet 9

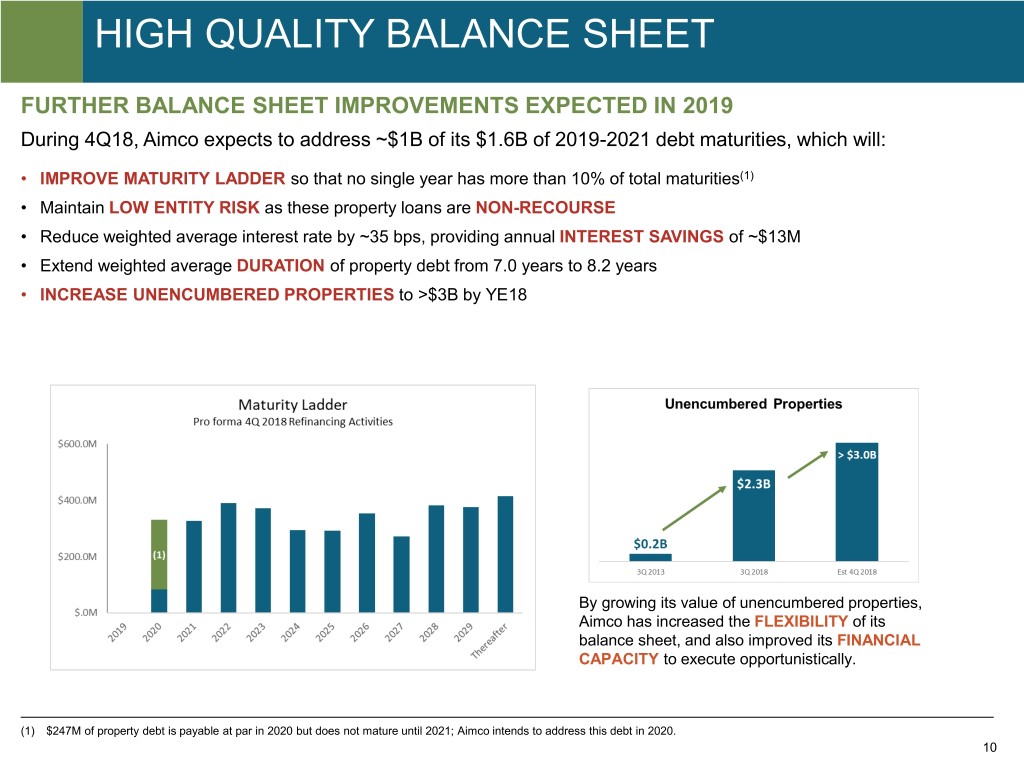

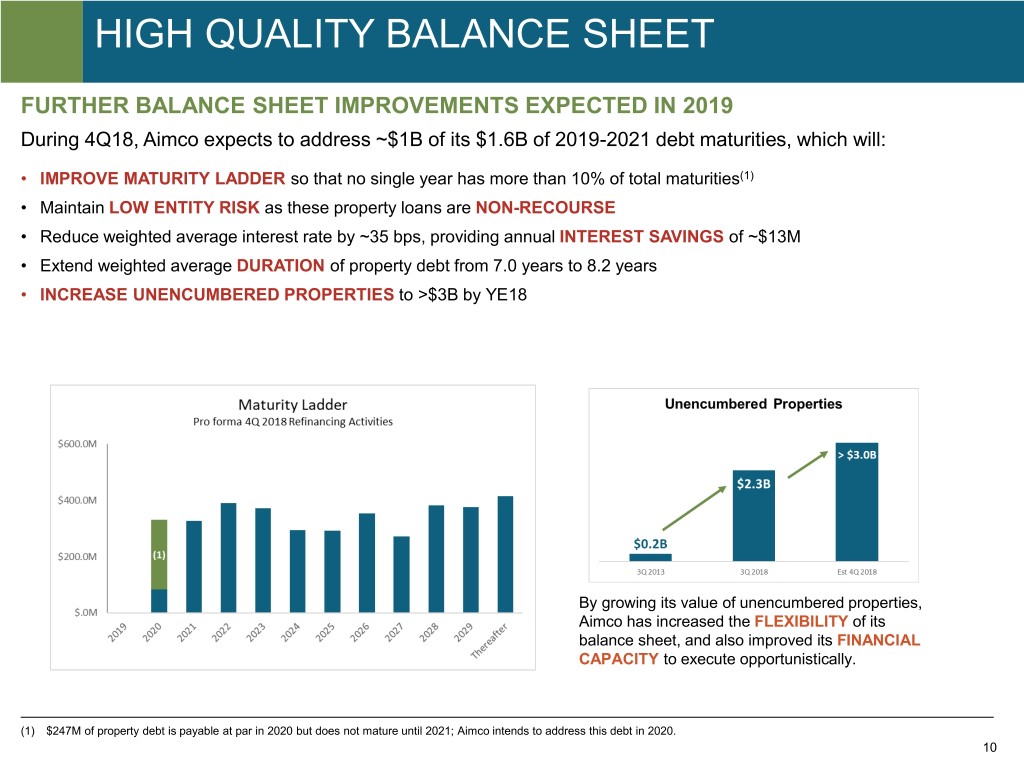

HIGH QUALITY BALANCE SHEET FURTHER BALANCE SHEET IMPROVEMENTS EXPECTED IN 2019 During 4Q18, Aimco expects to address ~$1B of its $1.6B of 2019-2021 debt maturities, which will: • IMPROVE MATURITY LADDER so that no single year has more than 10% of total maturities(1) • Maintain LOW ENTITY RISK as these property loans are NON-RECOURSE • Reduce weighted average interest rate by ~35 bps, providing annual INTEREST SAVINGS of ~$13M • Extend weighted average DURATION of property debt from 7.0 years to 8.2 years • INCREASE UNENCUMBERED PROPERTIES to >$3B by YE18 By growing its value of unencumbered properties, Aimco has increased the FLEXIBILITY of its balance sheet, and also improved its FINANCIAL CAPACITY to execute opportunistically. (1) $247M of property debt is payable at par in 2020 but does not mature until 2021; Aimco intends to address this debt in 2020. 10

POTENTIAL 2019 RISKS Aimco regularly assesses risks that may impact its business and takes prudent precautions to ensure that the company is well-positioned. Mitigating Factors • Aimco maintains a portfolio that is diversified by geography and price point to mitigate the New Supply impact of competitive new supply. Aimco exposure to new supply is expected to be less in 2019 than in 2018 and is discussed on pg. 12. • Aimco resident retention averaged 52% over the five years ended 3Q 2018, limiting the U.S. Economy impact of new lease pricing if the market were to decline. • After 4Q 2018 expected refinancings, Aimco has limited exposure to increasing interest Interest Rates rates: $3.5B (91% of total leverage) is fixed-rate; $650M (17% of total leverage) matures in next three years. • Aimco government affairs and legal teams work directly with federal, state and local governments and also through industry groups to make relevant government decision making better informed, for example: o Aimco teams participated with the industry coalition to oppose Prop 10 in California. Political Risk • Aimco works with federal, state and local governments to protect the right of property owners to select their residents and their neighbors. o Aimco is engaged in litigation with Airbnb to cause it to cease brokering, promoting, and profiting from short-term rentals that violate Aimco apartment leases and cause trespassing on Aimco communities. 11

EXPOSURE TO NEW SUPPLY • Aimco considers competitive new supply to be significant primarily to “A” price point communities in submarkets with projected completions of more than 2.0% of existing stock. Based on third-party forecasts of new supply, Aimco properties representing 9% of GAV will be so affected in 2019, down from 23% at the beginning of 2018. • Even where markets face elevated new supply, the quality of the Aimco offering or its location, or an increase in local demand, for example from job growth, can reduce or offset the impact of new supply. % Aimco GAV 2019 Invested in "A" Completions 2019 New Jobs Submarket Graded as a % of per Unit Market Submarket Communities Stock(1) Completed(2) Aimco Specific Mitigating Factors Philadelphia Center City 6.4% 3.2% 7 Declining supply outlook with strong job growth expected in 2019. Supply pressure could exist, however it is expected to be delivered at a higher Denver Littleton 0.4% 4.1% 3 price point than current Aimco rents. Supply pressure could exist in Central DuPage, however new jobs data suggests Chicago Central DuPage County 1.0% 4.0% 6 2019 supply should be absorbed. Midtown Atlanta 0.4% 7.1% New supply completions are expected to continue into 2019 and pressure could Atlanta 5 exist, however new supply is expected to be delivered at a higher price point than Buckhead 0.2% 7.4% current Aimco rents. New supply completions are expected to continue into 2019 and pressure could Nashville West Nashville 0.4% 5.8% 6 exist, however new supply is expected to be delivered at a higher price point than current Aimco rents. Total % of Aimco GAV Exposed 8.8% Declining Maintaining Increasing to Supply Outlook High Supply High Supply • Additionally, select Aimco “B” submarket graded communities may face supply pressure based on the direct proximity of new product being delivered, e.g. Yacht Club in Miami and 3400 Avenue of the Arts in Orange County, which both have lease-ups directly across the street. • Based on the 3Q 2018 updated forecasts for new supply, the following Aimco submarkets are no longer identified as “at-risk:” Mid-Wilshire (Los Angeles)(3), South San Mateo County (Bay Area), North Aurora (Denver), Southeast DuPage County (Chicago), Uptown/St. Louis Park (Minneapolis), and La Jolla/University City (San Diego). (1) Based on submarket data for deliveries in 2019 as a percentage of 4Q18 forecasted stock as of 3Q 2018, available from Axio/MPF Research. (2) Employment figures are based on market data as reported by Green Street Advisors (Sept 2018). As a rule of thumb, at least five new jobs are necessary to absorb one unit of new supply. (3) Mid-Wilshire forecasted supply dropped from ~2.0% completions as a percent of existing stock in 2018 to 1.6% in 2019. Source: Axio/MPF Research. 12

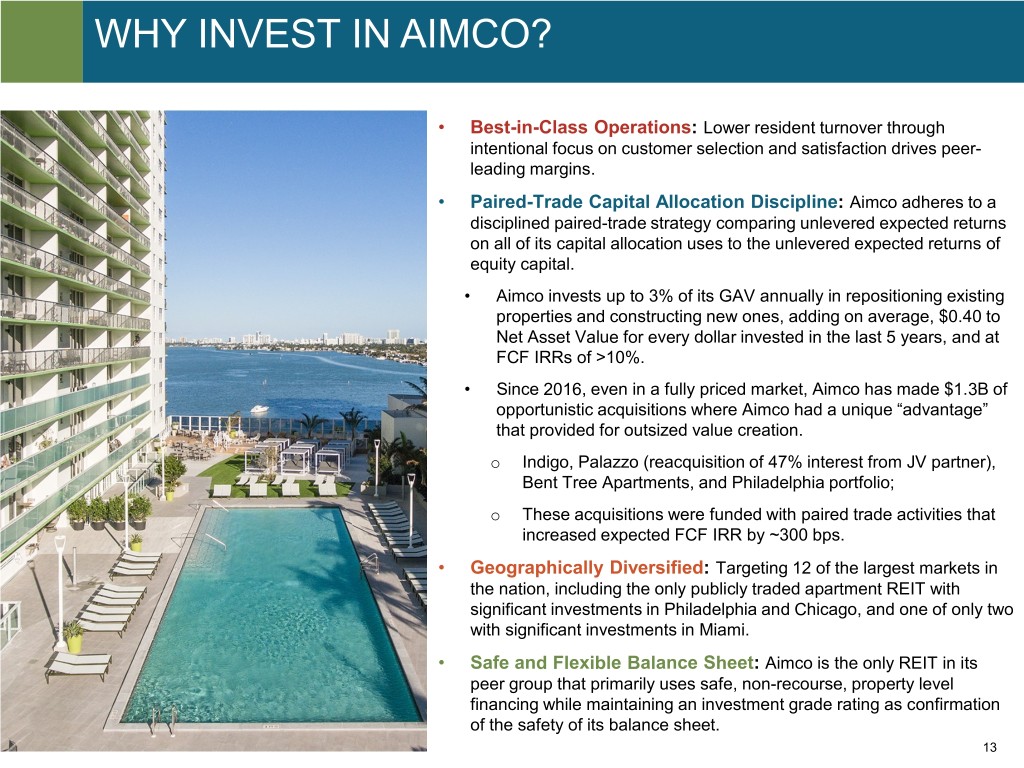

WHY INVEST IN AIMCO? • Best-in-Class Operations: Lower resident turnover through intentional focus on customer selection and satisfaction drives peer- leading margins. • Paired-Trade Capital Allocation Discipline: Aimco adheres to a disciplined paired-trade strategy comparing unlevered expected returns on all of its capital allocation uses to the unlevered expected returns of equity capital. • Aimco invests up to 3% of its GAV annually in repositioning existing properties and constructing new ones, adding on average, $0.40 to Net Asset Value for every dollar invested in the last 5 years, and at FCF IRRs of >10%. • Since 2016, even in a fully priced market, Aimco has made $1.3B of opportunistic acquisitions where Aimco had a unique “advantage” that provided for outsized value creation. o Indigo, Palazzo (reacquisition of 47% interest from JV partner), Bent Tree Apartments, and Philadelphia portfolio; o These acquisitions were funded with paired trade activities that increased expected FCF IRR by ~300 bps. • Geographically Diversified: Targeting 12 of the largest markets in the nation, including the only publicly traded apartment REIT with significant investments in Philadelphia and Chicago, and one of only two with significant investments in Miami. • Safe and Flexible Balance Sheet: Aimco is the only REIT in its peer group that primarily uses safe, non-recourse, property level financing while maintaining an investment grade rating as confirmation of the safety of its balance sheet. 13

FORWARD LOOKING STATEMENTS & OTHER INFORMATION This presentation contains forward-looking statements within the meaning of the federal securities laws, including, without limitation, statements regarding projected results and specifically forecasts of 2018 results and 2019 expectations, including but not limited to: AFFO and selected components thereof; Aimco redevelopment and development investments and projected value creation from such investments; Aimco refinancing activities; and Aimco liquidity and leverage metrics. These forward-looking statements are based on management’s judgment as of this date, which is subject to risks and uncertainties. Risks and uncertainties include, but are not limited to: Aimco’s ability to maintain current or meet projected occupancy, rental rate and property operating results; the effect of acquisitions, dispositions, redevelopments and developments; Aimco’s ability to meet budgeted costs and timelines, and achieve budgeted rental rates related to Aimco redevelopments and developments; and Aimco’s ability to comply with debt covenants, including financial coverage ratios. Actual results may differ materially from those described in these forward-looking statements and, in addition, will be affected by a variety of risks and factors, some of which are beyond Aimco’s control, including, without limitation: • Real estate and operating risks, including fluctuations in real estate values and the general economic climate in the markets in which Aimco operates and competition for residents in such markets; national and local economic conditions, including the pace of job growth and the level of unemployment; the amount, location and quality of competitive new housing supply; the timing of acquisitions, dispositions, redevelopments and developments; and changes in operating costs, including energy costs; • Financing risks, including the availability and cost of capital markets’ financing; the risk that cash flows from operations may be insufficient to meet required payments of principal and interest; and the risk that earnings may not be sufficient to maintain compliance with debt covenants; • Insurance risks, including the cost of insurance, and natural disasters and severe weather such as hurricanes; and • Legal and regulatory risks, including costs associated with prosecuting or defending claims and any adverse outcomes; the terms of governmental regulations that affect Aimco and interpretations of those regulations; and possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of apartment communities presently or previously owned by Aimco. In addition, Aimco’s current and continuing qualification as a real estate investment trust involves the application of highly technical and complex provisions of the Internal Revenue Code and depends on Aimco’s ability to meet the various requirements imposed by the Internal Revenue Code, through actual operating results, distribution levels and diversity of stock ownership. Pursuant to its existing authority to repurchase up to 19.3M shares, the company may make repurchases from time to time in the open market or in privately negotiated transactions at the company’s discretion and in accordance with the requirements of the SEC. The timing and amount of repurchases, if at all, will depend on market pricing as well as other conditions. Readers should carefully review Aimco’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of Aimco’s Annual Report on Form 10-K for the year ended December 31, 2017, and the other documents Aimco files from time to time with the Securities and Exchange Commission. These forward-looking statements reflect management’s judgment as of this date, and Aimco assumes no obligation to revise or update them to reflect future events or circumstances. This presentation does not constitute an offer of securities for sale. Glossary & Reconciliations of Non-GAAP Financial and Operating Measures Financial and operating measures discussed in this document include certain financial measures used by Aimco management, that are measures not defined under accounting principles generally accepted in the United States, or GAAP. Certain Aimco terms and Non-GAAP measures are defined in the Glossary and Reconciliations of Non-GAAP Financial and Operating Measures included in Aimco’s Third Quarter 2018 Earnings Release dated November 1, 2018. 14